UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary proxy statement | o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o Definitive Proxy Statement

o Definitive Additional Materials

xSoliciting Material Pursuant to Rule 14a-12

STRATEGIC DIAGNOSTICS INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

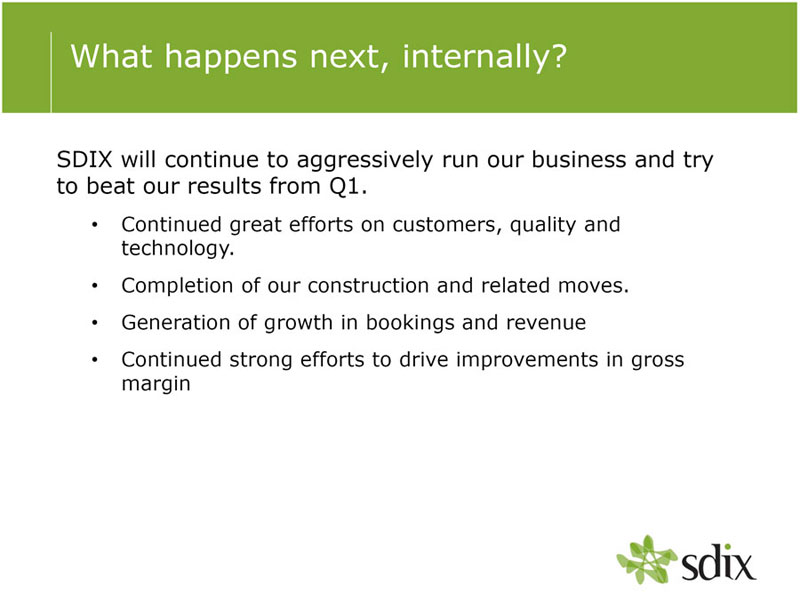

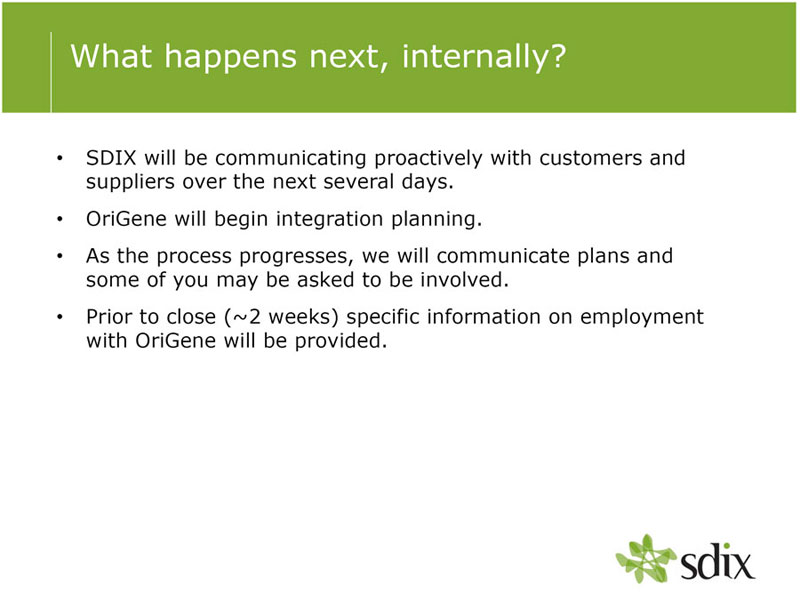

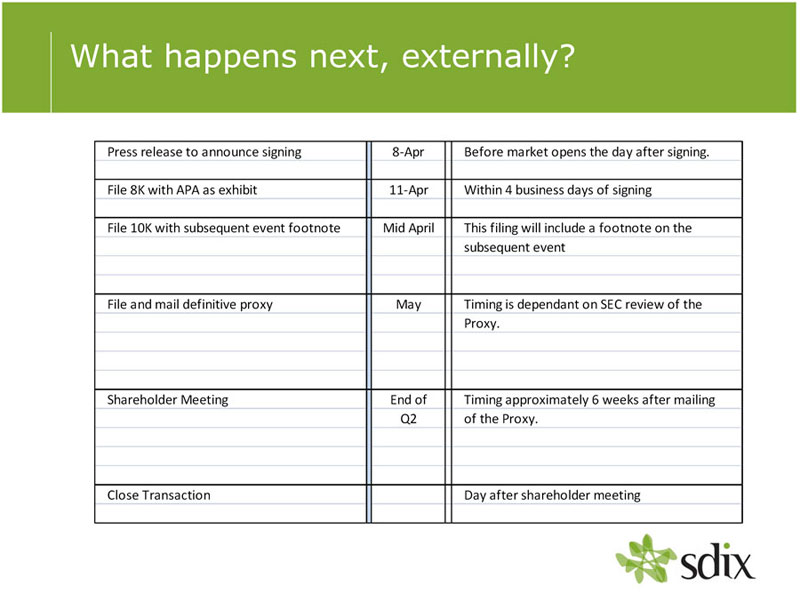

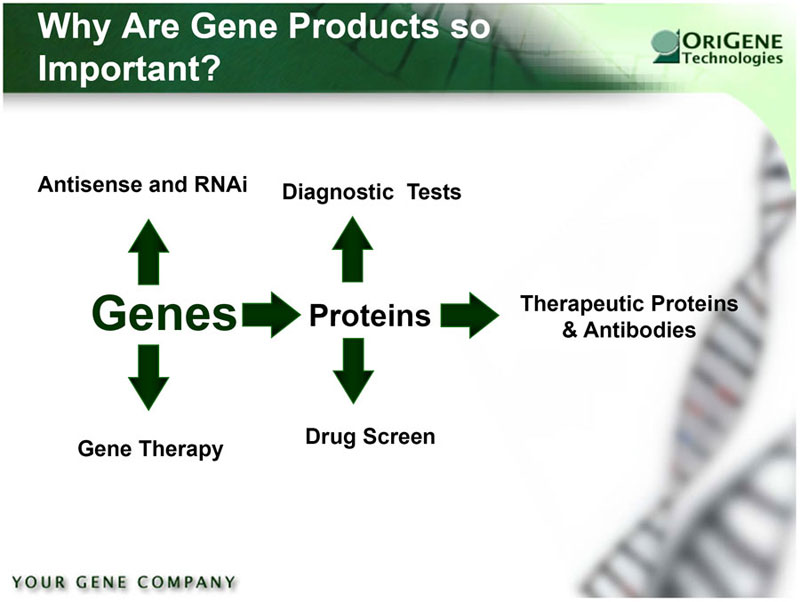

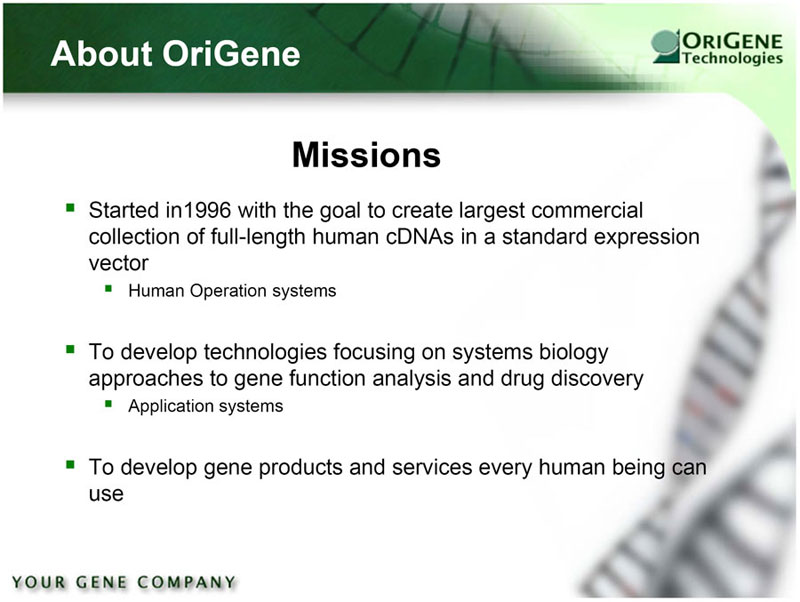

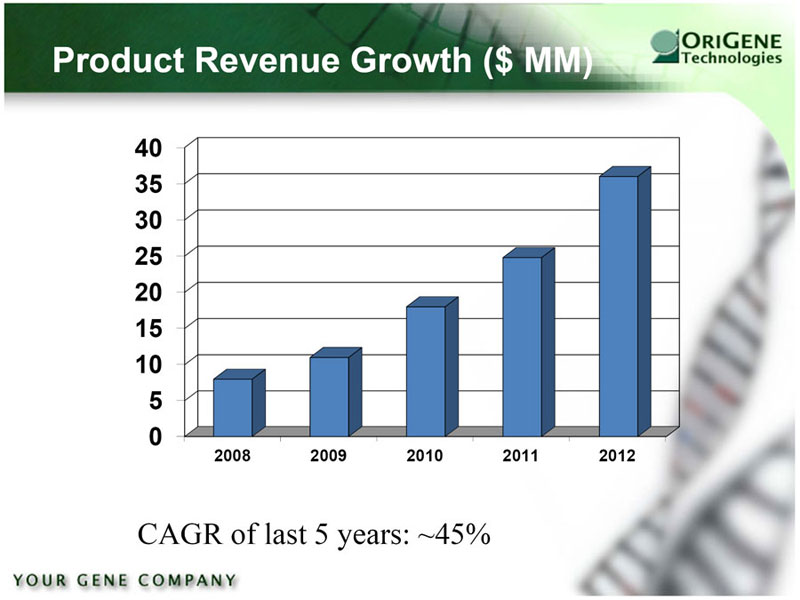

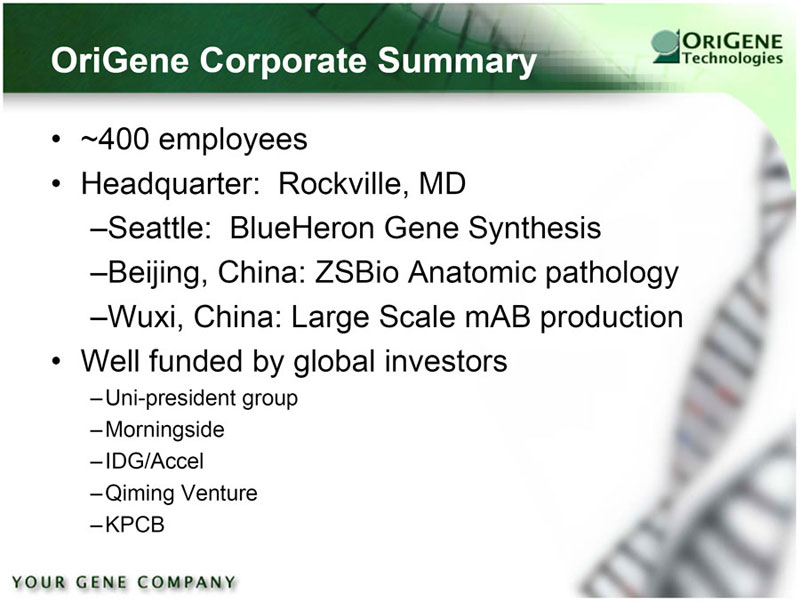

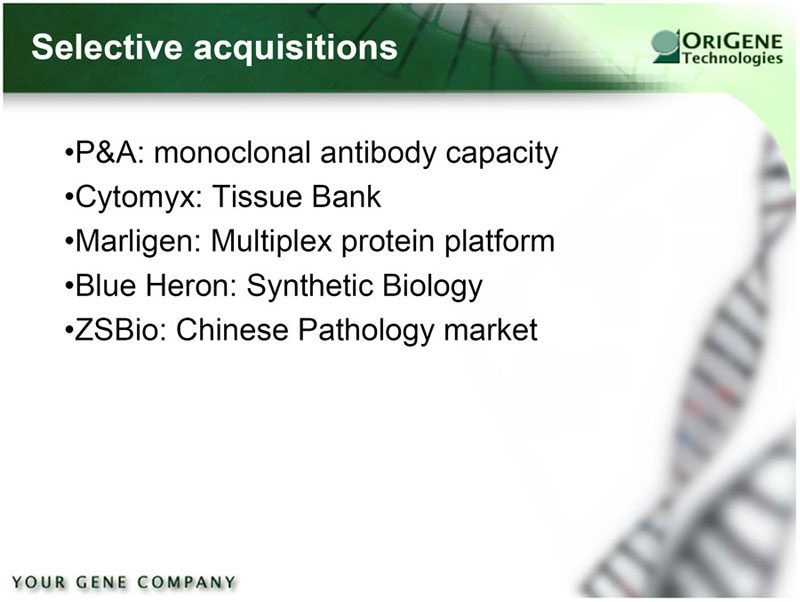

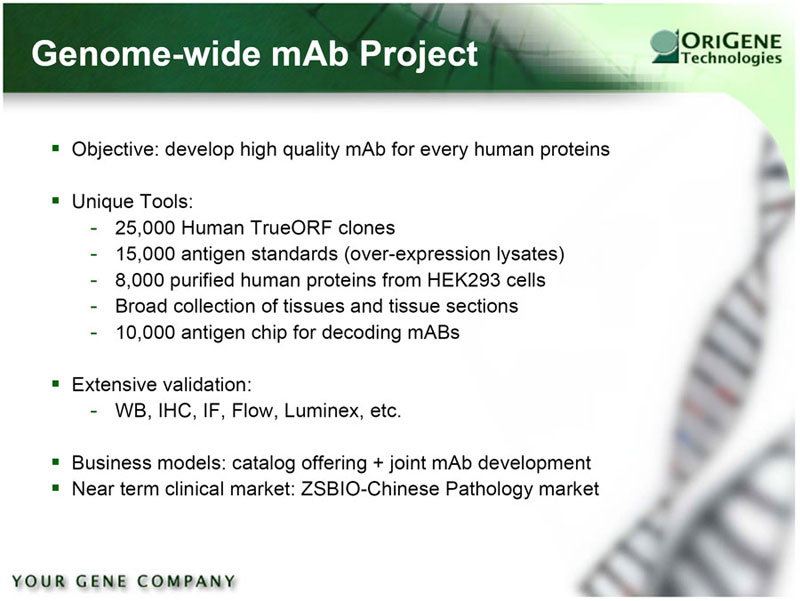

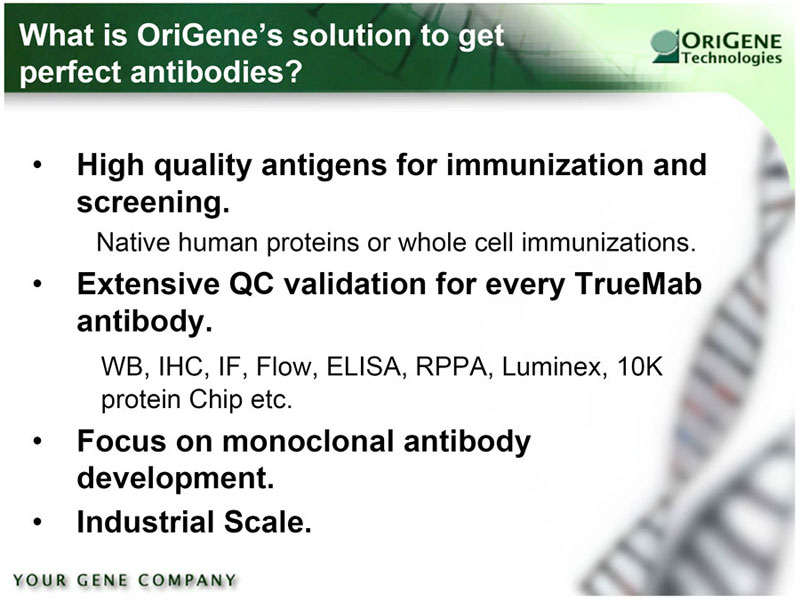

On April 5, 2013, Strategic Diagnostics Inc., a Delaware corporation (the “Company”), SDIX, LLC, a Delaware limited liability company (“Purchaser”), and OriGene Technologies, Inc., a Delaware corporation and the ultimate parent of the Purchaser (“Parent”), entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”). The presentations which follow were made to all employees of the Company following the announcement of the asset sale transaction (the “Asset Sale Transaction”) contemplated by the Asset Purchase Agreement.

Forward Looking Statements:

This filing contains forward-looking statements, which may be identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “should,” “seeks,” “future,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors that could cause actual results to differ materially include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Asset Purchase Agreement; (2) the outcome of any legal proceedings that may be instituted against the Company and others following announcement of the Asset Purchase Agreement; (3) the inability to complete the Asset Sale Transaction due to the failure to satisfy the conditions to the Asset Sale Transaction, including obtaining the affirmative vote of at least a majority of the votes cast by the holders of the Company’s outstanding shares of common stock entitled to vote on the approval of the Asset Sale Transaction; (4) risks that the proposed Asset Sale Transaction disrupts current plans and operations and potential difficulties in employee and customer retention as a result of the Asset Sale Transaction; (5) the ability to recognize the benefits of the Asset Sale Transaction; (6) legislative, regulatory and economic developments; and (7) other factors described in the Company’s filings with the SEC. Many of the factors that will determine the outcome of the subject matter of this filing are beyond the Company’s ability to control or predict. The Company can give no assurance that the conditions to the Asset Sale Transaction will be satisfied. Except as required by law, the Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

This communication does not constitute a solicitation of any vote or approval. The proposed Asset Sale Transaction between the Company, Purchaser and Parent will be submitted to the stockholders of the Company for their consideration. The Company expects to file with the Securities and Exchange Commission (“SEC”) a proxy statement with respect to the proposed Asset Sale Transaction. INVESTORS AND SECURITY HOLDERS OF the Company AND OTHER INVESTORS ARE ADVISED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ASSET SALE TRANSACTION. The definitive proxy statement will be mailed to stockholders of the Company. Investors and security holders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by the Company with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the proxy statement, when it becomes available, and the Company’s other filings with the SEC may also be obtained from the Company by directing a request to the Company’s Investor Relations department, email: investor-relations@sdix.com.

Participants in Solicitation

The Company and its directors, executive officers and other members of its management and employees may be deemed to be soliciting proxies from the Company’s stockholders in favor of the proposed Asset Sale Transaction. Information regarding the Company’s directors and executive officers is available in its Annual Report on Form 10-K for the fiscal year ended December 31, 2012 filed with the SEC on April 15, 2013, and definitive proxy statement relating to its 2012 Annual Meeting of Stockholders filed with the SEC on April 16, 2012. Stockholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the proposed Asset Sale Transaction, which may be different than those of the Company’s stockholders generally, by reading the proxy statement and other relevant documents filed with the SEC when they become available.

Any information concerning Purchaser or Parent contained in this document has been taken from, or is based upon, publicly available information. Although the Company does not have any information that would indicate that the information contained in this document that has been taken from such documents is inaccurate or incomplete, the Company does not take any responsibility for the accuracy or completeness of such information.