HOLLINGER INC.

ANNUAL INFORMATION FORM

March 7, 2007

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS | 1 |

GLOSSARY OF TERMS | 2 |

CORPORATE STRUCTURE | 10 |

GENERAL DEVELOPMENT OF THE CORPORATION AND ITS BUSINESS | 16 |

DESCRIPTION OF THE BUSINESS | 34 |

RISK FACTORS | 36 |

DIVIDENDS | 45 |

CAPITAL STRUCTURE | 46 |

MARKET FOR SECURITIES | 47 |

DIRECTORS AND OFFICERS | 50 |

2006 EXECUTIVE COMPENSATION | 57 |

2005 EXECUTIVE COMPENSATION | 65 |

EQUITY COMPENSATION PLANS | 71 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 72 |

LEGAL PROCEEDINGS | 72 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 84 |

MATERIAL CONTRACTS | 87 |

TRANSFER AND REGISTRAR AGENT | 88 |

AUDIT COMMITTEE | 88 |

AUDITORS | 89 |

INTERESTS OF EXPERTS | 89 |

ADDITIONAL INFORMATION | 90 |

| | |

EXHIBITS | |

| | |

EXHIBIT A – CHARTER OF THE AUDIT COMMITTEE OF HOLLINGER INC. | A-1 |

Unless otherwise indicated or the context otherwise indicates, in this document "Hollinger" and the "Corporation" refer to Hollinger Inc.

Unless otherwise stated, all amounts are expressed in Canadian dollars.

The information contained in this Annual Information Form is given as of March 31, 2006 except where otherwise indicated. The information contained herein concerning Sun-Times Media Group, Inc. and its subsidiaries has been taken from, or is based on, publicly available documents or records on file with Canadian securities regulatory authorities and other public sources and has not been independently verified by Hollinger. Hollinger has no nominees on the Sun-Times board of directors and has no access to non-public information about Sun-Times.

FORWARD-LOOKING STATEMENTS

This Annual Information Form contains certain forward-looking statements. Words such as "will", "expects", "anticipates", "intends", "plans", "believes", "seeks", "estimates" and variations of such words and similar expressions are intended to identify these forward-looking statements. Specifically, and without limiting the generality of the foregoing, all statements included in this Annual Information Form that address activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including such items as business strategies and measures to implement such strategies, competitive strengths, goals, expansion and growth, or references to the litigation or future success of the Corporation, its subsidiaries and the companies or partnerships in which the Corporation has equity investments are forward-looking statements. Actual results could differ materially from those reflected in the forward-looking statements as a result of: (i) general economic market or business conditions; (ii) the opportunities (or lack thereof) that may be presented to and pursued by the Corporation; (iii) competitive actions by other entities; (iv) changes in laws; (v) the outcome of litigation or regulatory proceedings; and (vi) other factors, many of which are beyond the control of the Corporation.

All written and oral forward-looking statements attributable to the Corporation, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements set forth above. Readers of this Annual Information Form are cautioned not to place undue reliance on forward-looking statements contained in this Annual Information Form, which reflect the analysis of management only as of the date of this Annual Information Form, or such date as is otherwise indicated. The Corporation undertakes no obligation to release publicly the results of any revision to these forward-looking statements which may be made to reflect events or circumstances after the date of this Annual Information Form or to reflect the occurrence of unanticipated events.

GLOSSARY OF TERMS

Capitalized terms used but not otherwise defined in this Annual Information Form have the following meanings:

"2004 Unaudited Balance Sheet" means the unaudited consolidated balance sheet of the Corporation dated as at September 30, 2004 prepared on a non-GAAP alternative basis;

"2005 Financial Year" means the Corporation's financial year for the 12-month period ended December 31, 2005;

"2006 Financial Year" means the Corporation's transitional financial year for the three-month period ended March 31, 2006;

"Advisory Agreement" means the advisory agreement dated November 11, 2005 and effective as of July 15, 2005, between the Corporation, Benson Consulting and Benson;

"Advisory Agreement MOA" means the memorandum of agreement dated January 15, 2007 between Benson Consulting, Benson and the Corporation providing for, among other things, the termination of the Advisory Agreement;

"AIF" means this Annual Information Form;

"Amiel-Black" means Barbara Amiel-Black;

"Argus" means Argus Corporation Limited;

"ASA" means the Securities Act (Alberta) as amended, and all regulations promulgated thereunder;

"Atkinson" means Peter Y. Atkinson;

"Audit Committee" means the audit committee of the Corporation;

"BCSA" means the Securities Act (British Columbia) as amended, and all regulations promulgated thereunder;

"Beck" means Stanley M. Beck, Q.C.;

"Benson" means Randall C. Benson;

"Benson Consulting" means RC Benson Consulting Inc., formerly called 1379074 Ontario Ltd.;

"Black" means Conrad Black;

"Board" or "Board of Directors" means the board of directors of the Corporation;

"Boultbee" means John A. Boultbee;

"CanWest" means CanWest Global Communications Corp.;

"Carroll" means Paul A. Carroll, Q.C.;

"Catalyst" means Catalyst Fund General Partner I Inc., a private equity fund managed by Catalyst Capital Group Inc., in respect of which Glassman is the Managing Partner;

"CBCA" means the Canada Business Corporations Act, as amended, and all regulations promulgated thereunder;

"CCAA" means the Companies' Creditors Arrangement Act (Canada), as amended, and all regulations promulgated thereunder;

"CICA Handbook" means the Canadian Institute of Chartered Accountants Handbook;

"Colson" means Daniel W. Colson;

"Common Shares" means the retractable common shares of the Corporation;

"Consent" means the Consent Agreement entered into March 10, 2003 between Sun-Times and Wachovia Trust Corporation;

"Contribution Agreement" means the contribution agreement entered into in March 2003 between the Corporation, RMI and RCL under which RCL agreed, among other things, to guarantee RMI's obligations under the Support Agreement;

"Co-operation Agreement" means the co-operation agreement entered into between the Corporation and the United States Attorney's Office for the Northern District of Illinois on May 15, 2006 wherein the Corporation agreed to co-operate with the United States Attorney's Office's ongoing investigation and prosecution of Black, Boultbee, Atkinson, Kipnis and RCL;

"CRC" means the Corporate Review Committee of the Sun-Times Board;

"Delaware Order" means the Order and Judgment entered by the Court of Chancery of the State of Delaware on June 28, 2004;

"Directors' Share Unit Plan" means the Corporation's Directors' Share Unit Plan, as approved and adopted by the Board on February 24, 1999 and amended as of February 6, 2004;

"Domgroup" means Domgroup Ltd., a wholly owned subsidiary of the Corporation;

"Drinkwater" means David W. Drinkwater;

"ELR" means Editorial La Razon, S.A., a wholly owned subsidiary of the Corporation;

"First Indenture" means the indenture governing the First Senior Secured Notes dated as of March 10, 2003 between the Corporation, as issuer, Delaware Trust Company, National Association (formerly Wachovia Trust Company, National Association), as trustee, RMI and 4322525 Canada Inc. (formerly 504468 N.B. Inc.), as guarantors, and RCL and Sugra Limited, as amended by the supplemental indenture dated as of September 30, 2004 and as otherwise amended, amended and restated, supplemented or otherwise modified from time to time;

"First Senior Secured Notes" means the Corporation's 11.875% senior secured notes due March 1, 2011 issued pursuant to the First Indenture on March 10, 2003;

"GAAP" means Canadian generally accepted accounting principles in effect from time to time;

"Gillespie" means Robert Gillespie;

"Glacier" means Glacier Ventures International Corp.;

"Glassman" means Newton G.Z. Glassman;

"HCN" means Hollinger Canadian Newspapers, Limited Partnership;

"HCPH Co." means Hollinger Canadian Publishing Holdings Co.;

"Hodgson" means Patrick W.E. Hodgson;

"Hollinger Consent Order" means the Consent Order approved on July 8, 2005 by Justice Colin L. Campbell of the Ontario Court reconstituting the Board of Directors;

"Hollinger Independent Directors' Trust" means the trust formed pursuant to a trust and contribution agreement dated June 30, 2004 in support of the Corporation's indemnification obligations to certain former directors;

"Indentures" means, collectively, the First Indenture and the Second Indenture;

"Inspection" means the investigation conducted by the Inspector of the affairs of the Corporation as ordered by Justice Colin L. Campbell of the Ontario Court on September 3, 2004;

"Inspector" means Ernst & Young Inc.;

"Interim Directors" means the following five former directors of the Corporation who served on the Board for a period during 2004 and 2005: Carroll, Metcalfe, Vale, Walker and Wakefield;

"Kipnis" means Mark Kipnis;

"KPMG Canada" means KPMG LLP, a Canadian limited liability partnership;

"KPMG USA" means KPMG LLP, a U.S. limited liability partnership;

"Loss of Control" means ceasing to control or exercise significant influence over a corporation, as those terms are defined in the CICA Handbook;

"Mareva Injunction" means injunctive relief granted by a court to prevent a defendant from disposing of its assets;

"MCTO" means the final cease trade order issued by the OSC on June 1, 2004, as amended, prohibiting certain then current and former directors, officers and insiders of the Corporation from trading in securities of the Corporation, subject to certain exceptions;

"MD&A" means management's discussion and analysis;

"Metcalfe" means Robert J. Metcalfe;

"MI 52-110" means Multilateral Instrument 52-110 - Audit Committees;

"Mitchell" means Ronald B. Mitchell;

"MRRS Decision Document" means the decision of the OSC and the securities regulatory authorities of certain other provinces of Canada dated December 7, 2006, granting to the Corporation exemptive relief from certain requirements of applicable securities laws;

"NI 51-102" means National Instrument 51-102 - Continuous Disclosure Obligations;

"Ontario Court" means the Ontario Superior Court of Justice;

"Option Plan" means the Corporation's Amended and Restated Executive Share Option Plan dated September 14, 1994 and amended December 3, 1996;

"OSA" means the Securities Act (Ontario), as amended, and all regulations promulgated thereunder;

"OSC" means the Ontario Securities Commission;

"OSC Hearing" means the hearing scheduled in connection with the OSC Notice of Hearing and a Statement of Allegations dated March 18, 2005;

"Other Milestones" means the milestones under the Advisory Agreement, other than the Ravelston Receivable Milestone and the Ravelston Litigation Milestone, in relation to material projects, actions, transactions and/or agreements in respect of the Corporation or any asset, liability, ownership interest claim, proceeding or circumstance relating to the Corporation which are not in the ordinary course or of a routine nature;

"Perle" means Richard N. Perle;

"PGWML" means Peter G. White Management Ltd., a corporation controlled by White;

"PHIL" means Press Holdings International Limited;

"Preference Shares" means the preference shares of the Corporation, of which as at each of March 31, 2006 and December 31, 2005, only Series II Preference Shares are outstanding;

"Publishing" means Hollinger International Publishing Inc., a wholly owned subsidiary of Sun-Times;

"Radler" means F. David Radler;

"Rattee" means David A. Rattee;

"Ravelston Entities" means RCL and associated parties other than the Corporation and its subsidiaries;

"Ravelston Litigation Milestone" means the milestones under the Advisory Agreement relating to certain of the Corporation's claims against the Corporation's past and current direct and indirect shareholders, and certain past directors, officers, employees and related parties, including certain of the Ravelston Entities, in respect of which the Corporation has commenced a legal proceeding;

"Ravelston Milestone Fees" means fees in relation to the achievement of the Ravelston Receivable Milestone and the Ravelston Litigation Milestone under the Advisory Agreement;

"Ravelston Receivable Milestone" means the milestones under the Advisory Agreement relating to certain amounts payable to the Corporation by the Ravelston Entities;

"RCL" means The Ravelston Corporation Limited, a corporation existing under the laws of the Province of Ontario;

"Receivership and CCAA Orders" means the orders issued by Justice James Farley of the Ontario Court on April 20, 2005 whereby RCL and RMI were (i) placed in receivership pursuant to the Courts of Justice Act (Ontario) and (ii) granted protection pursuant to the CCAA and the Bankruptcy and Insolvency Act (Canada);

"Restructuring Agreement" means the agreement between Sun-Times and Black dated November 15, 2003 providing for, among other things, restitution by the Corporation, Black, Radler, Boultbee and Atkinson to Sun-Times of the full amount of the unauthorized "non-competition" payments, plus interest and termination of the Services Agreements;

"Richter" means RSM Richter Inc., in its capacity as receiver and manager of RCL and RMI under the Receivership and CCAA Orders;

"RMI" means Ravelston Management Inc., a corporation existing under the laws of the Province of Ontario and a wholly owned subsidiary of RCL;

"SEC" means the United States Securities and Exchange Commission;

"SEC Action" means the action filed on November 15, 2004 by the SEC in the United States District for the Northern District of Illinois against Black, Radler and the Corporation;

"Second Indenture" means the indenture governing the Second Senior Secured Notes dated as of September 30, 2004 between the Corporation, as issuer, HSBC Bank USA, National Association, as trustee, RMI and 4322525 Canada Inc. (formerly 504468 N.B. Inc.), as guarantors, and RCL and Sugra Limited, as amended, amended and restated, supplemented or otherwise modified from time to time;

"Second Senior Secured Notes" means the Corporation's 11.875% senior secured notes due March 1, 2011 issued pursuant to the Second Indenture on September 30, 2004;

"SEDAR" means the System for Electronic Document Analysis and Retrieval;

"Senior Secured Notes" means, collectively, the First Senior Secured Notes and the Second Senior Secured Notes;

"Series I Preference Shares" means the exchangeable non-voting preference shares series I of the Corporation, none of which are outstanding as of the date hereof;

"Series II Preference Shares" means the exchangeable non-voting preference shares series II of the Corporation;

"Series III Preference Shares" means the non-voting preference shares series III of the Corporation, none of which are outstanding as of the date hereof;

"Services Agreements" means the management services agreements entered into between RCL and Sun-Times and its subsidiaries that were transferred to RMI in July 2002 and terminated pursuant to the Restructuring Agreement as of June 1, 2004;

"Special Monitor" means Richard C. Breeden, the special monitor of the Sun-Times Board appointed in certain circumstances pursuant to the Sun-Times Consent Order;

"Strategic Process" means the process adopted by the Sun-Times Board on or about November 15, 2003 involving the consideration and assessment of a range of alternative strategic transactions;

"Subscription Receipts" means the subscription receipts offered and sold by the Corporation on April 7, 2004;

"Sun-Times" means Sun-Times Media Group, Inc. (formerly Hollinger International Inc.), a corporation existing under the laws of the State of Delaware;

"Sun-Times 2004 SEC Action" means the matter of the United States Securities and Exchange Commission v. Hollinger International Inc. brought in the U.S. District Court for the Northern District of Illinois;

"Sun-Times A Shares" means the Class A Common Stock of Sun-Times;

"Sun-Times Audit Committee" means the audit committee of Sun-Times;

"Sun-Times B Shares" means the Class B Common Stock of Sun-Times;

"Sun-Times Board" means the board of directors of Sun-Times;

"Sun-Times Consent Order" means the Court Order issued January 16, 2004 by the United States District Court for the Northern District of Illinois in the January 2004 SEC Action;

"Sun-Times Executive Committee" means the executive committee of the Sun-Times Board;

"Sun-Times News Group" means the Sun-Times News Group operating segment of Sun-Times, consisting of more than 100 newspapers and associated websites and news products in the greater Chicago metropolitan area;

"Sun-Times Special Committee" means the special committee established by the Sun-Times Board in June 2003;

"Sun-Times SRP" means the shareholders' rights plan adopted by Sun-Times on January 25, 2004;

"Sun-Times SRP Right" means a preferred share purchase right issued pursuant to the Sun-Times SRP;

"Support Agreement" means the support agreement entered into in March 2003 between RMI and the Corporation in connection with the Corporation's issuance of the First Senior Secured Notes;

"Tax Act" means the Income Tax Act (Canada), including all regulations made thereunder, and all amendments to such statute and regulations from time to time;

"Telegraph Group" means the Telegraph Group Limited, which consisted of The Daily Telegraph, The Sunday Telegraph, The Weekly Telegraph, telegraph.co.uk and The Spectator and Apollo magazines;

"TSI" means 10 Toronto Street Inc., a wholly owned indirect subsidiary of the Corporation;

"TSX" means the Toronto Stock Exchange;

"US$" means United States dollars;

"Vale" means Donald M.J. Vale;

"VC&Co." means VC & Co. Incorporated, a corporation controlled by Voorheis;

"Voorheis" means G. Wesley Voorheis;

"Voorheis Engagement Agreement" means the agreement dated January 15, 2007 between the Corporation, VC&Co. and Voorheis, pursuant to which Voorheis agreed to act as a senior executive of the Corporation subject to the satisfaction of certain conditions;

"Wakefield" means Allan Wakefield;

"Walker" means Gordon W. Walker, Q.C.;

"White" means Peter G. White;

"Wright" means Joseph H. Wright; and

"Zeifman" or the "Auditors" means Zeifman & Company, LLP, the auditors of the Corporation.

CORPORATE STRUCTURE

Name and Incorporation

Hollinger is the continuing corporation, under the CBCA, resulting from the 1985 amalgamation of Argent Holdings Inc., Hollinger Argus Limited (incorporated June 28, 1910) and Labmin Resources Limited. The head and registered office of the Corporation is 10 Toronto Street, Toronto, Ontario M5C 2B7. The Corporation is a "mutual fund corporation" under the Tax Act.

Intercorporate Relationships

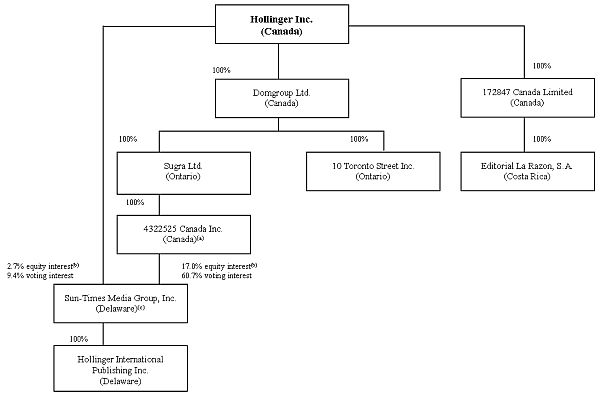

The following simplified chart shows the basic corporate structure of the Corporation and its subsidiaries and operating segments, their jurisdictions of incorporation and the percentage of voting securities beneficially owned, or over which control or direction is exercised, by the Corporation as at December 31, 2006.

Notes:

| (a) | 4322525 Canada Inc. was formerly 504468 N.B. Inc. |

| (b) | The Corporation owns in the aggregate, directly and indirectly, shares of Sun-Times that represent an approximate equity interest of 19.7% and a voting interest of 70.1%. |

| (c) | The total number of Sun-Times A Shares and Sun-Times B Shares owned directly and indirectly by the Corporation has not changed since December 31, 2005. As at December 31, 2005 (prior to the buyback of shares by Sun-Times through its common stock repurchase program, which came into effect on March 15, 2006), the Corporation owned shares of Sun-Times that represented an approximate 17.4% equity interest and 66.8% voting interest in Sun-Times. |

Capital Structure

The authorized capital of the Corporation consists of an unlimited number of Common Shares and an unlimited number of Preference Shares, issuable in series. As of each of December 31, 2006, March 31, 2006 and December 31, 2005, 34,945,776 Common Shares and 1,701,995 Series II Preference Shares were issued and outstanding.

Each of the outstanding shares of the Corporation is retractable at the option of the holder. The outstanding Common Shares and Series II Preference Shares are listed on the TSX under the symbols "HLG.C" and "HLG.PR.B", respectively.

The Common Shares are retractable, at the option of the holder, for an amount based on the market value of the Corporation's net assets, determined on a non-consolidated basis. The Corporation's Series II Preference Shares are retractable at the option of the holder, for an amount based on the market trading value of Sun-Times A Shares.

On retraction, each Series II Preference Share is exchangeable into 0.46 of a Sun-Times A Share held by the Corporation or, at the Corporation's option, cash of equivalent value. In certain circumstances, the Corporation may also satisfy its obligation to deliver Sun-Times A Shares on a retraction of Series II Preference Shares by delivering Sun-Times A Shares that are subject to restrictions on resale in accordance with applicable securities laws.

Until certain events of default under the Indentures are remedied or waived, the terms of the Indentures prevent the Corporation from honouring retractions of the Common Shares and the Series II Preference Shares. See "– Senior Secured Notes".

Senior Secured Notes

The Corporation has outstanding US$78 million principal amount of the First Senior Secured Notes and US$15 million principal amount of the Second Senior Secured Notes. The Senior Secured Notes are fully and unconditionally guaranteed by RMI and certain wholly owned subsidiaries of the Corporation. The First Senior Secured Notes are secured by, among other things, a first priority lien on the 14,990,000 Sun-Times B Shares owned, directly or indirectly, by the Corporation. The Second Senior Secured Notes are secured by a second priority lien on the same 14,990,000 Sun-Times B Shares. Under the terms of the Indentures, the Corporation is subject to certain financial covenants and other restrictions.

Under the terms of the Indentures, the Corporation was required to cause an exchange offer registration statement to be declared effective with the SEC under the United StatesSecurities Act of 1933, as amended, within a certain period of time. As a result of this registration default, the annual interest rate on the Senior Secured Notes increased by 0.5% to 12⅜% from November 4, 2003. The annual interest rate increased by an additional 0.5% on February 2, 2004, resulting in the maximum additional interest rate of 1.0% per year over the 11⅞% interest rate on the Senior Secured Notes until such time as the registration default is cured, whereupon the interest rate would revert to the original level. The registration of the securities has not been and is not being sought by the Corporation.

As a result of the Corporation's inability to file its financial statements as at and for the year ended December 31, 2003 with Canadian securities regulatory authorities, and its inability to file its 2003 Form 20-F with the SEC within the required time period, subsequent to June 30, 2004, the Corporation was not in compliance with its obligations to deliver to relevant parties such documents as required under the Indentures. This non-compliance led to a default under the Indentures. However on September 30, 2004, the Corporation sought and obtained a waiver with respect to this event of default. At such time, the Corporation also sought and obtained consent for a temporary suspension of the Corporation's obligation under the Indentures to furnish relevant parties with periodic and other reports under applicable U.S. federal securities laws until January 1, 2006. A consent fee equal to 3.5% of the US$78 million of the First Senior Secured Notes outstanding at that time or $3.5 million (US$2.7 million) was paid. As a result of the Corporation's inability to file its financial statements by such date, the Corporation was required to pay a penalty in an amount equal to 0.50% of the principal amount of the Senior Secured Notes outstanding as of December 31, 2005 to the trustees under the Indentures.

As a result of the commencement of insolvency proceedings by RMI, a guarantor of the Senior Secured Notes, an event of default occurred under the terms of the Indentures. As a result, the relevant trustee under the Indentures or the holders of at least 25% of the outstanding principal amount of the Senior Secured Notes have the right to accelerate the maturity of the Senior Secured Notes. Until such event of default is remedied or a waiver is provided by holders of the Senior Secured Notes, the terms of each Indenture also prevent the Corporation from honouring retractions of its Common Shares and Series II Preference Shares submitted after April 19, 2005. As of December 31, 2006, March 31, 2006 and December 31, 2005, there were retraction notices, net of subsequent withdrawals and cancellations, from holders of 153,846 Common Shares at a retraction price of $9.00 per share and 211 Common Shares at a retraction price of $7.25 per share, which are unable to be completed at the present time.

The Corporation did not receive the minimum aggregate cash payments from RMI, Sun-Times and its subsidiaries as required under the terms of the Indentures in the 2006 Financial Year. As a result, in addition to the continuing defaults and events of default referred to above, another event of default under the Senior Secured Notes has occurred.

On each of September 1, 2006 and March 1, 2007, the Corporation paid US$6.0 million to holders of Senior Secured Notes in respect of its semi-annual interest payment obligations. While there are certain continuing defaults under the Senior Secured Notes, there are no payment defaults.

At the close of business on March 1, 2007, the closing trading price of the Sun-Times A Shares was US$5.41. Based on this trading price, the market value of the Corporation's holdings in Sun-Times was approximately $85.3 million. As of March 1, 2007, there was approximately US$81.1 million aggregate collateral securing the US$78 million principal amount of the First Senior Secured Notes and the US$15 million principal amount of the Second Senior Secured Notes outstanding.

Ownership of Securities of the Corporation

As of December 31, 2006, none of the directors and executive officers of the Corporation, or, to the knowledge of the Corporation or such directors and executive officers, after reasonable enquiry, (i) their respective associates, (ii) any person or company holding more than 10% of any class of equity securities of the Corporation, or (iii) any person or company acting jointly or in concert with the Corporation, beneficially owns, directly or indirectly, or controls or exercises direction over, any securities of the Corporation or its subsidiaries, except for:

| (a) | RCL, which beneficially owns, directly or indirectly, or exercises control or direction over, a total of 27,363,170 Common Shares or approximately 78.3% of the issued and outstanding Common Shares and a total of 66,377 Series II Preference Shares or approximately 3.9% of the issued and outstanding Series II Preference Shares.1 RCL is currently in receivership and under the control and direction of Richter in accordance with the Receivership and CCAA Orders. Richter therefore exercises control or direction over approximately 78.3% of the outstanding Common Shares; |

| (b) | Catalyst, which beneficially owns, directly or indirectly, or exercises control or direction over, a total of 882,323 Common Shares or approximately 2.5% of the issued and outstanding Common Shares, a total of 1,398,000 Series II Preference Shares or approximately 80% of the issued and outstanding Series II Preference Shares and 585 Sun-Times A Shares or less than 0.1% of the issued and outstanding Sun-Times A Shares;2 |

| (c) | VC&Co., a corporation controlled by Voorheis, which beneficially owns a total of 1,000 Common Shares or less than 0.1% of the issued and outstanding Common Shares; |

| (d) | Hodgson, who beneficially owns a total of 118,100 Common Shares or approximately 0.3% of the issued and outstanding Common Shares; and |

| (e) | Beck, who beneficially owns a total of 3,525.67 Sun-Times A Shares or less than 0.1% of the issued and outstanding Sun-Times A Shares. |

Management and Insider Cease Trade Orders

On May 18, 2004, as a result of the inability of the Corporation to file financial statements on a timely basis as required under the OSA, the OSC issued a temporary cease trade order that prohibited certain then current and former directors, officers and insiders of the Corporation from trading in securities of the Corporation, subject to certain exceptions. On June 1, 2004, the OSC issued the MCTO. The MCTO was subsequently varied on March 8, 2005, August 10, 2005 and April 28, 2006. The April 28, 2006 variation added the then current directors and officers of the Corporation to the list of persons subject to the MCTO. The MCTO currently remains in effect. In order to have the MCTO revoked, the Corporation must make an application to the OSC. The Corporation intends to make such an application following the filing of this AIF and certain of its other continuous disclosure documents on SEDAR.

1. | RCL's ownership of Common Shares and Series II Preference Shares, expressed in each case as a number and as a percentage of the total outstanding number, was the same as at each of March 31, 2006 and December 31, 2005. |

2. | Catalyst's ownership of Common Shares, Series II Preference Shares and Sun-Times A Shares, expressed in each case as a number and as a percentage of the total outstanding number, was the same as at each of March 31, 2006 and December 31, 2005. |

Certain related orders were also issued by the Securities Commissions of British Columbia and Alberta. See "General Development of the Corporation and its Business − Management and Insider Cease Trade Orders".

Sun-Times' Shareholders' Rights Plan

On January 25, 2004, Sun-Times adopted the Sun-Times SRP. The Sun-Times SRP is an anti-takeover device designed to deter direct or indirect acquisitions of Sun-Times stock beyond a specified percentage voting interest (in this case, 20%) without the approval of the Sun-Times Board. See "General Development of the Corporation and Its Business – Sun-Times' Shareholders' Rights Plan".

Under the Sun-Times SRP, each Sun-Times shareholder holds a right, initially stapled to the Sun-Times A Shares and Sun-Times B Shares, that becomes exercisable only in certain circumstances. If a person becomes the "Beneficial Owner" of a 20% voting interest, that person becomes an "Acquiring Person" and the rights cease to be stapled and become exercisable. Every shareholder, other than the Acquiring Person and its "Affiliates" and "Associates", then becomes entitled to purchase, for each right, $50 worth of Sun-Times A Shares at 50% of the then prevailing market value. The Acquiring Person's rights, together with those held by any Affiliate or Associate of the Acquiring Person, are voided so it cannot purchase discount stock with the result that it suffers massive dilution.

When the Sun-Times SRP was adopted, the Corporation, as the holder of more than a 20% voting interest, was excluded from the definition of "Acquiring Person" so that it would not immediately trigger the Sun-Times SRP and suffer dilution. When Richter became the receiver for RCL and RMI, the Sun-Times SRP was amended to exclude Richter from the definition of "Acquiring Person" as well, subject to certain conditions.

Although it is currently exempt from the definition of an "Acquiring Person", the Corporation will become an "Acquiring Person" if:

| (a) | the Corporation ceases to be a subsidiary of RCL; |

| (b) | Richter or the Corporation purchases or otherwise becomes the beneficial owner of any additional shares of Sun-Times; or |

| (c) | Richter ceases to be the receiver for RCL. |

If, as a result of the sale by Richter, as receiver for RCL, of the Common Shares or the issuance of additional shares by the Corporation, RCL were to cease to own a majority of the voting power of the Corporation, the Corporation would become an Acquiring Person, thereby triggering the Sun-Times SRP and its dilutive effect.

Under the Sun-Times SRP, ownership of shares of the Corporation can constitute deemed beneficial ownership of Sun-Times shares and thereby trigger the Sun-Times SRP. This occurs in circumstances in which the Corporation becomes an Affiliate or Associate of one of its shareholders. Determining whether someone has become an Acquiring Person requires the aggregation of the holdings of that person with its Affiliates and Associates. By virtue of the size of the Corporation's holdings in Sun-Times, if anyone became an Affiliate or Associate of the Corporation, that person would automatically become an Acquiring Person under the Sun-Times SRP. However, the Sun-Times SRP has a proviso to the definition of "Beneficial Ownership" that effectively limits deemed beneficial ownership in the case of "non-controlled" Affiliates and Associates.

GENERAL DEVELOPMENT OF THE CORPORATION AND ITS BUSINESS

Overview

The Corporation is a holding company whose principal asset is its equity and voting interest in Sun-Times, a newspaper publisher formerly known as Hollinger International Inc., the assets of which include the Chicago Sun-Times, a large number of community newspapers in the Chicago area and a portfolio of news media investments. The Corporation also owns a portfolio of commercial real estate in Canada, from which property sales have contributed to the Corporation's earnings and cash flow. As of December 31, 2006, the Corporation had sold, or had entered into agreements to sell, properties comprising a significant portion of this commercial real estate portfolio. As of December 31, 2006, the Corporation owned, directly or indirectly, 782,923 Sun-Times A Shares and 14,990,000 Sun-Times B Shares, being approximately 19.7% of the equity and 70.1% of the voting interest in Sun-Times.3

All of the Corporation's Sun-Times A Shares are held in escrow in support of future retractions of its Series II Preference Shares. All of the Corporation's Sun-Times B Shares are pledged as security in connection with the Senior Secured Notes.

In its financial statements in respect of periods ending on or before September 30, 2003, the Corporation accounted for its investment in Sun-Times using the consolidation method, as it exercised "control" over Sun-Times, as that term is defined in the CICA Handbook. The business and affairs of the Corporation, Sun-Times and their respective subsidiaries were predicated on the fact that, as the majority shareholder of Sun-Times, the Corporation controlled Sun-Times in that it managed, or supervised the management of, the business and affairs of Sun-Times. However, during and following November 2003, certain events occurred that caused the Corporation to experience a Loss of Control over Sun-Times.

The following is a chronological summary of recent events that have influenced the general development of the business of the Corporation.

Support Agreement and First Senior Secured Notes

On March 10, 2003, the Corporation issued US$120 million aggregate principal amount of First Senior Secured Notes, which were secured by, among other things, a first priority lien on the Sun-Times B Shares owned, directly or indirectly, by the Corporation. The net proceeds totalled approximately US$114 million, before expenses. The proceeds were used by the Corporation as to US$94.3 million to repay indebtedness owed to its banks and to RCL, and as to US$11.5 million to advance a subordinated loan to RCL, which has since been repaid, and the balance was used for general corporate purposes. On the date of issue by the Corporation of the First Senior Secured Notes, RMI entered into the Support Agreement under which RMI agreed to make annual support payments in cash to the Corporation on a periodic basis by way of contributions to the capital of the Corporation or subordinated debt. The Corporation, RMI and RCL also entered into the Contribution Agreement. Under the Contribution Agreement, RCL unconditionally guaranteed RMI's obligations under the Support Agreement, with such guarantee supported by a pledge of RCL's shares of RMI. The amount of the annual support payments is equal to the greater of (a) the non-consolidated negative net cash flow of the Corporation (which does not extend to outlays for retractions and redemptions in respect of the share capital of the Corporation), or (b) US$14 million per year (less any future payments of services agreement fees directly to the Corporation, and any excess in the net dividend amount received by the Corporation on the shares of Sun-Times that is over $4.7 million per year), in either case, as reduced by any permanent repayment of debt owing by RCL to the Corporation. The Support Agreement terminates upon the repayment in full of the Senior Secured Notes.

3 | The total number of Sun-Times A Shares and Sun-Times B Shares owned directly and indirectly by the Corporation has not changed since December 31, 2005. As at each of March 31, 2006 and December 31, 2005, the Corporation owned approximately 17.4% of the equity and 66.8% of the voting interest in Sun-Times. |

RCL and RMI have defaulted on their obligations under the Support Agreement. No payments have been made by RCL or RMI under the Support Agreement since March 2004.

Events Leading to Loss of Control Over Sun-Times

Prior to May 2003, the Sun-Times Board was composed of five inside directors (Black, Amiel-Black, Radler, Colson and Atkinson) and eight outside directors (Richard Burt, Henry Kissinger, Marie-Josée Kravis, Shmuel Meitar, Richard N. Perle, Alfred Taubman, James R. Thompson and Leslie H. Wexner).

In May 2003, Tweedy, Browne Company, LLC, a shareholder of Sun-Times, demanded that the Sun-Times Board undertake an investigation with respect to certain allegations regarding related party transactions. In the same month, three of the outside directors did not stand for re-election and an additional outside director, Gordon Paris, was appointed to the Sun-Times Board, resulting in a total of six remaining outside directors.

In June 2003, the Sun-Times Board established the Sun-Times Special Committee to examine shareholders' allegations and appointed Paris to be its Chair. In July of 2003, two additional outside directors, Graham Savage and Raymond Seitz, were appointed to the Sun-Times Board and made members of the Sun-Times Special Committee.

In early November 2003, the Sun-Times Special Committee reported the preliminary results of its investigation to the Sun-Times Board. The Sun-Times Special Committee determined that approximately US$32.15 million in unauthorized payments had been made by Sun-Times to related parties who included Black, Radler, Atkinson and Boultbee. As a consequence of these investigations, the Sun-Times Special Committee took steps to secure Sun-Times' ability to act autonomously and independently. Sun-Times made a number of demands of Black which led to the Restructuring Agreement pursuant to which Black agreed, in his capacity as Chairman of Sun-Times, that he would devote his principal time and energy to pursuing the Strategic Process. As well, Black agreed, in his capacity as the majority indirect stockholder of the Corporation, that he would not support a transaction involving ownership interests in the Corporation if such transaction would negatively affect Sun-Times' ability to consummate a transaction resulting from the Strategic Process unless it was necessary to enable the Corporation to avoid a material default or insolvency. Black also agreed that a number of personnel changes would be made at Sun-Times, including the resignation of a number of the Corporation's nominees from the Sun-Times Board.

On November 17, 2003, Black resigned as Sun-Times' Chief Executive Officer. At the same time, Radler resigned as President and Chief Operating Officer and as a director of Sun-Times and Atkinson resigned as a director of Sun-Times. In addition, Kipnis resigned as Sun-Times' Vice-President and Corporate Counsel and Boultbee was terminated from his position as Executive Vice-President of Sun-Times. Black, Radler, Atkinson and Boultbee were all nominees of the Corporation at that time.

On the same day, Sun-Times announced the Restructuring Agreement pursuant to which it terminated each of the Services Agreements, effective June 1, 2004. Subsequent to December 2003, Sun-Times ceased to make any payments to RMI under the Services Agreements. This termination had an impact on RMI's ability to make its required payments to the Corporation under the Support Agreement. Among other things, the failure of RMI to make the cash payments to the Corporation as required under the Support Agreement resulted in the Corporation being in default under the terms governing the Senior Secured Notes.

Sun-Times also announced on November 17, 2003 that the Sun-Times Board had retained a financial advisor to review and evaluate the Strategic Process. The Strategic Process was to be under the direction of the newly reconstituted five member Sun-Times Executive Committee, of which only one member, Black, was a nominee of the Corporation to the Sun-Times Board.

As a result of the foregoing, by the end of November 2003, the Corporation had experienced a Loss of Control over Sun-Times. Since then, without any input from the Corporation, the Sun-Times Board has approved the disposition of several of Sun-Times' material assets, including the Telegraph Group in July 2004, The Jerusalem Post and its related publications in December 2004 and certain Canadian newspaper operations in December 2005.

On December 23, 2003, KPMG Canada resigned as the auditors of the Corporation.

Appointment of Special Monitor

On January 16, 2004, the Sun-Times Consent Order was issued in connection with the January 2004 SEC Action. The Sun-Times Consent Order provided that, among other things, the Special Monitor would be appointed to oversee the activities of the Sun-Times Board in certain circumstances, including in the event that any of the Corporation's nominees were elected to the Sun-Times Board without its endorsement. The Special Monitor's mandate would be to, among other things, protect the interests of the non-controlling shareholders of Sun-Times to the extent permitted by law. See "Legal Proceedings – United States Securities and Exchange Commission v. Hollinger International Inc."

U.S. Action by Sun-Times Against the Corporation

On or about January 16, 2004, Sun-Times filed a civil complaint in the United States District Court for the Northern District of Illinois asserting breach of fiduciary duty and other claims against the Corporation, RCL, RMI, Black, Radler and Boultbee, which complaint was amended on May 7, 2004, and again on October 29, 2004. The second amended complaint, in which Amiel-Black, Colson and Perle were also named as defendants, seeks to recover approximately US$542 million in damages, including prejudgment interest of approximately US$117 million, and punitive damages. See "Legal Proceedings – Hollinger International Inc. v. Hollinger Inc. et al."

Resignation of Black as Chairman of the Board of Sun-Times

On January 17, 2004, Black resigned as Chairman of the Sun-Times Board.

Proposed Sale to Press Holdings International Limited

On January 18, 2004, Black and RCL entered into an agreement with PHIL whereby Black, RCL and related parties agreed to sell their shares in the Corporation to PHIL. The following related events subsequently transpired:

| (a) | On January 20, 2004, the Sun-Times Board adopted resolutions creating the CRC. The CRC was composed of all of the members of the Sun-Times Board except the nominees of the Corporation. The CRC was delegated, essentially, all of the strategic powers of the Sun-Times Board. |

| (b) | On January 23, 2004, the Corporation purported to amend the by-laws of Sun-Times to, among other things, disband the CRC and protect its interests as the majority voting shareholder of Sun-Times. |

| (c) | On January 25, 2004, notwithstanding the amendments to the by-laws, the CRC caused Sun-Times to adopt the Sun-Times SRP (see "Corporate Structure – Sun-Times' Shareholders' Rights Plan") which, among other things, effectively prevented Black and RCL from agreeing to sell their shares in the Corporation to PHIL but deferred the implementation of the Sun-Times SRP until a court of competent jurisdiction could determine whether the CRC remained a valid committee of the Sun-Times Board and had the power to adopt the Sun-Times SRP. |

| (d) | On January 26, 2004, Sun-Times commenced an action against the Corporation and others in the Court of Chancery of the State of Delaware. By an Order and Judgment entered on March 4, 2004, Vice-Chancellor Strine ruled in favour of Sun-Times and held, among other things, that the by-law amendments referred to above were ineffective, that the CRC was duly constituted, that the Sun-Times SRP was permissibly adopted and that the Corporation and others be enjoined from taking any steps to pursue or consummate the sale of the Corporation's shares to PHIL or any other transaction which would frustrate the Strategic Process. |

Sun-Times' Shareholders' Rights Plan

Under the Sun-Times SRP, on February 27, 2004, Sun-Times paid a dividend of one Sun-Times SRP Right for each Sun-Times A Share and Sun-Times B Share held of record at the close of business on February 5, 2004. See "Corporate Structure – Sun-Times' Shareholders' Rights Plan".

As a result of the Receivership and CCAA Orders issued on April 20, 2005 (see "– Receivership of RCL and RMI"), on May 10, 2005, the CRC amended the Sun-Times SRP to include Richter as an "exempt stockholder" for purposes of the Sun-Times SRP.

The Sun-Times SRP provides that on or before January 25, 2005, the Sun-Times Special Committee (or, subject to certain qualifications, any other committee of independent directors of the Sun-Times Board) would re-evaluate the Sun-Times SRP to determine whether it remained in the best interests of Sun-Times' shareholders and whether to recommend amendments to its terms, or redemption of the Sun-Times SRP Rights. On January 27, 2005, the Sun-Times Special Committee reaffirmed the Sun-Times SRP following the re-evaluation and it remains in effect. Unless earlier redeemed, the Sun-Times SRP will expire on January 25, 2014.

U.S. Class Actions Against the Corporation and Others

In February and April 2004, shareholders of Sun-Times initiated three separate class action suits in the United States District Court for the Northern District of Illinois against Black, various entities controlled directly or indirectly by Black, including the Corporation, Sun-Times, RCL and certain affiliated entities, and others. See "Legal Proceedings – Class Actions Initiated Against the Corporation".

Sun-Times Claim for Books and Records

On February 10, 2004, Sun-Times commenced an action in the Ontario Court against the Corporation, RCL and RMI for access to and possession of all of Sun-Times' property, including books and records, in possession of the Corporation, RCL and RMI and located at 10 Toronto Street, Toronto, Ontario. On March 25, 2004, the parties negotiated and executed a protocol providing for access and possession by Sun-Times to the claimed property.

Counterclaim by the Corporation Against Sun-Times

On March 10, 2004, the Corporation filed a statement of defense and counterclaim against Sun-Times seeking $300 million in respect of Sun-Times' refusal to pay its obligations under its services agreement with RCL. This litigation was stayed in August 2004 pending a final resolution of the proceedings in Illinois and Delaware. See "Legal Proceedings – Hollinger International Inc. v. RCL, RMI and Hollinger Inc."

Refusal of Sun-Times to Co-operate with the Auditor

On March 12, 2004, the Corporation's new auditors, Zeifman, wrote to Sun-Times requesting co-operation by Sun-Times' management and by Sun-Times' auditors to the extent necessary to permit Zeifman to complete an audit of the Corporation. On March 19, 2004, Sun-Times replied to Zeifman essentially denying the co-operation of Sun-Times' management. Both KPMG Canada and KPMG USA also refused to allow Zeifman to rely on their past, and in the case of KPMG USA, present and future, audit work.

Loans to RCL by Domgroup

On March 23, 2004, in order to assist the Corporation in complying with the terms of the First Indenture and avoiding the potential acceleration of the First Senior Secured Notes upon the occurrence of an event of default under the First Indenture, Domgroup lent to RCL approximately $4.7 million, evidenced by a demand promissory note bearing interest at prime plus 4% per annum. As security therefor, RCL entered into a general security agreement in favour of Domgroup. All of the proceeds of the loan were immediately contributed by RCL to RMI as a capital contribution, and RMI immediately paid such proceeds to the Corporation as a contribution to the capital of the Corporation pursuant to the terms of the Support Agreement. On June 29, 2004 and August 27, 2004, similar loans were made by Domgroup to RCL in the principal amount of approximately $4.8 million and $5.2 million, respectively, for the same reason and used by RCL and RMI in the manner set forth above. The principal amount of those loans and accrued interest thereon remain outstanding. See "Interest of Management and others in Material Transactions".

A loan in the principal amount of $1.1 million was also made to RCL by Domgroup on June 30, 2004. The loan, together with interest at the prime rate plus 8% per annum, was repaid in full by RCL on September 29, 2004.

Continued Separation of the Corporation and Sun-Times

During the first quarter of 2004, Sun-Times commenced the process of providing for its own corporate accounting and reporting functions, including computerized consolidation systems, making such systems distinct and separate from those of the Corporation, RMI and RCL. This included hiring its own staff, leasing its own premises and making offers of employment to certain RMI employees. Sun-Times also commenced the process of discontinuing its previous practice of storing detailed financial information on systems shared with the Corporation and ceased sharing any financial information with the Corporation. During 2004, Sun-Times restricted direct access by the Corporation to the Corporation's systems, historical data and servers, a situation that was partially, but not satisfactorily, remedied in June 2005.

On March 24, 2004, Colson resigned as deputy chairman and chief executive officer of the Telegraph Group and as chief operating officer of Sun-Times, leaving no associates of Black remaining in the management of Sun-Times.

In March 2004, the Corporation commenced a pre-filing process with OSC staff indicating that it had experienced a Loss of Control over Sun-Times during 2003 and wished to explore possible accounting alternatives going forward.

Subscription Receipts and Redemption of Series III Preference Shares

On April 7, 2004, the Corporation offered and sold 20,096,919 subscription receipts (the "Subscription Receipts") at a price of $10.50 per Subscription Receipt for gross proceeds of approximately $211 million. Each Subscription Receipt represented the right to receive, without payment of any additional consideration, one Series II Preference Share upon satisfaction of a number of escrow release conditions. On June 8, 2004, 20,096,919 Series II Preference Shares were issued on exercise of the Subscription Receipts. On June 11, 2004, using net proceeds from the offering of Subscription Receipts, the Corporation redeemed US$42 million aggregate principal amount of the First Senior Secured Notes and redeemed all of the Corporation's previously outstanding Series III Preference Shares. As a result of the offering of Subscription Receipts, the Corporation's interest obligations on the First Senior Secured Notes was reduced, the Corporation's dividend obligations on the previously outstanding Series III Preference Shares ceased and there was a decrease in the dividends receivable by the Corporation on the Sun-Times A Shares held by it, directly or indirectly. The net effect of the foregoing was a reduction of the Corporation's annual non-consolidated negative net cash flow resulting in a reduction of the amounts payable by RMI pursuant to the Support Agreement (subject to the US$14 million minimum annual support payments).

Amendment to the Series II Preference Share Provisions

At a special meeting of shareholders held on May 27, 2004, the holders of the Series II Preference Shares approved, by special resolution, an amendment to the articles of the Corporation. The amendment related to provisions in the articles requiring the Corporation to deliver Sun-Times A Shares on a retraction of Series II Preference Shares. Prior to the amendment, the Corporation was required to take certain steps to ensure that such Sun-Times A Shares would not be subject to any resale restrictions. These steps included filing a prospectus, having a registration statement declared effective and listing such shares on one or more stock exchanges. The amendment approved on May 27, 2004 amended these provisions by providing that, in certain circumstances the Corporation may also satisfy its obligation to deliver Sun-Times A Shares on a retraction of Series II Preference Shares by delivering Sun-Times A Shares that are subject to restrictions on resale in accordance with applicable securities laws.

Management and Insider Cease Trade Orders

On May 18, 2004, as a result of the inability of the Corporation to file financial statements on a timely basis as required under the OSA, the OSC issued a temporary cease trade order that prohibited certain then current and former directors, officers and insiders of the Corporation from trading in securities of the Corporation, subject to certain exceptions. On June 1, 2004, the OSC issued the MCTO. The MCTO was subsequently varied on March 8, 2005, August 10, 2005 and April 28, 2006. The April 28, 2006 variation added the then current directors and officers of the Corporation to the list of persons subject to the MCTO. The MCTO currently remains in effect. In order to have the MCTO revoked, the Corporation must make an application to the OSC. The Corporation intends to make such an application following the filing of this AIF and certain of its other continuous disclosure documents on SEDAR.

On May 31, 2004, in coordination with the MCTO, and pursuant to the BCSA, the Executive Director of the British Columbia Securities Commission ordered that all trading by a then current insider of the Corporation in securities of the Corporation cease, subject to the exceptions noted in the MCTO, until the Corporation had filed all required records, completed in accordance with the BCSA, and the Executive Director made an order under the BCSA revoking the order.

On June 10, 2004, the Alberta Securities Commission issued an order prohibiting trading by a then current insider of the Corporation in securities of the Corporation. The order is to be in full effect until the earlier of two full business days following the date the Corporation files with the Executive Director of the Alberta Securities Commission its financial statements, as required by the ASA, or further order of the Alberta Securities Commission or until the order has been revoked.

The Delaware Order

Pursuant to the Delaware Order, the Corporation and Black were ordered to jointly pay to Sun-Times an aggregate of US$16.55 million on account of non-compete payments received by the Corporation in prior years, plus accrued interest of US$4.7 million. On July 16, 2004, Sun-Times was paid US$21.3 million pursuant to this order of which US$15.3 million was advanced by Black and US$6.0 million was advanced by the Corporation. The terms of the Corporation's obligation to make restitution to Black, if any, have not been resolved. The Corporation appealed the Delaware Order to the Delaware Supreme Court, but the appeal was denied on April 19, 2005.

Pursuant to the Delaware Order, on July 6, 2004, Black also repaid to Sun-Times US$8.75 million on account of non-compete payments received by him in prior years (inclusive of accrued interest). In 2004, Radler repaid to Sun-Times approximately US$9.3 million on account of non-compete payments received by him in prior years (inclusive of accrued interest). In 2004, Atkinson repaid to Sun-Times approximately US$2.8 million on account of non-compete payments received by him in prior years and payments under the incentive compensation plan of Hollinger Digital LLC (inclusive of accrued interest).

Trusts in Respect of Interim Directors and Certain Officers

Beginning in June 2004, the Corporation placed certain amounts in trust in support of the Corporation's indemnities in respect of the Interim Directors. On June 30, 2004, $500,000 was placed in trust. On February 7, 2005, an additional $1.5 million was placed in trust. On March 30, 2005, a further $6.0 million was deposited into the same trust account. Directors' and officers' liability insurance was subsequently obtained, effective July 1, 2005. There was no directors' and officers' liability insurance from July 2004 to the end of June 2005.

Under the terms of a settlement between the Corporation and the Interim Directors announced on February 26, 2007, these trusts were collapsed. An aggregate of $1.25 million was paid to the Interim Directors in full satisfaction of all of their claims against the Corporation. An additional $0.7 million was paid out of the trusts towards the legal fees and disbursements of the Interim Directors. The balance of approximately $6.0 million plus interest was returned to the Corporation. See "Legal Proceedings − Action Against Former Interim Directors".

On March 8, 2005, the Corporation agreed to establish a similar trust to that described above in support of the Corporation's indemnities in respect of two of its officers, with a deposit of $500,000. The deposit was made on July 7, 2005.

Trust Relating to Sale of 10 Toronto Street

On February 17, 2006, $750,000 was deposited in escrow with the law firm Davies Ward Phillips & Vineberg LLP in support of the obligations of TSI in connection with the sale of the real property located at 10 Toronto Street, Toronto, Ontario. It is anticipated that this escrow will terminate and the funds will be returned to TSI once the sale is completed in May 2007. See "− Sale of Real Property".

Sale of Telegraph Group by Sun-Times

On July 1, 2004, the Corporation filed a complaint in the Delaware Chancery Court seeking to have the court require that Sun-Times submit the sale of its U.K. assets (principally the Telegraph Group) to ratification by its shareholders. On July 29, 2004, the Delaware Chancery Court denied the Corporation's complaint. Sun-Times completed the sale of the Telegraph Group on July 30, 2004.

Inspection Order

On September 3, 2004, Justice Campbell of the Ontario Court ordered that an inspector conduct an investigation of the Corporation. On October 27, 2004, the Inspector was appointed pursuant to section 229(1) of the CBCA at the request of Catalyst. In making the appointment, Justice Campbell noted that the efforts of the Corporation had been neither sufficient nor timely in addressing the legitimate concerns raised by the public shareholders of the Corporation regarding related party transactions involving the Corporation, which at that time remained under the indirect control and direction of Black. The Inspector's mandate was to investigate and report to the Ontario Court upon the facts in relation to any "related party transaction" (as defined in the Ontario Court order granting the Inspection) between the Corporation (including any of its subsidiaries, other than Sun-Times or its subsidiaries), and a "related party" for the period from January 1, 1997 to the date of the order (October 14, 2004).

Saskatchewan and Ontario Class Actions

On September 7, 2004, a group of Sun-Times shareholders initiated class proceedings in Saskatchewan and Ontario. The Saskatchewan and Ontario claims are identical in all material respects. The defendants include Black, Sun-Times, certain current and former directors and officers of Sun-Times, the Corporation, RCL and certain affiliated entities and others. The representative plaintiffs allege, among other things, deceit, breach of fiduciary duty, unjust enrichment, misrepresentation and negligence, and seek unspecified monetary damages. A similar class action was subsequently filed in Quebec (see "− Quebec Class Action"). See also "Legal Proceedings – Class Actions Initiated Against the Corporation".

Second Senior Secured Notes

On September 30, 2004, the Corporation received consents from holders of a majority in aggregate principal amount of the outstanding First Senior Secured Notes approving a number of amendments to the First Indenture and the related security agreement. The amendments included a provision permitting the Corporation to incur indebtedness in an aggregate amount outstanding not to exceed US$15 million (and to grant a second priority security interest in the collateral supporting the First Senior Secured Notes in connection therewith) through the issuance of notes substantially similar to the First Senior Secured Notes pursuant to an indenture substantially similar to the First Indenture. The amendments further permitted the Corporation to direct the trustee of the First Senior Secured Notes to apply up to approximately US$10.5 million, held at that time as cash collateral under the First Indenture, to satisfy future interest payment obligations on the outstanding First Senior Secured Notes. On September 30, 2004, the Corporation also obtained a waiver from holders of a majority in aggregate principal amount of the outstanding First Senior Secured Notes in respect of any and all defaults or events of default under, and non-compliance with, certain covenants of the First Indenture. On such date, the Corporation entered into the Second Indenture and completed the closing of a private placement of US$15 million in aggregate principal amount of Second Senior Secured Notes at 100% of the face amount. The net proceeds from the sale of such Second Senior Secured Notes totalled approximately US$13.9 million, after deducting the expenses of the offering. The Second Senior Secured Notes are guaranteed by RMI and certain wholly owned subsidiaries of the Corporation. Currently, there is US$78 million principal amount of the First Senior Secured Notes and US$15 million principal amount of the Second Senior Secured Notes outstanding. The Senior Secured Notes are secured by, among other things, a second priority lien on the 14,990,000 Sun-Times B Shares owned, directly or indirectly, by the Corporation.

Until certain events of default are remedied or waived, the terms of the Indentures prevent the Corporation from honouring retractions of the Common Shares and the Series II Preference Shares. See "Corporate Structure – Senior Secured Notes".

Proposed Transaction

On October 28, 2004, the Board of Directors was advised by Black of a proposal by RCL for a going private transaction involving the Corporation. The proposed transaction would have been structured as a consolidation of the outstanding Common Shares and Series II Preference Shares of the Corporation. Upon completion of the proposed going private transaction, RCL would have controlled all of the Corporation's shares.

Resignation of Black and Removal of Directors

On November 2, 2004, Black resigned as a director and officer of the Corporation.

On November 14, 2004, Justice Campbell of the Ontario Court issued a decision in connection with an application commenced by Catalyst seeking an order to, among other things, remove all of the directors of the Corporation (except for Metcalfe and Wakefield) and to appoint replacement directors.

Justice Campbell ordered the removal of three directors, being Amiel-Black, Boultbee and Radler, effective November 14, 2004. Justice Campbell also ruled that there was no need at the time for any additional directors to be appointed. As a result, the Board of Directors was subsequently comprised of the following six persons: Metcalfe, Walker, Wakefield, Carroll, Vale and White.

SEC Action Against Black

On November 15, 2004, the SEC commenced the SEC Action alleging certain violations of U.S. securities laws. The SEC seeks declaratory and injunctive relief, disgorgement of amounts improperly paid to the defendants, a civil monetary penalty, an order barring Black and Radler from serving as an officer or director of any issuer required to file reports with the SEC, and a voting trust on Sun-Times shares held by Black and the Corporation. See "Legal Proceedings – United States Securities and Exchange Commission v. Conrad M. Black, et al."

Continued Failure of Sun-Times to Co-operate with the Corporation's Auditors

Through to the end of 2004, the Corporation continued discussions with Sun-Times in an attempt to reach an agreement regarding Sun-Times' co-operation with the Corporation and Zeifman to facilitate the preparation of the Corporation's audited financial statements, among other things. These discussions failed to result in any definitive agreement between the parties, as the terms upon which Sun-Times was prepared to offer its co-operation were insufficient to facilitate the preparation of the Corporation's audited financial statements.

Quebec Class Action

On February 3, 2005, substantially the same group of plaintiffs as in the Saskatchewan and Ontario claims (see "– Saskatchewan and Ontario Class Actions") initiated a class action in Quebec. The Quebec claim is substantially similar to the Saskatchewan and Ontario claims and the defendants are the same as in the other two proceedings. The plaintiffs allege, among other things, breach of fiduciary duty and breaches of obligations under the CBCA. See "Legal Proceedings – Class Actions Initiated Against the Corporation".

Unaudited Consolidated Balance Sheet

On March 4, 2005, the Corporation released the 2004 Unaudited Balance Sheet, together with notes thereto. The alternative financial information was prepared by the management of the Corporation at that time and was not audited or reviewed by the Corporation's auditors.

Proposed Meeting of Shareholders with Respect to the Proposed Transaction

On March 8, 2005, the Corporation announced that the Board of Directors had unanimously determined to call a special meeting of the Corporation's shareholders in connection with the proposed going private transaction originally announced on October 28, 2004. The Board had determined not to make a recommendation as to whether shareholders should accept or reject either the resolution effecting a consolidation of the outstanding Common Shares of the Corporation or the resolution effecting a consolidation of the outstanding Series II Preference Shares of the Corporation. The special meeting of shareholders was to be held on March 31, 2005.

OSC Notice of Hearing

On March 18, 2005, the OSC issued a Notice of Hearing and a Statement of Allegations in connection with the OSC Hearing to consider whether, pursuant to sections 127(1) and 127.1 of the OSA, it was in the public interest for the OSC to make certain orders in respect of the Corporation, Black, Radler, Boultbee and Atkinson.�� The Statement of Allegations included allegations relating to the failure by the Corporation to file (a) interim statements and MD&A related thereto for the three-month period ended March 31, 2004 and subsequent interim materials, and (b) annual financial statements and MD&A related thereto and its Annual Information Form for the year ended December 31, 2003, contrary to the requirements of Ontario securities law. The OSC hearing is presently scheduled for June 1, 2007.

OSC Denies Relief Necessary to Proceed with Proposed Transaction

On March 27, 2005, the OSC released its decision that it was unable to form the opinion that it would not be prejudicial to the public interest to allow the proposed going private transaction involving the Corporation to proceed.

In light of the decision of the OSC, the Board of Directors cancelled the special meeting of the Corporation's shareholders scheduled for March 31, 2005.

Action by the Corporation Against RCL, RMI, Moffatt Management Inc. et al.

On March 29, 2005, the Corporation and Domgroup issued a statement of claim in the Ontario Court against RCL, RMI, Moffatt Management Inc. and Black Amiel Management Inc., as well as Black, Radler, Boultbee and Atkinson. The claims made are for monetary damages from all defendants jointly and severally in the amount of $550 million, as well as reimbursement of certain amounts owing to the Corporation in the amount of approximately $86 million, plus accrued interest and costs. The monetary damages include management fees and non-competition payments paid to RCL and the individual defendants during a period since 1998, as well as reimbursement of fees and costs related to the Inspection and the Strategic Process.

This action was stayed as a result of the Receivership and CCAA Orders. The Corporation issued a further statement of claim against Black and other defendants on February 27, 2006. See "Legal Proceedings – Action by the Corporation Against RCL, RMI, Moffatt Management Inc. et al."

The Corporation Takes Steps to Seize Shares Held by RCL

On April 13, 2005 the Corporation took steps to seize shares held by RCL in the Corporation, Argus and other RCL-related companies. These shares are part of the collateral for debt in the amount of approximately $15 million owing by RCL to the Corporation, which debt was, and continues to be, in default. The collateral represents part of the direct and indirect control position held by RCL in the Corporation.

This action was stayed as a result of the Receivership and CCAA Orders. See "Legal Proceedings – RCL Receivership and CCAA Proceedings".

Receivership of RCL and RMI

On April 20, 2005, the Ontario Court issued the Receivership and CCAA Orders. At that time, Richter was appointed as receiver of all of the assets of RCL and RMI, except for certain shares of Sun-Times owned directly or indirectly by RCL that were excluded. The Receivership and CCAA Orders also provided, among other things, that until May 20, 2005 or such later date as the Ontario Court may order, no proceeding or enforcement process in any court or tribunal is to be commenced or continued against or in respect of either or both of RCL and RMI, and any such proceedings then under way (including the Corporation's lawsuit) pertaining to RCL and RMI were temporarily stayed. On January 12, 2007 the stay of proceedings was extended to June 8, 2007.

On May 18, 2005, the Receivership and CCAA Orders were extended to Argus and five of its subsidiaries, which collectively own, directly or indirectly, 61.8% of the outstanding Common Shares. Further, the Ontario Court approved the agreement between Sun-Times and Richter pursuant to which Sun-Times altered the Sun-Times SRP to exempt Richter from its provisions by making Richter an "exempt stockholder", the effect of which was to allow Richter to take control of the Sun-Times shares that had been excluded under the Receivership and CCAA Orders. The agreement further provided that Sun-Times would not object to the sale by Richter of a number of Common Shares in order to pay for the costs of the receivership. On June 12, 2006, the Ontario Court appointed Richter as manager and interim receiver of all the property, assets and undertaking of Argent News Inc., a wholly owned subsidiary of RCL.

On January 22, 2007, the Corporation and Domgroup served a motion seeking an order confirming the secured obligations owed by RCL to the Corporation and Domgroup and declaring that the applicable security agreements are valid, perfected and enforceable. In the motion, the Corporation and Domgroup claim that the secured obligations owing by RCL total more than $25 million. Sun-Times has served material seeking, among other things, to stay that motion.

On January 25, 2007, the Ontario Court commenced a hearing into a motion brought by Richter seeking approval of a plea agreement negotiated with the U.S. Attorney's Office in respect of indictments laid in the United States against RCL. The motion was supported by the Corporation and Sun-Times and was opposed by Black, Conrad Black Capital Corporation, White and PGWML.

On February 7, 2007, the Ontario Court granted Richter's motion and authorized Richter to enter into the plea agreement. Black, Conrad Black Capital Corporation, White and PGWML filed a notice of appeal with the Court of Appeal for Ontario appealing the decision. That appeal was heard on February 26, 2007 and on March 1, 2007, the Court of Appeal for Ontario issued a decision denying the appeal and upholding the decision of the Ontario Court. On March 5, 2007, the U.S. court accepted RCL's guilty plea in accordance with the plea agreement.

On February 15, 2007, the Ontario Court issued a decision permitting Richter to file a "payments report" once it is finalized. The payments report will report on and analyze the monies received by and distributions made by RCL during the period of January 3, 2002 to April 20, 2005, by RMI during the period of July 3, 2002 to April 20, 2005 and by Argus during the period of January 1, 1999 to April 30, 2005. On February 26, 2007, the Ontario Court of Appeal heard an appeal of this decision by Black and on March 1, 2007 it issued a decision denying the appeal and upholding the decision of the Ontario Court. See "Legal Proceedings – RCL Receivership and CCAA Proceedings".

Reconstitution of the Corporation's Board

On June 8, 2005, Justice Campbell of the Ontario Court ordered that White be removed as a director and officer of the Corporation effective immediately and that the Corporation was not required to indemnify White for his legal expenses with respect to the removal motion. The removal had been requested by the Interim Directors.

On June 29, 2005, Vale retired as a director of the Corporation. From November 24, 2004 until May 16, 2005, Vale had the title of President of the Corporation.

On July 8, 2005, Justice Campbell approved the Hollinger Consent Order reconstituting the Board of Directors. The Hollinger Consent Order provided for the removal of two (Carroll and Walker) of the then remaining four Interim Directors (Carroll, Metcalfe, Wakefield and Walker) and for the appointment of five new directors, provided that each such proposed director accepted his appointment. Later that month, the two remaining Interim Directors (Metcalfe and Wakefield) resigned from the Corporation's board of directors, and four new directors, namely Beck, Wright, Glassman and Benson, were appointed to the Corporation's Board of Directors. Benson was appointed as the Corporation's Chief Restructuring Officer. The four new directors, together with Drinkwater and Rattee, who were appointed in August 2005, formed a new Board of Directors.

Action Against Former Interim Directors

In October 2005, the Corporation sought to vary the Hollinger Consent Order made in respect of the Interim Directors that changed the composition of the Corporation's Board. The current Board questioned the compensation of the Interim Directors and the governance process used to approve such compensation.

On July 12, 2006, the Ontario Court ordered a trial of the issue to determine whether the Ontario Court should vary the Hollinger Consent Order made in respect of the Interim Directors. The Ontario Court ruled there will have to be a "factual determination of the fairness and reasonability" of the commitments that the Interim Directors made on behalf of the Corporation for their own benefit.

On February 9, 2007, the Corporation announced that four of the Interim Directors (Walker, Carroll, Metcalfe and Wakefield) had commenced an action against the Corporation in the Ontario Court claiming management and directors' fees, departure bonuses, and punitive damages.

On February 26, 2007, the Corporation announced it had entered into an agreement to settle all of its disputes with the Interim Directors. See "Legal Proceedings – Action Against Former Interim Directors".

Report of the Inspector

On November 14, 2005, the Inspector delivered its tenth report to Justice Campbell and the Corporation. The cost to the Corporation of the Inspection (including the costs associated with the Inspector and its legal counsel, as well as the Corporation's legal counsel) was in excess of $20.9 million.

Representation on the Sun-Times Board

At the Sun-Times shareholders' meeting held on January 24, 2006, the Corporation nominated two representatives, Beck and Benson, who were elected to the Sun-Times Board of nine directors. The Corporation's representatives were not endorsed by the Sun-Times Board and, as a result, in accordance with the Sun-Times Consent Order, the Special Monitor was appointed in January 2006. Beck and Benson were not appointed to any committees of the Sun-Times Board.

Resignation of Wright