SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to 240.14a-12 |

Aston Funds

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing party: |

| | (4) | | Date Filed: |

April 28, 2016

ASTON FUNDS

ASTON SMALL CAP FUND

(FORMERLY, ASTON/TAMRO SMALL CAP FUND)

Dear Valued Shareholder:

I am writing to you about two important proposals relating to ASTON Small Cap Fund (formerly, ASTON/TAMRO Small Cap Fund) (the “Fund”), a series of Aston Funds (“Aston Funds” or the “Trust”). This proxy statement asks you to consider and vote on the following two proposals: (1) to approve a new subadvisory agreement between Aston Asset Management, LLC and GW&K Investment Management, LLC (“GW&K”) with respect to the Fund and (2) to amend certain of the Fund’s “fundamental” investment restrictions. GW&K has been acting as the Fund’s subadvisor on an interim basis since February 1, 2016, when it replaced TAMRO Capital Partners LLC (“TAMRO”) as subadvisor to the Fund. Under applicable regulations, if shareholders do not approve the new subadvisory agreement with GW&K on or before June 30, 2016, GW&K may no longer be able to act as subadvisor to the Fund and the Board of Trustees may consider other alternatives for the Fund, including possible liquidation of the Fund. The fee paid to GW&K under the interim and new agreement is the same rate that was paid to TAMRO and is paid by the Fund’s investment adviser, and the approval of the new subadvisory agreement will not increase the management fee rate borne by Fund shareholders.

A special meeting of shareholders (the “Meeting”) of the Fund has been scheduled for June 3, 2016 to vote on these matters. If you are a shareholder of record of the Fund as of the close of business on April 21, 2016, you are entitled to vote at the Meeting and any adjournment(s) or postponement(s) of all or any portion of the Meeting, even if you no longer own your shares.

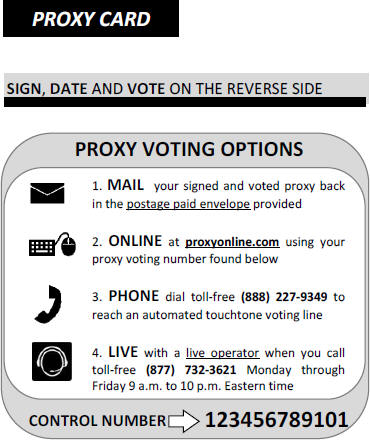

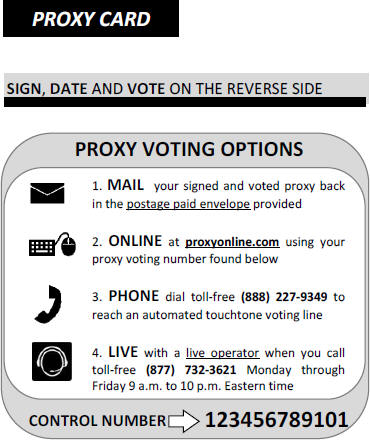

Pursuant to these materials, you are being asked to vote on the proposals, as noted above.For the reasons discussed in the enclosed materials, the Board of Trustees of Aston Funds recommends that you vote “FOR” both proposals. You can vote in one of four ways:

| | • | | Over the Internet, through the website listed on the proxy card, |

| | • | | By telephone, using the toll-free number listed on the proxy card, |

| | • | | By mail, using the enclosed proxy card — be sure to sign, date and return the proxy card in the enclosed postage-paid envelope, or |

| | • | | In person at the shareholder meeting on June 3, 2016. |

We encourage you to vote over the Internet or by telephone using the voting control number that appears on your proxy card.

Please take the time to carefully consider and vote on these important proposals. Please also read the enclosed information carefully before voting. If you have questions, please call D.F. King & Co., Inc., an ASTOne Company, the Fund’s proxy solicitor, toll-free at 1-877-732-3621.

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

|

| Sincerely, |

|

/s/ Jeffrey T. Cerutti |

| Jeffrey T. Cerutti |

| President |

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

QUESTIONS AND ANSWERS

The following “Questions and Answers” section is a summary and is not intended to be as detailed as the discussion found in the proxy statement to shareholders (“Proxy Statement”). For this reason, the information is qualified in its entirety by reference to the enclosed Proxy Statement.

| Q. | Why am I receiving this Proxy Statement? |

| A. | You are receiving these proxy materials — that include the Proxy Statement and your proxy card — because you have the right to vote on important proposals concerning ASTON Small Cap Fund (formerly, ASTON/TAMRO Small Cap Fund) (the “Fund”), a series of Aston Funds (“Aston Funds” or the “Trust”). The proposals are described below. |

| Q. | What are the proposals about? |

| A. | The Proxy Statement presents two proposals. |

Proposal 1

This proposal relates to a proposed new subadvisory agreement between Aston Asset Management, LLC (“Aston” or the “Investment Adviser”) and GW&K Investment Management, LLC (“GW&K”) with respect to the Fund. At an in-person meeting held on January 11, 2016, and based upon the recommendation of the Investment Adviser and other factors, the Trust’s Board of Trustees (the “Board”) terminated the subadvisory agreement with TAMRO Capital Partners LLC, the then-current subadvisor of the Fund (“TAMRO”), and approved the appointment of GW&K as the subadvisor to the Fund on an interim basis to replace TAMRO, with GW&K’s services beginning on February 1, 2016. GW&K was appointed interim subadvisor pursuant to an interim subadvisory agreement as permitted by Rule 15a-4 under the Investment Company Act of 1940, as amended (the “1940 Act”). At the in-person meeting held on January 11, 2016, the Board also approved the longer-term appointment of GW&K as the subadvisor to the Fund and the adoption of a new subadvisory agreement between the Investment Adviser and GW&K, subject to shareholder approval. In accordance with Rule 15a-4 under the 1940 Act, shareholders of the Fund must approve the new subadvisory agreement on or before June 30, 2016 in order for GW&K to serve as subadvisor to the Fund on an uninterrupted basis following that date.For the reasons discussed in the Proxy Statement, the Board recommends that you vote “FOR” this Proposal 1.

Proposal 2

This proposal relates to the proposed amendment of the fundamental investment restrictions of the Fund. The proposed changes are intended to update and standardize the Fund’s fundamental investment restrictions, while continuing to fully satisfy the requirements of the 1940 Act, and the rules and regulations thereunder. The proposed changes are designed to provide the Fund’s subadvisor and the Board increased flexibility to respond to market, industry and regulatory changes. There may be additional risks associated with such increased flexibility, as described in Proposal 2. Also, the proposed changes are intended to reduce administrative burdens and ongoing costs to the Trust, and the AMG Funds Family of Funds, a mutual fund complex comprised of 74 different funds, each having distinct investment management objectives, strategies, risks, and policies (the “AMG Funds Family of Funds”), more generally, by simplifying and making uniform the fundamental investment restrictions across most of the other funds in the AMG Funds Family of Funds. Furthermore, Aston has indicated that it has no current intention to change in any significant way the Fund’s investment strategies or the manner in which the Fund is managed if the proposal is approved.For the reasons discussed in the Proxy Statement, the Board recommends that you vote “FOR” this Proposal 2.

| A. | The enclosed proxy is being solicited for use at the special meeting of shareholders of the Fund to be held on June 3, 2016 (the “Meeting”) at 3:00 p.m. (Eastern Time) at the offices of AMG Funds LLC, located at 600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830, and, if the Meeting is adjourned or postponed, at any later meetings, for the purposes stated in the Notice of Special Meeting of Shareholders. |

i

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration,the Board unanimously recommends that you vote “FOR” both proposals. Please see the section of the Proxy Statement discussing each proposal for a discussion of the Board’s considerations in making such recommendation. |

| Q. | What vote is required to approve each proposal? |

| A. | Each proposal and sub-proposal must be approved by a “vote of a majority of the outstanding voting securities” of the Fund. The “vote of a majority of the outstanding voting securities” is defined in the 1940 Act as the lesser of the vote of (i) 67% or more of the voting securities of the Fund entitled to vote on the proposal present at the Meeting or represented by proxy, if more than 50% of the Fund’s outstanding voting securities are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund entitled to vote on the proposal. |

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the proposals can be acted upon. We encourage all shareholders to participate in the governance of their Fund. Additionally, you will help save the costs of any further solicitations by providing your immediate response on the enclosed proxy card, over the Internet or by telephone. |

| Q. | If I am a small investor, why should I vote? |

| A. | You should vote because every vote is important. If numerous shareholders just like you fail to vote, the Fund may not receive enough votes to go forward with the Meeting. If this happens, the Fund will need to solicit votes again. This may delay the Meeting and the approval of the proposals and generate unnecessary costs. |

| Q. | How do I place my vote? |

| A. | You may provide the Fund with your vote by mail using the enclosed proxy card, over the Internet by following the instructions on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person at the Meeting. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to utilize any of these voting methods. If you need more information on how to vote, or if you have any questions, please call D.F. King & Co., Inc., an ASTOne Company, the Fund’s proxy solicitor (“D.F. King”), toll-free at 1-877-732-3621. |

| Q. | Whom do I call if I have questions? |

| A. | We will be happy to answer your questions about this proxy solicitation. If you have questions, please call D.F. King, toll-free at 1-877-732-3621. |

Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting.

PROMPT VOTING IS REQUESTED.

ASTON FUNDS

ASTON SMALL CAP FUND

(FORMERLY, ASTON/TAMRO SMALL CAP FUND)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 3, 2016

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of ASTON Small Cap Fund (formerly ASTON/TAMRO Small Cap Fund) (the “Fund”), a series of Aston Funds (“Aston Funds” or the “Trust”), will be held on June 3, 2016 at 3:00 p.m. (Eastern Time) at the offices of AMG Funds LLC, located at 600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830 for the purposes listed below:

Proposal Summary

| 1. | Approval of a new subadvisory agreement between Aston Asset Management, LLC and GW&K Investment Management, LLC with respect to the Fund. |

| 2. | Amendment of “fundamental” investment restrictions of the Fund. |

| 3. | Transaction of such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

After careful consideration, the Trust’s Board of Trustees (the “Board” or the “Trustees”) unanimously recommends that shareholders vote “FOR” all proposals.

Shareholders of record at the close of business on April 21, 2016 are entitled to notice of, and to vote at, the Meeting, even if any such shareholders no longer own shares.

We call your attention to the accompanying proxy statement. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting by telephone or over the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Fund prior to the Meeting, or by voting in person at the Meeting. Please call D.F. King & Co., Inc., an ASTOne Company, the Fund’s proxy solicitor, toll-free at 1-877-732-3621 if you have any questions relating to attending the Meeting in person or your vote instructions.

| | |

| By Order of the Board of Trustees, |

| |

| | /s/ Mark J. Duggan |

| | Mark J. Duggan, Secretary |

| | April 28, 2016 |

iii

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING TO BE HELD ON JUNE 3, 2016

This Proxy Statement and the accompanying Notice of Special Meeting of Shareholders are available at the website listed on your proxy card. In addition, shareholders can find important information about the Fund in the Fund’s annual report, for the fiscal year ended October 31, 2015, including financial statements for the fiscal year ended October 31, 2015. You may obtain copies of this report and other Fund documents, including the Fund’s current prospectus, without charge, upon request, by writing to Aston Funds, P.O. Box 9765, Providence, Rhode Island 02940, or by calling 1-800-992-8151, or on the Fund’s website atwww.astonfunds.com.

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF VOTES YOU HOLD. SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETING ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IT IS IMPORTANT THAT YOUR PROXY CARD BE RETURNED PROMPTLY.

FOR YOUR CONVENIENCE, YOU MAY ALSO VOTE BY TELEPHONE OR OVER THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY TELEPHONE OR OVER THE INTERNET, PLEASE DO NOT RETURN YOUR PROXY CARD UNLESS YOU ELECT TO CHANGE YOUR VOTE.

iv

ASTON FUNDS

ASTON SMALL CAP FUND

(FORMERLY, ASTON/TAMRO SMALL CAP FUND)

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 3, 2016

This proxy statement (“Proxy Statement”) and the enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Aston Funds (“Aston Funds” or the “Trust”) on behalf of its series, ASTON Small Cap Fund (formerly, ASTON/TAMRO Small Cap Fund) (the “Fund”). The proxies are being solicited for use at a special meeting of shareholders of the Fund to be held on June 3, 2016 (the “Meeting”) at 3:00 p.m. (Eastern Time) at the offices of AMG Funds LLC, located at 600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830, and at any and all adjournments or postponements of all or any portion thereof (the “Meeting”).

The Board has called the Meeting and is soliciting proxies from shareholders of the Fund for the purposes listed below:

Proposal Summary

| 1. | Approval of a new subadvisory agreement between Aston Asset Management, LLC and GW&K Investment Management, LLC with respect to the Fund. |

| 2. | Amendment of fundamental investment restrictions of the Fund with respect to (a) borrowing and issuing senior securities and (b) lending. |

| 3. | Transaction of such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

This Proxy Statement and the accompanying notice and proxy card are being first mailed to shareholders on or about May 3, 2016.

Shareholders of record at the close of business on April 21, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof, even if shareholders no longer own shares.

If you have any questions about the proposals or about voting, please call D.F. King & Co., Inc., an ASTOne Company, the Fund’s proxy solicitor, toll-free at 1-877-732-3621.

OVERVIEW OF THE PROPOSALS

Proposal 1

At an in-person meeting held on January 11, 2016, and based upon the recommendation of Aston Asset Management, LLC (the “Investment Adviser” or “Aston”) and other factors, the Board terminated the subadvisory agreement with TAMRO Capital Partners LLC (“TAMRO”), the then-current subadvisor of the Fund, and approved the appointment of GW&K Investment Management, LLC (“GW&K”) as the subadvisor to the Fund on an interim basis to replace TAMRO with GW&K’s services beginning on February 1, 2016. Aston and the Board believed that termination of the subadvisory agreement with TAMRO and the proposed new arrangements with GW&K were in the best interests of the Fund. GW&K was appointed subadvisor pursuant to an interim subadvisory agreement between Aston and GW&K (the “Interim Subadvisory Agreement”), to be effective until the earlier of 150 days

1

after February 1, 2016 or the approval of a new subadvisory agreement with GW&K by the Fund’s Board and shareholders. At the in-person meeting held on January 11, 2016, the Board, including a majority of the Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of Aston Funds (the “Independent Trustees”), also approved (i) the longer-term appointment of GW&K as the subadvisor to the Fund, (ii) a new subadvisory agreement between Aston and GW&K with respect to the Fund (the “New Subadvisory Agreement”) and (iii) the submission of the New Subadvisory Agreement to Fund shareholders for approval. As discussed in greater detail below, the Board has unanimously determined to recommend a vote “FOR” this proposal.

Proposal 2

You are being asked to approve updates to, and the standardization of, certain of the investment restrictions of the Fund through the amendment of the Fund’s fundamental investment restrictions. The proposed changes are intended to update and standardize the Fund’s fundamental investment restrictions, while continuing to fully satisfy the requirements of the 1940 Act, and the rules and regulations thereunder. The proposed changes are designed to provide the Fund’s subadvisor and the Board increased flexibility to respond to market, industry and regulatory changes. There may be additional risks associated with such increased flexibility, as described in Proposal 2. Also, the proposed changes are intended to reduce administrative burdens and ongoing costs to the Trust, and the AMG Funds Family of Funds, a mutual fund complex comprised of 74 different funds, each having distinct investment management objectives, strategies, risks, and policies (the “AMG Funds Family of Funds”), more generally, by simplifying and making uniform the fundamental investment restrictions across most of the other funds in the AMG Funds Family of Funds. Furthermore, Aston has indicated that it has no current intention to change in any significant way the Fund’s investment strategies or the manner in which the Fund is managed if the proposal is approved. As to sub-proposals 2.A and 2.B, the shareholders of the Fund will vote separately on a sub-proposal-by-sub-proposal basis. Therefore, should a change to a fundamental investment restriction not be approved for the Fund, the Fund’s current fundamental investment restriction would continue to apply. As discussed in greater detail below, the Board has unanimously determined to recommend a vote “FOR” this proposal.

PROPOSAL 1: APPROVAL OF THE NEW SUBADVISORY AGREEMENT BETWEEN THE INVESTMENT ADVISER AND GW&K WITH RESPECT TO ASTON SMALL CAP FUND

Introduction

The Fund is a series of Aston Funds, a statutory trust organized under the laws of the State of Delaware pursuant to a Trust Instrument filed with the State of Delaware on September 10, 1993, as amended (the “Trust Instrument”). The operations of the Fund are governed by Delaware law and by the Trust Instrument and the Amended and Restated By-Laws of Aston Funds (the “Bylaws”). The Trust is registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company and subject to the provisions of the 1940 Act, and the rules and regulations thereunder. Aston is an indirect, wholly-owned subsidiary of Affiliated Managers Group, Inc. (“AMG”). AMG’s interests in Aston are held through AMG’s wholly-owned subsidiary, AMG Funds LLC (“AMGF”). The Investment Adviser, located at 120 North LaSalle Street, 25th Floor, Chicago, Illinois 60602, serves as investment adviser and administrator of the Fund and is responsible for the Fund’s overall administration and management. Foreside Funds Distributors LLC, located at 400 Berwyn Park, 899 Cassatt Road Berwyn, Pennsylvania 19312, serves as the Fund’s distributor.

The principal executive offices of the Trust are located at 120 North LaSalle Street, 25th Floor Chicago, Illinois 60602.

At an in-person meeting held on January 11, 2016, and based upon the recommendation of the Investment Adviser and other factors, the Board, including a majority of the Independent Trustees, terminated the subadvisory agreement with TAMRO, the then-current subadvisor of the Fund, and approved the appointment of GW&K as the subadvisor to the Fund on an interim basis to replace TAMRO, with GW&K’s services beginning on February 1, 2016 (the “Implementation Date”). The Investment Adviser and the Board believed that termination of the subadvisory agreement with TAMRO and the proposed new arrangements with GW&K were in the best interests of the Fund. GW&K was appointed subadvisor pursuant to the Interim Subadvisory Agreement between the

2

Investment Adviser and GW&K, to be effective until the earlier of 150 days after February 1, 2016 or the approval of a new subadvisory agreement with GW&K by the Board and Fund shareholders. At the in-person meeting held on January 11, 2016, the Board, including a majority of the Independent Trustees, also approved (i) the longer-term appointment of GW&K as the subadvisor to the Fund, (ii) the New Subadvisory Agreement between the Investment Adviser and GW&K with respect to the Fund and (iii) the submission of the New Subadvisory Agreement to Fund shareholders for approval. The material differences between the Interim Subadvisory Agreement and the former subadvisory agreement between the Investment Adviser and TAMRO (the “Former Subadvisory Agreement”) with respect to the Fund, as well as the differences between the New Subadvisory Agreement and the Former Subadvisory Agreement, are described below.

In addition to the changes described above, at the Board meeting held on January 11, 2016, the Board also approved a proposal to change the Fund’s name from ASTON/TAMRO Small Cap Fund to ASTON Small Cap Fund, which became effective as of February 1, 2016.

If the shareholders of the Fund approve Proposal 1, GW&K will continue to serve as subadvisor to the Fund under the terms of the New Subadvisory Agreement.

Information About GW&K

GW&K, located at 222 Berkeley Street, 15th Floor, Boston, Massachusetts 02116, is an investment management firm that has advised individual and institutional clients since 1974. As of December 31, 2015, the firm had approximately $27.58 billion in assets under management. In 2008, GW&K became an affiliate of AMGF. Under this partnership, AMG, through its wholly-owned subsidiary, AMG Boston Holdings, LLC, indirectly owns a majority interest in GW&K, with the remaining ownership interest held among members of GW&K’s management team. GW&K’s management team is responsible for the day-to-day management of the firm and maintains full autonomy over the investment process. AMG is a publicly traded, global asset management company (NYSE:AMG) with investments in a diverse group of boutique investment management firms. As of December 31, 2015, AMG had approximately $628 billion in assets under management by its affiliated investment management firms.

Information about the directors and principal executive officers of GW&K is set forth below. The address of each of them is c/o GW&K Investment Management, LLC, 222 Berkeley Street, 15th Floor, Boston, Massachusetts 02116.

| | |

Name of Directors and Principal Executive Officers | | Principal Occupation(s) |

| Harold G. Kotler, CFA | | Chief Executive Officer; Chief Investment Officer |

| Thomas Williams Roberts, III | | Co-President; Chief Compliance Officer |

| Thomas F.X. Powers | | Co-President |

Board of Trustees Approvals

At an in-person meeting held on January 11, 2016, and based upon the recommendation of the Investment Adviser and other factors, the Board, including a majority of the Independent Trustees, approved the appointment of GW&K as the subadvisor to the Fund on an interim basis to replace TAMRO and approved the Interim Subadvisory Agreement, with GW&K’s services beginning on the Implementation Date. On February 1, 2016, GW&K began serving as the subadvisor to the Fund on an interim basis as permitted by Rule 15a-4 under the 1940 Act. At the in-person meeting held on January 11, 2016, the Board, including a majority of the Independent Trustees, also approved the longer-term appointment of GW&K as the subadvisor to the Fund and approved the New Subadvisory Agreement, subject to shareholder approval. In approving the Interim Subadvisory Agreement and the New Subadvisory Agreement, the Board, including a majority of the Independent Trustees, determined that the hiring of GW&K is in the best interests of the Fund. The Board’s determination to approve the appointment of GW&K as subadvisor of the Fund and to approve the Interim Subadvisory Agreement and the New Subadvisory Agreement was based on a variety of factors and considerations, including (i) recommendation by Aston, which was based on its on-going evaluation of Fund characteristics and exposures and subadvisor performance and investment strategy, (ii) qualitative and quantitative analysis of GW&K’s organizational structure, investment process, style and long-term performance record, (iii) that the management fee paid by the Fund would not change as a result of the

3

appointment of GW&K as subadvisor and that GW&K would receive the same rate of compensation under the Interim Subadvisory Agreement and New Subadvisory Agreement as TAMRO received under the Former Subadvisory Agreement and (iv) information provided to the Board about GW&K’s performance as subadvisor to other funds in the AMG Funds Family of Funds. The Investment Adviser has stated that its recommendation to hire GW&K was based on Aston’s belief that GW&K is a high quality investment adviser with a demonstrated ability to manage small market capitalization portfolios and to manage the overall risk of the Fund’s portfolio and would be appropriately suited to manage assets for the Fund. Accordingly, the Board, including a majority of the Independent Trustees, approved the hiring of GW&K and the adoption of the Interim Subadvisory Agreement, effective on the Implementation Date, for a term not to exceed 150 days after February 1, 2016 (as provided by Rule 15a-4), and, subject to shareholder approval, the adoption of the New Subadvisory Agreement. A form of the proposed New Subadvisory Agreement is attached as Appendix A and all references to the New Subadvisory Agreement herein are qualified in their entirety by reference to such appendix.

Description of the Interim Subadvisory Agreement

The terms of the Interim Subadvisory Agreement are similar, in all material respects (including with respect to subadvisory fee rate), as the terms of the Former Subadvisory Agreement, except for certain provisions described below that are intended to standardize the agreement with the current form of agreement used for newer Aston Funds. While the Former Subadvisory Agreement continued in effect from year to year for so long as its continuation is approved at least annually (a) by a majority of the Trustees who were not parties to such agreement or interested persons of any such party except in their capacity as Trustees of the Fund or (b) by the shareholders of the Fund or the Board, the Interim Subadvisory Agreement will continue in effect only until the earlier of 150 days from the Implementation Date or the date upon which shareholders approve the New Subadvisory Agreement. Like the Former Subadvisory Agreement, the Interim Subadvisory Agreement may be terminated by the subadvisor without penalty upon 60 days’ written notice to the Investment Adviser and Aston Funds and will terminate upon the termination of the investment advisory agreement with Aston. However, while the Former Subadvisory Agreement could be terminated upon 60 days’ written notice to the subadvisor that the Board, the Investment Adviser, or the shareholders of the Fund have terminated the agreement, the Interim Subadvisory Agreement may be terminated upon ten days’ written notice in such event.

The compensation terms under the Interim Subadvisory Agreement are the same, in all material respects (including with respect to subadvisory fee rates), as the terms of the Former Subadvisory Agreement, dated May 30, 2014, and Schedule A and Schedule B thereto, amended December 19, 2014. Under the terms of the Former Subadvisory Agreement, the subadvisor received an amount equal to the positive difference, if any, of (x) 50% of the advisory fee payable to the Investment Adviser with respect to the Allocated Assets (as such term is defined in the agreements) of the Fund (before deduction of the fee payable to the subadvisor) minus (y) the sum of: (i) 50% of any investment advisory fees waived by the Investment Adviser pursuant to an expense limitation or reimbursement agreement with the Fund, (ii) 50% of any reimbursement of expenses by the Investment Adviser pursuant to an expense limitation or reimbursement agreement with the Fund, and (iii) the Specified Percentage (as defined below) of any payments made by the Investment Adviser to third parties that provide distribution, shareholder services or similar services on behalf of the Fund; provided that such fee equaled 50% of the advisory fee payable to the Investment Adviser with respect to the Allocated Assets if average monthly net assets exceeded $625 million. If the foregoing calculation resulted in a negative amount, such amount would be payable by the subadvisor within 30 days of receipt of notice from the Investment Adviser, and notice included the basis for the calculation. Aston receives a management fee from the Fund at an annual rate of 0.90% of the Fund’s average daily assets, before any waivers or reimbursements.

Under the terms of the Former Subadvisory Agreement, the Specified Percentage meant the rate set forth in the table below, which percentage was determined monthly based on average monthly net assets of the Fund. If average monthly net assets exceeded a Trigger Level, as set forth in the table below, the subadvisor was responsible for the Specified Percentage for that level for as long as the Fund’s average monthly net assets remained in the corresponding Asset Range, as set forth in the table below. If the Fund’s average monthly net assets fell below the Asset Range corresponding to a Trigger Level, then the Specified Percentage was the rate corresponding to the new Asset Range, and such Specified Percentage would decrease only if the applicable higher Trigger Level was reached.

4

| | | | | | | | |

Trigger Level (Average Monthly Net Assets) | | | Asset Range (Average

Monthly Net Assets) | | Specified Percentage | |

| $ | 0 | | | Less than $500 million | | | 50 | % |

| | |

| $ | 525 million | | | $500 million to $550 million | | | 40 | % |

| | |

| $ | 575 million | | | $550 million to $600 million | | | 25 | % |

| | |

| $ | 625 million | | | $600 million and higher | | | None | |

The Interim Subadvisory Agreement contains the same compensation terms as the Former Subadvisory Agreement.

In addition, the Interim Subadvisory Agreement includes the following additional provisions, in order to standardize the agreement with agreements for newer Aston Funds: (i) the Investment Adviser may terminate the agreement upon less than ten days’ notice to GW&K upon a material breach of the agreement or if the Board determines that other circumstances have, or likely will have, a material adverse effect on GW&K’s abilities to perform its obligations under the agreement; (ii) GW&K will maintain at all times during the term of the agreement insurance with reputable insurance carriers, in such amounts, covering such risks and liabilities, and with such deductibles and self-insurance as are consistent with customary industry practice; (iii) GW&K will pay expenses incurred by Aston Funds for any matters related to any transaction or event that is deemed to result in a change of control of GW&K or otherwise result in the assignment of the agreement under the 1940 Act; (iv) GW&K will not solicit or induce any of the Fund’s shareholders to withdraw investment in any series of Aston Funds during the term of the Agreement and for 18 months following termination; and (v) Aston and GW&K will indemnify each other from and against certain damages related to the performance of services by the other party under the Interim Subadvisory Agreement.

Description of the New Subadvisory Agreement

Services

Under the New Subadvisory Agreement, GW&K will agree, subject to the stated investment objective and policies of the Fund as set forth in the Trust’s current registration statement and subject to the supervision of the Investment Adviser and the Board, to (i) develop and furnish continuously an investment program and strategy for the Fund in compliance with the Fund’s investment objective and policies as set forth in the Trust’s current registration statement, (ii) provide research and analysis relative to the investment program and investments of the Fund, (iii) determine (subject to the overall supervision of the Board) what investments shall be purchased, held, sold or exchanged by the Fund and what portion, if any, of the assets of the Fund shall be held in cash or cash equivalents, and (iv) make changes on behalf of Aston Funds in the investments of the Fund. GW&K will also arrange for the placing of all orders for the purchase and sale of securities and other investments for the Fund’s account and will exercise full discretion and act for Aston Funds in the same manner and with the same force and effect as Aston Funds might or could do with respect to the purchases, sales or other transactions, as well as with respect to all other things necessary or incidental to the furtherance or conduct of the purchases, sales or transactions. GW&K will also make its officers and employees available to meet with Aston’s officers and directors on due notice at reasonable times to review the investments and investment program of the Fund in the light of current and prospective economic and market conditions.

Under the New Subadvisory Agreement, GW&K will exercise voting authority with respect to proxies that the Fund is entitled to vote by virtue of the ownership of assets attributable to that portion of the Fund for which GW&K has investment management responsibility; provided that the exercise of the authority will be subject to periodic review by Aston and the Board, and provided, further that the authority may be revoked in whole or in part by Aston if required by applicable law. GW&K will exercise its proxy voting authority in accordance with the proxy voting policies and procedures as Aston Funds may designate from time to time. GW&K will provide the information relating to its exercise of proxy voting authority (including the manner in which it has voted proxies and its resolution of conflicts of interest) as reasonably requested by Aston from time to time.

5

Under the New Subadvisory Agreement, GW&K, in connection with the management of the investment and reinvestment of the Fund, will be authorized to select the broker or dealers that will execute purchase and sale transactions for the Fund. GW&K will also render to the Board periodic and special reports that the Board may request with respect to matters relating to the duties of GW&K.

The Former Subadvisory Agreement contains similar terms, except that it contains less specificity with respect to proxy voting authority.

Compensation

The compensation terms under the New Subadvisory Agreement are the same, in all material respects (including with respect to subadvisory fee rates), as the terms of the Former Subadvisory Agreement. Under the New Subadvisory Agreement, GW&K would receive a subadvisory fee in an amount equal to the positive difference, if any, of (x) 50% of the advisory fee payable to the Investment Adviser with respect to the Allocated Assets (as such term is defined in the New Subadvisory Agreement) of the Fund (before reduction of the fee payable to GW&K) minus (y) the sum of: (i) 50% of any investment advisory fees waived by the Investment Adviser pursuant to an expense limitation or reimbursement agreement with the Fund, (ii) 50% of any reimbursement of expenses by the Investment Adviser pursuant to an expense limitation or reimbursement agreement with the Fund, and (iii) the Specified Percentage (as defined below) of any payments made by the Investment Adviser to third parties that provide distribution, shareholder services or similar services on behalf of the Fund, provided that such fee will equal 50% of the advisory fee payable to the Investment Adviser with respect to the Allocated Assets if average monthly net assets exceed $625 million. If the foregoing calculation results in a negative amount, such amount will be payable by GW&K within 30 days of receipt of notice from Aston, which notice shall include the basis for the calculation.

Under the terms of the New Subadvisory Agreement and the Former Subadvisory Agreement, the Specified Percentage means the rate set forth in the table below, which percentage shall be determined monthly based on average monthly net assets of the Fund. If average monthly net assets exceed a Trigger Level, as set forth in the table below, GW&K is responsible for the Specified Percentage for that level for as long as the Fund’s average monthly net assets remain in the corresponding Asset Range, as set forth in the table below. If the Fund’s average monthly net assets fall below the Asset Range corresponding to a Trigger Level, then the Specified Percentage shall be the rate corresponding to the new Asset Range, and such Specified Percentage would decrease only if the applicable higher Trigger Level is reached.

| | | | | | | | |

Trigger Level (Average Monthly Net Assets) | | | Asset Range (Average

Monthly Net Assets) | | Specified Percentage | |

| $ | 0 | | | Less than $500 million | | | 50 | % |

| | |

| $ | 525 million | | | $500 million to $550 million | | | 40 | % |

| | |

| $ | 575 million | | | $550 million to $600 million | | | 25 | % |

| | |

| $ | 625 million | | | $600 million and higher | | | None | |

To illustrate the above schedule, the following examples are based on the current advisory fee of 0.90% and assume that fee and expense waivers paid by the Investment Adviser equal 0.03% and payments to intermediaries by the Investment Adviser equal 0.10%. Based on these assumptions, the following table illustrates the fee payable to GW&K:

| | | | | | | | |

Average Monthly Assets | | | Annual Sub-Advisory Fee Rate | | | Calculation |

| $ | 510 million | | | | 0.385 | % | | 50% * 0.90% - [50% * 0.03% + 50% * 0.10%] |

| | |

| $ | 570 million | | | | 0.395 | % | | 50% * 0.90% - [50% * 0.03% + 40% * 0.10%] |

6

The fee paid to GW&K under the New Subadvisory Agreement and the Former Subadvisory Agreement is not paid by the Fund. As investment adviser to the Fund, the Investment Adviser is paid an advisory fee based on the average daily net assets of the Fund. Out of its fee, the Investment Adviser will pay GW&K the subadvisory fee. The approval of the New Subadvisory Agreement will not increase the management fee borne by Fund shareholders. Under the investment advisory agreement between Aston Funds and the Investment Adviser dated May 30, 2014, the Fund pays the Investment Adviser a fee at the annual rate of 0.90% of the Fund’s average daily net assets. For the fiscal year ended October 31, 2015, the Fund paid the Investment Adviser $6,312,433 for advisory services provided to the Fund.

Other Terms

The terms of the New Subadvisory Agreement are not materially different from the terms of the Former Subadvisory Agreement. Because the Former Subadvisory Agreement is based on the Aston Funds agreement, and the New Subadvisory Agreement is based on the form in effect for other funds in the AMG Funds Family of Funds subadvised by GW&K, there are some differences between the agreements. Among the differences between the agreements is that the Former Subadvisory Agreement was silent as to periodic review and revocation of the subadvisor’s voting authority, while the New Subadvisory Agreement provides that the exercise of the proxy voting authority will be subject to periodic review by the Investment Adviser and the Board; provided, further that the authority may be revoked in whole or in part by the Investment Adviser if required by applicable law. While the Former Subadvisory Agreement does not include a provision on agency status, the New Subadvisory Agreement states that, in the performance if its duties, GW&K is and will be an independent contractor and, except as expressly provided for in the agreement or otherwise, will have no authority to act for or represent the Fund or Aston Funds in any way or otherwise be deemed to be an agent of the Fund, Aston Funds or the Investment Adviser.

In addition, while the Former Subadvisory Agreement does not include a provision on cross transactions, the New Subadvisory Agreement states that GW&K may buy securities for the Fund at the same time it is selling the securities for another client account and may sell securities for the Fund at the time it is buying the securities for another client account, if it deems this to be advantageous, in each case, subject to applicable legal and regulatory requirements and in compliance with the procedures of Aston Funds. Under the New Subadvisory Agreement, the parties expressly acknowledge that GW&K may cause the Fund to enter into types of investment transactions (e.g., a long position on an index) at the same time it is causing other client accounts to take opposite economic positions (e.g., a short position on the same index). Furthermore, while the Former Subadvisory Agreement does not include a provision on restricted transactions, the New Subadvisory Agreement states that the Investment Adviser will have the right by written notice to identify securities that may not be purchased on behalf of the Fund and/or brokers and dealers through which portfolio transactions on behalf of the Fund may not be effected, including, without limitation, brokers or dealers affiliated with the Investment Adviser. The New Subadvisory Agreement states that GW&K will not direct portfolio transactions for the Fund through any broker or dealer that is an “affiliated person” (as defined in the 1940 Act) of GW&K without the prior written approval of the Investment Adviser, which will not be unreasonably withheld. Applicable law places limits on GW&K’s ability to engage in cross transactions and use affiliated brokers or otherwise engage in affiliated transactions that are similar to those contained in the New Subadvisory Agreement.

Whereas the Former Subadvisory Agreement did not discuss an expense limitation agreement, the New Subadvisory Agreement states that, subject to any expense limitation agreement, Aston Funds will assume and will pay (i) issue and transfer taxes chargeable to Aston Funds in connection with securities transactions to which the Fund is a party, and (ii) interest on borrowed money, if any. In addition, the New Subadvisory Agreement provides that Aston Funds will pay all brokers’ and underwriting commissions chargeable to Aston Funds in connection with securities transactions to which the Fund is a party. Whereas the Former Subadvisory Agreement provided that the

7

subadvisor would act in conformity with “procedures and guidelines” of the Fund, the New Subadvisory Agreement states that GW&K will establish compliance procedures reasonably calculated to ensure compliance at all times with applicable rules, regulations and provisions of Aston Funds’ governing documents. In addition, the New Subadvisory Agreement provides that Aston Funds adopted a written code of ethics and GW&K agrees that it will, on a timely basis, furnish, to the Investment Adviser and Aston Funds, all reports and information required to be provided under the code of ethics.

The Former Subadvisory Agreement provided that the subadvisor was not protected against liability for its willful misfeasance, bad faith, or gross negligence or the reckless disregard of its obligations and duties, the New Subadvisory Agreement provides that GW&K is not protected against liability for its willful misfeasance, bad faith or negligence or the reckless disregard of its obligations and duties. While the Former Subadvisory Agreement was silent with respect to indemnification, the New Subadvisory Agreement provides that the Investment Adviser and GW&K will indemnify each other from and against certain damages related to the performance of services by the other party under the New Subadvisory Agreement to the extent such damages result from willful misfeasance, bad faith or negligence or the reckless disregard of obligations and duties. Finally, unlike the Former Subadvisory Agreement, the New Subadvisory Agreement contains a provision that each party represents and warrants to the other party that the execution, delivery and performance of the agreement does not violate any obligation to which the party is bound, duly authorized, and, when executed will be the legal, valid and binding obligation of the party.

The Former Subadvisory Agreement between Aston and TAMRO was not submitted for shareholder approval because TAMRO was appointed by the Board under Aston Funds’ manager-of-managers exemptive order, which did not require shareholder approval. The Board, including a majority of the Independent Trustees, last renewed the Former Subadvisory Agreement between Aston and TAMRO on December 10, 2015.

In accordance with Rule 15a-4 under the 1940 Act, Fund shareholders must approve the New Subadvisory Agreement on or before June 30, 2016 in order for GW&K to continue serving as subadvisor to the Fund on an uninterrupted basis following that date. If shareholders do not approve the New Subadvisory Agreement, the Board will take such action as it deems in the best interest of the Fund, including possible liquidation of the Fund.

Portfolio Managers

If shareholders of the Fund approve Proposal 1, it is expected that GW&K’s current portfolio management team that has managed the Fund under the Interim Subadvisory Agreement since February 1, 2016 will continue to manage the Fund’s assets.

GW&K manages the Fund using its small cap growth strategy. Daniel L. Miller, CFA and Joseph C. Craigen, CFA are the portfolio managers jointly and primarily responsible for the day-to-day management of the Fund’s portfolio under the Interim Subadvisory Agreement. Mr. Miller joined GW&K in December 2008 as Partner and Director of Equities, responsible for overseeing all aspects of GW&K’s equity group, including portfolio management, research and trading. Mr. Miller spent 21 years at Putnam Investments, where he was Chief Investment Officer for the Specialty Growth Group from 1996 to 2004. After retiring from Putnam Investments in 2004, Mr. Miller worked as an investment consultant and financial consultant for various companies from 2004 to 2008, until he joined GW&K. Mr. Craigen joined GW&K in 2008 and is a Vice President. He is a member of the GW&K Equity team analyzing small cap companies and is also a member of the firm’s Investment Committee. He started his investment career as an Equity Research Associate at Tucker Anthony from 1999 to 2001, and later held positions as an Equity Analyst at Needham & Company from 2001 to 2005 and at Citizens Funds from 2005 to 2008.

Board of Trustees Recommendation

At an in-person meeting held on January 11, 2016, the Board, and separately a majority of the Independent Trustees, voted to approve the Interim Subadvisory Agreement between the Investment Adviser and GW&K, the New Subadvisory Agreement between the Investment Adviser and GW&K (together with the Interim Subadvisory Agreement, the “Agreements”), and the presentation of the New Subadvisory Agreement for shareholder approval at a special meeting to be held for such purpose. The Independent Trustees were separately represented by independent legal counsel in their consideration of the Agreements.

8

In considering the Agreements, the Trustees considered the information relating to the Fund and GW&K provided to them, including performance information for the Fund and the Russell 2000® Growth Index and, with respect to GW&K, comparative performance information for the composite investment portfolio managed by GW&K in its small cap growth strategy (the “Small Cap Growth Strategy”). In considering the Agreements, the Trustees also considered the information provided to them regarding the nature, extent and quality of services provided by GW&K to the five other funds that GW&K sub-advises in the AMG Funds Family of Funds, and to be provided by GW&K under the Agreements. Prior to voting, the Independent Trustees: (a) reviewed the foregoing information with their independent legal counsel and with management; (b) discussed with their independent legal counsel the legal standards applicable to their consideration of the Agreements; and (c) met with their independent legal counsel in a private session at which no representatives of management were present.

Nature, extent and quality of services. In considering the nature, extent and quality of the services to be provided by GW&K, the Trustees reviewed information relating to GW&K’s financial condition, operations and personnel and the investment philosophy, strategies and techniques (the “Investment Strategy”) that are intended to be used by GW&K in managing the Fund. Among other things, the Trustees reviewed biographical information on portfolio management and other professional staff, information regarding GW&K’s organizational and management structure and GW&K’s brokerage policies and practices. The Trustees considered specific information provided regarding the experience of the individuals at GW&K that are expected to have portfolio management responsibility for the Fund. The Trustees noted that one proposed portfolio manager joined GW&K in 2008, serves as co-portfolio manager on two other funds subadvised by GW&K in the AMG Funds Family of Funds and is a Partner and Director of Equities at GW&K. The Trustees also noted that the other proposed portfolio manager joined GW&K in 2008, serves as a co-portfolio manager on one other fund subadvised by GW&K in the AMG Funds Family of Funds and is a Vice President at GW&K. In the course of their deliberations, the Trustees evaluated, among other things: (a) the expected services to be rendered by GW&K to the Fund; (b) the qualifications and experience of GW&K’s personnel; and (c) GW&K’s compliance program. The Trustees also considered GW&K’s risk management processes. The Trustees also took into account the financial condition of GW&K with respect to its ability to provide the services required under the Agreements and noted that, as of September 30, 2015, GW&K managed approximately $4.3 billion in assets across their equity business.

Performance. The Trustees considered information relating to the Fund’s performance and GW&K’s performance managing small cap strategies. Among other information relating to GW&K’s performance, the Trustees considered the performance of GW&K with respect to its Small Cap Growth Strategy, noting that, for the one-year period and the period since inception of the strategy (April 1, 2008), in each case, ended December 31, 2015, the annualized gross performance and annualized net performance of the Small Cap Growth Strategy exceeded the performance of the Russell 2000® Growth Index for the same periods. The Trustees considered that for the three-year and five-year periods, in each case, ended December 31, 2015, the annualized gross performance of the Small Cap Growth Strategy was slightly below and above, respectively, the performance of the Russell 2000® Growth Index and the annualized net performance of the Small Cap Growth Strategy, in each case, was below the performance of the Russell 2000® Growth Index for the same periods. The Trustees concluded that this performance record supported the approval of the Agreements.

Subadvisory Fees, Profitability and Economies of Scale. The Trustees noted that the Investment Adviser, and not the Fund, is responsible for paying the fees charged by GW&K. In considering the anticipated profitability of GW&K with respect to the provision of subadvisory services to the Fund, the Trustees considered information regarding GW&K’s organization, management and financial stability. The Trustees noted that, because GW&K is an affiliate of the Investment Adviser, such anticipated profitability might be directly or indirectly shared by the Investment Adviser. The Trustees also noted that the subadvisory fee rate to be paid to GW&K under each Agreement was the same as the rate paid to TAMRO under the Former Subadvisory Agreement. The Board took into account management’s discussion of the proposed subadvisory fee structure, and the services GW&K is expected to provide in performing its functions under the Agreements. Based on the foregoing, the Trustees concluded that the profitability to GW&K is expected to be reasonable.

In addition, the Trustees considered other potential benefits of the subadvisory relationship to GW&K, including, among others, the indirect benefits that GW&K may receive from GW&K’s relationship with the Fund, including any so-called “fallout benefits” to GW&K, such as reputational value derived from GW&K serving as subadvisor to the Fund. With respect to economies of scale, given that GW&K is being hired as a new subadvisor

9

for the Fund, the Trustees did not consider potential economies of scale in the management of the Fund by GW&K to be a material factor in their deliberations at this time. In addition, with respect to fee comparisons, the Trustees noted that the fee rates to be charged by GW&K are the same as those charged by TAMRO under the Former Subadvisory Agreement with respect to the Fund. Taking into account all of the foregoing, the Trustees concluded that, in light of the nature, extent and quality of the services to be provided by GW&K, and the other considerations noted above with respect to GW&K, the Fund’s subadvisory fees are reasonable.

* * * *

After consideration of the foregoing, the Trustees reached the following conclusions (in addition to the conclusions discussed above) regarding each Agreement: (a) GW&K has demonstrated that it possesses the capability and resources to perform the duties required of it under each Agreement; (b) GW&K has provided similar services to five other funds in the AMG Funds Family of Funds; (c) GW&K’s Investment Strategy is appropriate for pursuing the Fund’s investment objectives; (d) GW&K is reasonably likely to execute its investment strategy consistently over time; and (e) GW&K maintains appropriate compliance programs.

Based on all of the above-mentioned factors and their related conclusions, with no single factor or conclusion being determinative and with each Trustee not necessarily attributing the same weight to each factor, the Trustees concluded that approval of each Agreement would be in the best interests of the Fund. Accordingly, on January 11, 2016, the Trustees, and separately a majority of the Independent Trustees, voted to approve each Agreement. If the vote required to approve Proposal 1 is not obtained from the Fund’s shareholders, the New Subadvisory Agreement between the Investment Adviser and GW&K will not take effect, and the Trustees will consider what other actions to take with respect to the Fund.

The Trustees unanimously recommend that shareholders of the Fund vote “FOR” Proposal 1.

PROPOSAL 2: APPROVAL OF THE AMENDMENT OF FUNDAMENTAL INVESTMENT RESTRICTIONS

As described in the following sub-proposals, the Trustees also recommend that the shareholders of the Fund approve updates to, and the standardization of, certain of the fundamental investment restrictions of the Fund through the amendment of the restrictions as described below. The proposed changes are intended to update and standardize the Fund’s fundamental investment restrictions, while continuing to fully satisfy the requirements of the 1940 Act, and the rules and regulations thereunder. The proposed changes are designed to provide the Fund’s subadvisor and the Board increased flexibility to respond to market, industry and regulatory changes. There may be additional risks associated with such increased flexibility, as described below. Also, the proposed changes are intended to reduce administrative burdens and ongoing costs to the Trust, and the AMG Funds Family of Funds more generally, by simplifying and making uniform the fundamental investment restrictions across most of the other funds in the AMG Funds Family of Funds. Furthermore, Aston has indicated that it has no present intention to change in any significant way the Fund’s investment strategies or the manner in which the Fund is managed if the proposal is approved. The Fund has fundamental investment objectives and policies that are not intended to be changed in connection with, and are beyond the scope of, this Proxy Statement.

As to sub-proposals 2.A and 2.B, the shareholders of the Fund will vote separately on a sub-proposal-by-sub-proposal basis. A list of the restrictions that would apply to the Fund if each sub-proposal is approved is set forth in Appendix B.

10

The 1940 Act requires registered investment companies like the Fund to adopt “fundamental” investment restrictions governing certain of their investment practices. Investment companies may also voluntarily designate restrictions relating to other investment practices as “fundamental.” The following chart sets forth the existing and proposed fundamental investment restrictions of the Fund with respect to borrowing and issuing senior securities and lending.

| | | | |

| | | Existing Fundamental Investment Restrictions for ASTON Small

Cap Fund | | Proposed Fundamental Investment Restrictions for ASTON Small

Cap Fund |

| Borrowing | | The Fund may not borrow money or issue senior securities, except that the Fund may borrow from banks and enter into reverse repurchase agreements for temporary purposes in amounts up to one-third of the value of its total assets at the time of such borrowing. The Fund may not mortgage, pledge or hypothecate any assets, except in connection with any such borrowing and in amounts not in excess of the lesser of the dollar amounts borrowed or 10% of the value of the total assets of the Fund at the time of its borrowing. All borrowings will be done from a bank and asset coverage of at least 300% is required. The Fund will not purchase securities when borrowings exceed 5% of the Fund’s total assets. | | The Fund may borrow money and issue senior securities to the extent permitted by the Investment Company Act of 1940, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time, or by regulatory guidance or interpretations of, or any exemptive order or other relief issued by the Securities and Exchange Commission or any successor organization or their staff under, such Act, rules or regulations. |

| Lending | | The Fund may not make loans, except that this restriction shall not prohibit (a) the purchase and holding of debt instruments in accordance with the Fund’s investment objective and policies, (b) the lending of portfolio securities, or (c) the entry into repurchase agreements with banks or broker-dealers. | | The Fund may lend money to the extent permitted by the Investment Company Act of 1940, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time, or by regulatory guidance or interpretations of, or any exemptive order or other relief issued by the Securities and Exchange Commission or any successor organization or their staff under, such Act, rules or regulations. |

Background

As noted above, the 1940 Act requires registered investment companies like the Fund to adopt “fundamental” investment restrictions governing certain of their investment practices. Under the 1940 Act, a “fundamental” policy of a Fund cannot be changed without the vote of a “majority of the outstanding voting securities” of the Fund. A majority of the outstanding voting securities is defined in the 1940 Act as the lesser of (a) 67% or more of the voting securities present at a meeting if the holders of more than 50% of the outstanding voting securities are present or represented by proxy, or (b) more than 50% of the outstanding voting securities.

The differences between the current and proposed fundamental investment restrictions of the Fund are discussed below. The Investment Adviser believes that the fundamental investment restrictions as proposed to be amended preserve important investor protections while providing increased flexibility to respond to changing markets, new investment opportunities and future changes in applicable law. There may be additional risks associated with such increased flexibility, as described below. Furthermore, Aston has indicated that it has no current intention to change in any significant way the Fund’s investment strategies or the manner in which the Fund is managed if the proposal is approved. To the extent that the 1940 Act, or the rules and regulations thereunder, as such statute, rules or regulations may be amended from time to time, require the Trust to seek a shareholder vote before changing the Fund’s fundamental investment restriction, the Trust will seek to obtain such shareholder vote.

| | 2.A. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO BORROWING AND ISSUING SENIOR SECURITIES |

The 1940 Act requires the Fund to state the extent to which it may borrow money. The 1940 Act generally permits a fund to borrow money in amounts of up to 33 1/3% of its total assets (including the amount borrowed) from banks for any purpose. The 1940 Act requires that after any borrowing from a bank a fund shall maintain an

11

asset coverage of at least 300% for all of the fund’s borrowings, and, in the event that such asset coverage shall at any time fall below 300%, a fund must, within three days thereafter (not including Sundays and holidays), reduce the amount of its borrowings to an extent that the asset coverage of all of the fund’s borrowings shall be at least 300%. In addition to the foregoing borrowings, a fund may borrow up to 5% of its total assets from banks or other lenders for temporary purposes (a loan is presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed).

The 1940 Act also requires the Fund to state the extent to which it may issue senior securities. Under Section 18(f)(1) of the 1940 Act, an open-end investment company may not issue senior securities, except that it may borrow from banks, for any purpose, up to 33 1/3% of its total assets (including the amount borrowed). Generally, a “senior security” means any bond, debenture, note or similar instrument or obligation having priority over a fund’s common shares for purposes of distributions and the payment of dividends. Under the 1940 Act, a senior security does not include any promissory note or evidence of indebtedness where such loan is for temporary purposes only and in an amount not exceeding 5% of the value of the total assets of the fund at the time the loan is made (a loan is presumed to be for temporary purposes if it is repaid within 60 days and is not extended or renewed). Further, the SEC and/or its staff has indicated that certain investment practices may raise senior security issues unless a fund takes appropriate steps to segregate assets against, or cover, its obligations.

The Fund’s current fundamental investment restriction with respect to borrowing and issuing senior securities is as follows:

The Fund may not borrow money or issue senior securities, except that the Fund may borrow from banks and enter into reverse repurchase agreements for temporary purposes in amounts up to one-third of the value of its total assets at the time of such borrowing. The Fund may not mortgage, pledge or hypothecate any assets, except in connection with any such borrowing and in amounts not in excess of the lesser of the dollar amounts borrowed or 10% of the value of the total assets of the Fund at the time of its borrowing. All borrowings will be done from a bank and asset coverage of at least 300% is required. The Fund will not purchase securities when borrowings exceed 5% of the Fund’s total assets.

If this sub-proposal is approved, the Fund’s new fundamental investment restriction with respect to borrowing and issuing senior securities would read:

The Fund may borrow money and issue senior securities to the extent permitted by the Investment Company Act of 1940, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time, or by regulatory guidance or interpretations of, or any exemptive order or other relief issued by the Securities and Exchange Commission or any successor organization or their staff under, such Act, rules or regulations.

The Trustees recommend that the Fund amend its current fundamental restriction to allow the Fund to borrow money and issue senior securities to the extent permitted under applicable law or any applicable exemptive order or orders or other relief. The proposed amendment would have the effect of conforming the Fund’s restriction more closely to the 1940 Act statutory and regulatory requirements and restrictions, as they may exist from time to time, as modified by any applicable exemptive order or other relief, without incurring the time and expense of obtaining shareholder approval to change the restriction as those requirements change. In addition, the proposed amendment would reduce administrative burdens by simplifying and making uniform the fundamental investment restriction with respect to borrowing money and issuing senior securities across most of the other funds in the AMG Funds Family of Funds.

To satisfy redemption requests or to cover unanticipated cash shortfalls (due to “sales fails” or other factors), eligible funds in the AMG Funds Family of Funds have entered into a master interfund lending agreement (“Interfund Lending Agreement”) under which a fund would lend money and borrow money for temporary purposes directly to and from another eligible fund in the AMG Funds Family of Funds through a credit facility (each an “Interfund Loan”), subject to meeting the conditions of an SEC exemptive order granted to the AMG Funds Family of Funds permitting such interfund lending. No fund may borrow more than the lesser of the amount permitted by Section 18 of the 1940 Act, and the rules and regulations thereunder, as modified by the above mentioned and any other applicable SEC exemptive order or other relief, or the amount permitted by its fundamental investment

12

restrictions. All Interfund Loans will consist only of uninvested cash reserves that a fund otherwise would invest in short-term repurchase agreements or other short-term instruments either directly or through a money market fund. The Fund’s current fundamental investment restriction on borrowing does not permit the Fund to participate in the Interfund Lending Agreement. The proposed amendment to the Fund’s fundamental investment restriction with respect to borrowing would have the effect of increasing the Fund’s current ability to borrow money and of permitting the Fund to participate in the Interfund Lending Agreement to the same extent as other eligible funds in the AMG Funds Family of Funds. If this sub-proposal is approved, under current laws, as modified by the above mentioned SEC exemptive order, generally the Fund would be able to borrow through an Interfund Loan on an unsecured basis if its outstanding borrowings from all sources immediately after the interfund borrowing would total 10% or less of its total assets, and the Fund would be able to borrow through an Interfund Loan on a secured basis if its total outstanding borrowings immediately after the interfund borrowing would be greater than 10% of its total assets, provided that the Fund may not borrow through an Interfund Loan or from any other source if its total outstanding borrowings immediately after such borrowing would exceed 33 1/3% of the value of the Fund’s total assets. The Investment Adviser and the Board believe that the ability to engage in interfund lending is in the best interests of the Fund. The Investment Adviser has indicated that it has no current intention to change the investment strategy of the Fund in connection with this change in fundamental investment restriction.

| | 2.B. | AMEND FUNDAMENTAL INVESTMENT RESTRICTION WITH RESPECT TO LENDING |

The 1940 Act requires the Fund to state the extent to which it intends to make loans to other persons. Under the 1940 Act, a fund generally may not lend portfolio securities representing more than one-third of its total asset value (including the value of collateral received for loans of portfolio securities).

The Fund’s current fundamental investment restriction with respect to making loans is as follows:

The Fund may not make loans, except that this restriction shall not prohibit (a) the purchase and holding of debt instruments in accordance with the Fund’s investment objective and policies, (b) the lending of portfolio securities, or (c) the entry into repurchase agreements with banks or broker-dealers.

If this sub-proposal is approved, the Fund’s new fundamental investment restriction with respect to lending would read:

The Fund may lend money to the extent permitted by the Investment Company Act of 1940, or the rules or regulations thereunder, as such statute, rules or regulations may be amended from time to time, or by regulatory guidance or interpretations of, or any exemptive order or other relief issued by the Securities and Exchange Commission or any successor organization or their staff under, such Act, rules or regulations.

The Trustees recommend that the Fund amend its current fundamental restriction to allow the Fund to lend money to the extent permitted under applicable law or any applicable exemptive order or orders or other relief. The proposed amendment would have the effect of conforming the Fund’s restriction more closely to the 1940 Act statutory and regulatory requirements and restrictions, as they may exist from time to time, as modified by any applicable exemptive order or other relief, without incurring the time and expense of obtaining shareholder approval to change the restriction as those requirements change. In addition, the proposed amendment would reduce administrative burdens by simplifying and making uniform the fundamental investment restriction with respect to lending money across most of the other funds in the AMG Funds Family of Funds.

As discussed in Section 2.A above, to satisfy redemption requests or to cover unanticipated cash shortfalls (due to “sales fails” or other factors), eligible funds in the AMG Funds Family of Funds have entered into an Interfund Lending Agreement under which a fund would lend money and borrow money for temporary purposes directly to and from another eligible fund in the AMG Funds Family of Funds through a credit facility, subject to meeting the conditions of an SEC exemptive order granted to the AMG Funds Family of Funds permitting such interfund lending. No fund may lend more than the lesser of the amount permitted by Section 18 of the 1940 Act, and the rules and regulations thereunder, as modified by the above mentioned and any other applicable SEC exemptive order or other relief, or the amount permitted by its fundamental investment restrictions. All Interfund

13

Loans will consist only of uninvested cash reserves that the applicable fund otherwise would invest in short-term repurchase agreements or other short-term instruments either directly or through a money market fund. The Fund’s current fundamental investment restriction regarding lending does not permit the Fund to participate in the Interfund Lending Agreement. The proposed amendment to the Fund’s fundamental investment restriction with respect to lending would have the effect of increasing the Fund’s current ability to lend money and permitting the Fund to participate in the Interfund Lending Agreement to the same extent as other eligible funds in the AMG Funds Family of Funds, to the extent permitted by Section 18 of the 1940 Act, and the rules and regulations thereunder, as modified by the above mentioned and any other applicable SEC exemptive order or other relief. If this sub-proposal is approved, under current laws, as modified by the above mentioned SEC exemptive order, generally the Fund would be able to lend up to 15% of its current net assets through the interfund lending credit facility, provided that the Fund’s Interfund Loans to any eligible fund in the AMG Funds Family of Funds does not exceed 5% of the lending Fund’s net assets. Under current laws, the Fund may not lend portfolio securities representing more than 33 1/3% of its total asset value (including the value of collateral received for loans of portfolio securities). The Investment Adviser and the Board believe that the ability to engage in interfund lending is in the best interests of the Fund. The Investment Adviser has indicated that it has no current intention to change the investment strategy of the Fund in connection with this change in fundamental investment restriction.

Board recommendation on Proposal 2

The Trustees unanimously recommend that shareholders vote “FOR” sub-proposals 2.A and 2.B

14

OTHER BUSINESS

The Trustees do not know of any additional matters to be presented at the Meeting other than those set forth in this Proxy Statement. If other business should properly come before the Meeting or any adjournment or postponement thereof, proxies will be voted in accordance with the judgment of the persons named in the accompanying proxy.

ADDITIONAL INFORMATION

Other Information

Proxy materials, reports and other information filed by the Fund can be inspected and copied at the Public Reference Facilities maintained by the SEC at 100 F Street, NE, Washington, DC 20549. The SEC maintains an Internet web site (at http://www.sec.gov), which contains other information about the Fund.

Voting Information

Voting Procedures

Shareholders of the Fund who own shares at the close of business on the Record Date will be entitled to notice of, and to vote at, the Meeting and any adjournment(s) or postponement(s) thereof. You are entitled to one vote, or fraction thereof, for each share of the Fund, or fraction thereof, that you own on each matter as to which such shares are to be voted at the Meeting.