| | |

| | ROPES & GRAY LLP PRUDENTIAL TOWER 800 BOYLSTON STREET BOSTON, MA 02199-3600 WWW.ROPESGRAY.COM |

| | |

| | William M. Beaudoin T +1 617 854 2337 william.beaudoin@ropesgray.com |

February 21, 2018

VIA EDGAR

Ms. Kimberly A. Browning, Esq.

Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549

Re: AMG Funds IV (Registration Nos. 033-68666 and 811-08004)

Dear Ms. Browning:

I am writing on behalf of AMG Funds IV (the “Trust”) to respond to the comments of the staff (the “Staff”) of the Securities and Exchange Commission to Post-Effective Amendment No. 183 (the “485(a) Amendment”) under the Securities Act of 1933, as amended (the “1933 Act”), to the Trust’s Registration Statement on Form N-1A (the “Registration Statement”) filed on December 29, 2017, relating to AMG GW&K U.S. Small Cap Growth Fund and AMG Managers Fairpointe ESG Equity Fund (each a “Fund,” and collectively the “Funds”), each a series of the Trust. The Trust appreciates this opportunity to respond to the Staff’s comments. One of the Staff’s comments and the Trust’s response are set forth below. Certain defined terms used herein have the meaning set forth in the Funds’ prospectus. A separate letter will be submitted via EDGAR correspondence responding to the remainder of the comments provided by the Staff regarding the 485(a) Amendment.

1. Comment: To the extent each Fund’s fee table, portfolio turnover rate and performance data was not included in the 485(a) Amendment, please provide such information to the Staff at least one week before filing a post-effective amendment to the Trust’s Registration Statement relating to the Funds to be filed pursuant to Rule 485(b) under the 1933 Act.

Response: The Trust notes that each Fund’s fee table was included in the 485(a) Amendment. Each Fund’s portfolio turnover rate and performance data has been attached hereto as Appendix A.

Please direct any questions you may have with respect to this filing to me at (617) 854-2337.

Very truly yours,

|

/s/ William M. Beaudoin |

|

William M. Beaudoin |

|

cc : Mark Duggan, Esq. |

Maureen A. Meredith, Esq. |

Gregory C. Davis, Esq. |

Adam M. Schlichtmann, Esq. |

Appendix A

AMG GW&K U.S Small Cap Growth Fund

Portfolio Turnover

During the most recent fiscal year, the Fund’s portfolio turnover rate was 24% of the average value of its portfolio.

Performance

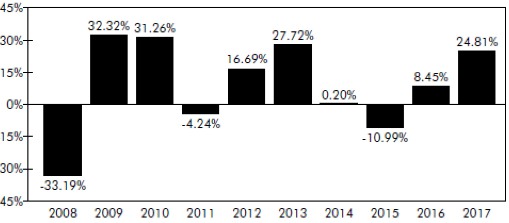

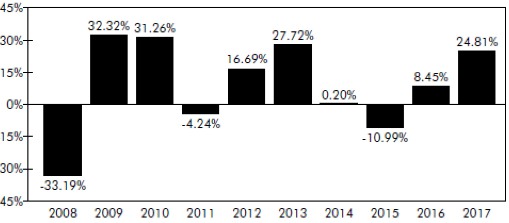

Calendar Year Total Returns as of 12/31/17 (Class N)

Best Quarter: 16.79% (4th Quarter 2010)

Worst Quarter: -25.91% (4th Quarter 2008)

Average Annual Total Returns as of 12/31/17

| | | | | | |

AMG GW&K U.S. Small Cap Growth Fund | | 1 Year | | 5 Years | | 10 Years |

Class N Return Before Taxes | | 24.81% | | 9.04% | | 7.17% |

Class N Return After Taxes on Distributions | | 20.22% | | 1.49% | | 3.03% |

Class N Return After Taxes on Distributions and Sale of Fund Shares | | 17.54% | | 5.99% | | 5.23% |

Class I Return Before Taxes | | 25.35% | | 9.36% | | 7.46% |

Russell 2000® Growth Index (reflects no deduction for fees, expenses, or taxes) | | 22.17% | | 15.21% | | 9.19% |

AMG Managers Fairpointe ESG Equity Fund

Portfolio Turnover

During the most recent fiscal year, the Fund’s portfolio turnover rate was 51% of the average value of its portfolio.

Performance

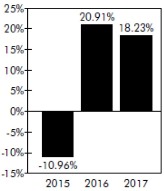

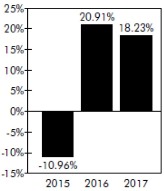

Calendar Year Total Returns as of 12/31/17 (Class N)

Best Quarter: 10.23% (3rd Quarter 2016)

Worst Quarter: -14.36% (3rd Quarter 2015)

Average Annual Total Returns as of 12/31/17

| | | | |

AMG Managers Fairpointe ESG Equity Fund | | 1 Year | | Since Inception1 |

Class N Return Before Taxes | | 18.23% | | 7.95% |

Class N Return After Taxes on Distributions | | 17.89% | | 7.75% |

Class N Return After Taxes on Distributions and Sale of Fund Shares | | 10.61% | | 6.14% |

Class I Return Before Taxes | | 18.50% | | 8.19% |

Russell 1000® Index (reflects no deduction for fees, expenses, or taxes) | | 21.69% | | 10.78% |

1 Performance shown reflects performance since the inception date of the Fund on December 24, 2014.