UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

|

| | | |

| Filed by the Registrant | x | |

| | | | |

| Filed by a Party other than the Registrant | o | |

| Check the appropriate box: | | |

| o | Preliminary Proxy Statement | | |

| | | | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | |

| x | Definitive Proxy Statement | | |

| | | | |

| o | Definitive Additional Materials | | |

| | | | |

| o | Soliciting Material Pursuant to §240.14a-12 |

VIAVI SOLUTIONS INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| 1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| 2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| 4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| 5) | Total fee paid: |

| | |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| 1) | Amount Previously Paid: |

| | |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| 3) | Filing Party: |

| | |

| | |

| 4) | Date Filed: |

| | |

VIAVI SOLUTIONS INC.

6001 America Center Drive

6th Floor, San Jose, California 95002

(408) 404-3600

Virtual Annual Meeting of Stockholders

Proxy Statement

2020 Annual Report

|

|

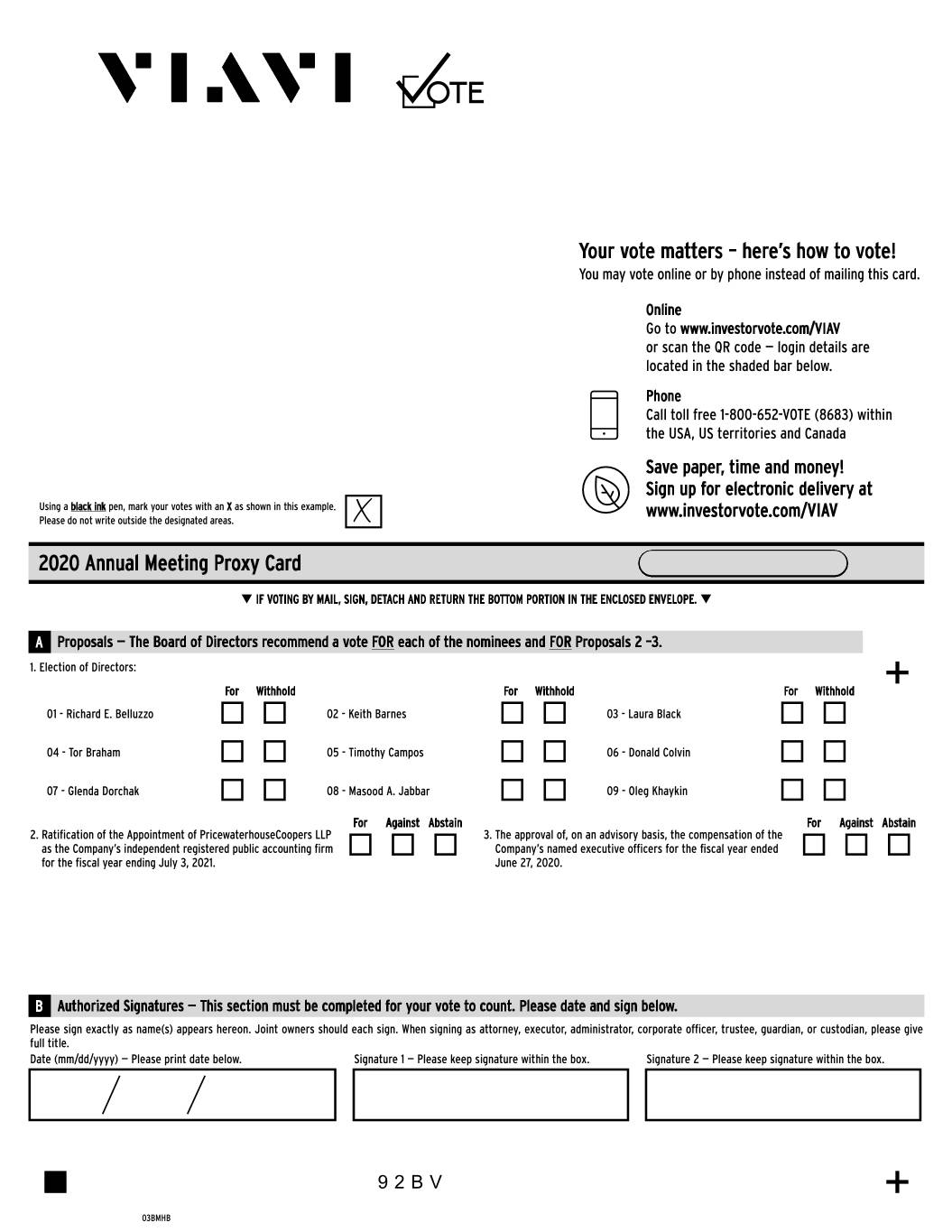

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. PLEASE REFER TO (I) THE INSTRUCTIONS OF THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL, (II) THE SECTION ENTITLED GENERAL INFORMATION BEGINNING ON PAGE 1 OF THIS PROXY STATEMENT, OR (III) IF YOU REQUESTED TO RECEIVE PRINTED PROXY MATERIALS, YOUR ENCLOSED PROXY CARD. |

| |

|

|

IMPORTANT NOTICE REGARDING THE PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 11, 2020: The notice of annual meeting, proxy statement and the annual report on Form 10-K for the fiscal year ended June 27, 2020, are available free of charge at the following website: www.edocumentview.com/VIAV |

| |

GO GREEN!

REGISTER ELECTRONICALLY FOR STOCKHOLDER MATERIALS

Viavi Solutions Inc. is pleased to take advantage of the Securities and Exchange Commission (the “SEC”) rules allowing companies to furnish this Proxy Statement and Annual Report over the Internet to our stockholders who hold Common Stock. We believe that this e-proxy process, also known as “Notice and Access” will expedite the receipt of proxy materials by our stockholders, reduce our printing and mailing expenses and reduce the environmental impact of producing the materials required for our annual meeting of stockholders.

You should refer to the “General Information” portion of the following Proxy Statement or contact our Investor Relations hotline at 408-404-6305 for assistance regarding instructions on how to register for and access our Proxy Statement and Annual Report online.

TABLE OF CONTENTS

October 2, 2020

Dear Stockholders:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Viavi Solutions Inc. (“VIAVI”). Preservation of health and safety is of the utmost importance to VIAVI and continues to drive our business decisions. To support the health and well-being of our stockholders, employees and directors in light of the COVID-19 pandemic, our 2020 Annual Meeting of Stockholders will be held as a virtual meeting of stockholders and stockholders will not be able to attend the meeting in person. Our Annual Meeting of Stockholders will be conducted exclusively via the internet at a virtual audio web conference at www.meetingcenter.io/210764753 on November 11, 2020, at 9:00 a.m. Pacific Time. Stockholders of record as of the close of business on September 23, 2020 are entitled to vote.

You can attend the 2020 Annual Meeting of Stockholders online, vote your shares during the online meeting and submit questions during the online meeting by visiting the above-mentioned internet site. We are committed to ensuring, to the extent possible, that stockholders will be afforded the ability to participate at the virtual meeting like they would at an in-person meeting. We hope to resume our historical practice of holding an in-person meeting next year. Details regarding how to access the virtual meeting via the internet and the business to be conducted at the meeting are more fully described in the accompanying Notice of 2020 Annual Meeting of Stockholders and proxy statement.

We have also elected to deliver our proxy materials to our stockholders over the internet and will mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement for our 2020 Annual Meeting of Stockholders and 2020 annual report to stockholders. This notice also provides instructions on how to vote by telephone or through the internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

The matters to be acted upon are described in the accompanying notice of annual meeting and proxy statement.

We hope that you will be able to attend this year’s Annual Meeting of Stockholders. Whether or not you plan to attend the meeting, please vote through the internet or by telephone or request, sign and return a proxy card to ensure your representation at the meeting. Your vote is important.

On behalf of the Board of Directors, we would like to express our appreciation for your continued support of VIAVI.

Sincerely,

Oleg Khaykin

President and Chief Executive Officer

Notice of 2020 Annual Meeting of Stockholders

Virtual Meeting Logistics

|

| | | | |

| | | | |

Date

Wednesday, November 11, 2020 | | Time

9:00 a.m., Pacific Time | | Live Webcast

www.meetingcenter.io/210764753 access begins at

8:30 a.m., Pacific Time |

Items of Business

| |

| • | To elect the 9 directors named in this proxy statement; |

| |

| • | To ratify the appointment of the independent registered public accounting firm for the fiscal year ending July 3, 2021; |

| |

| • | To approve, on an advisory basis, VIAVI's executive compensation; and |

| |

| • | To consider such other business as may properly come before the meeting. |

Important Meeting Information

Record Date

Stockholders of record as of September 23, 2020 will be able to vote and participate in the 2020 Annual Meeting of Stockholders using the control number included on their Notice of Internet Availability of Proxy Materials, proxy card or on the instructions that accompanied their proxy materials, and the password VIAV2020.

A Notice of Internet Availability of Proxy Materials was first sent on or about October 2, 2020.

Technical Issues

Contact (800) 736-3001 (toll-free) or +1 (781) 575-3100 (international) or review the instructions on the virtual meeting website if you experience any technical difficulties or have trouble accessing the virtual meeting.

Asking Questions

During the meeting, questions can only be submitted in the question box provided at: www.meetingcenter.io/210764753.

Your Vote is Important.

Whether or not you plan to attend the meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. please refer to (i) the instructions of the Notice of Internet Availability of Proxy Materials you received in the mail, (ii) the section entitled general information beginning on page 1 of this proxy statement, or (iii) if you requested to receive printed proxy materials, your enclosed proxy card.

Notice of 2020 Annual Meeting of Stockholders (Continued)

By Order of the Board of Directors,

Oleg Khaykin

President and Chief Executive Officer

San Jose, California

October 2, 2020

|

|

IMPORTANT NOTICE REGARDING THE PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 11, 2020: The notice of annual meeting, proxy statement and the annual report on Form 10-K for the fiscal year ended June 27, 2020, are available free of charge at the following website: www.edocumentview.com/VIAV |

| |

This summary provides an overview of selected information in this year’s proxy statement. We encourage you to read the entire proxy statement before voting.

Annual Meeting of Stockholders

|

| |

| Date & Time: | Wednesday, November 11, 2020 at 9:00 a.m. Pacific Time |

| Location: | www.meetingcenter.io/210764753 |

| Record Date: | September 23, 2020 |

Voting Matters

Stockholders will be asked to vote on the following matters at the 2020 Annual Meeting of Stockholders (the "2020 Annual Meeting") of Viavi Solutions Inc. (“VIAVI”):

|

| | |

| | Board Recommendation |

ITEM 1. Election of Directors The Board of Directors (the "Board') believes that each of the director nominees has the knowledge, experience, skills and background necessary to contribute to an effective and well-functioning Board. | | Vote FOR each director nominee |

ITEM 2. Ratification of the Appointment of PricewaterhouseCoopers LLP as VIAVI’s independent registered public accounting firm for fiscal year 2021 The Audit Committee and the Board believe that the continued retention of PricewaterhouseCoopers LLP to serve as VIAVI’s independent auditors is in the best interests of VIAVI and its stockholders.

|

| Vote FOR |

ITEM 3. Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers The Board believes that the compensation of our named executive officers as disclosed in this proxy statement for fiscal year 2020 is well aligned with VIAVI’s performance and the interests of our stockholders.

| | Vote FOR |

| | | |

VIAVI at a Glance

Our Values

The six VIAVI business values below articulate the cultural identity for VIAVI and provide shared understanding of expectations across the company.

These values were identified through global workshops to understand the foundational components of working at VIAVI, as well as the guiding principles that will help us to achieve our objectives globally. These values clarify the desired operating environment of the employees and management. The values reinforce the importance of how we approach working together in service of our stakeholders and creating a winning company strategy.

Governance Highlights

Board Composition

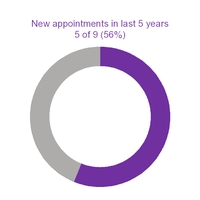

The Governance Committee regularly reviews the overall composition of the Board and its committees to assess whether it reflects the appropriate mix of skills, experience, backgrounds and qualifications that are relevant to VIAVI’s current and future global business and strategy.1

Board Tenure

The Board considers length of tenure when reviewing nominees in order to maintain an overall balance of experience, continuity and fresh perspective.

|

| | | |

0-5 Years: 56% | 5-10 Years: 78% | 10+ Years: 22% | Average tenure of all director nominees: 7 years |

Board Profile

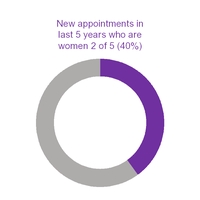

Board Refreshment

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience and qualifications, introduce fresh perspectives, and broaden and diversify the views and experience represented on the Board.

_________________________________________

| |

1 | For the purpose of the charts, each year refers to the 12-month period ending on October 2. |

Our Director Nominees

|

| | | | | | | |

| | | | | Committee Memberships (effective June 27, 2020) |

| Nominee | Age at Record Date | Primary Occupation | Director Since | Audit Committee | Compensation Committee | Corporate Development Committee | Governance Committee |

| Richard E. Belluzzo(C) | 66 | US Venture Partner of Innogest SGR SpA | February 2005 | | ● | | ● |

| Keith Barnes | 69 | Former Chief Executive Officer and Chair of the Board of Verigy Ltd. | October 2011 | ●FE | ● | | ● |

| Laura Black | 59 | Managing Director of Needham & Company, LLC | February 2018 | | | ● | ● |

| Tor Braham | 62 | Former Managing Director and Global Head, Technology, M&A for Deutsche Bank Securities | October 2015 | | | ● | |

| Timothy Campos | 47 | Chief Executive Officer of Woven, Inc. | April 2014 | | ● | ● | |

| Donald Colvin | 67 | Former Interim Chief Financial Officer of Isola Group Ltd. | October 2015 | ●FE | | ● | |

| Glenda Dorchak | 66 | Independent technology business consultant. | November 2019 | | ● | | |

| Masood A. Jabbar | 70 | Former Chief Executive Officer of XDS Inc. | March 2006 | ●FE | | ● | |

| Oleg Khaykin | 55 | Chief Executive Officer of Viavi Solutions Inc. | February 2016 | | | | |

(C): Chair of the Board

●: Committee Chair

●: Member

FE: Audit Committee Financial expert

Governance Practices

We are vocal advocates for the adoption of sound corporate governance policies that include strong Board leadership and strategic deliberation, prudent management practices and transparency.

Highlights of our governance practices, among others include:

|

| | |

| ● | | Non-executive, independent Chairman |

| ● | | Annual election of directors |

| ● | | Majority voting for directors in uncontested elections |

| ● | | All committees are comprised of independent directors |

| ● | | All members of the Audit Committee are Audit Committee Financial Experts |

| ● | | Executive sessions of independent directors |

| ● | | Annual Board and Committee evaluations |

| ● | | Risk oversight by Board and Committees, including with respect to cybersecurity |

| ● | | Procedures for shareholders to communicate directly with the Board |

| ● | | Stock ownership requirements for directors and executives |

| ● | | Annual advisory vote on executive compensation |

| ● | | Annual review of Committee charters and Corporate Governance Guidelines |

| ● | | Governance Committee oversight of environmental, social and governance matters |

Stockholder Engagement and Outreach

Stockholder engagement is essential to our ongoing review of our corporate governance and executive compensation programs and practices. Executive management, Investor Relations and the Corporate Secretary engage with stockholders from time to time to understand their perspectives on a variety of corporate governance matters, including executive compensation, corporate governance policies and corporate sustainability practices.

We also communicate with stockholders through a number of routine forums, including:

|

| | | |

| ● | | Quarterly earnings presentations; | In 2020, we spoke to stockholders, representing 53% of our shares outstanding. |

| ● | | SEC filings; |

| ● | | The annual report and proxy statement; |

| ● | | The annual stockholders meeting; and |

| ● | | Investor meetings, conferences and web communications. |

We relay stockholder feedback and trends on corporate governance and sustainability developments to our Board and its standing Committees and work with them to enhance our practices and improve our disclosures.

Compensation Discussion and Analysis Highlights

Compensation Policies and Practices

Our commitment to designing an executive compensation program that is consistent with responsible financial and risk management is reflected in the following policies and practices:

|

| | | | | |

| | What We Do | | | What We Don’t Do | |

| | | | | | |

| | | | | | |

| Compensation Committee is comprised 100% of independent directors. | | | No repricing or repurchasing of underwater stock options without stockholder approval. | |

| Independent compensation consultant retained by the Compensation Committee. | | | No dividends or dividend equivalents on unearned awards. | |

| Balance short- and long-term incentives, cash and equity and fixed and variable pay elements. | | | No pledging or hedging of VIAVI securities. | |

| Performance-based awards comprising approximately 50% of the overall equity allocation to executive officers. | | | No “single trigger” change in control acceleration of vesting for equity awards. | |

| Require one-year minimum vesting for awards granted under the Amended and Restated 2003 Equity Incentive Plan, subject to certain exceptions. | | | No excessive perquisites or severance benefits. | |

| Maintain a clawback policy that applies to both cash incentives and equity awards. | | | No executive pension plans or supplemental retirement plans. | |

| Assess and mitigate compensation risk. | | | No “golden parachute” tax gross-ups. | |

| Solicit an annual advisory vote on executive compensation. | | | | |

| Maintain stock ownership guidelines. | | | | |

| | | | | | |

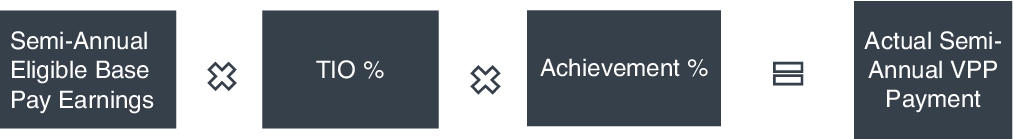

Incentive Program – Pay-for-Performance Highlights

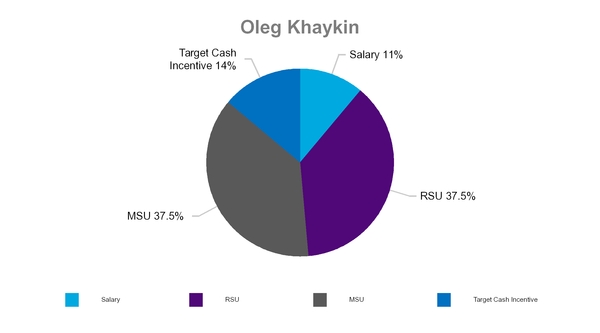

As described more fully in the Compensation Discussion and Analysis section of this proxy statement, our Named Executive Officers (NEOs) are compensated in a manner consistent with our performance-based pay philosophy and corporate governance best practices. Below are a few highlights of our pay for performance philosophy as they relate to our CEO.

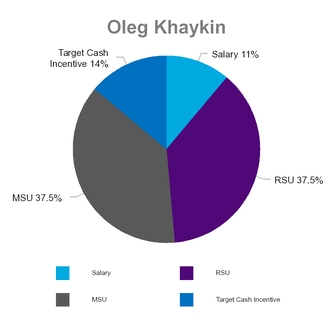

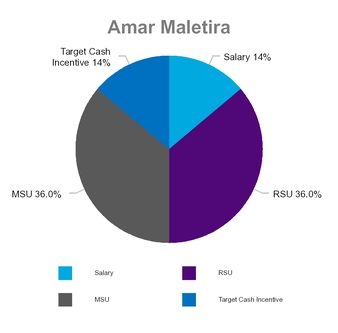

Fiscal 2020 CEO Target Total Direct Compensation

51.5% performance-based and 89% at risk

Fiscal Year 2020 Incentive Plan Results (CEO)

|

| | |

Fiscal Year 2020 VPP Payout | MSUs Earned in Fiscal Year 2020

| Fiscal Year 2020 Performance

|

$514K for H1 of FY2020 | FY2016 MSUs: 150% of 4th tranche earned | 87.5 percentile TSR ranking |

$0 for H2 of FY2020 (waived by CEO) | FY2017 MSUs: 150% of 3rd tranche earned | 86.3 percentile TSR ranking |

| | FY2018 MSUs: 142.5% of 2nd tranche earned | 72 percentile TSR ranking |

| | FY2019 MSUs: 150% of 1st tranche earned | 90.9 percentile TSR ranking |

Fiscal Year 2020 Financial Performance

The first half of fiscal year 2020 was characterized by significant increases in 6-months revenue and GAAP and non-GAAP operating profits. The second half, however, was heavily impacted by the COVID-19 pandemic. Despite the pandemic disruption, VIAVI demonstrated solid execution and still grew revenue and profitability in fiscal year 2020 compared to fiscal year 2019.

|

| |

| Net revenue | |

| |

| $1,136.3 million, up $6.0 million or 0.5% year-over-year | |

| | |

| GAAP operating margin | Non-GAAP operating margin* |

|

|

| 10.4%, up 440 bps year-over-year | 18.6%, up 110 bps year-over-year |

| | |

| GAAP EPS | Non-GAAP EPS* |

|

|

| $0.12, up $0.09 or 300.0% year-over-year | $0.73, up $0.05 or 7.4% year-over-year |

| | |

* See Annex A for non-GAAP reconciliation.

Environmental Social and Governance (ESG) Highlights

Environmental Stewardship

| |

| • | Reducing Our Carbon Footprint. We have continued to focus on energy efficiency, both in our products and business practices, which has resulted in a significant reduction of our carbon footprint over the years. |

| |

| • | Sustainability Reporting. In 2020, we resumed submission of carbon and water sustainability reporting with the Carbon Disclosure Project. |

Corporate and Global Citizenship

| |

| • | Employee Feedback on Social Matters. Our CEO recently established a grass-roots initiative seeking input from employees worldwide on social topics of key importance to them and recommendations for organizations we can more actively support. |

| |

| • | Giving to Our Communities. As a result of that feedback, we made a $50,000 donation to the NAACP Legal Defense and Education Fund and are establishing a program through which regional offices will receive annual philanthropic funding and committees of local employees will decide where and how to allocate those funds. |

Governance and Human Capital Management

| |

| • | New Female Directors. We appointed two highly respected female industry experts to our Board in the past two calendar years. |

| |

| • | Everyday Development Approach. We have implemented a new approach, Everyday Development, to talent and performance management to better align with the way we run our business, where teams are being coached and supported throughout the year. |

| |

| • | New Graduate Outreach. We have established several outreach programs to engage recent engineering and computer science graduates from diverse countries and backgrounds. |

| |

| • | Prioritizing Health and Safety. During the COVID-19 pandemic, health and safety has come into an even sharper focus and our decisions around travel, work from home, safety practices, and reopening sites have been formed based upon the guidance of leading public health authorities, local government regulations, and the expertise of our global Human Resources, Employee Health and Safety, Information Technology, Operations, Legal, and Communications teams. |

| |

| • | Prioritizing Our Workforce as a Whole. Our NEOs waived their fiscal year 2020 second half bonuses so that such bonuses could be allocated to the general pool for non-executive employees, in keeping with our commitment to support our employees as a whole and in recognition of their continued hard work and dedication. |

General Information

Why am I receiving these proxy materials?

The Board is furnishing these proxy materials to you in connection with 2020 Annual Meeting. The 2020 Annual Meeting will be held on November 11, 2020 online via audio webcast, at 9:00 a.m., Pacific Standard Time. You are invited to attend the 2020 Annual Meeting online and are entitled and requested to vote on the proposals outlined in this Proxy Statement.

Why is the 2020 Annual Meeting being held as a virtual, online meeting?

To support the health and well-being of our stockholders, employees and directors in light of the recent COVID-19 pandemic, the 2020 Annual Meeting will be a virtual meeting of stockholders where stockholders will participate by accessing a website using the internet, and there will not be a physical meeting location. In light of the public health and safety concerns related to the COVID-19 pandemic, we believe that hosting a virtual meeting will facilitate stockholder attendance and participation at the 2020 Annual Meeting by enabling stockholders to participate remotely from any location around the world. We have designed the virtual 2020 Annual Meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform. We hope to return to holding an in-person annual meeting in 2021.

Who can vote their shares and attend the 2020 Annual Meeting?

Stockholders as of the record date for the meeting, September 23, 2020, are entitled to vote their shares and attend the virtual annual meeting. At the close of business on the record date, there were 229,375,510 shares of VIAVI common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on September 23, 2020, your shares were registered directly in your name with our transfer agent, Computershare, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the meeting or vote by proxy and you do not need to register to attend the meeting. Whether or not you plan to attend the meeting, we urge you to vote by telephone or through the internet, or if you request or receive paper proxy materials by mail, by filling out and returning a proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If on September 23, 2020, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the meeting. Because you are not the stockholder of record, you may not attend or vote your shares at the meeting unless you (i) request and obtain a legal proxy giving you the right to vote the shares at the meeting from the organization that holds your shares and (ii) register to attend the 2020 Annual Meeting. Please see “How do I register to attend the virtual 2020 Annual Meeting?” below for information on how to register to attend the 2020 Annual Meeting.

How do I virtually attend the 2020 Annual Meeting?

We will host the 2020 Annual Meeting live online via audio webcast. You may attend the 2020 Annual Meeting live online by visiting www.meetingcenter.io/210764753. The webcast will start at 9:00 a.m. Pacific Time on November 11, 2020. If you are a stockholder of record, you will need to enter the control number included on your proxy card and the password VIAV2020 in order to be able to enter the 2020 Annual Meeting online. If you are a beneficial owner and have registered in advance to participate in the 2020 Annual Meeting, you will need to enter the control number that you received from Computershare and the password VIAV2020. Online check-in will begin at 8:30 a.m. Pacific Time on November 11, 2020, and you should allow ample time for the online check-in proceedings. if you experience any technical difficulties or have trouble accessing the virtual meeting, contact 1 (800) 736-3001 (toll-free) or +1 (781) 575-3100 (international) or review the instructions on the virtual meeting website.

How do I register to attend the virtual 2020 Annual Meeting?

If you are a stockholder of record, you do not need to register to attend the 2020 Annual Meeting. However, if you are the beneficial owner of your shares, you must register in advance to attend the 2020 Annual Meeting. To register to attend the virtual 2020 Annual Meeting online, you must obtain a legal proxy from your brokerage firm, bank or other nominee and submit proof of your legal proxy reflecting your holdings of our stock, along with your legal name and email address, to our virtual meeting provider, Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on November 5, 2020. You will receive a confirmation of your registration by email and a control number after we receive your registration materials. Requests for registration should be directed to the following:

| |

| • | By email: Forward the email from your brokerage firm, bank or other nominee, or attach an image of your legal proxy, to legalproxy@computershare.com. |

| |

| • | By mail: Mail to Computershare, VIAVI Legal Proxy, P.O. Box 505000 Louisville, KY 40233-5005 unless this is an overnight request. Overnight requests should be mailed to Computershare, VIAVI Legal Proxy, 462 South 4th Street, Suite 1600, Louisville, KY 40202. |

How do I vote?

You may vote by mail or follow any alternative voting procedure (such as telephone or internet voting) described on your proxy card or your voting instruction card. To use an alternative voting procedure, follow the instructions on each proxy card or your voting instruction card that you receive. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote before the 2020 Annual Meeting:

| |

| • | by telephone or through the internet - in order to do so, please follow the instructions shown on your Notice of Internet Availability or proxy card; or |

| |

| • | by mail - if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the pre-paid envelope provided; or |

You may also vote during the 2020 Annual Meeting through the internet.

If you want to vote by telephone before the meeting, your votes must be submitted by 11:59 p.m. Eastern Time, on November 10, 2020. If you want to vote through the internet, your votes can be submitted before and during the 2020 Annual Meeting. Submitting your proxy, whether by telephone, through the internet or by mail if you request or received a paper proxy card, will not affect your right to vote should you decide to attend the virtual 2020 Annual Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Other Nominee

If you are not the stockholder of record, please refer to the voting instructions provided by your nominee regarding how to vote your shares. Your vote is important. To ensure that your vote is counted, complete and mail the voting instruction card provided by your brokerage firm, bank, or other nominee as directed by your nominee. To vote at the 2020 Annual Meeting, you must obtain a legal proxy from your nominee and register to attend the meeting. Please see “How do I register to attend the virtual 2020 Annual Meeting?” above for information on how to register to attend the 2020 Annual Meeting. Whether or not you plan to attend the meeting, we urge you to vote your voting instruction card to ensure that your vote is counted.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor by any of the methods listed below:

Georgeson LLC

1290 Avenue of the Americas

9th Floor

New York, NY 10104

Shareholders, Banks and Brokers Call: 1 (888) 867-6963

Will you make a list of the stockholders of record entitled to vote at the 2020 Annual Meeting available through electronic means?

We will make available an electronic list of stockholders of record as of the record date for inspection by stockholders from November 1, 2020 through November 10, 2020. To access the electronic list during this time, please send your request, along with proof of ownership, by email to investor.relations@viavisolutions.com. You will receive confirmation of your request and instructions on how to view the electronic list online. The list will also be available to stockholders at www.meetingcenter.io/210764753 during the live audio webcast of the 2020 Annual Meeting.

Why did I receive the Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities & Exchange Commission (the "SEC"), we have elected to provide stockholders with access to our proxy materials over the Internet. Most of our stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the “Notice of Internet Availability of Proxy Materials” (the “Notice”), which was mailed on or about October 2, 2020 to our stockholders as of the record date, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or e-mail copy of our proxy materials, you should follow the instructions in the Notice for requesting such materials. We encourage stockholders to take advantage of the availability of our proxy materials via the Internet to help reduce the environmental impact of our Annual Meetings.

How do I obtain electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

| |

| • | View our proxy materials for the Annual Meeting on the Internet; and |

| |

| • | Instruct us to send our future proxy materials to you electronically by e-mail. |

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

What if I prefer to receive paper copies of the materials?

If you would prefer to continue receiving paper copies of proxy materials, please mark the “Paper Copies” box on your Proxy Card (or provide this information when you vote telephonically or via the Internet). The Company must provide paper copies via first class mail to any stockholder who, after receiving the Notice, requests a paper copy. Accordingly, even if you do not check the “Paper Copies” box now, you will still have the right to request delivery of a free set of proxy materials upon receipt of any Notice in the future.

Additionally, you may request a paper copy of the materials by (i) calling 1-800-962-4284 or 781-575-3120 for international callers; (ii) sending an e-mail to investorvote@computershare.com; or (iii) logging onto https://www.computershare.com/investor. There is no charge to receive the materials by mail. If requesting material by e-mail, please include the “Control Number” (located on the front page of the Notice).

What is included in the proxy materials?

The proxy materials include this Proxy Statement and our Annual Report on Form 10-K for the year ended June 27, 2020, as filed with the SEC on August 24, 2020 (the “Annual Report”). These materials were first made available to you via the Internet on or about October 2, 2020. Our principal executive offices are located at 6001 America Center Drive, 6th Floor, San Jose, California 95002, and our telephone number is (408) 404-3600. We maintain a website at www.viavisolutions.com. The information on our website is not a part of this Proxy Statement.

How can I avoid having duplicate copies of the Proxy Statement sent to my household?

Some brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports, which results in cost savings for the Company. Householding means that only one copy of the Proxy Statement and Annual Report or notice of internet availability of proxy materials will be sent to multiple stockholders who share an address. The Company will promptly deliver a separate copy of either document to any stockholder who contacts

the Company’s Investor Relations Department at (408) 404-6305 or 6001 America Center Drive, 6th Floor, San Jose, California 95002, Attention: Investor Relations, requesting such copies. If a stockholder is receiving multiple copies of the Proxy Statement and Annual Report at the stockholder’s household and would like to receive a single copy of those documents for a stockholder’s household in the future, that stockholder should contact their broker, other nominee record holder, or the Company’s Investor Relations Department to request mailing of a single copy of the Proxy Statement and Annual Report.

What if I return a proxy card but do not make specific choices?

When proxies are properly dated, executed, and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations of our Board of Directors as described below. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described under “Can I change my vote or revoke my proxy after submitting my proxy?”

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding and entitled to vote on the Record Date will constitute a quorum permitting the Annual Meeting to conduct its business.

What proposals will be voted on at the Annual Meeting?

The following proposals are scheduled to be voted on at the Annual Meeting:

| |

| 1. | To elect the nine nominees named in the Proxy Statement as directors to serve until the 2021 Annual Meeting and until their respective successors are elected and qualified. |

| |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm (the “independent auditors”) for the fiscal year ending July 3, 2021. |

| |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers for the year ended June 27, 2020, as set forth in the Proxy Statement. |

| |

| 4. | To consider such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

What are the recommendations of the Company’s Board of Directors?

The Board recommends that you vote “FOR” each of the proposals presented in this Proxy Statement.

Specifically, the Board recommends you vote:

| |

| • | “FOR” the election of the directors, |

| |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending July 3, 2021, and |

| |

| • | “FOR” the approval of the Company’s executive compensation programs. |

How are abstentions and broker non-votes treated?

Under Delaware law, an abstaining vote and a broker non-vote are counted as present and are included for purposes of determining whether a quorum is present at the Annual Meeting.

Broker non-votes are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting authority with respect to that item and has not received instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held by them as nominee, brokers have

the discretion to vote such shares only on routine matters. Where a matter is not considered routine, shares held by your broker will not be voted absent specific instruction from you, which means your shares may go unvoted and not affect the outcome if you do not specify a vote. None of the matters to be voted on at the Annual Meeting are considered routine, except for the ratification of the Company’s independent auditors.

For the purpose of determining whether the stockholders have approved matters, other than the election of directors, abstentions will have the same effect as a vote against the proposal.

What is the voting requirement to approve each of the proposals?

Proposal 1. Each director must be elected by the affirmative vote of a majority of the shares of our common stock cast with respect to such director by the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. This means that the number of votes cast for a director must exceed the number of votes cast against that director, with abstentions and broker non-votes not counted as votes cast as either for or against such director’s election.

Proposal 2. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm requires the affirmative vote of a majority of the shares of our common stock present or represented by proxy and entitled to vote on this proposal at the Annual Meeting. Abstentions and broker non-votes will be counted towards a quorum. As a result, abstentions will have the same effect as votes against the proposal. Brokers will have discretion to vote on this proposal.

Proposal 3. Approval of the non-binding advisory vote on the Company’s executive compensation programs requires the affirmative vote of a majority of the shares of our common stock present or represented by proxy and entitled to vote on this proposal at the Annual Meeting. Abstentions and broker non-votes will be counted towards a quorum. As a result, abstentions will have the same effect as votes against the proposal. Broker non-votes will have no effect on the outcome of this proposal.

All shares of our common stock represented by valid proxies will be voted in accordance with the instructions contained therein. In the absence of instructions, proxies from holders of our common stock will be voted in accordance with the recommendations set forth in the Proxy Statement.

Who will tabulate the votes?

A representative of our transfer agent, Computershare will tabulate the votes and act as inspector of election.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements or to allow for the tabulation and/or certification of the vote.

Can I change my vote or revoke my proxy after submitting my proxy?

You may revoke your proxy at any time before the final vote deadline of 11:59 p.m. Eastern Standard Time (8:59 p.m. Pacific Time) on November 10, 2020. You may do so by one of the following ways:

| |

| • | submitting another proxy card bearing a later date; |

| |

| • | sending a written notice of revocation to the Company’s Secretary at 6001 America Center Drive, 6th Floor, San Jose, California 95002; or |

| |

| • | submitting new voting instructions via telephone or the Internet. |

For shares you hold beneficially in street name, you generally may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

Who is paying for this proxy solicitation?

This solicitation is made by the Company. The Company will bear the cost of soliciting proxies, including preparation, assembly, printing and mailing of the Proxy Statement. If you are a holder of our common stock and if you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. The Company has retained the services of Georgeson LLC. as its proxy solicitor for this year for a fee of approximately $12,500 plus reasonable out-of-pocket costs and expenses. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, either personally, by telephone, facsimile, or telegram.

How can I find out the voting results?

The Company will announce the preliminary results at the Annual Meeting and publish the final results in a Current Report on Form 8-K within four business days after the Annual Meeting. Stockholders may also find out the final results by calling the Company’s Investor Relations Department at (408) 404-6305.

When are stockholder proposals due for next year’s annual meeting?

In order for stockholder proposals to be considered properly brought before an annual meeting, the stockholder must have given timely notice in writing to the Company’s Secretary at 6001 America Center Drive, 6th Floor, San Jose, California 95002. To be timely for the 2021 Annual Meeting, a stockholder’s notice must be received by the Company at its principal executive offices not less than 60 days nor more than 90 days prior to the first anniversary of the date of the prior year’s annual meeting; provided, however, that if no meeting was held the prior year, or if the date of the annual meeting is advanced by more than 30 days or delayed (other than as a result of adjournment) by more than 60 days, notice must be received by the Company no later than the 90th day prior to the annual meeting or the 10th day following the public announcement of the meeting date. Therefore, to be timely for the 2021 Annual Meeting, the Secretary must receive the written notice no earlier than August 13, 2021 and no later than September 12, 2021. A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the 2020 Annual Meeting: (i) a brief description of the business desired to be brought before the 2021 Annual Meeting and the text of the proposal or business; (ii) the name and record address of the stockholder proposing such business and the beneficial owner, if any, on whose behalf the proposal is being made; (iii) a representation that the stockholder is a holder of record of the Company’s stock, is entitled to vote at the meeting and intends to appear in person or by proxy to propose the business specified in the notice; (iv) any material interest of the stockholder or any proposing person in such business; (v) the number of shares owned beneficially and of record by the stockholder or proposing person, including derivative interests, contracts or other agreements related to ownership or rights to vote the Company’s shares and other economic interests in the Company’s securities; and (vi) any other information required pursuant to Section 14 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Our Bylaws specify in greater detail the requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to bring any item before an annual meeting review a copy of our Bylaws, as amended and restated to date, which can be found at www.viavisolutions.com. We will not entertain any proposals at the 2021 Annual Meeting that do not meet the requirements set forth in the Company's Bylaws. Subject to applicable laws and regulations, the Company has discretion over what stockholder proposals will be included in the agenda for the 2021 Annual Meeting and/or in the related proxy materials. If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Exchange Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal.

Proposals that a stockholder intends to present at the 2021 Annual Meeting and wishes to be considered for inclusion in the Company’s Proxy Statement for the 2021 Annual Meeting must be received by the Company at its principal executive offices not less than 120 days prior to the anniversary date the Proxy Statement for the Annual Meeting was made available to stockholders. Therefore, for a stockholder proposal to be considered for inclusion in the Company’s Proxy Statement for the 2021 Annual Meeting, the Secretary must receive the written proposal no later than June 4, 2021. If we change the date of the 2020 Annual Meeting by more than 30 days from the anniversary of the date of this year’s meeting, then the deadline to submit proposals will be a reasonable time before we begin to print and mail our proxy materials. All such proposals must comply with Rule 14a-8 under the Exchange Act, which lists the requirements for the inclusion of stockholder proposals in Company-sponsored proxy materials.

How do I suggest potential candidates for director positions?

Stockholders wishing to recommend candidates for director positions may do so by providing a timely notice in writing to the Company’s Secretary at 6001 America Center Drive, 6th Floor, San Jose, California 95002, providing the candidate’s name, biographical data and qualifications, a document indicating the candidate’s willingness to act if elected, and evidence of the

nominating stockholder’s ownership of Company’s stock not less than 60 days nor more than 90 days prior to the first anniversary of the date of the prior year’s annual meeting to assure time for meaningful consideration by the Governance Committee; provided, however, that if no meeting was held the prior year, or if the date of the annual meeting is advanced by more than 30 days or delayed (other than as a result of adjournment) by more than 60 days, notice must be received by the Secretary no later than the 90th day prior to the annual meeting or the 10th day following the public announcement of the meeting date. Therefore, to be timely for the 2021 Annual Meeting, the Secretary must receive written notice no earlier than August 13, 2021 and no later than September 12, 2021. Our Bylaws specify in greater detail the requirements as to the form and content of the stockholder’s notice. We recommend that any stockholder wishing to nominate a director review a copy of our Bylaws, as amended and restated to date, which can be found at www.viavisolutions.com.

Proposal 1 - Election of Directors

Election of Directors

At this Annual Meeting, the stockholders will elect nine directors recommended by the Governance Committee and nominated by the Board, each to serve a one-year term until the 2021 Annual Meeting and until a qualified successor is elected and qualified or until the director’s earlier resignation or removal. The Board has no reason to believe that the nominees named below will be unable or unwilling to serve as a director if elected.

Considerations in Director Selection

The Company’s Governance Committee is responsible for reviewing, evaluating and nominating individuals for election to the Company’s Board. The Governance Committee selects nominees from a broad base of potential candidates. The Governance Committee’s charter instructs it to seek qualified candidates regardless of race, color, religion, ancestry, national origin, gender, sexual orientation, etc. It is the Governance Committee’s goal to nominate candidates with diverse backgrounds and capabilities, to reflect the diverse nature of the Company’s stakeholders (security holders, employees, customers and suppliers), while emphasizing core excellence in areas relevant to the Company’s long-term business and strategic objectives.

The Board believes that it is necessary for each of the Company’s directors to possess many qualities and skills. When searching for new candidates, the Governance Committee seeks individuals of the highest ethical and professional character who will exercise sound business judgment. The Governance Committee also seeks people who are accomplished in their respective field and have superior credentials. In selecting nominees, the Governance Committee seeks individuals who can work effectively together to further the interests of the Company, while preserving their ability to differ with each other on particular issues. A candidate’s specific background and qualifications are also reviewed in light of the particular needs of the Board at the time of an opening. In November 2019, the Board appointed Glenda Dorchak after an extensive search and upon recommendation from another board member.

Certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole are described below. Biographical information is as of the date of this Proxy Statement.

2020 Director Nominees

Richard E. Belluzzo

Age 66

Director Since: February 2005

Chair of the Board Since: November 2012

Experience:

Mr. Belluzzo served as interim Chief Executive Officer of VIAVI from August 2015 through February 2016. Mr. Belluzzo has served as US Venture Partner of Innogest SGR SpA, a European Venture Fund since February 2015. From April 2011 to August 2012, he served as Executive Chair of Quantum Corporation, a provider of backup, recovery and archive products and services. From 2002 to 2011, he was Chair and Chief Executive Officer of Quantum Corporation. Prior to that, Mr. Belluzzo was President and Chief Operating Officer of Microsoft Corporation. Prior to becoming its President and Chief Operating Officer, Mr. Belluzzo served as Microsoft’s Group Vice President of the Personal Services and Devices Group and was Group Vice President for the Consumer Group. Prior to Microsoft, Mr. Belluzzo was Chief Executive Officer of Silicon Graphics Inc. Before Silicon Graphics, Mr. Belluzzo held a series of increasingly senior roles at Hewlett Packard Company, culminating in his service as Executive Vice President of the Computer Products Organization. Mr. Belluzzo recently served on the boards of Quantum Corporation and PMC-Sierra, and previously served as the Chair of the Board of Directors, a member of the Governance and Nominating Committee, and Chair of the Compensation Committee of InfoBlox.

Qualifications:

Mr. Belluzzo’s background and experience as the Chief Executive Officer of public companies, as well as his deep knowledge of the technology industry, senior leadership roles and service on the boards of other prominent public

companies allow him to contribute significantly to the Board as its independent Chair and to its Compensation and Governance Committee.

Keith Barnes

Age 69

Director Since: October 2011

Experience:

Mr. Barnes served as Chief Executive Officer of Verigy Ltd, a semiconductor automatic test equipment company, from 2006 through 2010 and as Chair of the Board of Verigy from 2008 through 2011. Prior to that he was Chair and Chief Executive Officer of Electroglas, Inc. from 2003 through 2006 and Chair and Chief Executive Officer of Integrated Measurement Systems, Inc. from 1995 through 2001. Mr. Barnes is currently a member of the Board of Directors, Chair of Governance and Nominating Committee, and member of the Audit Committee of Knowles Corporation. Mr. Barnes is a member of the Board of Directors, Chair of the Compensation Committee and member of the Governance and Nominating committees of Rogers Corporation. Within the past five years, Mr. Barnes also served on the Boards of Directors of Mentor Graphics and Spansion Inc.

Qualifications:

Mr. Barnes’ extensive management experience as Chief Executive Officer of several technology companies, test and measurement industry background, and international sales and marketing knowledge, along with his experience as a board member for several public technology companies, provide important perspective and expertise as a director and Chair of the Compensation Committee and a member of the Audit and Governance Committee.

Laura Black

Age 59

Director Since: February 2018

Experience:

Ms. Black has served as a Managing Director of Needham & Company, LLC, a full-service investment banking firm since 1999. At Needham, she has raised public and private equity capital for numerous technology companies and served as strategic financial advisor on multiple mergers and acquisitions transactions. From July 1995 to February 1999, she served as a Managing Director of Corporate Finance at Black & Company, a regional investment bank subsequently acquired by Wells Fargo Van Kasper. From July 1993 to June 1995, Ms. Black served as a Director for TRW Avionics & Surveillance Group where she evaluated acquisition candidates, managed direct investments and raised venture capital to back spin-off companies. From August 1983 to August 1992, she worked at TRW as an electrical engineer designing spread spectrum communication systems. Ms. Black is currently a member of the Board of Directors, Chair of the Nominating and Governance Committee and member of the Audit Committee of Ichor Holdings, Ltd. Within the last five years, Ms. Black also served as Chair on the Audit Committee of Super Micro Computer, Inc.

Qualifications:

Ms. Black’s investment banking background and substantial experience with mergers and acquisitions and technology-focused firms as well as her experience as a public company audit committee chair, bring important perspective and expertise to the Board and its Corporate Development Committee and assist the Board in evaluating strategic opportunities.

Tor Braham

Age 63

Director Since: October 2015

Experience:

Mr. Braham served as Managing Director and Global Head, Technology, Mergers and Acquisitions for Deutsche Bank Securities, from 2004 until 2012. From 2000 to 2004, he served as Managing Director and Co-head, West Coast U.S.

Technology, Mergers and Acquisitions for Credit Suisse First Boston. Prior to that, Mr. Braham was an investment banker with UBS Securities and a lawyer at a prominent Silicon Valley law firm. Mr. Braham currently serves as a member of the Board of Directors and member of the Audit Committee of Altaba, Inc., formerly Yahoo! Inc. Mr. Braham also serves as a member of the Board of Directors, and a member of the Audit Committee and Compensation Committee of A10 Networks, a networking and security company. Within the past five years, Mr. Braham also served on the Boards of Directors of Sigma Designs, Inc. and NetApp, Inc.

Qualifications:

Mr. Braham’s substantial mergers and acquisitions experience assist the Board in evaluating the Company’s strategic opportunities and bring important perspective and expertise to the Board and its Corporate Development Committee.

Timothy Campos

Age 47

Director Since: April 2014

Experience:

Mr. Campos has served as the Chief Executive Officer of Woven, Inc. since December 2016. Mr. Campos served as the Chief Information Officer and Vice President of Information Technology of Facebook, Inc. from August 2010 to November 2016. Prior to Facebook, he served as the Chief Information Officer and Vice President of Information Technology at KLA-Tencor from 2005 to 2009. Prior to KLA-Tencor, Mr. Campos worked at internet startup Portera Systems where he was responsible for engineering and hosting architecture. Mr. Campos is currently a member of the Board of Directors of Rackspace.

Qualifications:

Mr. Campos’ extensive industry experience in enterprise networks, application hosting and managing big data provides valuable insight into those markets and brings important perspective and expertise to the Board and its Compensation and Corporate Development Committee.

Donald Colvin

Age 67

Director Since: October 2015

Experience:

Mr. Colvin was the Interim Chief Financial Officer of Isola Group Ltd. from June 2015 to July 2016. Mr. Colvin previously served as Chief Financial Officer of Caesars Entertainment Corporation from November 2012 to January 2015 and before that was Executive Vice President and Chief Financial Officer of ON Semiconductor Corp. from April 2003 to October 2012. Prior to joining ON Semiconductor, he held a number of financial leadership positions, including Vice President of Finance and Chief Financial Officer of Atmel Corporation, Chief Financial Officer of European Silicon Structures as well as several financial roles at Motorola Inc. Mr. Colvin recently joined the Board of Directors of Maxeon Solar Technologies and is Chair of the Audit Committee and a member of the Compensation Committee. Mr. Colvin currently serves as a member of the board of directors and Chair of the Audit Committee of Agilysys, Inc. and was previously a director of Applied Micro Circuits Corp.

Qualifications:

Mr. Colvin’s financial expertise and service on several public company boards of directors provide valuable perspective on the Company’s operations and opportunities and provide valuable perspective and expertise as a director and Chair of the Audit Committee and member of the Corporate Development Committee.

Glenda Dorchak

Age 66

Director Since: November 2019

Experience:

Ms. Dorchak is an independent technology business consultant. From April 2010 to June 2013 Ms. Dorchak served as Executive Vice President and General Manager of Global Business for Spansion, Inc. From January 2009 until September 2010, Ms. Dorchak was the Chief Executive Officer and Vice Chair of VirtualLogix, Inc. Prior to VirtualLogix, Inc., she served as Chair and Chief executive officer of Intrinsyc Software International, Inc. Prior to that Ms. Dorchak was an executive at Intel Corporation from 2001 to 2006. Prior to her tenure at Intel Corporation, she served as Chair and Chief Executive Officer of Value America, Inc., from September 1999 to November 2000 and president from September 1998 to August 1999. From 1974 to 1998, Ms. Dorchak worked for IBM Corporation. Ms. Dorchak is currently a member of the Board of Directors, Compensation Committee, and Governance and Nominations Committee of Cree Inc. She is also currently a member of the Board of Directors, Chair of the Nominating and Governance Committee and member of the Strategic Partnerships and Transactions Committee and Compensation Committee of ANSYS, Inc. Within the past five years, Ms. Dorchak also served on the Boards of Directors of Mellanox Technologies Ltd and Quantenna Communications, Inc.

Qualifications:

Ms. Dorchak’s extensive experience as a Chief Executive Officer for three technology companies, two of which were publicly traded, as well as 30 years of executive operating roles for global technology companies, including Intel and IBM Corporations, give her deep experience in the areas of executive leadership, global operations and compensation practices. She has served as a public company director for 22 years and has broad committee experience including chairing Compensation and Nominating and Governance committees. All these qualifications provide important perspectives and expertise as a director and member of the Compensation Committee.

Masood A. Jabbar

Age 70

Director Since: March 2006

Experience:

Mr. Jabbar served as Lead Independent Director from November 2015 to February 2016. Mr. Jabbar was Chief Executive Officer of XDS Inc. from 2004 to 2006. Prior to that, he worked at Sun Microsystems Inc. (“Sun”) from 1986 to 2003, where he served in a series of progressively responsible roles including President of the Computer Systems Division, Chief Financial Officer of Sun Microsystems Computer Corporation, and Executive Vice President of Global Sales Operations. Mr. Jabbar’s career at Sun culminated as Executive Vice President and Advisor to the Chief Executive Officer, where he was responsible for advising the CEO on critical strategic issues. Prior to joining Sun, Mr. Jabbar spent ten years in finance and accounting at Xerox Corporation, and two years at IBM Corporation. Mr. Jabbar is a member of the board of directors, and Chair of the board of directors of Trice Imaging, Inc. Within the past five years, Mr. Jabbar also served on the board of directors of RF Micro Devices, Inc.

Qualifications:

Mr. Jabbar brings significant mergers and acquisitions, global sales and marketing and operational expertise gained from his experience in executive roles at Sun Microsystems, Inc. In addition, Mr. Jabbar’s experiences at Xerox and IBM and as a senior executive of Sun Microsystems provide the Board with valuable accounting and financial reporting expertise particularly relevant to his service on the Company’s Audit Committee. Finally, Mr. Jabbar’s service on the boards of several other technology companies provides him with valuable perspective as a director and Chair of the Company’s Corporate Development Committee and as a member of the Audit Committee.

Oleg Khaykin

Age 55

Director Since: February 2016

Experience:

Mr. Khaykin joined VIAVI in February 2016 as President and Chief Executive Officer. Prior to joining the Company, Mr. Khaykin was a Senior Advisor with Silver Lake Partners from February 2015 to February 2016. Before that, he was President and Chief Executive Officer of International Rectifier from 2008 until its acquisition by Infineon AG in January

of 2015. He has also served as Chief Operating Officer of Amkor Technology and Vice President of Strategy & Business Development at Conexant Systems. Earlier in his career he spent eight years with The Boston Consulting Group and prior to that, he was an engineer at Motorola, Inc. Mr. Khaykin is currently a member of the board of directors of Avnet, Inc. where Mr. Khaykin serves on the Audit and Finance committees. Within the past five years, Mr. Khaykin also served as Chair of the Executive Compensation Committee and a member of the Nominating and Governance Committee at Marvell Technology Group.

Qualifications:

Mr. Khaykin’s hands on experience leading the Company provides him with day-to-day knowledge of the Company’s operations. Additionally, Mr. Khaykin’s extensive operational and strategic experience at other technology companies adds substantial value to the Board and the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE NOMINEES NAMED ABOVE.

Corporate Governance

Corporate Governance Principles

The Board and management of the Company believe that good corporate governance is an important component in enhancing investor confidence in the Company and increasing long-term stakeholder value. Continuing to develop and implement best practices throughout our corporate governance structure is a fundamental part of our strategy to enhance performance by creating an environment that increases operational efficiency and ensures long-term productivity growth. Good corporate governance practices also ensure alignment with stockholder interests by promoting fairness, transparency and accountability in business activities among employees, management and the Board.

Our corporate governance practices represent our commitment to the highest standards of corporate ethics, compliance with laws, financial transparency and reporting with objectivity and the highest degree of integrity. Steps we have taken to fulfill this commitment include, among others:

Code of Ethics

The Company has adopted a Code of Ethics (known as the Code of Business Conduct) for its directors, officers and other employees. The Company will post on its website any amendments to, or waivers from, any provision of its Code of Business Conduct. A copy of the Code of Business Conduct is available on the Company’s website at https://www.viavisolutions.com/en-us/literature/code-business-conduct-en.pdf.

Environmental Social Governance (ESG)

At VIAVI, we are striving to make our workforce more inclusive, our business more sustainable, and our communities more engaged.

Environment Environmental Stewardship

We are working to conserve resources, reduce emissions, recycle water and minimize waste throughout our operations and supply chain.

Social

We are a global corporation with strong ties to the local communities in which we operate. We promote the vitality of community and culture by working to build an inclusive and welcoming workplace. We encourage our employees to actively participate in volunteering efforts and support educational organizations.

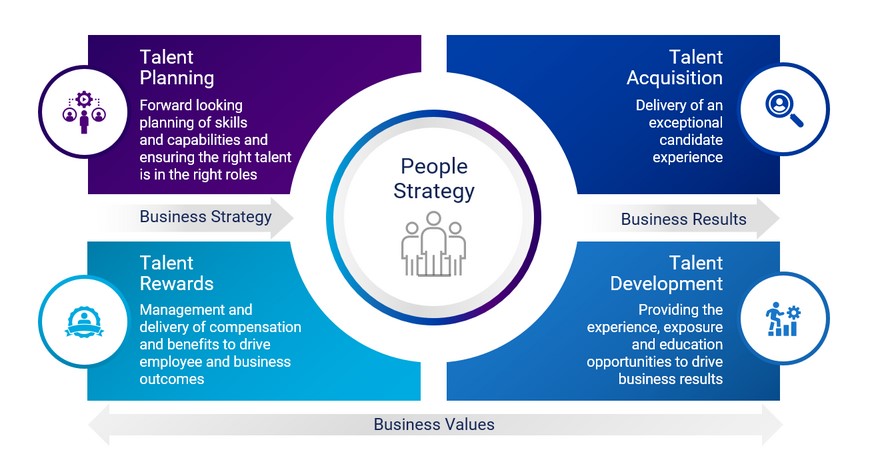

Further, our human capital management & people strategy defines our talent priorities and the roadmap for the execution of human capital investment in support of our business strategy. Our HR team partners with business teams to help ensure that the right programs and investment are prioritized and aligned in order to accelerate our corporate strategy.

Governance

Our policies, procedures and values are intended to reflect transparency, sustainability and compliance. We strive to both conduct our business in an ethically responsible manner and maintain the highest standards of integrity and practices. Highlights of our governance practices include, among others:

|

| | |

ü

| | Non-executive, independent Chairman |

| ü | | Annual election of directors |

| ü | | Majority voting for directors in uncontested elections |

| ü | | All committees are comprised of independent directors |

| ü | | All members of the Audit Committee are Audit Committee Financial Experts |

| ü | | Executive sessions of independent directors |

| ü | | Annual Board and Committee evaluations |

| ü | | Risk oversight by Board and Committees, including with respect to cybersecurity |

| ü | | Procedures for shareholders to communicate directly with the Board |

| ü | | Stock ownership requirements for directors and executives |

| ü | | Annual advisory vote on executive compensation |

| ü | | Annual review of Committee charters and Corporate Governance Guidelines |

| ü | | Governance Committee oversight of environmental, social and governance matters |

For more information regarding our ESG initiatives, progress to date and related matters, please visit the "Corporate Social Responsibility" section of our corporate website, which can be found at www.viavisolutions.com/csr.

Director Independence

In accordance with current Nasdaq listing standards, the Board, on an annual basis, affirmatively determines the independence of each director and nominee for election as a director. Our director independence standards include all elements of independence set forth in the Nasdaq listing standards, and can be found in our Corporate Governance Guidelines, which are included in the “Governance” section of our website at www.viavisolutions.com/csr. The Board has determined that each of its non-employee directors was independent as determined by the relevant Nasdaq listing standard for board independence and for any committee on which such director served during fiscal year 2020.

The Company is not aware of any agreements or arrangements between any director and any person or entity other than the Company relating to compensation or other payment in connection with such director’s candidacy or service as a member of the Board.

Board Leadership

The Board has determined that it is in the best interests of the Company to maintain the Board Chair and Chief Executive Officer positions separately. The Board believes that having an outside, independent director serve as Chair is the most appropriate leadership structure, as this enhances its independent oversight of management and the Company’s strategic planning, reinforces the Board’s ability to exercise its independent judgment to represent stockholder interests, and strengthens the objectivity and integrity of the Board. Moreover, we believe an independent Chair can more effectively lead the Board in objectively evaluating the performance of management, including the chief executive officer, and guide it through appropriate Board governance processes.

The duties of the Chairman of the Board and Chief Executive Officer are set forth in the table below:

|

| |

| Chairman of the Board | Chief Executive Officer |

Sets the agenda of Board meetings Presides over meetings of the full Board Contributes to Board governance and Board processes Communicates with all directors on key issues and concerns outside of Board meetings Presides over meetings of stockholders | Sets strategic direction for the Company Creates and implements the Company’s vision and mission Leads the affairs of the Company, subject to the overall direction and supervision of the Board and its committees and subject to such powers as reserved by the Board and its committees |

Board Oversight of Risk

We take a comprehensive approach to risk management as we believe risk can arise in every decision and action taken by the Company, whether strategic or operational. Consequently, we seek to include risk management principles in all of our management processes and in the responsibilities of our employees at every level. Our comprehensive approach is reflected in the reporting processes by which our management provides timely and comprehensive information to the Board to support the Board’s role in oversight, approval and decision-making.

Role of Management

Management is responsible for the day-to-day supervision of risk, while the Board, as a whole and through its committees, has the ultimate responsibility for the oversight of risk management. In fiscal 2020, the Company completed a comprehensive enterprise risk assessment survey covering key functional areas and business units. The results were calibrated by senior

management and presented to the full Board. Senior management attends Board meetings, provides presentations on operations including significant risks, and is available to address any questions or concerns raised by the Board.

Role of Committees

Additionally, our Board committees assist the Board in fulfilling its oversight responsibilities. Generally, the committee with subject matter expertise in a particular area is responsible for overseeing the management of risk in that area. The Audit Committee coordinates the Board’s oversight of the Company’s internal controls over financial reporting and disclosure controls and procedures as well as the Company’s cybersecurity and information technology risks, controls and procedures. Management regularly reports to the Audit Committee on these areas and the Audit Committee periodically conducts risk assessments in these areas. Additionally, the Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs as well as succession planning for senior executives. The Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, and corporate governance topics. When any of the committees receives a report related to material risk oversight, the chair of the relevant committee reports on the discussion to the full Board.

Managing COVID-19 Risks

The Company’s continues to prioritize our strong commitment to protect the health and safety of its employees and their families, while at the same time focusing on our clients’ success. To minimize the risk of exposure to COVID-19, and in line with guidance and mandates from local and national governments and health authorities, the Company imposed a range of travel restrictions, office closures, social distancing measures, and remote working policies to maintain its operations while prioritizing the safety of its employees and customers. The Company mobilized local, regional, and global teams to address the pandemic’s impact on the Company and to address potential risks proactively, including forming a COVID-19 Task Force comprised of cross-functional and operational executives. Through regular updates and communications with management, the Board has actively participated in overseeing the Company’s COVID-19 response by: monitoring the impact of COVID-19 on the Company’s financial position and results of operations, understanding how management is assessing the impact, and considering the nature and adequacy of management’s responses, including health safeguards, business continuity, internal communications, and infrastructure.

Compensation Program Risk Assessment

Consistent with SEC disclosure requirements, in fiscal year 2020, a team composed of senior members of our human resources, finance and legal departments and our compensation consultant, Compensia, Inc. (“Compensia”), inventoried and reviewed elements of our compensation policies and practices. This team then reviewed these policies and practices with Company’s management to assess whether any of our policies or practices create risks that are reasonably likely to have a material adverse effect on the Company. This assessment included a review of the primary design features of the Company’s compensation policies and practices, the process for determining executive and employee compensation and consideration of features of our compensation program that help to mitigate risk. Management reviewed and discussed the results of this assessment with the Compensation Committee, which consulted with Compensia. Based on this review, we believe that our compensation policies and practices, individually and in the aggregate, do not create risks that are reasonably likely to have a material adverse effect on the Company.

Board Committees and Meetings

During fiscal year 2020, the Board held 7 meetings. The Board has four standing committees: an Audit Committee, Compensation Committee, Corporate Development Committee, and Governance Committee. The members of the committees are identified below.