EXHIBIT 99.3

THIS LETTER OF TRANSMITTAL MUST BE PROPERLY COMPLETED, DULY EXECUTED AND RETURNED TO THE DEPOSITARY, COMPUTERSHARE INVESTOR SERVICES INC. IT IS IMPORTANT THAT YOU PROPERLY COMPLETE, DULY EXECUTE AND RETURN THIS LETTER OF TRANSMITTAL ON A TIMELY BASIS IN ACCORDANCE WITH THE INSTRUCTIONS CONTAINED HEREIN AND IN THE INFORMATION CIRCULAR OF CE FRANKLIN LTD. DATED JUNE 15, 2012.

LETTER OF TRANSMITTAL

to accompany certificates for common shares of

CE Franklin Ltd.

This Letter of Transmittal is for use by holders ("Shareholders") of common shares ("CEF Shares") in the capital of CE Franklin Ltd. ("CEF") in connection with the proposed acquisition of CEF by NOCL Holding B.V. ("NOCL") through its wholly-owned subsidiary, NOV Distribution Services ULC (Acquisitionco), to take place by way of a plan of arrangement ("Arrangement"). The full text of the arrangement agreement among CEF, Acquisitionco, NOCL and Dreco Energy Services ULC, dated as of May 30, 2012, as amended and restated on June 15, 2012 ("Arrangement Agreement"), is set out in the management information circular of CEF dated June 15, 2012 ("Information Circular"). Capitalized terms used but not defined in this Letter of Transmittal shall have the meanings given to them in the Information Circular.

At the Effective Time of the Arrangement, each issued and outstanding CEF Share (excluding CEF Shares held by Dissenting Shareholders) will be exchanged for $12.75 in cash (the "Consideration"). Subject to the approval of the Arrangement by the CEF Shareholders at the special meeting of the shareholders to be held on July 16, 2012 (the "Meeting"), the approval of the Court and the satisfaction of certain other conditions described in the Information Circular, the effective date of the Arrangement is anticipated to be on or about July 16, 2012. All amounts are referred to in Canadian dollars unless otherwise specified.

In order for this Letter of Transmittal to be properly completed, you must complete each of the steps indicated below, as applicable. Shareholders whose CEF Shares are registered in the name of a broker, investment dealer, bank, trust company, depositary or other nominee should contact that nominee for instructions and assistance in delivering those CEF Shares to the Depositary under the Arrangement.

| TO: | CE Franklin Ltd. ("CEF") |

| AND TO: | NOV Distribution Servcies ULC ("Acquisitionco") |

| AND TO: | NOCL Holding B.V. ("NOCL") |

| AND TO: | Computershare Investor Services Inc. (the "Depositary") |

STEP 1 - DESCRIPTION OF CE FRANKLIN LTD. SHARES TRANSMITTED

The undersigned registered Shareholder hereby deposits with the Depositary the number of CEF Shares represented by the enclosed certificate(s) and the undersigned delivers such certificate(s) in exchange for the Consideration upon the Arrangement becoming effective pursuant to and in accordance with the terms of the Plan of Arrangement. The following are the details of the enclosed certificate(s):

You must complete this Step. If space is insufficient, please attach a signed list. See Instruction 4.

| Description of CEF Shares Transmitted |

| Names and Addresses of Registered Shareholder(s) | Certificate Number(s) | Number of CEF Shares |

| | | |

| | | |

| | | |

o | Some or all of my CEF Share certificates have been lost, stolen or destroyed. Please review Instruction 7 of the instructions hereof for the procedure to replace lost or destroyed certificates. (Check box if applicable) |

GENERAL INFORMATION FOR ALL HOLDERS OF CEF SHARES

All Shareholders are required to complete Steps 1, 4 and 5 and complete Steps 2, 3 and Schedule "A" if applicable.

The undersigned:

| | (a) | represents and warrants that the undersigned is the registered owner of the CEF Shares represented by the certificates listed on page 1 hereof and has good title to and is the beneficial owner of such CEF Shares and has the rights represented by the above mentioned certificates, free and clear of all liens, charges, encumbrances, claims and equities and has full power and authority to deliver such certificates; |

| | (b) | represents and warrants that all information provided by the undersigned in this Letter of Transmittal is true, accurate and complete; |

| | (c) | represents and warrants that the certificates described above, together with any other certificates submitted with a separate Letter of Transmittal as required by the attached instructions, represents all of the CEF Shares owned by the undersigned; |

| | (d) | represents and warrants that the undersigned has full power and authority to complete, execute and deliver this Letter of Transmittal and, unless the undersigned shall have revoked this Letter of Transmittal by notice in writing given to the Depositary, the undersigned will not, prior to such time, transfer or permit to be transferred or grant any security interest or other right or interest in and to any of the CEF Shares represented by the certificates delivered herewith; |

| | (e) | directs the Depositary, upon receipt of: (i) this Letter of Transmittal, (ii) the CEF Share certificate(s) and (iii) all other required documentation, and following the Effective Time of the Arrangement, to send to the undersigned or hold for pick up, in accordance with the instructions given in Steps 2 and 3, the cheque(s) in the amount which the undersigned is entitled to receive under the Arrangement. The cheque(s) will be made payable in the name of the Shareholder as it appears on the register, unless special payment instructions are provided in Step 2; |

| | (f) | covenants and agrees to execute, upon request, any additional documents, transfers and other assurances as may be necessary or desirable to give effect to the exchange of certificate(s) representing CEF Shares in to the Consideration; |

| | (g) | acknowledges that all authority conferred or agreed to be conferred by the undersigned herein may be exercised during any subsequent legal incapacity of the undersigned and shall survive the death or incapacity, bankruptcy or insolvency of the undersigned and all obligations of the undersigned herein shall be binding upon the heirs, personal representatives, successors and assigns of the undersigned; and |

| | (h) | irrevocably constitutes and appoints each and any officer of Acquisitionco, and any other person designated by Acquisitionco in writing, the true and lawful agent, attorney and attorney-in-fact of the undersigned with respect to the CEF Shares, represented by the certificates delivered herewith, purchased in connection with the Arrangement with full power of substitution (such power of attorney, being coupled with an interest, being irrevocable) to, in the name of and on behalf of the undersigned, execute and negotiate any cheques or other instruments representing any such distribution payable to or to the order of the undersigned. |

The undersigned acknowledges and agrees that the covenants, representations and warranties of the undersigned herein shall survive the completion of the Arrangement.

The undersigned revokes any and all authority, other than as granted in this Letter of Transmittal or any proxy granted for use at the Meeting, whether as agent, attorney-in-fact, attorney, proxy or otherwise, previously conferred or agreed to be conferred by the undersigned at any time with respect to the CEF Shares represented by the certificates being deposited. No subsequent authority, whether as agent, attorney-in-fact, attorney, proxy or otherwise, except a proxy granted for use at the Meeting, will be granted with respect to the CEF Shares represented by the certificates being deposited.

Following completion of the Arrangement, the undersigned instructs Acquisitionco, NOCL and the Depositary to deliver by first class mail the cheque(s) in the amount which the undersigned is entitled to receive under the Arrangement to the undersigned at the address of the undersigned shown on the register of Shareholders, deliver or to hold such cheque(s) for pick-up according to the instructions provided below in Steps 2 and 3.

If the Arrangement is not completed, the deposited CEF Shares and all other ancillary documents will be returned to the undersigned by mail at the address of the undersigned shown on the register of Shareholders or in accordance with the instructions under Step 2 and Step 3. The undersigned recognizes that CEF has no obligation pursuant to the instructions given below to transfer any CEF Shares from the name of the registered Shareholder thereof if the Arrangement is not completed.

The Arrangement provides that any certificate formerly representing CEF Shares that is not deposited with all other documents required by the Plan of Arrangement on or before the third anniversary of the Effective Date shall cease to represent a claim or right of any nature whatsoever and shall be deemed to have been surrendered for no consideration to Acquisitionco and NOCL.

By reason of the use by the undersigned of an English language form of this Letter of Transmittal, the undersigned is deemed to have required that any contract evidenced by the Arrangement as accepted through this Letter of Transmittal, as well as all documents related thereto, be drawn exclusively in the English language. En utilisant une version anglaise de cette lettre d'envoi et formulaire de choix, le soussigné est réputé avoir exigé que tout contrat attesté par l'Arrangement, tel qu'il est accepté au moyen de cette lettre d'envoi et formulaire de choix, de même que tous les documents qui s'y rapportent, soient rédigés exclusivement en anglais.

STEP 2 - SPECIAL REGISTRATION AND DELIVERY INSTRUCTIONS

This Step is optional

| | SPECIAL REGISTRATION INSTRUCTIONS | | | | SPECIAL DELIVERY INSTRUCTIONS | |

| | To be completed ONLY if the cheque(s) are to be issued in the name of someone other than the person(s) indicated in Step 5 under "Shareholder(s) Signature(s)". See Instructions 2 and 6 below. | | | | To be completed ONLY if the cheque(s) are to be sent to a name or address other than the name and address of the Shareholder set out in Step 5 under "Shareholder(s) Signature(s)". See Instructions 2 and 6 below. | |

| | | | | | | |

| | Issue cheque(s) to: | | | | | |

| | | | | | Mail cheque(s) to: | |

| | | | | | | |

| | (Name) | | | | (Name) | |

| | | | | | | |

| | | | | | | |

| | (Street Address and Number) | | | | (Street Address and Number) | |

| | | | | | | |

| | | | | | | |

| | (City and Province or State) | | | | (City and Province or State) | |

| | | | | | | |

| | | | | | | |

| | (Country and Postal/Zip Code) | | | | (Country and Postal/Zip Code) | |

| | | | | | | |

| | | | | | | |

| | (Telephone - Business Hours) | | | | (Telephone - Business Hours) | |

| | | | | | | |

| | | | | | | |

| | (Social Insurance or Social Security No.) | | | | | |

| | | | | | | |

| | | | | | | |

| | U.S. residents/citizens must provide their TaxpayerIdentification Number | | | | | |

| | | | | | | |

| | | | | | | |

STEP 3 - HOLD FOR PICK-UP

This Step is optional

¨ Check here if the cheque(s) to which the undersigned is entitled under the Arrangement are to be held for pick-up at the office of the Depositary at which this Letter of Transmittal is deposited. |

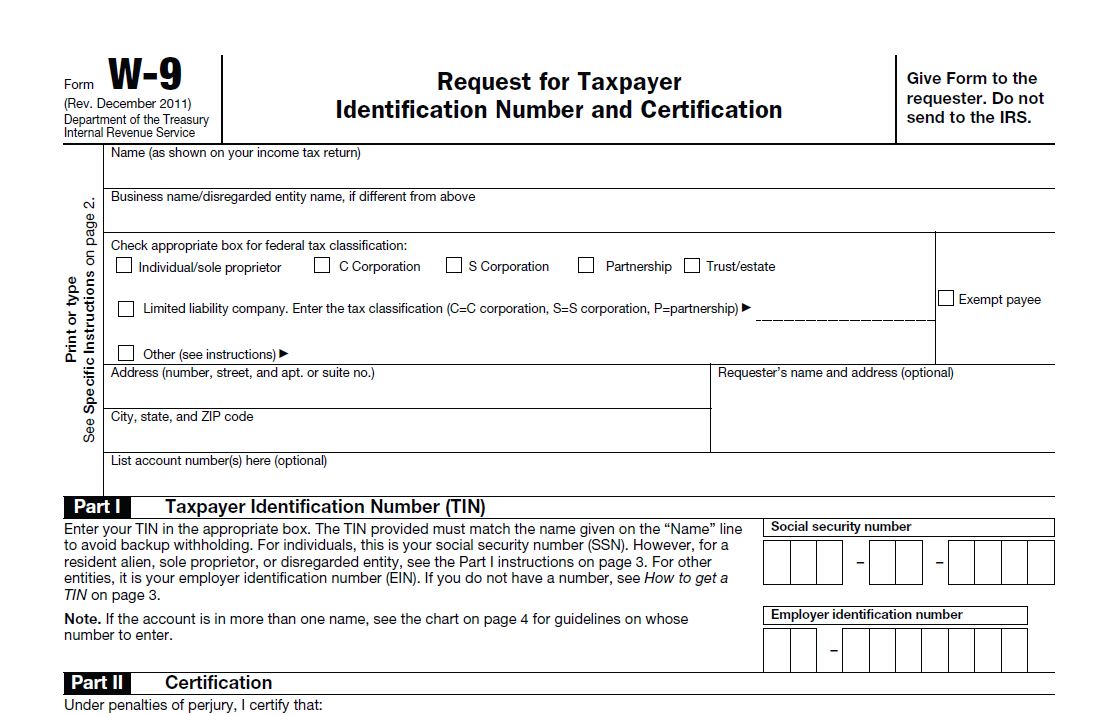

STEP 4 - U.S. SHAREHOLDERS

You must complete this Step.

| Indicate whether you are a U.S. Shareholder or are acting on behalf of a U.S. Shareholder. |

¨ The undersigned represents that it is not a U.S. Shareholder and is not acting on behalf of a U.S. Shareholder. |

¨ The undersigned is a U.S. Shareholder or is acting on behalf of a U.S. Shareholder. |

| A U.S. Shareholder is any Shareholder that is a U.S. person for United States federal income tax purposes. |

If you are a U.S. Shareholder or are acting on behalf of a U.S. Shareholder, then in order to avoid backup withholding you must complete the Form W-9 set forth as part of Schedule "A" to this Letter of Transmittal or otherwise provide certification that you are exempt from backup withholding, as provided in the instructions. If you are not a U.S. Shareholder and you provide an address in Step 5 that is located in the United States, you must complete an appropriate Form W-8. If you require a Form W-8, please contact the Depositary. |

All Shareholders are urged to consult their own tax advisors to determine which forms should be used and whether they are exempt from backup withholding.

STEP 5 - SHAREHOLDER(S) SIGNATURE(S)

You must complete this Step.

By signing your name below, you agree with the following statements:

| 1. | You agree with the representations, warranties and statements made on page 2 of this Letter of Transmittal under the heading "General Information for all Holders of CEF Shares". |

| 2. | You understand that upon receipt of a properly completed and duly executed copy of this Letter of Transmittal and the certificate(s) and all other required documentation described herein, the cheque(s) in the amount to which you are entitled pursuant to the Arrangement will be issued to you as soon as practicable following the Effective Time. |

| 3. | You agree to receive $12.75 in cash for each deposited CEF Share made payable by cheque(s) as per your instructions in this Letter of Transmittal. |

| 4. | You agree that the cheque(s) to which you are entitled pursuant to the Arrangement be delivered by first class mail, postage prepaid, to you at the address as shown on the register of CEF Shares unless the Special Delivery instructions have been completed in Step 2 or the Hold for Pick-Up Box has been selected in Step 3 above. |

This box must be signed by registered Shareholder(s) exactly as name(s) appear(s) on the CEF Share certificate(s). See Instruction 5. If the signature is by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or any other person acting in a fiduciary or representative capacity, please provide the information described in Instruction 5.

| | | | |

| | | Signature(s) of Shareholders or Authorized Representative: | |

| (Name - please print) | | | |

| | | | |

| (Capacity or Title) | | | |

| | | Dated: | | |

| (Street Address and Number) | | | |

| | | | |

| (City and Province or State) | | Guarantee of Signatures: | |

| | | | |

| (Country and Postal (Zip) Code) | | Authorised Signature on behalf of an Eligible Institution. See Instruction 2 below | |

| | | | |

| (Social Insurance or Tax Identification Number - must be provided) | | Name of Guarantor (please print or type): | |

| | | | |

| | | | |

| Telephone - Business hours | | | |

| | | Address of Guarantor (please print or type): | |

INSTRUCTIONS

| 1. | Use of Letter of Transmittal |

This Letter of Transmittal (or a manually signed facsimile thereof), together with the accompanying certificate(s) representing CEF Shares and any other required documents must be received by the Depositary at one of the addresses set forth on page 9 order to receive the cheque(s) in the amount which the Shareholder is entitled to receive under the Arrangement.

This Letter of Transmittal is for use only by registered holders of CEF Shares. Shareholders whose CEF Shares are registered in the name of a nominee should contact their stockbroker, investment dealer, bank, trust company or other nominee for assistance in depositing their CEF Shares.

| 2. | Guarantee of Signatures |

The signature guarantee on this Letter of Transmittal is not required if: (i) this Letter of Transmittal is signed by the registered Shareholder of the CEF Shares transmitted by this Letter of Transmittal, unless the Shareholder has requested the cheque(s) be issued to a person other than the Shareholder or delivery to an address other than the current registered address of the CEF Shares in "Step 2 - Special Registration and Delivery Instructions", in which case the signature guarantee is required; or (ii) the CEF Shares are transmitted for the account of an Eligible Institution.

An "Eligible Institution" means a Canadian schedule 1 chartered bank, a member of the Securities Transfer Agent Medallion Program (STAMP), a member of the Stock Exchanges Medallion Program (SEMP), or a member of the New York Stock Exchange Inc. Medallion Signature Program (MSP). Members of these programs are usually members of a recognized stock exchange in Canada and/or the United States, members of the Investment Regulatory Organization of Canada, members of the Financial Industry Regulatory Authority or banks and trust companies in the United States. The guarantor must affix a stamp bearing the actual words "Signature Guaranteed" or "Medallion Guaranteed". Signature guarantees are not accepted from Treasury Branches, Credit Unions or Caisses Populaires unless they are members of the Stamp Medallion Program. In all other cases, all signatures on this Letter of Transmittal must be guaranteed by an Eligible Institution. See also Instruction 5.

| 3. | Delivery of Letter of Transmittal and Certificates |

This Letter of Transmittal is to be completed by registered Shareholders of certificates representing CEF Shares to be submitted with this Letter of Transmittal and accompanying CEF Shares. The method used to deliver this Letter of Transmittal, the accompanying certificate(s) representing CEF Shares and all other required documents is at the option and risk of the person transmitting the certificates and delivery will be deemed to be effective only once such documents are received. CEF recommends that these documents be delivered by hand to the Depositary at the address specified on page 9 and a receipt be obtained for the documents or, if mailed, that registered mail, properly insured, be used with an acknowledgment of receipt requested.

If the space provided in this Letter of Transmittal is inadequate, the certificate number(s) and the number of CEF Shares represented thereby should be listed on a separate list attached to this Letter of Transmittal which separate list must be signed by the Shareholder in accordance with Instructions 2, as applicable, and 5.

| 5. | Signatures on Letter of Transmittal, Powers and Endorsements |

| | (a) | If this Letter of Transmittal is signed by the registered holder(s) of the accompanying certificate(s) representing CEF Shares, the signature(s) must correspond with the name(s) as written on the face of the certificate(s) without alteration, enlargement or any change whatsoever. In this circumstance, a signature guarantee is not required. |

| | (b) | If any of the certificates representing CEF Shares are held of record by two or more joint owners, all the owners must sign this Letter of Transmittal. |

| | (c) | If any transmitted CEF Shares are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations or certificates. |

| | (d) | If this Letter of Transmittal or any certificates or powers are signed by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or any other person acting in a fiduciary or |

| | | representative capacity, those persons should so indicate below the signature on the line marked "Authorized Representative" when signing, and proper evidence satisfactory to the Depositary of their authority to act should be submitted. Any of the Depositary, NOCL or Acquisitionco, at their discretion, may require additional evidence of authority or additional documentation. |

| | (e) | If this Letter of Transmittal is signed by the registered holder(s) of the CEF Shares evidenced by certificates listed and submitted with this Letter of Transmittal, no endorsements of certificates or separate powers are required unless the cheque(s) are to be delivered to a person other than the registered holder(s). Signatures on those certificates or powers must be guaranteed by an Eligible Institution. |

| | (f) | If this Letter of Transmittal is signed by a person other than the registered holder(s) of the CEF Shares evidenced by certificates listed and submitted by this Letter of Transmittal, the certificates must be endorsed or accompanied by appropriate share transfer or share transfer powers, in either case signed exactly as the name or names of the registered holder or holders appear on these certificates. Signatures on the certificates or powers must be guaranteed by an Eligible Institution. |

| 6. | Special Registration and Special Delivery Instructions |

If the cheque(s) in the amount to which you are entitled to receive under the Arrangement are to be issued to a person other than the registered Shareholder or sent to an address other than the current address of the Shareholder as shown on CEF's registers, your signature provided in Step 5 must be guaranteed. See Instruction 2.

If a CEF Share certificate has been lost, stolen or destroyed, this Letter of Transmittal should be completed as fully as possible and forwarded, together with a letter describing the loss, to the Depositary. The Depositary will respond with the replacement requirements in order for you to receive your entitlement, which shall include a requirement to provide a declaration of loss and such other requirements as the Depositary or CEF's transfer agent may determine in their sole discretion, including an indemnity bond and indemnification against any claim that may be made against CEF, NOCL, Acquisitionco, the Depositary or CEF's transfer agent with respect to the certificate alleged to be lost, stolen or destroyed.

| 8. | Requests for Assistance or Additional Copies |

Questions and requests for assistance may be directed to the Depositary and additional copies of this Letter of Transmittal may be obtained without charge on request from the Depositary at the telephone numbers or address set forth on page 9. The Letter of Transmittal is also available on the internet at www.sedar.com. Shareholders may also contact their local broker, dealer, commercial bank, Canadian chartered bank, trust company or other nominee for assistance.

| 9. | Defects or Irregularities |

Any defect or irregularity in this Letter of Transmittal will, subject to the discretion of CEF, and after the Effective Time, NOCL and Acquisitionco, invalidate such Letter of Transmittal and, as a result thereof, will mean that the Shareholder will not receive any cheque(s) until a properly completed and duly executed Letter of Transmittal is ultimately received. CEF, and after the Effective Time, NOCL and Acquisitionco, reserve the right, if it so elects, in its absolute discretion to instruct the Depositary to waive any defect or irregularity contained in any Letter of Transmittal received by it.

| | (a) | No alternative, conditional or contingent deposits will be accepted. |

| | (b) | The Arrangement and any agreement in connection with the Arrangement will be construed in accordance with and governed by the laws of the Province of Alberta and the laws of Canada applicable therein. |

Computershare Investor Services Inc. ("Computershare) is committed to protecting your personal information. In the course of providing services to you and our corporate clients, we receive non-public personal information about you - from transactions we perform for you, forms you send us, other communications we have with you or your representatives, etc. This information could include your name, address, social insurance number, securities holdings and other financial information. We use this to administer your account, to better serve your and our clients' needs and for other lawful purposes relating to our services. Some of your information may be transferred to services in the U.S.A. for data processing and/or storage. We have prepared a Privacy Code to tell you more about our information practices, how your privacy is protected and how to contact our Chief Privacy Officer. It is available at our website, computershare.com, or by

writing us at 100 University Avenue, Toronto, Ontario, M5J 2Y1. Computershare will use the information you are providing in order to process your request and will treat your signature(s) as your consent to us so doing.

Offices of the Depositary, Computershare Investor Services Inc.

By Mail:

Computershare Investor Services Inc.

P.O. Box 7021

31 Adelaide St. E.

Toronto, Ontario M5C 3H2

Attention: Corporate Actions

By Hand, Courier or Registered Mail:

Computershare Investor Services Inc. 100 University Avenue, 9th Floor Toronto, Ontario M5J 2Y1 | Computershare Investor Services Inc. 600, 530 - 8th Avenue S.W. Calgary, Alberta T2P 3S8 |

Toll Free Telephone (within Canada and the U.S.): 1-800-564-6253

E-mail: corporateactions@computershare.com

Any questions and requests for assistance may be directed by the Shareholders to the Depositary at

the e-mail address, telephone number and addresses set out above

SCHEDULE "A"

FOR U.S. SHAREHOLDERS ONLY

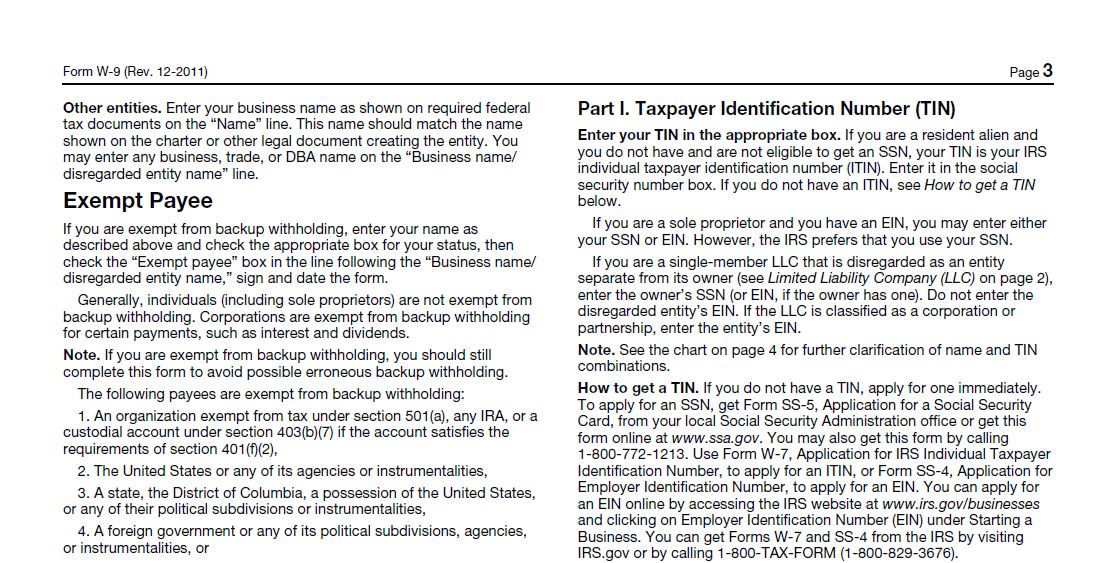

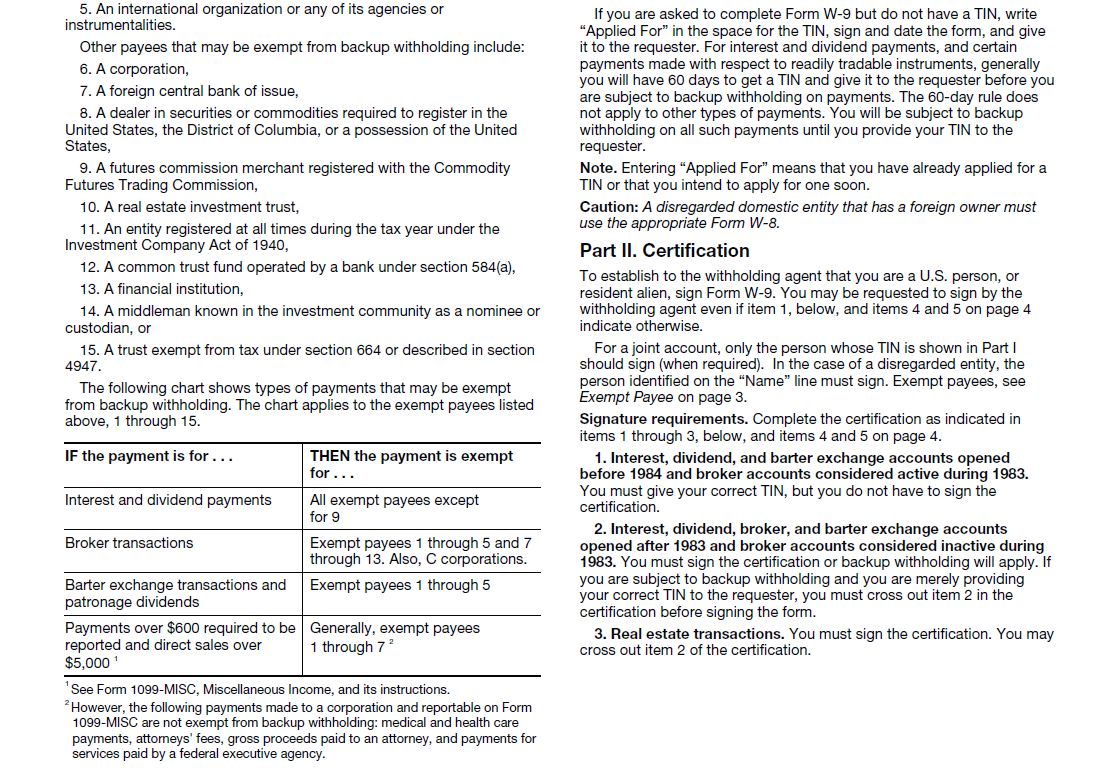

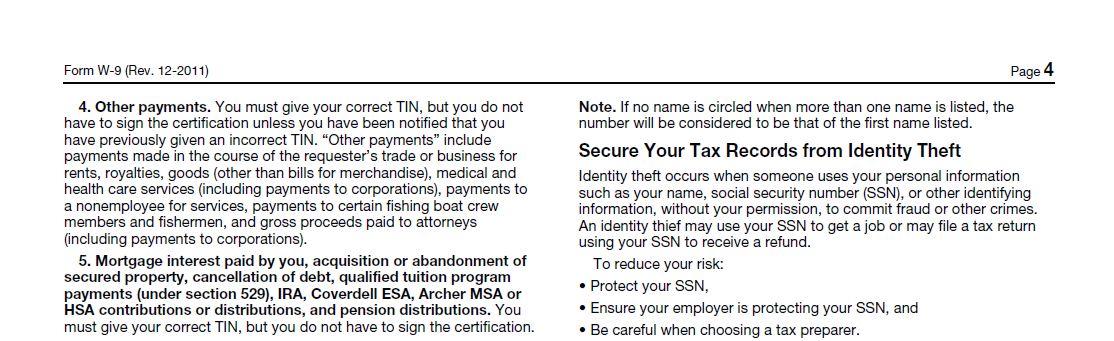

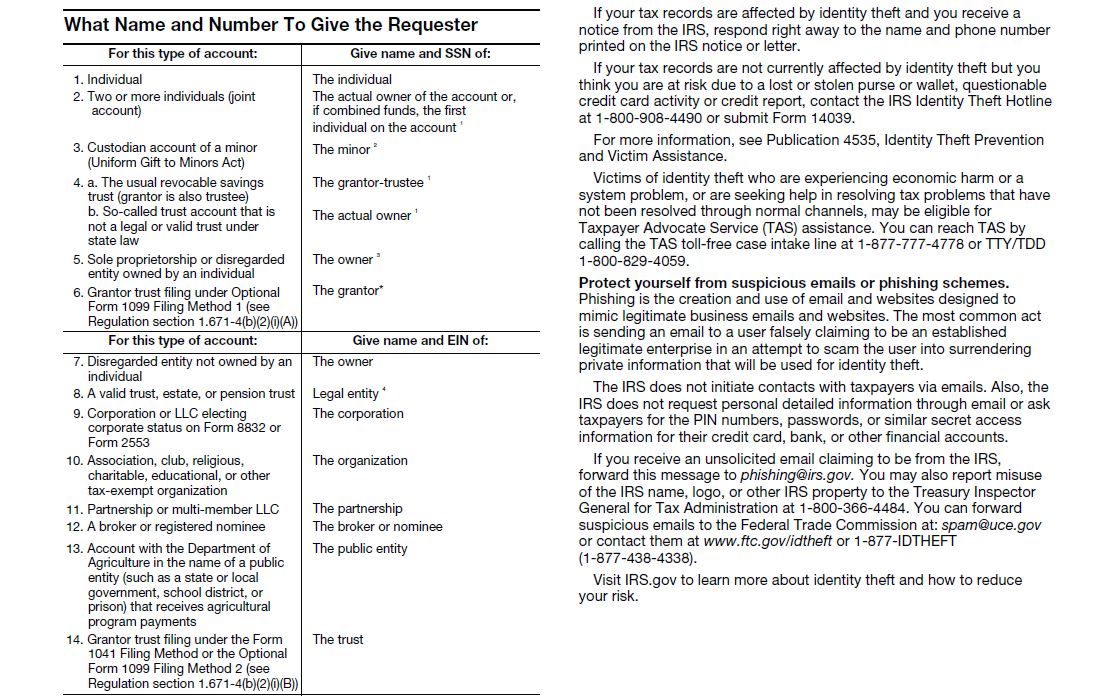

U.S. Shareholders and Form W-9

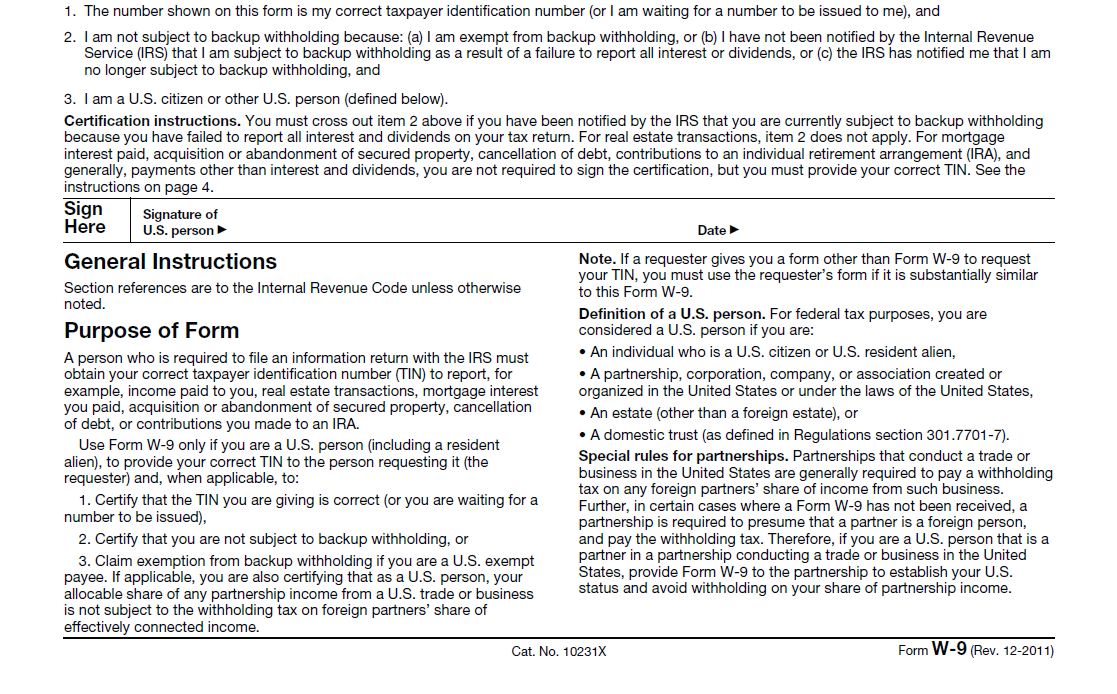

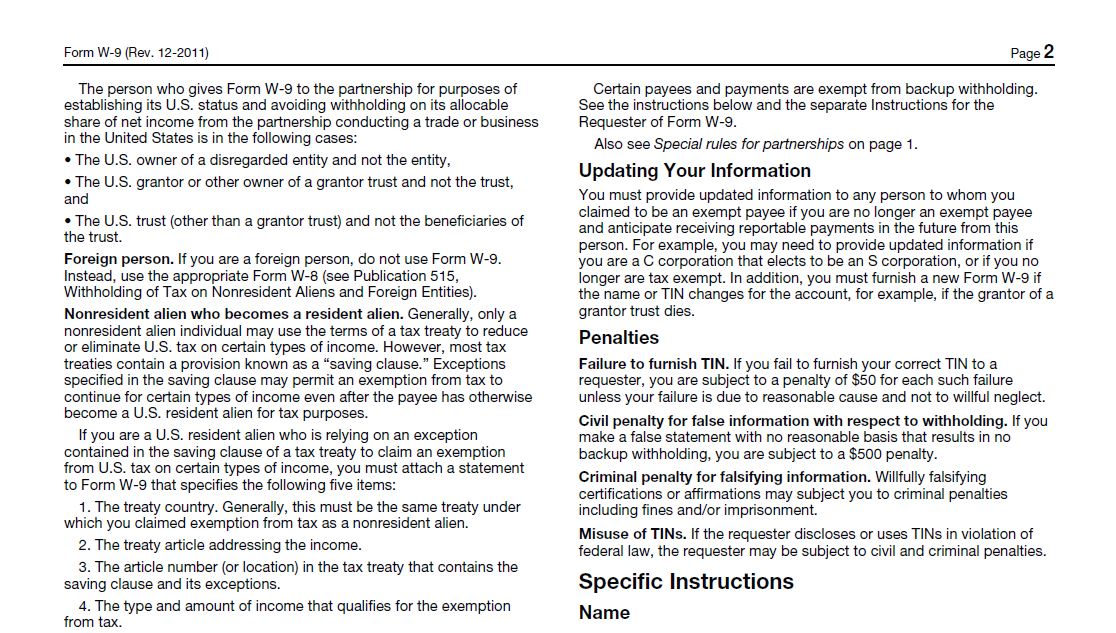

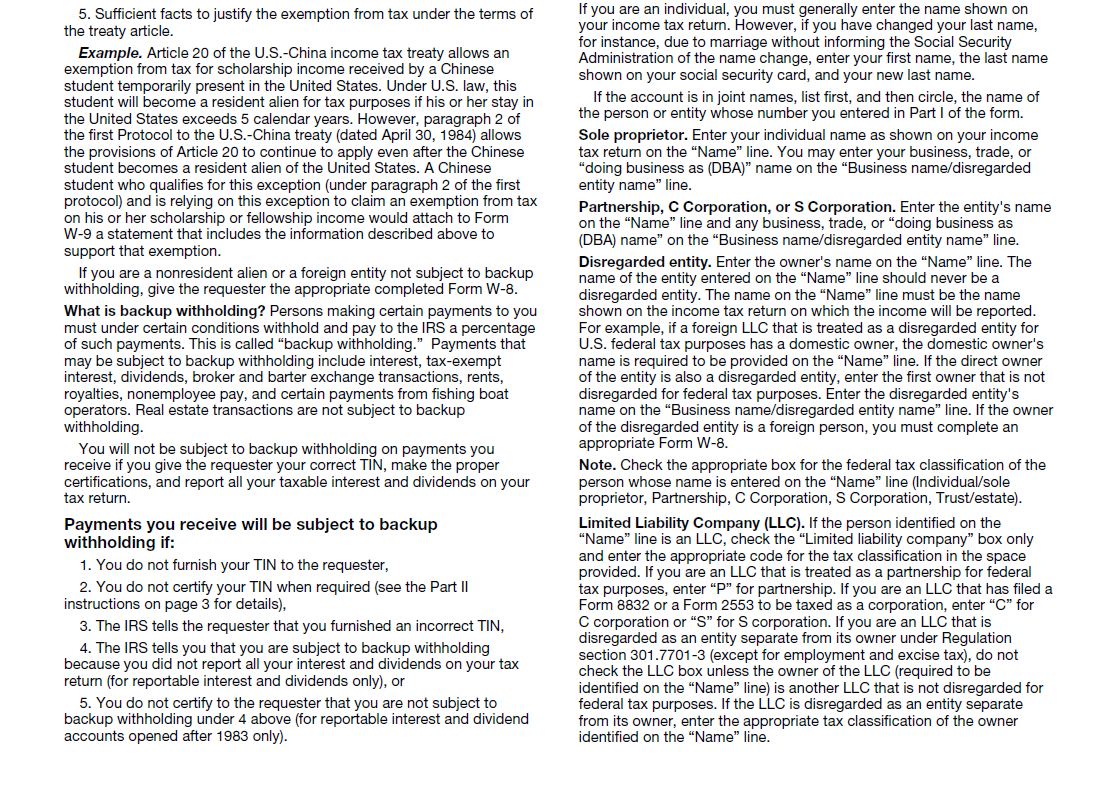

United States federal income tax law generally requires that a U.S. Shareholder who receives cash in exchange for CEF Shares provide the Depositary with his correct Taxpayer Identification Number ("TIN"), which, in the case of a holder of CEF Shares who is an individual, is generally the individual’s social security number and, in the case of a holder of CEF Shares that is a non-individual, is generally the holder's Employer Identification Number ("EIN"). If the Depositary is not provided with the correct TIN or EIN or an adequate basis for an exemption, as the case may be, such holder may be subject to penalties imposed by the Internal Revenue Service and backup withholding in an amount equal to 28% of the gross proceeds of any payment received hereunder. If backup withholding results in an overpayment of U.S. federal income taxes, a refund may be obtained by the holder from the Internal Revenue Service ("IRS"), provided that the required information is furnished to the IRS in a timely manner.

To prevent backup withholding, each U.S. Shareholder must provide its correct TIN by completing the Form W-9 accompanying this document, which requires such holder to certify under penalty of perjury: (1) that the TIN or EIN provided is correct (or that such holder is awaiting a TIN); (2) that (i) the holder is exempt from backup withholding; (ii) the holder has not been notified by the Internal Revenue Service that he is subject to backup withholding as a result of a failure to report all interest or dividends; or (iii) the Internal Revenue Service has notified the holder that he is no longer subject to backup withholding; and (3) that the holder is a U.S. person (including a U.S. resident alien).

Certain U.S. Shareholders are exempt from backup withholding and reporting requirements. To prevent possible erroneous backup withholding, an exempt holder must enter its correct TIN in Part 1 of Form W-9, certify in Part 2 of such form, and sign and date the form. See the "General Instructions" and "Specific Instructions" of the Form W-9 (the "W-9 Guidelines") set forth in the accompanying Form W-9. If CEF Shares are held in more than one name or are not in the name of the actual owner, consult the W-9 Guidelines for information on which TIN to report.

If a U.S. Shareholder does not have a TIN, such holder should: (i) consult the W-9 Guidelines for instructions on applying for a TIN; (ii) write "Applied For" in the space for the TIN in Part I of the Form W-9; and (iii) sign and date the Form W-9 and the Certificate of Awaiting Taxpayer Identification Number set out in this document. In such case, the Depositary will withhold 28% of the gross proceeds of any payment made to such holder prior to the time a properly certified TIN is provided to the Depositary, and if the Depositary is not provided with a TIN within sixty (60) days, such amounts will be paid over to the Internal Revenue Service.

If the Form W-9 is not applicable to a holder because such holder is not a U.S. Shareholder, but such holder provides an address in Step 5 that is located in the United States, such holder will instead need to submit an appropriate and properly completed IRS Form W-8 Certificate of Foreign Status, signed under penalty of perjury to avoid U.S. federal backup withholding tax. An appropriate IRS Form W-8 (W-8BEN, W-8ECI or other form) may be obtained from the Depositary, or at http://www.irs.gov.

A U.S. SHAREHOLDER WHO FAILS TO PROPERLY COMPLETE THE FORM W-9 ACCOMPANYING THIS LETTER OF TRANSMITTAL MAY BE SUBJECT TO BACKUP WITHHOLDING OF 28% OF THE GROSS PROCEEDS OF ANY PAYMENTS MADE TO SUCH HOLDER PURSUANT TO THE ARRANGEMENT. BACKUP WITHHOLDING IS NOT AN ADDITIONAL TAX. RATHER, THE U.S. FEDERAL INCOME TAX LIABILITY OF PERSONS SUBJECT TO BACKUP WITHHOLDING WILL BE REDUCED BY THE AMOUNT OF TAX WITHHELD. IF WITHHOLDING RESULTS IN AN OVERPAYMENT OF TAXES, A REFUND MAY BE OBTAINED BY FILING A TAX RETURN WITH THE IRS. THE DEPOSITARY CANNOT REFUND AMOUNTS WITHHELD BY REASON OF BACKUP WITHHOLDING.

Each holder of CEF Shares is urged to consult their own tax advisor to determine whether such holder is required to furnish a Form W-9, is exempt from backup withholding and information reporting, or is required to furnish an IRS Form W-8.

| IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this document is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter that is contained in this document. |