ABOUT CE FRANKLIN

For more than half a century, CE Franklin has been a wide. The Company’s core market is the Canadian oil used for drilling and completions, production, oil sands and enhanced recovery projects and supplies Company’s products and services facilitate and enhance pipelining operations.

We serve our customers through an extensive network of as internationally. Additional stocking locations storage sites. All are connected by state-of-the-art ment system.

Shares of CE Franklin trade on the Toronto Stock under the symbol “CFK.” At December 31, 2005, there ing. Smith International, Inc., the parent company of Company’s outstanding shares.

ANNUAL MEETING OF SHAREHOLDERS

CE Franklin’s 2006 Annual Meeting of Shareholders 319 – 5 Avenue S.W., Calgary, Alberta on Tuesday, parties are invited to attend.

Forward-Looking Information

Certain of the statements set forth in this annual report areforward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933 and Section 21E of the United States Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited Customer to, with respect to commodity prices, projections relating to oilsands spending and estimated annual total revenue per employee. Although the Company believes that its expectations are based on reasonable assumptions, it can give no assurance that the expected results will be achieved. There are numerous risks and uncertainties that can affect the outcome and timing of such events, including many factors beyond the control of the Company. These factors include, but are not limited to, economic conditions, seasonality of drilling activity, commodity prices for oil and gas, currency fluctuations, and government regulations. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, the Company's actual results and plans for 2005 and beyond could differ materially from those expressed in the forward looking statements. Please refer to pages 34 to 37 for a detailed description of the Company's risk factors. | CONTENTS |

2005 Highlights 2 |

Message to Shareholders 4 |

Our Leadership Team 10 |

Customer Service and Quality 12 |

Serving Our Communities 14 |

Health, Safety and Environment 16 |

Our Mission and Operating Values 17 |

Management's Discussion and Analysis 18 |

Management's Report 38 |

Auditors' Report 39 |

Financial Statements 40 |

Notes to Financial Statements 44 |

Supplementary Information 54 |

Leadership Team Information 58 |

Board of Directors Information 59 |

Corporate Information 60 |

Our Dedicated Employees inside back cover |

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 1 |

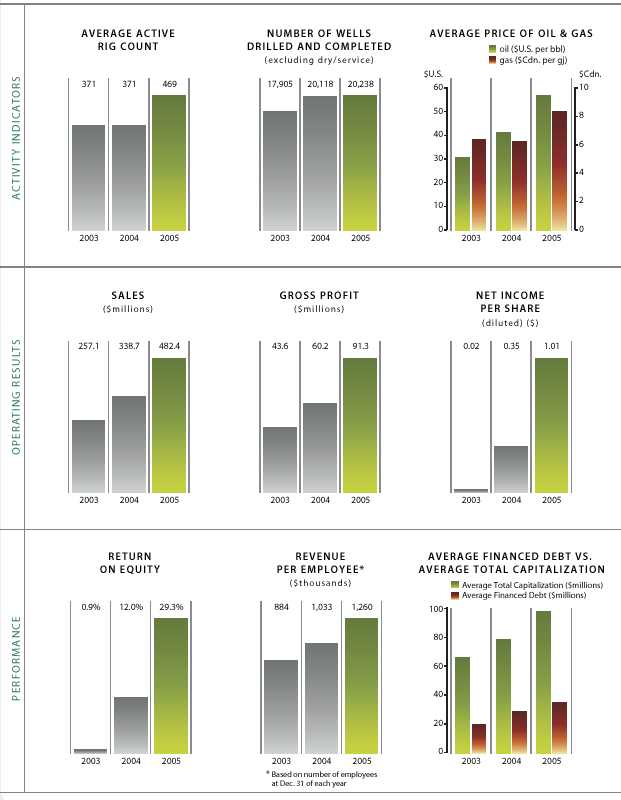

2005 Highlights

(in millions of Canadian, except per share amounts)

| 2005 | 2004 | 2003 | 2002 | 2001 |

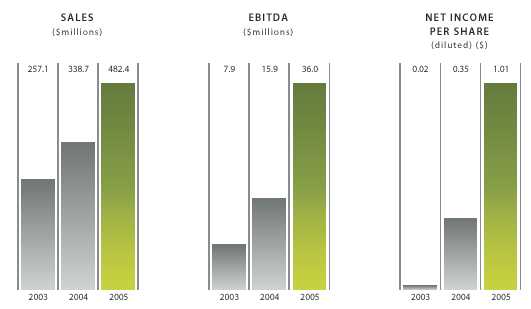

Sales | 482.4 | 338.7 | 257.1 | 255.1 | 371.1 |

(1) | 36.0 | 15.9 | 7.9 | 1.7 | 4.2 |

(1)as a % of Sales | 7.5% | 4.7% | 3.1% | 0.7% | 1.1% |

Income (loss) from | 18.9 | 6.1 | 1.3 | (2.0) | (1.1) |

Net income (loss) | 18.9 | 6.1 | 0.4 | (2.5) | 0.6 |

Net income (loss) per share | | | |

- continuing operations | | | | |

Basic | 1.09 | 0.36 | 0.07 | (0.12) | (0.06) |

Diluted | 1.01 | 0.35 | 0.07 | (0.12) | (0.06) |

Net income (loss) per share | | | |

Basic | 1.09 | 0.36 | 0.02 | (0.15) | 0.04 |

Diluted | 1.01 | 0.35 | 0.02 | (0.15) | 0.04 |

Balance Sheet Results | | | | | |

Current assets | 180.0 | 131.4 | 100.6 | 79.0 | 89.8 |

Total assets | 192.5 | 145.5 | 117.6 | 99.5 | 112.9 |

Current liabilities | 116.1 | 90.2 | 68.4 | 49.7 | 58.9 |

Long-term liabilities | 0.4 | 1.2 | 1.6 | 2.6 | 4.0 |

Shareholders’ equity | 75.9 | 54.1 | 47.6 | 47.2 | 50.0 |

(1)EBITDA represents income from continuing operations before non-GAAP financial measure used by management, as well as as presented, represents a useful means of assessing the Company’s earnings trends without showing the impact of through to EBITDA and EBITDA as a percentage of sales because is not used by management as an alternative to net income as other measure of performance in conformity with generally activities as a measure of liquidity. Not all companies prescribed by GAAP. Accordingly, EBITDA, as the term is used page 25 for a reconciliation of income from continuing

| 2 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

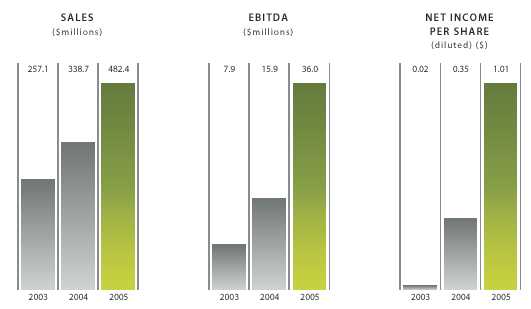

CE Franklin’s 42.4% growth in sales clearly outpaced the increase in activity levels, reflecting our ability to attract a larger share of the market through successful service, sales and marketing efforts.

CE Franklin’s EBITDA (earnings before interest, taxes, depreciation and amortization) increased 126% to $36 million in 2005 compared to $15.9 million for 2004.

Our commitment to build a profitable and sustainable business model through resulted in a 208% year-over-year increase share (diluted) rose 189% to $1.01.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 3 |

MESSAGE TO SHAREHOLDERS

Outperforming the Market and Sustainable Growth

2005: Strong Results through

For CE Franklin, 2005 was a record-breaking year. We posted higher sales, net income per fully diluted share than any year in the Company's history. The financial community rewarded our performance, and our stock saw a significant increase in value.

Key financial results in 2005, compared to 2004:

Sales climbed 42.4% to $482.4 million

Net income rose 208% to $18.9 million

Net income per share (diluted) increased

Revenue per employee, a key efficiency

CE Franklin’s common shares appreciated and average trading volumes moved from 2005 to Dec. 31, 2005).

When the current management team assumed leadership of the Company in 2002,we implemented a strategy of disciplined growth. The successful execution of our strategy has enabled CE Franklin to enjoy 13 consecutive quarters of year-over-year improvement, and in 2005 the Company achieved four straight comparative quarters of record results.

Results Outperforming Market Activity

Our stated goal in 2005 was to outperform the market activity in our product and service segment, as measured by two exploration and production activity indicators.

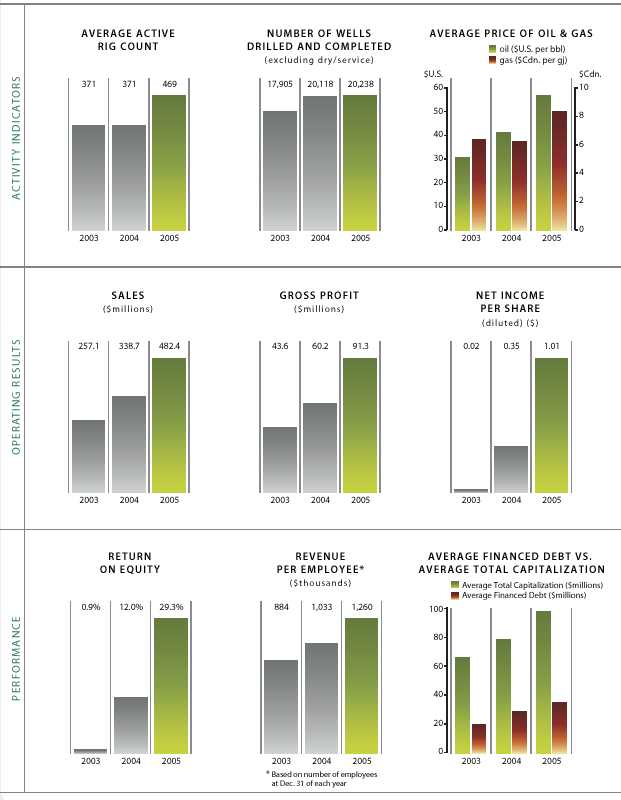

Rig activity rose 26.4% in 2005,to 469 average rigs compared to 371 the previous year. The total number of wells completed in Western Canada (excluding dry and service wells) remained relatively constant, rising just 0.6%during the year (20,238 versus 20,118 wells in 2004). CE Franklin's 42.4%growth in sales clearly outpaced the increase in activity levels,reflecting our ability to attract a larger share of the market through successful service, sales, and marketing ef forts.

Fulfilling Our Promises: 2002 vs. 2005

Our commitment to build a profitable and sustainable business model through disciplined growth resulted in a 208% year-over-year increase in net income to $18.9 million in 2005.Net income per share (diluted) rose 189% to $1.01.

In 2001,before the leadership change,CE Franklin showed a net loss from continuing operations of $1.1 million,despite achieving $371.1 million in sales. The strategies we implemented in 2002 led

| 4 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

to a turnaround in profitability in the third quarter of 2003.Continued enhancements to these operational improvements have resulted in 10 successive quarters of profitability.

These strategies ensure that all internal processes are performed consistently throughout the Company and that individual employees are accountable for their contribution to the organization.

CE Franklin's EBITDA (earnings before interest, taxes, depreciation and amortization) increased 126% to $36 million in 2005 compared to $15.9 million for 2004.We have continued to grow, but most importantly, we have continued to deliver profitable f low-through to the bottom line. The $143.7 million increase in sales resulted in 14%incremental f low-through to EBITDA, compared to 10%incremental f low-through to EBITDA in 2004.

We also made further improvements to EBITDA as a percentage of sales, which was 7.5%in 2005, up from 4.7%in 2004,3.1%in 2003,and 0.7%in 2002. CE Franklin measures revenue dollars per employee as another operating efficiency benchmark. Revenue per employee in 2005 was up 22% year-over-year and has improved by 58% since 2002. Our lines invoiced per employee, another productivity measure, improved 33% from the prior year.

These improvements to our bottom line were attained despite extreme cost pressures, such as higher wages due to the labour shortage in Western Canada, fuel cost increases, occupancy cost increases, and substantial cost increases in freight, vehicles and utilities. We did not implement price increases in 2004 or 2005,over and above increases by suppliers from the rise in steel prices.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 5 |

MESSAGE TO SHAREHOLDERS

Building A Market Leader

Strong partnerships with our vendors have also contributed to our success. Gross profit improved 51.6%in 2005 to $91.3 million from $60.2 million the year before. The improvement results from steps initiated in 2003 and supported in 2004 and 2005,including offshore procurement, vendor standardization of certain product lines, and more disciplined procurement practices.

In 2005 we opened three new field branches in Alberta to support new customer contracts and expanding markets in Rocky Mountain House, Strathmore, and Grande Cache. Same-store sales, which exclude sales from new stores, improved 45% over 2004.

We are committed to ensuring the Company's long-term success by developing its people. We put more staff through training and development programs in 2005 than in any previous year. We worked on developing the Company's technical skills as well as its leadership and behavioural skills. We also developed a solid succession planning program for key positions within the organization.

We will continue to support our employees by putting them through capability training and core competency training programs.We will also deliver more aggressive recruitment and retention programs in 2006,with the goal of hiring and retaining the best available work force.

In 2005,we were proud to add the Starlight Starbright Children's Foundation to the list of charities that we support. CE Franklin had the honour and privilege of helping sponsor four children's wishes in 2005 and was able to help make a difference in the lives of these sick children. Active involvement in our communities is a cornerstone of our success and a responsibility we take seriously in all 41 markets in which we operate.

Foundation for Growth

Foundation for Growth

Over the past three years, we have built a solid foundation for the Company's future growth. This growth will be driven by the same key disciplines and operating strategies that have guided us since 2002.We will continue to focus on enhancing our customer service, streamlining operations, and developing our people.

Going forward, we expect strong commodity prices and market activity levels to support high demand for CE Franklin's products and services. We intend to meet this demand by exploring potential new store openings and expanding the capacity of existing stores in Western Canada.

We will be looking to enhance our organic growth by diversifying our services and products primarily through joint ventures and acquisitions. We will explore opportunities to be involved in the total

product life cycle and better serve our customers with complementary products and services. All opportunities executed will be incremental to our growth and provide an immediate positive impact

on the bottom line.

We will also expand our global reach through partnerships and joint ventures. We are in the infancy of our international development and are committed to disciplined growth. As part of this initiative, we are leveraging the expertise of U.S.-based Wilson Supply to expand our markets and diversify our product lines. Wilson Supply is a division of Smith International, Inc., CE Franklin's major shareholder.

Our first international joint venture with Wilson will be in Libya and is currently in the business development stage. We expect to have the value model solidified in 2006 and be ready to contribute to profit in 2007.

| 6 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 7 |

MESSAGE TO SHAREHOLDERS

Wilson and CE Franklin have been successful in joint marketing activities in the past and will leverage Wilson's international expertise to mitigate risk and maximize opportunities in the future.

Enhancing Shareholder Value

Shares of CE Franklin trade on the Toronto Stock Exchange under the symbol "CFT" and on the American Stock Exchange under the symbol "CFK." Our Company's performance during 2005 has attracted increased interest from the investment community in both Canada and the United States.

As a result, average daily trading volumes increased significantly from 106,000 shares in 2004 to 180,000 shares in 2005.The share price appreciated 242% year-over-year from U.S.$4.06 to U.S.$13.89.We are conf ident that shareholders will be well rewarded for their loyalty, as we continue to enhance shareholder value.

The Company's total capitalization (financed debt plus equity) comprised 28.1%debt at year-end 2005 (versus 33.3 %at year end 2004) and 71.9% equity (versus 66.7%), giving us a healthy debt to equity ratio of 0.39 and a solid platform for growth.

In Closing

In closing, I wish to congratulate employees for their efforts and the pride they took in their work, which generated record results. Without their dedication and expertise, our accomplishments would not have been possible. I would also like to acknowledge our Board of Directors for their continued support and invaluable guidance.

I also extend a sincere thanks to Salvatore (Sam) Secreti, who will be resigning from the position of Vice President and Chief Financial Officer of the Company, effective the end of May. Mr. Secreti has been with the Company since January 2001 and was instrumental in its successful return to profitability. We wish him well in his future endeavours.

CE Franklin is well positioned to become the leading supplier of products, services, and solutions to the energy industry worldwide. We will build on our successes by serving our customers, delivering strong incremental flow-through to the bottom line, and further enhancing shareholder value.

Michael S. West

Chairman, President and

Chief Executive Officer

| 8 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 9 |

Our Leadership

1 RON BROWNVP, SALES

"We continue to increase sales by adhering to the basics of our business, knowing our customers and delivering a high level of Customer Service. We have built a Sales Team that supports these

objectives and will continue to work closely with operations to achieve our common goals."

2 RON KOPERVP, BUSINESS EFFECTIVENESS

"Piece by piece we are building a force in the marketplace, one which will drive sustained value for customers, employees, investors, Suppliers and communities. Re-investments in people, processes, products and quality have begun to show returns. It was an honour and privilege to serve, support and challenge CE Franklin people in 2005."

3 JIM BAUMGARTNERVP, OPERATIONS

"We continue to view and interact with our customers as business partners. The results of 2005 show that this practice, along with listening to the needs of our customers and employees is helping us achieve our operational objectives we established four years ago."

4 SAM SECRETIVP AND CHIEF FINANCIAL OFFICER

"The employees of CE Franklin should be proud of the turnaround of the Company. It is through their hard work, dedication and commitment to continuous improvement that has gotten us to this first milestone. We are proud of what we have accomplished but are not yet satisfied with the result."

| 10 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

5 MICHAEL S. WESTCHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER

"The Company is well positioned for the continuing challenges that lie ahead. Our appetite for continuous improvement remains strong. I am proud of our employees progress to date."

6 BRENT GREENWOODVP, MARKETING AND SUPPLY

"2005 was another year of continued progress. We achieved significant improvement to our bottom line results by continuing to focus on the basics of our business-customer service, operational efficiency and prudent management of our assets."

7 ROD TATHAMDIRECTOR, QUALITY AND CUSTOMER SERVICE

"I have always been amazed at what can be accomplished by a team of focused, motivated people. CE Franklin employees continue to demonstrate their commitment to Shared Success. Congratulations on a good result."

8TIM RITCHIEVP, STRATEGIC INITIATIVES

"The service and value that we deliver to our customers is supported by two pillars: talented people with a passion for continuous improvement and strong vendor partnerships. We will continue to focus on offering the best employment experience for our valued people and on increasing the level of collaboration with our vendors in order to drive ongoing improvement in our results."

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 11 |

Customer Service and Quality

The backbone of any service company is the quality of its customer service. Whether we are serving our external customers, our vendors, employees, or shareholders, CE Franklin seeks to provide all our stakeholders with premier service. We do this by meeting and even exceeding their expectations, while continually improving our value offering.

In 2003, CE Franklin received ISO 9001-2000 quality management accreditation. We demonstrated our commitment to quality service by developing and implementing a quality management system.

This system is designed to measure and continually improve our performance with customers and stakeholders. The system is built on eight quality management principles, which serve as the foundation of the Company's total value offering. These are as follows:

#1 CUSTOMER FOCUS

#1 CUSTOMER FOCUS

Operating in a service industry, the quality of customer service is what distinguishes CE Franklin from the competition. Our commitment to quality is built into the Company's Mission Statement and Operating Values: "We are committed to excellence in everything we do ;we strive for continuous improvement; we are passionate about exceeding expectations." We also recognize the need to know our capabilities and not to promise what we can't deliver.

To fulfill these promises, we developed a performance measurement system. We use this system to document customer

issues and feedback, ensure corrective action is taken, and achieve resolution in a timely manner. The system helps us make continual improvements in key ser vice areas, such as on-time delivery, order accuracy, and responsiveness.

#2 LEADERSHIP

Leadership behaviors are expected of all CE Franklin leaders and are built into their job profiles. As stated in our management system, we expect our leaders to create a clear direction for the Company, to define the role played by all team members in the Company's success, to model attitudes required for success, to fully empower employees by delegating effectively, and to involve others in decision-making processes that affect them.

In addition, the Company has developed a strategic planning process, where functional areas of the organization work together to set clear direction and goals for their operating unit. Our leaders establish working agreements with employees by engaging in structured conversations. This process identifies employee needs and contributions and also helps ensure the Company delivers on its commitments and promises.

#3 INVOLVEMENT OF PEOPLE

We recognize that our employees are our Company's most important asset. As such, we strive to enable employees to fully utilize their abilities for the organization's benefit. We continually seek to identify what our employees need and provide the systems, processes, and training for their success.

As a result, we have built a strong team that is customer-focused, results-driven, and fully accountable. Shared success is a personal value for each of our employees,as they work together to make our customers, the Company, and each other successful.

#4 PROCESS APPROACH

At CE Franklin, employees work together to document processes and procedures that will improve the organization and enhance customer satisfaction. This result is achieved by identifying issues and the actions required to address these issues satisfactorily.

As part of this process, we define key performance indicators to help the Company measure its progress toward organizational goals. Specifically, the progress we have made in streamlining operations

| 12 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

and ensuring all internal processes are performed consistently throughout the Company has continued to improve both customer service and operating performance.

#5 SYSTEM APPROACH TO MANAGEMENT

In addition to working on individual processes as described above, we also manage inter-related processes. We do this by building a unified system that contributes to the organization's effectiveness. Our Mission Statement and Operating Values underpin everything we do, as we strive to be the market leader in servicing the energy industry through our people, our performance, and our partnerships.

#6 CONTINUAL IMPROVEMENT

CE Franklin is committed to excellence in everything we do and aims to continually improve performance. Strategic planning and goal-setting drive our Company's continual improvement efforts.

The Senior Leadership Team is responsible for the development of a strategic plan as well as internal control and management systems. At regularly scheduled meetings, members of the Team review the Company's progress toward reaching its goals.

Management is responsible for identifying key performance indicators to measure the Company's success in meeting its goals. Management seeks to continually improve the Company's operations by identifying whether an action needs to be corrected or simply prevented. As par t of the process, management analyzes the root cause of specific issues that need to

be addressed.

#7 FACTUAL APPROACH TO DECISION-MAKING

CE Franklin is diligent in managing our business to ensure all our decisions are based on factual information with decisions clearly communicated and implemented. As a result, all the steps the Company has taken, since it transformed itself into a customer-service and team-oriented culture in 2002,have shown positive results.

We listen to our customers and employees, define key improvement measures, redesign processes, refocus resources as needed, and track our improvements. The strategies that we have put in place as a result of our factual approach to decision-making has positioned the Company to be the market leader in its industry.

#8 MUTUALLY BENEFICIAL SUPPLIER RELATIONSHIPS

CE Franklin enjoys a mutually beneficial relationship with its vendors. CE Franklin has developed a close working relationship with Wilson Supply, a division of Smith International, Inc., CE Franklin's major shareholder. We are leveraging the best practices of these two companies to develop a seamless worldwide supply chain for customers. In 2006,we plan to expand our global reach through an international joint venture with Wilson Supply. These and other initiatives are helping CE Franklin grow market share in Canada and internationally.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 13 |

Serving our Communities

CE Franklin had the honour and privilege of helping sponsor four childrens' wishes in 2005 through the Starlight Starbright Children's Foundation.

The Starlight Starbright Children's Foundation is a non-profit organization dedicated to brightening the lives of seriously ill children and their families by providing a broad array of both in-hospital and out patient programs designed to enhance their ability to cope with the stress of illness.

Please check www.starlightcanada.org for more information about this organization.

SAMANTHA’S WISH

Thirteen year old Samantha has Cerebral Palsy. She was wishing for a shopping spree at the mall where she and her best friend could pick out all kinds of cool clothes, along with the latest in music CD's and movies. Thanks to the generosity of CE Franklin, Samantha, her mom and her best friend went on Samantha's wish in early August. They had the best time, and Samantha was so surprised when the white stretch limousine pulled up in front of her house to drive her to the mall. In addition to her new clothes, she purchased some Hillary Duff and Britney Spears music CD's,and quite an extensive DVD collection to watch on her favourite purchase of the day -a new portable DVD player! Samantha said that "it was the most wonderful day in her life". | JESSE’S WISH

Jesse is a five year old boy diagnosed with Acute Lymphoblastic Leukemia. The frequent hospital stays and numerous rounds of chemotherapy and radiation were particularly hard on Jesse, making him sad. Jesse's parents noticed a remarkable difference once Jesse found out he would be receiving his Starlight Starbright wish to visit Disney World. Despite the pain involved in his treatments, Jesse seemed happier and more determined. During the week-long trip last October Jesse visited the Magic Kingdom, Epcot Center and Sea World. Highlights included a ride on Buzz Lightyear's Space Ranger Spin and a special meal with Disney's most popular characters. Jesse's family is thrilled with the positive impact this trip has had on Jesse's outlook and recovery. Thanks to the dedication and generosity of CE Franklin for helping to show him the power and magic of dreams! |

| 14 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

Active participation in our communities is a cornerstone of CE Franklin's success.

CE Franklin allocates 3%of employee time to serving our communities, thereby demonstrating our community commitment, enhancing staff morale, encouraging team building, and

strengthening our community relationships.

Each of the Company's local branches actively participate in their communities. The time and energy put forth is inspiring to others and

helps in making their communities a better place to live.

Among the many ways CE Franklin demonstrates its commitment to our communities is by giving to such worthwhile causes as these:

- -Alberta Children's Hospital

- -Alberta Lung Association

- -Alberta Mentor Foundation

- -Canadian Cancer Society

- -Children's Wish Foundation

- -CNIB Visions

- -Cross Cancer Institute

- -Hospice Society

- -Juvenile Diabetes Research

- -Motive Action Training Foundation

- -MS Society of Canada

- -United Way

- -Women in Need Society

KELSEY’S WISH

Kelsey is a wonderful 16 year old girl who faces the daily challenges associated with Sturge Weber Syndrome. When recovering from treat-

ments or dealing with her seizures Kelsey can always count on the Wiggles to help her get through. Thanks to your generous support, Kelsey was treated to a first class Wiggles experience!! After attending a huge Wiggles party at her home Kelsey and her family flew to Ottawa to attend a Wiggles concert in VIP seats. When she got to her hotel she found Wiggles gift packages with more videos, games, and toys than she could ever imagine!! To top off this incredible trip Kelsey attended a personal meet and greet session with the Wiggles guys back stage after the concert. | AMY’S WISH

Amy is a beautiful young girl who is struggling with her relapse from Burkitts Lymphoma. For her wish she decided on a trip to Los Angeles where she would visit the Hollywood Walk of Fame, Disneyland, and dip her foot in the

ocean.Due to the kindness of CE Franklin the Starlight Starbright Children's Foundation was able to make Amy's wish come true. Amy's dream vacation to California consisted of a stay in a luxurious hotel, three days at Disneyland

and day trips to Universal Studios and Knott's Berry Farm. Amy's wish provided a much needed break from the rigors of her treatment and frequent visits from doctors and nurses. Amy and her parents were able to take their wish trip in late August and Amy told us "it was better than I ever dreamed." |

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 15 |

Health, Safety and Environment

CE Franklin Ltd. is committed to a safety and environmental program that protects our people, our partners, and our communities. All levels of the organization participate in and support this commitment, from the Board of Directors to the front-line employees. Health, safety and environment are an integral part of our operations.

At the Board of Directors level, an Environment, Health and Safety Committee meets quarterly. This Committee is responsible to oversee the management of the organization's risks, liabilities, policies, practices and procedures.

CE Franklin also maintains a Corporate Safety Steering Committee, which meets monthly to review the company's performance in the areas of environment and safety. The Committee is a resource to front-line employees to provide guidance, information, and standards as well as ensure the company complies with all regulations. Members of the Senior Leadership Team participate on this Committee, emphasizing the commitment to safety from the top level of the organization.

Our front-line employees participate in bi-monthly safety meetings and are given the training and resources to properly assess, investigate and eliminate potential hazards. Additionally, members of the Senior Leadership Team visit each one of our 41 branch locations to talk about safety on a regular basis.

To support front-line employees, CE Franklin offers a series of online safety training courses. These courses are available to all employees. Based on job profiles and regulatory standards, various courses are compulsory to ensure safe working conditions and regulatory compliance. Courses offered include: Basic Safety Program IRP-16 on basic safety orientation; lifting; forklift operations; hazard assessment; WHIMIS (Workplace Hazardous Materials Information System), Canada's national standard; TDG (Transportation of Dangerous Goods); NORM (Naturally Occurring Radioactive Materials), as well as accident investigation and hazard reporting.

To support front-line employees, CE Franklin offers a series of online safety training courses. These courses are available to all employees. Based on job profiles and regulatory standards, various courses are compulsory to ensure safe working conditions and regulatory compliance. Courses offered include: Basic Safety Program IRP-16 on basic safety orientation; lifting; forklift operations; hazard assessment; WHIMIS (Workplace Hazardous Materials Information System), Canada's national standard; TDG (Transportation of Dangerous Goods); NORM (Naturally Occurring Radioactive Materials), as well as accident investigation and hazard reporting.

Training is supplemented and supported by a quarterly Safety Newsletter sent out to all employees. For information that requires a more timely response, Memos and Bulletins are communicated to employees, as required, to alert them to potential hazards or safety issues or to inform them of any changes in regulatory or Company requirements.

CE Franklin adopted the industry-wide, comprehensive safety management system IRP-9 in 2004. The program was developed by representative organizations of the petroleum industry, including PSAC (Petroleum Services Association of Canada); CAPP (Canadian Association of Petroleum Producers); CAODC (Canadian Association of Oilwell Drilling Contractors); and SEPAC (Small Explorers and Producers Association of Canada).

In addition to IRP-9,CE Franklin is an accredited member of the Partners in Injury Reduction (PIR). This program is a collaborative initiative with the Workers' Compensation Board. We have achieved our Certificate of Recognition (COR) in Alberta and are currently working toward achieving certification in British Columbia and Saskatchewan.

CE Franklin participates in Safety Stand Down week, an annual event sponsored by Enform. The event is designed to increase safety awareness and provide an opportunity for Senior Leadership to visit branch locations and talk safety with front-line workers.

CE Franklin holds safety among one of its highest priorities, and our dedication has helped make CE Franklin a recognized leader of service and safety in our industry.

| 16 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

Our Mission

CE Franklin will be the market leader in the supply of products, services and solutions to the energy industry. We will achieve leadership by delivering superior customer service through our people,our performance and our partnerships.

Our Operating Values

INTEGRITY

We adhere to the highest ethical standards.

CREDIBILITY

We say what we mean and do what we say.

PERFORMANCE

We are committed to excellence in everything we do; we strive for continuous improvement; we are passionate about exceeding expectations.

TEAMWORK

We achieve success by working as a team.

SERVICE ETHIC

We are driven by the needs of our customers, both external and internal; they are met by interested, competent, passionate individuals. Our success depends upon that of our customers.

TRUST

We trust, respect and support each other and we strive to earn the trust of our colleagues and partners.

RESPONSIBILITY

We take responsibility as individuals and as teams for our actions and we hold ourselves accountable.

COMMUNITY

We belong and contribute to the communities that we operate within through our actions and commitment to safety, our environmental responsibility and our personal involvement.

"SHARED SUCCESS"

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 17 |

Management’s Discussion and Analysis

| 18 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

As at February 2, 2006

The following Management’s Discussion and Analysis of to assist readers in understanding CE Franklin’s financial may impact future performance of CE Franklin. This discussion Franklin and the related notes thereto.

The selected financial data presented below is presented in For a discussion of the principal differences between CE GAAP, see Note 17 to the financial statements of CE Franklin CE Franklin has made in this MD&A forward-looking statements Section 21E of the Securities Exchange Act of 1934. These CE Franklin’s operations, performance and financial results heading “Forward-Looking Statements.” Such statements are rially from those expressed or implied by the forward-looking and elsewhere in this MD&A and in CE Franklin’s other public CE Franklin undertakes no obligation to update or revise

OVERVIEW

CE Franklin distributes pipe, valves, flanges, fittings, oilfield supplies to producers of oil and gas in and cities that serve particular oil and gas fields Company distributes general oilfield supplies to the oilfield related industries such as the forestry and

The Company also distributes tubular products, including tubing that is used to bring the production to the producers of oil and gas in Canada. Tubular product Alberta, where most of the Canadian oil and gas branches in the western Canadian sedimentary basin. tories of the manufacturers or from Company owned will be laid.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 19 |

The Company operates its business in only one operating segment, which is the distribution of pipe, valves, flanges, fittings, tubular products, production equipment and general oilfield supplies to the producers of oil and gas in Canada. CE Franklin considers all of the products it distributes to have similar economic characteristics, and are sold to the same class of customers being producers of oil and gas. Operating results by product lines, geographic area or other lower level components or units of operations are not regularly reviewed by our chief operating decisions makers to make decisions about the allocation of resources to, or the assessment of performance of, such product lines, geographic areas or components or units of operations.

SALES

The Company’s sales are dependent upon the level of oil and gas exploration and production activity in the western Canadian sedimentary basin, including the oilsands. This activity is cyclical and is primarily influenced by worldwide energy prices, but may also be affected by expectations related to the worldwide supply of and demand for oil and natural gas, finding and development costs, economic and political events and uncertainties and environmental concerns. The Company mitigates the cyclical nature of its business by adjusting its variable and fixed (primarily salaries and benefits) selling, general and administrative costs (SG&A) as activity levels change.

The Company generates sales principally from the distribution of pipe, valves, flanges, fittings, production equipment, general oilfield supplies and tubular products to producers of oil and gas in the western Canadian sedimentary basin. The Company’s sales for the year ended December 31, 2005 were $482.4 million, compared to $338.7 million for the year ended December 31, 2004 and $257.1 million for the year ended December 31, 2003. The sales growth is attributable to an increase in market activity and anincrease in market share.

Commodity prices generally remained high in 2005. The price of oil and the price of gas as at December 31, 2005 were U.S. $61.04 per bbl (West Texas Intermediate) and Cdn. $9.01 per gj (AECO spot) respectively, and the average price of oil and the average price of gas for the year ended December 31, 2005 were U.S. $56.57 per bbl and Cdn $8.31 per gj respectively. This compares to U.S. $43.45 per bbl for oil and Cdn. $5.90 per gj for gas as at December 31, 2004, and to an average of U.S. $41.37 per bbl for oil and an average of Cdn. $6.22 per gj for gas for the year ended December 31, 2004. As at December 31, 2003 the price of oil and the price of gas were U.S. $32.79 per bbl and Cdn $6.88 per gj respectively, and the average price of oil and the average price for gas for the year ended December 31, 2003 were U.S. $31.04 per bbl and Cdn. $6.32 per gj respectively. The strong commodity prices resulted in Canadian oil and gas producers having increased cash flow which enabled them to increase capital spending on exploration and production activities.

The Company uses oil and gas well completions and average rig counts as industry activity measures. Oil and gas well completions require the products sold by the Company and therefore are a good general indicator of market activity. Average rig counts provide a general indication of energy industry activity levels.

For the year ended December 31, 2005 the total number of wells completed (excluding dry and service wells) in western Canada increased 0.6% to 20,238 wells compared to 20,118 wells for the year ended December 31, 2004.

For the year ended December 31, 2004, the total number of wells completed (excluding dry and service wells) in western Canada increased 12.4% to 20,118 wells, compared to 17,905 wells for the year ended December 31, 2003.

The average rig count for the year ended December 31, 2005 increased 26.4% to 469 average rigs as compared to 371 average rigs for the year ended December 31, 2004.

| 20 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

The average rig count for the year ended December 31, 2004 was 371 average rigs, which is the same as the average rig count for the year ended December 31, 2003.

The Company’s sales are also affected by weather conditions. Many exploration and production areas in the northern portion of the western Canadian sedimentary basin are accessible only in the winter months when the ground is frozen. As warm weather returns in the spring (April/May of each year), the ground thaws, rendering many secondary roads incapable of supporting the weight of the heavy equipment necessary for exploration and production activities in that region until they have dried out. As a result, the first and fourth quarters typically represent the busiest time and highest sales activity for the Company. Sales levels drop dramatically during the second quarter until such time as the roads have dried and road bans have been lifted. This typically results in a significant reduction in earnings during the second quarter as the Company does not reduce its SG&A expenses dur ing the second quarter to offset the reduction in sales.

The Company distributes its products through 41 branches and tubular stocking points, which are situated in the towns and cities that serve particular oil and gas fields of the western Canadian sedimentary basin. The Company will, from time to time, open or close branches to meet customers’ requirements and fluctuating market conditions, which will impact the Company’s sales. The Company also has a 100,000 square-foot centralized distribution centre located in Edmonton, Alberta. The distribution centre is strategically located within reasonable proximity to a majority of vendors and acts as the hub for its operations.

The Company’s sales, which are almost entirely comprised of product sales, are generally subject to arrangements which specify price and general terms and conditions. The Company recognizes product sales when title and the related risk of loss transfers to customers. Several customers have looked to the Company for its expertise in materials management and other service support. Through these alliances, the Company manages approximately 50 warehouses for its customers. CE Franklin consigns inventory to these customer warehouses and recognizes sales when the customer uses the products stored at these warehouses. The sales and profits from customer warehouses are insignificant from a financial perspective as compared to total sales and profitability. The trend is for the Company’s customers tofocus on their core competencies and outsource non-core supply chain areas to the Company.

The Company’s sales depend to a large extent on the Company’s strong relationships with its customers. To ensure coordination and close contact with all of the Company’s major customers, a sales group working out of Calgary, Alberta (where many of the head offices of the Company’s customers are located) act as account managers with specific individual responsibilities for managing the Company’s business and alliance relationships with its customers. In addition, the Company has regional area sales representatives that coordinate sales and activities in the field.

CE Franklin has two vendors with which it does significant business. If either of those relationships were terminated it could have a material effect on the Company’s sales, business and financial condition. The Company believes that it has historically had, and continues to have, a good relationship with these two suppliers, and alternate sources of supply are available for the products purchased from the supplier. Customers reaching a certain tonnage of tubular products, for the most part, could have the volume to bypass distribution companies such as CE Franklin and purchase directly from steel mills. Loss of such tubular product customers could have a material effect on the Company’s sales.

EXPENSES

The Company’s expenses are comprised of cost of sales, selling, general and administrative expenses, amortization expense, interest expense relating to the Company’s demand bank operating loan and obligations under capital leases, and other income and expenses. Each of the items is discussed below in detail.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 21 |

Cost of Sales

Cost of sales is comprised of the average cost of products purchased from various manufacturers and sold to the Company’s customers, net of vendor rebates from suppliers, freight expense and inventory obsolescence and shrink expenses. The Company’s 41 branches, and distribution centre stock 25,000 regularly-stocked Stock Keeping Units (“SKU’s”) of product/inventory for its customers. In addition, the Company will purchase and resell non-regularly stocked products as required by its customers. These products are purchased from various manufacturers at prices reflecting the volume of product purchased from the manufacturers. Inventories are valued at the lower of average cost or net realizable value.

Selling, General and Administrative Expenses

SG&A is comprised of certain fixed expenses such as employee salaries and benefits, sales and marketing costs, occupancy and warehouse costs, office and vehicle costs, as well as certain variable expenses such as agent’s commissions, which are paid to branch agents based on a percentage of gross profit dollars earned by the branch agent, and performance pay incentives to employees.

For the year-ended December 31, 2005, fixed expenses were approximately 68% of total SG&A (2004 – 75%; 2003 – 86%).

In 2006, SG&A expenses will include costs associated with the Company’s SOX404 certification (outside consulting and audit fees). It is anticipated that the SOX404 certification will cost the Company approximately $1.5 million to $2.0 million or $0.05 to $0.07 per share, diluted, in 2006.

Amortization

Amortization expense relates to the Company’s investment in property and equipment, which is recorded at cost, less related accumulated amortization. The Company’s property and equipment is comprised of investments in its enterprise and electronic commerce systems, building and leasehold improvements, equipment and machinery and furniture and office equipment relating to its 41 branch locations, its centralized distribution facility, and its corporate head office.

Property and equipment decreased 42.0% to $3.5 million as at December 31, 2005. This decrease reflects amortization expense of $4.4 million offset by capital expenditures of $587,000 and $1.2 million in additions to rental equipment assets and capital leases. As at December 31, 2005, approximately $388,000 in property and equipment (original cost of $16 million) relates to the Company’s investment in its enterprise and electronic commerce systems. This accounted for $2.3 million in amortization expensefor the year-ended December 31, 2005. As at December 31, 2005 the majority of these assets have been fully amortized and, as a result, the $2.3 million amortization expense incurred in 2005 will decrease to $388,000 in 2006 resulting in an increase in net income of approximately $0.06 per share diluted. The Company anticipates that its enterprise and electronic commerce systems will operate beyond 2006 without any significant costs for upgrades. However, there can be no assurances in this regard.

Interest

Interest expense is comprised of interest on the Company’s demand bank operating facility, and interest expense related to obligations under capital leases. The Company finances its working capital requirements, accounts receivable, inventory, bank overdraft, accounts payable and accrued liabilities with its bank operating loan. The Company will fund capital expenditures from cash flow from operating activities and capital leases where available.

| 22 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

Other Expenses (Income)

Other expenses include foreign exchange gains or losses relating to the purchase of inventory from U.S. and international suppliers, and gains or losses on the sale of property and equipment.

CRITICAL ACCOUNTING ESTIMATES

The preparation of the financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The Company evaluates its estimates on an ongoing basis, based on historical experience and other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions and conditions.

The Company believes the following describes the significant judgments and estimates used in the preparation of its financial statements.

Accounts Receivable and SG&A Expenses

The Company extends credit to customers and other parties in the normal course of business. Management regularly reviews outstanding accounts receivable and provides for estimated losses through an allowance for doubtful accounts. In evaluating the level of the established allowance, management makes judgments regarding the parties’ ability to make required payments, economic events and other factors. As the financial condition of these parties change, circumstances develop or additional information becomes available, adjustments to the allowance for doubtful accounts may be required. These adjustments, if required, would result in a decrease in accounts receivable and an increase in bad debt expense included under SG&A. The effect on the overall performance of the Company would be dependent on the size of the customer in relation to the Company’s sales. For the three years ended December 31, 2005, 2004 and 2003, the Company’s bad debt expense has been $459,000, $244,000 and $266,000, respectively.

Carrying Value of Inventory and Cost of Sales

The Company has made significant investments in inventory to service its customers. On a routine basis, the Company uses judgments in determining the level of write-downs required to record inventory at the lower of average cost or market. Management’s estimates are primarily influenced by technological innovations, market activity levels and the physical condition of products. Changes in these or other factors may result in a write-down in the carrying value of inventory that would result in an increase in cost of sales and a reduction in inventories. For the three years ended December 31, 2005, 2004 and 2003 inventory write-downs included in cost of sales were $280,000, $1.5 million and $1.5 million respectively. Inventory write-downs declined dramatically in 2005 due to the Company focusing on the sale of its core products.

Future Tax Assets and Liabilities

Future tax assets and liabilities are recognized for differences between the book value and tax value of the net assets of the Company. In providing for future taxes, management considers current tax regulations, estimates of future taxable income and available tax planning strategies. If tax regulations, operating results or the ability to implement tax planning strategies vary, adjustments to the carrying valueof future tax assets and liabilities may be required. See note 7 to the financial statements for the significant components of the future income tax assets and liabilities, and a reconciliation of the Company’s income tax provision.

Stock-based Compensation

As of January 1, 2003, the Company adopted prospectively the fair value based method of accounting for stock options, which means that the amount expensed in each period for common share options granted to employees, officers and directors is the fair value of the options, calculated using the Black-Scholes options-pricing model and net of options forfeited in the period, amortized over the vesting period of the options. Compensation expense of $552,000 was recorded in 2005, $256,000 in 2004 and $36,000 was recorded in 2003. See note 8b to the financial statements for a description of the effect on the financial statements if the fair value method had been adopted for options awarded prior to January 1, 2003.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 23 |

Goodwill

The Company acquired certain operations during the past decade, which has resulted in the recording of a material amount of goodwill on the balance sheet. In accordance with Canadian GAAP, the Company is required to perform an annual goodwill impairment evaluation, which is largely influenced by future cash flow projections, earnings and cash flow multiples. Estimating future cash flows of the Company’s operations, earnings and cash flow multiples requires management to make judgments about future operating results and working capital requirements. The majority of the Company’s goodwill is the result of the combination by reverse takeover of Franklin Supply and Continental Emsco Company Limited on November 3, 1995.

A.

OPERATING RESULTS

The following table summarizes CE Franklin’s results of operations.

| (in thousands of Cdn. dollars except per share data) | | | | |

| For the years ended December 31 | | 2005 | | 2004 | | 2003 |

| Statements of Operations | | | | | | |

| Sales | $ | 482,403 | $ | 338,701 | $ | 257,125 |

| Gross Profit | | 91,314 | | 60,243 | | 43,550 |

| Gross Profit - % | | 18.9% | | 17.8% | | 16.9% |

| Other expenses (income) | | | | | | |

| Selling, general and administrative expenses | | 55,303 | | 44,299 | | 36,416 |

| Amortization | | 4,393 | | 4,328 | | 4,130 |

| Interest | | 1,945 | | 1,455 | | 959 |

| Other | | 8 | | 16 | | (749) |

| | | 61,649 | | 50,098 | | 40,756 |

| Income before income taxes | | 29,665 | | 10,145 | | 2,794 |

| Income tax expense | | 10,801 | | 4,003 | | 1,494 |

| Income from continuing operations | | 18,864 | | 6,142 | | 1,300 |

| Loss from discontinued operations | | - | | (27) | | (879) |

| Net income | $ | 18,864 | $ | 6,115 | $ | 421 |

| EBITDA(1) | | 36,003 | | 15,928 | | 7,883 |

| EBITDA as a % of sales | | 7.5% | | 4.7% | | 3.1% |

| Net income per share | | | | | | |

| Basic | $ | 1.09 | $ | 0.36 | $ | 0.02 |

| Diluted | $ | 1.01 | $ | 0.35 | $ | 0.02 |

(1) EBITDA represents income from continuing operations before interest, taxes, depreciation and amortization. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. Management believes that EBITDA, as presented, represents a useful means of assessing the performance of the Company’s ongoing operating activities, as it reflects the Company’s earnings trends without showing the impact of certain charges. The Company is also presenting EBITDA, incremental flow through to EBITDA and EBITDA as a percentage of sales because it is used by management as a supplemental measure of profitability. The use of EBITDA by the Company has certain material limitations because it excludes the recurring expenditures of interest, income tax, and amortization expenses. Interest expense is a necessary component of the Company’s expenses because the Company borrows money to finance its working capital and capital expend itures. Income tax expense is a necessary component of the Company’s expenses because the Company is required to pay cash income taxes. Amortization expense is a necessary component of the Company’s expenses because the Company uses property and equipment to generate sales. Management compensates for these limitations to the use of EBITDA by using EBITDA as only a supplementary measure of profitability. EBITDA is not used by management as an alternative to net income as an indicator of the Company’s operating performance, as an alternative to any other measure of performance in conformity with generally accepted accounting principles or as an alternative to cash flow from operating activities as a measure of liquidity. Not all companies calculate EBITDA in the same manner and EBITDA does not have a standardized meaning prescribed by GAAP. Accordingly, EBITDA, as the term is used herein, is unlikely to be comparable to EBITDA as reported by other entities.

| 24 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

The following is a reconciliation of income from continuing operations to EBITDA:

| (in thousands of Cdn. dollars) | | | | | | |

| For the years ended December 31 | | 2005 | | 2004 | | 2003 |

| Income from continuing operations | $ | 18,864 | $ | 6,142 | $ | 1,300 |

| Interest expense | | 1,945 | | 1,455 | | 959 |

| Income tax expense | | 10,801 | | 4,003 | | 1,494 |

| Amortization | | 4,393 | | 4,328 | | 4,130 |

| EBITDA | $ | 36,003 | $ | 15,928 | $ | 7,883 |

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Sales

Sales for the year ended December 31, 2005 increased 42.4% or $143.7 million to $482.4 million from $338.7 million for the year ended December 31, 2004. The sales increase was due to strong commodity prices which resulted in improved industry economics coupled with an increase in market share from sales to new customers and increased sales to existing customers. Sales also increased due to increasing supplier prices reflecting energy, raw materials and operational costs.

Gross Profit

Gross profit increased 51.6% to $91.3 million for the year ended December 31, 2005 from $60.2 million for the year ended December 31, 2004. Gross profit margins increased to 18.9% for the year ended December 31, 2005 from 17.8% for the year ended December 31, 2004.

The overall improvement in gross profit margins for the year ended December 31, 2005 is a result of a reduction in inventory write-downs from $1.5 million in 2004 to $280,000 in 2005, coupled with margin initiatives implemented by the Company in 2003, which include offshore procurement, standardization of certain product lines and a more disciplined procurement practice. The Company did not implement price increases to customers in 2004 and 2005 over and above price increases by the Company’s suppliers as a result of the rise in supplier pricing.

Selling, General and Administrative Costs

SG&A costs increased $11.0 million or 24.8% to $55.3 million for the year ended December 31, 2005 from $44.3 million for the year ended December 31, 2004. The increase in SG&A for the year ended December 31, 2005 related to salaries and benefits for new employees hired to support the increase in sales for the year, employee performance pay incentives and agents’ commissions due to the increase in sales and gross profit. Fixed expenses, which exclude agents’ commissions and employee performance pay incentives, increased 15.8% as compared to 2004.

The total number of employees increased 16.8% to 383 employees as at December 31, 2005 compared to 328 employees as at December 31, 2004. Revenue per employee based on December 31, 2005 and 2004 employee counts increased 22.0% to $1.26 million per employee as compared to $1.03 million per employee the previous year. The improvement reflects standardization of processes and procedures, whereby all internal processes are performed consistently throughout the Company’s operations resulting in process improvement efficiencies.

EBITDA(1)

EBITDA for the year ended December 31, 2005 increased $20.1 million or 126.0% to $36.0 million compared to $15.9 million for the year ended December 31, 2004. The $143.7 million increase in sales resulted in a 14.0% incremental flow through to EBITDA. EBITDA as a percentage of sales was 7.5% for the year ended December 31, 2005 versus 4.7% for the year ended December 31, 2004. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. For a reconciliation of income from continuing operations to EBITDA, please see page 19.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 25 |

Income Before Income Taxes

Income before income taxes improved $19.6 million to $29.7 million for the year ended December 31, 2005 compared to $10.1 million for the year ended December 31, 2004. The improvement is a result of the $31.1 million increase in gross profit offset by the $11.0 million increase in SG&A and an increase of $547,000 in other costs. Other costs include amortization, interest expense and foreign exchange. The $143.7 million increase in sales for the year ended December 31, 2005 resulted in a 13.6% incremental flow through to income before income taxes.

Income Taxes

The Company’s effective tax rate for the year ended December 31, 2005 was 36.4%, as compared to an effective tax rate of 39.5% for the year ended December 31, 2004. The Company’s combined federal and provincial statutory tax rate for the period ended December 31, 2005 was 34.4%, compared to 34.6% forthe period ended December 31, 2004. The reduction in the effective tax rate for the year ended December 31, 2005 is due to non-deductible items and capital and other taxes totaling $608,000 (2004 - $493,000) becoming a smaller component of the overall income tax charge in 2005 due to the increase in income before income taxes. See note 7a to the financial statements for a detailed reconciliation of the effective tax rate.

Loss from Discontinued Operations

On March 31, 2004, the Company sold its 50% interest in its small horsepower compression operations for cash proceeds of $961,000. No gain or loss on disposition resulted from this transaction.

Loss from discontinued operations for the year ended December 31, 2004 was $27,000.

Net Income and Earnings Per Share

Net income increased 208% to $18.9 million or $1.01 per share (diluted) for the year ended December 31, 2005 as compared to $6.1 million or $0.35 per share (diluted) for the year ended December 31, 2004.

Year Ended December 31, 2004 Compared to Year Ended December 31, 2003

Sales

Sales for the year ended December 31, 2004 increased 31.7% or $81.6 million to $338.7 million from $257.1 million for the year ended December 31, 2003. The sales increase was due to a 12.4% increase in well completions, as well as an increase in market share from new customers and increased sales to existing customers. Sales revenues also increased due to an increase in prices to customers to reflect the increase in the price of steel, which is used in many of the products the Company distributes.

Gross Profit

Gross profit increased 38.3% to $60.2 million for the year ended December 31, 2004 from $43.6 million for the year ended December 31, 2003. Gross profit margins increased to 17.8% for the year ended December 31, 2004 from 16.9% for the year ended December 31, 2003.

The improvement in gross profit margins is a result of margin initiatives implemented by the Company in 2003, which include offshore procurement, standardization of certain product lines and a more disciplined procurement practice. The Company did not implement price increases to customers in 2004 over and above price increases by the Company’s suppliers as a result of the rise in steel prices described above.

| 26 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

Selling, General and Administrative Costs

SG&A costs increased $7.9 million or 21.6% to $44.3 million for the year ended December 31, 2004 from $36.4 million for the year ended December 31, 2003. The majority of the increase in SG&A relates to variable expenses such as performance pay incentives to employees and agents commissions that are a result of the 31.7% increase in sales for the year ended December 31, 2004. Excluding these variable expenses, which will fluctuate with sales and gross profit, fixed SG&A increased 6.7% due primarily to an increase in salaries and benefits and occupancy costs.

The total number of employees increased 12.7% as at December 31, 2004 to 328 employees compared to 291 employees at the end of 2003.

Revenue per employee based on the December 31, 2004 and 2003 employee counts increased 16.7% to $1.03 million per employee as compared to $884,000 per employee for 2003. The improvement reflects standardization of processes and procedures, whereby all critical processes are performed consistently throughout the Company’s operations resulting in process improvement efficiencies.

EBITDA(1)

EBITDA for the year ended December 31, 2004 increased $8.0 million or 102.1% to $15.9 million compared to $7.9 million for the year ended December 31, 2003. The $81.6 million increase in sales resulted in a 9.9% incremental flow through to EBITDA. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. For a reconciliation of net income to EBITDA, please see page 19.

EBITDA as a percentage of sales was 4.7% for the year ended December 31, 2004 versus 3.1% for the year ended 2003.

Income Before Income Taxes

Income before income taxes improved $7.4 million to $10.1 million for the year ended December 31, 2004 compared to $2.8 million for the year ended December 31, 2003. The improvement is a result of the $16.7 million increase in gross profit offset by the $7.9 million increase in SG&A and $1.4 million increase in other costs. Other costs include an increase in amortization of $198,000, an increase in interest expense of $496,000 from investments in accounts receivables and inventories with the increased activity levels resulting in an overall increase in the demand bank operating loan, a decrease in foreign exchange gains of $551,000 and a decrease in other income of $214,000. The decrease in foreign exchange gains is due to a relatively lower level of movement in the Canadian dollar in 2004 as compared to 2003, which saw significant improvement in the Canadian dollar over the same period.

The $81.6 million increase in sales resulted in a 9.0% incremental flow through to income before income taxes.

Income Taxes

The Company’s effective tax rate for the year ended December 31, 2004 was 39.5%, as compared to an effective tax rate of 53.5% for the year ended December 31, 2003. The Company’s combined federal and provincial statutory tax rate for the year ended December 31, 2004 was 34.6%, compared to 37.1% for the year ended December 31, 2003. The reduction in the effective tax rate in 2004 is due to non-deductible items and capital and other taxes totaling $493,000 (2003 - $457,000) that were a smaller component of the overall income tax charge in 2004 due to the increase in income before income taxes.

Income from Continuing Operations

Income from continuing operations increased to $6.1 million or $0.35 per share (diluted) compared to $1.3 million or $0.07 per share (diluted) for the year ended December 31, 2003.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 27 |

Loss from Discontinued Operations

On March 31, 2004, the Company sold its 50% interest in its small horsepower compression operations for cash proceeds of $961,000. No gain or loss on disposition resulted from this transaction.

Loss from discontinued operations for the year ended December 31, 2004 was $27,000 as compared to a loss of $879,000 for the year ended December 31, 2003.

Net Income and Earnings per Share

Net income for the year ended December 31, 2004 was $6.1 million or $0.35 per share (diluted) as compared to $421,000 or $0.02 per share (diluted) for the year ended December 31, 2003. This represents an income improvement of $5.7 million or $0.33 per share (diluted).

SUMMARY OF QUARTERLY FINANCIAL DATA

The selected quarterly financial data presented below is presented in Canadian dollars and in accordance with Canadian GAAP. There are no Statements of Operations differences between Canadian and U.S. GAAP.

| (in thousands of Cdn. dollars except per share data) | | | | | | |

| Unaudited | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| | 2004 | 2004 | 2004 | 2004 | 2005 | 2005 | 2005 | 2005 |

| Sales | 89,032 | 67,002 | 78,232 | 104,435 | 128,372 | 91,899 | 121,809 | 140,323 |

| Net income from | | | | | | | | |

| continuing operations | 1,587 | 518 | 1,198 | 2,839 | 5,804 | 2,543 | 4,214 | 6,303 |

| Loss from discontinued | | | | | | | | |

| operations | (27) | - | - | - | - | - | - | - |

| Net income | 1,560 | 518 | 1,198 | 2,839 | 5,804 | 2,543 | 4,214 | 6,303 |

| EBITDA(1) | 4,148 | 2,401 | 3,421 | 5,958 | 10,745 | 5,897 | 8,300 | 11,061 |

| EBITDA(1)as a % of sales | 4.7% | 3.6% | 4.4% | 5.7% | 8.4% | 6.4% | 6.8% | 7.9% |

| Net income as a % of sales | 1.8% | 0.8% | 1.5% | 2.7% | 4.5% | 2.8% | 3.5% | 4.5% |

| Net income per share | | | | | | | | |

| Basic | $ 0.09 | $ 0.03 | $ 0.07 | $ 0.17 | $ 0.34 | $ 0.14 | $ 0.25 | $ 0.36 |

| Diluted | $ 0.09 | $ 0.03 | $ 0.07 | $ 0.16 | $ 0.32 | $ 0.14 | $ 0.22 | $ 0.33 |

The Company’s sales levels are affected by weather conditions. As warm weather returns in the spring each year the winter’s frost comes out of the ground rendering many secondary roads incapable of supporting the weight of heavy equipment until they have dried out. In addition, many exploration and production areas in northern Canada are accessible only in the winter months when the ground is frozen. As a result, the first and fourth quarters typically represent the busiest time and highest sales activity for the Company. Sales levels drop dramatically during the second quarter until such time as the roads have dried and road bans have been lifted.

Sales for the quarter ended December 31, 2005 increased 34.4% to $140.3 million from $104.4 million for the quarter ended December 31, 2004 reflecting a general increase in activity levels coupled with an increase in market share. The $35.9 million increase in sales resulted in an incremental flow through to EBITDA of 14.2% and 9.7% to net income. Net income was $6.3 million or $0.33 per share (diluted) for the quarter ended December 31, 2005 compared to $2.8 million or $0.16 per share (diluted) for the quarter ended December 31, 2004.

As indicated above the first and fourth quarters typically represent the busiest time and highest sales activity for the Company. Sales for the quarter ended December 31, 2005 was $140.3 million as compared to sales for the quarter ended March 31, 2005 of $128.4 million. Net income for the quarter ended December 31, 2005 was $6.3 million or $0.33 per share (diluted) versus $5.8 million or $0.32 per share (diluted) for the quarter ended March 31, 2005. The $12.0 million increase in sales resulted in an incremental flow through of 4.2% to net income. This was due to a 74.5% increase in variable SG&A cost (agents commissions and employee performance pay incentives) and a 10.3% increase in fixed SG&A costs Q4 2005 versus Q1 2005, respectively.

| 28 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

B.

LIQUIDITY AND CAPITAL RESOURCES

In 2005, the Company generated $21.9 million in cash from cash flow from operating activities, before net change in non-cash working capital balances, and $2.5 million in the issuance of capital stock from the exercise of employee stock options. This was offset by a $26.5 million increase in working capital (including bank overdraft but excluding the bank operating loan), $587,000 in capital and other expenditures and $261,000 in repayments on capital leases. These activities resulted in a $2.9 million increase in the bank operating loan.

In 2004, the Company generated $11.4 million in cash from cash flow from operating activities, before net change in non-cash working capital balances, $50,000 from proceeds on the disposal of property and equipment, and $961,000 from proceeds on the sale of its 50% interest in its small horsepower compression operations. This was offset by a $14.1 million increase in working capital (including bank overdraft and cash but excluding the bank operating loan), $861,000 in capital and other expendituresand $327,000 in repayments on capital leases. These activities resulted in a $2.8 million increase in the bank operating loan.

In 2003, the Company generated $4.7 million in cash flow from operating activities, before net change in non-cash working capital balances, $247,000 from proceeds on disposal of property and equipment and $538,000 from the sale of a 50% interest in its small horsepower compression operations. This was offset by a $6.2 million increase in working capital (including bank overdraft and cash but excluding the bank operating loan), $881,000 in capital and other expenditures and $343,000 in repayments on capital leases. These activities resulted in a $1.9 million increase in the bank operating loan.

The Company’s primary internal source of liquidity is cash flow from operating activities, before net change in non-cash working capital balances, which increased to $21.9 million for the year ended December 31, 2005, an improvement of $10.5 million as compared to 2004. The improvement reflects improvement in profitability of the Company during 2005 due to the increase in the level of exploration and production activity in the western Canadian sedimentary basin, increased market share and gross profit margin improvement.

The $21.9 million in cash flow from operating activities in 2005 was reinvested into accounts receivable, inventories and other current assets, net of accounts payable and accrued liabilities and other current liabilities. The 42.4% increase in sales in 2005 required a reinvestment in accounts receivable and inventories in order to maintain activity levels.

As at December 31, 2005 accounts receivable increased $29.9 million or 45.0% to $96.5 million from $66.6 million as at December 31, 2004. The increase in accounts receivable reflects a 34.4% increase in sales to $140.3 million during the fourth quarter of 2005 as compared to $104.4 million for the fourth quarter of 2004. Average days sales outstanding (DSO) for the quarter ended December 31, 2005 was 56.2 days as compared to 50.9 days for the quarter ended December 31, 2004. The deterioration in DSO for the quarter reflects, in part, slower approval and processing of paper by both the Company and its customers due to the high volume of activity.

DSO was 53.4 days in 2005 as compared to 52.7 days in 2004. Accounts receivable greater than 90 days old was 3.3% of accounts receivable as at December 31, 2005 versus 1.5% as at December 31, 2004. Trade accounts receivables are tightly managed by the Company with daily calls to customers to solve payment issues. In addition, the Company’s accounts receivable team works closely with customers to help simplify payment and approval processes. Bad debt expense in 2005 was $459,000 (0.1% of sales) as compared to $244,000 (0.1% of sales) for the year ended December 31, 2004 and $266,000 (0.1% of sales) for the year ended December 31, 2003. Although accounts greater than 90 days old increased as compared to the previous year, bad debt expense remained within acceptable levels.

| 2005 ANNUAL REPORT CE FRANKLIN LTD. 29 |

Total inventory for the Company increased 25.2% to $80.5 million as at December 31, 2005 as compared to $64.3 million as at December 31, 2004. The increase in inventory levels reflects the 34.4% increase in sales during Q4 2005 as compared to the previous year. Also, the Company has increased its inventory of high turning items in anticipation of higher activity levels in the first quarter of 2006.

The Company measures inventory efficiency by using an inventory turns calculation, because the higher the inventory turns, the better the Company’s inventory is managed. Inventory turns are calculated by taking cost of sales for the year divided by average inventory. Inventory turned 5.3 times in 2005, compared to 4.9 times in 2004 and 5.0 times in 2003. CE Franklin targets inventory turns of 5.0 times. The Company monitors its inventory on a daily basis in order to reduce surplus, improve turns and reduce obsolescence. The Company’s inventory write-down expense declined substantially in 2005 to $280,000 (approximately 0.1% of sales) compared to $1.5 million (0.4% of sales) in 2004 and $1.5 million (0.6% of sales) in 2003.

Accounts payable, accrued liabilities and bank overdraft have increased $18.2 million to $79.0 million as at December 31, 2005 as compared to the previous year. The increase reflects increased inventory purchases due to higher activity levels during Q4 2005, as compared to the previous year, coupled with the increase in inventory levels at year-end in anticipation of high activity levels in the first quarter of 2006.

Property and equipment decreased 42.0% to $3.5 million from $6.1 million. This decrease reflects amortization expense of $4.4 million offset by capital expenditures of $587,000 and $1.2 million in additions to rental equipment assets, through transfers from inventory, and capital leases. As at December 31, 2005, approximately $388,000 in property and equipment (original cost of $16.0 million) relates to the Company’s investment in its enterprise software and electronic commerce systems. For the year-ended December 31, 2005, $2.3 million in amortization expense was incurred relating to these assets. This will decrease to $388,000 in 2006. The Company currently anticipates that its enterprise and electronic commerce systems will operate beyond 2006 without any significant costs for upgrades in the range of its initial investments. However, there can be no assurances in this regard.

As at December 31, 2005 the Company’s total capitalization (financed debt plus equity) was comprised of debt of 28.1% compared to 33.3% as at December 31, 2004 and equity of 71.9% compared to 66.7% as at December 31, 2004.

On July 29, 2005, the Company renewed its 364 day bank operating facility. The facility has been increased to $60.0 million, bears interest at rates between prime plus 0.5% and prime plus 0.875%. The Company’s borrowing capacity under its 364 day bank operating facility is dependent on maintaining compliance with certain financial covenants and a borrowing base formula applied to accounts receivable and inventories. As at December 31, 2005, the Company was well within the covenant compliance thresholds and was able to draw up to $60.0 million against its bank operating line based on the borrowing base formula.

The Company will fund capital expenditures from cash flow from operating activities and capital leases where available. The Company anticipates its capital expenditures in 2006 to be related to standard upgrades to its enterprise systems, purchase of new locations if leasing of these facilities prove to be uneconomical, as well as leasehold improvements to its 41 locations, and potential increases to its rental assets.

| 30 CE FRANKLIN LTD. 2005 ANNUAL REPORT | |

CONTRACTUAL OBLIGATIONS