CONTENTS

22006 Highlights3 Message to Shareholders8Commitment to Employees

12Commitment to Strong Supplier Partnerships13Commitment to Customer Service14Commitment to Quality

16Commitment to Safety18Commitment to Communities20Management’s Discussion and Analysis

38Management’s Report on Internal Control Over Financial Reporting39Management’s Report40Auditors’ Report

41Consolidated Financial Statements45Notes to Consolidated Financial Statements56Supplemental Information

60Board of Directors62Leadership Team63Corporate Information |

ANNUAL MEETING OF SHAREHOLDERS

CE Franklin’s 2006 Annual Meeting of Shareholders will be held at the Calgary Petroleum Club in the President’s Room, 319 – 5 Avenue S.W., Calgary, Alberta on Wednesday, May 2, 2007 at 2:30 pm Mountain time. Shareholders and other interested parties are invited to attend.

Forward-looking Statements

The information in this annual report may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, that address activities, events, outcomes and other matters that CE Franklin plans, expects, intends, assumes, believes, budgets, predicts, forecasts, projects, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the MD&A , including those found under the caption “Risk factors”.

About CE Franklin

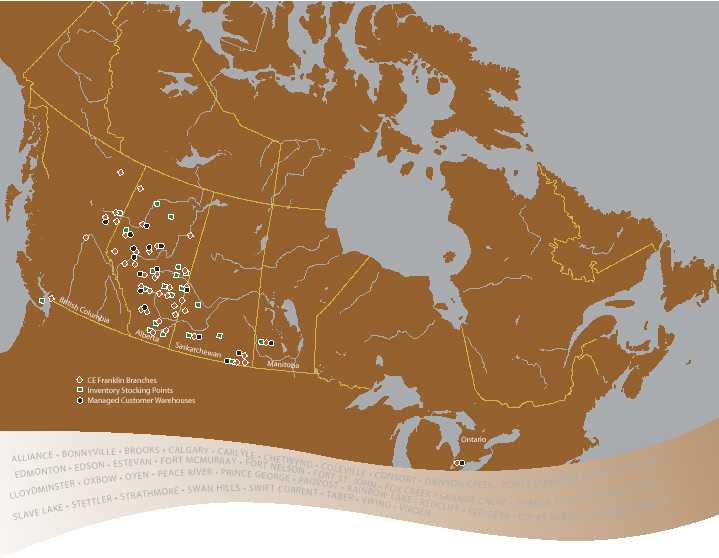

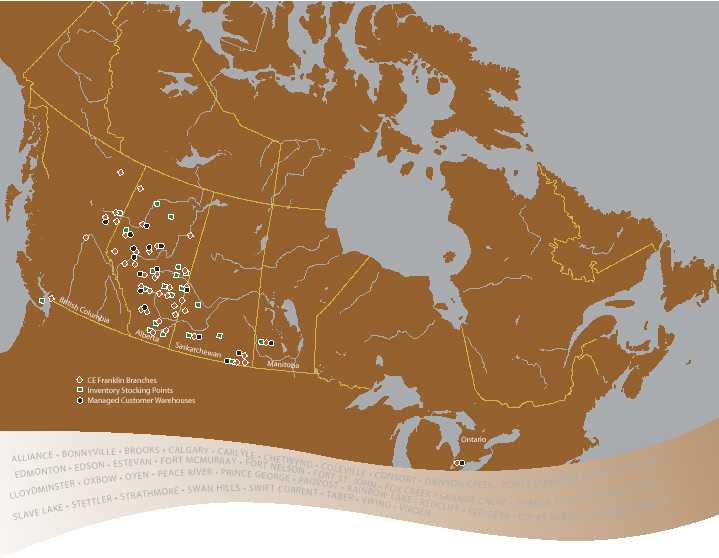

For more than half a century, CE Franklin has been a leading supplier of products and services to the energy industry. CE Franklin distributes pipe, valves, flanges, fittings, production equipment, tubular products and other general oilfield supplies to oil and gas producers in Canada. These products are distributed through its 42 branches, which are situated in towns and cities serving particular oil and gas fields of the western Canadian sedimentary basin. In addition, the Company distributes pipe, valves, flanges and fittings to the oilsands, refining, heavy oil and petrochemical industries and non-oilfield related industries such as the forestry and mining industries.

We serve our customers through an extensive network of branches, managed customer warehouses and offsite inventory stocking locations. All are connected by state-of-the-art technology that offers our customers an efficient supply chain management system.

Shares of CE Franklin trade on the Toronto Stock Exchange under the symbol “CFT” and on the American Stock Exchange under the symbol “CFK.” At December 31, 2006, there were 18.2 million common shares of the Company issued and outstanding. Smith International, Inc., the parent company of CE Franklin’s North American partner Wilson Supply, owns approximately 52% of the Company’s outstanding shares.

Commitment to Shareholder Value

2006 HIGHLIGHTS

(in millions of Canadian dollars, except per share amounts)

| 2006 | 2005 | 2004 | 2003 | 2002 |

Sales | 555.2 | 484.2 | 339.7 | 257.9 | 255.7 |

EBITDA(1) | 40.1 | 36.0 | 15.9 | 7.9 | 1.7 |

EBITDA(1) as a % of Sales | 7.2% | 7.4% | 4.7% | 3.1% | 0.7% |

Income (loss) from continuing operations | 22.9 | 18.9 | 6.1 | 1.3 | (2.0) |

Net income (loss) | 22.9 | 18.9 | 6.1 | 0.4 | (2.5) |

Net income (loss) per share - continuing operations | | | | | |

Basic | 1.27 | 1.09 | 0.36 | 0.07 | (0.12) |

Diluted | 1.22 | 1.01 | 0.35 | 0.07 | (0.12) |

Net income (loss) per share | | | | | |

Basic | 1.27 | 1.09 | 0.36 | 0.02 | (0.15) |

Diluted | 1.22 | 1.01 | 0.35 | 0.02 | (0.15) |

Balance Sheet Results | | | | | |

Current assets | 187.8 | 180.0 | 131.4 | 100.6 | 79.0 |

Total assets | 205.4 | 192.5 | 145.5 | 117.6 | 99.5 |

Current liabilities | 102.1 | 116.1 | 90.2 | 68.4 | 49.7 |

Long-term liabilities | 0.8 | 0.4 | 1.2 | 1.6 | 2.6 |

Shareholders’ equity | 102.5 | 75.9 | 54.1 | 47.6 | 47.2 |

(1)EBITDA represents net income before interest, taxes, depreciation and amortization. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. Management believes that EBITDA, as presented, represents a useful means of assessing the performance of the Company’s ongoing operating activities, as it reflects the Company’s earnings trends without showing the impact of certain charges. The Company is also presenting EBITDA, incremental flow through to EBITDA and EBITDA as a percentage of sales because it is used by management as a supplemental measure of profitability. The use of EBITDA by the Company has certain m aterial limitations because it excludes the recurring expenditures of interest, income tax, and amortization expenses. Interest expense is a necessary component of the Company’s expenses because the Company borrows money to finance its working capital and capital expenditures. Income tax expense is a necessary component of the Company’s expenses because the Company is required to pay cash income taxes. Amortization expense is a necessary component of the Company’s expenses because the Company uses property and equipment to generate sales. Management compensates for these limitations to the use of EBITDA by using EBITDA as only a supplementary measure of profitability. EBITDA is not used by management as an alternative to net income as an indicator of the Company’s operating performance, as an alternative to any other measure of performance in conformity with generally accepted accounting principles or as an alternative to cash flow from operating activiti es as a measure of liquidity. Not all companies calculate EBITDA in the same manner and EBITDA does not have a standardized meaning prescribed by GAAP. Accordingly, EBITDA, as the term is used herein, is unlikely to be comparable to EBITDA as reported by other entities. |

Message to Shareholders

Continued Record Growth in 2006

CE Franklin posted record results in 2006, beating its previous historical best result in both sales and EPS from 2005.

Sales and earnings both improved at a better rate than market activity. CE Franklin showed disciplined flow-through to the bottom line on its growth, despite significant cost and competitive pressures in western Canada. Our continued pursuit of operational excellence as well as aggressive sales and marketing are the catalysts for the continued improvement.

Net income rose 21.6% from a year ago to $22.9 million, on a 14.7% gain in sales to $555.2 million. CE Franklin’s increase in sales reflects our pursuit of market share. Net income per fully diluted share was $1.22, up $0.21 from the prior year. Revenue per employee, a key productivity benchmark, was up 3% year-over-year to $1.3 million per employee, reflecting improved efficiencies from the standardization of processes and procedures throughout the organization.

In contrast to our double-digit gains in both sales and per share earnings, the total number of wells completed in western Canada (excluding dry and service wells) was up just 3.4% for the year to 20,926 wells versus 20,238 wells in 2005. The average rig count increased by 6.2% in 2006 to 498 rigs compared to 469 rigs the year before.

We achieved record results in 2006, despite many challenges, which we continue to manage. Looking ahead, CE Franklin sees many opportunities. The last five years of hard work have positioned us well to pursue these exciting opportunities and to deliver continued improvement in results.

What were the biggest challenges in 2006?

We experienced significant cost pressures and capacity constraints in 2006. The whole industry has experienced rapid growth over the last three years and this has led to labour shortages, cost escalations, and significant delays in delivery within the supply chain. Many of our vendors, with whom we have solid partnerships, were part of our accelerated growth. As a result, they reached capacity constraints, resulting in a considerable lengthening of lead times. The situation forced CE Franklin to invest in more inventory to insulate our customers from supply volatility.

As a publicly listed company on a U.S. exchange (AMEX: CFK), CE Franklin must comply with Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”) for corporate accountability. Sarbanes-Oxley compliance and certification also led to significant costs as well as time requirements from many CE Franklin personnel. We utilized our own personnel and information technology systems to manage a majority of the SOX certification program. In addition, consulting and audit fees amounted to approximately $1.4 million or $0.05 per share after tax (diluted).

Despite all these pressures, we still were able to achieve incremental flow through on revenue growth to EBITDA of 5.7%. Now that we have achieved our Sarbanes-Oxley certification, our IT resources, in addition to performing the ongoing work required to maintain our SOX certification, can focus more time on expanding our IT capacity for our front-line users and customer-interface, with the goal of improved user-efficiency and customer service.

In 2006, the number of employees increased 11.5% to 427 from 383 a year ago. We delivered aggressive recruitment and retention programs for front-line workers that have a significant impact on customer service. We also continued to invest in developing our staff through management and leadership training programs. We implemented a succession planning program for key positions in the Company. We plan to accelerate these training and development programs to support the Company’s continued growth.

Increased occupancy costs related to new and expanded locations also put pressure on operating margins. We signed a lease agreement relating to the construction of a new Distribution Centre in Edmonton, Alberta, which should be completed in late 2007 or early 2008 to support both our continued long-term growth and our oilsands initiative. Although the shortage of real estate and construction crews in western Canada’s strong economy have presented challenges, we will continue to look at opportunities to expand our footprint with new locations where earnings will be accretive.

What are the greatest opportunities in 2007?

We have built a solid platform for growth over the last five years and remain committed to our long-term growth strategies, despite the possibility of a near-term market correction in 2007.

The oilsands, which currently contributes a small portion of revenue, is an area where we expect to see year-over-year growth that will help offset an expected decline in conventional oil and gas drilling. We are aggressively pursuing new projects and have a dedicated group that is targeting the engineering and procurement companies and the oilsands producers. We are expecting incremental revenue from these projects to generate an estimated $25 million in 2007 and $60 million in 2008.

We are also focused on expanding our markets abroad through partnerships and joint ventures. Our first project in Tripoli, Libya is operational. The showroom is built and inventory arrived in early 2007. CE Franklin provided the human resources to train local Libyan employees in our products, systems and services.

We are well positioned to meet the demand for our products and services from a number of large energy companies that are expected to drill and produce from their properties in Libya over the coming years. Some of these companies are already customers of our partner in this initiative, Wilson Supply, a subsidiary of Smith International, which is a major shareholder of CE Franklin.

We expect our Libyan operations to have a positive impact on earnings in 2008, as the country’s business climate becomes increasingly conducive to new investments. We are also exploring other international markets and remain committed to shareholders that any international diversifications will be implemented while properly managing the risk and being accretive to earnings.

In an effort to diversify our products and service offerings, we are also pursuing potential acquisitions and joint ventures. We are reviewing opportunities that will add to our growth and differentiate us from the competition as a service provider to our customers. Specifically, we are seeking to provide a broader range of services to our customers to assist them in their day-to-day operation of the products we sell. These may provide new revenue streams that will improve our operating margins. The opportunities that we are considering would allow us to participate in the total product life cycle and add value to the products we distribute. We will pursue acquisitions that will have an immediate positive impact on earnings.

What is the short-term and longer-term market outlook?

Industry analysts are currently forecasting activity levels to be lower in 2007 than they were in 2006 and estimates range from a 10%-20% decline. Decreases in both oil and natural gas prices have led E&P companies to re-evaluate their CAPEX programs.

That said, the western Canadian rig fleet continues to grow. The fact that investment continues in the development of new rigs indicates that the slowdown in activity levels will most likely be short-term and the long-term fundamentals remain healthy. CE Franklin sees the near-term correction as an opportunity, and we will continue our efforts to outperform the market, while prudently managing expenses to support incremental flow through to the bottom line.

The Company is well positioned to be cash flow positive and remain profitable in a market downturn. As such, we intend to take advantage of opportunities to create value for shareholders in this environment. We will continue to aggressively recruit and retain front-line sales staff and invest in inventory to gain market share and support the Company’s organic growth. With a solid balance sheet comprised of about 22% debt and 78% equity, CE Franklin has the financial flexibility to pursue attractive acquisition opportunities that may present themselves in this environment.

Are there steps in place to improve the share price?

Despite the Company’s record results in 2006, CE Franklin’s share value has seen depreciation this past year. We obviously have no control over the stock price, but we do have control over our performance. We will continue to work on improving our operating and financial results and expect that the share price will reflect that over the long-term.

The oil and gas service sector share price index, in general, backed off sharply from the previous year, but we believe the sector will perform well over the long-term, as global demand for these commodities remains strong.

How does the Company’s performance compare up against the commitments made in the five years since this new management team assumed leadership?

Over the past five years, we have built a solid platform for continued growth:

>>

We committed to return the Company to profitability, and we took the Company from a loss of $0.15 per share in 2002 to a profit of $1.22 per share in 2006.

>>

We committed to regain market share by enhancing our customer service value offering, and we have won numerous customer alliance relationships.

>>

We committed to rebuilding the Company’s operating efficiencies in pursuit of operational excellence, and we have improved our revenue per employee from $795,000 in 2002 to $1.3 million in 2006.

>>

We committed to incremental flow-through on revenue growth to EBITDA of 10%. EBITDA incremental flow-through in 2006 vs. 2002 increased 12.8%.

>>

We committed to outperforming market activity in topline growth, and our 118% growth in sales since 2002 clearly outpaced activity levels.

>>

We committed to actively participating in the communities in which we operate and to date we’ve donated both time and money to community activities in the markets where we operate while continuing to support corporate charities.

We continue to revisit the commitments we made in 2002 to ensure that we are still delivering them. We have also met our latest commitments, which include the following initiatives:

>>

We said in 2005 that we planned to develop an oilsands strategy. That initiative is in place and we expect to produce results in 2007.

>>

We committed to international diversification, and our Libyan venture has been launched.

>>

We intended to improve on the record performance of 2005, and we produced better results in 2006.

How does the Smith ownership and Wilson relationship benefit shareholders?

Smith International owns Wilson Supply, a U.S. based division of Smith International, a leading distributor of oil and gas supplies to energy markets in the U.S. and abroad. Smith is a majority shareholder in CE Franklin, owning approximately 52% of our outstanding shares. CE Franklin committed in 2002 to work with Wilson to leverage opportunity in the market place. Our alliance with Wilson allows us to share information and best practices in developing a worldwide supply chain for customers. We are leveraging Wilson’s expertise in international markets in the Libya joint venture, and we intend to partner with them in other opportunities in North America and internationally. CE Franklin also benefits from the expertise of John Kennedy, Wilson’s CEO, and Doug Rock, Chairman and CEO of Smith International, who are members of the CE Franklin Board an d have stellar track records in the oil and gas services sector.

Global demand for the products and services we offer is putting supply and cost pressures on the western sedimentary basin in North America. In order to keep our competitive position in the market, it is critical that we continue to maintain our existing relationships and develop new relationships with mill-direct suppliers. The tonnage we sell determines our place in the supply chain. Our partnership with Wilson, together with our continued growth, ensures our continued access to these sources of supply.

What would you like to say to employees?

Our employees are essential to our success. I would like to thank each one of them throughout the organizationÑin operations, sales, materials management, information technology, and corporate supportÑfor their efforts in helping the Company deliver record results. Going forward, it will be even more important that we continue to operate in a culture of continuous improvement in pursuit of operational excellence.

I especially want to thank employees for their commitment to the Company’s Sarbanes-Oxley certification. The extra workload they took on this year to get the project completed will add value to the Company, and we will utilize our ongoing SOX certification requirement as a vehicle to add shareholder value.

I also would like to thank fellow members of our Board of Directors for their expert counsel and foresight in keeping the Company on course with our growth strategy. I extend sincere thanks for their years of valuable service to Mr. S. Douglas Martin and Mr. Gordon R. Schnell, who both retired from the Board. Finally, I am delighted to welcome Mr. Robert McClinton and Mr. Michael J.C. Hogan, who both joined the Board in 2006. They bring many years of experience in acquisitions and international start-ups that will help guide the Company in its future growth.

The CE Franklin team has worked hard over the past five years, and our hard work has positioned the Company for continued growth in the year ahead in whatever environment we find ourselves in. When the market strengthens, we’re ready. If the market weakens, we are ready. With a strong balance sheet and a prudent infrastructure, this is our time to seize the future.

“signed”

Michael S. West

Chairman, President, and Chief Executive Officer

Commitment to Employees

We promise an organization that will listen to the people within it, help them learn, help them create a company where they can do what they do best, be appreciated and enjoy the pride of being on a winning team.

We have worked toward this commitment for more than five yearsÑthis promise will be fulfilled.

We are more organized, focused and ready to fulfill this commitment than CE Franklin has been at any point in its past. In 2007, we are going to listen, lead, support, challenge and give more leadership accountability to our people. Work is underway to:

>>

Train more people, with new tools, processes, ideas and trainers.

>>

Map out more compelling careers than we have ever done before.

>>

Add valuable tools to help our people create satisfied customers easier, faster, and more effectively.

>>

Listen more closely to employees and respond more decisively.

>>

Continue to appreciate and reward our employees.

>>

Solicit their input and challenge our people to continually improve, especially in a year forecast to have decreased market activity.

The details of how we are implementing these programs are exciting and you will read about them next year in our 2007 annual report. The plans and details, however, absolutely pale in comparison to the commitment our people have, to make CE Franklin a place worth belonging to.

Our people are ready to seize the future.

Our Employees Speak...

To find out how well we are meeting the needs of our people, CE Franklin went directly to its employees. We asked them to share their honest thoughts on a variety of issues, such as corporate culture, training, and what they like most about working for CE Franklin. Their answers are intended to give our stakeholders greater insight into CE Franklin’s unique corporate culture.

ON WHY THEY LIKE WORKING FOR CE FRANKLIN...

>>

There is so much help out there if you need it. CEF has such high operating values that how could one not be happy with the way things are done. - K.J. Humber, Swan Hills, AB

>>

I am amazed at the number of long-term employees there are with CEF. To me, this speaks volumes about a company and how it treats its employees. - Kerry No‘l, Edmonton, AB

>>

CEF upper management actually listens to employees down the line and accepts suggestions on improvements. - Scott Wilson, Calgary, AB

>>

Before I started with CEF, I didn’t think I could find an employer with such an open, positive, and friendly attitude in Calgary’s downtown core. - Petr Stika, Calgary, AB

>>

I am impressed with how the Company handles every situation an employee has, with compassion and understanding. When a company is willing to believe in me and help me out, I am more than willing to do my best for that company. - Kandyce Hirsch, Estevan, SK

>>

Employees are often involved in decisions that will affect them. - Gary Warchola, Edmonton, AB

>>

About five years ago my daughter Charity had an idea to run the “Carlyle Drive for a Cure” charity golf tournament to raise money for breast cancer research. CE Franklin has been a corporate sponsor of this event since. Orval Brown, Carlyle, SK

>>

At CEF we all seem like one big happy family. - Wayne Wheeler, Fort Nelson, BC

ON TRAINING PROGRAMS...

>>

I completed H2S to gain access to local gas plants, and it was a huge eye-opener on what our customers face in the field every day. - Mike Krawetz, Grande Cache, AB

>>

I submitted myself to the 360 Assessment. The program allowed me to get feedback from my peers and work hard to further develop my strengths. It also provided assistance on turning weaknesses into strengths. - Blake Pedersen, Redcliff, AB

>>

These training courses have allowed me to feel better prepared in talking to customers about their specific job requirements. - Jason Lajeunesse, Sarnia, ON

>>

The Communication Workshop last year was very enlightening. Everyone seems to be more aware of their words and the impact they might have. - Josie Gaudet, Calgary, AB

ON IMPROVEMENTS THAT TOOK PLACE IN 2006...

>>

Working agreements have enabled people to feel like they are part of the bigger picture. They know that their input and influence is valued and needed. They also know that management truly cares about their individual happiness and growth. - David T Bentley, Grande Prairie, AB

>>

An increased focus on safety and environment at our branch has demonstrated that our corporation cares about its employees and their well-being. - Rick Dyck, Lloydminster, AB

ON CE FRANKLIN’S CORPORATE CULTURE...

>>

...market leading, always striving to improve, never resting on our laurels, and holding each employee accountable for the improvement of the Company. Management is never afraid to send an e-mail or call or stop in a branch and give thanks and credit for jobs well done.

- - Troy Armstrong, Brooks, AB

>>

Our corporate ethics and clear leadership direction and information via Townhall meetings are appreciated by everyone. - John Law ASR, Fort McMurray, AB

>>

No offense Mike West, but we’ve never seen you lift a valve, pump or even a flange. But thanks for acknowledging those of us that do it daily. - Mike Krawetz , Grande Cache, AB

>>

“Shared Success” is no longer just a statement. It is used daily in communication, and our people understand its importance to our stakeholders, employees, vendors, and customers. - Orval Brown, Carlyle, SK

>>

CEF has become more oriented towards keeping employees around and insuring a positive growth for the Company overall. A strong foundation built on great employees will only keep this Company going forward. - Kerry No‘l, Edmonton, AB

>>

... a leadership team focused on corporate culture has made us a stronger, more focused company. The sales numbers & employee turnover rate speak for themselves. - Mark Day, Calgary, AB

>>

A transformational culture was developed when Mike West revised and implemented our core values and mission statement, and then we as an organization demonstrated to the market that these changes were embraced at all levels. - Rick Dyck, Lloydminster, AB

>>

...management wants employees to strive to make CEF not only a profitable, well run company, but also to provide our customers with good pricing and service where they feel they are getting their best value. - Scott Wilson, Calgary, AB

>>

Being part of the team is a big part of being here. - Gregg Holden, Stettler, AB

Commitment to Strong Supplier Partnerships

Strong and dynamic partnerships with our major suppliers are key to our success and to the success of our customers. We have worked with many of our core suppliers for decades and we are continually strengthening our partnerships with them. Our experienced Procurement and Materials Management Team manages supplier relationships.

Quality products and efficient supply chain management are an integral part of our value offering. We demonstrate our commitment to quality by measuring our suppliers’ performance through the Vendor section of our Performance Management System. We hold our suppliers to the same standards that our customers apply to us, including quality product, on-time delivery, order accuracy, responsiveness and cost-competitiveness.

One of our ongoing challenges is to balance quality and reliability with cost-competitiveness. We continue to work with all of our core suppliers to reduce costs through more efficient business practices, without sacrificing quality or reliability.

We continue to pursue overseas sourcing and direct-to-manufacturer business to support our “four pillars of growth” strategy. In 2006, we shifted a significant component of our valve procurement to a manufacturer-direct model, specifically to enhance our ability to supply products to the oilsands. Lead times for manufacturer and mill direct business are presently in the four to six month range. These long lead times require disciplined forecasting and procurement practices in order to maintain customer service and inventory turns.

We also continue to consolidate purchases with the least number of suppliers in an effort to increase standardization of our product lines. Standardization allows us to improve our asset velocity and to gain the best possible costs for our customers through greater volumes of procurement with core suppliers.

Customer service is paramount in our business. The primary customer service metric for our Materials Management team is the fill rate from our Distribution Centre to our branches. During the last three quarters of 2006, we achieved our target of a 94% fill rate on branch orders. The higher our Distribution Centre fill rate to our branches, the less pressure on our front line workers to source material to get our fill rate to our customers up close to 99%. Our increase in overall inventory levels, along with product standardization and improved communication practices with our operations groups, enabled us to achieve this goal.

Another challenge for our business is to balance customer service with efficient and effective asset management. While we increased overall inventory levels in 2006 to support our customers’ needs, we continued to focus on reducing the level of non-moving inventory, which has declined substantially over the past five years.

Through ongoing dialogue with both our core customers and suppliers, we believe that we are focused on all of the most important attributes of effective supply chain management. We are committed to continual improvement in all of our measures.

Commitment to Customer Service

Our service commitment to our customers continues to drive our success. Customer service is the core of our business culture. We have built our business through our people, our systems, and our processes, keeping a single-minded focus on providing a superior customer service experience. We have maintained this focus by empowering our people and supporting them through training, improving processes, measuring results, and committing to “Shared Success”.

We continue to listen to our customers through our internally developed Performance Management Site.This online management tool allows us to enter and track customer issues, identify root causes, and ensure resolution.

We also have implemented sales and account management tools that track frequency of contacts. These tools help ensure that we are coordinating activity through our integrated sales structure and allow us to capitalize on opportunities that are identified.

In addition, we have established focus groups with key customers to review our actions and activities. The focus groups allow us to benchmark our internal and external measurements and define courses of action for service improvement.

Our hub and spoke distribution model is a key differentiator in the quality of service we provide. We have commenced construction of a new distribution centre and pipe yard to improve our ability to create value from this service model.

The forecasted slowdown within our industry in 2007 should provide an opportunity to fine-tune our customer service focus. We will continue to support our people and manage our processes and position ourselves to capture Increased market share through superior service performance.

Commitment to Quality

Quality and customer service are key components of our total value offering and the foundation of the Company’s Mission Statement and Operating Values. We are looking to the future and working hard to continue to generate value through continuous improvement in quality and customer service.

CE Franklin maintains a quality management system built to the ISO 9001:2000 standard. By meeting this standard, we have been able to improve quality, customer service, and efficiency within the organization. All CE Franklin locations adhere to the ISO 9001:2000 standard and our Edmonton Distribution Centre, the Calgary branch and the Fort McMurray branch are certified to this standard.

By utilizing the eight quality management principles of the ISO standard, we have created a systematic approach that is holistic and brings visibility to quality at all levels of the organization. The program encompasses all stages of our supply chain, from vendor selection and purchasing to storage, packaging, handling and delivery, as well as inspection, quarantine and management of any additional customer requirements or requests. We are confident that these practices support CE Franklin’s high level of reliability and customer service and create value for all stakeholders.

The Company’s Performance Management Site plays an integral role in the quality management system and provides a structure for feedback on the outcomes of processes. The feedback recorded on the site comes from customers, employees and vendors and is analyzed to detect and correct deficiencies as well as to ensure that improvements at one location are leveraged throughout the organization.

All levels of the organization are actively involved in the continuous improvement effort. Front-line employees utilize the Performance Management Site and are engaged in identifying opportunities for improvement and establishing solutions. The Senior Leadership Team reviews information from the Performance Management Site on a weekly basis and provides support and resources to empower our front-line employees in this process. CE Franklin’s front-line employees are committed to exceeding the expectations of our stakeholders and are taking the initiative to make this happen.

CE Franklin is taking a proactive approach to continuous improvement. By placing ownership of processes with front-line employees, our people have the ability to identify and act on opportunities for improvement as they arise.

CE Franklin believes that ensuring consistency

and improvement in all our processes will create value

for all of our stakeholders.

Commitment to Safety

CE Franklin’s Safety and Environmental Management Program is designed to protect our people, our partners, our communities, and the environment. All levels of the organization are aware of our commitment and the importance of their individual contributions. Our people are responsible and accountable for their safety performance.

To support our commitment to safety, CE Franklin has adopted the comprehensive safety management system IRP-9, developed by the petroleum industry. We are also an accredited member of the Partners in Injury Reduction, a collaborative initiative with the Workers’ Compensation Board. Our Alberta branch offices have obtained a Certificate of Recognition from the Partners in Injury Reduction.

CE Franklin is proud to participate in the industry’s annual Safety Stand Down Week. During the week, our Senior Leadership Team visit branches to engage in conversations about Safety. These face-to-face conversations about safety provide valuable feedback from the people who make the program work and help to reinforce the Company’s commitment to create a safer workplace.

Front-line employees actively participate in the Company’s Health and Safety Program. Employees receive safety training relevant to their positions and participate in regular safety meetings at each location. These meetings are an opportunity to discuss safety or environment-related information as well as to identify hazards and opportunities for improvement. Each branch location also participates in an annual safety inspection to identify opportunities to enhance our program and improve results.

Safety information is provided to employees to ensure they understand their responsibilities and are engaged in the safety program. All employees have access to the Safety Site on the Company intranet. The Safety Site serves as a resource by providing information and training materials about the safety program, and serving as a forum for feedback and reporting of activities. Information is also sent to employees via the Quarterly Safety Newsletter. The newsletter includes information on relevant safety issues, safety quizzes to support previous safety training, and the Company’s safety information. For more timely information, bulletins and memos are sent out to alert employees to potential hazards or inform them of any changes in regulatory or Company requirements as they occur.

CE Franklin is increasing safety awareness by providing support to Safety Representatives in the branch locations. In 2006, we worked to complete a Safety Representative Manual and initiated a monthly e-mail to communicate safety issues. As well, a series of safety-related topics were developed to assist the Safety Representatives in providing value in the regularly scheduled branch safety meetings. In 2007, we will be delivering a training program to Safety Representatives in each branch.

Along with front-line employees, members of our Senior Leadership Team are active participants in the Corporate Safety Steering Committee. The Committee meets monthly to review the Company’s safety and environmental information and works with employees to offer support and resources that will provide a safe working environment. The Committee reports quarterly to the Board of Directors in a review of CE Franklin’s safety performance.

The total reported injury rate in 2006 was reduced by over 30% from 2005. Increased awareness of safety hazards and improved communication with safety representatives in our branch locations contributed to this effort. Our people are working together to continue to create a safer workplace at CE Franklin.

Commitment to Communities

CE Franklin encourages and supports the involvement of its employees in their communities. Through donations and contributions of time and ideas, we invest in many organizations in each community that we operate. We get involved to help improve the communities in which our employees work and raise their families, and we are dedicated to the welfare of these communities.

CE Franklin touches the lives of many people across our country. Community commitment is woven into our Company and is shown through the contributions we have madeÑand will continue to make. The many causes we support include the Alberta Children’s Hospital, Alberta Lung Association, Alberta Mentor Foundation, Canadian Cancer Society, CNIB Visions, Cross Cancer Institute, Hospice Society, Juvenile Diabetes Research, Motive Action Training Foundation, MS Society of Canada, Starlight Starbright Children’s Foundation, United Way, and the Women in Need Society.

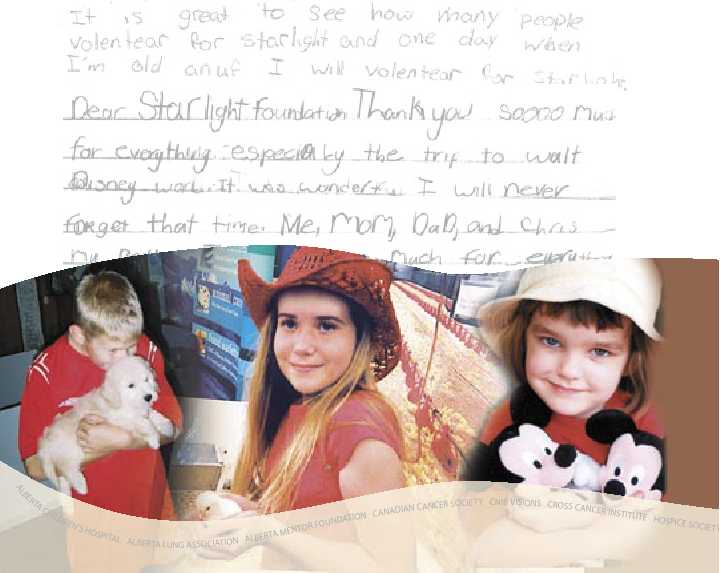

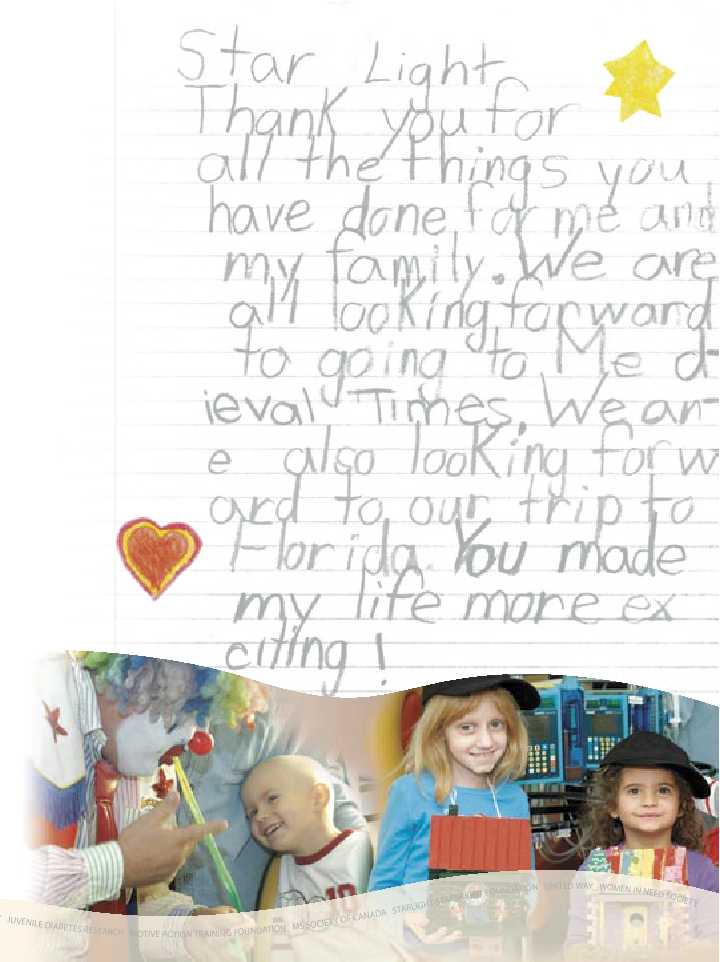

Charities such as the Starlight Starbright Children’s Foundation, where we sponsored six wishes in 2006, help us make a difference. By helping sick children fulfill their wishes, we are dedicated to brightening the lives of these children and their families. Some of the heartfelt thanks received from these children and their families are clearly expressed in the letters below.

Management’s Discussion and Analysis

As at January 30, 2007

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is provided to assist readers in understanding CE Franklin’s financial performance during the periods presented and significant trends that may impact future performance of CE Franklin.This discussion should be read in conjunction with the consolidated financial statements of CE Franklin and the related notes thereto.

The selected financial data presented below is presented in Canadian dollars and in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). For a discussion of the principle differences between CE Franklin’s financial results as calculated under U.S. GAAP, see note 20 to the consolidated financial statements of CE Franklin.

Forward-Looking Statements

The information in this MD&A, may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, that address activities, events, outcomes and other matters that CE Franklin plans, expects, intends, assumes, believes, budgets, predicts, forecasts, projects, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements.These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this MD&A, including those found under the caption “Risk factors”.

Forward-looking statements appear in a number of places and include statements with respect to, among other things:

>> the forecasted activity levels into 2007;

>> planned capital expenditures and working capital and availability of capital resources to fund capital expenditures and working capital;

>> the Company’s future financial condition or results of operations and future revenues and expenses; >> the Company’s future gross profit and net profit margins;

>> the Company’s business strategy and other plans and objectives for future operations;

>> fluctuations in worldwide prices and demand for oil and gas;

>> fluctuations in levels of gas and oil exploration and development activities; and >> fluctuations in the demand for the Company’s products and services.

We caution you that these forward-looking statements are subject to risks and uncertainties, many of which are beyond CE Franklin’s control.These risks include, but are not limited to, economic conditions, seasonality of drilling activity, commodity price volatility for oil and gas, currency fluctuations, inflation, regulatory changes and the other risks described under the caption “Risk factors”.

Should one or more of the risks or uncertainties described above or elsewhere in this MD&A occur, or should underlying assumptions prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements expressed or implied, included in this MD&A and attributable to CE Franklin are qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that CE Franklin or persons acting on its behalf might issue.CE Franklin does not undertake any obligation to update any forward-looking statements to reflect events or circumstances after the date of filing this MD&A with the Securities and Exchange Commission, except as required by law.

OVERVIEW

CE Franklin distributes pipe, valves, flanges, fittings, production equipment, tubular products and other general oilfield supplies to producers of oil and gas in Canada through its 42 branches which are situated in towns and cities that serve particular oil and gas fields of the western Canadian sedimentary basin. In addition, the Company distributes pipe, valves, flanges and fittings to the oilsands, refining, heavy oil and petrochemical industries and non-oilfield related industries such as the forestry and mining industries.

The Company’s 42 branches each warehouse an inventory of products to meet the day to day needs of customers. Other inventory, such as pipe or tubular products, may be sourced from various stocking points located throughout the western Canadian sedimentary basin and shipped direct to the customers’ location. The branches also have access to a sales force located at the Company’s headquarters in Calgary, Alberta that provides product expertise and logistics to get the product to the customer.

The primary driver of the Company’s profitability is the level of oil and gas exploration and production activity, particularly in the western Canadian sedimentary basin. The price of oil and gas, well completions and rig counts are common indicators of activity levels in the energy industry. Other drivers of profitability include activity levels within specific regions, the mix of products sold and customer mix.

Activity levels within specific regions will fluctuate due to various factors including the mix of oil and gas activity within the region and oil and gas producers entering or leaving the region. The Company responds to these fluctuations by opening or closing branch locations in order to service it’s customers needs and ensure there is coverage in areas of higher activity.

The mix of products sold and the customer mix will affect profitability. Profit margins will vary for different products and the method of sale. Walk-in business at the branches will generate higher profit margins compared to bids, which are typically larger orders where the Company can take advantage of volume discounts and longer lead times. Customer contracts can affect profit margin where different customers receive different pricing structures based on factors such as size, service requirements and complexity.

SALES

The Company’s sales are dependent upon the level of oil and gas exploration and production activity in the western Canadian sedimentary basin, including the oilsands. This activity is cyclical and is primarily influenced by worldwide energy prices, but may also be affected by expectations related to the worldwide supply of and demand for oil and natural gas, finding and development costs, economic and political events and uncertainties and environmental concerns. The Company mitigates the cyclical nature of its business by adjusting its variable and fixed (primarily salaries and benefits) selling, general and administrative costs (“SG&A”) as activity levels change.

The Company generates sales principally from the distribution of pipe, valves, flanges, fittings, production equipment, tubular products and other general oilfield supplies to producers of oil and gas in the western Canadian sedimentary basin. The Company’s sales for the year ended December 31, 2006 were $555.2 million, compared to $484.2 million for the year ended December 31, 2005 and $339.7 million for the year ended December 31, 2004.

The price of oil and gas as at December 31, 2006 were U.S. $61.05 per bbl (West Texas Intermediate) and Cdn. $6.00 per gj (AECO spot) respectively, and the average price of oil and average price of gas for the year ended December 31, 2006 were U.S. $66.05 per bbl and Cdn $6.55 per gj respectively. This compares to U.S. $61.04 per bbl for oil and Cdn. $9.01 per gj for gas as at December 31, 2005, and to an average of U.S. $56.57 per bbl for oil and an average of Cdn. $8.31 per gj for gas for the year ended December 31, 2005. As at December 31, 2004 the price of oil and the price of gas were U.S. $43.45 per bbl and Cdn $5.90 per gj respectively, and the average price of oil and the average price for gas for the year ended December 31, 2004 were U.S. $41.37 per bbl and Cdn. $6.22 per gj respectively. The strong commodity prices resulted in Canadian oil and gas producers having increased cash flow and, therefore, being able to increase capital spending on exploration and production activities.

The Company uses oil and gas well completions and average rig counts as industry activity measures. Oil and gas well completions require the products sold by the Company and therefore are a good general indicator of market activity. Average rig counts provide a general indication of energy industry activity levels.

For the year ended December 31, 2006 the total number of wells completed (excluding dry and service wells) in western Canada increased 3.4% to 20,926 wells compared to 20,238 wells for the year ended December 31, 2005. For the year ended December 31, 2005, the total number of wells completed (excluding dry and service wells) in western Canada increased 0.6% to 20,238 wells, compared to 20,118 wells for the year ended December 31, 2004.

The average rig count for the year ended December 31, 2006 increased 6.2% to 498 average rigs as compared to 469 average rigs for the year ended December 31, 2005. The average rig count for the year ended December 31, 2005 was 469 average rigs compared to 371 average rigs for the year ended December 31, 2004.

The Company’s sales are also affected by weather conditions. Many exploration and production areas in the northern portion of the western Canadian sedimentary basin are accessible only in the winter months when the ground is frozen. As warm weather returns in the spring (April/May of each year), the ground thaws, rendering many secondary roads incapable of supporting the weight of the heavy equipment necessary for exploration and production activities in that region until they have dried out. As a result, the first and fourth quarters typically represent the busiest time and highest sales activity for the Company. Sales levels drop dramatically during the second quarter until such time as the roads have dried and road bans have been lifted. This typically results in a significant reduction in earnings during the second quarter as the Company does not reduce its SG&A expenses during the second quarter to offset the reduction in sales.

The Company distributes its products through 42 branches and inventory stocking points, which are situated in the towns and cities that serve particular oil and gas fields of the western Canadian sedimentary basin. The Company will, from time to time, open or close branches to meet customer requirements and fluctuating market conditions, which will impact the Company’s sales. The Company also has a 100,000 square-foot centralized distribution centre located in Edmonton, Alberta. The distribution centre is strategically located within reasonable proximity to a majority of vendors and acts as the hub for its operations.

The Company’s sales, which are almost entirely comprised of product sales, are generally subject to arrangements which specify price and general terms and conditions. The Company recognizes product sales when title and the related risk of loss transfers to customers. Several customers have looked to the Company for its expertise in materials management and other service support. Through these alliances, the Company manages approximately 50 warehouses for its customers. CE Franklin consigns inventory to these customer warehouses and recognizes sales when the customer uses the products stored at these warehouses. The sales and profits from customer warehouses are insignificant from a financial perspective as compared to total sales and profitability. The trend is for the Company’s customers to focus on their core competencies and outs ource non-core supply chain areas to the Company.

The Company’s sales depend to a large extent on the Company’s strong relationships with its customers. To ensure coordination and close contact with all of the Company’s major customers, a sales group working out of Calgary, Alberta (where many of the head offices of the Company’s customers are located) act as account managers with specific individual responsibilities for managing the Company’s business and alliance relationships with its customers. In addition, the Company has regional area sales representatives that coordinate sales and activities in the field.

CE Franklin has two vendors with which it does significant business. If either of those relationships were terminated it could have a material effect on the Company’s sales, business and financial condition. The Company believes that it has historically had, and continues to have, a good relationship with these two suppliers, and alternate sources of supply are available for the products purchased from the suppliers.

EXPENSES

The Company’s expenses are comprised of cost of sales, selling, general and administrative expenses, amortization expense, interest expense relating to the Company’s demand bank operating loan and obligations under capital leases, and other income and expenses. Each of the items is discussed below in detail.

Cost of Sales

Cost of sales is comprised of the average cost of products purchased from various manufacturers and sold to the Company’s customers, net of vendor rebates from suppliers, freight expense and inventory obsolescence and shrink expenses. The Company’s 42 branches, and distribution centre stock 25,000 regularly-stocked Stock Keeping Units (“SKU’s”) of product/inventory for its customers. In addition, the Company will purchase and resell non-regularly stocked products as required by its customers. These products are purchased from various manufacturers at prices reflecting the volume of product purchased from the manufacturers. Inventories are valued at the lower of average cost or net realizable value.

Selling, General and Administrative Expenses

SG&A is comprised of certain fixed expenses such as employee salaries and benefits, sales and marketing costs, occupancy and warehouse costs, office and vehicle costs, as well as certain variable expenses such as agent’s commissions, which are paid to branch agents based on a percentage of gross profit dollars earned by the branch agent, and performance pay incentives to employees.

For the year-ended December 31, 2006, fixed expenses were approximately 73% of total SG&A (2005 – 68%; 2004 – 75%).

In 2006, SG&A expenses included costs associated with the Company’s SOX404 certification (outside consulting and audit fees). SOX404 certification cost the Company approximately $1.4 million or $0.05 per share, diluted after tax, in 2006.

Amortization

Amortization expense relates to the Company’s investment in property and equipment, which is recorded at cost, less related accumulated amortization. The Company’s property and equipment is comprised of investments in its enterprise and electronic commerce systems, building and leasehold improvements, equipment and machinery and furniture and office equipment relating to its 42 branch locations, its centralized distribution facility, and its corporate head office.

Property and equipment increased 56.8% to $5.5 million as at December 31, 2006. This increase reflects capital expenditures of $3.6 million and $1.2 million in additions to rental equipment assets. The additions were offset by amortization expense of $2.8 million.

Interest

Interest expense is comprised of interest on the Company’s demand bank operating facility, and interest expense related to obligations under capital leases. The Company finances its working capital requirements, accounts receivable, inventory, bank overdraft, accounts payable and accrued liabilities with its bank operating loan. The Company will fund capital expenditures from cash flow from operating activities and capital leases where available.

Other Expenses (Income)

Other expenses include foreign exchange gains or losses relating to the purchase of inventory from U.S. and international suppliers, and gains or losses on the sale of property and equipment.

CRITICAL ACCOUNTING ESTIMATES

The preparation of the consolidated financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The Company evaluates its estimates on an ongoing basis, based on historical experience and other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions and conditions.

The Company believes the following describes the significant judgments and estimates used in the preparation of its consolidated financial statements.

Accounts Receivable and SG&A Expenses

The Company extends credit to customers and other parties in the normal course of business. Management regularly reviews outstanding accounts receivable and provides for estimated losses through an allowance for doubtful accounts. In evaluating the level of the established allowance, management makes judgments regarding the parties’ ability to make required payments, economic events and other factors. As the financial condition of these parties change, circumstances develop or additional information becomes available, adjustments to the allowance for doubtful accounts may be required. These adjustments, if required, would result in a decrease in accounts receivable and an increase in bad debt expense included under SG&A. The effect on the overall performance of the Company would be dependent on the size of the customer in relation to the C ompany’s sales. For the three years ended December 31, 2006, 2005 and 2004, the Company’s bad debt expense has been $713,000, $459,000 and $244,000 respectively.

Carrying Value of Inventory and Cost of Sales

The Company has made significant investments in inventory to service its customers. On a routine basis, the Company uses judgments in determining the level of write-downs required to record inventory at the lower of average cost or market. Management’s estimates are primarily influenced by technological innovations, market activity levels and the physical condition of products. Changes in these or other factors may result in a write-down in the carrying value of inventory that would result in an increase in cost of sales and a reduction in inventories. For the three years ended December 31, 2006, 2005 and 2004 inventory write-downs included in cost of sales were $312,000, $280,000 and $1.5 million respectively. Inventory write-downs declined dramatically in 2005 and 2006 due to the Company focusing on the sale of its core products.

Future Tax Assets and Liabilities

Future tax assets and liabilities are recognized for differences between the book value and tax value of the net assets of the Company. In providing for future taxes, management considers current tax regulations, estimates of future taxable income and available tax planning strategies. If tax regulations, operating results or the ability to implement tax planning strategies vary, adjustments to the carrying value of future tax assets and liabilities may be required. See note 8 to the consolidated financial statements for the significant components of the future income tax assets and liabilities, and a reconciliation of the Company’s income tax provision.

Stock-based Compensation

As of January 1, 2003, the Company adopted prospectively the fair value based method of accounting for stock options, which means that the amount expensed in each period for common share options granted to employees, officers and directors is the fair value of the options, calculated using the Black-Scholes options-pricing model and net of options forfeited in the period, amortized over the vesting period of the options. Compensation expense of $529,000 was recorded in 2006, $552,000 in 2005 and $256,000 was recorded in 2004. See note 9 b) to the consolidated financial statements for a description of the effect on the financial statements if the fair value method had been adopted for options awarded prior to January 1, 2003.

Effective May 2, 2006, the Company adopted the Performance Share Unit ("PSU") and Deferred Share Unit ("DSU") plans approved by shareholders on that date. Under these plans, PSU's and DSU's are granted which entitle the participant, at the Company's option, to receive either a common share or cash equivalent in exchange for a vested unit. The vesting period for PSU's is one third per year over the three year period from the grant date. DSU's vest on the date of grant. Compensation expense related to the units granted is recognized over the vesting period based on the fair value of the units at the date of the grant and is recorded to compensation expense and contributed surplus. The contributed surplus balance is reduced as the vested units are settled. A total of 132,816 PSU's and DSU's were granted in 2006 and the compensation expense recorded for the year ended December 31, 2006 was $1,703,000 (2005 - nil).

Goodwill

The Company acquired certain operations during the past decade, which has resulted in the recording of a material amount of goodwill on the balance sheet. In accordance with Canadian GAAP, the Company is required to perform an annual goodwill impairment evaluation, which is largely influenced by future cash flow projections, earnings and cash flow multiples. Estimating future cash flows of the Company’s operations, earnings and cash flow multiples requires management to make judgments about future operating results and working capital requirements. The majority of the Company’s goodwill is the result of the combination by reverse takeover of Franklin Supply and Continental Emsco Company Limited on November 3, 1995.

OPERATING RESULTS

The following table summarizes CE Franklin’s results of operations.

| | | | | | |

(in thousands of Cdn. dollars except per share data) |

For the years ended December 31 | 2006 | | 2005 | | 2004 |

| | | | | | |

Statements of Operations |

Sales | $555,227 | | $484,245 | | $339,742 |

Gross Profit | 103,494 | | 91,314 | | 60,243 |

Gross Profit - % | 0.2% | | 0.2% | | 0.2% |

| | | | | | |

Other expenses (income) |

Selling, general and administrative expenses | 63,287 | | 55,303 | | 44,299 |

Amortization | 2,819 | | 4,393 | | 4,328 |

Interest | 2,661 | | 1,945 | | 1,455 |

Other | 130 | | 8 | | 16 |

| | 68,897 | | 61,649 | | 50,098 |

| | | | | | |

Income before income taxes | 34,597 | | 29,665 | | 10,145 |

Income tax expense | 11,658 | | 10,801 | | 4,003 |

Income from continuing operations | 22,939 | | 18,864 | | 6,142 |

Loss from discontinued operations | - | | - | | (27) |

Net income | $22,939 | | $18,864 | | $6,115 |

| | | | | | |

| | | | | | |

| | | | | | |

EBITDA(1) | 40,077 | | 36,003 | | 15,928 |

EBITDA as a % of sales | 0.1% | | 0.1% | | 0.0% |

Net income per share |

Basic | $1.27 | | $1.09 | | $0.36 |

Diluted | $1.22 | | $1.01 | | $0.35 |

(1) EBITDA represents net income before interest, taxes, depreciation and amortization. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. Management believes that EBITDA, as presented, represents a useful means of assessing the performance of the Company’s ongoing operating activities, as it reflects the Company’s earnings trends without showing the impact of certain charges. The Company is also presenting EBITDA, incremental flow through to EBITDA and EBITDA as a percentage of sales because it is used by management as a supplemental measure of profitability. The use of EBITDA by the Company has certain material limitations because it excludes the recurring expenditures of interest, income tax, and amortization expenses. Interest expense is a neces sary component of the Company’s expenses because the Company borrows money to finance its working capital and capital expenditures. Income tax expense is a necessary component of the Company’s expenses because the Company is required to pay cash income taxes. Amortization expense is a necessary component of the Company’s expenses because the Company uses property and equipment to generate sales. Management compensates for these limitations to the use of EBITDA by using EBITDA as only a supplementary measure of profitability. EBITDA is not used by management as an alternative to net income as an indicator of the Company’s operating performance, as an alternative to any other measure of performance in conformity with generally accepted accounting principles or as an alternative to cash flow from operating activities as a measure of liquidity. Not all companies calculate EBITDA in the same manner and EBITDA does not have a standardized meaning prescribed by GAAP . Accordingly, EBITDA, as the term is used herein, is unlikely to be comparable to EBITDA as reported by other entities.

The following is a reconciliation of income from continuing operations to EBITDA:

| | | | | | |

(in thousands of Cdn. dollars) |

For the years ended December 31 | 2006 | | 2005 | | 2004 |

Income from continuing operations | $22,939 | | $18,864 | | $6,142 |

Interest expense | 2,661 | | 1,945 | | 1,455 |

Income tax expense | 11,658 | | 10,801 | | 4,003 |

Amortization | 2,819 | | 4,393 | | 4,328 |

EBITDA | $40,077 | | $36,003 | | $15,928 |

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Sales

Sales for the year ended December 31, 2006 increased 14.7% or $71.0 million to $555.2 million from $484.2 million for the year ended December 31, 2005. The sales increase was due to strong commodity prices during the first half of 2006, which resulted in improved industry economics. Activity levels declined in the third and fourth quarters resulting in the overall sales increase of 14.7% for the year.

Gross Profit

Gross profit increased 13.3% to $103.5 million for the year ended December 31, 2006 from $91.3 million for the year ended December 31, 2005. Gross profit margins decreased to 18.6% for the year ended December 31, 2006 from 18.9% for the year ended December 31, 2005.

The overall reduction in gross profit margins for the year ended December 31, 2006 is a result of increased freight costs partially offset by margin initiatives which include offshore procurement, standardization of certain product lines and a more disciplined procurement practice.

Selling, General and Administrative Costs

SG&A costs increased $8.0 million or 14.4% to $63.3 million for the year ended December 31, 2006 from $55.3 million for the year ended December 31, 2005. The increase in SG&A for the year ended December 31, 2006 related mainly to salaries and related costs for new employees hired to support the increase in sales, occupancy costs related to new and expanded locations to support the increase in sales and costs related to compliance with the Sarbanes-Oxley Act of 2002 (“SOX”).

The total number of employees increased 11.5% to 427 employees as at December 31, 2006 compared to 383 employees as at December 31, 2005. Average revenue per employee for the year ended December 31, 2006 increased 3.1% as compared to the previous year. Maintaining an average revenue per employee reflects standardization of processes and procedures, whereby all internal processes are performed consistently throughout the Company’s operations resulting in process improvement efficiencies.

In 2006, SG&A expenses included costs associated with the Company’s SOX404 certification (outside consulting and audit fees) of approximately $1.4 million or $0.05 per share after tax (diluted).

EBITDA

EBITDA for the year ended December 31, 2006 increased $4.1 million or 11.3% to $40.1 million compared to $36.0 million for the year ended December 31, 2005. The $71.0 million increase in sales resulted in a 5.7% incremental flow through to EBITDA. EBITDA as a percentage of sales was 7.2% for the year ended December 31, 2006 versus 7.4% for the year ended December 31, 2005.

EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. For a reconciliation of net income to EBITDA, please see page 19.

Income Before Income Taxes

Income before income taxes improved $4.9 million to $34.6 million for the year ended December 31, 2006 compared to $29.7 million for the year ended December 31, 2005. The improvement is a result of the $12.2 million increase in gross profit offset by the $8.0 million increase in SG&A and a decrease of $736,000 in other costs. Other costs include amortization, interest expense and foreign exchange. The $71.0 million increase in sales for the year ended December 31, 2006 resulted in a 6.9% incremental flow through to income before income taxes.

Income Taxes

The Company’s effective tax rate for the year ended December 31, 2006 was 33.7%, as compared to an effective tax rate of 36.4% for the year ended December 31, 2005. The Company’s combined federal and provincial statutory tax rate for the period ended December 31, 2006 was 33.1%, compared to 34.4% for the period ended December 31, 2005. The reduction in the effective tax rate for the year is due to a reduction to statutory tax rates and from changes in non-deductible items. See note 8 to the consolidated financial statements for a detailed reconciliation of the effective tax rate.

Loss from Discontinued Operations

On March 31, 2004, the Company sold its 50% interest in its small horsepower compression operations for cash proceeds of $961,000. No gain or loss on disposition resulted from this transaction.

Loss from discontinued operations for the year ended December 31, 2004 was $27,000.

Net Income

Net Income increased 21.6% to $22.9 million or $1.22 per share (diluted) for the year ended December 31, 2006 as compared to $18.9 million or $1.01 per share (diluted) for the year ended December 31, 2005.

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Sales

Sales for the year ended December 31, 2005 increased 42.5% or $144.5 million to $484.2 million from $339.7 million for the year ended December 31, 2004. The sales increase was due to strong commodity prices, which resulted in improved industry economics, coupled with an increase in market share from sales to new customers and increased sales to existing customers. Sales also increased due to increasing supplier prices reflecting an increase in energy, raw materials and operational costs.

Gross Profit

Gross profit increased 51.6% to $91.3 million for the year ended December 31, 2005 from $60.2 million for the year ended December 31, 2004. Gross profit margins increased to 18.9% for the year ended December 31, 2005 from 17.7% for the year ended December 31, 2004.

The overall improvement in gross profit margins for the year ended December 31, 2005 is a result of a reduction in inventory write-downs from $1.5 million in 2004 to $280,000 in 2005, coupled with margin initiatives implemented by the Company in 2003, which include offshore procurement, standardization of certain product lines and a more disciplined procurement practice. The Company did not implement price increases to customers in 2004 and 2005 over and above price increases by the Company’s suppliers as a result of the rise in supplier pricing.

Selling, General and Administrative Costs

SG&A costs increased $11.0 million or 24.8% to $55.3 million for the year ended December 31, 2005 from $44.3 million for the year ended December 31, 2004. The increase in SG&A for the year ended December 31, 2005 related to salaries and benefits for new employees hired to support the increase in sales for the year, employee performance pay incentives and agents’ commissions due to the increase in sales and gross profit. Fixed expenses, which exclude agent’s commissions and employee performance pay incentives, increased 15.8% as compared to 2004.

The total number of employees increased 16.8% to 383 employees as at December 31, 2005 compared to 328 employees as at December 31, 2004. Average revenue per employee for the year ended December 31, 2005 increased 22% to $1.3 million per employee as compared to $1.0 million per employee the previous year. The improvement reflects standardization of processes and procedures, whereby all internal processes are performed consistently throughout the Company’s operations resulting in process improvement efficiencies.

EBITDA

EBITDA for the year ended December 31, 2005 increased $20.1 million or 126.0% to $36.0 million compared to $15.9 million for the year ended December 31, 2004. The $144.5 million increase in sales resulted in a 13.9% incremental flow through to EBITDA. EBITDA as a percentage of sales was 7.4% for the year ended December 31, 2005 versus 4.7% for the year ended December 31, 2004.

EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. For a reconciliation of net income to EBITDA, please see page 28.

Income Before Income Taxes

Income before income taxes improved $19.6 million to $29.7 million for the year ended December 31, 2005 compared to $10.1 million for the year ended December 31, 2004. The improvement is a result of the $31.1 million increase in gross profit offset by the $11.0 million increase in SG&A and an increase of $547,000 in other costs. Other costs include amortization, interest expense and foreign exchange. The $144.5 million increase in sales for the year ended December 31, 2005 resulted in a 13.5% incremental flow through to income before income taxes.

Income Taxes

The Company’s effective tax rate for the year ended December 31, 2005 was 36.4%, as compared to an effective tax rate of 39.5% for the year ended December 31, 2004. The Company’s combined federal and provincial statutory tax rate for the period ended December 31, 2005 was 34.4%, compared to 34.6% for the period ended December 31, 2004. The reduction in the effective tax rate for the year ended December 31, 2005 is due to non-deductible items and capital and other taxes totaling $608,000 (2004 - $493,000) becoming a smaller component of the overall income tax charge in 2005 due to the increase in income before income taxes. See note 8 to the consolidated financial statements for a detailed reconciliation of the effective tax rate.

Loss from Discontinued Operations

On March 31, 2004, the Company sold its 50% interest in its small horsepower compression operations for cash proceeds of $961,000. No gain or loss on disposition resulted from this transaction.

Loss from discontinued operations for the year ended December 31, 2004 was $27,000.

Net Income

Net Income increased 208% to $18.9 million or $1.01 per share (diluted) for the year ended December 31, 2005 as compared to $6.1 million or $0.35 per share (diluted) for the year ended December 31, 2004.

SUMMARY OF QUARTERLY FINANCIAL DATA

The selected quarterly financial data presented below is presented in Canadian dollars and in accordance with Canadian GAAP. See note 20 to the consolidated financial statements for a reconciliation to U.S. GAAP.

| | | | | | | | | | | | | | | | |

(in thousands of Cdn. dollars except per share data) |

Unaudited | | | | | | | | | | | | | | | |

| | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 |

| | 2005 | | 2005 | | 2005 | | 2005 | | 2006 | | 2006 | | 2006 | | 2006 |

| | | | | | | | | | | | | | | | |

Sales | $128,786 | | $92,169 | | $122,224 | | $141,066 | | $176,957 | | $115,947 | | $131,675 | | $130,648 |

| | | | | | | | | | | | | | | | |

EBITDA(see page 19) | 10,745 | | 5,897 | | 8,300 | | 11,061 | | 15,094 | | 7,023 | | 8,386 | | 9,574 |

EBITDA as a % of sales | 0.1% | | 0.1% | | 0.1% | | 0.1% | | 0.1% | | 0.1% | | 0.1% | | 0.1% |

| | | | | | | | | | | | | | | | |

Net income | 5,804 | | 2,543 | | 4,214 | | 6,303 | | 8,879 | | 3,914 | | 4,719 | | 5,427 |

Net income as a % of sales | 0.0% | | 0.0% | | 0.0% | | 0.0% | | 0.1% | | 0.0% | | 0.0% | | 0.0% |

| | | | | | | | | | | | | | | | |

Net income per share |

Basic (Cdn. $) | $ 0.34 | | $ 0.14 | | $ 0.25 | | $ 0.36 | | $ 0.50 | | $ 0.21 | | $ 0.26 | | $ 0.30 |

Diluted (Cdn. $) | $ 0.32 | | $ 0.14 | | $ 0.22 | | $ 0.33 | | $ 0.47 | | $ 0.21 | | $ 0.25 | | $ 0.29 |

The Company’s sales levels are affected by weather conditions. As warm weather returns in the spring each year the winter’s frost comes out of the ground rendering many secondary roads incapable of supporting the weight of heavy equipment until they have dried out. In addition, many exploration and production areas in northern Canada are accessible only in the winter months when the ground is frozen. As a result, the first and fourth quarters typically represent the busiest time and highest sales activity for the Company. Sales levels drop dramatically during the second quarter until such time as the roads have dried and road bans have been lifted.

Sales for the quarter ended December 31, 2006 decreased 7.4% to $130.6 million from $141.1 million for the quarter ended December 31, 2005 reflecting a general decrease in activity levels. EBITDA decreased 13.4% to $9.6 million for the quarter ended December 31, 2006 compared to $11.1 million for the quarter ended December 31, 2005. Net income was $5.4 million or $0.29 per share (diluted) for the quarter ended December 31, 2006 compared to $6.3 million or $0.33 per share (diluted) for the quarter ended December 31, 2005.

Due to a decline in activity levels in the fourth quarter of 2006 sales for the quarter ended December 31, 2006 were down 0.8% or $1.0 million to $130.6 million compared to sales for the quarter ended September 30, 2006 of $131.6 million. Net income for the quarter ended December 31, 2006 was $5.4 million or $0.29 per share (diluted) versus $4.7 million or $0.25 per share (diluted) for the quarter ended September 30, 2006. The $1.0 million decrease in sales was offset by an improvement in gross profit margins resulting in the increase in net income for the fourth quarter of 2006 compared to the third quarter of 2006.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s primary internal source of liquidity is cash flow from operating activities before net changes in non-cash working capital balances. Cash flow from operating activities and the Company’s 364-day bank operating facility are used to finance the Company’s working capital, capital expenditures and potential acquisitions. Working capital, which is primarily comprised of accounts receivable, inventories and other current assets, net of accounts payable and accrued liabilities, income tax payable and other current liabilities.