Click here for a printer-friendly version of this document

Click here for a printer-friendly version of this document

OUR PURSUIT OF EXCELLENCE

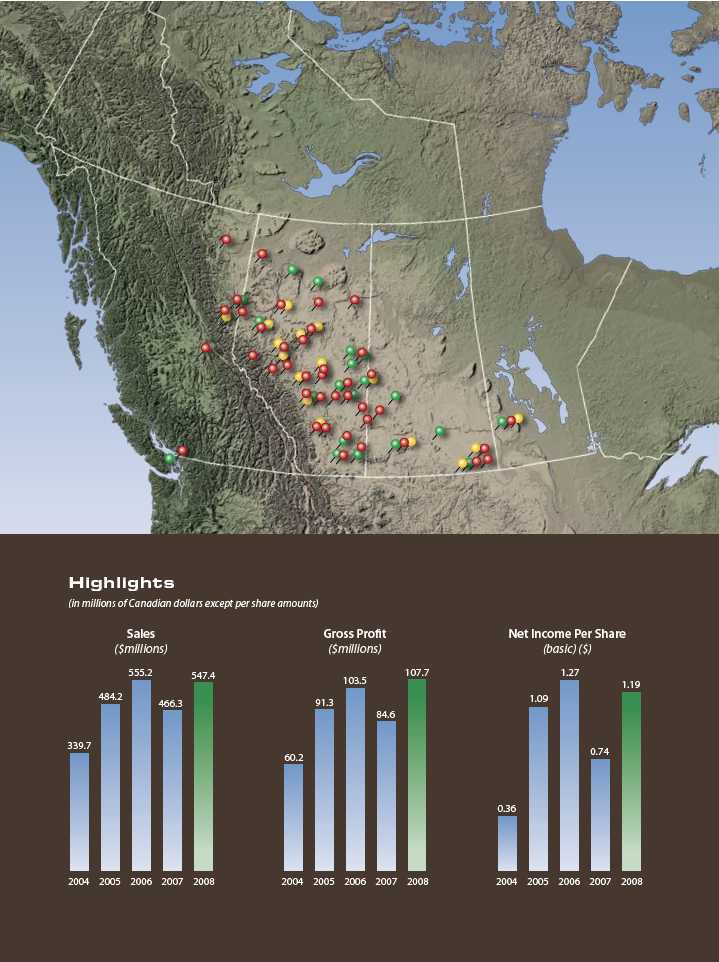

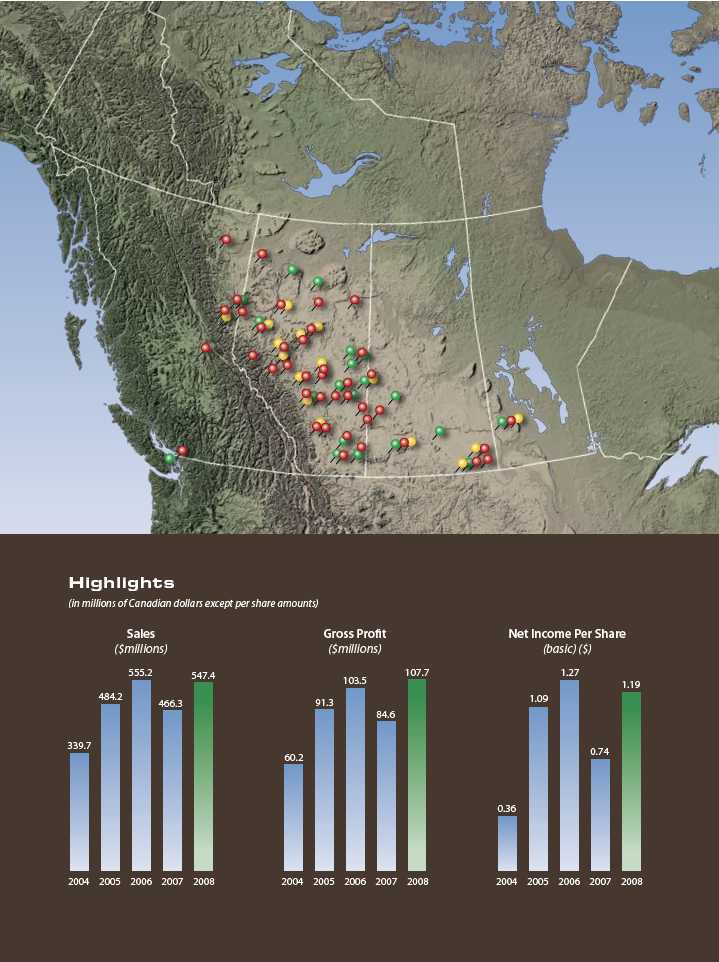

For more than half a century, CE Franklin has been a leading supplier of products and services to the energy industry.CE Franklin distributes pipe, valves, flanges, fittings, production equipment, tubular products and other general oilfield supplies and field services to oil and gas producers. In addition, the Company distributes pipe, valves, flanges and fittings to the oil sands, refining and petrochemical industries and non-oilfield related industries such as forestry and mining.

The Company’s distribution network services over 3,000 customers by providing the right materials where and when they are needed, for the best value. Our industry leading Edmonton Distribution Centre stocks over 25,000 products from over 2,000 suppliers and is the hub for the Company’s 44 branches, situated in towns and cities serving oil and gas fields of the Western Canada Sedimentary Basin.

Shares of CE Franklin trade on the TSX (CFT) and AMEX (CFK) stock exchanges. At December 31, 2008, there were 18.1 million common shares outstanding. Smith International, Inc. (“Smith International” or “Smith”), a major oilfield service company based in the United States, owns approximately 54% of the Company’s shares. CE Franklin leverages its relationship with Wilson Supply, a leading oilfield equipment distributor operating in the United States and a wholly owned subsidiary of Smith, to offer North American solutions to its customer base.

SOLID RESULTS IN 2008

CE Franklin achieved solid results in 2008 – the second most profitable year in the Company’s history – despite economic uncertainty in the oil and gas industry and in the broader marketplace. We are entering a challenging business environment in 2009 with a strong balance sheet, a proven track record of profitability, and clear strategies to increase market share in both the conventional oilfield and oil sands markets.

Net income improved 60% to $21.7 million. Sales improved 17% to $547.4 million. Sales growth has come mainly from acquisitions and our oil sands initiatives. Gross profit rose 27% to $107.7 million while the gross profit margin improved to 19.7% from 18.1% in 2007. Importantly, we achieved incremental revenue flow-through to EBITDA of 12%, and EBITDA as a percentage of sales growing year over year from 5.5% to 6.5%. It was also the second best earnings year in CE Franklin’s history. Net income per share (basic) was $1.19 in 2008, up from $0.74 in 2007.

These results reflect significant investments in infrastructure to facilitate growth:

n

Our new Edmonton Distribution Centre is the largest in the Canadian energy industry and gives us 76% more functional capacity than our previous facility. We completed the move in four days without customer or business interruption – and with a perfect safety record, accentuating our planning capability.

n

We expanded the capacity at two branches and opened our 44th branch in Red Earth, Alberta. Over the past five years, we have upgraded or expanded 12 of our branches.

n

Our oil sands strategy, which is a natural expansion of our general supplies business, is becoming a significant contributor to our growth. Our market penetration in the oil sands sector is increasing, with $39 million in sales in 2008 (ahead of plan) and the award of our first MRO (maintenance, repair, and operating) supplies contract. Our major projects team, formed in late 2005 to market our services to engineering and procurement companies and the oil sands producers, is developing a strong competitive position. We have expanded our customer base, brought on new product lines to support our oil sands initiative, and established relationships with mills to support our product requirements.

n

The successful integration of JEN Supply, acquired in December 2007, has strengthened our presence in southeastern Alberta and benefited our customer base in the area. With this acquisition, we gained valuable experience in effectively integrating a tuck-in acquisition, expertise that we can apply in future transactions.

n

The acquisition of Full Tilt Field Services in July 2007 has enhanced our visibility in the Lloydminster marketplace by differentiating our service offering. Adding service capability, to participate in the full life cycle of the products we sell, is key to our growth strategy. The services business is a natural fit and extension to our current logistics and distribution expertise and sets us up to continue our plan of expansion. We have now expanded this service capability to the Grande Prairie marketplace, and we will continue to expand to other markets where we have strong oilfield production equipment sales.

n

The international component of our strategy continues to evolve, with sales increasing modestly in 2008. We remain focused on leveraging our domestic supply chain logistics capability to service international customers from our Edmonton Distribution Centre.

n

Revenue per employee, a key productivity benchmark, was up 11% year over year, to $1.2 million. In 2008, we focused our employees on process and operational improvements, using this opportunity to work through some capacity constraints incurred during our rapid growth over the last few years.

Our results demonstrate that we have built a solid business that is profitable in all cycles of the industry. CE Franklin is able to weather economic downturns and is well positioned to take advantage of growth opportunities.

IMPROVING OUR ASSET VELOCITY

At CE Franklin, we continuously work on streamlining processes and creating operational efficiencies to improve our asset velocity. As a distribution company, our business is not capital-intensive. Our primary balance sheet assets are inventory and accounts receivable and our profitability hinges on our margins. Our margin improvement over the last five years has been achieved by gaining operational efficiencies and leveraging the supply chain – it has not been at the expense of our customers.

Improving asset velocity is an internal focus to efficiently turn inventory and collect receivables freeing up cash for other strategic investments.

We measure our inventory performance in terms of customer fill rates and inventory turns, targeting five or more inventory turns annually. While we improved our inventory turns by 20% in 2008 over the prior year, declining market activity at year-end, combined with long-lead time products arriving into stock, resulted in a year over year increase in inventory of $33 million. Over the next five years, our goal is to see our inventory turns improve as we continue to work on standardizing primary and secondary vendors to improve our process efficiencies, enhance margins, and mitigate our inventory management costs.

We measure our collections performance in terms of days sales outstanding, or DSO. To gain improvements, we look at the entire billing process as a service. We work with our customers to meet their paperwork requirements while minimizing the administrative impact on our supply chain costs. In February 2008, we introduced new document management software to support our invoicing and improve efficiency. The software is now doing what it was designed to do, but issues with the initial installation caused our DSO to bulge to 74 days at its peak in mid-year. Despite the temporary disruption, our average fourth quarter DSO improved 18% in 2008 to 51 days , from 62 days in 2007.

With our new Distribution Centre, we have increased our efficiency in the hub – critical in a hub and spoke model. We plan to shift more of our business direct from the Distribution Centre to our customers and avoid double handling in our branches. This will help make the supply chain more efficient, increasing our revenue per employee and alleviating the difficulty of recruiting employees in remote locations.

COPING WITH AN UNCERTAIN BUSINESS ENVIRONMENT

The Canadian oil and gas sector competes in a global market, where capital allocation decisions are made based on relative economics and investment returns. In 2008, oil and gas activity indictors were up slightly from 2007 despite the economic environment.

As the global economy contracted and the price of oil and natural gas collapsed in the fourth quarter, activity levels in western Canada remained relatively strong. The average rig count in 2008 rose 8% while well completions were up 2%, indicating a lag time between drilling and well tie-ins. In part, this was due to shortages of crews and materials, especially tubular steel and other steel-based products.

With extremely tight global supply conditions during 2008, steel mills operated at capacity and were unable to keep pace with demand. This supply-demand imbalance caused steel prices to rise dramatically. With prices in some cases more than doubling, steel became a driver of industry activity, affecting customers’ buying patterns and decision-making. Steel prices have now started to decline, although specialty products, such as large diameter pipe and specialized alloys, continue to command premium prices.

Despite the weakening economy, the oil and gas sector in western Canada continued to be challenged by labour shortages and ongoing cost pressures for wages, materials, and real estate in 2008. Operating and capital costs have started to improve, but that is now being offset by declining industry cash flows, due to lower commodity prices, and capital constraints.

The recent upheaval in global credit markets has resulted in deleveraging, repricing of risk and, ultimately, retrenchment of consumption. Energy markets have experienced similar upheaval, and the impact of lower cash flows on industry activity levels will be clearly visible in 2009.

Our customers continue to assess the impact of these changes on their businesses and capital expenditure plans in 2009. We expect oil and gas well completions will decline sharply in 2009 to levels not seen since 2002. These conditions will likely result in deflation of product costs and improved labour availability, along with increased mergers and acquisitions of oil and gas customers.

DRIVING OUR STRATEGIES FORWARD

Disciplined execution of strategies, operational efficiency and prudent management will be critical to withstand the downturn. CE Franklin has shown the ability to perform well in all cycles of the industry.

We enter 2009 with a strong balance sheet and are positioned to pursue our strategies to increase market share in both the conventional oilfield and oil sands markets. Over the medium to longer term, we are confident in our ability to improve the profitability of our distribution network by expanding product lines, strengthening supplier relationships and enhancing our capability to service additional oil and gas and industrial end use markets.

Our strategy of expanding our capabilities to leverage our existing infrastructure and scope is more relevant today than ever. From a competitive standpoint, we are well positioned – no matter which direction the economy goes.

We view the current business environment as an opportunity to increase the value of CE Franklin by driving our strategies forward to achieve greater profitability. We will focus on growth and that potential will be realized by diversifying our products and services. For example, in the first quarter of 2009, we will open our valve actuation centre, a new source of revenue that complements our existing valve sales. Executing diversification initiatives will improve our long term results and help us weather the storm in the short term.

One of the advantages of weaker economic times is that it creates the potential for partnerships and consolidation. We see this as a time of opportunity. With a ratio of debt to total capitalization of 20% and unused borrowing capacity of $25 million, we are in a strong position to enhance or accelerate our strategies through opportunistic acquisitions, without being reliant on them to achieve our growth and diversification objectives. We will look at acquisitions that will extend our capabilities and products, adding new revenue streams. We will also look at selected tuck-in acquisitions to strengthen our existing capabilities.

OUR SOLID TRACK RECORD FORMS THE BASIS FOR OUR NEW FIVE-YEAR PLAN

In 2002, CE Franklin’s executive team made a commitment to build a long-term, sustainable company. We committed to continually gain market share, outperform market activity in revenue, and manage our margins and expenses prudently. We have established a solid track record of creating a plan and then delivering the results. Our vision is to become the best run distribution business. Period.

We continue to evolve our strategies, looking for ways to continue to improve, diversify and leverage the capabilities we have built.

We will pursue this goal by:

n

leveraging our existing supply chain infrastructure to expand the scope of products we sell;

n

adding products that have more engineering and skill based applications supported by our current logistics capabilities;

n

growing our customer base within the mining, power generation, forestry and infrastructure industries;

n

expanding our distribution capability to eastern Canada;

n

pursuing market share gains through industry consolidation;

n

improving our asset velocity by maximizing our investment in working capital and continually improving inventory turns and DSO performance; and

n

continuing to encourage employee input and influence into our strategy.

We are strongly positioned for growth with a solid balance sheet, a proven track record of profitability, and a clear strategy.

LEADERSHIP CHANGES

In 2008, we enhanced the governance of our Board by separating the roles of Chair and CEO. Robert McClinton, an independent director, was unanimously elected as Chairman.

Doug Rock stepped down from our Board of Directors in 2008, due to time constraints associated with his responsibilities at Smith International. Doug had significant input into CE Franklin’s strategies and was a role model for me, personally. On behalf of the Board, I would like to thank Doug for his commitment and contribution to CE Franklin over the last nine years.

We were pleased to welcome Don McKenzie, an advisor to the CEO of Smith International, as the new Smith representative on our Board. Don recently retired as President and CEO of M-I SWACO, a Houston-based energy services company jointly owned by Smith and Schlumberger Limited. CE Franklin is fortunate to have the benefit of Don’s many years of service industry experience.

In September, Merv Day joined CE Franklin in the newly created position of Senior Vice President, Business Development. Merv will help us leverage and expand our product and service capability as we embark on our new five year plan.

CONTRIBUTING TO OUR SUCCESS

In closing, I would like to thank all of our stakeholders for supporting us and contributing to our success.

To our customers, thank you for your business. More importantly, thank you for your ongoing feedback: this is essential to our continuous improvement efforts. Because of your feedback, we have made investments to support your needs. We have helped you through product and supply shortages so you have not had to slow down work or production and we have worked deliberately on operational improvements to help offset cost inflation. We look forward to continuing to add value to your business.

To our suppliers, we view you as our partners and we will continue to rely on you to work with us to improve supply chain efficiencies.

To our employees, you are CE Franklin. This is your company and it is exciting that you treat it like your own. I am proud that you are passionate and loyal, vocal with your input and influence and continually helping to improve our performance.

To our communities, we are serious about our commitment to you. Financially healthy companies make better corporate citizens and as our success has grown, so has our investment in the 44 communities where our branches are located.

And to our shareholders, I am grateful for your ongoing support. In particular, I would like to acknowledge the support of our major shareholder, Smith International, who understands that operating in a cyclical business environment requires balancing the desire for short-term results with expanding and diversifying our business to ensure long-term sustainable growth.

Michael S. West

President and Chief Executive Officer

January 29, 2009

2008 was a year of change, growth, innovation and opportunity at CE Franklin. We continue to pursue growth by expanding our core business, increasing our major projects capability and presence, and diversifying our service capabilities.

CHANGE & GROWTH

On April 22, 2008, we moved into our new Distribution Centre in Edmonton, Alberta. The move, requiring over 230 semi trailer loads, was completed in 96 hours with no interruption to customer service and no injuries.

Located on 20 acres, our new location is the largest distribution centre in the Canadian energy industry. It acts as a supply hub for our 44 branches, providing overnight access to products our customers require, and allows us to focus on industry-leading purchasing and logistics practices.

The 76% increase in capacity of our new Distribution Centre will afford future growth opportunities.

Full Tilt, Powered by CE Franklin

The acquisition of Full Tilt Field Services on July 1, 2007, gave us the capability to support the production equipment we sell while strengthening our presence in the Lloydminster marketplace. In early 2009, we will complete construction of a new 53,000 square foot facility in Lloydminster, bringing the CE Franklin and Full Tilt operations together under one roof to create additional operational synergies, alleviate capacity constraints and facilitate growth. We have expanded our Full Tilt services into the Grande Prairie marketplace and plan to expand this service into other markets.

Strengthening our Market Presence and Reach

Changes to Alberta’s royalty framework have resulted in a shift in activity into neighbouring British Columbia and Saskatchewan, provinces with more favourable royalty regimes. Conventional oil exploration has shifted to southeastern Saskatchewan, where horizontal drilling and multi-stage fracturing techniques are being used to develop the Bakken light oil play. In northeastern British Columbia, drilling activity is centered on deeper gas targets in the Montney formation, where similar drilling and completion techniques are proving successful. We have a well-established presence in Saskatchewan and British Columbia and our branches are benefitting from increased activity in these areas.

Our hub and spoke distribution model allows us to be flexible and fluid in serving our existing customers while gaining new customers, improving operational efficiency, and shifting resources to active markets. We continue to increase the amount of goods supplied direct from our Distribution Centre to our customers’ sites.

n

The December 2007 acquisition of JEN Supply strengthened our presence in east-central Alberta, enhancing existing field locations in Stettler and Consort and creating a new presence for CE Franklin in Drumheller and Vermilion.

n

In 2008, we opened a new branch in Red Earth, Alberta, and expanded our locations in Prince George, British Columbia and Drumheller, Alberta.

n

In 2009, we will complete the expansion of our branches in Fort St John, British Columbia; Redcliff, Alberta; Estevan, Saskatchewan; and Virden, Manitoba.

Advancing our Oil Sands Strategy

With our strong logistics expertise, we are gaining a reputation as a solid partner to supply products to large energy projects, including oil sands, refineries, and pipelines.

Our major projects team, formed in late 2005 to pursue oil sands and major projects business, continued to gain momentum in 2008. Along with other project work, CE Franklin was awarded a major MRO contract in Fort McMurray.

Since moving into our new facility in Edmonton, we have been able to offer a superior project management solution, including marshalling services for large diameter product from our two pipe yards. We have also brought on new product lines to support our oil sands strategy, and vendors are partnering with us to deliver their products.

INNOVATION

To be a market leader, we must constantly challenge existing systems and processes, looking to increase the knowledge and productivity of our people. Our new five-year plan is aggressive and will require our people to commit to learning and continuous improvement – delivering the best performance possible through teamwork and collaboration.

As part of our corporate culture, our employees are expected to influence and effect change. We conduct regular employee surveys and involve employees in communication workshops designed to help identify goals, purpose and opportunities to achieve results. We have adapted key human resources systems and processes to give line managers better information and support to focus on career development. We have invested in dedicated training resources to provide a focus on design, development and delivery of training.

We have developed a road map for learning, designed by our employees. In 2008, we launched an online Learning Management System that will extend our training capabilities to all locations and improve delivery and retention of material. We implemented product training and introduced new field sales training and safety representative training courses. We invested more money on training in 2008 than we had in any other year.

We will continue to give our people tools to help them become superb communicators, technical experts, and respected business people. Our people turn possibilities into performance.

Helping our Customers Succeed

Over several decades, CE Franklin has built long-term relationships with its customers. We add value by aligning our goals with those of our customers and effectively managing the cost drivers of the supply chain. Our sales team has undergone a realignment that allows them to coordinate better with our customers to eliminate obstacles. Effective internal coordination has helped to standardize service delivery while fostering stronger feedback links with our customers. In turn, customer feedback has led to ongoing process alignment initiatives that have enabled our customers to realize process cost savings and efficient quality control in the supply chain.

Working with customers to better understand their needs and requirements produced some key system changes in 2008. We introduced a new document management system and developed substantial billing interface improvements to serve the needs of our customers. We also invested in a significant upgrade of our computing infrastructure to increase system speed at all locations and facilitate future growth.

Our goal is to continue to drive value into the supply chain and reduce waste. Greater integration within the Edmonton Distribution Centre to coordinate purchases will help us leverage our relationships efficiently and ensure the ongoing success of our long-term customer partnerships.

OPPORTUNITIES

Changes, growth and innovation in 2008 have led to increased capabilities and new opportunities.

The new Distribution Centre significantly increases our capacity to execute projects. The staging area and inventory capacity will support our unique service offerings such as the direct to customer program, in which we work with customers to better plan and execute projects. This service eliminates redundancies and streamlines process, helps standardize products and services at a cost benefit to both the customer and CE Franklin.

The Distribution Centre has also paved the way for CE Franklin to develop new sources of revenue. For example, we are developing a new valve actuation centre. By assembling valves and actuators as a complete package, we can enhance the value of our product offering to our customers while incrementally growing our top line revenue. The new business will take advantage of our existing valve inventory and shorten the supply chain.

SAFETY AND ENVIRONMENTAL MANAGEMENT

CE Franklin is committed to a safety and environmental management program that protects our people, our partners, our communities, and the environment while meeting government regulations.

Safety is a part of our culture and we are focused on continuously improving our performance. To promote this culture, we ensure that all employees receive the necessary training and information to make the right choices. We raised awareness and strengthened our safety program with a number of training initiatives in 2008.

We also integrated the Full Tilt operations into our Certificate of Recognition (COR). Participation in this program is the fundamental building block to create employee interest and involvement. The COR is a formal acknowledgement by Alberta Human Resources and Employment that a company has a health and safety program that meets approved standards.

We continued to focus on environmental management by improving our operating efficiency, purchasing fuel-efficient vehicles and energy efficient electronics, recycling paper and plastics, and helping our customers reduce waste through surplus utilization programs.

SUPPORTING OUR COMMUNITIES

CE Franklin and its employees are proud of their involvement in all 44 communities where we operate.

Our commitment to our communities is two-fold:

n

First, we strive to ensure that we have healthy employees who have the time and energy to contribute to local organizations. CE Franklin allocates 3% of employees’ time to volunteer activities. In 2008, our employees donated hundreds of hours to various causes in the 44 communities where our branches are located.

n

Second, we lend financial support to community projects – from helping to raise the roof on the local arena to ensuring children have lunch at school. CE Franklin also donated over $170,000 to more than 100 charities, including United Way, Canadian Diabetes Association, Alberta Lung Association, Canadian Cancer Society, MS Society of Canada, and Alberta Children’s Hospital Foundation. Proudly, we are a platinum sponsor of the Starlight Starbright Children’s Foundation and every year we sponsor the wishes of several critically ill children.

SUPPORTING HOME-TOWN HEROES

In 2008, CE Franklin helped these home-town heroes reach their goals.

Denny Morrison

Speedskater

n 2008 World Champion

n 2008 Canadian Speedskater of the Year

n 2006 Olympic Silver Medalist

n 1500 metres World Record Holder

n World Cup Gold Medalist

n Hometown: Fort St. John, BC

Codey McCurrach

Professional Chuckwagon Driver

n 2007 WPCA Rookie of the Year, placing 19th in the World

n 3rd Generation Wagon Driver with 17 years wagon driving experience

n CE Franklin Tarp at the Drumheller Wagon Races

n Hometown: Eckville, AB

Christine Nesbitt

Speedskater

n 2008 World Champion Silver Medalist

n 2006 Olympic Silver Medalist

n Member of Canada’s National Team since 2005

n World Cup Gold Medalist

n Hometown: London, ON

Jessica Zelinka

Heptathlon(100-m Hurdles, Shot Put, High Jump, Long Jump, Javelin Throw and 200m and 800m runs.)

n Fifth at 2008 Olympic Games in Beijing

n Pan American Games Gold Medalist

n Canadian University Track & Field Athlete of the Year, 2004 & 2005

n Currently Ranked 4th in the World

n Hometown: London, ON

LEADERSHIP TEAM

Michael S. West

Mike West joined CE Franklin as President and Chief Executive Officer in January 2002. He also served as Chairman of the Board from December 2003 to April 2008. Mike has held executive positions in the oilfield supply and distribution business for the past 12 years. Prior to 1996, he worked for 11 years in various capacities in the automotive aftermarkets industry.

W. Mark Schweitzer

Mark Schweitzer joined CE Franklin as Vice President and Chief Financial Officer in August 2007. Previously, he was the Executive Vice President and Chief Financial Officer of a large diversified business income fund. Mark has extensive financial experience in oil and gas, mining and other industry sectors.

Merv Day

Merv Day joined CE Franklin as Senior Vice President, Business Development in September 2008. Previously, he was President of a major valve manufacturer in Canada. Merv has over 30 years experience in the manufacturing and distribution of pipe, valves and fittings in the energy industry in Canada and internationally.

James E. Baumgartner

Jim Baumgartner is Vice President, Commercial Strategies. Prior to joining CE Franklin in 2001, Jim was the General Manager for a competitor in the oilfield and industrial project supply distribution business. He has over 27 years experience in distribution of pipe, valves and fittings to the energy industry in Canada and internationally.

Michael A. Boyles

Mike Boyles is Vice President, Brand Development, Marketing and Communications. Prior to joining CE Franklin in 2007, he was a Partner and Vice President of Sales and Marketing with a sporting goods manufacturer. A graduate of business administration from Grant McEwan College, Mike has extensive experience in building companies and brands.

Brent W. Greenwood

Brent Greenwood is Vice President, Supply Chain Management. He began his career with Franklin Supply in 1980 and has held various positions with the Company over the past 28 years. Brent graduated from the University of Saskatchewan with a Masters of Arts degree in History and earned his MBA from the University of Calgary in 1999.

Ronald L. Koper

Ron Koper is Vice President, Business Effectiveness. Prior to joining CE Franklin in 2000, Ron worked with a variety of large and mid-sized corporations in the human resources and organizational development profession. He graduated from the University of Calgary in 1984 with a Bachelor of Commerce degree.

Timothy M. Ritchie

Tim Ritchie is Vice President, Sales. He began his career with Franklin Supply in the field over 15 years ago and has progressively taken on more senior roles. Tim graduated from the University of Lethbridge with a Bachelor of Arts degree in 1993 and earned his MBA from the University of Calgary in 2000.

Roderick H. Tatham

Rod Tatham is Vice President, Operations. He is responsible and accountable for overall operational performance. Prior to joining CE Franklin in May 2002, Rod worked in various management capacities including Business Process & Design, Quality, Branch Management and Materials Management.

Management’s Discussion and Analysis

As at January 29, 2009

The following Management’s Discussion and Analysis (“MD&A”) is provided to assist readers in understanding CE Franklin Ltd.’s (“CE Franklin” or the “Company”)) financial performance and position during the periods presented and significant trends that may impact future performance of CE Franklin. This discussion should be read in conjunction with the audited consolidated financial statements of CE Franklin and the related notes thereto.

All amounts are expressed in Canadian dollars and in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”), except where otherwise noted. For a discussion of the principle differences between CE Franklin’s financial results as calculated under U.S. GAAP, see note 16 to the consolidated financial statements of CE Franklin.

OVERVIEW

CE Franklin is a leading distributor of pipe, valves, flanges, fittings, production equipment, tubular products and other general industrial supplies primarily to the oil and gas industry through its 44 branches situated in towns and cities that serve oil and gas fields of the western Canadian sedimentary basin. In addition, the Company distributes similar products to the oil sands, refining, and petrochemical industries and non-oilfield related industries such as forestry and mining.

The Company’s branch operations service over 3,000 customers by providing the right materials where and when they are needed, and for the best value. Our branches, supported by our centralized Distribution Centre in Edmonton, Alberta, stock over 25,000 stock keeping units. This infrastructure enables us to provide our customers with the products they need on a same day or over night basis. Our centralized inventory and procurement capabilities allow us to leverage our scale to enable industry leading hub and spoke purchasing and logistics capabilities. The branches are also supported by services provided by the Company’s corporate office in Calgary, Alberta including sales, marketing, product expertise, logistics, invoicing, credit and collection and other business services.

The Company’s shares trade on the TSX (“CFT”) and AMEX (“CFK”) stock exchanges. Smith International Inc. (“Smith”), a major oilfield service company based in the United States, owns 54% of the Company’s shares.

BUSINESS AND OPERATING STRATEGY

The Canadian oilfield equipment supply industry is highly competitive and fragmented. There are approximately 250 oilfield supply stores in Canada which generate annual estimated sales of $2 to $3 billion. CE Franklin competes with four other large oilfield equipment distributors and with numerous local and regional distributors as well as specialty equipment distributors and manufacturers. The oilfield equipment market is part of the larger industrial equipment supply market, which is also serviced by numerous competitors. The oil sands and niche industrial product markets are more specialized and solutions oriented and require more in-depth product knowledge and supplier relationships to service specific customer requirements.

Oilfield equipment distributors compete based on price and level of service. Service includes the ability to consistently provide required products to a customer’s operating site when needed, project management services, product expertise and support, billing and expenditure management services, and related equipment services.

Demand for oilfield equipment is driven by the level of oil and gas industry capital expenditures as well as by production related maintenance, repair and operating (“MRO”) requirements. MRO demand tends to be relatively stable over time and predictable in terms of product and service requirements. Capital project demand fluctuates over time with oil and gas commodity prices.

The mix of products sold and customers served will affect profitability. Local walk in relationship business will typically generate higher profit margins compared to project bids, which are typically larger orders where the Company can take advantage of volume discounts and longer lead times. Larger oil and gas customers typically have a broader geographic operating reach requiring multi-site service capability, conduct larger capital projects, and require more sophisticated billing and project management services than do smaller customers. The Company has entered into a number of formal alliances with larger customers where the scale and repeat nature of business enables efficiencies which are shared with the customer through lower profit margins.

Barriers to entry in the oilfield supply business are low with start up operations typically focused on servicing local relationship based MRO customers. To compete effectively on capital project business and to service larger customers requires multi-location branch operations, increased financial, procurement, product expertise and breadth of product lines, information systems and process capability.

The Company’s 44 branch operations provide substantial geographic coverage across the oil and gas producing regions in western Canada. Each branch competes for local business supported by centralized support services provided by the Company’s Distribution Centre and corporate office in Calgary. The Company’s large branch network, coupled with its centralized capabilities enables it to develop strong supply chain relationships with suppliers and provide it with a competitive advantage over local independent oilfield and specialty equipment distributors for larger customers who are seeking one stop shopping and more comprehensive service. The Company’s relationship with Wilson Supply, a leading oilfield equipment distributor operating in the United States, and a wholly owned subsidiary of Smith, enables it to provide North American solutions to its customer base and provides increased purchasing scale with equipment suppliers.

The Company is pursuing the following strategies to grow its business profitably:

n

Expand the reach and market share serviced by our distribution network. We are focusing our sales efforts and product offering on servicing complex, multi-site needs of large and emerging customers in the energy sector. In 2008, we continued to invest in our distribution network by opening a new branch operation in Red Earth, Alberta and by expanding our facilities at five existing branch operations. Last spring, we successfully completed the move to our new 153,000 square foot Distribution Centre and nine acre pipe yard located in Edmonton, Alberta, which positions us to service our growing distribution network. Organic growth is expected to be complemented by selected acquisitions such as the December 2007 acquisition of JEN Supply Inc. (“JEN Supply”) which increased our market share in two existing markets and expanded our pr esence in two additional markets.

n

Expand our production equipment service capability to capture more of the product life cycle requirements for the equipment we sell such as down hole pump repair, oilfield engine maintenance, well optimization and on site project management. This will differentiate our service offering from our competitors and deepen our relationship with customers. In the first quarter of 2009, we plan to open a valve actuation centre at our Edmonton Distribution Centre, to service our customers’ valve automation requirements. The acquisition of Full Tilt Field Services Limited (“Full Tilt”) in July 2007 provided us with the capability to service oilfield engines and parts that we were previously selling, and, by doing so, position us to attract new customers to our core oilfield equipment distribution business.

n

Focus on the oil sands and industrial project and MRO business by leveraging our existing supply chain infrastructure, product and project expertise. The Company is expanding its product line, supplier relationships and expertise to provide the automation, instrumentation and other specialty products that these customers require.

BUSINESS OUTLOOK

The recent upheaval in global credit markets has contributed to significant capital market volatility, resulting in deleveraging, repricing of risk and ultimately the retrenchment of consumption. Oil and gas markets have experienced similar upheaval. Our customers continue to assess the impact of these changes on their businesses and capital expenditure plans in 2009. We expect oil and gas well completions will decline sharply in 2009 to levels not seen since 2002. Approximately 60% of the Company’s sales are driven by our customers’ capital project expenditures.

The Company expects these conditions will contribute to increased consolidation of oil and gas customers, stable to deflationary product costs and improved labour availability. We enter 2009 with a strong balance sheet and are positioned to pursue our strategies to increase market share in both the conventional oilfield and oil sands markets.

Over the medium to longer term, the Company is confident that it can continue to strengthen and improve the profitability of its distribution network by expanding its product lines, supplier relationships and capability to service additional oil and gas and industrial end use markets.

OPERATING RESULTS

The following table summarizes the consolidated results of operations of the Company for the last three years:

| | | | | | |

(in millions of Cdn. dollars except per share data) |

Years Ended December 31, | 2008 | 2007 | 2006 |

| Amount | % | Amount | % | Amount | % |

Sales | $547.4 | 100.0 | $466.3 | 100.0 | $555.2 | 100.0 |

Cost of sales | (439.7) | (80.3) | (381.7) | (81.9) | (451.7) | (81.4) |

Gross profit | 107.7 | 19.7 | 84.6 | 18.1 | 103.5 | 18.6 |

Selling, general and administrative expenses | (71.6) | (13.1) | (58.1) | (12.4) | (63.3) | (11.4) |

Foreign exchange loss and other | (0.2) | (0.0) | (0.8) | (0.2) | (0.1) | 0.0 |

EBITDA(1) | 35.8 | 6.5 | 25.7 | 5.5 | 40.1 | 7.2 |

Amortization | (2.4) | (0.4) | (2.8) | (0.6) | (2.8) | (0.5) |

Interest | (1.0) | (0.2) | (2.0) | (0.4) | (2.7) | (0.5) |

Income before taxes | 32.4 | 6.0 | 20.9 | 4.5 | 34.6 | 6.2 |

Income tax expense | (10.7) | (2.0) | (7.3) | (1.6) | (11.7) | (2.1) |

Net income | 21.7 | 4.0 | 13.6 | 2.9 | 22.9 | 4.1 |

Net income per share | | | | | | |

Basic (Cdn. $) | $ 1.19 | | $ 0.74 | | $ 1.27 | |

Diluted (Cdn. $) | $ 1.17 | | $ 0.72 | | $ 1.22 | |

Weighted average number of shares

outstanding (000’s) | | | | | | |

Basic | 18,255 | | 18,337 | | 18,099 | |

Diluted | 18,561 | | 18,807 | | 18,724 | |

(1) EBITDA represents net income before interest, taxes, depreciation and amortization. EBITDA is a supplemental non-GAAP financial measure used by management, as well as industry analysts, to evaluate operations. Management believes that EBITDA, as presented, represents a useful means of assessing the performance of the Company’s ongoing operating activities, as it reflects the Company’s earnings trends without showing the impact of certain charges. The Company is also presenting EBITDA, incremental flow through to EBITDA and EBITDA as a percentage of sales because it is used by management as a supplemental measure of profitability. The use of EBITDA by the Company has certain material limitations because it excludes the recurring expenditures of interest, income tax, and amortization expenses. Interest expense is a necessary component of the Company� 46;s expenses because the Company borrows money to finance its working capital and capital expenditures. Income tax expense is a necessary component of the Company’s expenses because the Company is required to pay cash income taxes. Amortization expense is a necessary component of the Company’s expenses because the Company uses property and equipment to generate sales. Management compensates for these limitations to the use of EBITDA by using EBITDA as only a supplementary measure of profitability. EBITDA is not used by management as an alternative to net income as an indicator of the Company’s operating performance, as an alternative to any other measure of performance in conformity with generally accepted accounting principles or as an alternative to cash flow from operating activities as a measure of liquidity. A reconciliation of EBITDA to Net income is provided within the table above. Not all companies calculate EBITDA in the same manner and EBITDA does not have a standardized meaning prescribed by Canadian GAAP. Accordingly, EBITDA, as the term is used herein, is unlikely to be comparable to EBITDA as reported by other entities.

2008 COMPARED TO 2007

Net income for the year ended December 31, 2008 was $21.7 million, up $8.1 million (60%) from the year ended December 31, 2007. Sales reached $547.4 million, up $81.2 million (17%) compared to the prior year. The increase in sales was attributable to increased tubular product prices, the acquisitions of JEN Supply and Full Tilt and increased oil sands and conventional oilfield market share and industry activity. Average rig count increased by 8% and well completions increased by 2% from prior year levels. Gross profit increased by $23.1 million (27%) over the prior year to a record $107.7 million, due to increased sales and gross profit margins. Increased supplier rebates associated with higher purchasing levels, and increased tubular margins were the principal reasons for the improvement in margins. Selling, general and administrative expenses increased by $13.5 mill ion (23%) in 2008 to $71.6 million due to the addition of operating expenses associated with the JEN Supply and Full Tilt acquisitions, increased variable compensation expense driven by the increase in earnings, and increased facility costs associated with the opening of the new Distribution Centre in the second quarter of 2008. Interest expense declined due to reduced average debt levels and floating interest rates in 2008. Income taxes increased by $3.4 million in 2008 due to higher pre-tax earnings offset slightly by a reduction in income tax rates. The weighted average number of shares outstanding during the year was down slightly compared to the prior year. Net income per share (basic) was $1.19 for the year, an increase of 61%, consistent with the increase in net income.

2007 COMPARED TO 2006

Net income for 2007 was $13.6 million, down $9.3 million (41%) from 2006 levels. Sales declined by 16% due to reduced oil and gas industry capital expenditures in 2007 and gross profit margins declined by 3% due to reduced supplier rebates, resulting in an $18.9 million (18%) decline in gross profit. Selling, general and administrative expenses declined by $5.2 million (8%) due to lower incentive compensation costs, reduced Sarbanes Oxley compliance costs, and lower selling costs resulting from the acquisition of two agent operated branches during the first half of 2007. Lower interest expense associated with reduced average debt levels in 2007 was offset by foreign exchange losses driven by the rapid appreciation in the Canadian dollar during 2007. Income taxes declined by $4.4 million in 2007 due to the reduced level of pre-tax earnings. Net income per share (basic) was $0.74 in 2007, down 42% due principally to the decline in net income combined with a 1% increase in the weighted average number of shares outstanding.

FOURTH QUARTER RESULTS

Net income for the fourth quarter of 2008 was a record at $8.8 million, up $6.4 million from the fourth quarter of 2007. Sales reached $161.2 million, an increase of $48.9 million (44%) from the fourth quarter of 2007. Capital project business comprised 60% of sales, and increased $34.6 million (55%) over the prior year period, driven by a 39% increase in well completions over the comparable period. Continued growth of oil sands revenues and increased tubular steel sales also contributed to increased capital project sales. Extremely tight tubular steel supply conditions during 2008 have resulted in product cost increases in excess of 50%, and contributed to the increase in sales. The acquisition of JEN Supply in the fourth quarter of 2007 contributed to the increase in MRO sales. Gross profit increased by $13.5 million (66%) over the prior year perio d due to the increase in sales and gross profit margins. Gross profit margins for the fourth quarter were 21.0% up from the prior year period at 18.2%. Selling, general and administrative expenses increased by $4.1 million to $19.4 million for the quarter due to increased variable compensation driven by the increase in earnings, increased facility costs with the opening of the new Edmonton Distribution Centre during the second quarter, and the addition of the JEN Supply operating costs. Lower interest expense was associated with reduced average debt levels and lower floating interest rates in the fourth quarter of 2008 as compared to the same period in 2007. Income taxes increased by $3.2 million in the fourth quarter compared to the prior year period due to higher pre-tax earnings offset slightly by a reduction in income tax rates. The weighted average number of shares outstanding during the fourth quarter was down slightly from the prior year period. Net income per share (basic) was $0.48 in the fourth quarter of 2008, an increase of 269% over the $0.13 earned in the fourth quarter of 2007, consistent with the increase in net earnings.

A more detailed discussion of the Company’s annual results from operations is provided below:

Sales

Sales for 2008 were $547.4 million, up $81.1 million (17%) from 2007 levels, due to increased tubular product prices, the acquisitions of JEN Supply and Full Tilt and increased oil sands and conventional oilfield market share and industry activity. In 2007, sales decreased to $466.3 million (16%) from 2006 levels, due to a decline in oil and gas industry capital expenditures.

| | | | | | |

(in millions of Cdn. $) | 2008 | 2007 | 2006 |

End use sales demand | $ | % | $ | % | $ | % |

Capital projects | 314.0 | 57 | 269.6 | 58 | 338.8 | 61 |

Maintenance, repair and operating supplies (MRO) | 233.4 | 43 | 196.7 | 42 | 216.4 | 39 |

Total sales | 547.4 | 100 | 466.3 | 100 | 555.2 | 100 |

Note: Capital project end use sales are defined by the Company as consisting of tubulars and 80% of pipe, flanges and fittings; and valves and accessories product sales respectively. MRO Sales are defined by the Company as consisting of pumps and production equipment, production services; general product and 20% of pipes, flanges and fittings; and valves and accessory product sales respectively.

The relative level of oil and gas commodity prices is a key driver of industry capital project activity as product prices directly impact the economic returns realized by oil and gas companies. The Company uses oil and gas well completions and average rig counts as industry activity measures to assess demand for oilfield equipment used in capital projects. Oil and gas well completions require the products sold by the Company to complete a well and bring production on stream and are a good general indicator of energy industry activity levels. Average drilling rig counts are also used by management to assess industry activity levels as the number of rigs in use ultimately drives well completion requirements.

The table below provides well completion, rig count and commodity price information for the last 3 years.

| | | | |

| As at December 31, 2008 | Average for the years ended December 31 |

| 2008 | 2007 | 2006 |

Gas - Cdn. $/gj (AECO spot) | $6.63 | $8.18 | $6.47 | $6.55 |

Oil - Cdn. $/bbl (Synthetic Crude) | $34.61 | $103.03 | $76.48 | $72.96 |

Average rig count | 313 | 398 | 367 | 498 |

Well completions: | | | | |

Oil | n/a | 6,223 | 5,443 | 5,609 |

Gas | n/a | 12,342 | 12,717 | 15,317 |

Total well completions | n/a | 18,565 | 18,160 | 20,926 |

Average statistics are shown except for well completions.

Sources: Oil and Gas prices – First Energy Capital Corp.; Rig count data – Hughes Christensen; Well completion data – Daily Oil Bulletin

Sales of capital project related products were $314.0 million in 2008, up $44.4 million (16%) from 2007. Increased capital project sales in 2008 reflected higher tubular sales due to significant product cost increases experienced during the year, and increased industry activity and market share. Total well completions increased 2% to 18,565 for 2008 while the average working rig count was up 8% to 398 rigs compared to 2007. Gas wells comprised 66% of the total wells completed in western Canada in 2008 compared to 70% in 2007 and 73% in 2006. Oil and gas capital expenditure activity began to recover in the second and third quarters of 2008 and continued through the fourth quarter resulting in part from emerging gas exploration plays in northeast British Columbia and oil pool development in southeast Saskatchewan combined with strong oil and gas prices earlier in the ye ar. Spot gas and oil prices ended the year at $6.63 per GJ (AECO spot) and $34.61 per bbl (Synthetic Crude), a decrease of 19% and 66%, respectively, from 2008 average prices. This, in combination with the volatility experienced across global capital markets, is expected to result in reduced industry cash flow, access to capital and capital expenditure economics, which in turn is expected to decrease demand for the Company’s products in 2009. Sales of capital project related products were $269.6 million in 2007, down $69.2 million (20%) from 2006 levels. Total well completions declined by 13% to 18,160 in 2007 and the average working rig count declined by 26% to 367 in 2007, contributing to lower demand for the Company’s capital project related products. Lower oil and gas capital expenditure activity in 2007 and early 2008 reflected the continuation of soft gas prices in 2007, compounded by increased industry capital and operating costs and uncertainty and lower returns resulting from t he Alberta government’s royalty study and subsequent decision announced in the fourth quarter of 2007 to increase royalty rates.

MRO product sales are related to overall oil and gas industry production levels and tend to be more stable than capital project sales. MRO product sales for 2008 increased by $36.7 million (19%) to $233.4 million compared to 2007 and comprised 43% of the Company’s total sales (2007 – 42%). The acquisition of JEN Supply in December 2007 and Full Tilt in July 2007 contributed incremental sales of $20.1 million in 2008. MRO product sales for 2007 were down $19.7 million (9%) from 2006 MRO product sales levels due to reduced industry activity levels.

The Company services over 3,000 customers of which the top ten customers comprised 42% of total sales in 2008 (2007 – 43%, 2006 - 38%). The Company’s largest customer comprised 10% of total sales in 2008 (2007 – 11%, 2006 - 11%). The increased concentration of sales in 2008 and 2007 was due to the Company’s focus on alliance customer programs coupled with lower capital program activity experienced by smaller oil and gas companies due to reduced access to capital markets resulting from increasingly challenging industry and capital market conditions. This trend is expected to continue in 2009.

The Company distributes approximately 25,000 stock keeping units sourced from over 2,000 suppliers. In 2008, the top 10 suppliers comprised 59% of total cost of goods sold (2007 – 43%, 2006 - 50%) of which two suppliers comprised 31% of total cost of goods sold (2007 – two suppliers comprised 28%, 2006 – two suppliers comprised 30%). Reduced supplier concentration in 2007 was principally due to the decline in capital project related product sales which tend to be more focused across fewer products than MRO product sales.

The Company’s strategy is to grow profitability by focusing on its core western Canadian oilfield equipment service business, complemented by an increase in the product life cycle services provided to its customers, and the focus on emerging oil sands capital project and MRO sales opportunities. Revenue results of these initiatives to date are provided below:

| | | | | | |

| 2008 | 2007 | 2006 |

Sales ($millions) | $ | % | $ | % | $ | % |

Oilfield | 491.3 | 90 | 431.4 | 93 | 529.2 | 96 |

Oil sands | 39.4 | 7 | 23.7 | 5 | 19.1 | 3 |

Production services | 16.7 | 3 | 11.2 | 2 | 6.9 | 1 |

Total sales | 547.4 | 100 | 466.3 | 100 | 555.2 | 100 |

Sales of oilfield products to conventional western Canada oil and gas end use applications were $491.3 million for 2008, up $59.9 million (14%) from 2007. This increase was comprised of incremental sales from the acquisition of JEN Supply, the increased sale of tubular products, and increased industry activity and market share. International oilfield sales, at $5.8 million in 2008, improved over prior year sales levels.

Sales to oil sands end use applications increased to $39.4 million up $15.7 million in 2008, a 66% increase compared to $23.7 million for 2007. The Company continues to position its sales focus, Distribution Centre and Fort McMurray branch to penetrate this emerging market for capital project and MRO products. Sales growth is expected to continue in 2009.

Production service sales were $16.7 million in 2008, up $5.5 million (49%) compared to $11.2 million in 2007. Full Tilt was acquired at the end of the second quarter of 2007, which provides oilfield engine maintenance and crane equipment services based in Lloydminster.

| | | |

Gross Profit | 2008 | 2007 | 2006 |

Gross profit (millions) | $107.7 | $84.6 | $103.5 |

Gross profit as a % of sales | 19.7% | 18.1% | 18.6% |

Gross profit composition by product sales category: | | | |

Tubulars | 13% | 8% | 8% |

Pipe, flanges and fittings | 31% | 32% | 35% |

Valves and accessories | 17% | 18% | 20% |

Pumps, production equipment and services | 15% | 17% | 13% |

General | 24% | 25% | 24% |

Total gross profit | 100% | 100% | 100% |

Gross profit reached a record $107.7 million in 2008, up $23.1 million (27%) from 2007, due to a 17% increase in sales and increased gross profit margins from 18.1% in 2007 to 19.7% in 2008. Gross profit margins improved in 2008 due to increased supplier rebates associated with higher purchasing levels and improved tubular margins reflecting tight product supply conditions. Gross profit was $84.6 million in 2007, down $18.9 million (18%) from 2006, due to a 16% decline in sales and a 3% decline in gross margin. Gross profit composition by product sales remained quite stable over the three year period with the exception of tubulars, where sales and gross profit increased due in part to the product cost inflation of steel and tight product supply conditions experienced in 2008.

Selling, General and Administrative (“SG&A”) Costs

| | | | | | |

| 2008 | 2007 | 2006 |

($millions) | $ | % | $ | % | $ | % |

People costs | 41.3 | 58 | 32.8 | 57 | 33.9 | 54 |

Selling costs | 10.2 | 14 | 7.8 | 13 | 13.4 | 21 |

Facility and office costs | 12.8 | 18 | 9.7 | 17 | 8.6 | 14 |

Other | 7.3 | 10 | 7.8 | 13 | 7.4 | 11 |

SG&A costs | 71.6 | 100 | 58.1 | 100 | 63.3 | 100 |

SG&A costs as % of sales | 13% | | 12% | | 11% | |

SG&A costs increased $13.5 million (23%) in 2008 from the prior year and represented 13% of sales compared to 12% in 2007. The increase in people costs of $8.5 million reflects increased variable compensation due to the increase in earnings and a 13% increase in the number of employees. Sales productivity reached $1.2 million per employee in 2008, up 9% from 2007 and down 8% from 2006 levels. Selling costs were up $2.4 million compared to the prior year due to increased sales commissions and accounts receivable bad debt allowances. Selling costs declined significantly in 2007 due to the acquisition of two agent operations in 2006 and early 2007 which reduced commission costs. Facility and office costs have increased in 2008 as the Company moved into a new, larger Distribution Centre in Edmonton in the second quarter. The addition of the JEN Supply facilities and c ontinued occupancy cost pressure in western Canada contributed the remaining increase in cost. The Company leases 34 of its 44 branch locations as well as its corporate office in Calgary and Distribution Centre. Five branch locations are owned and five are operated by agents. The Company mitigates the cyclical nature of industry activity levels by adjusting its variable and fixed (primarily salaries and benefits) SG&A costs as activity levels change.

Amortization Expense

Amortization expense was $2.4 million in 2008, down from $2.8 million in 2007 and 2006.

Interest Expense

Interest expense was $1.0 million in 2008, down $1.0 million from 2007 due to a 21% decline in average borrowing levels and a 42% decline in average floating interest rates. Interest expense decreased in 2007 by $0.6 million over 2006 due principally to lower borrowing levels and average floating interest rates.

Foreign Exchange Loss and Other

Foreign exchange losses were $0.2 million in 2008 (2007 - $0.8 million, 2006 – $0.1) despite significantly increased exchange rate volatility in 2008. Losses reflect the impact of the weakening Canadian dollar on United States dollar denominated product purchases and net working capital liabilities.

Income Tax Expense

The Company’s effective tax rate for 2008 was 33.0%, compared to 35.0% and 33.7% in 2007 and 2006, respectively, due principally to a reduction in statutory tax rates. Substantially all of the Company’s tax provision is currently payable.

Summary of Quarterly Financial Data

The selected quarterly financial data presented below is presented in Canadian dollars and in accordance with Canadian GAAP. This information is derived from the Company’s unaudited quarterly financial statements.

| | | | | | | | |

(in millions of Cdn. dollars except per share data) |

(Unaudited) | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| 2007 | 2007 | 2007 | 2007 | 2008 | 2008 | 2008 | 2008 |

Sales | $154.3 | $82.9 | $116.8 | $112.3 | $140.6 | $96.4 | $149.3 | $161.2 |

Gross profit | 26.3 | 16.8 | 21.0 | 20.4 | 27.1 | 19.0 | 27.8 | 33.9 |

Gross profit % | 17.0% | 20.3% | 18.0% | 18.2% | 19.3% | 19.7% | 18.6% | 21.0% |

EBITDA | 11.0 | 2.2 | 7.4 | 5.1 | 10.2 | 2.3 | 9.1 | 14.3 |

EBITDA as a % of sales | 7.1% | 2.7% | 6.4% | 4.5% | 7.2% | 2.4% | 6.1% | 8.9% |

Net income | 6.4 | 0.6 | 4.1 | 2.4 | 6.3 | 1.0 | 5.7 | 8.8 |

Net income as a % of sales | 4.1% | 0.7% | 3.6% | 2.1% | 4.5% | 1.0% | 3.8% | 5.5% |

Net income per share | | | | | | | | |

Basic | $ 0.35 | $ 0.03 | $ 0.22 | $ 0.13 | $ 0.34 | $ 0.05 | $ 0.31 | $ 0.48 |

Diluted | $ 0.34 | $ 0.03 | $ 0.22 | $ 0.13 | $ 0.34 | $ 0.05 | $ 0.31 | $ 0.47 |

Net working capital(1) | 124.0 | 127.0 | 128.7 | 134.7 | 117.4 | 114.9 | 123.1 | 142.8 |

Bank operating loan(1) | 33.6 | 36.0 | 35.4 | 44.3 | 21.8 | 18.4 | 20.9 | 34.9 |

Total well completions | 6,200 | 3,057 | 3,877 | 5,026 | 4,595 | 2,607 | 4,392 | 6,971 |

(1)Net working capital and bank operating loan amounts are as at quarter end. |

The Company’s sales levels are affected by weather conditions. As warm weather returns in the spring each year, the winter’s frost comes out of the ground rendering many secondary roads incapable of supporting the weight of heavy equipment until they have dried out. In addition, many exploration and production areas in northern Canada are accessible only in the winter months when the ground is frozen. As a result, the first and fourth quarters typically represent the busiest time for oil and gas industry activity and the highest sales activity for the Company. Sales levels drop dramatically during the second quarter until such time as the roads have dried and road bans have been lifted. This typically results in a significant reduction in earnings during the second quarter as the Company does not reduce its SG&A expenses during the second qua rter to offset the reduction in sales. Net working capital (defined as current assets less accounts payable and accrued liabilities, income taxes payable and other current liabilities) and bank operating loan borrowing levels follow similar seasonal patterns as sales.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s primary internal source of liquidity is cash flow from operating activities before net changes in non-cash working capital balances. Cash flow from operating activities and the Company’s 364-day bank operating facility are used to finance the Company’s net working capital, capital expenditures and acquisitions.

As at December 31, 2008, borrowings under the Company’s bank operating loan were $34.9 million, a decrease of $9.4 million from December 31, 2007. Borrowing levels have decreased due to the Company generating $25.8 million in cash flow from operating activities, before net changes in non-cash working capital balances. This was offset by an $8.3 million increase in net working capital, $5.2 million in capital and other expenditures, $0.9 million in repayments of long term debt and capital lease obligations and $2.0 million for the purchase of shares to resource stock compensation obligations.

As at December 31, 2007, borrowings under the Company’s bank operating loan were $44.3 million, an increase of $10.3 million from December 31, 2006. Borrowing levels increased as business acquisitions of $18.0 million and net investments of $2.0 million to maintain property and equipment were funded principally by bank borrowings and cash flow from operations of $9.8 million.

In 2006, the Company generated $27.8 million in cash from cash flow from operating activities, before net change in non-cash working capital balances, and $1.7 million in the issuance of capital stock from the exercise of employee stock options. This was offset by a $14.2 million increase in working capital, $2.6 million to purchase a two branch distribution operation, $3.1 million in capital and other expenditures, $0.2 million in repayments on capital leases and $0.3 million in purchase of shares held in trust. These activities resulted in a $9.1 million decrease in the bank operating loan.

Net working capital was $142.8 million at December 31, 2008, an increase of $8.1 million from December 31, 2007. Accounts receivable increased by $11.2 million (13%) to $100.5 million at December 31, 2008 from December 31, 2007, due to increased sales in the fourth quarter offset by a 18% improvement in days sales outstanding in accounts receivable (“DSO”) in the fourth quarter of 2008 to 51 days compared to 62 days in the fourth quarter of 2007. The improvement in DSO performance during the fourth quarter of 2008 was due in part to a more efficient invoicing process implemented in the first quarter of 2008 and a general improvement in collections performance. DSO is calculated using average sales per day for the quarter compared to the period end accounts receivable balance. Inventory increased by $33.0 million (38%) at December 31, 2008 from December 31, 2 007 in order to resource a similar increase in sales levels. Inventory turns for the fourth quarter of 2008 remained consistent at 4.2 times compared to 4.3 times in the fourth quarter of 2007. Inventory turns are calculated using cost of goods sold for the quarter on an annualized basis compared to the period end inventory balance. The company will adjust its investment in inventory to align with anticipated lower industry activity levels and compressed supplier lead times in 2009 in order to improve inventory turnover efficiency. Accounts payable and accrued liabilities increased by $38.4 million (86%) to $83.2 million at December 31, 2008 from December 31, 2007 due mainly to an increase in purchasing to resource higher sales levels.

Capital expenditures in 2008 were $5.6 million, an increase of $3.6 million and $2.5 million over 2007 and 2006 expenditures, respectively. Increased expenditures were directed towards the new Distribution Centre which increased capacity by approximately 75% over the previous facility and the purchase of a new Fort St. John branch location which will more than double the Company’s capacity in the growing north east British Columbia market.

No acquisitions were completed in 2008. In 2007, the acquisition of JEN Supply, Full Tilt, and two agent operations were completed at a combined cost of $18.0 million. In 2006, two agent operations were acquired at a cost of $3.1 million.

The Company has a 364 day bank operating loan facility in the amount of $60.0 million (2007 - $75 million) arranged with a syndicate of three banks that matures in July 2009. The loan facility bears interest based on floating interest rates and is secured by a general security agreement covering all assets of the Company. The maximum amount available under the facility is subject to a borrowing base formula applied to accounts receivable and inventories, and a covenant restricting the Company’s average debt to 2.25 times trailing twelve month EBITDA. As at December 31, 2008, the Company’s average debt to EBITDA ratio was 0.7 times (December 31, 2007 – 1.7 times) which provides a maximum borrowing ability of $60 million under the facility. As at December 31, 2008, the ratio of the Company’s debt to total capitalization (debt plus equity) was 20% (December 31, 2007 – 28%).

Contractual Obligations

The following table outlines the Company’s contractual obligations for debt, lease and related obligations having initial terms in excess of one year.

| | | | | |

Period Due (millions of Canadian dollars) | Bank operating loan | Long term debt and capital lease obligations | Operating lease commitments | U.S.$ forward purchase contracts | Total |

2009 | 34.9 | – | 7.3 | 2.0 | 44.2 |

2010 | – | – | 7.1 | – | 7.1 |

2011 | – | – | 6.2 | – | 6.2 |

2012 | – | 0.5 | 5.7 | – | 6.2 |

2013 | – | – | 5.2 | – | 5.2 |

thereafter | – | – | 29.9 | – | 29.9 |

| 34.9 | 0.5 | 61.4 | 2.0 | 98.8 |

Approximately 95% of operating lease obligations related to office, warehouse, and store facility leases (2007 - 93%). Automobile and warehouse equipment leases comprised the remaining lease obligations. Future operating lease commitments at December 31, 2008 were $61.4 million, an $8.0 million increase from 2007 commitments. Capital expenditures in 2009 are anticipated to be in the $4 million to $6 million range. Approximately half of 2009 expenditures will be directed towards expanding distribution network capacity and service capability. In management’s opinion, the Company’s existing working capital position combined with available borrowing capacity under its bank operating loan facility and ongoing cash flow from operations, are sufficient to resource its anticipated contractual commitments. The Company anticipates its 364 day bank operating loan to be exten ded in 2009 in the normal course.

The Company’s bank operating loan bears interest based on floating Canadian interest rates. As at December 31, 2008, the Company’s average borrowing cost was 3.2% (2007 - 6%). Based on the Company’s borrowings levels as at December 31, 2008, an increase or decrease of one percent in interest rates would be expected to decrease or increase the Company’s annual net income by $0.3 million.

The Company purchases certain products priced in U.S. dollars and sells such products to its customers typically priced in Canadian dollars. As a result, fluctuations in the value of the Canadian dollar relative to the U.S. dollar can result in foreign exchange gains and losses. As at December 31, 2008, the Company had entered into a contract to purchase in 2009, U.S. $2.0 million at a fixed exchange rate for the purpose of mitigating its foreign exchange exposure. The Company does not use financial instruments for speculative purposes.

CAPITAL STOCK

The weighted average number of shares outstanding during 2008 was 18.3 million, a decrease of 0.1 million shares from 2007 due principally to the purchase of common shares to resource restricted share unit obligations. The diluted weighted average number of shares outstanding was 18.6 million, a decrease of 0.2 million shares from 2007, due to a reduction in the dilutive impact of stock options and restricted share units resulting from the decrease in the Company’s stock price in 2008.

As at December 31, 2008 and 2007, the following shares and securities convertible into shares were outstanding:

| | |

| Dec. 31, 2008 | Dec. 31, 2007 |

(millions) | Shares | Shares |

Shares outstanding | 18.1 | 18.4 |

Stock options | 1.3 | 1.3 |

Restricted share units | 0.2 | 0.2 |

Shares outstanding and issuable | 19.6 | 19.9 |

The Company has established an independent trust to purchase common shares of the Company on the open market to resource restricted share unit obligations. In 2008, the trust acquired 300,095 common shares at an average cost per share of $6.86 (2007 – 40,200 common shares at an average cost per share of $8.08). As at December 31, 2008, the trust held 343,892 shares (2007 – 54,551 shares).

On January 6, 2009, the Company announced a normal course issuer bid to purchase for cancellation, up to 900,000 common shares representing approximately 5% of its outstanding common shares.

Critical Accounting Estimates

The preparation of the consolidated financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. The Company evaluates its estimates on an ongoing basis, based on historical experience and other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions and conditions.

The Company believes the following describes the significant judgments and estimates used in the preparation of its consolidated financial statements.

Allowance for Doubtful Accounts

The Company extends credit to customers and other parties in the normal course of business. Management regularly reviews outstanding accounts receivable and provides for estimated losses through an allowance for doubtful accounts. In evaluating the level of the established allowance, management makes judgments regarding a party’s ability to make required payments, economic events and other factors. As the financial condition of a party changes, circumstances develop or additional information becomes available, adjustments to the allowance for doubtful accounts may be required. As at December 31, 2008 and 2007, the allowance for doubtful accounts was $2.8 million and $1.5 million, respectively.

Inventory Reserves

The Company has made significant investments in inventory to service its customers. On a routine basis, the Company uses judgments in determining the level of write-downs required to record inventory at the lower of average cost or net realizable value. Management’s estimates are primarily influenced by technological innovations, market activity levels and the physical condition of products. Changes in these or other factors may result in a write-down in the carrying value of inventory. As at December 31, 2008 and December 31, 2007, the Company had recorded reserves for inventory obsolescence of $2.8 million and $1.8 million, respectively.

Goodwill

The Company has acquired certain operations which have resulted in the recording of $20.6 million of goodwill on the balance sheet as at December 31, 2008. In accordance with Canadian GAAP, the Company is required to perform an annual goodwill impairment evaluation. The Company evaluates goodwill impairment at the consolidated level as it operates through a single operating segment. The impairment evaluation involves comparing the estimated fair value of the Company’s business to its carrying amount to determine if a write down to fair value is required. Fair value is estimated using future cash flow projections, discounted to their present value and earnings and cash flow multiples for comparable public energy service and distribution companies. The required valuation methodology and underlying financial information that is used to determine fair value require significant j udgments to be made by management. These judgments include, but are not limited to, long term projections of future financial performance and the selection of appropriate discount rates used to determine the present value of future cash flow and may be impacted by changes in oil and gas industry conditions. See “Business Outlook” for discussion of industry conditions. Changes in such estimates or the application of alternative assumptions could produce significantly different results.

Future Tax Assets and Liabilities

Future tax assets and liabilities are recognized for differences between the book value and tax value of the net assets of the Company. In providing for future taxes, management considers current tax regulations, estimates of future taxable income and available tax planning strategies. If tax regulations, operating results or the ability to implement tax planning strategies vary, adjustments to the carrying value of future tax assets and liabilities may be required. See Note 10 to the consolidated financial statements for the significant components of the future income tax assets and liabilities, and a reconciliation of the Company’s income tax provision.

RISK FACTORS

In addition to the information set forth elsewhere in this MD&A, the following factors should be carefully considered when evaluating CE Franklin.

Fluctuations in the overall profitability of the oil and gas industry can affect the demand for CE Franklin’s products and services and, therefore, CE Franklin’s sales, cash flows and profitability. CE Franklin’s operations are materially dependent upon the level of activity in oil and gas exploration, development and production. Both short-term and long-term trends in oil and gas prices affect the level of such activity. Other factors that can impact the level of drilling, exploration and production and oil sands project activity and the overall profitability of the oil and gas industry include:

n

relatively minor changes in, or threats to, the worldwide supply of and demand for oil and natural gas;

n

the ability of the members of the Organization of Petroleum Exporting Countries (“OPEC”) to maintain price stability through voluntary production limits;

n

the level of production by non-OPEC countries;

n

North American demand for gas;

n

the movement of the Canadian dollar relative to its U.S. counterpart (crude oil and natural gas exports are generally traded in U.S. dollars);

n

general economic and political conditions in North America and worldwide; and

n

the presence or absence of drilling incentives such as Canadian provincial royalty holidays, availability of new leases and concessions and government regulations regarding, among other things, export controls, carbon taxes, regulatory emissions reduction targets and other environmental protection measures, changes in royalty rates, taxation, price controls and availability of product transportation and refining capacity.