Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

Serious Infections.

[LOGO]

Serious Business.

Statements made during this presentation that are not historical fact may be forward-looking statements that are subject to a variety of risks and uncertainties. There are a number of important factors that could cause actual results to differ materially from those projected or suggested in any forward-looking statements made by the Company. These and other factors are contained in the Company’s filings with the Securities and Exchange Commission.

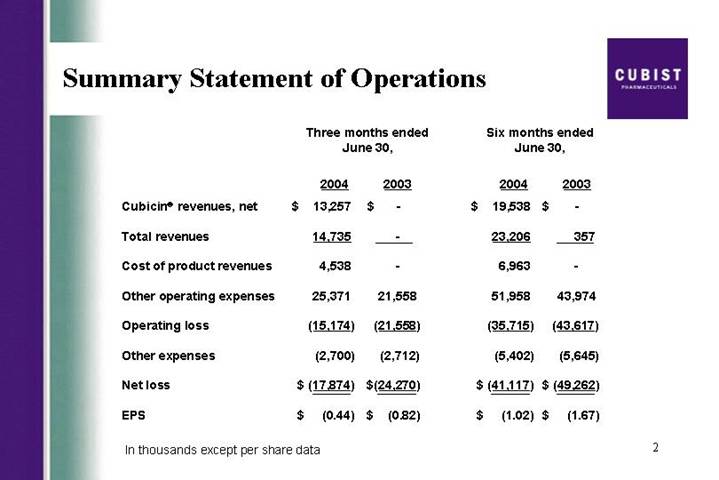

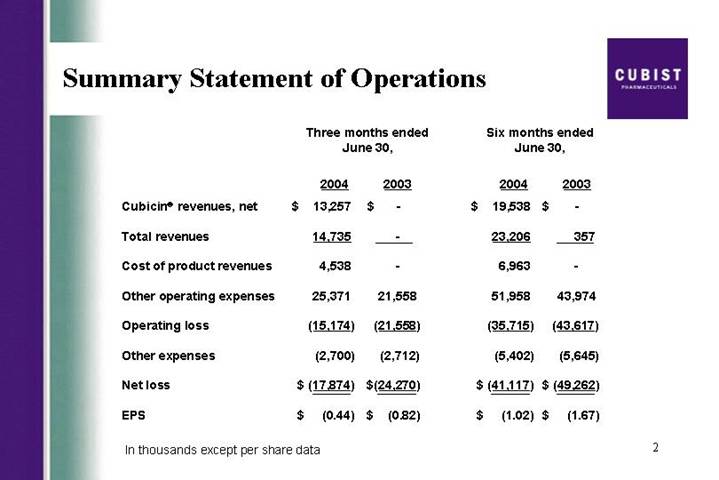

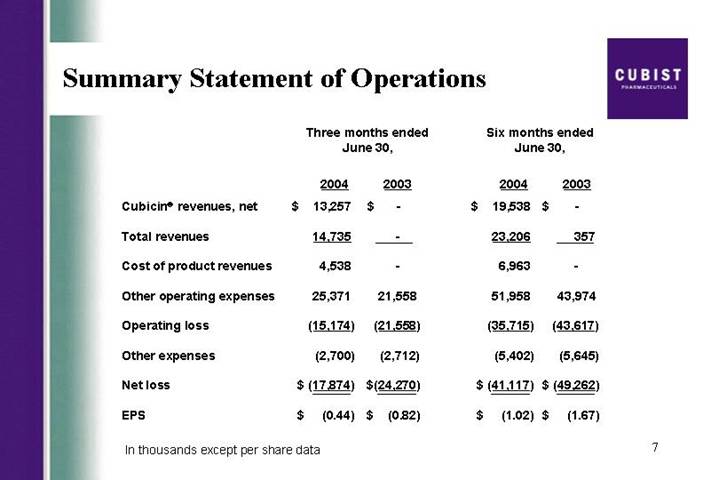

Summary Statement of Operations | | [LOGO] |

| | Three months ended

June 30, | | Six months ended

June 30, | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Cubicin® revenues, net | | $ | 13,257 | | $ | — | | $ | 19,538 | | $ | — | |

| | | | | | | | | |

Total revenues | | 14,735 | | — | | 23,206 | | 357 | |

| | | | | | | | | |

Cost of product revenues | | 4,538 | | — | | 6,963 | | — | |

| | | | | | | | | |

Other operating expenses | | 25,371 | | 21,558 | | 51,958 | | 43,974 | |

| | | | | | | | | |

Operating loss | | (15,174 | ) | (21,558 | ) | (35,715 | ) | (43,617 | ) |

| | | | | | | | | |

Other expenses | | (2,700 | ) | (2,712 | ) | (5,402 | ) | (5,645 | ) |

| | | | | | | | | |

Net loss | | $ | (17,874 | ) | $ | (24,270 | ) | $ | (41,117 | ) | $ | (49,262 | ) |

| | | | | | | | | |

EPS | | $ | (0.44 | ) | $ | (0.82 | ) | $ | (1.02 | ) | $ | (1.67 | ) |

In thousands except per share data

2

Vancomycin

Rising Clinical Failure Rates

JOURNAL OF CLINICAL MICROBIOLOGY, June 2004, p. 2398-2402 | Vol. 42, No. 6 |

0095-1137/04/$08.00+0 DOI: 10.1128/JCM.42.6.2398-2402.2004 | |

Copyrifht © 2004, American Society for Microbiology. All Rights Reserved. | |

Relationship of MIC and Bactericidal Activity to Efficacy of

Vancomycin for Treatment of Methicillin-Resistant

Staphylococcus aureus Bacteremia

George Sakoulas, (1)* Pamela A. Moise-Broder,(2) Jerome Schentag,(2) Alan Forrest,(2)

Robert C. Moellering, Jr.,(3) and George M. Eliopoulos(3)

Crystal Run Healthcare, Middletown,(1) School of Pharmacy, State University of New York at Buffalo, Buffalo,

and CPL Associates LLC, Amherst,(2) New York, and Beth Israel Deaconess Medical Center and

Harvard Medical School, Boston, Massachusetts(3)

3

JCM Article Summary

Relationship of MIC to Vancomycin Failure

30 MRSA Bacteremia Patients

| | MIC < 0.5 | | 1.0 < MIC < 2.0 | | P value | |

Clinical Success | | 55.6 | % | 9.5 | % | P=0.02 | |

| | n=9 | | n=21 | | | |

Overall Success Rate 23%

MIC = Minimum Inhibitory Concentration

Source: JCM, June 2004, Sakoulas, et. al.

4

Cubist at IDSA and ICAAC 2004

Infectious Disease Society of America

September 30 – October 3, 2004

Boston, MA | [LOGO] |

| |

Interscience Conference on

Antimicrobial Agents and Chemotherapy

October 30–November 2, 2004

Washington, DC | [LOGO] |

5

HepeX-BTM

Novel Monoclonal Antibody Product

• Licensed from XTL Biopharmaceuticals in June 2004

• Currently in international Phase 2b trial for prevention of re-infection by hepatitis B (HBV) in liver transplant patients

• Potential advantages over current standard of care

• Lower infusion volume/higher potency

• Non-serum derived

• Safety improvements possible

• $100 million worldwide opportunity and growing

• Highly concentrated global target market

• Synergistic with Cubicin U.S. marketing infrastructure/could enable international expansion of efforts

6

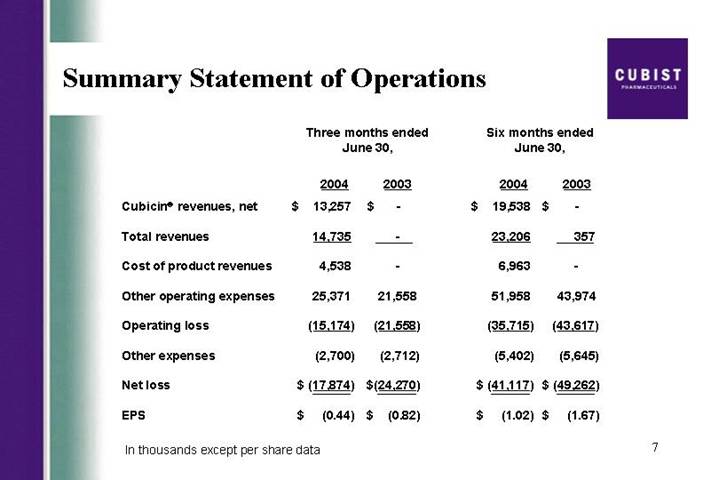

Summary Statement of Operations

| | Three months ended

June 30, | | Six months ended

June 30, | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Cubicin® revenues, net | | $ | 13,257 | | $ | — | | $ | 19,538 | | $ | — | |

| | | | | | | | | |

Total revenues | | 14,735 | | — | | 23,206 | | 357 | |

| | | | | | | | | |

Cost of product revenues | | 4,538 | | — | | 6,963 | | — | |

| | | | | | | | | |

Other operating expenses | | 25,371 | | 21,558 | | 51,958 | | 43,974 | |

| | | | | | | | | |

Operating loss | | (15,174 | ) | (21,558 | ) | (35,715 | ) | (43,617 | ) |

| | | | | | | | | |

Other expenses | | (2,700 | ) | (2,712 | ) | (5,402 | ) | (5,645 | ) |

| | | | | | | | | |

Net loss | | $ | (17,874 | ) | $ | (24,270 | ) | $ | (41,117 | ) | $ | (49,262 | ) |

| | | | | | | | | |

EPS | | $ | (0.44 | ) | $ | (0.82 | ) | $ | (1.02 | ) | $ | (1.67 | ) |

In thousands except per share data

7

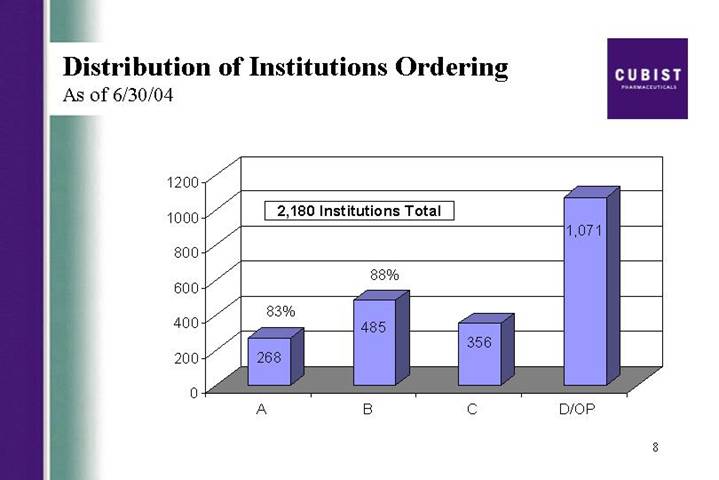

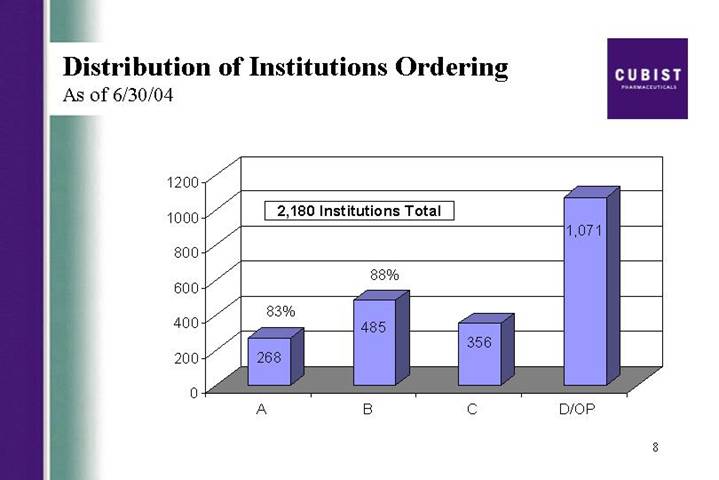

Distribution of Institutions Ordering

As of 6/30/04

[CHART]

8

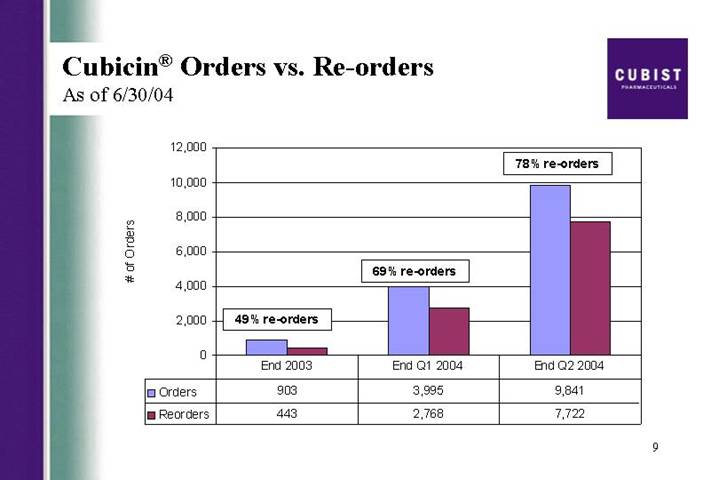

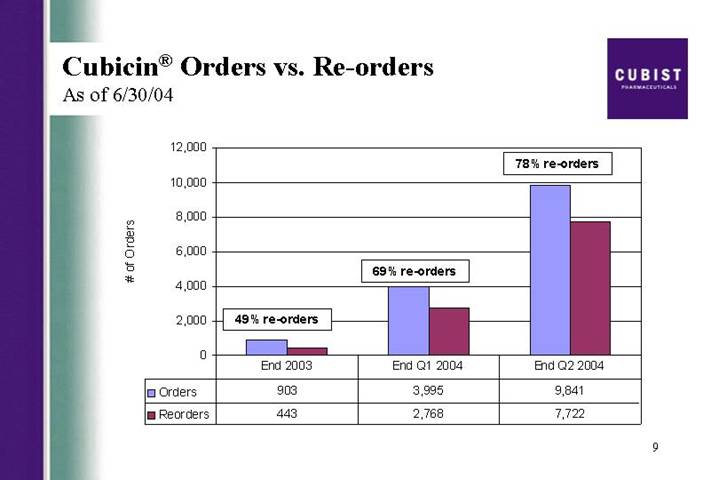

Cubicin® Orders vs. Re-orders

As of 6/30/04

[CHART]

9

Cubicin® Formulary Trends

A & B Institutions as of 6/30/04

| | A | | B | | Overall | |

Restricted Acceptances | | 151 | | 199 | | 350 | |

Unrestricted Acceptances | | 15 | | 27 | | 42 | |

Rejections * | | 6 | | 8 | | 14 | |

Total in Type | | 325 | | 550 | | 875 | |

% Acceptance | | 97 | % | 97 | % | 97 | % |

% Unrestricted | | 9 | % | 12 | % | 11 | % |

% Having Met | | 53 | % | 43 | % | 46 | % |

* All have ordered Cubicin®; As reported by Cubist sales force

10

Cubicin® New vs. Repeat Accounts

New vs. Repeat Accounts (5 day rolling average)

[CHART]

11

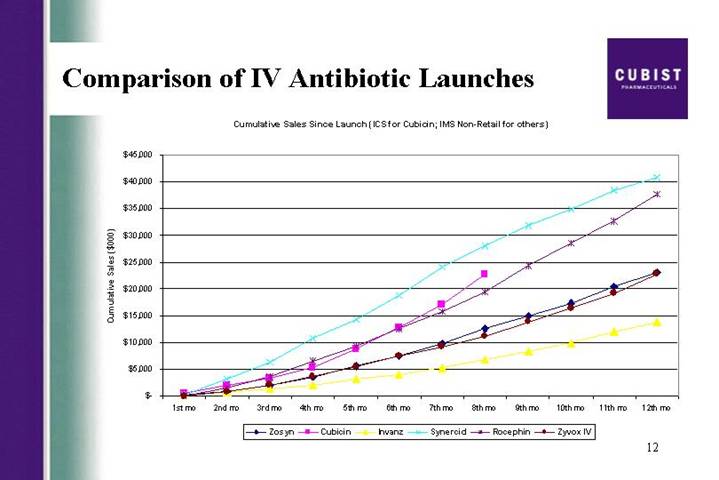

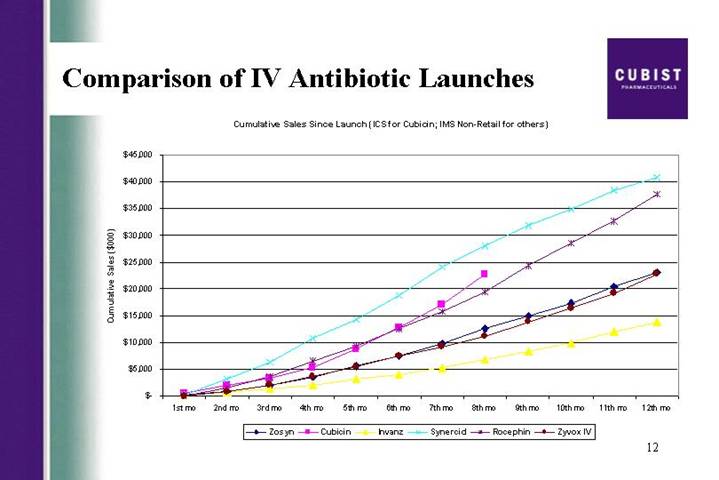

Comparison of IV Antibiotic Launches

Cumulative Sales Since Launch (ICS for Cubicin; IMS Non-Retail for others)

[CHART]

12

Cubist Pharmaceuticals | | CBST | | Q2 2004 Earnings Call | | Aug. 5, 2004 |

Company5 | | Ticker5 | | Event Type5 | | Date5 |

MANAGEMENT DISCUSSION SECTION

Operator: Good morning ladies and gentleman and welcome to your Cubist Pharmaceuticals Second Quarter Conference call (tech difficulty) and all participants have been placed on a listen-only mode and the floor will be opened for questions following today’s presentation. If you would like to queue up to ask a question at any time, you may do so by pressing star one on your touchtone phone. At this time, I would like turn the floor over to your host Michael Bonney, President and CEO of Cubist. Sir, the floor is yours.

Michael Bonney, President and Chief Executive Officer

Thank you Ashley. Good morning and thank you for joining us today to discuss our existing results for the second quarter of 2004. Joining me today are David McGirr, our CFO and Chris Guiffre, our General Counsel. Before, we begin I will read a short Safe Harbor Statement.

Forward-looking statements may be made during this call. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those projected or suggested here. Such risks and uncertainties are detailed in the company’s periodic filings with the Securities and Exchange Commission. We’d also like to add that due to significant interest in the launch of CUBICIN, we will again be discussing early trends on this call, but disclaim any duty to provide updates on the specific data points mentioned here today.

In addition, based on positive feedback on the data and slides we provided on our last call, we decided to continue the practice on this call. These slides are available via the front page of our website www.cubist.com.

First slide please.

As you can see from the press release this morning, we recorded strong revenues of $14.7 million for the second quarter of 2004, based on the CUBICIN sales that were roughly 25% higher the consensus estimates and more than doubled the first quarter. As a result, we are raising our 2004 revenue guidance on CUBICIN from the previous range of $40 million to $50 million to a range of $45 million to $55 million. While David will go through the actual numbers later in this call, I did want to provide some further color on CUBICIN launch trends, briefly discuss our product pipeline, and along the way address some frequently asked questions.

Most importantly, lets start with CUBICIN, with net sales of $13.3 million in the second quarter and almost $20 million in the first half of this year, we continue to take great pride in the launch of this drug. The infectious disease community, while conservative by nature, appears to be increasingly embracing CUBICIN for Staph infections. We believe these very strong revenues are due to a handful of factors; first, the high reorder rates we have seen and the increasing frequency in size of these orders, reflect physician acceptance of the product and positive outcomes achieved for their patients. Second, we continue to receive positive feedback from physicians on how quickly CUBICIN is working. We believe this is a result of CUBICIN’s rapidly bactericidal activity. Third, CUBICIN’s ease of use as a result of its safety profile, its one daily dosing, and 30 minute infusion time appears to be driving high usage rates particularly in the home and outpatient care settings. And fourth, as you will see on the next slide, physicians are becoming more and more dissatisfied with the performance of vancomycin, particularly in treating MRSA or resistance Staph infections. In fact, during the quarter, there were two important manuscripts published in top infectious disease journals, Clinical Infectious Diseases and The Journal of Clinical Microbiology. Lets focus on vancomycin’s rising clinical failure rate.

The JCM article from investigators here at Beth Israel in Boston and at SUNY Buffalo in New York, discusses an alarming trend that we wanted to share with you today. On the next slide, you will

1

see the detailed results of the study, let me explain. As many of you know, when a patient presents with a serious infection, a sample is taken and lab tests are done on that sample to determine what types of bacteria are present and also to which drugs the bacterial are susceptible or resistant.

Standards are set by centralized body called the MCCLS that provide cut-off values called breakpoints that define levels of resistance. The breakpoint for vancomycin is two. In the JCM article, the investigators examined outcomes data from 30 patients treated with vancomycin for bacteremia caused by MRSA and also looked at how the accompanying lab test correlated to the outcome achieved. While, all of the MRSA strains tested susceptible to vancomycin in the lab, overall clinical efficacy was only 23 percent. When broken down into breakpoint sub groups, patients with the more susceptible strains, that is MIC is less than or equal to 0.5, which represented about one-third of the patients in the study had clinical success rates of 55.6 percent. While those tested between one and two still susceptible by the standards and about two-thirds of the patients studied had a success rate of only 9.5 percent. That’s over a 90% failure rate in two-thirds of the patients, whose bacterial strain tested susceptible for vancomycin. All of these data were statistically significant.

While we want to make it clear that CUBICIN is not indicated for bacteremia, we do intend to seek a claim for the indication should the ongoing Phase 3 CUBICIN study in endocarditis and bacteremia conclude favorably. Well, what do we think these data mean? Basically we believe they support the growing body of evidence indicating that the pool of patients for whom vancomycin is an effective treatment option, is much smaller than previously thought. This further supports our market research, which indicates that physicians are indeed looking for new choices to treat Staph infections.

So to summarize, we believe that four factors; positive outcomes, speed of cure, ease of use, and the increasing recognition that vancomycin is not the drug it once was are helping CUBICIN achieve a very strong launch. Although, we are promoting CUBICIN for its approved use of complicated skin and skin structure infections, recently completed market research indicates that about half of the use of CUBICIN is on label. In addition, in 21% of the 300 cases tracked in this market research, CUBICIN was used as first line therapy. That’s higher than we anticipated at this point in the launch, gives us confidence in our raised revenue guidance, and we hope, finally puts to rest the skeptics argument that CUBICN will only be used as a drug of last resort.

Throughout the rest of the year, we expect a significant amount of new CUBICIN data to be published. In addition, to several manuscripts, we are aware that physicians have submitted and have been notified of posture acceptances to both the IDSA and ICAAC meetings in the fall.

Next slide. Posters and presentations on CUBICIN, including a number from a range of treatment settings beyond those undertaken in our development program. We also expect data from our CORE registry to become available late this year or early next year.

As you saw from our press release yesterday, we have continued to make progress in our Phase 3 trail in endocarditis and bacteremia. We announced that an independent safety monitoring committee had met for the third time to review blinded safety data from the trial, this time reviewing well over 100 treated patients and that they have reiterated their recommendation to continue the study, we again view this finding as positive. In addition, we wanted to provide additional detail on the endocarditis bacteremia trial itself. Over the course of the enrollment in this trial, we’ve had many conversations with the FDA. These interactions have indicated to us that the FDA views this trial as significant as it is the first Phase 3 clinical study to be conducted in this indication in about 20 years and because it focuses on a serious disease associated with the high and rising mortality rate.

The population of patients with endocarditis and bacteremia is quite heterogeneous and includes patients with both right and left-sided endocarditis. This is fully appreciated by the FDA which after reviewing the Data Monitoring Committee Report asked us to amend the protocol and begin

2

enrolling the to treat left-sided patients which we have started to do. We view this as a positive, as it could result in a broad endocarditis and bacteremia label.

We are also announcing, for the first time today, that as of yesterday we had completed targeted enrollment of the right-sided and bacteremia patients in the study. The enrollment of a modest number of left-sided patients is now the rate-limiting step for the completing of the study. We continue to believe and likely that we will see data from the study in the first half of 2005. However, this amendment may cause us to slip into the third quarter. We believe the potential upside for the product outweighs any possible delay in reviewing the results. We will continue to provide updates on our subsequent quarterly calls. One last upcoming milestone to mention on CUBICIN, comes as a result of the announcement by Chiron during the quarter. As expected, Chiron provided clarity on their regulatory plans for CUBICIN announcing that they plan to file the MAA on CUBICIN in Europe by the end of this year and anticipate approval and launch in early 2006.

A quick note on manufacturing. As most of you know, we had a corporate goal to secure a second bulk product manufacturer for CUBICIN by mid year. While we have made good progress here, we are about two months behind where we thought we would be. In addition, we are close to signing a contract with a second full-finished provider. Validation runs at that side should begin shortly. A key goal for us is to have these two sites up and approved by early 2005 in order to be prepared for demand in excess of current consensus.

Now on to the pipeline. Next slide. On our last conference call, we discussed in depth, our criteria for strengthening our pipeline. Today, we are very pleased to discuss the exciting addition to our development pipeline that matches up extremely well with these criteria. As we announced in early June, we completed a license agreement for the worldwide development and commercialization of an antibody product currently know as HepeX-B from the Israeli Company, XTL Biopharmaceuticals. HepeX-B is currently in a Phase 2b study for the prevention of reinfection of the Hepatitis B Virus or HBV for short in liver transplant patients. Our market currently estimated to be about $100 million worldwide. We currently expect the Phase 2b study to complete by mid 2005, at which if successful, we will request a pre-Phase 3 meeting with the FDA to clarify the development plan going forward. This deal typifies our strategy to build a near-term pipeline beyond CUBICIN. We intend to continue our efforts to look for additional products and product candidates both late and early stage, that we believe, could increase shareholder value.

While we have committed to this program of in-licensing, we also remain committed to our internal discovery capabilities, keeping in mind the financial demands of the CUBICIN launch and pipeline building activities. As such, over the past 18 months, we have done a comprehensive analysis of our research efforts, and as a result have consolidated our discovery programs with the goal of achieving efficiencies and focusing on only those programs most likely to generate IND candidates that can be taken into the development in the foreseeable future. We would be happy to answer questions on these programs during the Q&A session. I will now turn the call over to David to run through the numbers, then I will return with some concluding comments. David?

David McGirr, Chief Financial Officer, Sr. Vice President

Thanks Mike. Lets start with our CUBICIN sales. As you saw from the press release—next slide please, we generated $13.3 million in net CUBICIN sales in the second quarter of 2004, which is up from $1.7 million in net sales during the fourth quarter of 2003 and up from $6.3 million in the first quarter of this year. That is an increased of 111% second quarter over first quarter. Now, that is topline growth. As Mike mentioned earlier, based on the results from the first two quarters of 2004, we are raising our full year sales guidance to the range of $45 million to $55 million

We did want to point out today that historically, sales of hospital pharmaceutical softened during the several months, as hospital census numbers dropped off slightly. Although, we don’t yet know if there will be a seasonal pattern to the sales of CUBICIN as the summer is not yet over, we are

3

comfortable raising our annual guidance now. Over the next few slides, you will find updates to the launch trend data that we provided in the past and that many of you have told us have been helpful to your analyses.

Next Slide. This slide looks at the institutions ordering CUBICIN. Around 2,200 institutions had ordered CUBICIN as of the end of June. The chart shows the demand broken down by our A, B, C, and D institutions. Outpatient centers included here in the D group, now represents about one-third of sales, up slightly from previous quarter. As a reminder our sales team calls on A and B institutions only.

This next slide illustrates our reorder rates broken down quarterly. You can see that 78% of all institutions had reordered the drug at least once by the end of the second quarter, and that this figure has continued to grow steadily since the launch and is up from 69% at the end of Q1.

The next slide looks at formulary metrics. By the end of June, 97% of our A and B accounts, that had met and made a decision, had added CUBICIN to their formulary. These are the institutions called on by our sales team. A 11% of the A and B formularies have added CUBICIN without restriction to its use. This continues to be slightly higher than our initial expectation. Of all our targeted A and B accounts, 46% had met and made a decision as of the end of June, this is up from 40% at the end of May and represents over a 50 additional institutions. We are now on formulary at over 50% of the A accounts.

The final slide in this section shows trends in ordering. Earlier trends have carried though from pervious periods, and we continue to add nearly 75 new accounts per week through the end of June. There is some softening to the number of new institutions ordering as you would expect, given that we have continued to increase the breadth of coverage and therefore reduced the number of remaining institutions available for an initial sale.

Looking at the upper line, which is the number of distinct re-orders, as of the end of June, we were averaging almost 100 institutional orders per day, this is up from 55 institutional orders per day at the end of March. As you can see from the figures in the press release, we continue to direct our expenses towards the items that are supporting the successful launch of CUBICIN: cost of goods sold and sales and marketing. As expected, our gross margin continued to improve, but costs of goods sold down from 38% of net sales in the March quarter to 34% in the June quarter.

We continue to expect total operating expenses, excluding cost of good sold, to be around $120 million for the full year. As these expenses were 52 million in the first half of 2004, clearly we see an increase in the second half to about 68 million. The projected breakdown of the $120 million for the full year is 38 million for sales and marketing, 19 million for G&A, and 63 million for R&D. There are two important points to understand from these figures. First, sales and marketing and G&A expenses are about 5% lower than our previous guidance for the full year. And this funds, the 5% increase in R&D expense, which now includes the addition of HepeX-B to the pipeline. Second, we do not expected our march to profitability will necessarily be a straight line on a quarterly basis, as we continue to balance our investment in CUBICIN and in the pipeline. However, we expect the overall direction should remain positive when looked out on an annual basis.

Now to a brief discussion of cash usage. In the first six months of 2004, we used $56 million of cash. In the second half of 2004, we are projecting our total cash usage to be in the range $55 million to $60 million. As we ended the second quarter with 86 million in cash and equivalents, this would indicate that without returning to the capital markets, we would end 2004 with roughly 26 million to 31 million in cash. We continue to take an opportunistic approach for rising new funds and would likely return to the capital markets, when conditions are favorable for us to do so. With that I will turn it back to Mike to conclude and then we will open up for questions. Mike?

4

Michael Bonney, President, Chief Executive Officer, Director

Thanks David. With almost $20 million in CUBICIN net sales for 2004 thus far, we believe CUBICIN is on track to have one of the most successful IV antibiotic launches in the US history. As you can see from the next slide, the first eight months of CUBICIN sales compare very well with other IV antibiotics marketed and have now surpass those of Rocephin at eight months post launch. As a reminder, we are well aware that these are not strict to apples-to-apples comparisons, but we still believe this slide provides good context for understanding the success of the CUBICIN launch like to conclude today by recapping all the progress we have made so far this year. We’ve been able to effect the successful CUBICIN launch with an estimated 23,000 patients treated through the end of June; we are continuing to expand the amount of clinical data surrounding CUBICIN and have made significant progress in enrolling the endocarditis bacteremia trail; we launched CORE the first registry of its kind, that will track outcomes data from patients treated with CUBICIN; we work closely with Chiron to help them solidify their development strategy for Cubicin in Europe; we made some difficult decisions to discontinue two pipeline projects, but have been able to replace them with the late stage program that leverages our expertise across many levels of the organization, and that we believe will create shareholder value; and, we are working to complete the consolidation of our research efforts at our headquarters, in an attempt to improve the flow of IND candidates from our programs.

Over the next six to twelve months, we look forward to continue quarterly reports on CUBICIN sales; additional clinical publications on CUBICIN; the European filing for regulatory approval of CUBICIN in that territory; approval of our second API and drug product facilities; completion of the endocarditis bacteremia study; updates on our new product pipeline; continued business development activities; and improving our financial position of the company, driven by continued execution on the CUBICIN introduction and financial discipline applied to our cost base. With that, why don’t we open it up to questions. Ashley?

5

QUESTION AND ANSWER SECTION

Operator: Thank you. The floor is now open for questions. If you have a question, please press star then one on your touchtone phone, at this time. If at any point your question has been answered, you may remove yourself from the queue by pressing the # key. We do ask that while you pose your question, then you pickup your handset to provide optimum sound quality. Once again, to ask a question please press star then one on your touchtone at this time. Our first question is coming from Joel Sendek of Lazard. Please go ahead.

<Q – Joel Sendek>: Thanks a lot. I wanted to ask about the guidance. I know you’ve mentioned a little softness in the summer time. But, you know, if the current run rate with the good number you had in second quarter here – the low-end of the guidance, I guess, it’s just a sequential reduction in top line size in sales. I was wondering if you could just talk about that, is that, you know, just leaving the room for upside, for yourself as far as your reported numbers versus guidance or is there something you are seeing in the sales trends, that we didn’t see on the slide?

<A>: Thank you Joel. I wouldn’t read anything into the guidance along those lines at all. What we are trying to do is, give you a range that we are comfortable based on what we have seen to date. And, as we said in the comments, we are only half way through the summer, so it would be wrong to interrupt the whole summer. So, we think these are good numbers, good guidance numbers and you should be comfortable with them.

<Q – Joel Sendek>: Okay. And, then a question to Mike, on the paper that you’ve mentioned at the beginning, can you explain or do you know, review on why there wasn’t inconsistency between the clinical success and the laboratory susceptibility testing?

<A – Michael Bonney>: Well, I think that what the authors generally concluded is that – and actually, the other paper that was published, I believe it was done over the same cohort is that there appears to be a genetic marker for these strains that have the higher susceptibility that somehow comprises vancomycin ability to effectively treat patients with the strains of MRSA with a breakpoint of MIC 90 rather one to two. One of the important elements of this study that I referenced Joel is that, the patients were all very carefully monitored and the cross levels, which is an important element for effectively using vancomycin, were all spot on to where they needed to be.

<Q – Joel Sendek>: Okay. That’s all, well thanks a lot.

Operator: Thank you. Our next question is coming from Matt Duffy of Black Diamond Research. Please go ahead.

<Q – Matt Duffy>: Good morning. Thanks and congratulations on the quarter. Couple of different things I want to touch based on, would you comment a little bit on the indications of off-label use that you are seeing in the cardiovascular osteomyelitis and how that might breakdown?

<A>: We do have reports from the market research that CUBICIN is being used in endocarditis bacteremia and osteomyelitis. It is our sense that it is – in those indication it is often used in the circumstance where a physician has tried another therapy first and is not getting the either speed or quality of response that they are looking for, in which case they will switch. We are not in a position at this point, to have given the data that we have Matt, to quantify by indication, how they use this.

<Q – Matt Duffy>: Okay. And then, are you still seeing higher average doses when it’s used for those types of indications?

<A>: Yes, there is. They are using higher doses in some of those cases.

<Q – Matt Duffy>: Okay. Do you think there is chance, given the fact that you’ve finished the left-sided enrollment in the bacteremia endocarditis trial. We might see either interim or subgroup

6

analysis before the final report and perhaps a report on the bacteremia and left-sided, before right sided, is that a possibility under the protocol?

<A>: Actually Matt, let me just switch around here. What we have completed is enrollment of the right-sided and bacteremia patients, and what we need to do is enroll a handful of left-sided patients. Given that is our intent ultimately to seek a label for the treatment of endocarditis and bacteremia, assuming the results are positive, it’s unlikely that we’ll see sub group analysis before we complete the study because that, of course, then creates a question about introducing bias as the study is being completed.

<Q – Matt Duffy>: Okay.

<A>: And, what we now have to do based on these recent amendments of the protocol is enroll the handful of left-sided patients. Given that, it is our intent to ultimately to seek a label for the treatment of endocarditis and bacteremia assuming, the results are positive. It is unlikely that we will see subgroup analysis, before we have completed the study, because that of course, then creates a question about introducing bias as the study is being completed.

<Q – Matt Duffy>: Okay. Thanks very much.

<A>: Okay.

Operator: Thank you. Our next question is coming from Steven Harr of Morgan Stanley. Please go ahead.

<Q – Steven Harr>: Great. Thank you. I had a couple of quick questions. First of all, on last quarter there was a discussion of 5 million in restructuring charges to come, is that still part of your plan as you went down some of your, I guess, research expenses? Second of all, I know last time you guys had discussed the ability to kick the profitability with your current cash on hand, is that now something that you are backing away from, as you see other opportunities to invest in the CUBICIN business or in the pipeline? And then finally, if you could just get us quick comment on where inventory level stand?

<A>: Steve, the 5 million that we talked about for restructuring, is in the numbers, the 120 million that I mentioned, it was before and still is. So that’s, a component of that number.

<Q – Steven Harr>: And, how you are going to break that out in pro forma and GAAP, are you just including that as a cost of ongoing business?

<A>: Well, some of it is obviously in CapEx and some of it is in expense. But, I don’t think, it’s broken out specifically, it will just be in the numbers you see.

<Q – Steven Harr>: Okay, great.

<A>: Cash in terms of the breakeven. I think, what we all said, was that we saw our way through to breakeven with our existing cash resources subject to what we did on pipeline building, and what we did on building the CUBICIN franchise and clearly the main goal for the company, is to take the great momentum we’ve got going in the CUBICIN launch and turn that into a growing and sustainable company. So, we will do that first, rather than trying to shoe horn ourselves into a tight cash position. So, we continue to watch it very closely, but we felt that bringing the HepX-B opportunity onboard then was better than sticking to a tight cash constraint. Our inventory levels, I think you can see from the press release are up slightly. From the period end, we have gone up from 3.8 million at the end of December to 6.6 million at the end of June. You would expect, that as we build the sales, we have got to have the inventory behind us to support the sales.

7

<A>: The other element of inventory of course, Steve and I am not sure if this is part of your question, is that we continue to execute on the drop ship model. So, that is the inventory that exists outside of our warehouse if you will, is stocked on the shelves in the hospital with the infusion centers etc.

<Q – Steven Harr>: Okay. Thank you very much, I appreciate it.

Operator: Thank you. Our next question is coming from Jason Kantor of WR Hambrecht. Please go ahead.

<Q – Jason Kantor>: Thanks. I have a couple of questions. First, congratulations on a good quarter. Second, could you give us an update on what’s the average order – original order and reorder sizes are that you are seeing, I mean how those trends are going? And, if you can give us some sort of update on, how the drug is being used in that outpatient setting?

<A>: Well, the reorder as opposed to initial orders continue, as we have discussed previously. The reorder size is significantly larger than the initial order sizes. And, we are seeing a bit of increase in frequency of those orders of course as well. In terms of outpatient views, we haven’t done a lot more market research in that environment, since the last quarter. But, what I would tell you, is basically what we heard is, that; A) The outpatient use has been driven by the same physicians that we target in our A and B accounts. So, it’s simply another distribution channel, if you will to fulfill the CUBICIN prescription. B) It seems to be driven by the very easy use given the once daily infusion that’s only half hour long versus an hour for many antibiotics and so forth. And the fact that doctors don’t have to worry about side effects at this point, they don’t get the calls, you know, after the patients start the therapy in the outpatient world. It does appear that there is some use within the skin and skin structure indication and other use in the outpatient is, in other indication. There is a breakdown of patients probably roughly 1/3rd of the patients are initiated as outpatients. And probably, the 2/3rd that are stepdown from the hospital, is a portion of those, who are on CUBICIN in the hospital and a portion of those, who are on other antibiotics in the hospital. But, because of the ease of use, they are converted to CUBICIN when they were discharged and finished their course.

<Q – Jason Kantor>: And, one other question. You know, I was happy to see some of the expenses coming in control this quarter. But, I am just wondering, you know, how do you guys project an increase in R&D spending when you say that you consolidated some of that, was presumably that – I infer from that that is in place sort of the cost savings, you’ve stopped some programs. I thought, the discontinuation of the program was meant to pay for the HepX-B. Is this HepX-B program more expensive than you thought and is it worth it given the market size?

<A>: I think there is a couple of things embedded in your question base. The first thing you have to understand is that, the vast majority of our R&D expense is in track, expense in support of the CUBICIN launch. Not only the endocarditis/bacteremia study, but also our support of investigator initiated studies is embedded as an R&D expense, as our efforts to bring up the second full finish in second API side, those manufacturing development cost are all part of our R&D as well. And, in fact we have not changed our guidance for the year on what our total expenses would be, there’s only been a minor shift from SG&A expenses into R&D. And so we are – actually executing consistent with what we said, which is we believe, the subsequent of the discontinuation of the two programs earlier in the year that would – in the guidance we had provided at that point, we have the financial capacity to rebuild the pipeline and HepX-B is just the first step in that.

<Q – Jason Kantor>: Right. So, you are not actually shifting some expense, you are saving money in one place and spending more, not I guess, I would like to see, you spend less just straight across the board but….

<A>: Well, you know, Jason we would like to spend less as well, as I have said, we are committed to building a strong pipeline here and to insure that, you know, the first priority is that CUBICIN can

8

achieve kind of peak year sales that we think are possible. One is the benefits of a single indication approval is time, we were able to get the drugs to the market fairly quickly. One of the cost associated with the single indication approval is that you have additional development work to do once you get into the market and that’s what you are seeing as a bulk of our R&D spend at this point. Our discovery spend is actually down in a meaningful way from 2003 and we continue to keep a tight reign on our core discovery spends, it is intentionally less than 10 million of the 63 million that we have articulated for the total year in R&D.

Operator: Thank you. Our next question is coming from Eun Yang of Wells Fargo. Please go ahead.

<Q – Eun Yang>: Thanks. I have a several questions. Number one, at the end of March, you know, you guys had mentioned that there were about 7,000 to 8,000 patients on CUBICIN, I would like to know how many patients are – how they have been treated with the CUBICIN at the end of June? And also, you mentioned there were about 20% about 300 cases and market research was done, was it actually, you know, in that growth, CUBICIN was used as a first line. Can you tell us what indications were they in the first line use? And secondly, regarding endocarditis trials, I don’t know, If you can give how many patients have been enrolled so far? And in that regard, I am wondering how many left-sided patient does the FDA want you to enroll in your trial? And lastly, in the number of patients, how many left-sided number of patients have been enrolled so far? Thank you.

<A>: Okay, Eun. A bunch of questions there. So, through the end of June, we estimate that 23,000, patients have been treated with CUBICIN. In the market research, they consisted of the review of 300 cases from a variety of hospitals, about 21% of the cases were used as first line. Most of the first line used is in the skin and skin structure indication, most of the used outside the skin and skin structure is used subsequent to a use of another antibiotic, where the physician, apparently is not pleased with the response that they are getting. In terms of endo, what we have said historically, is that we needed to target about 200 total patients in this study, this was before the left side of the amendment. We have achieved that number on the right-sided and bacteremia patients and we need to only enroll a handful of additional – actually a couple of handfuls of additional left-sided patients at this point and we are just early in that process, we enrolled our first left-sided patient just a few weeks ago.

<Q – Eun Yang>: Okay. So, quick question to David. When I look at the sales and marketing expense in the second quarter, it’s kind of a little bit lower than from the first two quarter and then [indiscernible] you are guiding for full year of about $38 million. So, it seems to me that they would likely to be a lot of marketing efforts in the second half of this year, does that mean you guys are having more sales people?

<A – David McGirr>: You are correct Eun. We are going to spend more money on the sales and marketing efforts in the second half, that’s part of our plan and obviously to keep this momentum going on the sales for CUBICIN. I think as Mike has mentioned before, we think often about the size of the sales force, we have not made any decision the appropriate time will be thought of. It was necessary to make a change in the sales force, we would.

<Q – Eun Yang>: Okay, thank very much.

Operator: Thank you. Our next question is coming from Beth Alexander of Sterling Financial. Please go ahead.

<Q>: On the 2200 hospitals that you have ordered CUBICIN, what parentage is that of the total that you had targeted?

<A>: Okay, let’s – 2200, that is the total number of accounts, which include hospitals and outpatient infusion centers etc.

9

<Q>: Okay.

<A>: Okay. In terms of our targeted accounts, which are about 900, roughly 300 As and 600 Bs, we are running at about an 80 plus percent of the As have ordered the drug and about 55% or 60% of the Bs have ordered the drug to the end of the first quarter

<Q>: Okay. And then, could you also comment on, you said that of the – can you just say how much of the formularies that have made a decision, what percentage of them selected CUBICIN?

<A>: Sure. Of our targeted accounts, roughly 46% have met and made a decision and 97% have put CUBICIN on the formulary.

<Q>: Okay, great. Thank you very much.

<A>: You bet.

Operator: Thank you. Our next question is coming from Greg Wade of Pacific Growth.

<Q – Greg Wade>: Gentlemen and thanks for taking my questions. Mike, I am really interested in the market research that you have done with respect to these 300 patients, I was wondering if you could give us little more detail. First of, could you tell us a little bit about the dose that some of these patients are receiving and the number of days of therapy, you know, what type of patients are the sales group that’s being treated with CUBICIN, and how long is their therapy lasting, I guess with CUBICIN and then previous therapy that they were receiving? Do you think that the doctors are getting feedback from CUBICIN or they are going to get the message that maybe they should have chosen CUBICIN upfront as the result of the switching in recurring? And then lastly, on the formulary. Can you tell us how many formularies are now using the drug unrestricted? And do you have any indications that the unrestricted nature is leading to increased ordering in those institutions? Thanks.

<A – Michael Bonney>: Okay Greg. Let me just make sure I captured all of these questions here and I will try to knock them down for you. Let me start with just updating – Beth, I misspoke, I said 60% or so of the Bs, it’s actually almost 90% or so of the Bs have ordered the drug at least once among nearly 2200 institutions in the first half. In terms of the 300 patients, patient records rather that we have reviewed as part of this market research, not a lot further – I would like go, it is certainly the case that the indications outside the skin are more often where CUBICIN has used as a second line agent. It generally will 2 to 5 days after they have initiated therapy with another antibodies of the – antibiotic once for 2 to 5 days and then move to CUBICIN. It is clear that the average course amongst the 300 cases, the number of days of CUBICIN achieved is higher than the average number of days of vancomycin across all of its uses, which is five. And, it is also evident from this that there is, as I mentioned early, there is some use in a meaningful way at doses above 4 mg per kg particularly in those cases where the physicians are switching from a previous antibiotic to CUBICIN.

In terms of the unrestricted, about 11% of our overall targeted accounts have no restrictions on the use of CUBICIN and while it’s early it does appear that lack of restriction does allow for both broader penetration and deeper penetration into those accounts.

<Q – Greg Wade>: And, then just lastly, from those market research that you have done, days of therapy, can you assess whether or not patients that are receiving CUBICIN, they upfront or receiving last days of therapy when you compare to those patients who have had to be switched to CUBICIN?

10

<A>: That’s a level of granularity that I don’t have my hands around, but remember Greg that in the Phase 3, study patients who were successfully treated with CUBICIN, did receive one less day of therapies and those treated with the combination of the semisynthetic penicillins and vancomycin.

<Q – Greg Wade>: Great. Thanks for taking out my questions.

Operator: Once again, to ask a question please press star then one on your touchtone phone at this time. Our next question is coming from Matt Craig of [indiscernible]. Please go ahead.

<Q – Matt Craig>: Well, hi guys. That was a terrific quarter, congratulations.

<A>: Thank you.

<Q – Matt Craig>: I just wanted to follow up on Joel’s initial question. When he asked about the guidance, it just seems a little odd that, although, you are raising guidance after 100% up type of quarter that you are giving guidance that is potentially showing for no growth in the second half, I’m just wondering, are you being intentionally conservative or are you trying to lower growth expectations right now?

<A>: No, I think, the point here is that, you know, we are still in the first year of launch, we haven’t even completed 12 month on the marketplace, and we want to provide guidance range that we have complete confidence in and that’s what the 45 million to 55 million represents. Clearly, the low end of that range would assume that there is virtually no growth for the balance of the year, but given the slowdown that has happened in the summer months in hospital census and so forth, we think, that is prudent since we are still prognosticating. We have not been through a full 12 months yet of this launch.

<Q – Matt Craig>: Okay. But, it seems in contrast to hiring more sales people into the overly bullish tone of the numbers that did come out, I hate to throw red meat to the shorts, after you deliver a great quarter, and that’s why –there’s just a little confusion there. But second question would be – When do you expect to stop the drop shipments, when do you expect to go into your distribution type of model?

<A>: That’s good question. We right now believe that the earliest likely and this date is sliding out is the middle of next year. We have gain – we believe to be tremendous leverage for our sales force by being able to provide them with daily sales updates and of course once we go to wholesalers stocking model, we will not be able to do that with any kind of accuracy at all. So we would like to get well into the introduction of this product before we make that move.

<Q – Matt Craig>: Thank you very much. Great quarter.

<A>: Thank you.

Operator: Thank you. Our next question is coming from Dallas Webb of Stanford Financial. Please go ahead.

<Q – Dallas Webb>: Hi, guys just a couple of quick questions. First, can you provide an update about the ongoing and plan studies for example, the assimilated pharmacoeconomic study timing etc? Also, will there be a pharmacoeconomic analysis associated with the ongoing Phase 3? And then finally any plans on paying down, any of your debt within the next year?

<A>: Let me try and take those in sequence results.

<A>: Right, osteomyelitis, pharmacoeconomics, and so forth. We have agreed to support an investigator initiated study looking the pharmacoeconomics of CUBICIN, that is up in running as we speak. We do also have pharmacoeconomic end points embedded in the Phase 3 program with

11

the endocarditis bacteremia study. Osteomyelitis, we continue to progress and collect data, so that we can get clarity on what the appropriate clinical course is for that, it is unlikely that we would initiate a Phase 3 study until earliest, probably late this year or first half of next year, then that of course is dependent upon the data that we are currently assembling all point us in a clear direction.

<A>: Right, we continue to be committed to pushing out the maturity of the $29 million debt that underlays our corporate headquarters and while we are well into negotiations with an entity to do that. We have not yet finalized any agreement.

<Q – Dallas Webb>: Okay thanks and just real quick. When the DMC looks at the safety data, is it only safety data that we are looking at or they are also looking at any type of efficacy or for example how fast patients are getting all therapy or is it just strictly head-to-head comparison of safety?

<A>: It really is the head-to-head comparison of safety. You know they get A versus B with serious adverse events. They do look at things like persistence of bacteremia, which may, you may call an efficacy end point or safety end point. They are looking at it because they believe I think as most clinicians do that, more bacteremia is not a good thing, so it represents a safety signal, but that’s what they are looking at.

<Q – Dallas Webb>: Okay thank you.

Operator: Thank you our next question is coming from David Webber of First Albany. Please go ahead.

<Q – David Webber>: Thanks. I have lost my connection a couple time, so please let me know if these questions have already been asked? First, should we still figure that the sales allowance to get some gross to net sales was about 7 percent?

<A>: As sign of date, that we are looking at all those as we gained experience in the charge backs, and rebates, and provisions for returns, and over time that number we hope will become tighter, but it’s a reasonable assumption.

<Q – David Webber>: Okay. And, can you give us any sense of, you know, how many are formulary decisions are you know, on the agenda or scheduled to be made in the coming three months or so?

<A>: You know, the three months following the second quarter, which we reported on, so July, August and September tend to be pretty flat months, David. So we don’t – I don’t have the exact projection that our sales force has put in place for us, but July and August is historically formula committees don’t meet unless there is an unusual circumstance. They will pick up again in September.

<Q – David Webber>: Okay. And, then regarding the left-sided endocarditis patients. Can you tell us what the number is of patients that you will be enrolling and will they be equally randomized and I am assuming they will part of the primary analysis?

<A>: They will certainly be part of the primary analysis. They are equally randomized and its very modest number, we haven’t articulated the actual number but, it’s a relatively small percentage of that which have already enrolled. And, we did talk about that earlier David with having achieved about 200 and the right-sided and bacteremia population.

<Q – David Webber>: Thanks Scott, I did catch that and a last question, you mentioned earlier, that you have 21% of the patients in your market research survey who were treated. Was that number up from their previous similar survey?

12

<A>: This is really the first survey of this size where we actually able to go in and review in a blinded ay patients records. So, we don’t have a comparison the previous market research of the 21 percent, but certainly relative to our expectation six or seven month into launch 21% first line usage is higher than we expected.

<Q – David Webber>: And then – I infer from what you were saying that those are primarily skin infection?

<A>: That is correct.

<Q – David Webber>: Okay. Thank you.

Operator: Thank you. Our next question is a follow-up question coming from Jason Kantor of WR Hambrecht. Please go ahead.

<Q – Jason Kantor>: Thanks for taking up my follow-up. I wanted to ask about the endocarditis study, two questions. One, is this standard that you take all the DSMC data to the FDA, what sort of got that discussion going and who – why do the FDA want you to look at this particular group? And also why you keep the study enrolling to get these additional patients, we’ve been enrolling more right-sided endocarditis and should we infer that that’s going to increase the power of the study on the final analysis?

<A>: Okay. A rather compound question you have for me Jason. Data safety and monitoring committees are put in place to do exactly what they say, at their name, which is to in circumstances where you are comparing a investigational agent with the standard of care in a high mortality in particular. It can be high morbidity, but a high mortality particular indication they are putting in place to ensure that the patients are protected. And in fact this is been a concern of the FDA from our very early discussions with them about endocarditis trial. Clearly the mortality in endocarditis is anywhere from 15 to 50 percent. It tends to be 15 to 20% on the right side and 25 to 50% on the left side. So, the left-sided are more difficult to treat group of patients. And, there were number of patient protection provision built into this protocol in beyond the safety monitoring committee. That’s one of them, but it is also, as you know a unblinded study. We are blinded to the data, but the investigator at the site, who is treating the patient, knows whether they are getting comparator or they are getting Cubicin. And that’s put in place to ensure that if a patient is not respond to therapy, the clinician, who is treating that patient can take appropriate action to deal with that.

So in terms of the provision of the reports to the FDA, I can’t speak to data safety monitoring committees overall. We agreed for this with the FDA, so that they were comforted with the safety of the drug as we progress. And evidently that is part of their stimulus for what was the DMC report, was part of their stimulus for requesting that we are move into the more difficult to treat higher morbidity group of left-sided patient.

Are we going to continue to enroll on right-sided? That is our current view, we want to both maintain operational momentum in the studies, so that we can get the small number of left-sided as quickly as possible. And, so if we keep enrollment open, broadly that helps the slides maintain momentum number one and number two that will and of course also have the effect of increasing power.

<Q – Jason Kantor>: Great.

Operator: Thank you our next question is coming from Eun Yang of Wells Fargo. Please go ahead.

<Q – Eun Yang>: Thank you. Just a follow-up on the endocarditis study, patients who have endocarditis, how many percents of patients have right-sided endocarditis versus the left-sided? And the second question is on the manufacturing, now that it looks like second manufacturing

13

facility is going to be ready in the first half of the next year. Do you have in the event of that you know sales to grow much rapidly than you anticipated and do you have enough to how the supply can meet the demand and you know particularly, if sales go above 60 billion or something? Thank you.

<A>: Okay, on the right-sided versus left-sided, I don’t have that hard data at my fingertips. But, right-sided, as you know is often a follow on to IV drug use. And as a result, it is my impression that it represents more than 50% of the entitled of the total endocarditis population out there. It certainly appears to be more common, based on early returns on enrollment data. In terms of the second manufacturing, as I said in the script, it will be important for us to have both the second API site and the second full finish site up in running in early 2005, in order to deal with a significant increase in the slope of the curve over what’s in consensus currently for 2005.

Operator: Are you ready for your next question?

<Q – Aaron Reames>: Sure.

Operator: Your next question is coming from Aaron Reames of Stanford Financial. Please go a head.

<Q – Aaron Reames>: Hi, I have just a question on that planned or ongoing trails. Based on the word that came out of State University of New York, are there any studies that are either initiated or planned at the investigator level to look at the effectiveness of Cubicin against the MRSA, isolates with group 2 have polymorphisms?

<A>: Yes. We are actually working with those investigators right now to try and get samples of those strains to test tube and against them.

<Q – Aaron Reames>: Okay, and then regarding bacteremia and endocarditis are those infection characterized by, I guess the group two for polymorphisms more predominantly than let’s say just a regular infection?

<A>: We don’t know.

<Q – Aaron Reames>: Okay. Thank you.

<A>: All right.

Operator: Our next question is coming from Greg Wade of Pacific Growth. Please go ahead.

<Q – Greg Wade>: I quick follow up on endocarditis study, when the study concludes, do you have to win in both the left and right-sided, you know, comparator to the standard delta or will you be able to stratify by – after right-sided men – is there a what’s the delta after the comparison? Thanks.

<A>: The primary end point is our commerce and the delta from that – the delta that is drove the sizing of the study was a 20% delta. It is also clear from my interactions with the agency, that they are very interested in looking at various subgroups from a critical standpoint. The subgroups probably aren’t going to be large enough to do hardcore stats, but they want to take us – get a sense of – in each of the subgroups, how does the drug react. So there is a whole host of analysis that are rightly going to come from endocarditis factoring a study.

<Q – Greg Wade>: Thanks so much.

Operator: At this time, I would like to turn the floor back over to Michael Bonney, for any closing remark.

14

<Michael Bonney>

Thank you all for joining us today. We are very pleased of course for the quarter that we have just completed and announced. And we look forward to continuing to grow the business in a very effective way going forward. I did also want to note that our conference call for the third quarter will be October 27th this is slightly earlier than we have done it in the past and I wanted to make sure everybody knew to mark their calendars. Have a great day. Thanks very much.

Operator: Thank you. That does conclude today’s teleconference. You may disconnect your lines at this time and have a wonderful day.

15