Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| CUBIST PHARMACEUTICALS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF CUBIST PHARMACEUTICALS, INC.:

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of Stockholders of Cubist Pharmaceuticals, Inc., or the 2011 Annual Meeting, will be held at our offices at 55 Hayden Avenue, Lexington, MA 02421, on Thursday, June 2, 2011 at 8:30 A.M. local time, for the following purposes:

- 1.

- To elect three (3) Class III directors to our Board of Directors, each to hold office for a three-year term and until his successor has been duly elected and qualified.

- 2.

- To consider and vote on whether to approve, on an advisory basis, the compensation paid to our Named Executive Officers (as that term is defined in the Proxy Statement for the 2011 Annual Meeting).

- 3.

- To consider and vote, on an advisory basis, on how frequently we should seek approval from our stockholders, on an advisory basis, of the compensation paid to our Named Executive Officers.

- 4.

- To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011.

- 5.

- To transact such other business as may properly come before the 2011 Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed April 7, 2011 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2011 Annual Meeting. Accordingly, only stockholders of record at the close of business on the record date will be entitled to notice of, and to vote at, the meeting or any adjournments thereof.

We are pleased to take advantage of Securities and Exchange Commission rules that allow us to furnish proxy materials, including this Notice, the Proxy Statement filed for our 2011 Annual Meeting, our 2010 Annual Report and the proxy card for the 2011 Annual Meeting, to our stockholders via the Internet. Taking advantage of these rules allows us to lower the cost of delivering annual meeting materials to our stockholders and reduce the environmental impact of printing and mailing these materials.

To ensure your representation at the 2011 Annual Meeting, you are urged to vote by proxy by one of the following steps as promptly as possible:

- (a)

- Vote via the Internet pursuant to the instructions provided in the Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, that we will mail no later than April 21, 2011 to all stockholders of record and beneficial owners as of the record date; or

- (b)

- Request email or printed copies of the proxy materials pursuant to the instructions provided in the Notice of Internet Availability and either:

- (i)

- complete, date, sign and return the proxy card that you will receive in response to your request; or

- (ii)

- vote via telephone (toll-free) in the United States or Canada in accordance with the instructions on the proxy card.

The Internet and telephone voting procedures are designed to authenticate stockholders' identities, to allow stockholders to vote their shares, and to confirm that stockholders' instructions have been properly recorded. Voting via the Internet or telephone must be completed by 2:00 A.M. Eastern Time on June 2, 2011 (assuming the meeting is not postponed or adjourned). Your shares cannot be voted

Table of Contents

unless you vote by one of the methods described above or attend the 2011 Annual Meeting in person. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before the stockholders is important.

| | |

| | | By Order of the Board of Directors, |

|

|

TAMARA L. JOSEPH

Secretary |

April 21, 2011

| | |

|

| NOTE: | | THE BOARD OF DIRECTORS SOLICITS YOUR VOTE BY PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE 2011 ANNUAL MEETING, PLEASE PROMPTLY VOTE VIA ANY OF THE METHODS DESCRIBED ABOVE. IF YOU ATTEND THE 2011 ANNUAL MEETING, YOU MAY REVOKE ANY PROXY GIVEN BY YOU AND VOTE YOUR SHARES IN PERSON. |

|

Table of Contents

TABLE OF CONTENTS

| | | | | |

GENERAL INFORMATION | | | 1 | |

PRINCIPAL AND MANAGEMENT STOCKHOLDERS | | | 4 | |

| | Principal Stockholders | | | 4 | |

| | Management Stockholders | | | 5 | |

EXECUTIVE OFFICER COMPENSATION | | | 6 | |

| | Compensation Discussion & Analysis | | | 6 | |

| | Summary Compensation Table | | | 24 | |

| | Grants of Plan-Based Awards in 2010 | | | 25 | |

| | Outstanding Equity Awards at 2010 Fiscal Year End | | | 26 | |

| | Option Exercises and Stock Vested in 2010 | | | 28 | |

| | Termination of Employment and Change-in-Control Agreements | | | 29 | |

COMPENSATION COMMITTEE REPORT | | | 33 | |

INFORMATION AS TO OUR BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | | 34 | |

| | Information as to Directors and Nominees for Director | | | 34 | |

| | Director Compensation | | | 41 | |

| | Information about Meetings and Board Committees | | | 46 | |

| | Information about our Board Committees | | | 47 | |

| | Corporate Governance | | | 49 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | | | 53 | |

TRANSACTIONS WITH RELATED PERSONS | | | 53 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | | 53 | |

EQUITY COMPENSATION PLANS | | | 54 | |

AUDIT COMMITTEE REPORT | | | 55 | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 56 | |

PROPOSAL NO. 1 ELECTION OF DIRECTORS | | | 57 | |

PROPOSAL NO. 2 ADVISORY VOTE ON EXECUTIVE COMPENSATION | | | 58 | |

PROPOSAL NO. 3 ADVISORY VOTE ON FREQUENCY OF EXECUTIVE COMPENSATION ADVISORY VOTES | | | 59 | |

PROPOSAL NO. 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 60 | |

STOCKHOLDER PROPOSALS AND BOARD CANDIDATES | | | 61 | |

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS | | | 61 | |

OTHER BUSINESS | | | 61 | |

WHERE YOU CAN FIND MORE INFORMATION | | | 62 | |

Table of Contents

CUBIST PHARMACEUTICALS, INC.

65 Hayden Avenue

Lexington, MA 02421

PROXY STATEMENT

GENERAL INFORMATION

Why are we soliciting proxies?

We are furnishing this Proxy Statement to the holders of our common stock, $.001 par value per share, in connection with the solicitation of proxies on behalf of our Board of Directors, or our Board, for use at our 2011 Annual Meeting of Stockholders, or the 2011 Annual Meeting.

When and where is the 2011 Annual Meeting?

The 2011 Annual Meeting will be held at our offices at 55 Hayden Avenue, Lexington, Massachusetts on Thursday, June 2, 2011 at 8:30 A.M. local time or at any future date and time following an adjournment or postponement of the meeting.

What are the purposes of the 2011 Annual Meeting?

The purposes of the 2011 Annual Meeting and the matters to be acted upon are set forth in the accompanying Notice of 2011 Annual Meeting of Stockholders, or the Notice. The Board knows of no other business that will come before the 2011 Annual Meeting.

How will I receive proxy materials?

We are furnishing our proxy materials, including the Notice, this Proxy Statement, our 2010 Annual Report to Stockholders and the proxy card for the 2011 Annual Meeting, by providing access to such documents on the Internet. We will send a Notice of Internet Availability of Proxy Materials, or the Notice of Internet Availability, no later than April 21, 2011 to our stockholders of record and beneficial owners as of April 7, 2011, the record date for the 2011 Annual Meeting. The Notice of Internet Availability contains instructions for accessing and reviewing our proxy materials on the Internet and voting by proxy over the Internet. If you prefer to receive email or printed copies of our proxy materials, the Notice of Internet Availability contains instructions on how to request such materials.You will not receive printed copies of the proxy materials unless you request them or have requested them in response to a Notice of Internet Availability in the past. Viewing our proxy materials and voting by proxy electronically will save us the cost of printing and mailing documents to you and will reduce the impact on the environment.

Who will pay the costs of soliciting proxies and how would you solicit proxies?

We will pay the costs of soliciting proxies. We will solicit proxies by email from stockholders who are our employees or who previously requested to receive proxy materials electronically. Members of the Board, whom we refer to as our directors, and our officers and employees also may solicit proxies on our behalf, personally or by telephone, without additional compensation. We also may utilize the assistance of third parties in connection with our proxy solicitation efforts, and we would compensate such third parties for their efforts. We have engaged one such third party, The Proxy Advisory Group, LLC, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of expenses that are not expected to exceed $20,000 in the aggregate.

Table of Contents

Who can vote?

Only stockholders of record at the close of business on April 7, 2011, the record date for the 2011 Annual Meeting, are entitled to notice of, and to vote at, the 2011 Annual Meeting or any adjournment or postponement of the meeting. On the record date, we had outstanding 59,595,971 shares of common stock, each of which is entitled to one vote upon each of the matters to be presented at the 2011 Annual Meeting.

How do I vote?

Stockholders of record can vote their shares (1) via the Internet, (2) via a toll-free telephone call from the U.S. or Canada, (3) by mailing a signed proxy card, or (4) in person at the 2011 Annual Meeting. The Internet and telephone voting procedures are designed to authenticate stockholders' identities, to allow stockholders to vote their shares, and to confirm that their instructions have been properly recorded.

You will be asked to vote, as follows:

- •

- ForProposal No. 1, you will be asked, with respect to each nominee for Class III director, to vote "FOR" such nominee or to "WITHHOLD" your vote from such nominee.

- •

- ForProposal No. 2, you will be asked to vote, on an advisory, non-binding basis, "FOR" the compensation paid to our Named Executive Officers in 2010 (as defined in the Compensation Discussion and Analysis section of this Proxy Statement, or CD&A), "AGAINST" such compensation or to "ABSTAIN" from voting on such compensation. We will refer to this Proposal as the "Say-on-Pay Proposal."

- •

- ForProposal No. 3, you will be asked to vote, on an advisory, non-binding, basis, whether we should seek advisory stockholder approval of the compensation paid to our Named Executive Officers every "ONE YEAR," "TWO YEARS," or "THREE YEARS" or to "ABSTAIN" from voting on the frequency with which we seek such approval. We will refer to this Proposal as the "Say-on-Frequency Proposal."

- •

- ForProposal No. 4, you will be asked to vote "FOR" the ratification of our selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011, "AGAINST" such ratification or to "ABSTAIN" from voting to so ratify our selection.

Stockholders may revoke the authority granted by their execution of proxies at any time before the effective exercise of such authority by filing with our Secretary, at Cubist Pharmaceuticals, Inc., 65 Hayden Avenue, Lexington, MA 02421, a written revocation or a duly executed proxy bearing a later date or by voting in person at the 2011 Annual Meeting. Shares represented by executed and unrevoked proxies will be voted in accordance with the choice or instructions specified thereon. If no choices or instructions are given, the proxies intend to vote the shares represented thereby:

- •

- "FOR" Proposal No. 1 to elect the Class III director nominees to the Board;

- •

- "FOR" Proposal No. 2, the Say-on-Pay Proposal, to approve, on an advisory basis, the compensation paid to our Named Executive Officers in 2010;

- •

- for "THREE YEARS" in response to Proposal No. 3, the Say-on-Frequency Proposal, as the frequency with which we seek an advisory say-on-pay vote;

- •

- "FOR" Proposal No. 4 to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011; and

2

Table of Contents

- •

- in accordance with the proxies' best judgment on any other matters that may properly come before the 2011 Annual Meeting.

What is the vote required for a quorum?

The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock on the record date, will constitute a quorum for the transaction of business at the 2011 Annual Meeting. Votes withheld from any nominee, abstentions, and broker non-votes (as described below) are counted as present or represented for purposes of determining the presence or absence of a quorum for the 2011 Annual Meeting.

What is a broker non-vote and what is the impact of not voting?

A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on one or more proposals because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner, which is also referred to as someone who holds shares in street name. Your bank or broker does not have discretion to vote uninstructed shares on the proposals in this Proxy Statement, except for Proposal No. 4 to ratify the appointment of our independent registered public accounting firm. As a result, if you hold your shares in street name it is critical that you provide instructions to your bank or broker, if you want your vote to count in the election of directors and the advisory votes related to executive compensation.

If you are a shareholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

What is the vote required for a proposal to pass?

- •

- Proposal No. 1—Election of directors: the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the 2011 Annual Meeting, in person or by proxy, is required for the election of each of the nominees. Abstentions and broker "non-votes" will have no effect on the voting outcome with respect to the election of directors.

- •

- Proposal No. 2—Say-on-Pay: Because this proposal asks for a non-binding, advisory vote, there is no required vote that would constitute approval. We value the opinions expressed by our stockholders in this advisory vote, and our Compensation Committee, which is responsible for overseeing and administering our executive compensation programs, will consider the outcome of the vote when designing our compensation programs and making future compensation decisions for our Named Executive Officers. Abstentions and broker non-votes, if any, will not have any impact on this advisory vote.

- •

- Proposal No. 3—Say-on-Frequency: This proposal also calls for a non-binding, advisory vote. Our Board has recommended that the advisory vote by stockholders on the compensation paid to our Named Executive Officers should occur once every three years; however, if another frequency receives more votes, our Board will take that fact into account when making its decision on how often to hold advisory votes on our Named Executive Officer compensation. Abstentions and broker non-votes, if any, will not have any effect on the results of those deliberations. As required by United States Securities and Exchange Commission, or SEC, rules, our Board will disclose the frequency that we will hold future say-on-pay votes by October 25, 2011.

- •

- Proposal No. 4—Ratification of the selection of our independent registered public accounting firm: The affirmative vote of the holders of a majority of shares of common stock present in person or represented by proxy at the 2011 Annual Meeting and entitled to vote on this proposal, is required to ratify our selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011. Abstentions will have the practical effect of a vote to not ratify our selection. Because Proposal No. 4 is a routine proposal on which a broker or other nominee is generally empowered to vote, broker "non-votes" likely will not result from this Proposal.

3

Table of Contents

PRINCIPAL AND MANAGEMENT STOCKHOLDERS

Principal Stockholders

The following table sets forth certain information with respect to each person known to us to be the beneficial owner of more than 5% of our issued and outstanding common stock as of April 7, 2011. On April 7, 2011, we had 59,595,971 shares of common stock outstanding.

| | | | |

Name and Address of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | Percentage

of Class(1) |

|---|

Federated Investors, Inc.(2)

Federated Investors Tower

Pittsburgh, PA 15222-3779 | | 8,699,647 | | 14.6% |

BlackRock, Inc.(3)

40 East 52nd Street

New York, NY 10022 | | 7,485,783 | | 12.6% |

Wellington Management Company, LLP(4)

280 Congress Street

Boston, Massachusetts 02210 | | 6,482,282 | | 10.9% |

The Vanguard Group, Inc.(5)

100 Vanguard Blvd.

Malvern, PA 19355 | | 3,015,997 | | 5.1% |

- (1)

- We calculated the percentage of class based on the number of shares reported as beneficially owned in the SEC filings of the beneficial owners divided by the actual number of shares outstanding as of April 7, 2011. The percentages in the table may differ from the percentages reported in the beneficial owners' filings with the SEC because the beneficial owners may have used different denominators than the actual number of shares outstanding as of April 7, 2011.

- (2)

- The information reported is based on a Schedule 13G/A filed with the SEC on February 9, 2011 jointly by Federated Investors, Inc., or Federated, Voting Shares Irrevocable Trust, or the Trust, and John F. Donahue, Rhodora J. Donahue and J. Christopher Donahue, each individually and as a trustee of the Trust. Federated reported that it had sole voting and dispositive power with respect to 8,699,647 shares as of December 31, 2010. Federated reported that it is the parent holding company of Federated Equity Management Company of Pennsylvania and Federated Global Investment Management Corp., which act as investment advisers to registered investment companies and separate accounts that own such shares.

- (3)

- The information reported is based on a Schedule 13G/A filed with the SEC on January 10, 2011 by BlackRock, Inc., or BlackRock. BlackRock reported that it beneficially owned 7,485,783 shares and that it had sole voting power and sole dispositive power with respect to all such shares as of December 31, 2010. BlackRock reported that it is a parent holding company of BlackRock Fund Advisors and various other subsidiaries, which collectively own such shares.

- (4)

- The information reported is based on a Schedule 13G/A filed with the SEC on February 14, 2011 by Wellington Management Company, LLP, or Wellington. Wellington, an investment adviser, reported that it beneficially owned 6,482,282 shares and that it had shared voting power with respect to 5,359,813 of such shares and shared dispositive power

4

Table of Contents

with respect to all of such shares as of December 31, 2010. Wellington reported that various of its clients have the right or the power to direct the receipt of dividends from, or the proceeds from the sale of, such shares.

- (5)

- The information reported is based on a Schedule 13G filed with the SEC on February 10, 2011 by The Vanguard Group, Inc., or Vanguard. Vanguard, an investment advisor, reported that it beneficially owned 3,015,997 shares and that it had sole voting power with respect to 76,729 of such shares, sole dispositive power with respect to 2,939,268 of such shares and shared dispositive power with respect to 76,729 of such shares as of December 31, 2010. Vanguard reported that its wholly-owned subsidiary, Vanguard Fiduciary Trust Company, is the beneficial owner of 76,729 of such shares.

Management Stockholders

The following table sets forth information as of April 7, 2011, as reported to us, with respect to the beneficial ownership of common stock by our directors and each Named Executive Officer, and by all of our current directors and Executive Officers (as defined in the CD&A) as a group. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. Except as indicated below and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name.

| | | | | | | | |

| | Number of Shares Beneficially Owned | |

|

|---|

| | Percentage

of Shares

Beneficially

Owned(2) |

|---|

Name | | Shares

Owned | | Shares—Right

to Acquire(1) | | Total

Number |

|---|

Michael Bonney | | 123,216 | | 962,327 | | 1,085,543 | | 1.8% |

Steven Gilman | | 7,322 | | 132,500 | | 139,822 | | * |

David McGirr | | 13,870 | | 260,850 | | 274,720 | | * |

Robert Perez | | 17,885 | | 402,437 | | 420,322 | | * |

Santosh Vetticaden | | 3,670 | | 62,862 | | 66,532 | | * |

Kenneth Bate | | 5,839 | | 151,107 | | 156,946 | | * |

Mark Corrigan | | 1,705 | | 44,685 | | 46,390 | | * |

Sylvie Grégoire | | 5,085 | | 75,519 | | 80,604 | | * |

Nancy Hutson | | 2,000 | | 44,685 | | 46,685 | | * |

Leon Moulder, Jr. | | 305 | | 23,532 | | 23,837 | | * |

Martin Rosenberg | | 4,658 | | 89,019 | | 93,677 | | * |

Matthew Singleton | | 3,047 | | 107,519 | | 110,566 | | * |

Martin Soeters | | 5,500 | | 75,519 | | 81,019 | | * |

Michael Wood | | 6,385 | | 99,019 | | 105,404 | | * |

All directors and Executive Officers as a group (16 persons) | | 212,418 | | 2,736,318 | | 2,948,736 | | 4.7% |

- *

- Less than 1% of the issued and outstanding shares of common stock.

- (1)

- Represents shares subject to outstanding stock options that are currently exercisable or exercisable within 60 days of April 7, 2011 and restricted stock units, or RSUs, that will vest within 60 days of April 7, 2011.

- (2)

- On April 7, 2011, we had 59,595,971 shares of common stock outstanding. In computing percentage ownership of a person, shares of common stock subject to stock options and RSUs held by that person that are currently exercisable or which will become exercisable or vest within 60 days of April 7, 2011 also are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person.

5

Table of Contents

EXECUTIVE OFFICER COMPENSATION

Compensation Discussion & Analysis

Executive Summary

We emphasize results-oriented executive compensation as evidenced by our pay programs—consisting of base salary, annual cash bonus awards, and stock option and RSU awards—that award substantial pay for the achievement of positive results. Our Board, the Compensation Committee and Michael Bonney, our Chief Executive Officer and President, believe in taking a leadership position in results-oriented pay for our Executive Officers(1). We have consistently demonstrated that leadership over the years by providing Mr. Bonney and our other Executive Officers with moderate guaranteed pay (base salary) and making a substantial portion of their pay dependent upon the achievement of challenging annual corporate goals (through annual cash bonus awards) and long-term stock performance (through stock options and RSU awards with time-based vesting).

- (1)

- The term "Executive Officers" means all of our executive officers who are subject to the reporting requirements under Section 16 of the Securities and Exchange Act of 1934, or the Securities Exchange Act.

Our key executive compensation objectives are:

- •

- To align Executive Officer pay with our performance.

- •

- To provide competitive compensation that differentiates and rewards Executive Officers for their overall contribution to the company.

- •

- To further our short- and long-term strategic goals by aligning Executive Officer compensation with the achievement of individual and corporate objectives designed to promote the creation and protection of value for stockholders.

- •

- To design short- and long-term incentive compensation programs that attract and retain high-quality executive officers and motivate high performance at the individual and corporate levels.

Our Performance and its Relationship to Executive Officer Compensation:

Consistent with our objectives, pay-for-performance represents a significant criteria used in the development of our executive compensation program. The Compensation Committee structures our executive pay so that a substantial portion of the total compensation opportunity consists of variable compensation that is dependent upon our operational, strategic, financial and stock performance. Each Executive Officer's performance-based compensation in any given year consists of his or her annual cash bonus award under our Short Term Incentive Plan, or STIP, and option awards made under our 2010 Equity Incentive Plan, or 2010 Plan. Time-vested RSU awards like ours generally are considered to be non-performance based. However, the size of our Executive Officers' RSU awards are based, in part, on their performance, and our Executive Officers performance and contributions to Cubist are focused primarily on the achievement of our key short-term and long-term goals and strategy. The achievement of such goals and strategy is highly likely to impact our stock price and, as a result, impact the ultimate value of their RSU awards. Also, while base salary generally is considered to be non-performance based, annual salary increases for our Executive Officers are based, in part, on their performance in the previous year.

In 2010, we had a strong year of performance as evidenced in part by:

- •

- Our total net revenues growing 13% and our U.S. net CUBICIN® (daptomycin for injection) revenues growing 14% over 2009;

6

Table of Contents

- •

- Our operating income growing 38% over 2009;

- •

- Our stock price increasing by 13% in 2010; and

- •

- Our level of performance against challenging and diverse corporate goals, as detailed below.

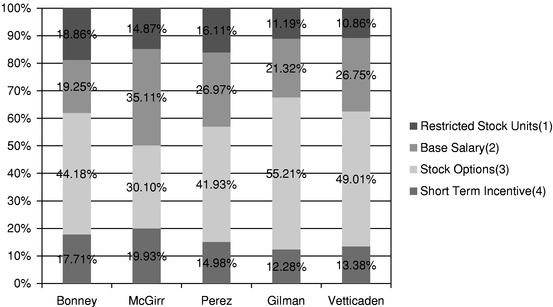

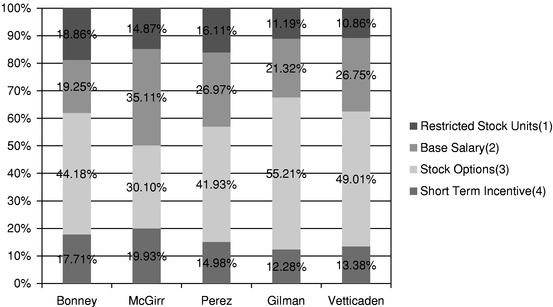

For 2010, Mr. Bonney's performance-based compensation (which, for this purpose, consists of annual cash bonus and stock option awards) comprised approximately 62% of his total compensation as shown in the chart below. Also shown in the chart below, for our other Named Executive Officers(2), performance-based compensation for 2010 comprised an average of approximately 59% of their total compensation.

- (2)

- The term "Named Executive Officers" means the "named executive officers" as defined by Item 402(a)(3) of Regulation S-K promulgated by the SEC. For 2010, our Named Executive Officers are: (1) Michael Bonney, our President and Chief Executive Officer, (2) David McGirr, our Senior Vice President and Chief Financial Officer, (3) Robert Perez, our Executive Vice President and Chief Operating Officer, (4) Steven Gilman, our Executive Vice President, Research & Development and Chief Scientific Officer, and (5) Santosh Vetticaden, our Senior Vice President, Chief Medical and Development Officer.

- (1)

- Detailed under the "Stock Awards" column in the Summary Compensation Table.

- (2)

- Detailed under the "Salary" column in the Summary Compensation Table.

- (3)

- Detailed under the "Option Awards" column in the Summary Compensation Table.

- (4)

- Detailed under the "Non-Equity Incentive Plan Compensation" column in the Summary Compensation Table.

In January 2011, the Compensation Committee reviewed an historical pay-for-performance analysis conducted by Pearl Meyer & Partners, or PM&P, a nationally-recognized, independent executive compensation consulting firm that the Compensation Committee engaged as its compensation consultant. The Compensation Committee used this analysis to evaluate the alignment of pay to performance versus a peer group approved by the Compensation Committee for the three-year period

7

Table of Contents

from 2007 through 2009. The analysis considered how each of the following metrics compared with the peer group over the three-year period:

- •

- our performance using operational and shareholder performance metrics, specifically our revenue growth, EBITDA margin, return on investment capital and total shareholder return;

- •

- the potential compensation opportunity for our executives; and

- •

- the amount of cash compensation our executives earned plus the in-the-money or realizable value of equity awarded during the three-year period.

Based on this analysis, the Compensation Committee concluded that our executive compensation is in alignment with our operational performance and total shareholder return. The analysis also took into account our strong performance compared to the peer group over the three-year period and confirmed that our executives' compensation, as compared to our peer group, was aligned with our performance relative to our peers over the period. Relative to our peers, our performance for the three-year period was at the 70th percentile for revenue growth, the 68th percentile for EBITDA margin, the 75th percentile for return on investment capital, and the 52nd percentile for total shareholder return. Our total shareholder return for the three-year period was 4.7%. Based on these metrics, we are performing above average relative to our peers, yet, as is detailed below, our executive compensation relative to our peers is at or below average primarily due to our heavy emphasis on stock options versus RSUs. This demonstrates our strong performance orientation, focus on aligning executive pay with shareholder return, our conservative, yet reasonable, approach to compensation and the high value that we receive from our executives.

Named Executive Officer Compensation:

2010 Named Executive Officer Compensation. For 2010, our Named Executive Officers earned base salary, annual cash bonus awards (paid in February 2011) and long-term incentives (awarded in 2010) as follows:

| | | | | | |

Name | | Salary | | Annual cash

performance awards | | Long-term incentives(1) |

|---|

Michael Bonney | | $550,000 | | $506,000 | | 135,000 stock options

25,000 RSUs |

David McGirr | | $381,761 | | $216,687 | | 35,000 stock options

7,500 RSUs |

Robert Perez | | $451,082 | | $250,621 | | 75,000 stock options

12,500 RSUs |

Steven Gilman | | $410,903 | | $236,647 | | 110,000 stock options

10,000 RSUs |

Santosh Vetticaden | | $398,120 | | $199,160 | | 75,000 stock options

7,500 RSUs |

- (1)

- All stock options and RSUs were awarded in May 2010 during our annual performance cycle except for a 50,000 stock option award to Dr. Gilman in October 2010 in connection with his promotion to Executive Vice President, Research & Development and Chief Scientific Officer, in September 2010, and a 40,000 stock option award to Dr. Vetticaden in October 2010 in connection with the expansion of his role to Senior Vice President, Chief Medical and Development Officer, in September 2010.

2009 and 2010 Named Executive Officer Short- and Long-Term Compensation Allocation. We allocate compensation between short-term (base salary and annual bonus) and long-term (stock options and RSUs) compensation with significant emphasis on long-term compensation due to our stage of

8

Table of Contents

growth, emphasis on pay-for-performance, and desire to focus on long-term results. In 2009 and 2010, we allocated Mr. Bonney's and our other Named Executive Officers' compensation between short- and long-term compensation based on practices by our peer group, broader market practices and according to our available corporate budget as follows:

| | | | |

| | 2010 Compensation Allocation | | 2009 Compensation Allocation |

|---|

Michael Bonney | | 19% base salary

18% annual cash bonus awards

63% long-term incentives | | 22% base salary

18% annual cash bonus awards

60% long-term incentives |

Other Named Executive Officers (averages) | | 28% base salary

15% annual cash bonus awards

57% long-term incentives | | 33% base salary

14% annual cash bonus awards

53% long-term incentives |

Other Compensation Matters

Retention Letters. Our Executive Officers have retention letters. The letters provide for severance payments, consisting of 24 months of salary continuation for Mr. Bonney and 18 months of salary continuation for our other Executive Officers, and other benefits if the Executive Officer is terminated without cause or if the Executive Officer is terminated without cause or resigns for good reason within 24 months after a change-in-control. Therefore, in the case of a change-in-control, our Executive Officers have some protection but they do not automatically receive severance. Rather, after a change-in-control they would still need to be terminated without cause or resign for a good reason in order to receive severance. We believe that this so-called "double-trigger" most appropriately aligns our Executive Officers' interests with our shareholders in the event we have the opportunity for a change-in-control, while at the same time providing a significant attraction/retention benefit to high quality executives. Among the other benefits included in the letters is that the equity incentives held by each Executive Officer will fully vest in the event the Executive Officer is terminated without cause or resigns for good reason within 24 months following a change-in-control. The letters do not provide for gross up payments to the Executive Officers based upon taxes they may owe as a result of the payments made pursuant to the letters. We believe that the benefits of the retention letters outweigh the potential costs in that they, among other things: assist us in attracting and retaining top executive talent by providing our executives with competitive severance arrangements; encourage frank discourse by our executives with Mr. Bonney and the Board, and between Mr. Bonney and the Board, by providing a financial safety net in order to limit the Executive Officers' fear of adverse consequences in response to their opinions; and better enables an Executive Officer to act in the best interest of our stockholders in a situation involving a potential change of control.

Risk Assessment. Subject to the Board's oversight, the Compensation Committee is responsible for reviewing and evaluating the risks related to our compensation programs, policies and practices. As part of this process, Cubist's risk management department, working in conjunction with other departments and outside advisors, conducted a risk assessment of our compensation programs, policies and practices. The risk assessment included, among other things, a review of program documentation, practices and controls, meetings with employees involved with the creation and administration of compensation programs, and reviews of policies and practices that are relevant to our compensation programs and practices. The results were reported to, and reviewed by, the Compensation Committee. The Chair of the Compensation Committee then reported the results to the Board. Several features of our compensation programs reduce the likelihood of excessive risk taking, including: the programs provide for a balanced mix between short- and long-term compensation; the broad mix of performance goals that factor into the determination of short-term compensation; the maximum payout levels under the STIP of 200% of target; the decreasing acceleration of payouts under our field-based sales incentive plans as certain levels of quotas are achieved; the close scrutiny and regular monitoring of

9

Table of Contents

achievement against corporate goals and quotas under sales incentive plans; that compliance and ethical behaviors are integral factors considered in performance evaluations, and resulting compensation decisions, and the importance of compliance within the company; the lengthy vesting schedules of our long-term equity incentive awards; the recoupment policy applicable to our Chief Executive Officer and Chief Financial Officer; and the stock ownership guidelines applicable to our directors and Executive Officers.

Ownership Guidelines. Executive Officers are subject to stock ownership guidelines. The guidelines are designed to align the interests of our Executive Officers with those of our stockholders by ensuring that our Executive Officers have a meaningful financial stake in our success.

Recoupment Policy. Our Chief Executive Officer and Chief Financial Officer are subject to a recoupment policy which is triggered by the fraud, gross negligence or intentional misconduct by either of these individuals which caused or contributed to us having to restate all or a portion of our financial statements. We will review and amend our recoupment policy to be in full compliance with changes in applicable laws and regulations that are expected to be finalized later this year.

Perquisites and Personal Benefits. Our Executive Officers are eligible to participate in the benefit programs that we provide to all employees at the same level as all other employees. As necessary, we provide relocation assistance to newly hired Executive Officers and other key employees as part of their compensation packages. In 2010, we provided the remainder of the relocation assistance to Dr. Vetticaden for his relocation to Massachusetts from California in connection with his commencement of employment with Cubist in December 2008. We did not provide relocation assistance to any other Executive Officer in 2010. The only other perquisite or personal benefit that we provide to our Executive Officers is a supplemental long-term disability policy so that the long-term disability benefit for our Executive Officers is comparable, in terms of the portion of the salary that would be paid to our Executive Officers in the event of a long-term disability, to that of our other employees. The amounts of these additional premiums for Executive Officers who need the supplemental long-term disability policy to have a comparable benefit to that of our other employees range from approximately $1,000 to approximately $4,000 annually and totaled less than $19,000 in 2010 for all of our Executive Officers.

Note about the Executive Summary. This Executive Summary is a summary only and, as such, it is meant to provide investors with an overview of the topics covered in more detail in this CD&A and this Proxy Statement, including in the "Summary Compensation Table" and "Termination of Employment and Change-in-Control Agreements" section.

10

Table of Contents

Overview and Objectives of our Key Compensation Programs

| | |

Compensation Program | | Summary |

|---|

| Short-Term Compensation | | |

Base salary |

|

Objectives: Rewards overall, baseline contribution of the individual and his or her role to the company; motivates high performance; and used to attract and retain high performing executives. Discretionary year-over-year increases are based on achievement of individual goals and, in the case of our Chief Executive Officer, overall corporate performance, which are aligned with long-term corporate strategy and goals. |

|

|

Target for Executive Officers: We target the median of the marketplace, based on peer group and survey data compiled by PM&P of executive compensation more broadly across our industry, to— |

| | • emphasize pay-for-performance and have the substantial portion of our pay determined by corporate and individual performance; and |

| | • ensure that we are competitive in attracting and retaining talent. |

|

|

In certain circumstances, we offer starting base salaries higher than the median for positions that require more complex work, have critical value to the company, are in high demand in the marketplace and have fewer qualified candidates, or in situations where candidates enter the position with extraordinary relevant experience. Higher base salaries may also be paid over time to reflect superior individual performance. |

Annual cash bonus awards |

|

Objectives: Rewards achievement of annual corporate and individual goals, which are aligned with long-term corporate strategy and goals; motivates high performance; and used to attract and retain high performing executives. |

|

|

Target for Executive Officers: We target potential annual cash awards that would allow total cash compensation to exceed the median of the marketplace, based on peer group and survey data compiled by PM&P of executive compensation more broadly across our industry, to— |

| | • encourage specific short-term behaviors that enhance company performance and create and protect stockholder value; |

| | • focus Executive Officers on important short-term business objectives that are expected to have a positive long-term impact on our success; and |

| | • provide competitive cash compensation packages if goals are met or exceeded. |

|

|

Other: All employees are eligible for annual cash bonus awards. Cash bonus awards for our Executive Officers and our other employees, other than our field-based sales force, are paid out under our STIP, which is described below. Cash bonus awards for our field-based sales force are paid out under our sales-based incentive compensation plans. |

11

Table of Contents

| | |

Compensation Program | | Summary |

|---|

| Long-Term Incentives | | |

Stock options/RSUs |

|

Objectives: Ties compensation directly to our long-term performance; motivates high performance because the value to the Executive Officer will increase as our stock price increases and Executive Officer performance contributes to company performance that may increase our stock price; aligns interests with stockholders; and used to attract and retain high performing executives. |

|

|

Target for Executive Officers: We target at or above the median of the marketplace, based on peer group and survey data compiled by PM&P of executive compensation more broadly across our industry, to: |

| | • focus Executive Officers on multi-year results; |

| | • provide Executive Officers with a financial interest in the appreciation of the value of our common stock and focus them on long-term financial objectives; |

| | • align Executive Officer interests with stockholder interests and to create motivation to increase stockholder value; |

| | • provide Executive Officers with a compensation package that is competitive with comparable companies; |

| | • retain Executive Officers over the long-term through the use of vesting of their equity awards; |

| | • in the case of RSUs, to incentivize our Executive Officers to remain with us and feel they are appropriately compensated for the high level of performance that we expect even during periods during which our stock price is down causing previously-granted stock options to have little or no realizable value. |

|

|

Factors—determination of awards: Participation is selective; generally awarded annually based on past performance, expected future performance, retention value, comparison to awards at our peer group companies, and a financial assessment of our ability to retain the Executive Officer based on the current market value of the Executive Officer's unvested stock options and RSUs. We target overall equity awards to account for a significant portion of each Executive Officer's total annual compensation (typically more than 50%) and target a split of awards between stock options and RSUs, calculated based on a Black-Scholes value, and RSUs, generally of approximately 70% stock options and 30% RSUs, which we believe provides the appropriate incentive to work to increase shareholder value, while encouraging retention and performance. |

|

|

Stock options—RSU award ratio for Executive Officers: For the annual performance cycle equity grants made in May 2010, stock options represented 70% of the present value of their long-term incentives and RSUs represented the remaining 30%. The awards granted to Drs. Gilman and Vetticaden in October 2010 in connection with Dr. Gilman's promotion and the expansion of Dr. Vetticaden's role in September 2010 were made entirely in stock options. |

|

|

Vesting: Stock options vest ratably on a quarterly basis over four years and RSUs vest ratably on an annual basis over four years. |

12

Table of Contents

Compensation Determinations and Use of Compensation Consultant

Our non-employee directors, based on recommendations from the Compensation Committee, make all of the compensation determinations with respect to Mr. Bonney. The Compensation Committee makes all of the compensation determinations with respect to our other Executive Officers. In making its determinations, the Compensation Committee takes into account the recommendations of Mr. Bonney and, with respect to each of their direct reports who are also Executive Officers, Mr. Perez and Dr. Gilman.

The Compensation Committee has the authority to select and retain independent advisors and counsel to assist it with carrying out its duties and responsibilities, and we are required to pay any associated expenses approved by the Compensation Committee. The Compensation Committee has exercised this authority to engage PM&P as its compensation consultant. PM&P serves as an independent advisor to the Compensation Committee on topics primarily related to Board and executive compensation. PM&P reports directly to the Compensation Committee Chair, takes direction solely from the Compensation Committee, and does not provide us with any services other than the services provided at the request of the Compensation Committee.

Information Used to Make Compensation Determinations

Compensation Benchmarking and Survey Data

As part of establishing the 2010 total compensation for our Executive Officers, the Compensation Committee reviewed the total compensation for comparable positions, based on similarity of job content, at comparable companies. PM&P recommended a list of comparable companies for compensation comparisons primarily based on the following pre-defined selection criteria:

- •

- industry similarity;

- •

- annual revenues of between $140 million and $1.3 billion; and

- •

- market capitalization of between $300 million and $2.8 billion.

In selecting this peer group, we also seek to have a group that includes a large enough number of companies such that the data will not be skewed heavily if there are one or two outliers on any of the items for which we use the peer group for comparison. The compensation paid by peer group companies to their respective executive officers does not factor into the Compensation Committee's determination of the peer group.

For the analysis of our 2010 Executive Officer compensation, the peer group was approved by the Compensation Committee and consisted of the following companies:

| | |

Alkermes, Inc. | | Salix Pharmaceuticals, Ltd. |

Amylin Pharmaceuticals, Inc. | | Sepracor, Inc.** |

BioMarin Pharmaceuticals, Inc. | | The Medicines Company |

Endo Pharmaceuticals, Inc. | | United Therapeutics Corporation |

Medicis Pharmaceuticals Company | | Vertex Pharmaceuticals Incorporated |

OSI Pharmaceuticals, Inc.* | | ViroPharma, Inc. |

PDL BioPharma, Inc. | | Warner Chilcott, Ltd. |

- *

- OSI Pharmaceuticals, Inc. was acquired by Astellas Pharma Inc. in June 2010.

- **

- Sepracor, Inc. (now known as Sunovion Pharmaceuticals Inc.) was acquired by Dainippon Sumitomo Pharma Co., Ltd. in October 2009, after the Compensation Committee had approved it as a peer.

13

Table of Contents

At the time of Compensation Committee approval, all of these companies except Vertex Pharmaceuticals Incorporated, or Vertex, met all three criteria described above. Vertex, which had a market capitalization of $4.7 billion at that time, met two of the three criteria.

The selection criteria and peer group companies are reviewed each year by the Compensation Committee and may change from year to year depending on changes to the selection criteria resulting from changes in our revenues or market capitalization, changes in the marketplace, acquisitions, divestitures and business focus of us and/or our peer group companies. In order to perform the analysis of our 2010 compensation, we added four new companies—Endo Pharmaceuticals, Inc., Medicis Pharmaceuticals Company, Sepracor, Inc. and Warner Chilcott, Ltd.—to our peer group, and removed two companies—Millennium Pharmaceuticals, Inc., or Millennium, and Nektar Therapeutics, Inc., or Nektar. We removed Nektar because it no longer met the annual revenues or market capitalization criteria, and we removed Millennium because its compensation information was no longer available publicly after its acquisition by Takeda Pharmaceutical Company Limited in May 2008.

The Compensation Committee utilized the peer group to provide context for its compensation decision-making. The data from peer group companies was compiled during the summer of 2009 after the 2009 proxy statements for the peer group companies were filed. After the peer group companies are selected, PM&P prepares and presents a report to the Compensation Committee summarizing the competitive data and comparisons of our Executive Officers to the comparable company market data utilizing publicly available data from the comparable companies and broad survey data (reflecting companies of similar size in the pharmaceutical/biotech industry). We use the broad survey data in conjunction with peer group data in evaluating our Executive Officer compensation practices. Each element of our compensation is reviewed as part of this analysis and evaluation.

Other Evaluation Criteria and Factors

Executive Officer compensation can be above or below the compensation target assigned to each Executive Officer by the peer group and survey comparison analysis described above, depending on a number of factors. These include retention considerations, individual and corporate performance, relative value of the position within the company as compared to peer companies, and internal equity considerations.

As part of making its decisions with respect to Mr. Bonney's compensation, the Board and the Compensation Committee also utilized the following data and other information:

- •

- Quantitative evaluations of our performance against our annual corporate goals and objectives;

- •

- Qualitative input on Mr. Bonney's performance from all directors, many of our Executive Officers, and some external sources for use in connection with Mr. Bonney's performance evaluation;

- •

- Our and Mr. Bonney's historical performance;

- •

- Retention considerations; and

- •

- Mr. Bonney's total cash compensation as compared to Mr. Perez, our second highest paid Executive Officer based on total cash compensation, and our lowest paid employee in order to determine whether Mr. Bonney's relative cash compensation is fair and reasonable in the context of internal equity.

As part of making its compensation decisions with respect to Executive Officers other than Mr. Bonney, the Compensation Committee took into account:

- •

- Quantitative evaluations of our performance against annual corporate goals and each Executive Officer's performance against individual goals;

14

Table of Contents

- •

- Qualitative evaluations, conducted by Mr. Bonney and by Mr. Perez and Dr. Gilman, in the case of their direct reports, of each Executive Officer's contribution to our corporate goals, performance against individual goals and potential future contributions to our success;

- •

- Retention considerations; and

- •

- Mr. Bonney's recommendations for our Executive Officers and Dr. Gilman's and Mr. Perez's compensation recommendations for their respective direct reports who are Executive Officers.

Compensation Determinations

Base salary—Chief Executive Officer: Mr. Bonney's 2010 base salary was set at $550,000, which represented a 10% increase from his 2009 base salary of $500,000. In recommending this salary increase to the Board, the Compensation Committee relied on Mr. Bonney having performed at a very high level in 2009, as evidenced by our strong 2009 performance (95% achievement against corporate goals), the overall strength of his leadership, his past and potential future contributions to the company, and the benchmarking and other data and information described above. The Compensation Committee also sought to align Mr. Bonney's pay more closely with that of Chief Executive Officers at our peer group companies. The Compensation Committee continues to maintain Mr. Bonney's base salary below the median of the market, based on our peer group and broader market data, due to the Compensation Committee's and Mr. Bonney's desire to demonstrate leadership in results-oriented pay and keeping Mr. Bonney's pay reasonable and consistent with our other Executive Officers. Mr. Bonney's 2010 base salary was at the 35th percentile as compared to the peer group and survey data used by the Compensation Committee and his 2009 base salary was at the 25th percentile as compared to such data. At these levels, Mr. Bonney's base salary for 2010 and 2009 was approximately $68,000 and $55,000, respectively, below the 50th percentile of the peer group and survey data used by the Compensation Committee for such years.

Base salary—other Named Executive Officers: The 2010 base salaries earned by our other Named Executive Officers are set forth in the Summary Compensation Table and footnotes to the table. The Compensation Committee set these salaries based upon the benchmarking and evaluation criteria described above. The 2010 base salaries of these Named Executive Officers were on average at about the 50th percentile, as compared to the peer group and survey data used by the Compensation Committee. The following table details the increases from 2009 to 2010 in the base salary of each of our Named Executive Officers other than Mr. Bonney:

| | | | | | |

Named Executive Officer | | 2009 Base Salary | | 2010 Base Salary | | % Change |

|---|

David McGirr | | $370,282 | | $381,761 | | 3.1% |

Robert Perez | | $430,011 | | $451,082 | | 4.9% |

Steven Gilman | | $387,000 | | $410,903 | | 6.2%* |

Santosh Vetticaden | | $370,000 | | $398,120 | | 7.6% |

- *

- Dr. Gilman's base salary was increased to $402,000, effective January 1, 2010, during the 2009 year-end performance review that occurred in February 2010 and then was increased to $430,000 in connection with his promotion to Executive Vice President, Research & Development and Chief Scientific Officer, in September 2010. His $410,903 base salary for 2010 represents the actual base salary he was paid in 2010.

The Compensation Committee and Mr. Bonney determined that these base salary increases were justified based on each individual Named Executive Officer's performance and the level of each Named Executive Officer's base salary as compared to similar positions at our peer group companies and to survey data, compiled by PM&P, of executive compensation more broadly across our industry.

15

Table of Contents

Annual cash bonus awards—Chief Executive Officer: Mr. Bonney was awarded a 2010 annual cash performance award of 92% of his target award, resulting in a bonus payment of $506,000. This performance award was determined based on our achievement of 92% of our 2010 corporate goals. Taken together, the 2010 base salary and annual cash performance award paid to Mr. Bonney were at about the 35th percentile as compared to the most recent information available for our peer group and survey data used by the Compensation Committee.

Annual cash bonus awards—other Named Executive Officers: The annual cash bonus awards for our Named Executive Officers were calculated using the formula set forth in the 2010 STIP and as described below. Details of the 2010 annual cash performance awards for these Named Executive Officers can be found in the Summary Compensation Table in this Proxy Statement. Taken together, the 2010 base salary and annual cash performance awards paid to these Named Executive Officers were at about the 50th percentile as compared to the most recent information available for our peer group and survey data used by the Compensation Committee.

Annual cash bonus awards—plan description: We provide for annual cash performance awards under the STIP. The key features of the plan, which is filed with the SEC, are as follows:

- •

- Set the target awards, expressed as a percentage of base salary and weighting of goals as between corporate and individual goals for our Executive Officers, as follows:

| | |

Executive Level | | 2010 Target Percentage

(as a percent

of base salary) |

|---|

Chief Executive Officer | | 100% |

Chief Operating Officer; Chief Financial Officer; EVP, R&D/Chief Scientific Officer | | 60% |

Other Executive Officers | | 50% |

| | | | |

Executive Level | | Portion of Award

Tied to Corporate

Results | | Portion of Award

Tied to Individual

Results |

|---|

Chief Executive Officer | | 100% | | 0% |

Chief Operating Officer, Chief Financial Officer, EVP, R&D | | 80% | | 20% |

Other Executive Officers | | 65% | | 35% |

- •

- Required us to achieve at least 70% of our corporate goals and 90% of our annual U.S. CUBICIN revenue goal for any annual performance awards to be paid. We believe that achievement of this minimum level of performance is necessary to justify the payment of any performance award, and that this minimum performance threshold is reasonable and consistent with industry practices.

- •

- Provided that the maximum annual cash bonus awards that can be paid were 200% of the target award.

To align better with our peer company practices, we increased the target percentages under the STIP from 2009 to 2010 from 80% to 100% for Mr. Bonney, from 50% to 60% for Mr. Perez, our Executive Vice President, Chief Operating Officer, Mr. McGirr, our Senior Vice President, Chief Financial Officer, and Dr. Gilman, our Executive Vice President, Research & Development and Chief Scientific Officer, after his promotion to this position in September 2010, and from 40% to 50% for our other Executive Officers.

Annual cash bonus awards—goals/achievement against goals: The Board, based upon the recommendation of the Compensation Committee and after discussion with the Compensation

16

Table of Contents

Committee and Mr. Bonney, approved the proposed 2010 corporate goals. The corporate and individual goals described below were set with a reasonable level of difficulty that could be met if our Executive Officers and the company as a whole performed at the high level that we expect but with the likelihood of attaining these goals not assured. Our historical level of achievement against corporate goals: 92% in 2010 (as detailed in the table below), 95% in 2009, 136% in 2008, and 96% in 2007.

For 2010, our corporate goals and our achievement against such goals were as follows:

| | | | |

Corporate Goal | | Weighting | | Actual Credit Received for

Achievement/Basis for

Achievement |

|---|

Revenue Secure and Grow Revenue | | 30% | | 30.1% |

• Net U.S. CUBICIN revenue of $604 million | | 25% | | Partially met goal (24.8%) |

• International CUBICIN revenue of $24 million | | | | ü Exceeded goal |

• Secure and qualify—2nd CUBICIN API supplier | | These four goals = aggregate of 5% | | Partially met goal |

• Complete ACS capacity expansion by 9/1/10 | | | | Partially met goal |

• Deliver MERREM I.V. or other revenue of $7 million | | | | ü Exceeded goal (total for all four = 5.3%) |

Pipeline Goals | | 40% | | 39.2% |

• Complete CONSERV-1 and -2 data (for ecallantide) analysis and define path forward by 6/1/10 | | 5% | | ü Met goal (5%) |

• Lipo CDAD (CB-183,315)—make go/no go decision on Phase 2 trial; if go, achieve 50% enrollment in Phase 2 by year-end (if no go, stop all spend within 1 quarter) | | 5% | | ü Exceeded goal (6.2%) |

• Tallymicin (CB-182,804)—make go/no go decision in Q1; if go, complete 20% enrollment in Phase 2 in complicated urinary tract infections (cUTI) (if no go, stop all spend within 1 quarter) | | 5% | | ü Met goal (5%) |

• At least 2 discovery programs in lead optimization by end of Q2 | | 5% | | ü Met goal (5%) |

• Acquire one additional late stage product (Phase 2 or later data) that fits strategy | | 5% | | Goal not achieved (0%) |

17

Table of Contents

| | | | |

Corporate Goal | | Weighting | | Actual Credit Received for

Achievement/Basis for

Achievement |

|---|

• Integrate Calixa by 3/31/10 and finalize development plans by 2/28/10. Execute development consistent with the plans | | 15% | | ü Exceeded goal (18%) |

Financial Goals: Increase operating income 20% over 2009 | | 10% | | ü Exceeded goal = 11.5% |

Business Development Goals: Acquire and launch a new, to Cubist, revenue generating product with three years of predicted revenues (minimum operating income to Cubist of $20 million/year) | | 10% | | Goal not achieved = 0% |

Capability Enhancement—Build Leadership Capabilities | | 10% | | ü Exceeded goal = 11% |

• Integrate leadership competency framework into the recruitment and selection of all people managers by 10/1/10 | | | | ü Exceeded goal |

• Integrate leadership competency framework into the development process and require all people managers to develop an individual development plan by year-end | | | | ü Exceeded goal |

• Execute on workforce plan by developing resource plans and strategies to close competency gaps | | | | ü Exceeded goal |

Kicker: Deliver upper end of net U.S. CUBICIN revenue guidance on top of at least 80% of the Pipeline Goals, Financial Goals, Business Development Goals and Capability Enhancement Goals | | Multiplier of 1.20 | | Goal not achieved = 0% |

Total | | | | 92% |

18

Table of Contents

Mr. Bonney's annual cash performance award is determined primarily by reference to our achievement against corporate goals. Our other Executive Officers have individual goals and, as noted above, their level of achievement against such goals factors into their annual cash performance award. The individual goals for these Executive Officers are determined by Mr. Bonney, and, in the case of their direct reports, Dr. Gilman and Mr. Perez, in consultation with each Executive Officer, and are designed to focus them on individual behaviors that support our overall performance and success. These goals generally consist of both objective and subjective goals that are relevant to the Executive Officer's responsibilities. The following is a summary of the 2010 individual goals of our Named Executive Officers (other than Mr. Bonney):

| | |

Executive Officer | | Summary of 2010 Individual Goals |

|---|

| Robert Perez | | • Achieve total net revenue of $635 million, including $604 million of net U.S. CUBICIN revenues, $7 million of service (or other) revenues, $24 million of international revenues and $2 million of non-product revenues |

| | • Provide adequate clinical supply for Phase 2 programs |

| | • Continue strategy to enhance security of CUBICIN supply and decrease costs of goods sold |

| | • Meet or exceed business development targets |

| | • Implement management development programs for all people managers |

David McGirr | | • Drive leadership competency model through his team; complete workforce planning and leadership development; organizational planning |

| | • Ensure our compliance with financial reporting requirements and increase capabilities |

| | • Manage expansion of the lab facility at 65 Hayden Avenue |

| | • Develop corporate communications team and a variety of related goals |

Steven Gilman | | • Enhance pipeline through support of clinical development activities and building discovery pipeline |

| | • Support business development activities |

| | • Execute workforce plan |

| | • Execute business executive responsibilities, including providing scientific and strategic leadership to the organization |

19

Table of Contents

| | |

Executive Officer | | Summary of 2010 Individual Goals |

|---|

Santosh Vetticaden | | • Support CUBICIN by providing leadership to the clinical development and medical affairs organization on CUBICIN projects |

| | • Enhance pipeline by providing leadership to clinical development programs and keeping them on track |

| | • Provide clinical development leadership on collaborations |

| | • Provide clinical development leadership on business development activities |

| | • Implement workforce plan and build leadership capabilities |

Each Executive Officer's (other than Mr. Bonney's) level of achievement against his or her individual goals is initially evaluated by Mr. Bonney and, in the case of their direct reports, Mr. Perez and Dr. Gilman. Dr. Gilman's and Mr. Perez's direct reports' level of achievement against individual goals also is reviewed by Mr. Bonney. Mr. Bonney then recommends a final level of achievement against individual goals of each Executive Officer to the Compensation Committee, which then can approve or adjust the proposed levels of achievement up or down. In 2010, the Compensation Committee approved the performance against individual goals of our Named Executive Officers (other than Mr. Bonney), as follows:

| | |

Executive Officer | | Summary of Achievement Against 2010 Individual Goals |

|---|

| Robert Perez | | • 95% achievement against individual goals primarily due to total net revenues meeting goals, leadership of the Technical Operations function and meeting supply-related goals, management of business development efforts, the level of achievement against his other goals and his overall leadership. |

David McGirr | | • 105% achievement against individual goals primarily due to achieving workforce, leadership and organizational goals, managing the expansion of 65 Hayden Avenue, the level of achievement against his other goals, and his overall leadership. |

Steven Gilman | | • 112% achievement against individual goals primarily due to achieving the enhanced pipeline, business development and workforce planning goals, the expansion of his responsibilities resulting from his September 2010 promotion to Executive Vice President, Research and Development and Chief Scientific Officer, the level of achievement against his other goals and his overall leadership. |

Santosh Vetticaden | | • 115% achievement against individual goals primarily due to achieving clinical development, business development and workforce planning goals, the expansion of his responsibilities resulting from the expansion of his role in September 2010 to Senior Vice President, Chief Medical and Development Officer, the level of achievement against his other goals and his overall leadership. |

20

Table of Contents

Long-term incentive awards—Chief Executive Officer: The Board's determination to grant Mr. Bonney 135,000 stock options and 25,000 RSUs in May 2010 was made after careful consideration of the benchmarking against peer group and survey data compiled by PM&P of executive compensation more broadly across our industry and other evaluation criteria described above, with significant emphasis placed on Mr. Bonney's overall contributions to our 2009 performance and Mr. Bonney's potential future contributions to our performance. The determination also took into account our available annual budget for long-term incentive awards. The 2010 long-term incentive awards to Mr. Bonney put his 2010 long-term incentive compensation at about the 45th percentile compared to the peer group and survey data used by the Compensation Committee.

Long-term incentive awards—other Named Executive Officers: The Compensation Committee's determinations to grant our Named Executive Officers (other than Mr. Bonney) stock options and RSUs during our annual performance cycle were made after careful consideration of the benchmarking against our peer group and broader market data and other evaluation criteria described above, with significant emphasis placed on retention considerations and each Named Executive Officer's potential future contributions to our performance. These determinations also took into account our available annual budget for long-term incentive awards. Details of the long-term incentive awards made to the Named Executive Officers in 2010 can be found in the Summary Compensation Table and Grants of Plan-Based Awards in 2010 Table in this Proxy Statement. All stock options and RSUs listed in the Summary Compensation Table for 2010 were awarded in May 2010 during our annual performance cycle except for a 50,000 stock option award to Dr. Gilman in October 2010 in connection with his promotion to Executive Vice President, Research & Development and Chief Scientific Officer, in September 2010, and a 40,000 stock option award to Dr. Vetticaden in October 2010 in connection with the expansion of his role to Senior Vice President, Chief Medical and Development Officer, in September 2010. The performance awards made as part of the annual performance cycle put the 2010 long-term incentive compensation paid to these Named Executive Officers at about the 55th percentile compared to the peer group and survey data used by the Compensation Committee. The size of Dr. Gilman's and Dr. Vetticaden's awards in October 2010 were determined based on market practices for grants made in connection with similar promotions and expansions of roles.

Retention Letters

As noted above, all of our Executive Officers have retention letters. The terms of the retention letters and the value of the payments to be received under the retention letters under various termination scenarios can be found in the section of this Proxy Statement entitled "Termination of Employment and Change-in-Control Agreements." The objectives of these retention letters are described in the Executive Summary section of this CD&A. To ensure that these agreements remain reasonable and competitive, the Compensation Committee periodically reviews competitive data provided by PM&P, as well as potential costs to the company of the retention letters under various potential termination scenarios. The retention letters of several of our Executive Officers, including our Chief Executive Officer, expired in October 2010. As a result, during 2010, the Compensation Committee, with the assistance of PM&P, reviewed the terms of the retention letters against competitive data, other relevant metrics and Executive Officer data, including walk-away values, wealth accumulation and similar data that shows the levels of compensation that an Executive Officer would receive under various termination scenarios. After this review, the Compensation Committee and the Board determined to enter into new retention letters with our Executive Officers with substantially similar terms as those that expired in October 2010.

21

Table of Contents

Perquisites and Personal Benefits

As noted above, our Executive Officers are eligible to participate in the benefit programs that we provide to all employees at the same level as all other employees (for example, medical, dental, 401(k) plan, life and disability insurance, employee stock purchase plan). In addition, we provide our Executive Officers with a supplemental long-term disability policy so that the long-term disability benefit for our Executive Officers is comparable, in terms of the portion of the salary that would be paid to our Executive Officers in the event of a long-term disability, to that of our other employees. The amounts of these additional premiums for Executive Officers who need the supplemental long-term disability policy to have a comparable benefit to that of our other employees range from approximately $1,000 to approximately $4,000 annually and totaled less than $19,000 in 2010 for all of our Executive Officers. As necessary, we also provide relocation assistance to newly hired Executive Officers and other key employees as part of their compensation packages. We believe that providing such relocation assistance is consistent with industry and peer group practices and enables us to better compete for key talent. The last Executive Officer to receive such relocation assistance was Dr. Vetticaden in connection with his hiring in December 2008.

Stock Ownership and Trading Guidelines

As noted above, Executive Officers are subject to the stock ownership guidelines as described in the table below. The guidelines are designed to align the interests of our Executive Officers with those of our stockholders by ensuring that our Executive Officers have a meaningful financial stake in our success. The amount of stock, which includes vested in-the-money stock options, required to be held to satisfy ownership requirements was established by the Board of Directors upon recommendation of the Compensation Committee, which, in making its recommendation, reviewed market practices of peer companies and determined the level of ownership that would best align executives and stockholders.

| | | | |

Group/Name | | Ownership Requirement

(Market Value of Stock Held) | | Time to Meet Requirement |

|---|

Mr. Bonney | | 4x Base Salary | | By January 1, 2012 |

Other Executive Officers | | 1.5x Base Salary | | By the later of (a) January 1, 2012 and (b) 6 years of becoming an Executive Officer |

As of January 1, 2011, Mr. Bonney and our other Executive Officers who are required to meet the ownership requirement by January 1, 2012 had achieved the ownership requirement. Our other Executive Officers are making significant progress towards meeting the ownership requirements. The guidelines require that any Executive Officer who has passed the date on which he or she is required to meet the ownership requirement and does not meet the requirement may only sell vested in-the-money stock options and vested RSUs, provided that he or she retains shares of common stock with a market value of at least 50% of the net proceeds received as a result of such sale.

As part of our Policy on Insider Trading and Confidentiality, all of our employees, including our Executive Officers, Directors and consultants are prohibited from engaging in speculative transactions in our stock, including short sales, puts/calls, hedging transactions and margin accounts or pledges.

Recoupment Policy