Serious infections.

[GRAPHIC]

[LOGO]

Serious Business.

Statements made during this presentation that are not historical fact may be forward-looking statements that are subject to a variety of risks and uncertainties. There are a number of important factors that could cause actual results to differ materially from those projected or suggested in any forward-looking statements made by the Company. These and other factors are contained in the Company’s filings with the Securities and Exchange Commission.

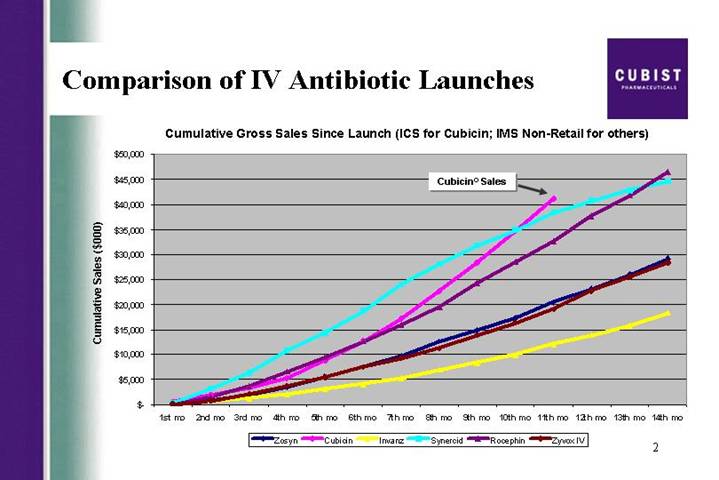

Comparison of IV Antibiotic Launches | [LOGO] |

Cumulative Gross Sales Since Launch (ICS for Cubicin; IMS Non-Retail for others)

[CHART]

2

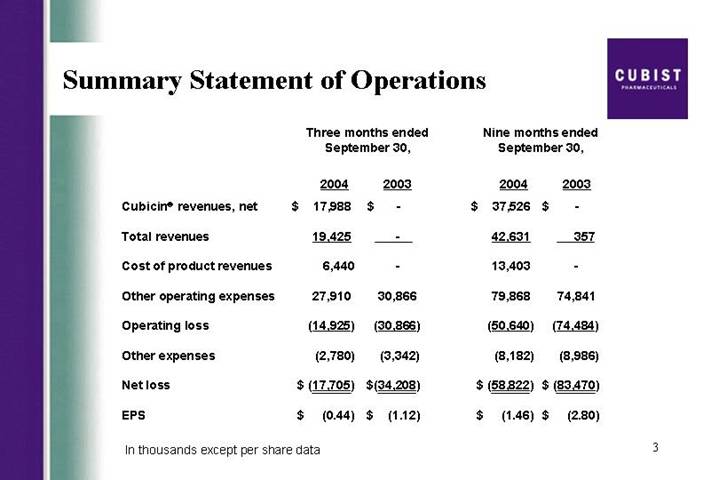

Summary Statement of Operations

| | Three months ended

September 30, | | Nine months ended

September 30, | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Cubicin® revenues, net | | $ | 17,988 | | $ | — | | $ | 37,526 | | $ | — | |

| | | | | | | | | |

Total revenues | | 19,425 | | — | | 42,631 | | 357 | |

| | | | | | | | | |

Cost of product revenues | | 6,440 | | — | | 13,403 | | — | |

| | | | | | | | | |

Other operating expenses | | 27,910 | | 30,866 | | 79,868 | | 74,841 | |

| | | | | | | | | |

Operating loss | | (14,925 | ) | (30,866 | ) | (50,640 | ) | (74,484 | ) |

| | | | | | | | | |

Other expenses | | (2,780 | ) | (3,342 | ) | (8,182 | ) | (8,986 | ) |

| | | | | | | | | |

Net loss | | $ | (17,705 | ) | $ | (34,208 | ) | $ | (58,822 | ) | $ | (83,470 | ) |

| | | | | | | | | |

EPS | | $ | (0.44 | ) | $ | (1.12 | ) | $ | (1.46 | ) | $ | (2.80 | ) |

In thousands except per share data

3

OUR PASSION IS INFECTIONS | | [LOGO] |

| | |

So is yours. Welcome to IDSA 2004. | | Serious Infections |

| | Serious Business |

4

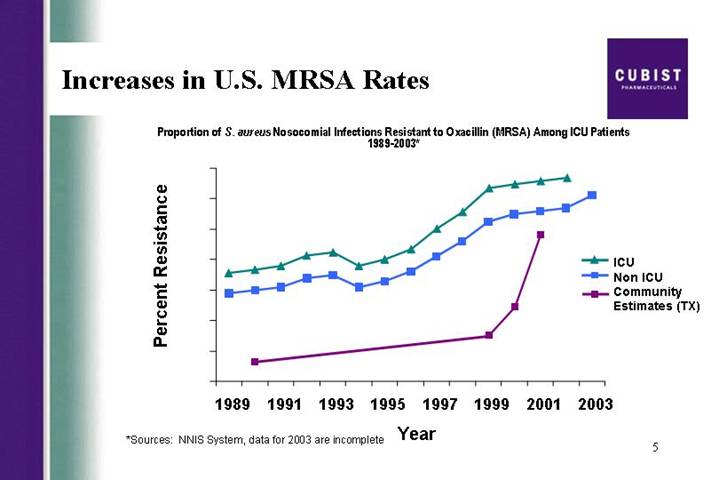

Increases in U.S. MRSA Rates

Proportion of S. aureus Nosocomial Infections Resistant to Oxacillin (MRSA) Among ICU Patients 1989-2003*

[CHART]

*Sources: NNIS System, data for 2003 are incomplete

5

DMC Reports

• September 2003 – “continue study”

• March 2004 – “continue study”

• July 2004 (over 100 patients) – “continue study”

• October 2004 (over 135 patients) – “continue study”

6

Pipeline

Strategic Focus

[CHART]

7

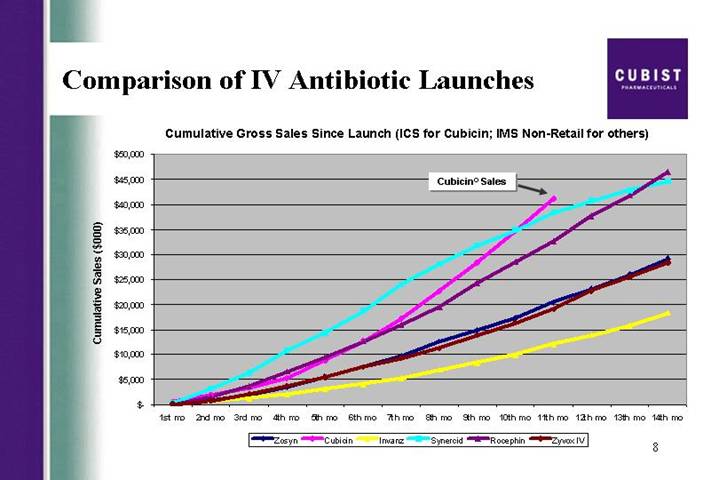

Comparison of IV Antibiotic Launches

Cumulative Gross Sales Since Launch (ICS for Cubicin; IMS Non-Retail for others)

[CHART]

8

Summary Statement of Operations

| | Three months ended

September 30, | | Nine months ended

September 30, | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Cubicin® revenues, net | | $ | 17,988 | | $ | — | | $ | 37,526 | | $ | — | |

| | | | | | | | | |

Total revenues | | 19,425 | | — | | 42,631 | | 357 | |

| | | | | | | | | |

Cost of product revenues | | 6,440 | | — | | 13,403 | | — | |

| | | | | | | | | |

Other operating expenses | | 27,910 | | 30,866 | | 79,868 | | 74,841 | |

| | | | | | | | | |

Operating loss | | (14,925 | ) | (30,866 | ) | (50,640 | ) | (74,484 | ) |

| | | | | | | | | |

Other expenses | | (2,780 | ) | (3,342 | ) | (8,182 | ) | (8,986 | ) |

�� | | | | | | | | | |

Net loss | | $ | (17,705 | ) | $ | (34,208 | ) | $ | (58,822 | ) | $ | (83,470 | ) |

| | | | | | | | | |

EPS | | $ | (0.44 | ) | $ | (1.12 | ) | $ | (1.46 | ) | $ | (2.80 | ) |

In thousands except per share data

9

Cubicin® Customers

Cumulative Number of Unique Customers

[CHART]

10

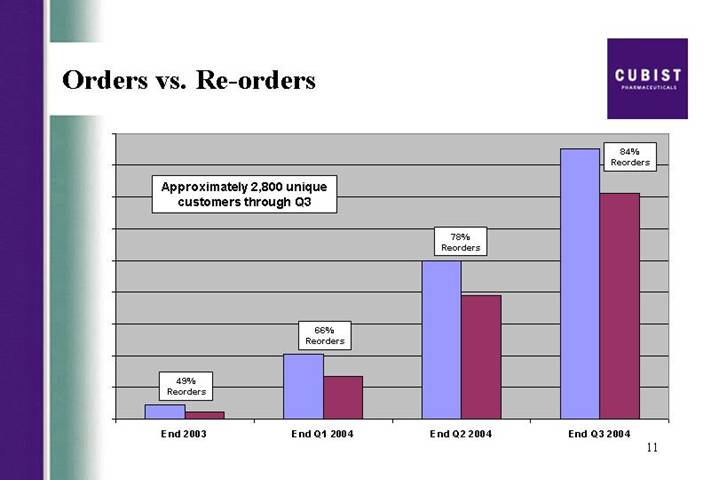

Orders vs. Re-orders

[CHART]

11

Cubicin® New vs. Repeat Accounts

[CHART]

12

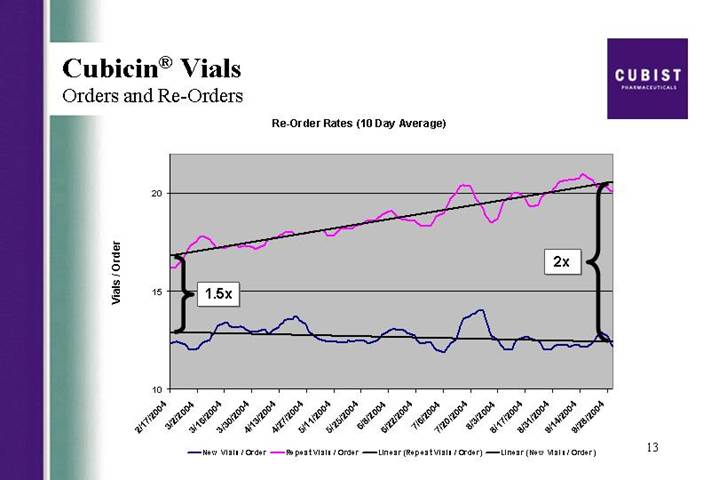

Cubicin® Vials

Orders and Re-Orders

Re-Order Rates (10 Day Average)

[CHART]

13

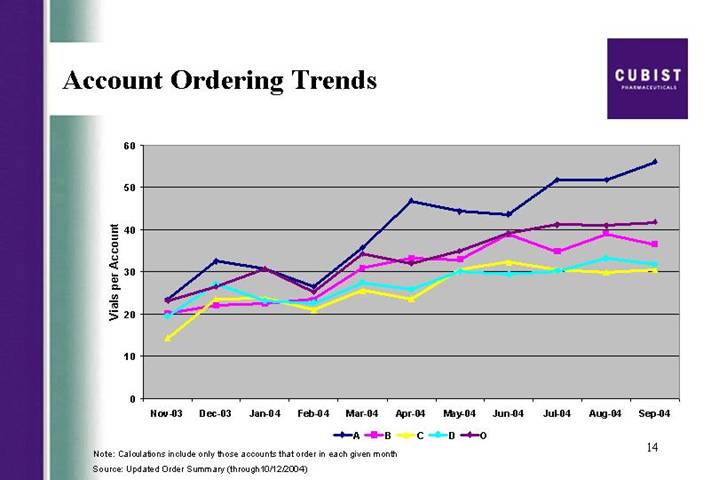

Account Ordering Trends

[CHART]

Note: Calculations include only those accounts that order in each given month

Source: Updated Order Summary (through10/12/2004)

14

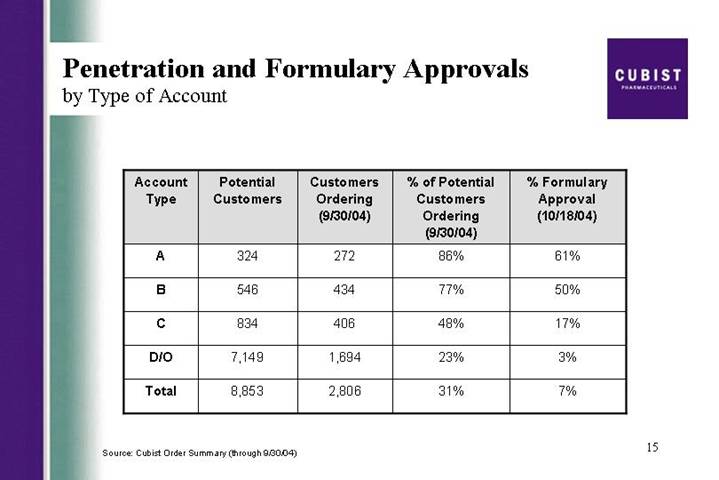

Penetration and Formulary Approvals

by Type of Account

Account Type | | Potential

Customers | | Customers

Ordering

(9/30/04) | | % of Potential

Customers

Ordering

(9/30/04) | | % Formulary

Approval

(10/18/04) | |

A | | 324 | | 272 | | 86 | % | 61 | % |

B | | 546 | | 434 | | 77 | % | 50 | % |

C | | 834 | | 406 | | 48 | % | 17 | % |

D/O | | 7,149 | | 1,694 | | 23 | % | 3 | % |

Total | | 8,853 | | 2,806 | | 31 | % | 7 | % |

Source: Cubist Order Summary (through 9/30/04)

15

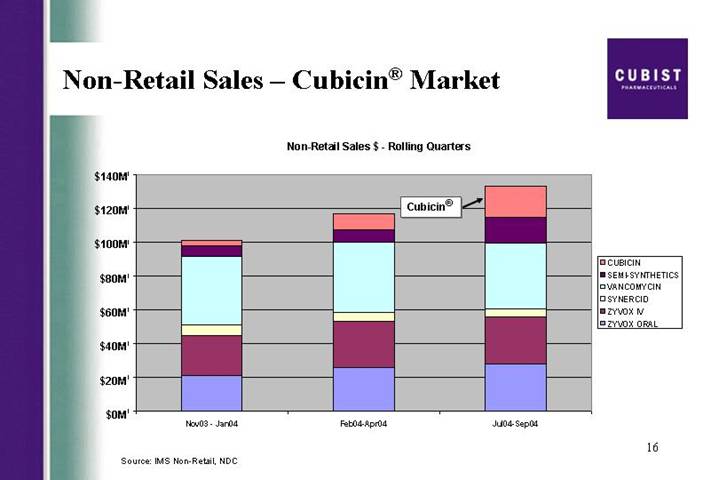

Non-Retail Sales – Cubicin® Market

Non-Retail Sales $ - Rolling Quarters

[CHART]

Source: IMS Non-Retail, NDC

16

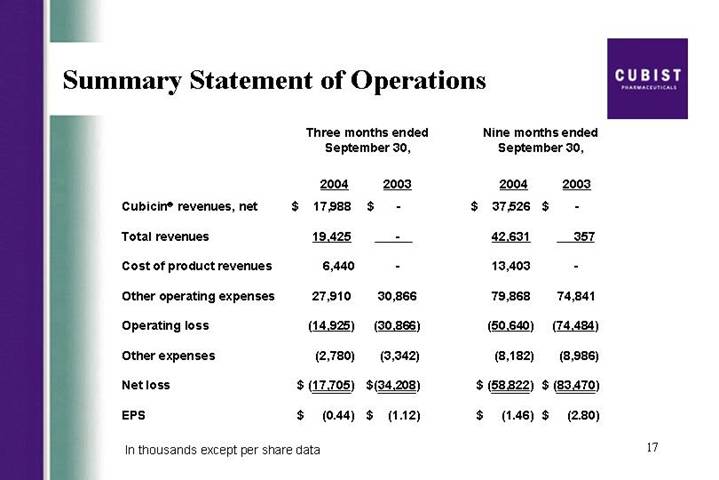

Summary Statement of Operations

| | Three months ended

September 30, | | Nine months ended

September 30, | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Cubicin® revenues, net | | $ | 17,988 | | $ | — | | $ | 37,526 | | $ | — | |

| | | | | | | | | |

Total revenues | | 19,425 | | — | | 42,631 | | 357 | |

| | | | | | | | | |

Cost of product revenues | | 6,440 | | — | | 13,403 | | — | |

| | | | | | | | | |

Other operating expenses | | 27,910 | | 30,866 | | 79,868 | | 74,841 | |

| | | | | | | | | |

Operating loss | | (14,925 | ) | (30,866 | ) | (50,640 | ) | (74,484 | ) |

| | | | | | | | | |

Other expenses | | (2,780 | ) | (3,342 | ) | (8,182 | ) | (8,986 | ) |

| | | | | | | | | |

Net loss | | $ | (17,705 | ) | $ | (34,208 | ) | $ | (58,822 | ) | $ | (83,470 | ) |

| | | | | | | | | |

EPS | | $ | (0.44 | ) | $ | (1.12 | ) | $ | (1.46 | ) | $ | (2.80 | ) |

In thousands except per share data

17

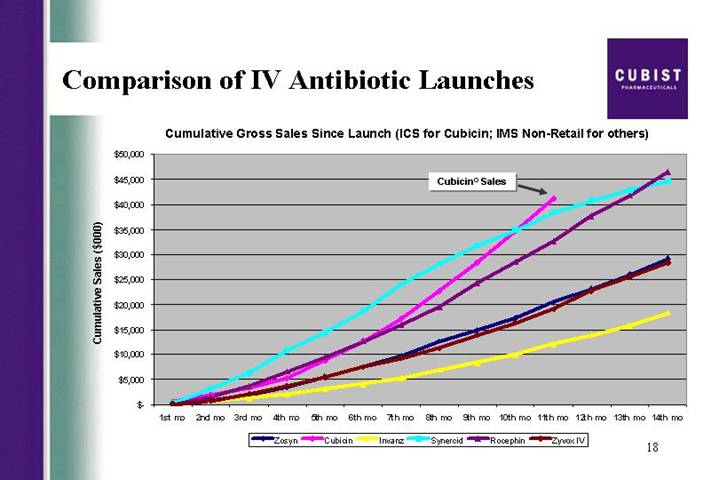

Comparison of IV Antibiotic Launches

Cumulative Gross Sales Since Launch (ICS for Cubicin; IMS Non-Retail for others)

[CHART]

18

Cubist Pharmaceuticals Conference Call Transcript

CBST - Q3 2004 Cubist Pharmaceuticals, Inc. Earnings Conference Call

Event Date/Time: Oct. 27. 2004 / 10:30AM ET

CORPORATE PARTICIPANTS

Michael W. Bonney

Cubist Pharmaceuticals, Inc. - President, CEO

David W.J. McGirr

Cubist Pharmaceuticals, Inc. - SVP and CFO

CONFERENCE CALL PARTICIPANTS

Vanik Blatko (ph)

Harris Nesbitt - - Analyst

Eun Yang

Wells Fargo Securities - Analyst

Jason Kantor

W.R. Hambrecht - - Analyst

Greg Wade

Pacific Growth Equities - Analyst

Joel Sendek

Lazard & Co., Ltd - Analyst

Michael Wood

Welsh Capital - Analyst

Steve Harr

Morgan Stanley - - Analyst

Dallas Webb

Stanford Group Company - Analyst

Matt Duffy

Black Diamond Research - Analyst

David Webber

First Albany - Analyst

Adam Cutler

JMP Securities - - Analyst

Jeff Reich

Merlin BioMed - Analyst

PRESENTATION

Operator

Good day, ladies and gentlemen and welcome to the Cubist Pharmaceuticals Inc. third quarter earnings conference call. At this time, all participants have been placed on a listen-only mode and the floor will be open for your questions following today’s presentation. I would now like to turn the floor over to your host, Mr. Michael Bonney, President and Chief Executive Officer of Cubist. Sir, the floor is yours.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thank you, Jackie. Good morning, and thank you for joining us today to discuss our results for the third quarter of 2004. Joining me at this end are David McGirr, our CFO, and Chris Guiffre, our General Counsel.

Before we begin, I will read a short Safe Harbor statement. Forward-looking statements may be made during the call. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those projected or suggested here. Such risks and uncertainties are detailed in the Company’s periodic filings with the Securities and Exchange Commission. We would also like to add that due to significant interests in the launch of Cubicinâ, we will again be discussing trends on this call but disclaim any duty to provide any updates on the specific data points mentioned here today. As in recent quarters, the slides we are using during this call are available via the front page of our website at WWW.CUBIST.COM. So let’s go ahead and get started.

First slide, please. The CUBICIN launch continues on a trajectory that is precedent-setting in U.S. IV antibiotic launch history. I’m proud to show you that at 11 months in, our gross revenue has reached a level not previously achieved with the launch of other IV antibiotics. As detailed in our release this morning, we recorded strong CUBICIN net revenues of $18 million for the third quarter of 2004, sales that were higher than consensus estimates at the end of Q3. As a result, we have decided to raise our 2004 net revenue guidance on CUBICIN for the final time this year, from the previous range of 45 to $55 million, to a new range of 55 to $60 million. I would also like to draw your attention to the bottom line news here. As reflected in our earnings per share number, of a loss of ($.44), versus a consensus estimate for EPS of a loss of ($.51) per share, we are doing a great job of managing our costs.

While David will go through the actual numbers later in this call, I will now provide a bit more perspective on CUBICIN’s success. I will also comment briefly on our pipeline building activities and along the way I will address some frequently asked questions.

With CUBICIN net sales of $18 million in the third quarter, and $37.5 million in the first 3 quarters of this year, we continue to take great pride in the launch of the drug. CUBICIN’s success to date is a story of terrific breadth and improving depth and you will see this when David shows you the number of institutions ordering and the vials per month by account. As anticipated, we did - - we did see some flattening in the rate of growth during the summer months consistent with our expectations for a seasonal drop-off expressed in our Q2 call. Even so, our third quarter revenue growth indicates strong demand for CUBICIN which is not surprising to anyone who understands the seriousness of the MRSA problem.

Our confidence in the significant and growing opportunity for CUBICIN was supported by themes running throughout the recent annual meeting of the Infectious Disease Society of America, or IDSA. A number of sessions were devoted to questions about confidence in Vancomycin efficacy. Also of concern to meeting attendees was community-acquired MRSA as a rapidly emerging threat to a different and new patient population than is threatened by hospital MRSA. These themes suggest to us that peak year sales for CUBICIN of as much as $500 million in the U.S. would not be out of the realm of possibility. We are making the right investment decisions today to address this growing need and market opportunity.

I’m pleased to announce that based on the continued positive momentum we’ve seen in the CUBICIN launch and the size of the market opportunity, we’ve decided to increase our sales force by 24 people in the first quarter of next year. This will allow us to expand our call universe from 900 hospitals to about 1300 and allow us to build solid relationships with the hospitals that represent roughly 80% of the use of Gram-positive IV antibiotics, up from about 66% that we call on today. This should put us into a stronger position to capitalize on results from the bacteremia endocarditis study should it be positive. We believe that making this investment early in the year will generate a positive return for shareholders during 2005. We continue to enroll patients in our Phase 3 Staph endocarditis/bacteremia trial and are working diligently to complete this study. As announced yesterday we have completed the fourth planned safety review and the DMC has recommended continuation of the trial. We expect to report results from this trial in mid 2005.

As referenced in previous calls, Cubist and Chiron are on track to file the MAA for CUBICIN by year-end. The MAA is the Marketing Authorization Application, the European community equivalent of the FDA’s new drug application, or NDA. We anticipate approval and launch in Europe early in 2006. In anticipation of continued growth in orders for CUBICIN we continue to expand our manufacturing capability. I am pleased to announce that we have filed a supplemental new drug application, or SNDA, for the second bulk product manufacturing facility, ACS Dobfar for additional production of CUBICIN. The pre-approval inspection, or PAI, of this facility has already been completed. We remain on track to have this facility and a second fill/finish provider approved by the end of Q1 ‘05. I’m also pleased to report that the Cubist fermentation pilot plant in Lexington is now up and running having been relocated from the U.K. This pilot facility allows us to fine tune various aspects of the manufacturing process.

Turning to the pipeline, our initiatives here all fit within our strategic footprint, serious and life-threatening infections treated in acute care facilities. As I mentioned in the call last quarter, we took the step to consolidate our discovery programs in early ‘03, with a focus on those most likely to generate IND candidates in the near term. We are pleased with how we’re tracking versus the benchmarks we’ve set to measure our progress. I will first comment on our work in natural product screening.

Our people have achieved a quantum leap versus what had been possible historically in screening individual spores from soil bacteria. We have also determined that our soil collection contains a significant number of previously unidentified soil bacteria. We have identified hits from unique organisms with very interesting anti-bacterial activity. The new fermentation pilot facility here in Lexington enables us to more quickly scale these hits from our screening program for a complete early analysis. The next steps are to determine structure and then attack the structure activity relationship through molecular genetics and medicinal chemistry. The other focus area for our discovery group is to expand the lipopeptide class, the same class as Daptomycin. Here we are looking for another lipopeptide that compliments CUBICIN and we are continuing to improve the activity of the new lipopeptides by using a combination of medicinal chemistry and molecular genetics. We are already seeing improvements in discovery productivity from the consolidation of our U.K. resources earlier this year.

Turning to in-licensing. As you know, we in-licensed HepeX-Bä in June and we continue to expect completion of the second Phase 2 study currently under way in mid 2005. We are committed to managing development and commercialization of this antibody product, a potential $100 million worldwide revenue opportunity prudently. We recognize the need to manage our cash flow carefully over the coming months as we balance the investment in CUBICIN and pipeline building activities with improvements in our net loss. Our primary focus over the next few quarters is building on the first year of success of CUBICIN, completing the endocarditis/bacteremia trial as quickly as possible, and continuing to refine our life cycle management plan to achieve the maximum revenue and profit potential from CUBICIN.

And now David will take you through the numbers before I return for some concluding comments. David?

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

Thanks, Mike. As you saw from the press release, we generated $18 million in net CUBICIN revenues in the third quarter of 2004. This is up from $13.3 million in the second quarter of this year, an increase of 35%, third quarter over second quarter. As Mike mentioned earlier, based on the results from the first 3 quarters of 2004, we are raising our full year CUBICIN net sales guidance to a range of 55 to $60 million. Our expenses are managed tightly and our operating loss and net loss show improvements over the prior periods. The net loss for Q3 of $17.7 million is lower than consensus loss for the quarter. Also, on another positive note, we ended Q3 with $63.2 million of cash and equivalents. I will talk about specifics of expenses shortly.

On the next few slides we want to give you an added dimension to the demand numbers and how that is driving the growth in revenues. Our demand comes from the number of hospitals and outpatient centers ordering the drug. This is the measure of breadth that Mike referred to earlier. This slide shows that we have grown the cumulative number of customers to almost 2800 by the end of Q3, which is up 26% from the end of Q2. As we have previously noted, revenues are up by 35%. So in the next 3 slides, we will explain the ordering trends behind this positive effect.

The first of these slides shows that the reorder rate has climbed from 78% at the end of Q2 to 84% at the end of Q3. As long as we continue to add new customers, as we will show in the following slide, our reorders clearly cannot represent 100% of all orders. Our next slide will be familiar to our regular webcast participants. The graph line nearest the X axis tracks the number of new customers we gain on a daily basis. We are very pleased to still be adding around 10 new customers a day, or 50 a week. This builds the breadth. The repeat customers continue to grow. And we are now seeing between 100 and 110 repeat customers a day, which is up from around 95 customers a day at the end of Q2.

And now we want to show you a new demand metric. This shows - - this slide shows the average number of vials ordered by new and repeat customers. This is a measure of the depth of penetration. As is clearly illustrated on this slide, our repeat customers who, as we have just shown, are growing in numbers, are also increasing the average number of vials in an order. At the beginning of our launch, we saw about a 1.5 times multiplier between new orders and reorders. Now, we’re seeing about a 2 times multiplier. When you couple this effect with the growing number of institutions in our active customer base and the increasing reorder rates, you can understand why our revenues grew 35% quarter over quarter.

The next slide is also new information. We are, as you seasoned webcast listeners will appreciate, being very transparent with our demand data. This slide of account ordering trends shows that on average an A account ordered 55 vials in September, and that we’ve seen a steady upward trend in that number. The same information is also shown for the B, C, D and outpatient accounts. Now to think about this in a different way, if the average reorder is 20 vials, and an A account orders 55 vials a month, this suggests that they placed 2.75 orders a month or not quite once a week. This velocity of ordering, as the economists might put it, supports our view that orders are for use by hospitals, not for inventory.

We will now look in the next slide at the penetration and formulary approvals. As of the end of September, 86% of our A accounts and 77% of our B accounts had ordered vials of CUBICIN, again a good measure of breadth. We continue to make good progress in formulary approval, even after the summer months when fewer formularies meet. Formulary approvals as of October 18 are at 61% for the A accounts, and 50% for the B accounts. This is up by over 10% Q3 over Q2 for the A accounts. The next slide gives you a view of our growing market share. Using third party sales tracking to allow us to take a competitive snapshot, you can see that our gains in sales come both from overall market growth and from an increasing share of the market. In each of the bars in this graph, CUBICIN is the top - - is the block at the top.

Now, let’s return to the quarterly financial results. As set out in the press release, we continue to direct our expenses towards the items that are supporting the successful launch of CUBICIN. Cost of goods sold, sales and marketing, and completing the Phase 3 study of endocarditis/bacteremia. Our cost of goods sold were up by 1.6% Q3 over Q2. This is attributable to a 1-time event in manufacturing. And, as mentioned earlier, our overall operating costs are lower than many of you might have expected. We have reduced our projected expenses for the full year, excluding COGS. With our closer proximity to year end we have a much better estimate of full-year expenses which we now expect to come in at around $113 million, which is $7 million lower than the figure we discussed on our last call. The break-down is expected to be $59 million in R&D, down from $63 million; $36 million in sales and marketing, down from $38 million; and $18 million in G&A, down from $19 million. We will continue to focus on the successful launch of CUBICIN and we will continue to exercise financial discipline.

Now, to a brief discussion of cash usage. We have improved this figure since we spoke with you after the Q2. Our expectations now are for a total 2004 net cash burn of less than $105 million. Which is 11 million less than the high end of the range we previously discussed. We continue to take an opportunistic approach to raising new funds and would likely return to the capital markets when conditions are favorable for us to do so.

With that, I will turn it back to Mike to conclude and then we will open up for questions. Mike?

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thanks, David. We continue to believe that the very positive, perhaps historic CUBICIN launch is a result of a few factors. First, the high reorder rates we have seen, and the increasing size of these orders reflects physician acceptance of the product, and

positive outcomes achieved for their patients. CUBICIN has now been used to treat an estimated 34,000 seriously ill patients. Second, we continue to receive positive feedback from physicians on how quickly CUBICIN is working. We believe this is a result of CUBICIN’s rapidly-bactericidal nature. Third, CUBICIN’s ease of use as a result of its safety profile, its once daily dosing and 30-minute infusion time appears to be driving high usage rates, particularly in the outpatient care setting. Fourth, this is a market that is expanding rapidly due to the challenging MRSA trends. We also anticipate continued growth in CUBICIN’s share of market due to the questions being raised about Vancomycin efficacy.

In the next few months we look forward to reporting continued success of CUBICIN, to our European filing, the publication of additional data about CUBICIN, and to continued achievement of milestones by our discovery scientists. In 2005, we eagerly await completion of our Phase 3 endocarditis/bacteremia trial. And every day we apply discipline to our cost base to enable us to scale the organization efficiently as we build shareholder value. With that, let’s open it up for questions. Jackie?

QUESTION AND ANSWER

Operator

Thank you. The floor is now open for questions. If do you have a question, you may press star 1 on your touch-tone telephone. If at any point your question has been answered, you may remove yourself from the queue by using the pound key. We do ask that if are you using your speaker phone to please pick up your handset to provide optimum sound quality. Once again for any questions at this time, press star 1 on your touch-tone telephone. Your first question is coming from Viknec Batho of Harris Nesbitt.

Vanik Blatko - Harris Nesbitt - Analyst

Hi, thanks for taking my question. Congratulations on a great quarter for CUBICIN.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thank you.

Vanik Blatko - Harris Nesbitt - Analyst

Tom here was never doubtful. I actually had a question about Anti-infective Drugs Advisory Committee meeting earlier this month and whether they’re, kind of, reluctance for primary bacteremia indications affects at all your filing plans in terms of CUBICIN?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

That is a good question. We were very pleased to be asked to present at this advisory committee that looks specifically at Staph bacteremia and really looked at it in 2 buckets. One was catheter-associated bacteremia, and the other was what I guess I would call systemic bacteremia.

Vanik Blatko - Harris Nesbitt - Analyst

Right.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

I think we got a very, very strong endorsement from the advisory committee that Staph bacteremia and the associated endocarditis, that it either generates or results from, represents a very serious

unmet medical need, and that that is really where the greatest need in the marketplace is. It actually aligns very, very well with our Phase 3 study that we’re currently conducting.

Vanik Blatko - Harris Nesbitt - Analyst

Right. Okay. That sounds great then.

I actually had another kind of logistical question in terms of manufacturing. I know right now in your current study you’re at the 6 mg/kg dose and I was wondering if you decide to apply for an indication with that amount, would you then be manufacturing 2 different vial sizes or would you - - do you have any idea of what you might be doing with that?

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Well, for the vast majority of patients, a 6 mg/kg dose is accommodated in a — in the current 500 milligram vial configuration.

Vanec Batho - Harris Nesbitt - Analyst

Okay.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

So we do not anticipate as a result of an approval in the future of a 6 mg/kg dose for bacteremia/endocarditis that we would need to add a second dose size.

Vanik Blatko - Harris Nesbitt - Analyst

Okay. Great. That’s all I had. Thank you.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thank you.

Operator

Thank you. Your next question is coming from Mr. Eun Yang of Wells Fargo. Please go ahead.

Eun Yang - Wells Fargo Securities - Analyst

I’m not. I’m Miss Eun Yang, first of all. A few questions.

Last time when we talked about CUBICIN usage in different areas, you mentioned that about 50% of the usage you see is on-label and then 30% out of that on-label was actually used as a first line in the hospital infection and I am just wondering if you can provide an update on that. And the second question is, now about 900 targeted hospitals, what’s the penetration rate there? And thirdly, David, you mentioned that the cost of goods sold in the third quarter, there is a 1-time event there, and I’m just wondering how much was related to the 1-time event. Thank you.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Okay. Eun, on CUBICIN usage we don’t really have any new data subsequent to which we articulated and I will just repeat it. Despite the fact that we do not promote this drug for uses outside of complicated skin and skin structure, market research does suggest that about 50% of the use is on-label and 50% of the use is off-label. Market research also indicates that within the on-label use of the drug, about 30% of it, just under that, 29%, is first line. 900 targeted hospitals currently, we characterize those as essentially the A and B’s and if you go to slide 15 in the presentation, what you will see is that 86% of the A’s have ordered as of the end of Q3 and 77% of the B’s have ordered as of the end of Q3. Overall, this would represent somewhere around 80% penetration of the current 900.

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

And Eun, this is David. On the cost of goods sold, the increased Q3 over Q2 was 1.6%. And that would be fully accounted for by the 1-time event in manufacturing.

Eun Yang - Wells Fargo Securities - Analyst

And one last question is: Michael, you mentioned that given the MRSA emergence, you don’t - - it’s not unreasonable to anticipate that CUBICIN peak sales could be $500 million. I’m just wondering whether the $500 million that you also assume that you get expanded indication, level of indication, in the endocarditis area.

Michael Bonney - - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Well, it is very clear, Eun, to achieve that kind of penetration, we will need to have a broader - - a broader label than we currently have. No question about it.

Eun Yang - Wells Fargo Securities - Analyst

Okay. Thanks.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thank you.

Operator

Thank you. Your next question is coming from Jason Kantor of W.R. Hambrecht.

Jason Kantor - W.R. Hambrecht - Analyst

Hi, a couple of questions. First of all, I think in your previous guidance for R&D, you had included a $5 million 1-time charge. Is that still in the guidance? Did any of that come into the third quarter or should we expect that all in the fourth quarter?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

No, the new $59 million number that we gave you today for the year includes the $5 million. And some of those costs have already been incurred and there will be still some more in the fourth quarter.

Jason Kantor - W.R. Hambrecht - Analyst

Can you quantify how much of that has been - - occurred already?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

No.

Jason Kantor - W.R. Hambrecht - Analyst

Okay. And then sort of back to the same question about the 1-time manufacturing charge, am I to understand then that the recurring cost of goods, as it is a percentage of sales, was the same in the third quarter as it was in the second quarter? And that the difference was just in the 1-time charge?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

It is in the ballpark of that number. That’s a reasonable assumption.

Jason Kantor - W.R. Hambrecht - Analyst

Well, was there a problem? Was it a lot that had to be written off or —

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

It was an issue with a batch, correct.

Jason Kantor - W.R. Hambrecht - Analyst

Okay. Thanks.

Operator

Thank you. Your next question is coming from Greg Wade of Pacific Growth Equity.

Greg Wade - Pacific Growth Equities - Analyst

Good morning, gentlemen. Thanks for taking my questions. A couple of things. First up, could you give us some insight as to what the manufacturing capacity for CUBICIN would be for the 2005 time frame? And when might we expect to see some data from the CUBICIN use registry? And then lastly, David, looking at the run rate for expenses in the fourth quarter, you know, is this a reasonable run rate to use for next year taking into account the increased sales and marketing expenses associated with the additional sales people? Thanks.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Okay, Greg, a couple of things. Manufacturing capacity in 2005 will be at a significant multiple of what it has been in 2004. The new facilities that we’re bringing on have much, much larger, from an API standpoint, much larger fermenters and as a result higher throughput in the fill/finish end of the equation. So that’s where a good - - we’re in good shape there. In terms of data from the core registry, those case report forms, if you will, are being completed in real time. The advisory group who reviews these data are looking at a series of publications. It is likely that those won’t actually hit public forum until sometime in 2005. And on the expenses, I’m going to turn that one over to David for a response.

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

The 2005 numbers we will discuss in our call in January.

Greg Wade - Pacific Growth Equities - Analyst

Thanks, David. And then if you can just give me your expected burn rate for ‘05, that would be great, too.

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

We will be happy to do that in January.

Operator

Thank you. Your next question is coming from Joel Sendek of Lazard.

Joel Sendek - Lazard & Co., Ltd - Analyst

Thanks a lot. With regard to the seasonal weakness, if I look at the numbers with an IMS and the reported numbers it doesn’t look like there is much weakness at all in CUBICIN sales. So could you just let us know where the weakness was, which months, for example, and what it could have been if you wouldn’t have had seasonal slow downs? Thanks.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

All right. The seasonal weakness is reflected in the reduction in the rate of growth, Joel. You may recall that Q2 over Q1, we went to 13.3 in Q2, from 6.3 Q1, and Q3, we saw a slightly less increase in revenue than we saw in previous quarters.

Joel Sendek - Lazard & Co., Ltd - Analyst

Okay and if I can just drill down a little bit further. Was there - - since we have access to the IMS data for the first 2 months of the quarter but not the third month, can you - - and I had some trouble looking at the slides on the webcast, can you give us a feel for the directional trend within the quarter from month to month? Can you provide us with that detail?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Well, of course, it is - - you have to be a little bit careful using IMS data to project these things, anyway, because what they capture in a given month can vary. Over the course of a year they’re pretty accurate but over a given month it may vary fairly well. In general, the trend that we have seen in revenue has been, you know, consistent with the trend that we’ve reported quarterly.

Joel Sendek - Lazard & Co., Ltd - Analyst

And the final is a - - a question on - - I guess 2 questions, if you don’t mind. One is on I guess a cash flow question, the net loss is about 18 million but the cash decreased by 23 million. and I was wondering what accounted for the 5 million delta.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

The build-out of the pilot fermentation process of CapX is the largest component.

Joel Sendek - Lazard & Co., Ltd - Analyst

Sorry. That helps. And then finally, is the - - if I remember going back to my notes, the royalty to Lilly is a tiered royalty and I can’t remember whether it goes up as sales increase or the royalty goes down as sales increase. Can you remind us what that is, if you disclosed it?

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

It goes up as sales increase and there are break points which we haven’t disclosed, but the number that we’ve guided people to use in the modeling is 14% as a pretty good base.

Joel Sendek - Lazard & Co., Ltd - Analyst

Thanks a lot.

Operator

Thank you. Your next question is coming from Michael Wood of Welsh Capital.

Michael Wood - Welsh Capital - Analyst

Good morning. Congratulations. Most of my questions have been answered. But maybe you could just review what activities you will have at the ICAAC meeting this coming weekend in terms of any data presentations as well as marketing activities and market activity to physicians.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure. We have roughly 15 abstracts and posters being presented. When I say we, there are 15 that have a focus on CUBICIN. Some are from the Company and some are from independent investigators. They range from kind of microbiologic, you know, activity against community MRSA; activity against historic collection of endocarditis Gram-positive bacteria to pharmaco-kinetic and preclinical work, there is one very interesting abstract being presented that looked at CUBICIN in a model of meningitis and compared it to Vancomycin. And there is just 1 or 2 clinical experience, if you will, presentations on CUBICIN in very, very difficult to treat patients. I know there is 1 on a liver transplant patient who was infected with a naselid, Vancomycin and ultimately synercid-resistant VRE that was treated with CUBICIN.

In terms of marketing activities, we have a marketing booth at the convention. We also have a medical affairs booth at the convention and that pretty much rounds it out. As we have become a commercial company, IDSA, the Infectious Disease Society of America meeting, which is really a much more clinically focused meeting than ICAAC which I would argue is a more scientifically focused meeting, has become an increasingly important meeting for us, so we had very similar kinds of activity at IDSA that was held a few weeks ago here in Boston.

Michael Wood - Welsh Capital - Analyst

Great. Thank you.

Operator

Thank you. Your next question is coming from Steve Harr of Morgan Stanley.

Steve Harr - Morgan Stanley - Analyst

Yeah, good morning, guys. A couple of questions. David, just so I make sure I have my math correct. I think you had given previous cash guidance for the end of the year around 35 million that would not return to capital markets and you’ve lowered your cash burn. What is your expectation now for a cash balance at the end of the year?

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

Well I think we’re around 30 million was the previous number and we are now saying we’re going to come in around 10 or 11 million better than that, so around 40 million.

Steve Harr - Morgan Stanley - Analyst

Okay. The second question: is there was an abstract at ICAAC where I guess 2 cases of CUBICIN resistance has emerged, I think it is out of 50 or 60 patients treated at one hospital setting. With your care database have you seen - - what kind of evidence do you have around emergence of CUBICIN resistance. Is this an anomaly or is this something being seen really more universally?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Good question, Steve. Let me just kind of orient everyone. In the NDA program conducted both at Lilly and Cubist, we treated essentially just under 1100 patients, infected patients, and saw 2 cases where bacteria had increased MIC 90s over the course of therapy. 2 cases of what would be called low-level resistance. Now we have been in the market just about a year, and if you include those original 2, we have seen an additional handful of reported cases of again low level resistance.

So let’s put this in context. 2 out of just under 1100 is an incident rate of about .1%. 5, let’s say out of 34,000 patients in the market is an incident rate of .02%. And what you would normally expect with an antibiotic with the level of exposure that CUBICIN has had in its first 12 months would be certainly a log better - - a log higher, rather, in many cases and 2 logs higher. And while we’re always concerned about evidence that bacteria do have increasing MIC 90s, the incident rate, based on the use of the drug in the market is very, very low and we think it recapitulates our experience in the lab where this is a very difficult drug for the bacteria to develop resistance to.

Steve Harr - Morgan Stanley - Analyst

Mike, do you have an idea yet what the mechanism is for resistance? And whether that’s transferable - - or transposable between bacterium?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

There is no - - based on the work we’ve done to date on those 2 early strains and some of the other strains that have been identified as having increased MIC 90s, there is no single mutation that causes the resistance. It appears that this is a simply a - - you know, based on selecting out strains within the total population that may be a little bit harder to treat. What we’ve seen in the lab is that it does take multiple mutations for pathogens to lose their susceptibility to CUBICIN. So there is no single smoking gun. We have no evidence that resistance is being transmitted from one bacteria to another.

Steve Harr - Morgan Stanley - Analyst

And then just one last question, and then a follow-up along an earlier question that you - - I thought that you will need a broader label to reach $500 million in peak sales. I was curious if you guys - - well, what other types of Phase 4 trials do you think you will need to do beyond endocarditis?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Well we’re looking at a whole host of areas of unmet medical need, Steve. As I mentioned before osteomyelitis remains an area of great interest within the clinical community. It is a very difficult, as you know, disease to treat, with persistent infections occurring in many patients. So that’s a possibility. How you conduct those studies is not completely clear at this point. So we continue to work with the FDA to try and define a protocol that is meaningful and yet also doable.

Another area that we would consider would be catheter-related bacteremia. Although if the current Phase 3 study is positive, the sense I got from the advisory committee held a couple of weeks ago is, if it is positive in Staph bacteremia and endocarditis, that’s kind of the big kahuna, people would have great confidence in its ability to treat catheter-related bacteremia as well. So those are a couple of ideas that we have.

Steve Harr - Morgan Stanley - Analyst

All right. And then what would that mean for kind of trend lines with R&D? Would you expect to see that continue to grow both from your off - - sorry, from both for Phase 4 trials and in licensing activity or have we seen a peak here for the near term in R&D spending? And that will be my last question.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

With respect to the CUBICIN R&D spending, recognize that it is not just clinical work that drives that number. The development activities to bring up manufacturing are also included in those numbers. So on a CUBICIN direct basis, I think what you see here is, you know, within a reasonable error bar, the level of investment that we think we need to make on - - from an R&D standpoint on CUBICIN. We may have to make that investment out into the future as we develop additional indications beyond endocarditis and bacteremia, assuming it is positive.

Steve Harr - Morgan Stanley - Analyst

Great. Thank you.

Operator

Thank you. Your next question is coming from Dallas Web of Stanford Financial.

Dallas Web - Stanford Financial - Analyst

Hey, guys. Good quarter. Can you provide an update on the osteomyelitis trial?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure, Dallas. We are actually not in a clinical trial of osteomyelitis. What we are doing at this point is capturing - - trying to capture as much data as we can from the off-label use that is occurring in the marketplace to understand what the outcomes are. In addition, we continue to progress a variety of animal models to determine what kinds of osteomyelitis, if you would, would be the best to study in terms of a clinical program. So that’s where we are with the osteo program.

Dallas Webb - Stanford Financial - Analyst

Okay, I understood you were going to meet with the FDA and kind of discuss end points. Is that still in the plans?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

There was an advisory committee of the FDA that met - - I’m trying to remember, I think it was back in July or August, where they did look at - - the fundamental question of the advisory committee was, “Are surrogates appropriate in antibiotic trials?” And we did present at that advisory committee, Barry did, about osteomyelitis, and there was general agreement there that osteo is probably the only infection where a surrogate could be considered. How you actually translate that into a Phase 3 trial we have not nailed down yet.

Dallas Webb - Stanford Financial - Analyst

Okay. And what is the actual current average daily dose that you’re seeing used in - - use with?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

It is actually a fair range. What we’ve seen from the various market research we’ve done, Dallas, is that a fair amount of the use is at 4, there is some at 6. And then there is some at other doses, which we think could be simply a patient who gets close to using a

full 500 milligram vial and rather than throwing away a little bit, they give it to the patient.

Dallas Webb - Stanford Financial - Analyst

Okay. And just finally, any update on the SEC question regarding the release of the cap data?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

We have really no update there, other than what was in our Q from the second quarter. Okay. Thank you.

Dallas Web - Stanford Financial - Analyst

Thank you.

Operator

Thank you. Your next question is coming from Matt Duffy of Black Diamond.

Matt Duffy - Black Diamond - Analyst

Good morning. Thanks for taking my call. Couple of questions. I wonder if you could give us a run down of your thoughts on any potential of Dalbavancin- - and how it might - - pluses and minuses relative to CUBICIN.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Well, this is a question that comes up often, Matt. Dalbavancin, I think is an interesting molecule. I think the first thing to consider is does it get approved. Because it hasn’t crossed that threshold yet, although the data looks very good - - or the data looks good, I guess, what we’ve seen of it. It is, as everyone know, I think, it is a glycopeptides, it is of the same class as Vancomycin, but it has an exceptionally long half life which allows the trials to be done with a single weekly dose. That’s one infusion every seven days. I think that, while on the surface offering some potential convenience advantages, I think also creates some obstacles in terms of increasing the exposure to sub therapeutic levels of the drug to a colony of bacteria and hence potentially driving some resistance, although that has not been reported to date.

It also is clear that the bacteria that carries the Van-A gene have no - - Dalbavancin is not active against those. And I think that there could well be a pricing question with Dalbavancin in that if you look across all of the Vancomycin use in hospitals today, the average course is about 5 days, but it varies from prophylactic use which may be a single or 2 doses to multiple weeks if it is an osteomyelitis case. And I think one of the questions would be how will it be priced in such a way as to not overpay for a 4 or 5 day case or a 9 or 10 day course where you would have to have 2 doses.

Matt Duffy - Black Diamond - Analyst

Okay. Great. And say, we’re about a year into the launch now, and sort of getting along in terms of expanded usage and experience by the doctors. I wonder if you could talk a little bit about how the marketing message has evolved from the launch where you’re just introducing the projects and trying to get, sort of, occasional usage as trial, and sort of what the reps are saying and what the marketing message is at this point to try and continue to extend usage?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure. Well, the marketing message, while it has evolved some, it has been - - remained fairly consistent. We focus on the activity of the drug against Staph aureus, independent of its resistance profile. We focus on the rapidly bactericidal nature of the drug and while we haven’t demonstrated that that represents superiority in a clinical setting, it is very, very interesting in patients who have compromised immune systems, for example, where the host immune response to an infection is blunted.

We, of course, also focus on the convenience of the drug, that it is in fact a single half hour infusion with a fairly predictable side effect profile, and those all in the context of complicated skin and skin structure infection, I think, resonate with the Docs in the context of what is going on in the marketplace with increasing questions about Vancomycin (Do the susceptibility steps that are done in the lab for Vancomycin truly represent bacteria that will likely respond in a clinical setting? et cetera). So I think it is a combination of the environmental issues going on with Vanc, plus the attributes of CUBICIN that we have been able to demonstrate in the complicated skin and skin structure label.

Matt Duffy - Black Diamond - Analyst

Good. Do you think this is pretty much it in terms of building up the sales force in terms of coverage for CUBICIN - - well, primarily CUBICIN anyway?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Yeah, I think it probably is. As I said earlier, by adding these additional 24 folks we are going to be able to increase our

coverage with the frequency that we think is appropriate, to about 1300 hospitals. That represents just about 80% of the current use of all IV antibiotics used to treat Gram-positive infections. Once you start expanding beyond this level, the marginal return for a given institution gets a little bit skinny, and it is much more difficult to justify with a given - with a single product.

Matt Duffy - Black Diamond - Analyst

Okay. Very good. Thanks very much. Good quarter.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thank you.

Operator

Thank you. Your next question is coming from David Weber of First Albany.

David Weber - First Albany - - Analyst

Thank you very much. A couple of questions on details. First going back to cost of goods, does your basic guidance remain unchanged that we should trend towards - - - I think it was the low 30s as a percentage?

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

Yes, we’re obviously driving the cost of goods as aggressively as we can, but do remember, as Mike said, we are bringing a second manufacturing plant on, and this is a process that depends on efficiencies so you have to see these collect in before some of the efficiencies turn up in the numbers.

David Weber - First Albany - - Analyst

Okay. And looking at the net sales calculation for CUBICIN, should we still be thinking about 7% as the size of the sales allowance?

David McGirr - Cubist Pharmaceuticals, Inc. - Chief Financial Officer, Senior Vice President

We obviously look at that constantly, and as we go through the end of the year, we will be seeing what provisions we’ve made and what the numbers are, so I would just watch that space.

David Weber - First Albany - - Analyst

Okay. And the last question I had was I just can’t recall, should we expect any more charges associated with the termination of the Slough facility?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

They are now all included. The last charges are in Q3.

David Weber - First Albany - - Analyst

They’re in Q3. Okay, thanks very much.

Operator

Thank you. Your next question is coming from Adam Cutler of JMP Securities.

Adam Cutler - JMP Securities - Analyst

Hi, thanks for taking my call. I was wondering if you could give us a little bit more color on the endocarditis and bacteremia trial? What may be some quantitative measures in terms of enrollment, and also when and how many more safety updates we can expect before the trial is completed?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure. We have essentially achieved, we’re actually now well north of our original target enrollment of 200 patients. The long pole of the tent as I mentioned last time was the enrollment of a small number of left-sided endocarditis patients. These are proving to be very difficult patients to enroll in that they have a very high mortality and they’re often so sick even at the time of diagnosis that they don’t meet the entry criteria.

That said, we remain actively pursuing them and we’ve got about 60 sites on both sides of the Atlantic that are looking for additional patients. Now we have not limited enrollment at this point to left-sided but that is our primary focus. We remain confident in our ability to actually complete this study, and look at the data from it in the middle part of 2005.

Adam Cutler - JMP Securities - Analyst

Okay. Great. One other question.

The data that you give us on a percentage of approvals by formulary committees, et cetera, is very helpful. I’m wondering if you can let us know if there have been any formulary rejections that you know of and any kind of color that you might be able to give us around that?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

There have been a handful of formulary rejections. The last data I saw on this, it was under 10% of the targeted accounts who have met and made a decision. So it is a very small number. The trends in that, to the degree that, literally, virtually single digit numbers of accounts, the trends in the rejections, basically break into 2 areas. One is a group who are waiting for more data, and the second is a group that thinks the drug needs to be less expensive, which I see as also a group waiting for more data. Some of the rejections that we had actually early in the launch have actually met again and put the drug on formulary. So we are seeing that evolve in real time, which is what we would expect with more experience and so forth.

I guess the final thing I would say is that virtually every institution that we are aware has met and made a decision not to include CUBICIN, on the formularies, actually ordered the drug. You will see on one of our slides there our penetration of the A’s from a formulary standpoint is around 60%, but in terms of ordering it is about 88%. So many of them are just using formulary rejection as a vehicle to control access during the earlier part of the launch of the drug.

Adam Cutler - JMP Securities - Analyst

So how does that end up playing out in the hospital, if the formulary is rejected and yet the hospital has ordered it?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Generally, the way it plays out is it is restricted to specific physicians. They may have to, depending on the institution, create - - complete some specific paperwork to get it. In other institutions, certain members of the ID service have access to any drug that they need for a given patient.

Adam Cutler - JMP Securities - Analyst

Okay. That’s helpful. Thank you. One other question is, obviously, with IDSA and ICAAC, there has been a flurry of data this fall. Are there any venues that you can point us to in the first half of next year that maybe things will look forward to, to see more data?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

It is - - - the one area will be ECCMID, which is the European equivalent essentially of ICAAC, where our partner Chiron may make some submissions.

Adam Cutler - JMP Securities - Analyst

Great. Thank you very much.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Okay.

Operator

Thank you. Your next question is coming from Jeff Reich of Merlin.

Jeff Reich - Merlin - Analyst

Hi, thanks for taking the call. Most of them have been answered. Just trying to get my brain around the market dynamics. The market share slide that you showed, it went by so fast, I couldn’t really digest it, but it looked like market share across all of the IV anti-infectives here in the staph space are growing. So where are you seeing that you’re taking market share from, if at all?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Really, sorry, we flashed by that so quickly. You will be able to see it on our website and look at it in more detail. Essentially, the 2 areas of the market that are growing are CUBICIN and the semi-synthetic penicillins. This market share graph was a dollar value market, not a utilization market, if you will, part of the market.

Jeff Reich - Merlin - Analyst

Okay. Uh-huh.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

And the semi-synthetics took, even though they’re generic, took some pretty aggressive price increases early in 2004, so I think part of what you’re seeing there is the effect of the price increases. Vancomycin continues to lose

share. Syncercid continues to lose share and Linezolid, in total, continues to lose share albeit at a modest rate. Linazolid at Zyvox is probably declining the least of the range of products that were represented on this market chart.

Jeff Reich - Merlin - Analyst

Okay. And from what you can tell, are you getting use in addition to Vanco, sort of piggybacked on to Vanco are or piggy-backed on to a course of Linezolid. Or are you getting CUBICIN usage solitary?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

To the best of our ability, and our ability is not perfect, but we have increasing data sets that we can look at. It appears that CUBICIN is being used instead of, not in addition to, in the vast majority of cases.

Jeff Reich - Merlin - Analyst

How about infectious disease for surgeons, can you break it down in terms of who is prescribing it?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

The bulk of the prescribing today is with infectious disease Docs, but candidly we don’t get detailed information on that, on who is prescribing in any kind of regular way.

Jeff Reich - Merlin - Analyst

Gotcha. Inpatient versus outpatient use?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Yeah, outpatient continues to be strong. We are now seeing in Q3 roughly 38% of our revenue coming from outpatient use. It is the same, best we can tell, it is essentially the same infectious disease physicians we’re calling on in the A and B accounts who are driving the outpatient use of the drug.

Jeff Reich - Merlin - Analyst

Gotcha. And then lastly, just the time line for the rest of the formulary decisions. When - - how do you expect those to meet, and what do you see over 2005 in terms of getting in front of formularies and getting on the ones that are in your sights?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Yet to go? Well the sales force expansion will help with the group of 400 additional hospitals that we haven’t been calling on in the launch to date. So sometime, you know, the middle of next year, I expect we will see a bit of a tick-up in that additional group. Between now and the delivery of the endocarditis/bacteremia study, I suspect we will see fairly consistent growth in the formularies, but I don’t expect that there will be any steep change in it until those data are available.

Jeff Reich - Merlin - Analyst

Gotcha. Okay. Thank you.

Operator

As a reminder, if you do have a question, you may press star 1 on your touch-tone telephone. Your next question is from Jason Kantor of W.R. Hambrecht.

Jason Kantor - W.R. Hambrecht - Analyst

Hi, thanks for taking my follow-up. 2 questions. You mentioned that you thought peak sales could be closer to $500 million, which I think is above where most folks are. Could you give us a sense of where you think that incremental - - those incremental sales come from? And over what time you think you could get to $500 million? And the second question is, the recent FDA meeting, there was a whole group of people who got up one after another and said how impossible it is to enroll patients in certain types of trials. And is it possible that the FDA is just being too difficult here, in requiring that you get these left-sided patients? And is there a possibility that you’re going to have to go back to them at some point and just say, you know, this is not reasonable for enrolling a trial like this?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Okay, Jason. First one, on the 500 million, we’re not going to declare when we think that can happen. But let me give you the market dynamics that lead us to that kind of ballpark. The first thing is that if you look at the Gram-positive IV antibiotic space, so I’m talking about Vancomycin, Zyvox IV, Synercid, the semi-synthetics and Cephasolin. That marketplace itself is growing at about 14 or 15% a year over the last 5 years. In CUBICIN dollars, 15% growth in that marketplace translates to $150 million, roughly, a year in market growth. We don’t see any evidence to date that that market growth is declining. So we think that we’re in a - - as demonstrated on the slides here, a market that is expanding

fairly nicely. And we’re getting an increasing share of that. So that is one element.

Second element is, as physicians get experience with this drug, they get very comfortable in using it in a variety of ways. You know, it is a new mechanism of action. It is rapidly bactericidal. It is easy to use. And so their patient population, if you will, that they consider us potential candidates, is expanding once they get experience. I think that is another element of it. Third element of it is the emerging and I think growing questions that are being raised about Vancomycin’s efficacy relative - - against MRSA, and what the susceptibility testing that is done in the lab is really telling people about Vancomycin as an effective treatment choice for MRSA infections in particular. So I think there is a whole host of reasons that would suggest that this marketplace and the need for a drug like CUBICIN is growing fairly rapidly and we’re well positioned to take advantage of that.

On your other questions, about the endo trial. I’m not going to comment on specifics of our enrollment, or interactions with the FDA, other than to say that we have had ongoing interactions with the FDA throughout the conduct of the study, for designing to conducting in fact. And we expect to continue to have interactions with the FDA about the conduct of this study. I have mentioned earlier that I feel quite strongly that we’re going to be able to look at data from this study, complete the study and look at data from the study by the middle part of next year and I stand by that. The other point I would make on your question is, while it is clearly a difficult study to do, I think if you listen to Frank, what you will hear in that presentation is, difficult but important, and what we’ve demonstrated is doable. We’ve enrolled well over 200 patients, which is what the targeted number was for this study initially. The challenge now is just to get this handful of left-sided folks.

Jason Kantor - W.R. Hambrecht - Analyst

Okay. Thank you.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thanks, Jason.

Operator

Thank you. Your next question is from Greg Wade of Pacific Growth Equities.

Greg Wade - Pacific Growth Equities - Analyst

Thanks for taking a quick follow-up. And just to be really quick have you noticed any new institutions moving CUBICIN up in front ahead of Vancomycin? And IDSA had a couple of commentaries around the combination use of CUBICIN with other things, seems to be an emerging theme with the drug. Can you just comment on any potential investigator-sponsored studies in that area? Thanks.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure, Greg. In terms of the latter, we do have some interest in investigators to look at CUBICIN in conjunction with other antibiotics and we have supported a few of those studies to date. We don’t have any data from them yet, but the data are being collected.

What was your first question, Greg? Sorry about that.

Greg Wade - Pacific Growth Equities - Analyst

If you noted any institutions moving CUBICIN up ahead of Vancomycin. I think there was commentary on the last call of something have seen.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Right. That is something we have seen. And what we are seeing, increasingly, at this point is individual physicians who have experience with the drug moving it up earlier and earlier into their treatment regimen.

Greg Wade - Pacific Growth Equities - Analyst

And the pharmaco-economic studies of the drug, how are those coming along?

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

They’re coming along very well. In fact, there is quite a plan in place at the American Society of Hospital Pharmacists meeting which is going to be in November, there will be data presented from the Phase 3 study that a pharmaco-economic analysis of not only the Phase 3 but of experience of an individual hospital that has a fair amount of experience with the drug from Ohio.

Greg Wade - Pacific Growth Equities - Analyst

Great. Thanks for taking my follow-ups.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Sure.

Operator

Thank you. Your final question is from Eun Yang of Wells Fargo.

Eun Yang - Wells Fargo Securities - Analyst

Thanks very much. My questions have been answered. Thank you.

Michael Bonney - Cubist Pharmaceuticals, Inc. - President, Chief Executive Officer

Thanks, Eun. Well, thank you all for joining us today. We are very pleased with our third quarter results that we’ve announced. And we look forward to continuing to grow this business and to creating value for our shareholders. I would like you all to mark your calendars for a conference call for the fourth quarter which will be on January 25th of 2005. And with that, I appreciate your time. I would not be a card-carrying member of the Boston community, if I didn’t say, go Sox. Thanks very much. Take care.

Operator

Thank you. This does conclude today’s teleconference. You may now disconnect your lines and have a wonderful day.