Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Serious Infections.

[LOGO]

Serious Business.

Statements made during this presentation that are not historical fact may be forward-looking statements that are subject to a variety of risks and uncertainties. There are a number of important factors that could cause actual results to differ materially from those projected or suggested in any forward-looking statements made by the Company. These and other factors are contained in the Company’s filings with the Securities and Exchange Commission.

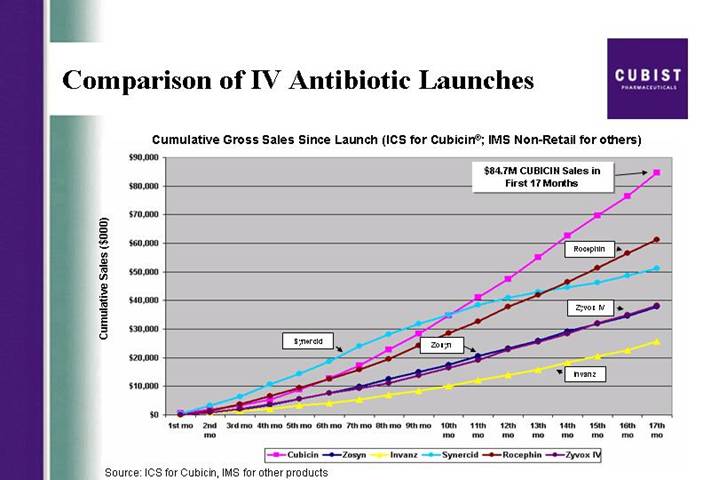

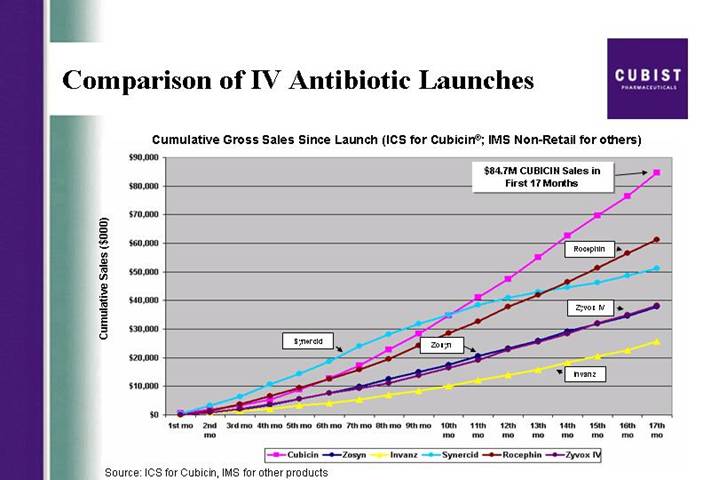

Comparison of IV Antibiotic Launches | [LOGO] |

Cumulative Gross Sales Since Launch (ICS for Cubicin®; IMS Non-Retail for others)

[CHART]

Source: ICS for Cubicin, IMS for other products

Cubicin® Opportunity

• MRSA growth in both the hospital and the community

• Questions about clinical efficacy of vancomycin

• Cubist expanded sales force

• Now calling on roughly 80% of market opportunity

• Interest in IE data release

• CUBICIN sales momentum coming out of Q105

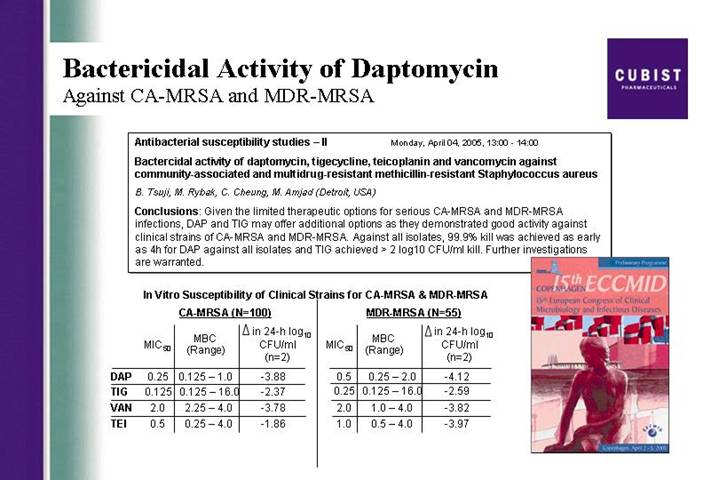

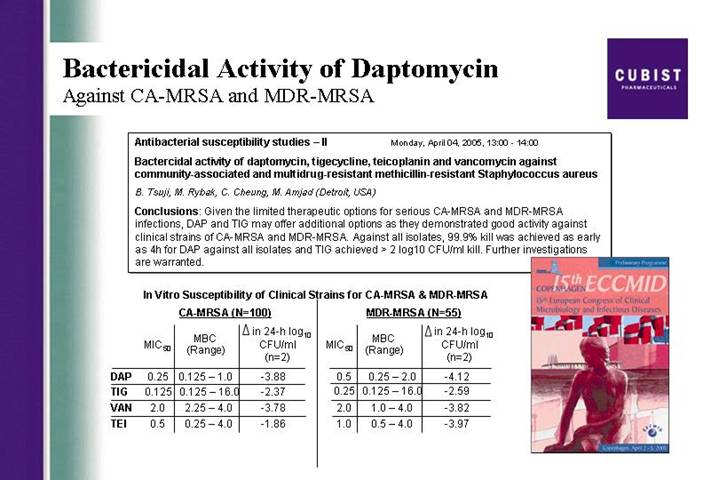

Bactericidal Activity of Daptomycin

Against CA-MRSA and MDR-MRSA

Antibacterial susceptibility studies – II Monday, April 04, 2005, 13:00 -14:00

Bactercidal activity of daptomycin, tigecycline, teicoplanin and vancomycin against community-associated and multidrug-resistant methicillin-resistant Staphylococcus aureus

B. Tsuji, M. Rybak, C. Cheung, M. Amjad (Detroit, USA)

Conclusions: Given the limited therapeutic options for serious CA-MRSA and MDR-MRSA infections, DAP and TIG may offer additional options as they demonstrated good activity against clinical strains of CA-MRSA and MDR-MRSA. Against all isolates, 99.9% kill was achieved as early as 4h for DAP against all isolates and TIG achieved > 2 log10 CFU/ml kill. Further investigations are warranted.

In Vitro Susceptibility of Clinical Strains for CA-MRSA & MDR-MRSA

| | CA-MRSA (N=100) | | MDR-MRSA (N=55) | |

| | MIC50 | | MBC

(Range) | |  in 24-h log10 in 24-h log10

CFU/ml

(n=2)

| | MIC50 | | MBC

(Range) | |  in 24-h log10 in 24-h log10

CFU/ml

(n=2)

| |

DAP | | 0.25 | | 0.125 – 1.0 | | -3.88 | | 0.5 | | 0.25 – 2.0 | | -4.12 | |

TIG | | 0.125 | | 0.125 – 16.0 | | -2.37 | | 0.25 | | 0.125 – 16.0 | | -2.59 | |

VAN | | 2.0 | | 2.25 – 4.0 | | -3.78 | | 2.0 | | 1.0 – 4.0 | | -3.82 | |

TEI | | 0.5 | | 0.25 – 4.0 | | -1.86 | | 1.0 | | 0.5 – 4.0 | | -3.97 | |

[GRAPHIC]

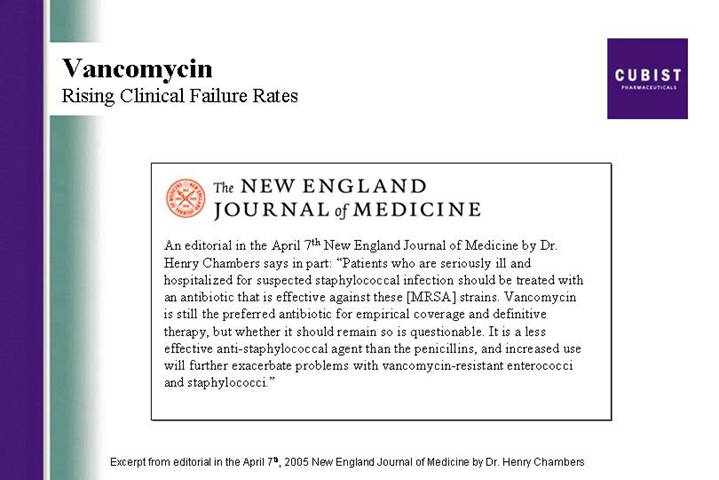

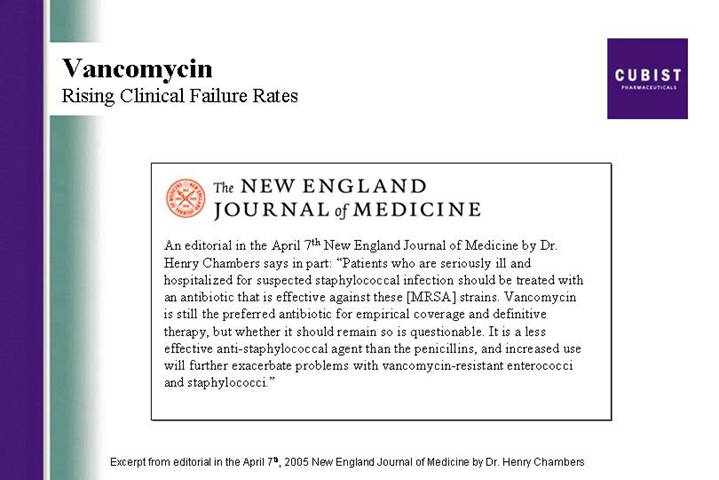

Vancomycin

Rising Clinical Failure Rates

[LOGO]

The NEW ENGLAND JOURNAL of MEDICINE

An editorial in the April 7th New England Journal of Medicine by Dr. Henry Chambers says in part: “Patients who are seriously ill and hospitalized for suspected staphylococcal infection should be treated with an antibiotic that is effective against these [MRSA] strains. Vancomycin is still the preferred antibiotic for empirical coverage and definitive therapy, but whether it should remain so is questionable. It is a less effective anti-staphylococcal agent than the penicillins, and increased use will further exacerbate problems with vancomycin-resistant enterococci and staphylococci.”

Excerpt from editorial in the April 7th, 2005 New England Journal of Medicine by Dr. Henry Chambers

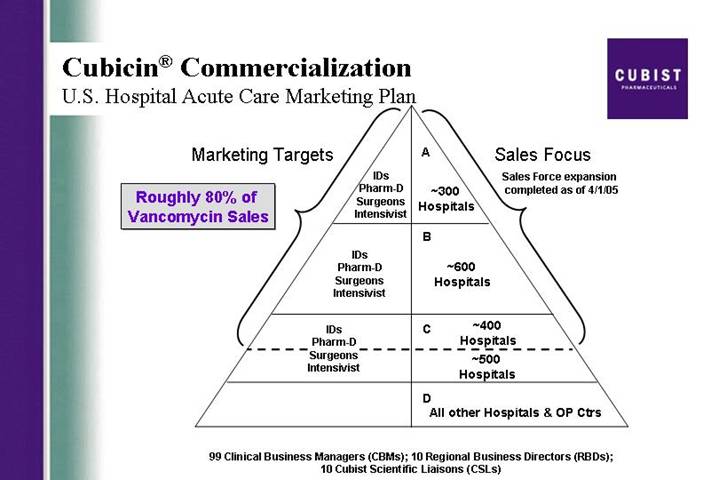

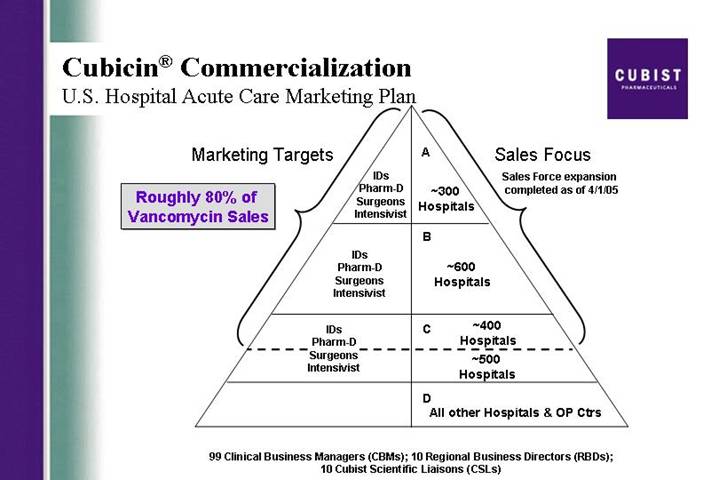

Cubicin® Commercialization

U.S. Hospital Acute Care Marketing Plan

Roughly 80% of Vancomycin Sales

[CHART]

99 Clinical Business Managers (CBMs); 10 Regional Business Directors (RBDs);

10 Cubist Scientific Liaisons (CSLs)

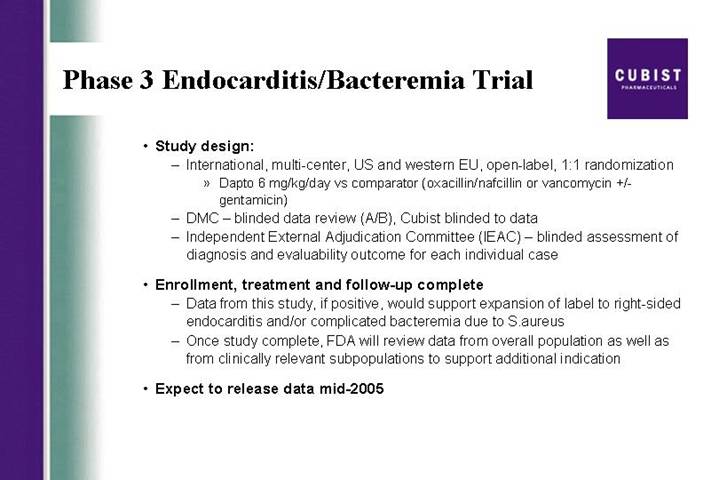

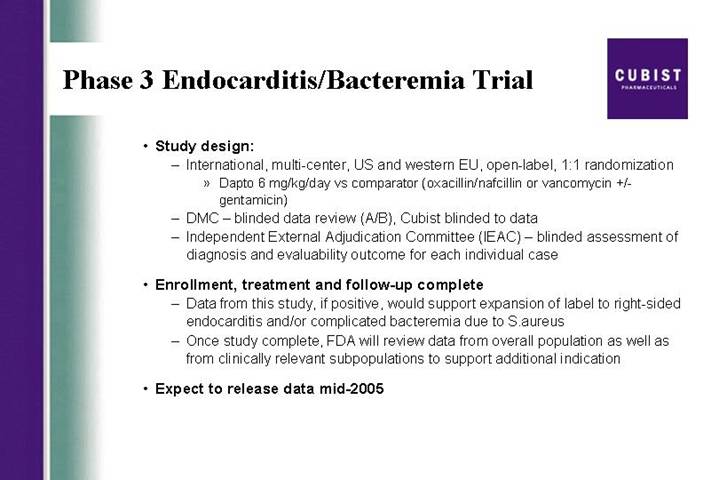

Phase 3 Endocarditis/Bacteremia Trial

• Study design:

• International, multi-center, US and western EU, open-label, 1:1 randomization

• Dapto 6 mg/kg/day vs comparator (oxacillin/nafcillin or vancomycin +/- gentamicin)

• DMC – blinded data review (A/B), Cubist blinded to data

• Independent External Adjudication Committee (IEAC) – blinded assessment of diagnosis and evaluability outcome for each individual case

• Enrollment, treatment and follow-up complete

• Data from this study, if positive, would support expansion of label to right-sided endocarditis and/or complicated bacteremia due to S.aureus

• Once study complete, FDA will review data from overall population as well as from clinically relevant subpopulations to support additional indication

• Expect to release data mid-2005

CORE*

Current Top Line Data

• 1160 infections were reported in the 2003-2004 CORE database

• Skin and skin structure infections were the most common category of infection

• Over 50% of infections for which information was provided were ascribed to methicillin resistant Staphylococcus aureus (ie., confirmed and suspected)

• Cubicin therapy was “first line” in over 25% of reported infections

* CORE (CUBICIN Outcomes Registry and Experience)

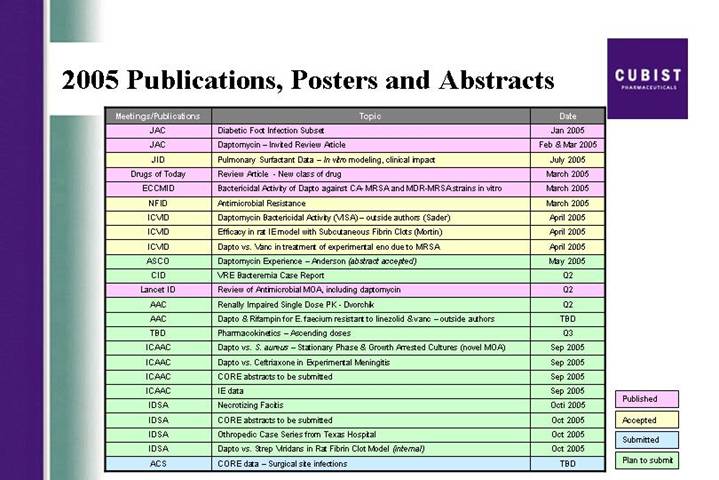

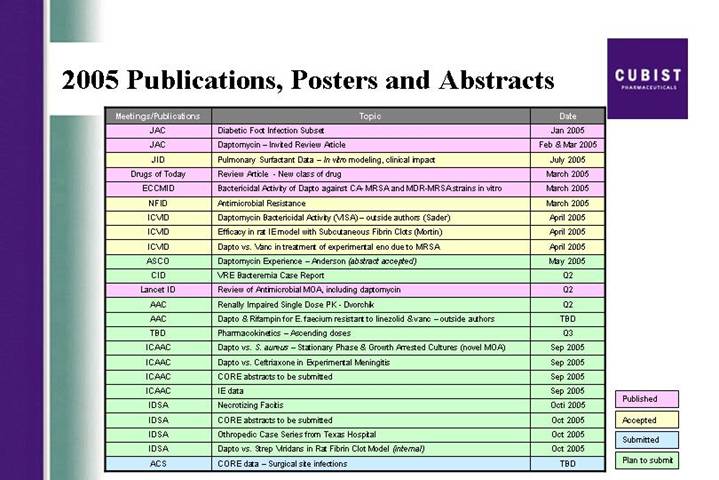

2005 Publications, Posters and Abstracts

Meetings/Publications | | Topic | | Date | |

JAC | | Diabetic Foot Infection Subset | | Jan 2005 | |

JAC | | Daptomycin – Invited Review Article | | Feb & Mar 2005 | |

JID | | Pulmonary Surfactant Data – In vitro modeling, clinical impact | | July 2005 | |

Drugs of Today | | Review Article - New class of drug | | March 2005 | |

ECCMID | | Bactericidal Activity of Dapto against CA- MRSA and MDR-MRSA strains in vitro | | March 2005 | |

NFID | | Antimicrobial Resistance | | March 2005 | |

ICVID | | Daptomycin Bactericidal Activity (VISA) – outside authors (Sader) | | April 2005 | |

ICVID | | Efficacy in rat IE model with Subcutaneous Fibrin Clots (Mortin) | | April 2005 | |

ICVID | | Dapto vs. Vanc in treatment of experimental eno due to MRSA | | April 2005 | |

ASCO | | Daptomycin Experience – Anderson (abstract accepted) | | May 2005 | |

CID | | VRE Bacteremia Case Report | | Q2 | |

Lancet ID | | Review of Antimicrobial MOA, including daptomycin | | Q2 | |

AAC | | Renally Impaired Single Dose PK - Dvorchik | | Q2 | |

AAC | | Dapto & Rifampin for E. faecium resistant to linezolid & vanc – outside authors | | TBD | |

TBD | | Pharmacokinetics – Ascending doses | | Q3 | |

ICAAC | | Dapto vs. S. aureus – Stationary Phase & Growth Arrested Cultures (novel MOA) | | Sep 2005 | |

ICAAC | | Dapto vs. Ceftriaxone in Experimental Meningitis | | Sep 2005 | |

ICAAC | | CORE abstracts to be submitted | | Sep 2005 | |

ICAAC | | IE data | | Sep 2005 | |

IDSA | | Necrotizing Facitis | | Octi 2005 | |

IDSA | | CORE abstracts to be submitted | | Oct 2005 | |

IDSA | | Othropedic Case Series from Texas Hospital | | Oct 2005 | |

IDSA | | Dapto vs. Strep Viridans in Rat Fibrin Clot Model (internal) | | Oct 2005 | |

ACS | | CORE data – Surgical site infections | | TBD | |

Published |

|

Accepted |

|

Submitted |

|

Plan to submit |

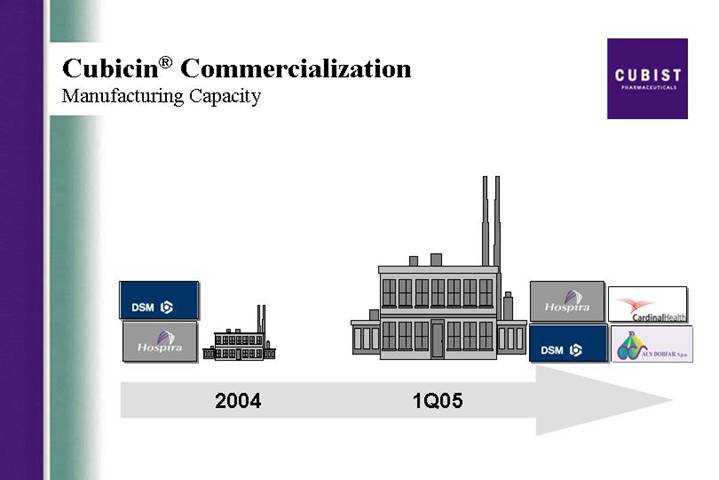

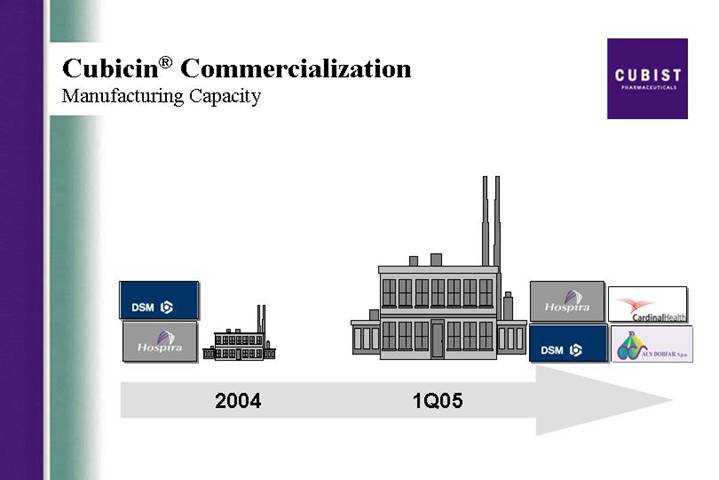

Cubicin® Commercialization

Manufacturing Capacity

[GRAPHIC] | [GRAPHIC] |

| |

2004 | 1Q05 |

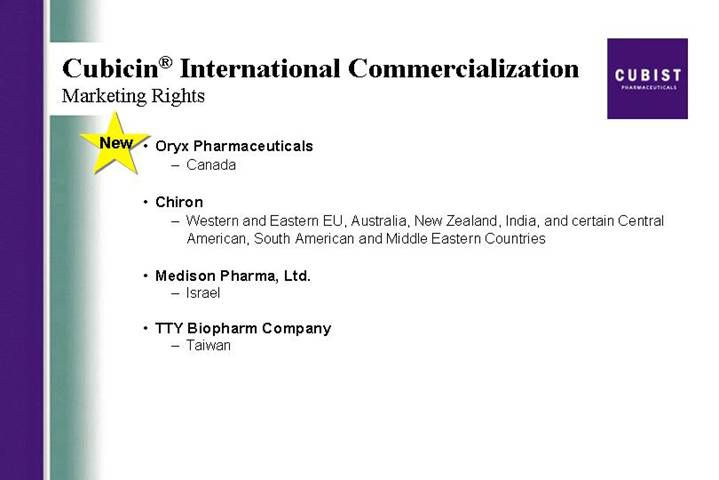

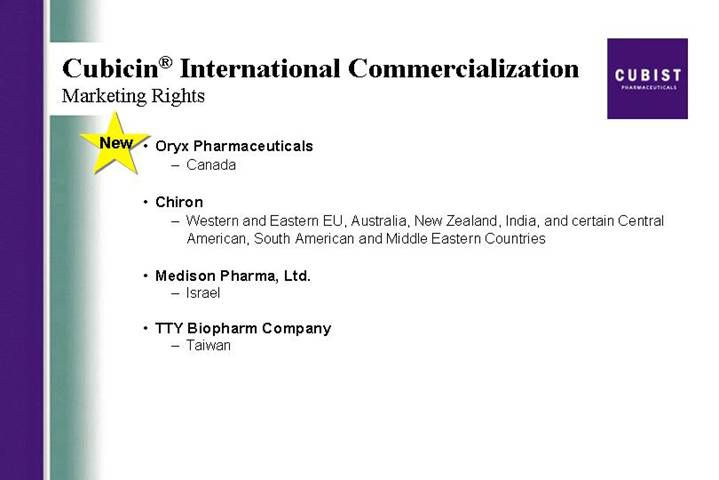

Cubicin® International Commercialization

Marketing Rights

[LOGO] | | • | Oryx Pharmaceuticals |

| | | | |

| | | • | Canada |

| | | | |

| | • | Chiron |

| | | | |

| | | • | Western and Eastern EU, Australia, New Zealand, India, and certain Central American, South American and Middle Eastern Countries |

| | | | |

| | • | Medison Pharma, Ltd. |

| | | | |

| | | • | Israel |

| | | | |

| | • | TTY Biopharm Company |

| | | | |

| | | • | Taiwan |

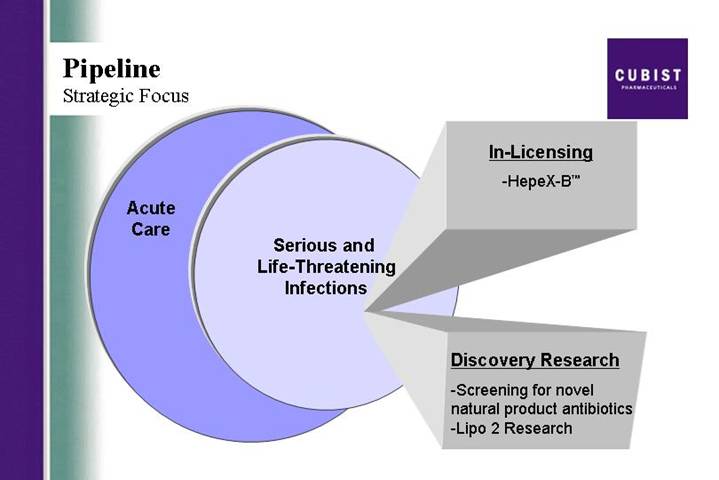

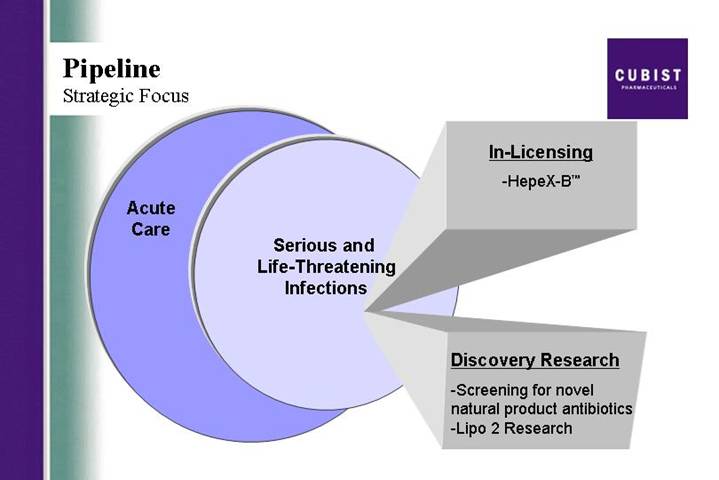

Pipeline

Strategic Focus

| | | | In-Licensing

|

Acute

Care | | Serious and

Life-Threatening

Infections | | • HepeX-B™ |

| | | | Discovery Research |

| | | |

• Screening for novel natural product antibiotics

• Lipo 2 Research |

Discovery Research

2nd Generation Lipopeptide with lung activity

Pulmonary reduction of burden of S. pneumoniae Infection in Mice

[CHART]

• Compound X shows reduced pulmonary bacterial burden by 5 logs (99.999%) compared to daptomycin at 1 log (90%) reduction.

Summary Statement of Operations

| | Three months ended

March 31, | |

| | 2005 | | 2004 | |

| | (Unaudited) | |

| | | | | |

Cubicin® revenues, net | | $ | 20,889 | | $ | 6,281 | |

| | | | | |

Total revenues | | 23,682 | | 8,471 | |

| | | | | |

Cost of product revenues | | 6,925 | | 2,425 | |

| | | | | |

Other operating expenses | | 28,050 | | 26,587 | |

| | | | | |

Operating loss | | (11,293 | ) | (20,541 | ) |

| | | | | |

Other expenses | | (1,589 | ) | (2,702 | ) |

| | | | | |

Net loss | | $ | (12,882 | ) | $ | (23,243 | ) |

| | | | | |

EPS | | $ | (0.25 | ) | $ | (0.58 | ) |

In thousands except per share data

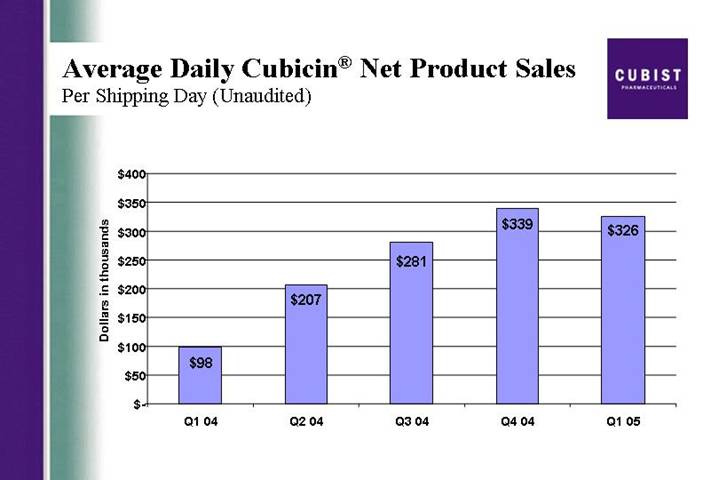

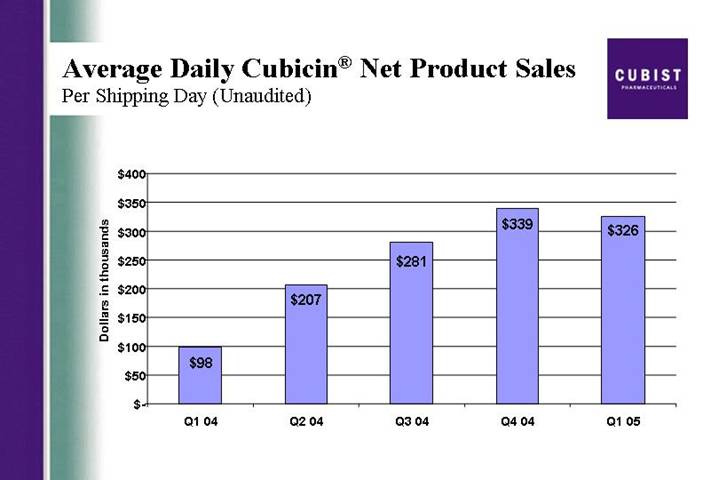

Average Daily Cubicin® Net Product Sales

Per Shipping Day (Unaudited)

[CHART]

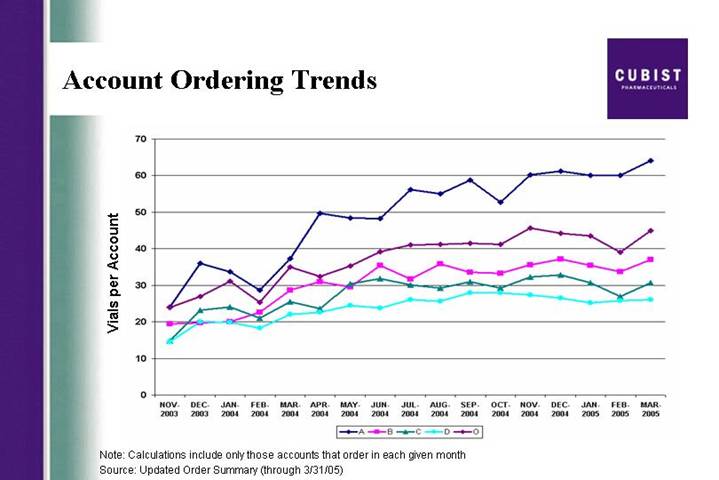

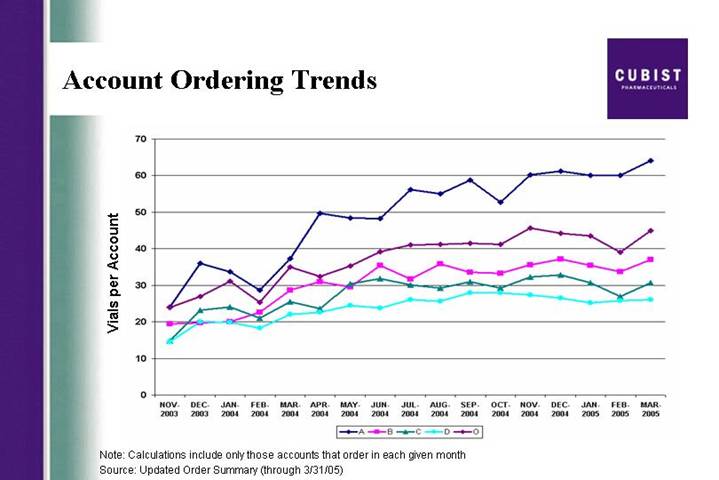

Account Ordering Trends

[CHART]

Note: Calculations include only those accounts that order in each given month

Source: Updated Order Summary (through 3/31/05)

Cubicin® Repeat Accounts

• Vial orders continue to trend upward

• On average – 125 repeat accounts ordering per day

• On average – 7 new accounts ordering per day

[CHART]

Source: Cubist Order Summary

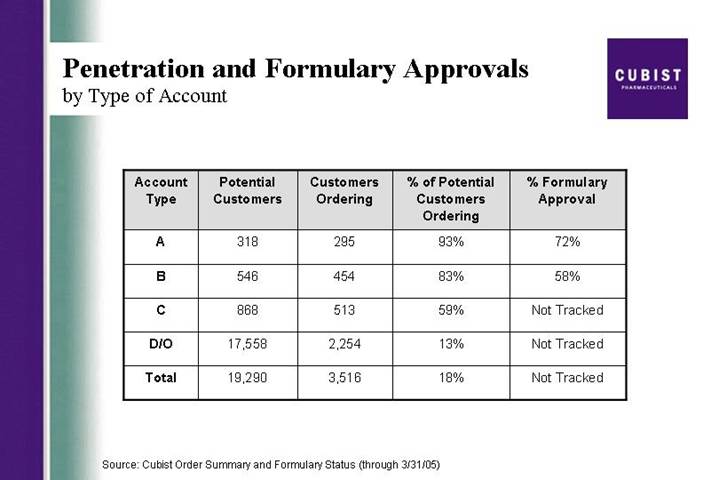

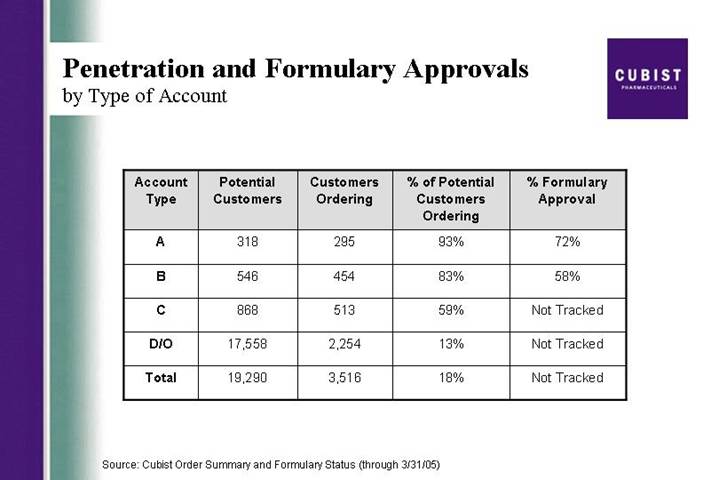

Penetration and Formulary Approvals

by Type of Account

Account

Type | | Potential

Customers | | Customers

Ordering | | % of Potential

Customers

Ordering | | % Formulary

Approval | |

| | | | | | | | | |

A | | | 318 | | 295 | | 93 | % | 72 | % |

| | | | | | | | | | |

B | | | 546 | | 454 | | 83 | % | 58 | % |

| | | | | | | | | | |

C | | | 868 | | 513 | | 59 | % | Not Tracked | |

| | | | | | | | | | |

D/O | | | 17,558 | | 2,254 | | 13 | % | Not Tracked | |

| | | | | | | | | | |

Total | | | 19,290 | | 3,516 | | 18 | % | Not Tracked | |

Source: Cubist Order Summary and Formulary Status (through 3/31/05)

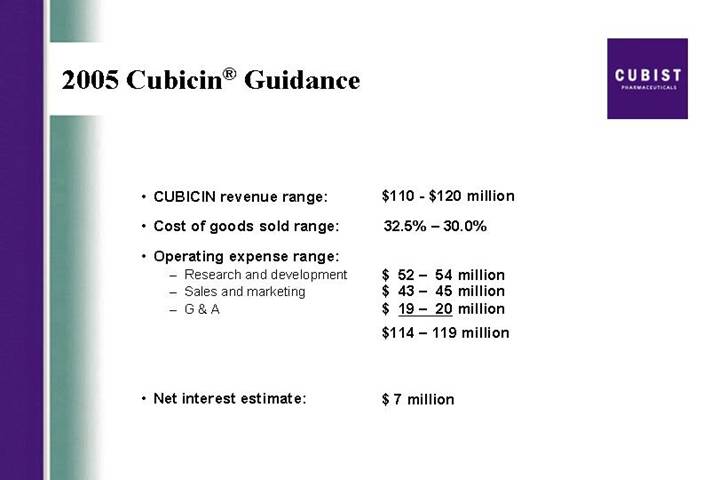

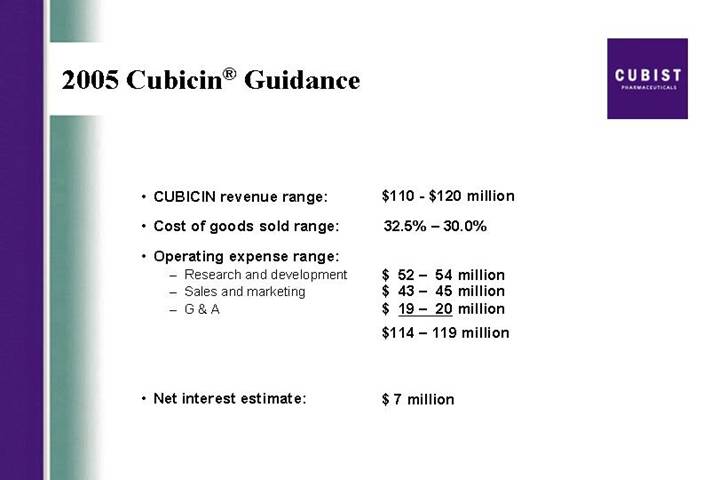

2005 Cubicin® Guidance

• CUBICIN revenue range: | | $110 – $120 million |

| | |

• Cost of goods sold range: | | 32.5% – 30.0% |

| | |

• Operating expense range: | | |

• Research and development | | $ 52 – 54 million |

• Sales and marketing | | $ 43 – 45 million |

• G & A | | $ 19 – 20 million |

| | $114 – 119 million |

| | |

• Net interest estimate: | | $ 7 million |

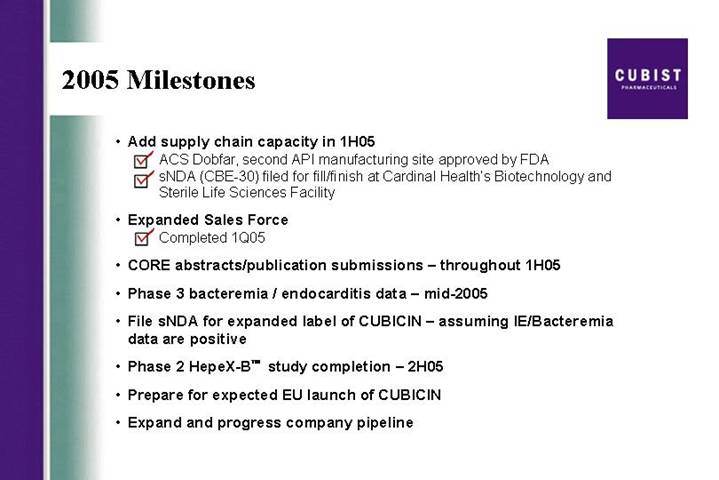

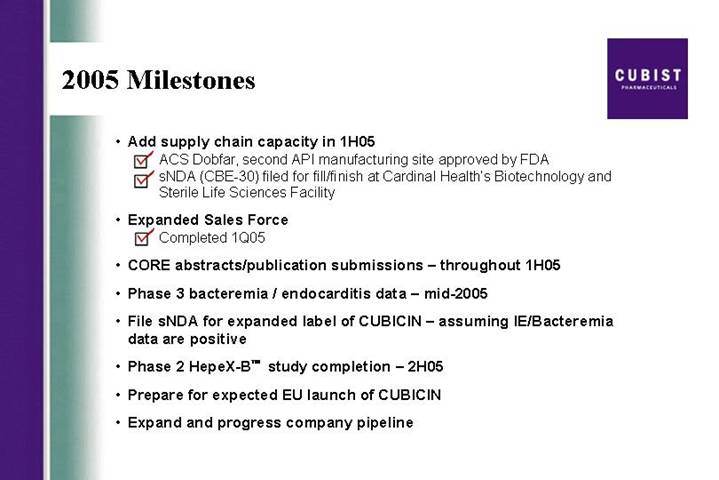

2005 Milestones

• Add supply chain capacity in 1H05

ý ACS Dobfar, second API manufacturing site approved by FDA

ý sNDA(CBE-30) filed for fill/finish at Cardinal Health’s Biotechnology and Sterile Life Sciences Facility

• Expanded Sales Force

ý Completed 1Q05

• CORE abstracts/publication submissions – throughout 1H05

• Phase 3 bacteremia / endocarditis data – mid-2005

• File sNDA for expanded label of CUBICIN – assuming IE/Bacteremia data are positive

• Phase 2 HepeX-B™ study completion – 2H05

• Prepare for expected EU launch of CUBICIN

• Expand and progress company pipeline

Comparison of IV Antibiotic Launches

Cumulative Gross Sales Since Launch (ICS for Cubicin®; IMS Non-Retail for others)

[CHART]

Source: ICS for Cubicin, IMS for other products

CUBIST PHARMACEUTICALS, INC.

Q1 2005 EARNINGS CONFERENCE CALL

APRIL 20, 2005

5:00 P.M. EST

PARTICIPANTS:

Michael Bonney, President and CEO

David McGirr, CFO

Dr. Frank Tally, CSO

Chris Guiffre, General Counsel

OPERATOR

Good afternoon, ladies and gentlemen, and welcome to your Cubist’s first quarter earnings conference call. At this time all participants have been placed on a listen only mode and the floor will be open for questions following today’s presentation. It is now my pleasure to turn the floor over to your host, Michael Bonney. Sir, the floor is yours.

MICHAEL W. BONNEY - CUBIST - PRESIDENT & CEO

Thank you, Ashley. Good afternoon and thank you all for joining us today to discuss Cubist’s results for the first quarter of 2005. Joining me at this end are David McGirr, our CFO, Frank Tally, our chief scientific officer, and Chris Guiffre, our general counsel. Before we begin, I will read a short Safe Harbor statement. Forward-looking statements may be made during the call. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those projected or suggested here. Such risks and uncertainties are detailed in the company’s periodic filings with the Securities and Exchange Commission. We also like to add due to the significant interest in the launch of CUBICIN, we will again be discussing trends on this call but disclaim any duty to provide any updates on the specific data points mentioned here today.

As in recent quarters, the slides we are using during this call are available via the link located on the front page of our Web site at www.cubist.com. We are pleased to report on Cubist’s results for the first quarter of 2005 and our progress on the goals we set for this year. Our sales trends since launch continues to validate the significant growth potential for Cubicinâ our first in class IV antibiotic. We had a good quarter for CUBICIN product revenue and ended the first quarter with a particularly strong March, our strongest revenue month since launch. On an annualized basis, March represents a $100 million net run rate for CUBICIN. After 17

1

months on the market, CUBICIN continues to track as the most successful IV antibiotic launch in U.S. history. As you know, we have provided product revenue guidance of $110 to $120 million for the full year of 2005.

We are confident in this guidance for several reasons. The continued problem of methicillin resistant Staph aureus or MRSA in hospitals, and, increasingly in the community; increasing questions regarding the clinical efficacy of vancomycin, the historic standard of care for methicillin resistant staph infections; the successful expansion of our sales force providing us the opportunity to target an additional 400 hospitals as of April 1st this year; the interest of the ID community in the infective endocarditis/bacteremia clinical trial data that we expect to release mid year; and finally, the CUBICIN sales trajectory as we exited the first quarter.

Just north of 3,500 unique customers had ordered CUBICIN by the end of March, up from just over 3,000 at year-end. We estimate that more than 70,000 patients have now been treated with this drug. This quarter did present some challenges. The market in which we compete — IV antibiotics used to treat Gram-positive infections — showed softness early in the quarter consistent with the pattern reported on by third-parties in previous years. However, we did see sequential growth for revenues throughout the quarter. As I mentioned, March was our strongest revenue month since launch. Thus we entered Q2 with the kind of momentum we expected.

Last quarter I reported on significant accomplishments in securing our base. Cubist now has a solid foundation. Today I will focus on continued execution of our plans both to optimize CUBICIN and to build Cubist as a successful antiinfective pharmaceutical company. We believe that CUBICIN continues to be well-positioned to deliver against a market opportunity driven by the prevalence of MRSA in U.S. hospitals and the alarming upward trend in outbreaks of community-acquired MRSA often referred to as CA-MRSA. This public health issue has been featured in two recent issues of the New England Journal of Medicine. In one of these earlier this month, the CDC authors warn, quote, clinicians should now consider MRSA as a potential pathogen in patients with suspected staph aureus infections in the community setting, close quote.

Such public health advisories are not surprising as otherwise healthy individuals are contracting these infections and because the MRSA strains are not the same as what we have seen in hospitals. These community MRSA infections usually involve the skin and hospitalization is common.

A poster presented at the ECCMID conference in Copenhagen earlier this month by a team of investigators from Wayne State University provided some impressive evidence concerning the bactericidal activity of CUBICIN against community-acquired and multi-drug-resistant MRSA. More than 100 different strains of CA- MRSA were included in this in vitro research. Against all isolates, 99.9% or 3 log kill was achieved as early as 4 hours after exposure to CUBICIN.

As the prevalence of MRSA grows, questions about the clinical efficacy of vancomycin continue to be raised. An editorial concerning community-acquired MRSA in the April 7th New England Journal of Medicine by

2

Dr. Henry “Chip” Chambers says in part, quote, vancomycin is still the preferred antibiotic for empirical coverage and definitive therapy but whether it should remain so is questionable, close quote.

One important milestone for CUBICIN as we began 2005 was the expansion of our sales force. We now have filled the 24 expansion positions with skilled, experienced new hires and we brought these new sales professionals together this quarter for sales training. As Q2 began, our sales organization was busy calling on our enlarged call universe of 1,300 target hospitals representing about 80% of the hospital market opportunity for IV antibiotics to treat Gram-positive infections. This is up from about two-thirds of the hospital market opportunity that we called on from launch through the first quarter of this year.

Another key milestone for Cubist this year is completion of the Phase 3 trial for CUBICIN for infective endocarditis and bacteremia caused by Staphylococcus aureus. In mid year, we expect to release top line data from this important trial. As many of you understand very well, this was a complicated trial to design and execute. For us to complete enrollment of over 230 patients, we screened 5,000 patients over a period of two years. Frank Tally, our chief scientific officer will now spend a few minutes to review the trial design. Frank?

Dr. RANCIS TALLY - CUBIST - CHIEF SCIENTIFIC OFFICER

Thanks, Mike. Our Phase 3 infective endocarditis/bacteremia trial, which is a standard non-inferiority trial, has two arms. In one arm, CUBICIN is dosed once daily at 6mg/kg (a higher dose than the 4 mg/kg in our label for complicated skin and soft tissue infections). In the second arm are the comparators: For MRSA isolates, the comparator is vancomycin, and for Methicillin Susceptible Staph aureus or MSSA isolates, the comparator is a semi-synthetic penicillin. For the comparators only, standard of care also calls for the addition of gentamicin for four days or until the blood clears for 48 hours. The patient population in this trial has some natural subsets, as patients may have right-sided endocarditis, complicated bacteremia or uncomplicated bacteremia.

The trial has been powered based on the ITT population of 200 patients with the expectation that 80% of the patients will be evaluable. The Independent External Adjudication Committee or IEAC is made of respected specialists in the field and is reviewing all of the 230-plus patient profiles and will be the final arbitrator of three things: The diagnosis of each patient, whether they are evaluable, and the outcome - which for an individual patient could be “cured”, “improved” or “failed”. The IEAC continues to meet to review sets of patient profiles and remains blind to treatment. Cubist remains blind to all patient data.

Once all profiles have been reviewed, data lock will occur and tables and listings of the results will be prepared. As we previous said in the middle of this year, we expect to release top line results. A fuller data presentation is likely to follow at either ICAAC and/or the IDSA. Assuming positive results, we will file an sNDA later this year. When we release top line results we will also make clear our filing intention. However,

3

you should not expect to see data from important subsets until we present the data to the infectious disease community this fall. I will now turn it back to Mike.

MICHAEL W. BONNEY - CUBIST - PRESIDENT & CEO

Thanks, Frank. While our phase 3 study data are eagerly anticipated, we are publishing and presenting a range of clinical data regarding CUBICIN throughout this year. Some of this is based on analysis of the case data gathered in our CORE database. Last quarter I provided an early snapshot of more than 150 well defined complicated skin and skin structure cases in that database. We have now taken a look at the CORE database as a whole and I can share a few statistics.

The total database of cases gathered through December 2004 includes data on 1,160 infections treated with CUBICIN. Skin and skin structure cases were the most common category of infection reported. Confirmed or suspected MRSA infections represented just over 50% of all the cases. We were pleased to see in this first year of its availability that CUBICIN was reported as first-line of therapy in more than 25% of the reported infections. This is a good indicator of the level of acceptance CUBICIN is getting from physicians who use it. Subsets of CORE data have been submitted for presentation at scientific and medical specialists meetings held throughout the balance of this year.

The publication and presentation plan for CUBICIN this year covers a variety of clinical data from CORE, Cubist initiated research, and studies from outside investigators. Studies include experience with specific types of complicated skin and skin structure infections such as surgical site infections and diabetic foot, as well as pharmacokinetic and pharmacoeconomic data. We also plan pharmacokinetic and pharmacoeconomic data outputs from the phase 3 infective endocarditis/bacteremia study. In the first quarter we also accomplished two significant milestones relating to our ability to supply the growing market for CUBICIN. As reported in late February, our sNDA for additional API or bulk drug, manufactured at the ACS Dobfar facility in Italy has been approved by the FDA. In mid March we also filed an sNDA CBE-30 (that’s a changes being effected 30 days), for an additional fill/finish plant in Albuquerque, New Mexico, operated by Cardinal Health. We can now ship finished product from this facility.

These facilities will provide for at least a tripling of capacity to supply CUBICIN to the market - and that more than meets our needs as we target a larger hospital universe, look forward to the potential filing for an expanded label late this year, and plan towards a likely Chiron launch in the EU early in 2006 plus other international markets that Chiron and other partners are opening for us. This month we signed an agreement with Oryx Pharmaceuticals for marketing rights to CUBICIN in Canada.

We expect that 2005 will be the year of notable progress in Cubist product pipeline developments. First in-licensing: As previously reported, we expect to see data from a second Phase 2 trial of our in-licensed compound HepeX-Bä in the second half of the year. Our business development team is busy seeking

4

additional anti-infective compounds that we might bring in to leverage our proven development and marketing capabilities. Hence our first priority here is a clinical stage compound.

Second, drug discovery: We have made further progress in our search for a lipopeptide to complement CUBICIN. We have now identified 7 promising second generation lipopeptides that have good potential to expand the therapeutic use of this class for the treatment of pulmonary infections. This slide shows the ability of one of these new compounds to reduce pulmonary bacterial burden by 5 logs, compared to a one log reduction for Daptomycin in an animal model of pneumonia. The objective here is to identify an IND candidate for development.

We also continue to make progress in our natural product drug screening program. In the first quarter of 2005, we screened over half a million organisms, isolated nearly 500 antibiotic producing bacteria and prioritized 31 of these extracts for additional evaluation based on the unique activity against multi-drug resistant bacteria.

I will now turn it over to David McGirr who will take you through the first quarter numbers in greater detail.

DAVID McGIRR - CUBIST – CFO

Thanks, Mike. I will take you through some detail on the first quarter 2005 financial results and also provide some CUBICIN-specific metrics.

First, the numbers for the quarter: As you saw in our press release, we generated roughly $21 million in net CUBICIN revenue in the first quarter of 2005 with total net revenue for the quarter coming in at almost $24 million. We believe that our overall revenue performance for the quarter and our March momentum sets us up well for the balance of the year and as Mike said, we are comfortable with our guidance for product revenue for the year at $110 to $120 million.

Our operating loss and net loss continue to show improvements over previous periods. The net loss for Q1 of $12.9 million or $0.25 per share is better than the consensus net loss of $13.2 million and meets the earnings per share expectation. We are particularly pleased with our continued improvements in the bottom line which we have accomplished while making needed investments in connection with our ongoing clinical trials, preparation of our second fill/finish site and the growth of our sales organization.

We ended the quarter with more than $117 million in cash, cash equivalents and investments. Our cash burned in the quarter was approximately $11 million. We continue to expect that our cash burn for the full year will be around $50 million. Now some detail on CUBICIN sales metrics: Average daily sales per shipping day for the quarter shows the impact of less market demand in the first two months of the year. As we said earlier, March was a strong month for us and one measure of that was that the average daily sales in March exceeded the daily average for Q4 2004. You will see that the March momentum is reflected in this

5

slide showing the monthly trend for vials ordered per account. The uptick is clearly illustrated.

On average in Q1, we saw about seven new accounts ordering each day and that led to the additional 500 accounts in the quarter. We averaged around 125 repeat orders accounts each day. Formulary approvals continue ahead of our expectations and we are now on formulary at 72% of the A accounts, up from 65% as of the end of 2004. There were modest gains in the percentage of customers ordering in the A and B accounts and more noticeable gains in the C accounts. This is good account growth during the quarter, where there was some necessary diversion of sales management time as we hired and extensively trained 24 new sales people.

One comment about sales metrics going forward. At some point this year, it probably will make sense for us to shift from the drop ship method of distribution with which we launched CUBICIN. We now have the comfort of a more robust supply chain as well as growing confidence that wholesalers will be able to give us account-specific data on a regular basis. We have all become accustomed to the sales detail. We are planning towards this change - although we have not yet set a date for the changeover.

Now, to review our guidance which is unchanged from what we provided last quarter. We expect to see total year net product revenues come in between $110 and $120 million. The anticipated range for cost of goods sold for the full year is 30 - 32½ %. For operating expenses: We project R&D, which includes clinical expenses for the IE trial and for the HepeX-Bä Phase 2 trial, at between $52 and $54 million. We project sales and marketing including the payroll and expenses associated with 24 new sales people at between $43 and $45 million and we project G&A at $19 to $20 million. Net interest expense for the year should come in at around $7 million.

One last note from finance - those of you who have read our 10-K that was issued last month saw that we received a clean audit report for the Section 404 Sarbanes-Oxley process. I would like to acknowledge the huge effort made by our team to achieve this result.

Now I will pass the call back to Mike Bonney.

MICHAEL W. BONNEY - CUBIST - PRESIDENT & CEO

Thanks, David. 2005 is really a year of great promise for us. We all eagerly await the data from our CUBICIN Phase 3 infective endocarditis/bacteremia trial. We are making progress in building our product pipeline. We continue to work towards profitability. Our enlarged sales force is trained, energized and working hard. Our skilled and dedicated clinical group is organized to process the IE data mid-year in a focused and efficient manner. The entire Cubist organization is driving towards our goals as we continue to build a successful anti-infective pharmaceutical company.

6

I would like to briefly restate the 2005 milestones I set forth last quarter: We have added capacity in the CUBICIN supply chain with additional bulk and fill/finish plants now available; We have completed the expansion of our sales force and are calling on 400 additional target hospitals; We are submitting more CUBICIN data as abstracts and manuscripts for conferences and publications this spring and fall; We expect to release top line data from the Phase 3 Staph aureus endocarditis/bacteremia trial in mid 2005; Assuming favorable trial results, we expect to submit a sNDA during the second half of the year; We plan to complete the second Phase 2 HepeX-Bä trial in the second half of this year; During 2005, we will continue to work with our partner Chiron as it prepares for an anticipated European launch of CUBICIN in 2006; We are focused on building our pipeline with a combination of internally generated and externally acquired compounds.

We are committed to delivering a return to you, our shareholders, and we are moving toward this goal in a deliberate fashion while continuing to make the investments necessarye to grow and create value as a biopharmaceutical company. I would like to conclude by reiterating how good we feel about the CUBICIN sales trend coming out of the first quarter at $100 million annual run rate. As stated before, we believe that this drug has the potential for peak sales of $500 million. We are confident in our guidance for the year and look forward to the release of the Phase 3 infective endocarditis/bacteremia trial data at mid-year.

That concludes our formal remarks this afternoon. We are prepared to take your questions. Operator.

OPERATOR

Thank you. The floor is now open for questions, if you have a question, please press *, then 1 on your touchtone telephone at this time. If at any point your question has been answered, you may remove yourself from the queue by pressing the # key. We do ask that while you pose your question, that you pick up your handset to provide the optimum sound quality. Once again, to ask a question, please press *, then 1 on your touchtone telephone at this time.

Your first question is coming from Matt Duffy of Black Diamond Research.

<Q>: Good afternoon and thanks for taking my call. Just wanted to ask Frank if you can discuss a little bit about the endocarditis trial, if you can talk specifically — I know obviously the end point is the overall intent to treat on all the patients and non-inferiority versus the comparators. I wonder if there are key subgroups within that if you think the ID community, as well as the FDA, will be particularly focused on and how exactly you think they will evaluate those. Will they simply be trends, will they take other looks at that and how might that impact what the label looks like assuming a positive outcome of the overall trial? Thanks.

<A>: It is a good question. The subsets, as I mentioned, when patients are coming in, you look at them on whether or not they have bacteremia or endocarditis and when the patients initially come into the study, they are known to have a positive blood culture for Staphylococcus aureus. And it’s remarkable we were able to

7

screen 5,000 patients. When they are initially enrolled, we use the Duke Criteria for endocarditis or definite endocarditis or possible endocarditis. When we presented the data at the advisory committee meeting on October 14th, 2004, when we looked at 217 cases, approximately two-thirds of our patients had endocarditis, possible endocarditis or complicated bacteremia and that’s the group of patients that the infectious disease community and the regulatory authorities are looking at in order to give the indication for endocarditis and bacteremia.

They want to be able to determine whether a drug is active against these sick patients with endocarditis and/or complicated infections. Mike, did you want to take this about the label?

<A>: Sure. Clearly, the data are going to be - any label is dependent upon what the data show us. The study as Frank has indicated is powered to show non-inferiority with a 20% delta CUBICIN versus comparator. The agency will also go through the various subset that Frank has articulated. I’m sure they will want to look at CUBICIN versus semi-synthetic penicillin and CUBICIN versus Vanc in the MS and MR groups as well. But clearly they understand that the study was not powered for a statistical analysis of those subgroups. It was powered for the overall ITT and the pro-protocol populations. So I think there are a variety of subsets that will be of interest to the agency and to the ID community and we have articulated what those are.

If the data support it, the label could be indicated at CUBICIN is indicated at 6 mg/kg for complicated bacteremia, right-sided endocarditis, that could be either/or both depending upon what the data show.

<Q>: Okay, very good, thanks.

OPERATOR:

Thank you. Your next question is coming from Michael Aberman of Morgan Stanley. Please go ahead.

<Q>: Hi, guys, can you hear me?

<A>: Hi, Michael. Yeah.

<Q>: Just wanted to touch base on the quarter. The quarter-over-quarter growth was kind of flat obviously. You mentioned January and February being down. Can you give more details as to what drove the decrease in those months and if there is any trend that you saw in terms of changing patterns of use that would be of concern?

<A>: Yeah. What we have seen so far and understand that we have market data for January and February only so far. We have not yet seen the March data. It indicates that both units and dollars declined compared

8

to the end of 2004. So in a sequential way, the market was actually just smaller in those first two months than it had been as we exited 2004.

This effect was apparent on our revenues as well. But, I want to reiterate we did see sequential growth throughout the quarter. And March sales for CUBICIN came back very, very strongly - representing our best month since launch. So, given this momentum we saw through the quarter as well as, the successful expansion of the sales force and, hence, our ability to be face-to-face with a greater percentage of the market opportunity here, coupled with what’s being published in the New England Journal and other articles, we remain very comfortable with our guidance of $110 to $120 million in product revenue for the year.

<Q>: Just as a quick follow-up. Do you track our competitors with vancomycin use or Zyvox use, were those numbers down at all in January and February or was this unique to your product?

<A>: No, the whole market was down and it was a shared pain. Not every product in the marketplace, as best we could tell, was down, but the market overall and the vast majority of the products were.

<Q>: Great. Thanks.

OPERATOR:

Thank you. Your next question is coming from Adam Cutler of JMP Securities. Please go ahead.

<Q>: Hi, thanks for taking my question. I wonder — you mentioned obviously March was your strongest month to date and that it represented $100 million run rate. But I imagine that you probably had some sales data already from April. Is there anything you can give us even just color-wise on how sales look so far in April?

<A>: Sure, Adam. The momentum that we saw build through the first quarter has been essentially maintained as far as into April as we are today.

<Q>: Okay. So sales have continued to grow from — in April from March? Am I reading that comment correctly?

<A>: It is too early to make that conclusion because we are not at the end of April but the momentum we saw develop over the first quarter has certainly continued into April to date.

<Q>: Okay. Fair enough.

<A>: Remember, April 1st is when we realigned the territories and created these 24 more, more territories and all of those people were trained and ready to go on the 1st. So our call audience in April has expanded

9

to 1,400 — I’m sorry – 1,300 hospitals from about 900 that we have been calling on from launch to the end of March.

<Q>: Great, sure, okay. That makes sense. One other question is related to the endocarditis and bacteremia study. Obviously one of the potential advantages of CUBICIN is its rapid bactericidal activity. I am wondering if that’s something that one way or another will be measured in a comparative fashion in that study.

<A>: I am going to turn that one over to Frank.

<A>: Yeah. We built in as a secondary end put right from the beginning the speed at which the bacteremia is cleared and the bacteria cleared from the bloodstream. And so, what we will look at is daily blood cultures until they become negative. And that may translate into a more rapid clearing of the blood. Now, there is a second — there is another secondary end point is defervescence. That’s when patients with fever, the time it takes the fever to resolve. And so, that will be followed also. There are a number of other subsets of factors we’ll look at, and I don’t think we ought to go into them here, looking at the speed of clearing. Now you won’t see a shortened duration of therapy because with endocarditis and complicated bacteremia everybody gets treated for four weeks.

<Q>: Okay. Okay. And one last question is you mentioned that you are making progress in identifying second generation lipopeptides. I’m wondering if you have any idea when you might be able to file an IND.

<A>: It is a good question, Adam. Where we are right now is we are exploring a variety of chemical spaces around the lipopeptide molecule and we have identified as I said seven compounds that show both in vitro and in some cases in vivo activity against pathogens that you would be concerned about in pneumonia. We’re going to continue to explore that space and would expect to make a selection for a lead compound later this year. We would then initiate GLP or good lab practice tox study to enable the IND. That is what we would anticipate occurring toward the latter part of 2006.

<Q>: Okay. And actually, if I can just add one other follow-up to the question about the market softness in particular in January and February. So I understand what you are saying is the category overall was weak and, you know, that obviously would explain some of the softness in CUBICIN sales. But it seems sort of counter intuitive given all of the media reports that we’re seeing about the increased incidence and severity for a lot of these infections that end up in the hospital. I am wondering how surprising was this to you and I am wondering if you have any reaction to that.

<A>: Recognize that the market was down in the sequential basis. If you compare the market in the beginning of 2005 to the beginning of 2004, it is up pretty dramatically but it was down on a sequential basis. Of course what we report is sequential sales, Q4, and then Q1 and then Q2, et cetera.

10

<Q>: But there is no clear kind of explanation of why that might be. It is just sort of random?

<A>: It is a pattern that has been seen — if you look at the third-party data, it is a pattern that’s seen in this marketplace fairly consistently. I don’t know exactly - we have a series of hypotheses we are considering but we don’t know exactly why the market seems to take a pause, if you will, in its growth from the end of one year to the beginning of the next.

<Q>: Okay. Thank you very much.

OPERATOR:

Thank you. Your next question is coming from Joel Sendek of Lazard. Please go ahead.

<Q>: Thanks a lot. Just on this $100 million annual run rate, so my simple math says that means March was $8.3 million month. You might have put that on the slide but I missed some of them. Was that kind of accurate.

<A>: You did the math, right, Joel.

<Q>: I guess the next question that I have is I am looking at the IMS data from the monthly dollar data from January and February. That shows a sequential decline from January to February. And you indicated that you had momentum throughout the quarter. I’m just trying to kind of rationalize those two things and the worry that I would have is that March — could March have been the aberration as opposed to the trend?

<A>: Sure. First thing I would say is a repeat of what I said in the last quarter’s conference call which is both of the third-party data sources NDC and IMS, because we don’t ship to the wholesalers, have difficulty in tracking CUBICIN sales accurately. Now, they are never completely accurate in my experience as well. But what we have with CUBICIN is great variability. Some months they under report pretty dramatically what we see and some months they over report compared to what we see internally. What I have reported on in terms of sequential growth for the three months of the quarter is what we have actually shipped out the door and been received by our customers and hence we have been allowed to recognize that revenue.

<Q>: Okay. And then if I can shift gears on the milestones for the rest of the year. Can you give us — now that we are in the fourth month already, can you give us any more detail or narrow down the window for when we will see endocarditis data that is safe to say in kind of the July, later summertime frame? Is that fair?

<A>: I am sticking with mid-year. Joel, we’re going to process this as quickly as we can and as soon as we have the final tables and listings and able to make sense of it, we’ll let you know.

11

<Q>: Thanks anyway.

<A>: Okay.

OPERATOR:

Thank you. Your next question is coming from Jason Kantor of RBC. Please go ahead.

<Q>: Thank you. Could you update us on the percent off-label and on-label used of percent in hospital versus outpatient use and then I have one other question.

<A>: Sure, sure, Jason. As you know, we don’t promote the drug for anything but complicated skin and skin structure infections. And it is also not — we haven’t yet found a good data source on a routine basis to answer your question. So what I have is market research and that kind of thing that we have done in the CORE database which all point in about the same direction, which is roughly 50% of the use of the drug is in complicated skin, and roughly 50% of the use of the drug is in other indications.

<Q>: Outpatient.

<A>: Outpatient in the quarter was about 37%, so it was just about the same numbers as it was through the balance of last year. We seem to be holding very steady there.

<Q>: With regard to the CORE database and how reliable that is, these are people that have agreed to be part of a measuring the use of CUBICIN in a setting, right? So would they be somewhat more biased to use CUBICIN first line and various other things you think represents more of the broader treatment? And then also, looking at your own slide where you have what I guess is the account ordering trends, you saw the exact same January, February, March trend last year and this is year. It is hard to believe that you guys don’t have a handle on exactly what that trend is since it seems to be repeating annually.

<A>: Right. So on CUBICIN first line, I take your point about a potential bias in the CORE data set except all the market research we have done which has been blinded, that is to say we don’t identify that it is Cubist doing the market research, indicate very similar data. That between 20 and 30% of the use of CUBICIN is in the first line position, the balance is in second line. You do see a greater bias in the market research. The first line use of CUBICIN in complicated skin as opposed to offlabel. Offlabel it is more likely to be second line. And so I think that the data are all lining up pretty consistently with respect to how much of the drug is being used first line.

I share your frustration with ‘can’t you figure out what’s going on in this marketplace in the first part of the year?’ - - as I said, we have a series of hypotheses we have explored. We don’t have any definitive answer at

12

this point but we are going to continue to pursue them and all I can tell you is it looks the same year-over-year. It looked like this if you take the data back to before we launched.

<Q>: Okay, thank you.

OPERATOR:

Thank you. Once again, to ask a question, please press star, then one on your touchtone telephone at this time. Your next question is coming from Eun Yang of Wells Fargo. Please go ahead.

<Q>: Thanks. Michael, you mentioned that the month of March was a very strong — strongest since CUBICIN launch. I am just wondering that strong sale in CUBICIN — in CUBICIN, I am just wondering whether that trend you see it in the overall marketplace as well.

<A>: I can’t answer the question, Eun, because we haven’t seen data on the full marketplace for March yet. We, like you, rely on the third-party data sources for the competitive products and they haven’t been produced for March yet.

<Q>: Okay. The second question is you have about 200 patients, intent-to-treat patients, in the endocarditis/bacteremia trial. Do you have the distribution in terms of number of patients between complicated bacteremia and right-sided endocarditis?

<A>: As Frank mentioned earlier — let me just clarify because I think there was some confusion in your question here. We powered the study assuming an 80% power for a 20% delta, and assuming a drop-out rate or nonevaluable rate, we powered the study for 200 patients. We have actually enrolled north of 230. Frank presented data in October at a FDA advisory committee where we had at that point information on 215 or so. About three-quarters of those patients met the Duke Criteria for probable or definite endocarditis, as I recall.

<A>: Right.

<Q>: Okay. Then you said that the possible indications for CUBICIN in this setting is that either it could be complicated bacteremia or endocarditis or both. So, I guess in the subgroup analysis you are looking at the trend to get that indication. Just wondering if you have a small number of patients in the complicated bacteremia, whether you would be able to detect even a trend in this setting?

<A>: When you start cutting the patients down into these groups, you are decreasing the power because you have lesser numbers with it. So the medical people are going to look at this and try and draw some conclusions. With the patient — the patients that we enrolled as I presented in October two-thirds of them fell

13

into this category of definite endocarditis, probable endocarditis or complicated bacteremia. And so we think we have a very good representative sample.

When you look in the literature at Staph aureus bacteremia, there is a paper by Fowler of 714 cases and the incidence of complicated disease in that study is 43%. So I think we enriched our study to have that two-thirds of the patients falling into that category. But we are not privy to the final data so I can’t give you any of the final data until we lock down the database.

<A>: Let me try and clarify one piece. Complicated bacteremia is defined as Staph aureus in the blood plus another foci of infection. By definition an endocarditis patient is also a complicated bacteremia patient. So we are kind of assuming that folks understand that but that may help you understand why we have some confidence here, given the data that Frank gave in October - we have sufficiently large “n”s so decisions can be made on this.

<Q>: Thanks very much.

<A>: Sure.

OPERATOR:

Thank you. Your next question is coming from Michael McNulty of Contex Capital. Please go ahead.

<Q>: Hi, thanks for taking the question. What type of off label uses are you seeing folks use this for? Is it endocarditis, bacteremia for the most part?

<A>: Bacteremia is the most common off label use of the drug based on the market research that we’ve done by quite a large margin. That would actually foot with the market dynamic overall, which indicates that vancomycin is used more frequently for bacteremia than any other indication.

Endocarditis is actually a relatively small number of patients but a very difficult to treat infection. Our use there again based on market research appears to be relatively small as it is in other assorted off label Gram-positive infections.

<Q>: And just anecdotally from what you are hearing from doctors coming back, how have the patients been performing, the off label patients been performing?

<A>: The anecdotes are very positive. We have done market research now two or three times since we launched the product and it has been fairly consistent. So my assumption is if it wasn’t working they wouldn’t keep using it. But beyond that, Rush Presbyterian a center out in Chicago presented data at IDSA last year

14

looking at a series of patients treated with CUBICIN where they reported quite strong results in staphylococcal and enterococcal bacteremia and endocarditis.

<Q>: Now are they not using it for endocarditis simply because they are used to using vancomycin and it works? Or does vancomycin work better?

<A>: It is an issue of incidence. So, if you look at 2003 is the last year for which we have vancomycin usage broken down by organ system, location of infection in the organ system, there is about a 20-fold increase in vancomycin use. It is about 25 fold actually, vancomycin use for endocarditis — for bacteremia rather as compared to endocarditis, just many more patients have bacteremia than have endocarditis.

<Q>: Okay, that’s fair. Then also just switching just to another side, there was some rumors running around that there is some earlier in the quarter that there was some competitive drugs out there and I was just wondering if you could speak to what you are seeing out there and also Nabi Pharmaceuticals has been making some noise that their vaccine is the next great cure. Can you just talk about how competitive drugs and/or vaccines out there, you know how you see them positioned versus CUBICIN, please.

<A>: Sure. In the marketplace today we compete primarily with vancomycin which is a non-promoted product.

<Q>: Right.

<A>: And linezolid, or Zyvox, which is promoted by Pfizer. We are also getting some business in susceptible Staph aureus disease - which of course would normally be treated with semi-synthetic penicillins, also a non-promoted group.

In terms of what’s coming, there is a product that has been filed with the FDA called Dalbavancin which is the same class as vancomycin. That’s a drug that’s administered as an IV once a week. If that should be approved, we think we can position CUBICIN very effectively against Dalbavancin. The Staph VAX is an interesting compound Nabi is working on. They have shown in a high-risk population, that is the patients who are on dialysis, a reduction in staphylococcal infections, although it did not reach the predetermined primary end point so they are having to redo that study at this point. So, we’ll have to see where those data end up and I think they are due to present that sometime later this year.

<Q>: Okay, thanks a lot. Appreciate it.

<A>: Okay.

15

OPERATOR:

Thank you. Your next question is coming from David Webber of First Albany. Please go ahead.

<Q>: Thanks for taking my question. A lot of them have already been asked. Just a couple, first, can you tell us how large the sales allowances were in the first quarter and fourth quarter?

<A>: I’m not sure, David, I understand your question. Sales allowances?

<Q>: Well, the reduction from growth to net sales.

<A>: It is somewhat of a moving target as I think we talked about in the past, David. And I would like you to wait for the 10-Q to be filed which will happen in the next few weeks to see the full details of the first quarter numbers if that would be okay.

<Q>: Okay. Thanks very much.

OPERATOR

Thank you. At this time, there are no further questions. I would like to turn the floor back over to the presenters for any closing remarks.

MICHAEL W. BONNEY - CUBIST - PRESIDENT & CEO

Thank you, Ashley. This concludes our call for this quarter and thank you for taking the time to join us this afternoon. You may want to mark your calendars now for our second quarter call which is scheduled for Wednesday, July 20th, at 5:00 p.m. as you have no doubt noticed, we have improved our performance on the closing and we are trying to get you this information as soon as possible and we expect we can reproduce the first quarter closing timeline in the second quarter. So we look forward looking to you on July 20th if not before. Thank you.

OPERATOR

Thank you. That does conclude today’s teleconference. You may disconnect your lines at this time and have a wonderful day.

16