Exhibit (a)(1)(Q)

Ken Frazier

Chairman, Chief Executive Officer

Merck & Co., Inc.

JPMorgan 2015 Healthcare Conference

January 12, 2015

MERCK Be well

Forward-Looking Statement

This communication includes “forward-looking statements.” Forward looking statements include statements regarding the timing and closing of the tender offer and the merger transactions, the ability of Merck to complete the transactions considering the various closing conditions, and any assumptions underlying any of the foregoing. These statements are based upon the current beliefs and expectations of Merck’s management and are subject to significant risks and uncertainties. There can be no guarantees with respect to pipeline products that the products will receive the necessary regulatory approvals or that they will prove to be commercially successful. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include but are not limited to, general industry conditions and competition; general economic factors, including interest rate and currency exchange rate fluctuations; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment; technological advances, new products and patents attained by competitors; challenges inherent in new product development, including obtaining regulatory approval; Merck’s ability to accurately predict future market conditions; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; dependence on the effectiveness of Merck’s patents and other protections for innovative products; the exposure to litigation, including patent litigation, and/or regulatory actions; timing of the tender offer and merger; uncertainties as to how many Cubist stockholders will tender shares in the tender offer; the possibility that competing offer may be made; the possibility that various closing conditions to transactions may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transactions; or that a material adverse effect occurs with respect to Cubist.

Merck undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except if required by applicable law. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in Merck’s 2013 Annual Report on Form 10-K and the company’s other filings with the SEC available at the SEC’s Internet site (www.sec.gov).

MERCK Be well

1

Important Information about the Tender Offer

This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares. On December 19, 2014, Merck filed a tender offer statement on Schedule TO with the SEC, and Cubist filed a solicitation/recommendation statement on Schedule 14D-9 with respect to the tender offer. The tender offer materials (including an offer to purchase, a related letter of transmittal and other tender offer documents) and the solicitation/ recommendation statement, as each may be amended or supplemented from time to time, contain important information that holders of Cubist common stock shares are urged to read carefully before making any decision regarding tendering their shares. All of these materials are available at no charge on the SEC’s website at www.sec.gov. In addition, copies of the tender offer materials may be obtained at no charge by contacting Merck at 2000 Galloping Hill Road, Kenilworth, N.J., 07033 or by phoning (908) 740-4000. Moreover, Merck and Cubist file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Merck or Cubist at the SEC public reference room at 100 F Street, N.E., Washington, D.C., 20549. For further information on the SEC public reference room, please call 1-800-SEC-0330. Merck’s and Cubist’s filings with the SEC are also available to the public from commercial document-retrieval services and at the SEC’s website at www.sec.gov.

MERCK Be well

2

Merck is Positioned for Long-Term Growth through Innovation

Premier Research-Driven Biopharmaceutical Company

New Focused Model Suite of Opportunities

Four Key Growth Advancing Innovative

Platforms Pipeline

Accelerating BD Strategy “Breakthrough Programs”

Improving Operating 7 New Product Launches

Model

MERCK Be well

3

Focused Areas Give Us a Strong Platform for Growth

DIABETES

Total deaths from diabetes are projected to increase by 50% in the next 10 years

HOSPITAL ACUTE CARE

Antibiotic-resistant bacteria infects over 2 million Americans annually, resulting in 23,000 deaths

VACCINES

Cervical cancer is the second most common cancer in women worldwide

ONCOLOGY

Every year, 8 million people die from cancer worldwide

Sources: CDC, WHO

MERCK Be well

4

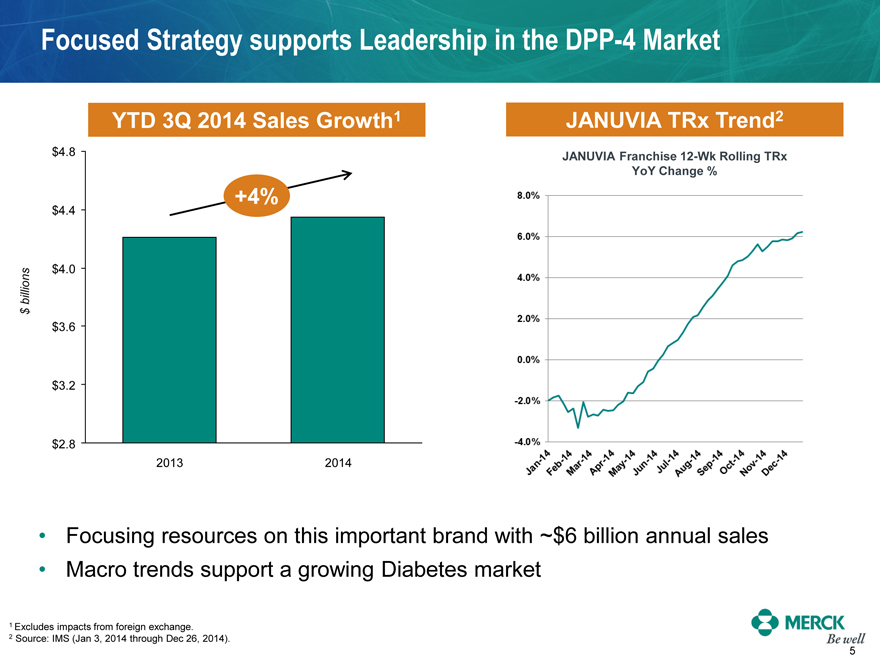

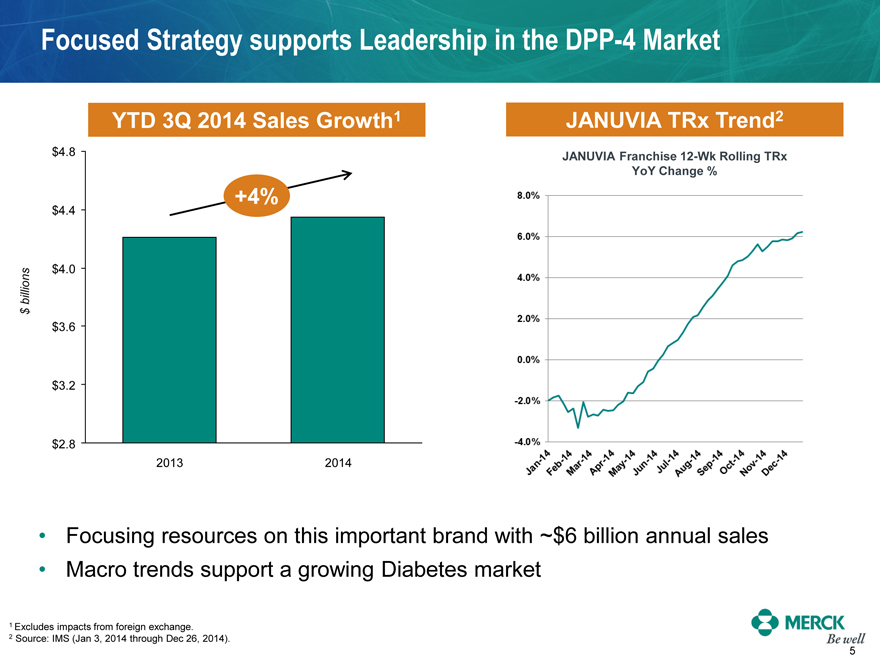

Focused Strategy supports Leadership in the DPP-4 Market

YTD 3Q 2014 Sales Growth1

$ billions

$4.8 $4.4 $4.0 $3.6 $3.2 $2.8

+4%

2013

2014

JANUVIA TRx Trend2

JANUVIA Franchise 12-Wk Rolling TRx YoY Change %

8.0%

6.0%

4.0%

2.0%

0.0%

-2.0%

-4.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Focusing resources on this important brand with ~$6 billion annual sales

Macro trends support a growing Diabetes market

1 Excludes impacts from foreign exchange.

2 Source: IMS (Jan 3, 2014 through Dec 26, 2014).

MERCK Be well

5

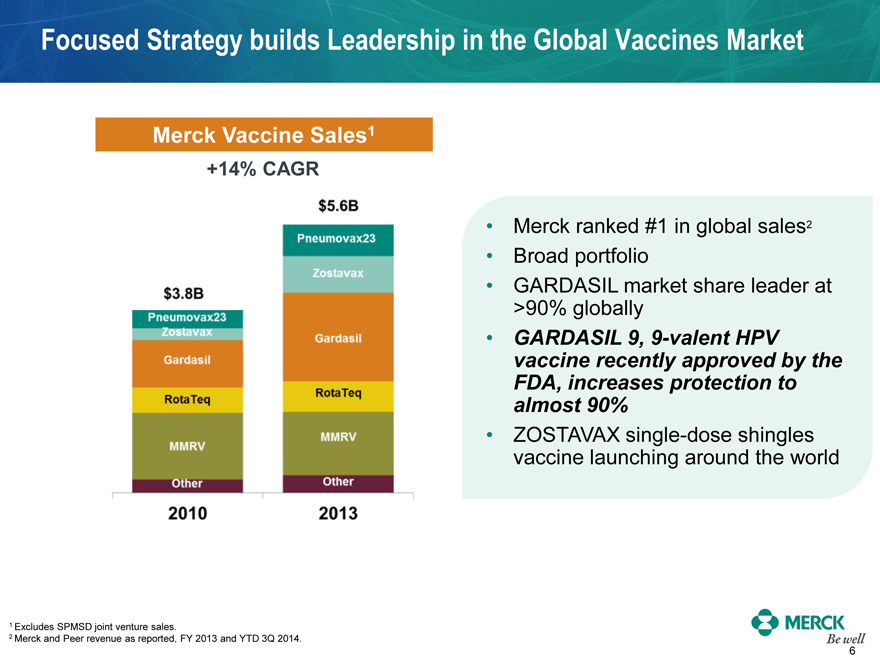

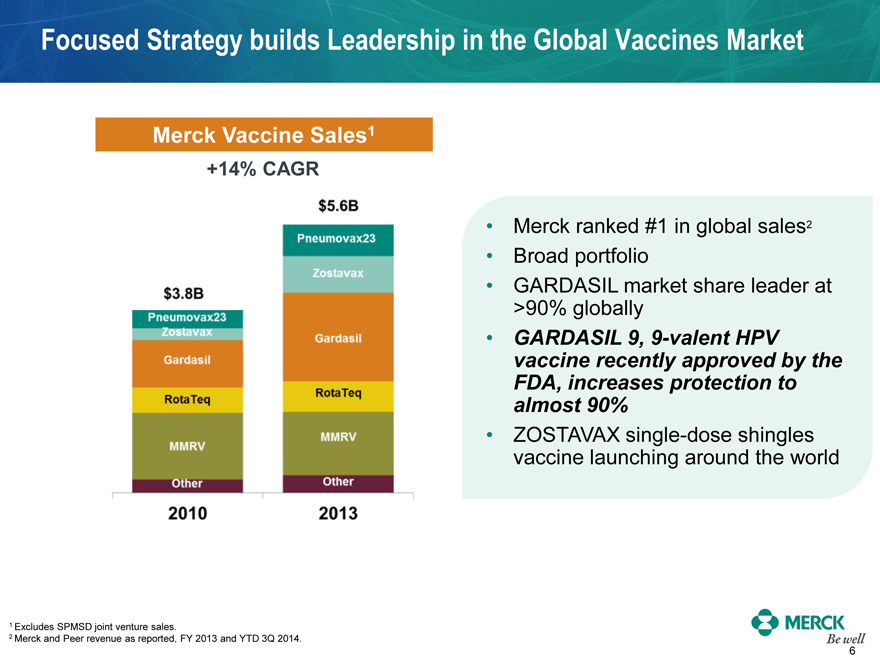

Focused Strategy builds Leadership in the Global Vaccines Market

Merck Vaccine Sales1

+14% CAGR

$3.8B

Pneumovax23

Gardasil

RotaTeq

MMRV

Other

2010

$5.6B

Pneumovax23

Gardasil

RotaTeq

MMRV

Other

2013

Merck ranked #1 in global sales2

Broad portfolio

GARDASIL market share leader at >90% globally

GARDASIL 9, 9-valent HPV vaccine recently approved by the FDA, increases protection to almost 90%

ZOSTAVAX single-dose shingles vaccine launching around the world

1 Excludes SPMSD joint venture sales.

2 Merck and Peer revenue as reported, FY 2013 and YTD 3Q 2014.

MERCK Be well

6

Focused Strategy builds First-in-Class Immuno-Oncology program

KEYTRUDA

(pembrolizumab) for Injection 50mg

First Anti-PD-1 launched in the US

Vast majority of ipilimumab-refractory patients are receiving KEYTRUDA

Reaching 90% of ipilimumab prescribers

Strong access in labeled indication with over 90% of claims paid in less than 60 days and without restrictions

Converted all patients on the Expanded Access Program to commercial product within 60 days of approval

MERCK Be well

7

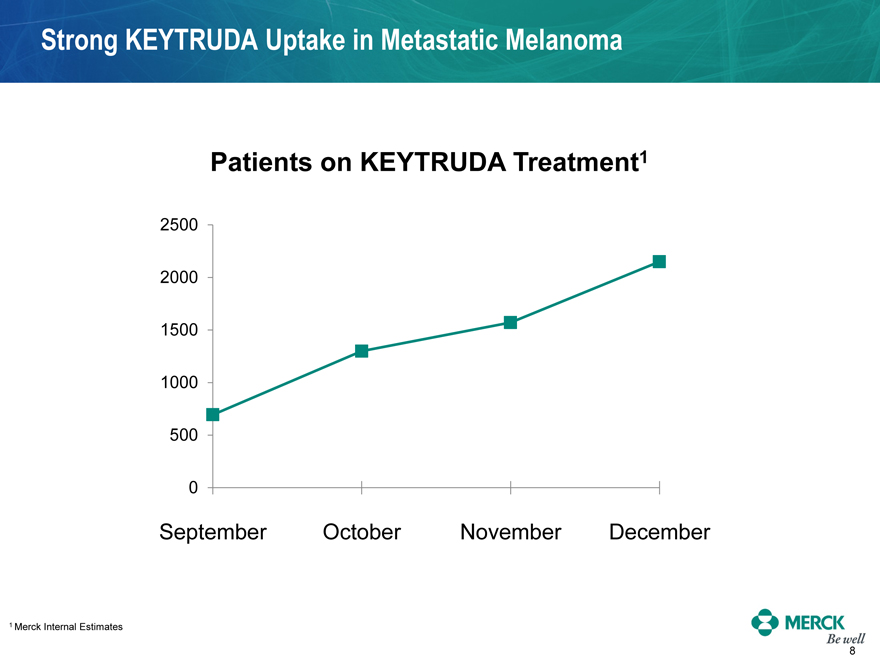

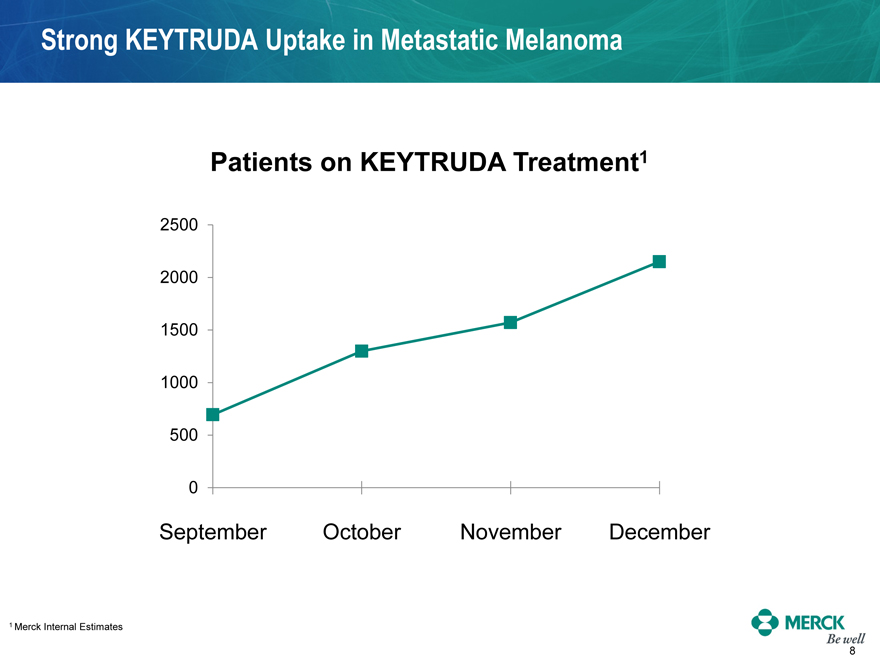

Strong KEYTRUDA Uptake in Metastatic Melanoma

Patients on KEYTRUDA Treatment1

2500 2000 1500 1000 500 0

September October November December

1 Merck Internal Estimates

MERCK Be well

8

Hospital Acute Care is an Area of Significant Unmet Need

Growing Medical Demand and High Unmet Need

Antimicrobial resistance is a global public health crisis

Drug-resistant superbugs could cost the global economy as much as $100 trillion between now and 20501

Hospitals: Central Hub for Healthcare Delivery Around the World

$2.1 trillion in global hospital spend; 25% of overall healthcare spend2

Growing 2x faster than overall pharma market (6.6% CAGR)2

Hospital Acute Care Market: $60 billion2

Targeting Areas of Highest Unmet Need, Customer Priorities, and Cost Burden

ICU – Single largest cost burden for hospitals (15% of total expenses)3

Surgery – Single largest revenue and profit driver (50%) for hospital4

ER/Discharge – Influences choice of care (discharge, ward, prescription)

Hematology – Major unmet need coupled with high rates of mortality

1Source: Kitamura, Makiko. “Deadly Superbugs Could Cost $100 Trillion by 2050.” Bloomberg Dec. 11, 2014. 2Source: Evaluate Pharma.

3Source: Critical care medicine in the United States. NA Helpern, Stephen M. Pastures MD. Crit Care, Med. 2010; 38: 65-71 , ICU Study, L Russell, Global

Institute for Health 2012. 4Source: Achieving Operating Room Efficiency through Process Integration, McKesson Information Solutions and the Healthcare Financial Management Association 2013.

MERCK Be well

9

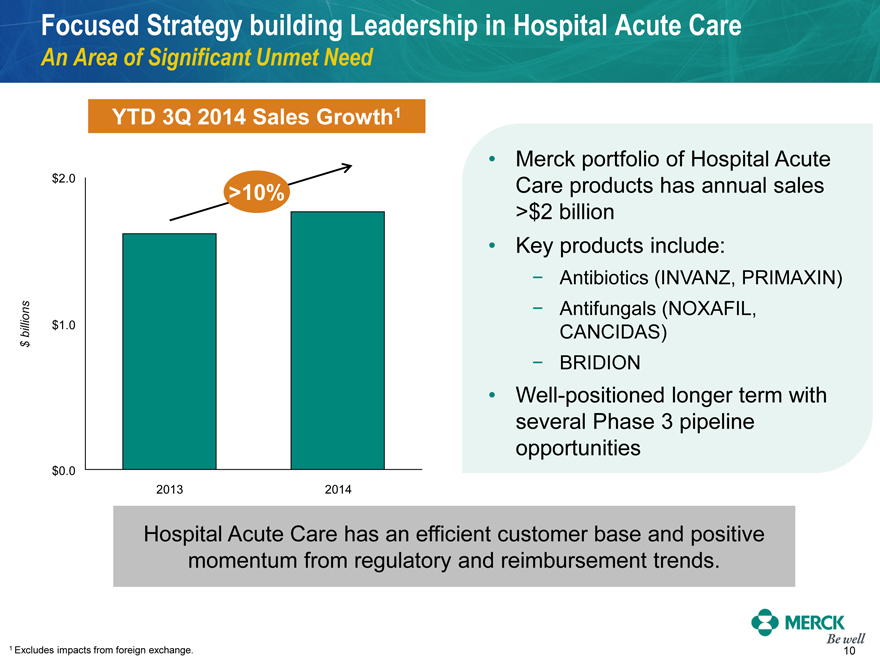

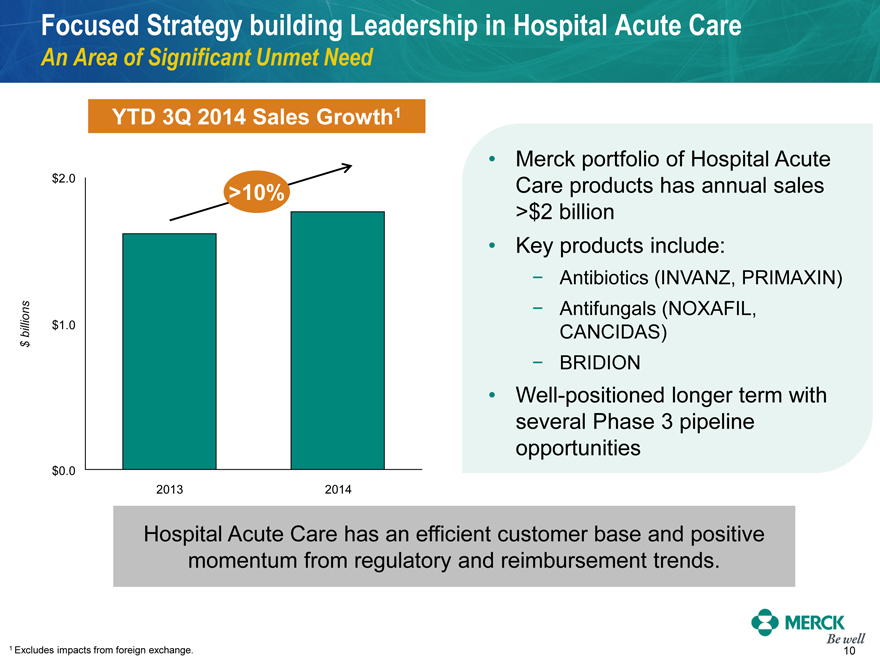

Focused Strategy building Leadership in Hospital Acute Care

An Area of Significant Unmet Need

YTD 3Q 2014 Sales Growth1

$ billions

$2.0 $1.0 $0.0

>10%

2013 2014

Merck portfolio of Hospital Acute Care products has annual sales

>$2 billion

Key products include:

- Antibiotics (INVANZ, PRIMAXIN)

- Antifungals (NOXAFIL, CANCIDAS)

- BRIDION

Well-positioned longer term with several Phase 3 pipeline opportunities

Hospital Acute Care has an efficient customer base and positive momentum from regulatory and reimbursement trends.

1 Excludes impacts from foreign exchange.

MERCK Be well

10

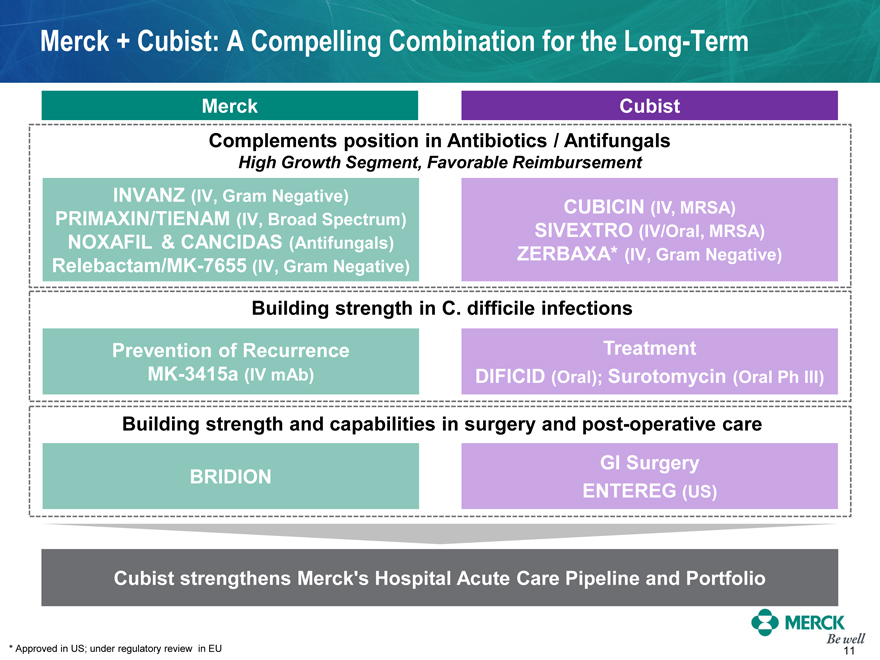

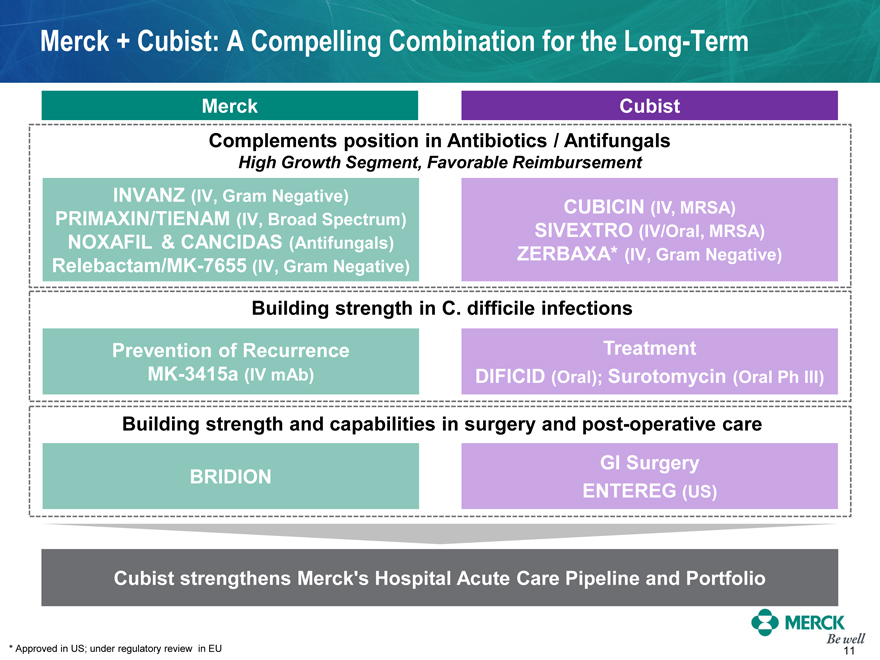

Merck + Cubist: A Compelling Combination for the Long-Term

Merck

Cubist

Complements position in Antibiotics / Antifungals

High Growth Segment, Favorable Reimbursement

INVANZ (IV, Gram Negative) PRIMAXIN/TIENAM (IV, Broad Spectrum)

NOXAFIL & CANCIDAS (Antifungals) Relebactam/MK-7655 (IV, Gram Negative)

CUBICIN (IV, MRSA) SIVEXTRO (IV/Oral, MRSA) ZERBAXA* (IV, Gram Negative)

Building strength in C. difficile infections

Prevention of Recurrence MK-3415a (IV mAb)

Treatment

DIFICID (Oral); Surotomycin (Oral Ph III)

Building strength and capabilities in surgery and post-operative care

BRIDION

GI Surgery

ENTEREG (US)

Cubist strengthens Merck’s Hospital Acute Care Pipeline and Portfolio

MERCK

* Approved in US; under regulatory review in EU

Be Well

11

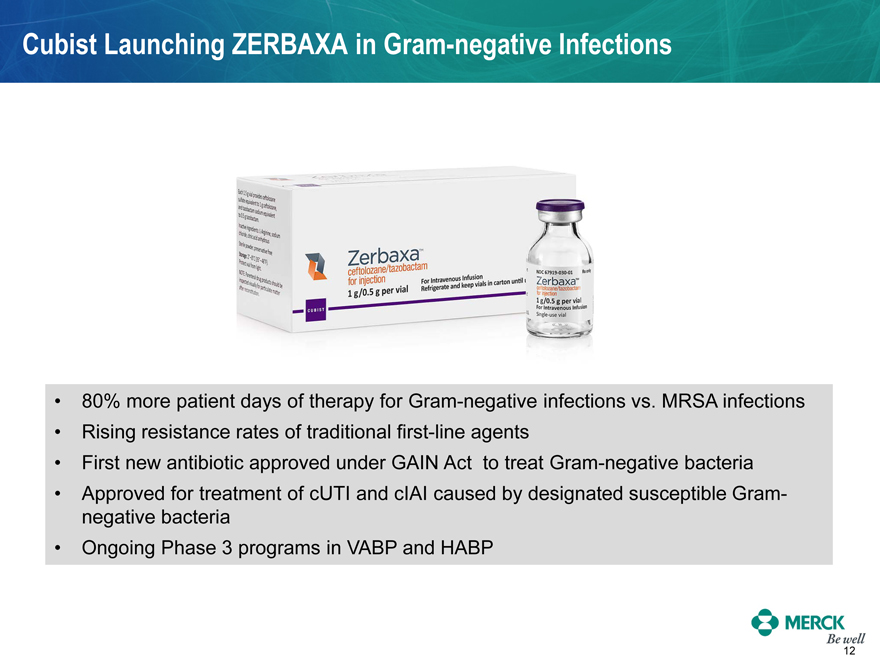

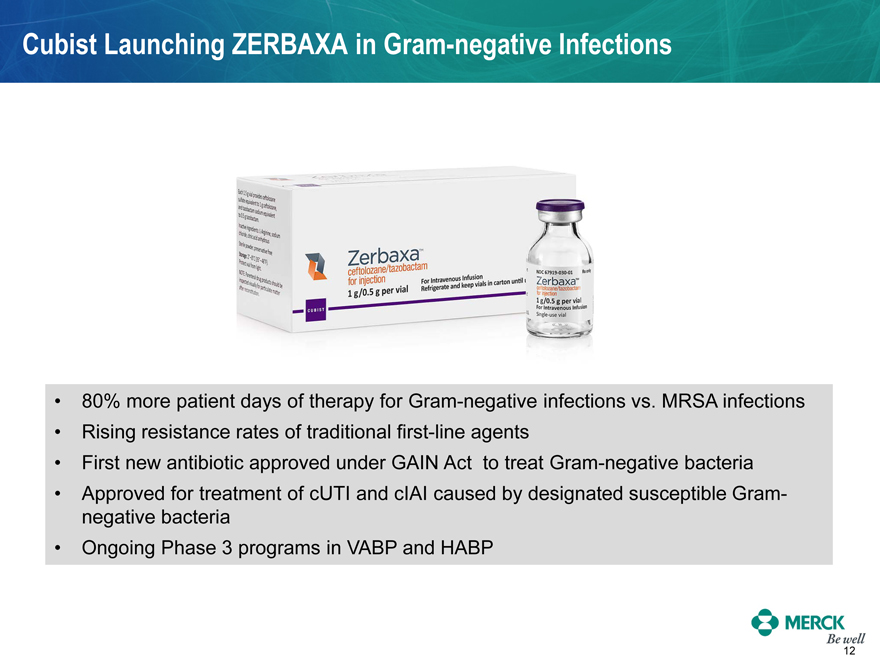

Cubist Launching ZERBAXA in Gram-negative Infections

80% more patient days of therapy for Gram-negative infections vs. MRSA infections

Rising resistance rates of traditional first-line agents

First new antibiotic approved under GAIN Act to treat Gram-negative bacteria

Approved for treatment of cUTI and cIAI caused by designated susceptible Gram-negative bacteria

Ongoing Phase 3 programs in VABP and HABP

MERCK

Be Well

12

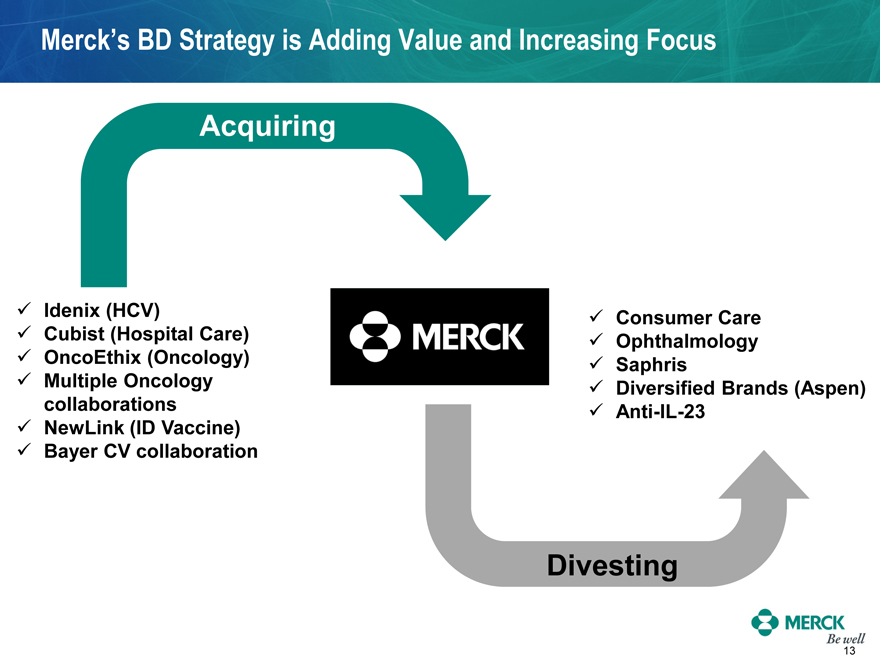

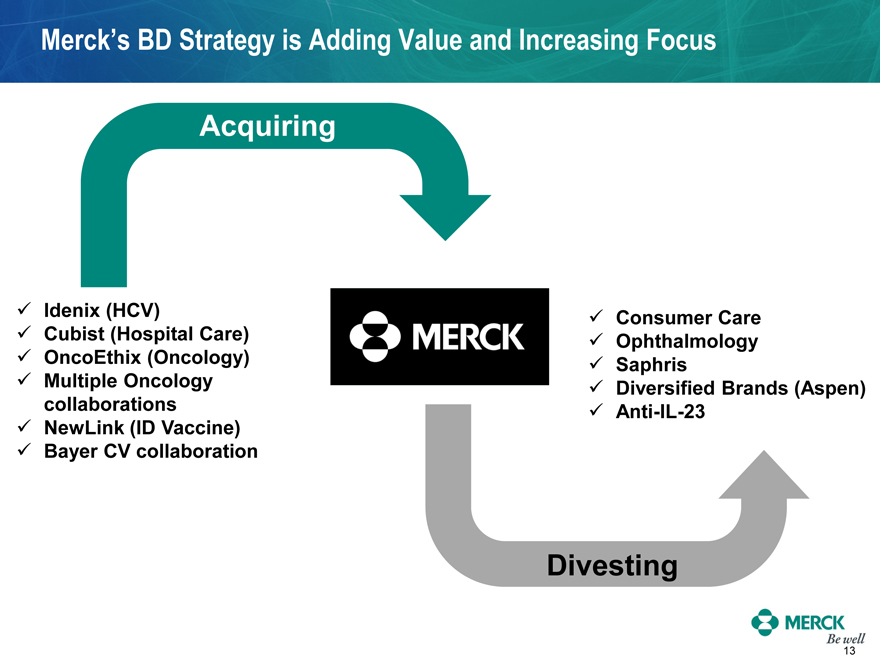

Merck’s BD Strategy is Adding Value and Increasing Focus

Acquiring

Idenix (HCV)

Cubist (Hospital Care)

OncoEthix (Oncology)

Multiple Oncology

collaborations

NewLink (ID Vaccine)

Bayer CV collaboration

MERCK

Consumer Care

Ophthalmology

Saphris

Diversified Brands (Aspen)

Anti-IL-23

Divesting

MERCK

Be Well

13

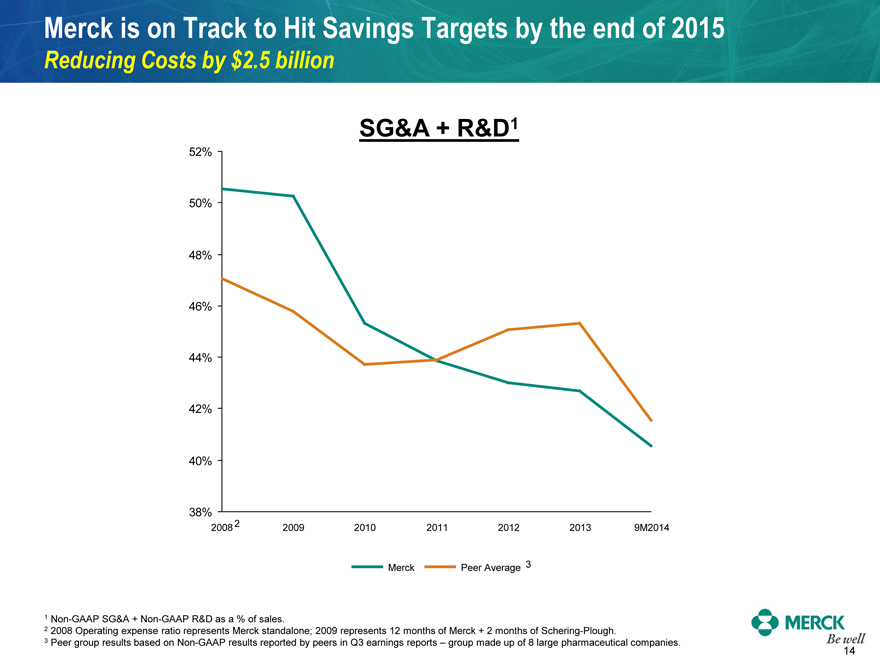

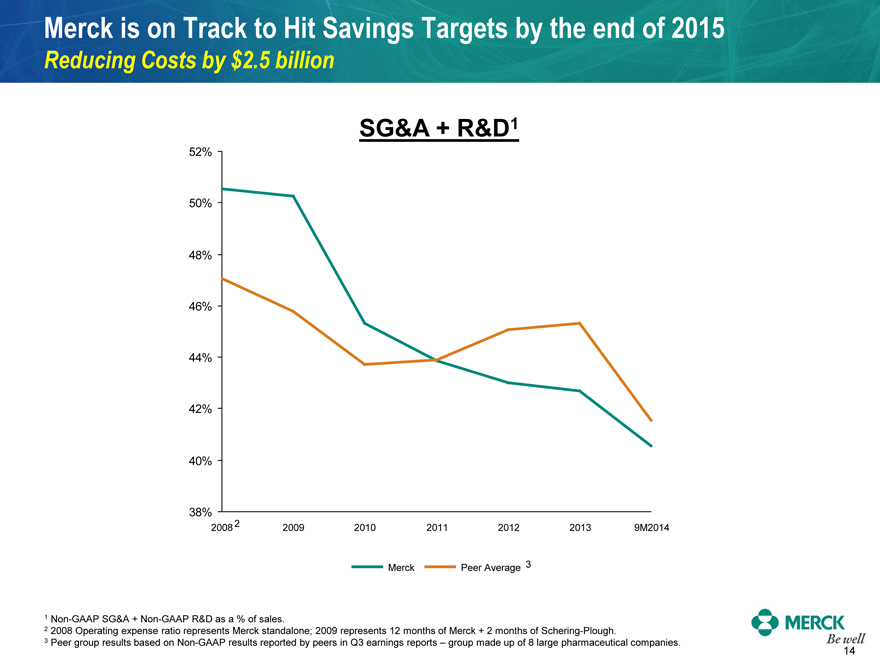

Merck is on Track to Hit Savings Targets by the end of 2015

Reducing Costs by $2.5 billion

SG&A + R&D1

52% 50% 48% 46% 44% 42% 40% 38%

2008 2 2009 2010 2011 2012 2013 9M2014

Merck Peer Average 3

1 Non-GAAP SG&A + Non-GAAP R&D as a % of sales.

2 2008 Operating expense ratio represents Merck standalone; 2009 represents 12 months of Merck + 2 months of Schering-Plough.

3 Peer group results based on Non-GAAP results reported by peers in Q3 earnings reports – group made up of 8 large pharmaceutical companies.

MERCK

Be Well

14

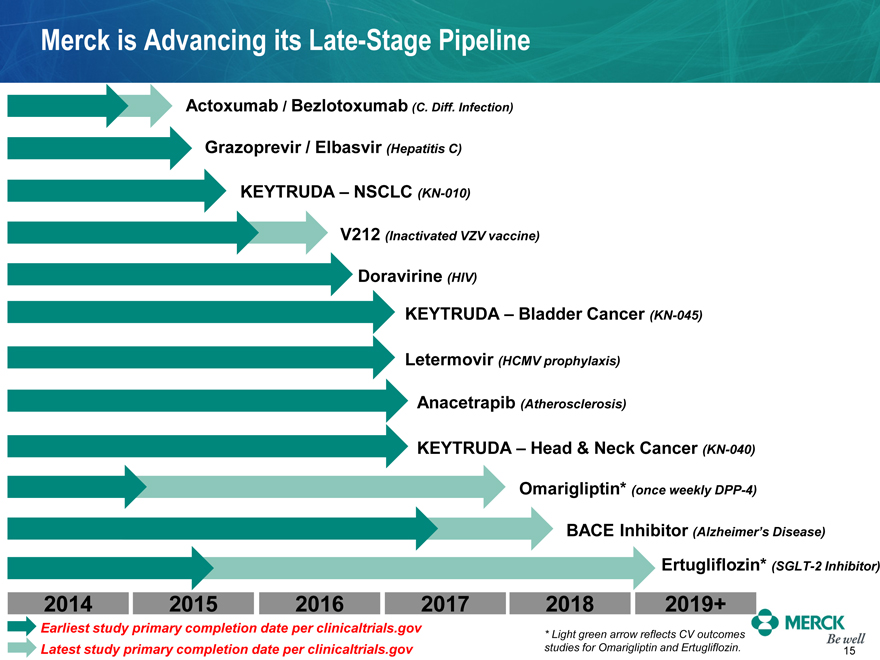

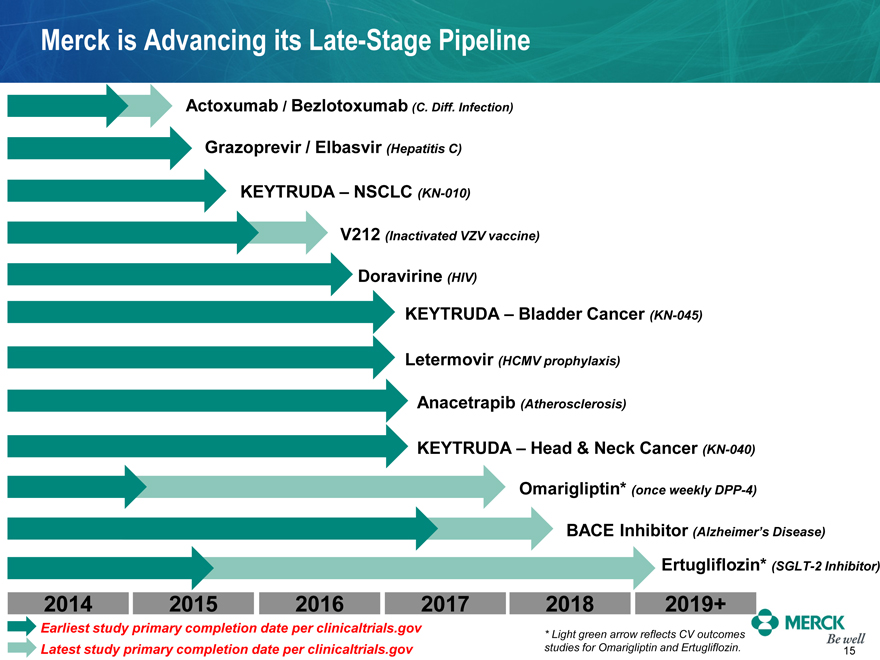

Merck is Advancing its Late-Stage Pipeline

Actoxumab / Bezlotoxumab (C. Diff. Infection)

Grazoprevir / Elbasvir (Hepatitis C)

KEYTRUDA – NSCLC (KN-010)

V212 (Inactivated VZV vaccine)

Doravirine (HIV)

KEYTRUDA – Bladder Cancer (KN-045)

Letermovir (HCMV prophylaxis)

Anacetrapib (Atherosclerosis)

KEYTRUDA – Head & Neck Cancer (KN-040)

Omarigliptin* (once weekly DPP-4)

BACE Inhibitor (Alzheimer’s Disease)

Ertugliflozin* (SGLT-2 Inhibitor)

2014 2015 2016 2017 2018 2019+

Earliest study primary completion date per clinicaltrials.gov

Latest study primary completion date per clinicaltrials.gov

* Light green arrow reflects CV outcomes studies for Omarigliptin and Ertugliflozin.

MERCK

Be Well

15

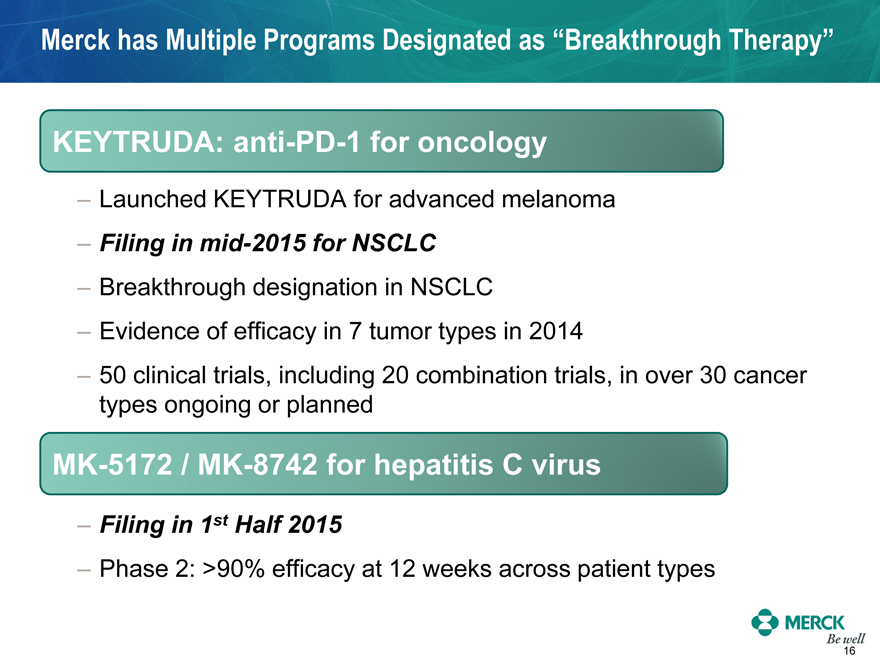

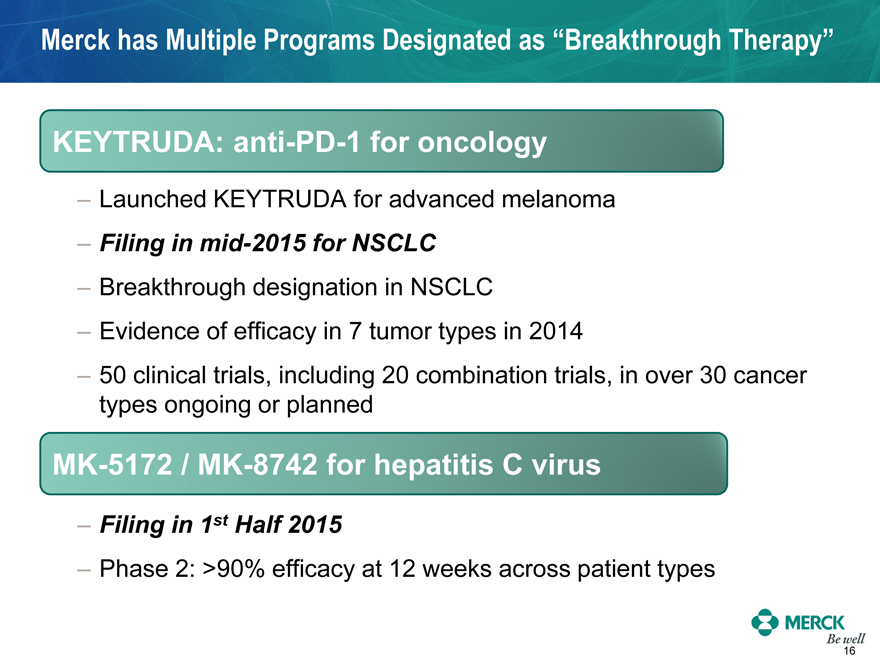

Merck has Multiple Programs Designated as “Breakthrough Therapy”

KEYTRUDA: anti-PD-1 for oncology

- Launched KEYTRUDA for advanced melanoma

- Filing in mid-2015 for NSCLC

- Breakthrough designation in NSCLC

- Evidence of efficacy in 7 tumor types in 2014

- 50 clinical trials, including 20 combination trials, in over 30 cancer types ongoing or planned

MK-5172 / MK-8742 for hepatitis C virus

- Filing in 1st Half 2015

- Phase 2: >90% efficacy at 12 weeks across patient types

MERCK

Be Well

16

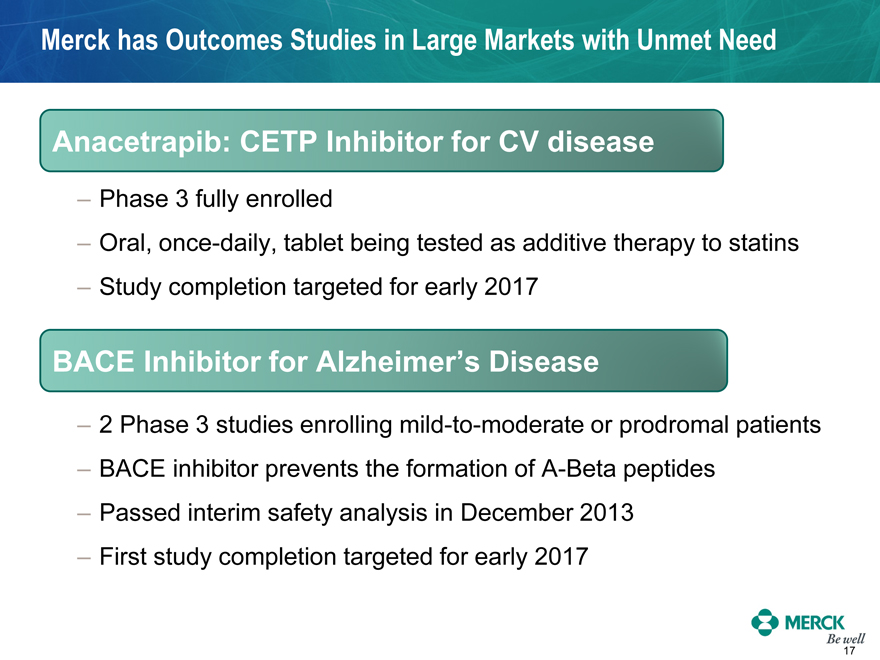

Merck has Outcomes Studies in Large Markets with Unmet Need

Anacetrapib: CETP Inhibitor for CV disease

- Phase 3 fully enrolled

- Oral, once-daily, tablet being tested as additive therapy to statins

- Study completion targeted for early 2017

BACE Inhibitor for Alzheimer’s Disease

- 2 Phase 3 studies enrolling mild-to-moderate or prodromal patients

- BACE inhibitor prevents the formation of A-Beta peptides

- Passed interim safety analysis in December 2013

- First study completion targeted for early 2017

MERCK

Be Well

17

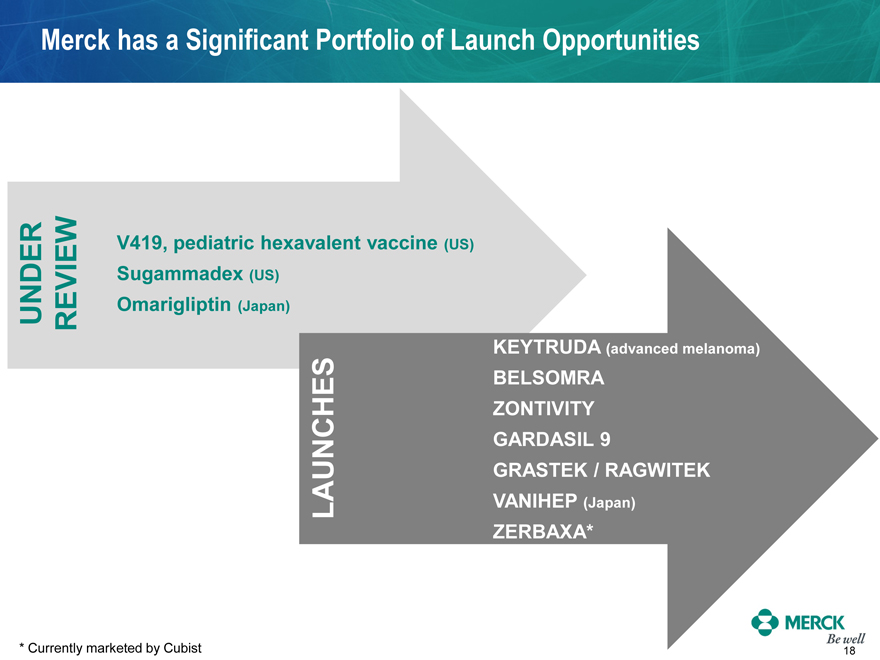

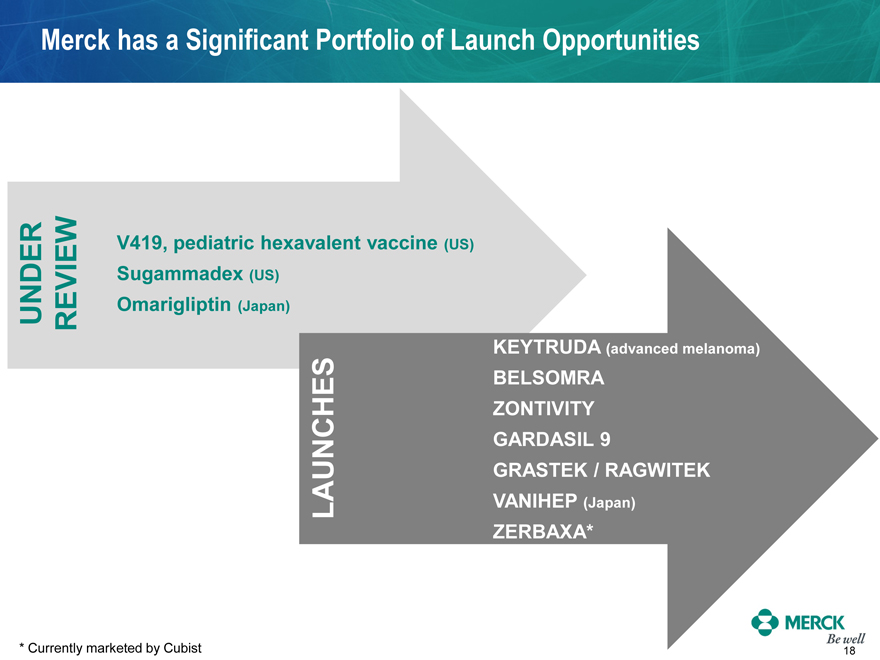

Merck has a Significant Portfolio of Launch Opportunities

UNDER REVIEW

V419, pediatric hexavalent vaccine (US)

Sugammadex (US)

Omarigliptin (Japan)

LAUNCHES

KEYTRUDA (advanced melanoma)

BELSOMRA

ZONTIVITY

GARDASIL 9

GRASTEK / RAGWITEK

VANIHEP (Japan)

ZERBAXA*

* Currently marketed by Cubist

MERCK

Be Well

18

Merck is Creating Value and Returning Cash to Shareholders

$ billion

15

10

5

0

2010 2011 2012 2013 2014*

Share Repurchase

Dividends Paid

* 2014 estimate. Cash returned to shareholders in the 9 months ended September 30, 2014 consisted of $6.1B share repurchase and $3.9B dividends paid.

MERCK

Be Well

19

2015: Merck Looking Forward to...

Seven product launches

Regulatory action for multiple programs

Filings in HCV, Lung Cancer, and Osteoporosis

Closing of the Cubist acquisition

Targeting business development to drive long-term value

MERCK

Be Well

20