Do you know why housing is so important to the economy?

Housing-related spending contributed just over $307 billion to the Canadian economy in 2009 or about 20% of Canada’s Gross Domestic Product. About $207 billion of this is housing-related consumption expenditures which include items such as rent, mortgage interest, property taxes, utilities and routine maintenance. Housing-related investment, which includes spending on new construction, renovations, and transfer costs, totalled more than $100 billion in 2009. (Source: Statistics Canada)

Two-thirds of Canadians are homeowners and 6 out of 10 have a mortgage. (Source: Statistics Canada)

On average, for every home that is sold, an additional $46,000 is spent on furnishings and other household goods. MLS® sales account for $22.3 billion in spin-off activity and over 200,000 jobs annually.

(Source: Canadian Real Estate Association)

Canadians spent about $53 billion renovating and maintaining their homes in 2008. (Source: CMHC)

Housing-related spending level and proportion of GDP continue to rise

About CMHC

For over 60 years, Canada Mortgage and Housing Corporation (CMHC) has been Canada’s national housing agency. Established as a federal Crown corporation in 1946 to help address post-war housing shortages, our role has evolved as Canadians’ needs have changed. Today, we work closely with provinces, territories and the private and not-for-profit sectors to help lower-income Canadians access affordable, better quality housing. We also help Aboriginal Canadians meet their distinct housing needs.

Our role in housing finance – providing mortgage loan insurance and securitization guarantee products – contributes to the health and stability of Canada’s housing finance system and facilitates access to financing for housing across the country. This includes loans for housing in small and rural communities and for nursing and retirement homes.

We also promote the efficiency of the Canadian housing system through research, market analysis, information transfer and export promotion.

We take pride in our history and, through a wide range of housing programs, products and services, we strive to keep Canadian housing AT WORK so that families can have a place to call home.

Our objectives

and strategic priorities

| | | | | |

| | | | | STRATEGIC PRIORITIES |

| | Help

Canadians

in need | | 1.1 Help Canadians in need access affordable, sound and suitable housing 1.2 Support Aboriginal Canadians to improve their living conditions |

| | | | | |

| | Facilitate

Access to More

Affordable, Better

Quality Housing

for ALL

Canadians | | 2.1 Ensure that Canadians have access to mortgage loan insurance products and tools that meet their needs 2.2 Enhance the supply of low-cost funds for mortgage lending by expanding the securitization program 2.3 Provide comprehensive, timely and relevant information to enable Canadian consumers as well as the housing sector to make informed decisions |

| | | | | |

| | Ensure the

Canadian

housing system

Remains One

of the Best in

the World | | 3.1 Promote sustainable housing and communities 3.2 Support and promote Canada’s world-class housing products, services and system internationally |

2 CANADA MORTGAGE AND HOUSING CORPORATION

Our programs,

products and services

| n | | Federal funding for social housing and renovation programs for lower-income Canadians |

| |

| n | | Housing programs for Aboriginal Canadians living on reserve |

| |

| n | | Mortgage loans (Direct Lending) to federally-sponsored social housing projects |

| |

| n | | Information, advice and financial assistance to groups seeking to develop more affordable housing |

| |

| n | | Research into housing needs and solutions |

| |

| n | | Mortgage loan insurance products to protect lenders against losses in the event of default for both homeowner, rental property loans and affordable housing projects |

| |

| n | | Securitization guarantee programs – National Housing Act Mortgage-Backed Securities (NHA MBS) and Canada Mortgage Bonds (CMBs) |

| |

| n | | Insured Mortgage Purchase Program (IMPP) |

| |

| n | | Market analysis reports, housing outlook conferences, market forecasts, consumer-oriented housing information |

| |

| n | | Research studies, grants and awards |

| |

| n | | Research and demonstration projects, including the EQuilibrium™ Sustainable Housing Demonstration Initiative |

| |

| n | | Export promotion activities designed to help Canadian exporters attain greater market diversification and representing Canada on housing matters on the international stage |

Additional information can be found in the Glossary or on CMHC’s website at www.cmhc.ca

Our values

We lead by example. We honour our obligations and are committed to:

Serving the public interest

As stewards of the public trust, we serve with fairness, impartiality and objectivity. All of our activities, including those that are commercial in nature, are carried out in support of our public policy objectives. Our actions are inspired by a respect for human dignity and the value of every person.

Achieving business excellence

We exercise the highest standards of competence, trustworthiness and prudence in conducting our business relationships and in managing the financial, physical and human resources entrusted in our care. We encourage learning, innovation and personal initiative to continuously improve the way we do business.

Building a workplace community

We practice mutual respect and honesty in our working relationships. We help each other achieve the goals of the team and the organization, and we strive to maintain a healthy balance between our CMHC work and other parts of our lives. We willingly explain our actions so that we may hold ourselves and each other accountable for living these values in the workplace.

Our structure

CMHC is governed by a Board of Directors appointed by the Government of Canada and we report to Parliament through the Minister of Human Resources and Skills Development. CMHC Management is comprised of the President and Chief Executive Officer, heads of business areas and support functions and regional centre General Managers. (See Other Disclosures and Information for list.) We have a workforce of approximately 2,000 employees. Our national office is located in Ottawa and our regional business centres are in Halifax, Montreal, Toronto, Calgary and Vancouver. Individual CMHC employees also serve as points of contact for several smaller and rural communities.

CMHC provides management, advisory and other services to the Canada Housing Trust, to the First Nations Market Housing Fund and to the Government of Canada with respect to administering Granville Island. Only the financial results of the Canada Housing Trust are consolidated with CMHC’s financial statements. For further information, see Glossary.

4 CANADA MORTGAGE AND HOUSING CORPORATION

| |

| Governments around the world, including the Government of Canada, took action to create jobs and economic growth. |

On behalf of CMHC’s Board of Directors, I am proud to present our 2009 Annual Report – Canadian Housing at Work – which builds on CMHC’s commitment to excellence in managing and reporting on the results of our housing programs and activities.

There is no doubt that 2009 was a tumultuous year for both the Canadian economy and for individual Canadians. We entered the year in an economic downturn and a global liquidity crisis to an extent not experienced since the Great Depression. Governments around the world, including the Government of Canada, took action in order to create jobs and economic growth.

Canada’s Economic Action Plan (CEAP) made available through CMHC close to $2 billion for social housing construction and renovation and up to $2 billion in low-cost loans to help finance housing-related municipal infrastructure over two years. In order to deliver on these CEAP investments, CMHC worked closely with its provincial and territorial partners, municipalities, First Nation communities, the not-for-profit sector, other federal departments and stakeholders throughout the year. We also maintained our steadfast presence in the Canadian housing finance market by providing mortgage loan insurance for qualified borrowers right across the country and helped improve the liquidity position of Canadian lenders so that they could continue to lend to both consumers and businesses.

Canadians received regular reports from the Government of Canada on the progress made against CEAP. CMHC’s Board of Directors also monitored take-up of CEAP social housing dollars and low-cost loans for housing-related municipal infrastructure projects through both quarterly performance reports and reports provided by the President at each meeting. The progress we have made in such a short time is nothing less than remarkable. The long-standing partnership between CMHC and provinces and territories, once again, was called upon. We look forward to continuing to work with them as well as with First Nations and many others as we enter the second year of CEAP, and as we continue to help Canadians in need through our core social housing activities.

The economic downturn also affected our mortgage loan insurance and securitization guarantee activities. With the global credit crunch, lenders turned to CMHC to insure and securitize mortgage loans in order to increase access to funds to lend to consumers and businesses. And, as expected, claims were also higher in 2009.

6 CANADA MORTGAGE AND HOUSING CORPORATION

We are confident, however, that our risk management practices and oversight will help ensure Canadians will continue to enjoy one of the soundest housing finance systems in the world.

The Board of Directors is committed to conducting our business in an open and transparent manner and this commitment is at the heart of all of the decisions that we make. Our efforts were recognized in 2009 by the Canadian Institute of Chartered Accountants who presented CMHC with the Award of Excellence in Corporate Reporting for Large Crown Corporations for our 2008 Annual Report, Enduring Commitment, Proven Results. Everyone at CMHC can be extremely proud of winning this award.

Governing in an open and transparent way also means obtaining feedback from Canadians. To that end, we held our first ever Annual Public Meeting in Kitchener-Waterloo this year, in conjunction with the first of our two Board of Directors meetings outside of Ottawa. The second meeting was held in Vancouver. These meetings provide us with opportunities to listen to housing stakeholders and to visit housing projects or other sites that are important to our mandate. They are also opportunities for the Board to engage with staff outside of Ottawa.

I am proud that CMHC received a number of employer awards in 2009, including being one of Canada’s Top 100 Employers, as well as one of the Best Diversity Employers. CMHC’s success is truly dependent on its workforce and most certainly on the leadership of CMHC’s President, Karen Kinsley, who won the Ottawa Business Journal CEO of the Year Award and, for the second consecutive year, was named by the Women’s Executive Network™ to be among Canada’s Most Powerful Women: Top 100 Winners.

The Board of Directors recognizes the passion and commitment of CMHC’s employees during this extremely busy and productive year. As we look ahead, I am confident we will continue to uphold our commitment to helping improve the lives of Canadians while also maintaining high standards of governance and regard for the environment. I look forward to meeting the challenges of 2010.

Dino Chiesa

Chairperson| |

CMHC received a number of awards in 2009 including the Canadian Institute

of Chartered Accountants’ (CICA’s) Award of Excellence in Corporate Reporting for Large Crown Corporations and MediaCorp’s Top 100 Employers in Canada. |

| |

| Canada’s Economic Action Plan will help house low-income Canadians, seniors, persons with disabilities, families in First Nation communities and in the North. |

Canadian Housing at Work truly reflects what 2009 was about. In setting the course for recovery, Canadian housing became part of the solution. Accounting for 20 per cent of Canada’s Gross Domestic Product (GDP) and having shown remarkable resiliency in the face of global economic turbulence, Canadian housing and housing-related municipal infrastructure created jobs for the Canadian economy when needed the most.

Canada is fortunate to have one of the best housing systems in the world – one that provides good housing for a wide spectrum of needs. Housing is an important component of the federal government’s 2009 Budget: Canada’s Economic Action Plan (CEAP). Over the next two years, out of $7.8 billion in housing-related measures, close to $2 billion will be provided through CMHC to build or to retrofit social housing for low-income Canadians. We will also provide up to $2 billion in low-cost loans to municipalities for housing-related infrastructure.

I am proud that CMHC took up additional responsibilities with vigour while also achieving the vast majority of goals we set for our ongoing activities.

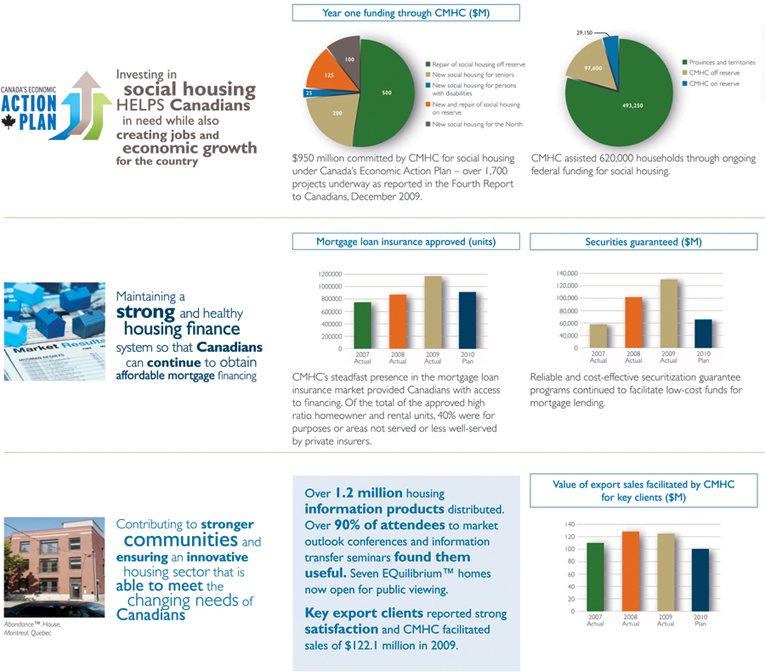

Immediately following the federal budget at the end of January, getting provincial and territorial partners on board became a priority. We were successful in putting agreements in place within a few short months of the beginning of the 2009-10 fiscal year. As reported in the Fourth Report to Canadians on Canada’s Economic Action Plan released in December 2009, CMHC has committed a total of $950 million towards social housing and made available up to $1 billion in low-cost loans for housing-related municipal infrastructure.

This was no easy feat. We understand the challenges that our social housing partners face. But we shared one collective goal – to use this one-time funding to help house Canadians, to give them a better, more affordable place to call home and to build stronger, healthier communities.

Mortgage-Backed Securities guaranteed under the National Housing Act also played an important role amongst federal measures to improve access to financing in the face of the global credit crunch which began in 2008. While healthy balance sheets and a sound regulatory system meant that Canadian lenders fared better than lenders in many other countries, we operate in a global economy and are not unaffected by what happens outside our borders.

8 CANADA MORTGAGE AND HOUSING CORPORATION

In order to address these challenges, the Government of Canada introduced in October 2008, a $25 billion Insured Mortgage Purchase Program. Under this program and subsequent enhancements, CMHC could purchase from lenders up to $125 billion in NHA Mortgage-Backed Securities backed by insured loans. At the height of the credit crunch, Canadian lenders made full use of the program and continued to see it as a valuable option in managing their funding needs in the face of ongoing global pressures. The program’s scheduled termination was extended from September 2009 to March 2010.

These measures are in response to extraordinary times, but the investments that are being made in social housing and in municipal infrastructure will endure for the benefit of all Canadians.

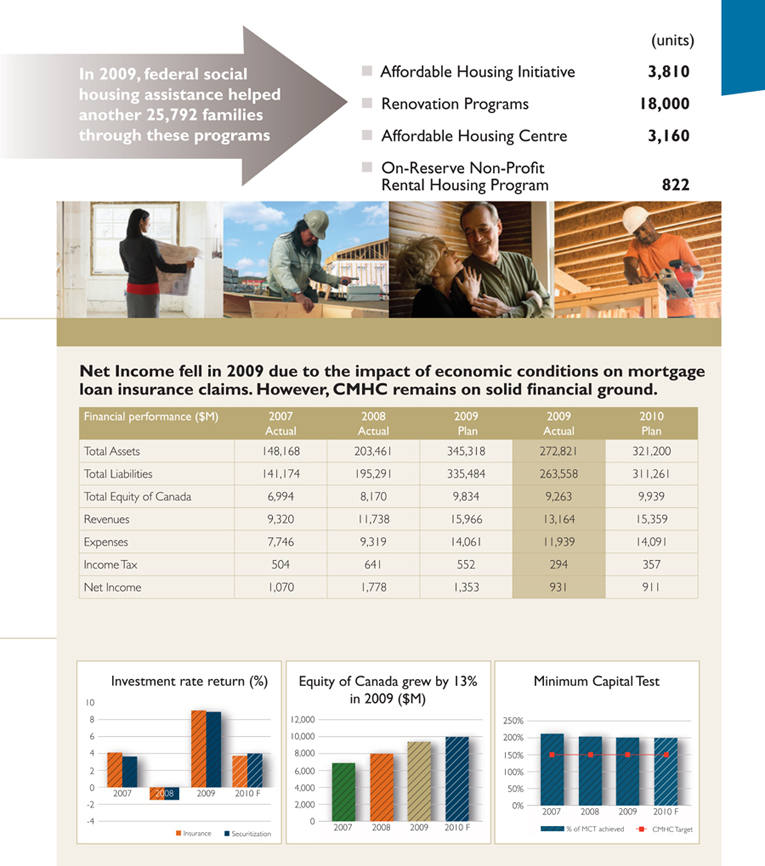

I am also proud that CMHC met the majority of its goals for all other ongoing core activities. We provided funding for social housing and implemented the two-year extension of the Affordable Housing Initiative (AHI) and our renovation programs. Six-hundred and twenty thousand (620,000) families were assisted through social housing with long-term subsidies and 3,810 new social housing units were created under the AHI. Our renovation programs assisted some 18,000 lower-income households to undertake needed repairs to their homes.

We exceeded planned mortgage loan insurance volumes and met market demand for our securitization products. Adoption of principles demonstrated through our EQuilibrium™ Sustainable Housing Demonstration Initiative has begun to take hold with a builder now marketing homes based on EQ™ principles and others taking steps in that direction. Over 1.2 million copies of CMHC information products on a range of housing topics were distributed to Canadians. In addition, our support to housing exporters in these difficult economic times proved valuable as we exceeded our facilitated-sales target.

The challenging economic climate in 2009 resulted in an increase in provisions for mortgage loan insurance net claims, which was not anticipated when our target was set in mid-2008. This increase in the provisions for claims is, in part, responsible for the Corporation not achieving its net income target of $1.353 billion. The rate of arrears on CMHC-insured loans, however, remains historically low and is trending in the same direction as rates currently experienced by lenders in general. We also continue to be on solid financial ground due to our rate of capitalization which is approximately double the rate required by the Office of the Superintendent of Financial Institutions for private insurers.

| |

| Ongoing social housing subsidies helped 620,000 families access affordable housing; 3,810 new social units were created under the AHI, and 18,000 families or rental property owners received assistance to repair or to rehabilitate their properties. |

While CEAP measures will continue to be the focus in the coming year, we do have an eye on the future. The two-year extension of the Affordable Housing Initiative and our renovation programs, part of the federal government’s five-year funding commitment to housing and homelessness programs, runs until March 2011. We are working closely with Human Resources and Skills Development Canada on developing options for the federal government to consider for the last three years of funding. I am confident that the next generation of federal housing and homelessness programs will build on the lessons learned and bring further benefits to Canadians. CMHC will also continue to assist provinces and territories to assess the long-term viability of

pre-1993 social housing units.

CMHC’s long-standing role in helping First Nations address housing needs will also continue to be a priority for us. Our regular programming resulted in an additional 822 non-profit rental housing units being developed and some 1,190 units renovated or rehabilitated this year for

First Nation families. While these and CEAP investments will help address the housing shortages on reserve, enhancing First Nations’ capacity and access to private financing are also critical to success in the long term.

The state of the economy will drive housing and mortgage markets going forward. While we expect that the economic recovery will bring increased competition in the mortgage loan insurance market, we will remain steadfast in our commitment to prudent underwriting, to improving our risk management tools, to providing excellent client service and to ensuring that Canadians have access to housing finance that meets their needs in a responsible manner.

As we look ahead, we are confident that the Canadian housing system will continue to serve Canadians well. Housing is truly working for Canadians and so is CMHC. To CMHC’s dedicated employees who excelled in a year where heavy demands were made of them, you have my gratitude and respect. To our shareholders – the Canadian people – you have the continuing commitment of CMHC to keep our housing system strong.

Karen Kinsley, FCAPresident and Chief Executive Officer

Karen Kinsley, FCAPresident and Chief Executive Officer 10 CANADA MORTGAGE AND HOUSING CORPORATION

Showcasing Canadian Housing... and CMHC...AT WORK

For CMHC, it has always been about helping Canadians to have a place they can call home. In Canada’s Economic Action Plan, the Government of Canada through CMHC increased its investment in social housing to help the most vulnerable in our society – low-income families, seniors, persons with disabilities, First Nations and northern communities. It also asked CMHC to manage a new Municipal Infrastructure Lending Program to provide low-cost loans to fund housing-related municipal infrastructure. These one-time, targeted investments will pay off today through the jobs and economic spin-offs they produce and will benefit needy Canadians for many years to come.

CMHC is playing a major role in overseeing investments while also maintaining our resolve to strengthen Canada’s housing finance system and to promote sustainable housing solutions and communities. These stories invite you to see how these investments are being used to make a difference in the lives of Canadians and demonstrate how CMHC is putting Canadian housing at work for them as well as for the general economic and social well-being of the country.

12 CANADA MORTGAGE AND HOUSING CORPORATION

AT WORK

In a few short months since the launch of CEAP social housing initiatives, over 1,700 projects are underway across Canada including in some 300 First Nation communities. Here are just a few:

Renovating and making social housing more energy efficient

Across Canada, there are thousands of low-income families living in social housing units developed over several decades since 1946. Renovating and increasing the energy-efficiency of these units while also improving living conditions for their residents is economically, environmentally and socially responsible.

The Haney Pioneer Village Co-operative in Maple Ridge, British Columbia (about 45 km to the east of Vancouver) has provided homes to some 84 senior households since the early 1970s. CMHC provided $208,462 to replace outdated single-pane windows with double-pane Energy Star® windows.

Workers installing new windows at the Haney

Workers installing new windows at the Haney

Pioneer Village Co-operative.The Piikani Nation is located on Peigan Indian Reserve 147 in southern Alberta and is part of the Blackfoot Nation. Through CEAP, the First Nation received $853,000 to improve housing conditions for their community. The funding will contribute to the retrofit of 41 social housing units.

SHOWCASES 13

| | | |

| | “CEAP has been instrumental in assisting the Piikani Nation...train and employ up to 35 Piikani Nation members, kick-start our market housing strategy and most importantly improve our living conditions.” Reg Crowshoe, Piikani Nation Chief

|

| Left to right: Ted Menzies, MP for Macleod, Chief Reg Crowshoe, Evan Berger, Alberta Ministry of Employment and Immigration, Jim Swagg, Adam North Peigan and Herman Many Horse (Band Councillors) |

Renovations are underway at the Coopérative d’habitation Place des Lilas in Jonquière, Quebec thanks to funding received under CEAP. The cooperative will receive $401,310 to replace an aging heating system and windows in their 32-unit project. These renovations are expected to improve the comfort of residents as well as add years to the life of the project which provides housing to families and single person households.

“The financial contributions provided under CEAP through CMHC will benefit the residents of Place des Lilas and will help ensure the quality of life of our families. We are very pleased to have received this funding which will help improve the comfort and safety of our residents.”

Louis Boily, Chair, Board of Directors, Place des Lilas

The Millbrook First Nation in Nova Scotia received $104,000 to retrofit four units in the community including one which was damaged by flooding. Extensions are being built to the other three units. Work began in the fall of 2009 – two of the renovations have been completed and the other two will be finished by early spring. In addition, the Millbrook First Nation received funding for two new units under CEAP.

“It (the funding) came at the right time and allowed us to accommodate a family with special needs as well as address overcrowding in some of the other units. This program has exposed us to new building practices which will be beneficial for years to come.”

Chief Lawrence Paul, Millbrook First Nation

14 CANADA MORTGAGE AND HOUSING CORPORATION

Creating new social housing

Canada’s Economic Action Plan also invests in new social housing so that more low-income Canadians, in particular seniors, persons with disabilities and Aboriginal people on reserve and northern Canadians have a better place to call home. Here are few examples:

Squamish Riverstones Development, 67 km north of Vancouver, will be an

84-unit seniors housing complex operated by the Sea to Sky Community Services Society. All of the units will be adapted to seniors’ needs, with such items as lever handles, wide doors and appliances with controls on the front. Twelve of the units will be fully accessible for tenants with disabilities. The project is receiving a total contribution of $4.35 million from the Government of Canada and the Province of British Columbia which will support 30 of the 84 units. As well, CMHC is insuring

a $7.8 million mortgage loan for the project. The project will help address the shortage of rental units in Squamish which has seen a decrease in its vacancy rate from 4.2 per cent to 1.3 per cent in 2009.

“Our community will benefit from this much-needed rental housing for our seniors, the accessibility-challenged and families. We will also benefit from the jobs that will be created from construction.”Greg Gardner, Mayor of the District of Squamish

Supporting over 500 people with intellectual disabilities in Windsor, Ontario, Community Living Windsor received $936,745 through CEAP to purchase three additional properties for its Supported Community Homes program. These properties will house between two to four occupants who, depending on their needs, may access 24-hour support. Integrating persons with disabilities into the community provides them with a greater sense of belonging and proximity to other services.

“Living in a home that looks just like others helps people to feel more connected to their community. By becoming connected to our neighbourhoods and communities, relationships develop and people gain a greater sense of self-worth.”

Xavier Noordermeer, Executive Director of Community Living Windsor

SHOWCASES 15

| | | | |

| | Among five projects in the Yukon Territory under CEAP’s funding for Northern housing is the Watson Lake Seniors Facility. This new 12-unit project will meet Yukon Housing Corporation’s SuperGreen Home energy standards and features Accommodating Home standards to ensure a barrier-free interior and exterior environment. This development will help seniors to live more independently in their community of just over 1,500, known as the Gateway to the Yukon.

| |

| Left to right: Premier Dennis Fentie, MLA for Watson Lake, Stephen Murphy, local contractor, the Honourable Vic Toews, President of the Treasury Board |

“I’ve been running a four to six man crew the last few years and I’ve had to hire for this project. I now have 14 employees.”

Stephen Murphy, Murphy Construction – contractor for Watson Lake Seniors Facility

The Musqueam First Nation Reserve is located adjacent to the City of Vancouver. The First Nation received $5.3 million under CEAP to construct 31 affordable single family homes for Aboriginal families, seniors and persons with disabilities on reserve. Occupants will pay rent until the mortgages are paid out and then will be eligible to become owners.

“I’m living with my mom currently. I have 5 children....This means a great deal to me. We are really looking forward to having our own space...and just settling, finally, after so long.”

Grace Point, Band Member on waiting list

| | | |

| | “Without CMHC’s assistance, Musqueam probably wouldn’t have been able to build the homes. We didn’t know how we were going to do it until Canada’s Economic Action Plan came into play.”

Allyson Fraser, Councillor, Musqueam Indian Band

Building stronger and more vibrant communities through social housing that benefits the most vulnerable in society is good public policy during these tough economic times. Equally important is investing in municipal infrastructure that supports housing development and economic growth. Check our story At WORK building sustainable communities. |

16 CANADA MORTGAGE AND HOUSING CORPORATION

AT WORK

The strength and soundness of Canada’s banking and housing finance system have been well publicized. Many factors have led to Canada’s ability to weather the global liquidity crisis better than many other countries, including the role that CMHC plays in housing finance.

For over 60 years, CMHC has worked to ensure the well-being of our housing sector in order to facilitate access to affordable, high quality housing for Canadians. The vast majority of Canadians (80 per cent) are able to meet their own housing needs without direct public assistance. When it comes time to buy a home, most Canadians obtain financing for what is likely the largest investment of their lives. CMHC mortgage loan insurance and securitization guarantee products facilitate access to this financing.

With CMHC mortgage loan insurance, lenders are able to offer qualified borrowers, with down payments of less than 20 per cent, interest rates that normally would only be available for loans with larger down payments. Generations of first-time homebuyers have been able to afford homeownership because of CMHC mortgage loan insurance.

| | | | |

| Our steadfast presence as the public mortgage loan insurer has led to underwriting practices that prudently take into account risks from a range of perspectives. Applications for mortgage loan insurance are carefully | |  |

| | | assessed based on the borrower’s ability to manage the debt and the property risks relative to current housing market conditions. Specific criteria must be met for lenders to qualify as an Approved Lender for CMHC mortgage loan insurance purposes as well as to qualify as an Approved Issuer for CMHC’s securitization programs. All these contribute to standard, well-established prudent underwriting practices right across the country, whether the loan is for a home in a large urban centre or in a remote village. | |

Our steadfast

presence as the

public mortgage loan

insurer has led

to underwriting

practices that

prudently take

into account risks

from a range

of perspectives. | | |

SHOWCASES 17

As Canadians faced tough economic times in 2009, CMHC was there, working with lenders, to find ways to help keep Canadians in their homes thus contributing to a more stable housing market.

Our housing system has also benefitted from CMHC’s securitization guarantee programs. By guaranteeing the timely payment of principal and interest associated with National Housing Act Mortgage-Backed Securities which were first introduced in 1987 and introducing Canada Mortgage Bonds (CMBs) in 2001, billions of dollars have been channelled to mortgage lending, lowering the cost for both mortgage lenders as well as borrowers.

Our role in securitization greatly facilitated the implementation of the federal government’s Insured Mortgage Purchase Program (IMPP) in 2008 and we continued to make the program available until March 2010.

Canadian Imperial Bank of Commerce senior economist, Benjamin Tal, describes CMHC as the “secret weapon”.

“One of the main reasons we did not need a bailout (of banks)

is because of CMHC and the ability to provide cheap credit through its facilities.”

Benjamin Tal, senior Economist, Canadian Imperial Bank of Commerce

18 CANADA MORTGAGE AND HOUSING CORPORATION

| | | |

| WORK | |

building sustainablecommunities |

Canadians are doing their part to protect the environment. CMHC is doing the same through:

Research and demonstration

Demonstration homes under the EQuilibrium™ (EQ™) Sustainable Housing Demonstration Initiative first became available for public viewing in 2007, with more following shortly thereafter. Several EQ™ teams are applying their expertise and knowledge towards the development of new housing projects. For example, the Edmonton-based developer of the Riverdale Net Zero EQ™ project, Habitat Studio and Workshop Ltd., has built two more net zero projects and is planning additional projects as a result of consumer interest generated by the Riverdale demonstration. As well, the NOW House EQ™ renovation

| | |

| project inspired housing providers in Windsor and Ottawa to undertake similar projects within their affordable housing portfolios. “The knowledge we gained by participating in the CMHC EQuilibiumTM Sustainable Housing Demonstration Initiative helped us to simplify the energy efficiency systems and technology, resulting in reduced construction costs for us. The publicity, promotion and demonstration component of EQTM also helped us establish a reputation in the community that has led to additional construction projects, with more in the planning phase.”Peter Amerongen, Habitat Studio and Workshop Ltd. CMHC and

Natural |

| Resources |  |

| Canada (NRCan) are now supporting the development of demonstration projects involving EQ™ principles at the community level. A national competition was launched in June 2009 under the Equilibrium™ Communities Initiative. CMHC and NRCan will provide financial and technical assistance to winners to develop and showcase community development that is more environmentally-friendly than what is generally in place today. |

SHOWCASES 19

CMHC Green Home Mortgage Loan Insurance

Increasing industry capacity to provide Canadians with environmentally-friendly choices when it comes to housing is done not only through our research and demonstration initiatives but also through CMHC mortgage loan insurance.

Our CMHC Green Home mortgage loan insurance product offers a 10 per cent premium refund to qualified borrowers who purchase an environmentally-sound home or make energy-efficient renovations to their properties, including rental properties. This product has reached a milestone – $3 million in premiums have been refunded to borrowers since 2005.

Providing low-cost loans to municipalities for housing-related infrastructure

Under Canada’s Economic Action Plan, CMHC is making available up to $2 billion in low-cost loans to municipalities to fund housing-related infrastructure. The Municipal Infrastructure Lending Program (MILP) will not only lower costs for municipalities but will also create jobs and economic growth, help to protect the environment and build stronger communities for the future. Eligible projects include sewers, water lines and neighbourhood regeneration projects. Modern and efficient water treatment plants are vital to ensure the supply of safe drinking water for expanding communities and for safeguarding the environment. Two communities who have benefitted from MILP are Corner Brook, Newfoundland and Saskatoon, Saskatchewan. Both have received MILP loans amounting to $19.5 million and $31 million, respectively.

“This project will ensure that all residents of the City of Corner Brook as well as the Town of Massey Drive and the Town of Mount Moriah will have water provided through a state-of-the-art water treatment plant. An enhanced water treatment facility has been a major goal of our city for over a decade.”Charles Pender, former Mayor of Corner Brook “The Economic Action Plan has had a tremendous impact on the City of Saskatoon. It has allowed us to free up other dollars to invest in other areas. And, in a lot of cases, those dollars are going to go back into affordable housing for our community.

The Action Plan keeps people employed.”

Donald Atchison, Mayor of Saskatoon

“When we compare the CMHC loan with our traditional borrowing, over the life of the loan, the city will save $1.2 million.”

Larry Shultz, Project Manager, City of Saskatoon

20 CANADA MORTGAGE AND HOUSING CORPORATION

Corporate Governance| Govern CMHC s Board of Directors Practicing good governance Being good corporate citizens |

CMHC’S BOARD OF DIRECTORS

The legislative framework governing CMHC consists primarily of the Canada Mortgage and Housing Act (CMHC Act), the National Housing Act (NHA) and the Financial Administration Act (FAA). Pursuant to the CMHC Act, the stewardship of the Corporation is the responsibility of the Board of Directors which is comprised of the Chairperson, the President and Chief Executive Officer and eight other directors. The Chairperson and the President and Chief Executive Officer are appointed by the Governor in Council. The eight other directors are appointed by the Minister designated for the purposes of the CMHC Act and the NHA (the Minister for CMHC) with Governor in Council approval. With the exception of the President and Chief Executive Officer, all members of the Board are independent of CMHC Management.

Members of the Board have diverse professional backgrounds and bring significant experience from private, public and not-for-profit sectors. This experience and commitment to sound corporate governance help to ensure that the Corporation fulfills its public mandate in a competent and accountable manner. (For additional biographical information see Other Disclosures and Information.)

All newly-appointed Board members are provided with a comprehensive orientation on the Corporation’ s activities and operations and may attend specialized courses offered by the Canada School of Public Service to further enhance their understanding of responsibilities as Crown corporation directors. There were no changes to the Board membership in 2009; one position remained vacant.

22 CANADA MORTGAGE AND HOUSING CORPORATION

In front row from left to right: Karen Kinsley, FCA, President and Chief Executive Officer, Dino Chiesa, BA, Chairperson, Sophie Joncas, CA, Vice-Chairperson In back row from left to right: Gary P. Mooney, BA, LLB, PhD, E. Anne MacDonald, BA, LLB, Brian Johnston, CA, James A. Millar, BA, MA, Harold Calla, CGA, CAFM, André G. Plourde, B. Admin. |

| |

| The following depicts CMHC’s governance structure. Also see Our Structure on page 4. |

| |

|

To assist in carrying out its stewardship of CMHC, the Board has established a number of committees: the Governance and Nominating Committee, the Audit Committee and the Human Resources Committee. Their terms of reference are posted on CMHC’s website (see www.cmhc.ca) and are reviewed on a regular basis to ensure that the Board benefits from the committees’ thorough examination of these key areas.

Board committees — key areas of responsibility

Governance and Nominating Committee

| | n | | Monitors best practices and trends and makes recommendations to the Board with respect to corporate governance. |

| |

| | n | | Reviews the Board’s Standards of Conduct. |

| |

| | n | | Identifies potential candidates for the positions of Chairperson and President and

Chief Executive Officer and also makes recommendations with respect to the profile

of the Board. |

| |

| | n | | Evaluates the performance of the President and Chief Executive Officer against pre-established objectives and goals. |

Audit Committee

| | n | | Advises the Board on the soundness of the Corporation’s financial management. |

| |

| | n | | Oversees the integrity and appropriateness of internal control systems, risk management practices and financial reporting and audit processes, including the annual financial audit and periodic Special Examinations pursuant to the FAA. |

Human Resources Committee

| | n | | Advises the Board on strategies with respect to employee recruitment, selection and retention and recommends changes in compensation and performance management policies. |

24 CANADA MORTGAGE AND HOUSING CORPORATION

The Board of Directors meets six times a year and its committees meet a minimum of twice a year. Two of the Board’s meetings are held outside the National Capital Region in order to allow Board members an opportunity to discuss issues with stakeholders, to obtain first-hand knowledge of local housing conditions and to learn about specific housing developments.

As part of their regional meetings, the Board also meets with CMHC staff. This year,

the regional meetings took place in the Kitchener-Waterloo area in May and in the Vancouver area in August.

The Board’s regional itineraries included meetings with housing officials, community planning experts, private sector affordable housing advocates and developers of energy efficient housing in Waterloo. They also toured facilities on Granville Island that are under CMHC management and visited an affordable housing project in Vancouver’s Downtown Eastside.

In conjunction with the regional meeting in Kitchener-Waterloo, the Board held its first annual public meeting at which the Chairperson and President provided information on the Corporation, its governance structure, activities and performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Attendance1/Meetings

|

| | Board | | | Total | | | Board of | | | Corporate | | | Audit | | | Human | | | Pension Fund | |

| | Member | | | Compensation | | | Directors | | | Governance | | | Committee | | | Resources | | | | |

| | | | | ($) | | | | | | and | | | | | | Committee | | | | |

| | | | | | | | | | | | | Nominating | | | | | | | | | | |

| | | | | | | | | | | | | Committee | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Dino Chiesa | | | | 47,600 | | | | 6/6 | | | 3/3 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Harold Calla | | | | 21,700 | | | | 6/6 | | | | | | 4/4 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Brian Johnston | | | | 19,200 | | | | 6/6 | | | | | | 2/4 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Sophie Joncas | | | | 27,200 | | | | 6/6 | | | 3/3 | | | 4/4 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Karen Kinsley2 | | | | N/A | | | | 6/6 | | | 2/3 | | | 4/4 | | | 3/3 | | | 3/4 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | E. Anne

MacDonald | | | | 23,200 | | | | 6/6 | | | | | | | | | 3/3 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | James A. Millar | | | | 21,200 | | | | 6/6 | | | | | | | | | 3/3 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Gary P. Mooney | | | | 19,700 | | | | 6/6 | | | 3/3 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | André G. Plourde | | | | 22,200 | | | | 6/6 | | | | | | | | | | | | 4/4 | |

| | | | | | | | | | | | | | | | | | | | | | | |

1 In person or via teleconference or videoconference.

2 Attendance at Audit and Human Resources committees as a non-member.

“CMHC’s

emphasis

on corporate

governance

demonstrates its

commitment as

responsible

corporate

citizens.”

Canadian Institute of

Chartered Accountants –

2009 CICA

Reporting Awards

PRACTICING GOOD GOVERNANCE

Corporate Planning

Each year, as required by the FAA, CMHC submits a five-year corporate plan to its Minister for approval by the Government of Canada. The corporate plan is the centrepiece of the accountability regime adopted by Parliament for Crown corporations. The corporate plan encompasses all of CMHC’s activities, budgets and resource requirements. The Board of Directors guides the development of the corporate plan, starting with a planning session during which it examines the internal and external operating environment and sets out key strategic directions for the Corporation. At its planning session in March 2009, the Board assessed the impact of the economic downturn on CMHC’s activities and reaffirmed the Corporation’s three objectives and seven strategic priorities, including directions in assisted housing, housing finance, research and information transfer and international activities. CMHC’s 2010-2014 Corporate Plan was approved by the Government of Canada in December 2009.

26 CANADA MORTGAGE AND HOUSING CORPORATION

In addition to the annual planning session, the Board provided direction on CMHC’s work on the primary housing finance markets over the long term. It also revisited goals in light of the challenges facing CMHC’s international activities caused by severe disruptions in foreign housing markets and economies.

Monitoring Performance and Risks

On a quarterly basis, the Board of Directors reviews a comprehensive report on the Corporation’s performance against plan. In 2009, Quarterly Performance Reports assessed changes in the environment, rated performance against some 28 success indicators and provided results against corporate plan performance measures. Given changing priorities, from time to time, the report recommended changes to the timing of deliverables and the allocation of resources. This report also assessed changes in seven key enterprise-wide risk areas. (See section on Risk Management.) Given the need to deliver CEAP housing-related initiatives as quickly as possible, the Board received regular reports on CEAP’s progress. Also on a quarterly basis, a detailed report examined specific financial risks.

Program evaluations

The Audit Committee oversees program evaluations that are carried out in accordance with government policy. In 2009, program evaluations were completed with respect to CMHC’s suite of renovation programs, including its Shelter Enhancement Program and the Affordable Housing Initiative. These evaluations provide objective assessments of the relevance and effectiveness of policies and are important to the government decision-making process. Results of the evaluations are further discussed in the Management Discussion and Analysis section of this annual report.

CMHC Pension Plan

The CMHC Pension Fund, created by the Board of Directors, is managed and administered by Trustees through a Trust Agreement. It provides eligible employees with benefits upon retirement from CMHC. The Trustees are responsible for setting investment objectives and policies, selecting external investment managers and monitoring investment results. CMHC’s Pension Fund governance structure and practices continue to meet or exceed the governance guidelines of the Canadian Association of Pension Supervisory Authorities (CAPSA).

In 2009, the Board approved revised terms of reference for the Pension Fund Trustees as recommended by its Governance and Nominating Committee. The revisions provide for an annual assessment of the Pension Fund’s governance structure and practices using the CAPSA self-assessment questionnaire. The Board also receives a written report on the Fund’s investment activities and decisions each year.

28 CANADA MORTGAGE AND HOUSING CORPORATION

BEING GOOD

Corporatecitizens

In addition to practicing good corporate governance and maintaining a high standard of business ethics, CMHC believes in giving back to the community in a meaningful way and in lessening our own impact on the environment.

Giving Back to the Community

CMHC supports a variety of charitable campaigns. The following are some of the key ones:

2009 WORKPLACE CHARITABLE CAMPAIGN

Employees and retirees of CMHC continue to demonstrate their commitment to Canadians with the success of the 2009 Workplace Charitable Campaign. CMHC raised a total of $215,807 – 14 per cent over the campaign goal of $189,000 and setting a new campaign record for the Corporation. With the average donation per employee being $284 and a participation rate of 70 per cent, CMHC employees have once again demonstrated their commitment to helping Canadians in need.

HABITAT FOR HUMANITY CANADA

CMHC is a gold sponsor of this internationally renowned organization and shares its vision of a world where everyone has a safe and decent place to live. The Corporation is the lead national sponsor of the Habitat for Humanity Aboriginal Housing program. The objective of the program is to engage Habitat for Humanity affiliates across Canada in implementing pilot programs that will help make the Habitat homeownership model available to more Aboriginal people.

8TH ANNUAL GINGERBREAD HOUSE COMPETITION

CMHC and Habitat for Humanity National Capital Region teamed up once again in 2009 to raise funds. All proceeds from the silent auction of the gingerbread houses went to Habitat for Humanity National Capital Region to help with the construction of new homes for families in need in the community. CMHC employees volunteered their time to this worthy cause. Several prizes were awarded, but the main winners will be local families whose dreams of homeownership will move closer to reality because of the event.

Doing our part to protect the environment

CMHC demonstrates its commitment to responsible environmental stewardship through its everyday operations. These include the establishment of an extensive recycling program, the re-use of components from information products and construction activities, the refurbishment of office equipment and furniture, the purchase of Energy Star® appliances, the use of recycled paper and the use of environmentally-friendly cleaning products.

In 2009, CMHC consumed 104 tons of recycled paper. The impact of choosing to purchase recycled paper instead of virgin paper has reduced the use of resources as well as the emission of greenhouse gases and generation of waste as follows:

| | | |

| Wood consumed | | 115 tons |

| | | |

| Net energy consumed | | 255 million BTUs |

| | | |

| Greenhouse gases emitted | | 76,526 Ibs of CO2 EQUIV. |

| | | |

| Wastewater generated | | 368,566 gallons |

| | | |

| Solid waste generated | | 22,377 Ibs |

Source: Environmental impact estimates were made using the Environmental Defence Fund Paper Calculator. For information visit: http://www.papercalculator.org

In addition, CMHC participates in Earth Day, the largest environmental awareness event in the world. On April 22, 2009, CMHC employees joined an estimated six million Canadians from coast-to-coast-to-coast in environmentally-friendly activities. President Karen Kinsley planted a tree and employees were informed on how to conserve energy and protect the environment including how to calculate their own ecological footprint.

|

| Left to right: David Stitt, Director, Administrative Services, Karen Kinsley, President and Chief Executive Officer and Michel Tremblay, Director, Financial Operations |

Building upon CMHC’s environmentally-friendly practices in many areas, CMHC will be developing its strategies to protect the environment further. CMHC believes that good governance and environmental stewardship go hand in hand.

30 CANADA MORTGAGE AND HOUSING CORPORATION

Management

Discussion & Analysis

Forward-looking statements

CMHC’s Annual Report contains forward-looking statements regarding objectives, strategies and expected financial results. There are risks and uncertainties beyond the control of CMHC that include, but are not limited to, economic, financial and regulatory conditions nationally and internationally. These factors, among others, may cause actual results to differ substantially from the expectations stated or implied in forward-looking statements.

| | | | |

| Table of Contents: | | page | |

| | | | | |

| | | 32 | |

| | | | | |

| | | 34 | |

| | | | | |

| | | 44 | |

| | | | | |

| | | 81 | |

| | | | | |

| | | 86 | |

| | | | | |

| | | 98 | |

THE OPERATING ENVIRONMENT IN 2009 AND OUTLOOK FOR 2010

Economic growth in Canada resumed in the third quarter of 2009 and picked up further in the fourth quarter. While the Gross Domestic Product (GDP) declined in 2009, signs in the latter part of the year pointed to a recovery taking hold in 2010 with real GDP growth in the range of 1.5 to 3.2 per cent. The unemployment rate increased to 8.3 per cent in 2009. In 2010, the unemployment rate is forecast to reach 8.4 per cent and edge back down to 8.1 per cent in 2011.

The Consumer Price Index (CPI) for 2009 increased by 0.3 per cent, well below the increase of 2.3 per cent in 2008. It is expected that inflation will remain within the

Bank of Canada’s target range of 1 to 3 per cent. Higher food and energy costs are major contributors to inflation. However, prices for energy commodities were lower in the second half of 2009 which helped moderate the rate of inflation for the year. The

year-over-year increase in the CPI peaked at 3.5 per cent in August 2008 but was only

1.3 per cent in December 2009. Since July 2008, the Bank of Canada has lowered its target for the overnight lending rate by a total of 275 basis points to 0.25 per cent – its lowest in history. These stimulative monetary policies should help boost domestic demand and contribute to stronger economic growth in 2010.

Following years of strong sellers’ market conditions, an easing in existing home sales through the Multiple Listing Service®1 (MLS®) and record high levels of new listings brought balance back to market conditions in the Canadian resale market in 2008. Since January 2009, however, a strong rebound in MLS® sales has pushed the sales-to-new listings ratio back to the sellers’ market range. National sales of existing homes through the MLS® are forecast to be within the 455,350 to 509,900 unit range in 2010. Housing starts have also moderated from historically high levels to reach 149,081 units in 2009, down from 211,056 units in 2008. Housing starts are forecast to be within the 152,000 to 189,300 unit range in 2010.

1 MLS ® is a registered trademark of the Canadian Real Estate Association.

32 CANADA MORTGAGE AND HOUSING CORPORATION

Demographic models suggest that current household formation is approximately 175,000 net new households per year. These projections are based on current age and gender make-up, projections for migration and past household formation. Housing starts and household formation are closely linked over time. The number of housing starts in a given year, however, can fluctuate above or below expected household formation depending on economic conditions or other factors such as conversions, demolitions and changes in vacancy rates. Housing starts are expected to improve gradually and be roughly in line with household formation over the medium term.

THE OPERATING ENVIRONMENT IN 2009 AND OUTLOOK FOR 2010 33

SUMMARY OF FINANCIAL RESULTS

Revenues and Expenses

CMHC reports on these principal business activities:

| | n | | Housing Programs: Expenditures and operating expenses are funded by Parliamentary appropriations. |

| |

| | n | | Lending: Revenues are earned from interest income on the loan portfolio which is funded through borrowings.

Lending and housing programs provide support for Canadians in need and are operated on a breakeven basis. |

| |

| | n | | Insurance: Revenues are earned from premiums, fees and investment income. Expenses consist of operating expenses and net claim expenses. The Corporation’s net income is primarily derived from this activity. |

| |

| | n | | Securitization: Securitization revenues are earned from guarantee fees and investment income. Expenses consist primarily of interest expenses. |

| |

| | n | | Canada Housing Trust (CHT): CHT revenue is earned primarily from investment income. Revenue derived from investment income is used to cover operating expenditures and Canada Mortgage Bonds (CMB) interest expense. |

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| | ($M except as | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | otherwise indicated) | | | Actual | | | Plan | | | Actual | | | Plan | |

| | Revenues | | | | 11,738 | | | | | 15,966 | | | | | 13,164 | | | | | 15,359 | | |

| | Expenses | | | | 9,319 | | | | | 14,061 | | | | | 11,939 | | | | | 14,091 | | |

| | Income taxes | | | | 641 | | | | | 552 | | | | | 294 | | | | | 357 | | |

| | Net income | | | | 1,778 | | | | | 1,353 | | | | | 931 | | | | | 911 | | |

| | Per cent of planned

net income achieved | | | | 112 | | | | | 95 | | | | | 69 | | | | | 95 | | |

| | Other comprehensive income | | | | (604) | | | | | 65 | | | | | 483 | | | | | 42 | | |

| | Comprehensive income | | | | 1,174 | | | | | 1,418 | | | | | 1,414 | | | | | 953 | | |

| | Resource Management | |

| | Operating expenses

(included in Expenses above) | | | | 385 | | | | | 460 | | | | | 416 | | | | | 494 | | |

| | Number of staff-years | | | | 1,945 | | | | | 2,030 | | | | | 1,999 | | | | | 2,138 | | |

| |

34 CANADA MORTGAGE AND HOUSING CORPORATION

Net Income

Consolidated net income was $931 million in 2009, $422 million (31 per cent) below plan. The impact of the economic downturn, primarily on CMHC’s insurance net claims, is the main reason for this variance. The Corporation’s 2009 Corporate Plan was prepared in the summer of 2008 and, therefore, did not include the impact of the economic crisis.

Other Comprehensive Income

CMHC’s other comprehensive income (OCI) consists of unrealized gains or losses caused by changes in the fair valuation of investments in insurance and securitization activities. In 2009, the fair value of these instruments resulted in a $483 million gain compared to a planned gain of $65 million.

Balance Sheet Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| | ($M) | | | 2008 | | | 2009 | | | 2009 | | | 2010 | |

| | | | | Actual | | | Plan | | | Actual | | | Plan | |

| | Total assets | | | | 203,461 | | | | | 345,318 | | | | | 272,821 | | | | | 321,200 | | |

| | Total liabilities | | | | 195,291 | | | | | 335,484 | | | | | 263,558 | | | | | 311,261 | | |

| | Contributed capital | | | | 25 | | | | | 25 | | | | | 25 | | | | | 25 | | |

| | Accumulated Other

Comprehensive Income

(AOCI) | | | | (276) | | | | | 531 | | | | | 207 | | | | | (201) | | |

| | Retained earnings (other)1 | | | | 2,998 | | | | | 3,974 | | | | | 2,556 | | | | | 2,743 | | |

| | Retained earnings set aside for

capitalization | | | | 5,423 | | | | | 5,304 | | | | | 6,475 | | | | | 7,372 | | |

| | Total Equity of Canada | | | | 8,170 | | | | | 9,834 | | | | | 9,263 | | | | | 9,939 | | |

| | 1 Includes Unappropriated Retained Earnings, Reserve Fund and Inter-entity Elimination | |

| |

Assets and Liabilities

In 2009, total assets were $273 billion, $72 billion or 21 per cent under plan. Total liabilities at year end were $264 billion, $72 billion or 21 per cent under plan. These variances from plan are largely due to the Insured Mortgage Purchase Program (IMPP) being $59 billion lower than planned and CMB issuances being $8 billion lower than planned. During the 2008 liquidity crisis, CMHC was called upon to implement IMPP. After the initial purchase of $25 billion in securities backed by insured mortgages from Canadian lenders, the Government of Canada increased the program by $100 billion for a total purchase of up to $125 billion. However, by the beginning of the second quarter of 2009, the global credit crisis and resulting funding pressures had

SUMMARY OF FINANCIAL RESULTS 35

largely abated, decreasing the demand for funding through IMPP. Since the program was initiated in the third quarter of 2008, there have been $66 billion in IMPP purchases.

Equity of Canada

Equity of Canada is made up of three components:

Contributed Capital

The capital of CMHC is $25 million unless otherwise determined by the Governor in Council.

AOCI

AOCI is the accumulated unrealized gains or losses caused by the change in fair valuation of investments in insurance and securitization activities. It was $207 million at the end of 2009.

Retained Earnings

Total retained earnings were $9,031 million of which $6,475 million is set aside for capitalization for insurance and securitization activities.

Within the Public Accounts of Canada, CMHC’s annual consolidated net income reduces the government’s annual deficit, and the consolidated retained earnings and accumulated other comprehensive income reduce the government’s accumulated deficit.

The CMHC Act and National Housing Act govern the use of the Corporation’s retained earnings. In particular, the retained earnings from insurance and securitization activities may only be used for the capitalization of CMHC’s mortgage loan insurance and securitization operations, for payment of a dividend to the Government of Canada, for the purposes of the National Housing Act or CMHC Act, any other purpose authorized by Parliament relating to housing, and for retention. In the last several years, a portion

36 CANADA MORTGAGE AND HOUSING CORPORATION

of retained earnings from the insurance activity has been used for capitalization (appropriated retained earnings). In 2009, CMHC also set aside a portion of retained earnings from the securitization activity for capitalization as a prudent business practice. All other insurance and securitization retained earnings have been retained (unappropriated retained earnings).

Retained earnings related to the insurance activity are appropriated in accordance with guidelines set out by the Office of the Superintendent of Financial Institutions (OSFI). CMHC’s target for capitalization is 150 per cent of the minimum capital test recommended by OSFI. Under these standards, the insurance activity is fully capitalized. Currently, CMHC maintains approximately twice the level of capital reserves recommended by OSFI. In 2009, retained earnings set aside for capitalization represent 1.3 per cent of the total insurance-in-force of $473 billion. Retained earnings set aside for capitalization in 2008 also represented 1.3 per cent of the total insurance-in-force of $408 billion.

Retained earnings related to the securitization activity are also appropriated based on regulatory and economic capital principles. CMHC has appropriated retained earnings representing 79 per cent of its target capital. Retained earnings set aside for capitalization represent 0.2 per cent of the $300 billion of guarantees-in-force. All other securitization retained earnings represent unrealized fair value fluctuations from the IMPP.

Retained earnings related to the lending activity have been kept by the Corporation as part of its strategy to address interest rate risk exposure on pre-payable loans. They also include amounts representing unrealized fair market value changes in financial instruments. These retained earnings are subject to statutory limits. Should the limits be exceeded, CMHC would be required to pay any excess to the Government of Canada.

SUMMARY OF FINANCIAL RESULTS 37

In Focus

Canada’s Economic Action Plan (CEAP)

The Action Plan takes important steps to ensure that Canada emerges from the recession in a solid position to succeed over the longer term in an even more globalized economy. CEAP measures are intended to create employment through timely and targeted investments to build new and to renovate existing social housing.

Through CEAP, the Government of Canada made close to $2 billion available through CMHC for social housing over a two-year period. In Canada’s Economic Action Plan – A Fourth Report to Canadians released in early December 2009, the government reported that a total of $725 million was committed to help renovate and retrofit existing social housing and to build new social housing for seniors and persons with disabilities off reserve in all provinces and territories. In addition, the government committed through CMHC $125 million for First Nations housing and $100 million for housing in the North.

| | | | | | |

| |

| | Commitments made through CMHC as reported in |

| | Canada’s Economic Action Plan – Fourth Report to Canadians ($M) |

| | Renovation and retrofit of social housing off reserve | | | 500 | |

| | New social housing for seniors | | | 200 | |

| | New social housing for persons with disabilities | | | 25 | |

| | New, renovation and retrofit of social housing for First Nations on reserve | | | 125 | |

| | New social housing for the North | | | 100 | |

| | Total | | | 950 | |

| |

CEAP also provides up to $2 billion in direct low-cost loans to municipalities, over two years through CMHC for housing-related infrastructure projects in towns and cities across the country. These low-cost loans will significantly decrease the cost of borrowing for municipalities, and can be used by them to fund projects such as sewers, water lines, roads and sidewalks related to new or existing residential developments. In Canada’s Economic Action Plan – A Fourth Report to Canadians, the government reported that 64 loans were approved.

Additional information on CEAP is provided under Objective 1 of this annual report.

38 CANADA MORTGAGE AND HOUSING CORPORATION

In Focus

Fair Value of Financial Instruments

CMHC’s Balance Sheet is comprised primarily of financial assets and liabilities subject to regular fair value measurement and recognition. At 31 December 2009, approximately $206 billion, or 76 per cent of our assets, and $188 billion, or 71 per cent of our liabilities, were carried at fair value.

These financial instruments are required to be measured at fair value on initial recognition (except for certain related party transactions). In subsequent periods, measurement and the recording of changes in fair market value depends on the accounting classification of the financial instruments (refer to Note 2 – Significant Accounting Policies in our Consolidated Financial Statements).

The following table shows the unrealized gains (losses) from financial instruments recorded by the Corporation over the past two years.

| | | | | | | | | | | | | |

| | | | | | | | | |

| | ($M) | | | 2008 | | | 2009 | |

| | | | | | | | | |

| | Net Income - Net | | | | | | | | | | | |

| | Unrealized Gains (Losses): | | | | | | | | | | | |

| | MAV II & III notes | | | | - | | | | | (7) | | |

| | CHT | | | | - | | | | | 212 | 1 | |

| | Direct Lending | | | | 145 | | | | | (74) | | |

| | IMPP | | | | 733 | | | | | (108) | | |

| | Eliminations | | | | 82 | | | | | (76) | | |

| | | | | | | | | |

| | Total | | | | 960 | | | | | (53) | | |

| | | | | | | | | |

| | Other Comprehensive

Income - Net Unrealized

Gains (Losses): | | | | | | | | | | | |

| | Insurance | | | | (479) | | | | | 490 | | |

| | Securitization | | | | (22) | | | | | 31 | | |

| | Eliminations | | | | (68) | | | | | 20 | | |

| | | | | | | | | |

| | Total | | | | (569) | | | | | 541 | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| | 1 As a result of the adoption of EIC 173 in 2009 (refer to Note 3 – Change in Accounting Policy in our 31 December 2009 Consolidated Financial Statements) | |

| | | | | | | | | |

As shown in the table, $53 million or 6 per cent of consolidated net income in 2009 related to net unrealized losses from financial instruments. In 2008, 54 per cent of consolidated net income related to net unrealized gains from financial instruments.

The net unrealized gains (losses) for the Direct Lending program represent fair valuations of assets, liabilities and derivatives. As the program is fully hedged, these fair valuation gains (losses) will offset each other over the term of the related assets and liabilities such that the program will result in no income or loss to the Corporation. For CHT and IMPP, only the unrealized gains (losses) of the derivatives are recorded which results in significant year over year variances. As with Direct Lending, these programs are fully hedged such that, over the course of the programs these fair valuation gains (losses) will offset each other resulting in no income or loss.

SUMMARY OF FINANCIAL RESULTS 39

Change in Accounting Policies

CMHC’s change in accounting policies are described in Note 3 of the Consolidated Financial Statements. Effective 1 January 2009, the Corporation adopted the Canadian Institute of Chartered Accountant (CICA) Handbook Emerging Issues Committee (EIC) abstract 173 entitled “Credit Risk and the Fair Value of Financial Assets and Financial Liabilities”. EIC 173 concluded that an entity’s own credit risk and the credit risk of the counterparty should be taken into account in determining the fair value of financial assets and financial liabilities, including derivative instruments.

The Corporation also adopted amendments to CICA Handbook 3862 – Financial Instruments: Disclosures and Section 3855 – Financial Instruments: Recognition and Measurement on 1 January 2009.

Future Accounting Changes

International Financial Reporting Standards (IFRS)

In accordance with the requirements of the Canadian Accounting Standards Board, CMHC will adopt International Financial Reporting Standards (IFRS) as of

1 January 2011 with comparatives for the prior year.

CMHC has established a formal project governance structure with oversight by an

IFRS Steering Committee, consisting of management from accounting and finance, information technology, and business operations. Regular updates of the status and progress of the IFRS conversion plan are presented to CMHC Management, the Audit Committee and the Board of Directors.

The Corporation has chosen to approach the conversion in five phases: Diagnostic Assessment, Design and Planning, Solutions Development, Implementation, and Post Implementation Review. During 2009, the Design and Planning phase was completed, and the Solutions Development Phase was substantially completed.

The transition to IFRS is progressing according to plan and the Corporation will begin the implementation phase early in 2010 which includes preparing the IFRS opening balance sheet. IFRS standards and interpretations continue to change and the Corporation has taken the proposed timeline of these changes into consideration.

40 CANADA MORTGAGE AND HOUSING CORPORATION

The Corporation has identified differences between IFRS and current Canadian GAAP as well as various policy choices available under IFRS. CMHC continues to assess the implications of such differences and policy choices.

Impact of Adoption of IFRS

The Corporation has not completed the full quantification of the impacts the future adoption of IFRS will have on its financial statements and operating performance measures; however, the impact is expected to be material.

Accounting Policy Choices

The measurement differences between Canadian GAAP and IFRS will have an impact on the opening financial position of the Corporation at transition. As well, the results of operations under IFRS will differ from Canadian GAAP.

Adoption of IFRS will initially require retrospective application as of the transition date, that is IFRS requirements need to be applied assuming that the Corporation was following IFRS since inception. IFRS 1 is a financial reporting standard that stipulates the requirements for an entity that is preparing IFRS compliant statements for the first time. It provides optional exemptions to the rule of retrospective application of IFRS. The Corporation will be taking the following exemptions to retrospective application:

| | n | | Employee benefits: Recognize unamortized actuarial gains and losses in retained earnings on transition to IFRS instead of deferring and amortizing these balances in future earnings. |

| |

| | n | | Investment property: The use of fair value as deemed cost for its investment property on transition instead of the original transaction cost. |

SUMMARY OF FINANCIAL RESULTS 41

Accounting policy choices upon implementation of IFRS that have been identified to date are summarized below:

| n | | Insurance contracts: Under IFRS, the Corporation has a choice to account for its mortgage loan insurance transactions as either an insurance contract or a financial guarantee contract. The Corporation will continue to account for mortgage loan insurance transactions as an insurance contract. |

| |

| n | | Employee benefits: Recognition of actuarial gains and losses in comprehensive income. |

| |

| n | | Real estate: Classified into three categories. CMHC owned business premises and equipment will be classified as property, plant and equipment and measured at cost less depreciation. Title transfer property arising from mortgage loan insurance defaults will be classified as non-current assets held for sale and measured at net realizable value. All other properties will be classified as investment property and measured at fair value. |

| |

| n | | Related party transactions: IFRS contains no guidance on related party transactions; therefore, CMHC will be required to retrospectively restate related party transactions involving financial instruments to fair value which will result in the recording of Day 1 gains/losses. |

| |

| n | | Financial instruments: Currently, CMHC has elected not to exercise the option to reclassify financial instruments to “Fair Value through Profit or Loss” or “Available for Sale” as the existing classifications accurately reflect management’s intent. This decision, however, is subject to further consultations regarding certain interpretations of the measurement standard. |

The International Accounting Standards Board (IASB) intends to further revise several accounting standards including, but not limited to, financial instruments, post employment benefits and insurance contracts that may result in modification to the accounting areas identified above. The IASB has also indicated several other convergence projects between IFRS and Financial Accounting Standard Boards (FASB) that may further alter this assessment.

42 CANADA MORTGAGE AND HOUSING CORPORATION

Identification and resolution of key information technology requirements

CMHC has performed an analysis of its data system infrastructure and has concluded that transition to IFRS will not result in a material modification to any of its financial systems.

Internal control over financial reporting

IFRS will also affect internal controls over financial reporting. Management does not currently expect such changes to be significant.

Training and communication requirements

CMHC has undertaken the development of a communication plan to inform external stakeholders and key internal staff of the relevant modifications to the accounting and reporting of financial results ensuing from the transition to IFRS. Training seminars on relevant IFRS standards and their potential impact have been provided and will continue for key CMHC personnel.

Key elements of CMHC’s IFRS conversion plan

| | | | | | | | | |

| |

| | Impact assessment | | | Selected key activities | | | Progress to date | |

| | Financial statement impact / Accounting policy choices | | | Identification of IFRS versus GAAP differences

Evaluate and select transitional and ongoing policy alternatives

Engage auditors in conversion process | | | Completed the identification of IFRS differences

Selection of transitional and policy choices is substantially completed

Auditors have commenced review of the Corporation’s accounting analysis and policy choices | |

| | IFRS impacts on its business | | | Identify and assign necessary resources for technical analysis and implementation

Assess impact of IFRS accounting standards on business activities | | | Critical tasks and resourcing have been identified and prioritized by project management

The Corporation has identified areas of significant IFRS differences that impact its business activities | |

| | Training and communication requirements | | | Provide training to key CMHC staff and Audit Committee members

Communication of progress on conversion plan | | | Focused training for management and affected employees provided

Communication ongoing | |

| | Information technology

requirements | | | Identify and address IFRS differences that require changes to financial systems

Evaluate and select method to dual report IFRS and GAAP in 2010 | | | No significant differences identified

Method for dual reporting has been

selected | |

| |

SUMMARY OF FINANCIAL RESULTS 43

OUR PERFORMANCE AGAINST OBJECTIVES

CMHC delivers programs, products and services in support of three objectives and seven strategic priorities.

| | | | | | |

| | Objective 1: Help Canadians in need | |

| | Strategic Priority 1.1 | | | Help Canadians in need access affordable, sound and suitable housing | |

| | Strategic Priority 1.2 | | | Support Aboriginal Canadians to improve their living conditions | |

| | Objective 2: Facilitate access to more affordable, better quality housing for all Canadians | |