EXHIBIT 99.2

BUILD LEAD SUCCEED 2014 ANNUAL REPORT Canada CMHC SCHL HOME TO CANADIANS

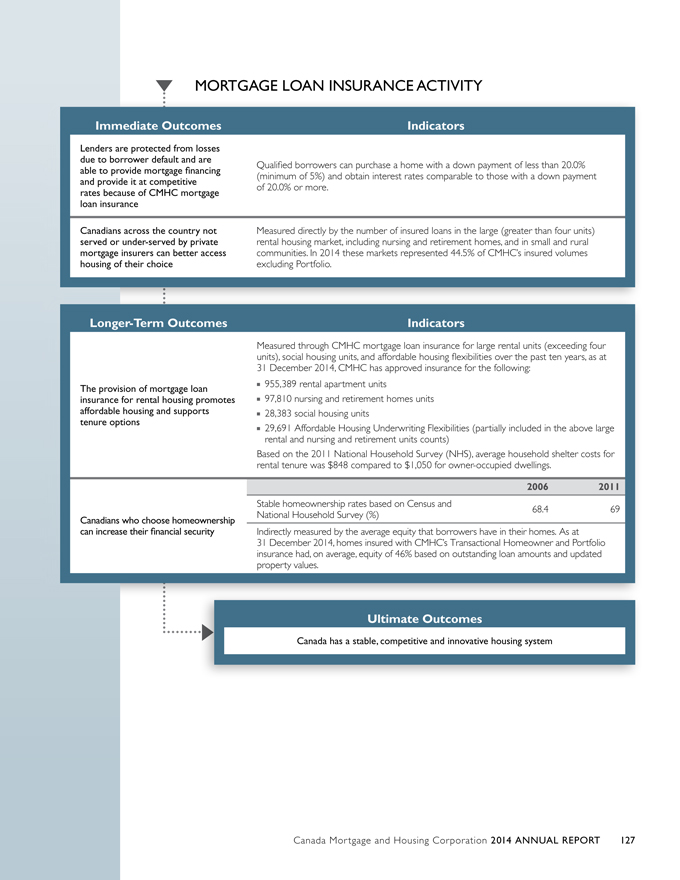

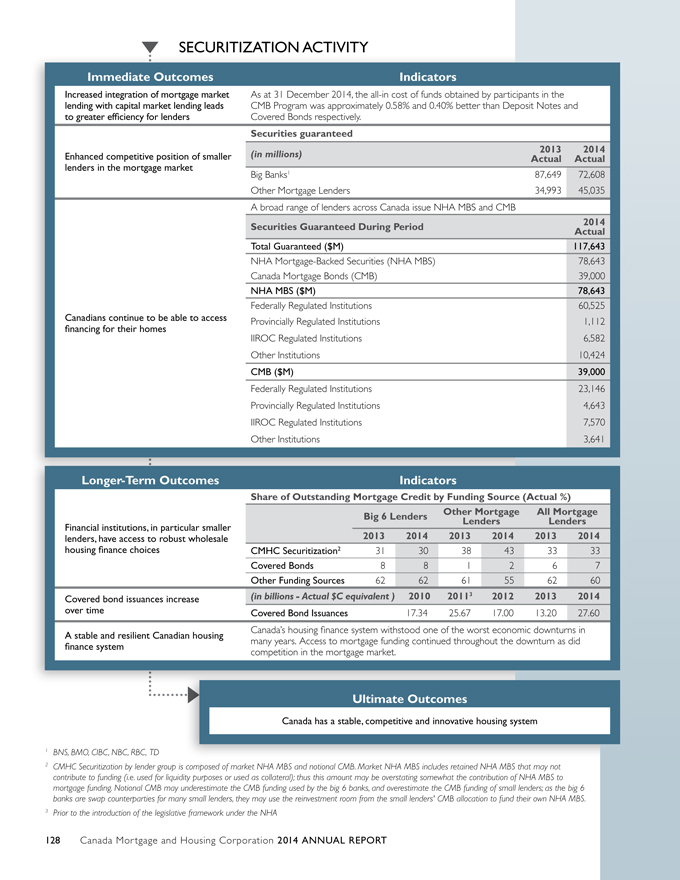

Canada’s CMHC Authority on housing OUR We help MISSION Canadians meet their housing needs The OUR Heart VISION of a world-leading housing system CONTENTS FINANCIAL HIGHLIGHTS 4 MESSAGES 5 MANAGEMENT’S DISCUSSION AND ANALYSIS 9 Operating Environment 10 Condensed Consolidated Financial Results 13 Performance by Activity 16 Market Analysis and Research 17 Assisted Housing 20 Mortgage Loan Insurance 24 Securitization 35 People and Processes 42 Risk Management 44 CONSOLIDATED FINANCIAL STATEMENTS 55 OTHER INFORMATION 119 EXPECTED OUTCOMES 125

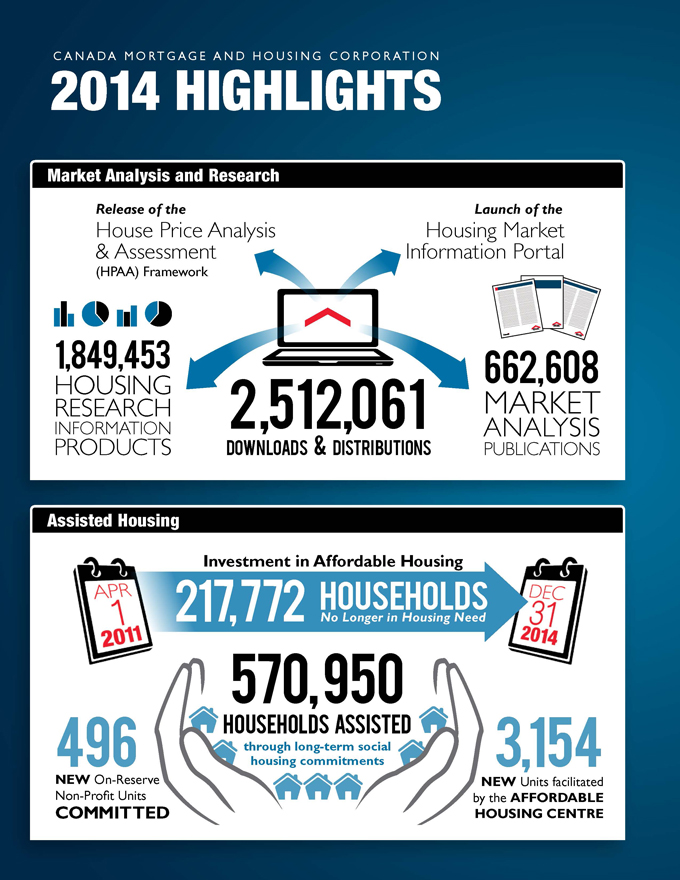

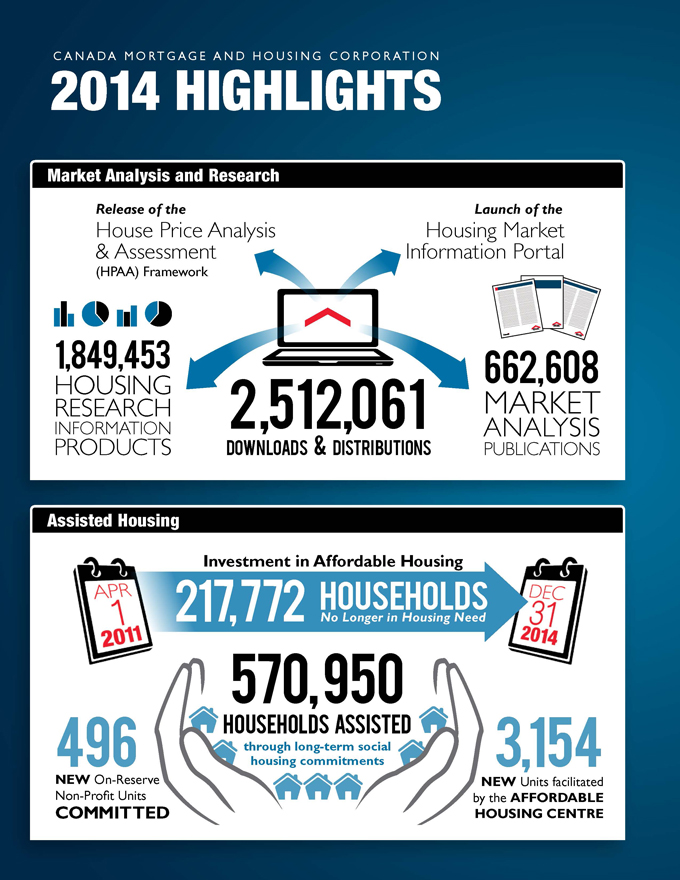

C ANAD A M O RT G A G E A N D H O U S I N G C O R P O R AT I O N 2014 HIGHLIGHTS Market Analysis and Research Release of the Launch of the House Price Analysis Housing Market & Assessment Information Portal (HPAA) Framework 1,849,453 662,608 HOUSING RESEARCH 2,512,061 MARKET PRODUCTS INFORMATION ANALYSIS DOWNLOADS & DISTRIBUTIONS PUBLICATIONS Assisted Housing Investment in Affordable Housing 217,772 HOUSEHOLDS No Longer in Housing Need 570,950 HOUSEHOLDS ASSISTED through long-term social 496 housing commitments 3,154 NEW On-Reserve NEW Units facilitated Non-Profit Units by the AFFORDABLE COMMITTED HOUSING CENTRE

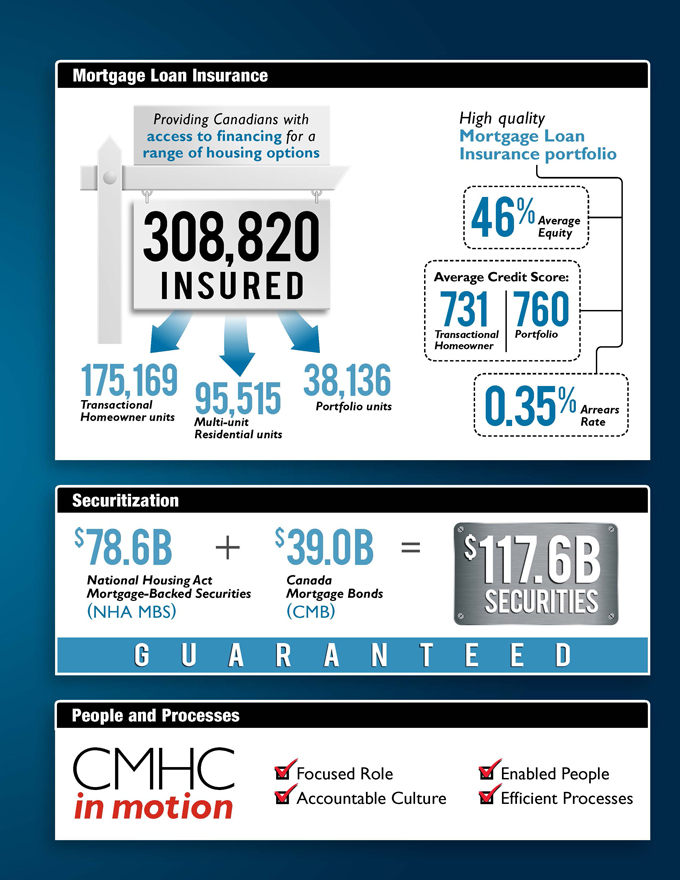

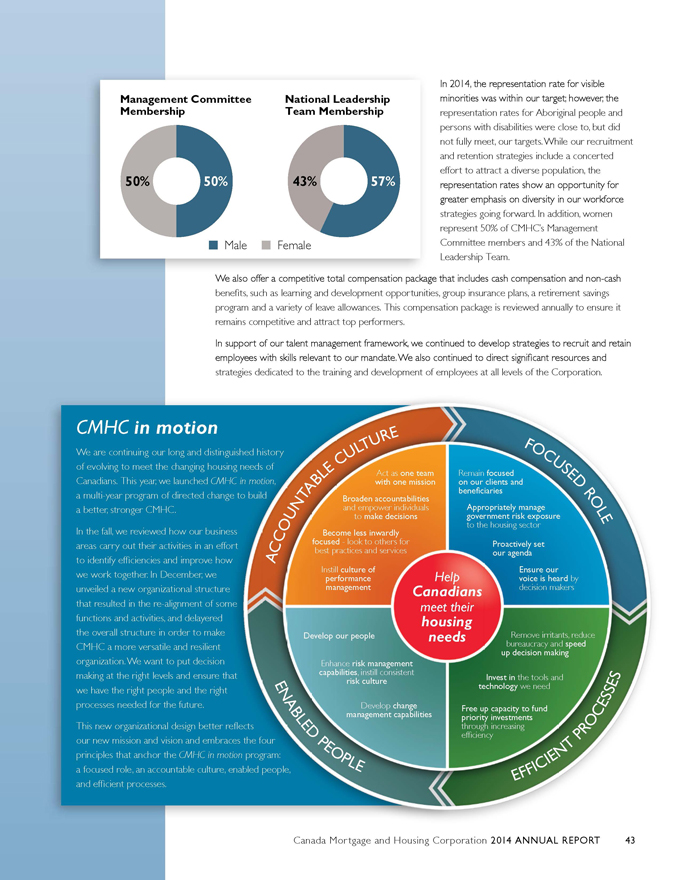

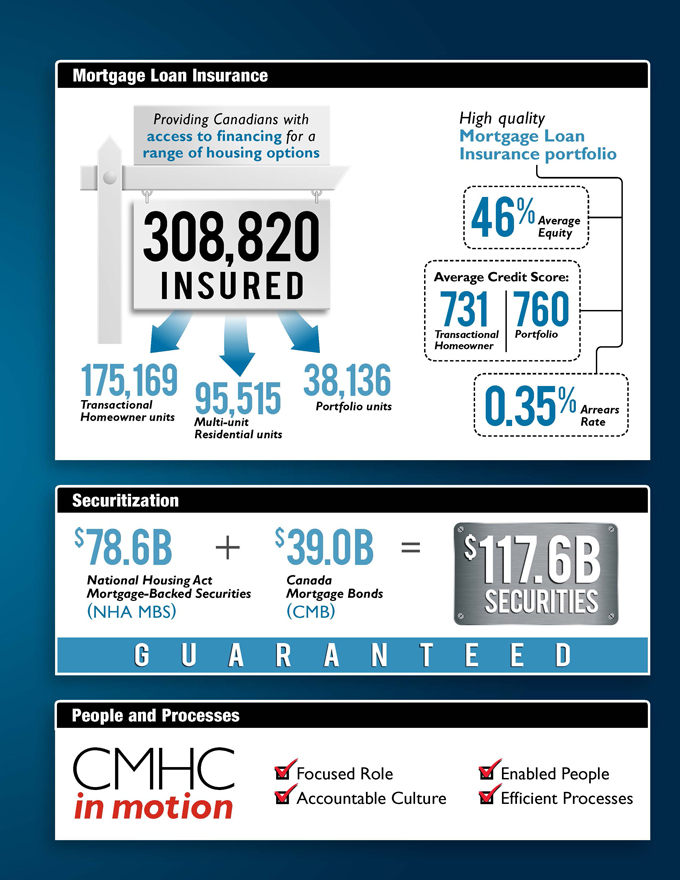

Mortgage Loan Insurance Providing Canadians with High quality access to financing for a Mortgage Loan range of housing options Insurance portfolio %Average 308,820 46 Equity I NSU RE D Average 731 Credit 760 Score: Transactional Portfolio Homeowner 175,169 38,136 Transactional 95,515 Portfolio units %Arrears Homeowner units Multi-unit 0.35 Rate Residential units Securitization $78.6B $39.0B $117.6B National Housing Act Canada Mortgage-Backed Securities Mortgage Bonds SECURITIES (NHA MBS) (CMB) G U A R A NTE E D People and Processes CMHC Focused Role Enabled People in motion Accountable Culture Efficient Processes

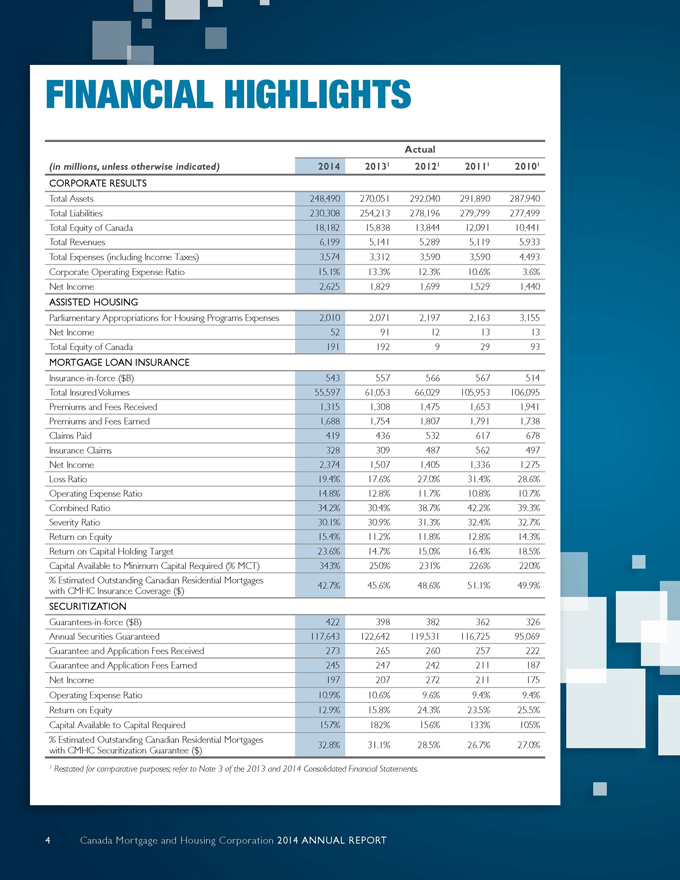

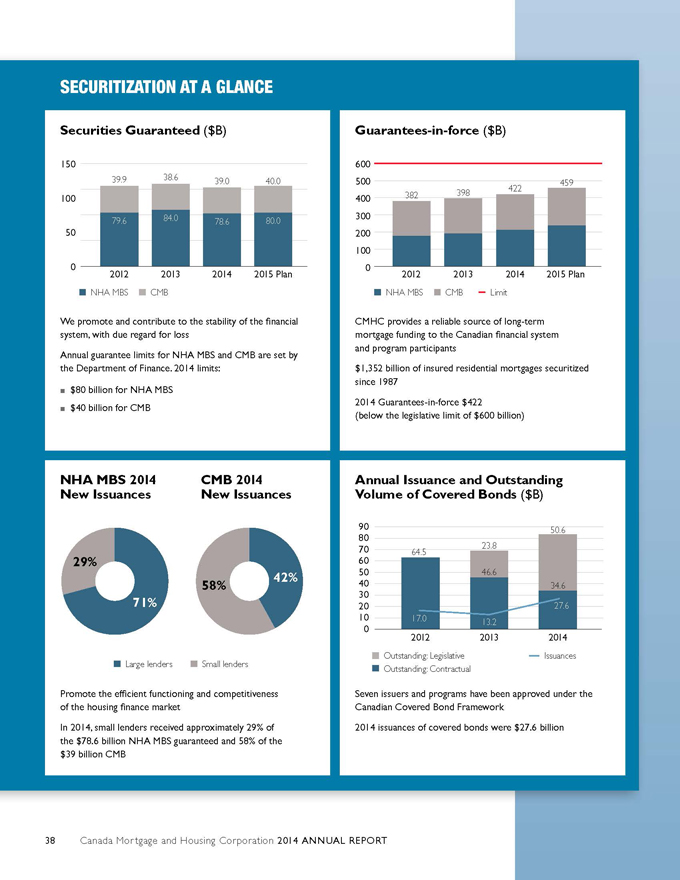

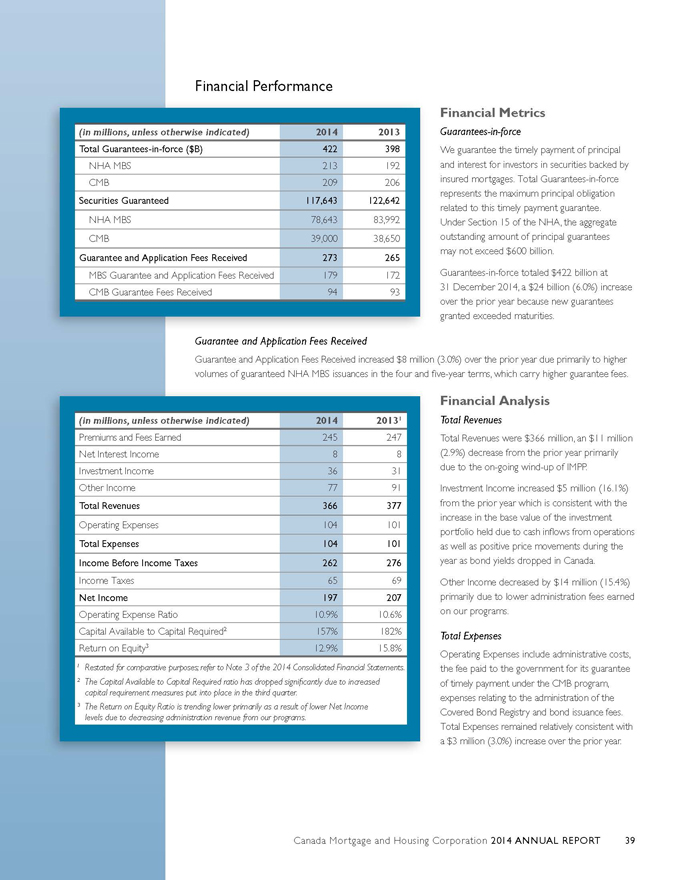

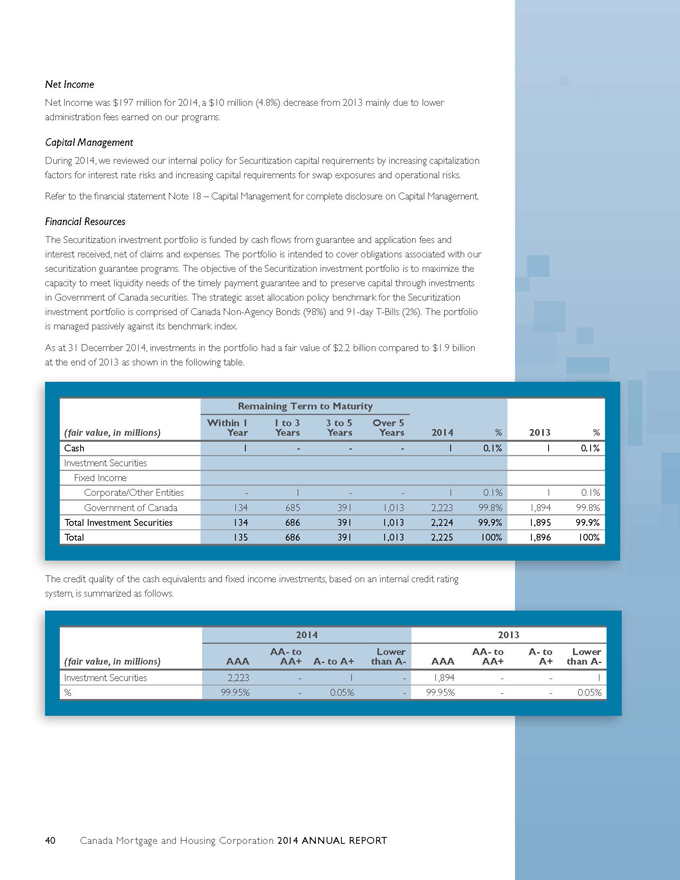

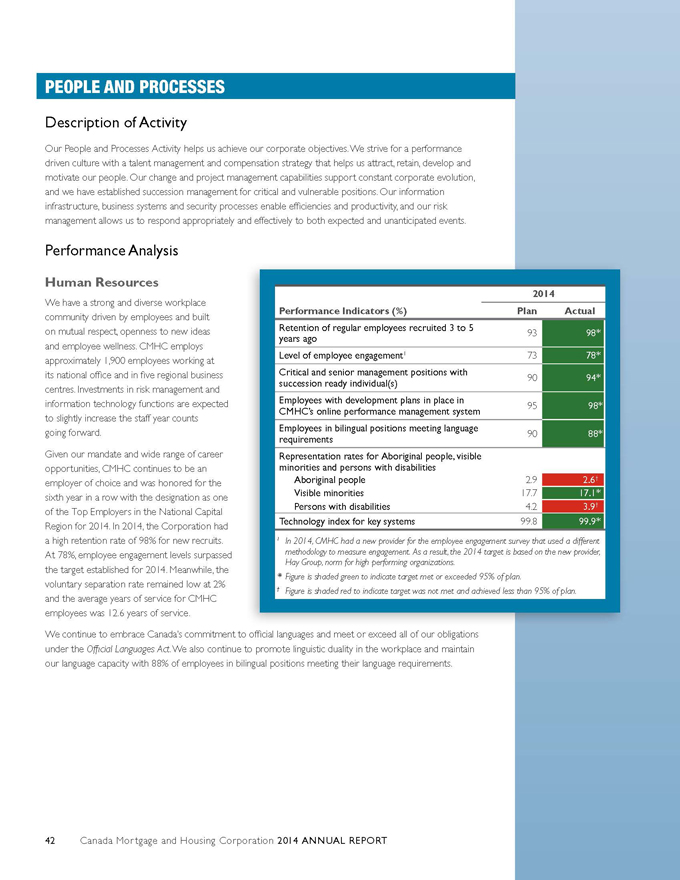

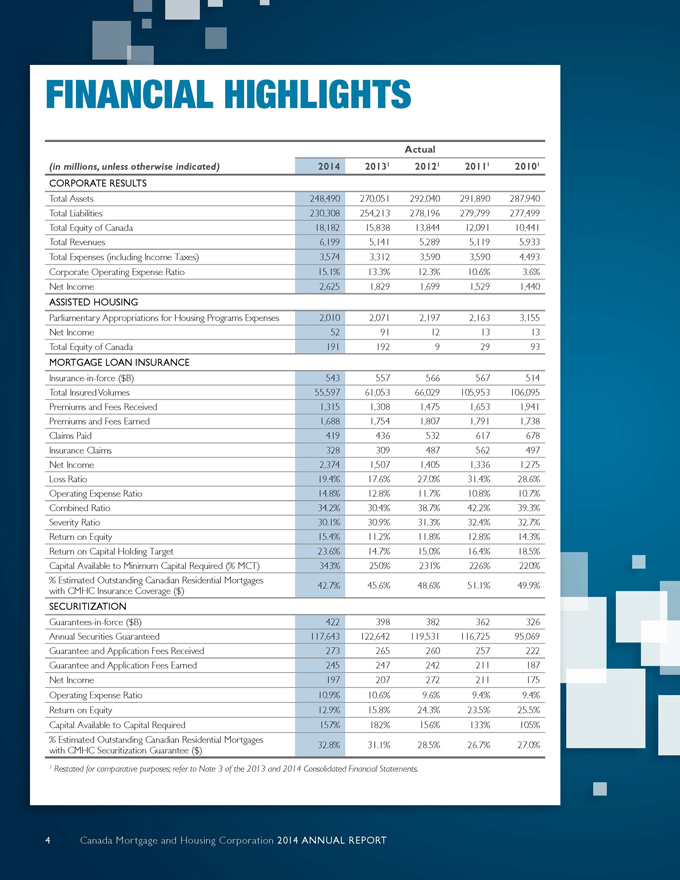

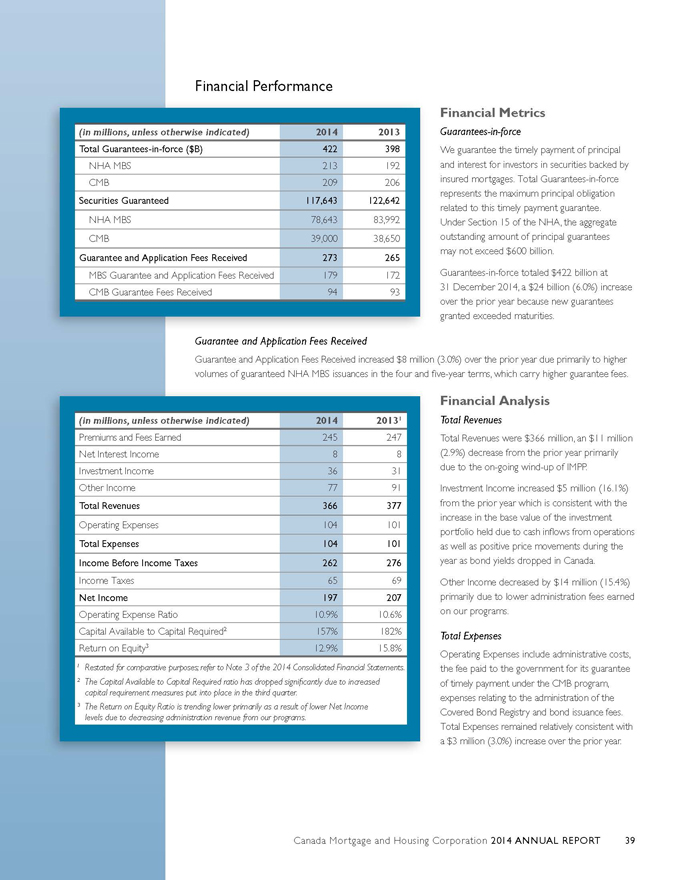

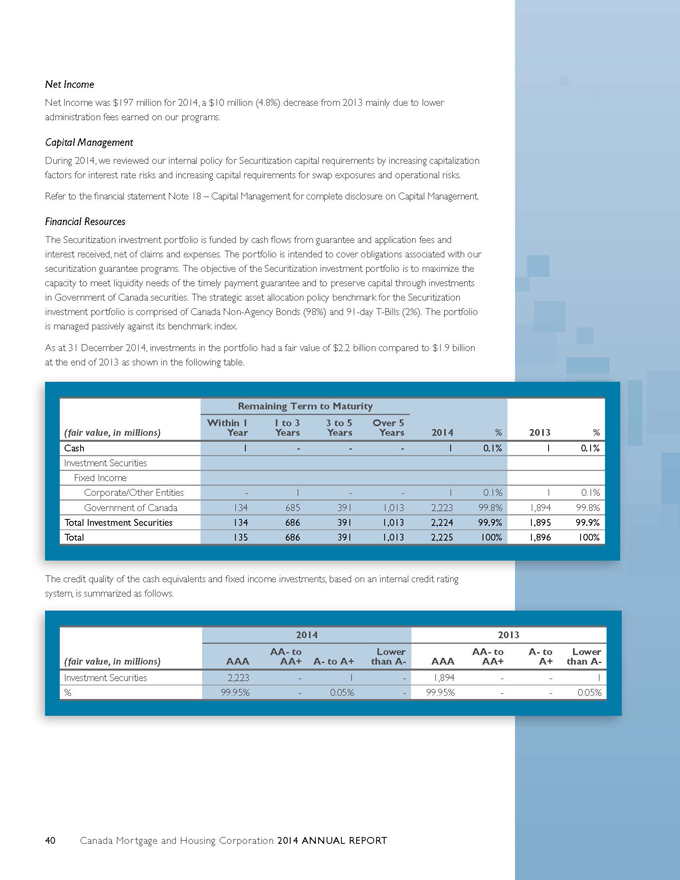

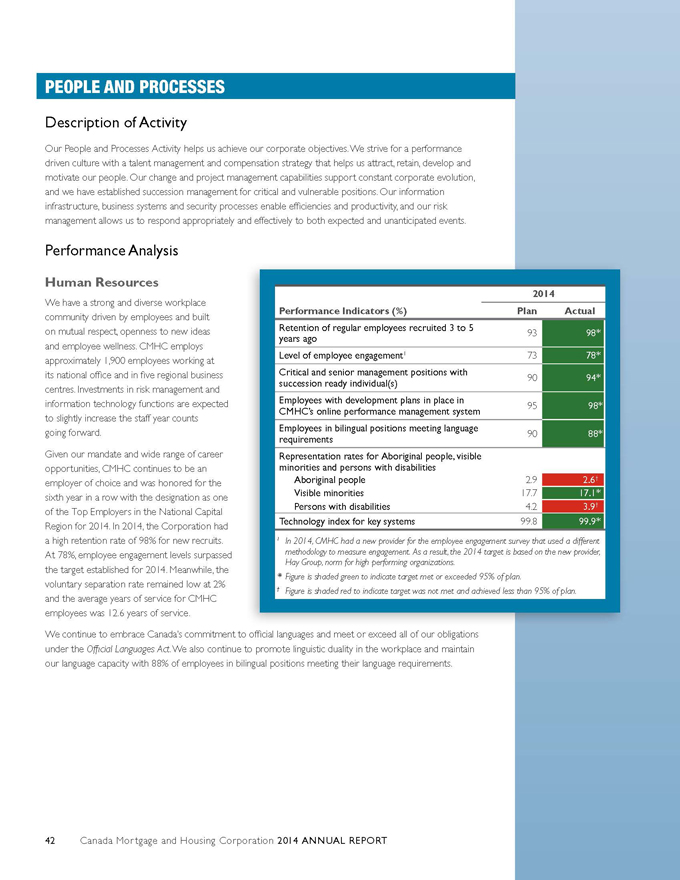

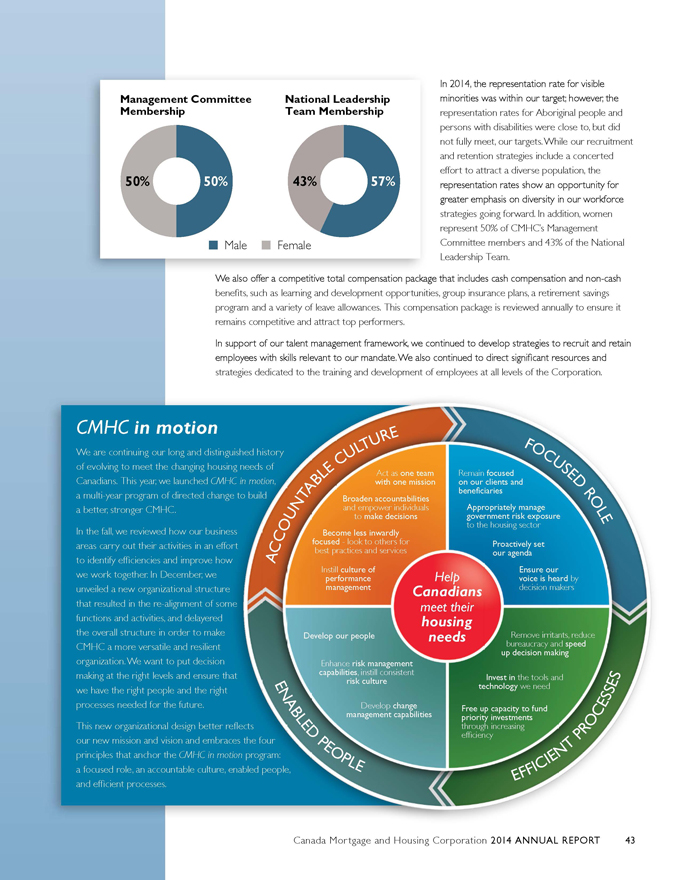

FINANCIAL HIGHLIGHTS Actual (in millions, unless otherwise indicated) 2014 20131 20121 20111 20101 CORPORATE RESULTS Total Assets 248,490 270,051 292,040 291,890 287,940 Total Liabilities 230,308 254,213 278,196 279,799 277,499 Total Equity of Canada 18,182 15,838 13,844 12,091 10,441 Total Revenues 6,199 5,141 5,289 5,119 5,933 Total Expenses (including Income Taxes) 3,574 3,312 3,590 3,590 4,493 Corporate Operating Expense Ratio 15.1% 13.3% 12.3% 10.6% 3.6% Net Income 2,625 1,829 1,699 1,529 1,440 ASSISTED HOUSING Parliamentary Appropriations for Housing Programs Expenses 2,010 2,071 2,197 2,163 3,155 Net Income 52 91 12 13 13 Total Equity of Canada 191 192 9 29 93 MORTGAGE LOAN INSURANCE Insurance-in-force ($B) 543 557 566 567 514 Total Insured Volumes 55,597 61,053 66,029 105,953 106,095 Premiums and Fees Received 1,315 1,308 1,475 1,653 1,941 Premiums and Fees Earned 1,688 1,754 1,807 1,791 1,738 Claims Paid 419 436 532 617 678 Insurance Claims 328 309 487 562 497 Net Income 2,374 1,507 1,405 1,336 1,275 Loss Ratio 19.4% 17.6% 27.0% 31.4% 28.6% Operating Expense Ratio 14.8% 12.8% 11.7% 10.8% 10.7% Combined Ratio 34.2% 30.4% 38.7% 42.2% 39.3% Severity Ratio 30.1% 30.9% 31.3% 32.4% 32.7% Return on Equity 15.4% 11.2% 11.8% 12.8% 14.3% Return on Capital Holding Target 23.6% 14.7% 15.0% 16.4% 18.5% Capital Available to Minimum Capital Required (% MCT) 343% 250% 231% 226% 220% % Estimated Outstanding Canadian Residential Mortgages 42.7% 45.6% 48.6% 51.1% 49.9% with CMHC Insurance Coverage ($) SECURITIZATION Guarantees-in-force ($B) 422 398 382 362 326 Annual Securities Guaranteed 117,643 122,642 119,531 116,725 95,069 Guarantee and Application Fees Received 273 265 260 257 222 Guarantee and Application Fees Earned 245 247 242 211 187 Net Income 197 207 272 211 175 Operating Expense Ratio 10.9% 10.6% 9.6% 9.4% 9.4% Return on Equity 12.9% 15.8% 24.3% 23.5% 25.5% Capital Available to Capital Required 157% 182% 156% 133% 105% % Estimated Outstanding Canadian Residential Mortgages 32.8% 31.1% 28.5% 26.7% 27.0% with CMHC Securitization Guarantee ($) 1 Restated for comparative purposes; refer to Note 3 of the 2013 and 2014 Consolidated Financial Statements. 4 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

MESSAGE FROM THE CHAIRPERSON On behalf of the Board of Directors, I am pleased to present CMHC’s 2014 Annual Report. This year, the Board focused on setting a course for CMHC that will ensure it is well positioned for the future to fulfill its mandate. Canada’s housing markets remained balanced for the most part in 2014 but there are emerging risks – notably the decline in oil prices in the latter part of the year, potential overvaluation and overbuilding in some markets and high levels of household debt. In addition, global events are contributing to instability around the world to which Canada is not immune. The impact of economic shocks, regardless of their cause, underscores the priority the Board set for CMHC in 2014 to improve its risk management practices and to bolster its data and analysis of housing markets. Through its mortgage loan insurance and securitization guarantee programs, CMHC facilitates national access to mortgage financing and contributes to the stability of the financial system. At the same time, these programs present real risks to the taxpayer. In support of the Government’s efforts to reduce taxpayer exposure to the housing sector, in 2014 CMHC discontinued certain mortgage loan insurance products and increased premiums. These decisions were made in the context of retaining CMHC’s ability to fulfill its core mandate while ensuring that it has the ability to scale up in times of economic duress to support financial stability, if required. Part of CMHC’s mandate is the support the Corporation provides to Canadians whose housing needs are not adequately met in the market. CMHC ensures that federal housing investments deliver maximum benefits to Canadians in need. Strong partnerships with other orders of government and housing providers are essential to CMHC’s success in this area. We have challenged CMHC to become a higher-performing organization and, as Board members, we have also challenged ourselves. This year, we undertook a peer assessment to identify areas for Board member development and improvement in the performance of our duties as stewards of the Corporation. I would like to take this opportunity to thank Michael Horgan, Rennie Pieterman, Michael Gendron and Brian Johnston, who retired from the Board this year. Recently, Sandra Hanington departed as a result of her appointment as Master of the Royal Canadian Mint. On behalf of the Board, I thank them for their contribution and wish them well in their future endeavours. The Board also welcomes new members Paul Rochon, the Deputy Minister of Finance, as well as Navjeet (Bob) Dhillon and Peter Sharpe who were appointed in February 2015. I would also like to acknowledge the outstanding support the Board received from CMHC management and employees in achieving our objectives this year. Robert P. Kelly Chairperson Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 5

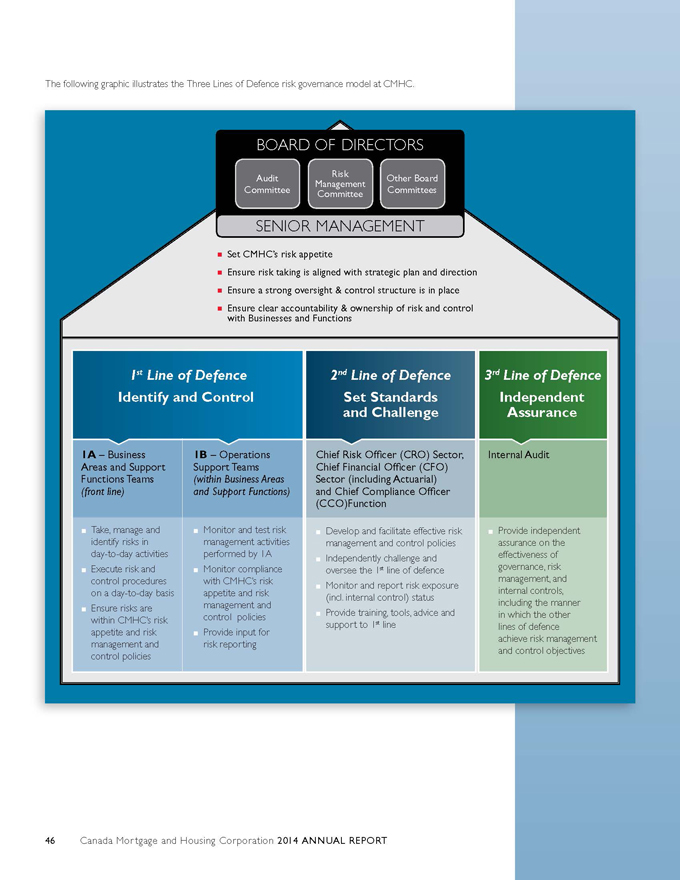

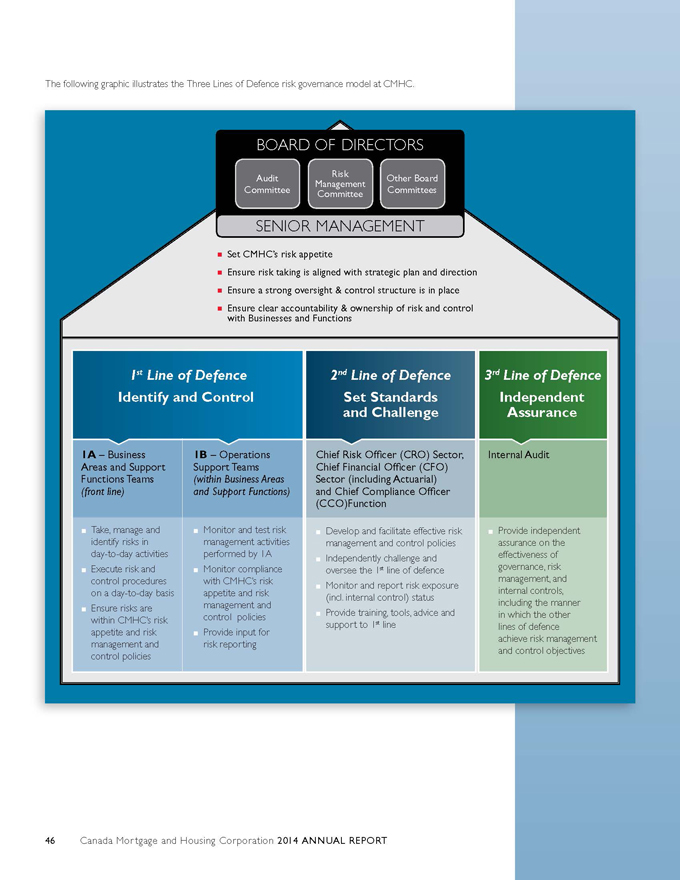

MESSAGE FROM THE PRESIDENT I’m very proud of what we accomplished in 2014, my first year as CMHC’s President and CEO. We moved quickly to articulate a new mission and vision that set the direction for our work in 2014 and for the future. Our mission to help Canadians meet their housing needs has helped us focus on activities that contribute most to fulfilling our mandate and to better serving Canadians. Our vision to be the heart of a world-leading housing system signals our aspiration not only to preserve but to improve financial stability and access to housing. Guided by our mission and vision, we pursued challenging goals for CMHC in 2014. Our activities and accomplishments for the year are discussed throughout this report. In particular, I want to highlight key achievements that most resonate with our refocused approach. This approach starts with ensuring that Canadians have access to housing financing through our mortgage loan insurance products while minimizing taxpayer exposure to risk. In keeping with our mission to help Canadians meet their housing needs, we discontinued second home mortgage loan insurance. We also no longer offer products to self-employed borrowers without 3rd party validation. As part of our efforts to ensure we have the capital required to be able to respond in times of economic duress, and minimize taxpayer exposure, we increased insurance premiums for Homeowner and 1-4 unit rental properties. CMHC’s securitization programs provide a reliable source of long-term mortgage funding for residential mortgage lenders. At the same time, we have a role to play in shaping the market. Increases to come into effect in 2015 to our guarantee fees for National Housing Act Mortgage-Backed Securities (NHA MBS) and to Canada Mortgage Bonds (CMB) are an important step toward further reducing taxpayer exposure to the housing sector and encouraging alternative funding options in the private market. In 2014 we also took additional steps to integrate risk management into all of our activities by introducing a risk governance model (“Three Lines of Defence”) which sets out responsibilities for managing risk at all levels of the organization. Over the year, I had the opportunity to meet with many others who share our commitment to improve access to quality, affordable housing for lower income Canadians, seniors, Aboriginal families and people with disabilities. In November, I met with my provincial and territorial government colleagues to strengthen our partnerships on affordable housing. Throughout 2014, we worked with provinces and territories to extend bilateral Investment in Affordable Housing Agreements (IAH) to 2019. Federal commitments under these agreements will total more than $1.9 billion since their inception in 2011. In support of housing programs on and off-reserve, CMHC spent just over $2 billion in Parliamentary appropriations on behalf of the Government of Canada in 2014. Through these investments, CMHC is helping to create affordable housing solutions to meet the needs of Canadians. 6 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

We want ours to be the leading voice in canadian market analysis and housing research and, in 2014, we made great strides toward this goal. By increasing reporting activities and by creating tools and products to help Canadians make more informed decisions, we addressed transparency concerns regarding gaps in the information we report. CMHC’s Insurance Business Supplement provided clarity with respect to our residential mortgage insurance business, while research on foreign investments in condominium markets, the launch of the Housing Market Information Portal and the release of the initial results from our House Price Analysis and Assessment (HPAA) framework have all expanded the availability and quality of housing market data. I am very thankful for the efforts and dedication of our employees across the country. Together in 2014, we took steps to transform CMHC into the higher-performing organization we want to be and to bring greater value to Canadians. This transformation is anchored by the four pillars of our CMHC in Motion program of change – a Focused Role, an Accountable Culture, Enabled People and Efficient Processes. Change is often difficult, but our employees have remained steadfast and resilient in ensuring CMHC continues to deliver the best possible service to Canadians. It is through their passion and commitment that CMHC will continue to Build, Lead, Succeed. Evan W. Siddall President and Chief Executive Officer Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 7

MANAGEMENT’S DISCUSSION AND ANALYSIS The following Management’s Discussion and Analysis (MD&A) of the financial condition and results of operations as approved by the Board of Directors on 26 March 2015 is prepared for the year ended 31 December 2014. This MD&A should be read in conjunction with the audited Consolidated Financial Statements. Unless otherwise indicated, all financial information in this report has been prepared in accordance with International Financial Reporting Standards (IFRS) and all amounts are expressed in Canadian dollars. Forward-Looking Statements Our Annual Report contains forward-looking statements including, but not limited to, statements made in the “Operating Environment”, “Performance by Activity”, “Risk Management”, and “Expected Outcomes” sections of the report. Specific forward-looking statements include, but are not limited to, statements with respect to our outlook for the regulatory environment in which we operate, the outlook and priorities for each activity and the risk environment. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. These risks and uncertainties, many of which are beyond our control, include, but are not limited to, national and international economic, financial and regulatory conditions, and could cause actual results to differ materially from the expectations expressed in these forward-looking statements. Forward-looking statements are typically identified by words such as “may”, “should”, “could”, “would”, “will”, as well as expressions such as “believe”, “expect”, “forecast”, “anticipate”, “intend”, “plan”, “estimate” and other similar expressions. The forward-looking information contained in the Annual Report is presented to assist readers in understanding our financial condition and performance. It may not be suitable for other purposes and readers should not place undue reliance on it. The forward-looking statements are based on management’s current predictions, forecasts, projections, expectations and conclusions and the assumptions related to these predictions, forecasts, projections, expectations and conclusions may not prove to be correct. We do not undertake to update any forward-looking statements made in this Annual Report. Non-IFRS Measures We use a number of financial measures to assess our performance. Some of these measures are not calculated in accordance with IFRS, are not defined by IFRS, and do not have standardized meanings that would ensure consistency and comparability with other institutions. These non-IFRS measures are presented to supplement the information disclosed in the Consolidated Financial Statements and Notes to the Consolidated Financial Statements which are prepared in accordance with IFRS and may be useful in analyzing performance and understanding the measures used by management in its financial and operational decision making. Where non-IFRS measures are used throughout the Annual Report, a definition of the term will be disclosed in the Glossary for Non-IFRS Financial Measures section at the end of this MD&A. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 9

Operating Environment Real Gross Domestic Product Consumer Price Index (% change) (% change) 7.5 7.5 6.0 6.0 4.5 4.5 3.0 2.5 3.0 1.9 2.0 2.0 1.5 1.5 1.5 0.9 0.0 2012 2013 2014 0.0 2012 2013 2014 Source: Statistics Canada, Consensus Economics Source: Statistics Canada Average Five-Year Posted Unemployment Rate Mortgage Interest Rate (%) (%) 7.5 7.5 7.2 7.1 6.9 6.0 6.0 5.3 5.2 4.9 4.5 4.5 3.0 3.0 1.5 1.5 0.0 0.0 2012 2013 2014 2012 2013 2014 Source: Bank of Canada Source: Statistics Canada HOUSING MARKETS Housing Starts (Units) Vacancy Rates (%) Average National House Prices ($) 220,000 7.5 450,000 214,827 400,000 408,068 210,000 6.0 382,613 363,477 350,000 200,000 4.5 300,000 189,329 2.8 2.9 3.0 190,000 187,923 3.0 250,000 180,000 1.5 200,000 170,000 0.0 150,000 2012 2013 2014 2012 2013 2014 2012 2013 2014 Source: CMHC Source: CMHC Source: CREA For additional information on housing markets in Canada, please visit our website at www.cmhc.ca 10 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

Economic Conditions and Housing Indicators

In 2014, resale market conditions remained balanced and broadly in-line with key indicators such as employment, gross domestic product (GDP) and population growth. Nationally, the average Multiple Listing Service® (MLS®) price increased by 6.7% relative to 2013 due in part to greater MLS® sales growth in more expensive markets in Ontario and British Columbia. The rental vacancy rate remained stable, as demand for rental housing was supported by net migration and steady levels of full-time employment in the 15 to 24 age group. Total housing starts remained at a similar level as in 2013, supported by low mortgage rates and employment. Fundamentals supporting Canada’s housing markets, such as migration, employment and income, were stronger in the western part of the country.

Economic conditions in Canada in 2015 overall are projected to be stable relative to 2014 according to the Consensus of Economic Forecasters of Canada, albeit with regional differences due to lower oil prices. The Consensus Private Sector Forecasters Survey as of 8 February 2015 notes that:

| | ¡ | | Canadian GDP is forecast to increase between 1.9% and 2.5% in 2015. |

| | ¡ | | The overall Canadian unemployment rate should decline, and is expected to be between 6.4% to 6.9% in 2015 compared to 6.9% in 2014. |

| | ¡ | | Low interest rates will continue to support Canada’s housing market in 2015. |

We expect housing starts to moderate at a gradual pace over the forecast horizon, from 189,329 units in 2014 to 187,400 units in 2015 and 185,100 units in 2016. MLS® sales in 2015 are expected to remain close to levels observed in 2014. By 2016, we expect demand for existing units to moderate slightly relative to 2014 and 2015, but still remain above their level over the 2009 to 2013 period. We expect national market conditions to remain relatively balanced and house prices are projected to remain in line with underlying demographic and economic factors. We expect the average MLS® price for Canada to increase by 1.5% in 2015 to $414,200 and by 1.6% in 2016 to $420,900. The average price for Canada is pushed up by the impact of higher priced markets such as Vancouver and Toronto. Excluding these two Census Metropolitan Areas, the average MLS® price for Canada is forecast to be $332,180 in 2015 and $339,450 in 2016. While the outlook for the Canadian housing sector is one of general stability, there are global and domestic risks to consider. The most significant downside risk to recently emerge is the decline in world oil prices. Household debt is also a vulnerability that requires close monitoring. The Canadian debt-to-income ratio continues to trend up, rising from 161.5 in the second quarter of 2014 to 162.6 in the third quarter of 2014.

Mortgage Loan Insurance Developments

In recent years, the Government of Canada has taken a number of measures to help ensure that Canada’s financial system remains strong and to reinforce the housing finance framework. Limiting government exposure to the housing sector continues to be an important objective of CMHC.

Amendments to the National Housing Act (NHA) and the Protection of Residential Mortgage or Hypothecary Insurance Act (PRMHIA) in Part 6, Division 24 of the Economic Action Plan 2014 Act, No.1

On 19 June 2014, Bill C-31, an Act to implement certain provisions of the budget tabled in Parliament on 11 February 2014 and other measures (Economic Action Plan 2014 Act, No. 1) received Royal Assent. The Act brings several amendments to the NHA and PRMHIA that affect us. Specifically, the Act explicitly extends regulation-making power over government-backed insurance to existing insured loans (as opposed to only new insurance) under the PRMHIA and the NHA. In addition, it amends PRMHIA to require that mortgage loans insured before the coming into force of PRMHIA must also comply with any regulations under the PRMHIA that relate to mortgage loans that may back securities guaranteed under the NHA.

Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT 11

Fees Payable to the Government of Canada

Pursuant to section 8.2 of the NHA, effective 1 January 2014, our mortgage loan insurance business is subject to a risk fee payable to the Government of Canada of 3.25% of premiums written and an additional 10 basis points on new portfolio insurance written. Our fee of 3.25% takes into account the full government backing of our insurance liabilities as opposed to the 90% guarantee of private mortgage insurers.

OSFI Guideline B-21: Residential Mortgage Insurance Underwriting Practices and Procedures

The Office of the Superintendent of Financial Institutions (OSFI) published its final Guideline B-21 Residential Mortgage Insurance Underwriting Practices and Procedures for mortgage insurers on 6 November 2014. Most of the practices and procedures in the guideline have already been adopted and we do not anticipate any significant changes to our operations.

Minimum Capital Test for Mortgage Loan Insurers

OSFI is in the process of developing a new capital framework specific to mortgage insurers which will replace the current Minimum Capital Test (MCT). This new framework is not expected to be in place until 2016 or later. As a result, mortgage loan insurers are expected to use an interim capital framework, which is a modified version of the MCT for federally regulated property and casualty insurers that was released by OSFI on 24 September 2014. Our MCT ratio declined by 17 percentage points as at 1 January 2015 under the modified MCT.

Review of Mortgage Loan Insurance Business

We evaluated our mortgage loan insurance products in 2014 against our new mission statement, which emphasizes housing needs. This review resulted in the elimination of certain product offerings, including the availability of insurance on loans for second homes, borrowers without independent income validation, and condominium construction financing.

Effective 1 May 2014, we increased our mortgage loan insurance premiums by approximately 15% on all Transactional Homeowner loans and 1-4 unit rental properties. In addition, effective 31 July 2014, we aligned our low ratio transactional mortgage loan insurance product with our high ratio product by establishing maximum housing prices, amortization periods and debt servicing ratios.

Other initiatives to support the efficient functioning and competitiveness of the housing finance system included modifications to our Portfolio insurance with a revised annual allocation of $9 billion and the elimination of the substitution feature for new Portfolio pools (those insured after 31 December 2013).

Securitization Developments

Annual Limit on New Securities Guaranteed

Pursuant to the NHA, the Minister of Finance approves the terms and conditions for our Securitization Programs, including the maximum guarantees for the year. In 2014, the maximums were $80 billion and $40 billion for NHA MBS and CMB, respectively, and will remain at these levels for 2015. Effective 1 April 2015, the fees we pay to the Government of Canada for their guarantee increased.

Covered Bonds

Beginning in the fourth quarter, the European Union (EU) recognized Canadian Covered Bonds as a Level 2A liquid asset for the purposes of EU-based financial institutions complying with the Liquidity Coverage Ratio under Basel III.

12 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

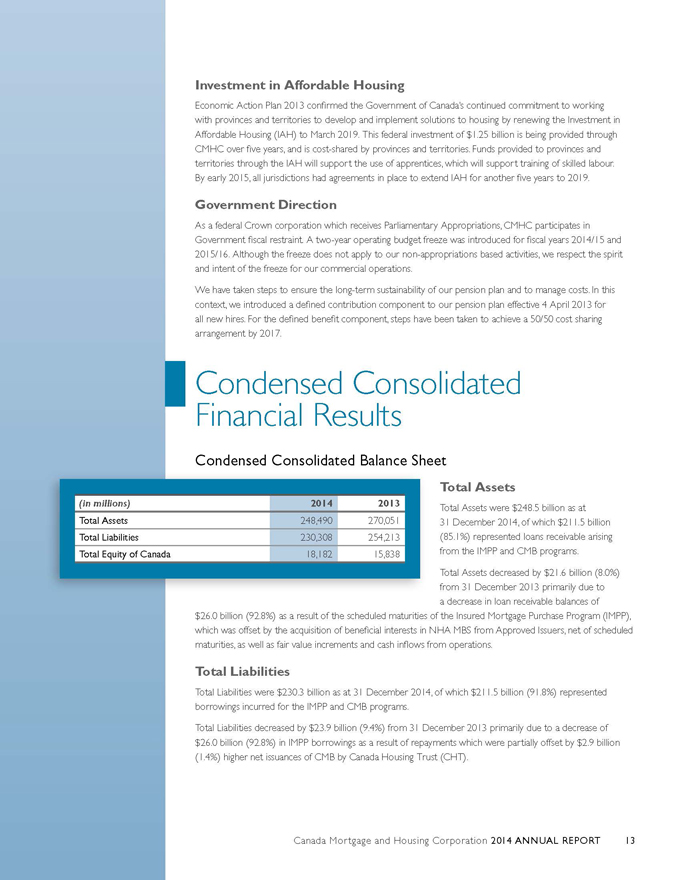

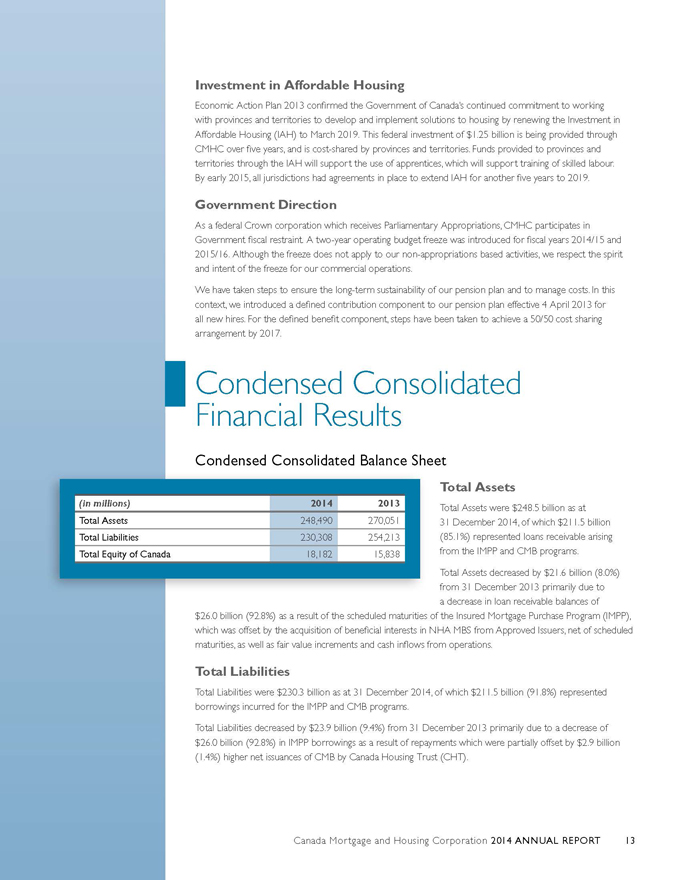

Investment in Affordable Housing Economic Action Plan 2013 confirmed the Government of Canada’s continued commitment to working with provinces and territories to develop and implement solutions to housing by renewing the Investment in Affordable Housing (IAH) to March 2019. This federal investment of $1.25 billion is being provided through CMHC over five years, and is cost-shared by provinces and territories. Funds provided to provinces and territories through the IAH will support the use of apprentices, which will support training of skilled labour. By early 2015, all jurisdictions had agreements in place to extend IAH for another five years to 2019. Government Direction As a federal Crown corporation which receives Parliamentary Appropriations, CMHC participates in Government fiscal restraint. A two-year operating budget freeze was introduced for fiscal years 2014/15 and 2015/16. Although the freeze does not apply to our non-appropriations based activities, we respect the spirit and intent of the freeze for our commercial operations. We have taken steps to ensure the long-term sustainability of our pension plan and to manage costs. In this context, we introduced a defined contribution component to our pension plan effective 4 April 2013 for all new hires. For the defined benefit component, steps have been taken to achieve a 50/50 cost sharing arrangement by 2017. Condensed Consolidated Financial Results Condensed Consolidated Balance Sheet (in millions) 2014 2013 Total Assets 248,490 270,051 Total Liabilities 230,308 254,213 Total Equity of Canada 18,182 15,838 Total Assets Total Assets were $248.5 billion as at 31 December 2014, of which $211.5 billion (85.1%) represented loans receivable arising from the IMPP and CMB programs. Total Assets decreased by $21.6 billion (8.0%) from 31 December 2013 primarily due to a decrease in loan receivable balances of $26.0 billion (92.8%) as a result of the scheduled maturities of the Insured Mortgage Purchase Program (IMPP), which was offset by the acquisition of beneficial interests in NHA MBS from Approved Issuers, net of scheduled maturities, as well as fair value increments and cash inflows from operations. Total Liabilities Total Liabilities were $230.3 billion as at 31 December 2014, of which $211.5 billion (91.8%) represented borrowings incurred for the IMPP and CMB programs. Total Liabilities decreased by $23.9 billion (9.4%) from 31 December 2013 primarily due to a decrease of $26.0 billion (92.8%) in IMPP borrowings as a result of repayments which were partially offset by $2.9 billion (1.4%) higher net issuances of CMB by Canada Housing Trust (CHT). Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 13

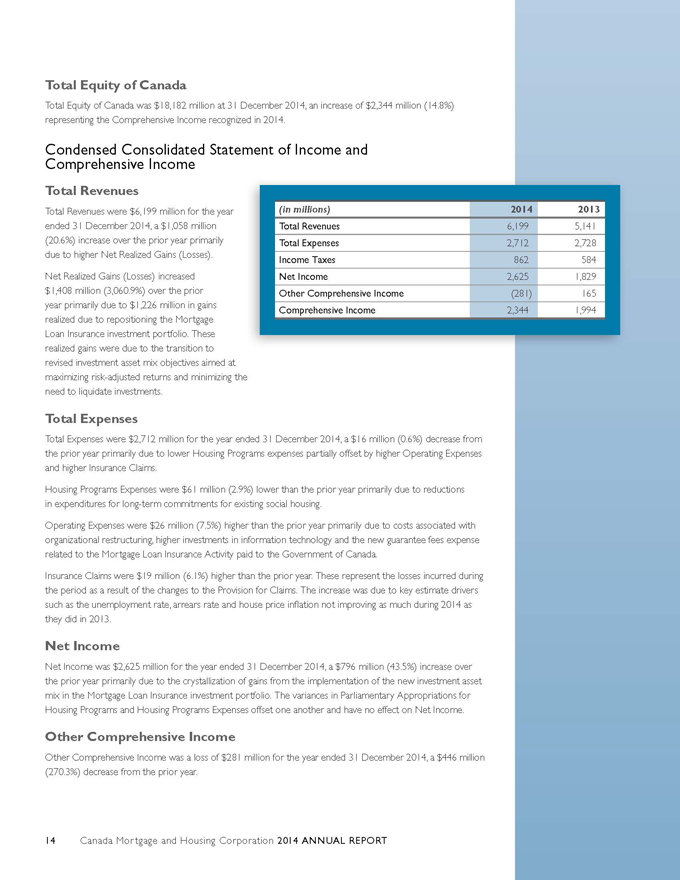

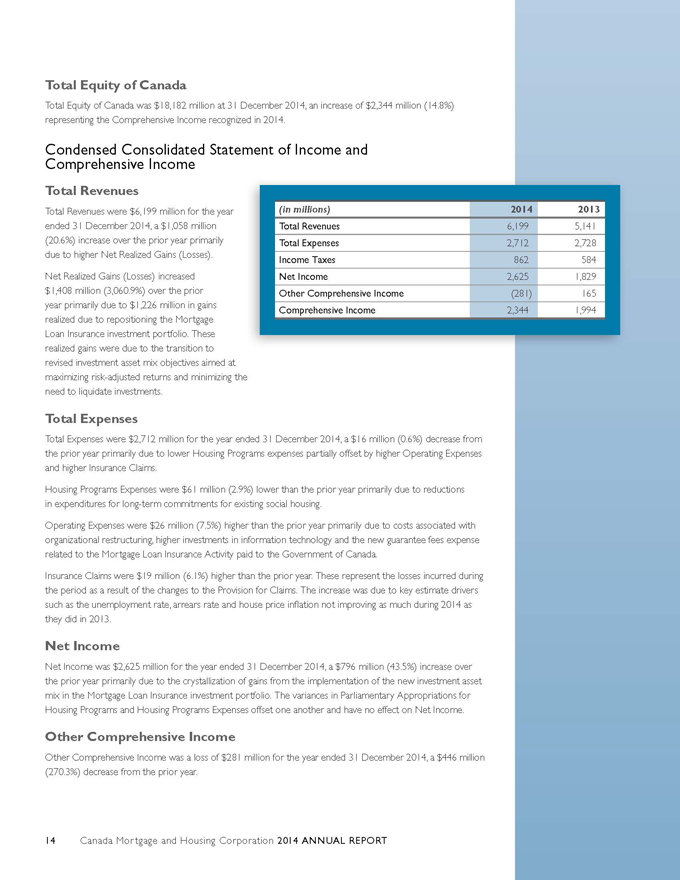

Total Equity of Canada Total Equity of Canada was $18,182 million at 31 December 2014, an increase of $2,344 million (14.8%) representing the Comprehensive Income recognized in 2014. Condensed Comprehensive Consolidated Income Statement of Income and Total Revenues Total Revenues were $6,199 million for the year ended 31 December 2014, a $1,058 million (20.6%) increase over the prior year primarily due to higher Net Realized Gains (Losses). Net Realized Gains (Losses) increased $1,408 million (3,060.9%) over the prior year primarily due to $1,226 million in gains realized due to repositioning the Mortgage Loan Insurance investment portfolio. These realized gains were due to the transition to revised investment asset mix objectives aimed at maximizing risk-adjusted returns and minimizing the need to liquidate investments. (in millions) 2014 2013 Total Revenues 6,199 5,141 Total Expenses 2,712 2,728 Income Taxes 862 584 Net Income 2,625 1,829 Other Comprehensive Income (281) 165 Comprehensive Income 2,344 1,994 Total Expenses Total Expenses were $2,712 million for the year ended 31 December 2014, a $16 million (0.6%) decrease from the prior year primarily due to lower Housing Programs expenses partially offset by higher Operating Expenses and higher Insurance Claims. Housing Programs Expenses were $61 million (2.9%) lower than the prior year primarily due to reductions in expenditures for long-term commitments for existing social housing. Operating Expenses were $26 million (7.5%) higher than the prior year primarily due to costs associated with organizational restructuring, higher investments in information technology and the new guarantee fees expense related to the Mortgage Loan Insurance Activity paid to the Government of Canada. Insurance Claims were $19 million (6.1%) higher than the prior year. These represent the losses incurred during the period as a result of the changes to the Provision for Claims. The increase was due to key estimate drivers such as the unemployment rate, arrears rate and house price inflation not improving as much during 2014 as they did in 2013. Net Income Net Income was $2,625 million for the year ended 31 December 2014, a $796 million (43.5%) increase over the prior year primarily due to the crystallization of gains from the implementation of the new investment asset mix in the Mortgage Loan Insurance investment portfolio. The variances in Parliamentary Appropriations for Housing Programs and Housing Programs Expenses offset one another and have no effect on Net Income. Other Comprehensive Income Other Comprehensive Income was a loss of $281 million for the year ended 31 December 2014, a $446 million (270.3%) decrease from the prior year. 14 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

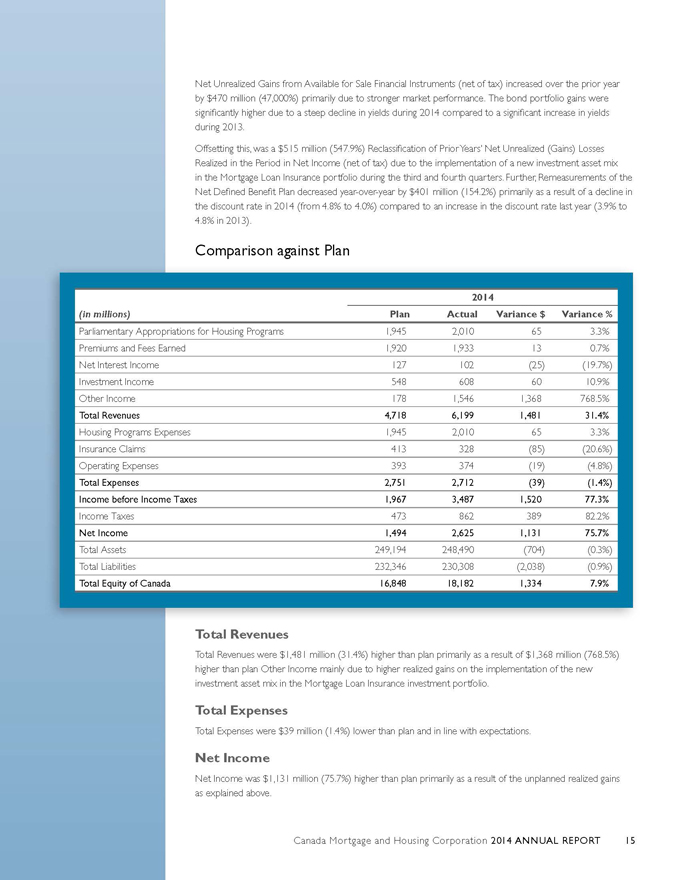

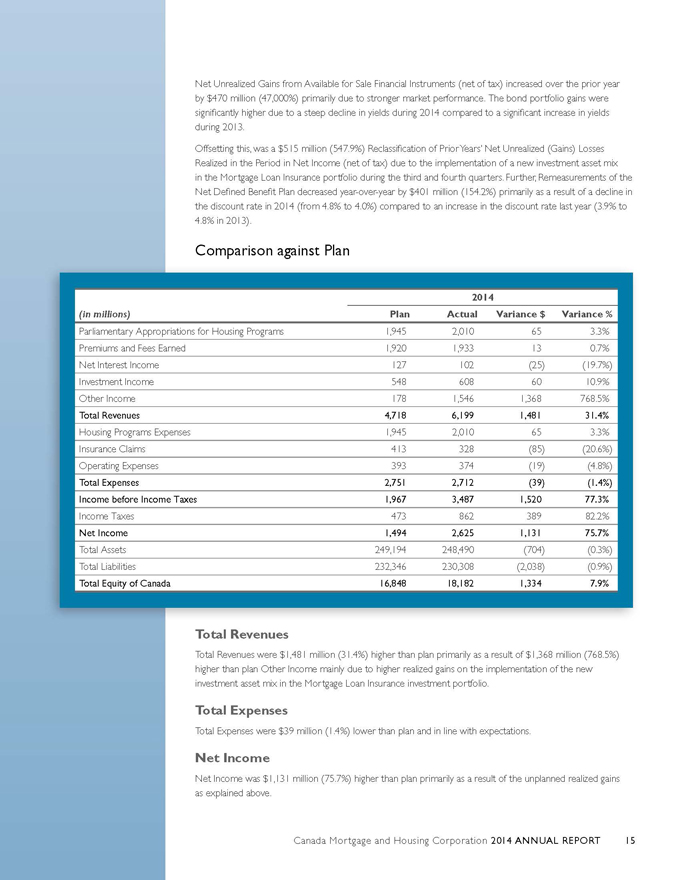

Net Unrealized Gains from Available for Sale Financial Instruments (net of tax) increased over the prior year by $470 million (47,000%) primarily due to stronger market performance. The bond portfolio gains were significantly higher due to a steep decline in yields during 2014 compared to a significant increase in yields during 2013. Offsetting this, was a $515 million (547.9%) Reclassification of Prior Years’ Net Unrealized (Gains) Losses Realized in the Period in Net Income (net of tax) due to the implementation of a new investment asset mix in the Mortgage Loan Insurance portfolio during the third and fourth quarters. Further, Remeasurements of the Net Defined Benefit Plan decreased year-over-year by $401 million (154.2%) primarily as a result of a decline in the discount rate in 2014 (from 4.8% to 4.0%) compared to an increase in the discount rate last year (3.9% to 4.8% in 2013). Comparison against Plan 2014 (in millions) Plan Actual Variance $ Variance % Parliamentary Appropriations for Housing Programs 1,945 2,010 65 3.3% Premiums and Fees Earned 1,920 1,933 13 0.7% Net Interest Income 127 102 (25) (19.7%) Investment Income 548 608 60 10.9% Other Income 178 1,546 1,368 768.5% Total Revenues 4,718 6,199 1,481 31.4% Housing Programs Expenses 1,945 2,010 65 3.3% Insurance Claims 413 328 (85) (20.6%) Operating Expenses 393 374 (19) (4.8%) Total Expenses 2,751 2,712 (39) (1.4%) Income before Income Taxes 1,967 3,487 1,520 77.3% Income Taxes 473 862 389 82.2% Net Income 1,494 2,625 1,131 75.7% Total Assets 249,194 248,490 (704) (0.3%) Total Liabilities 232,346 230,308 (2,038) (0.9%) Total Equity of Canada 16,848 18,182 1,334 7.9% Total Revenues Total Revenues were $1,481 million (31.4%) higher than plan primarily as a result of $1,368 million (768.5%) higher than plan Other Income mainly due to higher realized gains on the implementation of the new investment asset mix in the Mortgage Loan Insurance investment portfolio. Total Expenses Total Expenses were $39 million (1.4%) lower than plan and in line with expectations. Net Income Net Income was $1,131 million (75.7%) higher than plan primarily as a result of the unplanned realized gains as explained above. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 15

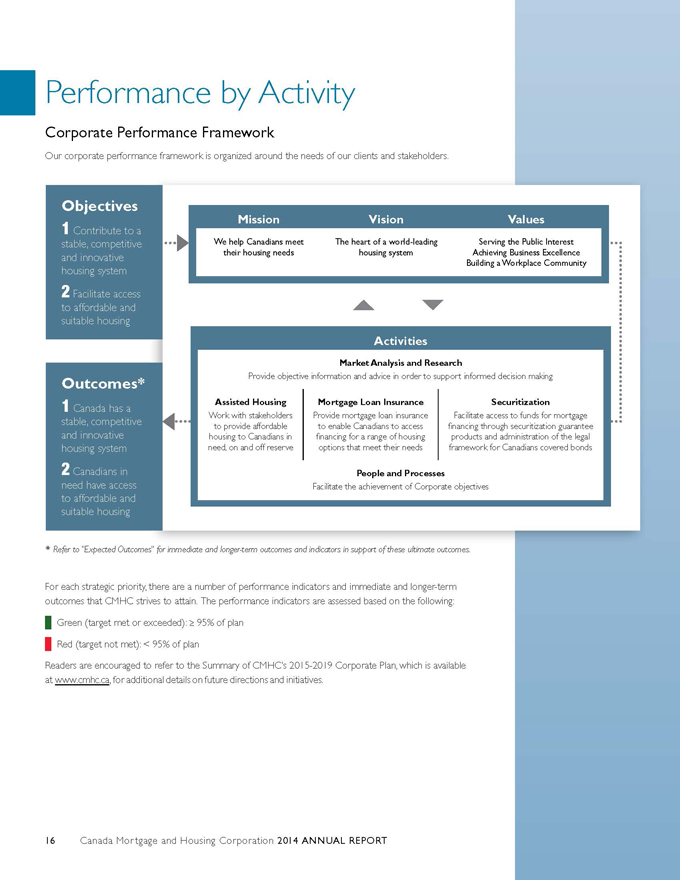

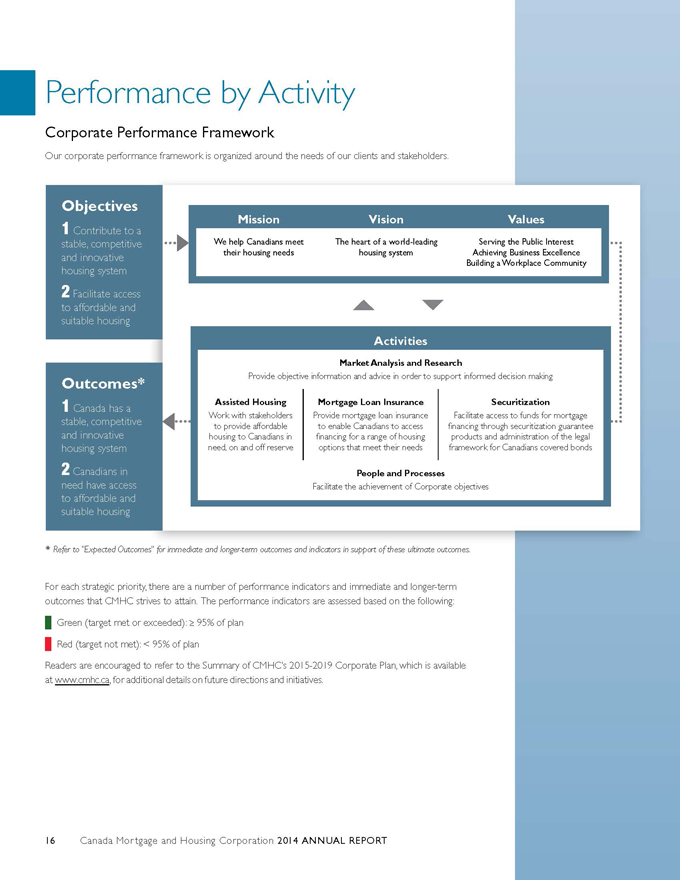

Performance by Activity Corporate Performance Framework Our corporate performance framework is organized around the needs of our clients and stakeholders. Objectives Mission Vision Values 1 Contribute to a stable, competitive We help Canadians meet The heart of a world-leading Serving the Public Interest and innovative their housing needs housing system Achieving Business Excellence Building a Workplace Community housing system 2 Facilitate access to affordable and suitable housing Activities Market Analysis and Research Outcomes* Provide objective information and advice in order to support informed decision making Assisted Housing Mortgage Loan Insurance Securitization 1 Canada has a Work with stakeholders Provide mortgage loan insurance Facilitate access to funds for mortgage stable, competitive to provide affordable to enable Canadians to access financing through securitization guarantee and innovative housing to Canadians in financing for a range of housing products and administration of the legal housing system need, on and off reserve options that meet their needs framework for Canadians covered bonds 2 Canadians in People and Processes need have access Facilitate the achievement of Corporate objectives to affordable and suitable housing * Refer to “Expected Outcomes” for immediate and longer-term outcomes and indicators in support of these ultimate outcomes. For each strategic priority, there are a number of performance indicators and immediate and longer-term outcomes that CMHC strives to attain. The performance indicators are assessed based on the following: Green (target met or exceeded): ? 95% of plan Red (target not met): < 95% of plan Readers are encouraged to refer to the Summary of CMHC’s 2015-2019 Corporate Plan, which is available at www.cmhc.ca, for additional details on future directions and initiatives. 16 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

MARKET ANALYSIS AND RESEARCH

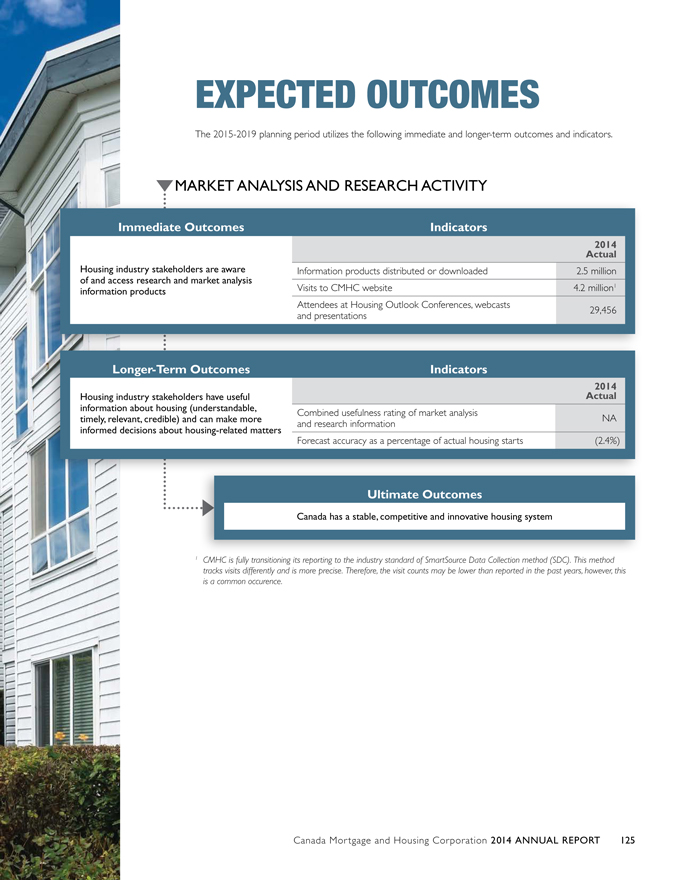

Description of Activity Our Market Analysis and Research Activities support informed decision making through the creation, interpretation and sharing of housing related data and information. We undertake surveys, data analysis and forecasting at the local, provincial and national levels and undertake research on a range of issues that support a well-functioning housing system and promote housing affordability and choice. These efforts improve the understanding of current and future housing challenges in Canada and facilitate the development of housing-related policy. Financial Highlights ?? Research expenditures decreased in 2014 primarily as a result of the federal government’s review of spending under Economic Action Plan 2012. Non-Financial Highlights ?? Launch of Housing Market Information Portal ?? Public release of House Price Analysis and Assessment (HPAA) Framework ?? Public release of inaugural Condominium Owners Survey Report for Toronto and Vancouver ?? Publication of statistics on foreign investor activity for 11 of the largest Canadian condominium markets Completion of CMHC’s leading edge EQuilibriumTM ?? Sustainable Housing Demonstration Initiative ?? Accurate forecasts for housing starts within 2.4% of actual ?? 662,608 market analysis publications downloaded or distributed ?? 1,849,453 housing research information products downloaded or distributed Performance Analysis 2014 Performance Indicators (%) Plan Actual Recipients of newly published Research 70 71* Highlights who found them useful Recipients of newly published AboutYour 80 95* House fact sheets who found them useful Subscribers to market analysis publications 93 94* who found them useful Attendees at Housing Outlook Conferences 95 99.8* who found them useful Within 10% Forecast accuracy of housing starts (2.4)* of actual * Figure is shaded green to indicate target met or exceeded 95% of plan. As Canada’s authority on housing, Canadians turn to us for accurate and impartial forecasts and in-depth analysis through: ?? 19 Housing Outlook Conferences across the country ?? Housing Market Outlook and other publications ?? The Canadian Housing Observer which addresses a wide range of housing issues including housing need and affordability In 2014, we launched the House Price Analysis and Assessment (HPAA) framework. The HPAA assesses housing market conditions by taking into consideration the economic, financial and demographic drivers of housing markets. The use of multiple indicators provides a robust picture of overall housing market conditions. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 17

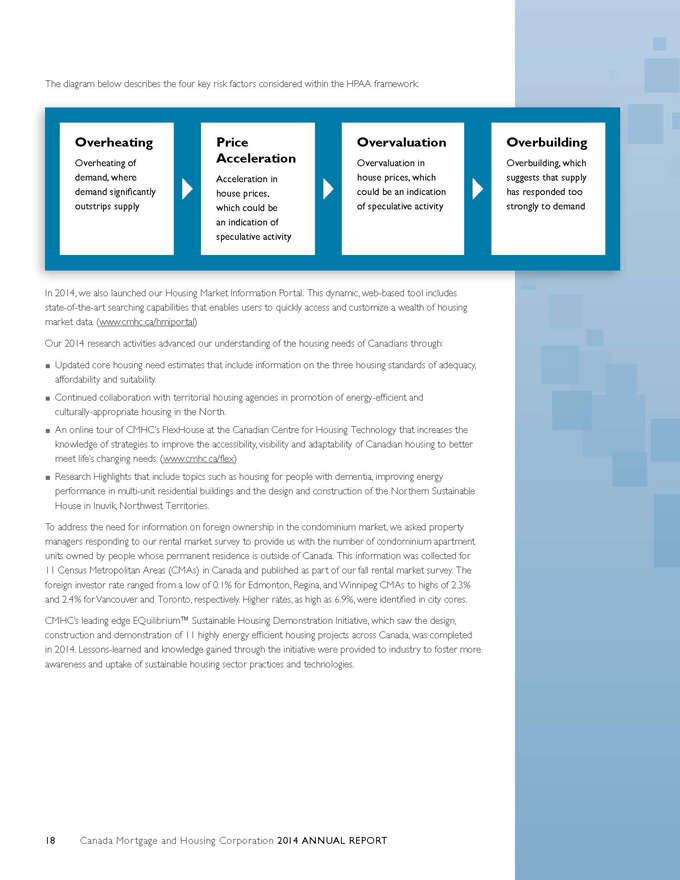

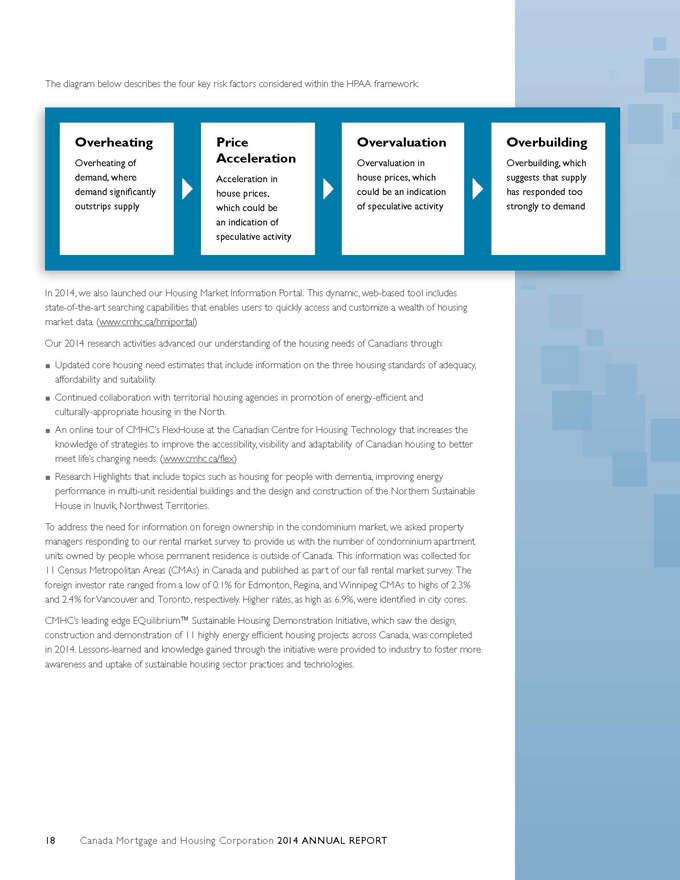

The diagram below describes the four key risk factors considered within the HPAA framework: Overheating Price Overvaluation Overbuilding Overheating of Acceleration Overvaluation in Overbuilding, which demand, where Acceleration in house prices, which suggests that supply demand significantly house prices, could be an indication has responded too outstrips supply which could be of speculative activity strongly to demand an indication of speculative activity In 2014, we also launched our Housing Market Information Portal. This dynamic, web-based tool includes state-of-the-art searching capabilities that enables users to quickly access and customize a wealth of housing market data. (www.cmhc.ca/hmiportal) Our 2014 research activities advanced our understanding of the housing needs of Canadians through: ?? Updated core housing need estimates that include information on the three housing standards of adequacy, affordability and suitability. ?? Continued collaboration with territorial housing agencies in promotion of energy-efficient and culturally-appropriate housing in the North. ?? An online tour of CMHC’s FlexHouse at the Canadian Centre for Housing Technology that increases the knowledge of strategies to improve the accessibility, visibility and adaptability of Canadian housing to better meet life’s changing needs. (www.cmhc.ca/flex) ?? Research Highlights that include topics such as housing for people with dementia, improving energy performance in multi-unit residential buildings and the design and construction of the Northern Sustainable House in Inuvik, Northwest Territories. To address the need for information on foreign ownership in the condominium market, we asked property managers responding to our rental market survey to provide us with the number of condominium apartment units owned by people whose permanent residence is outside of Canada. This information was collected for 11 Census Metropolitan Areas (CMAs) in Canada and published as part of our fall rental market survey. The foreign investor rate ranged from a low of 0.1% for Edmonton, Regina, and Winnipeg CMAs to highs of 2.3% and 2.4% for Vancouver and Toronto, respectively. Higher rates, as high as 6.9%, were identified in city cores. CMHC’s leading edge EQuilibrium™ Sustainable Housing Demonstration Initiative, which saw the design, construction and demonstration of 11 highly energy efficient housing projects across Canada, was completed in 2014. Lessons-learned and knowledge gained through the initiative were provided to industry to foster more awareness and uptake of sustainable housing sector practices and technologies. 18 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

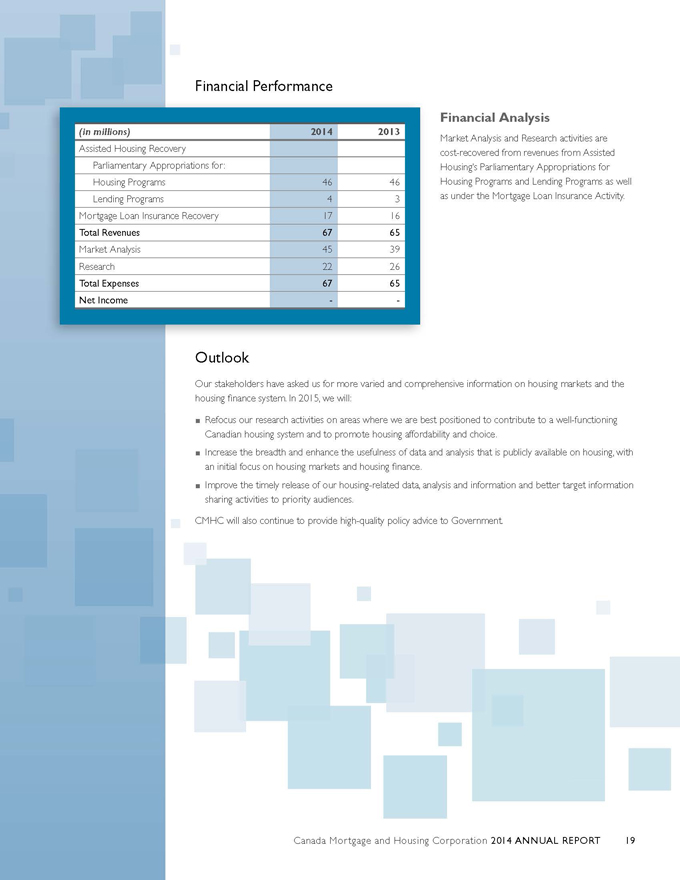

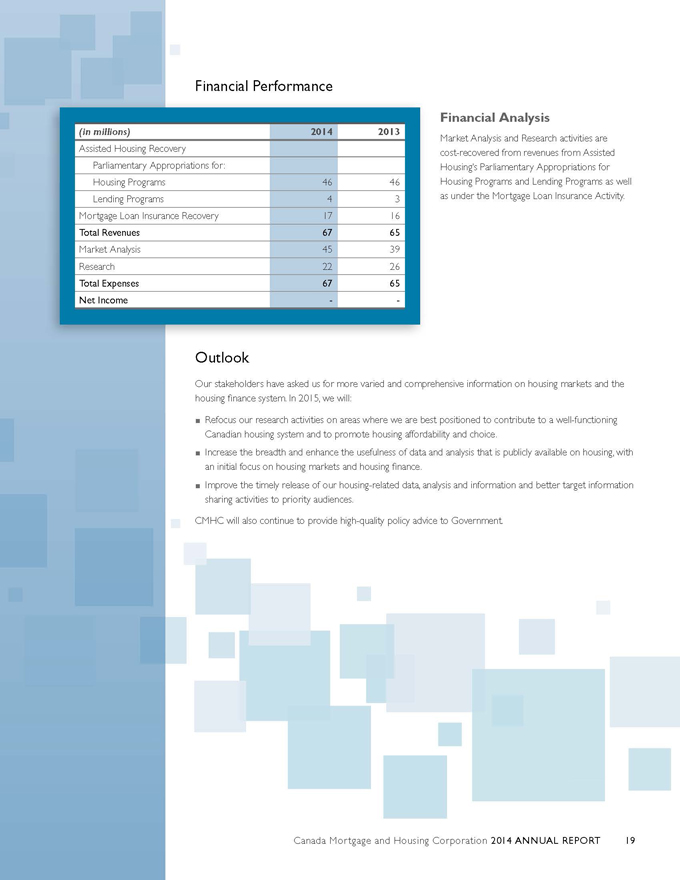

Financial Performance (in millions) 2014 2013 Assisted Housing Recovery Parliamentary Appropriations for: Housing Programs 46 46 Lending Programs 4 3 Mortgage Loan Insurance Recovery 17 16 Total Revenues 67 65 Market Analysis 45 39 Research 22 26 Total Expenses 67 65 Net Income — Financial Analysis Market Analysis and Research activities are cost-recovered from revenues from Assisted Housing’s Parliamentary Appropriations for Housing Programs and Lending Programs as well as under the Mortgage Loan Insurance Activity. Outlook Our stakeholders have asked us for more varied and comprehensive information on housing markets and the housing finance system. In 2015, we will: ?? Refocus our research activities on areas where we are best positioned to contribute to a well-functioning Canadian housing system and to promote housing affordability and choice. ?? Increase the breadth and enhance the usefulness of data and analysis that is publicly available on housing, with an initial focus on housing markets and housing finance. ?? Improve the timely release of our housing-related data, analysis and information and better target information sharing activities to priority audiences. CMHC will also continue to provide high-quality policy advice to Government. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 19

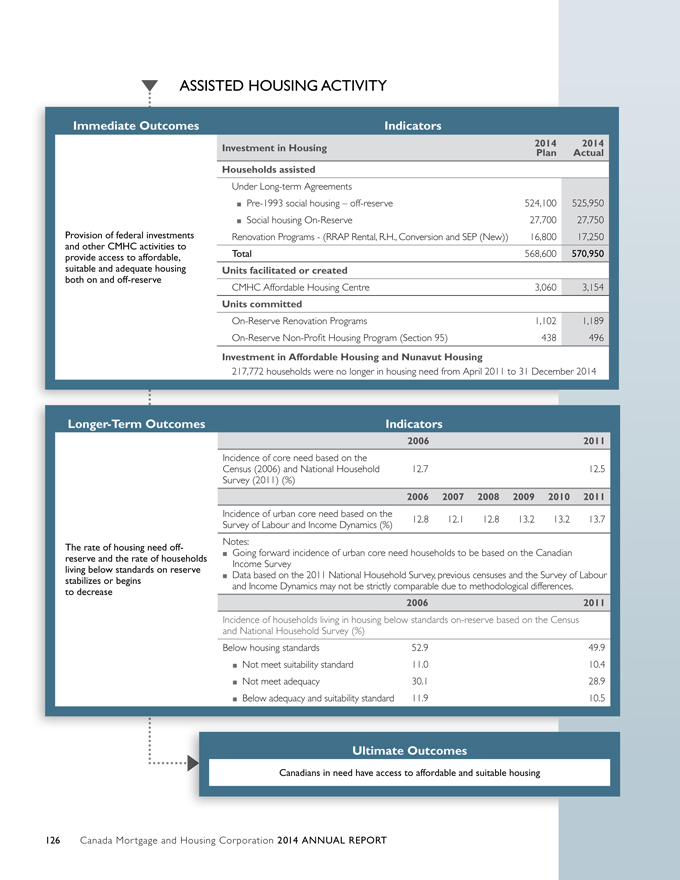

Description of Activity

Our Assisted Housing Activity provides financial assistance for existing social housing both off and on-reserve, and funding for affordable housing delivered through partnerships with provinces and territories. We support the creation of affordable housing through Seed Funding, Proposal Development Funding, Mortgage Loan Insurance underwriting flexibilities, information and advice. We provide assistance for new construction, renovation and repairs on-reserve, and support for Aboriginal capacity building.

Lending Programs

We make loans to social housing sponsors, First Nations, provinces, territories and municipalities, as well as non-subsidized housing support. We can offer loans at below market interest rates due to our ability to obtain funding through the Crown Borrowing Program. We operate our Lending Programs on a long-term, breakeven basis in order to help reduce project operating costs, thereby lowering direct subsidies for social housing.

Housing Programs

We receive Parliamentary Appropriations to fund our Housing Programs. Housing Programs operate on a breakeven basis as appropriations equal expenditures each year. The majority of the funding in Housing Programs helped support low-income households living in existing social housing on and off-reserve. In addition, funding is provided for housing programs on-reserve and other housing related services.

Funding is also provided for new commitments of affordable housing, including the renewed Investment in Affordable Housing (IAH) and the investment in Nunavut housing. Agreements were reached with 12 provinces and territories to extend funding for affordable housing through the IAH for the period of 2014 to 2019. Under this joint federal-provincial-territorial initiative which began in 2011, the federal government is providing more than $1.9 billion over eight years to help reduce the number of Canadians in housing need. The remaining $70 million in funding of the additional $100 million for new affordable housing in Nunavut announced in the Economic Action Plan is also being delivered through the IAH extension. Since April 2011, 217,772 households have benefitted from this funding.

CMHC also manages assets transferred from the Federal Co-operative Housing Stabilization Fund (the Fund) since the termination of its Indenture of Trust in April 2010. The Fund was set up under the federal Co-operative Housing Program and provides assistance to co-operative housing projects in financial difficulty committed under this program. The assets transferred from the Stabilization Fund are available to assist co-ops with an Indexed Linked Mortgage (ILM) in financial difficulty. Transferred mortgage receivables under administration during the year decreased from $45.8 million to $45.0 million at year end. Other assets transferred from the Stabilization Fund to CMHC that are available to assist ILM Co-ops in financial difficulty were $16.4 million at year end, which included $3.0 million in restricted funds for loan commitments approved but not yet advanced.

Financial Highlights

| ¡ | | $2,010 million in support of Housing Programs, including $1,655 million to fund long-term commitments for existing social housing and $302 million for new commitments of affordable housing. |

| ¡ | | $39 million decrease in Net Income for the Lending Programs over the prior year as a result of a decrease in Net Interest Income. |

20 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

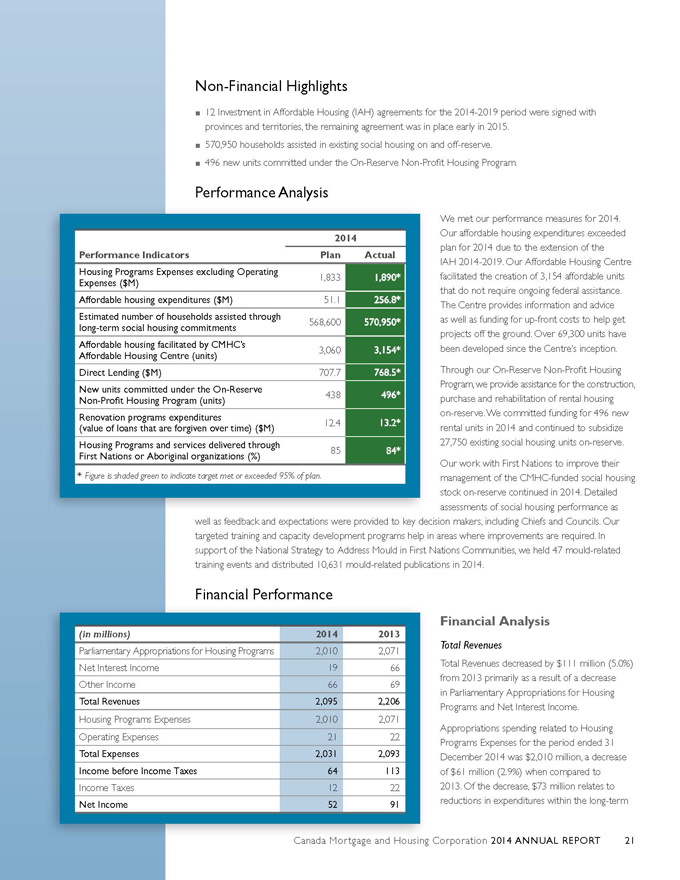

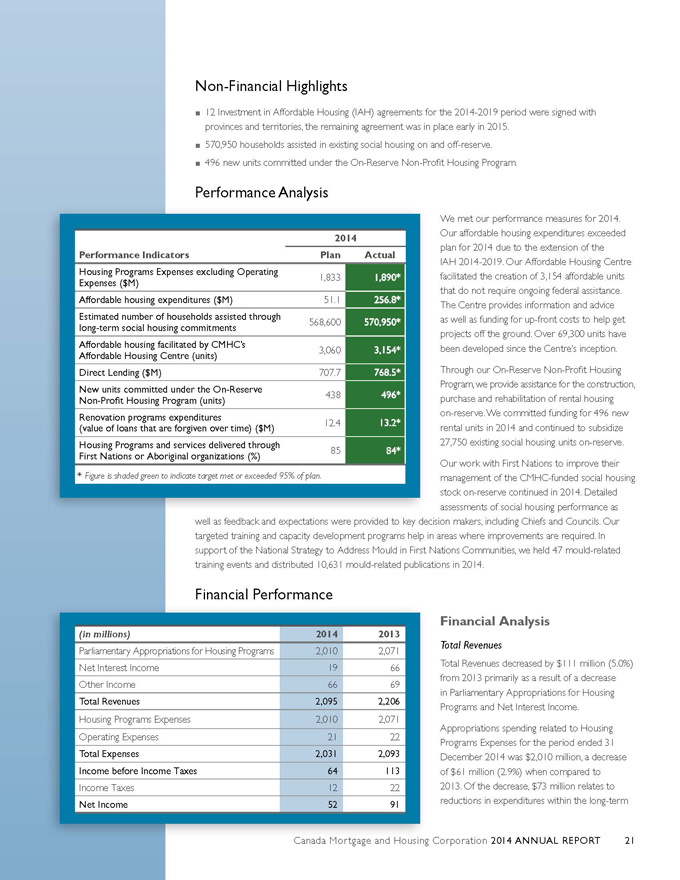

Non-Financial Highlights ?? 12 Investment in Affordable Housing (IAH) agreements for the 2014-2019 period were signed with provinces and territories, the remaining agreement was in place early in 2015. ?? 570,950 households assisted in existing social housing on and off-reserve. ?? 496 new units committed under the On-Reserve Non-Profit Housing Program. Performance Analysis 2014 Performance Indicators Plan Actual Housing Programs Expenses excluding Operating 1,833 1,890* Expenses ($M) Affordable housing expenditures ($M) 51.1 256.8* Estimated number of households assisted through 568,600 570,950* long-term social housing commitments Affordable housing facilitated by CMHC’s 3,060 3,154* Affordable Housing Centre (units) Direct Lending ($M) 707.7 768.5* New units committed under the On-Reserve 438 496* Non-Profit Housing Program (units) Renovation programs expenditures 12.4 13.2* (value of loans that are forgiven over time) ($M) Housing Programs and services delivered through 85 84* First Nations or Aboriginal organizations (%) * Figure is shaded green to indicate target met or exceeded 95% of plan. We met our performance measures for 2014. Our affordable housing expenditures exceeded plan for 2014 due to the extension of the IAH 2014-2019. Our Affordable Housing Centre facilitated the creation of 3,154 affordable units that do not require ongoing federal assistance. The Centre provides information and advice as well as funding for up-front costs to help get projects off the ground. Over 69,300 units have been developed since the Centre’s inception. Through our On-Reserve Non-Profit Housing Program, we provide assistance for the construction, purchase and rehabilitation of rental housing on-reserve. We committed funding for 496 new rental units in 2014 and continued to subsidize 27,750 existing social housing units on-reserve. ur work with First Nations to improve their management of the CMHC-funded social housing stock on-reserve continued in 2014. Detailed assessments of social housing performance as well as feedback and expectations were provided to key decision makers, including Chiefs and Councils. Our targeted training and capacity development programs help in areas where improvements are required. In support of the National Strategy to Address Mould in First Nations Communities, we held 47 mould-related training events and distributed 10,631 mould-related publications in 2014. Financial Performance (in millions) 2014 2013 Parliamentary Appropriations for Housing Programs 2,010 2,071 Net Interest Income 19 66 Other Income 66 69 Total Revenues 2,095 2,206 Housing Programs Expenses 2,010 2,071 Operating Expenses 21 22 Total Expenses 2,031 2,093 Income before Income Taxes 64 113 Income Taxes 12 22 Net Income 52 91 Financial Analysis Total Revenues Total Revenues decreased by $111 million (5.0%) from 2013 primarily as a result of a decrease in Parliamentary Appropriations for Housing Programs and Net Interest Income. Appropriations spending related to Housing Programs Expenses for the period ended 31 December 2014 was $2,010 million, a decrease of $61 million (2.9%) when compared to 2013. Of the decrease, $73 million relates to reductions in expenditures within the long-term Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 21

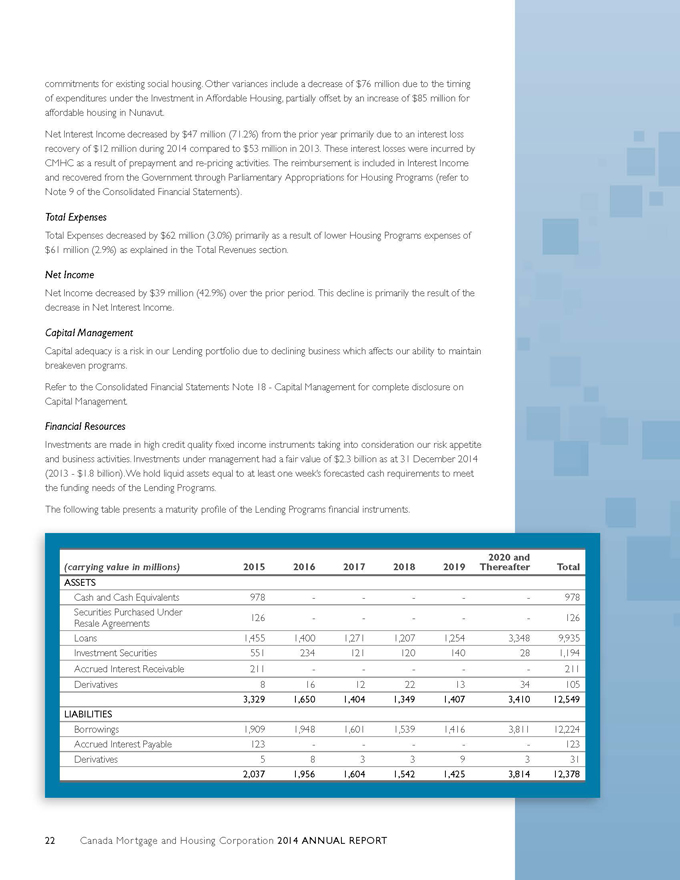

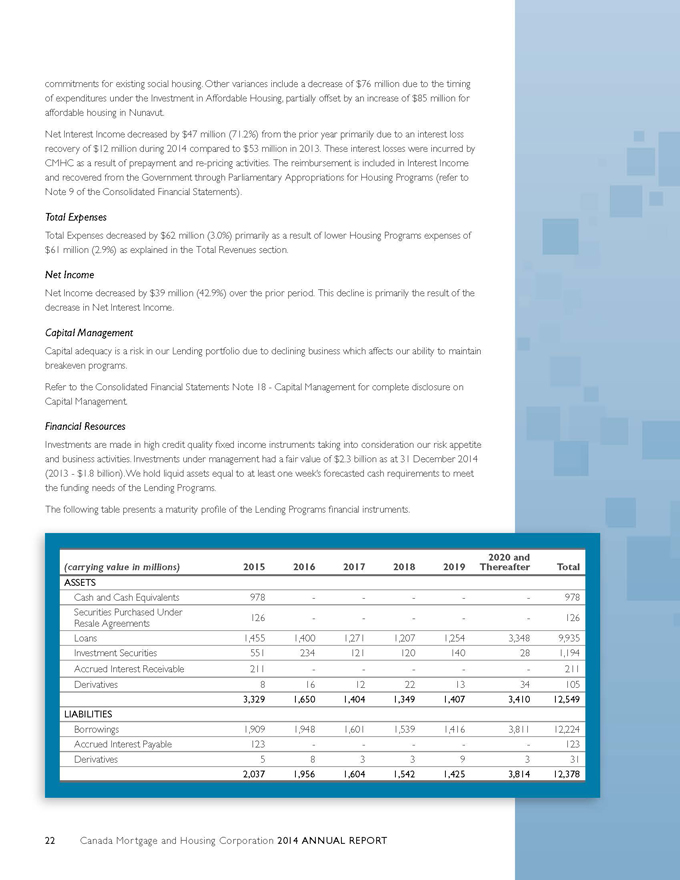

Commitments for existing social housing. Other variances include a decrease of $76 million due to the timing of expenditures under the Investment in Affordable Housing, partially offset by an increase of $85 million for affordable housing in Nunavut.Net Interest Income decreased by $47 million (71.2%) from the prior year primarily due to an interest loss recovery of $12 million during 2014 compared to $53 million in 2013. These interest losses were incurred by CMHC as a result of prepayment and re-pricing activities. The reimbursement is included in Interest Income and recovered from the Government through Parliamentary Appropriations for Housing Programs (refer to Note 9 of the Consolidated Financial Statements). Total Expenses Total Expenses decreased by $62 million (3.0%) primarily as a result of lower Housing Programs expenses of $61 million (2.9%) as explained in the Total Revenues section.Net Income Net Income decreased by $39 million (42.9%) over the prior period. This decline is primarily the result of the decrease in Net Interest Income. Capital Management Capital adequacy is a risk in our Lending portfolio due to declining business which affects our ability to maintain breakeven programs. Refer to the Consolidated Financial Statements Note 18 - Capital Management for complete disclosure on Capital Management. Financial Resources Investments are made in high credit quality fixed income instruments taking into consideration our risk appetite and business activities. Investments under management had a fair value of $2.3 billion as at 31 December 2014 (2013 - $1.8 billion). We hold liquid assets equal to at least one week’s forecasted cash requirements to meet the funding needs of the Lending Programs. The following table presents a maturity profile of the Lending Programs financial instruments.(carrying value in millions) 2015 2016 2017 2018 2019 Thereafter 2020 and Total ASSETS Cash and Cash Equivalents 978 - - - - - 978 Securities Purchased Under 126 - - - - - 126 Resale Agreements Loans 1,455 1,400 1,271 1,207 1,254 3,348 9,935 Investment Securities 551 234 121 120 140 28 1,194 Accrued Interest Receivable 211 - - - - - 211 Derivatives 8 16 12 22 13 34 1053,329 1,650 1,404 1,349 1,407 3,410 12,549 LIABILITIES Borrowings 1,909 1,948 1,601 1,539 1,416 3,811 12,224 Accrued Interest Payable 123 - - - - - 123 Derivatives 5 8 3 3 9 3 312,037 1,956 1,604 1,542 1,425 3,814 12,37822 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

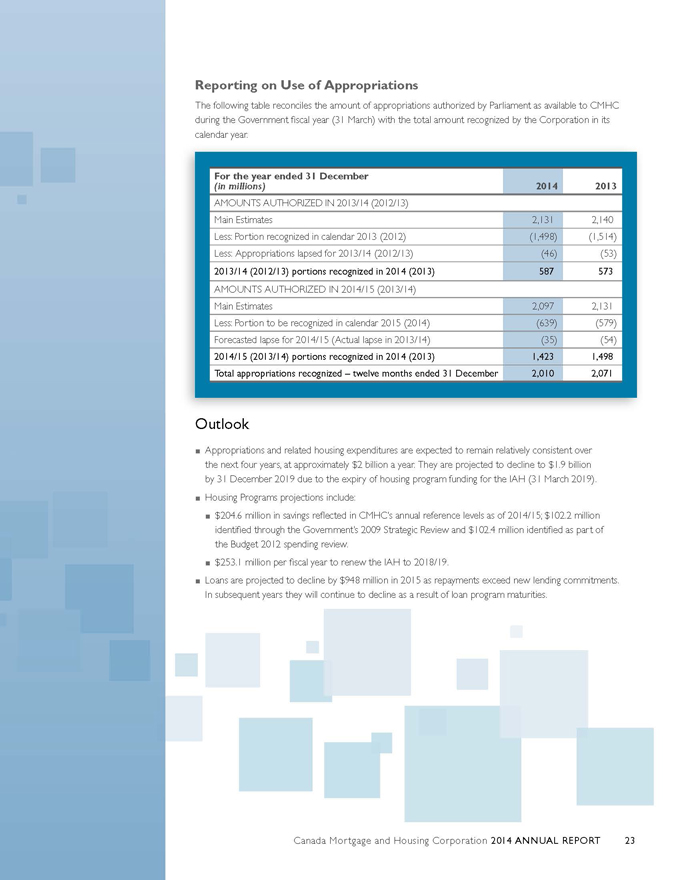

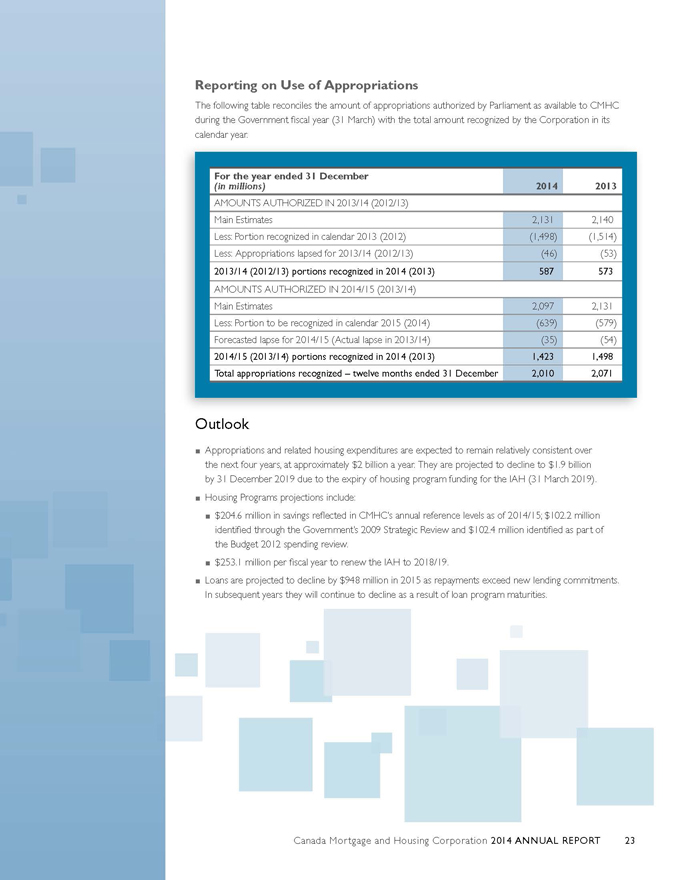

Reporting on Use of Appropriations The following table reconciles the amount of appropriations authorized by Parliament as available to CMHC during the Government fiscal year (31 March) with the total amount recognized by the Corporation in its calendar year. For the year ended 31 December (in millions) 2014 2013 AMOUNTS AUTHORIZED IN 2013/14 (2012/13) Main Estimates 2,131 2,140 Less: Portion recognized in calendar 2013 (2012) (1,498) (1,514) Less: Appropriations lapsed for 2013/14 (2012/13) (46) (53) 2013/14 (2012/13) portions recognized in 2014 (2013) 587 573 AMOUNTS AUTHORIZED IN 2014/15 (2013/14) Main Estimates 2,097 2,131 Less: Portion to be recognized in calendar 2015 (2014) (639) (579) Forecasted lapse for 2014/15 (Actual lapse in 2013/14) (35) (54) 2014/15 (2013/14) portions recognized in 2014 (2013) 1,423 1,498 Total appropriations recognized – twelve months ended 31 December 2,010 2,071 Outlook ?? Appropriations and related housing expenditures are expected to remain relatively consistent over the next four years, at approximately $2 billion a year. They are projected to decline to $1.9 billion by 31 December 2019 due to the expiry of housing program funding for the IAH (31 March 2019). ?? Housing Programs projections include: ?? $204.6 million in savings reflected in CMHC’s annual reference levels as of 2014/15; $102.2 million identified through the Government’s 2009 Strategic Review and $102.4 million identified as part of the Budget 2012 spending review. ?? $253.1 million per fiscal year to renew the IAH to 2018/19. ?? Loans are projected to decline by $948 million in 2015 as repayments exceed new lending commitments. In subsequent years they will continue to decline as a result of loan program maturities. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 23

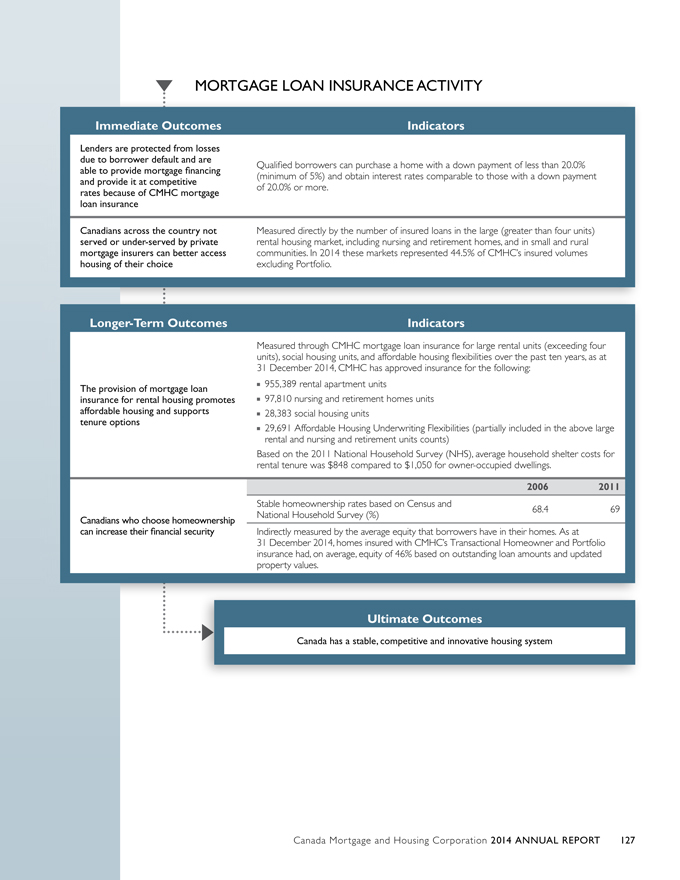

Description of Activity

We provide mortgage loan insurance for Transactional Homeowner, Portfolio and Multi-unit Residential loans in all parts of Canada, including in areas or markets not served or under-served by private mortgage insurers. We operate these programs on a commercial basis. Revenue from premiums, fees and investments cover all expenses, including insurance claims losses, and we are expected to generate a reasonable return for the Government of Canada, with due regard for loss.

Our Products

| ¡ | | Transactional Homeowner – insurance against borrower default for loans secured by residential properties of 4 or fewer units at the time the loan is originated, the cost of which is paid to CMHC by lenders but usually passed on to the borrower, and includes: |

| | ¡ | | High ratio homeowner loans – the borrower has less than a 20% down payment at origination. At least one of the units must be owner-occupied. Mortgage loan insurance on these loans is a legislative requirement for federally regulated lenders and for most provincially regulated lenders. |

| | ¡ | | Low ratio homeowner loans – the borrower has a down payment of 20% or more at origination. Mortgage loan insurance on these loans is not a legislative requirement; however, lenders may require mortgage insurance as a condition of approving the loan. Units can be owner-occupied or non-owner occupied (i.e. rental units). |

| ¡ | | Portfolio – insurance against borrower default for pools of low ratio mortgages that are under repayment and secured by residential properties of 4 or fewer units. Unlike Transactional Homeowner Insurance, premiums are not passed on to the borrower. |

| ¡ | | Multi-unit Residential – insurance provided exclusively by CMHC in the marketplace against borrower default on loans for the construction, purchase and refinancing of Multi-unit Residential properties consisting of 5 or more units. These properties include rental buildings, licensed care facilities, retirement homes, affordable housing projects and purpose-built student housing. |

Financial Highlights

| ¡ | | Net Income of $2,374 million in 2014, an increase of 57.5% over 2013 |

| ¡ | | Total Assets of $23,765 million |

| ¡ | | Total Equity of Canada of $16,418 million, which is 343% of the minimum capital required |

| ¡ | | Insurance-in-force of $543 billion, a decline of $14 billion from 2013 |

| ¡ | | $9 billion annual limit of issuance of portfolio insurance |

24 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

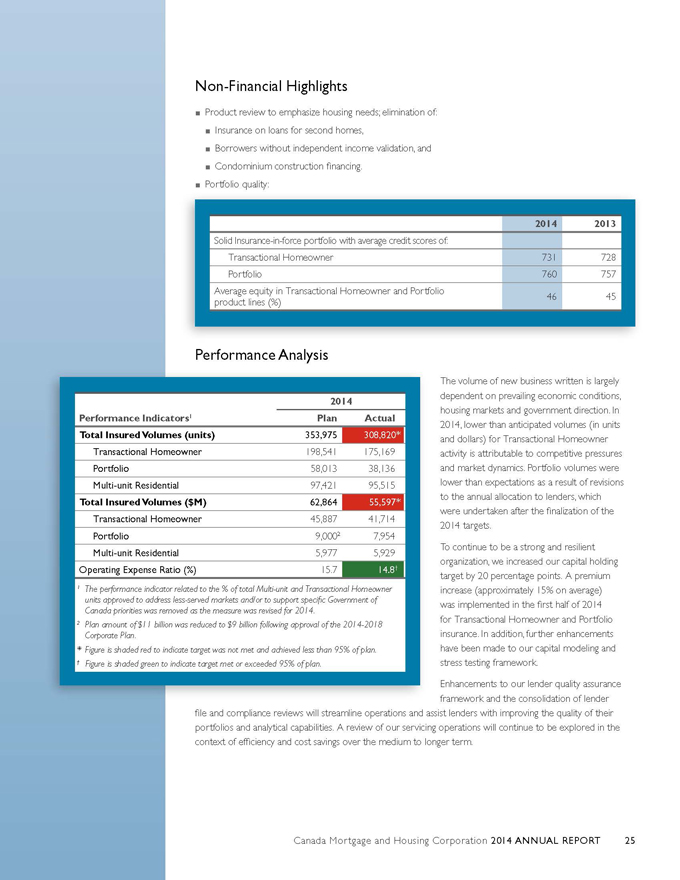

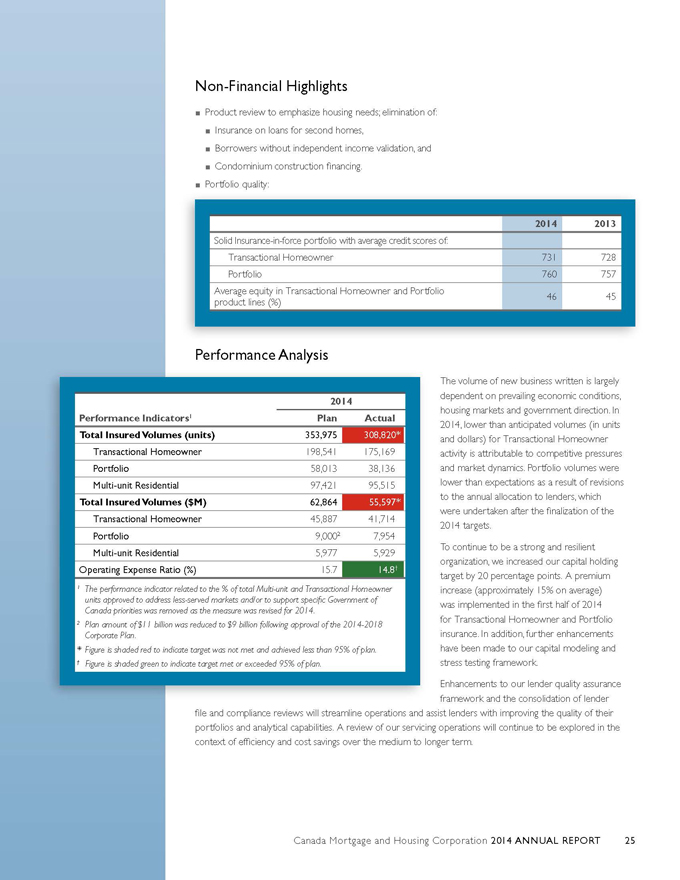

Non-Financial Highlights ?? Product review to emphasize housing needs; elimination of: ?? Insurance on loans for second homes, ?? Borrowers without independent income validation, and ?? Condominium construction financing. ?? Portfolio quality: 2014 2013 Solid Insurance-in-force portfolio with average credit scores of: Transactional Homeowner 731 728 Portfolio 760 757 Average equity in Transactional Homeowner and Portfolio 46 45 product lines (%) Performance Analysis The volume of new business written is largely dependent on prevailing economic conditions, 2014 housing markets and government direction. In Performance Indicators1 Plan Actual 2014, lower than anticipated volumes (in units Total Insured Volumes (units) 353,975 308,820* and dollars) for Transactional Homeowner Transactional Homeowner 198,541 175,169 activity is attributable to competitive pressures Portfolio 58,013 38,136 and market dynamics. Portfolio volumes were Multi-unit Residential 97,421 95,515 lower than expectations as a result of revisions to the annual allocation to lenders, which Total Insured Volumes ($M) 62,864 55,597* were undertaken after the finalization of the Transactional Homeowner 45,887 41,714 2014 targets. Portfolio 9,0002 7,954 To continue to be a strong and resilient Multi-unit Residential 5,977 5,929 organization, we increased our capital holding Operating Expense Ratio (%) 15.7 14.8† target by 20 percentage points. A premium ¹ The performance indicator related to the % of total Multi-unit and Transactional Homeowner increase (approximately 15% on average) units approved to address less-served markets and/or to support specific Government of was implemented in the first half of 2014 Canada priorities was removed as the measure was revised for 2014. for Transactional Homeowner and Portfolio 2 Plan amount of $11 billion was reduced to $9 billion following approval of the 2014-2018 Corporate Plan. insurance. In addition, further enhancements * Figure is shaded red to indicate target was not met and achieved less than 95% of plan. have been made to our capital modeling and † Figure is shaded green to indicate target met or exceeded 95% of plan. stress testing framework. Enhancements to our lender quality assurance framework and the consolidation of lender file and compliance reviews will streamline operations and assist lenders with improving the quality of their portfolios and analytical capabilities. A review of our servicing operations will continue to be explored in the context of efficiency and cost savings over the medium to longer term. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 25

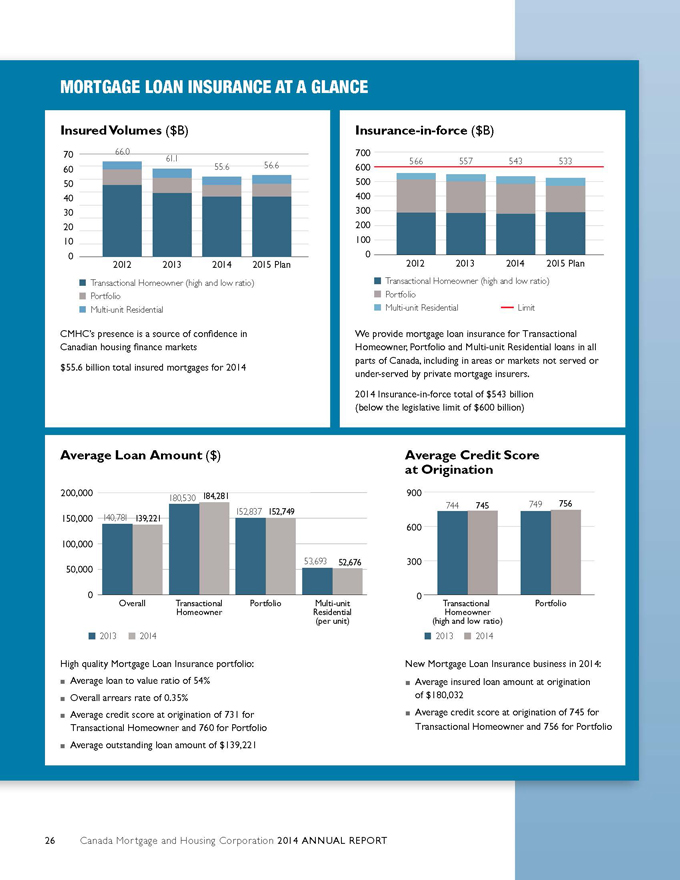

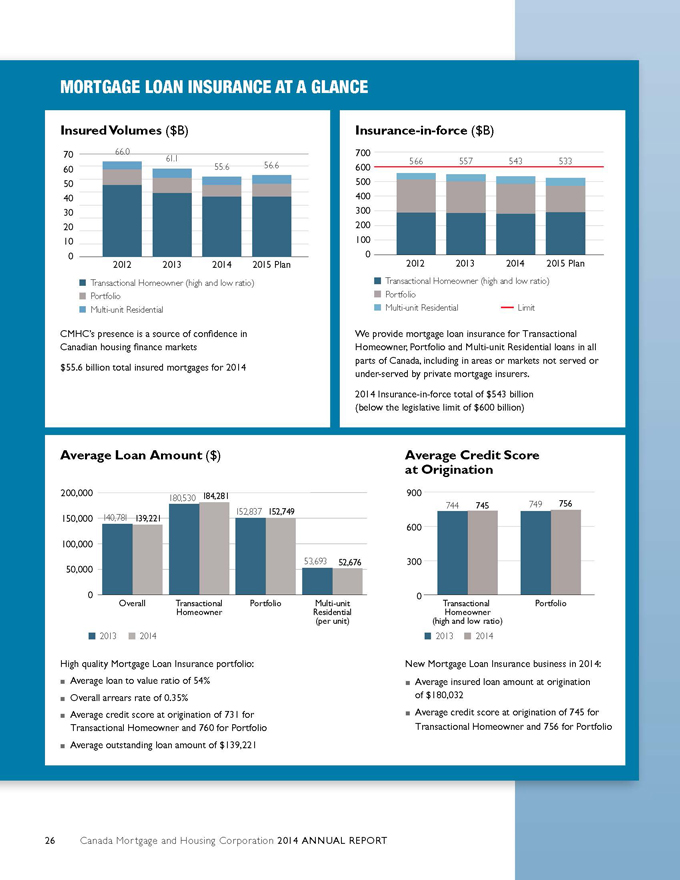

MORTGAGE LOAN INSURANCE AT A GLANCE Insured Volumes ($B) Insurance-in-force ($B) 70 66.0 700 61.1 566 557 543 533 60 55.6 56.6 600 50 500 40 400 30 300 20 200 10 100 0 0 2012 2013 2014 2015 Plan 2012 2013 2014 2015 Plan Transactional Homeowner (high and low ratio) Transactional Homeowner (high and low ratio) Portfolio Portfolio Multi-unit Residential Multi-unit Residential Limit CMHC’s presence is a source of confidence in We provide mortgage loan insurance for Transactional Canadian housing finance markets Homeowner, Portfolio and Multi-unit Residential loans in all parts of Canada, including in areas or markets not served or $55.6 billion total insured mortgages for 2014 under-served by private mortgage insurers. 2014 Insurance-in-force total of $543 billion (below the legislative limit of $600 billion) Average Loan Amount ($) Average Credit Score at Origination 200,000 184,281 900 180,530 152,837 152,749 744 745 749 756 150,000 140,781 139,221 600 100,000 50,000 53,693 52,676 300 0 Overall Transactional Portfolio Multi-unit 0 Transactional Portfolio Homeowner Residential Homeowner (per unit) (high and low ratio) 2013 2014 2013 2014 High quality Mortgage Loan Insurance portfolio: New Mortgage Loan Insurance business in 2014: ?? Average loan to value ratio of 54% ?? Average insured loan amount at origination Overall arrears of 0.35% of $180,032 ?? rate 731 ?? Average credit score at origination of 745 for ?? Average credit score at origination of for Transactional Homeowner and 760 for Portfolio Transactional Homeowner and 756 for Portfolio ?? Average outstanding loan amount of $139,221 26 Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT

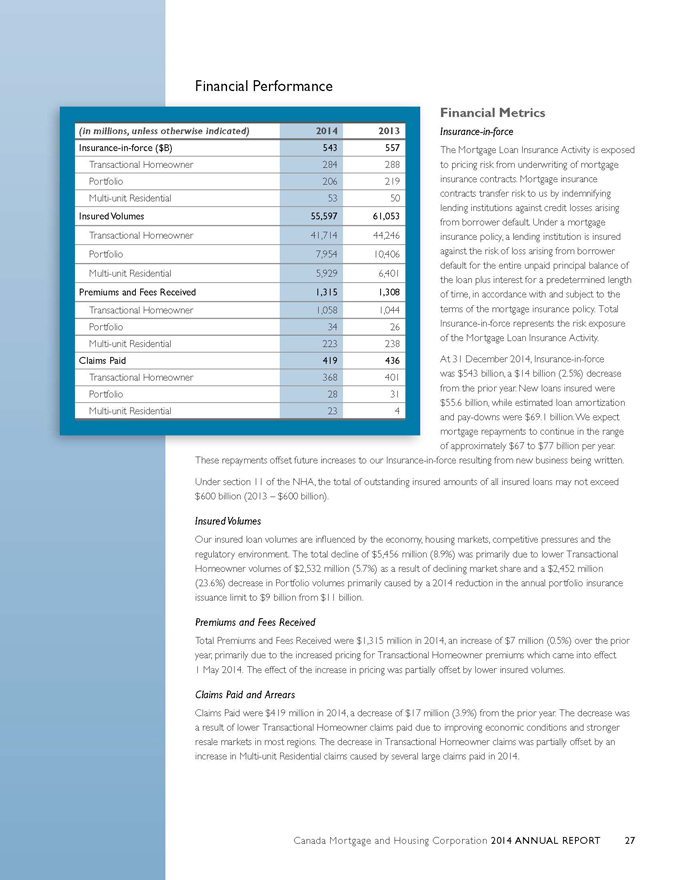

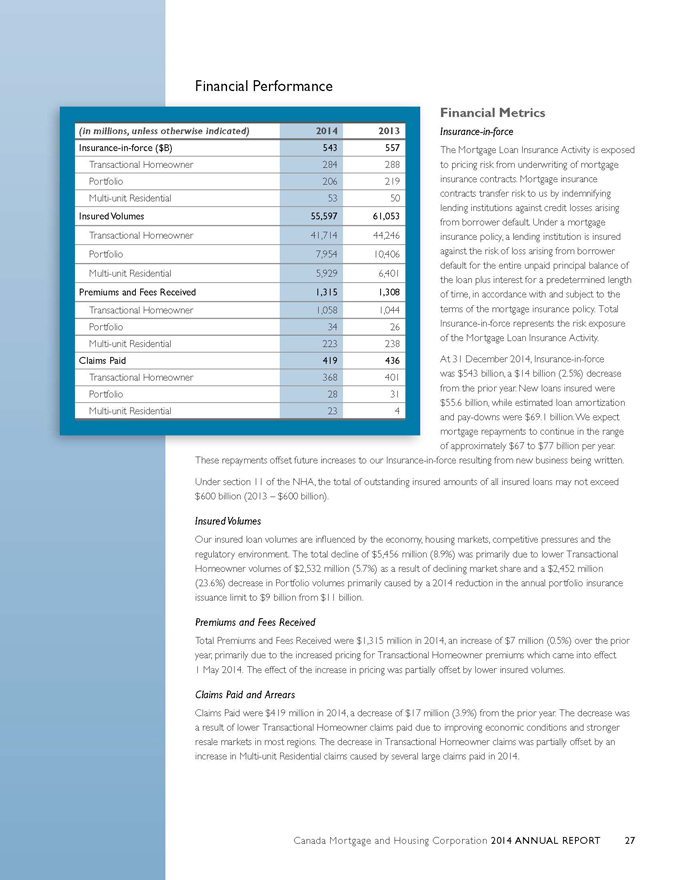

Financial Performance Financial Metrics (in millions, unless otherwise indicated) 2014 2013 Insurance-in-force Insurance-in-force ($B) 543 557 The Mortgage Loan Insurance Activity is exposed Transactional Homeowner 284 288 to pricing risk from underwriting of mortgage Portfolio 206 219 insurance contracts. Mortgage insurance contracts transfer risk to us by indemnifying Multi-unit Residential 53 50 lending institutions against credit losses arising Insured Volumes 55,597 61,053 from borrower default. Under a mortgage Transactional Homeowner 41,714 44,246 insurance policy, a lending institution is insured Portfolio 7,954 10,406 against the risk of loss arising from borrower default for the entire unpaid principal balance of Multi-unit Residential 5,929 6,401 the loan plus interest for a predetermined length Premiums and Fees Received 1,315 1,308 of time, in accordance with and subject to the Transactional Homeowner 1,058 1,044 terms of the mortgage insurance policy. Total Portfolio 34 26 Insurance-in-force represents the risk exposure of the Mortgage Loan Insurance Activity. Multi-unit Residential 223 238 Claims Paid 419 436 At 31 December 2014, Insurance-in-force Transactional Homeowner 368 401 was $543 billion, a $14 billion (2.5%) decrease from the prior year. New loans insured were Portfolio 28 31 Multi-unit Residential 23 4 $55.6 billion, while estimated loan amortization and pay-downs were $69.1 billion. We expect mortgage repayments to continue in the range of approximately $67 to $77 billion per year. These repayments offset future increases to our Insurance-in-force resulting from new business being written. Under section 11 of the NHA, the total of outstanding insured amounts of all insured loans may not exceed $600 billion (2013 – $600 billion). Insured Volumes Our insured loan volumes are influenced by the economy, housing markets, competitive pressures and the regulatory environment. The total decline of $5,456 million (8.9%) was primarily due to lower Transactional Homeowner volumes of $2,532 million (5.7%) as a result of declining market share and a $2,452 million (23.6%) decrease in Portfolio volumes primarily caused by a 2014 reduction in the annual portfolio insurance issuance limit to $9 billion from $11 billion. Premiums and Fees Received Total Premiums and Fees Received were $1,315 million in 2014, an increase of $7 million (0.5%) over the prior year, primarily due to the increased pricing for Transactional Homeowner premiums which came into effect 1 May 2014. The effect of the increase in pricing was partially offset by lower insured volumes. Claims Paid and Arrears Claims Paid were $419 million in 2014, a decrease of $17 million (3.9%) from the prior year. The decrease was a result of lower Transactional Homeowner claims paid due to improving economic conditions and stronger resale markets in most regions. The decrease in Transactional Homeowner claims was partially offset by an increase in Multi-unit Residential claims caused by several large claims paid in 2014. Canada Mor tgage and Housing Corporation 2014 ANNUAL REPORT 27

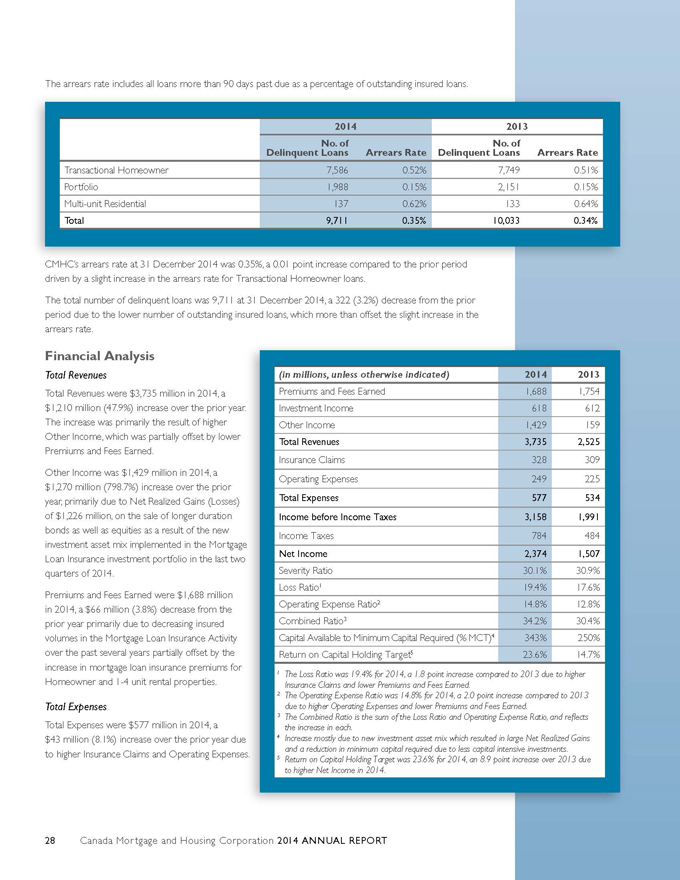

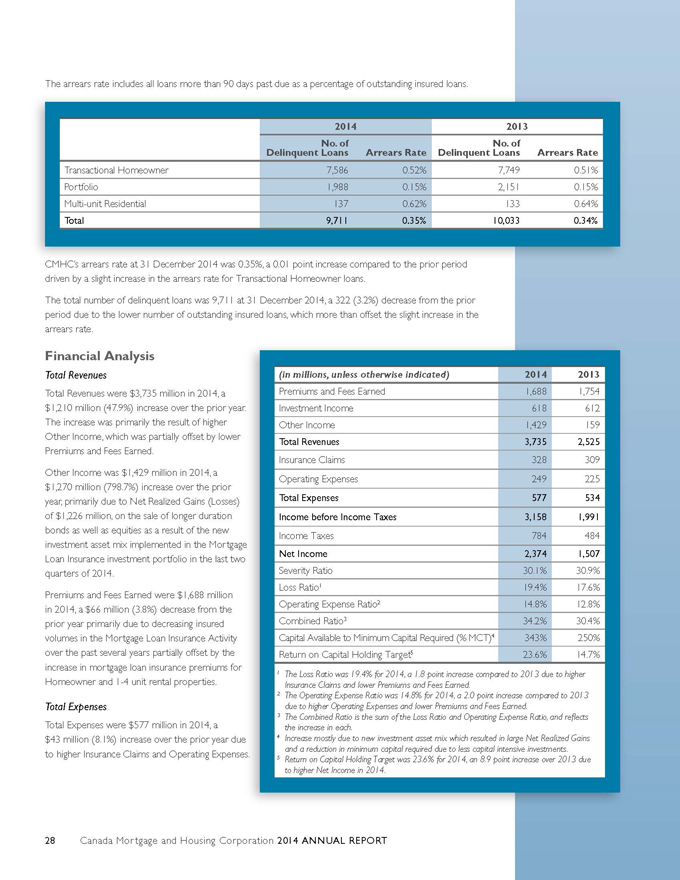

The arrears rate includes all loans more than 90 days past due as a percentage of outstanding insured loans. 2014 2013 Delinquent No Loans . of Arrears Rate Delinquent No Loans . of Arrears Rate Transactional Homeowner 7,586 0.52% 7,749 0.51% Portfolio 1,988 0.15% 2,151 0.15% Multi-unit Residential 137 0.62% 133 0.64% Total 9,711 0.35% 10,033 0.34% CMHC’s arrears rate at 31 December 2014 was 0.35%, a 0.01 point increase compared to the prior period driven by a slight increase in the arrears rate for Transactional Homeowner loans. The total number of delinquent loans was 9,711 at 31 December 2014, a 322 (3.2%) decrease from the prior period due to the lower number of outstanding insured loans, which more than offset the slight increase in the arrears rate. Financial Analysis Total Revenues (in millions, unless otherwise indicated) 2014 2013 Total Revenues were $3,735 million in 2014, a Premiums and Fees Earned 1,688 1,754 $1,210 million (47.9%) increase over the prior year Investment Income 618 612 The increase was primarily the result of higher Other Income 1,429 159 Other Income, which was partially offset by lower Premiums and Fees Earned. Total Revenues 3,735 2,525 Insurance Claims 328 309 Other Income was $1,429 million in 2014, a Operating Expenses 249 225 $1,270 million (798.7%) increase over the prior year, primarily due to Net Realized Gains (Losses) Total Expenses 577 534 of $1,226 million, on the sale of longer duration Income before Income Taxes 3,158 1,991 bonds as well as equities as a result of the new investment asset mix implemented in the Mortgage Income Taxes 784 484 Net Income 2,374 1,507 Loan Insurance investment portfolio in the last two quarters of 2014. Severity Ratio 30.1% 30.9% Loss Ratio1 19.4% 17.6% Premiums and Fees Earned were $1,688 million in 2014, a $66 million (3.8%) decrease from the Operating Expense Ratio2 14.8% 12.8% prior year primarily due to decreasing insured Combined Ratio3 34.2% 30.4% volumes in the Mortgage Loan Insurance Activity Capital Available to Minimum Capital Required (% MCT)4 343% 250% over the past several years partially offset by the Return on Capital Holding Target5 23.6% 14.7% increase in mortgage loan insurance premiums for 1 The Loss Ratio was 19.4% for 2014, a 1.8 point increase compared to 2013 due to higher Homeowner and 1-4 unit rental properties. Insurance Claims and lower Premiums and Fees Earned. ² The Operating Expense Ratio was 14.8% for 2014, a 2.0 point increase compared to 2013 Total Expenses due to higher Operating Expenses and lower Premiums and Fees Earned. Total Expenses were $577 million in 2014, a ³ The Combined Ratio is the sum of the Loss Ratio and Operating Expense Ratio, and reflects the increase in each. $43 million (8.1%) increase over the prior year due 4 Increase mostly due to new investment asset mix which resulted in large Net Realized Gains and a reduction in minimum capital required due to less capital intensive investments. to higher Insurance Claims and Operating Expenses 5 Return on Capital Holding Target was 23.6% for 2014, an 8.9 point increase over 2013 due to higher Net Income in 2014. 28 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

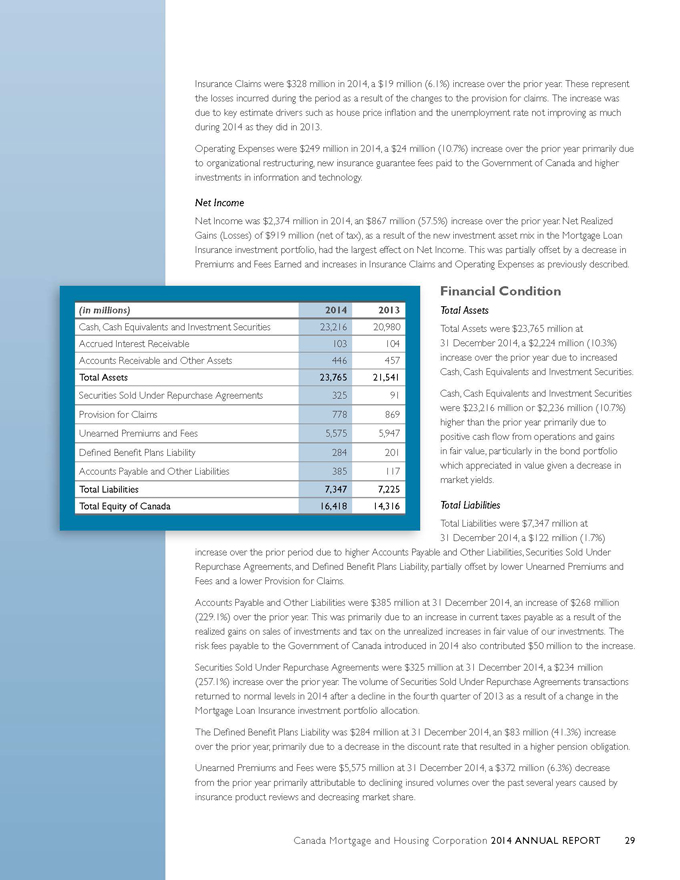

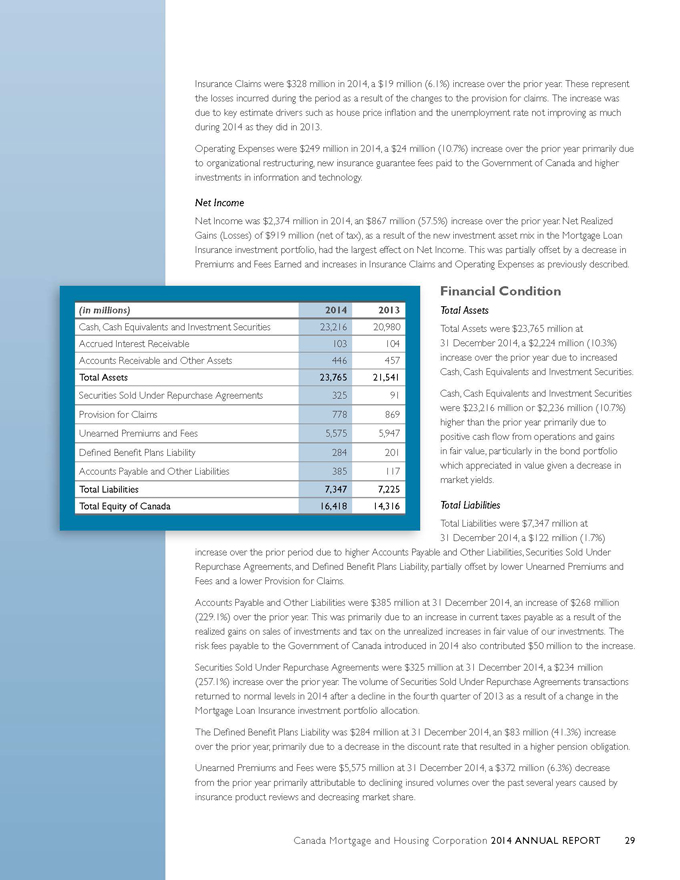

Insurance Claims were $328 million in 2014, a $19 million (6.1%) increase over the prior year. These represent the losses incurred during the period as a result of the changes to the provision for claims. The increase was due to key estimate drivers such as house price inflation and the unemployment rate not improving as much during 2014 as they did in 2013. Operating Expenses were $249 million in 2014, a $24 million (10.7%) increase over the prior year primarily due to organizational restructuring, new insurance guarantee fees paid to the Government of Canada and higher investments in information and technology. Net Income Net Income was $2,374 million in 2014, an $867 million (57.5%) increase over the prior year. Net Realized Gains (Losses) of $919 million (net of tax), as a result of the new investment asset mix in the Mortgage Loan Insurance investment portfolio, had the largest effect on Net Income. This was partially offset by a decrease in Premiums and Fees Earned and increases in Insurance Claims and Operating Expenses as previously described. Financial Condition (in millions) 2014 2013 Total Assets Cash, Cash Equivalents and Investment Securities 23,216 20,980 Total Assets were $23,765 million at Accrued Interest Receivable 103 104 31 December 2014, a $2,224 million (10.3%) Accounts Receivable and Other Assets 446 457 increase over the prior year due to increased Cash, Cash Equivalents and Investment Securities. Total Assets 23,765 21,541 Securities Sold Under Repurchase Agreements 325 91 Cash, Cash Equivalents and Investment Securities were $23,216 million or $2,236 million (10.7%) Provision for Claims 778 869 higher than the prior year primarily due to Unearned Premiums and Fees 5,575 5,947 positive cash flow from operations and gains Defined Benefit Plans Liability 284 201 in fair value, particularly in the bond portfolio which appreciated in value given a decrease in Accounts Payable and Other Liabilities 385 117 market yields. Total Liabilities 7,347 7,225 Total Equity of Canada 16,418 14,316 Total Liabilities Total Liabilities were $7,347 million at 31 December 2014, a $122 million (1.7%) increase over the prior period due to higher Accounts Payable and Other Liabilities, Securities Sold Under Repurchase Agreements, and Defined Benefit Plans Liability, partially offset by lower Unearned Premiums and Fees and a lower Provision for Claims. Accounts Payable and Other Liabilities were $385 million at 31 December 2014, an increase of $268 million (229.1%) over the prior year. This was primarily due to an increase in current taxes payable as a result of the realized gains on sales of investments and tax on the unrealized increases in fair value of our investments. The risk fees payable to the Government of Canada introduced in 2014 also contributed $50 million to the increase. Securities Sold Under Repurchase Agreements were $325 million at 31 December 2014, a $234 million (257.1%) increase over the prior year. The volume of Securities Sold Under Repurchase Agreements transactions returned to normal levels in 2014 after a decline in the fourth quarter of 2013 as a result of a change in the Mortgage Loan Insurance investment portfolio allocation. The Defined Benefit Plans Liability was $284 million at 31 December 2014, an $83 million (41.3%) increase over the prior year, primarily due to a decrease in the discount rate that resulted in a higher pension obligation. Unearned Premiums and Fees were $5,575 million at 31 December 2014, a $372 million (6.3%) decrease from the prior year primarily attributable to declining insured volumes over the past several years caused by insurance product reviews and decreasing market share. Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT 29

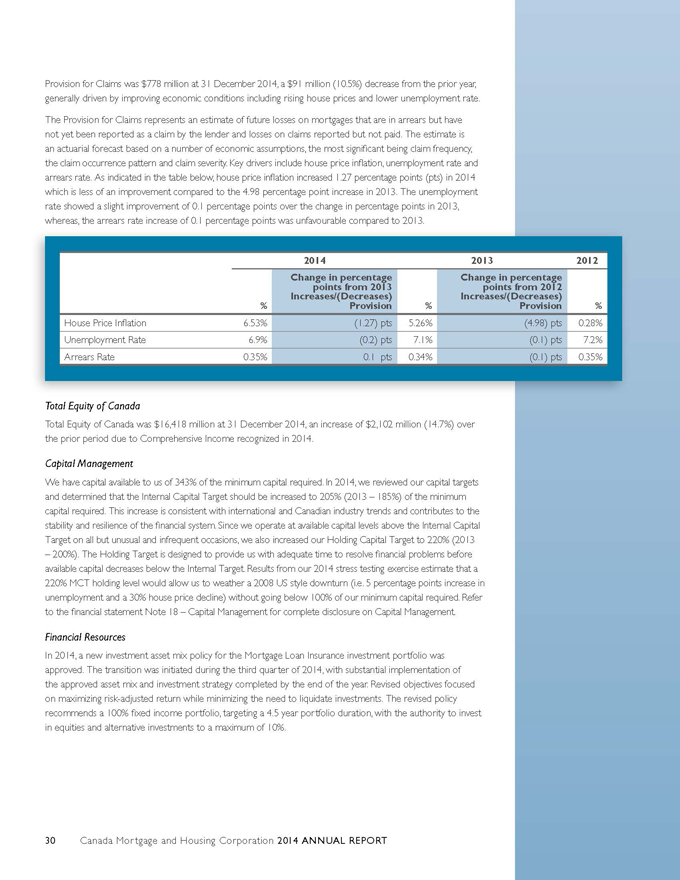

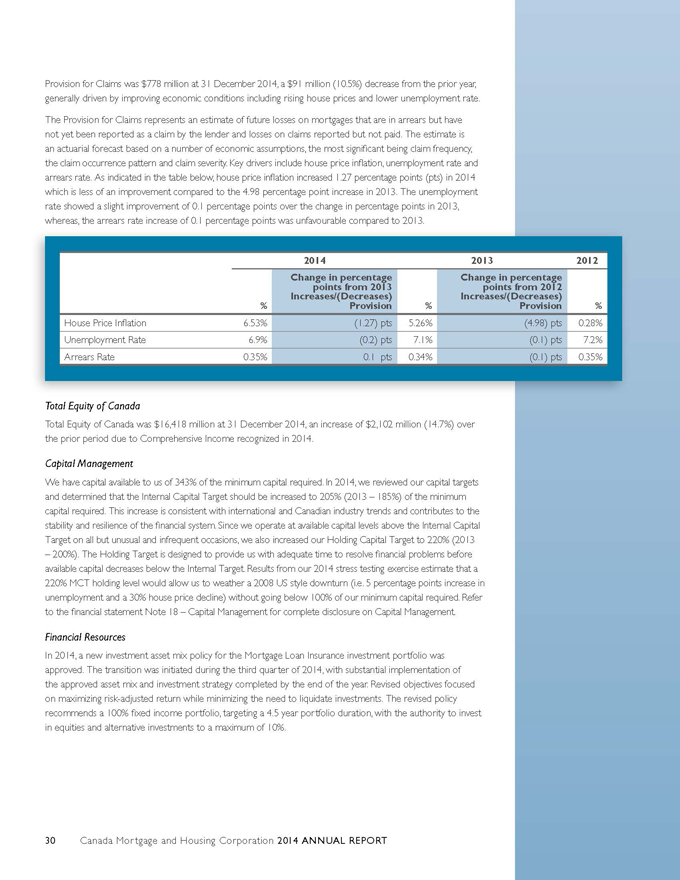

Provision for Claims was $778 million at 31 December 2014, a $91 million (10.5%) decrease from the prior year, generally driven by improving economic conditions including rising house prices and lower unemployment rate. The Provision for Claims represents an estimate of future losses on mortgages that are in arrears but have not yet been reported as a claim by the lender and losses on claims reported but not paid. The estimate is an actuarial forecast based on a number of economic assumptions, the most significant being claim frequency, the claim occurrence pattern and claim severity. Key drivers include house price inflation, unemployment rate and arrears rate. As indicated in the table below, house price inflation increased 1.27 percentage points (pts) in 2014 which is less of an improvement compared to the 4.98 percentage point increase in 2013. The unemployment rate showed a slight improvement of 0.1 percentage points over the change in percentage points in 2013, whereas, the arrears rate increase of 0.1 percentage points was unfavourable compared to 2013. 2014 2013 2012 Change points in percentage from 2013 Change points in percentage from 2012 % Increases/(Decreases) Provision % Increases/(Decreases) Provision % House Price Inflation 6.53% (1.27) pts 5.26% (4.98) pts 0.28% Unemployment Rate 6.9% (0.2) pts 7.1% (0.1) pts 7.2% Arrears Rate 0.35% 0.1 pts 0.34% (0.1) pts 0.35% Total Equity of Canada Total Equity of Canada was $16,418 million at 31 December 2014, an increase of $2,102 million (14.7%) over the prior period due to Comprehensive Income recognized in 2014. Capital Management We have capital available to us of 343% of the minimum capital required. In 2014, we reviewed our capital targets and determined that the Internal Capital Target should be increased to 205% (2013 – 185%) of the minimum capital required. This increase is consistent with international and Canadian industry trends and contributes to the stability and resilience of the financial system. Since we operate at available capital levels above the Internal Capital Target on all but unusual and infrequent occasions, we also increased our Holding Capital Target to 220% (2013 – 200%). The Holding Target is designed to provide us with adequate time to resolve financial problems before available capital decreases below the Internal Target. Results from our 2014 stress testing exercise estimate that a 220% MCT holding level would allow us to weather a 2008 US style downturn (i.e. 5 percentage points increase in unemployment and a 30% house price decline) without going below 100% of our minimum capital required. Refer to the financial statement Note 18 – Capital Management for complete disclosure on Capital Management. Financial Resources In 2014, a new investment asset mix policy for the Mortgage Loan Insurance investment portfolio was approved. The transition was initiated during the third quarter of 2014, with substantial implementation of the approved asset mix and investment strategy completed by the end of the year. Revised objectives focused on maximizing risk-adjusted return while minimizing the need to liquidate investments. The revised policy recommends a 100% fixed income portfolio, targeting a 4.5 year portfolio duration, with the authority to invest in equities and alternative investments to a maximum of 10%. 30 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

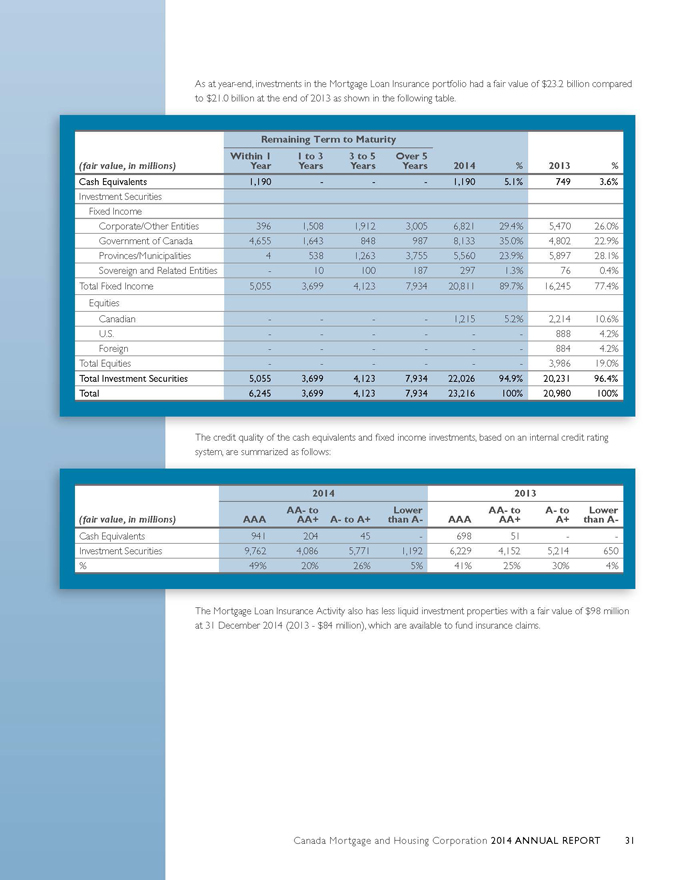

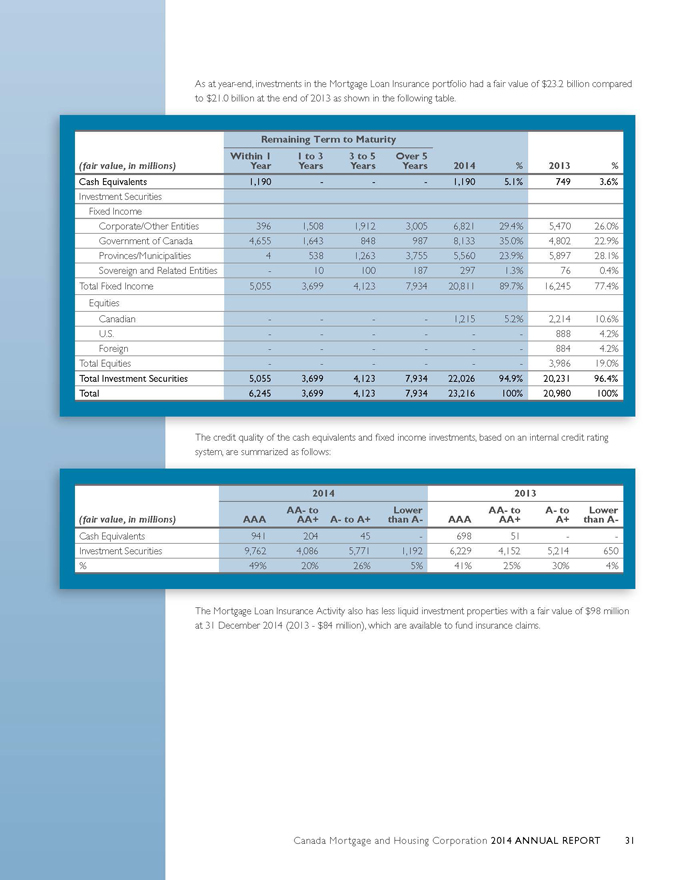

As at year-end, investments in the Mortgage Loan Insurance portfolio had a fair value of $23.2 billion compared to $21.0 billion at the end of 2013 as shown in the following table. Remaining Term to Maturity (fair value, in millions) Within Year 1 1 Years to 3 3 Years to 5 Over Years 5 2014 % 2013 % Cash Equivalents 1,190 ——1,190 5.1% 749 3.6% Investment Securities Fixed Income Corporate/Other Entities 396 1,508 1,912 3,005 6,821 29.4% 5,470 26.0% Government of Canada 4,655 1,643 848 987 8,133 35.0% 4,802 22.9% Provinces/Municipalities 4 538 1,263 3,755 5,560 23.9% 5,897 28.1% Sovereign and Related Entities—10 100 187 297 1.3% 76 0.4% Total Fixed Income 5,055 3,699 4,123 7,934 20,811 89.7% 16,245 77.4% Equities Canadian — — 1,215 5.2% 2,214 10.6% U.S. — — — 888 4.2% Foreign — — — 884 4.2% Total Equities — — — 3,986 19.0% Total Investment Securities 5,055 3,699 4,123 7,934 22,026 94.9% 20,231 96.4% Total 6,245 3,699 4,123 7,934 23,216 100% 20,980 100% The credit quality of the cash equivalents and fixed income investments, based on an internal credit rating system, are summarized as follows: 2014 2013 (fair value, in millions) AAA AA AA+—to A- to A+ than Lower A- AAA AA AA+—to A-A+ to than Lower A- Cash Equivalents 941 204 45—698 51 —Investment Securities 9,762 4,086 5,771 1,192 6,229 4,152 5,214 650 % 49% 20% 26% 5% 41% 25% 30% 4% The Mortgage Loan Insurance Activity also has less liquid investment properties with a fair value of $98 million at 31 December 2014 (2013—$84 million), which are available to fund insurance claims. Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT 31

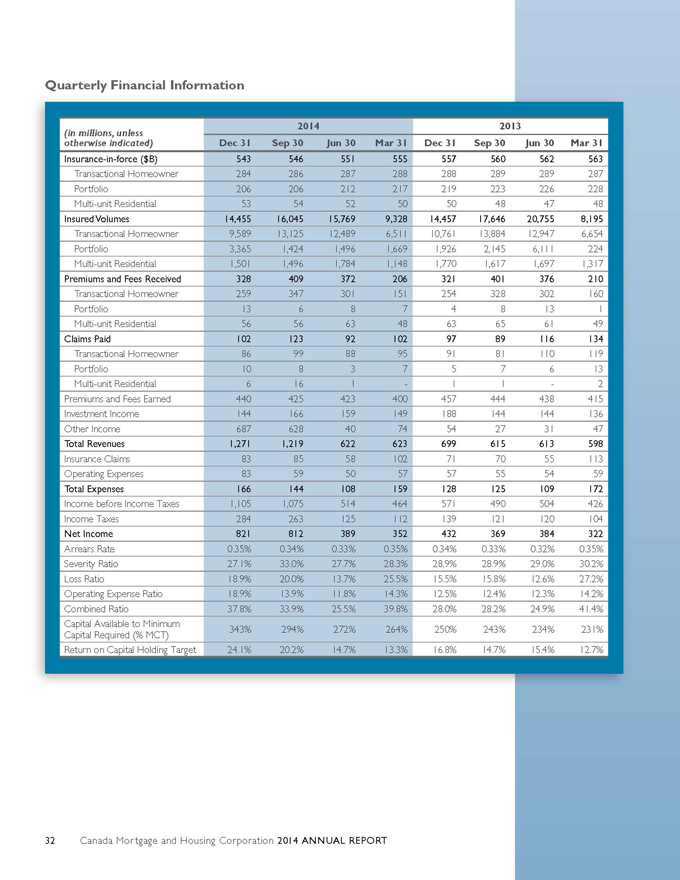

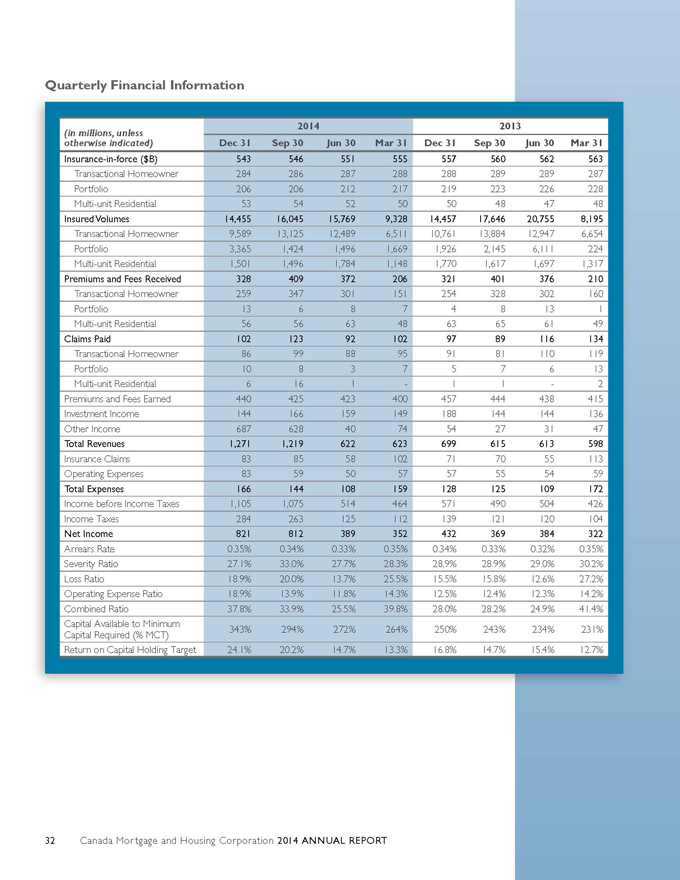

Quarterly Financial Information 2014 2013 (in millions, unless otherwise indicated) Dec 31 Sep 30 Jun 30 Mar 31 Dec 31 Sep 30 Jun 30 Mar 31 Insurance-in-force ($B) 543 546 551 555 557 560 562 563 Transactional Homeowner 284 286 287 288 288 289 289 287 Portfolio 206 206 212 217 219 223 226 228 Multi-unit Residential 53 54 52 50 50 48 47 48 Insured Volumes 14,455 16,045 15,769 9,328 14,457 17,646 20,755 8,195 Transactional Homeowner 9,589 13,125 12,489 6,511 10,761 13,884 12,947 6,654 Portfolio 3,365 1,424 1,496 1,669 1,926 2,145 6,111 224 Multi-unit Residential 1,501 1,496 1,784 1,148 1,770 1,617 1,697 1,317 Premiums and Fees Received 328 409 372 206 321 401 376 210 Transactional Homeowner 259 347 301 151 254 328 302 160 Portfolio 13 6 8 7 4 8 13 1 Multi-unit Residential 56 56 63 48 63 65 61 49 Claims Paid 102 123 92 102 97 89 116 134 Transactional Homeowner 86 99 88 95 91 81 110 119 Portfolio 10 8 3 7 5 7 6 13 Multi-unit Residential 6 16 1—1 1—2 Premiums and Fees Earned 440 425 423 400 457 444 438 415 Investment Income 144 166 159 149 188 144 144 136 Other Income 687 628 40 74 54 27 31 47 Total Revenues 1,271 1,219 622 623 699 615 613 598 Insurance Claims 83 85 58 102 71 70 55 113 Operating Expenses 83 59 50 57 57 55 54 59 Total Expenses 166 144 108 159 128 125 109 172 Income before Income Taxes 1,105 1,075 514 464 571 490 504 426 Income Taxes 284 263 125 112 139 121 120 104 Net Income 821 812 389 352 432 369 384 322 Arrears Rate 0.35% 0.34% 0.33% 0.35% 0.34% 0.33% 0.32% 0.35% Severity Ratio 27.1% 33.0% 27.7% 28.3% 28.9% 28.9% 29.0% 30.2% Loss Ratio 18.9% 20.0% 13.7% 25.5% 15.5% 15.8% 12.6% 27.2% Operating Expense Ratio 18.9% 13.9% 11.8% 14.3% 12.5% 12.4% 12.3% 14.2% Combined Ratio 37.8% 33.9% 25.5% 39.8% 28.0% 28.2% 24.9% 41.4% Capital Available to Minimum 343% 294% 272% 264% 250% 243% 234% 231% Capital Required (% MCT) Return on Capital Holding Target 24.1% 20.2% 14.7% 13.3% 16.8% 14.7% 15.4% 12.7% 32 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

Quarterly Trend Analysis

Our mortgage loan insurance business is exposed to seasonal variability, driven by the level of mortgage originations and related mortgage loan insurance policies written at different times during the year. Purchase transactions and insured volumes typically peak in the spring and summer months and are at their lowest level in the first quarter. For Premiums and Fees Received, the trend over the past eight quarters of declining year-over-year insured volumes was offset by the increased pricing for Transactional Homeowner premiums which came into effect 1 May 2014.

Financial results are also impacted by short and long-term changes in economic, employment and housing market trends as well as government regulations. These variables affect Claims Paid and Insurance Claims, as do the characteristics of the Insurance-in-force portfolio such as size and age.

Fourth Quarter Review

Q4 2014 vs. Q4 2013

Within the total insured volumes in Q4 2014, Transactional Homeowner volumes decreased by $1,172 million (10.9%) from Q4 2013 mainly due to a decrease in market share, whereas Portfolio volumes increased by $1,439 million (74.7%) from Q4 2013, with lenders insuring more of their annual allocation later in the year in 2014 than 2013. Multi-unit Residential volumes decreased by $269 million (15.2%) from Q4 2013 due to decreases in refinance transactions.

Total Premiums and Fees Received were $328 million in Q4 2014, a $7 million (2.2%) increase over Q4 2013. The increase in premium pricing for Transactional Homeowner insurance and growth in property values offset the decline in insured volumes. Premiums and Fees Received for other business were directionally consistent with changes in their volumes.

Total Revenues were $1,271 million in Q4 2014, an increase of $572 million (81.8%) over Q4 2013 primarily due to higher Net Realized Gains (Losses), a component of Other Income. Net Realized Gains (Losses) increased by $670 million (3,350.0%) due to the new investment asset mix in the Mortgage Loan Insurance investment portfolio.

Operating Expenses were $83 million in Q4 2014, a $26 million (45.6%) increase over Q4 2013 mainly due to costs associated with organizational restructuring, higher investments in technology and the new insurance guarantee fees paid to the Government of Canada.

Q4 2014 vs. Q3 2014

Total insured volumes were $14,455 million in Q4 2014, a decrease of $1,590 million (9.9%) from Q3 2014. The decrease was mainly driven by the seasonal decline in Transactional Homeowner volumes, partially offset by higher Portfolio volumes as lenders insured more of their annual allocation after lower take-up earlier in 2014. The seasonal decline in insured volumes led to lower Premiums and Fees Received in Q4 2014.

Total Revenues were $1,271 million in Q4 2014, an increase of $52 million (4.3%) over Q3 2014. This was mainly due to an increase in Other Income of $59 million (9.4%), primarily as a result of realized gains on a greater volume of bond sales. This was partially offset by a decrease of $22 million (13.3%) in Investment Income caused by lower dividend income on reduced holdings of equities. Premiums and Fees Earned increased by $15 million (3.5%).

Claims Paid were $102 million in Q4 2014, a $21 million (17.1%) decrease mainly as a result of several large Multi-unit Residential claims being paid in Q3 2014.

Operating Expenses were $83 million in Q4 2014, a $24 million (40.7%) increase over the prior period mainly due to costs associated organizational restructuring and higher investments in technology.

Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT 33

Outlook The Mortgage Loan Insurance Activity has a high level of exposure to the Canadian housing market and is influenced by a number of factors including interest rate trends, house price inflation, the unemployment rate, government regulation and competition within the Canadian housing finance market. ? Insurance-in-force is expected to decrease to approximately $533 billion by the end of 2015 as mortgage repayments continue to outpace new insurance written. ? The increased pricing of Transactional Homeowner premiums and the new risk fee payable to the Government of Canada, both introduced in 2014, will be more fully reflected in earnings over the coming periods. ? Projected Net Income is expected to decline from $2,374 million in 2014 to $1,458 million in 2015 as the gains realized on the implementation of the new investment asset mix in the Mortgage Loan Insurance investment portfolio are not expected to re-occur. 34 Canada Mortgage and Housing Corporation 2014 ANNUAL REPORT

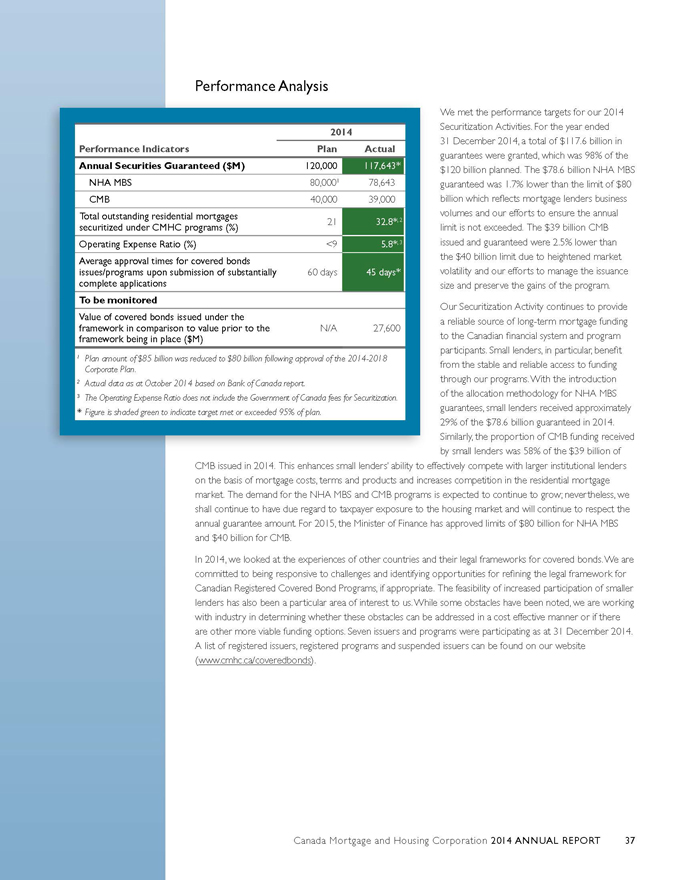

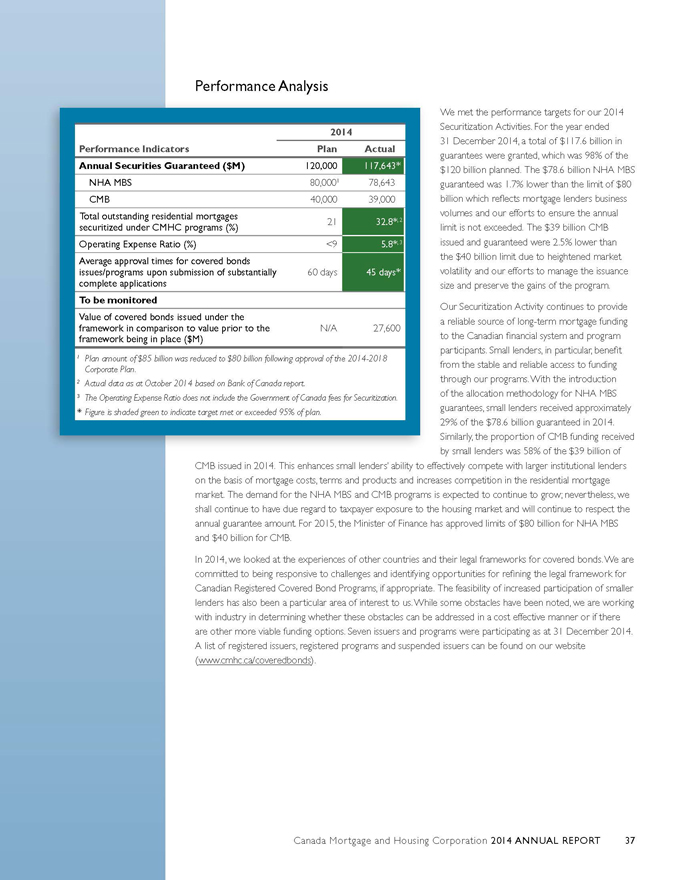

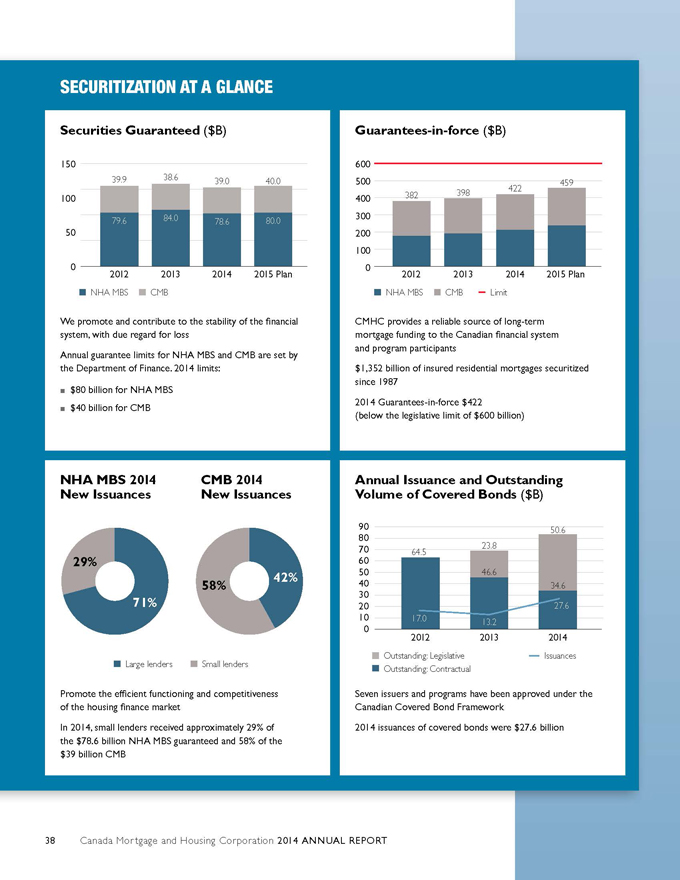

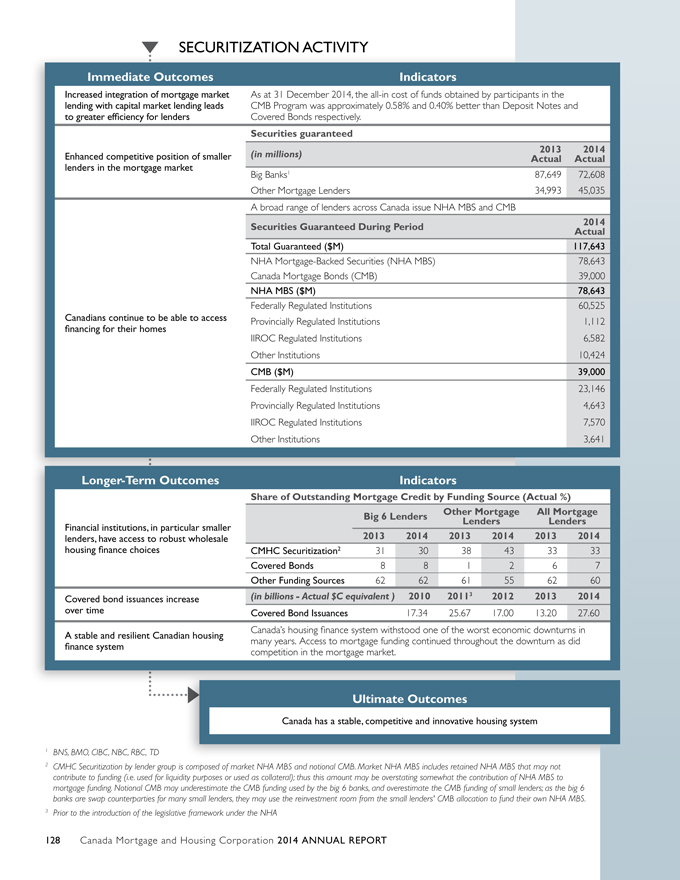

Description of Activity