EXHIBIT 99.2

TABLE OF CONTENTS

| | | | |

| |

| Our Corporate Plan Framework for 2017 | | | 2 | |

| |

| The Year At-A-Glance | | | 3 | |

| |

| 2017 Performance Highlights | | | 4 | |

| |

| Message from the Outgoing Chairperson | | | 5 | |

| |

| Message from the Incoming Chairperson | | | 5 | |

| |

| Message from the President | | | 6 | |

| |

| Message from the Chief Financial Officer | | | 8 | |

| |

| Management’s Discussion and Analysis | | | 9 | |

| |

Operating Environment | | | 10 | |

| |

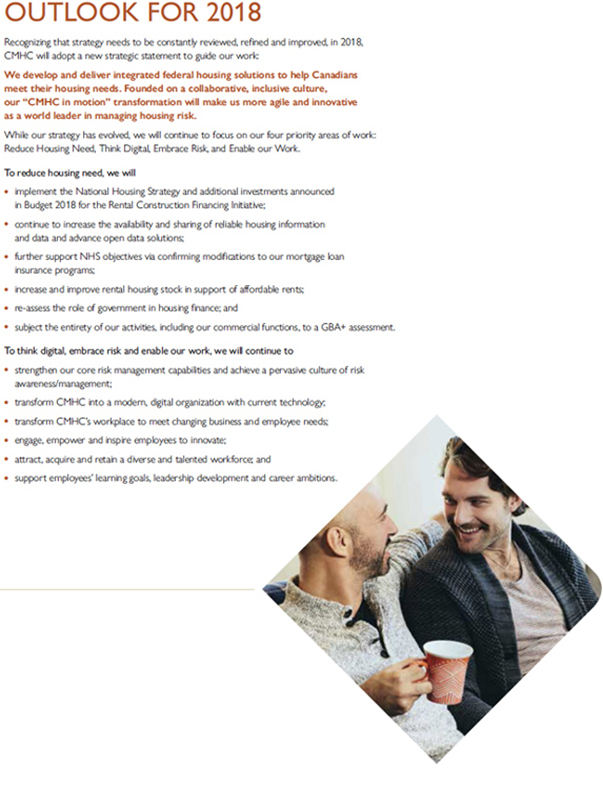

Outlook for 2018 | | | 12 | |

| |

The National Housing Strategy | | | 13 | |

| |

Risk Management | | | 15 | |

| |

Condensed Consolidated Financial Results | | | 18 | |

| |

Performance by Activity | | | 20 | |

| |

Future Changes to Accounting Standards | | | 45 | |

| |

| Historical Information | | | 46 | |

| |

| Consolidated Financial Statements | | | 47 | |

| |

| Corporate Governance | | | 104 | |

| |

| Board of Directors | | | 105 | |

| |

| Senior Management | | | 106 | |

| |

| Glossary | | | 108 | |

| | | | |

| 2017 ANNUAL REPORT | |  | | 1 |

OUR CORPORATE PLAN FRAMEWORK FOR 2017

| | | | |

| OUR MANDATE | | OUR MISSION | | OUR VISION |

| Facilitate access · Contribute to | | We help Canadians meet | | The heart of a world-leading |

| financial stability | | their housing needs | | housing system |

LONG-TERM OUTCOMES

Canada has a stable, competitive and innovative housing system

Canadians in need have access to affordable and suitable housing

| | | | |

| 2 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

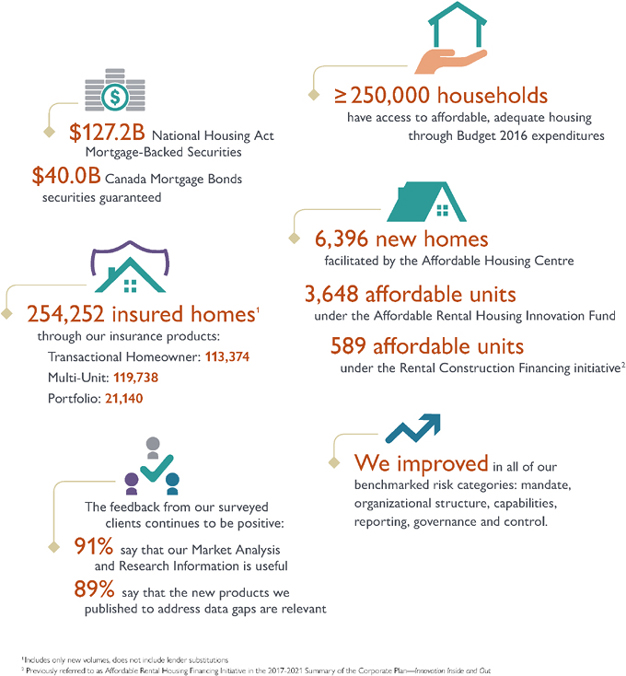

THE YEAR AT-A-GLANCE

Our strategic directions guided our decision making and priority setting for 2017.

Here’s a look at some of this year’s achievements:

| | |

| | LEAD THROUGH INNOVATION AND INSIGHT |

| | To drive housing solutions and support informed decision making, we |

| |

| | · through a partnership with Statistics Canada, strengthened the availability of housing-related data for Canadians |

| |

| | · produced new publications on mortgage and consumer trends |

| |

| | · held the first Pan-Canadian Voice for Women’s Housing Symposium |

| |

| | BE A HIGH-PERFORMING ORGANIZATION |

| | To deliver results for Canadians and excellent service to our clients, we |

| |

| | · confirmed our technology and business transformation, becoming a modern, digitally-enabled organization |

| |

| | · created a talent acquisition framework to meet our evolving business needs |

| |

| | · developed a career framework to support employees’ growth and leadership development |

| |

| | ACHIEVE BETTER OUTCOMES BY MANAGING RISK |

| |

| | To support housing affordability and financial stability, we |

| |

| | · developed policy and announced Canada’s first ever National Housing Strategy (NHS) |

| |

| | · strengthened our core risk management capabilities via an enhanced risk governance and refined risk appetite framework and modernized our economic capital and stress testing models |

| |

| | · increased the supply of rental housing by launching the Rental Construction Financing initiative and the Affordable Rental Housing Innovation Fund |

| |

| | · helped over 250,000 households across the country to meet their housing needs through Budget 2016 social infrastructure investments |

| | | | |

| 2017 ANNUAL REPORT | |  | | 3 |

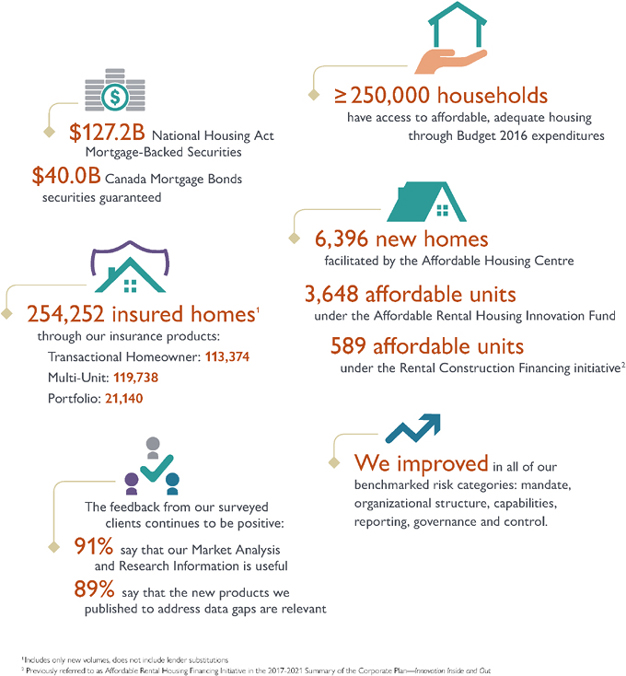

2017 PERFORMANCE HIGHLIGHTS

| | | | |

| 4 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

| | |

| |  |

MESSAGE FROM THE OUTGOING CHAIRPERSON | |

On behalf of the Board of Directors, I am pleased to present CMHC’s 2017 Annual Report, Envisioning a Place to Call Home. Throughout the year, our Board continued to provide operational oversight and direction in support of CMHC’s pursuit of its mandate. | |

CMHC has continued to manage its mortgage loan insurance and securitization businesses in a commercially viable manner. In June, it took an important step in preserving financial discipline by implementing a dividend framework, and subsequently declared $4.7 billion in dividends over the course of the year. | |

In 2017, the Government of Canada showed its confidence in CMHC by entrusting it with development and delivery of Canada’s first National Housing Strategy. Over the past year, CMHC successfully envisioned how it would bring to life this ambitious $40-billion, 10-year plan to ensure Canadians have a place to call home that meets their needs and that they can afford. | |

As my term as Chair comes to an end, I would like to recognize and sincerely thank my fellow Board members, the management team and the dedicated staff who so ably contributed to the evolution of CMHC during my tenure. We have taken many important steps together that have strengthened CMHC’s contributions to Canada’s financial stability and positioned the Corporation to deliver on the National Housing Strategy. It has truly been an honour and privilege to be a part of this great organization. | |

| |

| | |

| Robert P. Kelly | | |

| Chairperson | | |

| |

| |  |

MESSAGE FROM THE INCOMING CHAIRPERSON | |

| |

Safe and affordable housing is the foundation upon which our country can build a better, more prosperous future for all Canadians. It was therefore a great honour to be appointed Chairperson of CMHC in December 2017. | |

The Government of Canada’s renewed commitment to housing will be realized through the National Housing Strategy with CMHC having been asked to reassume a federal leadership role in housing. CMHC and our partners across the country have a vital role in implementing and delivering the Strategy, and I look forward to working with my fellow Board members and CMHC management and employees in helping to shape the future of Canadian housing. | |

| |

| | |

| Derek Ballantyne | | |

| Chairperson (effective April 2018) | | |

| | | | |

| 2017 ANNUAL REPORT | |  | | 5 |

MESSAGE FROM THE PRESIDENT

Last September I had the chance to meet Miriam—a woman who spoke passionately about her journey to Canada as a refugee, and the “life-changing” moment when she found safe affordable housing for her and her daughter. For Miriam—and for all of us—housing is more than just a roof and four walls. Housing is hope. It’s the stable foundation for caring for our families, studying, and finding and maintaining a job. And for over 70 years, no single organization has been more fundamental to ensuring Canadians have a place to call home than Canada Mortgage and Housing Corporation.

Meeting people like Miriam inspires all of us at CMHC to ensure the organization can anticipate and meet the housing needs of Canadians for many years to come. That is why, in recent years, we’ve been working hard to transform the way we work to become a more agile, high performing organization. Journeys like this are uneven and we have approached setback only as an opportunity to learn, adjust and improve.

Initially, we focussed on our “hardware”—our mission, vision, values, strategy and performance management. We’ve continued by transforming our technology and business tools, strengthening our risk management capacity, and creating a new career framework to guide our employees’ ongoing development. We have plugged several gaps in our housing information base and we continue to invest in research—so that we can better understand and address the complex factors shaping Canada’s housing markets.

This work positioned us for an historic accomplishment in 2017: announcing Canada’s first-ever National Housing Strategy. The federal government has entrusted CMHC with the development and implementation of this strategy, announced in November by Prime Minister Justin Trudeau and our minister, the Honourable Jean-Yves Duclos. The impact of this unprecedented investment, $40 billion over 10 years, will be impressive. It will reduce chronic homelessness by 50% and remove 530,000 households from housing need.

Canadians also depend on CMHC to ensure the housing market remains stable. As this Annual Report shows, CMHC remains a systemically important financial institution in Canada. We continue to support both our clients and Canadians through our mortgage loan insurance and securitization operations. Notably, we recently reimagined our multi-unit residential mortgage loan insurance segment to better support the rental housing sector and the nearly 30% of Canadians who live in homes they rent.

Our responsible management of these businesses benefits all Canadians. In 2017, we navigated a changing regulatory environment that significantly impacted our mortgage loan insurance volumes. Nonetheless, we generated a net income of $1.8 billion primarily as a result of some one-time investment gains and lower insurance claims, which resulted from stronger than expected economic performance. During 2017, we declared $4.7 billion in dividends to our shareholder, the Government of Canada. And an additional $1 billion dividend was declared on March 22, 2018. This decision reflects our strong financial performance, and pushes us to continue to manage our resources efficiently and be rigorous in our decision-making.

“We are building a stronger, more agile company in the service of Canadians.”

| | | | |

| 6 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

| | | | |

| 8 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following Management’s Discussion and Analysis (MD&A) of the financial condition and results of operations as approved by the Board of Directors on March 22, 2018 is prepared for the year ended December 31, 2017. This MD&A should be read in conjunction with the audited consolidated financial statements. Unless otherwise indicated, all financial information in this report has been prepared in accordance with International Financial Reporting Standards (IFRS) and all amounts are expressed in Canadian dollars.

FORWARD-LOOKING STATEMENTS

Our Annual Report contains forward-looking statements that include, but are not limited to, statements with respect to our outlook for the regulatory environment in which we operate, the outlook and priorities for each activity and the risk environment. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties that may cause actual results to differ materially from expectations expressed in the forward-looking statements.

NON-IFRS MEASURES

We use a number of financial measures to assess our performance. Some of these measures are not calculated in accordance with IFRS, are not defined by IFRS, and do not have standardized meanings that would ensure consistency and comparability with other institutions. These non-IFRS measures are presented to supplement the information disclosed in the consolidated financial statements and notes to the consolidated financial statements, which are prepared in accordance with IFRS and may be useful in analyzing performance and understanding the measures used by management in its financial and operational decision-making. Where non-IFRS measures are used throughout the Annual Report, a definition of the term will be disclosed in the glossary for non-IFRS financial measures.

| | | | |

| 2017 ANNUAL REPORT | |  | | 9 |

| | | | |

| 10 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

| | | | |

| 2017 ANNUAL REPORT | |  | | 11 |

| | | | |

| 12 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

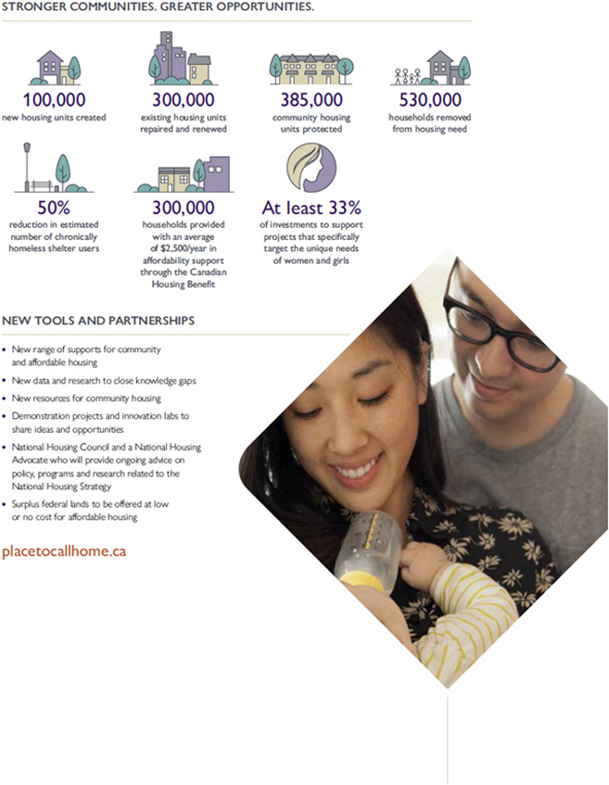

THE NATIONAL

HOUSING STRATEGY

| | |

The NHS—Canada’s first ever—was announced on 22 November, 2017, with the goal of ensuring that Canadians across the country can access housing that meets their needs and that they can afford. Building on investments announced in Budgets 2016 and 2017, the NHS is a detailed 10-year, $40 billion plan that will deliver results and benefit Canadians—with more affordable, accessible, inclusive and sustainable homes. In 2016, CMHC led the national consultations on the vision, themes, principles and outcomes of the NHS. Important learnings emerged from the Let’s Talk Housing consultations, and the NHS is stronger for it. Moving forward, CMHC will continue to lead the implementation of the NHS and work to ensure more Canadians across the country find a place to call home. The primary focus will be on meeting the needs of vulnerable populations, such as women and children fleeing family violence, seniors, Indigenous peoples, persons with disabilities, those dealing with mental health and addiction issues, veterans and young adults. In addition, the NHS is grounded in, and supportive of, the Government’s commitment to Gender Based Analysis (GBA+) to ensure that programs will not negatively impact Canadians on the basis of gender and other identity factors. To be successful, the NHS requires the collaboration and commitment of more partners than ever before, in a coherent, integrated and whole-of-government approach. CMHC will track and report on successes, and adapt its approach and priorities as needed as the NHS unfolds. | |  |

A ONCE-IN-A-GENERATION INVESTMENT

A 10-year plan to give more Canadians a place to call home

| | | | | | |

| $15.9 billion | | $9.1 billion | | $2.5 billion | | $4.0 billion |

| for the National Housing | | for Community | | for Federal-Provincial/Territorial | | for Canadian Housing Benefit * |

| Co-Investment Fund | | Housing Initiatives * | | Housing Partnership, | | |

| | | | including the North * | | |

| | | |

| $9.8 billion | | $2.2 billion | | $241 million | | $200 million |

| through existing agreements | | for Homelessness | | for Research, Data | | for Federal Lands Initiative |

| | Partnering Strategy | | and Demonstrations | | |

* Includes cost matching by Provinces and Territories.

“In 2016, CMHC led the national consultations on the vision, themes, principles and outcomes of the NHS. Important learnings emerged from the Let’s Talk Housing consultations, and the NHS is stronger for it. Moving forward, CMHC will continue to lead the implementation of the NHS and work to ensure more Canadians across the country find a place to call home.”

| | | | |

| 2017 ANNUAL REPORT | |  | | 13 |

| | | | |

| 14 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

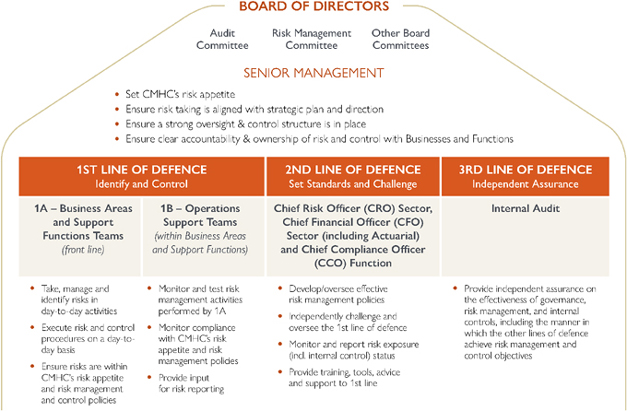

RISK MANAGEMENT

WHAT WE DO

Through the course of our work promoting the stability of the Canadian housing system, we are exposed to a variety of risks. We go to great lengths to protect the public resources entrusted to us as well as our reputation, as we strive to be a global leader in the management of housing risks.

ENTERPRISE RISK MANAGEMENT

We follow a comprehensive Enterprise Risk Management (ERM) Framework to guide our activities and support a risk-aware culture characterized by robust evaluation and management of risks across the Corporation. The framework is structured around the following four key dimensions that, together, contribute to our strong risk management practices and culture:

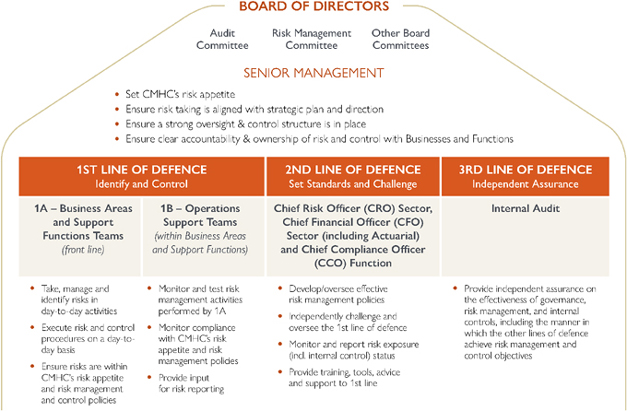

RISK GOVERNANCE

This dimension comprises our risk governance structure, risk management policies and a “three lines of defence” risk governance model that define roles and responsibilities across the corporation.

It includes:

| · | | the Board of Directors (the Board) which is responsible for managing CMHC’s affairs and the conduct of its business, including ensuring that major risks are identified and managed; | |

| · | | the Risk Management Committee of the Board which is responsible for assisting the Board in fulfilling its risk oversight responsibilities including legislative and regulatory compliance; | |

| · | | all members of Senior Management who play an integral role in identifying, monitoring and reporting risks within their areas of responsibility and overseeing activities performed within and across the “three lines of defence”; and | |

| · | | all employees who form the foundation of the “Three Lines of Defence” as outlined in the diagram below. | |

| | | | |

| 2017 ANNUAL REPORT | |  | | 15 |

RISK APPETITE

Our risk appetite defines the level and type of risks we are willing to accept to achieve our strategy, including in times of crisis. Our mandate requires us to manage strategic, operational and financial risks with strong risk management capabilities appropriate for our size, complexity and systemic importance.

In 2017, we reviewed our risk appetite framework to better align it with our mandate and strategic directions. This resulted in new risk appetite statements that addressed desired risk behaviours both in normal and stressed economic conditions.

RISK BEHAVIOUR

We continue to deliver training and education activities that foster desired risk behaviours and support risk management capabilities among all of our employees. Our risk culture is defined by aspirational risk culture statements that promote desired risk behaviours including innovation, risk-based decision-making, and understanding of risk management at all levels of the Corporation.

RISK MANAGEMENT PROGRAM

Our risk management programs are continuously being improved to enhance the identification, assessment, measurement and reporting of material risks across all of our activities. We also conduct an Own Risk and Solvency Assessment (ORSA) to identify risks and to assess our current and future capital needs and solvency positions.

Stress testing

Stress testing is an important part of our ORSA and is conducted annually on an enterprise-wide basis. We use stress testing to evaluate how various extreme economic and operational scenarios could affect our financial performance, capital adequacy and operational resiliency. Our annual corporate-wide stress testing program is developed through a structured, corporate-wide consultative process and, in all cases, confirms our ability to weather severe but extremely unlikely scenarios. In support of greater transparency, we have been publicly releasing our stress test results since 2015.

Risk Reporting & Monitoring

We identify, categorize and assess existing and emerging risks using seven risk categories; strategic, reputational, operational, insurance and guarantee, credit, market and liquidity. Our risk reporting and monitoring processes provide an enterprise-wide view of our risk profile, flags key and emerging risks and fosters a discussion about mitigating actions.

The table below outlines our seven risk categories and their assessment at 31 December, 2017:

| | | | | | | | | | | | | | | | | | | | | | | | |

STRATEGIC | | | | REPUTATIONAL | | | | OPERATIONAL | | | | INSURANCE & GUARANTEE | | | | CREDIT | | | | MARKET | | | | LIQUIDITY |

| MODERATE | | | | MODERATE | | | | HIGH | | | | LOW | | | | LOW | | | | LOW | | | | LOW |

As we continue on our transformation and movement away from legacy systems, operational risk was assessed as high and we are closely monitoring it, with cyber security and organizational change being identified as top concerns to the organization. Multiple concurrent business transformation and change initiatives are increasing the efficiency and effectiveness of our business processes and controls, improving our ageing information and technology infrastructure, and increasing our cyber security capabilities. Change fatigue is being closely monitored during the deployment of these various initiatives.

Our strategic and reputational risks were assessed as moderate given our rapidly changing internal and external environment. Economic uncertainties combined with regulatory changes related to mortgage lending, our technology and business transformation as well as heightened expectations from our many stakeholders following the launch of the NHS contribute to uncertainties in our environment and may impact our reputation and the way we execute our strategy.

Insurance and guarantee risk, credit, market and liquidity risk categories were assessed as low.

RISK CULTURE STATEMENTS

| · | | We follow best-in-class management standards |

| · | | We take the right type of risk to achieve our strategy and foster innovation |

| · | | We manage risks to drive better performance and outcomes |

| · | | We individually take ownership of risk and challenge each other |

| | | | |

| 16 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

Capital Management

Capital Framework

Under our capital management framework we validate and calibrate annually, if necessary, both our internal capital target and the operating capital holding target. Our capital targets ensure that a sufficient amount of capital is held for normal fluctuations in financial results and business needs. We set our capital at a level to promote market discipline, not to maximize our return on capital.

We conduct our ORSA to identify risks and assess our current and likely future capital needs and solvency positions.

Dividends

Over the course of the year, we declared $4.7 billion in dividends payable to our shareholder, the Government of Canada, including a one-time special dividend of $4 billion payable over a period not to exceed two years. As at year-end, $2.7 billion has been paid. An additional $1 billion was declared on March 22, 2018.

We intend to continue to return excess capital to the Government of Canada by assessing our capital needs on a long-term basis and following a stable dividend pattern to maintain our capital position approximately in line with our operating level of capital. By following this approach, we will effectively return profits that are not allocated to reserves or capitalization or used to meet the needs of the Corporation for the purposes of the National Housing Act (NHA), CMHC Act or any other purpose authorized by Parliament relating to housing. Payments are made in accordance with the NHA, CMHC Act, Financial Administration Act and our policies, which are consistent with the framework.

Dividend amounts are influenced by:

| · | | our internal view of capital needs in accordance with our specific risk profile and information from our models for economic capital and stress testing; |

| · | | the amount of capital to be set aside based on regulatory requirements; and |

| · | | a margin for uncertainty and provision for unknown risks informed by our risk appetite, stress testing and scenarios analysis. |

|

ENVISIONING a place to call home |

BUILDING A RESILIENT RISK CULTURE |

An earthquake, an oil price shock over a sustained period, or an extended period of global economic deflation—these are some of the extreme, but unlikely scenarios that we test our mortgage loan insurance and securitization business against. Our stress testing shows that we’re well positioned to withstand a major shock, which is great news. Last year, we chose to push this exercise further and take a risk. We decided to share not only the results, but also the methodology of our testing to help us improve our models and the reliability of our results. Our openness in releasing stress testing results was lauded by the financial services industry, and our transparency led to learning opportunities with our clients. This work is just one of the ways we have been transforming and strengthening our risk management and culture to help us deliver on our mandate. |

| | | | |

| 2017 ANNUAL REPORT | |  | | 17 |

CONDENSED CONSOLIDATED

FINANCIAL RESULTS

CONDENSED CONSOLIDATED BALANCE SHEET

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Total assets | | | 267,115 | | | | 259,532 | |

Total liabilities | | | 249,374 | | | | 238,542 | |

Total equity of Canada | | | 17,741 | | | | 20,990 | |

Our total equity of Canada decreased by $3,249 million (15%) primarily as a result of the declaration of $4,675 million in dividends partially offset by comprehensive income of $1,426 during the year.

An increase in our total assets of $7,583 million (3%) was driven by the issuance of Canada Mortgage Bonds (CMB), resulting in a $10,634 million (5%) increase in loans—loans and receivables offset by a reduction of $3,317 million in other financial assets used primarily to fund dividend payments of $2,675 million and to repay maturing Government of Canada borrowings.

Our total liabilities increased by $10,832 million (5%) mainly due to a $10,436 million (5%) increase in borrowings—other finance liabilities in line with increases in our loans—loans and receivables due to the issuance of CMBs. Furthermore, $2,000 million of dividends remain to be paid to the Government. Offsetting these increases is a reduction of $1,341 million in Government borrowings.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Total revenues | | | 6,152 | | | | 4,625 | |

Total expenses | | | 3,772 | | | | 2,806 | |

Income taxes | | | 577 | | | | 441 | |

Net income | | | 1,803 | | | | 1,378 | |

Other comprehensive income (loss) | | | (377) | | | | (27) | |

Comprehensive income | | | 1,426 | | | | 1,351 | |

REVENUES

Total revenues increased by $1,527 million (33%) primarily due to

| · | | Higher parliamentary appropriations for housing programs of $1,076 million (50%) mainly as a result of increased spending on new initiatives under Budget 2016. | |

| · | | net gains on financial instruments of $198 million (388%) as we realized gains on the sale of investment securities due to portfolio rebalancing in line with our investment policy. In addition, the cost to retire our CMBs decreased following increases in interest rates. | |

| · | | premiums and fees earned of $152 million (8%) mainly due to higher premiums and fees received in recent years within our Securitization and Mortgage Loan Insurance activities. | |

Other income increased by $85 million (224%) primarily from an $82 million increase in unrealized gains following the revaluation of investment properties.

| | | | |

| 18 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

EXPENSES

Total expenses increased by $966 million (34%) as a result of increases in housing programs expenses of $1,076 million (50%) in accordance with parliamentary appropriations for housing programs, and operating expenses of $77 million (24%) as we incurred higher costs from our technology and business transformation initiative, partially offset by a decrease in insurance claims.

Offsetting the increases in total expenses was a decrease in insurance claims of $187 million (56%) as a result of fewer policies in force, improvements in the unemployment rate throughout Canada and significant appreciation in housing prices especially in Ontario and British Columbia. These stronger economic conditions led to a decrease in incurred claims and a reduction in our incurred but not reported provision. In addition, we reduced our provision for social housing and index-linked mortgages due lower exposure as a result of a decrease in outstanding loan balances. Furthermore, we recognized a lower allowance on our workout loans to reflect expected future cash flows.

OTHER COMPREHENSIVE LOSS

We recognized a loss of $377 million—an increase of $350 million compared to our loss in 2016. Net unrealized losses from available for sale financial instruments and an increase in remeasurement losses on our defined benefit plans were the main contributors of the higher loss in 2017.

During the year we recognized additional net unrealized losses on our available for sale financial instruments of $126 million primarily on fixed income instruments as applicable interest rates increased throughout the year. Furthermore, as we rebalanced our investment portfolio during the year, $136 million in unrealized gains were reclassified from accumulated other comprehensive income to net gains on financial instruments, compared to $37 million in 2016.

Remeasurement losses on our defined benefits plans were primarily due to lower discount rate used to determine the benefit obligation in 2017, partially offset by an actual return on plan assets that was higher than expected. This had a net effect of increasing the defined benefit liability. By comparison, in 2016, there was a smaller decrease in the discount rate, which was more than offset by a higher than expected return on plan assets. This had a net effect of decreasing the defined benefit liability.

FINANCIAL PERFORMANCE AGAINST 2017 PLAN

| | | | | | | | |

| | | 2017 | |

| (IN MILLIONS) | | ACTUAL | | | PLAN | |

Total revenues | | | 6,152 | | | | 5,885 | |

Total expenses | | | 3,772 | | | | 4,013 | |

Income taxes | | | 577 | | | | 451 | |

Net income | | | 1,803 | | | | 1,421 | |

Total assets | | | 267,115 | | | | 269,234 | |

Total liabilities | | | 249,374 | | | | 247,222 | |

Total equity of Canada | | | 17,741 | | | | 22,012 | |

Total revenues were $267 million (5%) higher than Plan primarily a result of net gains on financial instruments following the sale of investment securities, in addition to a decrease in the cost to retire our CMBs following increases in interest rates.

Total expenses were $241 million (6%) lower than Plan primarily because of lower insurance claims as a result of favourable economic conditions and to the reduction of the allowance on our workout loans within our Mortgage Loan Insurance Activity.

During the year, we declared $4,675 million in dividends, $2,000 million of which remains to be paid at 31 December, 2017. This was not factored into our Plan and was the main reason for the $2,119 million (1%) decrease in our total assets, $2,152 million (1%) increase in our total liabilities and $4,271 million (19%) decrease in our total equity of Canada.

| | | | |

| 2017 ANNUAL REPORT | |  | | 19 |

PERFORMANCE BY ACTIVITY

To ensure we achieve our outcomes, we establish performance indicators for our activities related to each of our strategic directions and our core activities.

Our 2017 corporate performance is evaluated based on actual results of the performance indicators from the Summary of CMHC’s 2017-2021 Corporate Plan compared to targets.

For 2017, we achieved two out of three strategic directions and our core activities. The strategic direction “Be a High-Performing Organization” was assessed as partially achieved mostly due to delays in technology and business transformation and under-representation in three out of four employment equity groups.

Within the activity chapters, performance rating is indicated by colour

based on the following:

🌑 Green to indicate that actual meets or is within 2% of target

¨ Yellow to indicate that actual is between 2% and 5% of target

∎ Red to indicate that actual does not meet or is not within 5% of target

| | | | |

| 20 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

ASSISTED HOUSING

WHAT WE DO

We help Canadians in need gain access to suitable housing they can afford.

HOW WE DO IT

| · | | We receive parliamentary appropriations to fund housing programs; our programs operate on a breakeven basis as appropriations equal expenditures each year | |

| · | | We make loans at below market interest rates and provide non-subsidized housing support to our diverse partners; our lending programs operate on a long-term, breakeven basis to help reduce project operating costs and, in turn, their need for direct subsidies | |

| · | | We collaborate and work with all levels of government, non-profit organizations, private sector companies and First Nation communities across the country | |

PERFORMANCE AGAINST PLAN

OUR GOALS

Canadians in need have access to affordable and suitable housing.

| | | | |

| SHORT TERM OUTCOME (12 MONTHS) | | ACTUAL * | | TARGET * |

Canadians have improved access to affordable housing through existing programs and implementation of Budget 2016. | | 🌑 32% spending of Budget 2016 funds 1 | | = 100% or $647M for 2017-18 |

| | 🌑 62% spending of housing programs funds for Assisted Housing 1 | | = 100% or $2,476M for 2017-18 |

| | |

| | 🌑 377 new units committed under the On-Reserve Non-Profit Housing Program 1 | | > 852 for 2017-18 |

| | |

| | 🌑 6,396 affordable housing units facilitated by the Affordable Housing Centre | | > 4,300 |

| | |

MEDIUM TERM OUTCOME (2 TO 3 YEARS) | | ACTUAL * | | TARGET * |

Housing providers are able to provide more affordable, adequate housing. | | 🌑 252,367 increase in the number of households that will have access to affordable and adequate housing through 2016 Budget expenditures from April 2016 to December 2017. | | ³ 198,660 by 2017-18 (two year cumulative target) |

More Canadians in need are living in housing that they can afford and that meets their needs. | | | | |

* As of 31 Dec, 2017 (unless otherwise stated).

1 For 2017-18 targets that span our fiscal year end, the performance rating is based on expected results at March 31, 2018.

🌑 Figure is shaded green to indicate that actual meets or is within 2% of target.

| | | | |

| 2017 ANNUAL REPORT | |  | | 21 |

PERFORMANCE SNAPSHOT

We worked with our partners to deliver on Budget 2016 measures to invest in housing, in addition to existing funding and programs, by:

| · | | delivering social infrastructure investments: | |

| | | | | | | | |

| HOUSING PROGRAM | | $ (MILLIONS) | | | HOUSEHOLDS ASSISTED | |

Investment in Affordable Housing | | | 314.2 | | | | 119,767 | |

Renovation and retrofit (off reserve) | | | 495.0 | | | | 98,635 | |

Affordable housing for seniors | | | 108.4 | | | | 3,611 | |

Shelters for victims of violence | | | 63.0 | | | | 4,720 | |

Northern housing | | | 44.5 | | | | 500 | |

On-reserve programs | | | 59.6 | | | | 2,779 | |

Skills and capacity development (on reserve) | | | 5.5 | | | | 39 | |

| · | | continuing delivery of the Affordable Rental Housing Innovation Fund, which encourages new funding models and innovative building techniques in the rental housing market. As of 31 December 2017, CMHC has committed $33 million under the Innovation Fund to support the creation of 3,700 units, of which 3,648 will be affordable; and | |

| · | | delivering on Budget 2016: we launched the Rental Construction Financing Initiative (RCFi) that provides low-cost insured loans to housing developers, non-profit organizations and municipalities during the earliest stage of rental development. As of 31 December, 2017, CMHC committed $142.6 million under the RCFi to support the creation of 627 units, of which 589 will be affordable. | |

OTHER DEVELOPMENTS

| · | | We took a closer look at the way programs are delivered to First Nation’s communities, including capacity and skills development training, to tailor them to better meet specific needs of those communities and improve upon existing social housing. | |

| · | | We continued to support the goal of Indigenous autonomy, control and self-determination for housing programs and outcomes with our First Nation partners. This has resulted in year-over-year improvements in overall satisfaction on our performance among on-reserve housing managers. | |

| · | | We developed a response and action plan to address recommendations stemming from the National Housing Act Section 95 Housing Program evaluation for on-reserve First Nation communities. | |

| · | | We also managed assets transferred from the Federal Co-operative Housing Stabilization Fund (Fund) since the termination of its Indenture of Trust in April 2010. The assets transferred from the Fund are available to assist co-ops with an index-linked mortgage (ILM) in financial difficulty. Transferred mortgage receivables under administration during the year decreased from $44.1 million to $44.0 million at year end. Other assets transferred from the Fund to us that are available to assist ILM co-ops in financial difficulty were $37.2 million at year end, which included $0.8 million in restricted funds for loan commitments approved but not yet advanced. | |

MANAGING OUR RISKS

REPUTATIONAL RISK

Changing economic conditions have resulted in increased scrutiny on the role that CMHC and the Government play in social housing and the housing market, and the effectiveness of current policies. We undertake a number of proactive strategies and approaches to engage or inform our stakeholders, including advising the Government on options for social housing.

CREDIT RISK

The estimated fair value of loans arising from the Lending programs is $7.9 billion on an outstanding balance of $7.1 billion as at 31 December 2017.

As part of our credit risk management process, we regularly examine annual project level reports, including audited financial statements submitted by social housing project sponsors. These reports enable us to detect potential problems

| | | | |

| 22 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

and intervene, as appropriate, should a project face financial difficulty. Workouts or restructurings, which may involve additional financing or assistance, are determined on a case-by-case basis.

As at 31 December 2017, we are assured full collection of principal and accrued interest on 76% of our loans (2016 – 77%). The remaining 24% of loans (largely under the Municipal Infrastructure Lending Program) are assessed on a regular basis to determine if provisions for loss are necessary.

MARKET RISK

Prepayment risk exists on approximately 6.52% of CMHC’s loans. To evaluate the Corporation’s exposure to this risk, an analysis is performed to estimate the financial impact of CMHC receiving principal ahead of schedule and having to re-invest the funds in today’s investment (interest rate) environment.

CMHC mitigates exposure to interest rate risk in the loan portfolios by hedging using interest rate swaps, and cash flow matching. As at 31 December 2017, 98% of CMHC’s loan portfolio is hedged or matched funded.

Our risk management policies specify that the maximum exposure of the financing margin to interest rate movements with a confidence level of 95% be fixed at $1.5 million over a 12-month horizon. At 31 December 2017, the sensitivity of net interest income to interest rate movements was $1.2 million.

FINANCIAL RESULTS

The following developments contributed to our financial results:

RENTAL CONSTRUCTION FINANCING

In April 2017, we launched the Rental Construction Financing Initiative (RCFi) that will provide $2.5 billion in low-cost loans to support the construction of new rental housing. The initiative was announced as part of Budget 2016 and is expected to fund the construction of 10,000 new rental housing units in Canada. It will provide up to $625 million in loans each year for four years to encourage the development of new rental housing by municipalities, private sector developers and builders and non-profit housing providers.

The Initiative is designed such that we will hold the loans for a period of 10 years, at which point the borrower will need to arrange financing with a CMHC-approved lender. The loans will not be prepayable and we will fund the loans with borrowings from the Government. The loans and the related borrowings, once issued, are reflected in Lending programs of our Assisted Housing activity.

The loans will carry CMHC insurance for the full duration of the amortization period, which could be up to 50 years. The insurance premiums will be received through housing appropriations while applicable provincial sales taxes will be payable by the borrower. Premiums received, earned, and insurance claims and related liabilities are reflected in the Mortgage Loan Insurance Activity.

CAPITAL MANAGEMENT

We maintain a reserve fund pursuant to Section 29 of the CMHC Act. A portion of the Lending program’s earnings are retained in this reserve fund as part of our strategy to address interest rate and credit risk exposure on our loans. Unrealized fair value market fluctuations as well as remeasurement losses on defined benefit plans are absorbed in retained earnings.

We do not hold capital for Housing programs, as this activity does not present risks to the Corporation that would require capital to be set aside.

Refer to the Consolidated Financial Statements note 10—Capital Management for complete disclosure on capital management.

|

ENVISIONING a place to call home |

SUPPORTING CANADIANS IN NEED |

Anca Sultana, director of the Centre Mechtilde, has had the opportunity to reflect proudly on her organization’s accomplishments. The Gatineau, Quebec, centre has been providing shelter and safety for women and their children since 1979. Supported in part by the Social Infrastructure Fund, the group is now breaking ground on a unique project. The centre will deliver 31 transitional housing units and the rejuvenated building will open in the spring of 2018. The affordable units will provide safe housing for women facing homelessness and single mothers experiencing family violence. “Transitional homes help women regain their autonomy and build their self-confidence to prepare them for what’s ahead,” says Anca. “There’s collaboration between residents supporting one another and staff offering knowledge and coaching.” Collaboration is at the heart of the Centre Mechtilde and will be key to further address the needs of women and girls across the country. The National Housing Strategy recognizes that women and girls are disproportionately impacted by housing need. At least one third of investments will go to projects for women, girls, and their families, in recognition of their unique needs. |

| | | | |

| 2017 ANNUAL REPORT | |  | | 23 |

FINANCIAL ANALYSIS

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Net interest income | | | 13 | | | | 13 | |

Parliamentary appropriations for housing programs | | | 3,229 | | | | 2,153 | |

Other income 1 | | | 113 | | | | (22) | |

Total revenues | | | 3,355 | | | | 2,144 | |

Housing programs expenses | | | 3,229 | | | | 2,153 | |

Operating expenses | | | 27 | | | | 17 | |

Total expenses | | | 3,256 | | | | 2,170 | |

Income before income taxes | | | 99 | | | | (26) | |

Income taxes | | | 19 | | | | (12) | |

Net income (loss) | | | 80 | | | | (14) | |

1 Other income includes net gains (losses) on financial instruments.

Total revenues increased by $1,211 million (56%) while total expenses increased by $1,086 million (50%) mainly due to higher parliamentary appropriations for housing programs, $1,075 million of which was increased spending related to new initiatives under Budget 2016.

Other income increased by $135 million (614%) primarily from a $74 million increase in unrealized gains following the revaluation of investment properties. Furthermore, in 2016, we incurred a $51 million realized loss recognized on changes to estimated cash flows on borrowings—other financial liabilities, resulting from planned principal prepayment while net gains on financial instruments in 2017 were nil.

FINANCIAL CONDITION

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Total assets | | | 9,949 | | | | 11,172 | |

Total liabilities | | | 9,715 | | | | 10,976 | |

Total equity of Canada | | | 234 | | | | 196 | |

Total assets have decreased by $1,223 million (11%) primarily due to net repayments on current Lending programs but are expected to grow in future years under RCFi and NHS initiatives. Proceeds received from repayments and our investment activities were used primarily to repay matured Government Borrowings leading to a decrease of $1,261 million (11%) in liabilities.

| | | | |

| 24 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

REPORTING ON USE OF APPROPRIATIONS

The following table reconciles the amount of appropriations authorized by Parliament as available to us during the Government’s fiscal year (31 March) with the total amount recognized by us in our calendar year.

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Amounts provided for housing programs: | | | | | | | | |

Amounts authorized in 2016/17 (2015/16) | | | | | | | | |

Main estimates | | | 2,028 | | | | 2,026 | |

Supplementary estimates A 1,2 | | | 1,070 | | | | – | |

Supplementary estimates B 1,2 | | | 78 | | | | – | |

Less: Portion recognized in calendar 2016 (2015) | | | (1,563) | | | | (1,419) | |

Less: Appropriations lapsed for 2016/17 3 (2015/16) | | | (47) | | | | (17) | |

2016/17 (2015/16) portions recognized in 2017 (2016) | | | 1,566 | | | | 590 | |

Amounts authorized in 2017/18 (2016/17) | | | | | | | | |

Main estimates | | | 2,735 | | | | 2,028 | |

Supplementary estimates A 1,2,4 | | | 41 | | | | 1,070 | |

Supplementary estimates B 1,2,5 | | | 1 | | | | 78 | |

Supplementary estimates C 1,5 | | | 1 | | | | – | |

Total fiscal year appropriations | | | 2,778 | | | | 3,176 | |

Less: Portion to be recognized in subsequent quarters | | | (1,089) | | | | (1,566) | |

Forecasted lapse for 2017/2018 6 (Actual lapse in 2016/2017 3) | | | (26) | | | | (47) | |

2017/18 (2016/17) portions recognized in 2017 (2016) | | | 1,663 | | | | 1,563 | |

Total appropriations recognized—twelve months ended 31 December | | | 3,229 | | | | 2,153 | |

1 Supplementary estimates are additional appropriations voted on by Parliament during the Government‘s fiscal year.

2 Budget 2016 provided funding over two years for investments in social infrastructure, as well as funding over five years for a new Affordable Rental Housing Innovation Fund. Years one and two of these investments are reflected within the 2016-17 and 2017-18 appropriations.

3 Included in our lapse for fiscal year 2016/17 of $47 million was a frozen allotment in the amount of $35 million to reflect the transfer of delivery of the Inuit Housing Funding from CMHC to Indigenous and Northern Affairs Canada. When netted against this frozen allotment, CMHC’s actual lapse was $12 million.

4 Budget 2016 provided funding over four years to support the delivery of the RCFi, while Budget 2017 provided for three years of new funding in support of CMHC’s existing Housing Internship Initiative for First Nations and Inuit Youth program. Funding for year one for both of these programs is reflected in the 2017-18 appropriations ($37 million and $4 million, respectively).

5 Transfer received from other government departments as a result of in-year reallocation of resources related to the Youth Employment Strategy. This additional funding will be used to support the Housing Internship Initiative for First Nations and Inuit Youth program.

6 Included in our forecasted lapse of $26 million for fiscal year 2017/18 is a frozen allotment in the amount of $15 million to reflect the reduction in CMHC’s authorities due to the expiry of long-term operating agreements for existing social housing programs ($13 million) and the reprofiling of funding under the Investment in Affordable Housing program to fiscal year 2019/20 ($2 million). When netted against this frozen allotment, CMHC’s forecasted lapse is $11 million.

| | | | |

| 2017 ANNUAL REPORT | |  | | 25 |

MARKET ANALYSIS AND RESEARCH

WHAT WE DO

We provide accurate and timely evidence-based analysis and insight to support informed decision-making on housing policy matters.

HOW WE DO IT

| · | | We create, interpret and share housing-related information to support informed decision-making by housing policy makers and housing sector stakeholders. | |

| · | | We partner and collaborate with external partners to create and share information. | |

| · | | We undertake research and policy analysis on a range of issues that support a well-functioning housing system, financial stability, and promote housing affordability and choice. | |

PERFORMANCE AGAINST PLAN

OUR GOALS

Canada has a stable, competitive and innovative housing system and Canadians in need have access to affordable and suitable housing.

| | | | | | |

SHORT TERM OUTCOME (12 MONTHS) | | | | ACTUAL * | | TARGET * |

Policy recommendations on the strategic approach and tools needed to fill data gaps are implemented. | | 🌑 | | Policy recommendations were implemented and timelines met including the enhanced partnership with Statistics Canada and the introduction of new quarterly publication on mortgage and credit trends, with two releases in 2017. |

| | |

Government has timely, evidence-based policy advice. | | 🌑 | | Results of evaluations of Investment in Affordable Housing and Section 95 on-reserve non-profit housing programs informed housing policy and program design, including the co-development of the Canada Community Housing Initiative, the Federal/Provincial/Territorial Multilateral Housing Framework and distinctions-based Indigenous strategies under the National Housing Strategy. |

| | | |

| | 🌑 | | 89% of Policy and Research projects and activities on track to meet key milestones | | ³ 85% |

| | | |

Industry and housing stakeholders have timely, relevant information to make informed decisions. | | 🌑 | | 91% of surveyed clients say CMHC information is useful | | ³ 85% |

| | | |

| | 🌑 | | 89% of surveyed clients say new products addressing data gaps are relevant | | ³ 85% |

* As of 31 Dec, 2017 (unless otherwise stated).

● Figure is shaded green to indicate that actual meets or is within 2% of target.

| | |

| MEDIUM TERM OUTCOME (2 TO 3 YEARS) | | INDICATOR |

Comprehensive housing data is available for research, analysis and decision-making. | | Increase in the percentage of surveyed clients saying CMHC information is useful to ³ 90% (from 85%) |

PERFORMANCE SNAPSHOT

We expanded our suite of housing analytics tools and publications by:

| · | | producing user friendly reports and conducting surveys on topics such as mortgage and consumer credit trends, house price spillover effects, and ownership structure in the purpose-built rental market. We also surveyed the motivations of recent home buyers in Vancouver, Toronto and Montreal and finalized a report on escalating house prices in large Canadian cities which was published early in 2018. | |

| | | | |

| 26 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

| | | | | | |

| | | | ENVISIONING a place to call home |

We increased the availability of reliable housing information and data, and advanced open data solutions by: · partnering with organizations including Statistics Canada and UrbanSim (University of California—Berkeley) to strengthen the availability of housing-related data for Canadians; · enhancing surveys and infrastructure such as the Starts and Completions Survey and the annual estimates of housing stock to release new information not previously reported at national and regional levels. OTHER DEVELOPMENTS · We led the implementation of the National Housing Strategy that culminated in the release of a public policy document Canada’s National Housing Strategy: A place to call home on National Housing Day. The document outlines the principles, individual elements and targets of the NHS. Additionally, the preparation of the NHS drew on a number of CMHC research projects specifically undertaken to inform its development. · We hosted a number of events with participation from national, regional, provincial and municipal organizations, universities, and international experts on topics such as women and housing (the first Pan-Canadian Voice for Women’s Housing Symposium in September 2017, in Toronto) and housing finance (Housing Finance Symposium in October, 2017 in Ottawa). These events position CMHC as an international leader in housing and mark important conversations on housing finance. MANAGING OUR RISKS REPUTATIONAL RISK In order to meet client needs, the information and advice that we provide must be timely, relevant and accurate. A wide range of communication approaches and platforms are used to share information resulting from our market analysis and research. Communications and marketing, including stakeholder and media relations activities, promote CMHC’s knowledge creation and sharing role. Internal and external clients are consulted to ensure our priorities reflect information gaps and policy and research needs. In addition, surveys are conducted to measure the usefulness of our information products. | | | | | | STRENGTHENING OUR PARTNERSHIPS |

| | | | | | As Canada’s authority on housing, we want to make sure that Canadians understand the factors that influence the housing market and help them make informed decisions when looking for a place to call home. We want to have the answers to their questions, and that means getting better data so that we have a complete picture of Canada’s housing markets. In 2017, we signed a memorandum of understanding with Statistics Canada to strengthen our partnership and bring together our expertise to help better identify and address data gaps. We’re also working with Statistics Canada to develop the Canadian Housing Statistics Program (CHSP), which aims to provide detailed, comprehensive data on housing for all of Canada. Together, through the CHSP, we’ve already released data on foreign ownership in Toronto and Vancouver. |

| | | | | | |

| | | | | | |

FINANCIAL RESULTS

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Assisted housing recovery | | | 62 | | | | 56 | |

Mortgage loan insurance recovery | | | 19 | | | | 17 | |

Total revenue | | | 81 | | | | 73 | |

Market analysis | | | 46 | | | | 41 | |

Research | | | 35 | | | | 32 | |

Total expenses | | | 81 | | | | 73 | |

Net income | | | – | | | | – | |

Market analysis and research activities are cost-recovered from revenues from Assisted Housing’s parliamentary appropriations for housing programs, as well as under the Mortgage Loan Insurance Activity.

Total expenses increased by $8 million (11%) in 2017 as we invested additional resources

to support the development of the National Housing Strategy. In addition, we experienced

an increase in operating expenses due to our technology and business transformation initiative.

| | | | |

| 2017 ANNUAL REPORT | |  | | 27 |

MORTGAGE LOAN INSURANCE

WHAT WE DO

We provide competitive insurance products and industry-leading client service to support access to housing finance and stability in Canada’s housing and financial markets.

HOW WE DO IT

| · | | We work closely with partners throughout the mortgage industry to help Canadians make informed housing decisions. |

| · | | We offer exclusive support as Canada’s only mortgage loan insurer for multi-unit residential properties. |

OUR PRODUCTS

Transactional homeowner insurance is mandatory for federally regulated lenders in Canada when a homebuyer has less than a 20% down payment and is also available to homebuyers that have more than a 20% down payment. By protecting the lender against borrower default, we allow qualified borrowers to access homeownership at interest rates comparable to those available to buyers with larger down payments.

Portfolio insurance allows for low-ratio residential mortgages (1-4 unit properties) to be gathered into pools and insured for the purpose of creating mortgage-backed securities through CMHC’s securitization programs. Portfolio insurance supports competition in the mortgage lending industry, expanding choice for Canadian homebuyers.

Multi-unit residential insurance protects the lender against borrower default on loans for the construction, purchase and refinancing of multi-unit residential properties (5+ unit properties). We are Canada’s only mortgage loan insurer for multi-unit residential properties and our exclusive support helps ensure that Canadians have access to a range of housing options.

| | |

ENVISIONING a place to call home |

| | | EXPANDING OUR PRODUCTS TO INCREASE AFFORDABLE RENTAL OPTIONS FOR CANADIANS |

| | | Our products and services facilitate access to housing for all Canadians, not just homebuyers. The rental market is an important housing option for approximately 30% of Canadians. It is important for us to address these needs while supporting efforts to grow and preserve the supply of affordable housing. That’s why, in 2017, we launched a series of enhancements to our multi-unit mortgage loan insurance. This included policy changes designed to expand our participation in key rental market segments, including standard rental housing, single room occupancy projects, student housing, retirement homes and supportive housing projects. We also enhanced our flexibilities for affordable housing, introduced greater underwriting flexibilities and revised our premium schedule. These changes have resonated with multi-unit borrowers, who say our support is making a difference and contributing to the financial and social success of all types of residential properties. Additionally, we saw our total number of insured multi-unit volumes increase compared to 2016 and, for the first time in many years, eclipse our transactional homeowner volumes in terms of number of units insured. These changes have helped set the stage for our mortgage loan insurance products to further contribute to helping Canadians meet their rental housing needs. |

| | | | |

| 28 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

PERFORMANCE AGAINST PLAN

OUR GOALS

Canada has a stable, competitive and innovative housing system.

| | | | | | |

SHORT TERM OUTCOME (12 MONTHS) | | | | ACTUAL * | | TARGET * |

A range of mortgage insurance products and pricing is provided—spanning the spectrum of needs—and CMHC has a presence in all regions throughout the economic lifecycle. | | 254,252 insured homes through our products: 1 Transactional homeowner: 113,374 Multi-unit: 119,738 Portfolio: 21,140 | | For monitoring purposes, no target is set. |

| | | |

| | 🌑 | | 64.9% of applications insured were from first time buyers | | ³ 60% |

| | | |

| | 🌑 | | 13.6% of applications insured were from rural areas | | ³ 13.5% |

| | | |

MEDIUM TERM OUTCOME (2 TO 3 YEARS) | | | | ACTUAL * | | TARGET * |

Access to housing financing is facilitated through evolving services and products in a competitive and profitable mortgage insurance marketplace. | | 67.8% of Canadian households own their homes based on the 2016 Census of Population | | For monitoring purposes, no target is set. |

| | | |

| | 🌑 | | Operating expense ratio at 20.4% | | £ 23.8% (£ 21% by 2020) |

| | | |

| | 🌑 | | Percentage minimum capital required at 184% | | ³ 165% (³ 165% by 2020) |

| | | |

| | 🌑 | | Insurance-In-Force at $480B | | £ $512B |

| | | |

| | | | | | |

| | | |

Canadians have access to competitive mortgage insurance products that span the spectrum of their needs. | | 🌑 | | 64.9% of applications insured were from first time buyers | | ³ 60% (maintain the target in the medium term) |

| | | |

| | 🌑 | | 13.6% of applications insured were from rural areas | | ³ 13.5% (maintain the target in the medium term) |

| | | |

CMHC contributes to the stability of the housing finance system throughout the economic life cycle. | | 🌑 | | Return on capital holding target at 13.6% | | ³ 11% (Return on Required Equity ³ 10.7% by 2020) |

* As of 31 Dec, 2017 (unless otherwise stated).

1 Includes only new volumes, does not include lender substitutions

● Figure is shaded green to indicate that actual meets or is within 2% of target.

PERFORMANCE SNAPSHOT

We repositioned our multi-unit insurance business line and redeveloped our product offering by:

| · | | delivering the biggest package of multi-unit policy and product changes in nearly two decades, enhancing our definition of affordability, and introducing greater underwriting flexibilities and a revised premium schedule. | |

We evolved our mortgage loan insurance products to best serve Canadian borrowers and lenders by:

| · | | making changes to the Handbook for CMHC Approved Lenders to clarify the underwriting and administration of insured loans; | |

| · | | providing new Guaranteed Valuation Services for Lender property risk management through enhancements to the emili Low Ratio Assessment tool, improving available data used for mortgage risk analysis and model development required for future housing risk management solutions; and | |

| · | | adopting the Enhanced Claims Service as a permanent claim operating model, delivering efficiencies and costs savings to our clients. | |

| | | | |

| 2017 ANNUAL REPORT | |  | | 29 |

We provided policy advice to the government on the appropriate evolution of our role in housing finance by:

| · | | investigating measures to reduce vulnerabilities associated with high debt levels and rising house prices; | |

| · | | developing an action plan to reduce mortgage fraud in housing finance; and | |

| · | | assessing options for lender risk sharing. | |

OTHER DEVELOPMENTS

| · | | Delivered on Budget 2016 – Launched the Rental Construction Financing Initiative (RCFi) that provides low-cost insured loans to housing developers, non-profit organizations and municipalities during the earliest stage of rental development. The loans and the related borrowings, once issued, are reflected in our Assisted Housing activity. The loans will carry CMHC insurance for the full duration of the amortization period, which could be up to 50 years. The insurance premiums will be received through housing appropriations while applicable provincial sales taxes will be payable by the borrower. Premiums received, earned, and insurance claims and related liabilities are reflected in the Mortgage Loan Insurance Activity. As of 31 December, 2017, CMHC committed $142.6 million under the RCFi to support the creation of 627 units, of which 589 will be affordable. The financial impact of the lending activities is reflected in the Assisted Housing chapter. | |

MANAGING OUR RISKS

STRATEGIC RISK

Our market share is directly linked to the Canadian housing market and is influenced by a number of factors including interest rate trends, house price inflation, the unemployment rate, government regulation and competition within the Canadian housing finance market. Any change in the business environment, including actions by competitors and clients, could result in a change in our market share.

INSURANCE RISK

We assume the risk of loss from borrower default through mortgage insurance contracts entered into with lenders, exposing us to the uncertainty surrounding the timing, frequency and severity of future claims. We assess risks related to insurance for different types of residential properties using either our proprietary automated mortgage loan insurance risk assessment and approval system or a rigorous underwriting process, including a fraud management framework.

CREDIT RISK

We are exposed to credit risk from various sources directly and indirectly, including directly from investment and hedging activities. We mitigate our credit risk exposure through a variety of means including minimum credit rating requirements, issuer/group exposure limits, diversification limits, term restrictions and collateral.

MARKET RISK

We manage market risk through our strategic asset allocation process, which includes consideration of overall risk and return in selecting a specific asset allocation strategy, benchmarks, risk tolerances and controls.

FINANCIAL RESULTS

The following developments contributed to our financial results.

MORTGAGE LOAN INSURANCE PREMIUMS

As part of our 2016 annual review of insurance products, we increased transactional homeowner as well as portfolio mortgage insurance premiums to reflect the higher regulatory capital requirements mandated by OSFI. For the average CMHC-insured homebuyer, the higher transactional premium will result in an increase of approximately $5 to their monthly mortgage payment.

We also revised our premium schedule for multi-unit properties effective 15 May, 2017 to continue to support government efforts to expand and preserve the supply of affordable rental housing in key market segments that address the rental needs of Canadians. These segments include standard rental housing, student housing, single room occupancy projects, retirement homes and supportive housing projects.

| | | | |

| 30 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

AFFORDABLE RENTAL HOUSING

In addition to the revised premium schedule noted above, we introduced other changes to our multi-unit residential mortgage loan insurance effective 15 May, 2017 to encourage increases in the construction, purchase and refinancing of affordable rental housing options. These changes include greater underwriting flexibilities, such as higher loan-to-value ratios and lower debt coverage ratios.

CAPITAL MANAGEMENT

Our capital management framework follows OSFI regulations with respect to the use of the MCT for insurance companies. Refer to the Consolidated Financial Statements note 10—Capital Management for complete disclosure on capital management.

The table below presents our capital management ratios as at 31 December.

| | | | | | | | |

| (IN PERCENTAGES) | | 2017 | | | 2016 | |

Capital available to minimum capital required (% MCT) | | | 184 | | | | 384 | |

The ratio of capital available to minimum capital required decreased by 200 percentage points due to:

| · | | OSFI’s revised capital advisory for mortgage insurers implemented on 1 January 2017 which resulted in an increase in minimum capital required; and | |

| · | | a decrease in capital available driven by the declaration of $4,675 million in dividends. | |

We remain adequately capitalized as at 31 December 2017.

FINANCIAL METRICS

| | | | | | | | |

| (IN MILLIONS, UNLESS OTHERWISE INDICATED) | | 2017 | | | 2016 | |

Insurance-in-force ($B) | | | 480 | | | | 512 | |

Transactional homeowner | | | 249 | | | | 264 | |

Portfolio | | | 162 | | | | 185 | |

Multi-unit residential | | | 69 | | | | 63 | |

Insured volumes (units) | | | 294,899 | | | | 452,321 | |

Transactional homeowner | | | 113,374 | | | | 156,414 | |

Portfolio 1 | | | 61,787 | | | | 187,200 | |

Multi-unit residential | | | 119,738 | | | | 108,707 | |

Insured volumes | | | 53,569 | | | | 84,275 | |

Transactional homeowner | | | 29,612 | | | | 38,601 | |

Portfolio 1 | | | 12,502 | | | | 37,047 | |

Multi-unit residential | | | 11,455 | | | | 8,627 | |

Premiums and fees received | | | 1,438 | | | | 1,558 | |

Transactional homeowner | | | 996 | | | | 1,166 | |

Portfolio | | | 60 | | | | 91 | |

Multi-unit residential | | | 382 | | | | 301 | |

Claims paid 2 | | | 329 | | | | 377 | |

Transactional homeowner | | | 268 | | | | 316 | |

Portfolio | | | 19 | | | | 23 | |

Multi-unit residential | | | 42 | | | | 38 | |

1 Portfolio volumes have been modified to include Lender substitutions along with new business volumes. Portfolio substitutions were 40,647 units and $7,337 million in 2017 (96,525 units and $12,920 million in 2016)

2 Claims paid does not include social housing mortgage and index-linked mortgage claims.

| | | | |

| 2017 ANNUAL REPORT | |  | | 31 |

Insurance-in-force decreased by $32 billion (6%) due to lower volumes insured in the current year compared to recent years, and run-off of existing policies-in-force. New loans insured were $54 billion, while estimated loan amortization and pay-downs were $86 billion.

Lower transactional homeowner volumes were the result of a decrease in purchase and refinance volumes. This was largely as a consequence of the new regulations announced by the Government. In addition, portfolio volumes were down due to new pricing introduced January 1, 2017 as a result of the increased Capital requirements. In contrast, the increases in multi-unit residential volumes were attributable to more multi-unit residential purchase and refinance transactions mainly because of a continued low interest rate environment.

Total premiums and fees received decreased by $120 million (8%). Lower volumes in transactional and homeowner products were partially offset by higher multi-unit residential volumes as discussed above, resulting in an overall decrease in premiums and fees received. Partially offsetting this decrease was the price increases that took effect during the first quarter of 2017.

The decrease in claims paid of $48 million (13%) is primarily due to a reduction in the number of claims for transactional homeowner and portfolio in British Columbia, Ontario, Quebec and the Atlantic region resulting from stronger economic conditions.

| | | | | | | | | | | | | | | | |

| | | 2017 | | | 2016 | |

| | | NO. OF

DELINQUENT

LOANS | | | ARREARS RATE | | | NO. OF

DELINQUENT

LOANS | | | ARREARS RATE | |

Transactional homeowner | | | 5,376 | | | | 0.43% | | | | 6,456 | | | | 0.48% | |

Portfolio | | | 1,362 | | | | 0.13% | | | | 1,563 | | | | 0.13% | |

Multi-unit residential | | | 106 | | | | 0.48% | | | | 94 | | | | 0.43% | |

Total | | | 6,844 | | | | 0.29% | | | | 8,113 | | | | 0.32% | |

The arrears rate includes all loans more than 90 days past due as a percentage of outstanding insured loans. CMHC’s overall arrears rate decreased as a result of the lower delinquencies for the transactional homeowner and portfolio products. New reported delinquencies were lower because of decreases in all regions except Saskatchewan and the Territories which is consistent with the economic trends for these regions.

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Premiums and fees earned | | | 1,557 | | | | 1,505 | |

Investment income | | | 607 | | | | 594 | |

Other income 1 | | | 156 | | | | 58 | |

Total revenues | | | 2,320 | | | | 2,157 | |

Insurance claims | | | 147 | | | | 334 | |

Operating expenses | | | 318 | | | | 256 | |

Total expenses | | | 465 | | | | 590 | |

Income before income taxes | | | 1,855 | | | | 1,567 | |

Income taxes | | | 451 | | | | 384 | |

Net income | | | 1,404 | | | | 1,183 | |

1 Other income includes net gains (losses) on financial instruments and other income.

Premiums and fees earned increased by $52 million (3%) primarily due to higher premiums received in previous years being earned over time. This increase was partially offset by a revision to the earning patterns in the fourth quarter of 2017, which reflects emerging claim experience for transactional homeowner insurance over recent years.

Other income increased by $98 million (169%) mainly from net realized gains on the sale of investments securities as we rebalanced our portfolio to align with our investment policy.

| | | | |

| 32 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

Insurance claims dropped by $187 million (56%) due to a decrease in policies-in-force and improvements in the unemployment rate throughout Canada. A significant appreciation in house prices, especially in Ontario and British Columbia was also a contributing factor. These stronger economic conditions led to a decrease in incurred claims and a reduction in our incurred but not reported provision. In addition, we reduced our provision for social housing and index-linked mortgages because a decline in outstanding loan balances reduced our exposure. To reflect expected future cash flows, we reduced our allowance on our workout loans.

Operating expenses increased by $62 million (24%) mainly as a result of higher costs from our technology and business transformation initiative.

RATIOS

| | | | | | | | |

| (IN PERCENTAGES) | | 2017 | | | 2016 | |

Loss ratio | | | 9.4 | | | | 22.2 | |

Operating expense ratio | | | 20.4 | | | | 17.0 | |

Combined ratio | | | 29.8 | | | | 39.2 | |

Severity ratio | | | 32.2 | | | | 31.9 | |

Return on equity | | | 8.3 | | | | 6.5 | |

Return on capital holding target | | | 13.6 | | | | 11.6 | |

The loss ratio decreased by 12.8 percentage points primarily because of a decrease in insurance claims and higher premiums and fees earned, as explained above. The operating expense ratio increased by 3.4 percentage points due to higher operating expenses, partially offset by higher premiums and fees earned, as explained above. The combined ratio is the sum of the loss ratio and operating expense ratio and reflects the variation in each.

The return on equity increased by 1.8 percentage points due to higher net income and lower capital base as a result of the return of excess capital to the Government through our dividend payments.

The return on capital holding target increased by 2.0 percentage points mainly due to higher adjusted net income.

FINANCIAL CONDITION

| | | | | | | | |

| (IN MILLIONS) | | 2017 | | | 2016 | |

Cash, cash equivalents, investment securities and derivatives | | | 23,042 | | | | 25,300 | |

Accrued interest receivable | | | 140 | | | | 149 | |

Investment properties, accounts receivable and other assets | | | 667 | | | | 616 | |

Total assets | | | 23,849 | | | | 26,065 | |

Securities sold under repurchase agreements | | | 297 | | | | 704 | |

Accounts payable and other liabilities and derivatives | | | 114 | | | | 113 | |

Dividend payable | | | 2,000 | | | | – | |

Provision for claims | | | 555 | | | | 654 | |

Unearned premiums and fees | | | 5,352 | | | | 5,472 | |

Defined benefit plans liability | | | 266 | | | | 226 | |

Deferred income tax liabilities | | | 68 | | | | 80 | |

Total liabilities | | | 8,652 | | | | 7,249 | |

Total equity of Canada | | | 15,197 | | | | 18,816 | |

Cash, cash equivalents, investment securities and derivatives decreased by $2,258 million (9%) to fund our dividend payments. Investment properties, accounts receivable and other assets increased by $51 million (8%) primarily due to the reduction of the allowance on our workout loans.

| | | | |

| 2017 ANNUAL REPORT | |  | | 33 |

During 2017, we started declaring dividends to return excess capital to the Government. At 31 December 2017, $2,000 million of the $4,000 million special dividend remains to be paid to the Government.

Securities Sold Under Repurchase Agreements decreased by $407 million (58%) as a result of a decrease in repo market investment opportunities. We enter into repo transactions to generate additional income.

Provision for claims decreased by $99 million (15%) because of a reduction in policies in force and stronger economic conditions, which led to an improvement in arrears and a decline in our incurred but not reported and social housing and index-linked mortgages provision. Unearned premiums and fees went down by $120 million (2%) primarily attributable to lower premiums and fees received in 2017.

Total equity of Canada decreased by $3,619 million (19%) following the declaration of $4,675 in dividends to the Government partially offset by net income of $1,404 million in 2017.

FINANCIAL OUTLOOK

On 19 October 2017, OSFI released a revised Minimum Capital Test (MCT) Guideline (the new MCT Guideline) for federally regulated property and casualty insurers with an effective date of 1 January 2018. The new MCT Guideline removes requirements that are no longer applicable. It also aligns the terminology and with examples to the quarterly statutory returns for consistency.

We do not expect a material impact to our capital position in the Mortgage Loan Insurance activity as a result of the new MCT Guideline.

| | | | |

| 34 | |  | | CANADA MORTGAGE AND HOUSING CORPORATION |

SECURITIZATION

WHAT WE DO

We enable approved financial institutions to pool eligible mortgages into marketable securities that can be sold to investors to generate funds for residential mortgage financing. We also guarantee the timely payment of interest and principal of these securities.

We also administer the Canadian registered covered bond programs legal framework on behalf of the Government of Canada, which is another source of mortgage funding.

HOW WE DO IT

| · | | We deliver the National Housing Act Mortgage-Backed Securities (NHA MBS) program. | |

| · | | We provide lenders with a reliable source of mortgage financing through the Canada Housing Trust. | |

| · | | We oversee the Canadian registered covered bond programs legal framework and operate it on a cost recovery basis. | |

OUR PRODUCTS

| · | | National Housing Act Mortgage-Backed Securities—The NHA MBS program provides mortgage financing for approved financial institutions by transforming insured residential mortgages into marketable securities. Investors in these securities receive principal and interest payments that are guaranteed by CMHC and therefore backed by the Government. | |

| · | | Canada Mortgage Bonds (CMB)—The Canada Housing Trust (CHT) provides lenders with a reliable source of mortgage financing by selling CMB to investors and using the proceeds to purchase newly issued NHA MBS. The CHT collects the monthly cash flows of the underlying NHA MBS mortgages and converts these into fixed interest payments and principal at maturity. The timely payment of interest and principal is guaranteed by CMHC and therefore backed by the Government. | |