EXHIBIT 2

CANADA MORTGAGE AND HOUSING CORPORATION

2006 ANNUAL REPORT

12

TODAY’S OPPORTUNITIES,

TOMORROW’S SUCCESSES

Canada Mortgage and Housing Corporation

2006 Annual Report

Our Mission

Promote housing quality, affordability and choice for Canadians.

TABLE OF CONTENTS

| | | | | |

| | 7 | | | |

| | | | | |

| | 13 | | | |

| | | | | |

| | 20 | | | |

| | | | | |

| | 22 | | | |

| | | | | |

| | 55 | | | |

| | | | | |

| | 56 | | | |

| | | | | |

| | 65 | | | |

| | | | | |

| | 73 | | | |

| | | | | |

| | 105 | | | |

FORWARD-LOOKING STATEMENTS

CMHC’s Annual Report contains forward-looking statements regarding objectives, strategies and expected financial results. There are risks and uncertainties beyond the control of CMHC that include, but are not limited to, economic, financial, and regulatory conditions nationally and internationally. These factors, among others, may cause actual results to differ substantially from the expectations stated or implied by forward-looking statements.

Ce rapport est aussi disponible en français.

CMHC IS CANADA’S NATIONAL HOUSING AGENCY

In support of our three corporate objectives, we were engaged in a wide variety of activities in 2006 aimed at helping canadians meet their housing needs.

WE HELPED CANADIANS IN NEED

| ... | | by working with our partners to secure commitments of 6,000 new affordable housing units under the Affordable Housing Initiative, and another 3,400 units through our Partnership Centre |

| |

| ... | | by investing $1.8 billion to assist over 630,000 households who live in social housing |

| |

| ... | | by providing financial assistance to some 20,500 low-income housing units for much needed housing renovation |

| |

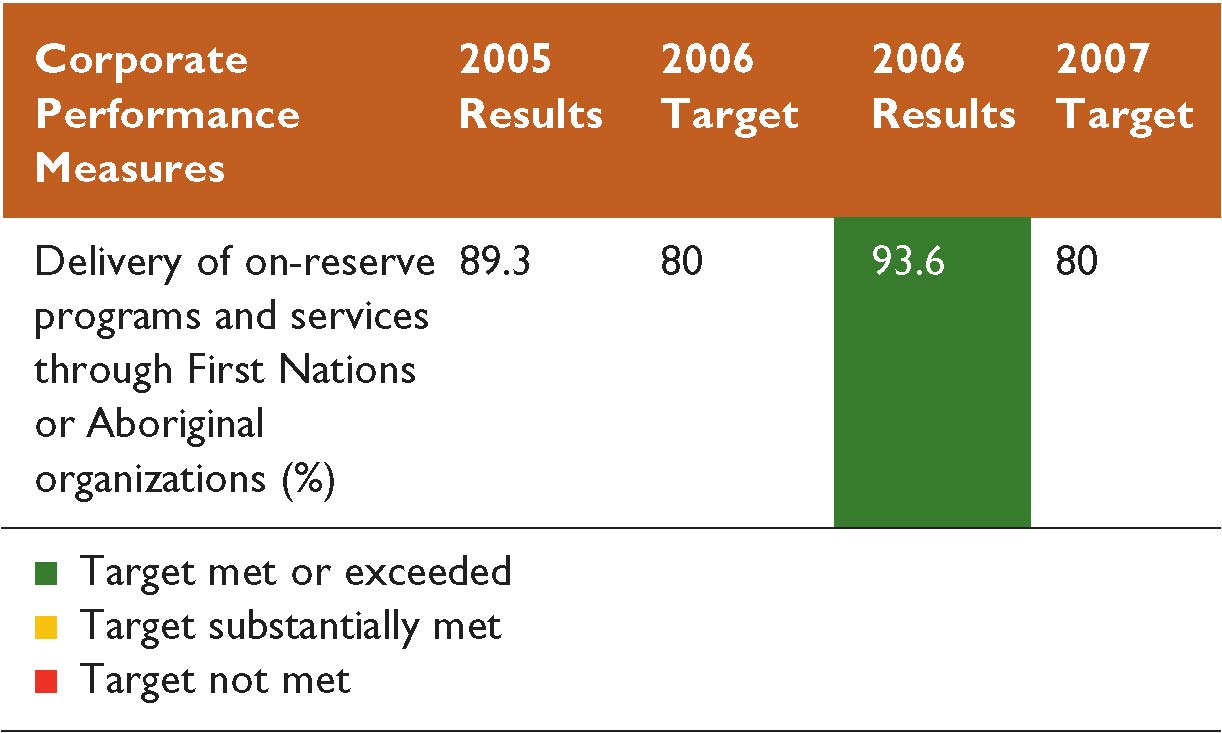

| ... | | by working with our partners to create conditions that encouraged delivery of over 90 per cent of our housing programs on-reserve by First Nations and Aboriginal organizations |

| |

| ... | | by working with First Nations to establish market housing on-reserve where desired by them |

WE FACILITATED ACCESS TO MORE AFFORDABLE, BETTER QUALITY HOUSING FOR ALL CANADIANS

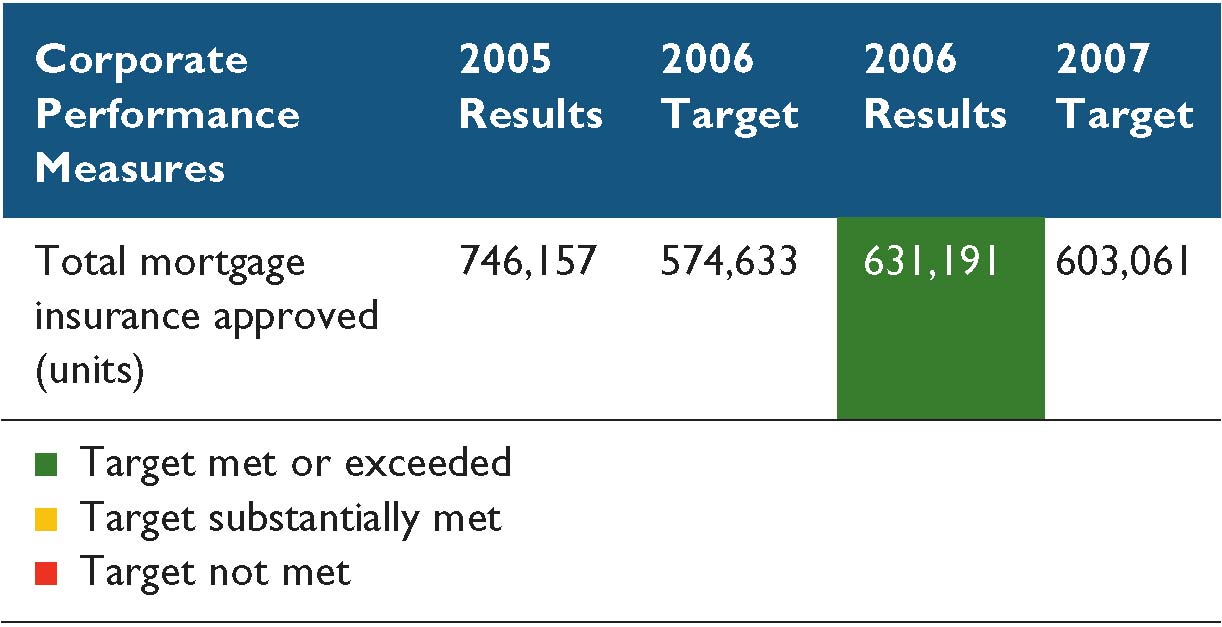

| ... | | by facilitating access to low-cost mortgages with the approval of approximately 631,000 mortgage insurance applications |

| |

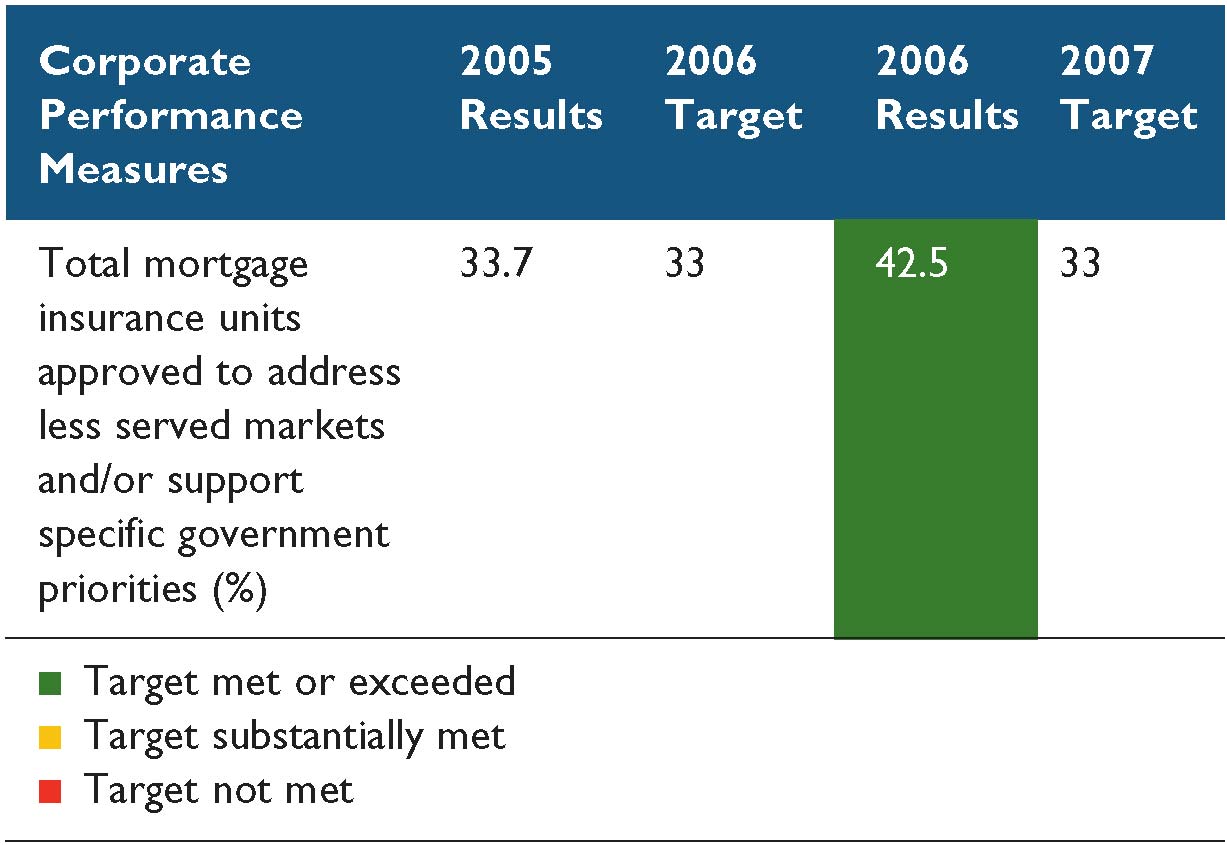

| ... | | by committing more than forty per cent of our mortgage insurance business in market segments not served or not well-served by the private sector |

| |

| ... | | by introducing new mortgage insurance products, such as our Flex 100 and 40-year Amortization, to better meet the needs of Canadians |

| |

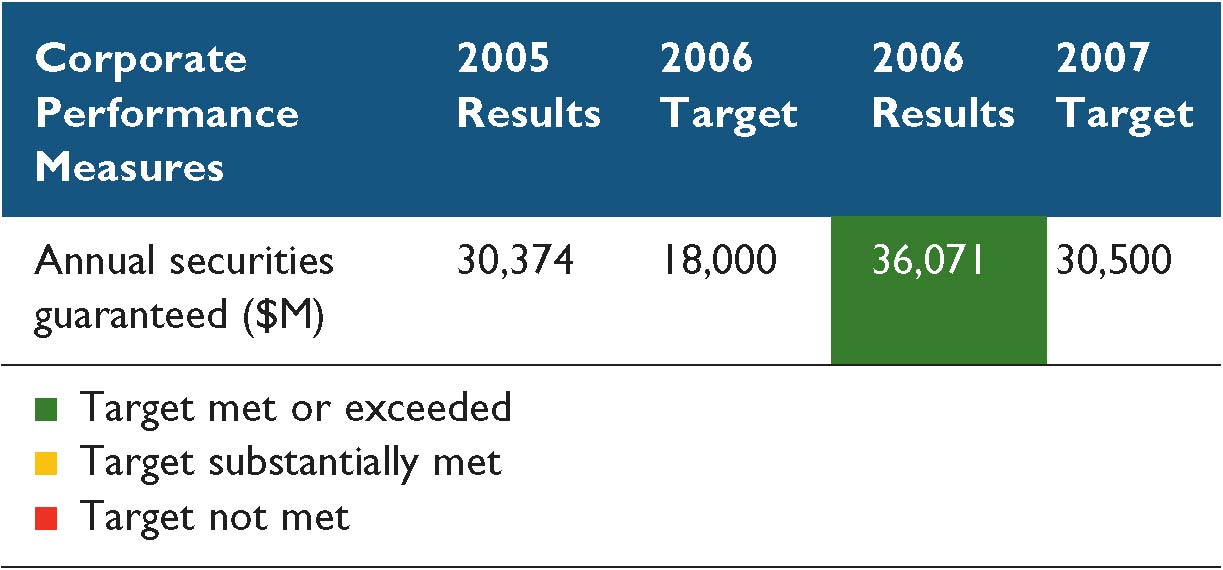

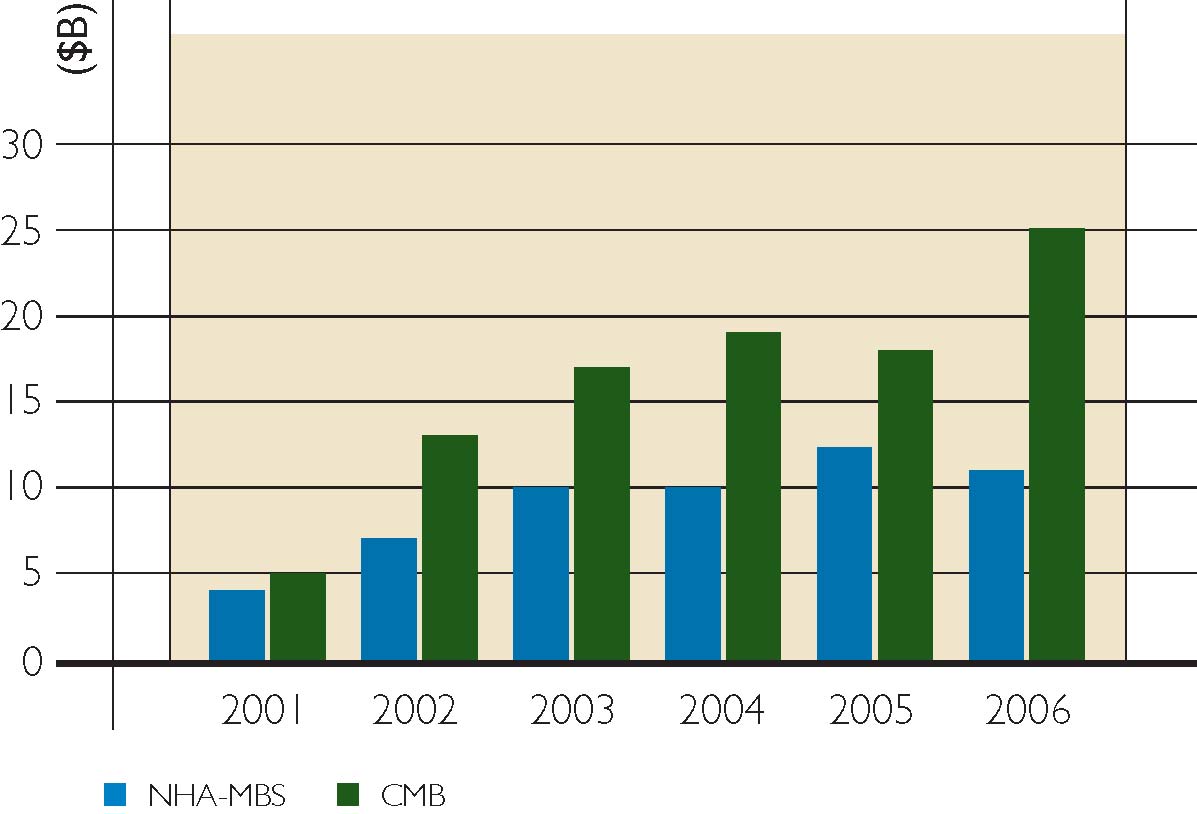

| ... | | by guaranteeing more than $36 billion in mortgage-related securities, ensuring a steady supply of low-cost funds for mortgage lending |

| |

| ... | | by providing objective and reliable housing research and market analysis products that meet the needs of the housing industry and consumers |

WE ENSURED THE CANADIAN HOUSING SYSTEM REMAINS ONE OF THE BEST IN THE WORLD

| ... | | by insuring 40 per cent of the Canadian residential mortgage market |

| |

| ... | | by continually enhancing our state-of-the-art automated mortgage insurance approval system, emili |

| |

| ... | | by increasing the knowledge and awareness of sustainable practices and standards and their impact on the environment through initiatives such as our EQuilibrium healthy housing initiative |

| |

| ... | | by advising the Government of Canada on matters of housing policy |

| |

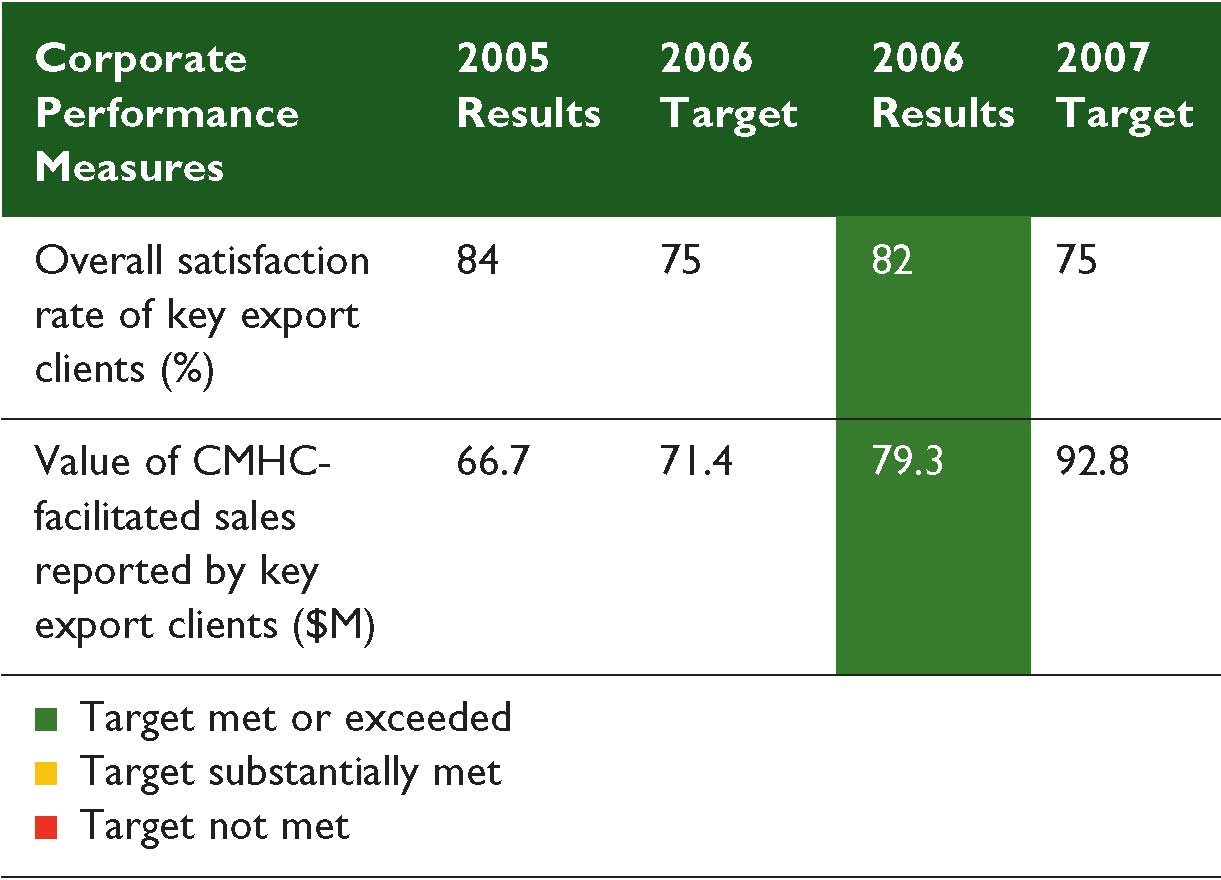

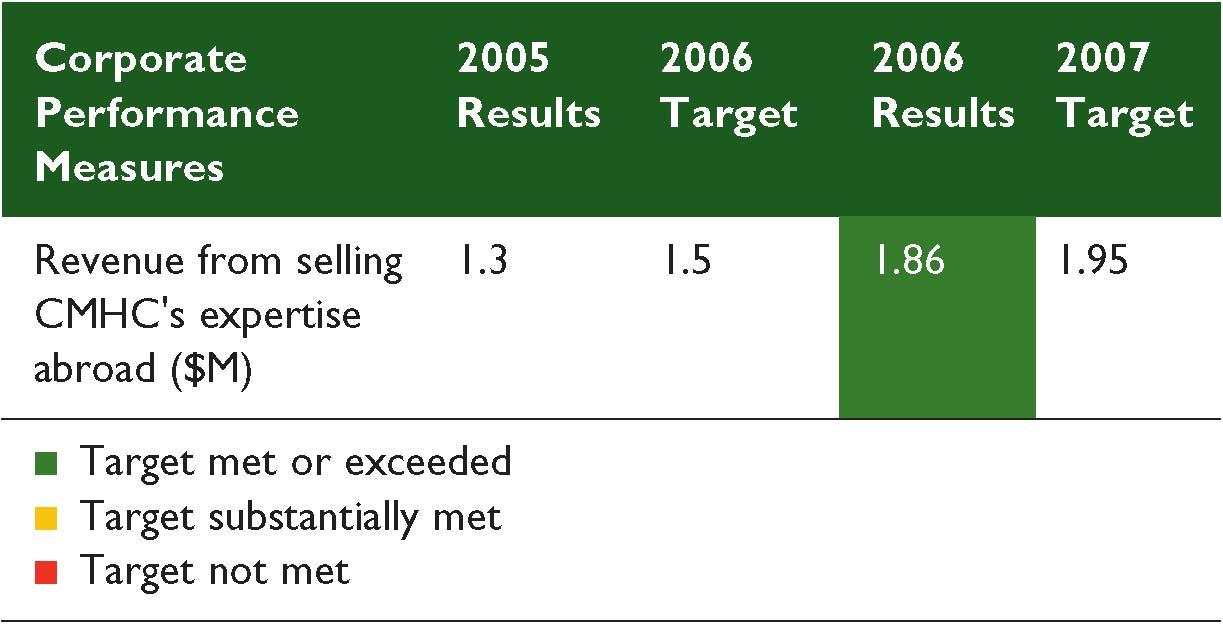

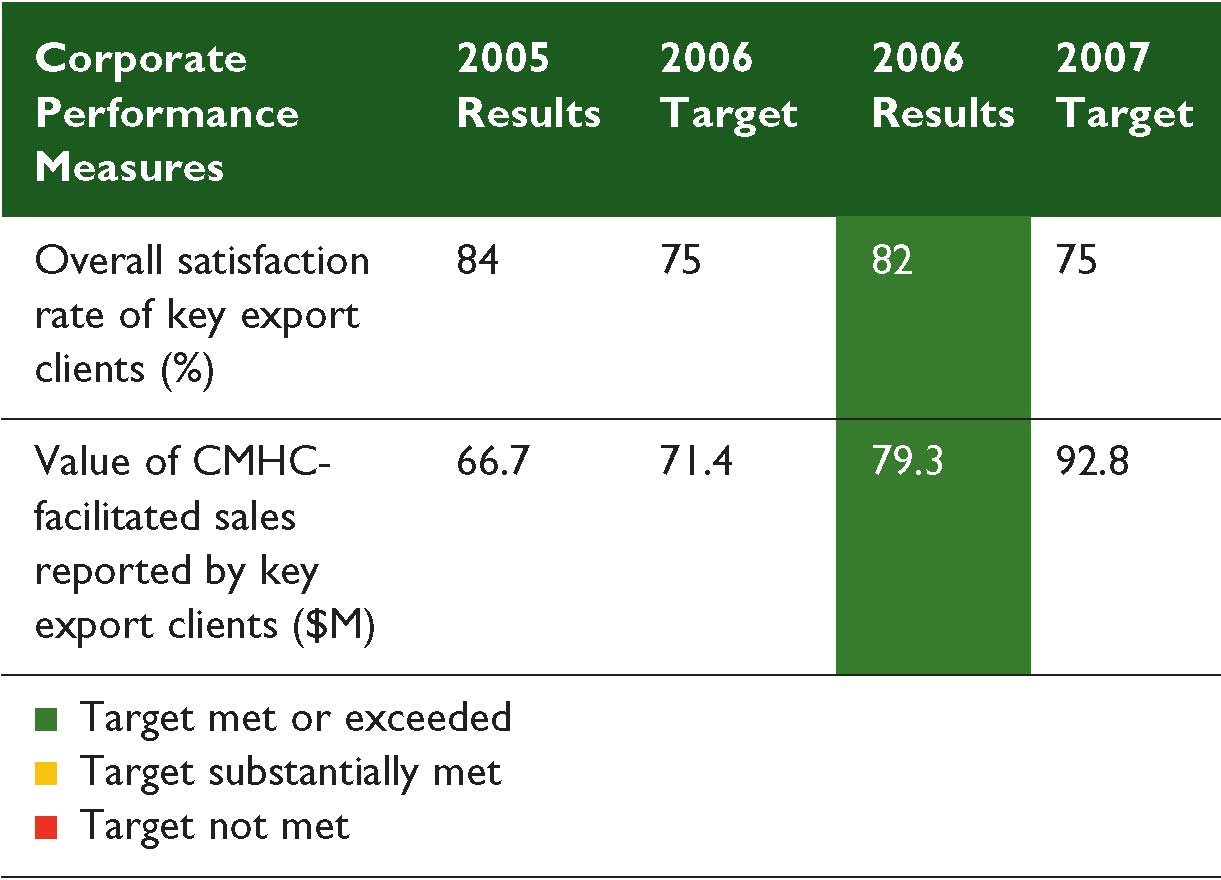

| ... | | by being a partner to the Canadian housing export industry leading to a near 20 per cent increase in client sales in key markets and almost 900 jobs for Canadians |

| |

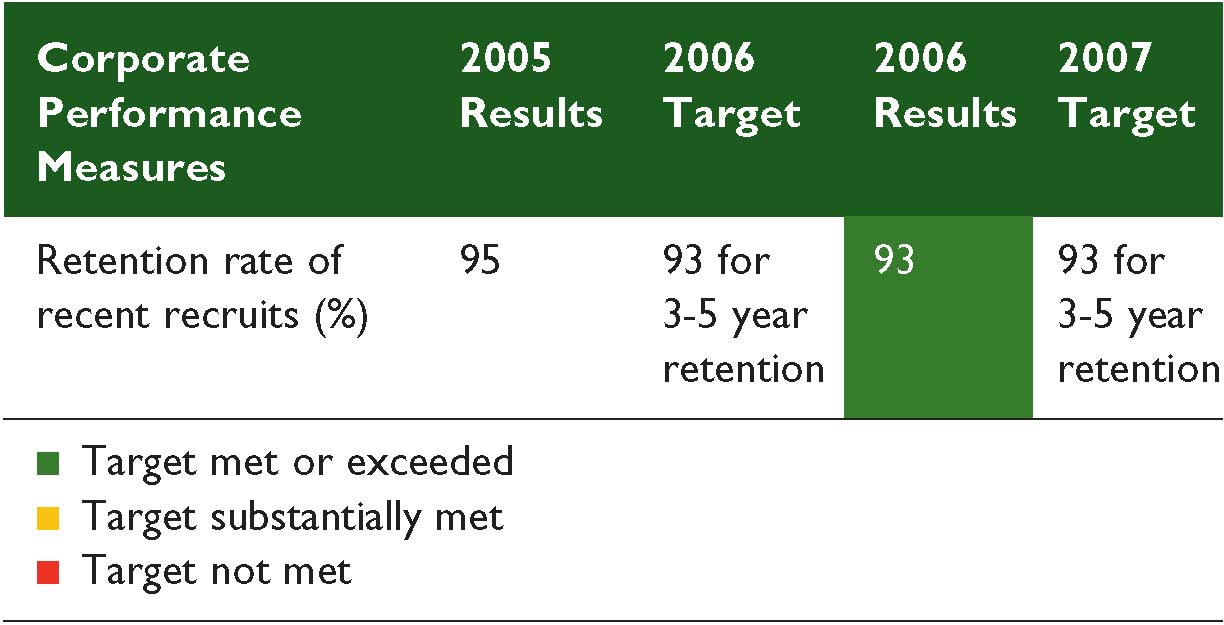

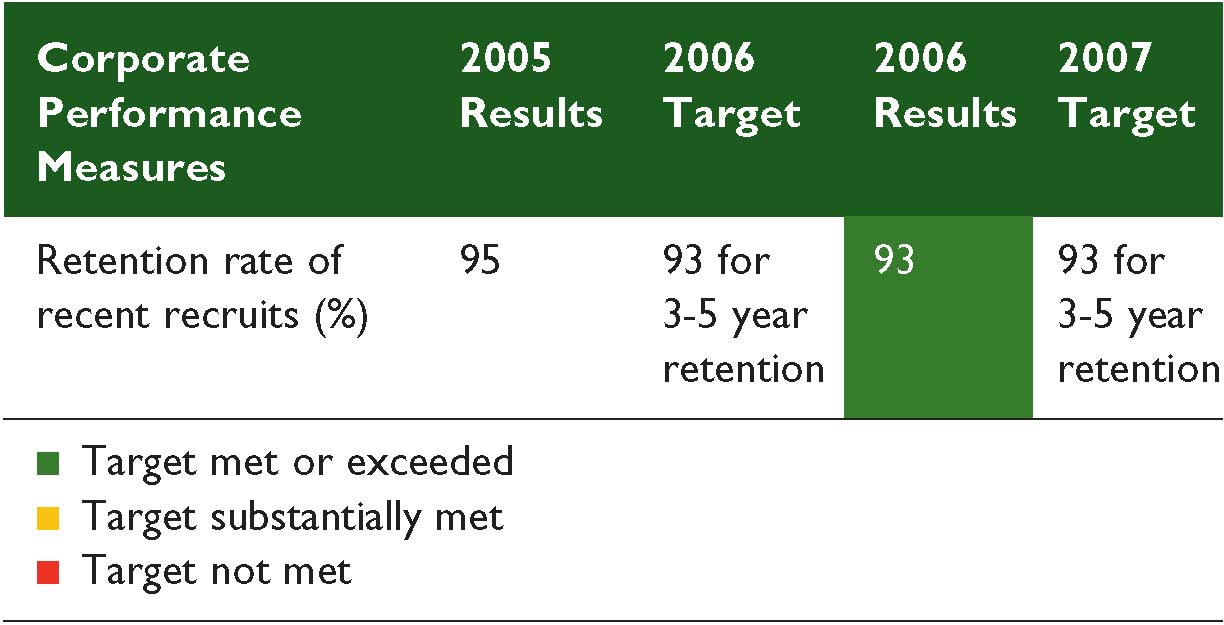

| ... | | by ensuring CMHC remains a strong organization, by introducing innovations such as new human resources management tools to help us attract and retain the talent we need to fulfill our mandate |

1

| | | | | | | | | | | | | | | | | |

| Financial Performance | | 2004 Actual | | 2005 Actual | | 2006 Actual | | 2006 Plan |

| |

| Total Assets ($M) | | | 81,008 | | | | 101,093 | | | | 124,218 | | | | 107,111 | |

| |

| Total Liabilities ($M) | | | 77,582 | | | | 96,665 | | | | 118,764 | | | | 101,802 | |

| |

| Total Equity ($M) | | | 3,426 | | | | 4,428 | | | | 5,454 | | | | 5,309 | |

| |

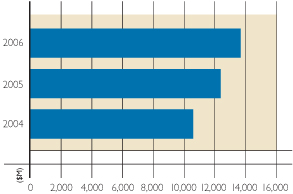

| Total Revenues ($M) | | | 6,560 | | | | 7,334 | | | | 8,262 | | | | 7,971 | |

| |

| Total Expenses ($M) | | | 5,161 | | | | 5,870 | | | | 6,780 | | | | 6,541 | |

| |

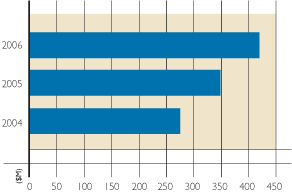

| Net Income ($M) | | | 950 | | | | 1,002 | | | | 1,026 | | | | 965 | |

| |

| Staff-Years | | | 1,814 | | | | 1,804 | | | | 1,877 | | | | 1,917 | |

| |

Financial prudence and strategic planning ensure we remain in sound financial health, and are able to continue our mission of promoting housing quality, affordability and choice for Canadians.

Residential Rehabilitation Assistance Program project in Brantford, Ontario.

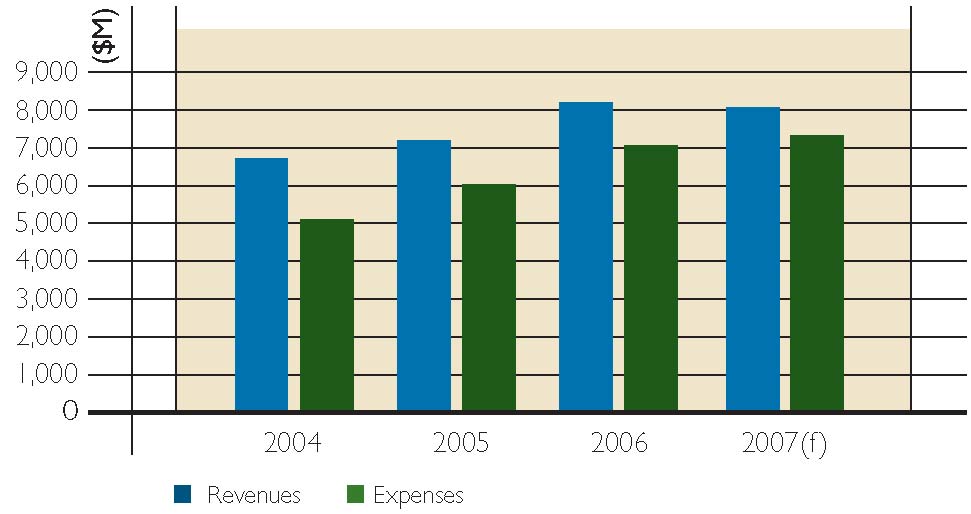

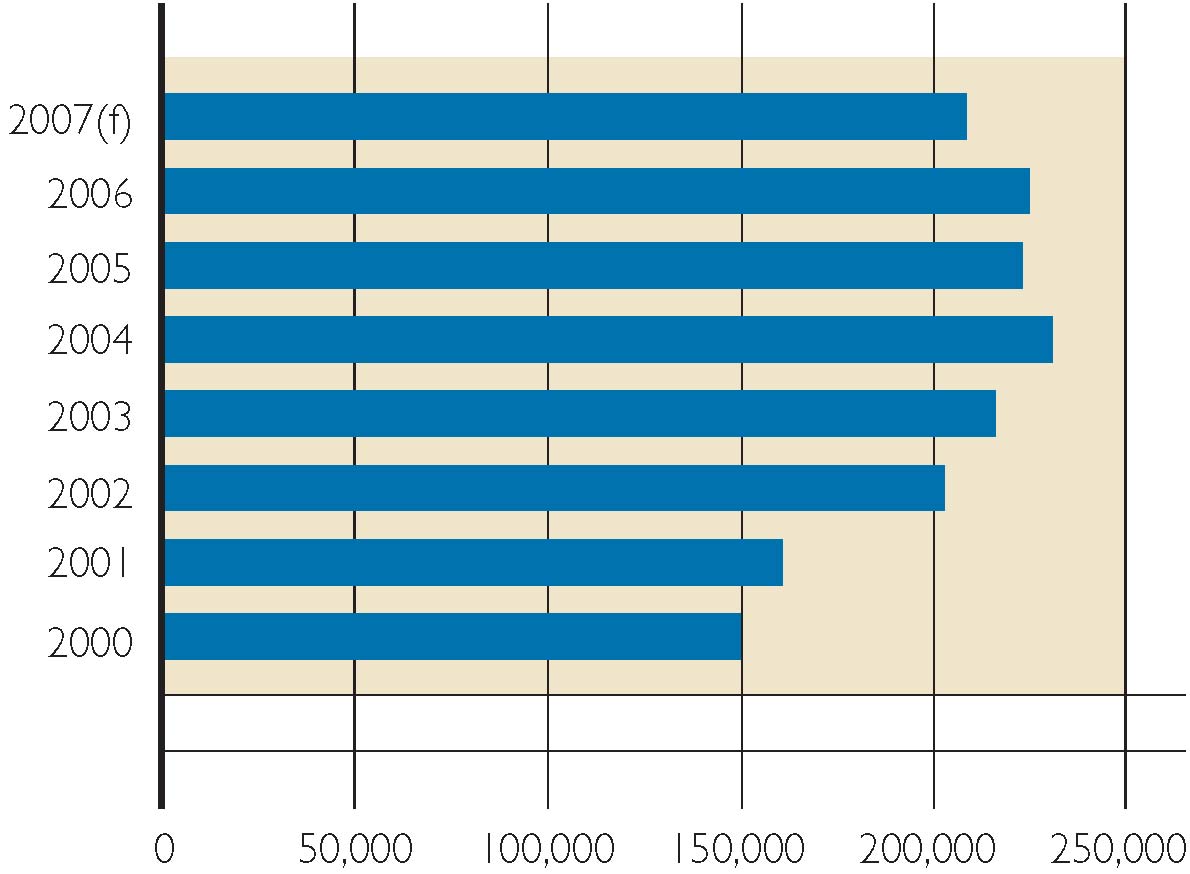

We continue to expand our business, while managing our expenses

Revenues & Expenses

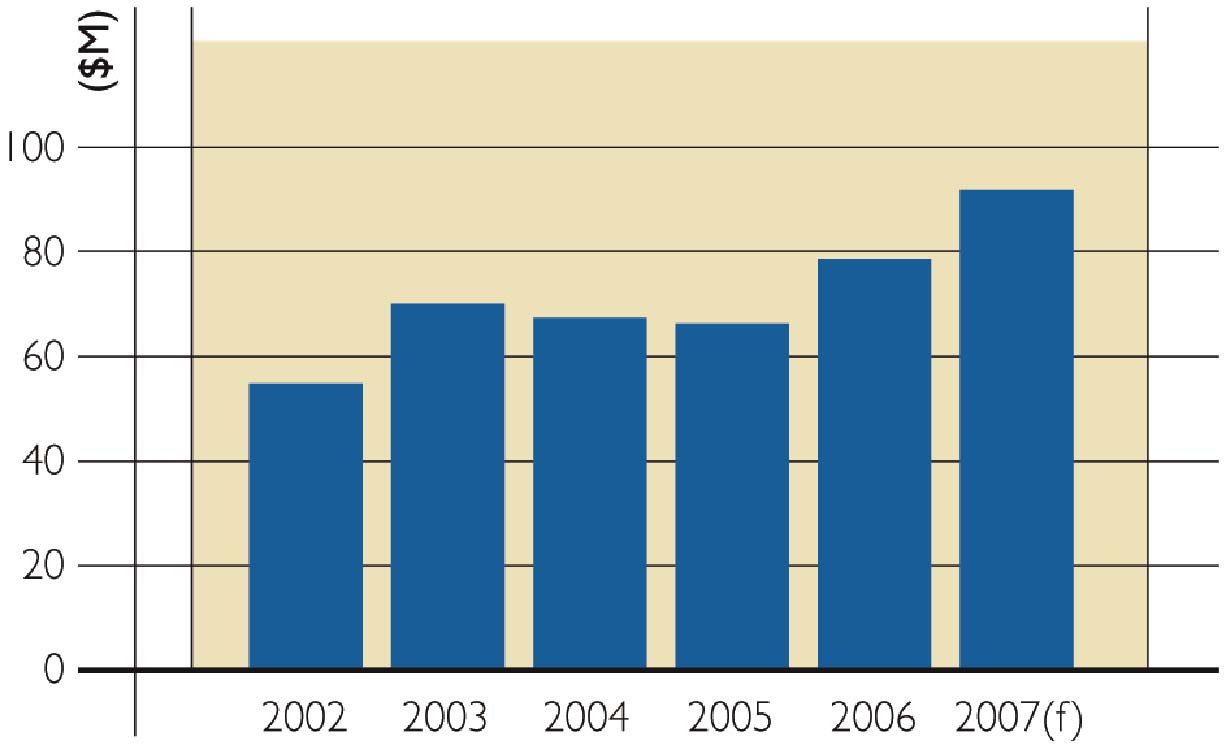

f = forecast

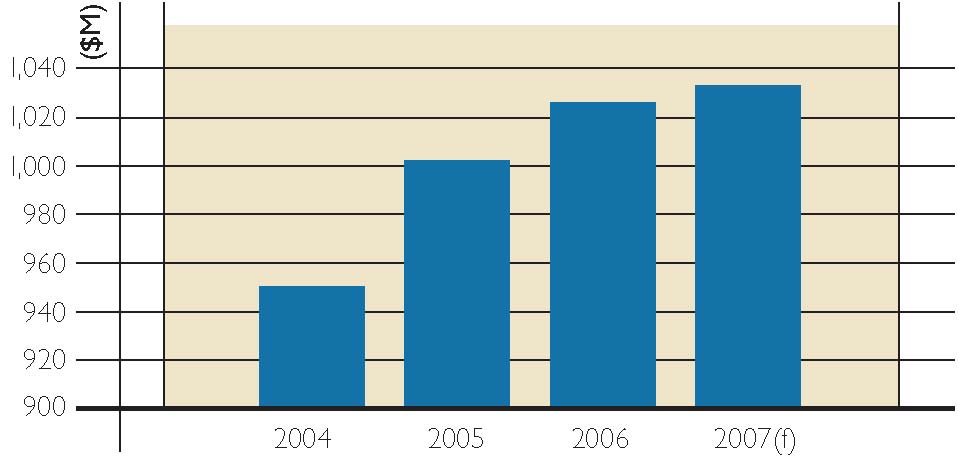

Net income increased slightly over 2005

Net Income

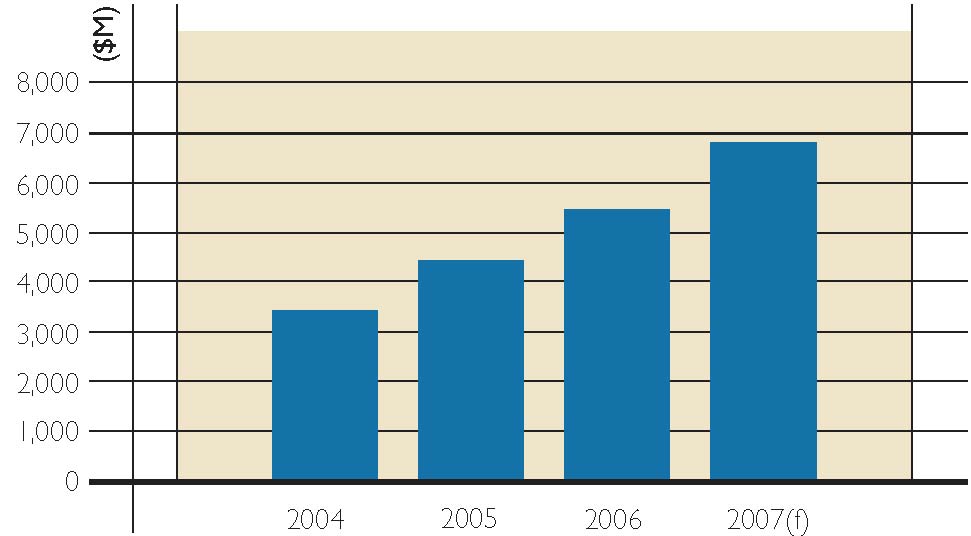

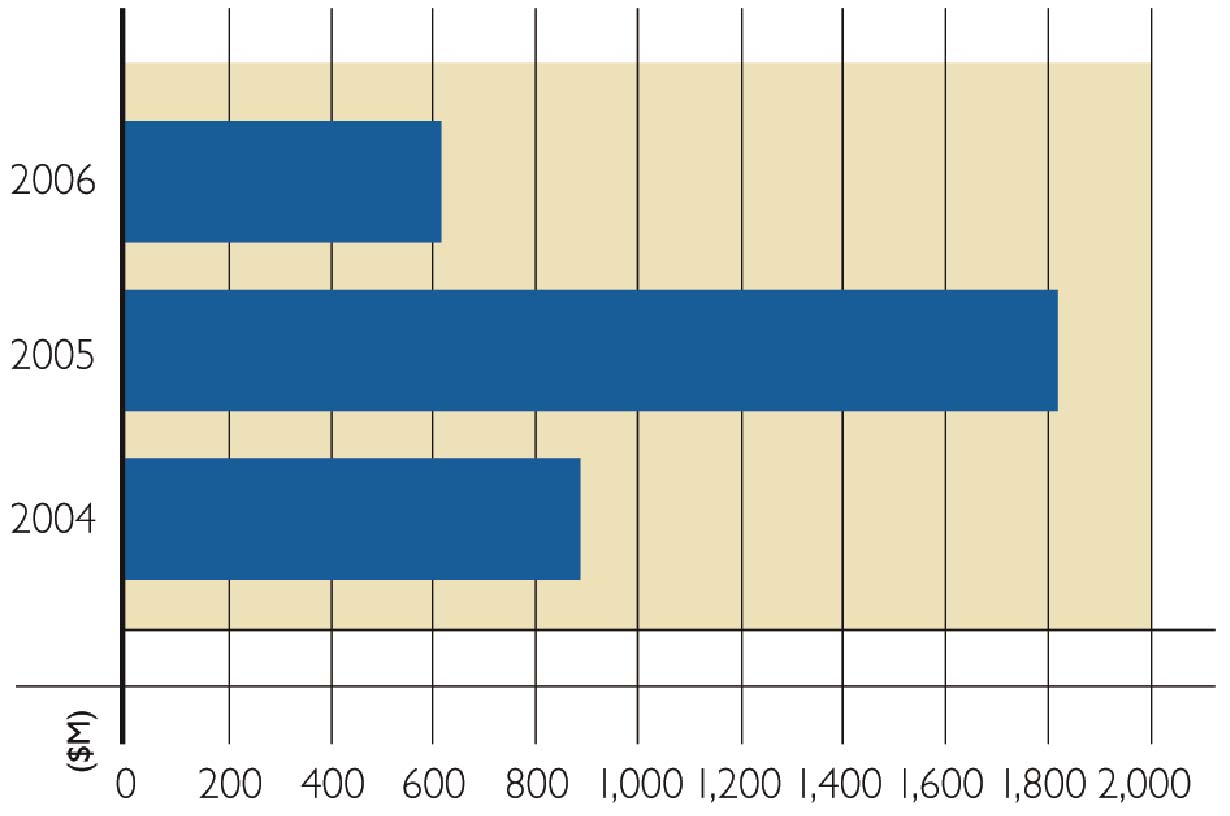

Total equity grew by 23% in 2006

Shareholder Equity

(f) = forecast

WHO WE ARE

CMHC, a federal Crown corporation, is Canada’s national housing agency. For more than 60 years, we have shaped Canada’s housing policies and programs to ensure that Canadians have access to high-quality and affordable housing.

Created in 1946 by the CMHC Act to provide affordable homes to returning war veterans, we have since evolved into a major national institution and Canada’s premier provider of housing policy and programs, housing research, mortgage insurance, and mortgage-related securities.

WHAT WE DO

We deliver housing programs that benefit Canadians

| • | | On behalf of the federal government, we provide financial assistance to help low- and moderate-income households obtain affordable, sound and suitable housing. |

| |

| • | | We support the housing market by providing objective and reliable information to the housing industry and consumers. |

| |

| • | | We support and promote the export of Canadian housing products and services, and provide housing consulting services around the world. |

We provide loans directly to social housing sponsors

| • | | We provide low-cost loans directly to social housing sponsors to refinance their projects and to First Nations to finance new housing production. This results in cost savings for housing providers, therefore maximizing the effectiveness of government housing subsidies. |

We offer mortgage insurance

| • | | We ensure the availability, accessibility and choice of housing funding for Canadians by providing mortgage insurance in all parts of the country. Mortgage insurance protects the lender from borrower default. This leads to lower interest rates for homebuyers, including those who have not saved a down payment. |

We provide guarantees on mortgage-related securities

| • | | We provide guarantees of timely payment of principal and interest on mortgage-related securities. This helps increase the amount of private capital available to fund low-cost mortgages for consumers. |

HOW WE DO IT

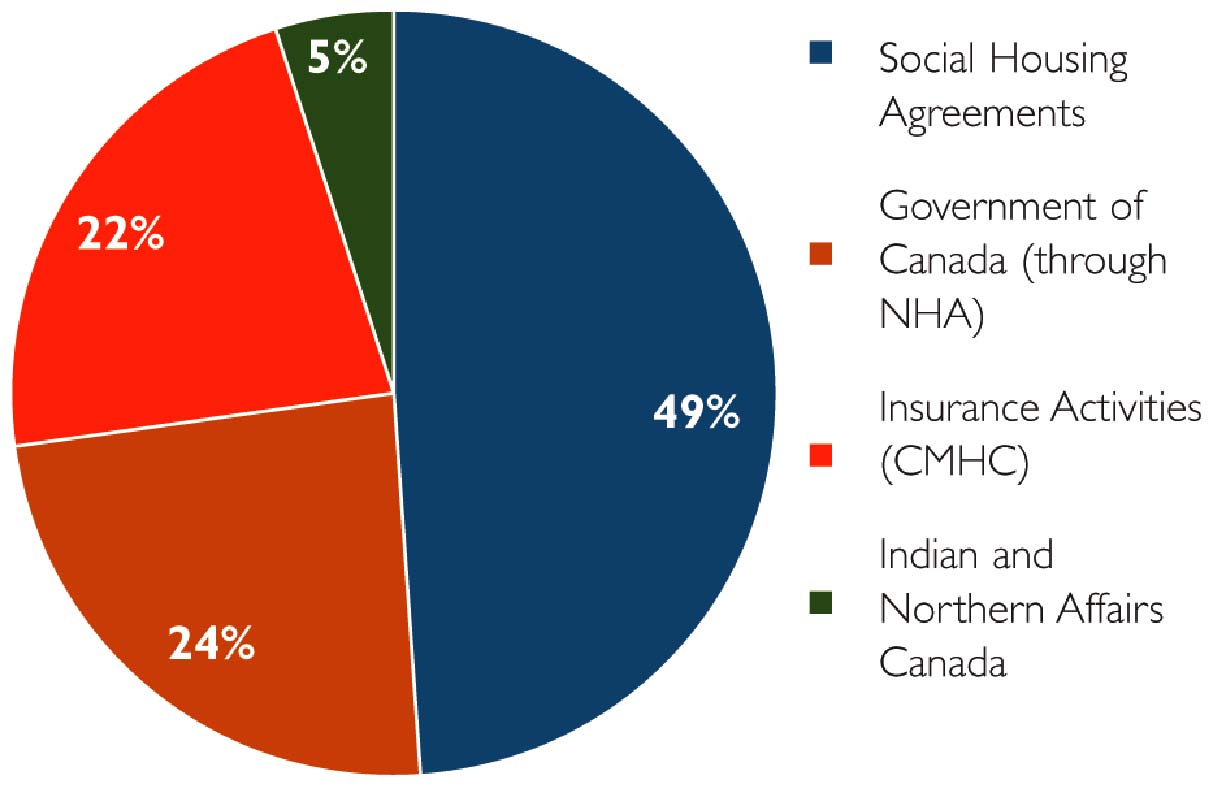

| • | | We receive Parliamentary appropriations, amounting to approximately $2 billion annually, to provide housing assistance programs on behalf of the federal government to Canadians in need. |

| |

| • | | Our break-even lending activities are funded through bond and commercial paper issuances on capital markets. |

| |

| • | | Our commercial mortgage insurance and securitization activities are expected to earn a reasonable rate of return in the long-term. We do not receive any direct government assistance. |

Affordable Housing Initiative project in Waterloo, Ontario.

2

Our Mandate

The promotion of:

| • | | housing construction, repair and modernization; |

| |

| • | | housing affordability and choice; |

| |

| • | | improvements to overall living conditions; |

| |

| • | | the availability of low-cost financing; and |

| |

| • | | the national well-being of the housing sector. |

Our Public Policy Objectives

| 1. | | Help Canadians in Need |

| |

| 2. | | Facilitate Access to More Affordable, Better Quality Housing For All Canadians |

| |

| 3. | | Ensure the Canadian Housing System Remains One of the Best in the World |

Our Values

We lead by example, we honour our obligations, and are committed to:

Serving the Public Interest

As stewards of the public trust we serve with fairness, impartiality and objectivity. All of our activities, including those that are commercial in nature, are carried out in support of our public policy objectives. Our actions are inspired by a respect for human dignity and the value of every person.

Achieving Business Excellence

We exercise the highest standards of competence, trustworthiness and prudence in conducting our business relationships and in managing the financial, physical, and human resources entrusted to our care. We encourage learning, innovation and personal initiative to continuously improve the way we do business and achieve the best possible results for the Canadian public.

Building a Workplace Community

We practice mutual respect and honesty in our working relationships. We help each other to achieve the goals of the team and the organization, and to maintain a healthy balance between our CMHC work and the other parts of our lives.

We willingly explain our actions so that we may hold ourselves, and each other, accountable for living these values in the workplace.

3

BUSINESS HIGHLIGHTS...

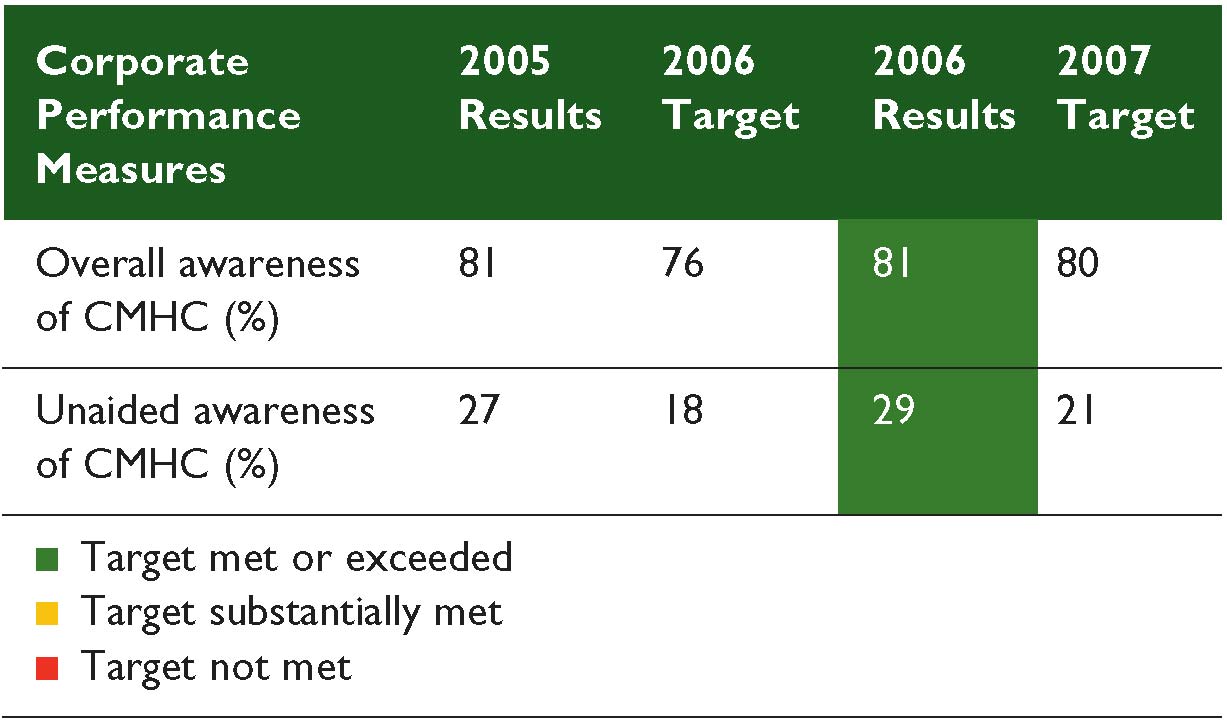

The following table summarizes CMHC’s results and projections for key business areas over the planning period.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Results | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2006 |

| | | Actual | | Actual | | Actual | | Actual | | Actual | | Plan |

| |

Total Assets ($M)1 | | | 41,430 | | | | 59,925 | | | | 81,008 | | | | 101,093 | | | | 124,218 | | | | 107,111 | |

Total Liabilities ($M)1 | | | 39,621 | | | | 57,449 | | | | 77,582 | | | | 96,665 | | | | 118,764 | | | | 101,802 | |

| Total Equity ($M) | | | 1,809 | | | | 2,476 | | | | 3,426 | | | | 4,428 | | | | 5,454 | | | | 5,309 | |

Total Revenues ($M)1 | | | 4,634 | | | | 5,563 | | | | 6,560 | | | | 7,334 | | | | 8,262 | | | | 7,971 | |

Total Expenses ($M)1 | | | 3,779 | | | | 4,556 | | | | 5,161 | | | | 5,870 | | | | 6,780 | | | | 6,541 | |

Total Operating Expenses ($M)1 | | | 257 | | | | 294 | | | | 305 | | | | 303 | | | | 298 | | | | 384 | |

| Net Income ($M) | | | 544 | | | | 667 | | | | 950 | | | | 1,002 | | | | 1,026 | | | | 965 | |

Other Comprehensive Income ($M)2 | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

Comprehensive Income ($M)2 | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Reserve Fund ($M) | | | 56 | | | | 91 | | | | 134 | | | | 143 | | | | 143 | | | | 139 | |

| Staff Years | | | 1,772 | | | | 1,799 | | | | 1,814 | | | | 1,804 | | | | 1,877 | | | | 1,917 | 6 |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

INSURANCE | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Insurance Units Approved | | | 583,225 | | | | 517,795 | | | | 652,573 | | | | 746,157 | | | | 631,191 | | | | 574,633 | |

| Insurance in Force ($M) | | | 224,345 | | | | 230,000 | | | | 243,800 | | | | 273,700 | | | | 291,400 | | | | 264,027 | |

| Net Insurance Claims Expense ($M) | 139 | | | | 188 | | | | 51 | | | | 119 | | | | 209 | | | | 171 | |

| Premiums and Fees Received ($M) | 1,285 | | | | 1,203 | | | | 1,446 | | | | 1,492 | | | | 1,383 | | | | 1,401 | |

Investments (including cash) ($M)3 | 5,863 | | | | 6,710 | | | | 7,831 | | | | 9,053 | | | | 9,974 | | | | 9,750 | |

| Net Income ($M) | | | 513 | | | | 602 | | | | 875 | | | | 951 | | | | 981 | | | | 927 | |

Other Comprehensive Income ($M)2 | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

Comprehensive Income ($M)2 | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Unappropriated Retained Earnings ($M) | | | 255 | | | | 0 | | | | 0 | | | | 657 | | | | 1,313 | | | | 1,273 | |

| Retained Earnings Set Aside for Capitalization ($M) | | | 1,380 | | | | 2,237 | | | | 3,112 | | | | 3,406 | | | | 3,731 | | | | 3,648 | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

SECURITIZATION | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Securities Guaranteed ($M) | 20,642 | | | | 27,017 | | | | 29,592 | | | | 30,374 | | | | 36,071 | | | | 18,000 | |

| Securitization Guarantees in Force ($M) | 45,473 | | | | 59,994 | | | | 80,800 | | | | 103,709 | | | | 129,500 | | | | 104,700 | |

| Fees Received ($M) | | | 45 | | | | 60 | | | | 66 | | | | 68 | | | | 85 | | | | 41 | |

Investments (including cash) ($M)3 | 158 | | | | 200 | | | | 266 | | | | 327 | | | | 396 | | | | 325 | |

| Net Income ($M) | | | 17 | | | | 30 | | | | 32 | | | | 42 | | | | 45 | | | | 36 | |

Other Comprehensive Income ($M)2 | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

Comprehensive Income ($M)2 | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Unappropriated Retained Earnings ($M) | | | 93 | | | | 123 | | | | 155 | | | | 197 | | | | 242 | | | | 223 | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

HOUSING PROGRAMS | | | | | | | | | | | | | | | | | | | | | | | | |

| Housing Program Expenses ($M) (excluding operating expenses) | | | 1,828 | | | | 1,972 | | | | 2,006 | | | | 1,973 | | | | 2,049 | | | | 2,059 | 6 |

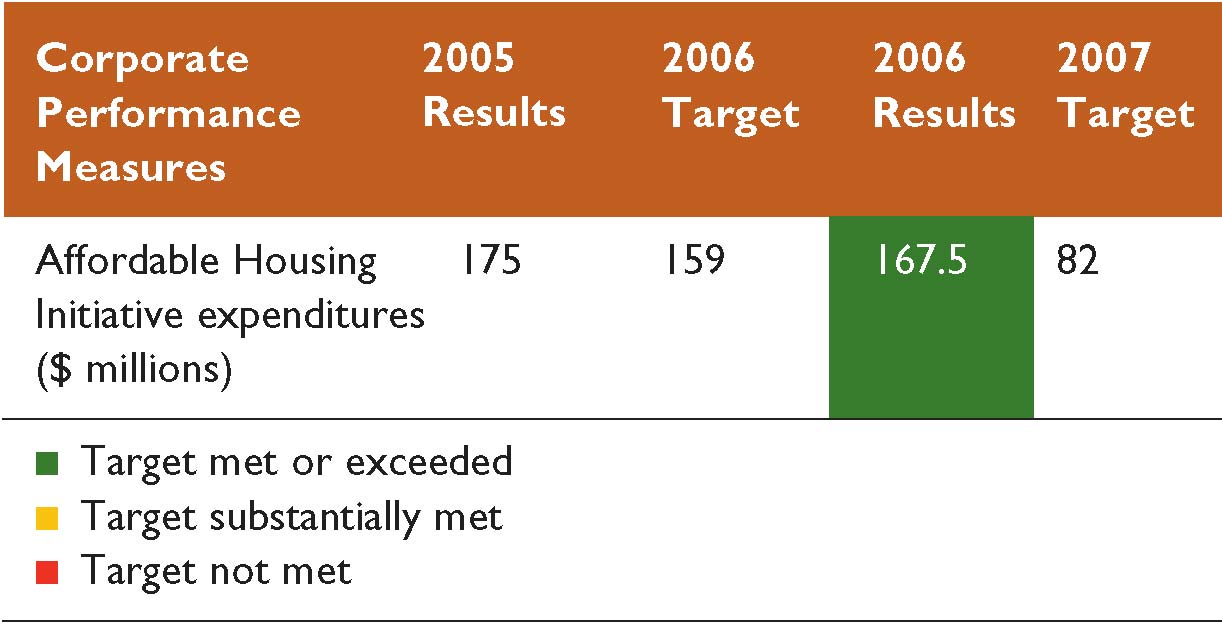

Affordable Housing Initiative Expenditures ($M)4 | | | 20 | | | | 166 | | | | 173 | | | | 175 | | | | 168 | | | | 159 | |

| Estimated Households Assisted Through Long-Term Commitments | | | 638,850 | | | | 635,900 | | | | 632,650 | | | | 633,000 | | | | 630,000 | | | | 632,000 | |

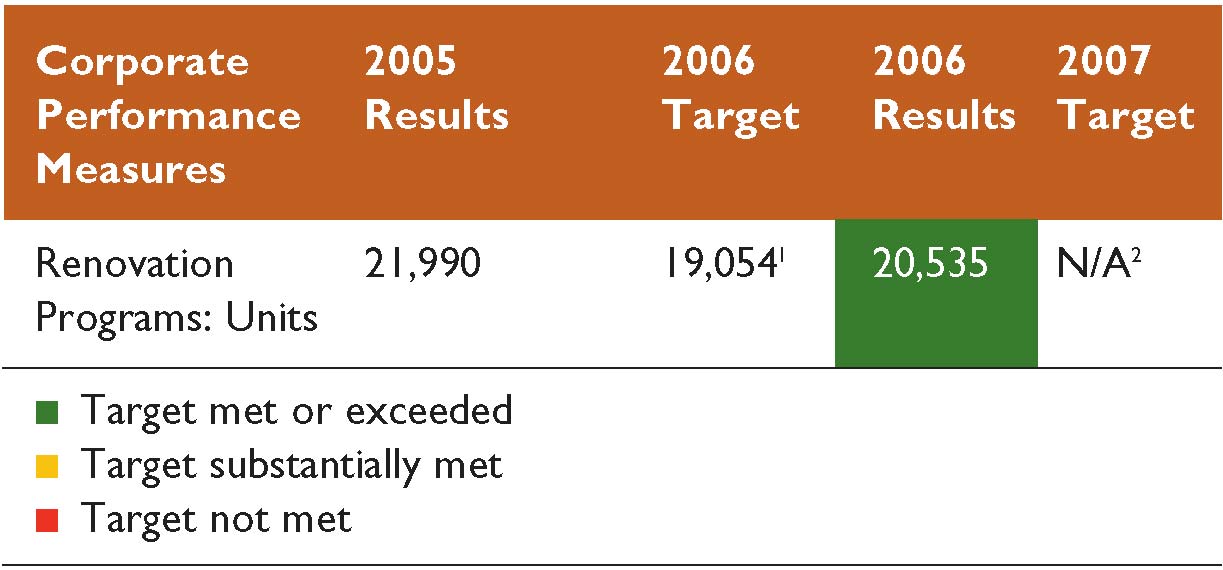

| Renovation Programs (units) | | | 24,850 | | | | 18,467 | | | | 25,539 | | | | 21,990 | | | | 20,535 | | | | 19,054 | 7 |

Renovation Programs — On-reserve (units)5 | | | 1,546 | | | | 1,183 | | | | 1,484 | | | | 1,508 | | | | 2,421 | | | | 979 | |

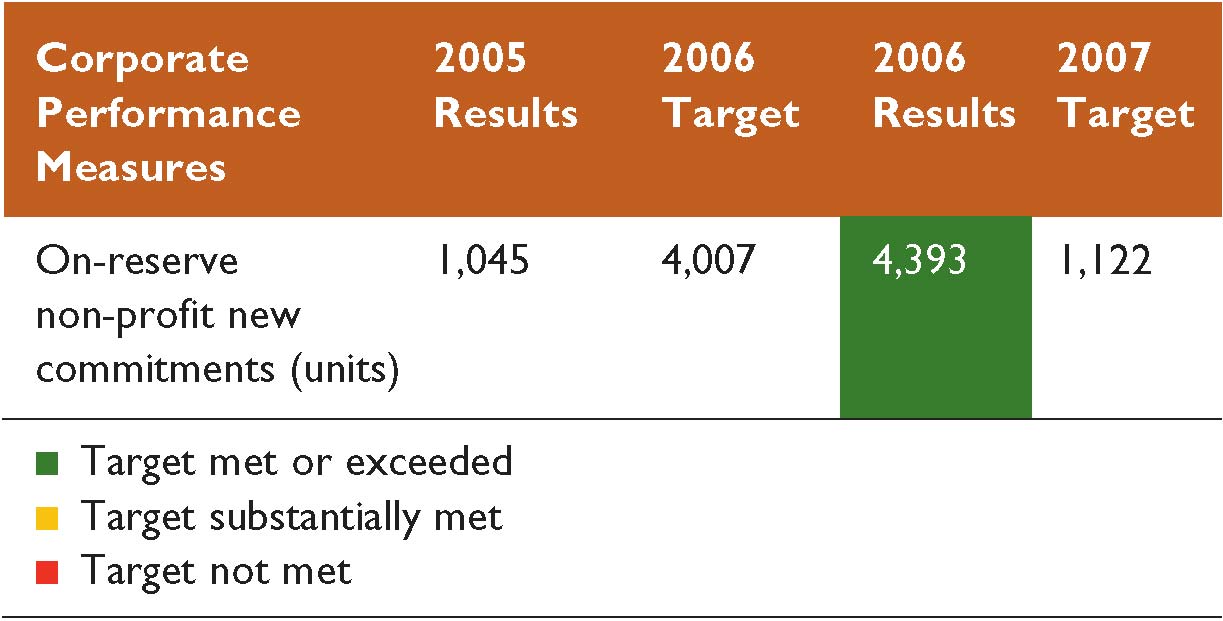

| On-Reserve Non-Profit New Commitments (units) | | | 1,050 | | | | 968 | | | | 978 | | | | 1,045 | | | | 4,393 | | | | 4,007 | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

LENDING | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and Investments in Housing Programs ($M) | | | 14,586 | | | | 14,075 | | | | 13,669 | | | | 13,170 | | | | 12,706 | | | | 13,186 | |

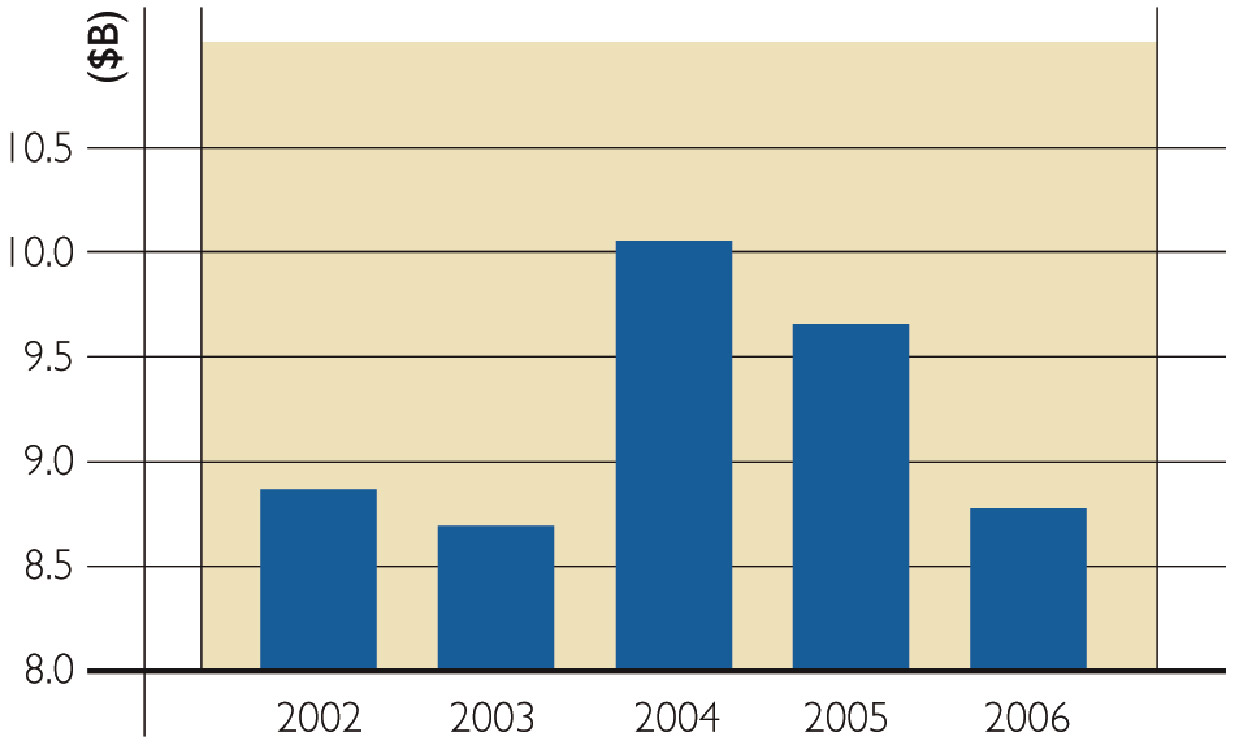

| Borrowings from Capital Markets ($M) | 10,242 | | | | 10,244 | | | | 9,212 | | | | 9,467 | | | | 8,625 | | | | 9,146 | |

| Borrowings from the Government of Canada ($M) | | | 5,474 | | | | 5,232 | | | | 5,045 | | | | 4,899 | | | | 4,701 | | | | 4,651 | |

| Net Income ($M) | | | 14 | | | | 35 | | | | 43 | | | | 9 | | | | 0 | | | | 1 | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

CANADA HOUSING TRUST | | | | | | | | | | | | | | | | | | | | | | | | |

| Canada Housing Trust Assets ($M) | 18,125 | | | | 35,422 | | | | 54,975 | | | | 73,208 | | | | 96,445 | | | | 81,016 | |

| Canada Housing Trust Liabilities ($M) | | 18,125 | | | | 35,422 | | | | 54,975 | | | | 73,208 | | | | 96,445 | | | | 81,016 | |

| |

| | |

| 1 | | Historical results have been restated to reflect the consolidation of Canada Housing Trust. |

| |

| 2 | | New components of the financial statements as required by the implementation of the financial instruments guidelines (see section on Management’s Discussion and Analysis, Future Accounting and Reporting Changes). |

| |

| 3 | | Excludes investments related to repurchase activities and accrued interest receivable. |

| |

| 4 | | A component of Housing Program Expenses. |

| |

| 5 | | A component of Renovation Programs. |

| |

| 6 | | Does not reflect the one-year extension of the Renovation Program announced in Budget 2006. |

| |

| 7 | | The 2006 target was revised from 5,378 to 19,054 as a result of the one-year extension of the Renovation Programs announced in Budget 2006. |

4

...AND OUTLOOK

| | | | | | | | | | | | | | | | | | | | | |

| Corporate Results | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 |

| | | Plan | | Plan | | Plan | | Plan | | Plan |

| |

Total Assets ($M)1 | | | 127,548 | | | | 132,282 | | | | 145,776 | | | | 155,541 | | | | 161,578 | |

Total Liabilities ($M)1 | | | 120,752 | | | | 124,342 | | | | 136,569 | | | | 145,037 | | | | 149,652 | |

| Total Equity ($M) | | | 6,796 | | | | 7,940 | | | | 9,207 | | | | 10,504 | | | | 11,926 | |

Total Revenues ($M)1 | | | 8,137 | | | | 8,342 | | | | 9,188 | | | | 9,846 | | | | 10,407 | |

Total Expenses ($M)1 | | | 6,606 | | | | 6,714 | | | | 7,470 | | | | 8,047 | | | | 8,529 | |

Total Operating Expenses ($M)1 | | | 362 | | | | 380 | | | | 402 | | | | 424 | | | | 467 | |

| Net Income ($M) | | | 1,033 | | | | 1,131 | | | | 1,202 | | | | 1,278 | | | | 1,334 | |

Other Comprehensive Income ($M)2 | | | 65 | | | | 13 | | | | 65 | | | | 20 | | | | 88 | |

Comprehensive Income ($M)2 | | | 1,098 | | | | 1,144 | | | | 1,267 | | | | 1,297 | | | | 1,422 | |

| Reserve Fund ($M) | | | 151 | | | | 147 | | | | 138 | | | | 127 | | | | 121 | |

| Staff Years | | | 1,897 | | | | 1,859 | | | | 1,851 | | | | 1,851 | | | | 1,842 | |

| |

| | | | | | | | | | | | | | | | | | | | | |

INSURANCE | | | | | | | | | | | | | | | | | | | | |

| Annual Insurance Units Approved | | | 603,061 | | | | 584,781 | | | | 574,659 | | | | 568,141 | | | | 559,150 | |

| Insurance in Force ($M) | | | 308,800 | | | | 314,400 | | | | 318,000 | | | | 320,000 | | | | 320,300 | |

| Net Insurance Claims Expense ($M) | | | 181 | | | | 208 | | | | 220 | | | | 222 | | | | 235 | |

| Premiums and Fees Received ($M) | | | 1,529 | | | | 1,530 | | | | 1,545 | | | | 1,562 | | | | 1,578 | |

Investments (including cash) ($M)3 | | | 11,760 | | | | 13,002 | | | | 14,240 | | | | 15,588 | | | | 17,063 | |

| Net Income ($M) | | | 991 | | | | 1,081 | | | | 1,151 | | | | 1,222 | | | | 1,270 | |

Other Comprehensive Income ($M)2 | | | 60 | | | | 15 | | | | 59 | | | | 22 | | | | 81 | |

Comprehensive Income ($M)2 | | | 1,051 | | | | 1,096 | | | | 1,210 | | | | 1,244 | | | | 1,351 | |

| Unappropriated Retained Earnings ($M) | | | 1,608 | | | | 2,314 | | | | 3,235 | | | | 4,267 | | | | 5,432 | |

| Retained Earnings Set Aside for Capitalization ($M) | | | 4,433 | | | | 4,807 | | | | 5,037 | | | | 5,227 | | | | 5,333 | |

| |

| | | | | | | | | | | | | | | | | | | | | |

SECURITIZATION | | | | | | | | | | | | | | | | | | | | |

| Annual Securities Guaranteed ($M) | | | 30,500 | | | | 32,500 | | | | 34,500 | | | | 36,500 | | | | 38,500 | |

| Securitization Guarantees in Force ($M) | | | 136,900 | | | | 140,500 | | | | 153,500 | | | | 160,400 | | | | 169,800 | |

| Fees Received ($M) | | | 69 | | | | 73 | | | | 78 | | | | 82 | | | | 87 | |

Investments (including cash) ($M)3 | | | 460 | | | | 517 | | | | 590 | | | | 655 | | | | 739 | |

| Net Income ($M) | | | 46 | | | | 54 | | | | 60 | | | | 67 | | | | 69 | |

Other Comprehensive Income ($M)2 | | | 4 | | | | (2 | ) | | | 5 | | | | (3 | ) | | | 7 | |

Comprehensive Income ($M)2 | | | 50 | | | | 52 | | | | 65 | | | | 64 | | | | 76 | |

| Unappropriated Retained Earnings ($M) | | | 288 | | | | 343 | | | | 403 | | | | 469 | | | | 538 | |

| |

| | | | | | | | | | | | | | | | | | | | | |

HOUSING PROGRAMS | | | | | | | | | | | | | | | | | | | | |

| Housing Program Expenses ($M) (excluding operating expenses) | | | 1,930 | | | | 1,884 | | | | 1,887 | | | | 1,853 | | | | 1,835 | |

Affordable Housing Initiative Expenditures ($M)5 | | | 82 | | | | 76 | | | | 63 | | | | 27 | | | | 9 | |

| Estimated Households Assisted through Long-term Commitments | | | 630,400 | | | | 623,200 | | | | 616,400 | | | | 608,000 | | | | 601,000 | |

Renovation Programs (units)4 | | | 3,694 | | | | 924 | | | | 924 | | | | 924 | | | | 924 | |

Renovation Programs — On-reserve (units)4,6 | | | 644 | | | | 601 | | | | 601 | | | | 601 | | | | 601 | |

| On-Reserve Non-Profit New Commitments (units) | | | 1,122 | | | | 809 | | | | 809 | | | | 809 | | | | 809 | |

| |

| | | | | | | | | | | | | | | | | | | | | |

LENDING | | | | | | | | | | | | | | | | | | | | |

| Loans and Investments in Housing Programs ($M) | | | 12,643 | | | | 12,273 | | | | 11,783 | | | | 11,343 | | | | 10,911 | |

| Borrowings from Capital Markets ($M) | | | 8,694 | | | | 8,773 | | | | 8,502 | | | | 8,263 | | | | 7,975 | |

| Borrowings from the Government of Canada ($M) | | | 4,446 | | | | 4,235 | | | | 4,025 | | | | 3,822 | | | | 3,675 | |

| Net Income ($M) | | | (4 | ) | | | (4 | ) | | | (9 | ) | | | (11 | ) | | | (6 | ) |

| |

| | | | | | | | | | | | | | | | | | | | | |

CANADA HOUSING TRUST | | | | | | | | | | | | | | | | | | | | |

| Canada Housing Trust Assets ($M) | | | 99,866 | | | | 103,541 | | | | 116,140 | | | | 125,042 | | | | 130,051 | |

| Canada Housing Trust Liabilities ($M) | | | 99,866 | | | | 103,541 | | | | 116,140 | | | | 125,042 | | | | 130,051 | |

| |

| | |

| 1 | | Historical results have been restated to reflect the consolidation of the Canada Housing Trust. |

| |

| 2 | | New components of the financial statements as required by the implementation of the financial instruments guidelines (see section on Management’s Discussion and Analysis, Future Accounting and Reporting Changes). |

| |

| 3 | | Excludes investments related to repurchase activities and accrued interest receivable. |

| |

| 4 | | Future year projected commitments reflect on-going funding of RRAP On-Reserve and Shelter Enhancement Program. |

| |

| 5 | | A component of Housing Program Expenses. |

| |

| 6 | | A component of Renovation Programs. |

5

OUR STRUCTURE

Our national office is located in Ottawa. We operate five regional business centres from the following major cities: Halifax (Atlantic region), Montreal (Quebec region), Toronto (Ontario region), Calgary (Prairie and Territories region) and Vancouver (British Columbia region). We also have points-of-service or corporate representatives in smaller centres throughout the country. National Office, the regional business centres and the points-of-service work in close cooperation to provide Canadians with front-line access to CMHC services.

Granville Island

CMHC is responsible for the management and administration of Granville Island on behalf of the Government of Canada, for which CMHC receives a management fee. The Island is a cultural, recreational and commercial development in the heart of Vancouver. Operationally, it is expected to be commercially viable. Capital additions are funded though operations, grants and contributions.

Canada Housing Trust

Canada Housing Trust (CHT) is an arms-length legal entity for which CMHC provides guarantees and financial advisory services, which has been consolidated due to the application of accounting rules. Its functions are limited to the acquisition of ownership interests in eligible housing loans such as National Housing Act Mortgage-Backed Securities (NHA MBS), the purchase of highly-rated investments, certain related financial hedging activities and the issuance of Canada Mortgage Bonds (CMB).

Our Senior Management Team

Karen Kinsley

President and Chief Executive Officer

NATIONAL OFFICE

Anthea English

Vice-President, Corporate Services and

Chief Financial Officer

Mark McInnis

Acting Vice-President, Insurance Underwriting,

Servicing and Policy

Sharon Matthews

Vice-President, Assisted Housing

Pierre Serré

Vice-President, Insurance Product and

Business Development

Douglas Stewart

Vice-President, Policy and Planning

Gail Tolley

Vice-President, Human Resources

Charles Chenard

Executive Director, Corporate Marketing

Pierre David

Executive Director, CMHC International

Anne Dawson

Executive Director, Communications

Gilles Proulx

Executive Director, Risk Management and Investments

Serge Gaudet

Director, Audit and Evaluation Services

Douglas Tyler

General Counsel

Luc Fournier

Corporate Secretary

REGIONAL BUSINESS CENTRES

Carolyn Kavanagh

General Manager, Atlantic Business Centre

Sylvie Crispo

General Manager, Quebec Business Centre

Peter Friedmann

General Manager, Ontario Business Centre, and

Managing Director, Securitization

Trevor Gloyn

General Manager, Prairie and Territories Business Centre

Nelson Merizzi

General Manager, British Columbia Business Centre

6

Message from the Chairperson

On behalf of the Board of Directors, I am pleased to present this report on our accomplishments for 2006. As a former employee, as someone who is heavily involved in the housing industry, and now as Chairman of the Board, I have seen CMHC from many perspectives. These perspectives have provided me with the opportunity to observe how CMHC affects the lives of Canadians in many different ways. I have noted CMHC’s success in combining our expertise with new insights to respond to the diverse housing needs of Canadians. We work at multiple levels and with multiple partners to help ensure decent, affordable housing for Canadians. And, we carry out these functions responsibly within a solid corporate governance framework that guides our actions and ensures good stewardship of the public resources entrusted to us.

Dino Chiesa

Chairperson of the Board

8

2006 ANNUAL REPORT — Messages

Sound corporate governance is central to our ability to achieve our goals. In 2006, the Board worked to ensure its governance practices are consistent with the Treasury Board governance review. We already have in place the recommended actions in many areas or have taken actions in other areas to ensure that CMHC’s governance regime meets or exceeds current best practices. We are proud of what we have accomplished so far and welcome the opportunity to further enhance our governance framework. Moving forward, we will work to maintain a strong governance system as we determine the best approach to increase the engagement of the Canadian public so that stakeholders will be able to express their views and seek information about the activities of the Corporation.

We strive to be effective as Directors and we regularly review our performance. In 2006, we used an external consultant to conduct an assessment of our performance. This evaluation provides us with a mechanism for the Board and the Chairperson to hold each other accountable. We look forward to receiving the final report in 2007 which will provide guidance on the implementation of improvements to existing practices.

We are proud of our role in promoting housing quality, affordability and choice for Canadians and our efforts to make a difference have been recognized. Last year, for example, our President was inducted into the Canadian Mortgage Hall of Fame in recognition of her outstanding service to the Canadian mortgage industry.

Our values and ethics have helped guide us as we serve Canadians from coast to coast to coast. By living these values, we are better able to attract talented employees in a competitive marketplace and strengthen stakeholder and community confidence in our ability to deliver results.

As Directors, we are dedicated to serving as stewards of Canada’s national housing agency and will continue to provide the Corporation with strong leadership as we anticipate the opportunities arising from competitive, regulatory and other changes in our business.

I would like to thank Catherine Cronin, who completed her term in 2006, for her outstanding contribution to CMHC. I would also like to welcome Joel Teal to the Board. Joel brings us experience as a former CMHC employee and, for many years, as an executive in housing construction and in the development industry.

I believe that the achievements outlined in this report, along with our solid partnerships with a diversity of stakeholders, and the commitment and dedication of our employees have created an environment where we will be able to turn today’s opportunities into tomorrow’s successes.

Dino Chiesa

Chairperson of the Board

9

Message from the President

Housing means different things to different people across Canada. For some Canadians, housing represents the opportunity to build a better life for their families by providing a sound, suitable environment. For those who have purchased their homes, housing represents a major financial asset that provides the opportunity to build wealth. For others, housing also represents economic opportunity by creating jobs in construction, real estate, banking and other areas.

CMHC has played a central role in helping Canadians pursue these opportunities. Over the years, we have listened to Canadians and responded to their evolving needs. By being attentive to consumers and working with other housing stakeholders, the Corporation has been instrumental in helping to create and maintain one of the best housing systems in the world.

Karen Kinsley, CA

President and Chief Executive Officer

10

2006 ANNUAL REPORT — Messages

OUR SUCCESSES

In 2006, CMHC achieved solid results across all of our corporate objectives. The accomplishments outlined in this report build on our past achievements, and demonstrate our commitment to excellence and to serving the people of Canada in a responsible and transparent manner.

Help Canadians in need

We continue to work with our provincial and territorial partners and other stakeholders to develop more affordable housing options for low-income Canadians. In addition to the 630,000 households we helped through long-term social housing assistance, we worked with our partners to increase the affordable housing stock by some 6,000 units through the Affordable Housing Initiative.

In 2006, the federal government announced a two-year extension of our renovation and repair programs. This investment of $256 million will help an estimated 38,000 households bring their homes up to standard or make modifications to them so they can live independently. We also provided project development and seed funding, and shared our expertise in financing and managing of affordable housing to help create almost 3,400 affordable housing units with little or no ongoing federal subsidy.

Aboriginal housing and capacity development remains a priority for CMHC. Thanks to a one-time budget allocation in 2005, almost 4,400 new non-profit units were committed on-reserve in 2006 — a 320-per-cent increase over 2005 — and some 2,400 households were assisted through our suite of on-reserve renovation programs. We worked to develop market-based solutions on-reserve and to promote greater reliance on the market. We helped increase private-sector lending with our mortgage insurance products. We believe we can do more to help create market solutions for those who can afford it, while maintaining support for those who cannot. Through these efforts, we can help more First Nations communities realize the economic benefits of housing that most other Canadians take for granted.

Facilitate access to more affordable, better quality housing for all Canadians

We are well aware of the increasing pace of change in the financial services sector. As Canada’s national housing agency, with a focus on helping Canadians, CMHC is well prepared to play a leadership role in ensuring that Canadians continue to benefit from an innovative and competitive marketplace within a well-functioning housing finance system. In 2006, we helped make homeownership more affordable, by providing mortgage insurance on 100-per-cent financing, and by extending repayment periods to up to 40 years.

We also helped increase the supply of low-cost mortgage funds through our securitization programs. In 2006, we guaranteed a record level of more than $36 billion in mortgage-related securities, as a result of strong demand for housing and the arrival of new entrants into the Canada Mortgage Bonds Program. Looking forward, we will continue to enhance our securitization programs to further increase the supply and variety of eligible mortgages and to offer funding solutions for smaller lenders, making it easier for them to compete in the marketplace.

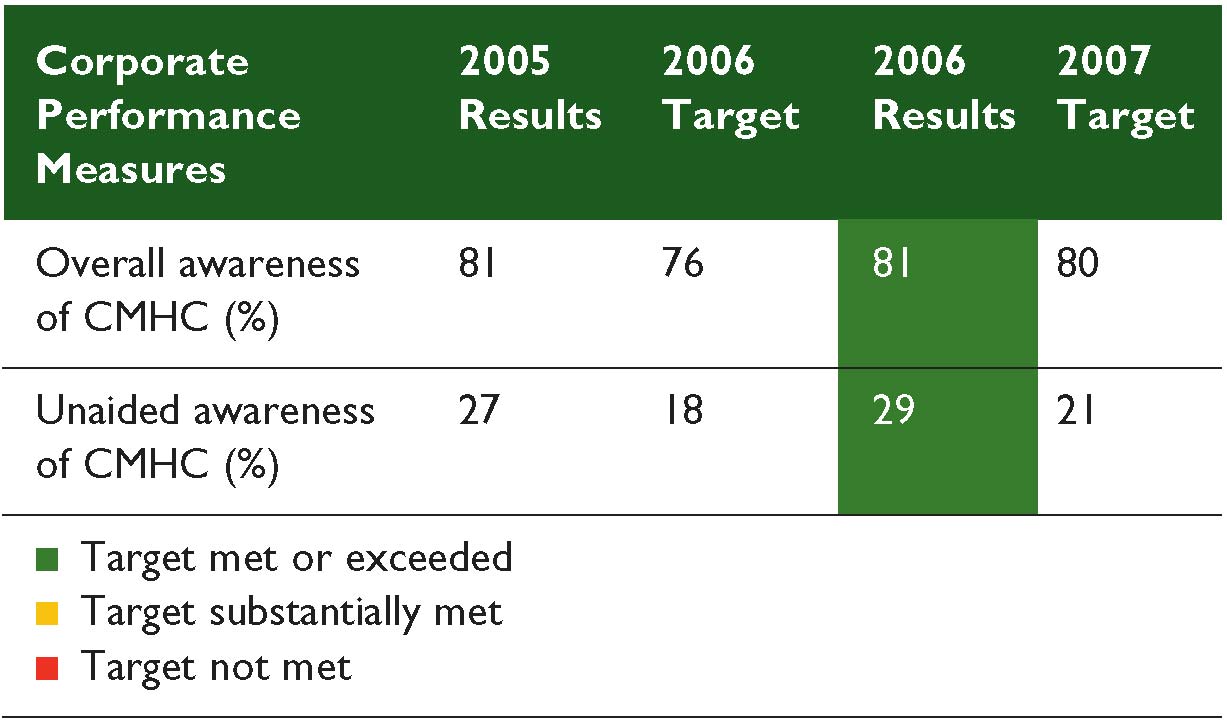

The Corporation also plays a key role in helping housing markets work better by providing housing expertise and information to Canadians. Last year, more than 1.6 million copies of our information products reached individuals and organizations across the country. And more than 50,000 individuals attended presentations on a variety of topics from our market analysis and technical experts.

11

Ensure the Canadian housing system remains one of the best in the world

Through the EQuilibrium Healthy Housing Initiative, we will support the housing industry to design, build and demonstrate affordable, healthy and energy-efficient housing. Working closely with demonstration teams in 2007, we will be able to show how the impact of housing on the environment can be significantly reduced.

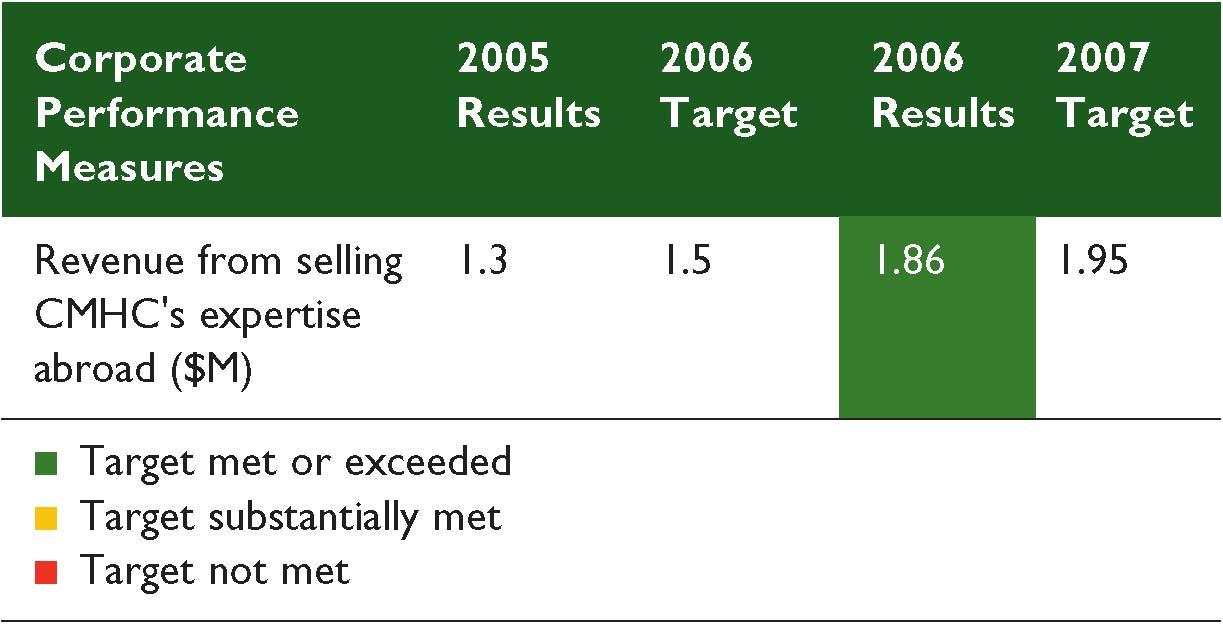

Internationally, we have been successful in creating jobs for Canadians by helping exporters develop their business in foreign markets. Last year, we helped modernize housing systems in developing countries as we expanded the scope of our consulting services. We also organized the 26th International Union of Housing Finance World Congress, bringing together global leaders on the topic of housing finance.

Recognizing that our people are our greatest resource, we continue to develop strategies to help our employees succeed in their chosen career path. In 2006, we adjusted our succession management practices to ensure that we continue to have the people with the necessary skills to effectively deliver our services to Canadians.

TOMORROW’S SUCCESSES

At CMHC we have always been motivated to contribute to the quality of life enjoyed by Canadians through a well-functioning housing system. The high standards we set for ourselves in serving Canadians have contributed to a housing system of which Canadians can be proud. As we reflect on our recent achievements, we are also looking for opportunities to better serve the needs of all Canadians in 2007 and beyond.

We recognize that we can do more to help people who may not have shared in the success of the Canadian housing system. We also know that our success is founded on being an organization that is well managed, accountable and responsible. We are proud of our accomplishments, but we know that we have not done it alone. Many of our partners are committed to solving the housing issues we currently face and we will continue to work with them to develop the solutions needed to ensure that all Canadians have an opportunity to find affordable, sound and suitable housing. By seeking out today’s opportunities, we can ensure that all Canadians can share in tomorrow’s successes.

Karen Kinsley, CA

President and Chief Executive Officer

12

Corporate Governance

As Canada’s national housing agency and one of Canada’s largest financial institutions, we operate within a complex and rapidly evolving environment. With change, comes both challenge and opportunity. Our public policy mandate amplifies the challenges of governance within this environment.

It is good corporate governance that enables us to successfully tackle the challenges in our environment. And it is good governance that is the guiding principle behind our ability to achieve success and provide value to Canadians well into the future by realizing the opportunities that abound today.

That is why our Board of Directors and Management Committee continue to make investments in corporate governance, bringing a particular focus in 2006 on: 1) ensuring that the Corporation’s approach to succession and talent management provides the right vision for managing human resources at CMHC over the coming years; 2) endorsing a newly-established review process which provides greater flexibility in adjusting our strategic priorities and resource allocation throughout the year to more effectively navigate the challenges and opportunities inherent in a dynamic and demanding environment; and 3) ensuring its governance regime continues to meet government expectations and best practices.

L to R

Louis Ranger, Harold Calla, Gary P. Mooney, Karen Kinsley, Alexander Werzberger, Dino Chiesa, Hugh Heron, Sophie Joncas, Joel Teal, Roberta Hayes.

14

2006 ANNUAL REPORT — Corporate Governance

THE BOARD OF DIRECTORS

CMHC currently reports to Parliament through the Minister of Human Resources and Social Development, and is governed by a Board of Directors that is accountable to the Minister.

CMHC’s Board of Directors is comprised of the Chairperson, the President and Chief Executive Officer and eight other members appointed by the Minister with Governor-in-Council approval. CMHC’s directors are a diverse group of individuals with significant accomplishments in business, government, and not-for-profit activities related to housing.

With the exception of the President and CEO, all CMHC directors are independent of management and are free from any interest and any business or other relationships which could or would reasonably be perceived to materially interfere with the director’s ability to act in the best interests of the Corporation and its shareholder, the Government of Canada.

The Board of Directors is responsible for the corporate governance of CMHC. In doing so, it must act honestly, in good faith, and in the best interests of CMHC. The Board has established four committees to assist it in exercising its responsibilities: the Corporate Governance Committee, the Audit Committee, the Human Resources Committee and the Nominating Committee. The President and CEO and one additional Board member also serve as trustees of the CMHC pension fund. The Board establishes and approves the structure, composition and terms of reference for each of the committees. These are reviewed regularly and updated as required.

| | | |

| 2006 Committee Membership |

| |

Governance

Committee | | Dino Chiesa (Chair), Sophie Joncas, Karen Kinsley and Alexander Werzberger |

| |

Audit

Committee | | Sophie Joncas (Chair), Catherine Cronin and Gary P. Mooney |

| |

Human

Resources

Committee | | Hugh Heron (Chair), Roberta Hayes, Harold Calla and Louis Ranger |

| |

Nominating

Committee | | Dino Chiesa (Chair), Hugh Heron, and Roberta Hayes |

| |

The Board of Directors is responsible for managing the affairs of the Corporation and the conduct of its business in accordance with the CMHC Act, the Financial Administration Act and the governing by-laws. As stewards of the Corporation, the Board sets the strategic direction of CMHC, ensures the integrity and adequacy of the Corporation’s information systems and management practices, periodically examines the continued relevance of the Corporation’s public policy objectives and legislated mandates, ensures the main corporate risks are managed, evaluates the Corporation’s performance, and monitors the Corporation’s financial results.

Successes in corporate governance are linked to the degree directors understand their roles and responsibilities as corporate stewards. To this end, the Board ensures an appropriate allocation of responsibilities between the Board and management. The Board also reviews CMHC’s governance policies and structures to ensure they remain responsive to the circumstances and needs of the Corporation. This involves ensuring they continue to reflect applicable legislation, guidance on matters of governance specific to Crown corporations, and recognized “best practices.”

Board Renewal

To achieve its objectives and carry out its mandate, CMHC’s Board of Directors must reflect the types of clients CMHC serves, and to the extent possible, represent Canadian society as a whole. As part of its succession planning, the Board and its Nominating Committee, strive for a proper balance of key criteria, including: previous experience and service on boards; gender; language; ethnicity; geographical representation; and understanding of housing needs.

CMHC’s recent experience with Board renewal demonstrates the importance the Board places on ensuring respect for transparency, accountability and the role of Parliament in the appointment process. In 2005, following the Board’s approval of selection criteria for the position of Chairperson as recommended by the Nominating Committee, CMHC was one of the first Crown corporations to have its candidate successfully appointed following a new process that included the hiring of an executive search firm and the candidate’s appearance before a Standing Committee of the House of Commons. Relying on its Board competency profile, the Board regularly provides advice to the Minister’s office on upcoming vacancies, skills gaps and the need to ensure an appropriate staggering of expiry dates.

Appointments to CMHC’s Board follow the Governor-in-Council appointment process and procedures. Effective January 2007, Board appointments are made for a four-year term. This was changed from a three-year term in accordance with the recent passage of the Federal Accountability Act. Open and constant communication between CMHC and its responsible Minister is a key component of the Board’s ability to ensure the Corporation benefits from a competent Board of Directors. In 2006, CMHC welcomed one new member to the Board of Directors.

In 2007, the Nominating Committee will be updating the Board’s competency profile as well as the selection criteria for the Corporation’s President and CEO.

15

Orientation and Ongoing Education of Board Members

CMHC provides two days of orientation to new directors, followed by periodic briefings, as warranted. In addition, directors are kept informed of CMHC’s operations at meetings of the Board and its Committees, and through reports and analyses by, and discussions with, management. To ensure that directors maintain the skills and knowledge necessary for them to meet their obligations, all Board members are encouraged to attend governance sessions organized by the Canada School of Public Service and the Privy Council Office. In addition, Audit Committee members regularly attend training sessions hosted by the Canadian Institute of Chartered Accountants.

Board Assessment Process

In order to assess its effectiveness and initiate renewal, the Board conducts an annual review of its performance and discusses what steps may be necessary or desirable to improve its effectiveness.

In 2006, led by the Corporate Governance Committee, the Board retained the services of an external consultant to assist it in updating its self-assessment process and to assist the Board in conducting an assessment of its performance through the year. CMHC’s Board believes that performance evaluations provide a mechanism for the Board and the Chairperson to hold each other accountable. Based on sound evaluation criteria and administered by independent experts, the 2006 performance evaluation was designed to probe for best practices in leadership and governance. Preliminary performance indicators from the evaluation indicate that CMHC enjoys strong corporate governance and board functioning, particularly in the areas of board-management functioning, board and management skills and leadership, and financial performance setting, oversight and accountability. The Board looks forward to receiving the final report which will provide guidance on the implementation of improvements to existing practices.

GOVERNANCE IN PRACTICE

The nature of CMHC’s activities makes its governance more complex, but still subject to the same expectations of efficiency, accountability and transparency that Canadians hold for their public agencies. As a Crown corporation, CMHC seeks high customer satisfaction and reasonable returns while meeting the rigour of public accountability. As a result, the Board of Directors evaluates CMHC’s performance based on the principle that its fundamental purpose is the creation of value for Canadians. Reaching this goal rests on the achievement of public policy objectives, solid financial results, efficient processes, and a healthy organization able to achieve success by being open to changes and new opportunities that will benefit Canadians.

Strategic Planning

Establishing the strategic direction for the Corporation is the foundation in fulfilling the Board’s governance responsibilities. The Board of Directors and CMHC management work together to build a view of the future of the Corporation, to focus efforts on priorities that deliver on the mission, vision and values of CMHC, and to foster the conditions for innovation and renewal.

As in past years, the Board of Directors provided direction to the Corporation at the outset of the 2006 planning cycle. The Board’s input into the process reflected the direction provided by the Minister in support of the Government of Canada’s current priorities. In particular, that guidance focused on preparing the Corporation to meet new challenges in the mortgage insurance business. This is being accomplished through short-term positioning and work on longer-term policy directions in housing finance.

With the support of the Board, CMHC introduced changes to the planning process by launching a quarterly review of priorities and resources that will maximize the Corporation’s flexibility and ability to successfully manage change. Through this comprehensive, formal review, the Board is now better able to review its current direction, and management can make adjustments in priorities and resources where circumstances warrant.

Risk Management

Enterprise risk management is a shared responsibility amongst the Board of Directors, management and operational units, who each play a role in ensuring that appropriate risk and performance management, governance, structure, processes, measures, controls and limits are in place. The Audit Committee approves appropriate policies and risk limits and advises the Board on emerging risks and opportunities and their impact on strategic directions. The Board then ensures appropriate action is taken with regards to all identified risks and opportunities.

16

2006 ANNUAL REPORT — Corporate Governance

In 2006, in addition to exploring long-term housing finance policy directions, the Board also reviewed CMHC’s progress in implementing succession management plans to reduce potential impacts on operations arising from the loss of critical employees.

Internal Control and Financial Reporting

The Board of Directors, with the help of the Audit Committee, works with CMHC’s internal auditors to ensure the integrity of the Corporation’s internal control framework and management of information systems. The Board ensures that the Corporation’s reporting on activities and performance is effective and that the information is reliable, relevant, balanced and complete. Management regularly reports on performance and risk management to the Audit Committee through its Quarterly Financial and Risk Management Report.

In keeping with Government of Canada guidelines, CMHC’s Audit Committee members are financially literate: two members hold accounting designations and the third member possesses expertise in financial management.

In 2006, the Audit Committee closely examined all current and potential implications of new and proposed accounting guidelines and industry practices to ensure continued fair presentation of CMHC’s financial information. Management’s responsibility for financial information contained in this annual report is outlined on page 74. In addition, the Board of Directors has reviewed and approved this annual report prior to its release.

The Corporation’s internal auditors report functionally to the Audit Committee and meet with the Audit Committee on a regular basis without management being present. In an effort to improve on existing practices, CMHC’s internal auditors embarked on a quality assessment review of the internal audit and evaluation services. The Audit Committee reviewed the results of the exercise and the action plan. The Committee also oversaw a review of the internal audit activity charter and approved an update to internal audit performance measures.

In other areas, CMHC’s compliance office completed mapping of core processes in all treasury-related activities in order to identify compliance gaps and ensure appropriate actions were taken where necessary. Due to the significant growth of the CMHC investment portfolios in recent years, personal trading guidelines were also established in 2006 and information sessions were conducted with impacted staff through the year. Finally, the Audit Committee updated the Board of Director’s travel and hospitality policy to ensure it continues to meet Canadians’ expectations of their public office holders.

Organizational Effectiveness

The Board supports the notion that values and ethics play a crucial role in modern business management. Through its Human Resources Committee, in 2004, the Board led a corporate-wide ethics awareness exercise involving the development of a variety of case studies applicable to CMHC’s environment. This was followed by the delivery of awareness sessions to employees across the Corporation.

In 2006, initiatives to continue to strengthen employees understanding of CMHC’s values included communication of additional case studies to employees, ethics awareness sessions for new employees and Conflict Resolution Workshops for managers and employees.

The Board and its Human Resources Committee are proud to say that, overall, this initiative has been a success. Supervisors, managers and directors are encouraged to keep the dialogue alive to ensure open discussion and resolution of issues.

In 2006, the Human Resources Committee reviewed and recommended a number of other items to the Board for approval. Management provided Committee members with a progress report on CMHC’s succession management initiative, and the Committee also reviewed and endorsed CMHC’s vision for talent management.

Communication with Stakeholders

In 2006, CMHC’s 60th anniversary was marked with numerous events across the country, providing the Board with opportunities to communicate with CMHC’s stakeholders. Two of the regularly scheduled Board meetings were held in different locations across the country to allow the Board to meet and communicate directly with CMHC’s employees, clients, partners and stakeholders, and to become better acquainted with regional issues.

In the spring of 2006, the Board convened in Quebec City where it met with a wide range of CMHC stakeholders and learn more about their priorities. In the summer, the Board traveled to Saint John, New Brunswick to gain a better understanding of CMHC’s business in the region. They were also able to get a first-hand look at how CMHC is working with community groups, non-profit organizations and industry to build strong and vital communities.

Crown Corporation Governance

CMHC continually introduces initiatives related to strategic planning, risk management and other aspects of corporate accountability that demonstrate its ongoing commitment to ensuring its governance framework remains strong and relevant.

17

Following a 2004 review of the Board committees’ terms of reference and structure by an outside consultant, the Board undertook an in-depth review of its practices to address some of the improvements highlighted in the report. Committee terms of reference were significantly updated and a number of responsibilities were reassigned. This exercise allowed directors to better understand their role as committee members and allowed committees to better focus their time and energy.

In February 2004, Treasury Board undertook a comprehensive review of the governance and accountability framework for Crown corporations. CMHC and its Board of Directors were actively engaged in the review process. Subsequently, regular reporting to the Board has ensured that CMHC has addressed the majority of the measures proposed in the final report. CMHC will continue to monitor those measures that still require input and guidance from the government.

Early in 2007, the Board approved its new Board director profile and updated the terms of reference for the Board and its committees. In an effort to enhance its openness, the Board has decided to post this information on the corporate website. CMHC will become one of the first Crown corporations to provide this type of information online.

CMHC and its Board of Directors will continue to participate in the review of Crown governance, and take all necessary actions to ensure that its governance regime meets best practice. This includes ensuring that its governance policies and practices are aligned with the new Federal Accountability Act.

The CMHC Pension Fund

Established by the Board of Directors, the CMHC pension fund is managed and administered by trustees pursuant to the Trust Agreement. The Trustees are responsible for setting investment objectives and policies, selecting external investment managers, and monitoring the investment results of the pension fund.

In 2006, CMHC’s pension governance structure and practices were reviewed. A final report was provided to the Trustees, the Corporate Governance Committee, and the Board of Directors. It was concluded that, overall, CMHC’s pension governance structure and practices meet or exceed the expectations of governance guidelines established by the Canadian Association of Pension Supervisory Authorities. CMHC is operating with many best practices such as regular meetings of trustees, orientation sessions for new trustees, clearly articulated policies, goals, and guidelines, and annual reviews of the financial status of the pension plan by CMHC’s management.

Directors total compensation and attendance at meetings of the Board and of Board Committees in 2006

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Human | | Pension |

| | | Total | | | | | | | | | | Governance | | Resources | | Fund |

| | | Compensation | | Board of | | Audit | | Committee | | Committee | | Trustees |

| | | (fees and | | Directors | | Committee | | (three | | (three | | (three |

| Board Member | | retainer $)1 | | (six meetings) | | (five meetings) | | meetings) | | meetings) | | meetings) |

Dino Chiesa | | | 52,595 | | | | 6/6 | | | | | | | | 3/3 | | | | | | | | | |

| |

Karen Kinsley2, 3 | | | | | | | 6/6 | | | | | | | | 2/2 | | | | | | | | 3/3 | |

| |

Harold Calla | | | 30,700 | | | | 6/6 | | | | | | | | | | | | 3/3 | | | | | |

| |

Roberta Hayes | | | 31,200 | | | | 6/6 | | | | | | | | | | | | 3/3 | | | | | |

| |

Hugh Heron | | | 28,200 | | | | 6/6 | | | | | | | | | | | | 3/3 | | | | | |

| |

Sophie Joncas | | | 33,200 | | | | 6/6 | | | | 5/5 | | | | 2/3 | | | | | | | | | |

| |

Gary P. Mooney4 | | | 18,700 | | | | 4/6 | | | | 3/5 | | | | | | | | | | | | | |

| |

Louis Ranger2 | | | | | | | 1/6 | | | | | | | | | | | | 2/3 | | | | | |

| |

Joel Teal5 | | | 3,213 | | | | 1/1 | | | | | | | | | | | | | | | | | |

| |

Alexander Werzberger | | | 23,200 | | | | 6/6 | | | | | | | | 3/3 | | | | | | | | | |

| |

Catherine Cronin6 | | | 31,987 | | | | 5/5 | | | | 4/4 | | | | | | | | | | | | 2/2 | |

| |

| | |

| N.B., the Nominating Committee did not meet in 2006. |

| |

| 1 | | Compensation levels are established by the federal government through an Order-in-Council. The Privy Council Office issues guidelines that set out the form, amounts and conditions of payment for the part-time services of persons appointed to office by the Governor-in-Council. The Chairperson of the Board is responsible for approving payment of Directors’ fees. |

| |

| 2 | | Members of the Public Service are not paid for their service. |

| |

| 3 | | Became a member of the Corporate Governance Committee in March 2006. |

| |

| 4 | | Absent due to illness. |

| |

| 5 | | Appointed 31 October 2006. |

| |

| 6 | | Term ended 30 October 2006. |

18

2006 ANNUAL REPORT — Corporate Governance

BOARD OF DIRECTORS

(as at 31 December 2006)

Dino Chiesa

Chairperson of the Board

Dino Chiesa is Vice-Chair of the Board of Trustees of the Canadian Apartment Properties Real Estate Investment Trust (CAP REIT). Prior to this, he was Chief Executive Officer of the Residential Real Estate Income Trust (RES REIT), Assistant Deputy Minister of Ontario’s Ministry of Municipal Affairs and Housing, and CEO of the Ontario Housing Corporation and Ontario Mortgage Corporation. Mr. Chiesa has been a member of the Board since June 2001 and was appointed Chairperson of the Board of Directors in March 2005.

Karen Kinsley, CA

President and Chief Executive Officer

Karen Kinsley joined CMHC in 1987, holding a variety of positions in senior management. She was appointed President and Chief Executive Officer in June 2003.

Harold Calla, CGA, CAFM

North Vancouver, British Columbia

Harold Calla is Chair of the First Nations Financial Management Board. He also holds a number of positions with the Squamish Nation, including surveyor of taxes, senior negotiator for economic development and bilateral accommodation negotiations with the province of British Columbia. He was appointed to CMHC’s Board of Directors in June 2005.

Roberta Hayes

Moncton, New Brunswick

Roberta Hayes is co-owner and manager of HomeLife Hayes Realty. Ms. Hayes was formerly the President and a director of the Greater Moncton Real Estate Board, as well as a director of both the New Brunswick Real Estate Association and the Canadian Real Estate Association. She was appointed to CMHC’s Board of Directors in October 2003.

Hugh Heron

Schomberg, Ontario

Hugh Heron is Principal and Partner of the Heron Group of Companies and President of Heron Homes Corporation. Mr. Heron is a past president of both the Toronto Home Builders’ Association and the Ontario Home Builders’ Association. He was appointed to CMHC’s Board of Directors in June 2001.

Sophie Joncas, CA

Longueuil, Québec

Sophie Joncas is a chartered accountant in private practice. She is a member of the continuing education committee of the Ordre des comptables agréés du Québec (OCAQ). She has also developed and taught courses on governance and on the role of the audit committee for the OCAQ. She is chair of the Association des gens d’affaires de Saint-Hubert. She was appointed to CMHC’s Board of Directors in August 2001.

Gary P. Mooney

Mississauga, Ontario

Gary P. Mooney is President and Chief Executive Officer of Fidelity National Financial, a Mississauga-based title insurance company. He is also a senior partner with the law firm Anderson, Sinclair. He was appointed to CMHC’s Board of Directors in June 2005.

Louis Ranger

Gatineau, Québec

Louis Ranger is Deputy Minister of Transport Canada and Deputy Head of Infrastructure Canada — Infrastructure and Communities. He was appointed to CMHC’s Board of Directors in September 2002.

Joel Teal

Saskatoon, Saskatchewan

Joel Teal is currently President, Dundee Development/Homes by Dundee and is Chair of the Board of Directors of the Saskatchewan Blue Cross. He was appointed to CMHC’s Board of Directors in October 2006.

Alexander Werzberger

Montréal, Québec

Alexander Werzberger is currently the President of Traklin Groups. Mr. Werzberger has served on the board of directors of various organizations, including L’Association provinciale des constructeurs d’habitations du Québec and L’ Association de la construction du Québec. He was appointed to the Board of Directors in April 2005.

19

Living our Corporate Values

At CMHC, we know that being an accountable organization means being proud not only of what we do, but also of how we do it. It means staying true to our convictions, knowing that the way we do business helps us attract and retain the talent we need to be successful and strengthen stakeholder confidence in our ability to deliver results. This sense of workplace integrity has a strong tradition at CMHC and is deeply rooted in the corporate mission and values that help guide us in our business. We have long known that the way we do our business today can lead to a successful tomorrow.

BUILDING A WORKPLACE COMMUNITY

We are working hard to create the right organizational environment for our employees. What is that environment? It’s one where our employees are engaged, where they feel safe in expressing their opinions and proud of their individual and collective contributions to our corporate performance.

Engaging our employees

Establishing effective management practices is critical to ensuring an engaged and committed workforce. CMHC’s human resources policies are considered best practices. Recognizing that our employees are the cornerstone of our commitment to governance, our governance framework includes employee standards of conduct, a values and ethics program, as well as a process for employees to bring forward information concerning wrongdoing in the workplace.

To help employees balance their commitments at home and at work, CMHC offers a variety of alternate work arrangements and attractive benefits, including family-related leave and maternity or parental benefits. CMHC also maintains an employee relations office dedicated to promoting a healthy environment by helping employees, managers and human resources professionals build and maintain strong relationships. When dealing with difficult personal or professional situations, our employees and their families also have access to a voluntary, short-term confidential counseling service to assist them in finding the help they need.

Through these and other policies and programs, we’re building a workplace community — a community reflecting the value of every person, mutual respect and honesty. CMHC has a well-established President’s Advisory Council which plays a key role in strengthening this sense of community. The Council provides an opportunity for employees to share their concerns, suggestions and recommendations with CMHC’s President and for the President to engage in a frank discussion with elected employee representatives from across the Corporation.

In 2006, CMHC engaged an external consultant to undertake a review of its management practices. Approximately 45 employees participated in interviews, lasting between one and two hours, to explore a variety of themes, including resource allocation, decision-making and communication. Through issue-focused employee consultations such as these, CMHC is able to assess the effectiveness of its management practices and identify areas for improvement that are most important to employees. As a result of this latest consultation, for example, CMHC is working towards establishing a decision-making framework that clearly identifies the owner of a particular issue, and offers the right consultation forum. In so doing, we are making certain that our employees are actively consulted and represented in decision-making.

As a testament to the success of our ongoing efforts to ensure an engaged workforce, CMHC’s resignation rate among regular staff, at 3.5 per cent, is below comparable types of employers such as financial services industries (7.7 per cent) and the government sector (5.1 per cent).

Building a diverse workforce

CMHC prides itself in building a representative workforce. By fostering diversity, we are better equipped to build stronger relationships with a range of communities, enhance our creativity and effectiveness as an organization, and expand our business opportunities at home and abroad.

| | | | | | | | | |

| | | CMHC | | Canadian |

| Employee Profile | | 2006 | | Labour Market1 |

| Women (%) | | | 59.5 | | | | 48.4 | |

| |

| Visible Minorities (%) | | | 12.3 | | | | 12.6 | |

| |

| Persons with Disabilities (%) | | | 4.2 | | | | 5.3 | |

| |

| Aboriginal Persons (%) | | | 2.5 | | | | 2.6 | |

| |

| | |

| 1 | | Based on latest available Census data (2001) |

CMHC has consistently received top marks in the Government of Canada’s annual report on employment equity. In the latest report published in 2005, CMHC received its first set of straight ‘A’s for attracting, developing and retaining women, Aboriginal peoples, persons with disabilities and visible minorities. This rating places CMHC among the top four federally-regulated private-sector employers and Crown corporations. As we continue our efforts to build a representative workforce, we will work on expanding our relationships with diverse communities as a means to enhancing our visibility as an employer.

20

2006 ANNUAL REPORT — Corporate Values

Giving back to our communities

CMHC employees support charitable organizations such as the Government of Canada Workplace Charitable campaign for the United Way. In 2006, CMHC employees and retirees raised more than $275,000 for use within our communities. In 2006, CMHC also hosted a series of gingerbread- and birdhouse-building charitable events across the country. We raised close to $41,000 for a variety of charitable organizations, including Habitat for Humanity.

SERVING THE PUBLIC INTEREST

We are strongly committed to bringing about results that benefit Canadians and our communities. Our ability to add value to Canada, however, goes beyond our mandate to deliver programs and create policies for the benefit of Canadians. Living our values means, for us, a commitment to serving the public interest in ways that show respect for human dignity and the value of every person.

Serving our clients

CMHC is committed to serving all its clients in a competent, fair and timely fashion. In 2006, CMHC received a Government of Canada Award of Excellence for contribution to Treasury Board’s Service Improvement Initiative over the 2000-2005 period. The initiative had, as one of its objectives, the achievement of a 10 per cent improvement in client satisfaction with federal public services. Over this period, client satisfaction in financial services, which included CMHC, improved over the baseline by 17 per cent, well in excess of the target.

Recent immigrants to Canada often require specialized services to help them access suitable housing. Given Canada’s rising immigration rates and the Toronto area’s burgeoning multicultural population, CMHC recently implemented a wide-ranging multicultural communications strategy in that city. Key CMHC information products are distributed in six languages (Chinese, Russian, Spanish, Tagalog, Arabic and Urdu), in addition to English and French, to targeted organizations in Toronto that serve new Canadians. CMHC’s culturally diverse staff is often able to offer assistance to new Canadians who want housing information in their first language.

Sustaining our commitment to official languages and linguistic minority communities

As a federal Crown corporation, CMHC embraces the spirit and intent of Canada’s commitment to official languages. In recent years, the Corporation has made significant progress in a number of areas, notably in developing and maintaining the linguistic capacities of its employees, with 90 per cent of employees in bilingual positions meeting the language requirements of their position in 2006. During the year, the Corporation also continued its support for the development of English and French linguistic minority communities through a broad range of activities, including media and association relations, program promotion and business development.

ACHIEVING BUSINESS EXCELLENCE

Attaining the confidence of those we serve and the best possible results for the Canadian public requires us to exercise the highest standards of competence, trustworthiness and prudence in conducting our business relationships and in managing the financial, physical and human resources entrusted to our care.

Investing in the growth and development of our employees

CMHC employees have access to excellent learning and development opportunities. In 2006, one in five employees was involved in a temporary developmental assignment, lateral transfer or promotion. Furthermore, at 2.7 per cent of payroll or $2,092 per employee, CMHC’s learning investments exceed the average investment in the financial services sector and are in the top 10 per cent of Canadian firms.

Managing the physical resources entrusted to our care

As of June 2006, CMHC falls under the requirements of the Canadian Environmental Assessment Act. This legislation requires an environmental assessment of a proposed project where a responsible authority (federal department) is either the proponent or, transfers land, provides funding or issues a permit or authorization. We are currently assessing each of our programs for the potential impacts of this requirement. Policies and procedures for some business lines have already been adapted to meet the Corporation’s obligations under the Act.

CMHC continues to work with its partners to reclaim and return brownfields — abandoned, idle or underused sites once occupied by industrial or commercial facilities — to productive use. With an estimated 30,000 brownfield sites across the country, these efforts have considerable potential to positively impact the environment. In 2006, we continued our research on the barriers to brownfield redevelopment. We also introduced mortgage insurance flexibilities, and initiated a risk-sharing framework in the communities of Orillia, Ontario and Sydney, Nova Scotia. This last initiative is intended to help mitigate environmental risks associated with brownfield properties.

We also manage our direct impact on the environment. CMHC regularly uses recycled paper, works towards reducing paper consumption, and has introduced various recycling initiatives for construction debris, food packaging, batteries, office consumables and used office equipment.

21

MAXIMIZING TODAY’S OPPORTUNITIES

Analysis of Our Performance in 2006

Being a strong organization is about making the most of today’s opportunities. It’s about using our experience as we respond to change and rise to new challenges — knowing when to stay the course and when to find new approaches to improving the lives of Canadians through affordable, quality, and environmentally-sustainable housing. Ultimately, it’s about preparing for a successful tomorrow, today, and continuing to create vibrant and healthy communities across Canada.

PUBLIC POLICY OBJECTIVES

Our goal is to contribute to Canadian society by helping those who are most in need, by improving the affordability and quality of housing, and by ensuring that the Canadian housing system continues to be among the best in the world. Our public policy objectives, and the priority areas under each objective, are outlined below. It is against these priorities that we measure our performance.

Objective One

HELP CANADIANS IN NEED

| 1.1 | | Help Canadians in need to access affordable, sound and suitable housing |

| |

| 1.2 | | Improve living conditions for Aboriginal Canadians |

Objective Two

FACILITATE ACCESS TO MORE AFFORDABLE, BETTER QUALITY HOUSING FOR ALL CANADIANS

| 2.1 | | Ensure Canadians have access to mortgage insurance products and tools that meet their needs |

| |

| 2.2 | | Enhance the supply of low-cost funds for mortgage lending by expanding the securitization program |

| |

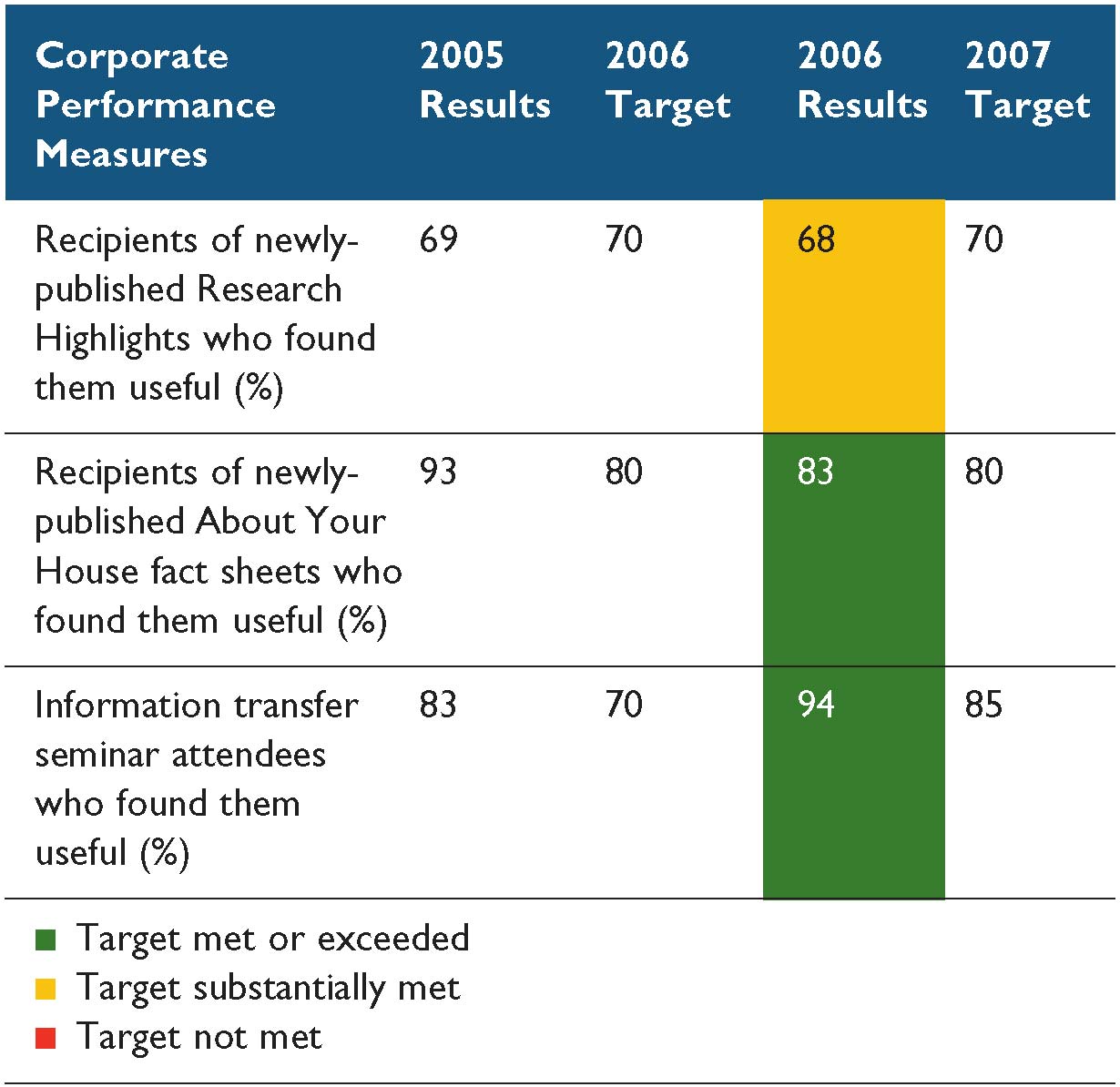

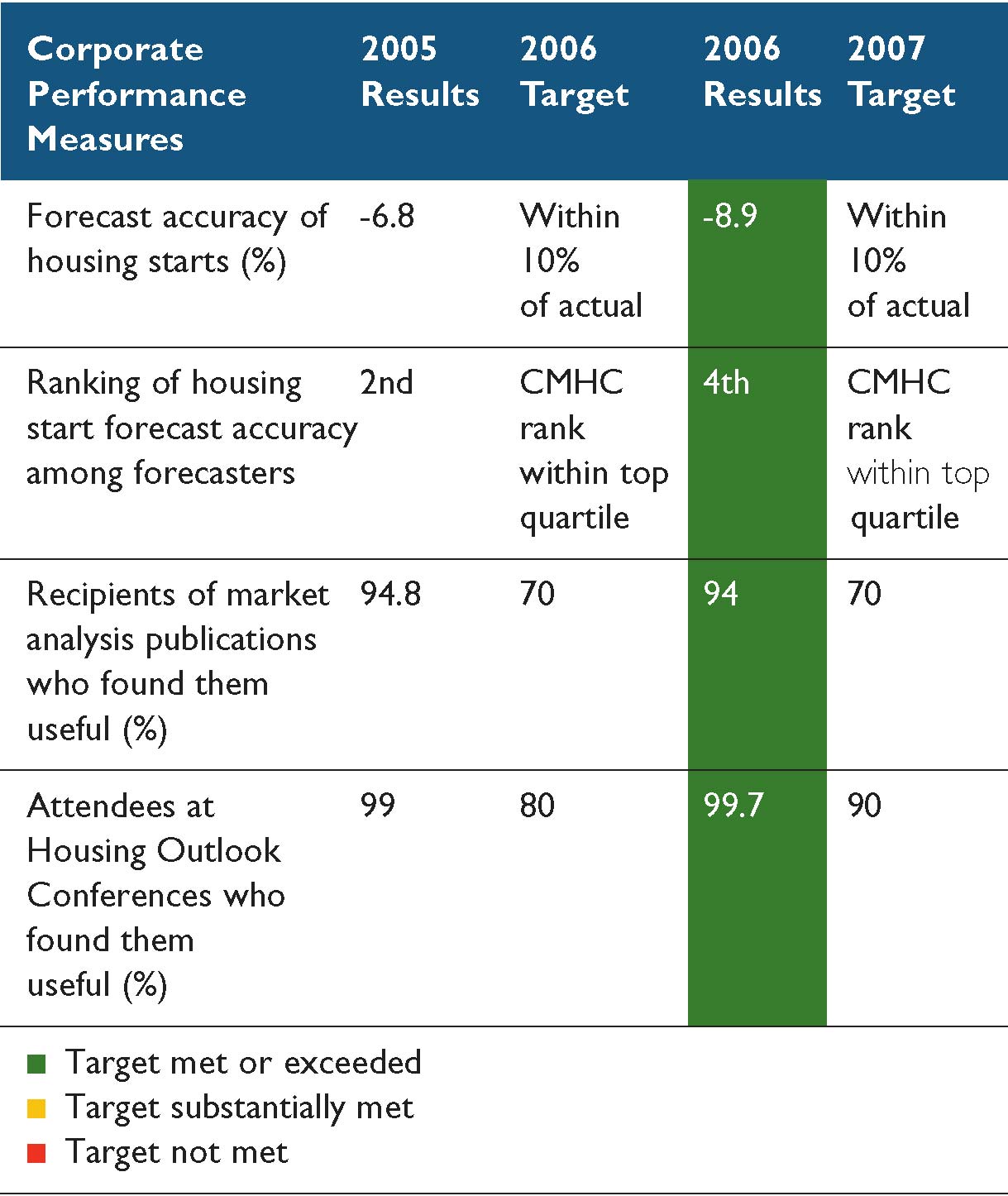

| 2.3 | | Provide comprehensive, timely and relevant information to enable Canadian consumers and the housing sector to make informed decisions |

Objective Three

ENSURE THE CANADIAN HOUSING SYSTEM REMAINS ONE OF THE BEST IN THE WORLD

| 3.1 | | Ensure Canada’s housing system remains one of the best in the world |

| |

| 3.2 | | Support and promote Canada’s world-class housing products, services and system internationally |

| |

| 3.3 | | Ensure CMHC remains a strong organization able to fulfill its mandate |

22

HELP CANADIANS IN NEED

For 60 years, we have been helping to provide a place to call home to millions of low-income families across the country. We have also been striving to close the housing gap faced by many Aboriginal Canadians. We are proud of our programs and policies that have helped Canadians access affordable, sound and suitable housing, and we will continue to help all Canadians share in these benefits.

RESOURCES

$56 million in operating expenses

386 staff years

23

Objective 1.1

HELP CANADIANS IN NEED TO ACCESS AFFORDABLE,

SOUND, AND SUITABLE HOUSING

What We Do

With our public and private partners, we help low- or modest-income Canadians obtain affordable, sound and suitable housing.

Why It Matters

Affordable, sound and suitable housing is essential to individual and community health and well-being.

How We Do It

On behalf of the federal government, we provide:

| 1) | | On-going financial assistance for existing social housing. |

| |

| 2) | | Funding to the provinces and territories to increase the supply of affordable housing. |

| |

| 3) | | Funding for renovations to preserve the stock of low-income housing. |

We provide low-cost loans directly to social housing providers.

We provide technical and financial support that leads to the development of affordable housing projects with no ongoing federal assistance.

We increase understanding of the distinct housing needs of those segments of the population who are at greater risk of housing need.

CMHC Toolbox

We draw on the following tools to achieve this strategic priority:

Affordable Housing Initiative

Flexible options for provinces and territories, including:

| • | | New rental housing |

| |

| • | | Home purchase |

| |

| • | | Homeownership preservation |

| |

| • | | Rental preservation |

| |

| • | | Rent supplements |

| |

| • | | Flexible mortgage loan insurance |

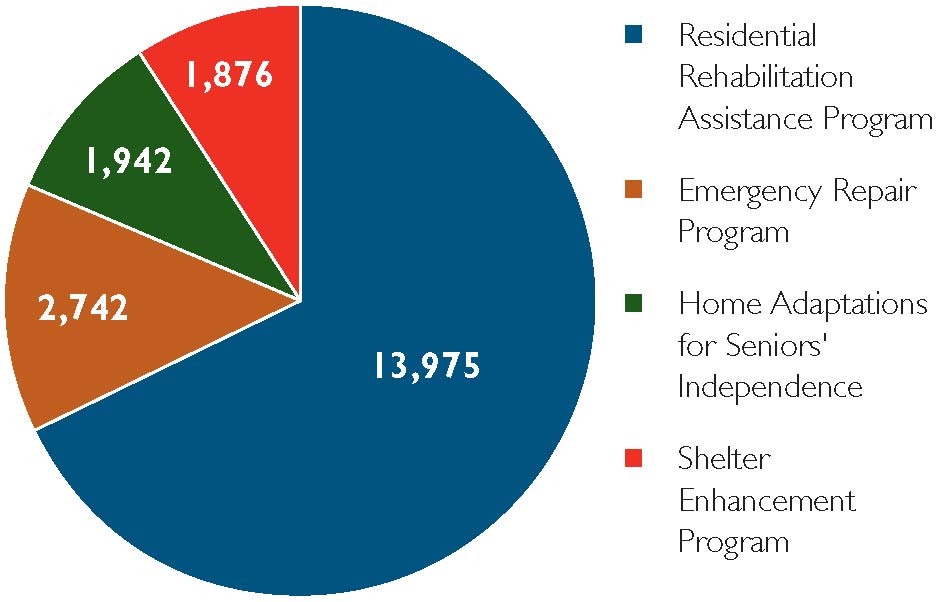

Renovation Programs

| • | | Residential Rehabilitation Assistance Program |

| |

| • | | Emergency Repair Program |

| |

| • | | Home Adaptations for Seniors Independence |

| |

| • | | Shelter Enhancement Program |

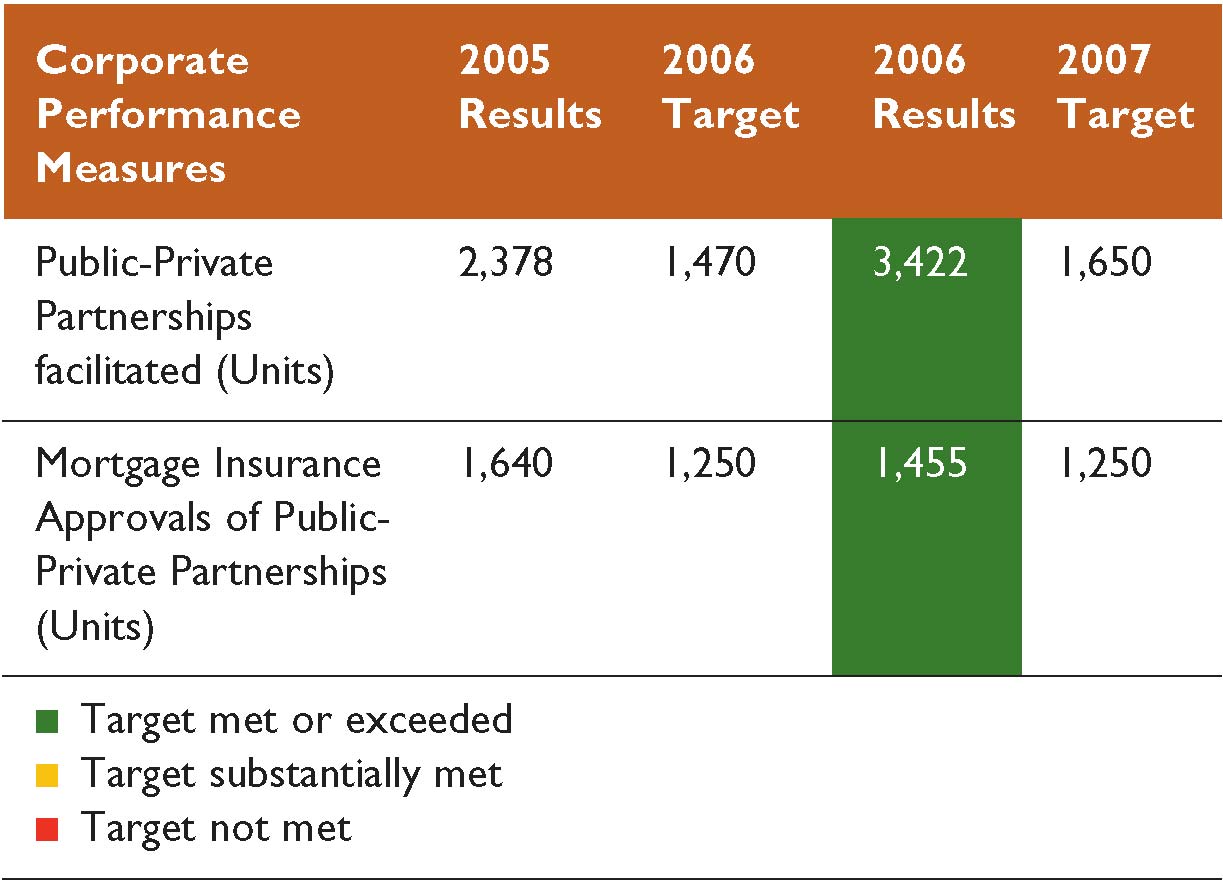

Public—Private Partnerships

| • | | Seed funding |

| |

| • | | Proposal development funding |

| |

| • | | Advice and skills development |

| |

| • | | Flexible mortgage loan insurance: |

| | • | | Insurance premium discounts |

| |

| | • | | Financing up to 95-per-cent of loan to lending value |

Housing Subsidies Under Long-Term Commitments

| • | | Public housing |

| |

| • | | Non-profit housing |

| |

| • | | Rent supplements |

| |

| • | | Co-operative housing |

Direct Lending

Research Products on Distinct Housing Needs, Including:

| • | | Newcomers Guide to Canadian Housing |

| |

| • | | Maintaining Seniors’ Independence Through Home Adaptations: A Self-Assessment Guide |

For additional information on CMHC’s programs and services, visit our website, www.cmhc.ca

24

2006 ANNUAL REPORT — Performance Against Objective 1

To ensure that all Canadians enjoy the benefits of a well-housed nation, we help those who are unable to afford sound, suitable housing on their own. We work with our government partners and other housing stakeholders to address these needs and make a difference.

What factors influenced our performance in 2006?

One in seven Canadian households cannot access housing that is affordable, sound and suitable

Overall, Canada has made progress in addressing housing need — 82,000 fewer households were in core housing need in 2001 compared to 1996. More than three-quarters of the almost 1.5 million households were in need because their housing was unaffordable, consuming more than 30 per cent of their income. Recent immigrants, lone-parents, seniors and Aboriginal households are more likely to be in core housing need than other Canadians. They are also the fastest growing segments of the Canadian population.

| | | | | | | | | |

| | | | | Households in |

| | | | | | | Core Housing |

| | | All Households | | Need |

| |

| Household Count | | | 10,805,600 | | | | 1,485,300 | |

| |

| Overall Incidence of Need | | | — | | | | 13.7 | |

| (% of households)* | | | | | | | | |

| |

| Average Annual Household Income ($) | | | 60,976 | | | | 17,439 | |

| |

| Average Monthly Shelter Cost ($) | | | 764 | | | | 643 | |

| |

| Average Shelter Cost to Income Ratio (%) | | | 21.3 | | | | 48 | |

| |

NB: Based on 2001 Census data. 2006 Census data on shelter costs will be available in May 2008. *excludes on-reserve

Rising demand kept rental vacancy rates low in 2006