- MAC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

The Macerich Company (MAC) 8-KResults of Operations and Financial Condition

Filed: 5 May 09, 12:00am

Supplemental Financial Information

For the three months ended March 31, 2009

The Macerich Company

Supplemental Financial and Operating Information

Table of Contents

All information included in this supplemental financial package is unaudited, unless otherwise indicated.

| | Page No. | |

|---|---|---|

Corporate Overview | 1-3 | |

Overview | 1 | |

Capital information and market capitalization | 2 | |

Changes in total common and equivalent shares/units | 3 | |

Financial Data | 4-5 | |

Supplemental FFO information | 4 | |

Capital expenditures | 5 | |

Operational Data | 6-9 | |

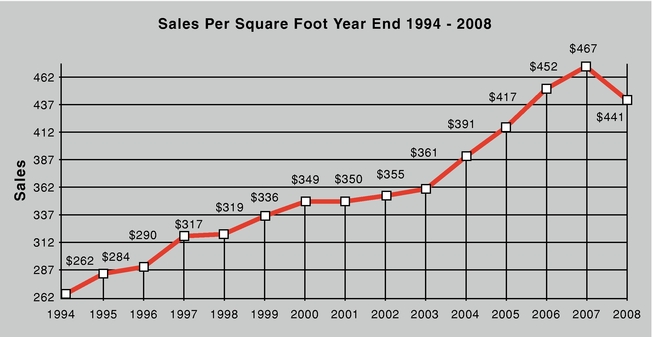

Sales per square foot | 6 | |

Occupancy | 7 | |

Rent | 8 | |

Cost of occupancy | 9 | |

Balance Sheet Information | 10-13 | |

Summarized balance sheet information | 10 | |

Debt summary | 11 | |

Outstanding debt by maturity date | 12-13 | |

Financing Activity | 14-15 | |

2009 Summary of financing activity | 14 | |

2010 Summary of financing activity | 15 | |

Development Pipeline Forecast | 16 |

This supplemental financial information should be read in connection with the Company's first quarter 2009 earnings announcement (included as Exhibit 99.1 of the Company's Current Report on 8-K, event date May 5, 2009) as certain disclosures, definitions and reconciliations in such announcement have not been included in this supplemental financial information.

The Macerich Company

Supplemental Financial and Operating Information

Overview

The Macerich Company (the "Company") is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional and community shopping centers located throughout the United States. The Company is the sole general partner of, and owns a majority of the ownership interests in, The Macerich Partnership, L.P., a Delaware limited partnership (the "Operating Partnership").

As of March 31, 2009, the Operating Partnership owned or had an ownership interest in 72 regional malls and 20 community shopping centers aggregating approximately 76 million square feet of gross leasable area ("GLA"). These 92 regional malls and community shopping centers are referred to hereinafter as the "Centers", unless the context requires otherwise.

The Company is a self-administered and self-managed real estate investment trust ("REIT") and conducts all of its operations through the Operating Partnership and the Company's management companies (collectively, the "Management Companies").

All references to the Company in this Exhibit include the Company, those entities owned or controlled by the Company and predecessors of the Company, unless the context indicates otherwise.

This document contains information that constitutes forward-looking statements and includes information regarding expectations regarding the Company's refinancing, development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, economic and business conditions; adverse changes in the real estate markets, including the liquidity of real estate investments; and risks of real estate development, redevelopment, and expansion, including availability, terms and cost of financing, construction delays, environmental and safety requirements, budget overruns, sunk costs and lease-up. Real estate development, redevelopment and expansion activities are also subject to risks relating to the inability to obtain, or delays in obtaining, all necessary zoning, land-use, building, and occupancy and other required governmental permits and authorizations and governmental actions and initiatives (including legislative and regulatory changes) as well as terrorist activities which could adversely affect all of the above factors. Furthermore, occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable. The reader is directed to the Company's various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2008 and the Quarterly Reports on Form 10-Q, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events unless required by law to do so.

1

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Information and Market Capitalization

| | Period Ended | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 3/31/2009 | 12/31/2008 | 12/31/2007 | 12/31/2006 | |||||||||

| | dollars in thousands except per share data | ||||||||||||

Closing common stock price per share | $ | 6.26 | $ | 18.16 | $ | 71.06 | $ | 86.57 | |||||

52 week high | $ | 76.50 | $ | 76.50 | $ | 103.59 | $ | 87.10 | |||||

52 week low | $ | 5.45 | $ | 8.31 | $ | 69.44 | $ | 66.70 | |||||

Shares outstanding at end of period | |||||||||||||

Class A participating convertible preferred units | — | — | 2,855,393 | 2,855,393 | |||||||||

Class A non-participating convertible preferred units | 193,164 | 193,164 | 219,828 | 287,176 | |||||||||

Series A cumulative convertible redeemable preferred stock | — | — | 3,067,131 | 3,627,131 | |||||||||

Common shares and partnership units | 88,724,277 | 88,529,334 | 84,864,600 | 84,767,432 | |||||||||

Total common and equivalent shares/units outstanding | 88,917,441 | 88,722,498 | 91,006,952 | 91,537,132 | |||||||||

Portfolio capitalization data | |||||||||||||

Total portfolio debt, including joint ventures at pro rata | $ | 7,931,989 | $ | 7,926,241 | $ | 7,507,559 | $ | 6,620,271 | |||||

Equity market capitalization | 556,623 | 1,611,201 | 6,466,954 | 7,924,369 | |||||||||

Total market capitalization | $ | 8,488,612 | $ | 9,537,442 | $ | 13,974,513 | $ | 14,544,640 | |||||

Floating rate debt as a percentage of total debt | 23.0 | % | 21.9 | % | 14.8 | % | 20.8 | % | |||||

2

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Changes in Total Common and Equivalent Shares/Units

| | Partnership Units | Company Common Shares | Class A Non-Participating Convertible Preferred Units ("NPCPUs") | Total Common and Equivalent Shares/ Units | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Balance as of December 31, 2008 | 11,645,700 | 76,883,634 | 193,164 | 88,722,498 | |||||||||

Issuance of stock/partnership units from stock option exercises, restricted stock issuance or other share- or unit-based plans | 46,410 | 148,533 | — | 194,943 | |||||||||

Balance as of March 31, 2009 | 11,692,110 | 77,032,167 | 193,164 | 88,917,441 | |||||||||

3

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Supplemental Funds from Operations ("FFO") Information(a)

| | As of March 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | |||||

| | dollars in millions | ||||||

Straight line rent receivable | $ | 63.8 | $ | 55.8 | |||

| | For the Three Months Ended March 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | |||||

| | dollars in millions | ||||||

Lease termination fees | $ | 1.9 | $ | 2.5 | |||

| |||||||

Straight line rental income | $ | 1.6 | $ | 2.1 | |||

| |||||||

Gain on sales of undepreciated assets | $ | 1.3 | $ | 1.6 | |||

| |||||||

Amortization of acquired above- and below-market leases (SFAS 141) | $ | 4.1 | $ | 4.6 | |||

| |||||||

Amortization of debt premiums/(discounts)(b) | $ | 0.3 | $ | (0.8 | ) | ||

| |||||||

Interest capitalized | $ | 6.5 | $ | 7.6 | |||

4

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Expenditures

| | For the Three Months Ended 3/31/09 | Year Ended 12/31/2008 | Year Ended 12/31/2007 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | dollars in millions | ||||||||||

Consolidated Centers | |||||||||||

Acquisitions of property and equipment | $ | 3.2 | $ | 87.5 | $ | 387.9 | |||||

Development, redevelopment and expansions of Centers | 58.8 | 446.1 | 545.9 | ||||||||

Renovations of Centers | 2.5 | 8.5 | 31.1 | ||||||||

Tenant allowances | 1.6 | 14.6 | 28.0 | ||||||||

Deferred leasing charges | 6.6 | 22.3 | 21.6 | ||||||||

Total | $ | 72.7 | $ | 579.0 | $ | 1,014.5 | |||||

Joint Venture Centers(a) | |||||||||||

Acquisitions of property and equipment | $ | 1.2 | $ | 294.4 | $ | 24.8 | |||||

Development, redevelopment and expansions of Centers | 15.0 | 60.8 | 33.5 | ||||||||

Renovations of Centers | 0.8 | 3.1 | 10.5 | ||||||||

Tenant allowances | 0.8 | 13.8 | 15.1 | ||||||||

Deferred leasing charges | 0.9 | 5.0 | 4.2 | ||||||||

Total | $ | 18.7 | $ | 377.1 | $ | 88.1 | |||||

5

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Sales Per Square Foot(a)

| | Wholly Owned Centers | Joint Venture Centers | Total Centers | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

03/31/2009(b) | $ | 419 | $ | 459 | $ | 440 | ||||

12/31/2008 | $ | 420 | $ | 460 | $ | 441 | ||||

12/31/2007(c) | $ | 448 | $ | 486 | $ | 467 | ||||

6

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Occupancy

Period Ended | Wholly Owned Regional Malls(a) | Joint Venture Regional Malls(a) | Total Regional Malls(a) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

03/31/2009 | 89.4 | % | 90.8 | % | 90.2 | % | ||||

12/31/2008 | 91.6 | % | 92.8 | % | 92.3 | % | ||||

12/31/2007 | 92.8 | % | 93.3 | % | 93.1 | % | ||||

Period Ended | Wholly Owned Centers(b) | Joint Venture Centers(b) | Total Centers(b) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

03/31/2009 | 89.1 | % | 90.8 | % | 90.1 | % | ||||

12/31/2008 | 91.3 | % | 93.1 | % | 92.3 | % | ||||

12/31/2007 | 92.8 | % | 94.0 | % | 93.5 | % | ||||

7

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Rent

| | Average Base Rent PSF(a) | Average Base Rent PSF on Leases Commencing During the Period(b) | Average Base Rent PSF on Leases Expiring(c) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Wholly Owned Centers | |||||||||||

03/31/2009 | $ | 42.44 | $ | 39.12 | $ | 35.49 | |||||

12/31/2008 | $ | 41.39 | $ | 42.70 | $ | 35.14 | |||||

12/31/2007 | $ | 38.49 | $ | 43.23 | $ | 34.21 | |||||

Joint Venture Centers | |||||||||||

03/31/2009 | $ | 42.68 | $ | 49.42 | $ | 36.65 | |||||

12/31/2008 | $ | 42.14 | $ | 49.74 | $ | 37.61 | |||||

12/31/2007 | $ | 38.72 | $ | 47.12 | $ | 34.87 | |||||

8

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Cost of Occupancy

| | For Years Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||||

Wholly Owned Centers | ||||||||||||

Minimum rents | 8.9 | % | 8.0 | % | 8.1 | % | ||||||

Percentage rents | 0.4 | % | 0.4 | % | 0.4 | % | ||||||

Expense recoveries(a) | 4.4 | % | 3.8 | % | 3.7 | % | ||||||

Total | 13.7 | % | 12.2 | % | 12.2 | % | ||||||

| | For Years Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | |||||||||

Joint Venture Centers | ||||||||||||

Minimum rents | 8.2 | % | 7.3 | % | 7.2 | % | ||||||

Percentage rents | 0.4 | % | 0.5 | % | 0.6 | % | ||||||

Expense recoveries(a) | 3.9 | % | 3.2 | % | 3.1 | % | ||||||

Total | 12.5 | % | 11.0 | % | 10.9 | % | ||||||

9

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Summarized Balance Sheet Information

| | March 31, 2009 | December 31, 2008 | December 31, 2007 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | dollars in thousands | ||||||||||

Cash and cash equivalents | $ | 79,536 | $ | 66,529 | $ | 85,273 | |||||

Pro rata cash and cash equivalents on unconsolidated entities | 44,612 | 91,103 | 56,194 | ||||||||

Investment in real estate, net (a) | 6,381,085 | 6,371,319 | 6,187,473 | ||||||||

Investment in unconsolidated entities | 1,046,947 | 1,094,845 | 785,643 | ||||||||

Total assets | 8,035,504 | 8,090,435 | 7,937,097 | ||||||||

Mortgage and notes payable (b) | 5,985,360 | 5,940,418 | 5,703,180 | ||||||||

Pro rata share of debt on unconsolidated entities | 2,013,570 | 2,017,705 | 1,820,411 | ||||||||

10

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Debt Summary (at Company's pro rata share)

| | As of March 31, 2009 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | Fixed Rate | Variable Rate(a) | Total | ||||||||

| | dollars in thousands | ||||||||||

Consolidated debt | $ | 4,292,894 | $ | 1,625,525 | $ | 5,918,419 | |||||

Unconsolidated debt | 1,815,075 | 198,495 | 2,013,570 | ||||||||

Total debt | $ | 6,107,969 | $ | 1,824,020 | $ | 7,931,989 | |||||

Weighted average interest rate | 5.99 | % | 2.39 | % | 5.16 | % | |||||

Weighted average maturity (years) | 3.37 | ||||||||||

11

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

Outstanding Debt by Maturity Date

| | As of March 31, 2009 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Center/Entity (dollars in thousands) | Maturity Date | Effective Interest Rate (a) | Fixed | Floating | Total Debt Balance (a) | |||||||||||

I. Consolidated Assets: | ||||||||||||||||

Carmel Plaza (b) | 05/01/09 | 8.18 | % | $ | 25,679 | $ | — | $ | 25,679 | |||||||

Paradise Valley Mall (c) | 05/01/09 | 5.89 | % | 20,009 | — | 20,009 | ||||||||||

Northridge Mall (d) | 07/01/09 | 4.94 | % | 79,280 | — | 79,280 | ||||||||||

Macerich Partnership Line of Credit (e) | 04/25/10 | 6.23 | % | 400,000 | — | 400,000 | ||||||||||

Macerich Partnership Term Loan (f) | 04/26/10 | 6.50 | % | 444,375 | — | 444,375 | ||||||||||

Vintage Faire Mall | 09/01/10 | 7.92 | % | 63,052 | — | 63,052 | ||||||||||

Santa Monica Place | 11/01/10 | 7.79 | % | 77,567 | — | 77,567 | ||||||||||

Valley View Center | 01/01/11 | 5.81 | % | 125,000 | — | 125,000 | ||||||||||

Danbury Fair Mall | 03/10/11 | 4.64 | % | 168,187 | — | 168,187 | ||||||||||

Shoppingtown Mall | 05/11/11 | 5.01 | % | 42,622 | — | 42,622 | ||||||||||

Capitola Mall | 05/15/11 | 7.13 | % | 37,014 | — | 37,014 | ||||||||||

Freehold Raceway Mall | 07/07/11 | 4.68 | % | 170,159 | — | 170,159 | ||||||||||

Pacific View | 08/31/11 | 7.25 | % | 80,491 | — | 80,491 | ||||||||||

Pacific View | 08/31/11 | 7.00 | % | 6,506 | — | 6,506 | ||||||||||

Rimrock Mall | 10/01/11 | 7.56 | % | 41,979 | — | 41,979 | ||||||||||

Prescott Gateway | 12/01/11 | 5.86 | % | 60,000 | — | 60,000 | ||||||||||

Hilton Village | 02/01/12 | 5.27 | % | 8,552 | — | 8,552 | ||||||||||

The Macerich Company—Convertible Senior Notes (g) | 03/15/12 | 5.41 | % | 636,728 | — | 636,728 | ||||||||||

Tucson La Encantada | 06/01/12 | 5.84 | % | 78,000 | — | 78,000 | ||||||||||

Chandler Fashion Center | 11/01/12 | 5.20 | % | 99,803 | — | 99,803 | ||||||||||

Chandler Fashion Center | 11/01/12 | 6.00 | % | 65,847 | — | 65,847 | ||||||||||

Towne Mall | 11/01/12 | 4.99 | % | 14,241 | — | 14,241 | ||||||||||

Deptford Mall | 01/15/13 | 5.41 | % | 172,500 | — | 172,500 | ||||||||||

Queens Center | 03/01/13 | 7.72 | % | 130,000 | — | 130,000 | ||||||||||

Queens Center | 03/31/13 | 7.00 | % | 212,269 | — | 212,269 | ||||||||||

Greeley—Defeasance | 09/01/13 | 6.34 | % | 26,865 | — | 26,865 | ||||||||||

FlatIron Crossing | 12/01/13 | 5.26 | % | 183,348 | — | 183,348 | ||||||||||

Great Northern Mall | 12/01/13 | 5.11 | % | 39,404 | — | 39,404 | ||||||||||

Fiesta Mall | 01/01/15 | 4.98 | % | 84,000 | — | 84,000 | ||||||||||

Fresno Fashion Fair | 08/01/15 | 6.76 | % | 168,960 | — | 168,960 | ||||||||||

Flagstaff Mall | 11/01/15 | 5.03 | % | 37,000 | — | 37,000 | ||||||||||

South Towne Center | 11/05/15 | 6.75 | % | 89,656 | — | 89,656 | ||||||||||

Valley River Center | 02/01/16 | 5.60 | % | 120,000 | — | 120,000 | ||||||||||

Salisbury, Center at | 05/01/16 | 5.83 | % | 115,000 | — | 115,000 | ||||||||||

Deptford Mall | 06/01/16 | 6.46 | % | 15,592 | — | 15,592 | ||||||||||

Chesterfield Towne Center | 01/01/24 | 9.07 | % | 53,690 | — | 53,690 | ||||||||||

South Plains Mall | 03/01/29 | 9.49 | % | 57,438 | — | 57,438 | ||||||||||

Wilton Mall (h) | 11/01/29 | 4.79 | % | 42,081 | — | 42,081 | ||||||||||

Total Fixed Rate Debt for Consolidated Assets | 6.06 | % | $ | 4,292,894 | $ | — | $ | 4,292,894 | ||||||||

La Cumbre Plaza | 08/09/09 | 1.94 | % | $ | — | $ | 30,000 | $ | 30,000 | |||||||

Promenade at Casa Grande (i) | 08/16/09 | 1.98 | % | — | 49,901 | 49,901 | ||||||||||

Panorama Mall | 02/28/10 | 1.62 | % | — | 50,000 | 50,000 | ||||||||||

Macerich Partnership Line of Credit | 04/25/10 | 1.78 | % | — | 758,500 | 758,500 | ||||||||||

Cactus Power Center (j) | 03/14/11 | 1.85 | % | — | 349 | 349 | ||||||||||

Twenty Ninth Street | 03/25/11 | 5.45 | % | — | 106,575 | 106,575 | ||||||||||

Victor Valley, Mall of | 05/06/11 | 2.37 | % | — | 100,000 | 100,000 | ||||||||||

Westside Pavilion | 06/05/11 | 3.14 | % | — | 175,000 | 175,000 | ||||||||||

SanTan Village Regional Center (k) | 06/13/11 | 3.27 | % | — | 108,444 | 108,444 | ||||||||||

Oaks, The | 07/10/11 | 2.55 | % | — | 165,000 | 165,000 | ||||||||||

Oaks, The | 07/10/11 | 3.26 | % | — | 81,756 | 81,756 | ||||||||||

Total Floating Rate Debt for Consolidated Assets | 2.46 | % | $ | — | $ | 1,625,525 | $ | 1,625,525 | ||||||||

Total Debt for Consolidated Assets | 5.07 | % | $ | 4,292,894 | $ | 1,625,525 | $ | 5,918,419 | ||||||||

II. Unconsolidated Assets (At Company's pro rata share): | ||||||||||||||||

North Bridge, The Shops at (50%) (l) | 07/01/09 | 4.67 | % | $ | 102,633 | $ | — | $ | 102,633 | |||||||

Redmond Office (51%) (m) | 07/10/09 | 6.77 | % | 30,872 | — | 30,872 | ||||||||||

Redmond Retail (51%) | 08/01/09 | 4.81 | % | 35,965 | — | 35,965 | ||||||||||

Corte Madera, The Village at (50.1%) | 11/01/09 | 7.75 | % | 31,907 | — | 31,907 | ||||||||||

Ridgmar (50%) | 04/11/10 | 6.11 | % | 28,700 | — | 28,700 | ||||||||||

Kitsap Mall/Place (51%) | 06/01/10 | 8.14 | % | 28,683 | — | 28,683 | ||||||||||

Cascade (51%) | 07/01/10 | 5.28 | % | 19,694 | — | 19,694 | ||||||||||

12

| | As of March 31, 2009 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Center/Entity (dollars in thousands) | Maturity Date | Effective Interest Rate (a) | Fixed | Floating | Total Debt Balance (a) | |||||||||||

Stonewood Mall (51%) | 12/11/10 | 7.44 | % | $ | 37,130 | $ | — | $ | 37,130 | |||||||

Inland Center (50%) | 02/11/11 | 4.69 | % | 27,000 | — | 27,000 | ||||||||||

Arrowhead Towne Center (33.3%) | 10/01/11 | 6.38 | % | 25,862 | — | 25,862 | ||||||||||

SanTan Village Power Center (34.9%) | 02/01/12 | 5.33 | % | 15,705 | — | 15,705 | ||||||||||

NorthPark Center (50%) | 05/10/12 | 5.96 | % | 91,763 | — | 91,763 | ||||||||||

NorthPark Center (50%) | 05/10/12 | 8.33 | % | 40,965 | — | 40,965 | ||||||||||

NorthPark Land (50%) | 05/10/12 | 8.33 | % | 39,568 | — | 39,568 | ||||||||||

Kierland Greenway (24.5%) | 01/01/13 | 6.02 | % | 15,345 | — | 15,345 | ||||||||||

Kierland Main Street (24.5%) | 01/02/13 | 4.99 | % | 3,739 | — | 3,739 | ||||||||||

Scottsdale Fashion Square (50%) | 07/08/13 | 5.66 | % | 275,000 | — | 275,000 | ||||||||||

Tysons Corner Center (50%) | 02/17/14 | 4.78 | % | 164,931 | — | 164,931 | ||||||||||

Lakewood Mall (51%) | 06/01/15 | 5.43 | % | 127,500 | — | 127,500 | ||||||||||

Broadway Plaza (50%) | 08/15/15 | 6.12 | % | 74,481 | — | 74,481 | ||||||||||

Chandler Festival (50%) | 11/01/15 | 6.39 | % | 14,850 | — | 14,850 | ||||||||||

Chandler Gateway (50%) | 11/01/15 | 6.37 | % | 9,450 | — | 9,450 | ||||||||||

Washington Square (51%) | 01/01/16 | 6.04 | % | 127,246 | — | 127,246 | ||||||||||

Eastland Mall (50%) | 06/01/16 | 5.80 | % | 84,000 | — | 84,000 | ||||||||||

Empire Mall (50%) | 06/01/16 | 5.81 | % | 88,150 | — | 88,150 | ||||||||||

Granite Run (50%) | 06/01/16 | 5.84 | % | 58,911 | — | 58,911 | ||||||||||

Mesa Mall (50%) | 06/01/16 | 5.82 | % | 43,625 | — | 43,625 | ||||||||||

Rushmore (50%) | 06/01/16 | 5.82 | % | 47,000 | — | 47,000 | ||||||||||

Southern Hills (50%) | 06/01/16 | 5.82 | % | 50,750 | — | 50,750 | ||||||||||

Valley Mall (50%) | 06/01/16 | 5.85 | % | 22,937 | — | 22,937 | ||||||||||

West Acres (19%) | 10/01/16 | 6.41 | % | 12,737 | — | 12,737 | ||||||||||

Biltmore Fashion Park (50%) (n) | 07/10/29 | 4.70 | % | 36,148 | — | 36,148 | ||||||||||

Wilshire Building (30%) | 01/01/33 | 6.35 | % | 1,828 | — | 1,828 | ||||||||||

Total Fixed Rate Debt for Unconsolidated Assets | 5.83 | % | $ | 1,815,075 | $ | — | $ | 1,815,075 | ||||||||

Superstition Springs Center (33.3%) | 09/09/09 | 0.93 | % | — | 22,498 | 22,498 | ||||||||||

Camelback Colonnade (75%) | 10/09/09 | 1.42 | % | — | 31,125 | 31,125 | ||||||||||

Metrocenter Mall (15%) | 02/09/10 | 6.05 | % | — | 16,800 | 16,800 | ||||||||||

Metrocenter Mall (15%) | 02/09/10 | 4.01 | % | — | 3,240 | 3,240 | ||||||||||

Desert Sky Mall (50%) | 03/04/10 | 1.66 | % | — | 25,750 | 25,750 | ||||||||||

Kierland Tower Lofts (15%) | 11/18/10 | 3.57 | % | — | 1,597 | 1,597 | ||||||||||

Boulevard Shops (50%) | 12/17/10 | 1.43 | % | — | 10,700 | 10,700 | ||||||||||

Chandler Village Center (50%) | 01/15/11 | 1.64 | % | — | 8,643 | 8,643 | ||||||||||

Market at Estrella Falls (35.1%) | 06/01/11 | 2.65 | % | — | 11,842 | 11,842 | ||||||||||

Los Cerritos Center (51%) | 07/01/11 | 1.20 | % | — | 66,300 | 66,300 | ||||||||||

Total Floating Rate Debt for Unconsolidated Assets | 1.86 | % | $ | — | $ | 198,495 | $ | 198,495 | ||||||||

Total Debt for Unconsolidated Assets | 5.44 | % | $ | 1,815,075 | $ | 198,495 | $ | 2,013,570 | ||||||||

Total Debt | 5.16 | % | $ | 6,107,969 | $ | 1,824,020 | $ | 7,931,989 | ||||||||

Percentage to Total | 77.00 | % | 23.00 | % | 100.00 | % | ||||||||||

13

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

2009 SUMMARY OF FINANCING ACTIVITY (at Company's pro rata share)

Center/Entity (dollars in thousands) | Maturity Date | Total Debt Maturing in 2009 (Balance as of 3/31/09) | Less Debt with Extension Options | Debt refinanced or to be refinanced in 2009 | Estimated New Proceeds(a) | Estimated Net Proceeds Over Existing Loan Amount | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2009 closed financings/commitments: | ||||||||||||||||||||

Queens Center (b) | 03/01/13 | $ | 88,651 | $ | 88,651 | $ | 130,000 | $ | 41,349 | |||||||||||

Redmond Office (51%) (c) | 07/10/09 | 30,872 | 30,872 | 31,620 | 748 | |||||||||||||||

North Bridge, The Shops at (50%) (d) | 07/01/09 | 102,633 | 102,633 | 102,500 | (133 | ) | ||||||||||||||

Northridge Mall (e) | 07/01/09 | 79,280 | 79,280 | 72,000 | (7,280 | ) | ||||||||||||||

Twenty Ninth Street (f) | 03/25/11 | 115,000 | 115,000 | 115,000 | — | |||||||||||||||

Washington Square (51%) (g) | 01/01/16 | 64,261 | 64,261 | 127,500 | 63,239 | |||||||||||||||

Subtotal—closed or committed: | 480,697 | 578,620 | 97,923 | |||||||||||||||||

2009 remaining loans maturing: | ||||||||||||||||||||

Carmel Plaza | 05/01/09 | 25,679 | 25,679 | 25,000 | (679 | ) | ||||||||||||||

Corte Madera, The Village at (50.1%) | 11/01/09 | 31,907 | 31,907 | 44,500 | 12,593 | |||||||||||||||

La Cumbre Plaza | 08/09/09 | 30,000 | 30,000 | 21,400 | (8,600 | ) | ||||||||||||||

Paradise Valley Mall (h) | 05/01/09 | 20,009 | 20,009 | 90,000 | 69,991 | |||||||||||||||

Redmond Retail (51%) | 08/01/09 | 35,965 | 35,965 | 36,000 | 35 | |||||||||||||||

Subtotal—remaining 2009 maturities | 143,560 | 216,900 | 73,340 | |||||||||||||||||

Expected fundings under existing loans and new construction loans: | ||||||||||||||||||||

Los Cerritos Center (51%) (i) | — | 35,000 | 35,000 | |||||||||||||||||

Northgate Mall (j) | — | 50,000 | 50,000 | |||||||||||||||||

The Oaks | — | 20,000 | 20,000 | |||||||||||||||||

2009 remaining maturities with extension options: | ||||||||||||||||||||

Camelback Colonnade (75%) (k) | 10/09/09 | 31,125 | 31,125 | — | — | — | ||||||||||||||

Promenade at Casa Grande (51.3%) (k) | 08/16/09 | 49,901 | 49,901 | — | — | — | ||||||||||||||

Superstition Springs Center (33.3%) (k) | 09/09/09 | 22,498 | 22,498 | — | — | — | ||||||||||||||

Total / Average | $ | 727,781 | $ | 103,524 | $ | 624,257 | $ | 900,520 | $ | 276,263 | ||||||||||

14

The Macerich Company

Supplemental Financial and Operating Information (Unaudited)

2010 SUMMARY OF FINANCING ACTIVITY (at Company's pro rata share)

Center/Entity (dollars in thousands) | Maturity Date | Total Debt Maturing in 2010 (Balance as of 3/31/09) | Less Debt with Extension Options | Net Debt Maturing in 2010 | Estimated New Proceeds(a) | Estimated Net Proceeds Over Existing Loan Amount | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2010 loans maturing: | |||||||||||||||||||

Boulevard Shops (50%) | 12/17/10 | $ | 10,700 | $ | 10,700 | $ | 10,500 | ($ | 200 | ) | |||||||||

Camelback Colonnade (75%) | 10/09/10 | 31,125 | 31,125 | 39,000 | 7,875 | ||||||||||||||

Cascade Mall (51%) | 07/01/10 | 19,694 | 19,694 | 20,000 | 306 | ||||||||||||||

Kierland Tower Lofts (15%) | 11/18/10 | 1,597 | 1,597 | — | (1,597 | ) | |||||||||||||

Kitsap Mall/Place (51%) | 06/01/10 | 28,683 | 28,683 | 29,000 | 317 | ||||||||||||||

Metrocenter Mall (15%) | 02/09/10 | 20,040 | 20,040 | 9,000 | (11,040 | ) | |||||||||||||

Ridgmar (50%) | 04/11/10 | 28,700 | 28,700 | 24,000 | (4,700 | ) | |||||||||||||

Santa Monica Place | 11/01/10 | 77,567 | 77,567 | 186,000 | 108,433 | ||||||||||||||

Stonewood Mall (51%) | 12/11/10 | 37,130 | 37,130 | 60,000 | 22,870 | ||||||||||||||

Vintage Faire Mall | 09/01/10 | 63,052 | 63,052 | 146,000 | 82,948 | ||||||||||||||

Expected fundings under existing development loans: | |||||||||||||||||||

Northgate Mall | — | 25,000 | 25,000 | ||||||||||||||||

The Oaks | — | 40,000 | 40,000 | ||||||||||||||||

2010 loans with extension options: | |||||||||||||||||||

Desert Sky Mall (50%) | 03/04/10 | 25,750 | 25,750 | — | — | — | |||||||||||||

Panorama Mall | 02/28/10 | 50,000 | 50,000 | — | — | — | |||||||||||||

Promenade at Casa Grande (51.3%) | 08/16/10 | 49,901 | 49,901 | — | — | — | |||||||||||||

Superstition Springs Center (33.3%) | 09/09/10 | 22,498 | 22,498 | — | — | — | |||||||||||||

Total / Average Property Secured Loans | $ | 466,437 | $ | 148,149 | $ | 318,288 | $ | 588,500 | $ | 270,212 | |||||||||

Macerich Partnership—Line of Credit | 04/26/10 | 1,158,500 | 1,158,500 | — | |||||||||||||||

Macerich Partnership—Term Loan (b) | 04/26/10 | 444,375 | 444,375 | ||||||||||||||||

15

The Macerich Company

Supplemental Financial and Operating Information

Development Pipeline Forecast

as of March 31, 2009

| | | | | | | | | Placed in Service | Estimated Year Placed in Service (a) | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | 2008 | 2009 | 2010 | ||||||||||||||||||||

| | | | | | Estimated Pro rata Project Cost (a) | Estimated Completion Date (a) | | |||||||||||||||||||||||

Property | Project Type | Estimated Project Size (a) | Estimated Total Project Cost (a) | Ownership % | Pro rata Spent to Date as of 3-31-09 | Pro rata Cost | Pro rata Cost | Pro rata Cost | ||||||||||||||||||||||

| | | | (dollars in thousands) | | (dollars in thousands) | | (dollars in thousands) | |||||||||||||||||||||||

REDEVELOPMENT | ||||||||||||||||||||||||||||||

Scottsdale Fashion Square | Expansion—Barneys New York | 170,000 | $ | 143,000 | 50 | % | $ | 71,500 | 2009/2010 | $ | 44,000 | $ | 60,775 | $ | 10,725 | |||||||||||||||

The Oaks | Expansion and Nordstrom | 97,288 | 235,000 | 100 | % | 235,000 | 2008/2009 | 216,000 | $ | 170,000 | 65,000 | |||||||||||||||||||

FlatIron Crossing | Redevelopment—Former Lord & Taylor | 100,000 | 17,000 | 100 | % | 17,000 | 2009/2010 | 10,000 | 14,000 | 3,000 | ||||||||||||||||||||

Northgate Mall | New Retail Development | 725,000 | 79,000 | 100 | % | 79,000 | 2009/2010 | 33,000 | �� | 50,000 | 29,000 | |||||||||||||||||||

Santa Monica Place | New Mall Development | 550,000 | 265,000 | 100 | % | 265,000 | 2010 | 88,000 | 265,000 | |||||||||||||||||||||

Fiesta Mall | Anchor Replacement | 110,000 | 50,000 | 100 | % | 50,000 | 2009 | 42,000 | 50,000 | |||||||||||||||||||||

Lakewood Mall | Anchor Addition—Costco | 160,000 | 23,000 | 51 | % | 11,730 | 2009 | 12,000 | 11,730 | |||||||||||||||||||||

Los Cerritos | Anchor Expansion—Nordstrom | 36,500 | 56,000 | 51 | % | 28,560 | 2010 | 9,000 | 28,560 | |||||||||||||||||||||

TOTAL | 1,948,788 | $ | 868,000 | $ | 757,790 | $ | 453,730 | $ | 170,000 | $ | 251,505 | $ | 336,285 | |||||||||||||||||

LESS COSTS INCURRED THROUGH 3-31-09 | $ | 170,000 | $ | 186,730 | $ | 97,000 | ||||||||||||||||||||||||

NET COSTS REMAINING TO BE INCURRED | $ | — | $ | 64,775 | $ | 239,285 | ||||||||||||||||||||||||

NOTES

(a)—Much of this information is estimated and may change from time to time. See the Company's Forward Looking Statements disclosure on page 1 for factors that may effect the information provided in this table.

16