QuickLinks -- Click here to rapidly navigate through this document

Dear Fellow Stockholders:

I would like to welcome you as you review our annual stockholders' report.

Overview

The year 2012 was a ground breaking year for Macerich—literally. It provides a solid foundation to build on in 2013. Last year, we broke ground on our 526,000 square foot enclosed, two-level Fashion Outlets of Chicago project. This center is expected to open on August 1, 2013, offering one of the most outstanding fashion line-ups of any new outlet center to open in the United States in many years. Our anchors, Last Call by Neiman Marcus, Bloomingdale's The Outlet Store, Saks Fifth Avenue Off 5th, and Forever 21, will be joined by such stellar fashion retailers as Longchamp, Brunello Cucinelli, Prada, Gucci, Giorgio Armani, Halston, Michael Kors, Coach, Coach Men's, Tory Burch and many others. We view Fashion Outlets of Chicago as a terrific addition to our portfolio, increasing the Company's presence in one of the largest markets in the country.

We also broke ground during 2012 on the mixed-use densification of Tysons Corner Center, which will add 1.4 million square feet to one of the country's premier retail centers. The Tysons expansion includes a 524,000 square foot, 22-story office tower; a 500,000 square foot, 30-story, 430 unit luxury residential tower; and a 17-story, 300 room Hyatt Regency hotel. We made it clear during the year that we would not proceed with the office component without signing a lead anchor tenant. In November of 2012, we were successful in signing Intelsat, the world's leading provider of satellite services, as our lead anchor tenant for the office tower. Leasing of the remainder of the Tysons office tower is progressing extremely well and we expect additional anchor announcements in the near future. It is important to note that Tysons Corner Center is already one of the top retail centers in the United States, generating almost $1 billion in annual sales, and is the dominant center in the Washington D.C. market. This center is anchored by Nordstrom, Bloomingdale's, Lord & Taylor, Macy's and one of the highest volume AMC Theatres in the United States.

The densification of Tysons Corner Center has been planned for over ten years and is intended to coincide with the grand opening of the Metrorail extension that will link Tysons Corner to downtown Washington D.C. later this year; and in the near future to Dulles Airport. Northern Virginia and Fairfax County officials desired a transit-oriented development surrounding this new important transportation hub and we were successful in obtaining the entitlements to create exactly that type of development at Tysons Corner. We believe we will not only create significant net asset value in each of the three new towers but, equally important, we will enhance the productivity of the retail center and demand from retailers for flagship locations at Tysons. We are confident that upon completion next year, this development will be one of the premier projects, possibly the premier project, of its kind in the United States.

Balance Sheet, Portfolio Management and Acquisitions

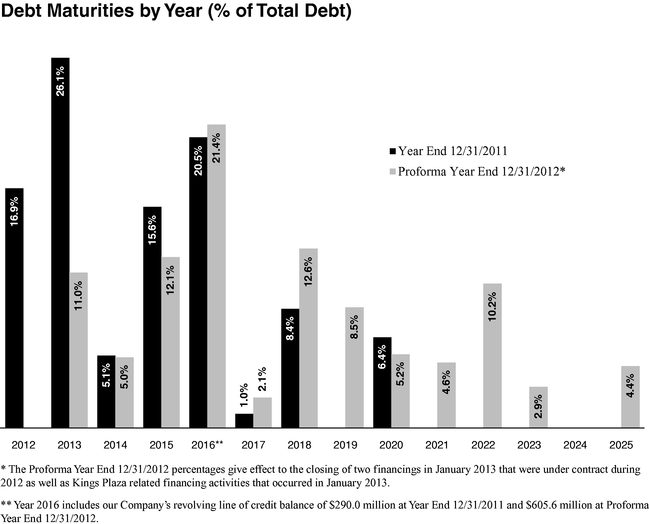

In 2012, we made significant progress in enhancing and strengthening our balance sheet while also rebalancing our portfolio through strategic acquisitions and dispositions of non-core assets. Notably, we successfully extended the average debt maturities on our balance sheet from approximately three years to over five years while reducing our average borrowing costs. The chart on page 4 illustrates this significant lengthening of our debt maturities. We financed over $2.4 billion of debt during the year, reducing our average effective interest rate from 5.0% as of December 2011 to 4.3% as of December 2012. These transactions produced excess proceeds of over $1.3 billion, which were used for acquisitions, developments, redevelopments, reduction of corporate debt and for general corporate purposes.

On the portfolio management side, we were successful in disposing of $468 million of non-core assets and this disposition of non-core assets will continue in 2013. More importantly, we acquired $1.7 billion of new assets and additional partnership interests in core assets. In Fall 2012, we increased

our ownership in FlatIron Crossing in Broomfield ($548 sales per square foot) to 100% from our previous 25% level, and we likewise acquired 100% ownership of Arrowhead Towne Center ($635 sales per square foot) in Northwest Phoenix, with the purchase of our partner's 33% interest.

We are also very excited about the $1.25 billion acquisition of Kings Plaza Shopping Center in Brooklyn, New York, completed in November 2012 and the January 2013 acquisition of Green Acres Mall in Valley Stream, New York. The acquisitions of Kings Plaza and Green Acres dramatically increase our investments in the greater New York Boroughs and regional market. More than 10% of our portfolio net operating income (NOI) is now generated from the Boroughs in New York. We have already demonstrated tremendous success in this market through Queens Center and are extremely confident about the future success of Kings Plaza as well as Green Acres in the years to come. These acquisitions highlight our strong interest in densely populated trade areas where we can create value through our market position and organizational resources.

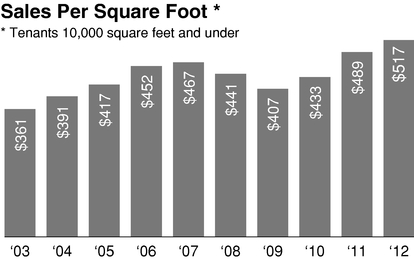

While I am pleased that our average sales reached $517 per square foot in 2012, I have felt for some time that this two-dimensional average does not reveal the true power of our portfolio. Therefore, we recently started disclosing our sales per square foot by property and providing specific guidance illustrating which properties generate our Company's NOI (see pages 9-10). This supplemental disclosure highlights the fact that our top 40 centers account for approximately 78% of our NOI and have average sales per square foot of almost $600. After our planned dispositions of non-core assets are completed, we anticipate our top 40 centers will produce sales of over $600 per square foot and about 85% of our NOI.

Operations

On the operating side, we had a very good year in terms of funds from operations growth, same center NOI growth, increased occupancies and leasing spreads. We believe the fundamentals in the regional mall business are strong. Our year-end portfolio average sales per square foot were approximately $517, representing a $50 a foot increase from the sales per square foot that we enjoyed in 2007—the first complete year prior to the severe recession of 2008/2009.

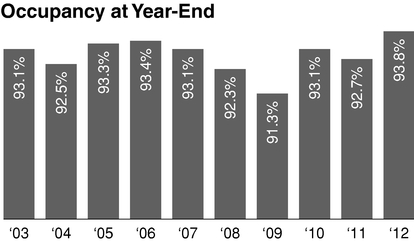

We had strong leasing spreads of 15% in 2012. In addition, our mall portfolio occupancy increased to 93.8% at December 31, 2012 compared to 92.7% at December 31, 2011. Although we saw a positive increase over 2011 same center NOI, our management team is focused on improving last year's 2.9% same center NOI growth. We are specifically focusing on increasing occupancy levels, converting temporary leases to permanent leases, and bringing expiring rents up to market in our improving environment where retail margins have widened and retailers' appetite for growth has returned. Both U.S. and global retailers are primarily targeting the United States for their new store strategies because of the safety and security that they find in our economy compared to the rest of the world.

Dispositions and Capital Recycling

Our guidance in February of this year assumed property sales in the range of $500 million to $1 billion of assets. Assuming the midpoint of that range, we believe upon completion of these dispositions, we will generate equity proceeds of approximately $700 million which will be utilized to primarily fund our remaining development pipeline over the next three to four years. This is an important component of our strategy to rebalance our portfolio by selling non-core assets and recycling the capital into highly productive core assets in our key markets.

The properties we plan to sell are generally in smaller cities, generate sales between $300 to $400 per square foot, and are unencumbered. As a result of these characteristics, these malls are attractive to an emerging market of private equity investors. We expect to sell seven to ten properties and look forward to refining our focus on our remaining portfolio, redevelopments, and new developments.

Developments and Redevelopments

Looking at our development and redevelopment pipeline:

- •

- We look forward to the grand opening of Fashion Outlets of Chicago in August of this year and anticipate it will be one of the strongest new outlet centers opening in many years.

- •

- We are working diligently at Tysons Corner and expect our expansion project will be delivered on time and on budget, opening in phases throughout 2014.

- •

- We will break ground soon on the 150,000 square foot expansion of Fashion Outlets of Niagara Falls USA, and our pre-leasing of this expansion space is proceeding very well.

- •

- We will further enhance The Shops at North Bridge with the highly anticipated 2013 opening of Eataly, the largest artisanal Italian food and wine emporium in the world. This will be Eataly's second U.S. location, its largest one, at 60,000 square feet, and a signature attraction for visitors.

- •

- We have made great progress on our development plans for Broadway Plaza in Walnut Creek and are optimistic we can commence demolition of approximately 60% of that center in January 2014, with the re-opening of the small shop area occurring in phases in 2016. Our terrific department store line-up of Neiman Marcus, Nordstrom and Macy's will remain open during construction as will much of the retail center. Upon completion, we anticipate adding 200,000 square feet to the center and investing approximately $250 million together with our 50% partner, Northwestern Mutual. We expect attractive returns on our investment and believe that this is an opportunity to create a highly desirable, fashion center in the Bay area. Similar to our transformation of Santa Monica Place, we believe we will transform Broadway Plaza from an already wonderful retail location into one of the most dynamic centers on the West Coast.

- •

- We are already formulating plans for the redevelopment of our newly acquired Kings Plaza and Green Acres. At Kings Plaza, we anticipate commencing the first phase in 2014 with the construction of a new food court, an interior remodel and a complete remerchandising of the center. There are over 50 tenants that have highly productive stores at our Queens Center but do not have a presence at Kings Plaza. We are working with unique retailers such as Michael Kors and anticipate Kings Plaza will be one of the great value enhancement opportunities in our future. The reception from the retailer community has been extremely positive given our success at Queens Center. At Green Acres, we are under contract to acquire approximately 20 acres of contiguous land and there is strong interest for big box and other uses that will further solidify this center that already generates over $800 million in annual sales.

General Outlook

As I mentioned earlier, the retail climate in the United States has steadily improved over the last three years and is now overall very good. Fundamentals are strong in terms of supply and demand in the regional mall industry and we believe that our focus on major metropolitan markets and dominant fortress assets will serve us well for many years to come. The Arizona economy has bottomed out, diversified and is experiencing a robust economic recovery which will benefit our portfolio in this market. Phoenix has generally led the nation in economic and/or population growth most years of every decade over the past 60 years and is expected to grow at a rate of twice the U.S. average over the next five years. We believe the current economic expansion that is underway in Arizona will provide us an opportunity to build another regional mall in West Phoenix in the Goodyear marketplace as well as potentially a fashion outlet mall in the North Scottsdale market over the next three to five years. Given our land holdings and control of the key growth corridors in the market, it is simply a question of when, not if, in Arizona.

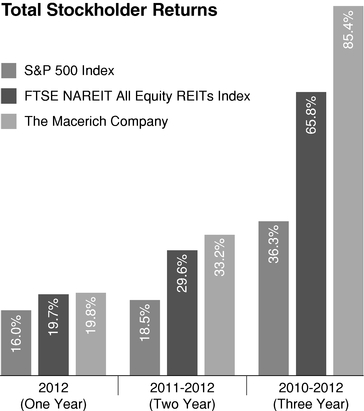

The regional economies in Southern California as well as Northern California are likewise strong and our markets in the Boroughs of New York and Northern Virginia are some of the best in the United States. We have numerous future growth opportunities and believe by concentrating on fewer, but higher quality assets, we can deliver the best possible stockholder return on a risk-adjusted basis.

Summary

We have an outstanding portfolio with nearly 80% of our NOI generated from high sales properties located in some of the most populated and fastest-growing markets in the United States. We are committed to further enhancing our portfolio and fueling our external growth by not only successfully executing our current development pipeline but also by unlocking our embedded redevelopment opportunities. Consistent with our investment strategy of recycling capital, we plan to fund most of our development and redevelopment pipeline through the sale of our non-core assets. While this may be a familiar theme in the real estate markets today, it is very difficult to achieve in the regional mall sector. The number of dominant regional mall opportunities to build or acquire is extremely scarce. Also, the universe of buyers to purchase our non-core assets is limited. We are confident we will be successful and will continue to make great progress in our evolution of rebalancing our portfolio and recycling our capital into our most productive properties and projects. We believe our redevelopment opportunities and key developments coupled with an improving environment for releasing and remerchandising make the future of our Company very bright.

I want to thank our stakeholders and our Board of Directors for their guidance during the year and welcome our new Board member, Andrea Stephen. I also want to thank Jim Cownie, who retired as a director in 2012, for his over 18 years of service to our Company. Jim made invaluable contributions to our Board and to the formation and growth of our Company.

I look forward to reporting to you during the balance of this year.

Very truly yours,  Arthur M. Coppola Chairman and Chief Executive Officer |