QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.2

Supplemental Financial Information

For the three months ended March 31, 2014

The Macerich Company

Supplemental Financial and Operating Information

Table of Contents

All information included in this supplemental financial package is unaudited, unless otherwise indicated.

| | |

| | Page No. |

|---|

| | | |

Corporate Overview | | 1-3 |

Overview | | 1 |

Capital Information and Market Capitalization | | 2 |

Changes in Total Common and Equivalent Shares/Units | | 3 |

Financial Data | | 4-9 |

Unaudited Pro Rata Statement of Operations | | 5 |

Notes to Unaudited Pro Rata Statement of Operations | | 6 |

Unaudited Pro Rata Balance Sheet | | 7 |

Supplemental FFO Information | | 8 |

Capital Expenditures | | 9 |

Operational Data | | 10-25 |

Sales Per Square Foot | | 10 |

Sales Per Square Foot by Property Ranking | | 11-15 |

Occupancy | | 16 |

Average Base Rent Per Square Foot | | 17 |

Cost of Occupancy | | 18 |

Percentage of Net Operating Income by State | | 19 |

Property Listing | | 20-23 |

Joint Venture List | | 24-25 |

Debt Tables | | 26-28 |

Debt Summary | | 26 |

Outstanding Debt by Maturity Date | | 27-28 |

Development Pipeline Forecast | | 29-30 |

Top Ten Tenants | | 31 |

Corporate Information | | 32 |

This Supplemental Financial Information should be read in connection with the Company's first quarter 2014 earnings announcement (included as Exhibit 99.1 of the Company's Current Report on 8-K, event date April 29, 2014) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Financial Information.

The Macerich Company

Supplemental Financial and Operating Information

Overview

The Macerich Company (the "Company") is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional and community/power shopping centers located throughout the United States. The Company is the sole general partner of, and owns a majority of the ownership interests in, The Macerich Partnership, L.P., a Delaware limited partnership (the "Operating Partnership").

As of March 31, 2014, the Operating Partnership owned or had an ownership interest in 52 regional shopping centers and nine community/power shopping centers aggregating approximately 55 million square feet of gross leasable area ("GLA"). These 61 centers are referred to hereinafter as the "Centers", unless the context requires otherwise.

The Company is a self-administered and self-managed real estate investment trust ("REIT") and conducts all of its operations through the Operating Partnership and the Company's management companies (collectively, the "Management Companies").

All references to the Company in this Exhibit include the Company, those entities owned or controlled by the Company and predecessors of the Company, unless the context indicates otherwise.

This document contains information constituting forward-looking statements and includes expectations regarding the Company's future operational results as well as development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, economic and business conditions, which will, among other things, affect demand for retail space or retail goods, availability and creditworthiness of current and prospective tenants, anchor or tenant bankruptcies, closures, mergers or consolidations, lease rates, terms and payments, interest rate fluctuations, availability, terms and cost of financing, operating expenses, and competition; adverse changes in the real estate markets, including the liquidity of real estate investments; and risks of real estate development, redevelopment, and expansion, including availability, terms and cost of financing, construction delays, environmental and safety requirements, budget overruns, sunk costs and lease-up; the inability to obtain, or delays in obtaining, all necessary zoning, land-use, building, and occupancy and other required governmental permits and authorizations; and governmental actions and initiatives (including legislative and regulatory changes) as well as terrorist activities or other acts of violence which could adversely affect all of the above factors. Furthermore, occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable. The reader is directed to the Company's various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2013, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events unless required by law to do so.

1

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Information and Market Capitalization

| | | | | | | | | | |

| | | | | | | | | | | |

| | Period Ended | |

|---|

| | 3/31/2014 | | 12/31/2013 | | 12/31/2012 | |

|---|

| | dollars in thousands, except per share data

| |

|---|

Closing common stock price per share | | $ | 62.33 | | $ | 58.89 | | $ | 58.30 | |

52 week high | | $ | 72.19 | | $ | 72.19 | | $ | 62.83 | |

52 week low | | $ | 55.13 | | $ | 55.13 | | $ | 49.67 | |

Shares outstanding at end of period | | | | | | | | | | |

Class A non-participating convertible preferred units | | | 184,304 | | | 184,304 | | | 184,304 | |

Common shares and partnership units | | | 150,998,837 | | | 150,673,110 | | | 147,601,848 | |

| | | | | | | | |

| | | | | | | | | | | |

Total common and equivalent shares/units outstanding | | | 151,183,141 | | | 150,857,414 | | | 147,786,152 | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

Portfolio capitalization data | | |

| | |

| | |

| |

Total portfolio debt, including joint ventures at pro rata | | $ | 6,055,261 | | $ | 6,037,219 | | $ | 6,620,507 | |

Equity market capitalization | | | 9,423,245 | | | 8,883,993 | | | 8,615,933 | |

| | | | | | | | |

| | | | | | | | | | | |

Total market capitalization | | $ | 15,478,506 | | $ | 14,921,212 | | $ | 15,236,440 | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

Leverage ratio(a) | | | 39.1 | % | | 40.5 | % | | 43.5 | % |

- (a)

- Debt as a percentage of total market capitalization.

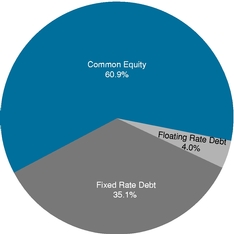

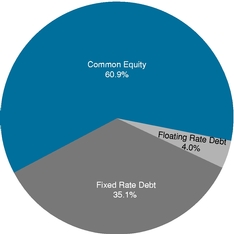

Portfolio Capitalization at March 31, 2014

2

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Changes in Total Common and Equivalent Shares/Units

| | | | | | | | | | | | | |

| |

|---|

| | Partnership

Units | | Company

Common

Shares | | Class A

Non-Participating

Convertible

Preferred Units | | Total

Common

and

Equivalent

Shares/

Units | |

|---|

Balance as of December 31, 2013 | | | 9,939,427 | | | 140,733,683 | | | 184,304 | | | 150,857,414 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

Conversion of partnership units to cash | | | (3,445 | ) | | — | | | — | | | (3,445 | ) |

Conversion of partnership units to common shares | | | (63,000 | ) | | 63,000 | | | — | | | — | |

Issuance of stock/partnership units from restricted stock issuance or other share- or unit-based plans | | | 246,471 | | | 82,701 | | | — | | | 329,172 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

Balance as of March 31, 2014 | | | 10,119,453 | | | 140,879,384 | | | 184,304 | | | 151,183,141 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

3

On the following pages, the Company presents its unaudited pro rata statement of operations and unaudited pro rata balance sheet reflecting the Company's proportionate ownership of each asset in its portfolio. The Company also reconciles net income attributable to the Company to funds from operations ("FFO") and FFO-diluted for the three months ended March 31, 2014.

4

THE MACERICH COMPANY

UNAUDITED PRO RATA STATEMENT OF OPERATIONS

(Dollars in thousands)

| | | | | | | | | | | | | | | | |

| |

| |

|---|

| | For the Three Months Ended March 31, 2014 | |

|---|

| | Consolidated | | Non-

Controlling

Interests(1) | | Company's

Consolidated

Share | | Company's

Share of

Joint

Ventures(2) | | Company's

Total

Share | |

|---|

Revenues: | | | | | | | | | | | | | | | | |

Minimum rents | | $ | 151,633 | | $ | (9,915 | ) | $ | 141,718 | | $ | 48,467 | | $ | 190,185 | |

Percentage rents | | | 2,853 | | | (195 | ) | | 2,658 | | | 990 | | | 3,648 | |

Tenant recoveries | | | 91,475 | | | (6,205 | ) | | 85,270 | | | 24,205 | | | 109,475 | |

Management Companies' revenues | | | 8,121 | | | — | | | 8,121 | | | — | | | 8,121 | |

Other income | | | 10,430 | | | (612 | ) | | 9,818 | | | 4,718 | | | 14,536 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total revenues | | | 264,512 | | | (16,927 | ) | | 247,585 | | | 78,380 | | | 325,965 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Shopping center and operating expenses | | | 90,376 | | | (6,356 | ) | | 84,020 | | | 27,060 | | | 111,080 | |

Management Companies' operating expenses | | | 22,772 | | | — | | | 22,772 | | | — | | | 22,772 | |

REIT general and administrative expenses | | | 6,877 | | | — | | | 6,877 | | | — | | | 6,877 | |

Depreciation and amortization | | | 88,657 | | | (5,460 | ) | | 83,197 | | | 20,375 | | | 103,572 | |

Interest expense | | | 46,338 | | | (2,731 | ) | | 43,607 | | | 17,114 | | | 60,721 | |

Loss on extinguishment of debt, net | | | 358 | | | — | | | 358 | | | — | | | 358 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total expenses | | | 255,378 | | | (14,547 | ) | | 240,831 | | | 64,549 | | | 305,380 | |

Equity in income of unconsolidated joint ventures | | | 13,769 | | | — | | | 13,769 | | | (13,769 | ) | | — | |

Co-venture expense | | | (1,820 | ) | | 1,820 | | | — | | | — | | | — | |

Income tax benefit | | | 172 | | | — | | | 172 | | | — | | | 172 | |

Loss on remeasurement, sale or write down of assets, net | | | (1,611 | ) | | — | | | (1,611 | ) | | (62 | ) | | (1,673 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income | | | 19,644 | | | (560 | ) | | 19,084 | | | — | | | 19,084 | |

Less net income attributable to noncontrolling interests | | | 1,825 | | | (560 | ) | | 1,265 | | | — | | | 1,265 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income attributable to the Company | | $ | 17,819 | | $ | — | | $ | 17,819 | | $ | — | | $ | 17,819 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Reconciliation of net income attributable to the Company to FFO(3): | | | | | | | | | | | | | | | | |

Net income attributable to the Company | | | | | | | | $ | 17,819 | | $ | — | | $ | 17,819 | |

Equity in income of unconsolidated joint ventures | | | | | | | | | (13,769 | ) | | 13,769 | | | — | |

Adjustments to reconcile net income to FFO—basic and diluted: | | | | | | | | | | | | | | | | |

Noncontrolling interests in the Operating Partnership | | | | | | | | | 1,265 | | | — | | | 1,265 | |

Loss on remeasurement, sale or write down of assets, net | | | | | | | | | 1,611 | | | 62 | | | 1,673 | |

Loss on sale of undepreciated assets, net | | | | | | | | | — | | | (2 | ) | | (2 | ) |

Depreciation and amortization of all property | | | | | | | | | 83,197 | | | 20,375 | | | 103,572 | |

Depreciation on personal property | | | | | | | | | (2,556 | ) | | (211 | ) | | (2,767 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total FFO—Basic and diluted | | | | | | | | $ | 87,567 | | $ | 33,993 | | $ | 121,560 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

5

The Macerich Company

Notes to Unaudited Pro Rata Statement of Operations

- (1)

- This represents the non-owned portion of consolidated joint ventures.

- (2)

- This represents the Company's pro rata share of unconsolidated joint ventures.

- (3)

- The Company uses FFO in addition to net income to report its operating and financial results and considers FFO and FFO-diluted as supplemental measures for the real estate industry and a supplement to Generally Accepted Accounting Principles ("GAAP") measures. The National Association of Real Estate Investment Trusts ("NAREIT") defines FFO as net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from extraordinary items and sales of depreciated operating properties, plus real estate related depreciation and amortization, impairment write-downs of real estate and write-downs of investments in an affiliate where the write-downs have been driven by a decrease in the value of real estate held by the affiliate and after adjustments for unconsolidated joint ventures. Adjustments for unconsolidated joint ventures are calculated to reflect FFO on the same basis.

FFO and FFO on a diluted basis are useful to investors in comparing operating and financial results between periods. This is especially true since FFO excludes real estate depreciation and amortization, as the Company believes real estate values fluctuate based on market conditions rather than depreciating in value ratably on a straight-line basis over time. The Company believes that such a presentation also provides investors with a more meaningful measure of its operating results in comparison to the operating results of other REITs. FFO on a diluted basis is a measure investors find most useful in measuring the dilutive impact of outstanding convertible securities. The Company believes that FFO does not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income (loss) as defined by GAAP, and is not indicative of cash available to fund all cash flow needs. The Company also cautions that FFO, as presented, may not be comparable to similarly titled measures reported by other REITs.

Management compensates for the limitations of FFO by providing investors with financial statements prepared according to GAAP, along with a detailed discussion of FFO and a reconciliation of FFO and FFO-diluted to net income attributable to the Company. Management believes that to further understand the Company's performance, FFO should be compared with the Company's reported net income and considered in addition to cash flows in accordance with GAAP, as presented in the Company's consolidated financial statements.

6

THE MACERICH COMPANY

UNAUDITED PRO RATA BALANCE SHEET

(Dollars in thousands)

| | | | | | | | | | | | | | | | |

| |

| |

|---|

| | As of March 31, 2014 | |

|---|

| | Consolidated | | Non-

Controlling

Interests(1) | | Company's

Consolidated

Share | | Company's

Share of

Joint

Ventures(2) | | Company's

Total

Share | |

|---|

ASSETS: | | | | | | | | | | | | | | | | |

Property, net(3) | | $ | 7,553,979 | | $ | (481,282 | ) | $ | 7,072,697 | | $ | 2,174,444 | | $ | 9,247,141 | |

Cash and cash equivalents | | | 64,926 | | | (13,639 | ) | | 51,287 | | | 42,233 | | | 93,520 | |

Restricted cash | | | 15,808 | | | (497 | ) | | 15,311 | | | 7,099 | | | 22,410 | |

Tenant and other receivables, net | | | 100,838 | | | (27,333 | ) | | 73,505 | | | 28,938 | | | 102,443 | |

Deferred charges and other assets, net | | | 516,277 | | | (13,950 | ) | | 502,327 | | | 60,071 | | | 562,398 | |

Loans to unconsolidated joint ventures | | | 3,374 | | | — | | | 3,374 | | | — | | | 3,374 | |

Due from affiliates | | | 28,559 | | | 319 | | | 28,878 | | | (1,576 | ) | | 27,302 | |

Investments in unconsolidated joint ventures | | | 724,630 | | | — | | | 724,630 | | | (724,630 | ) | | — | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total assets | | $ | 9,008,391 | | $ | (536,382 | ) | $ | 8,472,009 | | $ | 1,586,579 | | $ | 10,058,588 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

LIABILITIES AND EQUITY: | | | | | | | | | | | | | | | | |

Mortgage notes payable | | $ | 4,384,000 | | $ | (294,242 | ) | $ | 4,089,758 | | $ | 1,744,437 | | $ | 5,834,195 | |

Bank and other notes payable | | | 227,132 | | | (6,066 | ) | | 221,066 | | | — | | | 221,066 | |

Accounts payable and accrued expenses | | | 89,146 | | | (6,386 | ) | | 82,760 | | | 30,755 | | | 113,515 | |

Other accrued liabilities | | | 312,188 | | | (29,433 | ) | | 282,755 | | | 65,968 | | | 348,723 | |

Distributions in excess of investment in unconsolidated joint ventures | | | 254,581 | | | — | | | 254,581 | | | (254,581 | ) | | — | |

Co-venture obligation | | | 78,224 | | | (78,224 | ) | | — | | | — | | | — | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total liabilities | | | 5,345,271 | | | (414,351 | ) | | 4,930,920 | | | 1,586,579 | | | 6,517,499 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Commitments and contingencies | | | | | | | | | | | | | | | | |

Equity: | | | | | | | | | | | | | | | | |

Stockholders' equity: | | | | | | | | | | | | | | | | |

Common stock | | | 1,409 | | | — | | | 1,409 | | | — | | | 1,409 | |

Additional paid-in capital | | | 3,920,704 | | | — | | | 3,920,704 | | | — | | | 3,920,704 | |

Accumulated deficit | | | (618,277 | ) | | — | | | (618,277 | ) | | — | | | (618,277 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total stockholders' equity | | | 3,303,836 | | | — | | | 3,303,836 | | | — | | | 3,303,836 | |

Noncontrolling interests | | | 359,284 | | | (122,031 | ) | | 237,253 | | | — | | | 237,253 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total equity | | | 3,663,120 | | | (122,031 | ) | | 3,541,089 | | | — | | | 3,541,089 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total liabilities and equity | | $ | 9,008,391 | | $ | (536,382 | ) | $ | 8,472,009 | | $ | 1,586,579 | | $ | 10,058,588 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

- (1)

- This represents the non-owned portion of the consolidated joint ventures.

- (2)

- This represents the Company's pro rata share of unconsolidated joint ventures.

- (3)

- Includes construction in progress of $234,401 from the Company's consolidated share and $227,602 from its pro rata share of unconsolidated joint ventures.

7

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Supplemental FFO Information(a)

| | | | |

|

|---|

| | As of March 31, |

|---|

| | 2014 | | 2013 |

|---|

| | dollars in millions

|

|---|

Straight line rent receivable | | $70.5 | | $68.2 |

| | | | | | | |

| |

|---|

| | For the

Three Months Ended

March 31, | |

|---|

| | 2014 | | 2013 | |

|---|

| | dollars in millions

| |

|---|

Lease termination fees | | $ | 2.4 | | $ | 1.4 | |

Straight line rental income | | $ | 1.1 | | $ | 1.2 | |

Gain on sales of undepreciated assets | | $ | — | | $ | 2.2 | |

Amortization of acquired above- and below-market leases | | $ | 1.8 | | $ | 2.4 | |

Amortization of debt premiums | | $ | 1.3 | | $ | 2.5 | |

Interest capitalized | | $ | 4.9 | | $ | 4.8 | |

- (a)

- All joint venture amounts included at pro rata.

8

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Expenditures

| | | | | | | | | | | | | |

| |

| |

|---|

| | For the Three

Months Ended

3/31/14 | | For the Three

Months Ended

3/31/13 | | Year Ended

12/31/13 | | Year Ended

12/31/12 | |

|---|

| | dollars in millions

| |

|---|

Consolidated Centers | | | | | | | | | | | | | |

Acquisitions of property and equipment | | $ | 4.8 | | $ | 504.7 | | $ | 591.6 | | $ | 1,313.1 | |

Development, redevelopment, expansions and renovations of Centers | | | 21.9 | | | 40.9 | | | 164.4 | | | 158.5 | |

Tenant allowances | | | 4.7 | | | 3.5 | | | 20.9 | | | 18.1 | |

Deferred leasing charges | | | 6.0 | | | 8.9 | | | 23.9 | | | 23.5 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

Total | | $ | 37.4 | | $ | 558.0 | | $ | 800.8 | | $ | 1,513.2 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

Unconsolidated Joint Venture Centers(a) | | |

| | |

| | |

| | |

| |

Acquisitions of property and equipment | | $ | 0.3 | | $ | 1.4 | | $ | 8.2 | | $ | 5.1 | |

Development, redevelopment, expansions and renovations of Centers | | | 38.1 | | | 16.8 | | | 118.8 | | | 79.6 | |

Tenant allowances | | | 0.7 | | | 1.8 | | | 8.1 | | | 6.4 | |

Deferred leasing charges | | | 0.8 | | | 0.9 | | | 3.3 | | | 4.2 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

Total | | $ | 39.9 | | $ | 20.9 | | $ | 138.4 | | $ | 95.3 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | |

- (a)

- All joint venture amounts at pro rata.

9

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Regional Shopping Center Portfolio

Sales Per Square Foot(a)

| | | | | | |

|

|---|

| | Consolidated

Centers | | Unconsolidated

Joint Venture

Centers | | Total

Centers |

|---|

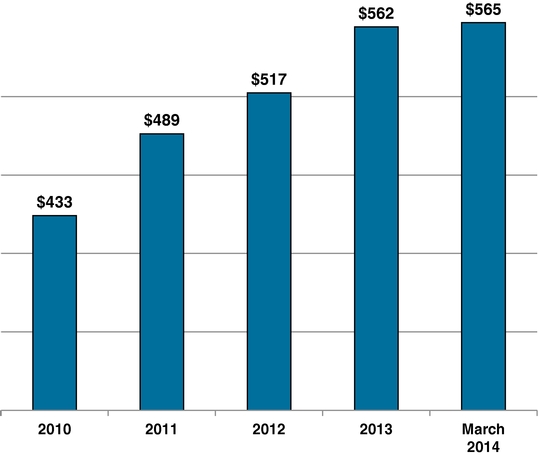

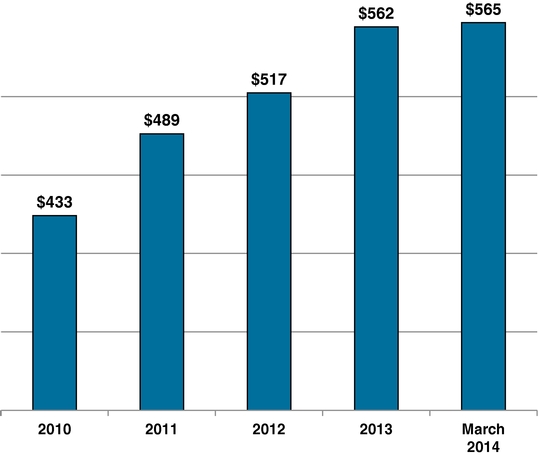

03/31/2014 | | $492 | | $709 | | $565 |

03/31/2013 | | $481 | | $643 | | $535 |

12/31/2013 | | $488 | | $717 | | $562 |

12/31/2012 | | $463 | | $629 | | $517 |

12/31/2011 | | $417 | | $597 | | $489 |

12/31/2010 | | $392 | | $468 | | $433 |

- (a)

- Sales are based on reports by retailers leasing mall and freestanding stores for the trailing 12 months for tenants which have occupied such stores for a minimum of 12 months. Sales per square foot are based on tenants 10,000 square feet and under for regional shopping centers. Sales per square foot exclude Centers under development and redevelopment.

Sales Per Square Foot

10

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | Outstanding

Debt

@ Pro Rata

($ in

thousands)

3/31/2014

(e) | |

|---|

| |

| |

| | Sales Per Square Foot | | Occupancy | | Cost of Occupancy

for the Trailing

12 Months

Ended 3/31/2014

(c) | |

| |

|---|

| |

| |

| | % of Portfolio

2014 Forecast

Pro Rata NOI

(d) | |

|---|

Count | | Properties | | 3/31/2014

(a) | | 12/31/2013

(a) | | 3/31/2013

(a) | | 3/31/2014

(b) | | 12/31/2013

(b) | | 3/31/2013

(b) | |

|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Group 1: Top 10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

1 |

|

|

|

Washington Square |

|

$ |

1,050 |

|

$ |

1,090 |

|

$ |

962 |

|

|

91.9 |

% |

|

92.2 |

% |

|

90.2 |

% |

|

|

|

|

|

|

|

118,301 |

|

| | 2 | | | | Queens Center | | $ | 1,054 | | $ | 1,038 | | $ | 1,016 | | | 96.5 | % | | 98.8 | % | | 95.5 | % | | | | | | | | 306,000 | |

|

3 |

|

|

|

Biltmore Fashion Park |

|

$ |

940 |

|

$ |

927 |

|

$ |

909 |

|

|

89.5 |

% |

|

90.0 |

% |

|

88.1 |

% |

|

|

|

|

|

|

|

28,899 |

|

| | 4 | | | | North Bridge, The Shops at | | $ | 905 | | $ | 906 | | $ | 907 | | | 98.1 | % | | 97.3 | % | | 89.7 | % | | | | | | | | 97,311 | |

|

5 |

|

|

|

Corte Madera, Village at |

|

$ |

907 |

|

$ |

902 |

|

$ |

877 |

|

|

97.9 |

% |

|

97.8 |

% |

|

98.3 |

% |

|

|

|

|

|

|

|

38,160 |

|

| | 6 | | | | Tysons Corner Center | | $ | 822 | | $ | 824 | | $ | 815 | | | 96.2 | % | | 98.2 | % | | 96.4 | % | | | | | | | | 421,360 | |

|

7 |

|

|

|

Santa Monica Place |

|

$ |

743 |

|

$ |

734 |

|

$ |

741 |

|

|

90.5 |

% |

|

90.5 |

% |

|

90.9 |

% |

|

|

|

|

|

|

|

234,160 |

|

| | 8 | | | | Broadway Plaza(f) | | | n/a | | $ | 726 | | $ | 678 | | | n/a | | | 87.1 | % | | 94.6 | % | | | | | | | | 69,180 | |

|

9 |

|

|

|

Tucson La Encantada |

|

$ |

702 |

|

$ |

694 |

|

$ |

697 |

|

|

92.8 |

% |

|

92.2 |

% |

|

88.5 |

% |

|

|

|

|

|

|

|

72,533 |

|

| | 10 | | | | Scottsdale Fashion Square | | $ | 692 | | $ | 694 | | $ | 626 | | | 95.4 | % | | 94.5 | % | | 95.6 | % | | | | | | | | 257,571 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Total Top 10: | | $ | 858 | | $ | 855 | | $ | 815 | | | 94.9 | % | | 95.0 | % | | 93.6 | % | | 13.7 | % | | 22.8 | % | | 1,643,475 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Group 2: Top 11-20 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

11 |

|

|

|

Fashion Outlets of Chicago(g) |

|

|

n/a |

|

|

n/a |

|

|

n/a |

|

|

95.4 |

% |

|

95.4 |

% |

|

n/a |

|

|

|

|

|

|

|

|

63,220 |

|

| | 12 | | | | Kings Plaza Shopping Center | | $ | 653 | | $ | 675 | | $ | 700 | | | 93.4 | % | | 95.9 | % | | 91.8 | % | | | | | | | | 488,075 | |

|

13 |

|

|

|

Los Cerritos Center |

|

$ |

666 |

|

$ |

674 |

|

$ |

684 |

|

|

96.1 |

% |

|

97.3 |

% |

|

95.5 |

% |

|

|

|

|

|

|

|

97,564 |

|

| | 14 | | | | Arrowhead Towne Center | | $ | 650 | | $ | 649 | | $ | 661 | | | 94.2 | % | | 96.8 | % | | 95.2 | % | | | | | | | | 234,214 | |

|

15 |

|

|

|

Kierland Commons |

|

$ |

637 |

|

$ |

637 |

|

$ |

641 |

|

|

97.2 |

% |

|

97.2 |

% |

|

95.6 |

% |

|

|

|

|

|

|

|

67,500 |

|

| | 16 | | | | Danbury Fair Mall | | $ | 626 | | $ | 636 | | $ | 633 | | | 98.6 | % | | 96.6 | % | | 96.0 | % | | | | | | | | 232,842 | |

|

17 |

|

|

|

Freehold Raceway Mall |

|

$ |

598 |

|

$ |

619 |

|

$ |

632 |

|

|

98.8 |

% |

|

98.5 |

% |

|

95.0 |

% |

|

|

|

|

|

|

|

116,355 |

|

| | 18 | | | | Twenty Ninth Street | | $ | 613 | | $ | 613 | | $ | 602 | | | 98.4 | % | | 95.7 | % | | 96.0 | % | | | | | | | | — | |

|

19 |

|

|

|

Fresno Fashion Fair |

|

$ |

604 |

|

$ |

609 |

|

$ |

637 |

|

|

95.8 |

% |

|

96.8 |

% |

|

96.3 |

% |

|

|

|

|

|

|

|

158,150 |

|

| | 20 | | | | Vintage Faire Mall | | $ | 587 | | $ | 594 | | $ | 588 | | | 99.9 | % | | 99.3 | % | | 99.9 | % | | | | | | | | 98,729 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

Total Top 11-20: |

|

$ |

624 |

|

$ |

632 |

|

$ |

640 |

|

|

97.0 |

% |

|

97.0 |

% |

|

95.6 |

% |

|

13.1 |

% |

|

27.7 |

% |

|

1,556,649 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

11

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | Outstanding

Debt

@ Pro Rata

($ in

thousands)

3/31/2014

(e) | |

|---|

| |

| |

| | Sales Per Square Foot | | Occupancy | | Cost of Occupancy

for the Trailing

12 Months

Ended 3/31/2014

(c) | |

| |

|---|

| |

| |

| | % of Portfolio

2014 Forecast

Pro Rata NOI

(d) | |

|---|

Count | | Properties | | 3/31/2014

(a) | | 12/31/2013

(a) | | 3/31/2013

(a) | | 3/31/2014

(b) | | 12/31/2013

(b) | | 3/31/2013

(b) | |

|---|

| | | | Group 3: Top 21-30 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

21 |

|

|

|

Chandler Fashion Center |

|

$ |

581 |

|

$ |

567 |

|

$ |

586 |

|

|

92.2 |

% |

|

97.5 |

% |

|

96.3 |

% |

|

|

|

|

|

|

|

100,200 |

|

| | 22 | | | | Green Acres Mall | | $ | 556 | | $ | 541 | | $ | 542 | | | 93.8 | % | | 93.4 | % | | 91.8 | % | | | | | | | | 318,249 | |

|

23 |

|

|

|

Fashion Outlets of Niagara Falls USA(f) |

|

|

n/a |

|

$ |

532 |

|

$ |

576 |

|

|

n/a |

|

|

94.6 |

% |

|

94.1 |

% |

|

|

|

|

|

|

|

123,352 |

|

| | 24 | | | | West Acres | | $ | 515 | | $ | 527 | | $ | 537 | | | 99.8 | % | | 99.8 | % | | 98.6 | % | | | | | | | | 11,254 | |

|

25 |

|

|

|

FlatIron Crossing |

|

$ |

524 |

|

$ |

525 |

|

$ |

531 |

|

|

95.2 |

% |

|

93.7 |

% |

|

95.2 |

% |

|

|

|

|

|

|

|

266,397 |

|

| | 26 | | | | Stonewood Center | | $ | 535 | | $ | 522 | | $ | 504 | | | 96.9 | % | | 96.1 | % | | 97.2 | % | | | | | | | | 53,791 | |

|

27 |

|

|

|

Victor Valley, Mall of |

|

$ |

504 |

|

$ |

509 |

|

$ |

479 |

|

|

96.7 |

% |

|

97.0 |

% |

|

93.8 |

% |

|

|

|

|

|

|

|

90,000 |

|

| | 28 | | | | Deptford Mall | | $ | 510 | | $ | 505 | | $ | 502 | | | 96.1 | % | | 96.7 | % | | 97.9 | % | | | | | | | | 215,140 | |

|

29 |

|

|

|

Oaks, The |

|

$ |

500 |

|

$ |

502 |

|

$ |

512 |

|

|

98.3 |

% |

|

97.2 |

% |

|

95.1 |

% |

|

|

|

|

|

|

|

213,244 |

|

| | 30 | | | | SanTan Village Regional Center | | $ | 493 | | $ | 495 | | $ | 486 | | | 96.3 | % | | 96.7 | % | | 96.5 | % | | | | | | | | 115,380 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

Total Top 21-30: |

|

$ |

525 |

|

$ |

524 |

|

$ |

531 |

|

|

95.8 |

% |

|

95.9 |

% |

|

95.2 |

% |

|

13.4 |

% |

|

22.6 |

% |

|

1,507,007 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Group 4: Top 31-40 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

31 |

|

|

|

Valley River Center |

|

$ |

467 |

|

$ |

478 |

|

$ |

503 |

|

|

96.3 |

% |

|

98.2 |

% |

|

96.4 |

% |

|

|

|

|

|

|

|

120,000 |

|

| | 32 | | | | South Plains Mall | | $ | 460 | | $ | 468 | | $ | 479 | | | 89.2 | % | | 88.3 | % | | 89.5 | % | | | | | | | | 72,449 | |

|

33 |

|

|

|

Lakewood Center |

|

$ |

431 |

|

$ |

430 |

|

$ |

417 |

|

|

96.2 |

% |

|

97.5 |

% |

|

93.9 |

% |

|

|

|

|

|

|

|

127,500 |

|

| | 34 | | | | Inland Center | | $ | 420 | | $ | 417 | | $ | 405 | | | 98.2 | % | | 97.9 | % | | 94.4 | % | | | | | | | | 25,000 | |

|

35 |

|

|

|

Pacific View |

|

$ |

398 |

|

$ |

405 |

|

$ |

422 |

|

|

96.5 |

% |

|

98.7 |

% |

|

97.8 |

% |

|

|

|

|

|

|

|

135,186 |

|

| | 36 | | | | Northgate Mall | | $ | 394 | | $ | 396 | | $ | 391 | | | 97.9 | % | | 97.9 | % | | 95.9 | % | | | | | | | | 64,000 | |

|

37 |

|

|

|

La Cumbre Plaza |

|

$ |

391 |

|

$ |

396 |

|

$ |

403 |

|

|

88.3 |

% |

|

86.4 |

% |

|

80.8 |

% |

|

|

|

|

|

|

|

— |

|

| | 38 | | | | Eastland Mall | | $ | 383 | | $ | 395 | | $ | 411 | | | 97.7 | % | | 98.8 | % | | 97.6 | % | | | | | | | | 168,000 | |

|

39 |

|

|

|

South Towne Center |

|

$ |

350 |

|

$ |

352 |

|

$ |

372 |

|

|

96.4 |

% |

|

88.9 |

% |

|

88.7 |

% |

|

|

|

|

|

|

|

— |

|

| | 40 | | | | Westside Pavilion | | $ | 343 | | $ | 348 | | $ | 365 | | | 95.6 | % | | 94.7 | % | | 95.9 | % | | | | | | | | 151,524 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

Total Top 31-40: |

|

$ |

406 |

|

$ |

410 |

|

$ |

418 |

|

|

95.5 |

% |

|

95.1 |

% |

|

93.6 |

% |

|

14.7 |

% |

|

15.9 |

% |

|

863,659 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Total Top 40: | | $ | 604 | | $ | 607 | | $ | 603 | | | 95.9 | % | | 95.8 | % | | 94.6 | % | | 13.6 | % | | 89.0 | % | | 5,570,790 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

12

The Macerich Company

Sales Per Square Foot by Property Ranking (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | Outstanding

Debt

@ Pro Rata

($ in

thousands)

3/31/2014

(e) | |

|---|

| |

| |

| | Sales Per Square Foot | | Occupancy | | Cost of Occupancy

for the Trailing

12 Months

Ended 3/31/2014

(c) | |

| |

|---|

| |

| |

| | % of Portfolio

2014 Forecast

Pro Rata NOI

(d) | |

|---|

Count | | Properties | | 3/31/2014

(a) | | 12/31/2013

(a) | | 3/31/2013

(a) | | 3/31/2014

(b) | | 12/31/2013

(b) | | 3/31/2013

(b) | |

|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Group 5: 41-52 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

41 |

|

|

|

Superstition Springs Center |

|

$ |

344 |

|

$ |

345 |

|

$ |

335 |

|

|

93.7 |

% |

|

96.9 |

% |

|

91.5 |

% |

|

|

|

|

|

|

|

68,316 |

|

| | 42 | | | | Towne Mall | | $ | 323 | | $ | 331 | | $ | 342 | | | 87.4 | % | | 86.4 | % | | 87.2 | % | | | | | | | | 22,897 | |

|

43 |

|

|

|

Capitola Mall |

|

$ |

322 |

|

$ |

326 |

|

$ |

331 |

|

|

83.0 |

% |

|

85.3 |

% |

|

78.9 |

% |

|

|

|

|

|

|

|

— |

|

| | 44 | | | | NorthPark Mall | | $ | 312 | | $ | 313 | | $ | 309 | | | 92.7 | % | | 91.6 | % | | 93.5 | % | | | | | | | | — | |

|

45 |

|

|

|

Flagstaff Mall |

|

$ |

312 |

|

$ |

310 |

|

$ |

302 |

|

|

74.4 |

% |

|

78.8 |

% |

|

84.9 |

% |

|

|

|

|

|

|

|

37,000 |

|

| | 46 | | | | Cascade Mall | | $ | 302 | | $ | 298 | | $ | 306 | | | 91.6 | % | | 91.5 | % | | 90.8 | % | | | | | | | | — | |

|

47 |

|

|

|

Wilton Mall |

|

$ |

293 |

|

$ |

296 |

|

$ |

311 |

|

|

90.5 |

% |

|

90.7 |

% |

|

93.9 |

% |

|

|

|

|

|

|

|

— |

|

| | 48 | | | | Valley Mall | | $ | 279 | | $ | 286 | | $ | 282 | | | 93.3 | % | | 95.4 | % | | 94.0 | % | | | | | | | | 41,955 | |

|

49 |

|

|

|

Desert Sky Mall |

|

$ |

271 |

|

$ |

270 |

|

$ |

262 |

|

|

93.4 |

% |

|

89.2 |

% |

|

95.0 |

% |

|

|

|

|

|

|

|

— |

|

| | 50 | | | | Great Northern Mall | | $ | 242 | | $ | 247 | | $ | 256 | | | 93.5 | % | | 95.5 | % | | 94.2 | % | | | | | | | | 35,235 | |

|

51 |

|

|

|

SouthPark Mall(f) |

|

|

n/a |

|

$ |

228 |

|

$ |

248 |

|

|

n/a |

|

|

79.4 |

% |

|

84.2 |

% |

|

|

|

|

|

|

|

— |

|

| | 52 | | | | Paradise Valley Mall(f) | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | n/a | | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

Total 41-52: |

|

$ |

301 |

|

$ |

295 |

|

$ |

298 |

|

|

90.9 |

% |

|

90.1 |

% |

|

90.8 |

% |

|

12.9 |

% |

|

7.8 |

% |

|

205,403 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Total Regional Shopping Centers | | $ | 565 | | $ | 565 | | $ | 560 | | | 95.1 | % | | 94.9 | % | | 94.0 | % | | 13.5 | % | | 96.8 | % | | 5,776,193 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

Total Community / Power Centers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.8 |

% |

|

56,365 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Other Non-mall Assets | | | | | | | | | | | | | | | | | | | | | | | | 0.4 | % | | 1,637 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13.4 |

% |

|

100.0 |

% |

|

5,834,195 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

13

The Macerich Company

Sales Per Square Foot by Property Ranking (unaudited)

| | | | | | | | | | | | | | | |

Count | | Properties | | Sales Per

Square Foot

12/31/2012

(a) | | Occupancy

12/31/2012

(b) | | % of Portfolio

2012

Pro Rata NOI

(h) | |

|---|

| | | | | | | | | | | | | | | | |

| | | | 2013 Disposition Centers | | | | | | | | | | |

|

1 |

|

|

|

Chesterfield Towne Center |

|

$ |

361 |

|

|

91.9 |

% |

|

|

|

| | 2 | | | | Fiesta Mall | | $ | 235 | | | 86.1 | % | | | |

|

3 |

|

|

|

Green Tree Mall |

|

$ |

400 |

|

|

91.2 |

% |

|

|

|

| | 4 | | | | Kitsap Mall | | $ | 383 | | | 92.4 | % | | | |

|

5 |

|

|

|

Northridge Mall |

|

$ |

342 |

|

|

97.2 |

% |

|

|

|

| | 6 | | | | Redmond Town Center | | $ | 361 | | | 89.2 | % | | | |

|

7 |

|

|

|

Redmond Town Center-Office |

|

|

n/a |

|

|

99.1 |

% |

|

|

|

| | 8 | | | | Ridgmar Mall | | $ | 332 | | | 84.6 | % | | | |

|

9 |

|

|

|

Rimrock Mall |

|

$ |

424 |

|

|

92.0 |

% |

|

|

|

| | 10 | | | | Salisbury, Centre at | | $ | 311 | | | 96.3 | % | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

10 |

|

Total 2013 Disposition Centers: |

|

$ |

348 |

|

|

92.1 |

% |

|

|

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | 2014 Disposition Centers | | | | | | | | | | |

|

1 |

|

|

|

Lake Square Mall |

|

$ |

232 |

|

|

86.4 |

% |

|

|

|

|

2 |

|

|

|

Rotterdam Square |

|

$ |

232 |

|

|

86.1 |

% |

|

|

|

|

3 |

|

|

|

Somersville Towne Center |

|

$ |

287 |

|

|

84.7 |

% |

|

|

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 3 | | Total 2014 Disposition Centers: | | $ | 244 | | | 85.9 | % | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

|

13 |

|

TOTAL DISPOSITION CENTERS |

|

$ |

333 |

|

|

91.2 |

% |

|

9.8 |

% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

14

The Macerich Company

Notes to Sales Per Square Foot by Property Ranking (unaudited)

| | |

| Footnotes |

| (a) | | Sales are based on reports by retailers leasing mall and freestanding stores for the trailing 12 months for tenants which have occupied such stores for a minimum of 12 months. Sales per square foot are based on tenants 10,000 square feet and under. Properties are ranked by Sales per square foot as of December 31, 2013. |

| (b) | | Occupancy is the percentage of mall and freestanding GLA leased as of the last day of the reporting period. Occupancy excludes Centers under development and redevelopment. |

| (c) | | Cost of Occupancy represents "Tenant Occupancy Costs" divided by "Tenant Sales". Tenant Occupancy Costs in this calculation are the amounts paid to the Company, including minimum rents, percentage rents and recoverable expenditures, which consist primarily of property operating expenses, real estate taxes and repair and maintenance expenditures. |

| (d) | | The percentage of Portfolio 2014 Forecast Pro Rata Net Operating Income ("NOI") is based on guidance reconfirmed on April 29, 2014. NOI excludes the following items: straight-line rent, above/below market adjustments to minimum rents and termination fee income. It does not reflect REIT expenses and net Management Company expenses. See the Company's forward-looking statements disclosure on page 1 for factors that may affect the information provided in this column. |

| (e) | | Please see further disclosures for Outstanding Debt at pro rata on pages 26-28. |

| (f) | | These assets are under redevelopment including demolition and reconfiguration of the Centers and tenant spaces, accordingly the Sales per square foot and Occupancy during the periods of redevelopment are not included. |

| (g) | | Fashion Outlets of Chicago opened August 1, 2013 and is included in "Group 2: Top 11 - 20" above based on the Company's expectations for Sales per square foot at this property. See the Company's forward-looking statements disclosure on page 1 for factors that may affect this information. |

| (h) | | The percentage of Portfolio 2012 Pro Rata NOI excludes the following items: straight-line rent, above/below market adjustments to minimum rents and termination fee income. It does not reflect REIT expenses and net Management Company expenses. |

15

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Occupancy(a)

| | | | | | | | | | |

| |

|---|

Regional Shopping Centers:

Period Ended | | Consolidated

Centers | | Unconsolidated

Joint Venture

Centers | | Total

Centers | |

|---|

03/31/2014 | | | 94.8% | | | 96.0% | | | 95.1% | |

03/31/2013 | | | 93.3% | | | 93.7% | | | 93.4% | |

12/31/2013(b) | | | 93.9% | | | 96.2% | | | 94.6% | |

12/31/2012 | | | 93.4% | | | 94.5% | | | 93.8%

| |

- (a)

- Occupancy is the percentage of mall and freestanding GLA leased as of the last day of the reporting period. Occupancy excludes Centers under development and redevelopment.

- (b)

- Rotterdam Square, sold January 15, 2014, is excluded at December 31, 2013.

16

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Average Base Rent Per Square Foot(a)

| | | | | | | | | | |

| |

| |

|---|

| | Average Base Rent

PSF(b) | | Average Base Rent

PSF on Leases

Executed during the

trailing twelve

months ended(c) | | Average Base Rent

PSF on Leases

Expiring(d) | |

|---|

Consolidated Centers | | | | | | | | | | |

03/31/2014 | | $ | 45.65 | | $ | 44.64 | | $ | 40.56 | |

03/31/2013 | | $ | 42.34 | | $ | 44.70 | | $ | 38.95 | |

12/31/2013 | | $ | 44.51 | | $ | 45.06 | | $ | 40.00 | |

12/31/2012 | | $ | 40.98 | | $ | 44.01 | | $ | 38.00 | |

Unconsolidated Joint Venture Centers | | |

| | |

| | |

| |

03/31/2014 | | $ | 62.99 | | $ | 67.71 | | $ | 52.13 | |

03/31/2013 | | $ | 56.91 | | $ | 57.44 | | $ | 49.85 | |

12/31/2013 | | $ | 62.47 | | $ | 63.44 | | $ | 48.43 | |

12/31/2012 | | $ | 55.64 | | $ | 55.72 | | $ | 48.74 | |

All Regional Shopping Centers | | |

| | |

| | |

| |

03/31/2014 | | $ | 49.21 | | $ | 49.39 | | $ | 43.02 | |

03/31/2013 | | $ | 45.66 | | $ | 47.60 | | $ | 41.43 | |

12/31/2013 | | $ | 48.16 | | $ | 49.09 | | $ | 41.88 | |

12/31/2012 | | $ | 44.29 | | $ | 46.78 | | $ | 40.54 | |

- (a)

- Average base rent per square foot is based on spaces 10,000 square feet and under. All joint venture amounts are included at pro rata. Centers under development and redevelopment are excluded.

- (b)

- Average base rent per square foot gives effect to the terms of each lease in effect, as of the applicable date, including any concessions, abatements and other adjustments or allowances that have been granted to the tenants. Rotterdam Square, sold January 15, 2014, is excluded at December 31, 2013.

- (c)

- The average base rent per square foot on leases executed during the period represents the actual rent to be paid during the first twelve months.

- (d)

- The average base rent per square foot on leases expiring during the period represents the final year minimum rent on a cash basis.

17

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Cost of Occupancy

| | | | | | | | | | |

| |

| |

|---|

| |

| | For Years Ended December 31, | |

|---|

| | For the trailing

twelve months ended

March 31, 2014 | |

|---|

| | 2013(a) | | 2012 | |

|---|

Consolidated Centers | | | | | | | | | | |

Minimum rents | | | 8.5 | % | | 8.4 | % | | 8.1 | % |

Percentage rents | | | 0.4 | % | | 0.4 | % | | 0.4 | % |

Expense recoveries(b) | | | 4.5 | % | | 4.5 | % | | 4.2 | % |

| | | | | | | | |

| | | | | | | | | | | |

Total | | | 13.4 | % | | 13.3 | % | | 12.7 | % |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| |

| |

|---|

| |

| | For Years Ended December 31, | |

|---|

| | For the trailing

twelve months ended

March 31, 2014 | |

|---|

| | 2013(a) | | 2012 | |

|---|

Unconsolidated Joint Venture Centers | | | | | | | | | | |

Minimum rents | | | 8.8 | % | | 8.8 | % | | 8.9 | % |

Percentage rents | | | 0.4 | % | | 0.4 | % | | 0.4 | % |

Expense recoveries(b) | | | 4.1 | % | | 4.0 | % | | 3.9 | % |

| | | | | | | | |

| | | | | | | | | | | |

Total | | | 13.3 | % | | 13.2 | % | | 13.2 | % |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| |

| |

|---|

| |

| | For Years Ended December 31, | |

|---|

| | For the trailing

twelve months ended

March 31, 2014 | |

|---|

| | 2013(a) | | 2012 | |

|---|

All Centers | | | | | | | | | | |

Minimum rents | | | 8.7 | % | | 8.6 | % | | 8.4 | % |

Percentage rents | | | 0.4 | % | | 0.4 | % | | 0.4 | % |

Expense recoveries(b) | | | 4.3 | % | | 4.3 | % | | 4.0 | % |

| | | | | | | | |

| | | | | | | | | | | |

Total | | | 13.4 | % | | 13.3 | % | | 12.8 | % |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

- (a)

- Rotterdam Square, sold January 15, 2014, is excluded for the year ended December 31, 2013.

- (b)

- Represents real estate tax and common area maintenance charges.

18

The Macerich Company

Percentage of Net Operating Income by State

| | | | |

| |

| |

|---|

State | | % of Portfolio

2014 Forecast Pro

Rata NOI(a) | |

|---|

California | | | 28.0 | % |

Arizona | | | 18.8 | % |

New York | | | 15.8 | % |

New Jersey & Connecticut | | | 9.2 | % |

Illinois, Indiana & Iowa | | | 8.1 | % |

Virginia | | | 5.7 | % |

Colorado | | | 5.5 | % |

Oregon | | | 3.7 | % |

Other(b) | | | 5.2 | % |

| | | | |

| | | | | |

Total | | | 100.0 | % |

| | | | |

| | | | | |

| | | | | |

| | | | |

- (a)

- The percentage of Portfolio 2014 Forecast Pro Rata NOI is based on guidance reconfirmed on April 29, 2014. NOI excludes the following items: straight-line rent, above/below market adjustments to minimum rents and termination fee income. NOI also does not reflect REIT expenses and net Management Company expenses. See the Company's forward-looking statements disclosure on page 1 for factors that may affect the information provided in this column.

- (b)

- "Other" includes Kentucky, North Dakota, Texas, Utah and Washington.

19

The Macerich Company

Property Listing

March 31, 2014

The following table sets forth certain information regarding the Centers and other locations that are wholly owned or partly owned by the Company.

| | | | | | | | | | | | | | | |

Count | | Company's

Ownership(a) | | Name of

Center/Location | | Year of

Original

Construction/

Acquisition | | Year of Most

Recent

Expansion/

Renovation | | Total

GLA(b) | |

|---|

| | | | CONSOLIDATED CENTERS: | | | | | | | |

| | 1 | | 100% | | Arrowhead Towne Center

Glendale, Arizona | | | 1993/2002 | | | 2004 | | | 1,198,000 | |

| | 2 | | 100% | | Capitola Mall(c)

Capitola, California | | | 1977/1995 | | | 1988 | | | 586,000 | |

| | 3 | | 50.1% | | Chandler Fashion Center

Chandler, Arizona | | | 2001/2002 | | | — | | | 1,323,000 | |

| | 4 | | 100% | | Danbury Fair Mall

Danbury, Connecticut | | | 1986/2005 | | | 2010 | | | 1,272,000 | |

| | 5 | | 100% | | Deptford Mall

Deptford, New Jersey | | | 1975/2006 | | | 1990 | | | 1,039,000 | |

| | 6 | | 100% | | Desert Sky Mall

Phoenix, Arizona | | | 1981/2002 | | | 2007 | | | 891,000 | |

| | 7 | | 100% | | Eastland Mall(c)

Evansville, Indiana | | | 1978/1998 | | | 1996 | | | 1,044,000 | |

| | 8 | | 60% | | Fashion Outlets of Chicago

Rosemont, Illinois | | | 2013/— | | | — | | | 529,000 | |

| | 9 | | 100% | | Flagstaff Mall

Flagstaff, Arizona | | | 1979/2002 | | | 2007 | | | 347,000 | |

| | 10 | | 100% | | FlatIron Crossing

Broomfield, Colorado | | | 2000/2002 | | | 2009 | | | 1,435,000 | |

| | 11 | | 50.1% | | Freehold Raceway Mall

Freehold, New Jersey | | | 1990/2005 | | | 2007 | | | 1,674,000 | |

| | 12 | | 100% | | Fresno Fashion Fair

Fresno, California | | | 1970/1996 | | | 2006 | | | 967,000 | |

| | 13 | | 100% | | Great Northern Mall

Clay, New York | | | 1988/2005 | | | — | | | 895,000 | |

| | 14 | | 100% | | Green Acres Mall(c)

Valley Stream, New York | | | 1956/2013 | | | 2007 | | | 1,790,000 | |

| | 15 | | 100% | | Kings Plaza Shopping Center(c)

Brooklyn, New York | | | 1971/2012 | | | 2002 | | | 1,195,000 | |

| | 16 | | 100% | | La Cumbre Plaza(c)

Santa Barbara, California | | | 1967/2004 | | | 1989 | | | 494,000 | |

| | 17 | | 100% | | Northgate Mall

San Rafael, California | | | 1964/1986 | | | 2010 | | | 720,000 | |

| | 18 | | 100% | | NorthPark Mall

Davenport, Iowa | | | 1973/1998 | | | 2001 | | | 1,050,000 | |

| | 19 | | 100% | | Oaks, The

Thousand Oaks, California | | | 1978/2002 | | | 2009 | | | 1,140,000 | |

| | 20 | | 100% | | Pacific View

Ventura, California | | | 1965/1996 | | | 2001 | | | 1,021,000 | |

| | 21 | | 100% | | Santa Monica Place

Santa Monica, California | | | 1980/1999 | | | 2010 | | | 475,000 | |

| | 22 | | 84.9% | | SanTan Village Regional Center

Gilbert, Arizona | | | 2007/— | | | 2009 | | | 1,006,000 | |

| | 23 | | 100% | | South Plains Mall

Lubbock, Texas | | | 1972/1998 | | | 1995 | | | 1,129,000 | |

| | 24 | | 100% | | South Towne Center

Sandy, Utah | | | 1987/1997 | | | 1997 | | | 1,278,000 | |

20

The Macerich Company

Property Listing

March 31, 2014

| | | | | | | | | | | | | | | |

Count | | Company's

Ownership(a) | | Name of

Center/Location | | Year of

Original

Construction/

Acquisition | | Year of Most

Recent

Expansion/

Renovation | | Total

GLA(b) | |

|---|

| | 25 | | 100% | | Superstition Springs Center

Mesa, Arizona | | | 1990/2002 | | | 2002 | | | 1,082,000 | |

| | 26 | | 100% | | Towne Mall

Elizabethtown, Kentucky | | | 1985/2005 | | | 1989 | | | 350,000 | |

| | 27 | | 100% | | Tucson La Encantada

Tucson, Arizona | | | 2002/2002 | | | 2005 | | | 243,000 | |

| | 28 | | 100% | | Twenty Ninth Street(c)

Boulder, Colorado | | | 1963/1979 | | | 2007 | | | 852,000 | |

| | 29 | | 100% | | Valley Mall

Harrisonburg, Virginia | | | 1978/1998 | | | 1992 | | | 504,000 | |

| | 30 | | 100% | | Valley River Center

Eugene, Oregon | | | 1969/2006 | | | 2007 | | | 925,000 | |

| | 31 | | 100% | | Victor Valley, Mall of

Victorville, California | | | 1986/2004 | | | 2012 | | | 580,000 | |

| | 32 | | 100% | | Vintage Faire Mall

Modesto, California | | | 1977/1996 | | | 2008 | | | 1,126,000 | |

| | 33 | | 100% | | Westside Pavilion

Los Angeles, California | | | 1985/1998 | | | 2007 | | | 755,000 | |

| | 34 | | 100% | | Wilton Mall

Saratoga Springs, New York | | | 1990/2005 | | | 1998 | | | 735,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Total Consolidated Centers | | | | | | 31,650,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | UNCONSOLIDATED JOINT VENTURE CENTERS: | | | | |

| | 35 | | 50% | | Biltmore Fashion Park

Phoenix, Arizona | | | 1963/2003 | | | 2006 | | | 525,000 | |

| | 36 | | 51% | | Cascade Mall

Burlington, Washington | | | 1989/1999 | | | 1998 | | | 592,000 | |

| | 37 | | 50.1% | | Corte Madera, Village at

Corte Madera, California | | | 1985/1998 | | | 2005 | | | 441,000 | |

| | 38 | | 50% | | Inland Center(c)

San Bernardino, California | | | 1966/2004 | | | 2004 | | | 933,000 | |

| | 39 | | 50% | | Kierland Commons

Scottsdale, Arizona | | | 1999/2005 | | | 2003 | | | 434,000 | |

| | 40 | | 51% | | Lakewood Center

Lakewood, California | | | 1953/1975 | | | 2008 | | | 2,066,000 | |

| | 41 | | 51% | | Los Cerritos Center

Cerritos, California | | | 1971/1999 | | | 2010 | | | 1,260,000 | |

| | 42 | | 50% | | North Bridge, The Shops at(c)

Chicago, Illinois | | | 1998/2008 | | | — | | | 671,000 | |

| | 43 | | 51% | | Queens Center(c)

Queens, New York | | | 1973/1995 | | | 2004 | | | 971,000 | |

| | 44 | | 50% | | Scottsdale Fashion Square

Scottsdale, Arizona | | | 1961/2002 | | | 2009 | | | 1,723,000 | |

| | 45 | | 51% | | Stonewood Center(c)

Downey, California | | | 1953/1997 | | | 1991 | | | 932,000 | |

| | 46 | | 50% | | Tysons Corner Center(c)

McLean, Virginia | | | 1968/2005 | | | 2005 | | | 1,956,000 | |

| | 47 | | 51% | | Washington Square

Portland, Oregon | | | 1974/1999 | | | 2005 | | | 1,440,000 | |

| | 48 | | 19% | | West Acres

Fargo, North Dakota | | | 1972/1986 | | | 2001 | | | 972,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Total Unconsolidated Joint Venture Centers | | | 14,916,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

21

The Macerich Company

Property Listing

March 31, 2014

| | | | | | | | | | | | | | | |

Count | | Company's

Ownership(a) | | Name of

Center/Location | | Year of

Original

Construction/

Acquisition | | Year of Most

Recent

Expansion/

Renovation | | Total

GLA(b) | |

|---|

| | REGIONAL SHOPPING CENTERS UNDER REDEVELOPMENT: | | | | |

| | 49 | | 50% | | Broadway Plaza(c)(d)

Walnut Creek, California | | | 1951/1985 | | | 1994 | | | 776,000 | |

| | 50 | | 100% | | Fashion Outlets of Niagara Falls USA(e)

Niagara Falls, New York | | | 1982/2011 | | | 2009 | | | 526,000 | |

| | 51 | | 100% | | Paradise Valley Mall(e)

Phoenix, Arizona | | | 1979/2002 | | | 2009 | | | 1,145,000 | |

| | 52 | | 100% | | SouthPark Mall(e)

Moline, Illinois | | | 1974/1998 | | | 1990 | | | 811,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Total Regional Shopping Centers | | | | | | 49,824,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | COMMUNITY / POWER CENTERS: | | | | | | | |

| | 1 | | 50% | | Atlas Park, The Shops at(d)

Queens, New York | | | 2006/2011 | | | 2013 | | | 327,000 | |

| | 2 | | 50% | | Boulevard Shops(d)

Chandler, Arizona | | | 2001/2002 | | | 2004 | | | 185,000 | |

| | 3 | | 67.5% | | Camelback Colonnade(e)

Phoenix, Arizona | | | 1961/2002 | | | 1994 | | | 619,000 | |

| | 4 | | 39.7% | | Estrella Falls, The Market at(d)

Goodyear, Arizona | | | 2009/— | | | 2009 | | | 242,000 | |

| | 5 | | 100% | | Panorama Mall(e)

Panorama, California | | | 1955/1979 | | | 2005 | | | 312,000 | |

| | 6 | | 89.4% | | Promenade at Casa Grande(e)

Casa Grande, Arizona | | | 2007/— | | | 2009 | | | 909,000 | |

| | 7 | | 100% | | Southridge Center(e)

Des Moines, Iowa | | | 1975/1998 | | | 2013 | | | 809,000 | |

| | 8 | | 100% | | Superstition Springs Power Center(e)

Mesa, Arizona | | | 1990/2002 | | | — | | | 206,000 | |

| | 9 | | 100% | | The Marketplace at Flagstaff Mall(c)(e)

Flagstaff, Arizona | | | 2007/— | | | — | | | 268,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Total Community / Power Centers | | | 3,877,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | OTHER ASSETS: | | | | | | | | | | |

| | | | 100% | | Various(e)(f) | | | | | | | | | 897,000 | |

| | | | 100% | | 500 North Michigan Avenue(e)

Chicago, Illinois | | | | | | | | | 323,000 | |

| | | | 50% | | Atlas Park, The Shops at-Office(d)

Queens, New York | | | | | | | | | 49,000 | |

| | | | 100% | | Paradise Village Ground Leases(e)

Phoenix, Arizona | | | | | | | | | 58,000 | |

| | | | 100% | | Paradise Village Office Park II(e)

Phoenix, Arizona | | | | | | | | | 46,000 | |

| | | | 50% | | Scottsdale Fashion Square-Office(d)

Scottsdale, Arizona | | | | | | | | | 124,000 | |

| | | | 50% | | Tysons Corner Center-Office(c)(d)

McLean, Virginia | | | | | | | | | 173,000 | |

| | | | 30% | | Wilshire Boulevard(d)

Santa Monica, California | | | | | | | | | 40,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Total Other Assets | | | | | | 1,710,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Grand Total at March 31, 2014 | | | | | | 55,411,000 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

22

The Macerich Company

Property Listing

March 31, 2014

- (a)

- The Company's ownership interest in this table reflects its legal ownership interest. See footnotes (a) and (b) on pages 24-25 regarding the legal versus economic ownership of joint venture entities.

- (b)

- Includes GLA attributable to anchors (whether owned or non-owned) and mall and freestanding stores as of March 31, 2014.

- (c)

- Portions of the land on which the Center is situated are subject to one or more long-term ground leases. With respect to 48 Centers, the underlying land controlled by the Company is owned in fee entirely by the Company, or, in the case of jointly-owned Centers, by the joint venture property partnership or limited liability company.

- (d)

- Included in Unconsolidated Joint Venture Centers.

- (e)

- Included in Consolidated Centers.

- (f)

- The Company owns a portfolio of 14 stores located at shopping centers not owned by the Company. Of these 14 stores, four have been leased to Forever 21, one has been leased to Kohl's, one has been leased to Burlington Coat Factory, and eight have been leased for non-Anchor usage. With respect to nine of the 14 stores, the underlying land is owned in fee entirely by the Company. With respect to the remaining five stores, the underlying land is owned by third parties and leased to the Company pursuant to long-term building or ground leases.

23

Joint Venture List

The following table sets forth certain information regarding the Centers and other operating properties that are not wholly-owned by the Company. This list of properties includes unconsolidated joint ventures, consolidated joint ventures, and co-venture arrangements. The percentages shown are the effective legal ownership and economic ownership interests of the Company as of March 31, 2014.

| | | | | | | | | | | | |

| |

|---|

Properties | | 3/31/2014

Legal

Ownership(a) | | 3/31/2014

Economic

Ownership(b) | | Joint Venture | | 3/31/2014

Total GLA(c) | |

|---|

Atlas Park, The Shops at | | | 50 | % | | 50 | % | WMAP, L.L.C. | | | 327,000 | |

Atlas Park, The Shops at-Office | | | 50 | % | | 50 | % | WMAP, L.L.C. | | | 49,000 | |

Biltmore Fashion Park | | | 50 | % | | 50 | % | Biltmore Shopping Center Partners LLC | | | 525,000 | |

Boulevard Shops | | | 50 | % | | 50 | % | Propcor II Associates, LLC | | | 185,000 | |

Broadway Plaza | | | 50 | % | | 50 | % | Macerich Northwestern Associates | | | 776,000 | |

Camelback Colonnade(d) | | | 67.5 | % | | 67.5 | % | Camelback Colonnade Associates LLC | | | 619,000 | |

Cascade Mall | | | 51 | % | | 51 | % | Pacific Premier Retail LP | | | 592,000 | |

Chandler Fashion Center(e) | | | 50.1 | % | | 50.1 | % | Freehold Chandler Holdings LP | | | 1,323,000 | |

Corte Madera, Village at | | | 50.1 | % | | 50.1 | % | Corte Madera Village, LLC | | | 441,000 | |

Estrella Falls, The Market at(f) | | | 39.7 | % | | 39.7 | % | The Market at Estrella Falls LLC | | | 242,000 | |

Fashion Outlets of Chicago(g) | | | 60 | % | | 60 | % | Fashion Outlets of Chicago LLC | | | 529,000 | |

Freehold Raceway Mall(e) | | | 50.1 | % | | 50.1 | % | Freehold Chandler Holdings LP | | | 1,674,000 | |

Inland Center | | | 50 | % | | 50 | % | WM Inland LP | | | 933,000 | |

Kierland Commons | | | 50 | % | | 50 | % | Kierland Commons Investment LLC | | | 434,000 | |

Lakewood Center | | | 51 | % | | 51 | % | Pacific Premier Retail LP | | | 2,066,000 | |

Los Cerritos Center | | | 51 | % | | 51 | % | Pacific Premier Retail LP | | | 1,260,000 | |

North Bridge, The Shops at | | | 50 | % | | 50 | % | North Bridge Chicago LLC | | | 671,000 | |

Promenade at Casa Grande(h) | | | 89.4 | % | | 89.4 | % | WP Casa Grande Retail LLC | | | 909,000 | |

Queens Center | | | 51 | % | | 51 | % | Queens JV LP | | | 971,000 | |

SanTan Village Regional Center | | | 84.9 | % | | 84.9 | % | Westcor SanTan Village LLC | | | 1,006,000 | |

Scottsdale Fashion Square | | | 50 | % | | 50 | % | Scottsdale Fashion Square Partnership | | | 1,723,000 | |

Scottsdale Fashion Square-Office | | | 50 | % | | 50 | % | Scottsdale Fashion Square Partnership | | | 124,000 | |

Stonewood Center | | | 51 | % | | 51 | % | Pacific Premier Retail LP | | | 932,000 | |

Tysons Corner Center | | | 50 | % | | 50 | % | Tysons Corner LLC | | | 1,956,000 | |

Tysons Corner Center-Office | | | 50 | % | | 50 | % | Tysons Corner Property LLC | | | 173,000 | |

Washington Square | | | 51 | % | | 51 | % | Pacific Premier Retail LP | | | 1,440,000 | |

West Acres | | | 19 | % | | 19 | % | West Acres Development, LLP | | | 972,000 | |

Wilshire Boulevard | | | 30 | % | | 30 | % | Wilshire Building—Tenants in Common | | | 40,000 | |

- (a)

- This column reflects the Company's legal ownership in the listed properties as of March 31, 2014.

Legal ownership may, at times, not equal the Company's economic interest in the listed properties because of various provisions in certain joint venture agreements regarding distributions of cash flow based on capital account balances, allocations of profits and losses and payments of preferred returns. As a result, the Company's actual economic interest (as distinct from its legal ownership interest) in certain of the properties could fluctuate from time to time and may not wholly align with its legal ownership interests. Substantially all of the Company's joint venture agreements contain rights of first refusal, buy-sell provisions, exit rights, default dilution remedies and/or other break up provisions or remedies which are customary in real estate joint venture agreements and which may, positively or negatively, affect the ultimate realization of cash flow and/or capital or liquidation proceeds.

- (b)

- Economic ownership represents the allocation of cash flow to the Company as of March 31, 2014, except as noted below. In cases where the Company receives a current cash distribution greater than its legal ownership percentage due to a capital account greater than its legal ownership percentage, only the legal ownership percentage is shown in this column. The Company's economic ownership of these properties may fluctuate based on a number of factors, including mortgage refinancings, partnership capital contributions and distributions, and proceeds and gains or losses from asset sales, and the matters set forth in the preceding paragraph.

- (c)

- Includes GLA attributable to anchors (whether owned or non-owned) and mall and freestanding stores as of March 31, 2014.

- (d)

- Cash flow from operations is distributed 67.5% to the Company and 32.5% to the third-party members. Distributions from capital event proceeds are also made at these percentages such that the members receive a defined return of and return on

24

agreed capital. Thereafter any excess capital event proceeds are distributed 52.5% to the Company and 47.5% to the third-party members.

- (e)

- The joint venture entity was formed in September 2009. Upon liquidation of the partnership, distributions are made in the following order: to the third-party partner until it receives a 13% internal rate of return on its aggregate unreturned capital contributions; to the Company until it receives a 13% internal rate of return on its aggregate unreturned capital contributions; and, thereafter, 35% to the third-party partner and 65% to the Company.

- (f)

- Columns 1 and 2 reflect the Company's indirect ownership interest in the property owner. The Company and a third-party partner are each members of a joint venture (the "MW Joint Venture") which, in turn, is a member in the joint venture that owns the property. Cash flow distributions for the MW Joint Venture are made in accordance with the members' relative capital accounts until the members have received distributions equal to their capital accounts, and thereafter in accordance with the members' relative legal ownership percentages. In addition, the Company has executed a joint and several guaranty of the mortgage for the property with its third-party partner. The Company may incur liabilities under such guaranty greater than its legal ownership percentage.

- (g)

- After the third anniversary of substantial completion of the development, the Company in its sole discretion may elect to purchase the interest of the other member based on a net operating income formula using a 6.5% capitalization rate, less any unpaid debt on the property. In addition, the Company has executed a guaranty of the mortgage for the property. The Company may incur liabilities under such guaranty greater than its legal ownership percentage.

- (h)

- Columns 1 and 2 reflect the Company's total direct and indirect ownership interest in the property owner. The Company and a third-party partner are each members of a joint venture (the "MW Joint Venture") which, in turn, is a member in the joint venture that owns the property. Cash flow distributions for the MW Joint Venture are made in accordance with the members' relative capital accounts until the members have received distributions equal to their capital accounts, and thereafter in accordance with the members' relative legal ownership percentages.

25

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Debt Summary (at Company's pro rata share)

| | | | | | | | | | |

| |

| |

|---|

| | As of March 31, 2014 | |

|---|

| | Fixed Rate | | Floating Rate | | Total | |

|---|

| | dollars in thousands

| |

|---|

Consolidated debt | | $ | 3,810,288 | | $ | 500,536 | | $ | 4,310,824 | |

Unconsolidated debt | | | 1,628,528 | | | 115,909 | | | 1,744,437 | |

| | | | | | | | |

| | | | | | | | | | | |

Total debt | | $ | 5,438,816 | | $ | 616,445 | | $ | 6,055,261 | |

Weighted average interest rate | | |

4.36 |

% | |

2.49 |

% | |

4.17 |

% |

Weighted average maturity (years) | | | | | | | | | 5.6 | |

26

The Macerich Company