Exhibit 99.2

Supplemental Financial Information

For the three months ended March 31, 2008

The Macerich Company

Supplemental Financial and Operating Information

Table of Contents

All information included in this supplemental financial package is unaudited, unless otherwise indicated.

| Page No. |

| |

Corporate overview | 1-3 |

Overview | 1 |

Capital information and market capitalization | 2 |

Changes in total common and equivalent shares/units | 3 |

| |

Financial data | 4-5 |

Supplemental FFO information | 4 |

Capital expenditures | 5 |

| |

Operational data | 6-9 |

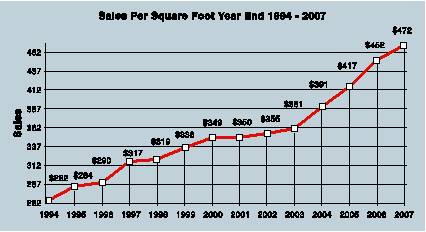

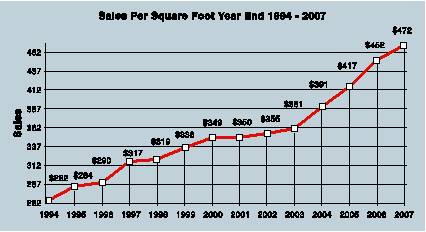

Sales per square foot | 6 |

Occupancy | 7 |

Rent | 8 |

Cost of occupancy | 9 |

| |

Balance sheet information | 10-12 |

Debt summary | 10 |

Outstanding debt by maturity | 11-12 |

| |

Development and Pipeline Forecast | 13 |

This supplemental financial information should be read in connection with the Company’s first quarter 2008 earnings announcement (included as Exhibit 99.1 of the Company’s Current Report on 8-K, event date May 8, 2008) as certain disclosures, definitions and reconciliations in such announcement have not been included in this supplemental financial information.

The Macerich Company

Supplemental Financial and Operating Information

Overview

The Macerich Company (the “Company”) is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional and community shopping centers located throughout the United States. The Company is the sole general partner of, and owns a majority of the ownership interests in, The Macerich Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”).

As of March 31, 2008, the Operating Partnership owned or had an ownership interest in 72 regional shopping centers and 19 community shopping centers aggregating approximately 77 million square feet of gross leasable area (“GLA”). These 91 regional and community shopping centers are referred to hereinafter as the “Centers”, unless the context requires otherwise.

The Company is a self-administered and self-managed real estate investment trust (“REIT”) and conducts all of its operations through the Operating Partnership and the Company’s management companies (collectively, the “Management Companies”).

All references to the Company in this Exhibit include the Company, those entities owned or controlled by the Company and predecessors of the Company, unless the context indicates otherwise.

This document contains information that constitutes forward-looking statements and includes information regarding expectations regarding the Company’s development, redevelopment and expansion activities. Stockholders are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to vary materially from those anticipated, expected or projected. Such factors include, among others, general industry, economic and business conditions; adverse changes in the real estate markets; and risks of real estate development, redevelopment, and expansion, including availability and cost of financing, construction delays, environmental and safety requirements, budget overruns, sunk costs and lease-up. Real estate development, redevelopment and expansion activities are also subject to risks relating to the inability to obtain, or delays in obtaining, all necessary zoning, land-use, building, and occupancy and other required governmental permits and authorizations and governmental actions and initiatives (including legislative and regulatory changes) as well as terrorist activities which could adversely affect all of the above factors. Furthermore, occupancy rates and rents at a newly completed property may not be sufficient to make the property profitable. The reader is directed to the Company’s various filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended December 31, 2007, for a discussion of such risks and uncertainties, which discussion is incorporated herein by reference. The Company does not intend, and undertakes no obligation, to update any forward-looking information to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

1

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Information and Market Capitalization

| | Period Ended | |

dollars in thousands except per share data | | 3/31/2008 | | 12/31/2007 | | 12/31/2006 | | 12/31/2005 | |

Closing common stock price per share | | $ | 70.27 | | $ | 71.06 | | $ | 86.57 | | $ | 67.14 | |

52 week high | | $ | 98.10 | | $ | 103.59 | | $ | 87.10 | | $ | 71.22 | |

52 week low | | $ | 57.50 | | $ | 69.44 | | $ | 66.70 | | $ | 53.10 | |

| | | | | | | | | |

Shares outstanding at end of period | | | | | | | | | |

Class A participating convertible preferred units | | — | | 2,855,393 | | 2,855,393 | | 2,855,393 | |

Class A non-participating convertible preferred units | | 219,828 | | 219,828 | | 287,176 | | 287,176 | |

Series A cumulative convertible redeemable preferred stock | | 3,067,131 | | 3,067,131 | | 3,627,131 | | 3,627,131 | |

Common shares and partnership units | | 85,090,528 | | 84,864,600 | | 84,767,432 | | 73,446,422 | |

Total common and equivalent shares/units outstanding | | 88,377,487 | | 91,006,952 | | 91,537,132 | | 80,216,122 | |

| | | | | | | | | |

Portfolio capitalization data | | | | | | | | | |

Total portfolio debt, including joint ventures at pro rata | | $ | 7,639,974 | | $ | 7,507,559 | | $ | 6,620,271 | | $ | 6,863,690 | |

| | | | | | | | | |

Equity market capitalization | | 6,210,286 | | 6,466,954 | | 7,924,369 | | 5,385,710 | |

| | | | | | | | | |

Total market capitalization | | $ | 13,850,260 | | $ | 13,974,513 | | $ | 14,544,640 | | $ | 12,249,400 | |

| | | | | | | | | |

Leverage ratio (%) (a) | | 55.2 | % | 53.7 | % | 45.5 | % | 56.0 | % |

| | | | | | | | | |

Floating rate debt as a percentage of total market capitalization | | 9.8 | % | 8.0 | % | 9.5 | % | 13.0 | % |

| | | | | | | | | |

Floating rate debt as a percentage of total debt | | 17.7 | % | 14.8 | % | 20.8 | % | 35.7 | % |

(a) Debt as a percentage of total market capitalization

Portfolio Capitalization at March 31, 2008

2

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Changes in Total Common and Equivalent Shares/Units

| | | | | | Class A | | Class A Non- | | Series A | | Total | |

| | | | | | Participating | | Participating | | Cumulative | | Common | |

| | | | | | Convertible | | Convertible | | Convertible | | and | |

| | | | Company | | Preferred | | Preferred | | Redeemable | | Equivalent | |

| | Partnership | | Common | | Units | | Units | | Preferred | | Shares/ | |

| | Units | | Shares | | (“PCPU’s”) | | (“NPCPU’s”) | | Stock | | Units | |

| | | | | | | | | | | | | |

Balance as of December 31, 2007 | | 12,552,837 | | 72,311,763 | | 2,855,393 | | 219,828 | | 3,067,131 | | 91,006,952 | |

| | | | | | | | | | | | | |

Redemption of PCPU’s in exchange for the distribution of interests in properties | | | | | | (2,855,393 | ) | | | | | (2,855,393 | ) |

| | | | | | | | | | | | | |

Issuance of stock/partnership units from stock option exercises, restricted stock issuance or other share or unit-based plans | | 6,821 | | 219,107 | | | | | | | | 225,928 | |

| | | | | | | | | | | | | |

Balance as of March 31, 2008 | | 12,559,658 | | 72,530,870 | | — | | 219,828 | | 3,067,131 | | 88,377,487 | |

3

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Supplemental Funds from Operations (“FFO”) Information (a)

| | As of March 31, | |

| | 2008 | | 2007 | |

Straight line rent receivable (dollars in millions) | | $ | 55.8 | | $ | 53.8 | |

| | | | | | | |

| | For the Three Months Ended | |

| | March 31, | |

dollars in millions | | 2008 | | 2007 | |

| | | | | |

Lease termination fees | | $ | 2.5 | | $ | 3.4 | |

| | | | | |

Straight line rental income | | $ | 2.1 | | $ | 1.6 | |

| | | | | |

Gain on sales of undepreciated assets | | $ | 1.6 | | $ | 0.9 | |

| | | | | |

Amortization of acquired above- and below-market leases (SFAS 141) | | $ | 4.6 | | $ | 4.0 | |

| | | | | |

Amortization of debt premiums | | $ | 2.7 | | $ | 3.9 | |

| | | | | |

Interest capitalized | | $ | 7.6 | | $ | 5.9 | |

(a) All joint venture amounts included at pro rata.

4

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Capital Expenditures

| | For the Three | | | | | |

| | Months Ended | | Year Ended | | Year Ended | |

dollars in millions | | 3/31/2008 | | 12/31/2007 | | 12/31/2006 | |

Consolidated Centers | | | | | | | |

Acquisitions of property and equipment | | $ | 38.1 | | $ | 387.9 | | $ | 580.5 | |

Development, redevelopment and expansions of Centers | | 89.1 | | 545.9 | | 184.3 | |

Renovations of Centers | | 5.0 | | 31.1 | | 51.4 | |

Tenant allowances | | 3.0 | | 28.0 | | 27.0 | |

Deferred leasing charges | | 6.0 | | 21.6 | | 21.6 | |

Total | | $ | 141.2 | | $ | 1,014.5 | | $ | 864.8 | |

| | | | | | | |

Joint Venture Centers (a) | | | | | | | |

Acquisitions of property and equipment | | $ | 262.3 | | $ | 24.8 | | $ | 28.7 | |

Development, redevelopment and expansions of Centers | | 6.6 | | 33.5 | | 48.8 | |

Renovations of Centers | | 5.5 | | 10.5 | | 8.1 | |

Tenant allowances | | 2.1 | | 15.1 | | 13.8 | |

Deferred leasing charges | | 1.6 | | 4.2 | | 4.3 | |

Total | | $ | 278.1 | | $ | 88.1 | | $ | 103.7 | |

(a) All joint venture amounts at pro rata.

5

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Sales Per Square Foot (a)

| | Wholly Owned | | Joint Venture | | | |

| | Centers | | Centers | | Total Centers | |

3/31/2008 (b) | | $ | 448 | | $ | 488 | | $ | 468 | |

12/31/2007 (c) | | $ | 453 | | $ | 488 | | $ | 472 | |

12/31/2006 | | $ | 435 | | $ | 470 | | $ | 452 | |

12/31/2005 | | $ | 395 | | $ | 440 | | $ | 417 | |

(a) Sales are based on reports by retailers leasing mall and freestanding stores for the trailing 12 months for tenants which have occupied such stores for a minimum of 12 months. Sales per square foot are based on tenants 10,000 square feet and under for regional malls.

(b) Due to tenant sales reporting timelines, the data presented is as of February 28, 2008.

(c) Due to tenant sales reporting timelines, the data presented is as of November 30, 2007. Sales per square foot were $472 after giving effect to the Rochester Redemption, including The Shops at North Bridge and excluding the Community/Specialty centers.

6

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Occupancy

| | Wholly Owned | | Joint Venture | | Total | |

Period Ended | | Centers (a) | | Centers (a) | | Centers (a) | |

3/31/2008 | | 92.3 | % | 93.0 | % | 92.7 | % |

12/31/2007 | | 92.8 | % | 94.0 | % | 93.5 | % |

12/31/2006 | | 93.0 | % | 94.2 | % | 93.6 | % |

12/31/2005 | | 93.2 | % | 93.8 | % | 93.5 | % |

(a) Occupancy data excludes space under development and redevelopment.

7

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Rent

| | | | Average Base Rent | | | |

| | | | PSF on Leases | | Average Base Rent | |

| | Average Base Rent | | Commencing During | | PSF on Leases | |

| | PSF (a) | | the Period (b) | | Expiring (c) | |

Wholly Owned Centers | | | | | | | |

3/31/2008 | | $ | 39.90 | | $ | 45.53 | | $ | 35.14 | |

12/31/2007 | | $ | 38.49 | | $ | 43.23 | | $ | 34.21 | |

12/31/2006 | | $ | 37.55 | | $ | 38.40 | | $ | 31.92 | |

12/31/2005 | | $ | 34.23 | | $ | 35.60 | | $ | 30.71 | |

| | | | | | | |

Joint Venture Centers | | | | | | | |

3/31/2008 | | $ | 40.96 | | $ | 42.31 | | $ | 37.61 | |

12/31/2007 | | $ | 38.72 | | $ | 47.12 | | $ | 34.87 | |

12/31/2006 | | $ | 37.94 | | $ | 41.43 | | $ | 36.19 | |

12/31/2005 | | $ | 36.35 | | $ | 39.08 | | $ | 30.18 | |

(a) Average base rent per square foot is based on Mall and Freestanding Store GLA for spaces 10,000 square feet and under, occupied as of the applicable date, for each of the Centers owned by the Company. Leases for Tucson La Encantada and the expansion area of Queens Center were excluded for Year 2005. Leases for Promenade at Casa Grande, SanTan Village Power Center and SanTan Village Regional Center were excluded for Year 2007 and the three months ended March 31, 2008. Leases for Santa Monica Place were excluded for the three months ended March 31, 2008.

(b) The average base rent per square foot on lease signings commencing during the period represents the actual rent to be paid during the first twelve months for tenants 10,000 square feet and under. Lease signings for Tucson La Encantada and the expansion area of Queens Center were excluded for Year 2005. Lease signings for Promenade at Casa Grande, SanTan Village Power Center and SanTan Village Regional Center were excluded for Year 2007 and the three months ended March 31, 2008. Lease signings for Santa Monica Place were excluded for the three months ended March 31, 2008.

(c) The average base rent per square foot on leases expiring during the period represents the final year minimum rent, on a cash basis, for all tenant leases 10,000 square feet and under expiring during the year. Leases for Tucson La Encantada and the expansion area of Queens Center were excluded for Year 2005. Leases for Promenade at Casa Grande, SanTan Village Power Center and SanTan Village Regional Center were excluded for Year 2007 and the three months ended March 31, 2008. Leases for Santa Monica Place were excluded for the three months ended March 31, 2008.

8

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Cost of Occupancy

| | For Years Ended December 31, | |

| | 2007 | | 2006 | | 2005 | |

Wholly Owned Centers | | | | | | | |

Minimum rents | | 8.0 | % | 8.1 | % | 8.3 | % |

Percentage rents | | 0.4 | % | 0.4 | % | 0.5 | % |

Expense recoveries (a) | | 3.8 | % | 3.7 | % | 3.6 | % |

Total | | 12.2 | % | 12.2 | % | 12.4 | % |

| | For Years Ended December 31, | |

| | 2007 | | 2006 | | 2005 | |

Joint Venture Centers | | | | | | | |

Minimum rents | | 7.3 | % | 7.2 | % | 7.4 | % |

Percentage rents | | 0.5 | % | 0.6 | % | 0.5 | % |

Expense recoveries (a) | | 3.2 | % | 3.1 | % | 3.0 | % |

Total | | 11.0 | % | 10.9 | % | 10.9 | % |

(a) Represents real estate tax and common area maintenance charges.

9

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Debt Summary

| | As of March 31, 2008 | |

dollars in thousands | | Fixed Rate | | Variable Rate (a) | | Total | |

Consolidated debt | | $ | 4,560,730 | | $ | 1,163,685 | | $ | 5,724,415 | |

Unconsolidated debt | | 1,723,620 | | 191,939 | | 1,915,559 | |

Total debt | | $ | 6,284,350 | | $ | 1,355,624 | | $ | 7,639,974 | |

| | | | | | | |

Weighted average interest rate | | 5.66 | % | 3.82 | % | 5.33 | % |

| | | | | | | |

Weighted average maturity (years) | | | | | | 3.68 | |

(a) Excludes swapped floating rate debt. Swapped debt is included in fixed debt category.

10

The Macerich Company

Supplemental Financial and Operating Information (unaudited)

Outstanding Debt by Maturity Date

| | As of March 31, 2008 | |

Center/Entity (dollars in thousands) | | Maturity Date | | Effective

Interest

Rate (a) | | Fixed | | Floating | | Total Debt Balance (a) | |

| | | | | | | | | | | |

I. Consolidated Assets: | | | | | | | | | | | |

| | | | | | | | | | | |

Westside Pavilion | | 07/01/08 | | 6.74 | % | $ | 91,649 | | $ | — | | $ | 91,649 | |

Village Fair North | | 07/15/08 | | 5.89 | % | 10,796 | | — | | 10,796 | |

Fresno Fashion Fair | | 08/10/08 | | 6.52 | % | 63,326 | | — | | 63,326 | |

South Towne Center | | 10/10/08 | | 6.66 | % | 64,000 | | — | | 64,000 | |

Queens Center | | 03/01/09 | | 7.11 | % | 90,120 | | — | | 90,120 | |

South Plains Mall | | 03/01/09 | | 8.29 | % | 58,480 | | — | | 58,480 | |

Carmel Plaza | | 05/01/09 | | 8.18 | % | 26,141 | | — | | 26,141 | |

Paradise Valley Mall | | 05/01/09 | | 5.89 | % | 20,993 | | — | | 20,993 | |

Northridge Mall | | 07/01/09 | | 4.94 | % | 80,762 | | — | | 80,762 | |

Wilton Mall | | 11/01/09 | | 4.79 | % | 44,120 | | — | | 44,120 | |

Macerich Partnership Term Loan (b) | | 04/25/10 | | 6.50 | % | 450,000 | | — | | 450,000 | |

Macerich Partnership Line of Credit (c) | | 04/25/10 | | 6.23 | % | 400,000 | | — | | 400,000 | |

Vintage Faire Mall | | 09/01/10 | | 7.91 | % | 64,130 | | — | | 64,130 | |

Santa Monica Place | | 11/01/10 | | 7.79 | % | 78,733 | | — | | 78,733 | |

Valley View Center | | 01/01/11 | | 5.81 | % | 125,000 | | — | | 125,000 | |

Danbury Fair Mall | | 02/01/11 | | 4.64 | % | 174,821 | | — | | 174,821 | |

Shoppingtown Mall | | 05/11/11 | | 5.01 | % | 44,244 | | — | | 44,244 | |

Capitola Mall | | 05/15/11 | | 7.13 | % | 38,865 | | — | | 38,865 | |

Freehold Raceway Mall | | 07/07/11 | | 4.68 | % | 176,196 | | — | | 176,196 | |

Pacific View | | 08/31/11 | | 7.25 | % | 81,893 | | — | | 81,893 | |

Pacific View | | 08/31/11 | | 7.00 | % | 6,605 | | — | | 6,605 | |

Rimrock Mall | | 10/01/11 | | 7.56 | % | 42,664 | | — | | 42,664 | |

Prescott Gateway | | 12/01/11 | | 5.86 | % | 60,000 | | — | | 60,000 | |

Hilton Village | | 02/01/12 | | 5.27 | % | 8,534 | | — | | 8,534 | |

The Macerich Company - Convertible Senior

Notes (d) | | 03/15/12 | | 3.66 | % | 942,485 | | — | | 942,485 | |

Tucson La Encantada | | 06/01/12 | | 5.84 | % | 78,000 | | — | | 78,000 | |

Chandler Fashion Center | | 11/01/12 | | 5.20 | % | 101,911 | | — | | 101,911 | |

Chandler Fashion Center | | 11/01/12 | | 6.00 | % | 67,072 | | — | | 67,072 | |

Towne Mall | | 11/01/12 | | 4.99 | % | 14,721 | | — | | 14,721 | |

Deptford Mall | | 01/15/13 | | 5.41 | % | 172,500 | | — | | 172,500 | |

Queens Center | | 03/31/13 | | 7.00 | % | 216,141 | | — | | 216,141 | |

Greeley - Defeaseance | | 09/01/13 | | 6.34 | % | 27,518 | | — | | 27,518 | |

FlatIron Crossing | | 12/01/13 | | 5.26 | % | 186,881 | | — | | 186,881 | |

Great Northern Mall | | 12/01/13 | | 5.19 | % | 40,112 | | — | | 40,112 | |

Fiesta Mall | | 01/01/15 | | 4.98 | % | 84,000 | | — | | 84,000 | |

Flagstaff Mall | | 11/01/15 | | 5.03 | % | 37,000 | | — | | 37,000 | |

Valley River Center | | 02/01/16 | | 5.60 | % | 120,000 | | — | | 120,000 | |

Salisbury, Center at | | 05/01/16 | | 5.83 | % | 115,000 | | — | | 115,000 | |

Chesterfield Towne Center | | 01/01/24 | | 9.07 | % | 55,317 | | — | | 55,317 | |

Total Fixed Rate Debt for Consolidated Assets | | | | 5.60 | % | $ | 4,560,730 | | $ | — | | $ | 4,560,730 | |

| | | | | | | | | | | |

La Cumbre Plaza | | 08/09/08 | | 4.20 | % | — | | 30,000 | | 30,000 | |

Twenty Ninth Street | | 06/05/09 | | 3.60 | % | — | | 115,000 | | 115,000 | |

Promende at Casa Grande (e) | | 08/16/09 | | 5.86 | % | — | | 45,305 | | 45,305 | |

Panorama Mall | | 02/28/10 | | 3.62 | % | — | | 50,000 | | 50,000 | |

Macerich Partnership Line of Credit | | 04/25/10 | | 3.72 | % | — | | 923,000 | | 923,000 | |

Prasada - Cactus Power Center (f) | | 03/14/11 | | 4.15 | % | — | | 380 | | 380 | |

Total Floating Rate Debt for Consolidated Assets | | | | 3.80 | % | $ | — | | $ | 1,163,685 | | $ | 1,163,685 | |

Total Debt for Consolidated Assets | | | | 5.23 | % | $ | 4,560,730 | | $ | 1,163,685 | | $ | 5,724,415 | |

11

| | As of March 31, 2008 | |

Center/Entity (dollars in thousands) | | Maturity Date | | Effective

Interest

Rate (a) | | Fixed | | Floating | | Total Debt Balance (a) | |

| | | | | | | | | | | |

II. Unconsolidated Joint Ventures (At Company's pro rata share): | | | | | | | | | | | |

| | | | | | | | | | | |

Broadway Plaza (50%) | | 08/01/08 | | 6.68 | % | $ | 29,687 | | $ | — | | $ | 29,687 | |

Chandler Festival (50%) | | 10/01/08 | | 4.37 | % | 14,789 | | — | | 14,789 | |

Chandler Gateway (50%) | | 10/01/08 | | 5.19 | % | 9,347 | | — | | 9,347 | |

Washington Square (51%) | | 02/01/09 | | 6.72 | % | 49,503 | | — | | 49,503 | |

Metrocenter Mall (15%) (g) | | 02/09/09 | | 5.34 | % | 16,800 | | — | | 16,800 | |

Inland Center (50%) | | 02/11/09 | | 4.69 | % | 27,000 | | — | | 27,000 | |

The Shops at North Bridge (50%) | | 07/01/09 | | 4.67 | % | 102,500 | | — | | 102,500 | |

Biltmore Fashion Park (50%) | | 07/10/09 | | 4.70 | % | 37,795 | | — | | 37,795 | |

Redmond Office (51%) | | 07/10/09 | | 6.77 | % | 33,144 | | — | | 33,144 | |

Redmond Retail (51%) | | 08/01/09 | | 4.81 | % | 36,628 | | — | | 36,628 | |

Corte Madera, The Village at (50.1%) | | 11/01/09 | | 7.75 | % | 32,510 | | — | | 32,510 | |

Ridgmar (50%) | | 04/11/10 | | 6.11 | % | 28,700 | | — | | 28,700 | |

Kitsap Mall/Place (51%) | | 06/01/10 | | 8.14 | % | 29,108 | | — | | 29,108 | |

Cascade (51%) | | 07/01/10 | | 5.27 | % | 20,028 | | — | | 20,028 | |

Stonewood Mall (51%) | | 12/11/10 | | 7.44 | % | 37,617 | | — | | 37,617 | |

Arrowhead Towne Center (33.3%) | | 10/01/11 | | 6.38 | % | 26,432 | | — | | 26,432 | |

SanTan Village Power Center (34.9%) | | 02/01/12 | | 5.33 | % | 15,705 | | — | | 15,705 | |

Northpark Center (50%) | | 05/10/12 | | 5.95 | % | 93,165 | | — | | 93,165 | |

NorthPark Center (50%) | | 05/10/12 | | 8.33 | % | 41,523 | | — | | 41,523 | |

NorthPark Land (50%) | | 05/10/12 | | 8.33 | % | 40,108 | | — | | 40,108 | |

Kierland Greenway (24.5%) | | 01/01/13 | | 6.01 | % | 15,747 | | — | | 15,747 | |

Kierland Main Street (24.5%) | | 01/02/13 | | 4.99 | % | 3,794 | | — | | 3,794 | |

Scottsdale Fashion Square (50%) | | 07/08/13 | | 5.66 | % | 275,000 | | — | | 275,000 | |

Tyson’s Corner (50%) | | 02/17/14 | | 4.78 | % | 168,167 | | — | | 168,167 | |

Lakewood Mall (51%) | | 06/01/15 | | 5.43 | % | 127,500 | | — | | 127,500 | |

Eastland Mall (50%) | | 06/01/16 | | 5.80 | % | 84,000 | | — | | 84,000 | |

Empire Mall (50%) | | 06/01/16 | | 5.81 | % | 88,150 | | — | | 88,150 | |

Granite Run (50%) | | 06/01/16 | | 5.84 | % | 59,711 | | — | | 59,711 | |

Mesa Mall (50%) | | 06/01/16 | | 5.82 | % | 43,625 | | — | | 43,625 | |

Rushmore (50%) | | 06/01/16 | | 5.82 | % | 47,000 | | — | | 47,000 | |

Southern Hills (50%) | | 06/01/16 | | 5.82 | % | 50,750 | | — | | 50,750 | |

Valley Mall (50%) | | 06/01/16 | | 5.85 | % | 23,248 | | — | | 23,248 | |

West Acres (19%) | | 10/01/16 | | 6.41 | % | 12,980 | | — | | 12,980 | |

Wilshire Building (30%) | | 01/01/33 | | 6.35 | % | 1,859 | | — | | 1,859 | |

Total Fixed Rate Debt for Unconsolidated Assets | | | | 5.81 | % | $ | 1,723,620 | | $ | — | | $ | 1,723,620 | |

| | | | | | | | | | | |

NorthPark Land (50%) | | 08/30/08 | | 5.25 | % | — | | 3,500 | | 3,500 | |

Superstition Springs Center (33.3%) | | 09/09/08 | | 3.15 | % | — | | 22,500 | | 22,500 | |

Camelback Colonnade (75%) | | 10/09/08 | | 3.55 | % | — | | 31,125 | | 31,125 | |

Kierland Tower Lofts (15%) | | 12/14/08 | | 4.38 | % | — | | 3,748 | | 3,748 | |

Washington Square (51%) | | 02/01/09 | | 5.12 | % | — | | 16,433 | | 16,433 | |

Metrocenter Mall (15%) | | 02/09/09 | | 8.02 | % | — | | 3,240 | | 3,240 | |

Desert Sky Mall (50%) | | 03/06/09 | | 3.92 | % | — | | 25,750 | | 25,750 | |

Boulevard Shops (50%) | | 12/17/10 | | 3.68 | % | — | | 10,700 | | 10,700 | |

Chandler Village Center (50%) | | 01/15/11 | | 3.70 | % | — | | 8,643 | | 8,643 | |

Los Cerritos Center (51%) | | 07/01/11 | | 3.83 | % | — | | 66,300 | | 66,300 | |

Total Floating Rate Debt for Unconsolidated Assets | | | | 3.92 | % | $ | — | | $ | 191,939 | | $ | 191,939 | |

Total Debt for Unconsolidated Assets | | | | 5.62 | % | $ | 1,723,620 | | $ | 191,939 | | $ | 1,915,559 | |

| | | | | | | | | | | |

Total Debt | | | | 5.33 | % | $ | 6,284,350 | | $ | 1,355,624 | | $ | 7,639,974 | |

Percentage to Total | | | | | | 82.3 | % | 17.7 | % | 100.0 | % |

a) The debt balances include the unamortized debt premiums/discounts. Debt premiums/discounts represent the excess of the fair value of debt over the principal value of debt assumed in various acquisitions and are amortized into interest expense over the remaining term of the related debt in a manner that approximates the effective interest method.The annual interest rate in the above table represents the effective interest rate, including the debt premiums/discounts and loan financing costs.

(b) This debt has an interest rate swap agreement which effectively fixed the interest rate from December 1, 2005 to April 25, 2010.

(c) This debt has an interest rate swap agreement which effectively fixed the interest rate from September 12, 2006 to April 25, 2011.

(d) These convertible senior notes were issued on 3/16/07 in an aggregate amount of $950.0 million. The above table includes the unamortized discount of $9.4 million and the annual interest rate represents the effective interest rate, including the discount.

(e) This property is a consolidated joint venture. The above debt balance represents the Company's pro rata share of 51.3%

(f) This property is a consolidated joint venture. The above debt balance represents the Company's pro rata share of 59.8%

(g) This debt has an interest rate swap agreement which effectively fixed the interest rate from January 15, 2005 to February 15, 2009.

12

The Macerich Company

Supplemental Financial and Operating Information

Development Pipeline Forecast

as of May 8, 2008

| | | | | | Estimated | | | | | | Estimated Pro | | Estimated | | ESTIMATED YEAR PLACED IN SERVICE (1) | |

| | | | | | Project Size | | Estimated Total | | | | rata Project Cost | | Completion Date | | 2007 | | 2008 | | 2009 | | 2010 | |

Property | | Location | | Project Type | | (1) | | Project Cost (1) | | Ownership % | | (1) | | (1) | | COST | | COST | | COST | | COST | |

REDEVELOPMENT | | | | | | | | | | | | | | | | | | | | | | | |

Arrowhead Towne Center | | Glendale, AZ | | Expansion - Dick’s Sporting Goods | | 70,000 | | $ | 13,000,000 | | 33.3 | % | $ | 4,329,000 | | 2008 | | | | $ | 4,329,000 | | | | | |

Freehold Raceway Mall | | Freehold, NJ | | Expansion - Lifestyle Village | | 95,000 | | $ | 43,000,000 | | 100 | % | $ | 43,000,000 | | 2007/2008 | | $ | 23,000,000 | | $ | 20,000,000 | | | | | |

Scottsdale Fashion Square | | Scottsdale, AZ | | Expansion - Barney’s New York/Retail | | 170,000 | | $ | 143,000,000 | | 50 | % | $ | 71,500,000 | | 2009/2010 | | | | | | $ | 60,775,000 | | $ | 10,725,000 | |

Shoppingtown Mall | | DeWitt, NY | | Expansion - Regal Theatres | | | | $ | 6,000,000 | | 100 | % | $ | 6,000,000 | | 2008 | | | | $ | 6,000,000 | | | | | |

Vintage Faire Mall | | Modesto, CA | | Expansion - Lifestyle Village | | 60,000 | | $ | 27,000,000 | | 100 | % | $ | 27,000,000 | | 2008/2009 | | | | $ | 23,000,000 | | $ | 4,000,000 | | | |

Wilton Mall | | Saratoga Springs, NY | | Expansion - JCPenney | | 85,000 | | $ | 3,000,000 | | 100 | % | $ | 3,000,000 | | 2007 | | $ | 3,000,000 | | | | | | | |

The Oaks | | Thousand Oaks, CA. | | Redevelopment/Expansion | | 97,288 | | $ | 250,000,000 | | 100 | % | $ | 250,000,000 | | 2008/2009 | | | | $ | 200,000,000 | | $ | 50,000,000 | | | |

Chesterfield Town Center | | Richmond, VI | | Redevelopment | | | | $ | 14,000,000 | | 100 | % | $ | 14,000,000 | | 2008 | | | | $ | 14,000,000 | | | | | |

FlatIron Crossing | | Broomfield, CO | | Redevelopment | | 100,000 | | $ | 17,000,000 | | 100 | % | $ | 17,000,000 | | 2009/2010 | | | | | | $ | 14,000,000 | | $ | 3,000,000 | |

Northgate Mall | | San Rafael, CA | | Redevelopment | | 700,000 | | $ | 70,000,000 | | 100 | % | $ | 70,000,000 | | 2009/2010 | | | | | | $ | 35,000,000 | | $ | 35,000,000 | |

Santa Monica Place | | Santa Monica, CA | | Redevelopment | | 550,000 | | $ | 265,000,000 | | 100 | % | $ | 265,000,000 | | 2009/2010 | | | | | | $ | 225,250,000 | | $ | 39,750,000 | |

Westside Pavilion | | West Los Angeles, CA | | Redevelopment | | 100,000 | | $ | 30,000,000 | | 100 | % | $ | 30,000,000 | | 2007/2008 | | $ | 21,000,000 | | $ | 9,000,000 | | | | | |

Fiesta Mall | | Mesa, AZ | | Anchor Replacement - Dick’s Sporting Goods/Best Buy | | 110,000 | | $ | 50,000,000 | | 100 | % | $ | 50,000,000 | | 2009 | | | | | | $ | 50,000,000 | | | |

Lakewood Mall | | Lakewood, CA | | Anchor Replacement - Costco | | 160,000 | | $ | 23,000,000 | | 51 | % | $ | 11,730,000 | | 2008 | | | | $ | 11,730,000 | | | | | |

Valley River | | Eugene, OR | | Anchor Replacement - Regal Cinema’s | | 70,000 | | $ | 9,000,000 | | 100 | % | $ | 9,000,000 | | 2007 | | $ | 9,000,000 | | | | | | | |

Washington Square | | Portland, OR | | Anchor Replacement - Dick’s Sporting Goods | | 80,000 | | $ | 15,000,000 | | 51 | % | $ | 7,650,000 | | 2008 | | | | $ | 7,650,000 | | | | | |

Danbury Fair Mall | | Danbury, CT | | Renovation | | | | $ | 31,000,000 | | 100 | % | $ | 31,000,000 | | 2008 | | | | $ | 31,000,000 | | | | | |

Flagstaff Mall | | Flagstaff, AZ | | Renovation | | | | $ | 12,500,000 | | 100 | % | $ | 12,500,000 | | 2007/2008 | | $ | 8,000,000 | | $ | 4,500,000 | | | | | |

Freehold Raceway Mall | | Freehold, NJ | | Renovation | | | | $ | 22,000,000 | | 100 | % | $ | 22,000,000 | | 2007/2008 | | $ | 13,000,000 | | 9,000,000 | | | | | |

La Cumbre Plaza | | Santa Barbara, CA | | Renovation | | | | $ | 22,000,000 | | 100 | % | $ | 22,000,000 | | 2008/2009 | | | | $ | 11,000,000 | | $ | 11,000,000 | | | |

TOTAL | | | | | | 2,447,288 | | $ | 1,065,500,000 | | | | $ | 966,709,000 | | | | $ | 77,000,000 | | $ | 351,209,000 | | $ | 450,025,000 | | $ | 88,475,000 | |

| | | | | | | | | | | | | | | | | | | | | | | |

GROUND UP DEVELOPMENT | | | | | | | | | | | | | | | | | | | | | | | |

Estrella Falls | | Goodyear, AZ | | Regional Mall | | 1,000,000 | | $ | 210,000,000 | | 84 | % | $ | 176,400,000 | | 2010/2011 | �� | | | | | | | $ | 149,940,000 | |

SanTan Village Regional Center | | Gilbert, AZ | | Regional Mall | | 1,200,000 | | $ | 205,000,000 | | 84.7 | % | $ | 173,635,000 | | 2007/2008 | | $ | 103,000,000 | | $ | 70,635,000 | | | | | |

Promenade at Casa Grande | | Casa Grande, AZ | | Lifestyle/Power Center | | 1,014,016 | | $ | 118,000,000 | | 51.3 | % | $ | 60,534,000 | | 2007/2008 | | $ | 30,267,000 | | $ | 30,267,000 | | | | | |

Marketplace at Flagstaff | | Flagstaff, AZ | | Lifestyle/Power Center | | 287,000 | | $ | 45,000,000 | | 100 | % | $ | 45,000,000 | | 2007/2008 | | $ | 34,000,000 | | $ | 11,000,000 | | | | | |

Market at Estrella Falls | | Goodyear, AZ | | Power Center | | 500,000 | | $ | 90,000,000 | | 35 | % | $ | 31,500,000 | | 2008/2009 | | | | $ | 18,900,000 | | $ | 9,450,000 | | $ | 3,150,000 | |

Prasada - Waddell Center West | | Surprise, AZ | | Power Center | | 500,024 | | $ | 58,000,000 | | 59.8 | % | $ | 34,684,000 | | 2009/2010 | | | | | | $ | 6,243,120 | | $ | 28,440,880 | |

Prasada - Cactus Power Center | | Surprise, AZ | | Power Center | | 674,800 | | $ | 132,000,000 | | 59.8 | % | $ | 78,936,000 | | 2010 | | | | | | | | $ | 78,936,000 | |

TOTAL | | | | | | 5,175,840 | | $ | 858,000,000 | | | | $ | 600,689,000 | | | | $ | 167,267,000 | | $ | 130,802,000 | | $ | 15,693,120 | | $ | 260,466,880 | |

| | | | | | | | | | | | | | | | | | | | | | | |

GRAND TOTAL | | | | | | 7,623,128 | | $ | 1,923,500,000 | | | | $ | 1,567,398,000 | | | | $ | 244,267,000 | | $ | 482,011,000 | | $ | 465,718,120 | | $ | 348,941,880 | |

| | | | | | | | | | | | | | | | | | | | | | | |

POTENTIAL DEVELOPMENT OPPORTUNITIES | | | | | | | | | | | | | | | | | | | | | |

Biltmore | | Phoenix, AZ | | Mixed-Use Expansion | | | | | | 50 | % | | | | | | | | | | | | |

Tysons Corner | | McLean, VA | | Mixed-Use Expansion | | | | | | 50 | % | | | | | | | | | | | | |

Scottsdale Fashion Square | | Scottsdale, AZ | | Mixed-Use Expansion | | | | | | 50 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

TOTAL | | | | | | | | | | | | | | | | | | | | | | | |

NOTES

(1) - Much of this information is estimated and may change from time to time. See the Company’s Forward Looking Statements disclosure on page 1 for factors that may effect the information provided in this table.

13