Exhibit 99.1

Exhibit 99.1

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

2013 Investor Day

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Jodi Allen

Director Investor Relations

Welcome and Agenda

Forward Looking Statements

During the course of this meeting we may make forward-looking statements. All statements that address expectations or projections about the future are forward-looking statements.

Some of these statements include words such as “expects”, “anticipates,” “plans,”

“intends,” “projects,” and “outlook.” Although they reflect our current expectations, these statements are not guarantees of future performance because they involve a number of risks, uncertainties, and assumptions.

We recommend that you review Cytec’s SEC filings for a discussion of some of the factors which could cause actual results to differ materially from its expectations and projections. This and other Cytec information may be accessed at www.cytec.com.

In sections of this presentation certain “non-GAAP” measures are provided and identified as such. We believe that the “non-GAAP” measures can more accurately reflect comparisons of year to year trends and is consistent with how we review the information. Reconciliation of “non-GAAP” measures to the applicable GAAP measure are provided on our website and SEC filings.

Agenda

9:00am Welcome and Agenda 10:00am Industrial Materials Jodi Allen William Avrin

Director Vice President

Investor Relations Corporate & Business Development

9:15am Strategic Overview 10:35am Specialty Chemicals Shane Fleming Michael Radossich

Chairman, President & President

Chief Executive Officer Specialty Chemicals

9:30am Aerospace Materials 11:15am Financial Review William Wood David Drillock

President Vice President & Aerospace Materials Chief Financial Officer

9:50am Leveraging Innovation 11:30am Closing Remarks and Q&A

Carmelo Lo Faro Shane Fleming

Vice President Technology, Chairman, President & Aerospace & Industrial Materials Chief Executive Officer

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Shane Fleming

Chairman, President & Chief Executive Officer

Strategic Overview

Growth Strategy Focused on Long-Term Value Creation

Refocused portfolio on growth strategy

Centered on secular growth in attractive end markets

Winning share with differentiated technology offerings

Common approach to development and commercialization

Accelerating growth and strengthening Cytec through an evolved enterprise model

Delivering profitable growth through leading market positions

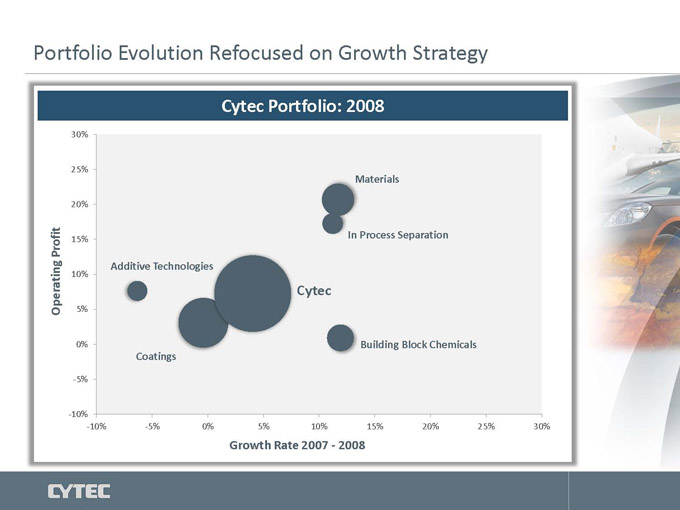

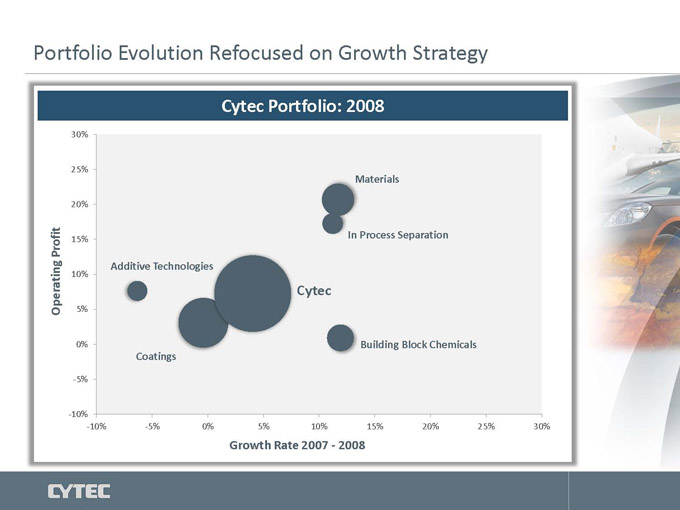

Portfolio Evolution Refocused on Growth Strategy

Cytec Portfolio: 2008

30%

25%

Materials

20%

Profit 15% In Process Separation

Additive Technologie

10%

Cytec

Operating 5%

0% Building Block Chemicals

Coatings

-5%

-10%

-10% -5% 0% 5% 10% 15% 20% 25% 30%

Growth Rate 2007—2008

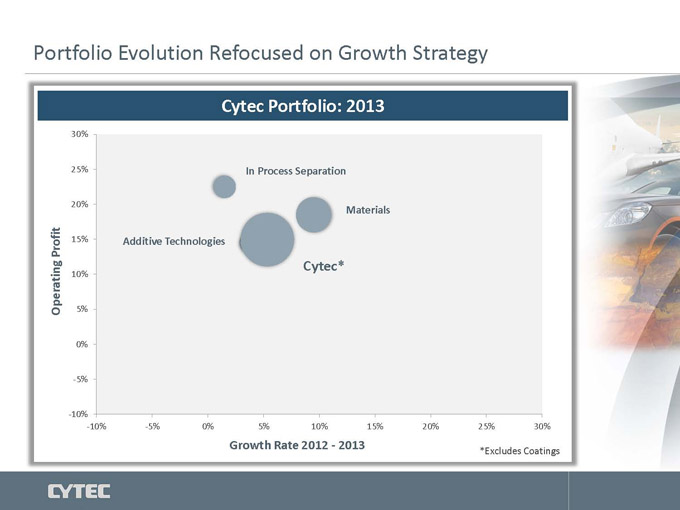

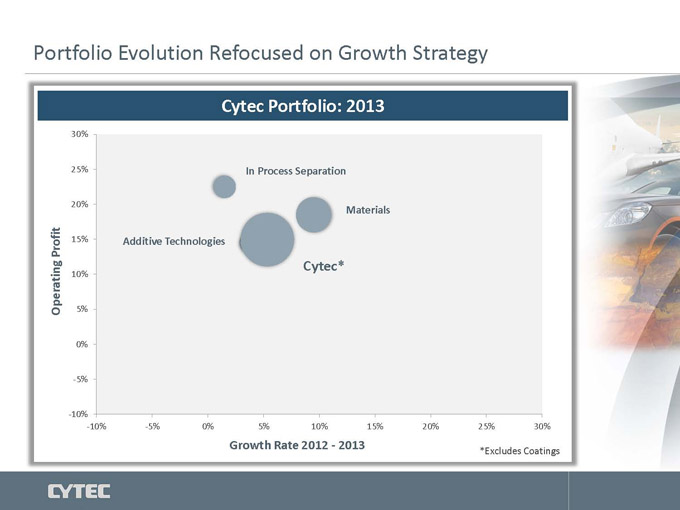

Portfolio Evolution Refocused on Growth Strategy

Cytec Portfolio: 2013

30%

25% In Process Separation

20%

Materials

Profit 15% Additive Technologies

Cytec*

10%

Operating 5%

0%

-5%

-10%

-10% -5% 0% 5% 10% 15% 20% 25% 30%

Growth Rate 2012—2013 *Excludes Coatings

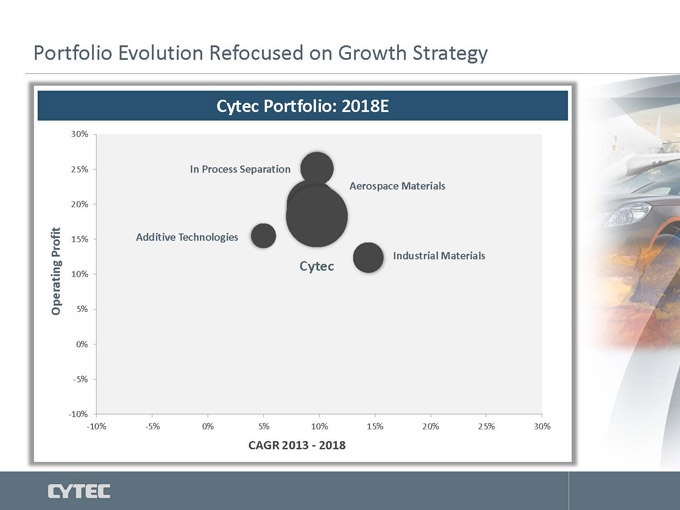

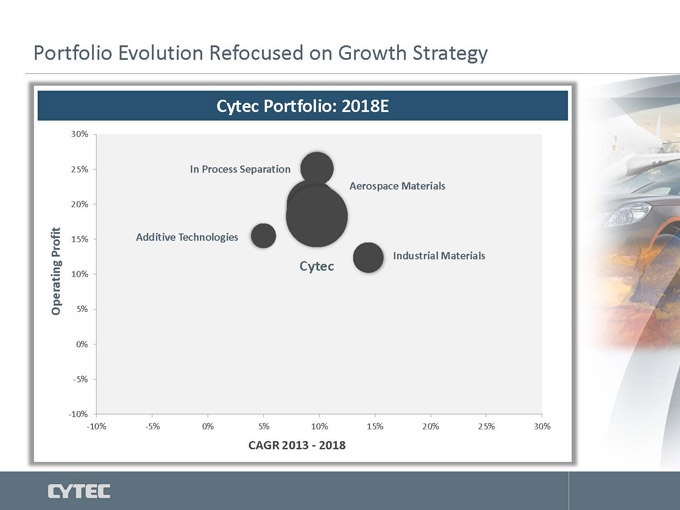

Portfolio Evolution Refocused on Growth Strategy

Cytec Portfolio: 2018E

30%

25% In Process Separation

Aerospace Materials

20%

Profit 15% Additive Technologies

Industrial Materials

Cytec

10%

Operating 5%

0%

-5%

-10%

-10% -5% 0% 5% 10% 15% 20% 25% 30%

CAGR 2013—2018

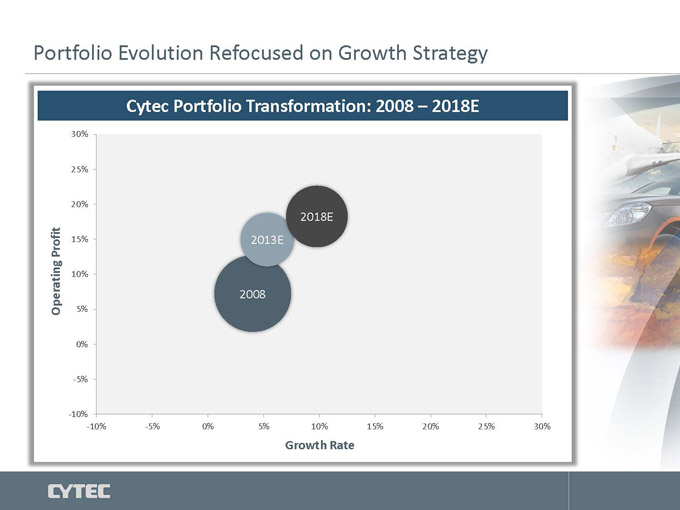

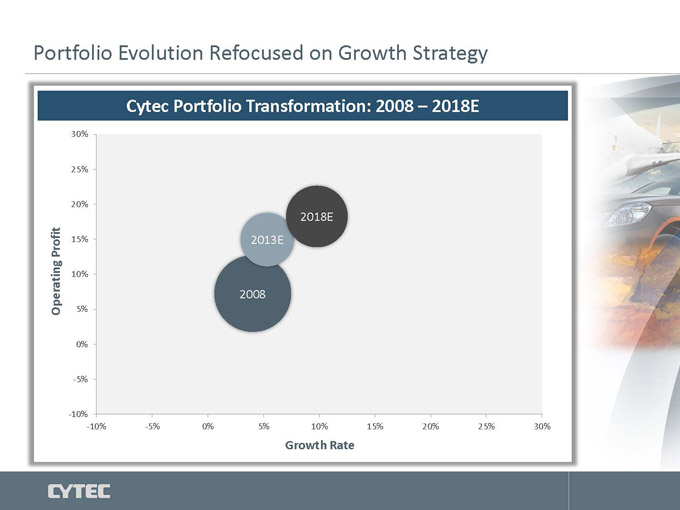

Portfolio Evolution Refocused on Growth Strategy

Cytec Portfolio Transformation: 2008 – 2018E

30%

25%

20%

2018E

Profit 15% 2013E

10%

2008

Operating 5%

0%

-5%

-10%

-10% -5% 0% 5% 10% 15% 20% 25% 30%

Growth Rate

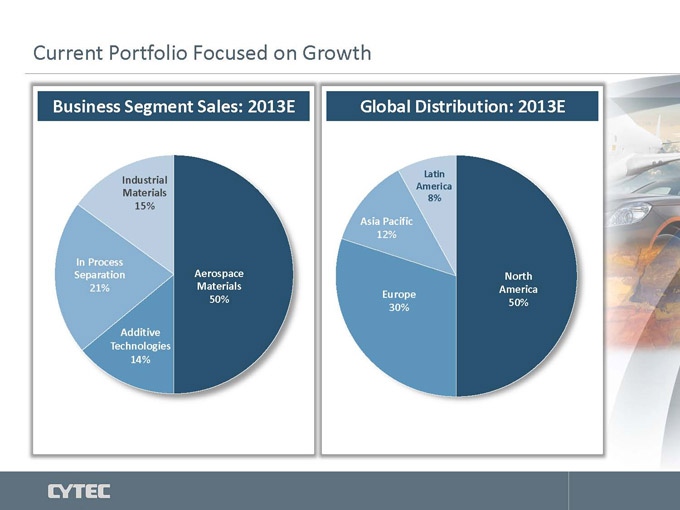

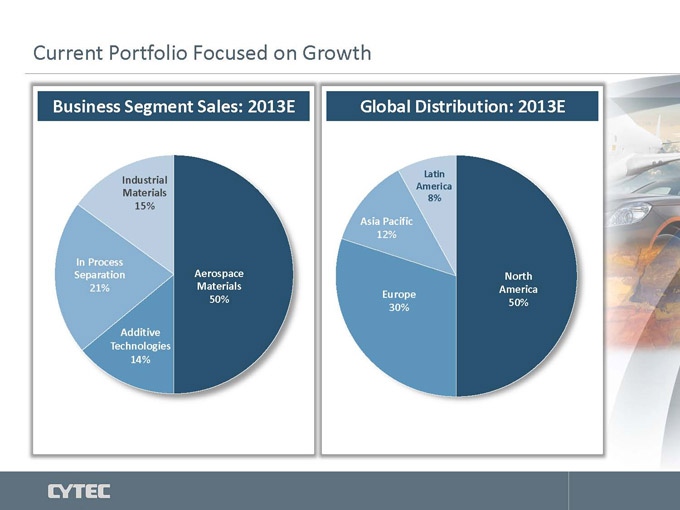

Current Portfolio Focused on Growth

Business Segment Sales: 2013E Global Distribution: 2013E

Industrial Latin

America

Materials 8%

15%

Asia Pacific

12%

In Process

Separation Aerospace North

21% Materials America

Europe

50% 50%

30%

Additive

Technologies

14%

Portfolio Centered on Secular Growth in Attractive End Markets

Shift toward greater Expansion of composite Declining ore grades

composite usage to use in more industrial require more complex

reduce weight and applications to reduce and innovative

improve fuel efficiency weight and improve solutions

Positive outlook for fuel efficiency Growth in emerging

long-term growth in air • Regulatory drivers, economies drives

travel including lower CO2 greater consumption of

High order backlog emissions, support metals

adoption of composites • New mine startups

require more metal

recovery

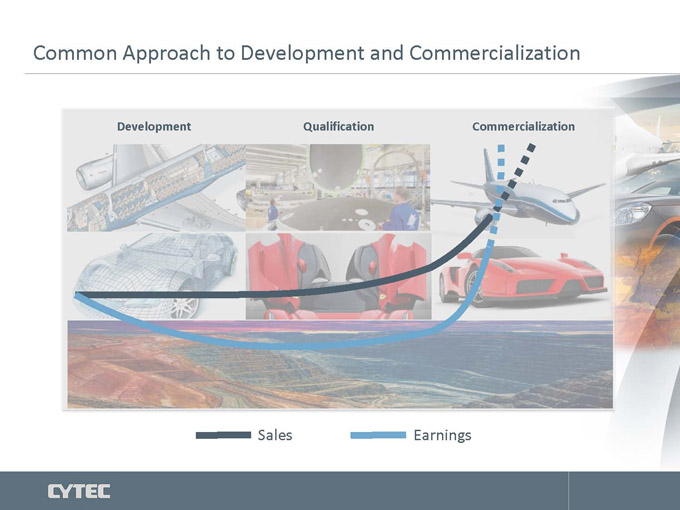

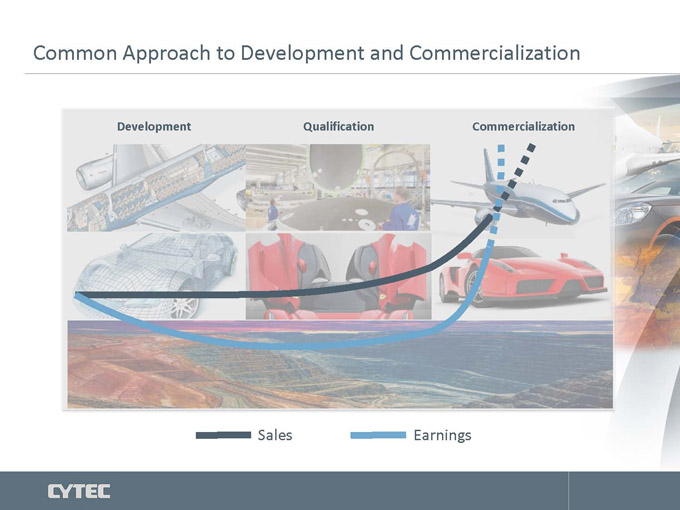

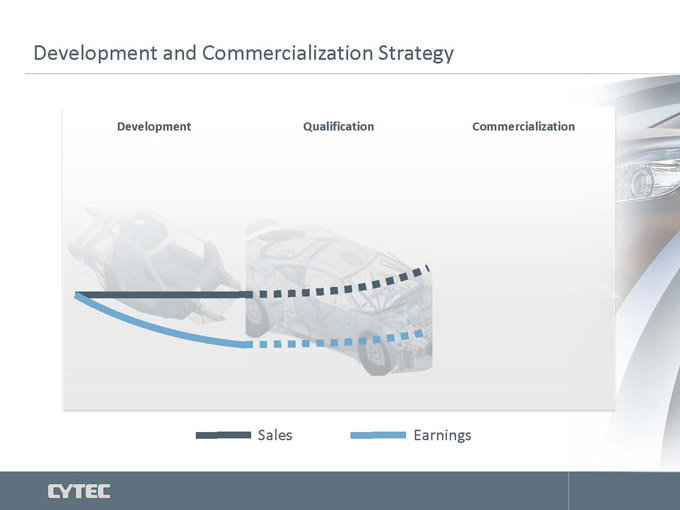

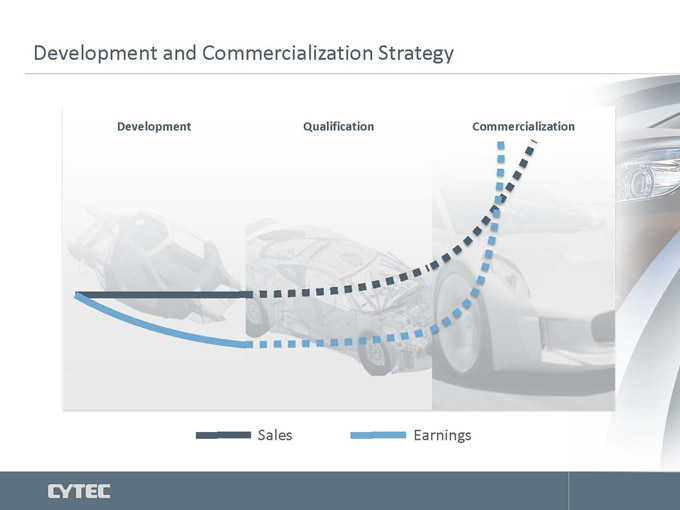

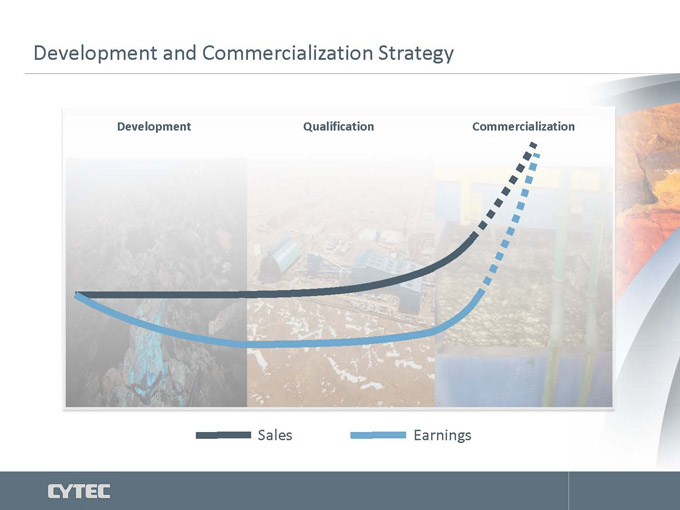

Common Approach to Development and Commercialization

Development Qualification Commercialization

Sales Earnings

Common Approach to Development and Commercialization

Development Qualification Commercialization

Sales Earnings

Common Approach to Development and Commercialization

Development Qualification Commercialization

Sales Earnings

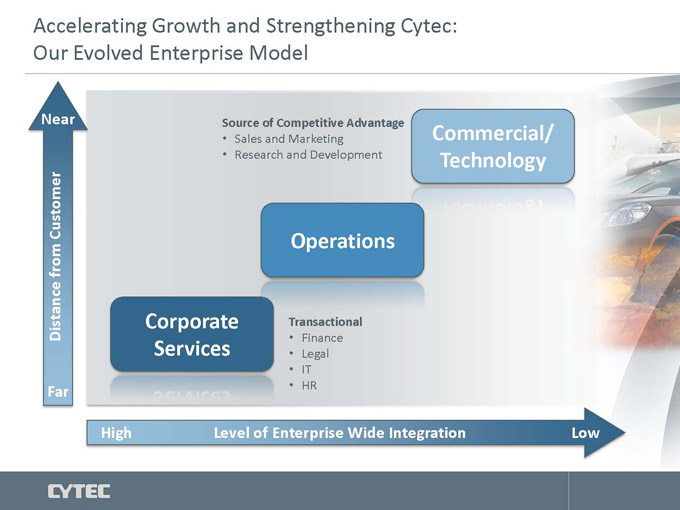

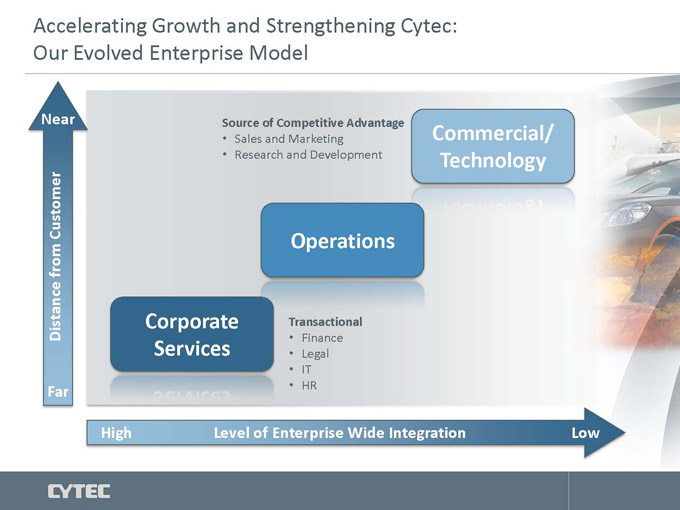

Accelerating Growth and Strengthening Cytec:

Our Evolved Enterprise Model

Near Source of Competitive Advantage

• Sales and Marketing Commercial/

• Research and Development Technology

Customer Operations

from

Distance Corporate Transactional

• Finance

Services • Legal

• IT

Far • HR

High Level of Enterprise Wide Integration Low

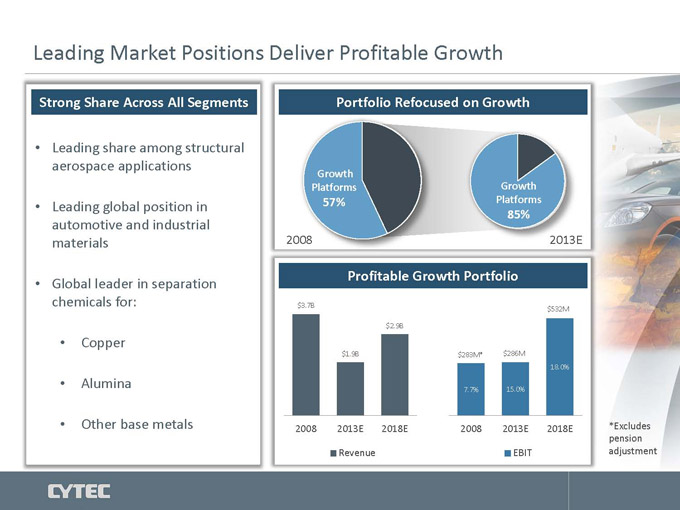

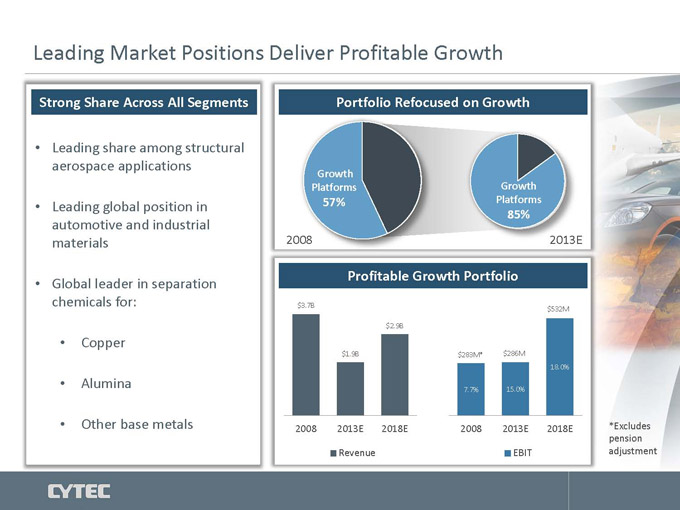

Leading Market Positions Deliver Profitable Growth

Strong Share Across All Segments Portfolio Refocused on Growth

Leading share among structural

aerospace applications

Growth

Platforms Growth

Leading global position in 57% Platforms

85%

automotive and industrial

materials 2008 2013E

Global leader in separation Profitable Growth Portfolio

chemicals for: $3.7B $532M

$2.9B

• Copper

$1.9B $283M* $286M

18.0%

• Alumina 7.7% 15.0%

• Other base metals 2008 2013E 2018E 2008 2013E 2018E *Excludes

pension

Revenue EBIT adjustment

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

William Wood

President Aerospace Materials

Aerospace Materials

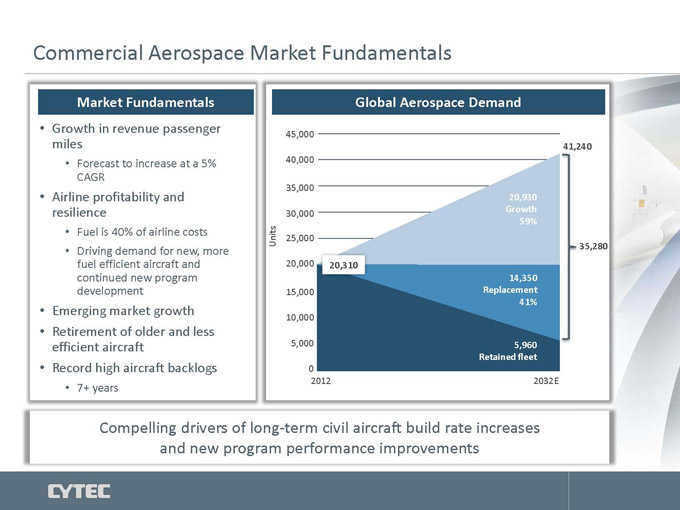

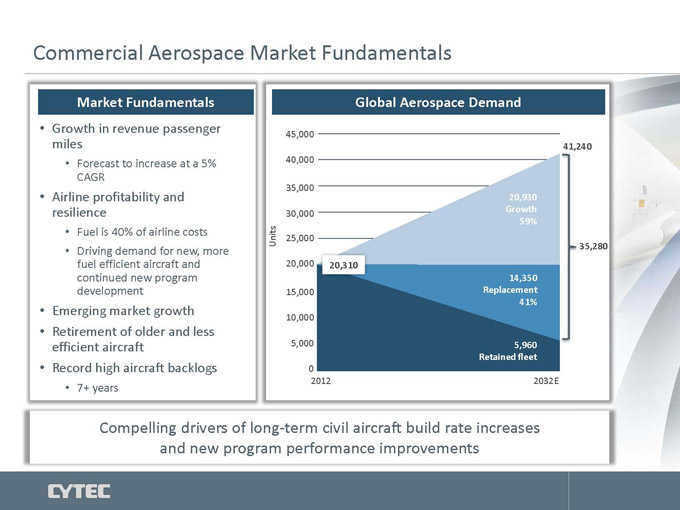

Commercial Aerospace Market Fundamentals

Market Fundamentals Global Aerospace Demand

Growth in revenue passenger 45,000

miles 41,240

• Forecast to increase at a 5% 40,000

CAGR

35,000

Airline profitability and 20,930

resilience 30,000 Growth

59%

• Fuel is 40% of airline costs Units 25,000

• Driving demand for new, more 35,280

fuel efficient aircraft and 20,000 20,310

continued new program 14,350

development 15,000 Replacement

41%

Emerging market growth 10,000

Retirement of older and less

efficient aircraft 5,000 5,960

Retained fleet

Record high aircraft backlogs 0

• 7+ years 2012 2032E

Compelling drivers of long-term civil aircraft build rate increases

and new program performance improvements

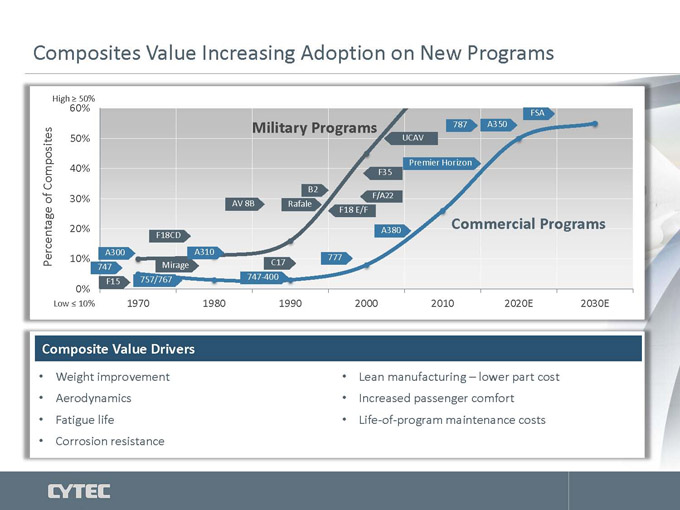

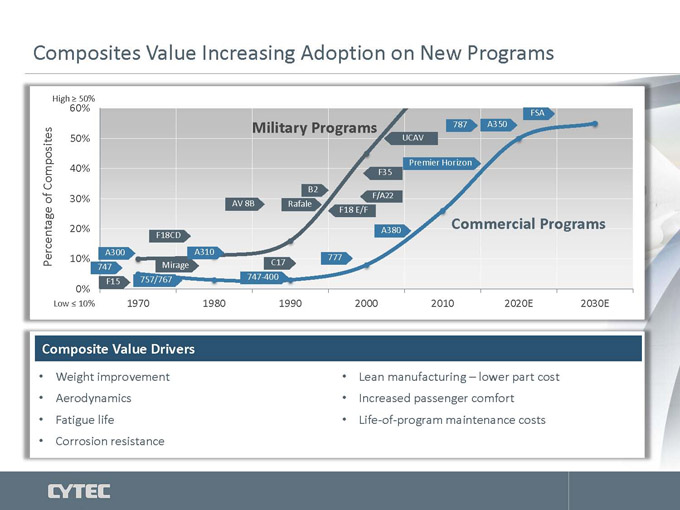

Composites Value Increasing Adoption on New Programs

High ? 50%

60% FSA

Military Programs 787 A350

50% UCAV

Premier Horizon

Composites 40% F35

B2

of 30% AV 8B Rafale F/A22

F18 E/F

20% A380 Commercial Programs

F18CD

A300 A310

Percentage 10% C17 777

747 Mirage

F15 757/767 747-400

0%

Low ? 10% 1970 1980 1990 2000 2010 2020E 2030E

Composite Value Drivers

Weight improvement Lean manufacturing – lower part cost

Aerodynamics Increased passenger comfort

Fatigue life Life-of-program maintenance costs

Corrosion resistance

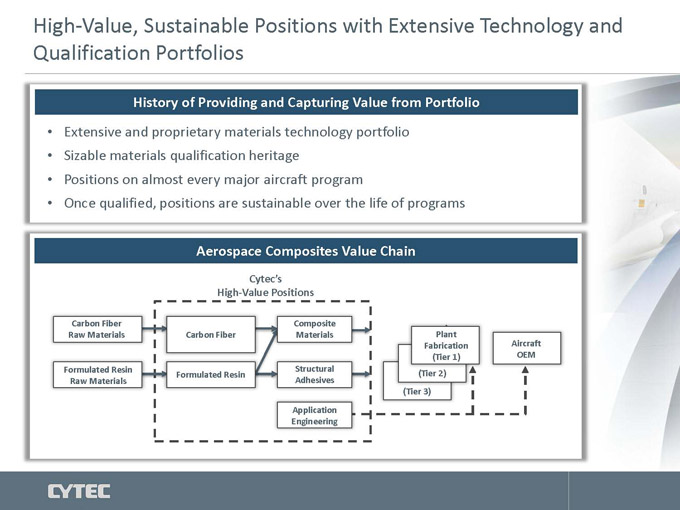

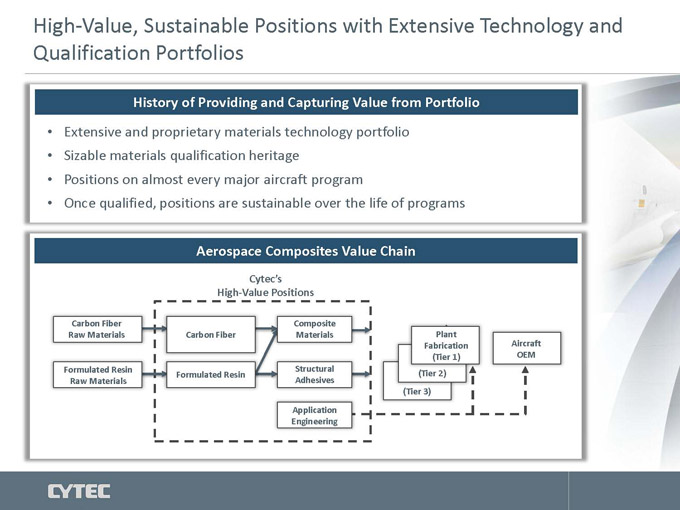

High-Value, Sustainable Positions with Extensive Technology and

Qualification Portfolios

History of Providing and Capturing Value from Portfolio

Extensive and proprietary materials technology portfolio

Sizable materials qualification heritage

Positions on almost every major aircraft program

Once qualified, positions are sustainable over the life of programs

Aerospace Composites Value Chain

Cytec’s

High-Value Positions

Carbon Fiber Composite

Raw Materials Carbon Fiber Materials Plant

Fabrication Aircraft

(Tier 1) OEM

Formulated Resin Structural

Formulated Resin (Tier 2)

Raw Materials Adhesives

(Tier 3)

Application

Engineering

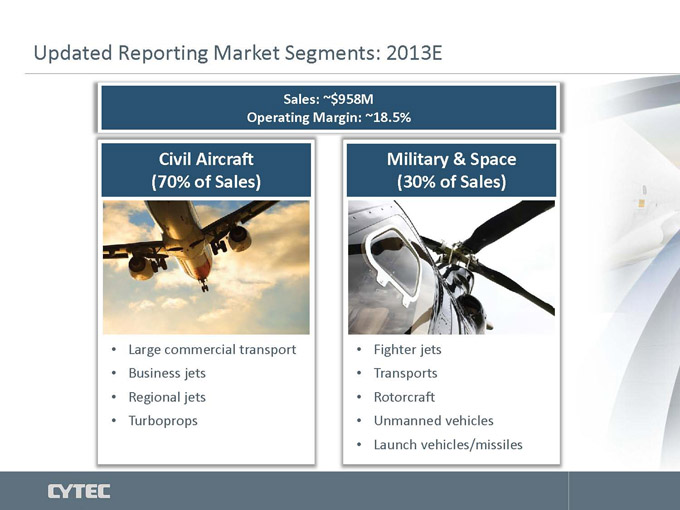

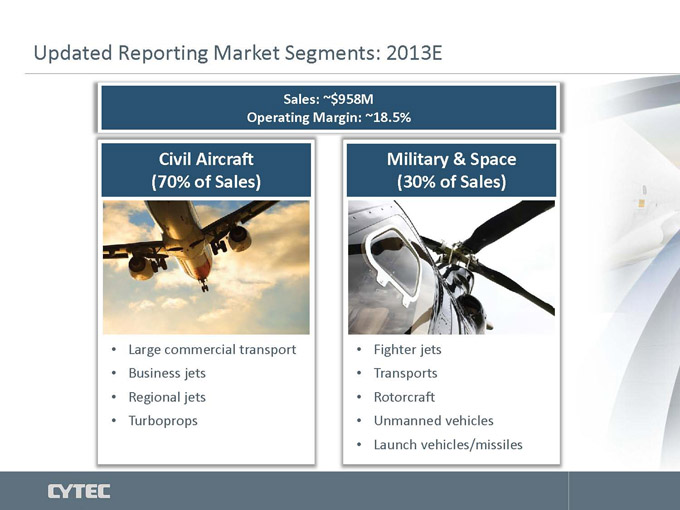

Updated Reporting Market Segments: 2013E

Sales: ~$958M

Operating Margin: ~18.5%

Civil Aircraft Military & Space

(70% of Sales) (30% of Sales)

Large commercial transport Fighter jets

Business jets Transports

Regional jets Rotorcraft

Turboprops Unmanned vehicles

• Launch vehicles/missiles

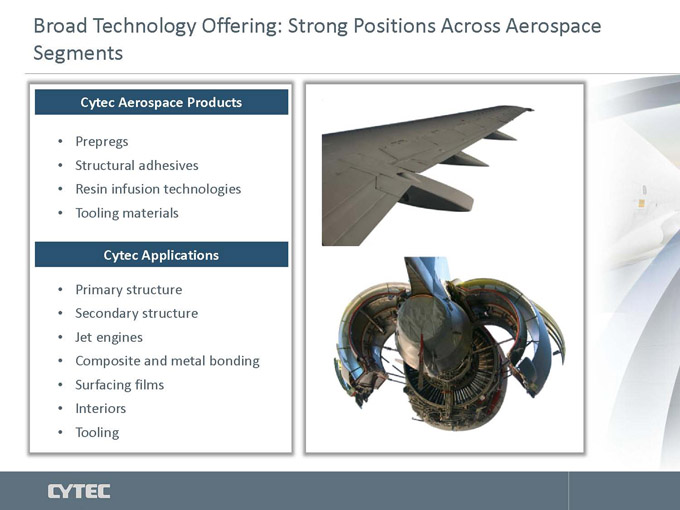

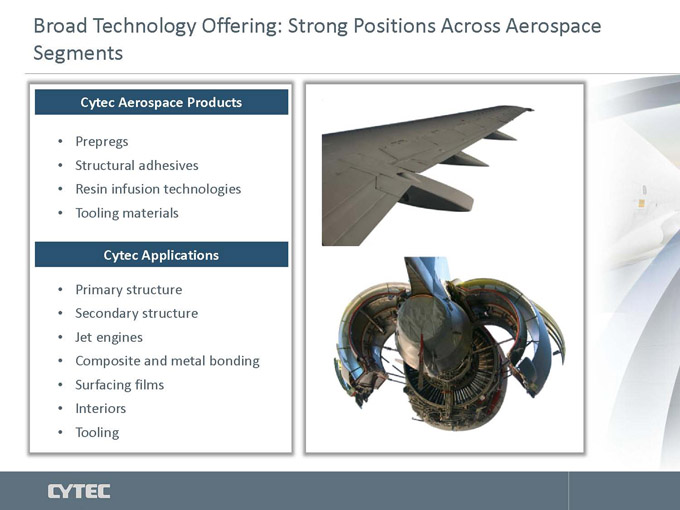

Broad Technology Offering: Strong Positions Across Aerospace

Segments

Cytec Aerospace Products

Prepregs

Structural adhesives

Resin infusion technologies

Tooling materials

Cytec Applications

Primary structure

Secondary structure

Jet engines

Composite and metal bonding

Surfacing films

Interiors

Tooling

Providing the Best Materials Solutions and Highly Specialized Support

Our Unique Value

Customer intimacy and mature customer Understand needs and barriers for customer

R&D collaboration capabilities design requirements

R&D and applications technology Able to develop solutions that

competencies create value

Qualification knowledge and Help customers with material qualifications

testing infrastructure and aircraft authority certifications

Global technical support Competency to guide to best fabrication

processes

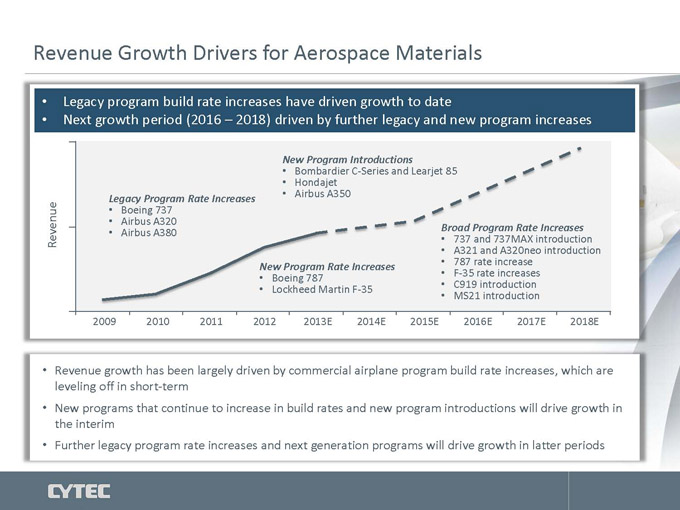

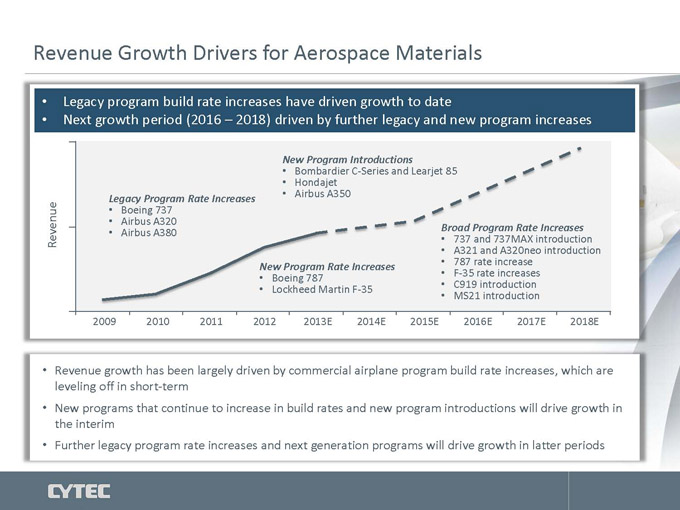

Revenue Growth Drivers for Aerospace Materials

Legacy program build rate increases have driven growth to date

Next growth period (2016 – 2018) driven by further legacy and new program increases

New Program Introductions

• Bombardier C-Series and Learjet 85

• Hondajet

Legacy Program Rate Increases • Airbus A350

• Boeing 737

• Airbus A320

• Airbus A380 Broad Program Rate Increases

Revenue • 737 and 737MAX introduction

• A321 and A320neo introduction

New Program Rate Increases • 787 rate increase

• Boeing 787 • F-35 rate increases

• Lockheed Martin F-35 • C919 introduction

• MS21 introduction

2009 2010 2011 2012 2013E 2014E 2015E 2016E 2017E 2018E

Revenue growth has been largely driven by commercial airplane program build rate increases, which are

leveling off in short-term

New programs that continue to increase in build rates and new program introductions will drive growth in

the interim

Further legacy program rate increases and next generation programs will drive growth in latter periods

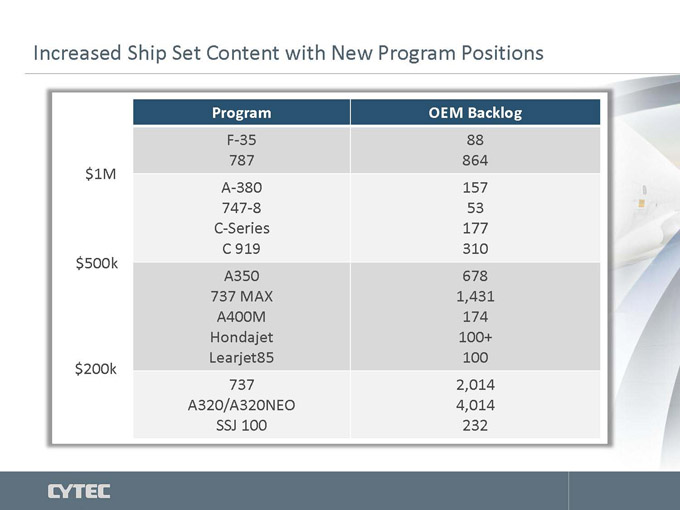

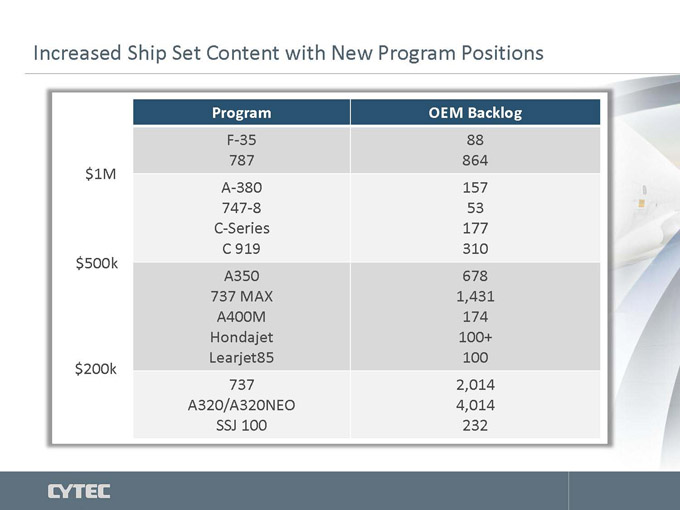

Increased Ship Set Content with New Program Positions

Program OEM Backlog

F-35 88

787 864

$1M

A-380 157

747-8 53

C-Series 177

C 919 310

$500k

A350 678

737 MAX 1,431

A400M 174

Hondajet 100+

Learjet85 100

$200k

737 2,014

A320/A320NEO 4,014

SSJ 100 232

Strong High Quality Technologies Positions on Key New Programs

787 C919 A350

Secondary structures and Major supplier of Structural adhesives

carbon fibers primary and secondary

structure materials • Surfacing films for lightning

High-value primary strike protection

structure • Structural adhesives

• High-value primary

Structural adhesives and structure

surfacing films

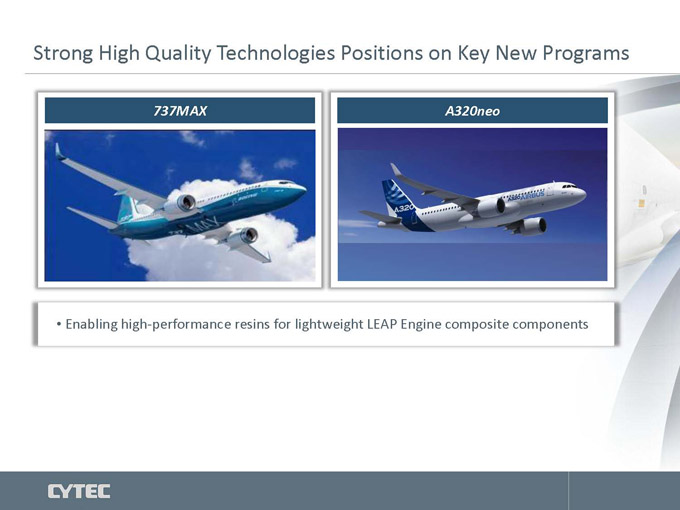

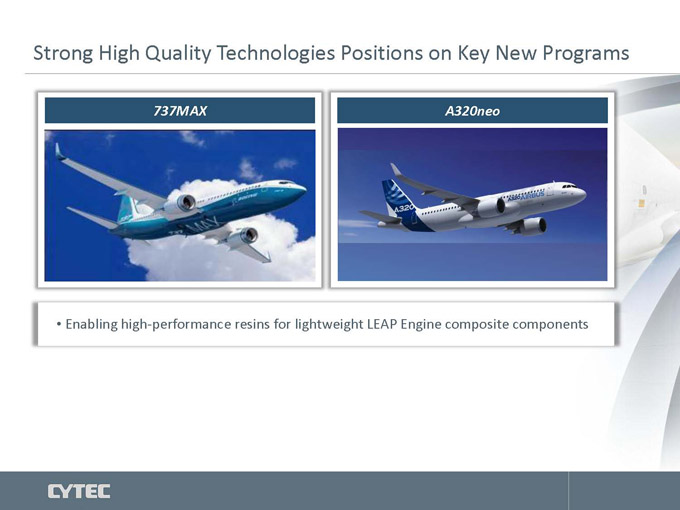

Strong High Quality Technologies Positions on Key New Programs

737MAX A320neo

Enabling high-performance resins for lightweight LEAP Engine composite components

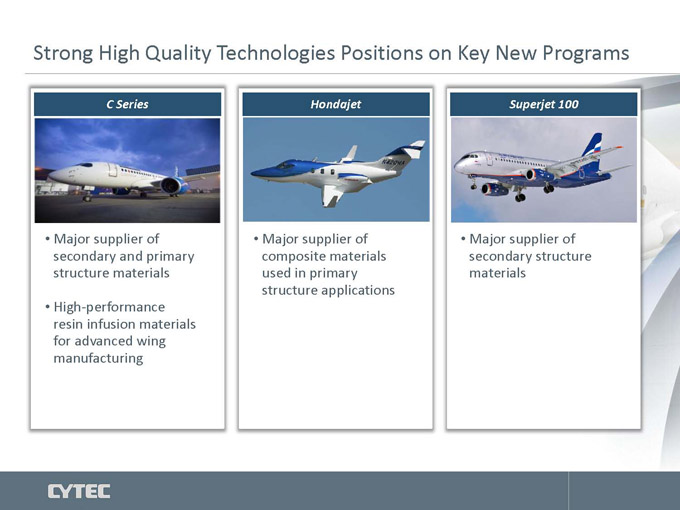

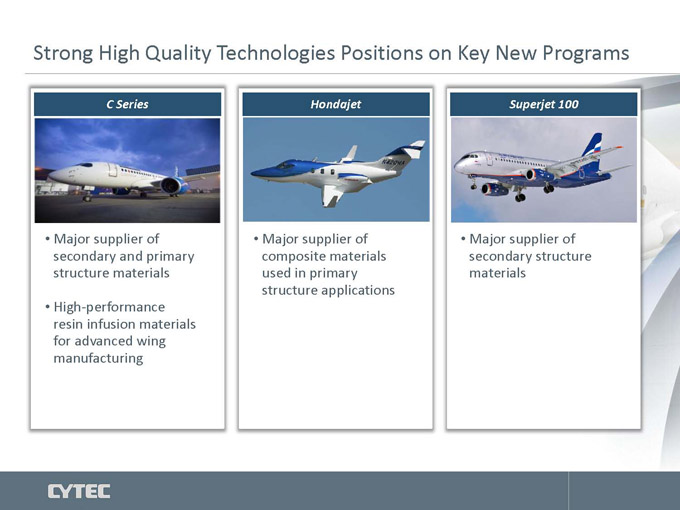

Strong High Quality Technologies Positions on Key New Programs

C Series Hondajet Superjet 100

Major supplier of Major supplier of Major supplier of

secondary and primary composite materials secondary structure

structure materials used in primary materials

structure applications

High-performance

resin infusion materials

for advanced wing

manufacturing

Strong High Quality Technologies Positions on Key New Programs

Joint Strike Fighter

Primary supplier of composite materials for primary and secondary

structure applications

Future Programs Provide Significant Opportunity for Composite

Materials

• Actively engaged on new programs

with legacy customers and new

customers in emerging regions

• New programs represent a range of

opportunities with both mid- and

long-term entry

• Continuing to invest in materials and

applications research

• Greater vertical integration of Cytec

carbon fibers required on certain new

programs

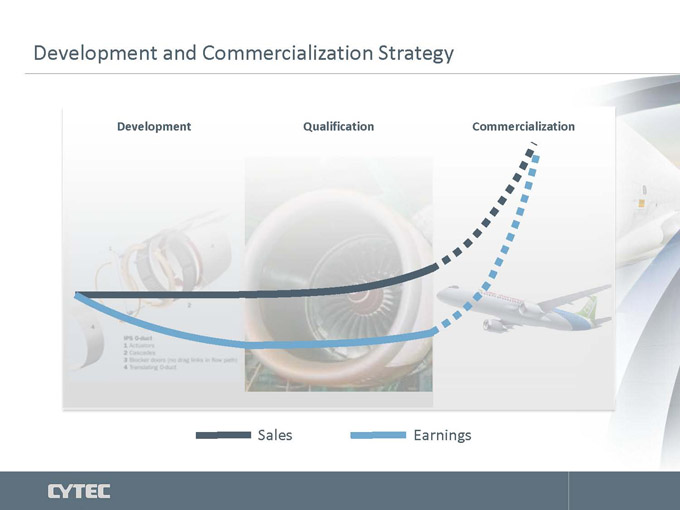

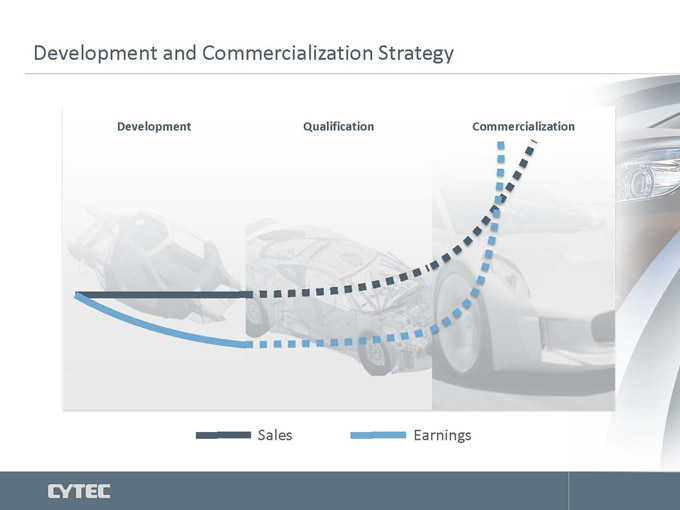

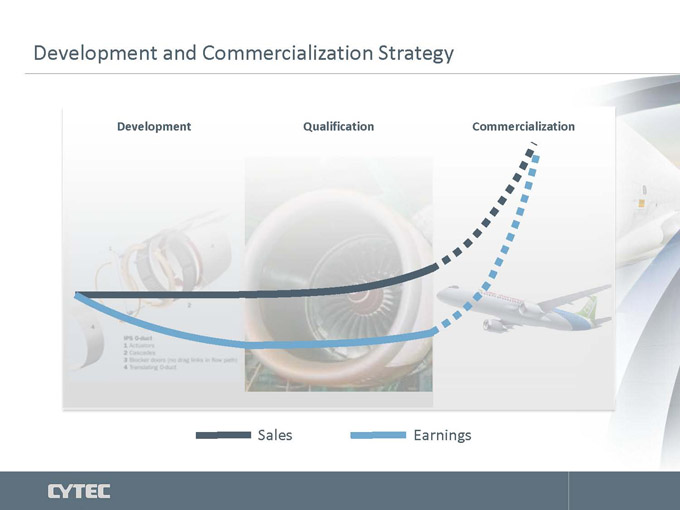

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

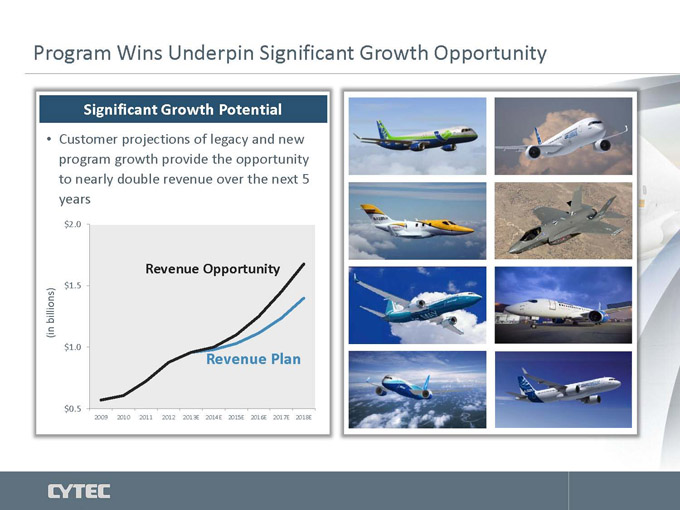

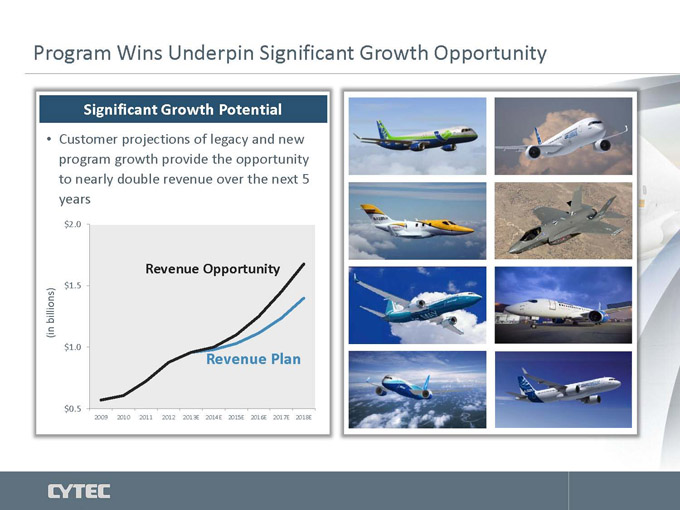

Program Wins Underpin Significant Growth Opportunity

Significant Growth Potential

Customer projections of legacy and new

program growth provide the opportunity

to nearly double revenue over the next 5

years

$ 2.0

Revenue Opportunity

$ 1.5

billions)

(in

$ 1.0

Revenue Plan

$ 0.5

2009 2010 2011 2012 2013E 2014E 2015E 2016E 2017E 2018E

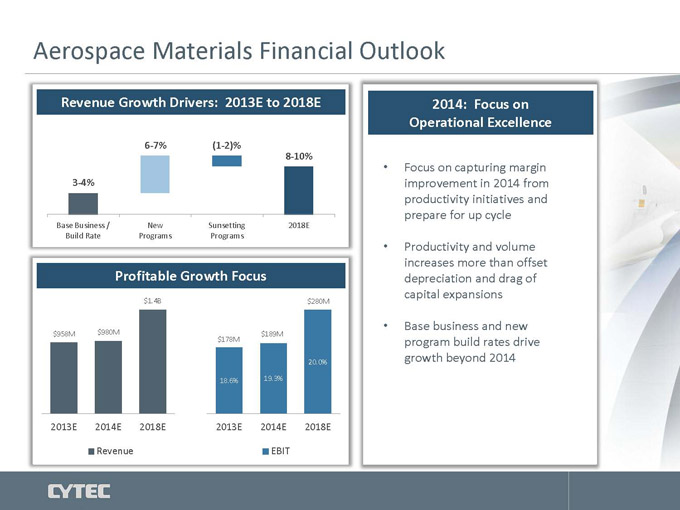

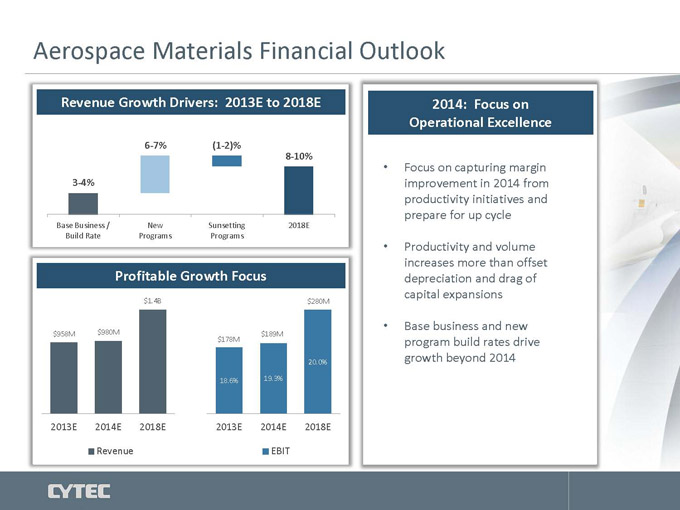

Aerospace Materials Financial Outlook

Revenue Growth Drivers: 2013E to 2018E 2014: Focus on

Operational Excellence

6-7% (1-2)%

8-10%

• Focus on capturing margin

3-4% improvement in 2014 from

productivity initiatives and

prepare for up cycle

Base Business / New Sunsetting 2018E

Build Rate Programs Programs

• Productivity and volume

increases more than offset

Profitable Growth Focus depreciation and drag of

capital expansions

$1.4B $280M

• Base business and new

$958M $980M $189M

$178M program build rates drive

20.0% growth beyond 2014

18.6% 19.3%

2013E 2014E 2018E 2013E 2014E 2018E

Revenue EBIT

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Carmelo Lo Faro

Vice President Technology, Aerospace & Industrial Materials

Leveraging Innovation

Fundamental Value of Composites Driving Increased Adoption

Fundamental Value of Composites

Fundamental value of composites

• Low weight (high specific strength and

stiffness)

• Fatigue life

• Corrosion resistance

• Aerodynamics

Future emphasis towards

affordability and adoption/maturity

Cytec is in the best position to

enhance the value of composites

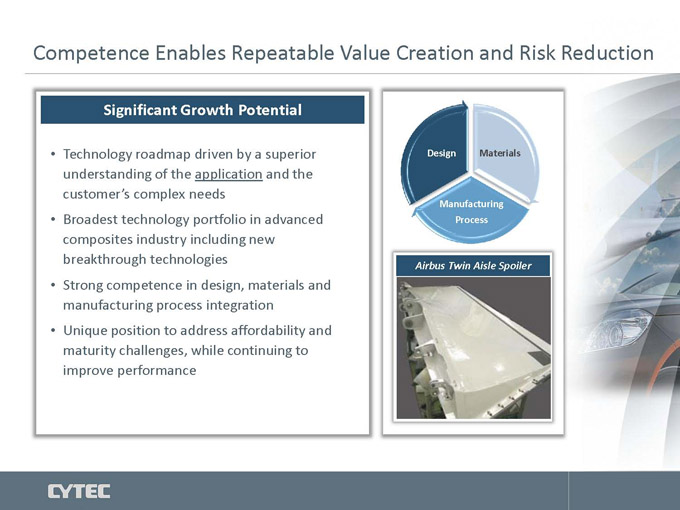

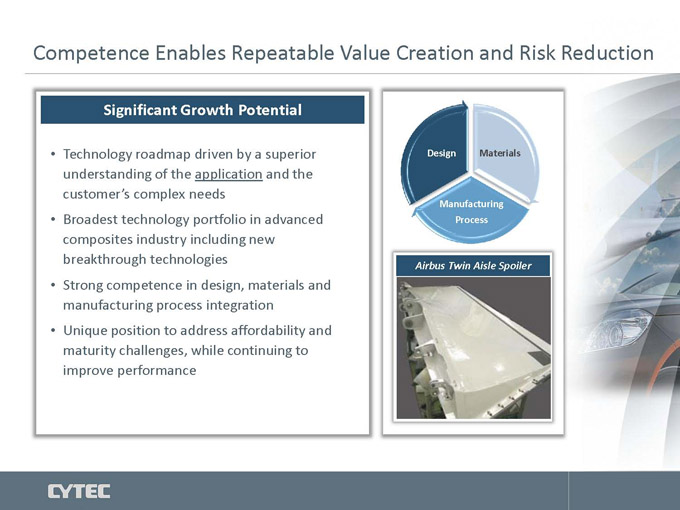

Competence Enables Repeatable Value Creation and Risk Reduction

Significant Growth Potential

Technology roadmap driven by a superior

understanding of the application and the

customer’s complex needs

Broadest technology portfolio in advanced

composites industry including new

breakthrough technologies Airbus Twin Aisle Spoiler

Strong competence in design, materials and

manufacturing process integration

Unique position to address affordability and

maturity challenges, while continuing to

improve performance

Continuing to Expand the Performance Envelope

Technology for Performance

Strategic IP developed and secured in

two key areas:

Molecules and toughening

Increase composite strength and

damage tolerance to reduce structural

weight

Multi-functionality

Integrate electrical conductivity, fire

resistance and sound dampening

functions to reduce cost and weight

New Materials and Processes for Affordable Performance

Technology for Affordability

Affordable performance and rate

for primary structure through low

capex / recurring costs

Reduce risk through lean part

manufacturing and

material/manufacturing

modelling

Adopted on a number of

programs:

? Defense

? Business jets

? Engines

? Large commercial aircraft

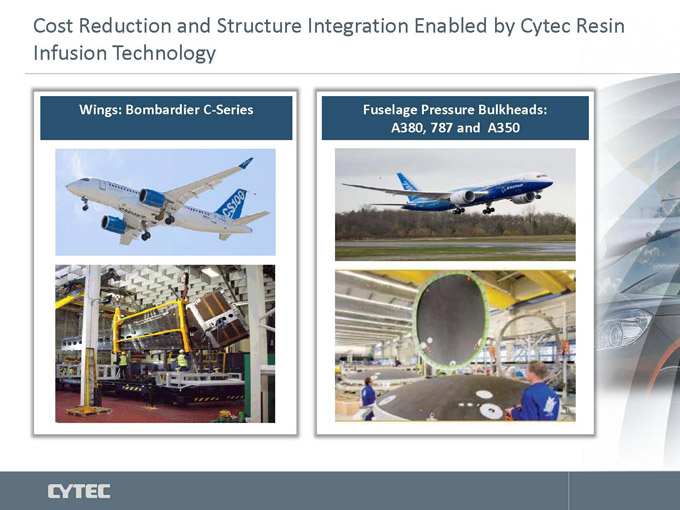

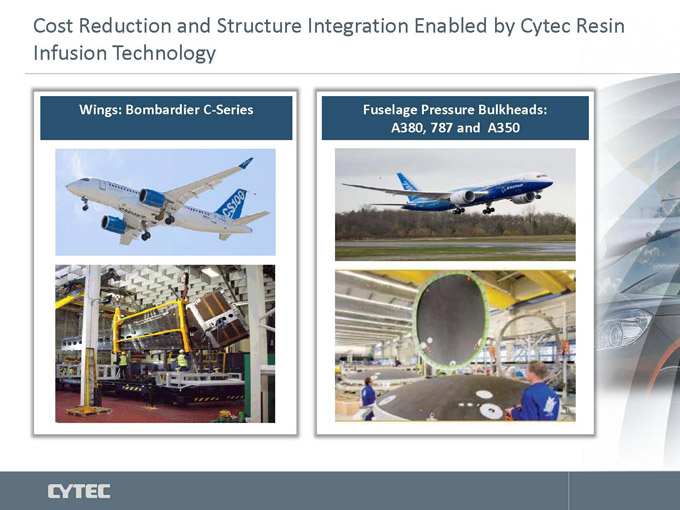

Cost Reduction and Structure Integration Enabled by Cytec Resin

Infusion Technology

Wings: Bombardier C-Series Fuselage Pressure Bulkheads:

A380, 787 and A350

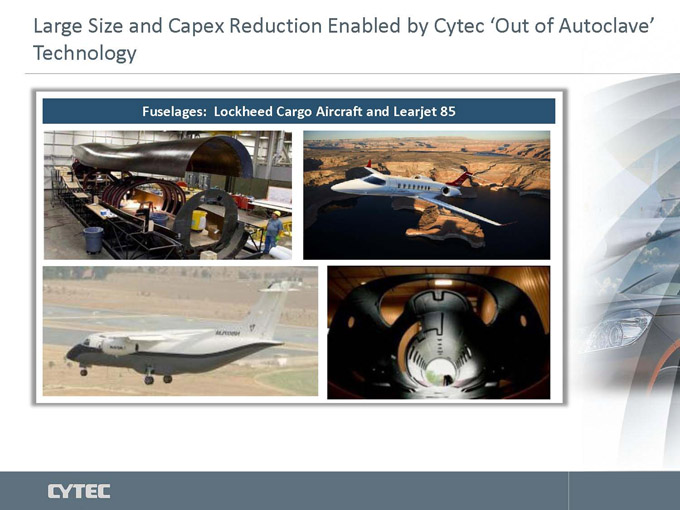

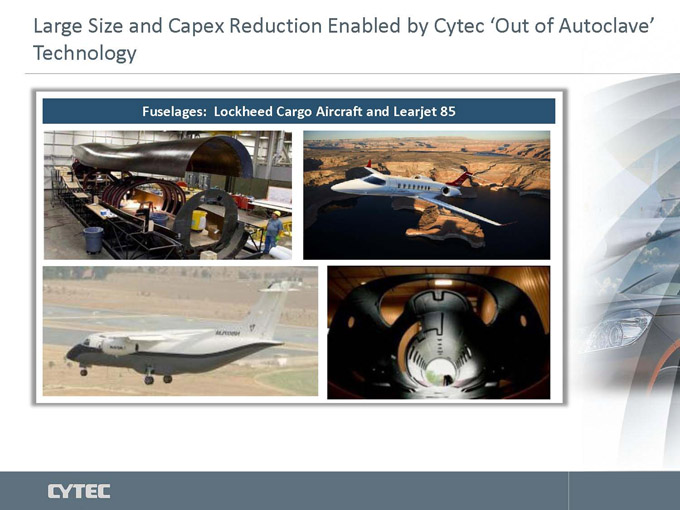

Large Size and Capex Reduction Enabled by Cytec ‘Out of Autoclave’

Technology

Fuselages: Lockheed Cargo Aircraft and Learjet 85

Affordable and High-Rate Manufacturing Enabled by Cytec Resin

Infusion

High Rate Parts: Leap X Engine Compressor Blades

Exploiting Core Competences for Serial Automotive

Well Positioned to Drive Composites

Adoption in Serial Auto

Strategic Auto OEM alliances to

understand future needs and drive low

risk insertion

Leveraging application competences and

technology portfolio to achieve

affordability and rate targets:

– Automation: rapid deposition methods

– High throughput: fast forming and cure

Potential for technologies to flow back

into aerospace to address the needs of

next generation single aisle programs

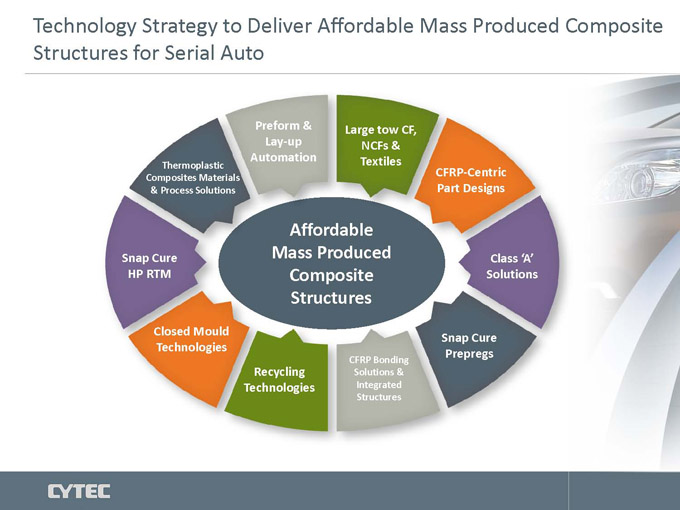

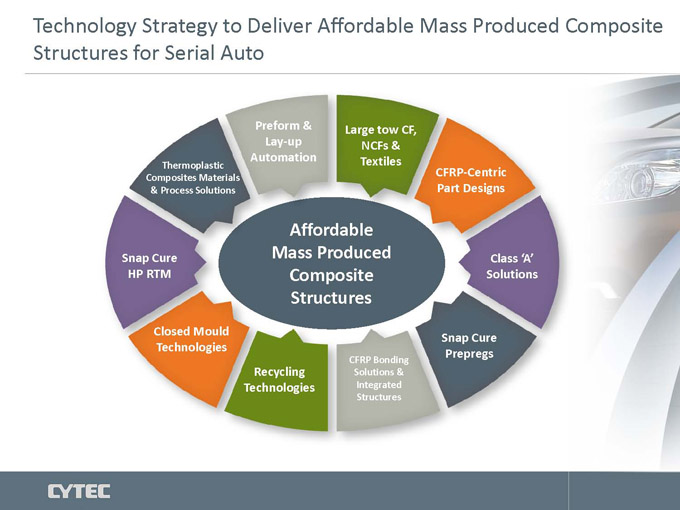

Technology Strategy to Deliver Affordable Mass Produced

Composite Structures for Serial Auto

Preform & Large tow CF,

Lay-up NCFs &

Automation Textiles

Thermoplastic

Composites Materials CFRP-Centric

& Process Solutions Part Designs

Affordable

Snap Cure Mass Produced Class ‘A’

HP RTM Composite Solutions

Structures

Closed Mould Snap Cure

Technologies Prepregs

CFRP Bonding

Recycling Solutions &

Technologies Integrated

Structures

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

William Avrin

Vice President

Corporate & Business Development

Industrial Materials

Industrial Materials Growth Strategy

Superior technology and application engineering

Leverage decades of supply to aerospace industry

Strong customer relationships

Leading positions in motorsports and high-performance

automotive markets

Significant growth opportunity in serial auto

Become the leading supplier of value-added composite

material solutions to the emerging industrial markets

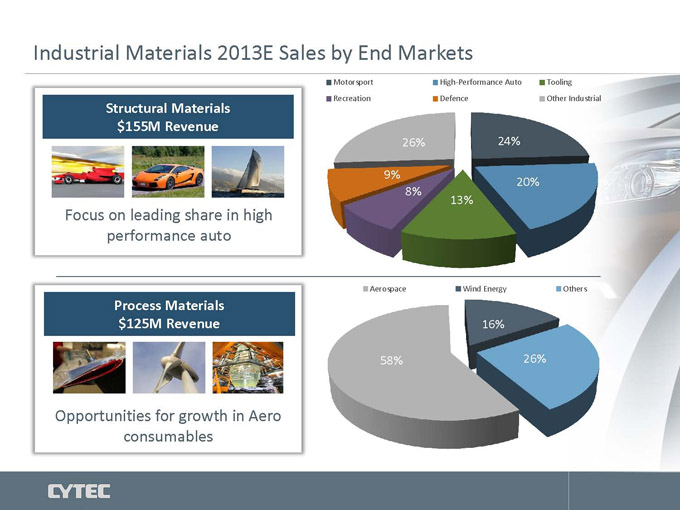

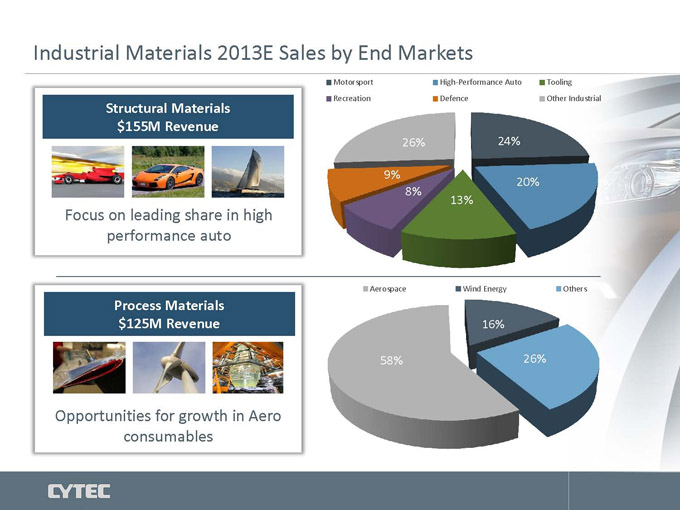

Industrial Materials 2013E Sales by End Markets

Motorsport High-Performance Auto Tooling

Recreation Defence Other Industrial

Structural Materials

$155M Revenue

26% 24%

9% 20%

8%

13%

Focus on leading share in high

performance auto

Aerospace Wind Energy Others

Process Materials

$125M Revenue 16%

58% 26%

Opportunities for growth in Aero

consumables

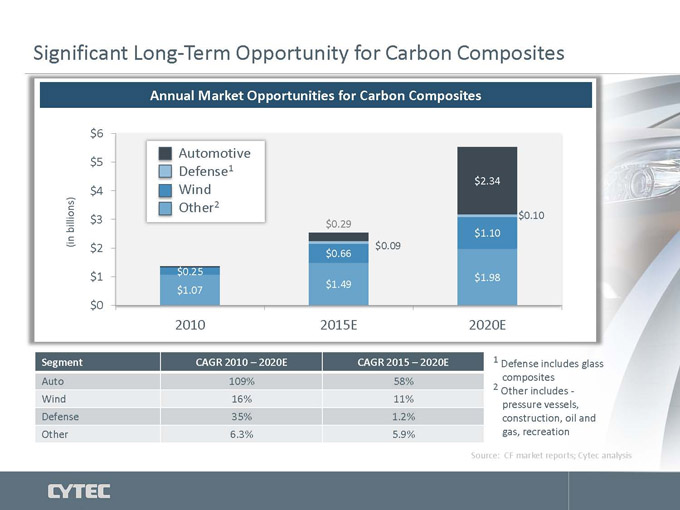

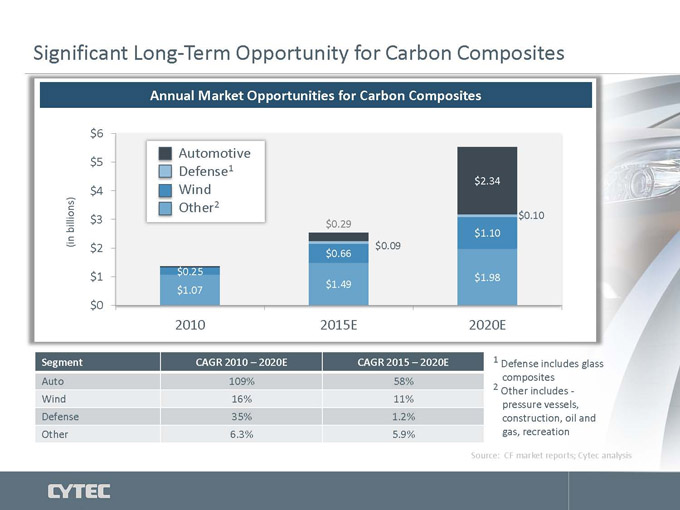

Significant Long-Term Opportunity for Carbon Composites Annual Market Opportunities for Carbon Composites

$ 6 Automotive $ 5

Defense1 $ 2.34 $ 4 Wind Other 2 $ 3 $ 0.10

billions) $ 0.29

$ 1.10

(in $ 2 $ 0.09

$ 0.66

$ 1 $ 0.25 $ 1.98

$ 1.07 $ 1.49

$ 0

2010 2015E 2020E

Segment CAGR 2010 – 2020E CAGR 2015 – 2020E 1 Defense includes glass

Auto 109% 58% composites

2 Other includes -

Wind 16% 11% pressure vessels,

Defense 35% 1.2% construction, oil and

Other 6.3% 5.9% gas, recreation

Source: CF market reports; Cytec analysis

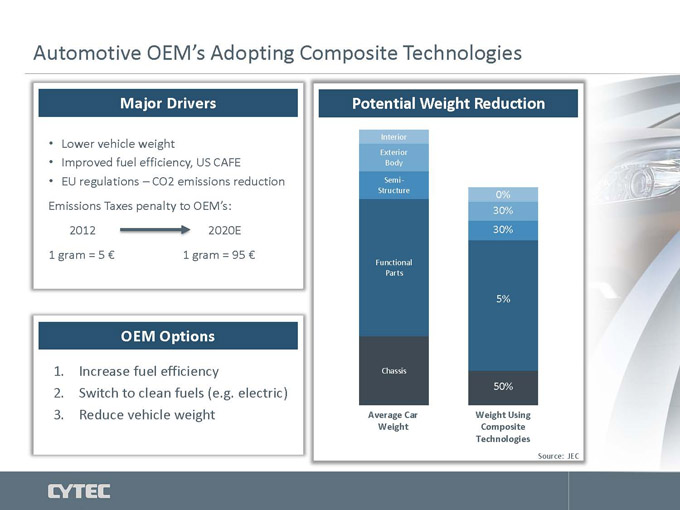

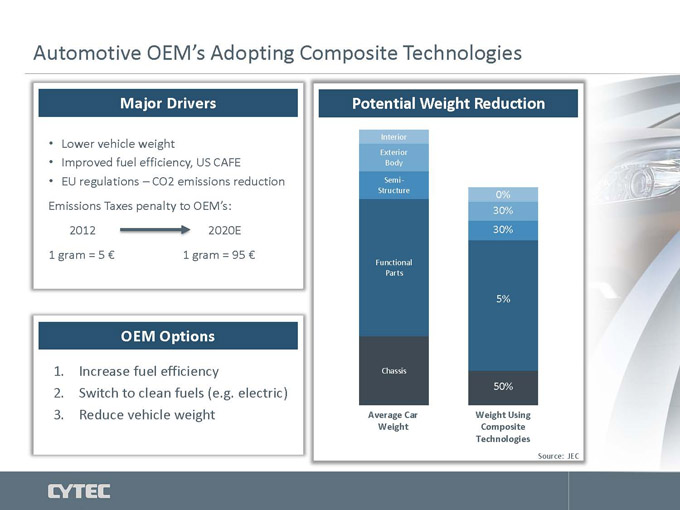

Automotive OEM’s Adopting Composite Technologies

Major Drivers Potential Weight Reduction

Lower vehicle weight Interior

Exterior

Improved fuel efficiency, US CAFE Body

EU regulations – CO2 emissions reduction Semi-

Structure 0%

Emissions Taxes penalty to OEM’s: 30%

2012 2020E 30%

1 gram = 5 € 1 gram = 95 €

Functional

Parts

5%

OEM Options

1. Increase fuel efficiency Chassis

2. Switch to clean fuels (e.g. electric) 50%

3. Reduce vehicle weight Average Car Weight Using

Weight Composite

Technologies

Source: JEC

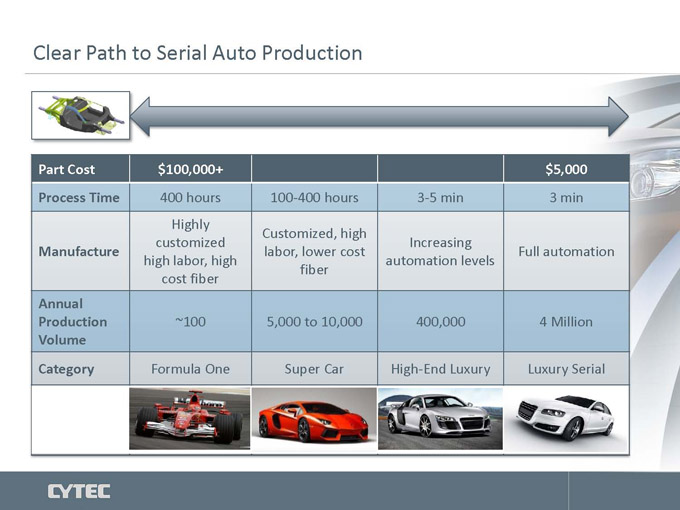

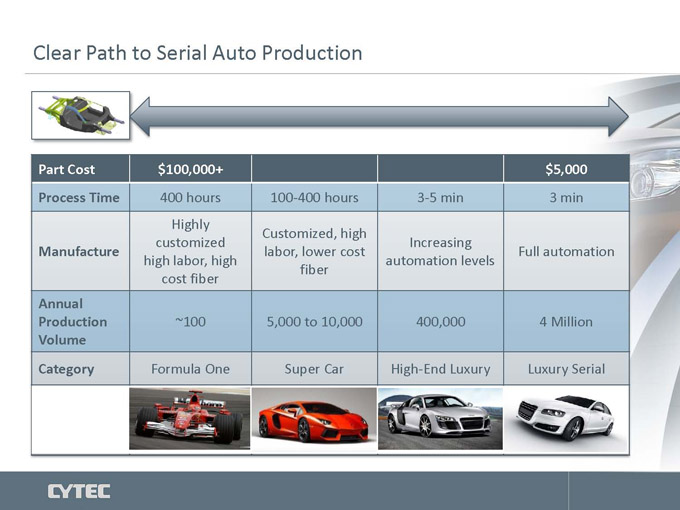

Clear Path to Serial Auto Production

Part Cost $100,000+ $5,000

Process Time 400 hours 100-400 hours 3-5 min 3 min

Highly

Customized, high

customized Increasing

Manufacture labor, lower cost Full automation

high labor, high automation levels

fiber

cost fiber

Annual

Production ~100 5,000 to 10,000 400,000 4 Million

Volume

Category Formula One Super Car High-End Luxury Luxury Serial

Technology Strategy to Deliver Affordable Mass Produced Composite

Structures for Serial Auto

Preform & Large tow CF,

Lay-up NCFs &

Automation Textiles

Thermoplastic

Composites Materials CFRP-Centric

& Process Solutions Part Designs

Affordable

Snap Cure Mass Produced Class ‘A’

HP RTM Composite Solutions

Structures

Closed Mould Snap Cure

Technologies Prepregs

CFRP Bonding

Recycling Solutions &

Technologies Integrated

Structures

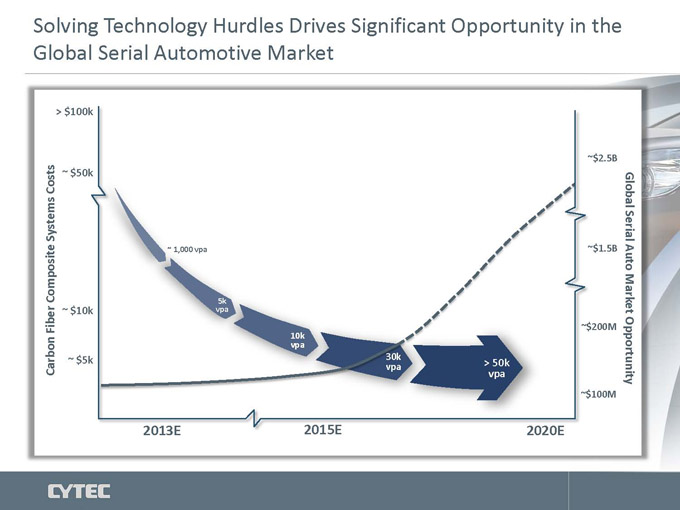

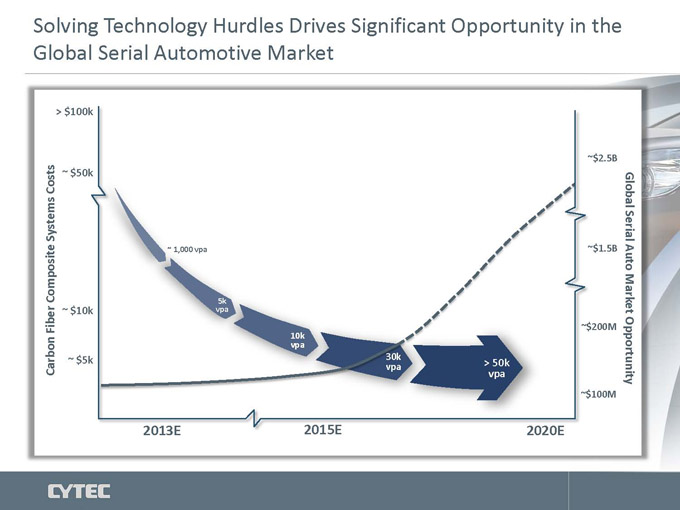

Solving Technology Hurdles Drives Significant Opportunity in the

Global Serial Automotive Market

> $100k

$ 2.5B

Costs ~ $50k Global

Systems Serial

Composite $ 1.5B Market Auto

~ $10k

Fiber 200M

Carbon ~ $5k Opportunity

100M

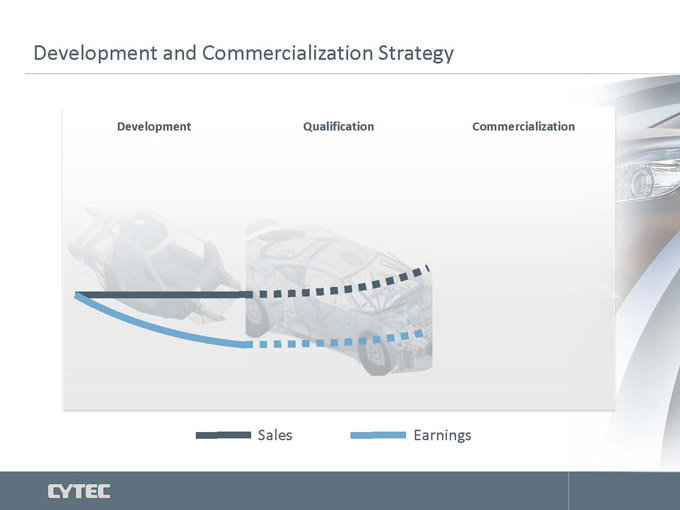

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

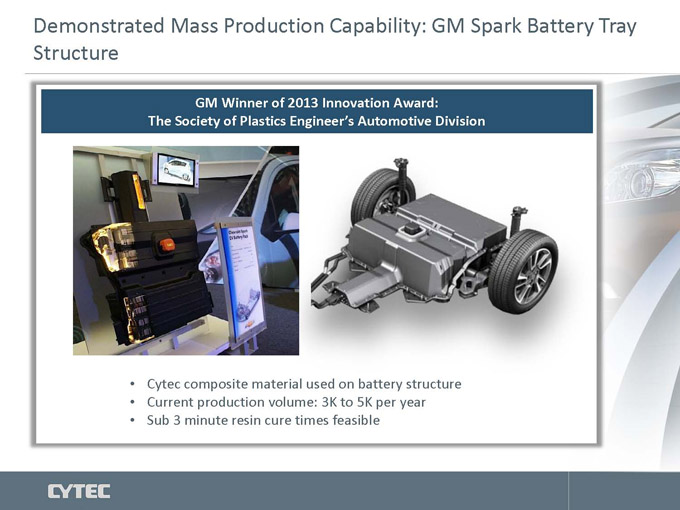

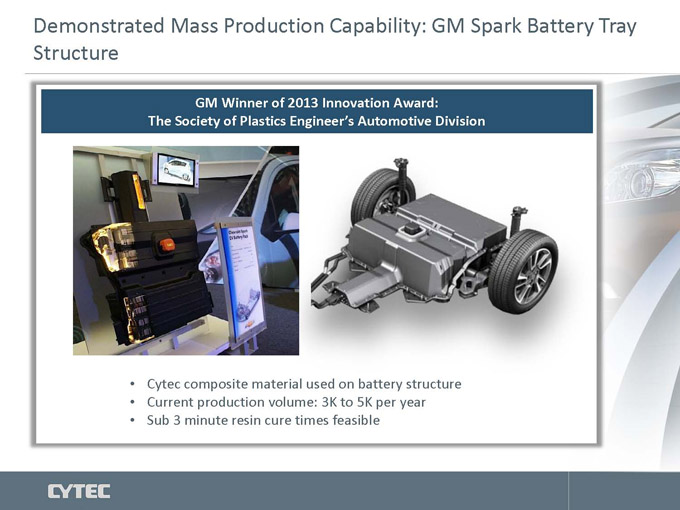

Demonstrated Mass Production Capability: GM Spark Battery Tray

Structure

GM Winner of 2013 Innovation Award:

The Society of Plastics Engineer’s Automotive Division

Cytec composite material used on battery structure

Current production volume: 3K to 5K per year

Sub 3 minute resin cure times feasible

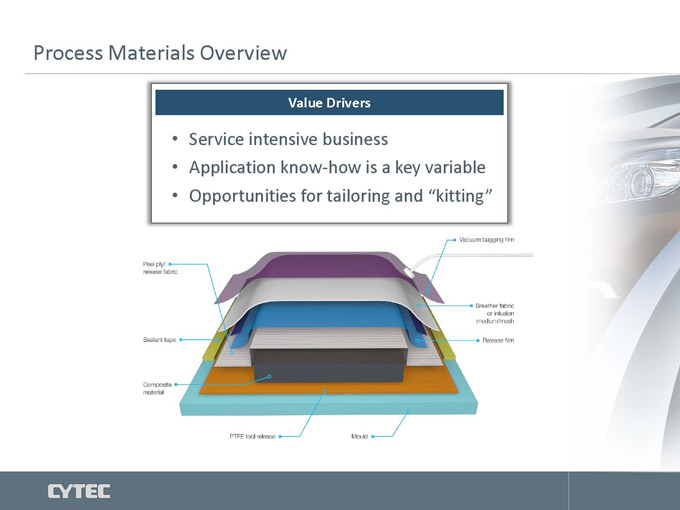

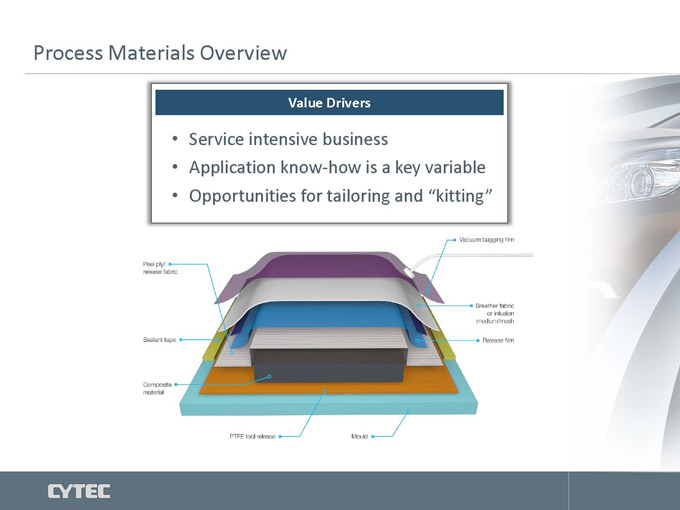

Process Materials Overview

Value Drivers

• Service intensive business

• Application know-how is a key variable

• Opportunities for tailoring and “kitting”

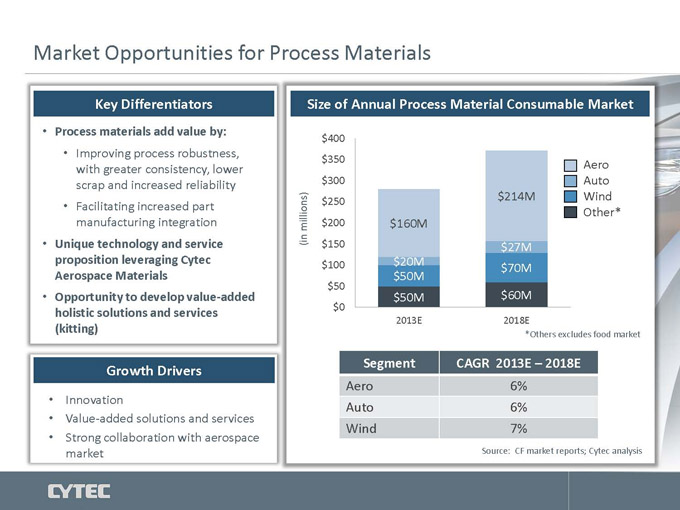

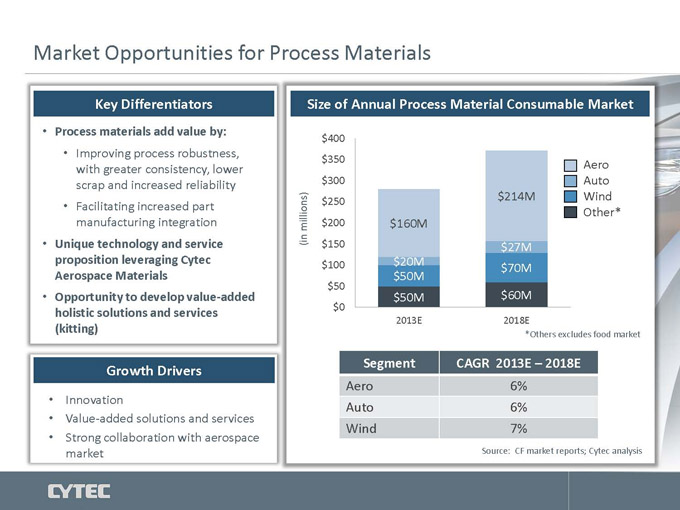

Market Opportunities for Process Materials

Key Differentiators Size of Annual Process Material Consumable Market

Process materials add value by: $400

• Improving process robustness,

with greater consistency, lower $350 Aero

scrap and increased reliability $300 Auto

$214M Wind

• Facilitating increased part $250 Other*

manufacturing integration millions) $200 $160M

Unique technology and service (in $150 $27M

proposition leveraging Cytec $100 $20M $70M

Aerospace Materials $50M

$50

Opportunity to develop value-added $50M $60M

holistic solutions and services $0

2013E 2018E

(kitting) *Others excludes food market

Growth Drivers Segment CAGR 2013E – 2018E

Aero 6%

Innovation Auto 6%

Value-added solutions and services

Strong collaboration with aerospace Wind 7%

market Source: CF market reports; Cytec analysis

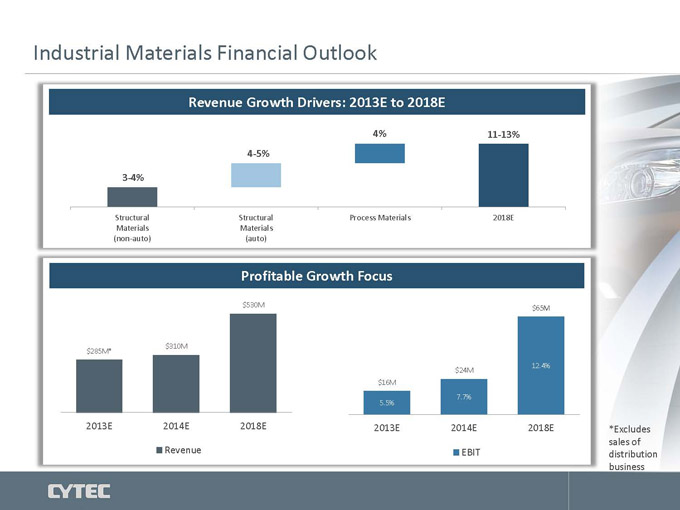

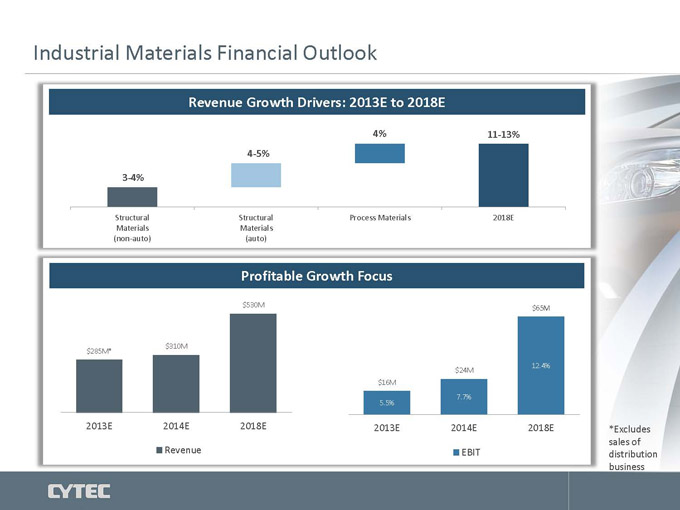

Industrial Materials Financial Outlook

Revenue Growth Drivers: 2013E to 2018E

4% 11-13%

4-5%

3-4%

Structural Structural Process Materials 2018E

Materials Materials

(non-auto) (auto)

Profitable Growth Focus

$530M $65M

$310M

$285M*

$24M 12.4%

$16M

7.7%

5.5%

2013E 2014E 2018E 2013E 2014E 2018E *Excludes

sales of

Revenue EBIT distribution

business

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Michael Radossich

President Specialty Chemicals

Specialty Chemicals

In Process Separation Growth Journey

Strategic Position

Leading global position in specialty

mining reagents and phosphine-

based chemicals

World class, leading-edge

technology supports strong margins

Unrivaled on-site technical service

and applications support to develop

tailored solutions

The right partner.

Deep customer relationships and The right chemical technologies.

ongoing collaborations to solve the

most demanding industry At just the right time.

challenges

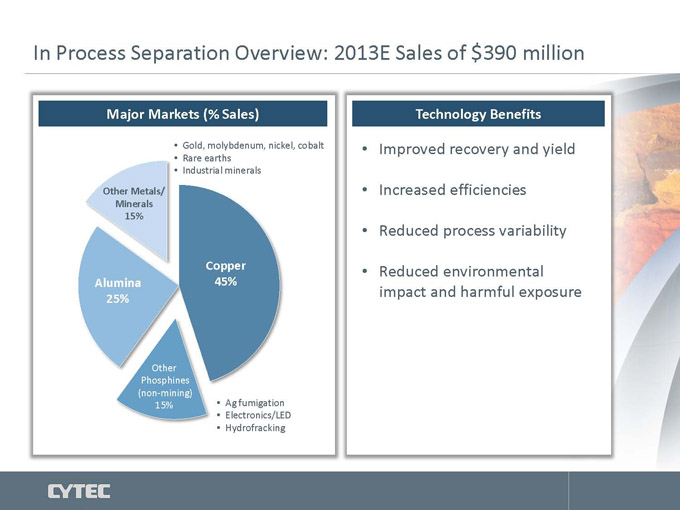

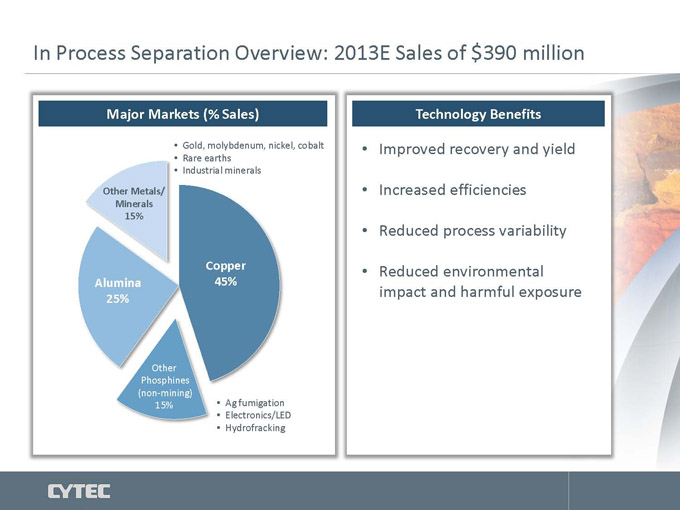

In Process Separation Overview: 2013E Sales of $390 million

Major Markets (% Sales) Technology Benefits

Gold, molybdenum, nickel, cobalt Improved recovery and yield

Rare earths

Industrial minerals

Other Metals/ • Increased efficiencies

Minerals

15%

• Reduced process variability

Copper • Reduced environmental

Alumina 45%

25% impact and harmful exposure

Other

Phosphines

(non-mining)

15% • Ag fumigation

• Electronics/LED

• Hydrofracking

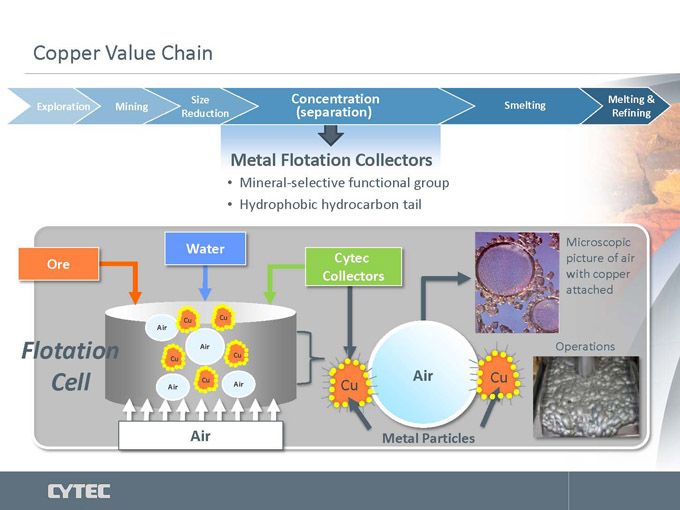

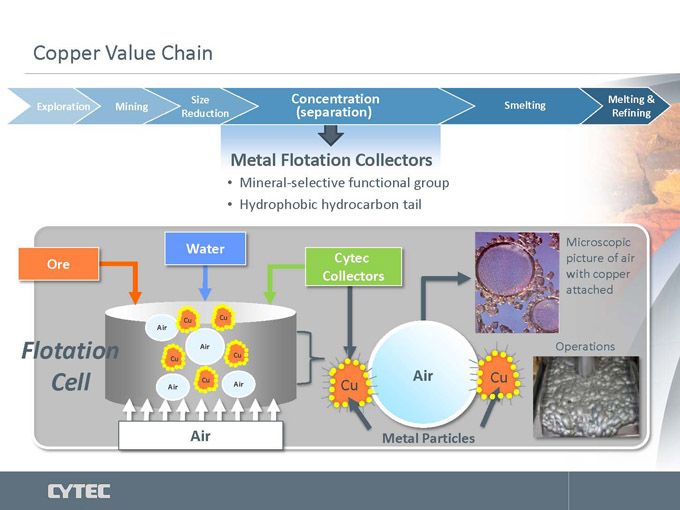

Copper Value Chain

Size Concentration Melting &

Exploration Mining Reduction (separation) Smelting Refining

Metal Flotation Collectors

• Mineral-selective functional group

• Hydrophobic hydrocarbon tail

Water Microscopic

Ore Cytec picture of air

Collectors with copper

attached

Cu Cu

Air

Air Operations

Flotation Cu

Cu

Cell Cu Cu Air Cu

Air Metal Particles

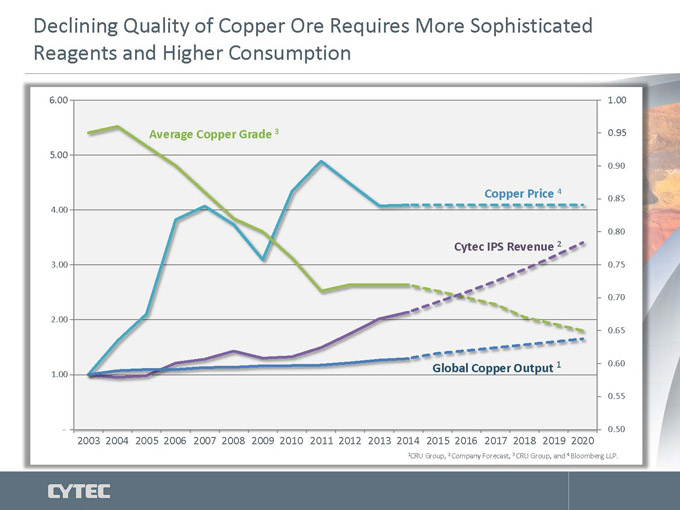

In Process Separation Business Drivers

Declining quality of copper ore requires improved technology and higher

reagent consumption

New product introductions that address customer needs drive strong growth

at high margins

New mines and brownfield expansions deliver volume growth

Adjacent applications in both mining and other non-mining phosphine

markets offers significant opportunities

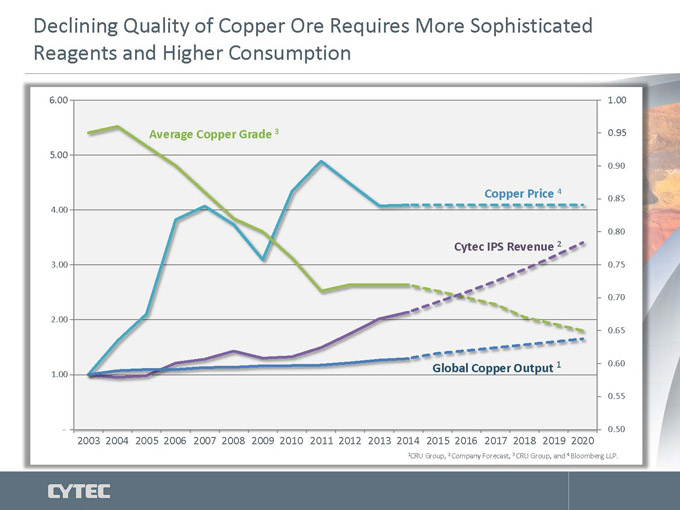

Declining Quality of Copper Ore Requires More Sophisticated

Reagents and Higher Consumption

6.00 1.00

Average Copper Grade 3 0.95

5.00

0.90

Copper Price 4 0.85

4.00

0.80

Cytec IPS Revenue 2

3.00 0.75

0.70

2.00

0.65

Global Copper Output 1 0.60

1.00

0.55

- 0.50

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

(1)CRU Group, (2)Company Forecast, (3)CRU Group, and (4)Bloomberg LLP.

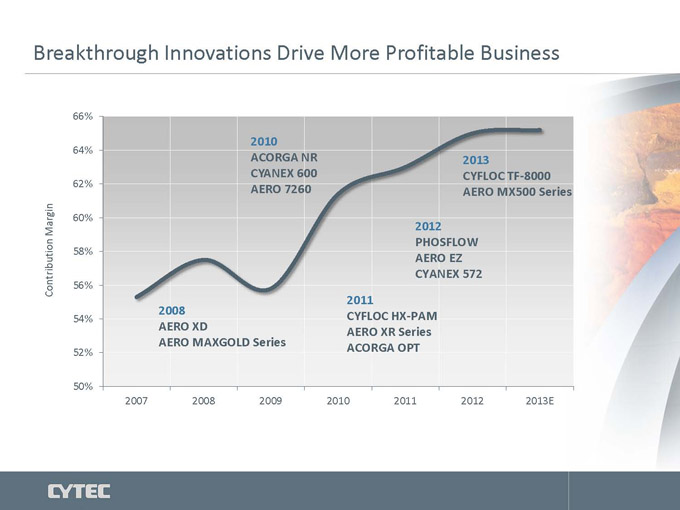

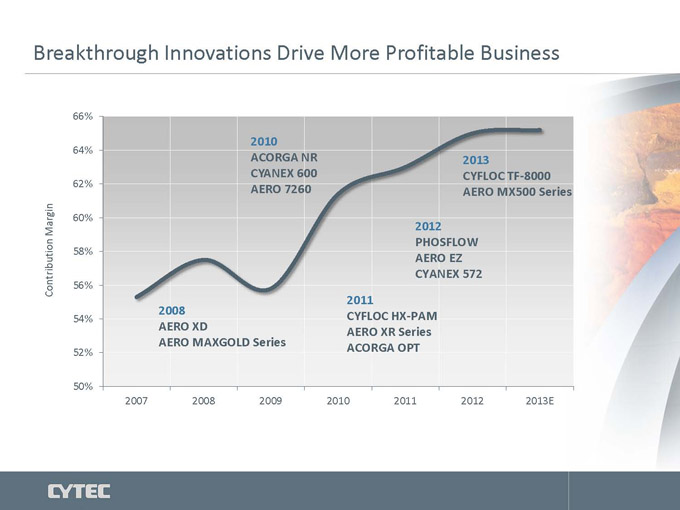

Breakthrough Innovations Drive More Profitable Business

66%

2010

64%

ACORGA NR 2013

CYANEX 600 CYFLOC TF-8000

62% AERO 7260 AERO MX500 Series

60%

Margin 2012

PHOSFLOW

58% AERO EZ

CYANEX 572

Contribution 56%

2011

2008

54% CYFLOC HX-PAM

AERO XD AERO XR Series

AERO MAXGOLD Series ACORGA OPT

52%

50%

2007 2008 2009 2010 2011 2012 2013E

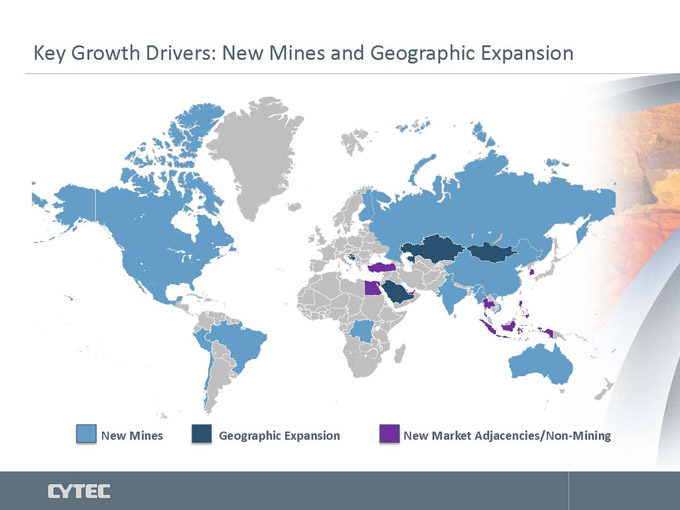

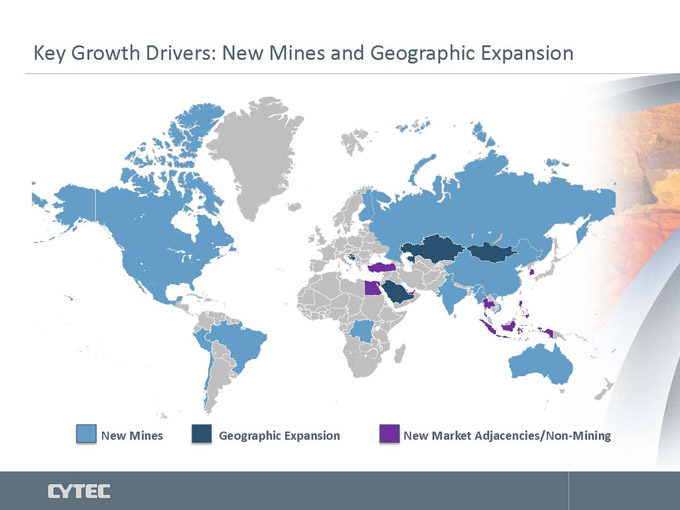

Key Growth Drivers: New Mines and Geographic Expansion

New Mines Geographic Expansion New Market Adjacencies/Non-Mining

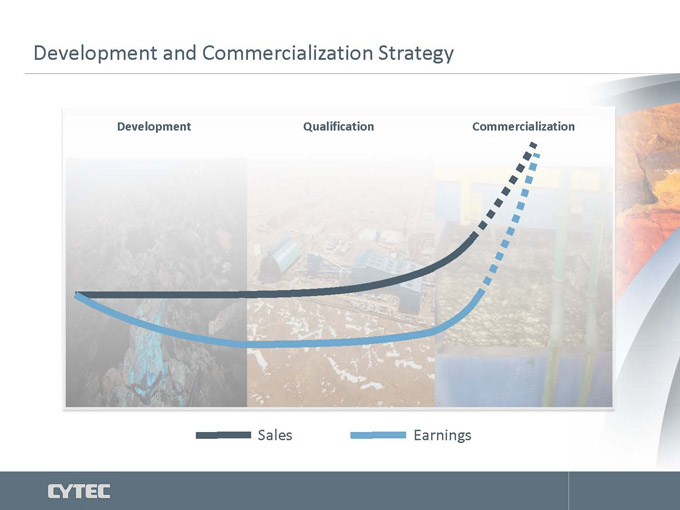

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Development and Commercialization Strategy

Development Qualification Commercialization

Sales Earnings

Leveraging Existing Technologies into Adjacent Markets Supports

Further Growth

Explore other metal Increasing phosphine Phosphine derivative Phosphine gas used as

and mineral demand for improved used as biocide in down post-harvest fumigant

applications including conductivity in LEDs well hydrofracking fluids for stored grains, nuts,

platinum group metals, to reduce/eliminate and fresh fruits

rare earths, industrial • Target markets include bacteria

• Methyl bromide will be

minerals automotive lighting, • Growing use of phased out in 2015

hand held displays,

Product development traffic lighting, and hydrofracking to extract “Montreal Protocol”

ongoing to target signage where colored natural gas from shale • Additional uses include

formations

potash, phosphate and lighting is needed flowers, tobacco, others

soda ash

In Process Separation Growth Supported by Ontario Plant Expansion

• $160 million expansion expected to be

mechanically complete by Q2’14

• Doubles plant capacity

• Planned startup Q3’14 to produce material

for customer qualifications

• Products to support growth in copper,

other metals, alumina, and other non-

mining markets

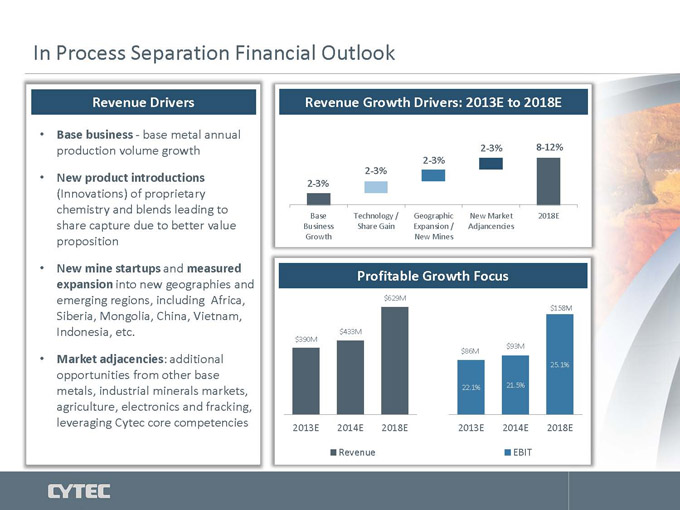

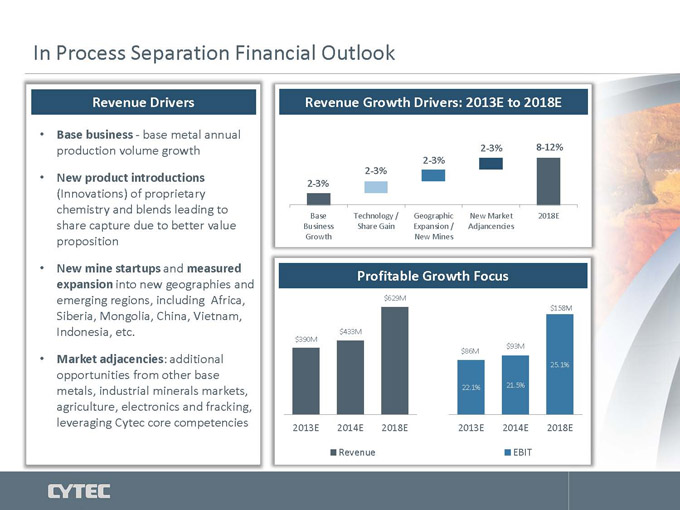

In Process Separation Financial Outlook

Revenue Drivers Revenue Growth Drivers: 2013E to 2018E

Base business—base metal annual

production volume growth 2-3% 8-12%

2-3%

New product introductions 2-3%

2-3%

(Innovations) of proprietary

chemistry and blends leading to Base Technology / Geographic New Market 2018E

share capture due to better value Business Share Gain Expansion / Adjancencies

proposition Growth New Mines

New mine startups and measured Profitable Growth Focus

expansion into new geographies and

emerging regions, including Africa, $629M

$158M

Siberia, Mongolia, China, Vietnam,

Indonesia, etc. $433M

$390M

$93M

$86M

Market adjacencies: additional 25.1%

opportunities from other base

metals, industrial minerals markets, 22.1% 21.5%

agriculture, electronics and fracking,

leveraging Cytec core competencies 2013E 2014E 2018E 2013E 2014E 2018E

Revenue EBIT

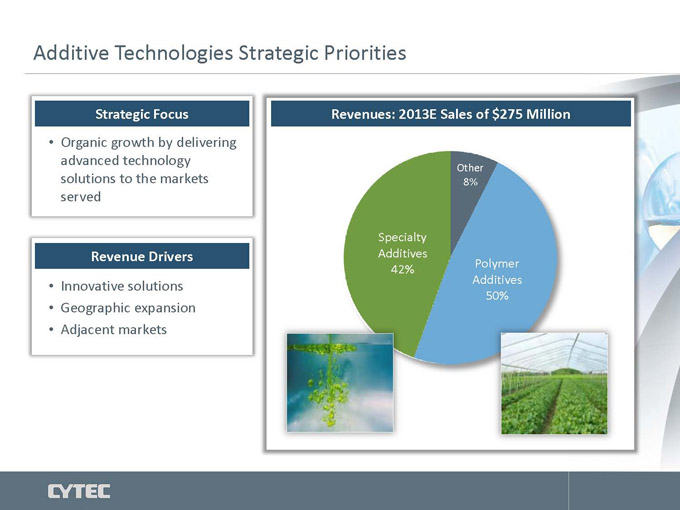

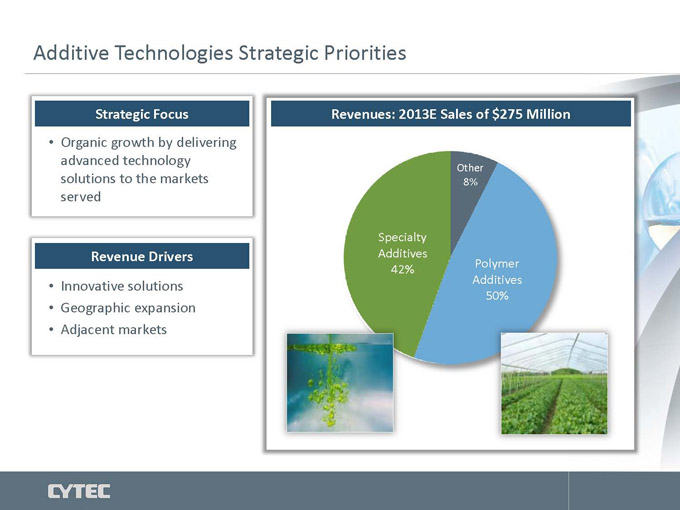

Additive Technologies Strategic Priorities

Strategic Focus Revenues: 2013E Sales of $275 Million

Organic growth by delivering

advanced technology Other

solutions to the markets 8%

served

Specialty

Revenue Drivers Additives

42% Polymer

Innovative solutions Additives

50%

Geographic expansion

Adjacent markets

Polymer Additives Growth Focused on IP Protected Technology

Solutions: 2013E 1

AUTOMOTIVE ROTOMOLDING

20% of Polymer Additives Sales 20% of Polymer Additives Sales

FILMS

AGRICULTURE SPECIALTY

18% of Polymer Additives Sales 12% of Polymer Additives Sales

BUILDING & CONSTRUCTION

1 Other represents ~20% of

10% of Polymer Additives Sales Polymer Additives sales.

Polymer Additives Innovative Solutions

Patented Technology Platform

CYASORB CYNERGY SOLUTIONS® is a family of stabilizers delivering superior UV durability and

performance

New innovative solutions are commercialized every year to grow profitably

Market Drivers for Polymer Additives

Increased use of low density plastics in automotive (weight reduction), which drives increased

volumes of polymer additives for UV protection

Example: automotive plastic applications are growing above market growth (7% to 8%)

Specialty Additives Target GDP Growth: 2013E

EMULSION POLYMERIZATION OIL INDUSTRY

35% of Specialty Additives Sales 5% of Specialty Additives Sales

PHARMA AGROCHEMICAL

15% of Specialty Additives Sales 5% of Specialty Additives Sales

1 Other represents ~40% of

Specialty Additives sales.

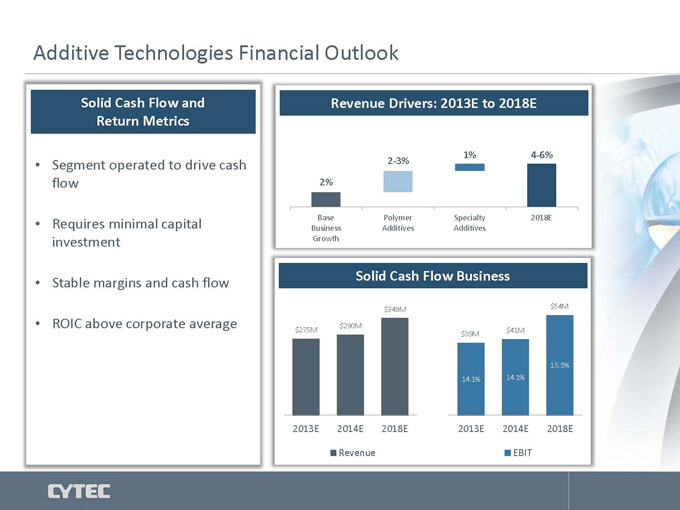

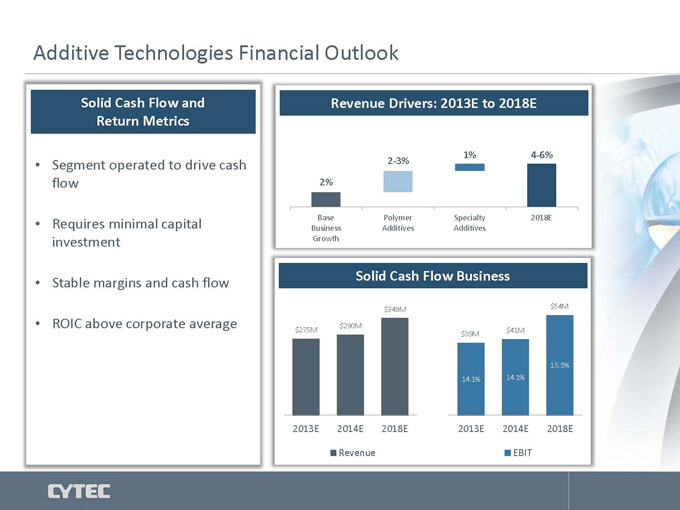

Additive Technologies Financial Outlook

Solid Cash Flow and Revenue Drivers: 2013E to 2018E

Return Metrics

1% 4-6%

Segment operated to drive cash 2-3%

flow 2%

Requires minimal capital Base Polymer Specialty 2018E

Business Additives Additives

investment Growth

Stable margins and cash flow Solid Cash Flow Business

$349M $54M

ROIC above corporate average $290M

$275M $41M

$39M

15.5%

14.1% 14.1%

2013E 2014E 2018E 2013E 2014E 2018E

Revenue EBIT

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

David Drillock

Vice President & Chief Financial Officer

Financial Review

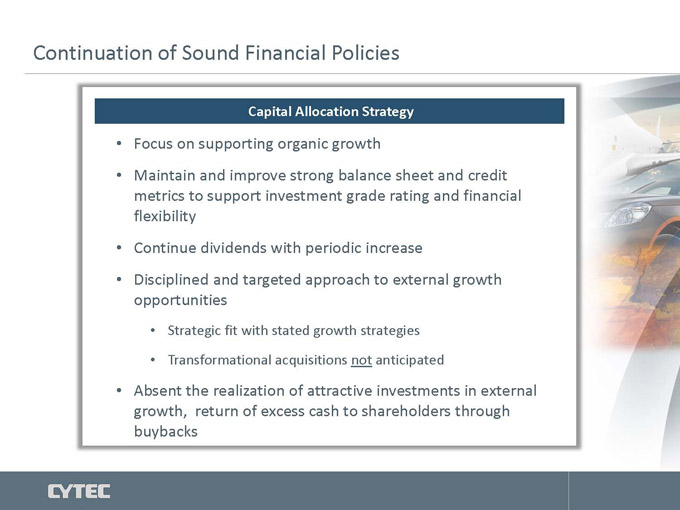

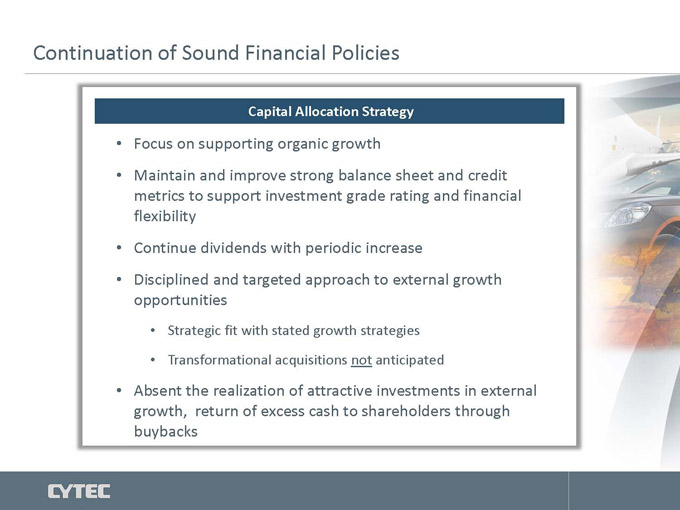

Continuation of Sound Financial Policies

Capital Allocation Strategy

Focus on supporting organic growth

Maintain and improve strong balance sheet and credit

metrics to support investment grade rating and financial

flexibility

Continue dividends with periodic increase

Disciplined and targeted approach to external growth

opportunities

• Strategic fit with stated growth strategies

• Transformational acquisitions not anticipated

Absent the realization of attractive investments in external

growth, return of excess cash to shareholders through

buybacks

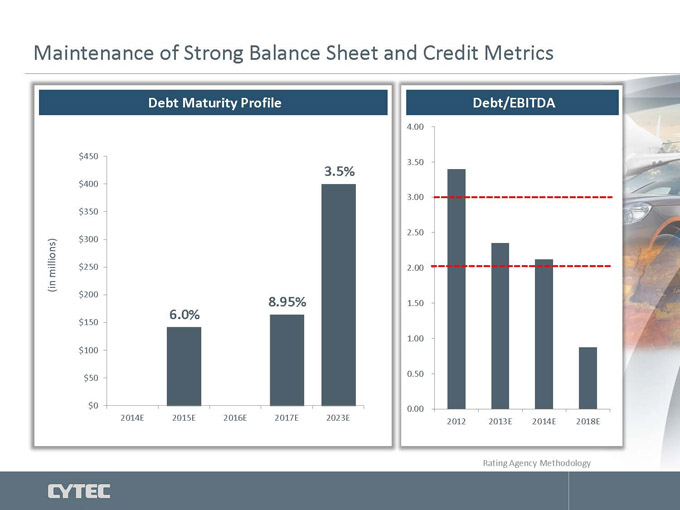

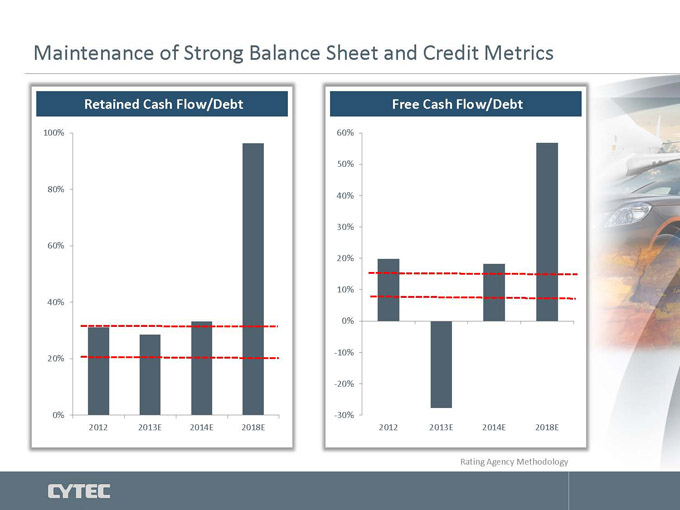

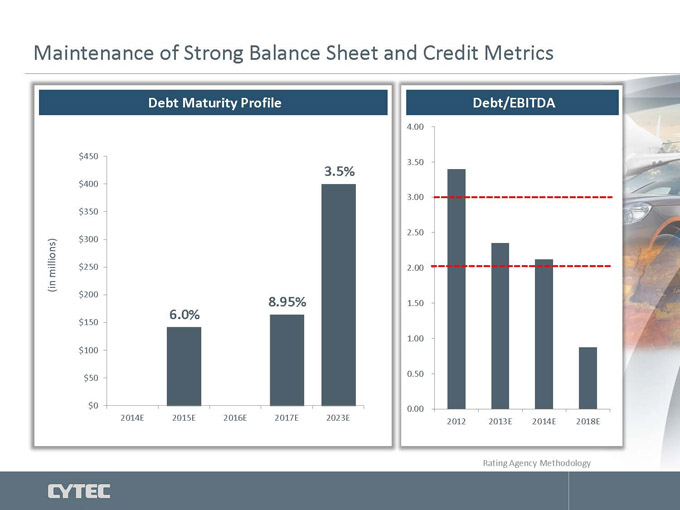

Maintenance of Strong Balance Sheet and Credit Metrics

Debt Maturity Profile Debt/EBITDA

4.00

$450

3.50

3.5%

$400

3.00

$350

2.50

$300

millions) $250 2.00

(in

$200

8.95% 1.50

6.0%

$150

1.00

$100

$50 0.50

$0 0.00

2014E 2015E 2016E 2017E 2023E 2012 2013E 2014E 2018E

Rating Agency Methodology

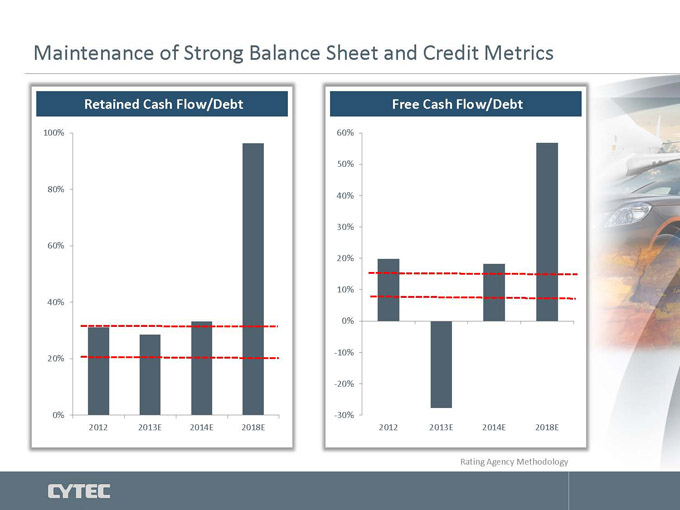

Maintenance of Strong Balance Sheet and Credit Metrics

Retained Cash Flow/Debt Free Cash Flow/Debt

100% 60%

50%

80%

40%

30%

60%

20%

10%

40%

0%

-10%

20%

-20%

0% -30%

2012 2013E 2014E 2018E 2012 2013E 2014E 2018E

Rating Agency Methodology

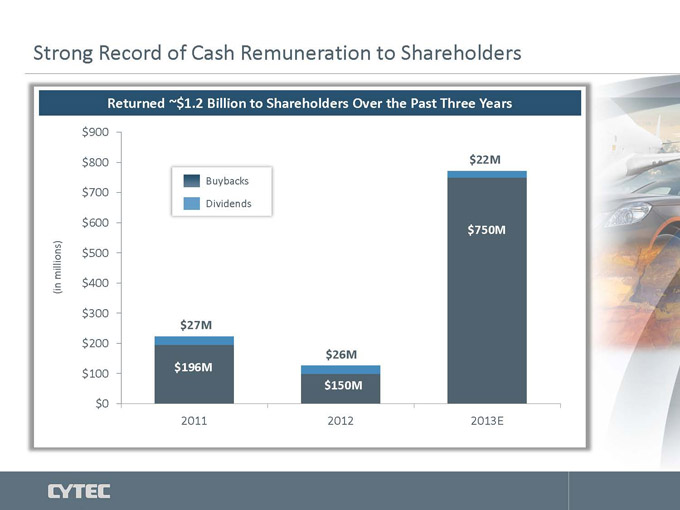

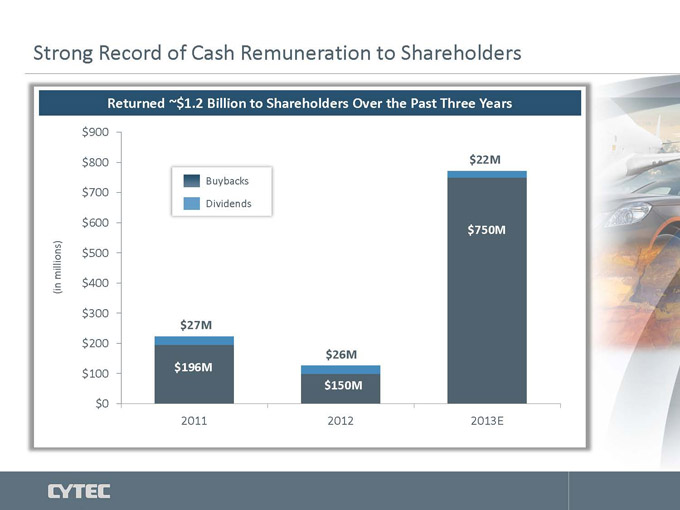

Strong Record of Cash Remuneration to Shareholders

Returned ~$1.2 Billion to Shareholders Over the Past Three Years

$900

$800 $22M

Buybacks

$700

Dividends

$600 $750M

millions) $500

(in $400

$300

$27M

$200

$26M

$100 $196M

$150M

$0

2011 2012 2013E

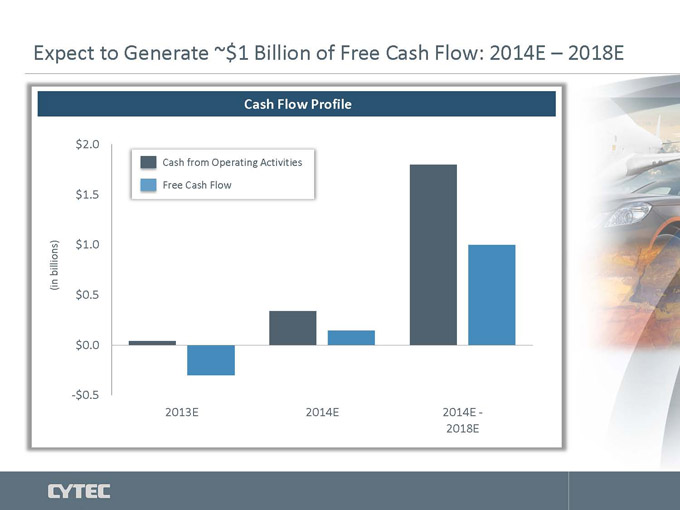

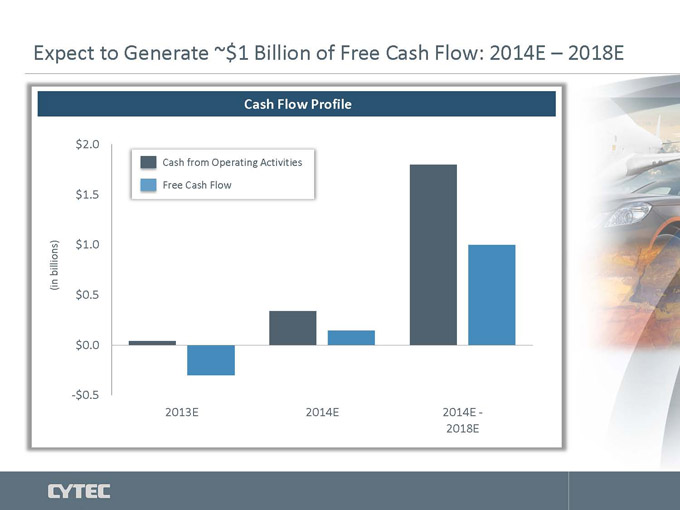

Expect to Generate ~$ 1 Billion of Free Cash Flow: 2014E – 2018E

Cash Flow Profile

$ 2.0

Cash from Operating Activities

Free Cash Flow

$ 1.5

$ 1.0

billions)

(in

$ 0.5

$ 0.0

-$ 0.5

2013E 2014E 2014E—

2018E

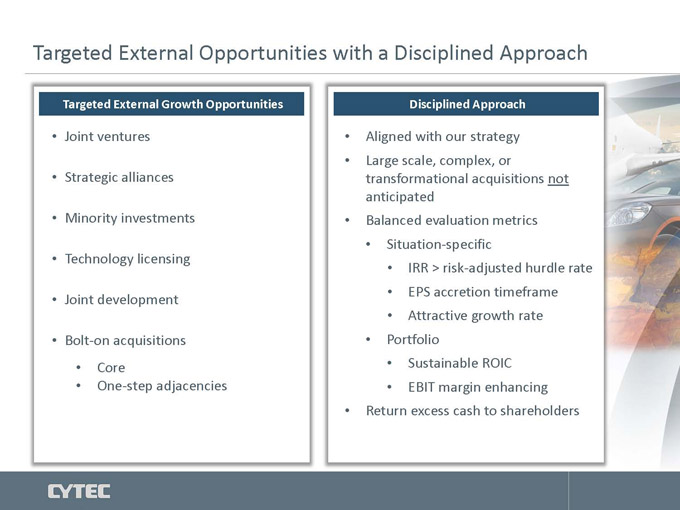

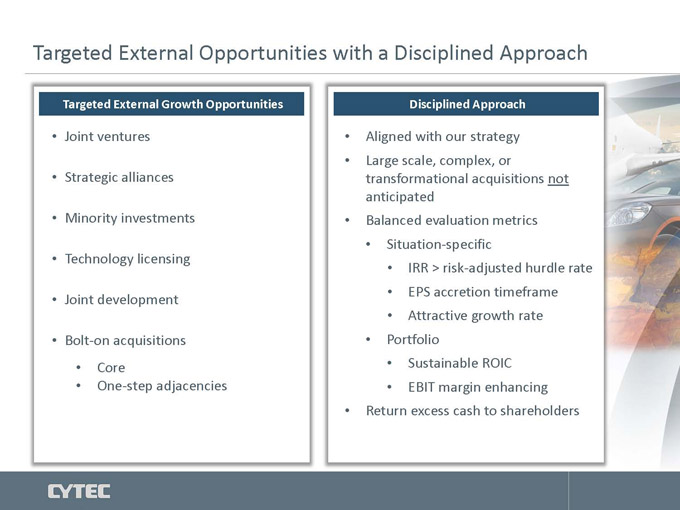

Targeted External Opportunities with a Disciplined Approach

Targeted External Growth Opportunities Disciplined Approach

Joint ventures Aligned with our strategy

• Large scale, complex, or

Strategic alliances transformational acquisitions not

anticipated

Minority investments Balanced evaluation metrics

• Situation-specific

Technology licensing IRR > risk-adjusted hurdle rate

Joint development EPS accretion timeframe

• Attractive growth rate

Bolt-on acquisitions Portfolio

• Core • Sustainable ROIC

• One-step adjacencies • EBIT margin enhancing

• Return excess cash to shareholders

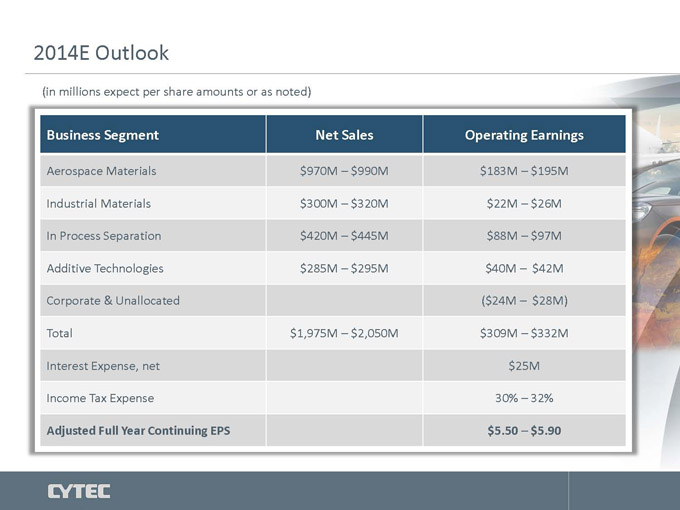

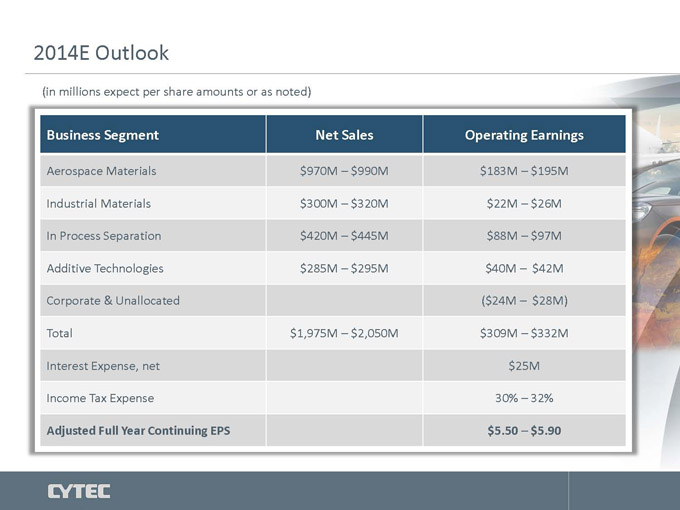

2014E Outlook

(in millions expect per share amounts or as noted)

Business Segment Net Sales Operating Earnings

Aerospace Materials $970M – $ 990M $183M – $195M

Industrial Materials $300M – $ 320M $22M – $26M

In Process Separation $420M – $ 445M $88M – $97M

Additive Technologies $285M – $ 295M $40M – $42M

Corporate & Unallocated ($24M – $28M)

Total $1,975M – $ 2,050M $309M – $332M

Interest Expense, net $25M

Income Tax Expense 30% – 32%

Adjusted Full Year Continuing EPS $5.50 – $5.90

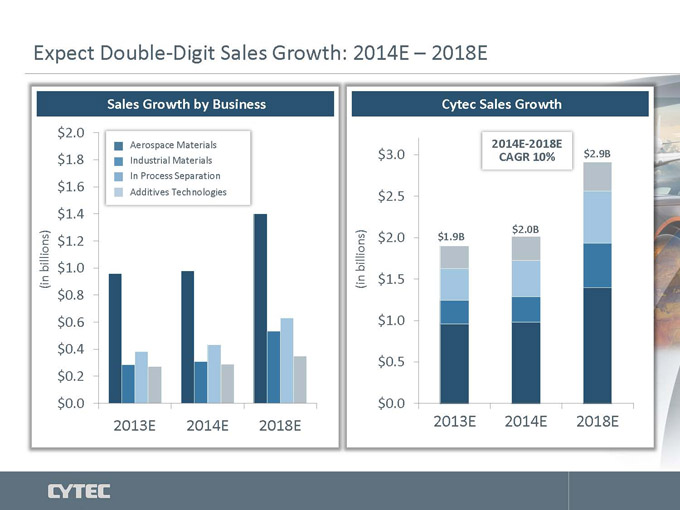

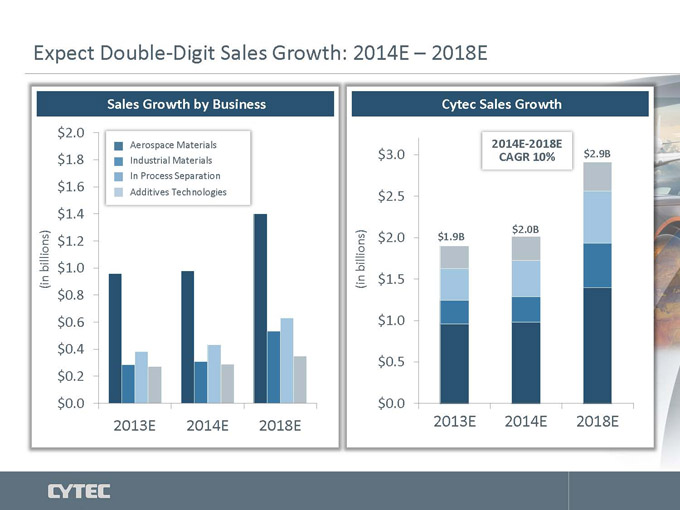

Expect Double-Digit Sales Growth: 2014E – 2018E

Sales Growth by Business Cytec Sales Growth

$ 2.0

Aerospace Materials 2014E-2018E

$ 1.8 Industrial Materials $ 3.0 CAGR 10% $2.9B

In Process Separation

$ 1.6

Additives Technologies $ 2.5

$ 1.4

$2.0B

billions) $ 1.2 billions) $ 2.0 $1.9B

$ 1.0

(in (in $ 1.5

$ 0.8

$ 0.6 $ 1.0

$ 0.4

$ 0.5

$ 0.2

$ 0.0 $ 0.0

2013E 2014E 2018E 2013E 2014E 2018E

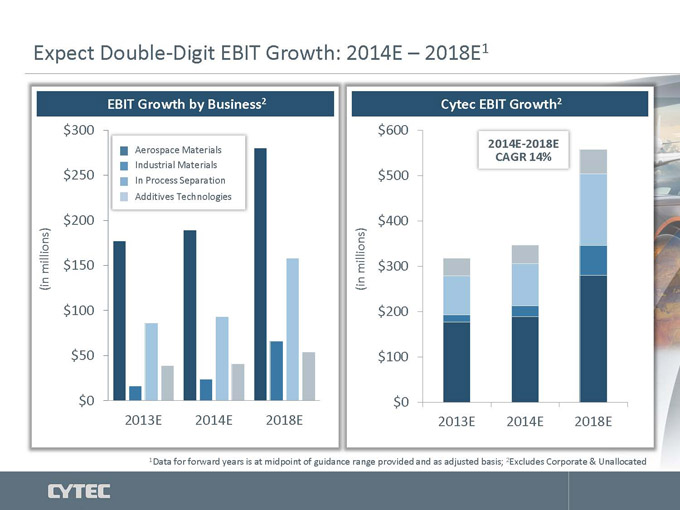

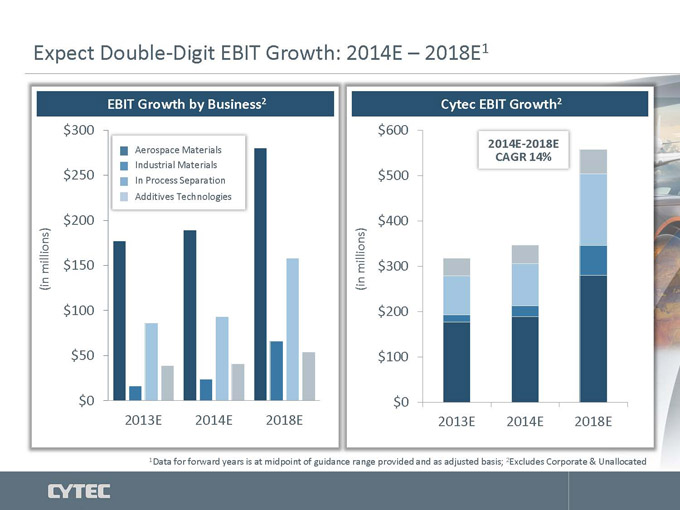

Expect Double-Digit EBIT Growth: 2014E – 2018E 1

EBIT Growth by Business 2 Cytec EBIT Growth 2

$300 $600

Aerospace Materials 2014E-2018E

CAGR 14%

Industrial Materials

$250 In Process Separation $500

Additives Technologies

$200 $400

millions) $150 millions) $300

(in (in

$100 $200

$50 $100

$0 $0

2013E 2014E 2018E 2013E 2014E 2018E

1 Data for forward years is at midpoint of guidance range provided and as adjusted basis; 2 Excludes Corporate & Unallocated

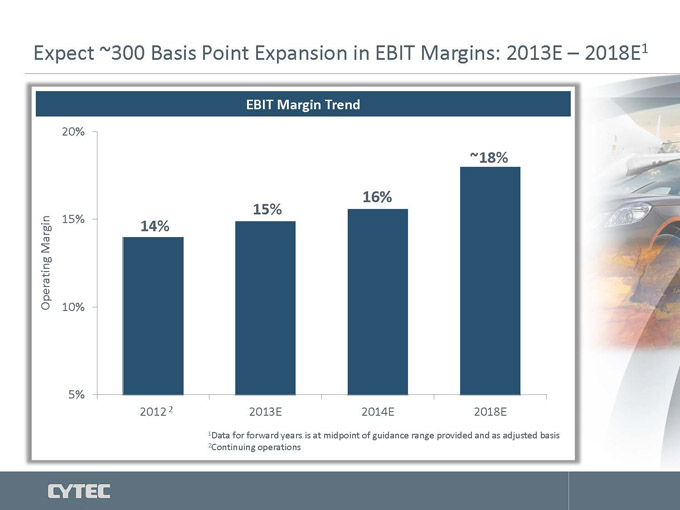

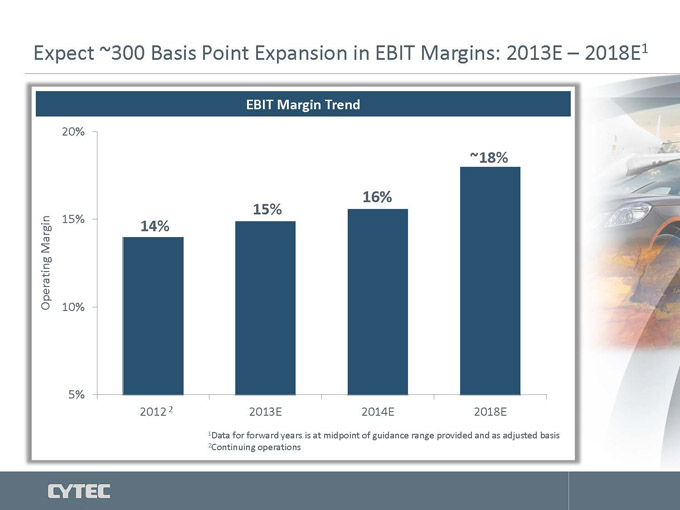

Expect ~300 Basis Point Expansion in EBIT Margins: 2013E – 2018E(1)

EBIT Margin Trend

20%

~18%

16%

15%

Margin15% 14%

Operating 10%

5%

2012 (2) 2013E 2014E 2018E

(1)Data for forward years is at midpoint of guidance range provided and as adjusted basis

(2)Continuing operations

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Shane Fleming

Chairman, President & Chief Executive Officer

Closing Remarks and Q&A

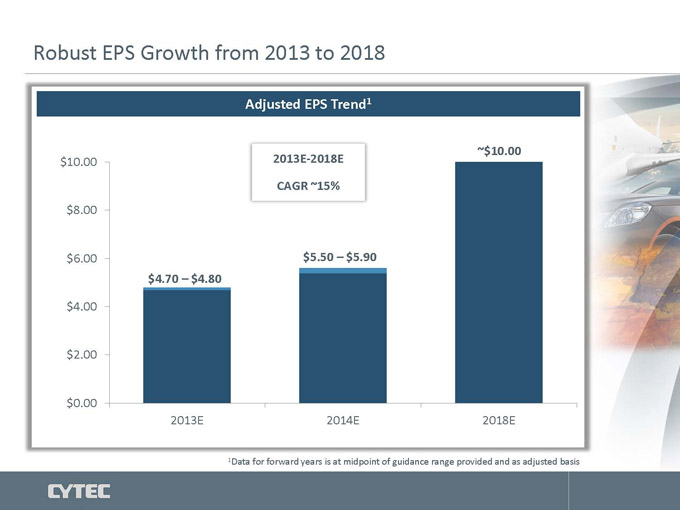

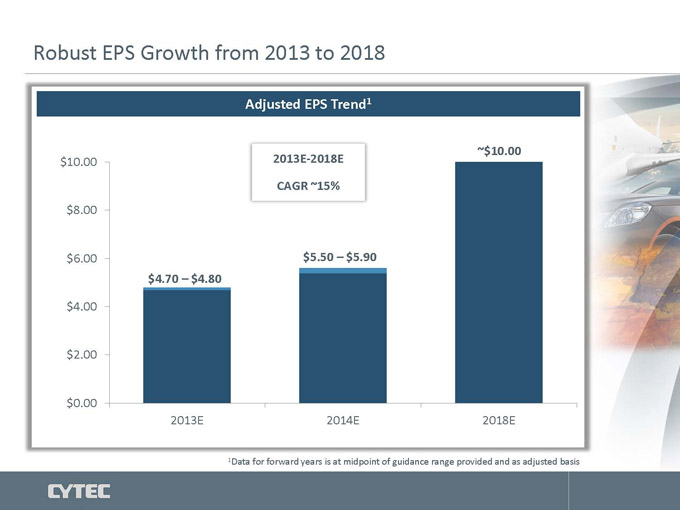

Robust EPS Growth from 2013 to 2018

Adjusted EPS Trend(1)

~$10.00

$10.00 2013E-2018E

CAGR ~15%

$8.00

$6.00 $5.50 – $5.90

$4.70 – $4.80

$4.00

$2.00

$0.00

2013E 2014E 2018E

(1)Data for forward years is at midpoint of guidance range provided and as adjusted basis

Closing Remarks

Refocused portfolio on growth strategy

Centered on secular growth in attractive end markets

Winning share with differentiated technology offerings

Common approach to development and commercialization

Accelerating growth and strengthening Cytec through our evolved enterprise model

Delivering profitable growth through leading market positions

CYTEC DELIVERING TECHNOLOGY BEYOND OUR CUSTOMERS’ IMAGINATION TM

Thank you