File No. 333-

As filed with the SEC on April 15, 2011

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes)

FEDERATED INSURANCE SERIES

(Exact Name of Registrant as Specified in Charter)

1-800-341-7400

(Area Code and Telephone Number)

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

Copies to:

Clair E. Pagnano, Esquire

K&L Gates LLP

State Street Financial Center

One Lincoln Street

Boston, MA 02111-2950

Acquisition of the assets of

MONEY MARKET PORTFOLIO

HIGH GRADE BOND PORTFOLIO

STRATEGIC YIELD PORTFOLIO

MANAGED PORTFOLIO

VALUE GROWTH PORTFOLIO

BLUE CHIP PORTFOLIO

portfolios of EquiTrust Variable Insurance Series Fund

By and in exchange for Primary Shares, Service Shares and undesignated shares of beneficial interest of

FEDERATED PRIME MONEY FUND II

FEDERATED QUALITY BOND FUND II

FEDERATED CAPITAL INCOME FUND II

FEDERATED CAPITAL APPRECIATION FUND II

portfolios of Federated Insurance Series Trust

Approximate Date of Proposed Public Offering: As soon as

practicable after this Registration Statement becomes effective

under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Primary Shares, Service Shares and undesignated shares of beneficial interest

without par value, of Federated Prime Money Fund II, Federated Quality Bond Fund II, Federated Capital Income

Fund II and Federated Capital Appreciation Fund II

It is proposed that this filing will become effective on May 16, 2011 pursuant to Rule 488.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

EQUITRUST VARIABLE INSURANCE SERIES FUND

5400 University Avenue

West Des Moines, Iowa 50266

[May 16], 2011

Dear Contractholder:

We are pleased to announce that, after extensive review and consideration, EquiTrust Variable Insurance Series Fund’s board of trustees has approved a recommendation to merge the Fund’s portfolios with funds managed by Federated Investors, Inc., a highly respected leader in cash management, fixed income and equity strategies. Federated Investors has provided asset management services for institutional and individual investors since 1955 and has more than [$355] billion in assets under management.

We believe this merger will be extremely favorable for Contractholders who maintain investments in the EquiTrust Variable Insurance Series Fund through a variable annuity contract or certificate and/or variable life insurance policy that participates in the Fund. It will allow you to leverage Federated Investors’ core competencies in mutual fund administration and asset management as you plan for your financial security.

The merger will have no impact on your relationship with your agent. He or she can continue to assist you with your subaccount investment(s), including those in the Federated funds.

Although the merger has been approved by the board of trustees, it is subject to shareholder approval. Information about the proposed merger and benefits to our Contractholders is enclosed, along with proxy materials to make it easy for you to vote your shares. If the merger is approved, the portfolios of EquiTrust Variable Insurance Series Fund will merge into Federated funds on or about [July 15], 2011.

Additional information about how the EquiTrust Variable Insurance Series Fund will be reorganized into comparable Federated funds is included in this mailing. Please take the time to read and understand all of the materials enclosed, and if we can answer questions or assist you with the Prospectus/Proxy Statement, please contact the Fund at 1-877-860-2904.

The Board of Trustees recommends that you vote in favor of this merger. After reviewing the contents of this mailing, we believe you’ll agree that the fund options available through Federated Investors will continue to help you achieve your financial goals and objectives.

Sincerely,

James E. Hohmann, Chief Executive Officer

FBL Financial Group, Inc.

Questions and Answers Regarding This Prospectus/Proxy Statement

EquiTrust Variable Insurance Series Fund, an open-end diversified management investment company consisting of six portfolios and managed by EquiTrust Investment Management Services, Inc., will hold a special meeting of shareholders on [July 14], 2011. It is important that you vote on the proposal outlined in this Prospectus/Proxy Statement. Please read the Prospectus/Proxy Statement in its entirety to ensure your full understanding of the proposal.

The information that follows summarizes the proposal and the voting process.

| A | EquiTrust Investment Management Services, Inc. (the “Adviser”), the investment adviser of the EquiTrust Variable Insurance Series Fund (the “Fund”), has recommended – and the Board of Trustees has approved – a proposal to reorganize and merge the Fund’s portfolios into funds managed by Federated Investors, Inc. or its affiliates (“Federated Investors”). |

| Q | What issue am I being asked to vote on? |

| A | You are being asked to approve a proposal to merge your investment(s) in the Fund’s portfolio(s) through a variable annuity contract or certificate and/or variable life insurance policy into a fund managed by Federated Investors, Inc. or its affiliates. The Fund’s Board of Trustees unanimously recommends that you vote in favor of this proposal. |

| Q | Why the Federated family of funds? |

| A | Federated Investors is one of the largest investment management organizations in the United States. They advise 135 funds and manage more than [$355] billion in assets. Federated has provided asset management services for institutional and individual investors since 1955. |

| Q | Why has this proposal been made? |

| A | Given the Fund’s assets and prospects for growth, the Adviser sought and recommended to the Board an organization whose core competencies include cash management, fixed income and equity strategies, as well as extensive mutual fund administration capabilities. The Board of Trustees believes it is in the best interests of the Fund to proceed with this merger. (Please refer to page 1 of the attached Prospectus/Proxy Statement for more discussion about the proposed reorganization.) |

| A | The reorganization of each Fund portfolio into a corresponding Federated fund will provide the Fund portfolios’ Contractholders with the following: |

| | • | | the opportunity to retain shares in a fund with a similar investment objective(s); |

| | • | | an investment in a larger combined fund with increased long-term growth prospects, which can spread relative fixed costs over a larger asset base; |

| | • | | an investment in a family of mutual funds managed by an investment adviser with extensive investment management resources; and |

| | • | | ongoing access to your current agent who can continue to assist you with your variable annuity contract or certificate and/or variable life insurance policy investment(s). |

| Q | What will happen to my EquiTrust Variable Insurance Series Fund investment(s)? |

| A | As part of the merger, the Fund portfolios will be closed and your investment(s) will be transferred to the corresponding Federated fund. This will happen automatically according to the mapping plan outlined below, and no action by you is required. Your account value will not change, but because the Federated funds will have different NAVs (net asset values) than the EquiTrust Variable Insurance Series Fund portfolios (with the exception of the Money Market Portfolio reorganization), it’s likely that the number of shares you hold will change as a result of the merger. |

| Q | Which Federated fund(s) will the Fund portfolios merge into upon approval of this proposal? |

| A | At merger, the EquiTrust Variable Insurance Series Fund portfolios will map to the Federated Funds as follows: |

| | |

EquiTrust Variable Insurance Series Fund | | Federated Investors |

Blue Chip and Value Growth Portfolios | | Capital Appreciation Fund II |

Managed Portfolio | | Capital Income Fund II |

High Grade Bond and Strategic Yield Portfolios | | Quality Bond Fund II |

Money Market Portfolio | | Prime Money Fund II |

| Q | When will the merger take place? |

| A | With shareholder approval, the portfolio(s) of the EquiTrust Variable Insurance Series Fund will merge into Federated Funds on or about [July 15], 2011. |

| Q | Will the merger cause me to have to pay any taxes? |

| A | No, this merger will be a tax-free event. |

| Q | Can I continue to work with my current agent? |

| A | Absolutely. Your current agent can continue to help you with all of the products and services you’ve relied on in the past – including contributions and redemptions for your variable annuity contract or certificate and/or variable life insurance policy. |

| Q | Will I still have access to historical information about my Fund investment(s)? |

| A | Yes. Because your investment(s) in the Fund is the result of owning a variable annuity contract or certificate and/or variable life insurance policy through an insurance company that utilized the Fund as an investment vehicle, all records related to your investment(s) in the Fund are maintained by the insurance company. |

| Q | Who will pay for the merger? |

| A | All fees and expenses incurred as a direct result of the merger will be paid by the Adviser, Federated’s advisers, and/or their affiliates. None of the costs of the reorganization transactions will be borne by the Fund’s contractholders. |

| Q | How do I vote my shares? |

| A | You may vote your Fund shares through one of the following methods: |

1) by phone, using the special toll-free number provided in the proxy materials;

2) online, using the instructions provided in the proxy materials;

3) at the special meeting of shareholders scheduled to be held on Thursday, July 14; or

4) by mailing the enclosed Proxy Card.

| Q | Who do I call with questions about the Proxy/Prospectus Statement? |

| A | Please contact your agent or you may call EquiTrust Variable Insurance Series Fund at 1-877-860-2904. |

Money Market Portfolio

High Grade Bond Portfolio

Strategic Yield Portfolio

Managed Portfolio

Value Growth Portfolio

Blue Chip Portfolio

portfolios of EQUITRUST VARIABLE INSURANCE SERIES FUND

5400 University Avenue

West Des Moines, Iowa 50266

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD [July 14], 2011

A special meeting of the shareholders of each Portfolio of EquiTrust Variable Insurance Series Fund (the “Fund”) listed above will be held at the offices of EquiTrust Investment Management Services, Inc., 5400 University Avenue, West Des Moines, Iowa 50266, on [July 14], 2011 for the following purposes:

| | 1. | For shareholders of Money Market Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Prime Money Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of Money Market Portfolio in exchange for shares of Federated Prime Money Fund II to be distributed pro rata by Money Market Portfolio to its holders of Initial and Service Class Shares, in complete liquidation and termination of Money Market Portfolio; |

| | 2. | For shareholders of High Grade Bond Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Quality Bond Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of High Grade Bond Portfolio in exchange for Primary Shares of Federated Quality Bond Fund II to be distributed pro rata by High Grade Bond Portfolio to its holders of Initial Class Shares, and for Primary Shares of Federated Quality Bond Fund II to be distributed pro rata by High Grade Bond Portfolio to its holders of Service Class Shares, in complete liquidation and termination of High Grade Bond Portfolio; |

| | 3. | For shareholders of Managed Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Capital Income Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of Managed Portfolio in exchange for shares of Federated Capital Income Fund II to be distributed pro rata by Managed Portfolio to its holders of Initial Class and Service Class Shares, in complete liquidation and termination of Managed Portfolio; |

| | 4. | For shareholders of Strategic Yield Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Quality Bond Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of Strategic Yield Portfolio in exchange for Primary Shares of Federated Quality Bond Fund II to be distributed pro rata by Strategic Yield Portfolio to its holders of Initial Class Shares, and for Primary Shares of Federated Quality Bond Fund II to be distributed pro rata by Strategic Yield Portfolio to its holders of Service Class Shares, in complete liquidation and termination of Strategic Yield Portfolio; |

| | 5. | For shareholders of Value Growth Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Capital Appreciation Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of Value Growth Portfolio in exchange for Primary Shares of Federated Capital Appreciation Fund II to be |

| | distributed pro rata by Value Growth Portfolio to its holders of Initial Class Shares, and for Primary Shares of Federated Capital Appreciation Fund II to be distributed pro rata by Value Growth Portfolio to its holders of Service Class Shares, in complete liquidation and termination of Value Growth Portfolio; |

| | 6. | For shareholders of Blue Chip Portfolio, to approve an Agreement and Plan of Reorganization pursuant to which Federated Capital Appreciation Fund II, a portfolio of Federated Insurance Series, would acquire substantially all of the assets of Blue Chip Portfolio in exchange for Primary Shares of Federated Capital Appreciation Fund II to be distributed pro rata by Blue Chip Portfolio to its holders of Initial Class Shares, and for Primary Shares of Federated Capital Appreciation Fund II to be distributed pro rata by Blue Chip Portfolio to its holders of Service Class Shares, in complete liquidation and termination of Blue Chip Portfolio; and |

| | 7. | To transact such other business as may properly come before the special meeting or any adjournment thereof. |

Each Portfolio of the Fund listed above is referred to individually as an “Acquired Fund” and collectively as the “Acquired Funds.”

Please note that owners of variable life insurance policies or variable annuity contracts or certificates (the “Contractholders”) issued by Farm Bureau Life Insurance Company, EquiTrust Life Insurance Company, American Equity Investment Life Insurance Company, Modern Woodmen of America, and COUNTRY Investors Life Assurance Company (each, an “Insurance Company”) who have invested in shares of the Acquired Funds through the investment divisions of a separate account or accounts of an Insurance Company will be given the opportunity, to the extent required by law, to provide the applicable Insurance Company with voting instructions on the above proposals.

The Board of Trustees has fixed [May 16,] 2011, as the record date for determination of shareholders entitled to vote at the special meeting.

|

| By Order of the Board of Trustees, |

|

/s/ Craig A. Lang |

| Craig A. Lang |

| President and Trustee |

| EquiTrust Variable Insurance Series Fund |

[May 16], 2011

YOU CAN HELP AVOID THE NECESSITY AND EXPENSE OF SENDING FOLLOW-UP LETTERS TO ENSURE A QUORUM BY PROMPTLY SIGNING AND RETURNING THE ENCLOSED PROXY CARD. IF YOU ARE UNABLE TO ATTEND THE MEETING, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD SO THAT THE NECESSARY QUORUM MAY BE REPRESENTED AT THE SPECIAL MEETING. THE ENCLOSED ENVELOPE REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

PROSPECTUS/PROXY STATEMENT

[May 16], 2011

Acquisition of the assets of:

MONEY MARKET PORTFOLIO

HIGH GRADE BOND PORTFOLIO

STRATEGIC YIELD PORTFOLIO

MANAGED PORTFOLIO

VALUE GROWTH PORTFOLIO

BLUE CHIP PORTFOLIO

each a portfolio of EQUITRUST VARIABLE INSURANCE SERIES FUND

5400 University Avenue

West Des Moines, Iowa 50266

Telephone No: 1-877-860-2904

By and in exchange for Shares of:

FEDERATED PRIME MONEY FUND II

FEDERATED QUALITY BOND FUND II

FEDERATED CAPITAL INCOME FUND II

or

FEDERATED CAPITAL APPRECIATION FUND II

each a portfolio of:

FEDERATED INSURANCE SERIES

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

Telephone No: 1-800-341-7400

1

This Combined Prospectus and Proxy Statement (the “Prospectus/Proxy Statement”) is being furnished to owners of variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contractholders”) issued by Farm Bureau Life Insurance Company, EquiTrust Life Insurance Company, American Equity Investment Life Insurance Company, Modern Woodmen of America, and COUNTRY Investors Life Assurance Company (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of [May 16], 2011, had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in one or more of the following Portfolios: Money Market Portfolio, High Grade Bond Portfolio, Managed Portfolio, Strategic Yield Portfolio, Value Growth Portfolio and Blue Chip Portfolio (collectively, the “Acquired Funds”), each a series of EquiTrust Variable Insurance Series Fund (the “EquiTrust Variable Fund”). This Prospectus/Proxy Statement also is being furnished to the Insurance Companies as the record owners of shares that were invested in one or more of the Acquired Funds as of [May 16], 2011. Contractholders are being provided the opportunity to instruct the applicable Insurance Company to approve or disapprove the proposals contained in this Proxy Statement/Prospectus in connection with the solicitation by the Board of Trustees of the EquiTrust Variable Fund (the “EquiTrust Variable Board”) of proxies to be used at the Special Meeting of Shareholders of the Acquired Funds to be held at the offices of EquiTrust Investment Management Services, Inc., 5400 University Avenue, West Des Moines, Iowa 50266, on [July 14], 2011, or any adjournment or adjournments thereof (the “Special Meeting”).

This Prospectus/Proxy Statement describes the proposals for the reorganizations (the “Reorganizations”) pursuant to six separate Agreements and Plans of Reorganization (the “Plans”), pursuant to which certain portfolios (each, an “EquiTrust Variable Portfolio”) of the EquiTrust Variable Fund as described in the chart below would transfer substantially all their assets to certain corresponding portfolios (each, a “Federated Insurance Fund” or an “Acquiring Fund”) of Federated Insurance Series (the “Federated Insurance Trust”) in exchange for shares and classes of the respective Federated Insurance Funds as set forth in the chart:

| | |

| Acquired Fund | | Acquiring Fund |

| Money Market Portfolio | | Federated Prime Money Fund II |

Initial Class Shares | | This Fund offers a single un-designated class of shares. |

Service Class Shares | |

| High Grade Bond Portfolio | | Federated Quality Bond Fund II |

Initial Class Shares | | Primary Shares |

Service Class Shares | | Primary Shares |

| Strategic Yield Portfolio | | Federated Quality Bond Fund II |

Initial Class Shares | | Primary Shares |

Service Class Shares | | Primary Shares |

| Managed Portfolio | | Federated Capital Income Fund II |

Initial Class Shares | | This Fund offers a single un-designated class of shares. |

Service Class Shares | |

| Value Growth Portfolio | | Federated Capital Appreciation Fund II |

Initial Class Shares | | Primary Shares |

Service Class Shares | | Primary Shares |

| Blue Chip Portfolio | | Federated Capital Appreciation Fund II |

Initial Class Shares | | Primary Shares |

Service Class Shares | | Primary Shares |

The designated shares of the respective Federated Insurance Funds will be distributed pro rata by each corresponding EquiTrust Variable Portfolio to its shareholders in complete liquidation and dissolution of the EquiTrust Variable Portfolio. As a result of the Reorganizations, each owner of shares of an EquiTrust Variable Portfolio will become the owner of shares of the corresponding Federated Insurance Fund having a total net asset value (“NAV”) equal to the total NAV of his or her holdings in the applicable EquiTrust Variable Portfolio on the date of the Reorganizations (the “Closing Date”), subject to the following: at the time of Reorganizations, the value

2

of the assets of each EquiTrust Variable Portfolio will be determined in accordance with the corresponding Federated Insurance Fund’s valuation procedures (although it is not anticipated that the use of Federated’s valuation procedures will result in a material revaluation of an EquiTrust Variable Portfolio’s assets at the time of the Reorganizations). Similarly, each Contractholder whose Contract values are invested in shares of one or more of the Acquired Funds would become an indirect owner of shares of the corresponding Acquiring Fund. Each such Contractholder would indirectly hold, immediately after the Closing Date, un-designated class shares or Primary Shares, as indicated in this Prospectus/Proxy Statement, of the applicable Acquiring Fund having an aggregate value equal to the aggregate value of the Initial Class or Service Class Acquired Fund Shares, as applicable, that were indirectly held by the Contractholder as of the Closing Date. With respect to the Money Market Portfolio Reorganization, because both Money Market Portfolio and Federated Prime Money Fund II value their shares at an NAV of $1.00 per share, each Contractholder whose Contract values are invested in shares of the Portfolio would indirectly hold the same number of shares of the Federated Fund as are currently held of the Portfolio. The separate Plans are substantially identical, and forms of such Plans are attached as Annex A-1 (for the money market fund Reorganization described in the chart above) and Annex A-2 (for one of the non-money market fund Reorganizations described in the chart above).

Each Contractholder whose Contract values are invested in shares of one or more of the Acquired Funds as of [May 16], 2011 may instruct the Insurance Company on how to vote the shares of the EquiTrust Variable Portfolios attributable to their Contract. The Insurance Company will vote all shares of the EquiTrust Variable Portfolios issued to it in proportion to the voting instructions with respect to the Portfolios timely received from the Contractholders.

For a comparison of the investment policies of the EquiTrust Variable Portfolios and the Federated Insurance Funds, see “Summary-Comparison of Investment Objectives, Policies, and Risks- Investment Limitations.” Information concerning shares of the Federated Insurance Funds, as compared to shares of the EquiTrust Variable Portfolios, is included in this Prospectus/Proxy Statement in the sections entitled “Summary-Comparative Fee Tables” and “Information About the Reorganizations-Description of the Federated Insurance Fund Share Classes and Capitalization.”

This Prospectus/Proxy Statement should be retained for further reference. It sets forth concisely the information about each Federated Insurance Fund that a shareholder should know before voting on the Reorganizations. This Prospectus/Proxy Statement is accompanied by the applicable Prospectus of the Federated Insurance Funds as follows: Federated Insurance Series Prime Money Fund II, Federated Insurance Series Quality Bond Fund II – Primary Shares, Federated Insurance Series Capital Income Fund II, and Federated Insurance Series Capital Appreciation Fund II – Primary Shares, each dated [April 30, 2011] and each of which is incorporated herein by reference (the “Incorporated Federated Insurance Fund Prospectuses”). A Statement of Additional Information (“SAI”) relating to this Prospectus/Proxy Statement dated [May 16], 2011, as well as the SAI for the Federated Insurance Funds, dated [April 30, 2011], containing additional information, have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated herein by reference.

Further information about each Federated Insurance Fund’s performance is contained in the Annual Report of the Federated Insurance Trust for the fiscal year ended December 31, 2010, which is incorporated herein by reference.

A Prospectus and SAI for the EquiTrust Variable Fund, dated [May 1, 2011], have been filed with the SEC and are incorporated herein by reference.

Further information regarding each EquiTrust Variable Portfolio’s performance is contained in EquiTrust Variable Fund’s Annual Report for the fiscal year ended December 31, 2010, which is incorporated herein by reference. Copies of these materials and other information about the Federated Insurance Funds and the EquiTrust Variable Fund may be obtained without charge by writing or by calling the Federated Insurance Funds or EquiTrust Variable Fund, as applicable, at the address and telephone number shown on the previous pages.

|

| THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS/PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. |

3

|

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS/PROXY STATEMENT AND IN THE MATERIALS EXPRESSLY INCORPORATED HEREIN BY REFERENCE AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUNDS. |

| |

THE SHARES OFFERED BY THIS PROSPECTUS/PROXY STATEMENT ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK. THESE SHARES ARE NOT FEDERALLY INSURED BY, GUARANTEED BY, OBLIGATIONS OF OR OTHERWISE SUPPORTED BY THE U.S. GOVERNMENT, THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD OR ANY OTHER GOVERNMENTAL AGENCY. INVESTMENT IN THESE SHARES INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL AMOUNT INVESTED. |

|

4

TABLE OF CONTENTS

5

SUMMARY

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, or incorporated herein by reference into this Prospectus/Proxy Statement. A copy of a form of the Plan to be used in connection with the Money Market Portfolio Reorganization is attached to this Prospectus/Proxy Statement as Annex A-1. A copy of a form of Plan to be used in connection with the Reorganizations of High Grade Bond Portfolio, Strategic Yield Portfolio, Managed Portfolio, Value Growth Portfolio, and Blue Chip Portfolio (each a “non-money market fund”) is attached to this Prospectus/Proxy Statement as Annex A-2. For more complete information, please read the prospectuses of the applicable Federated Insurance Fund and EquiTrust Variable Fund (collectively the “Funds” or individually a “Fund”) and the SAI relating to this Prospectus/Proxy Statement. A copy of the prospectus for each applicable Federated Insurance Fund accompanies this Prospectus/Proxy Statement.

In the event that one or more of the proposed Reorganizations is not approved by shareholders of the relevant EquiTrust Variable Portfolio(s), including the proposed reorganizations of the series of another investment company managed by the Portfolios’ investment adviser, it is possible that none of the proposed Reorganizations will take place. See “Agreement Among Federated, EquiTrust and FBL Financial Group, Inc.” below.

REASONS FOR THE PROPOSED REORGANIZATIONS

In 2009, EquiTrust began reviewing and discussing the future of the EquiTrust Variable Fund with the EquiTrust Variable Board, following an operational assessment conducted by FBL Financial Group, Inc., EquiTrust’s parent (“FBL”), of its mutual fund business. EquiTrust noted that, given the EquiTrust Variable Fund’s asset size, further expected reductions in assets and lack of economies of scale, along with FBL’s determination that the mutual fund business is not a core business for FBL, EquiTrust did not believe the EquiTrust Variable Fund was a viable investment option going forward. After further discussions with the EquiTrust Variable Board, EquiTrust sought and recommended to the EquiTrust Variable Board an organization that is positioned to manage and administer the EquiTrust Variable Fund’s assets, gather additional assets and continue to provide services to shareholders of the EquiTrust Variable Fund. In particular, rather than propose liquidating the EquiTrust Variable Fund, EquiTrust proposed to the EquiTrust Variable Board the Reorganizations of the EquiTrust Variable Portfolios with Federated Insurance Funds that are similar from an investment objective standpoint.

On April 11, 2011, EquiTrust and Federated made presentations to the EquiTrust Variable Board regarding the Reorganizations and EquiTrust formally proposed and the Board, including the independent Trustees, approved the terms of the Reorganizations. The Board has also agreed to recommend that the Reorganizations be approved by the shareholders of each EquiTrust Variable Portfolio.

In determining to recommend that shareholders of each EquiTrust Variable Portfolio approve its proposed Reorganization, the Board considered the factors described below:

| | • | | The asset size of the EquiTrust Variable Fund and lack of expected asset growth; |

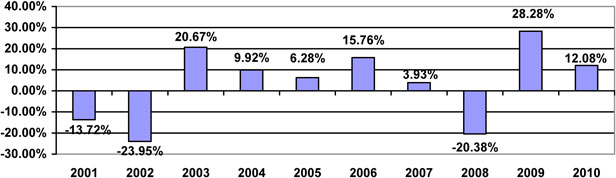

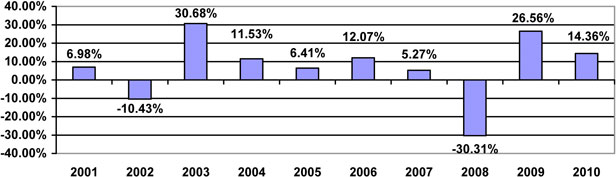

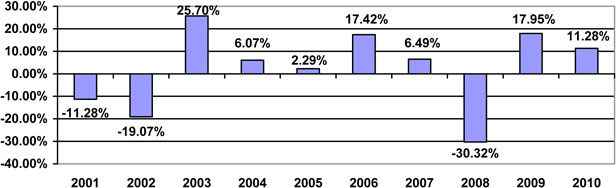

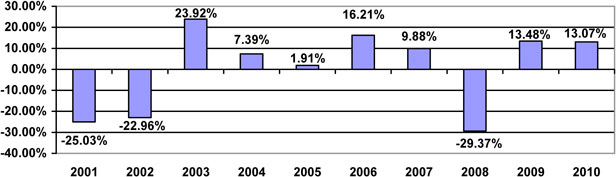

| | • | | The investment performance of the Federated Insurance Funds relative to that of the corresponding EquiTrust Variable Portfolios, and in particular, that each Federated Insurance Fund’s performance over one-, three-, five- and ten-year periods ended February 28, 2011, as applicable, was generally comparable to that of the corresponding EquiTrust Variable Portfolio, and in some cases, better than that of the corresponding EquiTrust Variable Portfolio |

| | • | | The investment objective, policies and restrictions of the Federated Insurance Funds are similar to the corresponding EquiTrust Variable Portfolios; |

| | • | | The size and financial stability of Federated and its experience managing mutual funds; |

| | • | | The fees and expenses of the Federated Insurance Funds relative to those of the corresponding EquiTrust Variable Portfolios, and in particular, that in all cases, except for the Service Class |

6

| | Shares of the Strategic Yield and Money Market Portfolios, the Federated Portfolio’s net expenses were higher than those of the corresponding EquiTrust Variable Portfolio. However, the Board noted that, at its November 2010 meeting, it had reviewed each EquiTrust Variable Portfolio’s total expense ratios (net of expense reimbursements, where applicable) with other registered funds pursuing broadly similar strategies as included in reports prepared by EquiTrust, which showed that each class of each EquiTrust Variable Portfolio’s expense ratios with the exception of Initial Class Shares of the Value Growth Portfolio were below average compared to similar mutual funds. The Board also noted Federated’s agreement to waive fees and/or reimburse expenses for each Federated Insurance Fund until the later of May 31, 2012 or the date of the Federated Insurance Fund’s next effective Prospectus; |

| | • | | The tax consequences of each Reorganization on the EquiTrust Variable Portfolio and its shareholders, and in particular, that the Reorganization would be a tax-free reorganization for federal tax purposes; |

| | • | | EquiTrust, Federated or their affiliates would bear all costs associated with the Reorganizations; |

| | • | | The terms and conditions of each Reorganization were fair and reasonable and generally consistent with industry practices; and |

| | • | | The services available to shareholders after the Reorganizations. |

Based on all of the above, the EquiTrust Variable Board concluded that each EquiTrust Variable Portfolio’s participation in the proposed Reorganization would be in the best interests of the EquiTrust Variable Fund. The EquiTrust Variable Board, including the independent Trustees, unanimously recommend that shareholders of each EquiTrust Variable Portfolio approve its proposed Reorganization.

FEDERAL INCOME TAX CONSEQUENCES

As a condition of the Reorganizations, the EquiTrust Variable Fund and the Federated Insurance Funds will receive opinions of counsel that the Reorganizations will be considered tax-free “reorganizations” under applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), so that no gain or loss will be recognized directly as a result of the Reorganizations by the EquiTrust Variable Fund or the Federated Insurance Funds or by the EquiTrust Variable Funds’ shareholders. The aggregate tax basis of the Federated Insurance Fund shares received by a shareholder of the corresponding EquiTrust Variable Fund will be the same as the aggregate tax basis of the EquiTrust Variable Fund shares previously held by such shareholder, and the holding period of the Federated Insurance Fund shares received generally will include the holding period of the EquiTrust Variable Fund shares surrendered in exchange. Each EquiTrust Variable Portfolio will distribute to shareholders any previously undistributed investment company taxable income (determined without regard to the deduction for dividends paid), net tax-exempt interest and realized net capital gains (after reduction by any available capital loss carryforwards) accumulated prior to the Reorganizations. This is not expected to be a taxable event for federal income tax purposes for variable annuity or variable life insurance contract owners.

COMPARISON OF INVESTMENT OBJECTIVES, POLICIES AND RISKS

This section will help you compare the investment objectives, policies and risks of each EquiTrust Variable Portfolio with its corresponding Federated Insurance Fund.

The investment objective of each EquiTrust Variable Portfolio is fundamental and can be changed only with shareholder approval. The investment objective of Federated Capital Appreciation Fund II is non-fundamental and can be changed by the Fund’s Board without shareholder approval. The investment objective of each other Federated Fund is fundamental and can be changed only with shareholder approval.

Please be aware that this is only a brief discussion. More complete information may be found in the EquiTrust

7

Variable Fund’s and Federated Insurance Funds’ prospectuses.

MONEY MARKET PORTFOLIO – FEDERATED PRIME MONEY FUND II

Each Fund’s investment objective is to provide current income consistent with stability of principal and liquidity.

Money Market Portfolio invests exclusively in U.S. dollar-denominated money market securities maturing in thirteen months or less from the date of purchase, including those issued by U.S. financial institutions, corporate issuers, the U.S. Government and its agencies, instrumentalities and municipalities. At least 97% of the Portfolio’s assets must be rated in the highest short-term category by a nationally recognized statistical rating organization (“NRSRO”) (e.g., P-1 by Moody’s Investors Service, Inc. (“Moody’s”) or A-1 by Standard & Poor’s Corporation (“S&P”)) (or its unrated equivalent), and 100% of its assets must be invested in securities rated in the two highest rating categories by an NRSRO (P-1/P-2 by Moody’s or A-1/A-2 by S&P). The Portfolio maintains a dollar-weighted average portfolio maturity of 60 days or less.

Federated Prime Money Fund II, on the other hand, invests primarily in a portfolio of high-quality, fixed-income securities issued by banks, corporations and the U.S. government, maturing in 397 days or less. Certain of the securities in which the Fund invests pay interest at a rate that is periodically adjusted (“Adjustable Rate Securities”). The Fund’s adviser actively manages the Fund’s portfolio, seeking to limit the credit risk taken by the Fund and to select investments with enhanced yields.

Federated Prime Money Fund II’s adviser performs a fundamental credit analysis to develop an approved list of issuers and securities that meet its standard for minimal credit risk. The Fund’s adviser monitors the credit risks of all portfolio securities on an ongoing basis by reviewing periodic financial data and ratings of NRSROs.

Federated Prime Money Fund II’s adviser monitors the credit risks of all portfolio securities by reviewing periodic financial data and ratings of NRSROs designated by Fund’s Board (“Designated NRSROs”). The Fund targets a dollar-weighted average portfolio maturity (“DWAM”) range based upon its interest rate outlook. The Fund formulates its interest rate outlook by analyzing a variety of factors, such as current and expected U.S. economic growth; current and expected interest rates and inflation; and the Federal Reserve Board’s monetary policy. The Fund’s adviser structures the portfolio by investing primarily in variable rate instruments and commercial paper to achieve a limited barbell structure. In this structure, the maturities of the Fund’s investments tend to be concentrated towards the shorter and longer ends of the maturity range of Fund’s investments, rather than evenly spread across the range. The Fund’s adviser generally adjusts the DWAM by increasing or decreasing the maturities of the investments at the longer end of the barbell. The Fund’s adviser generally shortens the DWAM when it expects interest rates to rise and extends the DWAM when it expects interest rates to fall. This strategy seeks to enhance the returns from favorable interest rate changes and reduce the effect of unfavorable changes.

Federated Prime Money Fund II: (1) maintains a DWAM of 60 days or less; and (2) maintains a weighted average life (“WAL”) of 120 days or less. For purposes of calculating DWAM, the maturity of an Adjustable Rate Security generally will be the period remaining until its next interest rate adjustment. For purposes of calculating WAL, the maturity of an Adjustable Rate Security will be its stated final maturity, without regard to interest rate adjustments; accordingly, the 120-day WAL limitation could serve to limit the Fund’s ability to invest in Adjustable Rate Securities.

Because Money Market Portfolio and Federated Prime Money Fund II have similar investment objectives and policies, their principal risks will be similar. All mutual funds take investment risks. Therefore, it is possible to lose money by investing in either Fund.

The following summarizes some of the more significant risk factors relating to both Funds. References to “Fund” are to both Money Market Portfolio and Federated Prime Money Fund II.

| | • | | Issuer Credit Risk. There is a possibility that issuers of securities in which the Fund may invest may default on the payment of interest or principal on the securities when due, which would cause the Fund to lose money. |

8

| | • | | Interest Rate Risk. Prices of fixed-income securities generally fall when interest rates rise. Interest rate changes have a greater effect on the price of fixed-income securities with longer maturities. |

| | • | | Risk Associated with Investing Share Purchase Proceeds. On days where there are net purchases of shares, the Fund must invest the proceeds at prevailing market yields or hold cash. If the yield of the securities purchased is less than that of the securities already in the Fund’s portfolio, or if the Fund holds cash, the Fund’s yield will likely decrease. Conversely, net purchases on days on which short-term yields rise will cause the Fund’s yield to increase. In the event of significant changes in short-term yields or significant net purchases, the Fund retains the discretion to close to new investments. However, the Fund is not required to close, and no assurance can be given that this will be done in any given circumstance. |

| | • | | Risk Associated with the Use of Amortized Cost. In the unlikely event that the Fund’s Board were to determine pursuant to Rule 2a-7 that the extent of the deviation between the Fund’s amortized cost per share and its market-based NAV per share may result in material dilution or other unfair results to shareholders, the Board will cause the Fund to take such action as it deems appropriate to eliminate or reduce to the extent practicable such dilution or unfair results. |

| | • | | Changing Distribution Levels Risk. There is no guarantee that the Fund will provide a certain level of income or that any such income will exceed the rate of inflation. |

| | • | | Short Term Trading. The Funds may sell portfolio securities prior to maturity to realize gains or losses to shorten the funds’ average maturity and may reduce or withhold dividends if they deem such actions appropriate to maintain a stable net asset value. In addition, the Funds may attempt, from time to time, to increase their yield by trading to take advantage of variations in the markets for short-term money market instruments. |

Because Federated Prime Money Fund II may invest in commercial paper, demand instruments, bank instruments, asset-backed securities, insurance contracts, foreign securities, securities that have credit enhancement, repurchase agreements, other investment companies and other permissible investments as a principal strategy, it is also subject to the following additional principal risks:

| | • | | Prepayment Risk. The Fund may invest in asset-backed and mortgage-backed securities, which may be subject to prepayment risk. If interest rates fall, and unscheduled prepayments on such securities accelerate, the Fund will be required to reinvest the proceeds at the lower interest rates then available. |

| | • | | Risk of Foreign Investing. Because the Fund invests in securities issued by foreign companies, the Fund may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than would otherwise be the case. |

| | • | | Counterparty Credit Risk. Counterparty credit risk includes the possibility that a party to a transaction involving the Fund will fail to meet its obligations. This could cause the Fund to lose the benefit of the transaction or prevent the Fund from selling or buying other securities to implement its investment strategies. |

| | • | | Sector Risk. A substantial part of the Fund’s portfolio may be comprised of securities issued by companies in the financial services industry. As a result, the Fund will be more susceptible to any economic, business, political or other developments which generally affect these companies. |

| | • | | Credit Enhancement Risk. The securities in which the Fund invests may be subject to credit enhancement (for example, guarantees, letters of credit or bond insurance). If the credit quality of the credit enhancement provider (for example, a bank) is downgraded, the rating on a security credit enhanced by such credit enhancement provider also may be downgraded. Having multiple securities credit enhanced by the same credit enhancement provider will increase the adverse effects on the Fund that are likely to result from a downgrading of, or a default by, such a credit enhancement provider. |

9

| | • | | Risk Associated with Investing Share Purchase Proceeds. On days where there are net purchases of Shares, the Fund must invest the proceeds at prevailing market yields or hold cash. If the yield of the securities purchased is less than that of the securities already in the Fund’s portfolio, or if the Fund holds cash, the Fund’s yield will likely decrease. Conversely, net purchases on days on which short-term yields rise will cause the Fund’s yield to increase. In the event of significant changes in short-term yields or significant net purchases, the Fund retains the discretion to close to new investments. However, the Fund is not required to close, and no assurance can be given that this will be done in any given circumstance. |

HIGH GRADE BOND PORTFOLIO AND STRATEGIC YIELD PORTFOLIO – FEDERATED QUALITY BOND FUND II

High Grade Bond Portfolio’s investment objective is to generate as high a level of current income as is consistent with investments in a diversified portfolio of high grade income-bearing debt securities. Strategic Yield Portfolio’s investment objective is to seek as high a level of current income as is consistent with an investment in a diversified portfolio of lower-rated, higher-yielding income-bearing securities. Strategic Yield Portfolio also seeks capital appreciation, but only when consistent with its primary investment objective. Federated Quality Bond Fund II’s investment objective is to provide current income by investing in a diversified portfolio of investment-grade, fixed-income securities.

Each of High Grade Bond Portfolio and Federated Quality Bond Fund II normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in high grade bonds.

High Grade Bond Portfolio intends to maintain an intermediate (typically 2-7 years) average portfolio duration. High grade bonds are debt securities rated, at the time of purchase, in the three highest rating categories by an NRSRO (e.g., A or higher by either Moody’s or S&P) or unrated securities that the Portfolio’s investment adviser determines are of comparable quality. It may invest in a broad range of debt securities of domestic corporate and government issuers. The corporate securities in which it may invest include debt securities of various types and maturities, e.g., debentures, notes, mortgage-backed securities, capital securities and other collateralized or asset-backed securities, as well as “junk” bonds. (Junk bonds are those rated, at the time of purchase, below the fourth credit grade by an NRSRO (e.g., Ba/BB or below by Moody’s/S&P) or unrated securities that the Portfolio’s adviser determines are of comparable quality.) The Portfolio may invest up to 20% of its total assets in unrated debt securities or debt securities rated lower than the three highest grades of S&P or Moody’s; or in convertible or non-convertible preferred stocks rated within the three highest grades of S&P or Moody’s. The Portfolio will not directly purchase common stocks. However, it may retain up to 10% of the value of its assets in common stocks acquired either by conversion of debt securities or by the exercise of warrants attached to debt securities. It may also invest up to 25% of its net assets in debt securities of foreign issuers as consistent with its investment objective.

Strategic Yield Portfolio pursues its investment objective by investing primarily (i.e., at least 65% of total assets) in fixed-income securities, including convertible and non-convertible debt securities and preferred stock, rated Baa/BBB or lower by Moody’s/S&P (and their unrated equivalents) including “junk” bonds; or in other high-yielding/high-risk securities that its investment adviser believes offer attractive risk/return characteristics. The remaining assets may be held in cash or investment-grade commercial paper, obligations of banks and savings institutions, U.S. Government securities, government agency securities and repurchase agreements. The Portfolio may also invest in mortgage-backed securities, capital securities and other collateralized or asset-backed securities. It may invest up to 25% of its net assets in debt securities of foreign issuers as consistent with its investment objective.

Federated Quality Bond Fund II invests in a diversified portfolio of investment-grade, fixed-income securities consisting primarily of corporate debt securities, U.S. government and privately issued mortgage-backed securities, and U.S. Treasury and agency securities. The Fund’s adviser seeks to enhance performance by allocating relatively more of its portfolio to the security type that the Fund’s adviser expects to offer the best balance between current income and risk. Some of the corporate debt securities in which the Fund invests are considered to be “foreign securities.” The foreign securities in which the Fund invests will be predominately denominated in U.S. dollars. The Fund may invest in derivative contracts and/or hybrid instruments to implement elements of its investment strategy as more fully described in the Fund’s prospectus.

10

Although the value of Federated Quality Bond Fund II’s shares will fluctuate, the Fund’s adviser will seek to manage the magnitude of fluctuation by limiting, under normal market conditions, the Fund’s dollar-weighted average maturity to between three and ten years and dollar-weighted average duration to between three and seven years. Maturity reflects the time until a fixed-income security becomes payable. Duration measures the price sensitivity of a fixed-income security to changes in interest rates.

Federated Quality Bond Fund II intends to invest in the securities of U.S. government-sponsored entities (GSEs), including GSE securities that are not backed by the full faith and credit of the U.S. government, such as those issued by the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, and the Federal Home Loan Bank System. These entities are, however, supported through federal subsidies, loans or other benefits. The Fund may also invest in GSE securities that are supported by the full faith and credit of the U.S. government, such as those issued by the Government National Mortgage Association. Finally, Federated Quality Bond Fund II may invest in a few GSE securities that have no explicit financial support, but which are regarded as having implied support because the federal government sponsors their activities. Such securities include those issued by the Farm Credit System and the Financing Corporation.

While Strategic Yield Portfolio may invest up to 65% of its assets in non-investment grade securities, Federated Quality Bond Fund II does not invest in such securities.

Because High Grade Bond Portfolio, Strategic Yield Portfolio and Federated Quality Bond Fund II have similar investment objectives and policies, their principal risks will be similar. All mutual funds take investment risks. Therefore, it is possible to lose money by investing in any of these Funds.

The following summarizes some of the more significant risk factors relating to all three Funds. References to “Fund” are to High Grade Bond Portfolio, Strategic Yield Portfolio and Federated Quality Bond Fund II.

| | • | | Interest Rate Risk. Prices of fixed-income securities generally fall when interest rates rise. Interest rate changes have a greater effect on the price of fixed-income securities with longer durations. |

| | • | | Credit Risk. There is a possibility that issuers of securities in which a Fund may invest may default in the payment of interest or principal on the securities when due, which would cause the Fund to lose money. |

| | • | | Call and Prepayment Risk. A Fund’s performance may be adversely affected by the possibility that an issuer of a security held by the Fund may redeem the security prior to maturity at a price below its current market value. For instance, when homeowners prepay their mortgages in response to current interest rates, a Fund will be required to reinvest the proceeds at the current interest rates available. Also, when interest rates fall, the price of mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities. |

| | • | | Risk of Foreign Investing. Because each Fund invests in securities issued by foreign companies, the Fund’s share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than could otherwise be the case. |

| | • | | Liquidity Risk. The fixed-income securities in which each Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. Liquidity risk also refers to the possibility that a Fund may not be able to sell a security or close out a derivative contract when it wants to. |

Because Federated Quality Bond Fund II may invest in complex collateralized mortgage obligations (“CMOs”), derivatives contracts and other hybrid instruments as a principal strategy, it is also subject to the following additional risks:

| | • | | Risk Associated with CMOs. CMOs with complex or highly variable prepayment terms, such as companion classes, IOs, POs, inverse floaters and residuals, generally entail greater market, prepayment and liquidity risks than other mortgage-backed securities. For example, their prices are more volatile and their trading market may be more limited. |

11

| | • | | Risk of Investing in Derivative Contracts and Hybrid Instruments. Please see important discussion below. |

| | • | | Leverage Risk. Leverage risk is created when an investment exposes the Fund to a level of risk that exceeds the amount invested. |

Strategic Yield Portfolio also is subject to the following risk:

| | • | | Risk Associated with Noninvestment-Grade Securities. The Portfolio may invest a significant portion of its assets in securities rated below investment grade (which are also known as junk bonds), which may be subject to greater credit, interest rate and liquidity risks than investment-grade securities. |

MANAGED PORTFOLIO – FEDERATED CAPITAL INCOME FUND II

Managed Portfolio’s investment objective is to seek the highest level of total return through income and capital appreciation. Federated Capital Income Fund II’s investment objective is to achieve high current income and moderate capital appreciation.

Managed Portfolio pursues its objective through a fully managed investment policy consisting of investment in the following three market sectors: (1) common stocks and other equity securities, (2) high grade debt securities and (3) money market instruments. It invests in both securities of companies that its investment adviser believes have a potential to earn a high return on capital and/or are undervalued by the market (i.e., “value stocks”) and securities of those companies that display more traditional growth characteristics such as established records of growth in sales and earnings. The Portfolio also invests in high grade bonds and money market securities. There are no restrictions as to the proportion of one or another type of security that it may hold. Accordingly, at any given time, it may be substantially invested in equity securities, debt securities or money market instruments. The Portfolio may also invest in mortgage-backed securities, capital securities, and other collateralized or asset-backed securities. It may invest up to 25% of its net assets in equity securities of foreign issuers as consistent with its investment objective.

Federated Capital Income Fund II, on the other hand, pursues its investment objective by investing in both equity and fixed-income securities that have high relative income potential. The Fund’s adviser’s process for selecting equity investments attempts to identify mature, mid- to large-cap value companies with high relative dividend yields that are likely to maintain and increase their dividends. The Fund’s adviser selects fixed-income investments that offer high current yields. The Fund’s adviser expects that these fixed-income investments will primarily be investment-grade debt issues, domestic non-investment-grade debt securities (also known as “junk bonds” or “high-yield bonds”) and foreign investment-grade and non-investment-grade fixed-income securities, including emerging market debt securities. The Fund’s adviser continuously analyzes a variety of economic and market indicators, considers the expected performance and risks unique to these categories of fixed-income investments, and attempts to strategically allocate among the categories to achieve strong income across changing business cycles. The Fund’s adviser does not target an average maturity or duration for the Fund’s portfolio and may invest in bonds of any maturity range. The Fund may buy or sell foreign currencies in lieu of or in addition to non-dollar denominated fixed-income securities in order to increase or decrease its exposure to foreign interest rate and/or currency markets.

Certain of the government securities in which Federated Capital Income Fund II invests are not backed by the full faith and credit of the U.S. government, such as those issued by the Federal Home Loan Mortgage Corporation (Freddie Mac), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Bank System. These entities are, however, supported through federal subsidies, loans or other benefits. The Fund may also invest in government securities that are supported by the full faith and credit of the U.S. government, such as those issued by the Government National Mortgage Association (Ginnie Mae). Finally, The Fund may invest in a few government securities that have no explicit financial support, but which are regarded as having implied support because the federal government sponsors their activities.

Federated Capital Income Fund II may use derivative contracts and/or hybrid instruments to implement elements of its investment strategy as more fully described in its Prospectus.

12

Because Managed Portfolio and Federated Capital Income Fund II have similar investment objectives and policies, their principal risks generally will be similar. All mutual funds take investment risks. Therefore, it is possible to lose money by investing in either fund.

The following summarizes some of the more significant risk factors relating to both Funds. References to “Fund” are to both Managed Portfolio and Federated Capital Income Fund II.

| | • | | Stock Market Risk. The value of equity securities in the Funds’ portfolio will fluctuate and, as a result, the Funds’ share price may decline suddenly or over a sustained period of time. |

| | • | | Risk Related to Investing for Value. Each Fund generally uses a “value” style of investing, so that the Fund’s share price may lag that of other funds using a different investment style. |

| | • | | Credit Risk. It is possible that issuers of fixed-income securities in which a Fund invests will fail to pay interest or principal on these securities when due, which would result in the Fund losing money. |

| | • | | Liquidity Risk. Trading opportunities are more limited for fixed-income securities that have not received any credit ratings, have received ratings below investment grade or are not widely held. Trading opportunities are more limited for collateralized mortgage obligations that have complex terms or that are not widely held. These features may make it more difficult to sell or buy a security at a favorable price or time. Consequently, a Fund may have to accept a lower price to sell a security, sell other securities to raise cash or give up an investment opportunity, any of which could have a negative effect on the Fund’s performance. Infrequent trading of securities may also lead to an increase in their price volatility. |

| | • | | Interest Rate Risk. Prices of fixed-income securities generally fall when interest rates rise. Interest rate changes have a greater effect on the price of fixed-income securities with longer maturities. |

| | • | | Prepayment Risk. When homeowners prepay their mortgages in response to lower interest rates, a Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the price of mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities. |

| | • | | Risk of Foreign Investing. Because either Fund may invest in securities issued by foreign companies, the Fund’s share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than could otherwise be the case. |

Because Federated Capital Income Fund II may invest in non-investment-grade securities, American Depository Receipts (“ADRs”), foreign currency-denominated securities, emerging markets, derivatives contracts, exchange traded funds (“ETFs”) and hybrid instruments as a principal strategy, it is also subject to the following additional principal risks:

| | • | | Risk Associated with Non-Investment-Grade Securities. Securities rated below investment grade may be subject to greater interest rate, credit and liquidity risks than investment-grade securities. |

| | • | | Risk of Investing in ADRs and Domestically Traded Securities of Foreign Issuers. Because the Fund may invest in ADRs and other domestically traded securities of foreign companies, the Fund’s share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than would otherwise be the case. |

| | • | | Currency Risk. Exchange rates for currencies fluctuate daily. Accordingly, a Fund may experience increased volatility with respect to the value of its shares and its returns as a result of its exposure to foreign currencies through direct holding of such currencies or holding of non-U.S. dollar denominated securities. |

| | • | | Emerging Markets Risk. Securities issued or traded in emerging markets generally entail greater risks than securities issued or traded in developed markets. Emerging market countries may have relatively |

13

| | unstable governments and may present the risk of nationalization of businesses, expropriation, confiscatory taxation or, in certain instances, reversion to closed market, centrally planned economics. |

| | • | | Risk of Investing in Derivative Contracts and Hybrid Instruments. Please see important disclosure below. |

| | • | | ETF Risk. An investment in an ETF generally presents the same primary risks as an investment in a conventional fund (i.e., one that is not exchanged traded) that has the same investment objectives, strategies and policies. |

VALUE GROWTH PORTFOLIO AND BLUE CHIP PORTFOLIO — FEDERATED CAPITAL APPRECIATION FUND II

Value Growth Portfolio investment objective is to seek capital appreciation, Blue Chip Portfolio’s investment objective is to seek long-term growth of capital and income, and Federated Capital Appreciation Fund II’s investment objective is to seek capital appreciation.

Value Growth Portfolio invests primarily (i.e., at least 65% of total assets) in equity securities of any size companies that its investment adviser believes have a potential to earn a high return on capital and/or are undervalued by the market (i.e., “value stocks”). It also may invest in “special situation” companies. (Special situation companies are ones that, in its investment adviser’s opinion, have potential for significant future earnings growth but have not performed well in the recent past. These companies may include ones with management changes, corporate or asset restructuring or significantly undervalued assets.) The Portfolio may also invest in capital securities and up to 25% of its net assets in equity securities of foreign issuers as consistent with its investment objective.

Under normal circumstances, Blue Chip Portfolio pursues its objective by investing at least 80% of net assets, plus the amount of any borrowings for investment purposes, in equity securities of well-capitalized, established companies. The Portfolio focuses on common stocks of approximately 50 large, well-known companies that its investment adviser believes to collectively comprise a representative cross-section of major industries, commonly referred to as “blue chip” companies, which are generally identified by their substantial capitalization, established history of earnings and superior management structure. Blue chip companies typically fall in the top 20% of U.S. companies by market capitalization. With respect to 25% of its total assets, the Portfolio may, from time to time, hold more than 5% of its assets in one or more such companies.

Federated Capital Appreciation Fund II pursues its investment objective by investing primarily in common stock of domestic companies with large and medium market capitalizations that offer superior growth prospects or of companies whose stock is undervalued. The Fund may also invest in common stocks of foreign issuers (including ADRs), and may also invest in convertible securities and preferred stocks of these domestic and foreign companies. The Fund may use derivative contracts and/or hybrid instruments to implement elements of its investment strategy as more fully described in the Fund’s prospectus.

Because Value Growth Portfolio, Blue Chip Portfolio and Federated Capital Appreciation Fund II have similar investment objectives and policies, their principal risks will be similar. All mutual funds take investment risks. Therefore, it is possible to lose money by investing in either fund.

The following summarizes the one significant risk factor relating to all three Funds. References to “Fund” are to Value Growth Portfolio, Blue Chip Portfolio and Federated Capital Appreciation Fund II.

| | • | | Stock Market Risk. The value of equity securities in a Fund’s portfolio will fluctuate and, as a result, the Fund’s share price may decline suddenly or over a sustained period of time. |

14

Value Growth Portfolio and Federated Capital Appreciation Fund II are subject to the following additional risks:

| | • | | Risk of Foreign Investing. Because these Funds may invest in securities issued by foreign companies, the Fund’s share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than could otherwise be the case. |

Federated Capital Appreciation Fund II also is subject to the following risks:

| | • | | Currency Risk. Exchange rates for currencies fluctuate daily. The combination of currency risk and market risk tends to make securities traded in foreign markets more volatile than securities traded exclusively in the United States. |

| | • | | Liquidity Risk. The equity securities in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. |

| | • | | Risk Related to Company Size. Because the smaller companies in which the Fund may invest may have unproven track records, a limited product or service base and limited access to capital, they may be more likely to fail than larger companies. |

| | • | | Sector Risk. Because the Fund may allocate relatively more assets to certain industry sectors than others, the Fund’s performance may be more susceptible to any developments which affect those sectors emphasized by the Fund. |

| | • | | Custodial Services and Related Investment Costs. Custodial services and other costs relating to investment in international securities markets generally are more expensive than in the United States. Such markets have settlement and clearance procedures that differ from those in the United States. The inability of the Fund to make intended securities purchases due to settlement problems could cause the Fund to miss attractive investment opportunities. |

| | • | | Risk of Investing in Derivative Contracts and Hybrid Instruments. Please see important disclosure below. |

Value Growth Portfolio is also subject to the following additional risk:

| | • | | Risk Related to Investing for Value. The Portfolio generally uses a “value” style of investing, so that its share price may lag that of other funds using a different investment style. |

ADDITIONAL INFORMATION REGARDING DERIVATIVES STRATEGIES

As described above, certain Federated Insurance Funds may use derivative contracts and/or hybrid instruments to increase or decrease the allocation of their portfolios to securities or types of securities in which each such Federated Insurance Fund may invest directly. These Federated Insurance Funds may also, for example, use derivative contracts to:

| | • | | obtain premiums from the sale of derivative contracts; |

| | • | | realize gains from trading a derivative contract; or |

| | • | | hedge against potential losses. |

Derivative contracts are financial instruments that require payments based upon changes in the values of designated securities, commodities, currencies, indices or other assets or instruments including other derivative contracts (each a “Reference Instrument” and collectively, “Reference Instruments”). The Federated Insurance Funds’ exposure to derivative contracts and hybrid instruments (either directly or through its investment in another investment

15

company) involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. First, changes in the value of the derivative contracts and hybrid instruments in which a Federated Insurance Fund invests may not be correlated with changes in the value of the underlying Reference Instruments or, if they are correlated, may move in the opposite direction than originally anticipated. Second, while some strategies involving derivatives may reduce the risk of loss, they may also reduce potential gains or, in some cases, result in losses by offsetting favorable price movements in portfolio holdings. Third, there is a risk that derivative contracts and hybrid instruments may be erroneously priced or improperly valued and, as a result, the Fund may need to make increased cash payments to the counterparty. Fourth, exposure to derivative contracts and hybrid instruments may have tax consequences to the Fund and its shareholders. For example, derivative contracts and hybrid instruments may cause the Fund to realize increased ordinary income or short-term capital gains (which are treated as ordinary income for federal income tax purposes) and, as a result, may increase taxable distributions to shareholders. Such distributions are not expected to be taxable for federal income tax purposes for variable annuity or variable life insurance contractowners. In addition, under certain circumstances certain derivative contracts and hybrid instruments may cause the Fund to: (a) incur an excise tax on a portion of the income related to those contracts and instruments; and/or (b) reclassify, as a return of capital, some or all of the distributions previously made to shareholders during the fiscal year as dividend income. Fifth, a common provision in over-the-counter (“OTC”) derivative contracts permits the counterparty to terminate any such contract between it and the Fund, if the value of the Fund’s total net assets declines below a specified level over a given time period. Factors that may contribute to such a decline (which usually must be substantial) include significant shareholder redemptions and/or a marked decrease in the market value of the Fund’s investments. Any such termination of the Fund’s OTC derivative contracts may adversely affect the Fund (for example, by increasing losses and/or costs, and/or preventing the Fund from fully implementing its investment strategies). Sixth, the Fund may use a derivative contract to benefit from a decline in the value of a Reference Instrument. If the value of the Reference Instrument declines during the term of the contract, the Fund makes a profit on the difference (less any payments the Fund is required to pay under the terms of the contract). Any such strategy involves risk. There is no assurance that the Reference Instrument will decline in value during the term of the contract and make a profit for the Fund. The Reference Instrument may instead appreciate in value creating a loss for the Fund. Finally, derivative contracts and hybrid instruments may also involve other risks described in this Prospectus/Proxy Statement, such as stock market, interest rate, credit, currency, liquidity and leverage risks.

The EquiTrust Variable Portfolios do not invest in derivatives contracts.

COMPARISON OF INVESTMENT LIMITATIONS

Each Fund has fundamental investment limitations that cannot be changed without shareholder approval, and non-fundamental investment limitations which may be changed with Board approval but without shareholder approval. The summary below is qualified in its entirety by the description of the fundamental limitations of each Federated Insurance Fund and each EquiTrust Variable Portfolio is set forth in Annex B to this Prospectus/ Proxy Statement. The limitations for each Federated Insurance Fund and each corresponding EquiTrust Variable Portfolio are substantially similar; however, you may want to note the following differences.

MONEY MARKET PORTFOLIO – FEDERATED PRIME MONEY FUND II

With respect to 100% of its assets, Money Market Portfolio may not purchase securities of any issuer (other than U.S. Government securities or government agency securities) if, as a result, more than 5% of the value of its assets (taken at the time of investment) would be invested in securities of that issuer. On the other hand, Federated Prime Money Fund II may not make such purchases with respect to securities comprising 75% of the value of its total assets.

Money Market Portfolio is subject to the following limitations whereas Federated Prime Money Fund II is not.

Money Market Portfolio may not:

16

| | • | | Purchase securities of other investment companies, except (i) by purchase in the open market involving only customary brokers’ commissions and only if immediately thereafter not more than 5% of its total net assets would be invested in such securities, or (ii) as part of a merger, consolidation or acquisition of assets. |

| | • | | Purchase any securities on margin (except that it may obtain such short-term credit as may be necessary for the clearance of purchases and sales of portfolio securities) or make short sales unless, by virtue of its ownership of other securities, it has the right to obtain securities equivalent in kind and amount to the securities sold and, if the right is conditional, the sale is made upon the same condition. |

| | • | | Purchase or retain the securities of any issuer if any of the officers or trustees of the EquiTrust Variable Fund or any officers or directors of its investment adviser own individually more than 0.50% of the securities of such issuer and together own more than 5% of the securities of such issuer. |

| | • | | Borrow money except from banks for temporary or emergency purposes, and in no event in excess of 5% of its total assets, or pledge or mortgage more than 15% of its total assets (Federated Prime Money Fund II may borrow money, directly or indirectly, and issue senior securities to the maximum extent permitted under the 1940 Act). |

| | • | | Participate on a joint (or a joint and several) basis in any trading account in securities (but this does not include the “bunching” of orders for the sale or purchase of the Portfolio’s securities with the other EquiTrust Variable Portfolios or with other investment company and client accounts managed by its investment adviser or its affiliates to reduce brokerage commissions or otherwise to achieve best overall execution). |

| | • | | Alone, or together with any other EquiTrust Variable Portfolios, make investments for the purpose of exercising control over, or management of, any issuer. |

| | • | | Lend its portfolio securities in excess of 20% of its net assets or in a manner inconsistent with the guidelines set forth under “Investment Objectives, Policies and Techniques” in its SAI. |

| | • | | Invest in foreign securities. |

| | • | | Write, purchase or sell puts, calls or combinations thereof, other than writing covered call options. |

HIGH GRADE BOND PORTFOLIO – FEDERATED QUALITY BOND FUND II

High Grade Bond Portfolio may not borrow money, except from banks for temporary or emergency purposes, and in no event in excess of 5% of its total assets, pledge or mortgage more than 15% of its total assets, or issue senior securities, except as appropriate to evidence indebtedness.

Federated Quality Bond Fund II will not issue senior securities except that the Fund may borrow money and engage in reverse repurchase agreements in amounts up to one-third of the value of its total assets, including the amounts borrowed. The Fund will not borrow money or engage in reverse repurchase agreements for investment leverage, but rather as a temporary, extraordinary or emergency measure to facilitate management of the portfolio by enabling the Fund to meet redemption requests when the liquidation of portfolio securities is deemed to be inconvenient or disadvantageous. The Fund will not purchase any securities while borrowings in excess of 5% of the value of its total assets are outstanding.

High Grade Bond Portfolio may not lend its portfolio securities in excess of 20% of its net assets, whereas Federated Quality Bond Fund II may lend portfolio securities up to one-third of the value of its total assets.

High Grade Bond Portfolio is subject to the following limitations whereas Federated Quality Bond Fund II is not:

17

High Grade Bond Portfolio may not: