1

2 Forward-Looking Statements This presentation contains various presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2012, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include: • changes in general economic conditions, the real estate industry and the markets in which we operate; • difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; • our liquidity and refinancing demands; • our ability to obtain or refinance maturing debt; • our ability to maintain compliance with covenants contained in our debt facilities; • availability of capital; • difficulties in completing acquisitions; • our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; • increases in interest rates and operating costs, including insurance premiums and real property taxes; • risks related to natural disasters; • general volatility of the capital markets and the market price of shares of our capital stock; • our failure to maintain our status as a REIT; • changes in real estate and zoning laws and regulations; • legislative or regulatory changes, including changes to laws governing the taxation of REITs; • litigation, judgments or settlements; • our ability to maintain rental rates and occupancy levels; • competitive market forces; and • the ability of manufactured home buyers to obtain financing and the level of repossessions by manufactured home lenders Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements.

Sun Communities, Inc. (NYSE: SUI) 3 Owns, develops, and manages manufactured housing (“MH”) and recreational vehicle (“RV”) sites. Sells, leases, and finances new and used manufactured homes. 183 communities across 24 states. Comprised of over 52,800 MH and 14,500 RV sites.

4 Gary A. Shiffman-Chairman and Chief Executive Officer Karen J. Dearing – Chief Financial Officer John B. McLaren – Chief Operating Officer Jonathan M. Colman– Executive Vice President of Acquisitions Experienced And Proven Leadership Team Provided the vision and leadership to generate consistent profitability through all cycles. Developed the home rental program and related underwriting and financing programs that have driven growth in occupancy and home sales. Managed the company through the Great 2008 Recession with a minimal loss of occupancy while maintaining the dividend and avoiding the sale of stock at extremely dilutive levels. Recruited a deep bench to support the growth of the communities and programs across the portfolio. Assimilated community growth of 35% (47 communities) over the last 20 months. Achieved performance metrics in occupancy growth, home rentals, and home sales which are unmatched in the industry. Managed the capital structure to reduce leverage and extend debt maturities and maintained financial flexibility during this period of extensive growth.

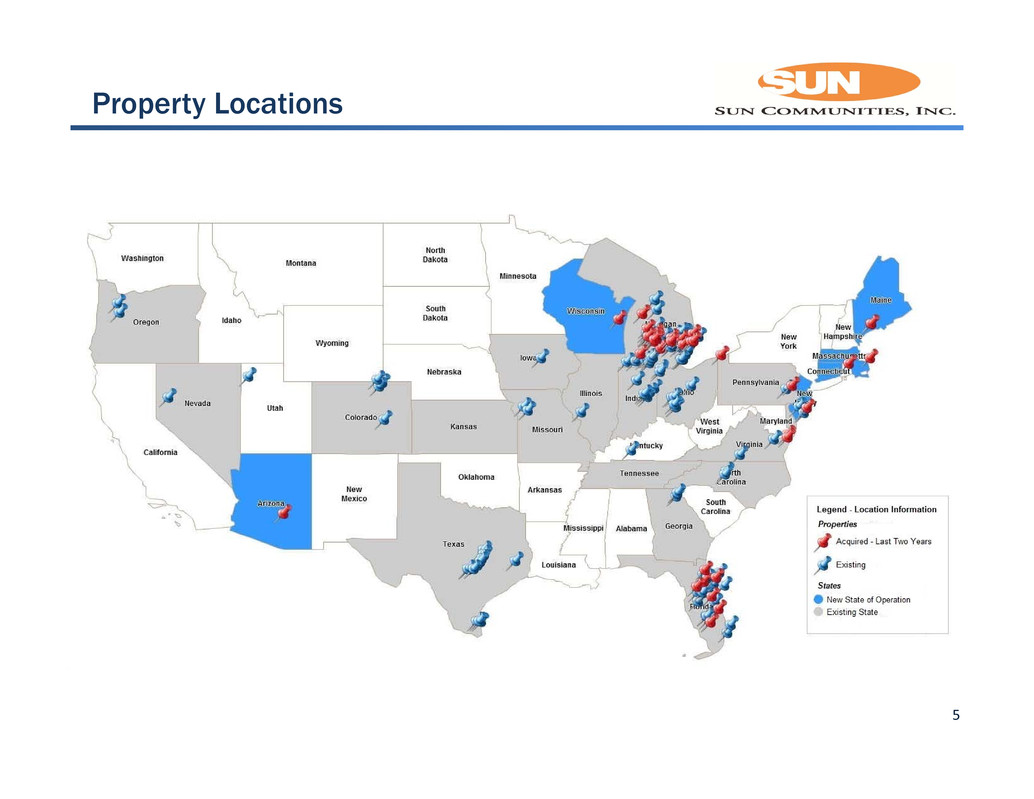

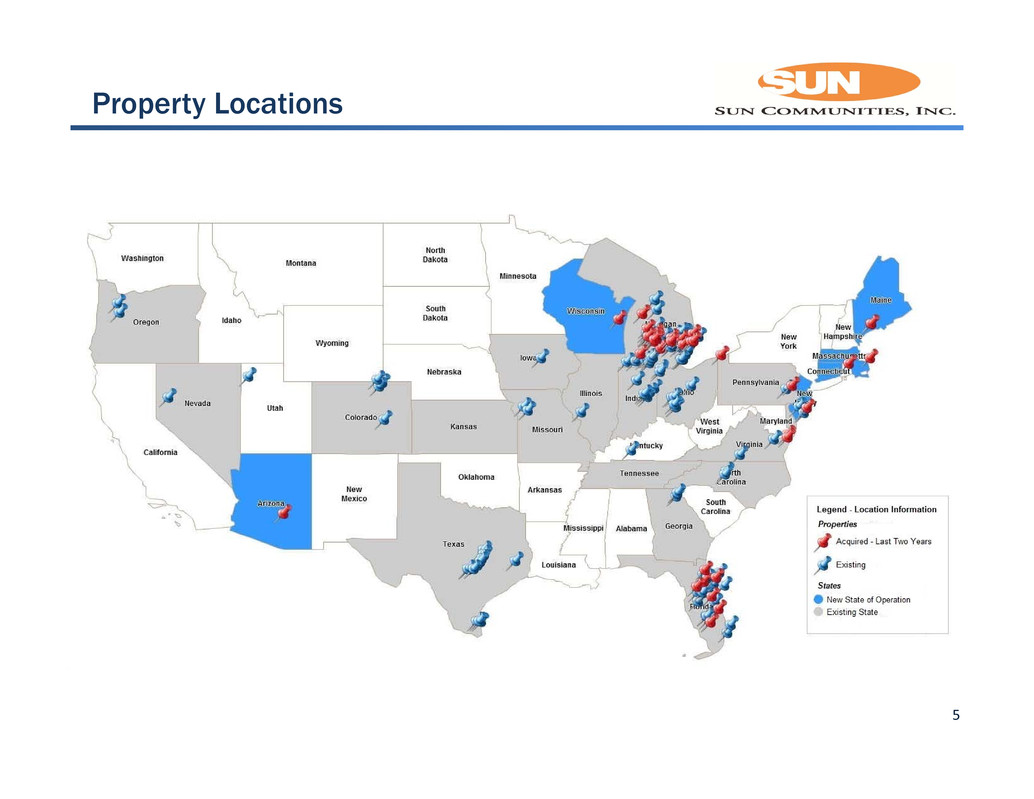

Property Locations 5

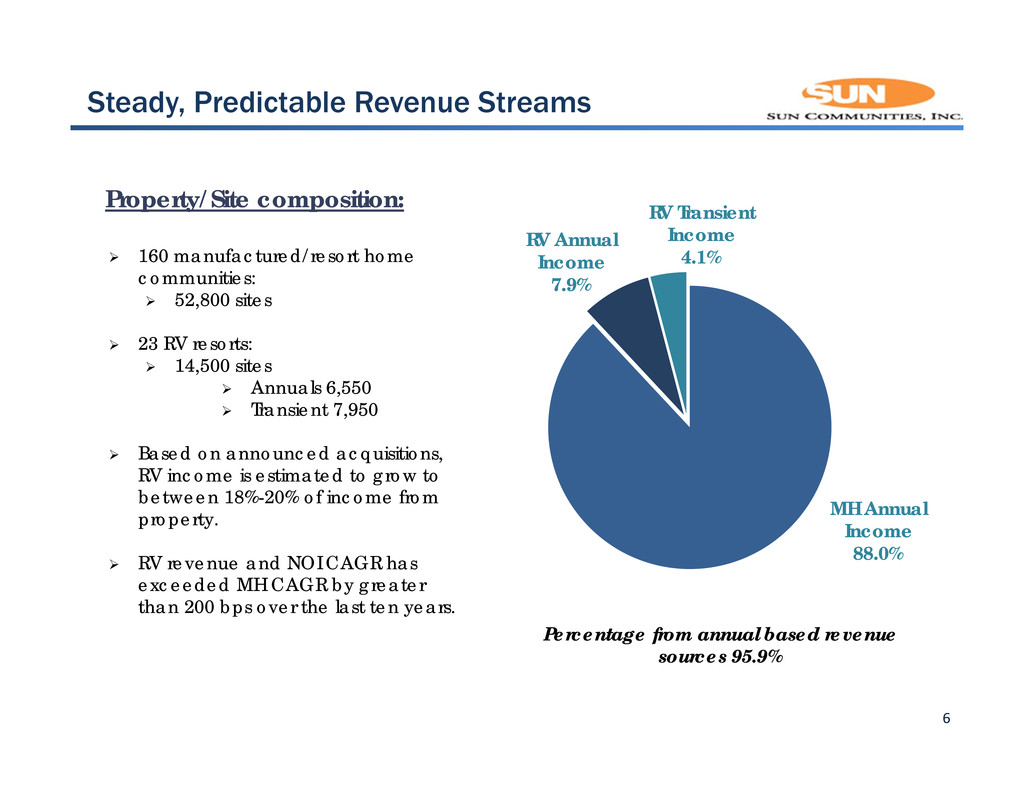

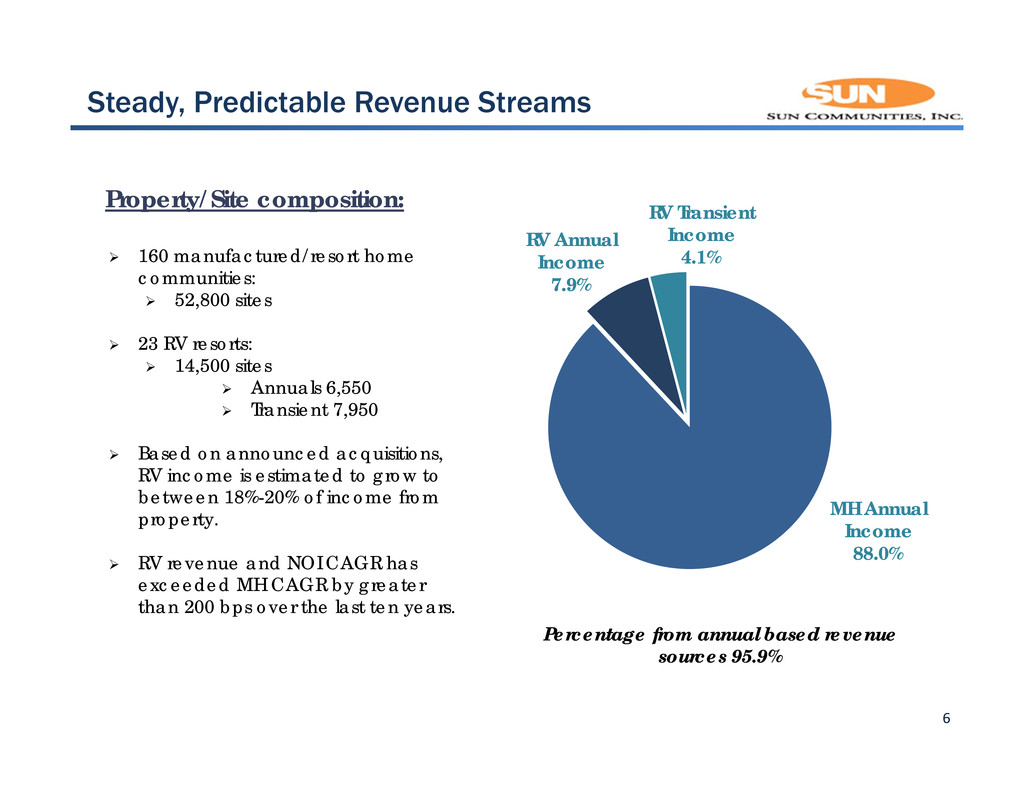

6 MH Annual Income 88.0% RV Annual Income 7.9% RV Transient Income 4.1% 160 manufactured/resort home communities: 52,800 sites 23 RV resorts: 14,500 sites Annuals 6,550 Transient 7,950 Based on announced acquisitions, RV income is estimated to grow to between 18%-20% of income from property. RV revenue and NOI CAGR has exceeded MH CAGR by greater than 200 bps over the last ten years. Property/Site composition: Steady, Predictable Revenue Streams Percentage from annual based revenue sources 95.9%

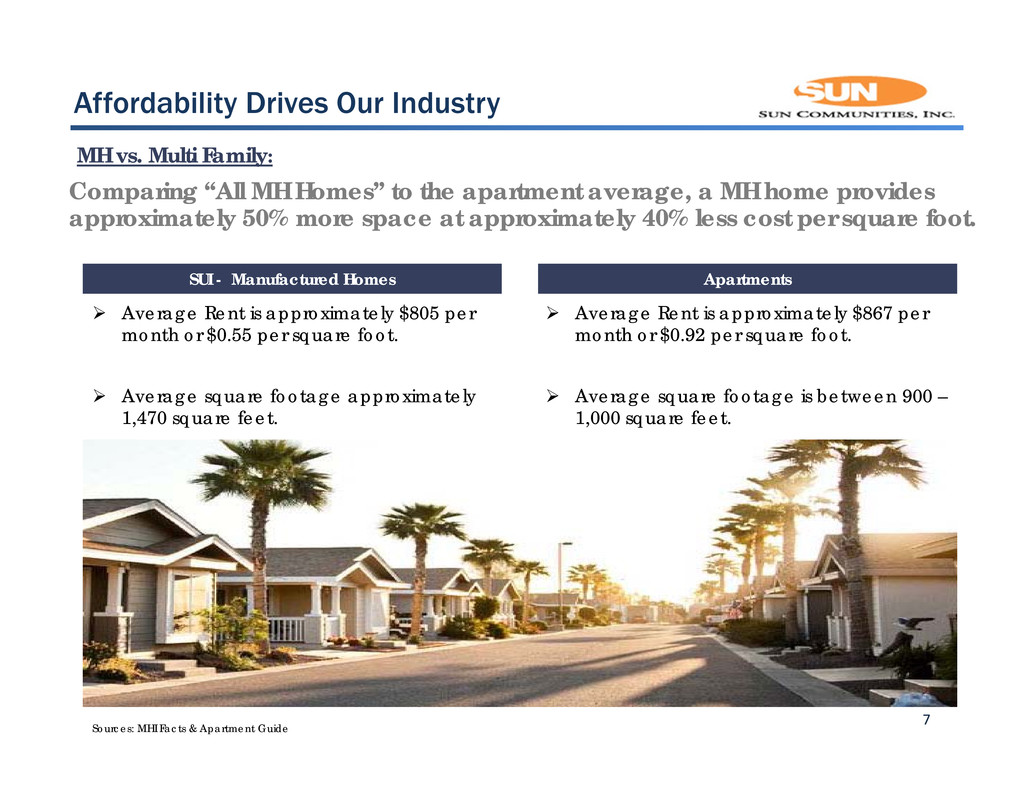

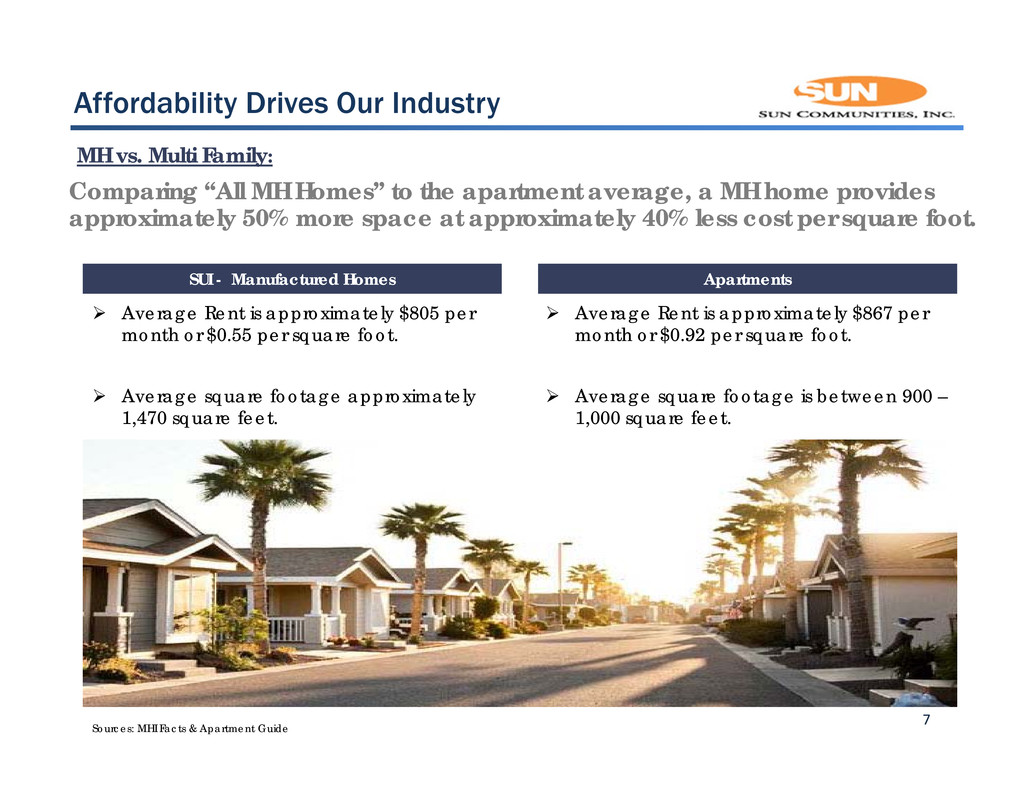

Affordability Drives Our Industry 7 ApartmentsSUI - Manufactured Homes Average Rent is approximately $805 per month or $0.55 per square foot. Average square footage approximately 1,470 square feet. Average Rent is approximately $867 per month or $0.92 per square foot. Average square footage is between 900 – 1,000 square feet. Comparing “All MH Homes” to the apartment average, a MH home provides approximately 50% more space at approximately 40% less cost per square foot. Sources: MHI Facts & Apartment Guide MH vs. Multi Family:

64,300 65,400 64,700 63,100 62,800 60,600 305,900 313,600 292,600 270,900 272,900 267,900 $0 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 2006 2007 2008 2009 2010 2011 Manufactured Housing Single-Family Affordability Drives Our Industry 8 Manufactured home prices are significantly lower than single-family prices nationally. Portion of purchase price attributable to land Source: MHI quick facts Even with the significant drop in single family housing prices since 2007, the average single family home still costs over 4X the price of a MH unit. MH vs. Single Family:

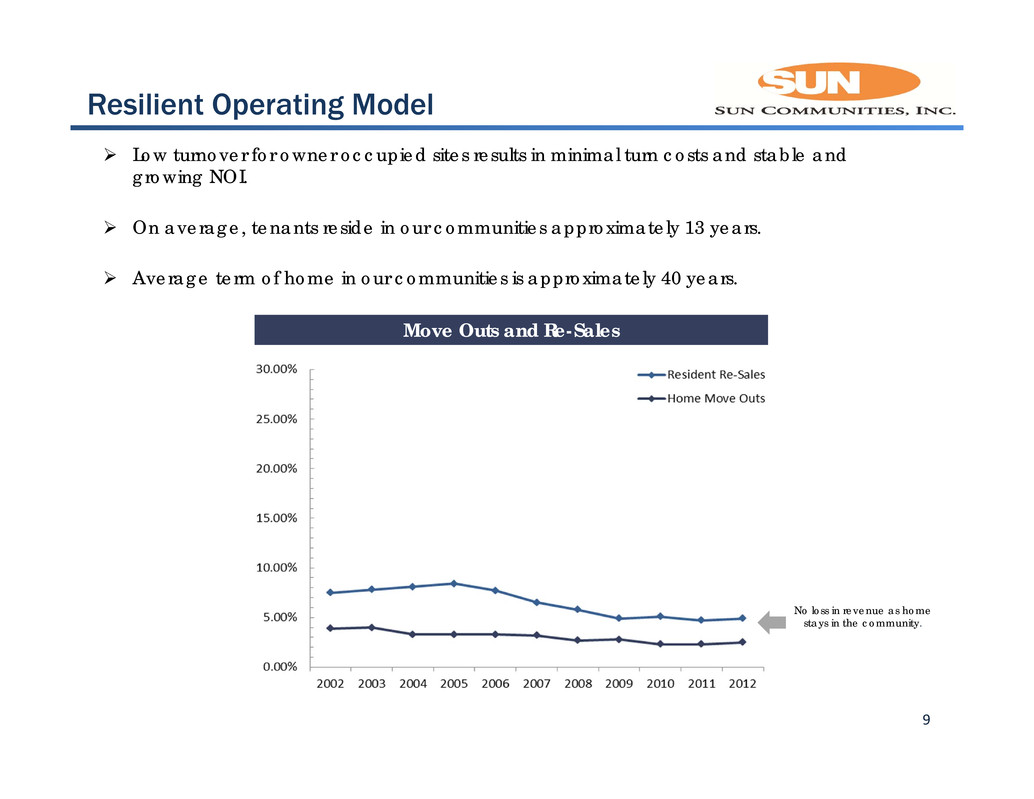

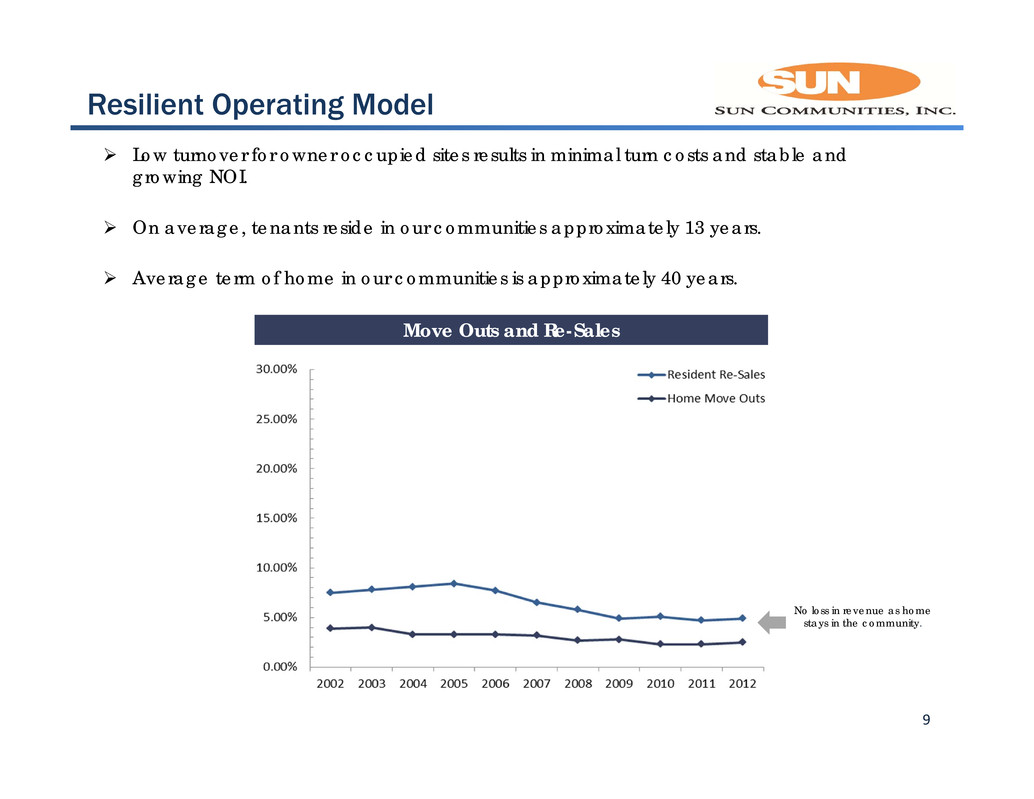

9 Resilient Operating Model Move Outs and Re-Sales Low turnover for owner occupied sites results in minimal turn costs and stable and growing NOI. On average, tenants reside in our communities approximately 13 years. Average term of home in our communities is approximately 40 years. No loss in revenue as home stays in the community.

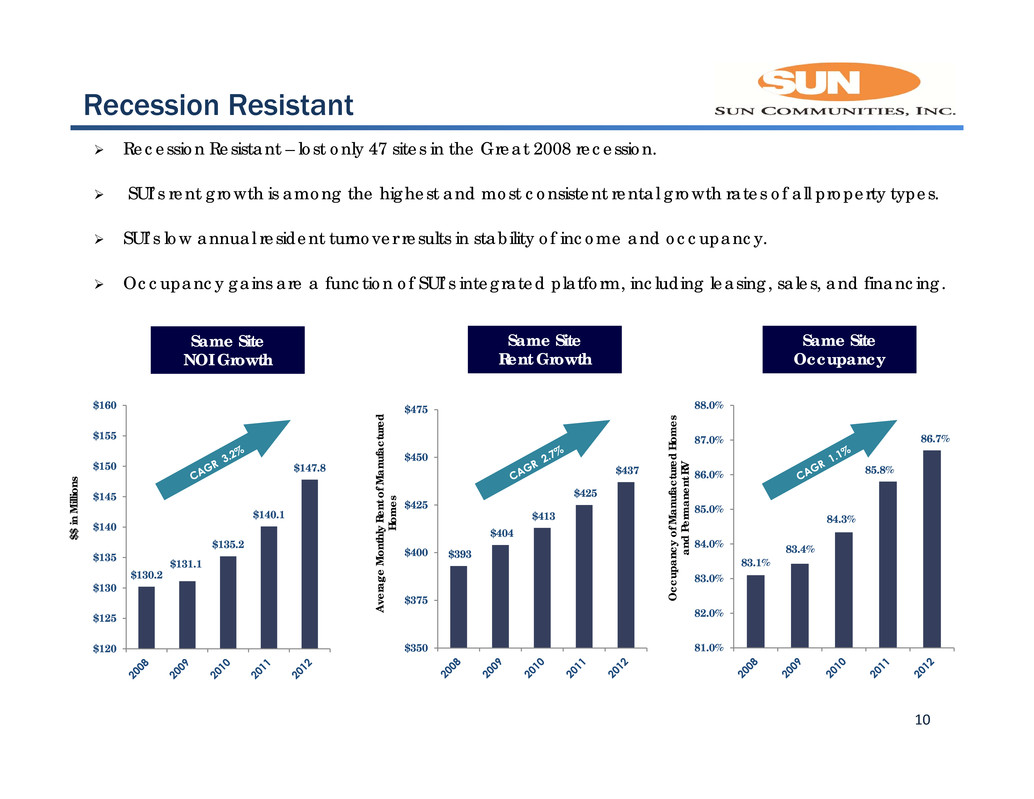

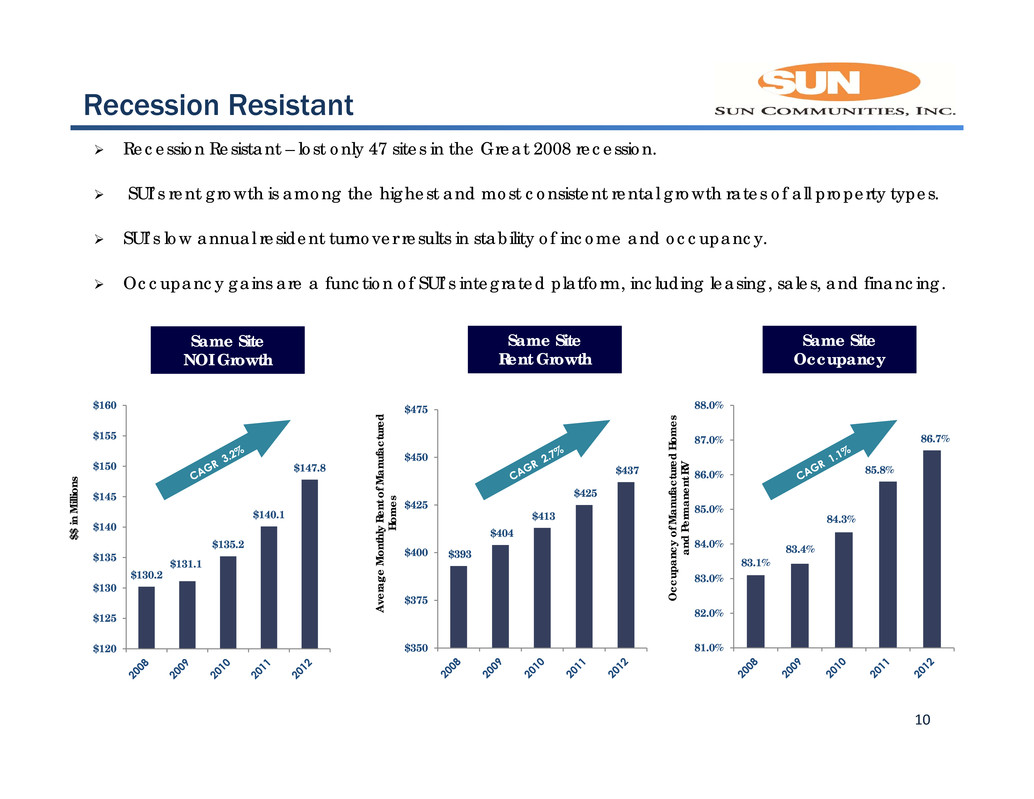

10 Recession Resistant Recession Resistant – lost only 47 sites in the Great 2008 recession. SUI’s rent growth is among the highest and most consistent rental growth rates of all property types. SUI’s low annual resident turnover results in stability of income and occupancy. Occupancy gains are a function of SUI’s integrated platform, including leasing, sales, and financing. O c c u p a n c y o f M a n u f a c t u r e d H o m e s a n d P e r m a n e n t R V A v e r a g e M o n t h l y R e n t o f M a n u f a c t u r e d H o m e s Same Site Occupancy $130.2 $131.1 $135.2 $140.1 $147.8 $120 $125 $130 $135 $140 $145 $150 $155 $160 $ $ i n M i l l i o n s Same Site NOI Growth Same Site Rent Growth $393 $404 $413 $425 $437 $350 $375 $400 $425 $450 $475 83.1% 83.4% 84.3% 85.8% 86.7% 81.0% 82.0% 83.0% 84.0% 85.0% 86.0% 87.0% 88.0%

11 Industry Average‐2.4% Apartment Average‐2.6% SUI Average‐3.8% Same Site NOI Source: Citi Investment research, February 2013. “REITs”- includes an index of REITs across a variety of asset classes including self storage, mixed office, regional malls, shopping centers, multifamily, student housing, manufactured homes and specialty.

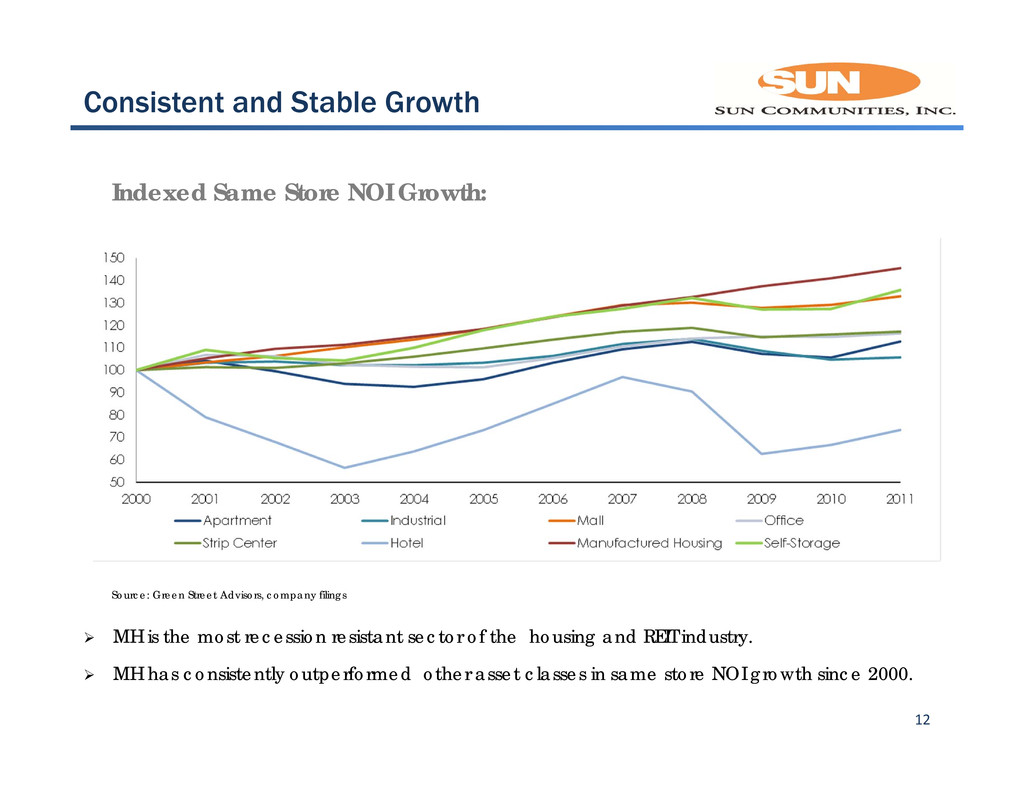

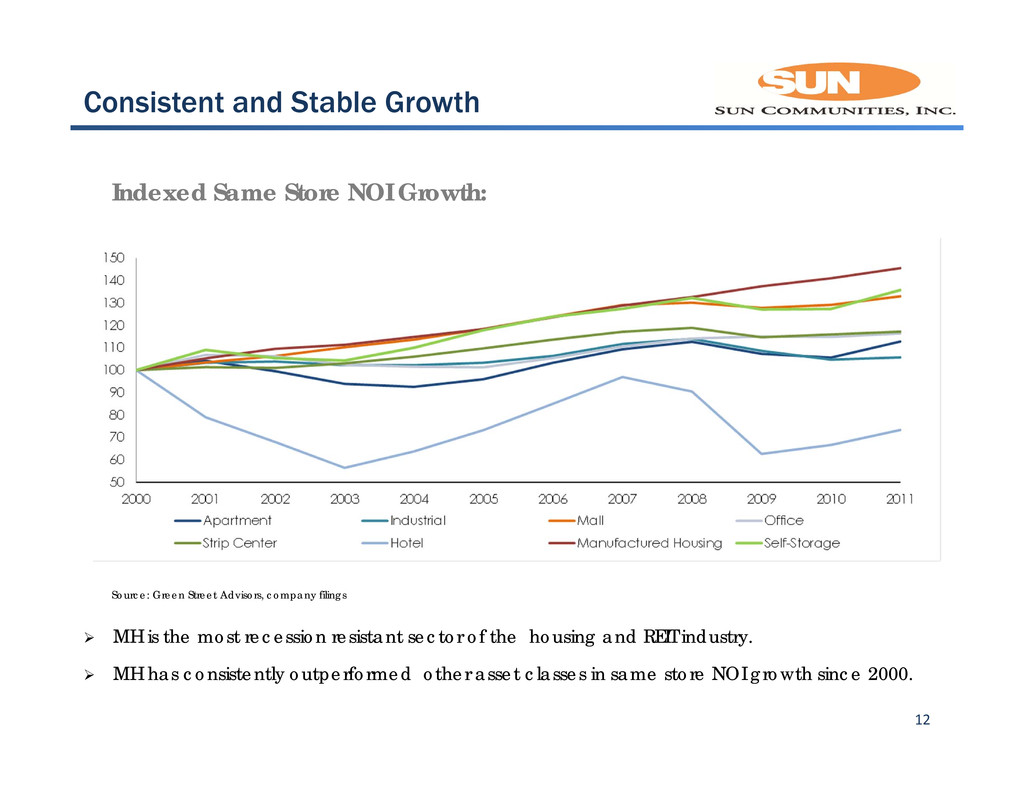

Consistent and Stable Growth 12 Indexed Same Store NOI Growth: MH is the most recession resistant sector of the housing and REIT industry. MH has consistently outperformed other asset classes in same store NOI growth since 2000. Source: Green Street Advisors, company filings

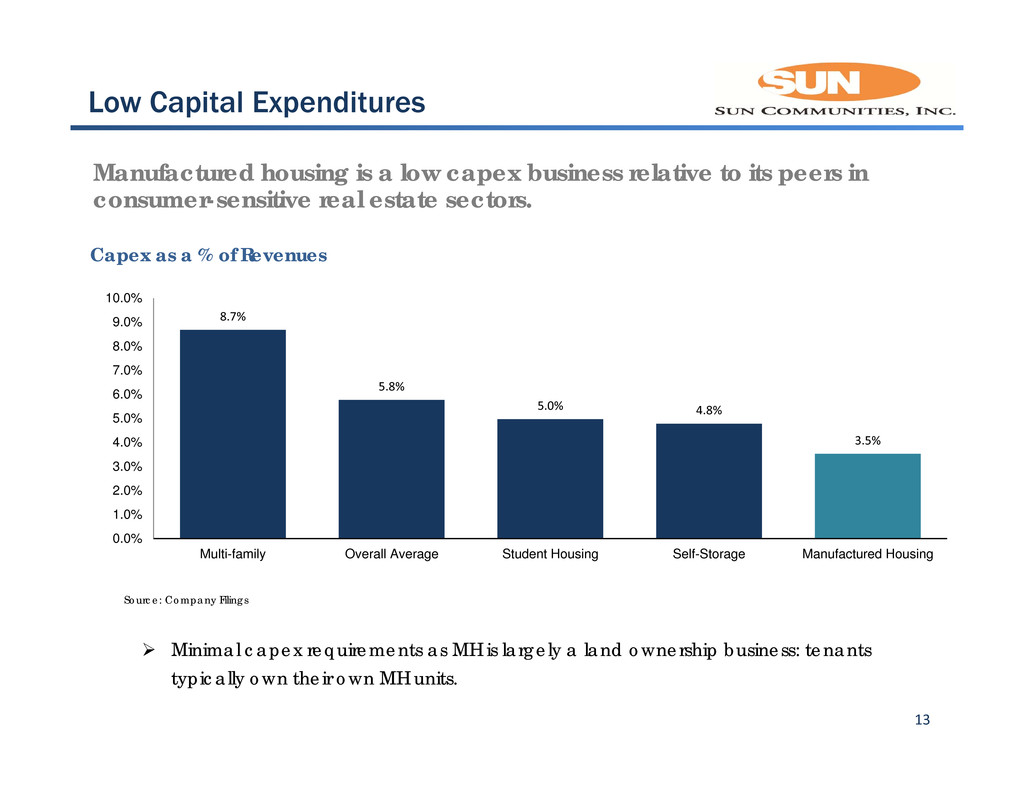

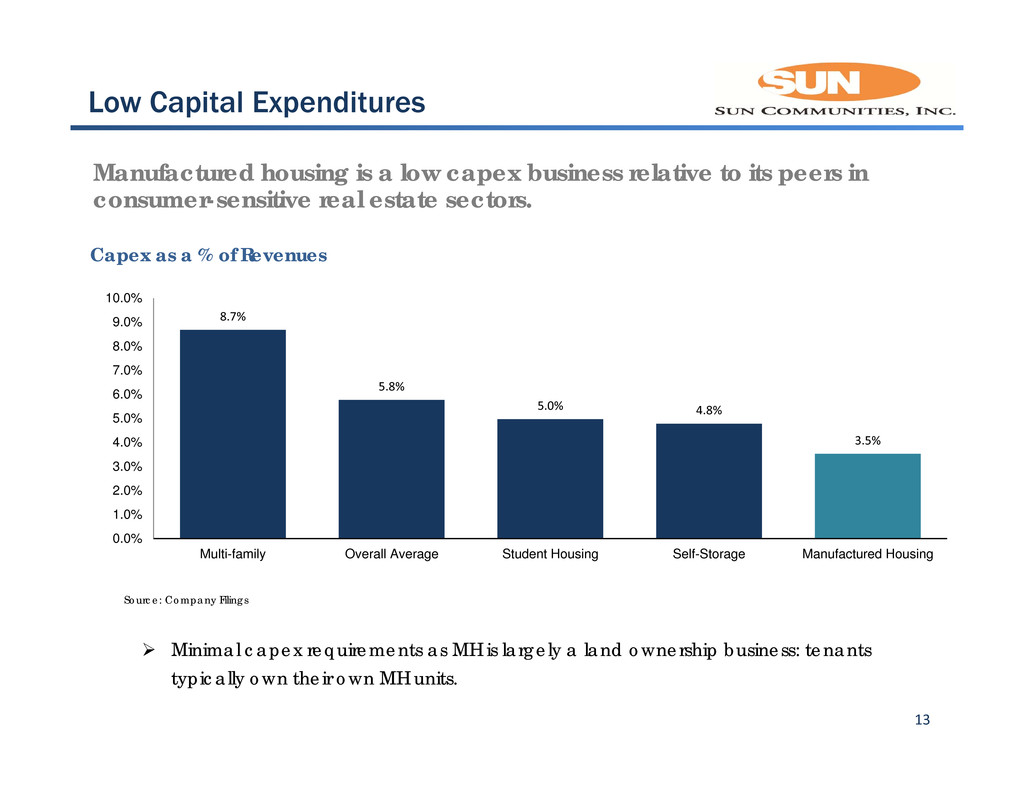

13 Capex as a % of Revenues Source: Company Filings Low Capital Expenditures Minimal capex requirements as MH is largely a land ownership business: tenants typically own their own MH units. Manufactured housing is a low capex business relative to its peers in consumer-sensitive real estate sectors. 8.7% 5.8% 5.0% 4.8% 3.5% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% Multi-family Overall Average Student Housing Self-Storage Manufactured Housing

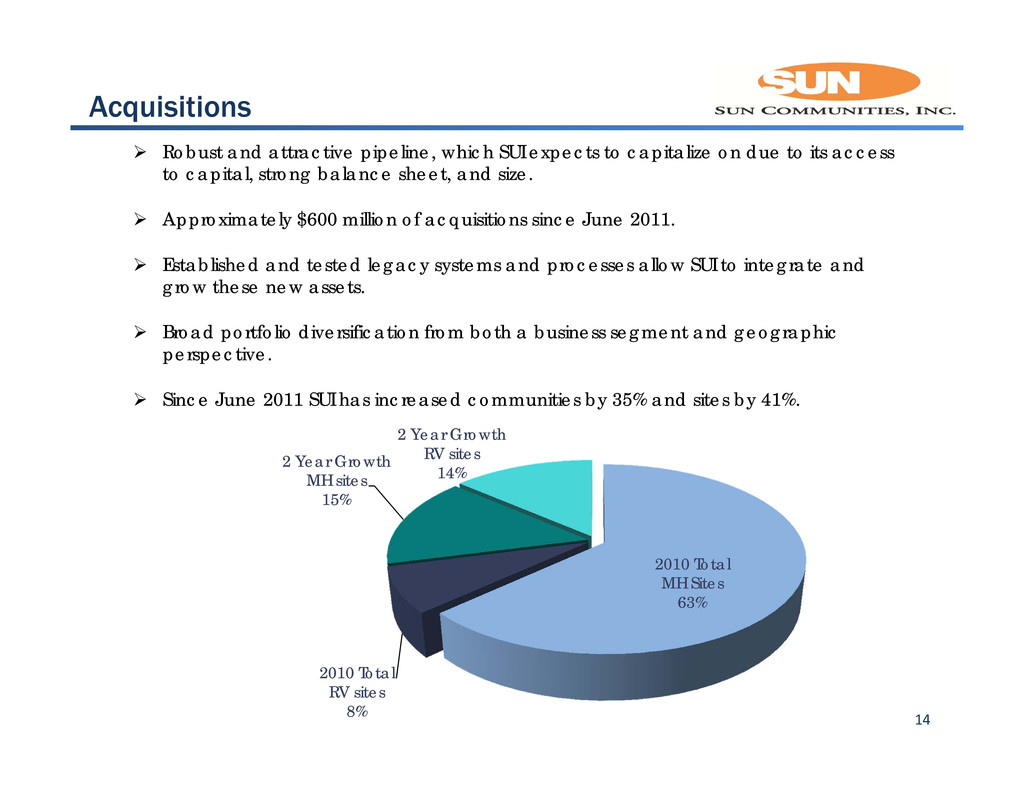

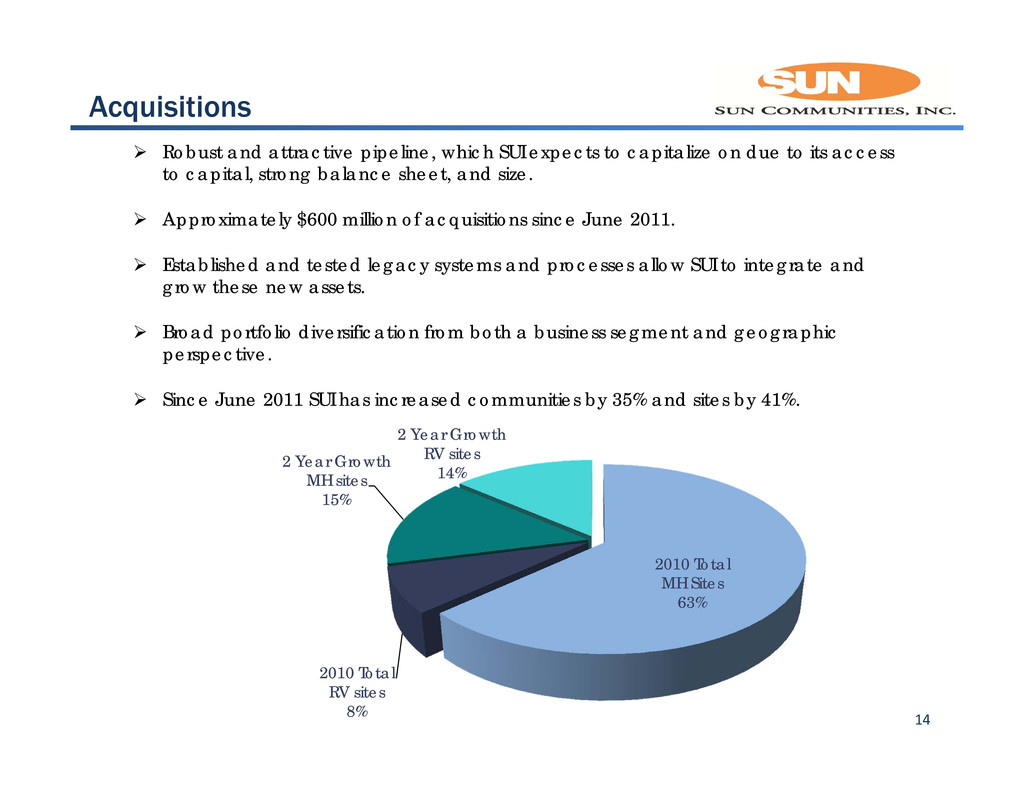

Acquisitions 14 Robust and attractive pipeline, which SUI expects to capitalize on due to its access to capital, strong balance sheet, and size. Approximately $600 million of acquisitions since June 2011. Established and tested legacy systems and processes allow SUI to integrate and grow these new assets. Broad portfolio diversification from both a business segment and geographic perspective. Since June 2011 SUI has increased communities by 35% and sites by 41%. 2010 Total MH Sites 63% 2010 Total RV sites 8% 2 Year Growth MH sites 15% 2 Year Growth RV sites 14%

MH Acquisitions Strategic Acquisition Opportunities Purchase for in-place NOI. Significant vacancy at $0 cost. Implementation of rental program. Acquisition Date June 2011 Overview Located in Western Michigan. 17 MH Communities and 1 RV Community. 5,044 MH sites and 393 RV sites. Acquisition Price $139.3 million Occupancy At acquisition occupancy - 82% 12/31/12 occupancy- 92%. Value Creation utilizing SUI’s IP capital 40% growth in NOI in 2.5 years. Kentland Note: NOI growth is calculated as of 12/31/2012. 15

MH Acquisitions Strategic Acquisition Opportunities 10%-15% below market rents. Implementation of rental program. Undermanaged. Acquisition Date November 2012 Overview Located in Southeast Michigan. 6 MH Communities, 3,586 sites. Acquisition Price $132.5 million Occupancy 12/31/2012 occupancy – 90% Value Creation utilizing SUI’s IP capital Estimated NOI growth of 15-20% within 2 years. Rudgate 16

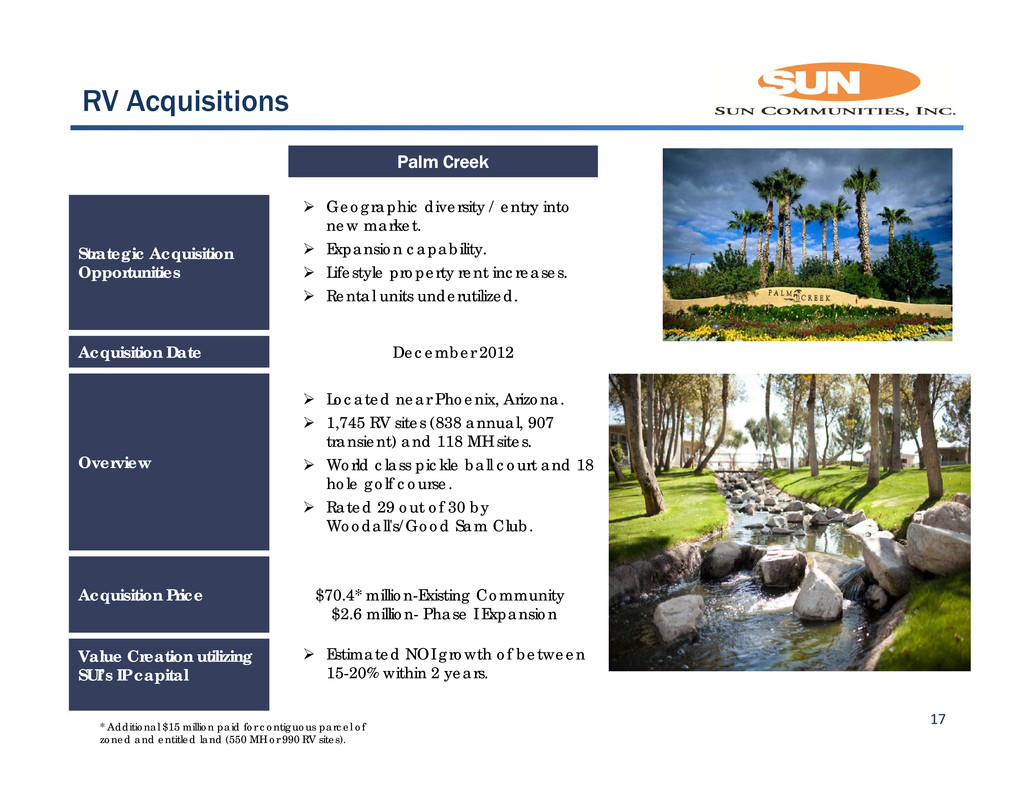

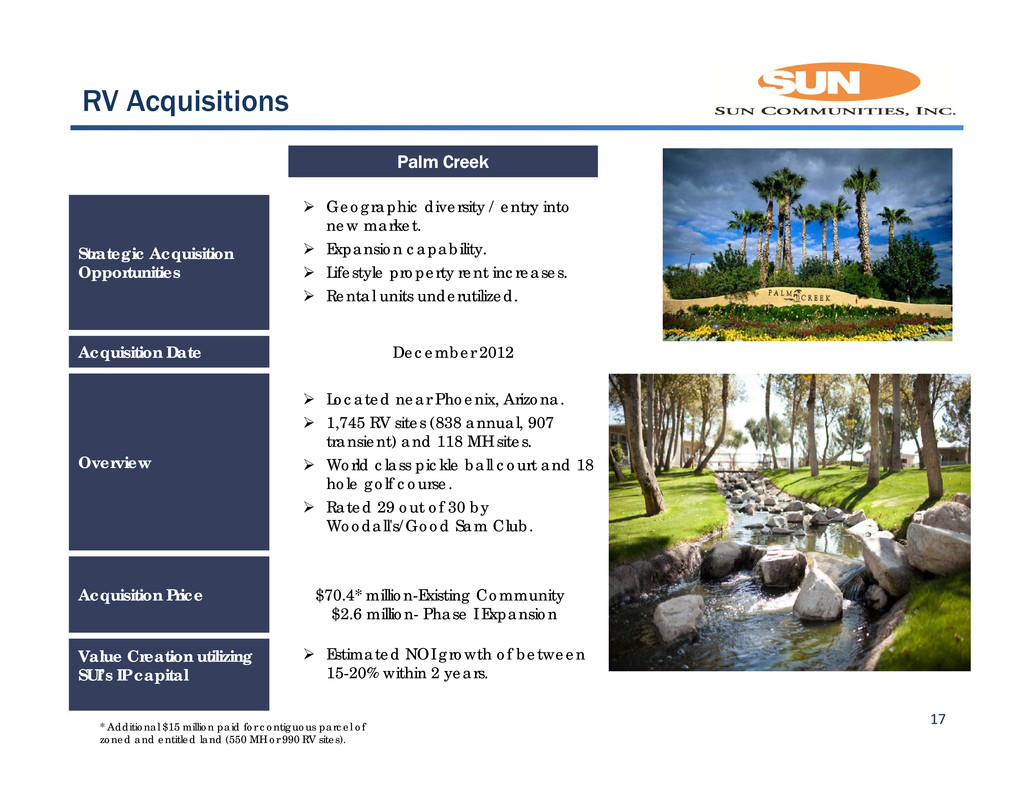

RV Acquisitions Strategic Acquisition Opportunities Geographic diversity / entry into new market. Expansion capability. Lifestyle property rent increases. Rental units underutilized. Acquisition Date December 2012 Overview Located near Phoenix, Arizona. 1,745 RV sites (838 annual, 907 transient) and 118 MH sites. World class pickle ball court and 18 hole golf course. Rated 29 out of 30 by Woodall's/Good Sam Club. Acquisition Price $70.4* million-Existing Community $2.6 million- Phase I Expansion Value Creation utilizing SUI’s IP capital Estimated NOI growth of between 15-20% within 2 years. Palm Creek * Additional $15 million paid for contiguous parcel of zoned and entitled land (550 MH or 990 RV sites). 17

RV Acquisitions Strategic Acquisition Opportunities Geographic & seasonal balance / entry into new northern market. Undermanaged. Invest capital to correct deferred maintenance and reposition properties. Acquisition Date February 2013 Overview Located in Maine, Virginia, Connecticut, Massachusetts, New Jersey, Ohio and Wisconsin. 3 communities on water-front and 6 communities within 10 miles of water. 10 RV Communities. 3,684 RV sites (1,561 annual, 2,033 transient). Acquisition Price $111.5 million Value Creation utilizing SUI’s IP capital After investing in and repositioning properties, expected growth in NOI of between 15-20% within 2 years. Morgan 18

Accretive Expansion Opportunities Expansion Strategy At 12/31/2012, have inventory of nearly 7,000 zoned and entitled sites available for expansion at 33 communities. Expanding in communities with strong demand and occupancy of approximately 95%. Expansion lease-up is driven by sales, rental and relocation programs. 1,100 sites planned for development this year in TX, CO and three other states. 3,300 sites planned for development in the next 5 years. 5 year projected unlevered IRR on typical 100 site expansion of 12% -14%. 19

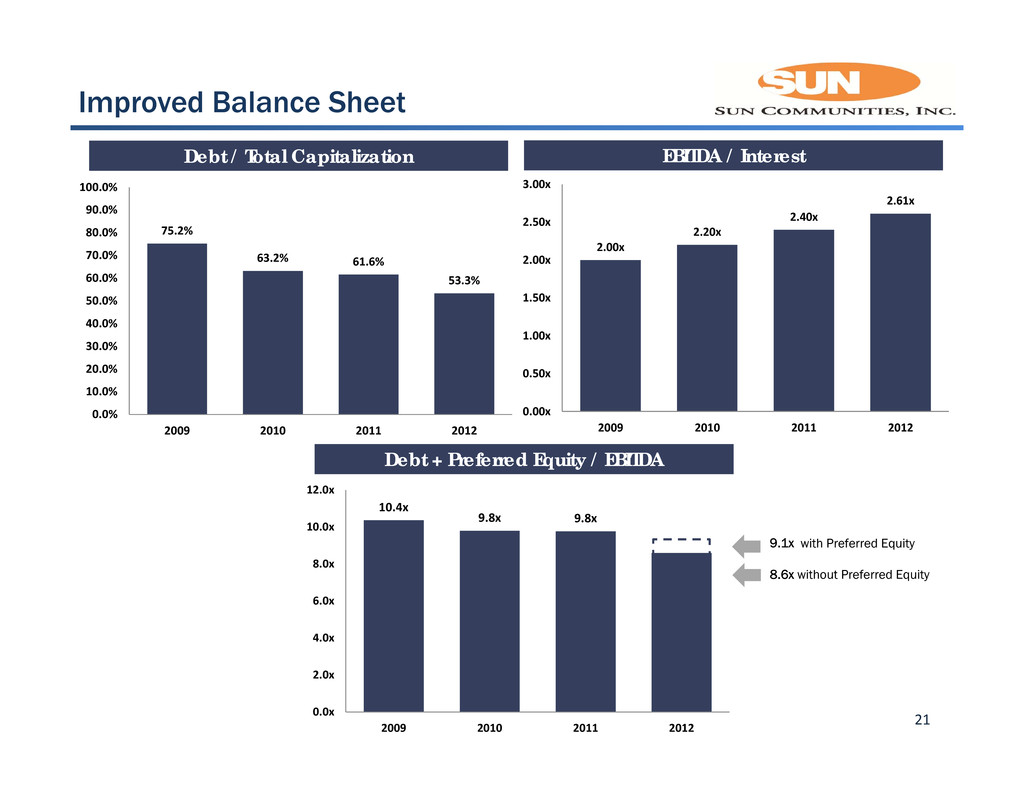

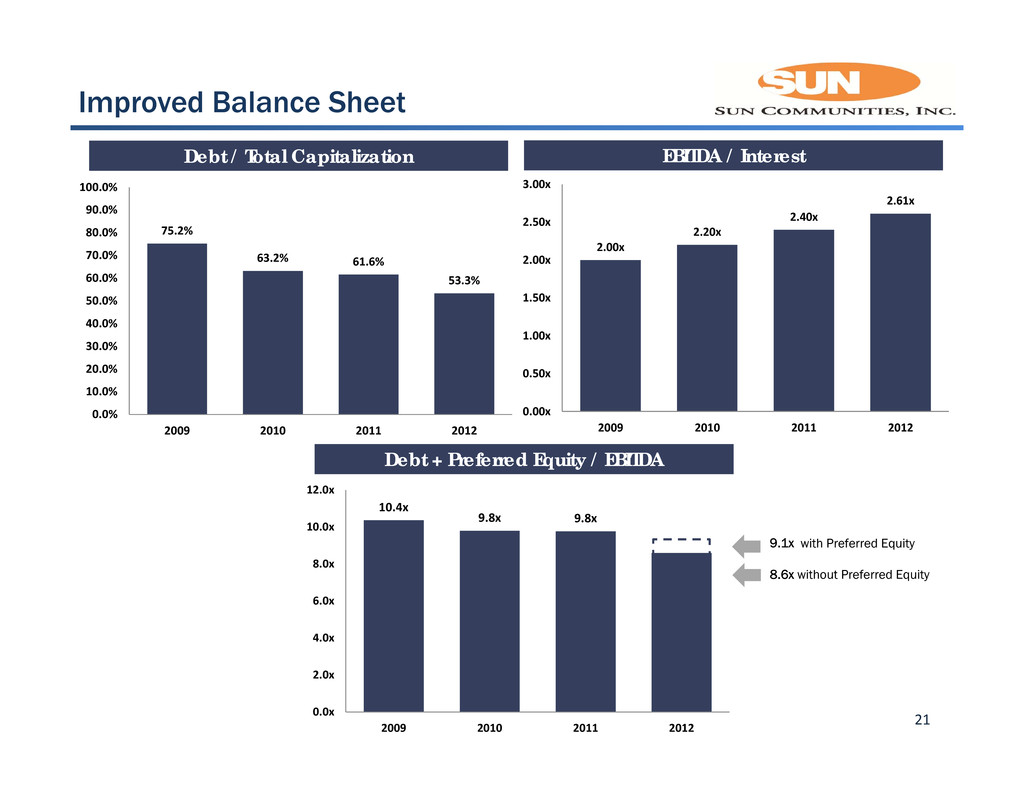

Capital Management Active and thoughtful balance sheet management. Since mid-2011: Refinanced line of credit facility and upsized to $150.0 million. Extended FNMA secured debt of $365.6 million. Accessed the preferred market via an inaugural $85.0 million offering in November 2012 at attractive 7.125% coupon. Raised over $300.0 million of equity, primarily through two successful follow-on offerings in January and September 2012. Focused on ensuring SUI has access to multiple sources of capital across multiple markets at attractive levels. Financial flexibility has positioned SUI to act as a leading industry consolidator. De-levered substantially even as SUI has materially expanded via acquisitions. 20

21 Improved Balance Sheet Debt / Total Capitalization Debt + Preferred Equity / EBITDA EBITDA / Interest 75.2% 63.2% 61.6% 53.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 2009 2010 2011 2012 2.00x 2.20x 2.40x 2.61x 0.00x 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x 2009 2010 2011 2012 10.4x 9.8x 9.8x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 2009 2010 2011 2012 9.1x with Preferred Equity 8.6x without Preferred Equity

22 Appendices

Performance vs. Consumer REIT Peers 23 The manufactured housing REITs have largely been ignored by investors in the past decade and are all at relatively large spreads to similar consumer- sensitive REITs. Implied Cap Rates Source: Green Street Advisors 6.7% 5.5% 5.0% 5.3% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 2/8/2008 8/8/2008 2/8/2009 8/8/2009 2/8/2010 8/8/2010 2/8/2011 8/8/2011 2/8/2012 8/8/2012 2/8/2013 Manufactured Home Park Apartment Self Storage Student Housing

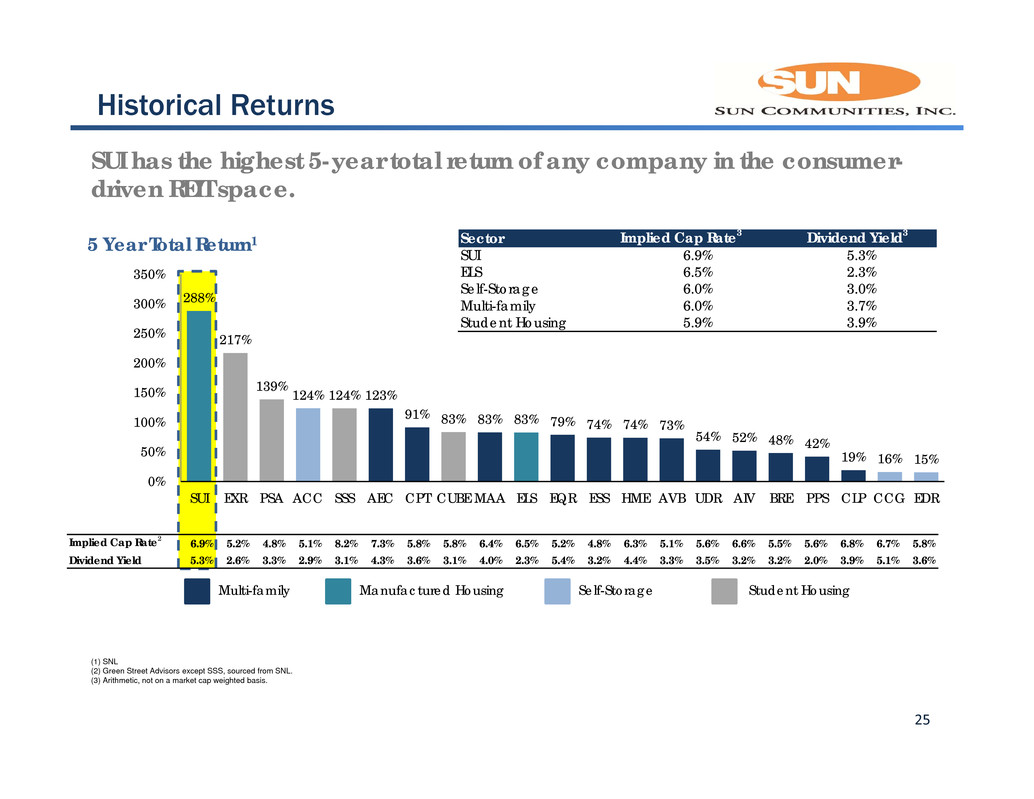

Historical Returns by Sector 24 Manufactured housing REITs have offered one of the most attractive historical returns among REIT sectors.. 1-year Total Returns: 3-year Total Returns: 5-year Total Returns: Source: SNL

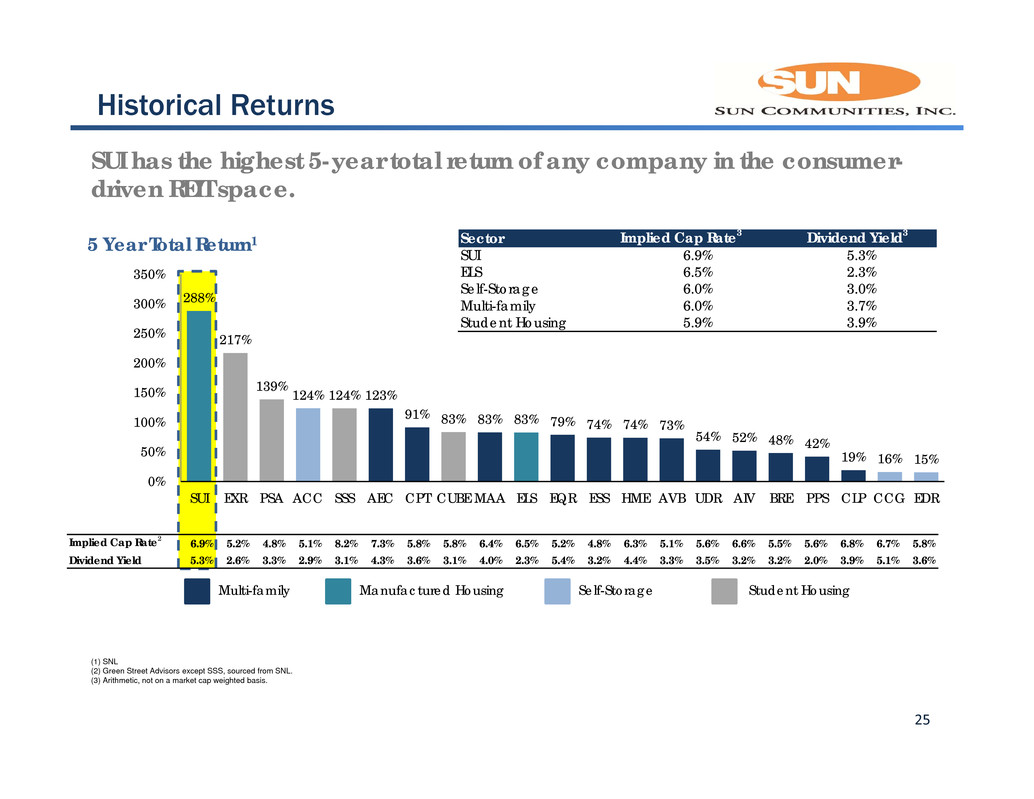

Implied Cap Rate2 6.9% 5.2% 4.8% 5.1% 8.2% 7.3% 5.8% 5.8% 6.4% 6.5% 5.2% 4.8% 6.3% 5.1% 5.6% 6.6% 5.5% 5.6% 6.8% 6.7% 5.8% Dividend Yield 5.3% 2.6% 3.3% 2.9% 3.1% 4.3% 3.6% 3.1% 4.0% 2.3% 5.4% 3.2% 4.4% 3.3% 3.5% 3.2% 3.2% 2.0% 3.9% 5.1% 3.6% 288% 217% 139% 124% 124% 123% 91% 83% 83% 83% 79% 74% 74% 73% 54% 52% 48% 42% 19% 16% 15% 0% 50% 100% 150% 200% 250% 300% 350% SUI EXR PSA ACC SSS AEC CPT CUBE MAA ELS EQR ESS HME AVB UDR AIV BRE PPS CLP CCG EDR Historical Returns 25 SUI has the highest 5-year total return of any company in the consumer- driven REIT space. 5 Year Total Return1 Self-StorageManufactured HousingMulti-family Student Housing (1) SNL (2) Green Street Advisors except SSS, sourced from SNL. (3) Arithmetic, not on a market cap weighted basis. Sector Implied Cap Rate3 Dividend Yield3 SUI 6.9% 5.3% ELS 6.5% 2.3% Self-Storage 6.0% 3.0% Multi-family 6.0% 3.7% Student Housing 5.9% 3.9%

26