INVESTOR PRESENTATION NOVEMBER 2017 PALM CREEK – CASA GRANDE, AZ

2 This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the “Company”, “Sun”) and from third-party sources indicated herein. Such third-party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2016, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include but are not limited to: changes in general economic conditions, the real estate industry and the markets in which we operate; difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; our liquidity and refinancing demands; our ability to obtain or refinance maturing debt; our ability to maintain compliance with covenants contained in our debt facilities; availability of capital; changes in foreign currency exchange rates, specifically between the U.S. dollar and Canadian dollar; our ability to maintain rental rates and occupancy levels; our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; increases in interest rates and operating costs, including insurance premiums and real property taxes; risks related to natural disasters; general volatility of the capital markets and the market price of shares of our capital stock; our failure to maintain our status as a REIT; changes in real estate and zoning laws and regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITs; litigation, judgments or settlements; competitive market forces; the ability of manufactured home buyers to obtain financing; and the level of repossessions by manufactured home lenders. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements. FORWARD-LOOKING STATEMENTS

SUN COMMUNITIES, INC. (NYSE: SUI) OVERVIEW Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 as well as Press Releases after September 30, 2017 for additional information. 4,882 1,595 680 149 1,757 25,756 3,009 1,277 916 1,156 2,904 548 2,150 698 237 672 481 1,049 475 413 976 226 2,483 473 7,802 42,921 4,614 324 6,501 3,420 349 communities consisting of ~120,500 sites across 29 states and Ontario, Canada Current Portfolio As of November 1, 2017 3 9% 25% 66% 31 manufactured housing and recreational vehicle communities 89 recreational vehicle only communities 229 manufactured housing communities 66% [VA LUE ] 34 % All-age communities Age-restricted communities Trailing Twelve Months Rental Revenue As of September 30, 2017 88% Annual Revenues Manufactured Housing 72% RV - Annual 16% RV - Transient 12%

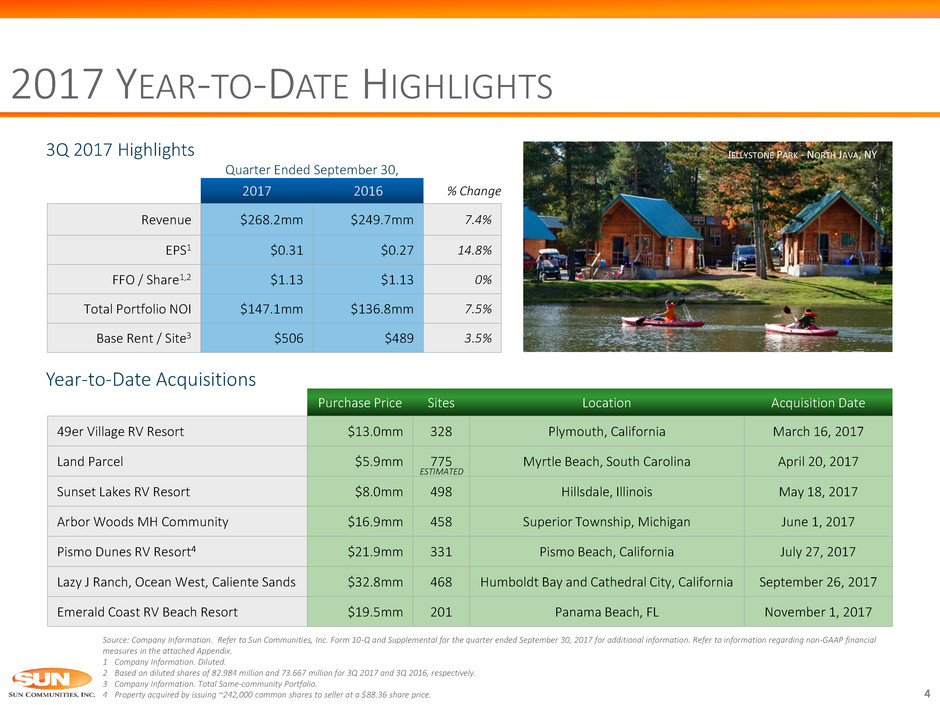

Purchase Price Sites Location Acquisition Date 49er Village RV Resort $13.0mm 328 Plymouth, California March 16, 2017 Land Parcel $5.9mm 775 Myrtle Beach, South Carolina April 20, 2017 Sunset Lakes RV Resort $8.0mm 498 Hillsdale, Illinois May 18, 2017 Arbor Woods MH Community $16.9mm 458 Superior Township, Michigan June 1, 2017 Pismo Dunes RV Resort4 $21.9mm 331 Pismo Beach, California July 27, 2017 Lazy J Ranch, Ocean West, Caliente Sands $32.8mm 468 Humboldt Bay and Cathedral City, California September 26, 2017 Emerald Coast RV Beach Resort $19.5mm 201 Panama Beach, FL November 1, 2017 2017 YEAR-TO-DATE HIGHLIGHTS 4 Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Company Information. Diluted. 2 Based on diluted shares of 82.984 million and 73.667 million for 3Q 2017 and 3Q 2016, respectively. 3 Company Information. Total Same-community Portfolio. 4 Property acquired by issuing ~242,000 common shares to seller at a $88.36 share price. Year-to-Date Acquisitions Quarter Ended September 30, 2017 2016 % Change Revenue $268.2mm $249.7mm 7.4% EPS1 $0.31 $0.27 14.8% FFO / Share1,2 $1.13 $1.13 0% Total Portfolio NOI $147.1mm $136.8mm 7.5% Base Rent / Site3 $506 $489 3.5% ESTIMATED 3Q 2017 Highlights JELLYSTONE PARK - NORTH JAVA, NY

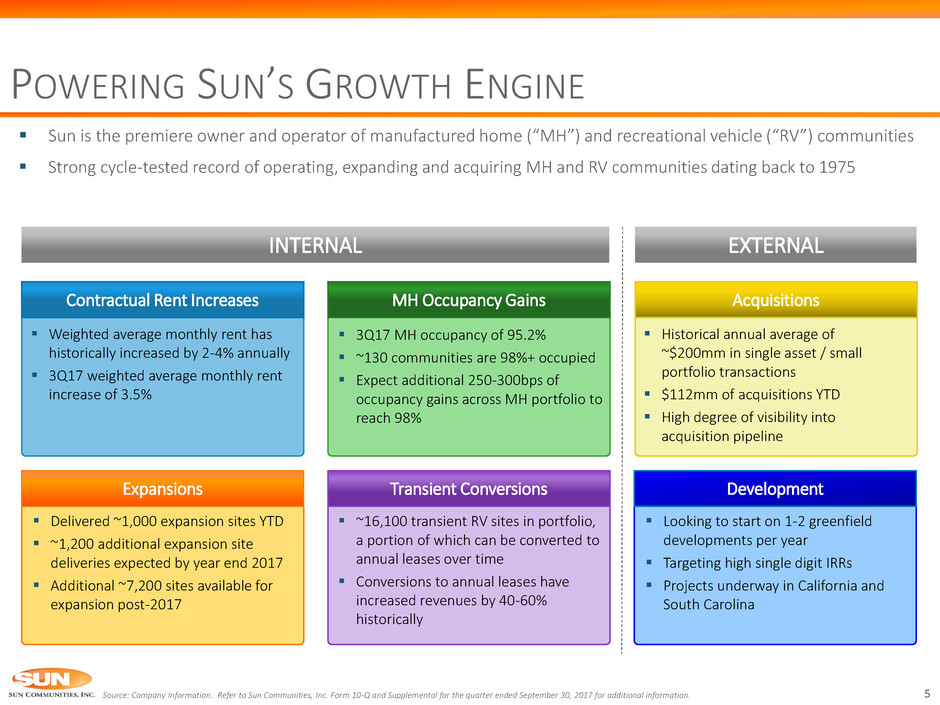

Sun is the premiere owner and operator of manufactured home (“MH”) and recreational vehicle (“RV”) communities Strong cycle-tested record of operating, expanding and acquiring MH and RV communities dating back to 1975 5 POWERING SUN’S GROWTH ENGINE Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. INTERNAL EXTERNAL Contractual Rent Increases Weighted average monthly rent has historically increased by 2-4% annually 3Q17 weighted average monthly rent increase of 3.5% MH Occupancy Gains 3Q17 MH occupancy of 95.2% ~130 communities are 98%+ occupied Expect additional 250-300bps of occupancy gains across MH portfolio to reach 98% Expansions Delivered ~1,000 expansion sites YTD ~1,200 additional expansion site deliveries expected by year end 2017 Additional ~7,200 sites available for expansion post-2017 ~16,100 transient RV sites in portfolio, a portion of which can be converted to annual leases over time Conversions to annual leases have increased revenues by 40-60% historically Historical annual average of ~$200mm in single asset / small portfolio transactions $112mm of acquisitions YTD High degree of visibility into acquisition pipeline Acquisitions Looking to start on 1-2 greenfield developments per year Targeting high single digit IRRs Projects underway in California and South Carolina Development Transient Conversions

SUN’S FAVORABLE REVENUE DRIVERS 6 The average cost to move a home ranges from $4K-$10K, resulting in low move-out of homes Tenure of homes in our communities is 44 years1 Tenure of residents in our communities is approximately 13 years1 Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Average since 2010. Three Year Average Resident Move-out Trends (Home stays in community) (Home leaves community) COUNTR HILL VILLAGE – HUDSONVILLE, MI WINDMILL VILLAGE - DAVENPORT, FL 6.13% 1.97% Resident Re-sales Resident Move-outs

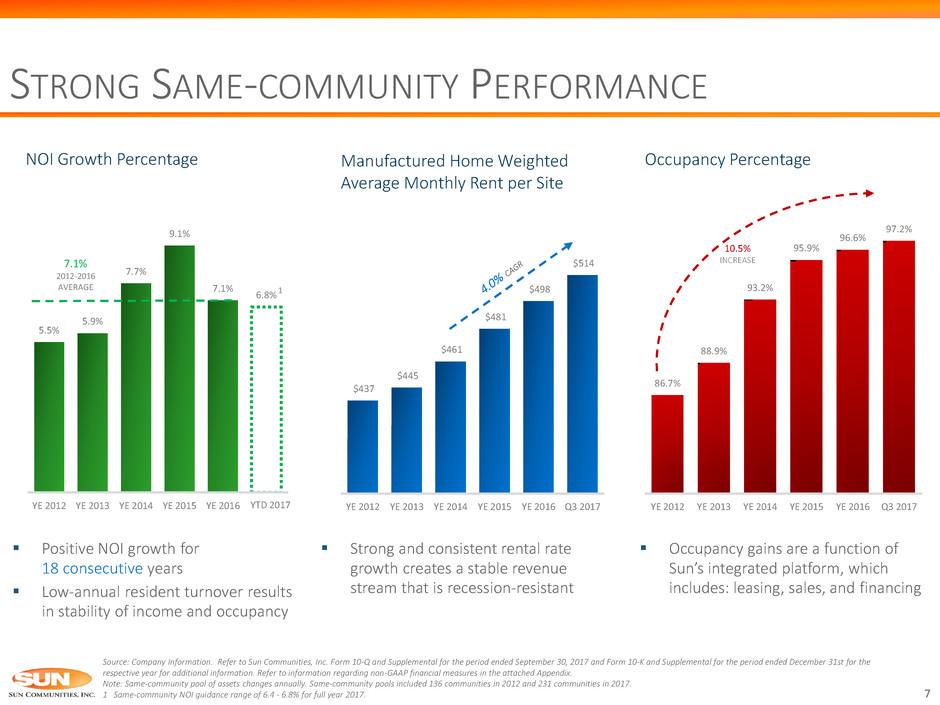

STRONG SAME-COMMUNITY PERFORMANCE 7 Positive NOI growth for 18 consecutive years Low-annual resident turnover results in stability of income and occupancy Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the period ended September 30, 2017 and Form 10-K and Supplemental for the period ended December 31st for the respective year for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: Same-community pool of assets changes annually. Same-community pools included 136 communities in 2012 and 231 communities in 2017. 1 Same-community NOI guidance range of 6.4 - 6.8% for full year 2017. NOI Growth Percentage Occupancy Percentage Manufactured Home Weighted Average Monthly Rent per Site Strong and consistent rental rate growth creates a stable revenue stream that is recession-resistant Occupancy gains are a function of Sun’s integrated platform, which includes: leasing, sales, and financing $437 $445 $461 $481 $498 $514 YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017 5.5% 5.9% 7.7% 9.1% 7.1% 6.8% YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017 7.1% 2012-2016 AVERAGE 86.7% 88.9% 93.2% 95.9% 96.6% 97.2% YE 2012 YE 2013 YE 2014 YE 2015 YE 2016 Q3 2017 10.5% INCREASE YTD 2017 1

8 GROWTH AND ATTRACTIVE RETURNS EXPANSIONS PROVIDE STRONG Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. Approximately 2,200 sites are expected to be developed by the end of 2017 At the start of 2018, inventory of ~7,200 zoned and entitled sites available for expansion at ~60 properties in 16 states and Ontario, Canada A 100 site expansion at a $35,000 cost per site, that is leased up in a year (8 sites/month), results in a 5-year unlevered IRR of 12 - 14% Expansion in communities with strong demand evidenced by occupancies >96% and continued strong demand PALM CREEK GOLF & RV RESORT – CASA GRANDE, AZ PARK ROYALE - PINELLAS PARK, FL WATER OAK – LADY LAKE, FL

9 SUPPORTED BY RENTAL PROGRAM EXPANSION OPPORTUNITIES Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. 1 Operating expenses include repairs and refurbishment, taxes and insurance, marketing, and commissions. Sun’s rental program is a key onboarding and conversion tool for our communities Rental Program All-in 5-Year Unlevered IRR $42,000 initial investment in new home Weighted average monthly rental rate $900 x 12 = $10,800 (3% annual increases) Monthly operating expenses1 +1 month vacancy factor $275 x 12 = $3,300 (3% annual increases) End of 5-year period sell the home and recoup ~90% of original invoice price All-in 5-year unlevered IRR in the high teens RENTAL: EAST VILLAGE ESTATES – WASHINGTON, MI RENTAL: CIDER MILL CROSSING – FENTON, MI

2013 EXTRACTING VALUE FROM STRATEGIC ACQUISITIONS 10 Since May 2011, Sun has acquired communities valued in excess of $4.4 billion, increasing its number of sites and communities by ~180% 1 2011 159 communities 54,811 sites 173 communities 63,697 sites 188 communities 69,789 sites 217 communities 79,554 sites 231 communities 88,612 sites 341 communities 117,376 sites Source: Company Information. Refer to Sun Communities, Inc. Form 10-K and Supplemental for the period ended December 31st for the respective year as well as Sun Communities, Inc. Form 10-Q and Supplemental for the period ended September 30, 2017 for additional information. 1 Includes 30 community dispositions realized in 2014 and 2015. 2012 2014 2015 2016 349 communities 120,544 sites 2017 Year-end Communities and Sites Y T D HOME SALES & RENTAL PROGRAM CALL CENTER & DIGITAL MARKETING OUTREACH SKILLED EXPENSE MANAGEMENT REPOSITIONING WITH ADDIT’L CAPEX ADDING VALUE WITH EXPANSIONS INCREASING MARKET RENT PROFESSIONAL OPERATIONAL MANAGEMENT

STRATEGIC BALANCE SHEET 11 Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. 1 The debt ratios are calculated using trailing 12 months EBITDA for the period ended September 30, 2017. Refer to information regarding non-GAAP financial measures in the attached Appendix. 2 Total Enterprise Value includes common shares outstanding (per Supplemental), OP Units and Preferred OP Units, as converted, outstanding at the end of each respective period. 3 Includes premium / discount on debt and financing costs. 61.5% 50.4% 45.8% 34.8% 34.0% 33.8% 28.3% 2011 2012 2013 2014 2015 2016 Q3 2017 GWYNN’S ISLAND RV RESORT – GWYNNS ISLAND, VA Net Debt / Adj. TTM EBITDA1 Net Debt / TEV2 Principal Outstanding3 WA Interest Rates Quarter Ended September 30, 2017 CMBS $452,311 5.11% Fannie Mae $1,032,621 4.38% Life Companies $949,970 3.89% Freddie Mac $387,738 3.86% Total $2,822,640 4.26% Mortgage Debt Financings principal amounts in thousands Mortgage Debt 5-Year Maturity Ladder amounts in thousands Balance sheet supports growth strategy Sun’s annual mortgage maturities average 3.8% from 2018-2022 Sun’s $450mm term loan / revolving credit facility currently at zero balance 2018 2019 2020 2021 2022 CMBS Fannie Mae Freddie Mac Life Companies $64,314 $117,351 $270,680 $58,078 9.7x 8.4x 7.2x 7.3x 6.6x 7.5x 6.0x 2011 2012 2013 2014 2015 2016 Q3 2017 $28,186

-10% -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% 1Q 02 2Q 02 3Q 02 4Q 02 1Q 03 2Q 03 3Q 03 4Q 03 1Q 04 2Q 04 3Q 04 4Q 04 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 2Q 06 3Q 06 4Q 06 1Q 07 2Q 07 3Q 07 4Q 07 1Q 08 2Q 08 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 3Q 14 4Q 14 1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 Sun Communities, Inc. Apartments Sun's Average (4.4%) Apartment Average (2.7%) REIT Industry Average (2.5%) 4.4% 2.5% 2.7% STRONG INTERNAL GROWTH 12 Source: Citi Investment research, September, 2017. “REIT Industry Average” includes an index of REITs across a variety of asset classes including: self storage, mixed office, regional malls, shopping centers, apartments, student housing, manufactured homes and specialty. Refer to information regarding non-GAAP financial measures of the attached Appendix. SUN’s average same community NOI growth has exceeded REIT industry average by ~190 bps and the apartment sector’s average by ~170 bps since 2002 Same-community NOI Growth Percentage

5-year Total Return STRATEGY-DRIVEN OUTPERFORMANCE 13 Sun has significantly outperformed major REIT and broader market indices over the last ten years 2017 Year to Date Total Return Source: SNL Financial as of September 30, 2017. 3-year Total Return 10-year Total Return Sun Communities, Inc. (SUI) MSCI US REIT (RMS) S&P 500 (20.0%) 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% 160.0% 145.2% 94.4% 58.0% (5.0%) 0.0% 5.0% 0.0% 15.0% 20.0% 25.0% 14.5% 14.2% 3.6% (100.0%) 0.0% 100.0% 200.0% 300.0% 400.0% 500.0% 600.0% 527.4% 104.9% 75.6% (20.0%) 0. % 20. % 40. % 60.0% 80.0% 100.0% 89.0% 36.1 31.9%

APPENDIX PETERS POND RV RESORT – SANDWICH, MA

CONSISTENT NOI GROWTH 15 Manufactured housing is one of the most recession-resistant sectors of the housing and commercial real estate sectors and has consistently outperformed multifamily in same community NOI growth since 2000 NOI Growth Source: Citi Investment research, September, 2017. Refer to information regarding non-GAAP financial measures in this Appendix. $90 $110 $130 $150 $170 $190 $210 $230 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Sun Communities Manufactured Housing Apartment Industrial Mall Office Strip Mall Self-storage $211 $207 $154 $223 $147 $138 $128 $134

16 MANUFACTURED HOUSING VS. MULTIFAMILY Sun’s manufactured homes provide nearly 15% more space at over 30% less cost per square foot Sun’s Manufactured Homes VS. RENT ~$908 1 per month Multifamily Housing ~$1,1502 per month SQUARE FOOTAGE PRICE ~1,2501 sq. ft. ~1,1002 sq. ft. $0.73 per sq. ft. $1.05 per sq. ft. 1 Source: Company Information. 2 Source: The RentPath Network. Represents average rent for a 2 bedroom apartment in major metropolitan areas Sun operates in adjusted for inflation as of September 2017.

Source: Manufactured Housing Institute, Quick Facts: “Trends and Information About the Manufactured Housing Industry, 2017.” 1 Historical average from SUI community applications. 17 MANUFACTURED HOUSING VS. SINGLE FAMILY Single Family Homes Manufactured Homes Average cost of Single Family is $286,814 or roughly 8 years median income Average cost of a new Manufactured Home is $70,600 or roughly 2 years median income Sun’s communities offer affordable options in attractive locations $63,100 $62,800 $60,500 $62,200 $64,000 $65,300 $68,000 $70,600 $203,182 $206,560 $207,950 $223,085 $249,429 $261,172 $276,284 $286,814 $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 Manufactured Homes Single Family Homes Portion of purchase price attributable to land Average Household Income ~$37,5001 2009 2010 2011 2012 2013 2014 2015 2016

NON-GAAP TERMS DEFINED 18 Investors in and analysts following the real estate industry utilize funds from operations (“FFO”), net operating income (“NOI”), and recurring earnings before interest, tax, depreciation and amortization (“Recurring EBITDA”) as supplemental performance measures. We believe FFO, NOI, and Recurring EBITDA are appropriate measures given their wide use by and relevance to investors and analysts. FFO, reflecting the assumption that real estate values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation/amortization of real estate assets. NOI provides a measure of rental operations and does not factor in depreciation/amortization and non-property specific expenses such as general and administrative expenses. Recurring EBITDA, a metric calculated as EBITDA exclusive of certain nonrecurring items, provides a further tool to evaluate ability to incur and service debt and to fund dividends and other cash needs. Additionally, FFO, NOI, and Recurring EBITDA are commonly used in various ratios, pricing multiples/yields and returns and valuation calculations used to measure financial position, performance and value. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as net income (loss) computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains (or losses) from sales of depreciable operating property, plus real estate-related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure that management believes is a useful supplemental measure of the Company’s operating performance. Management generally considers FFO to be a useful measure for reviewing comparative operating and financial performance because, by excluding gains and losses related to sales of previously depreciated operating real estate assets, impairment and excluding real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates), FFO provides a performance measure that, when compared period over period, reflects the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing perspective not readily apparent from net income (loss). Management believes that the use of FFO has been beneficial in improving the understanding of operating results of REITs among the investing public and making comparisons of REIT operating results more meaningful. FFO is computed in accordance with the Company's interpretation of standards established by NAREIT, which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than the Company. The Company also uses FFO excluding certain items, which excludes certain gain and loss items that management considers unrelated to the operational and financial performance of our core business. We believe that this provides investors with another financial measure of our operating performance that is more comparable when evaluating period over period results. Because FFO excludes significant economic components of net income (loss) including depreciation and amortization, FFO should be used as an adjunct to net income (loss) and not as an alternative to net income (loss). The principal limitation of FFO is that it does not represent cash flow from operations as defined by GAAP and is a supplemental measure of performance that does not replace net income (loss) as a measure of performance or net cash provided by operating activities as a measure of liquidity. In addition, FFO is not intended as a measure of a REIT’s ability to meet debt principal repayments and other cash requirements, nor as a measure of working capital. FFO only provides investors with an additional performance measure that, when combined with measures computed in accordance with GAAP such as net income (loss), cash flow from operating activities, investing activities and financing activities, provide investors with an indication of our ability to service debt and to fund acquisitions and other expenditures. Other REITs may use different methods for calculating FFO, accordingly, our FFO may not be comparable to other REITs. NOI is derived from revenues minus property operating expenses and real estate taxes. NOI does not represent cash generated from operating activities in accordance with GAAP and should not be considered to be an alternative to net income (loss) (determined in accordance with GAAP) as an indication of the Company's financial performance or to be an alternative to cash flow from operating activities (determined in accordance with GAAP) as a measure of the Company's liquidity; nor is it indicative of funds available for the Company's cash needs, including its ability to make cash distributions. The Company believes that net income (loss) is the most directly comparable GAAP measurement to NOI. Because of the inclusion of items such as interest, depreciation, and amortization, the use of net income (loss) as a performance measure is limited as these items may not accurately reflect the actual change in market value of a property, in the case of depreciation and in the case of interest, may not necessarily be linked to the operating performance of a real estate asset, as it is often incurred at a parent company level and not at a property level. The Company believes that NOI is helpful to investors as a measure of operating performance because it is an indicator of the return on property investment, and provides a method of comparing property performance over time. The Company uses NOI as a key management tool when evaluating performance and growth of particular properties and/or groups of properties. The principal limitation of NOI is that it excludes depreciation, amortization interest expense and non-property specific expenses such as general and administrative expenses, all of which are significant costs, therefore, NOI is a measure of the operating performance of the properties of the Company rather than of the Company overall. EBITDA is defined as NOI plus other income, plus (minus) equity earnings (loss) from affiliates, minus general and administrative expenses. EBITDA includes EBITDA from discontinued operations. The Company believes that net income (loss) is the most directly comparable GAAP measurement to EBITDA.

NET INCOME TO FFO RECONCILIATION 19 (amounts in thousands except per share data) Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. 2017 2016 2017 2016 2016 2015 2014 Net income attributable to Sun Communities, Inc. common stockholders 24,115$ 18,897$ 57,583$ 18,969$ 17,369$ 137,325$ 22,376$ Adjustments: Depreciation and amortization 64,484 61,809 190,143 159,225 221,576 178,048 134,252 Amounts attributable to noncontrolling interests 1,608 685 3,710 255 (41) 9,644 1,086 Preferred return to preferred OP units 578 616 1,750 1,858 2,462 2,612 281 Preferred distribution to Series A-4 preferred stock 441 683 1,666 - - - 76 Asset impairment charge - - - - - - 837 Gain on disposition of properties, net - - - - - (125,376) (17,654) Gain on disposition of assets, net (4,309) (4,667) (11,342) (12,226) (15,713) (10,125) (6,705) FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities 86,917$ 78,023$ 243,510$ 168,081$ 225,653$ 192,128$ 134,549$ Adjustments: Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259 Other acquisition related costs 343 1,467 2,712 1,467 3,328 - - Income from affiliate transactions - - - (500) (500) (7,500) - Foreign currency exchange - - - - 5,005 - - Contingent liability re-measurement - - - - 181 - - Gain on acquisition of property - - - - (510) - - Catastrophic weather related charges 7,756 - 8,124 - 1,172 - - Gain on settlement - - - - - - (4,452) Preferred stock redemption costs - - - - - 4,328 - Extinguishment of debt - - 759 - 1,127 2,800 - Other income, net (3,345) - (5,340) - - - - Debt premium write-off - - (438) - (839) - - Deferred tax benefit (81) - (745) - (400) 1,000 - FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities excluding certain items 93,757$ 83,681$ 255,572$ 196,939$ 266,131$ 210,559$ 148,356$ Weighted average common shares outstanding - basic 78,369 68,655 75,234 63,716 65,856 53,686 41,337 W ighted average common shares outstanding - fully diluted 82,984 73,667 80,176 68,031 70,165 57,979 44,022 FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities per share - fully diluted 1.05$ 1.06$ 3.04$ 2.47$ 3.22$ 3.31$ 3.06$ FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities per share excluding certain items - fully diluted 1.13$ 1.13$ 3.19$ 2.89$ 3.79$ 3.63$ 3.37$ Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,

NET INCOME TO NOI RECONCILIATION 20 (amounts in thousands) Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. 2017 2016 2017 2016 2016 2015 2014 Net income attributable to Sun Communities, Inc., common stockholders 24,115$ 18,897$ 57,583$ 18,969$ 17,369$ 137,325$ 22,376$ Other revenues (7,011) (5,689) (18,587) (15,459) (21,150) (18,157) (15,498) Home selling expenses 3,290 2,643 9,391 7,240 9,744 7,476 5,235 General and administrative 18,267 16,575 56,188 46,910 64,087 47,455 37,387 Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259 Depreciation and amortization 64,232 61,483 189,719 159,565 221,770 177,637 133,726 Asset impairment charge - - - - - - 837 Extinguishment of debt - - 759 - 1,127 2,800 - Interest expense 32,875 34,589 98,126 90,885 122,315 110,878 76,981 Catastrophic weather related charges 7,756 - 8,124 - 1,172 - - Other income, net (3,345) - (5,340) - 4,676 - - Gain on disposition of properties, net - - - - - (125,376) (17,654) Gain on settlement - - - - - - (4,452) Current tax (benefit) / expense (38) 283 133 567 683 158 219 Deferred tax benefit (81) - (745) - (400) 1,000 - Income from affiliate transactions - (500) - (500) (500) (7,500) (1,200) Preferred return to preferred OP units 1,112 1,257 3,482 3,793 5,006 4,973 2,935 Amounts attributable to noncontrolling interests 1,776 879 4,179 460 150 10,054 1,752 Preferred stock distributions 1,955 2,197 6,233 6,748 8,946 13,793 6,133 Preferred stock redemption costs - - - - - 4,328 - NOI/Gross Profit 147,070$ 136,805$ 416,235$ 347,069$ 466,909$ 384,647$ 267,036$ 2017 2016 2017 2016 2016 2015 2014 Real Property NOI 125,961$ 114,851$ 361,595$ 296,081$ 403,337$ 335,567$ 232,478$ Rental Program NOI 22,060 21,213 68,759 64,223 85,086 83,232 70,232 Home Sales NOI / Gross Profit 8,103 9,276 23,320 23,184 30,087 20,787 13,398 Ancillary NOI / Gross Profit 7,024 6,997 10,367 9,745 9,999 7,013 5,217 Site rent from Rental Program (included in Real Property NOI) (16,078) (15,532) (47,806) (46,164) (61,600) (61,952) (54,289) NOI / Gross Profit 147,070$ 136,805$ 416,235$ 347,069$ 466,909$ 384,647$ 267,036$ Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31, Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,

21 NET INCOME TO RECURRING EBITDA RECONCILIATION (amounts in thousands) Source: Company Information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended September 30, 2017 for additional information. 2017 2016 2017 2016 2016 2015 2014 Net income attributable to Sun Communities, Inc., common stockholders 24,115$ 18,897$ 57,573$ 18,969$ 17,369$ 137,325$ 22,376$ Interest 32,085 33,800 95,765 88,522 119,163 107,659 73,771 Interest on mandatorily redeemable preferred OP units 790 789 2,361 2,363 3,152 3,219 3,210 Depreciation and amortization 64,232 61,483 189,719 159,565 221,770 177,637 133,726 Asset impairment charge - - - - - - 837 Extinguishment of debt - - 759 - 1,127 2,800 - Transaction costs 2,167 4,191 6,990 27,891 31,914 17,803 18,259 Catastrophic weather related charges 7,756 - 8,124 - 1,172 - - Other income, net (3,345) - (5,340) - 4,676 - - Gains on disposition of properties, net - - - - - (125,376) (17,654) Gain on settlement - - - - - - (4,452) Current tax (benefit) / expense (38) 283 133 567 683 158 219 Deferred tax benefit (81) - (745) - (400) 1,000 - Income from affiliate transactions - (500) - (500) (500) (7,500) (1,200) Preferred return to preferred OP units 1,112 1,257 3,482 3,793 5,006 4,973 2,935 Amounts attributable to noncontrolling interests 1,776 879 4,179 460 150 10,054 1,752 Preferred stock distributions 1,955 2,197 6,233 6,748 8,946 13,793 6,133 Preferred stock redemption costs - - - - - 4,328 - Recurring EBITDA 132,524$ 123,276$ 369,233$ 308,378$ 414,228$ 347,873$ 239,912$ Three Months Ended September 30, Nine Months Ended September 30, Year Ended December 31,