- MAA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Mid-America Apartment Communities (MAA) DEF 14ADefinitive proxy

Filed: 7 Apr 20, 7:01am

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

| Mid-America Apartment Communities, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than Registrant) |

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

| PROXY STATEMENT |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

2020 ANNUAL MEETING OF SHAREHOLDERS

Tuesday, May 19, 2020

12:30 p.m. local time

MAA Corporate Headquarters

5th Floor

6815 Poplar Avenue, Suite 500

Germantown, Tennessee 38138

| MID-AMERICA APARTMENT COMMUNITIES, INC. |

April 7, 2020

TO MY FELLOW SHAREHOLDERS |

|

I am pleased to invite you to attend the 2020 Annual Meeting of Shareholders of Mid-America Apartment Communities, Inc. The meeting will be held at 12:30 p.m., local time, on Tuesday, May 19, 2020, at our corporate headquarters located at 6815 Poplar Avenue, Suite 500, Germantown, Tennessee 38138. The Notice of Annual Meeting of Shareholders and Proxy Statement, both of which accompany this letter, provide details regarding the business to be conducted at the meeting, as well as other important information about us.

If you are one of our long-term shareholders, you may have noticed that MAA has changed to the Notice and Access delivery format allowed under the Securities and Exchange Commission rules to distribute meeting materials this year. Under this delivery method, unless a prior shareholder request required otherwise, we mailed or electronically delivered a Notice of Internet Availability of Proxy Materials to eligible shareholders, which provided instructions on how to electronically access the materials related to the Annual Meeting of Shareholders rather than shipping and mailing hard copies. We believe this delivery format will

| 1) | help us to reduce the printing and postage expenses associated with our annual meetings, |

| 2) | provide you with additional time to review materials by making them available sooner, and |

| 3) | reduce our environmental impact by minimizing our paper and ink usage as well as the energy and fuel required to print and ship bulk materials. |

Of course, if you received a Notice of Internet Availability of Proxy Materials you still have the option to request hard copies, but we encourage all of our shareholders to not only review the materials online but to also sign up for electronic delivery of future notices to further reduce our collective impact on the environment.

We’ve included some information on our journey to formalize and enhance our sustainability efforts in the accompanying Proxy Statement and we invite you to visit https://www.maac.com/about-us/sustainability/ to learn more about our thoughts on sustainability and review our inaugural sustainability report to be issued later this year.

Whether or not you plan to attend the 2020 Annual Meeting of Shareholders in person, I encourage you to vote in advance of the meeting. Please review the instructions in How to Vote in the accompanying Proxy Statement to ensure that your shares will be represented and voted. Your vote is important. Along with the other members of the Board of Directors and management, I look forward to greeting you at the meeting if you are able to attend. Thank you for your support.

| Sincerely, | |

| |

|

| We intend to hold our annual meeting in person. However, we are actively monitoring coronavirus (COVID-19) developments in relation to the health and safety of our shareholders and associates, including protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting, which may include holding the meeting solely by means of remote communication, as promptly as practicable. We will file a Form 8-K with the SEC to announce any alternative arrangements. If you are planning to attend our meeting, please check our website at http://ir.maac.com/ one week prior to the meeting for updated information. |

TABLE OF CONTENTS

| REFERENCES AND ABBREVIATIONS |

For your reference, the below listing provides the definitions of various references and abbreviations used throughout the following Proxy Statement.

| MEETING AND MATERIALS | |

| Annual Meeting | 2020 Annual Meeting of Shareholders of Mid-America Apartment Communities, Inc. |

| Annual Meeting Notice | Notice of 2020 Annual Meeting of Shareholders |

| Annual Report | Annual Report to Shareholders for the Year Ended December 31, 2019 |

| Beneficial Shareholder | A Beneficial Shareholder is a shareholder whose shares are held by a bank, brokerage firm or other nominee. Such shares are often referred to as being held in Street Name. |

| MAA, we, us, our | Mid-America Apartment Communities, Inc. |

| Notice of Internet Availability | Notice Regarding Internet Availability of Proxy Materials |

| Proxy Statement | This Proxy Statement |

| Shareholder of Record or Registered Shareholder | A Shareholder of Record, also referred to as a Registered Shareholder, is a shareholder who owns their shares directly through MAA’s transfer agent, Broadridge Corporate Issuer Solutions, Inc. |

| EXECUTIVE AND DIRECTOR COMPENSATION (1) | |

| AIP | Annual Incentive Plan |

| Director Deferred Compensation Plan | Non-Qualified Deferred Compensation Plan for Outside Company Directors |

| Executive Deferred Compensation Plan | Non-Qualified Executive Deferred Compensation Plan |

| FAD | Funds Available for Distribution |

| FFO | Funds From Operations |

| FFO per Share | Funds From Operations per Diluted Common Share and Unit |

| GOI | Gross Operating Income |

| LTIP | Long-Term Incentive Program |

| NEO | Named Executive Officer |

| NOI | Net Operating Income |

| Pearl Meyer | Pearl Meyer & Partners, LLC |

| TSR | Total Shareholder Return |

| ACCOUNTING AND AUDITING | |

| ASC | Accounting Standards Codification |

| FASB | Financial Accounting Standards Board |

| GAAP | Generally Accepted Accounting Principles |

| GENERAL AND COMMON ABBREVIATIONS | |

| Board | Board of Directors of Mid-America Apartment Communities, Inc. |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| COO | Chief Operating Officer |

| ESG | Environmental, Social and Governance |

| EVP | Executive Vice President |

| GC | General Counsel |

| GRESB | Global Real Estate Sustainability Benchmark |

| NYSE | New York Stock Exchange |

| REIT | Real Estate Investment Trust |

| SEC | Securities and Exchange Commission |

| (1) | A reconciliation of non-GAAP financial measures to the most comparable GAAP measure can be found on page 75. |

| 2020 PROXY STATEMENT | 1 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| ITEMS OF BUSINESS | |

| VOTING PROPOSALS | BOARD RECOMMENDATION |

Proposal 1 Elect the 12 director nominees named in the Proxy Statement to serve until the 2021 Annual Meeting of Shareholders, and until their successors have been duly elected and qualified. | ü FOR Each Nominee |

Proposal 2 Advisory (non-binding) vote to approve NEO compensation. | ü FOR |

Proposal 3 Ratify Ernst & Young LLP as MAA’s independent registered public accounting firm for 2020. | ü FOR |

| Shareholders will also consider any other business as may properly come before the meeting or any adjournment or postponement thereof. | |

| ANNUAL MEETING ADMISSION | |||

To attend the Annual Meeting in person, you must: | |||

| 1. | Be a shareholder (or authorized proxy thereof) of MAA common stock as of the close of business on March 13, 2020, the record date. | ||

| 2. | Register in advance for an admission ticket by May 14, 2020: | ||

| HAVE YOUR | 16-digit control number ready (printed on proxy card or voter instruction form) | ||

| GO TO | www.ProxyVote.com | ||

| LOOK FOR | “Register for Meeting” | ||

| 3. | Bring your admission ticket, valid photo identification, and required legal proxy documentation (if applicable), to the Annual Meeting. | ||

| Your vote is very important. PLEASE VOTE YOUR SHARES in advance regardless of whether or not you plan to attend the Annual Meeting. | |

| By Order of the Board of Directors, | |

| |

| Leslie B.C. Wolfgang | |

| Senior Vice President, Chief Ethics and Compliance Officer, and Corporate Secretary | |

| April 7, 2020 | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR MAA’S ANNUAL MEETING TO BE HELD ON MAY 19, 2020 | |

| The following materials are available at http://materials.ProxyVote.com/59522J | |

| ⌂ | Notice of the Annual Meeting of Shareholders to be held on May 19, 2020 |

| ⌂ | 2020 Proxy Statement |

| ⌂ | Annual Report to Shareholders for fiscal year ended December 31, 2019 |

| A Notice Regarding the Internet Availability of Proxy Materials or the proxy statement, form of proxy and accompanying materials are first being sent to shareholders on or about April 7, 2020. | |

| LOGISTICS | ||

| DATE AND TIME | ||

| Tuesday, May 19, 2020 | ||

| 12:30 p.m. local time | ||

| PLACE | ||

| MAA Corporate Headquarters | ||

| 6815 Poplar Avenue, Suite 500 | ||

| Germantown, Tennessee 38138 | ||

| WHO CAN VOTE | ||

| Shareholders of record at the close of business on Friday, March 13, 2020, the record date, are entitled to receive this notice and vote. | ||

| HOW TO VOTE | |||

| MOST SHAREHOLDERS may vote in any of the following ways: | |||

| ONLINE | ||

| www.ProxyVote.com | |||

| BY PHONE | ||

| 800-690-6903 | |||

| BY MAIL | ||

| Complete, sign, date and return a valid Proxy Card or Voter Instruction Form in the postage-paid envelope provided | |||

| IN PERSON | ||

| Vote in person with a ticket obtained from registering in advance, a valid photo identification and legal proxy or authorization letter (if applicable) | |||

| If you are a BENEFICIAL SHAREHOLDER and are unable to vote following the above instructions, follow the instructions as provided by your bank or broker on your Voter Instruction Form to direct the voting of your shares. | |||

| See page 73 for additional information on how to vote and page 69 for requirements to attend the Annual Meeting in person. | |||

| 2020 PROXY STATEMENT | 2 |

1 | ELECT THE 12 DIRECTOR NOMINEES NAMED IN THE PROXY STATEMENT TO SERVE UNTIL THE 2021 ANNUAL MEETING OF SHAREHOLDERS. | BOARD FOR |

| DIRECTOR NOMINEES |

| A = Audit, C = Compensation, NCG = Nominating and Corporate Governance, REI = Real Estate Investment | OTHER | ||||||||

| COMMITTEES | PUBLIC | ||||||||

| AGE | GENDER | TENURE | A | C | NCG | REI | POSITION | BOARDS | |

H. Eric Bolton, Jr. Chairman | 63 | M | 1997 | ⌂ CHAIR | CEO of MAA | 1 | |||

Russell R. French INDEPENDENT SEC Financial Expert | 74 | M | 2016 | ⌂ | Special Limited Partner of Moseley & Co. VI, LLC and Class B Partner of Moseley & Co. VII, LLC and Moseley & Co. SBIC, LLC | None | |||

Alan B. Graf, Jr. LEAD INDEPENDENT SEC Financial Expert | 66 | M | 2002 | ⌂ CHAIR | EVP and CFO of FedEx Corporation (1) | 1 See page 24 | |||

Toni Jennings INDEPENDENT | 71 | F | 2016 | ⌂ | ⌂ | Chairman of Jack Jennings & Sons, Inc. | 2 | ||

James K. Lowder INDEPENDENT | 70 | M | 2013 | ⌂ | ⌂ | Chairman and President of The Colonial Company | None | ||

Thomas H. Lowder INDEPENDENT | 70 | M | 2013 | ⌂ | ⌂ | Past Chairman and CEO of Colonial Properties Trust | None | ||

Monica McGurk INDEPENDENT | 50 | F | 2016 | ⌂ | ⌂ | Chief Growth Officer of Kellogg Company | None | ||

Claude B. Nielsen INDEPENDENT | 69 | M | 2013 | ⌂ | ⌂ CHAIR | Chairman and Past CEO of Coca-Cola Bottling Company United, Inc. | None | ||

Philip W. Norwood INDEPENDENT | 72 | M | 2007 | ⌂ CHAIR | ⌂ | Past President and CEO of Faison Enterprises, Inc. | None | ||

W. Reid Sanders INDEPENDENT | 70 | M | 2010 | ⌂ | President of Sanders Properties, LLC | 2 | |||

Gary Shorb INDEPENDENT | 69 | M | 2012 | ⌂ | ⌂ | Executive Director of the Urban Child Institute, Past President and CEO of Methodist Le Bonheur Healthcare | None | ||

David P. Stockert NON-MANAGEMENT | 58 | M | 2016 | ⌂ | Past CEO of Post Properties, Inc. | 1 | |||

| (1) | On March 9, 2020, FedEx Corporation announced that Mr. Graf will retire effective December 31, 2020. See page 24 for additional information. |

See pages 22-29 for more information.

DIVERSITY

| ||

| The Board believes that diversity in personal attributes such as gender, race, ethnicity and age, among other factors, is important to ensure the broadest range of ideas and perspectives are contributed to Board discussions and to represent our associates, residents and investors. As such, the Board is committed to actively pursuing qualified candidates that will add diversity in these areas. The Board has directed the Nominating and Corporate Governance Committee to make diversity of race or ethnicity a key criteria for the next director addition to the Board. |

See pages 14 and 21-22 for more information.

| 2020 PROXY STATEMENT | 3 |

| PROXY STATEMENT HIGHLIGHTS | PROPOSAL 1: ELECTION OF DIRECTORS |

KEY EXPERIENCE, QUALIFICATIONS AND SKILLS

| The Board believes that experience or expertise in the following areas is particularly relevant to MAA’s business and structure and should be possessed by one or more members of the Board. These factors, along with others, were considered in selecting the nominees for election. | |||||

| Real Estate Industry – Investment | 6 | Nominees | ⌂⌂⌂⌂⌂⌂ | ||

| Real Estate Industry – Development/Construction | 6 | Nominees | ⌂⌂⌂⌂⌂⌂ | ||

| Public Company Platforms | 10 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Financial Literacy | 9 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Capital Markets | 9 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Strategic Planning and Oversight | 12 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Risk Oversight | 9 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Organization Leadership | 12 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

| Corporate Governance | 10 | Nominees | ⌂⌂⌂⌂⌂⌂⌂⌂⌂⌂ | ||

See pages 21-29 for more information.

CORPORATE GOVERNANCE

BOARD PRACTICES ■ Lead Independent Director ■ 100% Independent Audit, Compensation and Nominating and Corporate Governance Committees ■ Annual Board and committee evaluations ■ Regular executive sessions of independent and non-management directors ■ Required retirement (not eligible for nomination at age 75) ■ Director, CEO and NEO equity ownership requirements ■ Prohibition against hedging or pledging equity ■ Reimbursement of director education events ■ Ability for shareholders and other interested parties to communicate directly with Board ■ Accountable for public Code of Conduct ■ Public Corporate Governance Guidelines ■ Board authority to retain external advisors ■ Regular director, CEO and executive succession planning | ||

SHAREHOLDERS RIGHTS ■ Annual elections of all directors ■ Majority voting in uncontested elections with resignation policy ■ Bylaws include shareholder proxy access rights ■ Annual Say on Pay advisory vote ■ Shareholder rights to call special meetings (10% aggregate ownership) ■ No shareholder rights plan (poison pill) ■ Long standing active shareholder engagement with over 400 formal interactions in 2019 representing nearly 2/3rds of outstanding shares |

See pages 13-21 for more information.

ESG

| Ensuring the long-term success of MAA for our shareholders requires a long-term approach in all that we do. With the support and oversight of our Board, we are on a journey to formalize and enhance our ESG efforts. In 2019, we completed our first GRESB assessment to help assess and benchmark our ESG performance and provide a baseline for our inaugural sustainability report. In 2020, we will publish our inaugural sustainability report to include quantitative disclosure of key performance metrics related to our emissions, energy and water usages, and waste generation, including absolute and normalized scope 1 and 2 greenhouse gas emissions as well as our plans for progressive improvement. | ||||

| OPEN ARMS FOUNDATION | Learn more at https://www.maac.com/about-us/open-arms-foundation/ | |||

| Open Arms is MAA’s corporate charity and the heart of MAA’s service culture. Through Open Arms, we provide housing close to medical facilities for individuals who have to travel away from their home for long-term medical care. MAA donates two-bedroom apartments and our associates volunteer their time (both during and outside of work hours) to run the charity and raise additional funds to fully furnish the units and pay all of the utilities. Open Arms relieves the financial burden of long-term lodging near specialized medical facilities by doing what we do best, creating homes where family, friends and even pets can be together. | ||||

| ||||

| 2019 | ||||

| Apartments Donated | 53 homes in 13 states | |||

| Families Helped | 126 | |||

| Nights of Rest Provided | 15,441 | |||

| MAA Rent Concessions | $ 594,104 | |||

| Associate Fundraisers/Donations | $ 726,085 | |||

| ||||

See pages 11-12 for more information.

| 2020 PROXY STATEMENT | 4 |

| PROXY STATEMENT HIGHLIGHTS | PROPOSAL 2: EXECUTIVE COMPENSATION |

2 | ADVISORY (NON-BINDING) VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION. | BOARD FOR |

EXECUTIVE COMPENSATION PHILOSOPHY

| The Compensation Committee believes that the compensation programs for our executive officers should balance the following objectives. | ||

| ■ Attract and retain highly qualified executives | ||

| ■ Not overpay compared to industry peers | ||

| ■ Not incentivize undue risk | ||

| ■ Be fair and equitable | ||

| ■ Reflect individual responsibilities and qualifications | ||

| ■ Be quantifiable | ||

| ■ Align with our culture | ||

| ■ Align with business strategy and key strategic objectives | ||

| ■ Align with overall MAA performance | ||

| ■ Balance annual and long-term strategic goals | ||

| ■ Reward superior performance | ||

| ■ Align executive interests with shareholders | ||

| ■ Reward for creating long-term shareholder value | ||

| ■ Be sustainable | ||

| ■ Be supported by shareholders |

See page 34 for more information.

OTHER CONSIDERATIONS AND SAY ON PAY

In addition to the concepts represented in our executive compensation philosophy, the Compensation Committee considers various other factors when determining executive compensation, including:

■ Labor market conditions, ■ Personal development, ■ Quality of internal working relationships, leadership and human capital development, ■ Ability to assume increased responsibilities, and ■ Results of our shareholders’ input on executive compensation. | ||||

94.3% APPROVAL FOR Say on Pay In 2019 | Annual Say on Pay Shareholder Vote APPROVED EVERY YEAR Since Introduced in 2011 | Say on Pay Average Approval Rate Since 2011 96% | ||

See pages 35 and 39 for more information.

EXECUTIVE COMPENSATION PRACTICES

| WHAT WE DO | WHAT WE DON’T DO | |||

ü Align pay with performance ü Mitigate undue risk in compensation programs ü Include vesting periods on share awards ü Require compliance with NEO share ownership guidelines ü Require compliance with NEO share holding period policy ü Utilize an independent compensation consultant who provides no other services to MAA ü Cap award payouts ü Maintain clawback policy allowing for recoupment of performance-based incentive compensation in certain circumstances ü Conduct an annual compensation program risk assessment | NO Dividends ordividend equivalents on unearned performance shares NO Repricing underwater stock options NO Exchanges of underwater stock options for cash NO Multi-year guaranteed bonuses NO Inclusion of the value of equity awards in severance calculations NO Evergreen provisions in equity plans NO Tax “gross ups” for excess parachute payments NO “Single trigger” employment or change in control agreements NO Overlapping performance metrics among annual and long-term incentive plans for NEOs | |||

|

See pages 37-39 for more information.

| 2020 PROXY STATEMENT | 5 |

| PROXY STATEMENT HIGHLIGHTS | PROPOSAL 2: EXECUTIVE COMPENSATION |

2019 MAA PERFORMANCE

| IN 2019, MAA: | ||

■ Increased same store portfolio revenues by 3.4% over 2018 while holding same store expense growth to 2.9%,

■ Acquired one multifamily community consisting of 271 units and entered into two pre-purchase development deals for an additional 609 units expected to be delivered during 2021,

■ Redeveloped 8,329 units at an average cost of $5,876 per unit, achieving average rental rate increases of approximately 9.8% above non-renovated units,

■ Invested $113 million in our development pipeline, starting construction on three new projects and one expansion project to an existing multifamily community and completing the development of two expansion projects to existing multifamily communities, ending the year with five developments under construction for a total of 1,499 units,

■ Issued $300 million of 3.950% senior unsecured notes due in 2029 at an issue price of 99.720% with an additional $250 million of 3.950% senior unsecured notes due in 2029 with a reoffer yield of 2.985%, and $300 million of 2.750% senior unsecured notes due in 2030 through our primary operating partnership,

■ Ended the year with total debt to adjusted total assets (as defined in the covenants for the bonds issued by our primary operating partnership) of 31.4%, compared to 32.6% as of December 31, 2018,

■ Ended the year with total debt outstanding of $4.5 billion at an average effective interest rate of 3.8%, with 98.4% fixed or hedged against rising interest rates for an average of 7.6 years and 90.2% of our total NOI unencumbered, and

■ Completed our first GRESB assessment to help assess and benchmark our ESG performance and provide a baseline for our inaugural sustainability report to be issued in 2020.

|

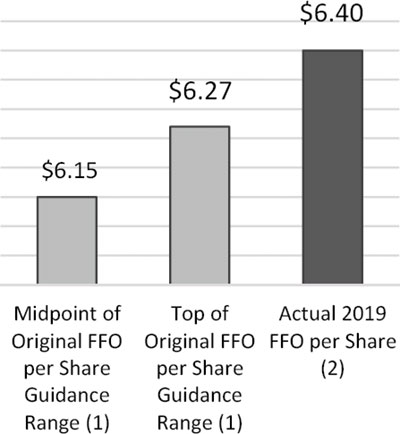

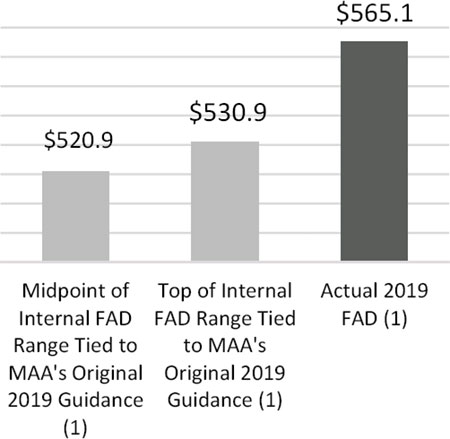

See pages 46-47 for more information.

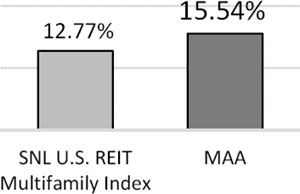

TOTAL SHAREHOLDER RETURN

| ANNUALIZED 2017 LTIP THREE YEAR TSR (1) | ||

(1) In order to eliminate the impact of the volatility generated by the price fluctuations of any one market day, the calculations for the three year TSR returns for MAA and the SNL U.S. REIT Multifamily Index under the 2017 LTIP utilizes the average of the closing stock prices in December 2016 and December 2019 as the beginning and ending stock prices for the annualized return calculations. |

See page 48 for more information.

DIVIDENDS

In 2019, MAA returned nearly $437 MILLION in dividends to common shareholders | In 2019, MAA declared its 104th COMMON QUARTERLY DIVIDEND PAYMENT | MAA has NEVER SUSPENDED NOR REDUCED our common dividend | ||

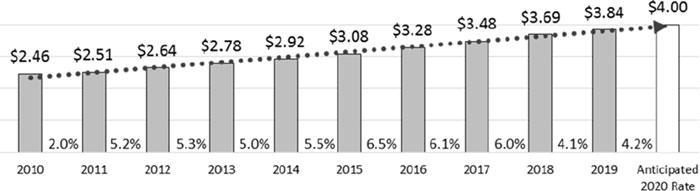

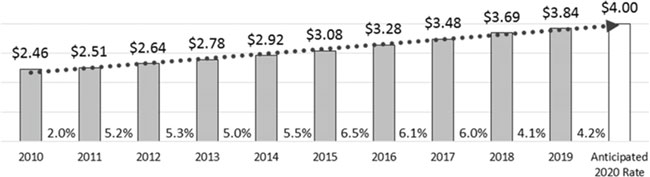

| ANNUAL DIVIDEND PAID PER COMMON SHARE | ||||

| ||||

See page 48 for more information.

| 2020 PROXY STATEMENT | 6 |

| PROXY STATEMENT HIGHLIGHTS | PROPOSAL 2: EXECUTIVE COMPENSATION |

2019 EXECUTIVE TOTAL DIRECT COMPENSATION

| The Compensation Committee strives to find the appropriate balance of compensation elements to provide a fixed base of cash compensation to attract talented executives (Salary), incent executives to achieve key business results and reward executives for their individual contributions to those results (AIP) and to tie executives’ interests to the long-term interests of our shareholders (LTIP). The mix of these elements established for the 2019 compensation packages of our executive officers is indicated below. | ||

| TOTAL 2019 DIRECT COMPENSATION TARGET PAY MIX | ||

| ||

See page 44-46 for more information.

2019 DIRECT COMPENSATION REALIZED

| Compensation realized by NEOs during 2019 related to their respective 2019 compensation packages: | ||||||||||||||||||||

| 2019 LTIP | TOTAL COMPENSATION REALIZED IN 2019 FROM 2019 COMPENSATION PLANS | |||||||||||||||||||

| 2019 AIP | Shares Of Restricted Stock Earned (1) | At Risk Target Realizable in Future Years (2) | Shares of | |||||||||||||||||

| Amount | Percent of Opportunity | Restricted | ||||||||||||||||||

| SALARY | Earned | Target | Maximum | Cash | Stock (1) | |||||||||||||||

| H. Eric Bolton, Jr. | $ 812,500 | $2,157,100 | 151% | 100% | 20,908 | 16,067 | $2,969,600 | 20,908 | ||||||||||||

| CEO | ||||||||||||||||||||

| Thomas L. Grimes, Jr. | $ 515,234 | $1,083,600 | 150% | 100% | 9,722 | 7,469 | $1,598,834 | 9,722 | ||||||||||||

| COO | ||||||||||||||||||||

| Albert M. Campbell, III | $ 502,750 | $ 900,006 | 143% | 99% | 9,487 | 7,288 | $1,402,756 | 9,487 | ||||||||||||

| CFO | ||||||||||||||||||||

| Robert J. DelPriore | $ 490,265 | $ 883,801 | 144% | 100% | 9,251 | 7,107 | $1,374,066 | 9,251 | ||||||||||||

| GC | ||||||||||||||||||||

(1) Shares of restricted stock will vest over various time periods, remaining subject to forfeiture until vested, dependent upon continued employment in good standing with MAA.

(2) Represents Target performance shares of restricted stock still at risk as they are realizable under the Three Year Relative TSR metric for which the performance period does not end until December 31, 2021.

| ||||||||||||||||||||

| Other compensation realized by NEOs during 2019 included awards earned for the Three Year Relative TSR metric under the 2017 LTIP, for which the performance period ended December 31, 2019 and NEOs earned 89.19% of their respective maximum opportunity. | ||||||||||||||||||||

See pages 49-50 for more information

| 2020 PROXY STATEMENT | 7 |

| PROXY STATEMENT HIGHLIGHTS | PROPOSAL 3: INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

3 | RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS MAA’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2020. | BOARD FOR |

PRACTICES RELATED TO THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| AUDIT COMMITTEE PRACTICES | ||

■ Sole authority to appoint or replace the independent registered public accounting firm ■ Pre-approves all auditing services ■ Pre-approves all permitted non-audit services ■ Annual evaluation of independent registered public accounting firm’s performance ■ Routine separate executive sessions with representatives of the independent registered public accounting firm as well as with management and the Director of Internal Audit ■ Maintains an anonymous whistleblower platform ■ Ensures the rotation of the lead audit partner and audit engagement team partners of the independent registered public accounting firm ■ All members of the Audit Committee are independent ■ Two SEC financial experts | ||

| MAA PRACTICES | ||

■ Will not hire an individual who is concurrently an employee of the independent registered public accounting firm ■ Will not hire an individual in an accounting or financial reporting oversight role if in a position to influence MAA’s independent registered public accounting firm’s operations or policies ■ CFO or Principal Accounting Officer must approve the hiring of individuals who previously served on MAA’s independent registered public accounting firm’s audit engagement team ■ Cooling off period required for individuals who previously served on MAA’s independent registered public accounting firm’s audit engagement team to serve in an accounting or financial reporting oversight role ■ Disclose all individuals hired who previously served on MAA’s independent registered public accounting firm’s audit engagement team to the Audit Committee | ||

Annual Ratification by Shareholders of the Audit Committee’s Appointment of Ernst & Young LLP AVERAGES OVER 99% (over last 10 years)

|

See pages 64-65 for more information.

AUDIT AND NON-AUDIT FEES

| Fees | 2019 | 2018 | ||

| Audit | $ 2,416,184 | $ 2,570,737 | ||

| Audit-Related | - | - | ||

| Tax | 365,770 | 476,035 | ||

| All Other | 2,000 | 2,000 | ||

| Total | $ 2,783,954 | $ 3,048,772 | ||

The Audit Committee has pre-approved all audit and non-audit services provided by our independent registered public accounting firm since 2002 and has determined that the nature and level of non-audit related services that Ernst & Young LLP provides to MAA is compatible with maintaining the independence of Ernst & Young LLP. | ||||

See pages 63-64 for more information.

REPRESENTATION AT ANNUAL MEETING

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting to make a statement if they so desire and to answer any appropriate questions.

|

See page 63 for more information.

| 2020 PROXY STATEMENT | 8 |

PROPOSAL 1: ELECTION OF DIRECTORS

| MATTER TO BE VOTED | ||

Election of the 12 director nominees named herein to serve until the 2021 Annual Meeting of Shareholders, and until their successors have been duly elected and qualified.

Our Board proposes that H. Eric Bolton, Jr., Russell R. French, Alan B. Graf, Jr., Toni Jennings, James K. Lowder, Thomas H. Lowder, Monica McGurk, Claude B. Nielsen, Philip W. Norwood, W. Reid Sanders, Gary Shorb and David P. Stockert, all of whom are currently serving as directors, be elected for a term of one year. | |||

| VOTE REQUIRED | ||

Each director nominee will be elected if there is a quorum at the Annual Meeting, either in person or by proxy, and the votes cast “FOR” each director nominee exceeds the votes cast “AGAINST” each director nominee.

We have no reason to believe that any of the nominees for director will not agree or be available to serve as a director if elected. However, should any director nominee become unable or unwilling to serve, the proxies may be voted for a substitute director nominee or to allow the vacancy to remain open until filled by our Board. | |||

| IMPACT OF ABSTENTIONS | ||

Abstentions will have no legal effect on whether each director nominee is approved. | |||

| IMPACT OF BROKER NON-VOTES | ||

Broker non-votes will have no legal effect on whether each director nominee is approved. | |||

| BOARD RECOMMENDATION | ||

Our Board recommends a vote FOR each of the director nominees. | |||

Our Board believes that it is necessary for our directors to possess a variety of backgrounds, skills and viewpoints in order to provide strong leadership to MAA. When searching for new candidates, the Nominating and Corporate Governance Committee considers the evolving needs of our Board and searches for candidates that fill any current or anticipated future gaps, considering each candidates credentials both independently and within the entirety of the Board.

When evaluating potential candidates, the Nominating and Corporate Governance Committee considers a variety of factors including expertise in areas relevant to the real estate industry, operating as a public company, financial expertise and navigating capital markets. They also consider experience in broader aptitudes such as strategic planning, risk oversight, corporate governance and human capital development. In addition to these key skills, the Nominating and Corporate Governance Committee also feels it is important for the Board to have a breadth of viewpoints and experiences by including a variety of backgrounds and expertise as well as diversity in attributes such as gender, race, age and tenure. The Nominating and Corporate Governance Committee also evaluates a candidate’s ability to provide quality service to the Board and considers any conflicts of interest, integrity and ethical character of the candidate and their commitment to the goal of maximizing long-term shareholder value. With respect to the nomination of continuing directors for re-election, the individual’s past contributions to our Board are also considered.

| THE BOARD’S ROLE AND RESPONSIBILITIES |

The Board is elected by shareholders and represents shareholder interests in the long-term success of MAA. Except for matters voted upon by shareholders, the Board acts as the ultimate decision maker of MAA. While management is responsible for the daily operations of MAA, the Board operates in an oversight capacity.

| 2020 PROXY STATEMENT | 9 |

| KEY BOARD RESPONSIBILITIES |

| STRATEGY |

Strategic planning and oversight of management’s execution of MAA’s strategic vision is a primary responsibility of the Board. Annually, management and the Board review and discuss detailed strategic plans for the next several years, including changes from previous strategic positions, market and economic projections, peer performance benchmarking data, areas of focus for each functional area, expected financial statement and shareholder investment impacts, resource requirements, risks and stress test scenarios, among other topics.

Throughout the year the Board and its committees receive updates from management and actively engage in further discussions regarding execution of the strategy, variables impacting results and changes to the strategic plan.

Each year, the Board holds one of its quarterly meetings in a different MAA market. In addition to its regular Board and committee meetings, the Board visits several properties representing different aspects of MAA’s strategy. The Board believes these on-site visits provide insight into MAA’s markets, operations, resident base, human capital management, technology usage and allocation of capital investments, and allow for better oversight of the company’s strategies.

| RISK MANAGEMENT |

While management is responsible for the day to day management of our risk exposures, both the Board as a whole and its respective committees serve active roles in overseeing the management of our risks. Our Board or its committees regularly review, with members of our senior management and outside advisors, information regarding our strategy and key areas of the company including operations, investment transactions and development, finance, information technology, human capital, legal and regulatory, as well as the risks associated with each. Senior management as well as outside advisors also periodically meet with each committee and make representations associated with their respective risk oversight responsibilities as outlined below:

| AUDIT COMMITTEE |

| ■ | Accounting practices and policies |

| ■ | Internal controls over financial reporting |

| ■ | Tax, including REIT compliance |

| ■ | Fraud assessments |

| ■ | Financial policies |

| ■ | Internal Audit |

| ■ | Cybersecurity |

| ■ | Ethics and compliance programs |

| ■ | Whistleblower platform |

| ■ | Independence of independent registered public accounting firm |

| COMPENSATION COMMITTEE |

| ■ | Executive compensation |

| ■ | Overall compensation practices and policies for all associates |

| ■ | Independence of compensation consultant |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| ■ | Corporate governance |

| ■ | Independence of Board |

| ■ | Conflicts of interest and related party transactions |

| ■ | Board composition |

While each committee is responsible for evaluating certain risks and overseeing the management of such risks, our Board is regularly informed through committee reports about risks assigned to committees. In addition, the Board periodically reviews the results of our enterprise risk management efforts and receives legal and operational updates from executive management at every meeting.

| SUCCESSION PLANNING |

The Board is responsible for appointing our CEO and for ensuring that adequate succession plans are in place to address both planned CEO succession as well as potential unexpected or emergency succession needs. The Nominating and Corporate Governance Committee oversees succession planning for both the Board and CEO, routinely obtaining input from and updating the full Board on succession plan reviews.

The Nominating and Corporate Governance Committee also oversees succession planning and associate development of executive and senior management positions to ensure adequate bench strength is available to meet the long-term needs of MAA. The CEO and other executive management periodically update the Nominating and

| 2020 PROXY STATEMENT | 10 |

Corporate Governance Committee and the full Board on senior management succession plans including associate development plans and areas of risk.

The Board has exposure to internal succession candidates on an ongoing basis, meeting with executives both inside and outside of Board meetings at least four times a year and also periodically meeting with key senior managers.

The Compensation Committee considers succession planning input from the Board and the Nominating and Corporate Governance Committee when determining compensation packages for the Board and NEOs.

| ESG |

Ensuring the long-term success of MAA for our shareholders requires a long-term approach in all that we do. The Board is directly responsible for setting MAA’s strategy, which includes long-term sustainability planning. Committees of the Board support sustainability within their respective purviews: the Nominating and Corporate Governance Committee directs the corporate governance aspects of MAA, the Audit Committee ensures that MAA’s accounting policies and procedures and auditing controls support the reporting of high quality financial statements, and the Compensation Committee considers the need to attract and retain qualified associates to deliver on our long-term strategic directives.

In response to investor engagement in 2018, the Board took steps to support management’s formalization of its ESG efforts and periodically receives updates from management on various aspects of ESG.

SOCIAL

| Open Arms Foundation | ||||

As our corporate charity that has been in place since soon after our initial public offering, the Open Arms Foundation is our primary focus in regards to social impact. The foundation supplies fully-furnished apartments to families and individuals who have to travel away from their own home to receive specialized longer-term medical treatment. These homes help ease the financial burden of long-distance lodging needs while providing a home where family, friends and even pets can support their loved one.

Since MAA formed the Open Arms Foundation our Board has authorized the annual donation of apartment homes from across our portfolio for the exclusive use as Open Arms homes. In addition, MAA makes donations during the holidays directly to individuals and families staying in Open Arms homes to help bring some joy to their season.

Open Arms is managed and operated 100% by MAA associates who donate time both during and outside of work hours to run the charity, raise additional funds to fully furnish the units and pay all of the utilities, and support our guests from throughout the world. | ||||

| 2019 | To learn more about The Open Arms Foundation: https://www.maac.com/about-us/open-arms-foundation/

| |||

| Apartments Donated | 53 homes in 13 states | |||

| Families Helped | 126 | |||

| Nights of Rest Provided | 15,441 | |||

| MAA Rent Concessions | $ 594,104 | |||

| MAA Holiday Donations | $ 7,800 | |||

| Associate Fundraisers/Donations | $ 726,085 | |||

| Other Civic and Charitable Contributions | ||||

In addition to providing a home away from home for those in medical crisis, we further support the communities where our residents live and our associates work by making financial contributions to various civic and charitable organizations.

These organizations work to enrich the economic and cultural environments of communities and encompass areas of focus from public safety, education, access to economic opportunities and quality of life to promoting diversity and sustainable living. In 2019, we made approximately $750,000 in commitments to such organizations to assist them in creating better environments and opportunities for us all. | ||||

| 2020 PROXY STATEMENT | 11 |

| The very nature of multi-family housing – using limited land resources to house thousands of families - is based in sustainability concepts. MAA is committed to ensuring that the impact we make on not only our associates, residents and investors, but also the surrounding communities, is a positive one. |

Below are some of the steps we’ve taken so far to formalize and strengthen our focus on improving our environmental impact and disclosures.

| ||

| 2018 | ■ | Formed a CEO-led ESG executive steering committee responsible for setting our company-wide sustainability strategy.

|

| ■ | Organized an Environmental Committee comprised of department heads across the company tasked with evaluating how we can further enhance our ongoing efforts to decrease our environmental impact.

| |

| 2019 | ■ | The Compensation Committee and full Board included responsibility for enhancing MAA’s sustainability efforts and ensuring that MAA is doing the work required to be in a position to produce its inaugural sustainability report by the end of 2020 in our CEO’s annual goals.

|

| ` | ■ | The Compensation Committee included responsibility for the implementation of our formal ESG efforts, including participation in the GRESB assessment, in our CFO’s annual goals and annual incentive opportunity.

|

| ■ | Completed our first GRESB assessment to assist in assessing and benchmarking our current state of ESG performance and provide insight for establishing our ESG goals.

| |

| ■ | Engaged an ESG consultant to help guide us in building our ESG program, establishing our environmental management system, improving our GRESB reporting and publishing or inaugural sustainability report. | |

And here’s what’s coming next. | ||

| 2020 | ■ | Complete our second GRESB assessment.

|

■ | Publish our inaugural sustainability report providing quantitative disclosure of key performance metrics related to our emissions, energy and water usages, and waste generation, including absolute and normalized scope 1 and 2 greenhouse gas emissions as well as our sustainability policies and plans for progressive improvement.

| |

| ■ | Continued incorporation of executive compensation goals tied to ESG initiatives. | |

Environmental Stewardship in Action While we are working on formalizing, documenting and providing disclosure of our ESG efforts in addition to continually striving for improvement, below are some examples of environmental stewardship we have already implemented.

|

Conserving Resources Conserving Resources | |

■ Low-flow toilets and WaterSense plumbing fixtures ■ Smart irrigation and water use efficiency audits ■ Landscape innovations minimizing turf and using drought tolerant plant material ■ Utility monitoring systems

| |

Reducing Waste Reducing Waste | |

■ On-site trash recycling options for residents ■ Trash compactions to reduce pick-ups ■ Online leasing and communication tools ■ Use of carpets made with recycled content ■ Vendor partnerships to recycle carpet and other flooring material

| |

Increasing Energy Efficiency Increasing Energy Efficiency | |

■ Reduced watt, high performance lighting fixtures in community breezeways and common areas ■ Routine maintenance and audits of HVAC systems and upgrades to efficient equipment ■ Energy Star rated appliances ■ Smart thermostats | |

GOVERNANCE

MAA is proud of our history of strong corporate governance. We are consistently recognized by third parties as having overall lower risk in areas of corporate governance and executive compensation in relation to various peer groups. Our Nominating and Corporate Governance Committee routinely reviews our corporate governance policies, considering developing best practices and the long-term best interests of our shareholders.

Policies regarding our Board and corporate structure, director and executive compensation, equity ownership and internal controls over the quality of our financial statements are provided throughout this proxy statement.

You can also find more documents and information related to our corporate governance practices on our website by going to http://ir.maac.com/Corporate-Governance.

|

| To learn more visit | https://www.maac.com/about-us/sustainability/ |

| To share your thoughts email | ESG@maac.com |

| 2020 PROXY STATEMENT | 12 |

We believe that our current board leadership model, when combined with the experience of our Board, the strong leadership of our independent directors and Lead Independent Director, the committees of the Board and the corporate governance policies in place, strikes an appropriate balance between informed, consistent leadership and independent oversight, allowing for efficiency and accountability, ultimately creating an environment for the effective execution of the Board’s duties and responsibilities.

| COMBINED CEO AND CHAIRMAN Provides benefit of management’s perspectives on MAA to enhance the Board’s oversight functions

|

| LEAD INDEPENDENT DIRECTOR Provides an appropriate contact for matters concerning the CEO and ensures agendas include all topics of interest to the Board

|

83% | SUPERMAJORITY OF INDEPENDENT DIRECTORS Provides for strong oversight of CEO and management

|

| NON-MANAGEMENT AND INDEPENDENT DIRECTOR EXECUTIVE SESSIONS Ensures candid discussions

|

100% | INDEPENDENT AUDIT, COMPENSATION, AND NOMINATING AND CORPORATE GOVERNANCE COMMITTEES Provides for better control and oversight of critical areas of responsibility

|

| EQUAL VOTES Each director’s vote holds the same weight to ensure all viewpoints are represented in decisions

|

| DIVERSITY Offers a breadth of knowledge, experiences, viewpoints and expertise

|

| SEC FINANCIAL EXPERTS Two SEC financial experts ensure the Audit Committee has the unique skills and expertise required to perform the committee’s oversight responsibilities

|

| EXTERNAL CONSULTANTS Ability to retain external consultants, experts and legal counsel provides the Board with appropriate resources to protect the interests of shareholders

|

| DIRECT COMMUNICATION WITH BOARD Provides shareholders and other interested parties with the ability to communicate with the groups representing their best interests: Board, committees, non-management directors or independent directors |

CURRENT BOARD COMPOSITION

The following table reflects our current Board composition.

Other Public Company Boards | |||||||||||

| Name | Age (1) | Gender | Director Since | Committee Memberships | |||||||

| A | C | NCG | REI | ||||||||

H. Eric Bolton, Jr. Chairman | 63 | M | 1997 | XC | 1 | L | Lead Independent Director | ||||

Russell R. French INDEPENDENT | 74 | M | 2016 | X, SFE | - | INDEPENDENT | Indicates that our Board has affirmatively determined the 10 Directors indicated meet the independence standards of our Corporate Governance Guidelines, the listing standards of the NYSE and applicable SEC rules | ||||

Alan B. Graf, Jr. INDEPENDENT | 66 | M | 2002 | L, XC, SFE | 1 See page 24 | ||||||

Toni Jennings INDEPENDENT | 71 | F | 2016 | X | X | 2 | |||||

James K. Lowder INDEPENDENT | 70 | M | 2013 | X | X | - | NM | Non-Management Director | |||

Thomas H. Lowder INDEPENDENT | 70 | M | 2013 | X | X | - | A | Audit Committee | |||

Monica McGurk INDEPENDENT | 50 | F | 2016 | X | X | - | C | Compensation Committee | |||

Claude B. Nielsen INDEPENDENT | 69 | M | 2013 | X | XC | - | NCG | Nominating and Corporate Governance Committee | |||

Philip W. Norwood INDEPENDENT | 72 | M | 2007 | XC | X | - | REI | Real Estate Investment Committee | |||

W. Reid Sanders INDEPENDENT | 70 | M | 2010 | X | 2 | X | Committee Member | ||||

Gary Shorb INDEPENDENT | 69 | M | 2012 | X | X | - | XC | Committee Chairman | |||

David P. Stockert NM | 58 | M | 2016 | X | 1 | SFE | SEC Financial Expert | ||||

| (1) | Age is as of May 19, 2020, the meeting date for the Annual Meeting. |

| 2020 PROXY STATEMENT | 13 |

BOARD DIVERSITY

The Board believes that diversity provides a breadth of knowledge, viewpoints and experiences that contribute to a stronger board and cultivates better decisions. The Board also believes that a diverse company will attract highly qualified associates and be appealing to residents, which will ultimately produce the best results for our shareholders. The current Board represents diversity in many areas, including those listed below.

■ Industry knowledge

■ Company structure and leadership models

■ Technical areas of expertise

■ Geographic market knowledge of our portfolio footprint

■ Gender

■ Age

■ Tenure on Board

| The Board believes that diversity in personal attributes such as gender, race, ethnicity and age are important to ensure the broadest range of ideas and perspectives are contributed to Board discussions. In addition, to be in a position to best lead MAA, the Board believes it is important that they reflect the diversity of our associates and residents. To that end, the Board is dedicated to expanding diversity in all areas, including personal attributes, and is committed to actively pursuing qualified candidates that will add diversity in areas such as race and ethnicity to the Board. As such, the Board has directed the Nominating and Corporate Governance Committee to make diversity of race or ethnicity a key criteria for the next director addition to the Board. |

BOARD AND COMMITTEE MEETINGS

MEETINGS OF THE BOARD, COMMITTEES AND OTHER GROUPS

The below schedule provides the number of meetings that the Board, each committee and certain other groups of the Board held during 2019.

| 4 | Board |

| 8 | Audit Committee |

| 3 | Compensation Committee |

| 4 | Nominating and Corporate Governance Committee |

| 7 | Real Estate Investment Committee |

| 4 | Non-Management Directors |

| 4 | Independent Directors |

As Lead Independent Director, Mr. Graf presides over the meetings of both the non-management directors and the independent directors.

DIRECTOR ATTENDANCE

All of the directors attended more than 75% of the meetings of our Board and their respective committees during the calendar year 2019.

INDEPENDENT DIRECTORS

A director is considered independent if our Board affirmatively determines that the director has no direct or indirect material relationship with us. Consistent with the requirements of the SEC and the NYSE, our Board reviews all relevant transactions or relationships between each director, or any of his or her family members, and us, our senior management and our independent auditors. Our Board has adopted the following categorical standards.

| ■ | A director who is an employee or whose immediate family member is one of our executive officers is not independent until three years after the end of such employment relationship. |

| ■ | A director who receives, or whose immediate family member receives, more than $120,000 in any given 12-month period in direct compensation from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), is not independent until three years after he or she ceases to receive more than $120,000 in any given 12-month period in such compensation. |

| ■ | A director who is affiliated with or employed by, or whose immediate family member is affiliated with or employed in a professional capacity by, any of our present or former internal or external auditors is not independent until three years after the end of the affiliation or the employment or auditing relationship. |

| ■ | A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executive officers serve on that company’s Compensation Committee is not independent until three years after the end of such service or the employment relationship. |

| ■ | A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues, is not independent until three years after falling below such threshold. |

| 2020 PROXY STATEMENT | 14 |

Our Board consults with both internal and external counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent”, including those set forth in pertinent listing standards of the NYSE, as in effect from time-to-time.

REGULAR MEETINGS WITHOUT MANAGEMENT

Both our non-management directors and our independent directors regularly meet without management present. The Board has determined that Mr. Stockert is not an independent director because he was the CEO of Post Properties, Inc. which MAA acquired within the past five years. We consider Mr. Stockert to be a non-management director. As such, Mr. Stockert meets from time-to-time with the independent directors without the participation of management.

STANDING COMMITTEES

Our Board has four standing committees: Audit; Compensation; Nominating and Corporate Governance; and Real Estate Investment. All of the members of the Audit, Compensation and Nominating and Corporate Governance committees are independent, pursuant to the standards set forth in our Corporate Governance Guidelines, the NYSE listing standards and applicable SEC rules. The Real Estate Investment Committee consists of three independent members and two non-independent members. The responsibilities of each committee are outlined below.

| AUDIT | RESPONSIBILITIES |

100% Independent Membership | ■ Appoint, determine the compensation of, oversee and evaluate the work of the independent registered public accounting firm |

| ■ Review and discuss with management and the independent registered public accounting firm the annual audited and quarterly unaudited financial statements and our disclosure under Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Form 10-Qs and Form 10-K | |

8 Meetings in 2019 | ■ Discuss earnings press releases, including the use of “pro forma” or “adjusted” non-GAAP information, and discuss generally the financial information and earnings guidance which has been or will be provided to analysts and rating agencies |

| ■ Review and discuss with management and the independent registered public accounting firm the adequacy and effectiveness of our systems of internal accounting and financial controls | |

2 SEC Financial Experts | ■ Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters |

| ■ Review with management and the independent registered public accounting firm our compliance with the requirements for qualification as a REIT | |

| ■ Meet with management responsible for oversight of the Company’s cybersecurity, crisis management and enterprise risk management programs at least annually to discuss the Company’s cybersecurity risks, including a review of the endeavors management has undergone to identify, assess, monitor and address those risks as well as response and recovery plans to address cybersecurity incidents | |

| ■ Review and reassess annually the Audit Committee Charter and submit any recommended changes to the Board for its consideration | |

| ■ Issue a report annually as required by the SEC’s proxy solicitation rules |

| COMPENSATION | RESPONSIBILITIES |

100% Independent Membership | ■ Review and approve our compensation objectives |

| ■ Review and recommend the compensation programs, plans, and awards for the CEO to the Board and review and approve the same for the other executive officers, after taking into consideration any past “Say-on-Pay” votes by our shareholders | |

| ■ Review and approve any employment and severance arrangements and benefits of the CEO and other executive officers | |

3 Meetings in 2019 | ■ Recommend to the Board how often MAA should submit the “Say-on-Pay” vote to shareholders |

| ■ Recommend the compensation for directors to the Board | |

| ■ Evaluate and oversee risks associated with the company’s compensation policies and practices | |

| ■ Act as administrator, as may be required, for our equity-related incentive plans | |

| ■ Review and discuss with management the information contained in the Compensation Discussion and Analysis section of the Proxy Statement | |

| ■ Assess the independence of, retain and oversee compensation consultants, outside counsel and other advisors assisting the committee with the performance of its duties | |

| ■ Review and reassess annually the Compensation Committee Charter and recommend any proposed changes to the Board for approval | |

| ■ Issue a report annually related to executive compensation, as required by the SEC’s proxy solicitation rules |

| 2020 PROXY STATEMENT | 15 |

| NOMINATING AND CORPORATE GOVERNANCE | RESPONSIBILITIES |

100% Independent Membership | ■ Provide assistance and oversight in identifying qualified individuals to serve as members of the Board and make recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a shareholder vote at the annual meeting of shareholders |

| ■ Review the qualification and performance of incumbent directors to determine whether to recommend them as director nominees for re-election | |

4 Meetings in 2019 | ■ Review and consider candidates for directors who may be suggested by any director or executive officer, or by any shareholder if made in accordance with our charter, bylaws and applicable law |

| ■ Provide assistance and oversight in recruiting and recommending qualified nominees for new or vacant positions on the Board | |

| ■ Make committee membership recommendations to the Board | |

| ■ Oversee the annual evaluation of the effectiveness of the current policies and practices of the Board and its committees | |

| ■ Review considerations relating to board composition and develop and recommend criteria for membership including diversity, independence, experience, expertise and skills to the Board for its approval | |

| ■ Review potential director conflicts of interest | |

| ■ Review and reassess annually the Nominating and Corporate Governance Committee Charter and submit any proposed changes to the Board for approval | |

| ■ Review and recommend to the Board appropriate corporate governance principles that best serve the practices and objectives of the Board | |

| ■ Review the orientation process and the continuing education program for all directors, as may be required by applicable listing standards or other regulatory requirements | |

| ■ Oversee succession planning for both the Board and CEO, and routinely obtain input from and update the full Board on succession plan reviews |

REAL ESTATE INVESTMENT | RESPONSIBILITIES |

Majority Independent Membership | ■ Consider and approve or disapprove specific property acquisitions presented by management which fall within the individual and aggregate committee approval levels as periodically established by the Board |

| ■ Consider and approve or disapprove the acquisition of land and subsequent initiation of construction for development projects presented by management which fall within the individual and aggregate committee approval levels as periodically established by the Board | |

7 Meetings in 2019 | ■ Refer and make a recommendation to the Board regarding proposed transactions which fall outside of the individual or aggregate approval levels as periodically established by the Board |

| ■ Consider and approve or disapprove disposition of individual properties not listed as a potential disposition property in the annual strategic plan as reviewed and approved by the Board as well as any property for which the disposition would result in materially less net proceeds than previously considered by the Board | |

| ■ Review and reassess annually the Real Estate Investment Committee Charter and submit to the Board any recommended changes |

Our Board may, from time-to-time, form other committees as circumstances warrant. Such committees will have authority and responsibility as delegated by our Board.

We believe that effective corporate governance is critical to our long-term sustainability and our ability to create long-term value for our shareholders. We continuously review our corporate governance policies and compare them to other public companies, our peers and industry best practices, and consider feedback we receive from investors and what we believe is in the long-term best interests of all of our shareholders. We will continue to monitor emerging developments in corporate governance and enhance our policies and procedures when required by regulation or when our Board determines that it would benefit our shareholders.

| 2020 PROXY STATEMENT | 16 |

GOVERNANCE DOCUMENTS

AUDIT COMMITTEE CHARTER

The Audit Committee Charter outlines the duties and responsibilities of the committee in fulfilling its responsibility to oversee the integrity of MAA’s financial statements, MAA’s compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualification and independence, the performance of MAA’s Internal Audit Department and independent registered public accounting firm, as well as the oversight of MAA’s cybersecurity efforts.

COMPENSATION COMMITTEE CHARTER

The Compensation Committee Charter outlines the duties and responsibilities of the committee in fulfilling its responsibilities to discharge the responsibilities of the Board relating to compensation of MAA’s executive officers, including: establishing compensation policies and incentive and equity-based award plans to attract, motivate and retain high quality leadership and compensating them in a manner consistent with the interests of MAA’s shareholders; overseeing MAA’s risk assessment and risk management relative to compensation structures; reviewing and discussing the Compensation Discussion and Analysis to be included in the Proxy Statement; and providing the Compensation Committee Report for inclusion in the Proxy Statement that complies with the rules and regulations of the SEC.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER

The Nominating and Corporate Governance Committee Charter outlines the duties and responsibilities of the committee to provide assistance to the Board in identifying and recommending individuals qualified to serve as directors of MAA, review the composition of the Board, review and recommend corporate governance policies for MAA, guide CEO and director succession plans and procedures, and oversee the evaluation of the Board, its committees and management.

REAL ESTATE INVESTMENT COMMITTEE CHARTER

The Real Estate Investment Committee Charter outlines the duties and responsibilities of the committee to consider and approve or disapprove specific property acquisitions, dispositions or development projects for MAA.

CODE OF CONDUCT

MAA’s Code of Conduct reflects our commitment to achieving high standards of business, personal and ethical conduct. The Code of Conduct is applicable to our Board, executive officers and all other associates, including our CEO, CFO (Principal Financial Officer) and Principal Accounting Officer. Each member of our Board and all of our executive officers annually review the requirements in the Code of Conduct, attest in writing to meet the standards therein and affirm their compliance with those standards. Amendments to or waivers from our Code of Conduct (to the extent applicable to our CEO, Principal Financial Officer or Principal Accounting Officer) are publicly disclosed on our website. No waivers to the Code of Conduct have been made as of the date of this Proxy Statement.

WHISTLEBLOWER POLICY

The Whistleblower Policy sets forth the procedures established by the Audit Committee to allow for the receipt, retention and treatment of complaints received by MAA regarding accounting, internal accounting controls or auditing matters as well as the confidential, anonymous submission of concerns regarding questionable accounting and auditing matters.

Full copies of our Corporate Governance Guidelines, Code of Conduct, Whistleblower Policy and all committee charters are available upon request at no charge.

| Online |

| http://ir.maac.com/Corporate-Governance

Information from our website is not incorporated by reference into this Proxy Statement.

| By Mail |

| MAA ATTN: Legal Department 6815 Poplar Avenue, Suite 500 Germantown, TN 38138 |

| 2020 PROXY STATEMENT | 17 |

CORPORATE GOVERNANCE GUIDELINES

Approved by the Board and reviewed annually by the Nominating and Corporate Governance Committee, the Corporate Governance Guidelines reflect the principles by which the Board operates. These guidelines help to ensure that the Board is operating in a fashion that allows it to represent the best interests of our shareholders. Each member of our Board and our NEOs annually review the requirements in the Corporate Governance Guidelines and affirm in writing their compliance with these standards. The guidelines encompass the following requirements, among others.

DIRECTOR INDEPENDENCE

At least a majority of directors on the Board must be independent.

OTHER PUBLIC BOARD SERVICE

Directors can only serve on a total of three other public boards. In addition, directors must notify the Nominating and Corporate Governance Committee before accepting any new directorship to a public board.

RESIGNATION UPON EMPLOYMENT CHANGE

Directors who have a change in employer or significant change in job responsibilities must submit an offer of resignation from the Board and all committees for consideration.

MANDATORY RETIREMENT AGE

Directors are ineligible for nomination for re-election following their 75th birthday unless a waiver is granted by the Board for special circumstances.

MAJORITY VOTE

Incumbent directors must tender their resignation to the Board for consideration if they fail to receive a majority of the vote for re-election in an uncontested election.

FREQUENCY OF MEETINGS

The Board is required to meet at least four times a year.

COMPLIANCE WITH ETHICS AND COMPLIANCE POLICIES

Directors and NEOs are required to comply with all MAA ethics and compliance policies. Any waivers must be approved by disinterested members of the Board and publicly disclosed.

NON-MANAGEMENT AND INDEPENDENT DIRECTOR MEETINGS

Non-management directors are required to meet in executive session at regularly scheduled Board meetings and independent directors are required to meet at least once a year.

BOARD ACCESS TO MANAGEMENT AND ADVISORS

The Board and its committees have full and free access to all associates and the authority to engage independent advisors without notifying or receiving approval from MAA.

ATTENDANCE AT ANNUAL MEETING

Directors are encouraged to attend annual meetings of shareholders. We have historically scheduled a Board meeting on the same day as our annual meeting of shareholders so that our directors will be on site for the meeting. All directors attended our 2019 Annual Meeting of Shareholders.

MINIMUM SHARE OWNERSHIP

Within five years of appointment, non-management directors must own 5x the annual cash retainer fee in shares of MAA stock or the equivalent. The CEO must own 3x his base salary and other NEOs must own 2x their respective base salary within three years of appointment to their respective position.

HOLDING PERIOD REQUIREMENT

NEOs are required to retain ownership of at least 50% of net shares, after the payment of taxes, acquired through equity incentive plans until they retire, otherwise terminate or are no longer serving as an NEO.

DIRECTOR EDUCATION

Directors are encouraged to attend accredited director education programs for which expenses are reimbursed by MAA. In addition, educational materials and presentations by external experts are periodically provided to the Board and its committees on various topics of interest and evolving areas.

ANNUAL PERFORMANCE EVALUATIONS

The Nominating and Corporate Governance Committee oversees the anonymous evaluation by directors of the performance of the Board and each of their respective committees on an annual basis. Results are reviewed and discussed by the committees and the Board as a whole.

BYLAWS AND CHARTER PROVISIONS

PROXY ACCESS

MAA’s bylaws allow a shareholder or a group of up to 20 shareholders that have collectively owned at least three percent of MAA’s common stock continually for a period of at least three years to nominate and include in our proxy materials director nominees constituting up to 20% of the Board, provided that the shareholder(s) and the nominees(s) satisfy the requirements specified in our bylaws.

| 2020 PROXY STATEMENT | 18 |

SPECIAL MEETINGS OF SHAREHOLDERS

MAA’s bylaws allow any of the following to call a special meeting of the shareholders.

| ■ | CEO |

| ■ | President |

| ■ | Majority of the Board |

| ■ | Majority of the independent directors |

| ■ | Shareholders representing more than 10% of voting shares |

Information on how shareholders can request a special meeting and the requirements to do so can be found in our bylaws.

ANNUAL ELECTIONS OF ALL DIRECTORS

MAA’s charter requires the annual election of all directors. The Board believes that annual elections is an appropriate timeframe to ensure that directors are being held accountable to shareholders.

Copies of our bylaws and charter can be found on the SEC website at https://www.sec.gov.

| Bylaws | See Exhibit 3.2(i) to the Form 8-K which was filed on March 14, 2018 |

| Charter | See Exhibit 3.1 to the Form 10-K which was filed on February 24, 2017 |

POLICIES REGARDING THE ABILITY OF EMPLOYEES OR DIRECTORS TO ENGAGE IN HEDGING TRANSACTIONS OR PLEDGING OF SECURITIES

Under MAA’s policies, directors, executive officers and certain designated employees who in the ordinary course of the performance of their duties have access to material, nonpublic information regarding MAA or any of MAA’s subsidiaries are prohibited from purchasing financial instruments, or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted as compensation, or held directly or indirectly by the individuals covered under the policies.

The above mentioned prohibitions also apply to any covered individual’s spouse, minor children, family members living within the same household and any other affiliates or affiliated entities.

More specifically, MAA’s policies prohibit executing short sales (the selling of securities that are not owned at the time of sale), purchasing or selling derivative securities or hedging transactions (including the buying and selling of puts, calls, other derivative securities, derivative securities that provide the economic equivalent of owning securities, any opportunity to profit from the change in value of securities and any other hedging transaction), using securities as collateral on margin accounts and pledging securities as collateral for a loan.

These prohibitions relate to all MAA and MAA subsidiary securities including common stock, preferred stock, units in limited partnerships, options to purchase common stock, any other type of securities that MAA or MAA’s subsidiaries may issue (such as convertible debentures, warrants, exchange-traded options or other derivative securities), any derivative securities that provide the economic equivalent of ownership of any securities issued by MAA or MAA’s subsidiaries, and any opportunity to profit from any change in the value of any of the securities issued by MAA or MAA’s subsidiaries.

While MAA’s policies prohibit directors, executive officers and other individuals, affiliates and affiliated entities (as outlined above) from pledging securities as collateral on a loan, at the time the prohibition was adopted, a one-time exception was made to grandfather an existing pledge amount which was already in place. The pledge was deemed to be of immaterial risk to shareholders and cannot be increased or expanded. No additional exceptions for pledges have been made, and the Nominating and Corporate Governance Committee of the Board of Directors has determined that no other exceptions for pledges will be granted.

OTHER GOVERNANCE PRACTICES

SHAREHOLDER ENGAGEMENT

The Board’s primary role is to represent the long-term interests of our shareholders. MAA’s management and our dedicated investor relations team continually engage with shareholders on a variety of topics through industry and investor conferences, non-deal road shows, MAA-hosted investor days, property tours, quarterly earnings calls and one-on-one calls and meetings, among other vehicles. The Board oversees our engagement practices and is routinely updated with feedback received from investors. We also consider all communications to our Board and its committees and use those as opportunities to reach out to investors to learn more about their positions.

Our shareholder’s views are important to us and several past and pending changes to our governance practices have been designed and implemented in collaboration with shareholders including moving from staggered to annual

| 2020 PROXY STATEMENT | 19 |

elections of directors, amending our bylaws to encompass proxy access rights for shareholders and the issuance of our inaugural sustainability report later in 2020.

In 2019 we had over 400 formal interactions with shareholders collectively representing approximately 2/3rds of the outstanding shares of our common stock. Shareholders with questions can reach our Investor Relations team at investor.relations@maac.com or (866) 576-9689.

COMMUNICATING DIRECTLY WITH OUR BOARD

Shareholders and other interested parties can communicate in writing with our Board, any of its committees, its non-management directors as a group or its independent directors as a group by using the following address.

| MAA ATTN: Corporate Secretary 6815 Poplar Avenue, Suite 500 Germantown, TN 38138 |

INDEPENDENT EXTERNAL CONSULTANT HELPS SET DIRECTOR COMPENSATION

The Board periodically engages an independent external compensation consultant to benchmark non-employee director compensation and make recommendations to the Nominating and Corporate Governance Committee on appropriate compensation packages.

PRACTICES RELATED TO EXECUTIVE COMPENSATION

For information specific to governance practices in place in regards to our NEOs, please see Program Structure and Governance in this Proxy Statement with the materials provided related to Proposal 2: Advisory Vote to Approve Executive Compensation.

PRACTICES RELATED TO FINANCIAL REPORTING, ACCOUNTING POLICIES AND AUDITING

For information specific to governance practices in place in regards to our accounting policies and procedures, controls over financial reporting and auditing practices, please see Audit Committee Policies in this Proxy Statement with the materials provided related to Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm.

PROCESS FOR IDENTIFYING AND SELECTING DIRECTOR NOMINEES

The Board is responsible for recommending director nominees to our shareholders for election at our annual meetings and, from time to time, for appointing directors to fill vacancies on the Board. Our Board has delegated the responsibility for evaluating Board needs and the process of identifying and recruiting director candidates for Board consideration to the Nominating and Corporate Governance Committee.