Exhibit 99.1

CAPITAL MARKETS UPDATE AUGUST 2015 WWW.MAAC.COM

2 DISCIPLINED PORTFOLIO STRATEGY ACROSS HIGH GROWTH REGION 3 COMPETITIVE ADVANTAGES DRIVES VALUE 4 TRANSFORMED PORTFOLIO DRIVES VALUE A PROVEN SUCCESSFUL FULL-CYCLE STRATEGY • Established record of high return on invested capital • Compounded AFFO Growth of 8.7% over the past 5 years • 86 consecutive quarterly dividends, never reduced or suspended • 21 year established public company platform; long-tenured management team (nearly 18 years for Executive team and 12 years for VP level and above) 2 • Scale/efficiencies and competitive advantage in markets where we operate • Opportunistic acquisitions and operating outperformance = outsized returns over the full cycle • Balance sheet strength; transaction execution capabilities and superior operational coverage drives competitive value • Significant deal flow; $1.73 billion in acquisitions since 2010, average age of 4 years; dispositions of $780 million since 2010, average age of 26 years • $118.8 million active development pipeline; meaningful redevelopment opportunity • Higher margins and stronger core growth rate establishes an improved earnings platform • Long-term outperformance; compounding performance drives consistent value creation over full cycle • Multiple disparity to sector pricing creates compelling buy opportunity 5 OPPORTUNITY 1 EXPERIENCED & SUCCESSFUL PLATFORM • Portfolio strategy based on full-cycle performance; outperformance and lower volatility designed to steadily compound value • Well-diversified across the high growth Southeast/Southwest markets with favorable supply/demand dynamics

2 DISCIPLINED PORTFOLIO STRATEGY ACROSS HIGH GROWTH REGION 3 COMPETITIVE ADVANTAGES DRIVES VALUE 4 TRANSFORMED PORTFOLIO DRIVES VALUE A PROVEN SUCCESSFUL FULL-CYCLE STRATEGY • Established record of high return on invested capital • Compounded AFFO Growth of 8.7% over the past 5 years • 86 consecutive quarterly dividends, never reduced or suspended • 21 year established public company platform; long-tenured management team (nearly 18 years for Executive team and 12 years for VP level and above) 2 • Scale/efficiencies and competitive advantage in markets where we operate • Opportunistic acquisitions and operating outperformance = outsized returns over the full cycle • Balance sheet strength; transaction execution capabilities and superior operational coverage drives competitive value • Significant deal flow; $1.73 billion in acquisitions since 2010, average age of 4 years; dispositions of $780 million since 2010, average age of 26 years • $118.8 million active development pipeline; meaningful redevelopment opportunity • Higher margins and stronger core growth rate establishes an improved earnings platform • Long-term outperformance; compounding performance drives consistent value creation over full cycle • Multiple disparity to sector pricing creates compelling buy opportunity 5 OPPORTUNITY 1 EXPERIENCED & SUCCESSFUL PLATFORM • Portfolio strategy based on full-cycle performance; outperformance and lower volatility designed to steadily compound value • Well-diversified across the high growth Southeast/Southwest markets with favorable supply/demand dynamics

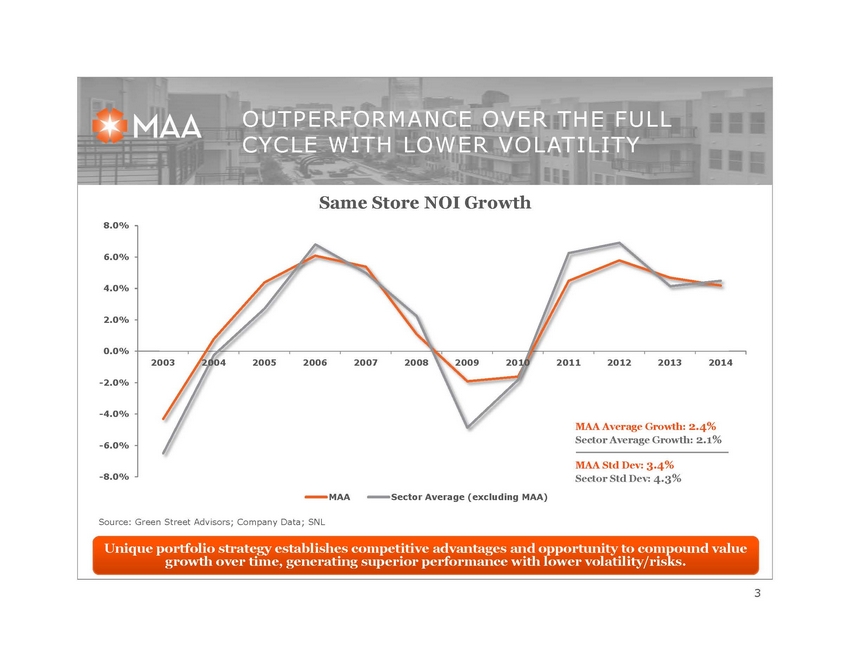

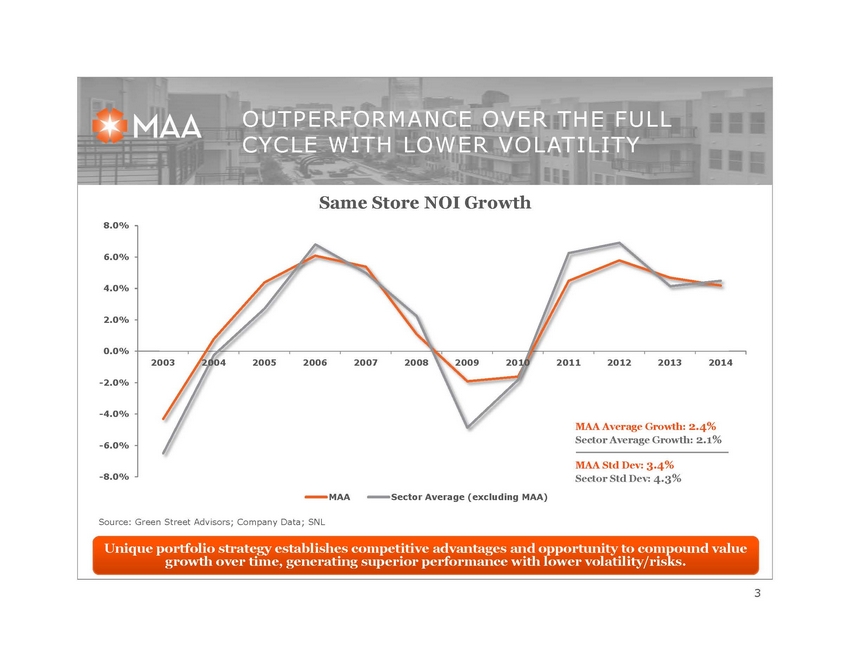

OUTPERFORMANCE OVER THE FULL CYCLE WITH LOWER VOLATILITY 3 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% Unique portfolio strategy establishes competitive advantages and opportunity to compound value growth over time, generating superior performance with lower volatility/risks.

OUTPERFORMANCE OVER THE FULL CYCLE WITH LOWER VOLATILITY 3 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% Unique portfolio strategy establishes competitive advantages and opportunity to compound value growth over time, generating superior performance with lower volatility/risks.

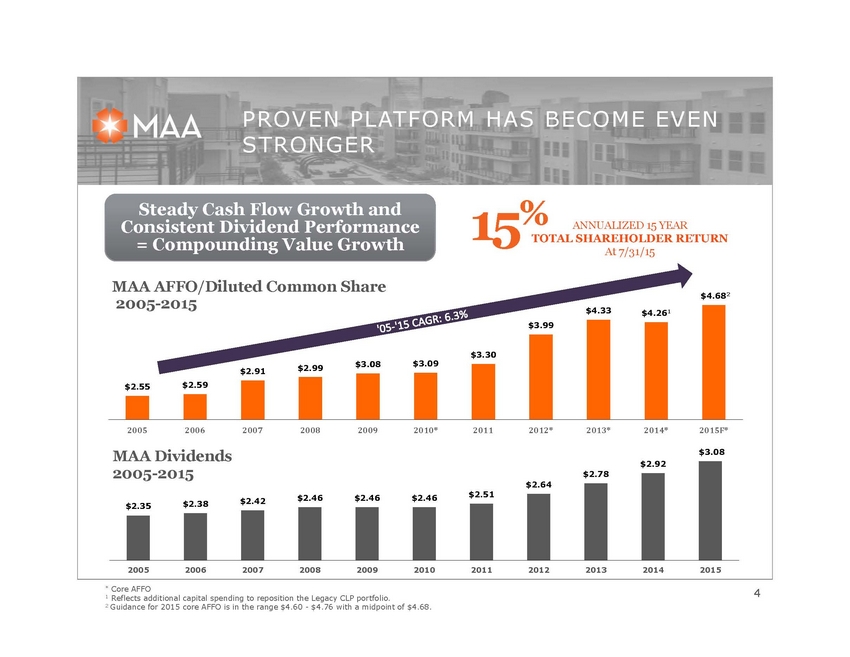

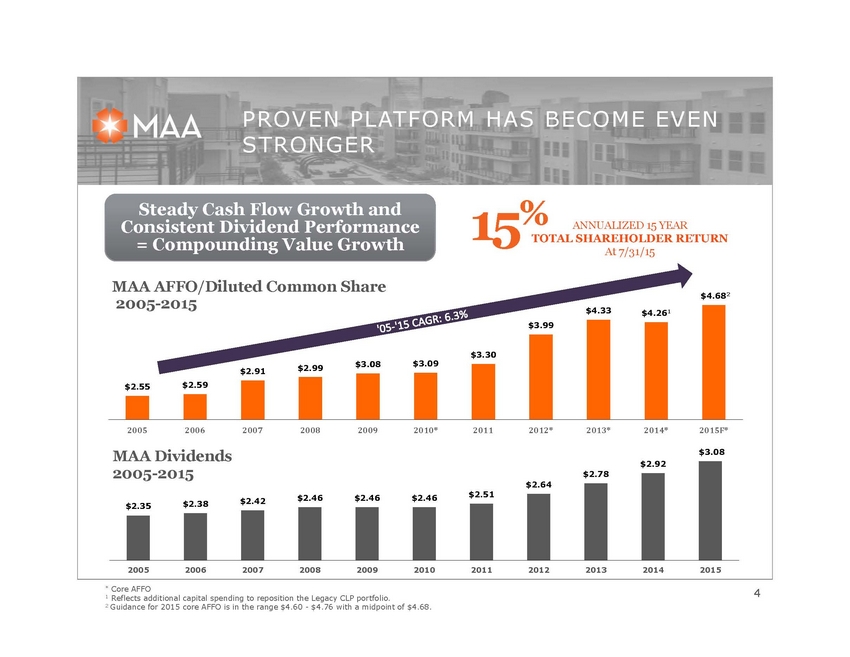

$2.35 $2.38 $2.42 $2.46 $2.46 $2.46 $2.51 $2.64 $2.78 $2.92 $3.08 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 MAA Dividends 2005-2015 PROVEN PLATFORM HAS BECOME EVEN STRONGER 4 * Core AFFO 1 Reflects additional capital spending to reposition the Legacy CLP portfolio. 2 Guidance for 2015 core AFFO is in the range $4.60 - $4.76 with a midpoint of $4.68. Steady Cash Flow Growth and Consistent Dividend Performance = Compounding Value Growth $2.55 $2.59 $2.91 $2.99 $3.08 $3.09 $3.30 $3.99 $4.33 $4.261 $4.682 2005 2006 2007 2008 2009 2010* 2011 2012* 2013* 2014* 2015F* MAA AFFO/Diluted Common Share 2005-2015 15% ANNUALIZED 15 YEAR TOTAL SHAREHOLDER RETURN At 7/31/15

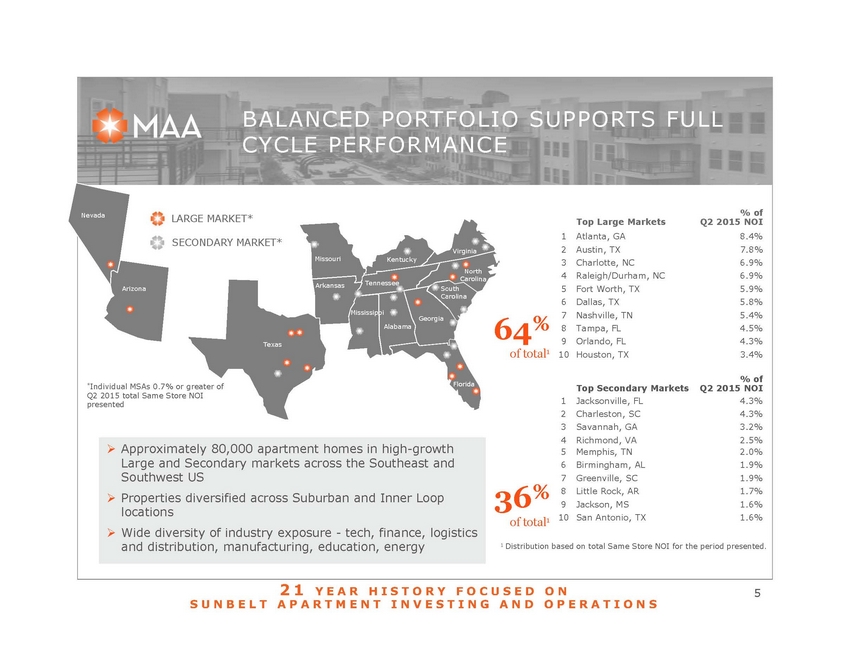

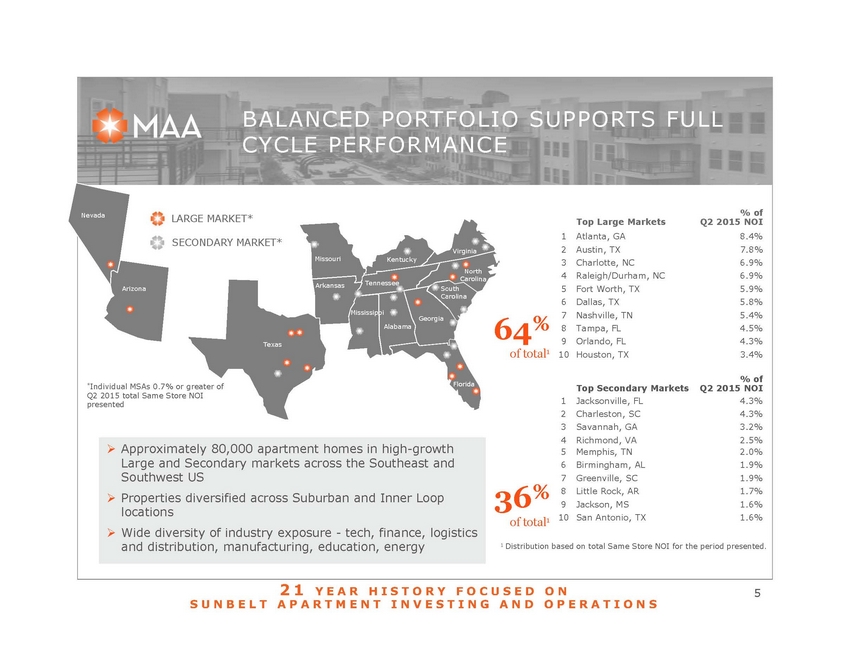

BALANCED PORTFOLIO SUPPORTS FULL CYCLE PERFORMANCE 5 Top Large Markets % of Q2 2015 NOI 1 Atlanta, GA 8.4% 2 Austin, TX 7.8% 3 Charlotte, NC 6.9% 4 Raleigh/Durham, NC 6.9% 5 Fort Worth,TX 5.9% 6 Dallas, TX 5.8% 7 Nashville, TN 5.4% 8 Tampa,FL 4.5% 9 Orlando,FL 4.3% 10 Houston, TX 3.4% Top Secondary Markets % of Q2 2015 NOI 1 Jacksonville, FL 4.3% 2 Charleston, SC 4.3% 3 Savannah, GA 3.2% 4 Richmond, VA 2.5% 5 Memphis,TN 2.0% 6 Birmingham, AL 1.9% 7 Greenville, SC 1.9% 8 Little Rock, AR 1.7% 9 Jackson,MS 1.6% 10 San Antonio, TX 1.6% 1 Distribution based on total Same Store NOI for the period presented. 64% of total1 36% of total1 Nevada Arizona Texas Mississippi Arkansas Missouri Kentucky Virginia North Carolina South Carolina Alabama Florida Georgia Tennessee LARGE MARKET* SECONDARY MARKET* *Individual MSAs 0.7% or greater of Q2 2015 total Same Store NOI presented „« Approximately 80,000 apartment homes in high-growth Large and Secondary markets across the Southeast and Southwest US „« Properties diversified across Suburban and Inner Loop locations „« Wide diversity of industry exposure - tech, finance, logistics and distribution, manufacturing, education, energy 21 Y E A R H I S T O R Y F O C U S E D O N S U N B E L T A P A R T M E N T I N V E S T I N G A N D O P E R A T I O N S

STRONG FUNDAMENTALS FOR OUR PORTFOLIO 6 Source: Moody’s Economy.com EMPLOYMENT Employment Growth Projections • Job growth, the primary driver of new household formation, continues to be most favorable in our region of the country • Our markets support a wide range of industries and employers (medical, automotive, energy, education, logistics, technology, government) DEMOGRAPHICS • Propensity to rent among young adults is at its highest point in recent history, with continued growth expected • People are getting married and starting families later in life, delaying trends that cause households to transition from renting into home ownership 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 2016 2017 MAA Large MAA Secondary Top 25 REIT Markets National Average

STRONG FUNDAMENTALS FOR OUR PORTFOLIO 7 Source: Moody’s Economy.com Projected Jobs : Projected Completions SUPPLY/DEMAND • Despite an increase in multifamily permitting in our markets, demand is expected to absorb the new supply • Over the last up cycle (2004-2007), the ratio of new jobs to multifamily completions in our markets averaged 7 to 1; 2015-16 projections exceed those totals • Likewise, turnover due to renting or buying single family homes continues to remain historically low AFFORDABILITY • Rent to income ratios continue to be in the 17-18% in range in both our Large and Secondary segments of the portfolio • This compares to 30-40% in the some of the more expensive bicoastal markets 6.8 12.6 8.3 16.6 0 2 4 6 8 10 12 14 16 18 Large Markets Secondary Markets 2015 2016

„X Scale and efficiency „X Recruit/retain top talent „X Margin outperformance STRATEGIC COMPETITIVE CAPABILITIES 8 INVESTING OPPORTUNISTICALLY SUPERIOR CAPITAL MANAGEMENT OPERATING AT A SUPERIOR LEVEL ASSET MANAGEMENT SUPERIORITY IN LOCAL MARKETS EXITING INVESTMENTS OPPORTUNISTICALLY „X Off market transactions „X Pre-purchase deals „X Pressured timing „X Experienced revenue mgmt. „X Web-based technology „X National contracts/scale „X 13K+ units since 2010 „X 13.5% average IRRs (leveraged) „X Investment Grade rated „X Multiple sources of capital „X Significant capacity SkySong; Phoenix, AZ

BEST ONLINE REPUTATION A m o n g P u b l i c M u l t i f a m i l y R E I T s a n d N M H C ’ s T o p 5 0 A p a r t m e n t M a n a g e r s 1 FOCUSED ON EXCEPTIONAL SERVICE GENERATING COMPETITIVE ADVANTAGES ACROSS REGION Implemented training and customer service process on CLP portfolio following merger; active ongoing focus across the portfolio Since merger, increased “recommend rate” for CLP portfolio on national third party rating site by 37 percentage points* Third party administered customer service survey jumped 6 percentage points and is now 12 percentage points above our competitors* Key customer focus on overall product and quality with 2,600 resident engagement events and over 360,000 surveys distributed annually* 9 DEDICATED TO EXCEEDING OUR RESIDENTS’ EXPECTATIONS; SUPPORTING SUPERIOR RESIDENT RETENTION, PRICING PERFORMANCE AND CORE GROWTH PERFORMANCE 1 J Turner ORA© Power Ranking at 4/30/2015 *Data as of 12/31/14

STRONG OPERATING PLATFORM DRIVES COMPETITIVE ADVANTAGES AND SUPERIOR OPERATING MARGINS Regional Market Leading Expertise • 21 years of institutional property management experience in markets we serve • Onsite teams have seen multiple cycles of the apartment markets in the same cities • We understand up and down performance at the market, sub-market and property level • 9 years of yield and revenue management system expertise • Competitive advantage in key markets vs. less sophisticated fee managers and smaller owner/ operators…ability to generate returns on capital that are higher than “market norms” Innovative Asset Management Programs • Robust revenue management capabilities • Unit interior redevelopment program • Centrally monitored delinquency, screening and resident selection process • Expertise in optimizing customer integration and interface through technology, onsite sales and customer service • Technical experts dedicated to supporting onsite service lowering resident turnover and increasing efficiency • Landscape group focused on superior curb appeal, vendor management and cost efficiency Proven Performance; CLP Portfolio Turn-Around • Improved CLP operating margin 80 bps • Revenue management platform drove 150 bps of above market comparison effective rent per unit • Proprietary system customizations increased fee collections performance • Reduced bad debt from 0.57% of rent to 0.35% of rent • Reduced same store personnel costs by 7% 10 COMPETITIVE ADVANTAGES ADD VALUE During 2014:

STRONG OPERATING PLATFORM DRIVES COMPETITIVE ADVANTAGES AND SUPERIOR OPERATING MARGINS Regional Market Leading Expertise • 21 years of institutional property management experience in markets we serve • Onsite teams have seen multiple cycles of the apartment markets in the same cities • We understand up and down performance at the market, sub-market and property level • 9 years of yield and revenue management system expertise • Competitive advantage in key markets vs. less sophisticated fee managers and smaller owner/ operators…ability to generate returns on capital that are higher than “market norms” Innovative Asset Management Programs • Robust revenue management capabilities • Unit interior redevelopment program • Centrally monitored delinquency, screening and resident selection process • Expertise in optimizing customer integration and interface through technology, onsite sales and customer service • Technical experts dedicated to supporting onsite service lowering resident turnover and increasing efficiency • Landscape group focused on superior curb appeal, vendor management and cost efficiency Proven Performance; CLP Portfolio Turn-Around • Improved CLP operating margin 80 bps • Revenue management platform drove 150 bps of above market comparison effective rent per unit • Proprietary system customizations increased fee collections performance • Reduced bad debt from 0.57% of rent to 0.35% of rent • Reduced same store personnel costs by 7% 10 COMPETITIVE ADVANTAGES ADD VALUE During 2014:

SOLID INVESTMENT GRADE BALANCE SHEET 11 Credit metrics MAA BBB Peers BBB+ Peers Total unencumbered assets to book value 70.3% 81.4% 73.9% Net debt / recurring EBITDA 6.0x 5.6x 6.1x Net debt / gross assets1 41.4% 34.9% 39.1% Secured debt / gross assets1 17.3% 14.3% 17.7% Fixed charge coverage ratio2 4.1x 4.0x 3.8x Note: As of 6/30/15 1 Gross assets is defined as total assets plus accumulated depreciation 2 Fixed charge coverage represents Recurring EBITDA divided by interest expense adjusted for mark-to-market debt adjustment % 0.0% 10.8% 6.1% 13.5% 57.0% maturing 12.6% Credit ratings Agency Rating Outlook Fitch Ratings3 BBB Positive Moody’s Investors Service4 Baa2 Stable S&P Ratings Services3 BBB Stable Debt maturity profile (in millions) 3 Mid-America Apartment Communities, Inc. & Mid-America Apartments, LP 4 Mid-America Apartments LP only • Over $1 billion of public bonds outstanding (2 public bond offerings) • Over $367 million in cash and debt capacity as of 6/30/2015 $304 $192 $469 $473 $2,003 2015 2016 2017 2018 2019+

SOLID INVESTMENT GRADE BALANCE SHEET 12 Debt Summary ($ in millions) 06/30/15 Secured Debt Fixed or Hedged Rate $1,308.0 Variable Rate 105.8 Total Secured Debt 1,413.8 Unsecured Debt Unsecured Bonds 1,319.4 Unsecured Term Loans 550.0 Unsecured Credit Facilities 159.0 Total Unsecured Debt 2,028.4 Total Debt $3,442.2 1 Total Capitalization equals the total number of shares of common stock and units times the closing stock price at period end plus total debt outstanding. Secured Debt, 15% Unsecured Debt, 22% Common Equity, 63% Total Capitalization1 at June 30, 2015 $5.79B Common Equity $3.44B Debt 9 2 % D E B T F I X E D O R H E D G E D

OUT-PERFORMANCE IN “NONINSTITUTIONAL” MARKETS 13 This market exposure contributes to a balanced portfolio and full cycle performance profile Our size, scale, technology, and operating platform relative to other operators in our markets drives revenue outperformance MAA’s market footprint is unique in the public multifamily REIT sector Market Annual Revenue Variance Savannah, GA 220 bps Huntsville, AL 220 bps Lexington, KY 210 bps San Antonio, TX 170 bps Jackson, MS 170 bps Little Rock, AR 140 bps Chattanooga, TN 130 bps Raleigh, NC 90 bps Virginia Beach, VA 60 bps Memphis, TN 50 bps Nashville, TN 40 bps Greenville, SC 40 bps Source: Market Data from Axiometrics Average Annual Revenue Outperformance vs Market (2012-2014)

61.7% 54.0% Sold Acquired 770 bps SIGNIFICANT CAPITAL RECYCLING OF PORTFOLIO SINCE 2010 14 Hi g h e r Ma r g i n s a n d Imp r o v e d Gr owt h P r o f i l e Transaction Volume1 (in millions) Age1 (in years) Effective Rent per Unit1, 2 Number of Units1 NOI Margin1, 2 After Capex NOI Margin1, 2 1 Inclusive of transactions from 2010 through 2015 YTD 2 Acquisition metrics reflect expected stabilization performance for acquired non-stabilized deals $1,730 $780 Acquired Sold 12,888 13,064 Acquired Sold 4 26 Acquired Sold $1,182 $715 Sold Acquired 58.0% 44.4% Sold Acquired 1,360 bps

61.7% 54.0% Sold Acquired 770 bps SIGNIFICANT CAPITAL RECYCLING OF PORTFOLIO SINCE 2010 14 Hi g h e r Ma r g i n s a n d Imp r o v e d Gr owt h P r o f i l e Transaction Volume1 (in millions) Age1 (in years) Effective Rent per Unit1, 2 Number of Units1 NOI Margin1, 2 After Capex NOI Margin1, 2 1 Inclusive of transactions from 2010 through 2015 YTD 2 Acquisition metrics reflect expected stabilization performance for acquired non-stabilized deals $1,730 $780 Acquired Sold 12,888 13,064 Acquired Sold 4 26 Acquired Sold $1,182 $715 Sold Acquired 58.0% 44.4% Sold Acquired 1,360 bps

$716 $750 $799 $863 $910 $969 $4,463 $4,684 $5,164 $5,766 $6,141 $6,792 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 $700 $750 $800 $850 $900 $950 $1,000 2010* 2011* 2012* 2013* 2014^ 2015F^ Same Store Effective Rent/Unit After Capex NOI/Unit MAA TODAY – A HIGHER QUALITY PORTFOLIO AND STRONGER CORE EARNINGS GROWTH PROSPECTS 15 Same Store NOI Margin after Capex Same Store Effective Rent & After Capex NOI/Unit Rent CAGR of 6.2% After Capex NOI/Unit CAGR of 8.8% * Legacy MAA portfolio ^ Combined portfolio Enclave; Charlotte, NC CR at Medical District; Dallas, TX 47.9% 48.0% 49.9% 51.8% 52.0% 53.6% 47.0% 48.0% 49.0% 50.0% 51.0% 52.0% 53.0% 54.0% 2010* 2011* 2012* 2013* 2014^ 2015F^ 570bps Improvement

MAA TODAY 16 Residences at Burlington Creek; Kansas City, MO Year Completed: 2014 Retreat at Vintage Park; Houston, TX Year Completed: 2014 Bulverde Oaks; San Antonio, TX Year Completed: 2014 Cityscape at Market Center; Dallas, TX Year Completed: 2013 Stonefield Commons; Charlottesville, VA Year Completed: 2013 CG at Lake Mary, Phase III; Orlando, FL Year Completed: 2014 2015 2014 2014 2014 2014 2014

MAA TODAY 17 CG at Randal Lakes; Orlando, FL Year Completed: 2014 CR at South End; Charlotte, NC Year Completed: 2014 Highlands of West Village, Atlanta, GA Year Completed: 2006/2012 Rivers Walk; Charleston, SC Year Completed: 2013 CR at Frisco Bridges; Dallas, TX Year Completed: 2013 1225 South Church, Phase II; Charlotte, NC Year Completed: 2013 2014 2014 2014 2013 2013 2013

MAA TODAY 17 CG at Randal Lakes; Orlando, FL Year Completed: 2014 CR at South End; Charlotte, NC Year Completed: 2014 Highlands of West Village, Atlanta, GA Year Completed: 2006/2012 Rivers Walk; Charleston, SC Year Completed: 2013 CR at Frisco Bridges; Dallas, TX Year Completed: 2013 1225 South Church, Phase II; Charlotte, NC Year Completed: 2013 2014 2014 2014 2013 2013 2013

MAA TODAY 18 Market Station; Kansas City, MO Year Completed: 2010 2013 2013 2013 2013 2013 2012 CG at Double Creek; Austin, TX Year Completed: 2013 CG at Windermere; Orlando, FL Year Completed: 2009 Station Square at Cosner’s Corner; Fredericksburg, VA Year Completed: 2012 CG at Ayrsley, II; Charlotte, NC Year Completed: 2013 Seasons at Celebrate VA, II; Fredericksburg, VA Year Completed: 2013

MAA TODAY 19 Haven at Blanco; San Antonio, TX Year Completed: 2010 Venue at Cool Springs; Nashville, TN Year Completed: 2012 Allure at Brookwood; Atlanta, GA Year Completed: 2008 Allure in Buckhead Village; Atlanta, GA Year Completed: 2002; Redeveloped: 2014 Alamo Ranch; San Antonio, TX Year Completed: 2009 Avala at Savannah Quarters; Savannah, GA Year Completed: 2009 2012 2012 2012 2012 2011 2011

OPPORTUNISTIC DEVELOPMENT STRATEGY; STRONG VALUE CREATION Expected Cost Stabilized Active Developments MSA Total Units NOI Yield Total (in millions) Per Unit (in thousands) 220 Riverside Jacksonville 294 $ 42.7 $ 145 7.1%2 Station Square at Cosner's Corner, II Fredericksburg 120 $ 20.1 $ 168 6.5%2 River’s Walk, II Charleston 78 $ 14.7 $ 188 7.9%2 CG at Randal Lakes, II Orlando 314 $ 41.3 $ 132 7.4%2 Total Active Development 1,026 $ 118.8 $ 147 20 Completed Developments MSA Year Complete Stabilized NOI Yield Venue at Cool Springs Nashville 2012 10.5% Ridge at Chenal Valley Little Rock 2012 9.6% 1225 South Church, II Charlotte 2013 8.9% River’s Walk Charleston 2013 10.7% CG at Randal Lakes Orlando 2014 5.6% CR at South End Charlotte 2014 5.8% CG at Lake Mary, III Orlando 2014 8.3% CG at Bellevue, II Nashville 2015 5.5%2 River’s Walk; Charleston, SC $450M 2012 – 2015 YTD PIPELINE 7.6% Average STABILIZED NOI YIELD1 $1,285 Average EFF. RENT/UNIT 1 Average of actual and proforma stabilized NOI yields for 2012-2015 YTD developments 2 Proforma stabilized NOI yield

MEANINGFUL REDEVELOPMENT OPPORTUNITY; STRONG VALUE CREATION 21 Redevelopment Opportunity • Redevelopments performed on turn at select communities with minimized down time providing efficiency in evaluating effectiveness of program for real-time improvements to product mix and scope • 30%-50% of the legacy CLP portfolio identified as a target for redevelopment; 15,000 to 20,000 units across same store portfolio with potential to create $245 million to $327 million of new value ($3 - $4 per share) • 4,549 units redeveloped in 2014 at an average cost of $3,649/unit and achieving an average rental rate increase of 9.3% relative to non-renovated units • Approximately 4,000 units identified for redevelopment in 2015 at an average cost of $4,350/unit – in Q2 of 2015, we redeveloped 1,410 units at an average cost of $4,531 per unit, achieving rental rate increases of 10.2% over non-renovated units • Assuming an $80 per month incremental increase above market level rent growth, every 4,000 units redeveloped creates $3.6 million of additional NOI opportunity once fully leased (assuming 95% occupancy) or $65 million of additional value at a 5.5% cap rate Allure in Buckhead Village; Atlanta, GA • Cabinets and Countertops • New Appliances • Plumbing and Light Fixtures • Flooring Unit Redevelopment Updates

MEANINGFUL REDEVELOPMENT OPPORTUNITY; STRONG VALUE CREATION 21 Redevelopment Opportunity • Redevelopments performed on turn at select communities with minimized down time providing efficiency in evaluating effectiveness of program for real-time improvements to product mix and scope • 30%-50% of the legacy CLP portfolio identified as a target for redevelopment; 15,000 to 20,000 units across same store portfolio with potential to create $245 million to $327 million of new value ($3 - $4 per share) • 4,549 units redeveloped in 2014 at an average cost of $3,649/unit and achieving an average rental rate increase of 9.3% relative to non-renovated units • Approximately 4,000 units identified for redevelopment in 2015 at an average cost of $4,350/unit – in Q2 of 2015, we redeveloped 1,410 units at an average cost of $4,531 per unit, achieving rental rate increases of 10.2% over non-renovated units • Assuming an $80 per month incremental increase above market level rent growth, every 4,000 units redeveloped creates $3.6 million of additional NOI opportunity once fully leased (assuming 95% occupancy) or $65 million of additional value at a 5.5% cap rate Allure in Buckhead Village; Atlanta, GA • Cabinets and Countertops • New Appliances • Plumbing and Light Fixtures • Flooring Unit Redevelopment Updates

RELATIVE PERFORMANCE COMPARED TO RELATIVE PRICING PROVIDES INVESTMENT OPPORTUNITY 22 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% MAA Current Multiple: 13.8 Sector Current Multiple: 19.2 MAA Historical Multiple1: 14.9 Sector Historical Multiple1: 19.3 1 At June 30, 2011-2015

RELATIVE PERFORMANCE COMPARED TO RELATIVE PRICING PROVIDES INVESTMENT OPPORTUNITY 22 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% MAA Current Multiple: 13.8 Sector Current Multiple: 19.2 MAA Historical Multiple1: 14.9 Sector Historical Multiple1: 19.3 1 At June 30, 2011-2015

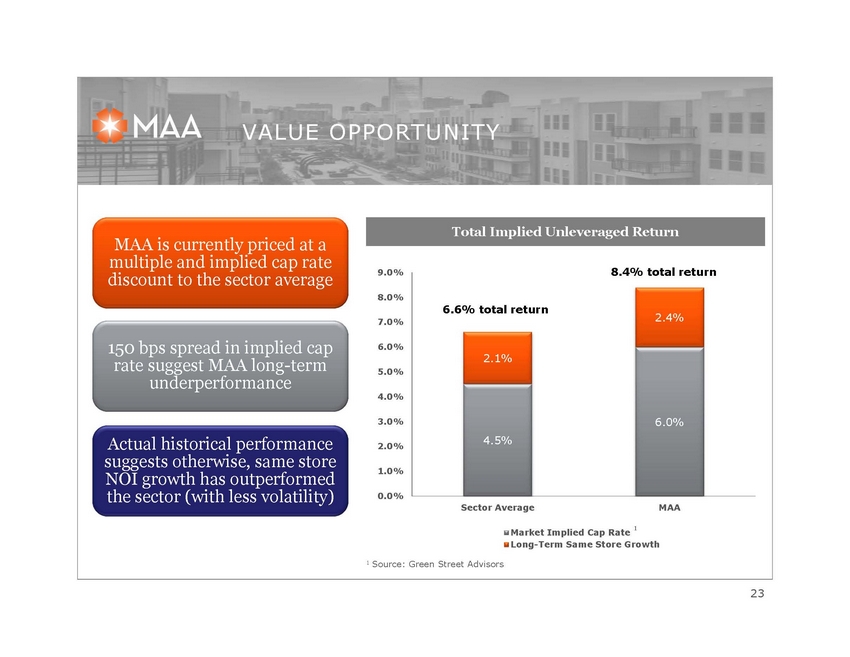

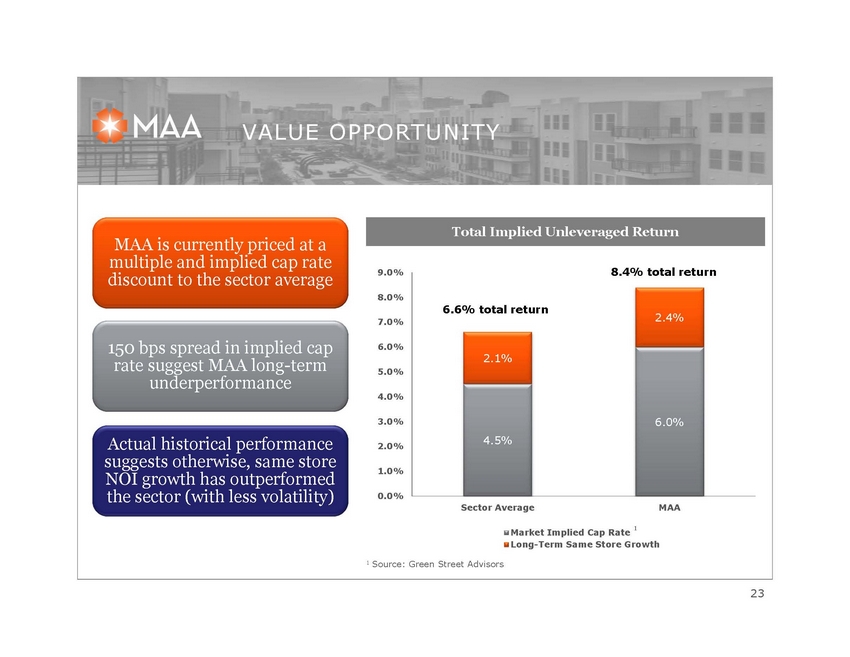

4.5% 6.0% 2.1% 2.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Sector Average MAA Market Implied Cap Rate Long-Term Same Store Growth 8.4% total return VALUE OPPORTUNITY 23 1 Source: Green Street Advisors Total Implied Unleveraged Return MAA is currently priced at a multiple and implied cap rate discount to the sector average 150 bps spread in implied cap rate suggest MAA long-term underperformance Actual historical performance suggests otherwise, same store NOI growth has outperformed the sector (with less volatility) 1 6.6% total return

4.5% 6.0% 2.1% 2.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Sector Average MAA Market Implied Cap Rate Long-Term Same Store Growth 8.4% total return VALUE OPPORTUNITY 23 1 Source: Green Street Advisors Total Implied Unleveraged Return MAA is currently priced at a multiple and implied cap rate discount to the sector average 150 bps spread in implied cap rate suggest MAA long-term underperformance Actual historical performance suggests otherwise, same store NOI growth has outperformed the sector (with less volatility) 1 6.6% total return

FORWARD LOOKING STATEMENTS 24 Certain matters in this presentation may constitute forward-looking statements within the meaning of Section 27-A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics, expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses. We undertake no duty to update these statements. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc., with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing. Eric Bolton Chairman and CEO 901-248-4127 eric.bolton@maac.com Al Campbell EVP, CFO 901-248-4169 al.campbell@maac.com Tim Argo SVP, Finance 901-248-4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901-435-5371 jennifer.patrick@maac.com Contact

FORWARD LOOKING STATEMENTS 24 Certain matters in this presentation may constitute forward-looking statements within the meaning of Section 27-A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics, expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses. We undertake no duty to update these statements. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc., with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing. Eric Bolton Chairman and CEO 901-248-4127 eric.bolton@maac.com Al Campbell EVP, CFO 901-248-4169 al.campbell@maac.com Tim Argo SVP, Finance 901-248-4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901-435-5371 jennifer.patrick@maac.com Contact

2 DISCIPLINED PORTFOLIO STRATEGY ACROSS HIGH GROWTH REGION 3 COMPETITIVE ADVANTAGES DRIVES VALUE 4 TRANSFORMED PORTFOLIO DRIVES VALUE A PROVEN SUCCESSFUL FULL-CYCLE STRATEGY • Established record of high return on invested capital • Compounded AFFO Growth of 8.7% over the past 5 years • 86 consecutive quarterly dividends, never reduced or suspended • 21 year established public company platform; long-tenured management team (nearly 18 years for Executive team and 12 years for VP level and above) 2 • Scale/efficiencies and competitive advantage in markets where we operate • Opportunistic acquisitions and operating outperformance = outsized returns over the full cycle • Balance sheet strength; transaction execution capabilities and superior operational coverage drives competitive value • Significant deal flow; $1.73 billion in acquisitions since 2010, average age of 4 years; dispositions of $780 million since 2010, average age of 26 years • $118.8 million active development pipeline; meaningful redevelopment opportunity • Higher margins and stronger core growth rate establishes an improved earnings platform • Long-term outperformance; compounding performance drives consistent value creation over full cycle • Multiple disparity to sector pricing creates compelling buy opportunity 5 OPPORTUNITY 1 EXPERIENCED & SUCCESSFUL PLATFORM • Portfolio strategy based on full-cycle performance; outperformance and lower volatility designed to steadily compound value • Well-diversified across the high growth Southeast/Southwest markets with favorable supply/demand dynamics

2 DISCIPLINED PORTFOLIO STRATEGY ACROSS HIGH GROWTH REGION 3 COMPETITIVE ADVANTAGES DRIVES VALUE 4 TRANSFORMED PORTFOLIO DRIVES VALUE A PROVEN SUCCESSFUL FULL-CYCLE STRATEGY • Established record of high return on invested capital • Compounded AFFO Growth of 8.7% over the past 5 years • 86 consecutive quarterly dividends, never reduced or suspended • 21 year established public company platform; long-tenured management team (nearly 18 years for Executive team and 12 years for VP level and above) 2 • Scale/efficiencies and competitive advantage in markets where we operate • Opportunistic acquisitions and operating outperformance = outsized returns over the full cycle • Balance sheet strength; transaction execution capabilities and superior operational coverage drives competitive value • Significant deal flow; $1.73 billion in acquisitions since 2010, average age of 4 years; dispositions of $780 million since 2010, average age of 26 years • $118.8 million active development pipeline; meaningful redevelopment opportunity • Higher margins and stronger core growth rate establishes an improved earnings platform • Long-term outperformance; compounding performance drives consistent value creation over full cycle • Multiple disparity to sector pricing creates compelling buy opportunity 5 OPPORTUNITY 1 EXPERIENCED & SUCCESSFUL PLATFORM • Portfolio strategy based on full-cycle performance; outperformance and lower volatility designed to steadily compound value • Well-diversified across the high growth Southeast/Southwest markets with favorable supply/demand dynamics OUTPERFORMANCE OVER THE FULL CYCLE WITH LOWER VOLATILITY 3 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% Unique portfolio strategy establishes competitive advantages and opportunity to compound value growth over time, generating superior performance with lower volatility/risks.

OUTPERFORMANCE OVER THE FULL CYCLE WITH LOWER VOLATILITY 3 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% Unique portfolio strategy establishes competitive advantages and opportunity to compound value growth over time, generating superior performance with lower volatility/risks.

STRONG OPERATING PLATFORM DRIVES COMPETITIVE ADVANTAGES AND SUPERIOR OPERATING MARGINS Regional Market Leading Expertise • 21 years of institutional property management experience in markets we serve • Onsite teams have seen multiple cycles of the apartment markets in the same cities • We understand up and down performance at the market, sub-market and property level • 9 years of yield and revenue management system expertise • Competitive advantage in key markets vs. less sophisticated fee managers and smaller owner/ operators…ability to generate returns on capital that are higher than “market norms” Innovative Asset Management Programs • Robust revenue management capabilities • Unit interior redevelopment program • Centrally monitored delinquency, screening and resident selection process • Expertise in optimizing customer integration and interface through technology, onsite sales and customer service • Technical experts dedicated to supporting onsite service lowering resident turnover and increasing efficiency • Landscape group focused on superior curb appeal, vendor management and cost efficiency Proven Performance; CLP Portfolio Turn-Around • Improved CLP operating margin 80 bps • Revenue management platform drove 150 bps of above market comparison effective rent per unit • Proprietary system customizations increased fee collections performance • Reduced bad debt from 0.57% of rent to 0.35% of rent • Reduced same store personnel costs by 7% 10 COMPETITIVE ADVANTAGES ADD VALUE During 2014:

STRONG OPERATING PLATFORM DRIVES COMPETITIVE ADVANTAGES AND SUPERIOR OPERATING MARGINS Regional Market Leading Expertise • 21 years of institutional property management experience in markets we serve • Onsite teams have seen multiple cycles of the apartment markets in the same cities • We understand up and down performance at the market, sub-market and property level • 9 years of yield and revenue management system expertise • Competitive advantage in key markets vs. less sophisticated fee managers and smaller owner/ operators…ability to generate returns on capital that are higher than “market norms” Innovative Asset Management Programs • Robust revenue management capabilities • Unit interior redevelopment program • Centrally monitored delinquency, screening and resident selection process • Expertise in optimizing customer integration and interface through technology, onsite sales and customer service • Technical experts dedicated to supporting onsite service lowering resident turnover and increasing efficiency • Landscape group focused on superior curb appeal, vendor management and cost efficiency Proven Performance; CLP Portfolio Turn-Around • Improved CLP operating margin 80 bps • Revenue management platform drove 150 bps of above market comparison effective rent per unit • Proprietary system customizations increased fee collections performance • Reduced bad debt from 0.57% of rent to 0.35% of rent • Reduced same store personnel costs by 7% 10 COMPETITIVE ADVANTAGES ADD VALUE During 2014:

61.7% 54.0% Sold Acquired 770 bps SIGNIFICANT CAPITAL RECYCLING OF PORTFOLIO SINCE 2010 14 Hi g h e r Ma r g i n s a n d Imp r o v e d Gr owt h P r o f i l e Transaction Volume1 (in millions) Age1 (in years) Effective Rent per Unit1, 2 Number of Units1 NOI Margin1, 2 After Capex NOI Margin1, 2 1 Inclusive of transactions from 2010 through 2015 YTD 2 Acquisition metrics reflect expected stabilization performance for acquired non-stabilized deals $1,730 $780 Acquired Sold 12,888 13,064 Acquired Sold 4 26 Acquired Sold $1,182 $715 Sold Acquired 58.0% 44.4% Sold Acquired 1,360 bps

61.7% 54.0% Sold Acquired 770 bps SIGNIFICANT CAPITAL RECYCLING OF PORTFOLIO SINCE 2010 14 Hi g h e r Ma r g i n s a n d Imp r o v e d Gr owt h P r o f i l e Transaction Volume1 (in millions) Age1 (in years) Effective Rent per Unit1, 2 Number of Units1 NOI Margin1, 2 After Capex NOI Margin1, 2 1 Inclusive of transactions from 2010 through 2015 YTD 2 Acquisition metrics reflect expected stabilization performance for acquired non-stabilized deals $1,730 $780 Acquired Sold 12,888 13,064 Acquired Sold 4 26 Acquired Sold $1,182 $715 Sold Acquired 58.0% 44.4% Sold Acquired 1,360 bps

MAA TODAY 17 CG at Randal Lakes; Orlando, FL Year Completed: 2014 CR at South End; Charlotte, NC Year Completed: 2014 Highlands of West Village, Atlanta, GA Year Completed: 2006/2012 Rivers Walk; Charleston, SC Year Completed: 2013 CR at Frisco Bridges; Dallas, TX Year Completed: 2013 1225 South Church, Phase II; Charlotte, NC Year Completed: 2013 2014 2014 2014 2013 2013 2013

MAA TODAY 17 CG at Randal Lakes; Orlando, FL Year Completed: 2014 CR at South End; Charlotte, NC Year Completed: 2014 Highlands of West Village, Atlanta, GA Year Completed: 2006/2012 Rivers Walk; Charleston, SC Year Completed: 2013 CR at Frisco Bridges; Dallas, TX Year Completed: 2013 1225 South Church, Phase II; Charlotte, NC Year Completed: 2013 2014 2014 2014 2013 2013 2013

MEANINGFUL REDEVELOPMENT OPPORTUNITY; STRONG VALUE CREATION 21 Redevelopment Opportunity • Redevelopments performed on turn at select communities with minimized down time providing efficiency in evaluating effectiveness of program for real-time improvements to product mix and scope • 30%-50% of the legacy CLP portfolio identified as a target for redevelopment; 15,000 to 20,000 units across same store portfolio with potential to create $245 million to $327 million of new value ($3 - $4 per share) • 4,549 units redeveloped in 2014 at an average cost of $3,649/unit and achieving an average rental rate increase of 9.3% relative to non-renovated units • Approximately 4,000 units identified for redevelopment in 2015 at an average cost of $4,350/unit – in Q2 of 2015, we redeveloped 1,410 units at an average cost of $4,531 per unit, achieving rental rate increases of 10.2% over non-renovated units • Assuming an $80 per month incremental increase above market level rent growth, every 4,000 units redeveloped creates $3.6 million of additional NOI opportunity once fully leased (assuming 95% occupancy) or $65 million of additional value at a 5.5% cap rate Allure in Buckhead Village; Atlanta, GA • Cabinets and Countertops • New Appliances • Plumbing and Light Fixtures • Flooring Unit Redevelopment Updates

MEANINGFUL REDEVELOPMENT OPPORTUNITY; STRONG VALUE CREATION 21 Redevelopment Opportunity • Redevelopments performed on turn at select communities with minimized down time providing efficiency in evaluating effectiveness of program for real-time improvements to product mix and scope • 30%-50% of the legacy CLP portfolio identified as a target for redevelopment; 15,000 to 20,000 units across same store portfolio with potential to create $245 million to $327 million of new value ($3 - $4 per share) • 4,549 units redeveloped in 2014 at an average cost of $3,649/unit and achieving an average rental rate increase of 9.3% relative to non-renovated units • Approximately 4,000 units identified for redevelopment in 2015 at an average cost of $4,350/unit – in Q2 of 2015, we redeveloped 1,410 units at an average cost of $4,531 per unit, achieving rental rate increases of 10.2% over non-renovated units • Assuming an $80 per month incremental increase above market level rent growth, every 4,000 units redeveloped creates $3.6 million of additional NOI opportunity once fully leased (assuming 95% occupancy) or $65 million of additional value at a 5.5% cap rate Allure in Buckhead Village; Atlanta, GA • Cabinets and Countertops • New Appliances • Plumbing and Light Fixtures • Flooring Unit Redevelopment Updates RELATIVE PERFORMANCE COMPARED TO RELATIVE PRICING PROVIDES INVESTMENT OPPORTUNITY 22 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% MAA Current Multiple: 13.8 Sector Current Multiple: 19.2 MAA Historical Multiple1: 14.9 Sector Historical Multiple1: 19.3 1 At June 30, 2011-2015

RELATIVE PERFORMANCE COMPARED TO RELATIVE PRICING PROVIDES INVESTMENT OPPORTUNITY 22 Source: Green Street Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% MAA Current Multiple: 13.8 Sector Current Multiple: 19.2 MAA Historical Multiple1: 14.9 Sector Historical Multiple1: 19.3 1 At June 30, 2011-2015 4.5% 6.0% 2.1% 2.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Sector Average MAA Market Implied Cap Rate Long-Term Same Store Growth 8.4% total return VALUE OPPORTUNITY 23 1 Source: Green Street Advisors Total Implied Unleveraged Return MAA is currently priced at a multiple and implied cap rate discount to the sector average 150 bps spread in implied cap rate suggest MAA long-term underperformance Actual historical performance suggests otherwise, same store NOI growth has outperformed the sector (with less volatility) 1 6.6% total return

4.5% 6.0% 2.1% 2.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Sector Average MAA Market Implied Cap Rate Long-Term Same Store Growth 8.4% total return VALUE OPPORTUNITY 23 1 Source: Green Street Advisors Total Implied Unleveraged Return MAA is currently priced at a multiple and implied cap rate discount to the sector average 150 bps spread in implied cap rate suggest MAA long-term underperformance Actual historical performance suggests otherwise, same store NOI growth has outperformed the sector (with less volatility) 1 6.6% total return FORWARD LOOKING STATEMENTS 24 Certain matters in this presentation may constitute forward-looking statements within the meaning of Section 27-A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics, expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses. We undertake no duty to update these statements. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc., with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing. Eric Bolton Chairman and CEO 901-248-4127 eric.bolton@maac.com Al Campbell EVP, CFO 901-248-4169 al.campbell@maac.com Tim Argo SVP, Finance 901-248-4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901-435-5371 jennifer.patrick@maac.com Contact

FORWARD LOOKING STATEMENTS 24 Certain matters in this presentation may constitute forward-looking statements within the meaning of Section 27-A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics, expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses. We undertake no duty to update these statements. Reference is hereby made to the filings of Mid-America Apartment Communities, Inc., with the Securities and Exchange Commission, including quarterly reports on Form 10-Q, reports on Form 8-K, and its annual report on Form 10-K, particularly including the risk factors contained in the latter filing. Eric Bolton Chairman and CEO 901-248-4127 eric.bolton@maac.com Al Campbell EVP, CFO 901-248-4169 al.campbell@maac.com Tim Argo SVP, Finance 901-248-4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901-435-5371 jennifer.patrick@maac.com Contact