Investor Presentation May 2018 NASDAQ:FWRD www.ForwardAirCorp.com

Forward Looking Statements Disclosure Today’s presentation and discussion will contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects,” “anticipates,” “intends,” “estimates,” or similar expressions are intended to identify these forward-looking statements. These statements, which include statements regarding our competitive advantages, synergies, and scalable platform, and future technology investments are based on Forward Air’s current plans and expectations and involve risks and uncertainties that could cause future activities and results of operations to be materially different from those set forth in the forward-looking statements. For further information, please refer to Forward Air’s reports and filings with the Securities and Exchange Commission. To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we have included the following non-GAAP financial information in this presentation: adjusted revenue, EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted operating income, adjusted operating margin, adjusted income taxes, adjusted net income and adjusted EPS. The reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP can be found in the Appendix to this presentation. Because these non- GAAP financial measures exclude certain items as described herein, they may not be indicative of the results that the Company expects to recognize for future periods. As a result, these non- GAAP financial measures should be considered in addition to, and not a substitute for, financial information prepared in accordance with GAAP. 2

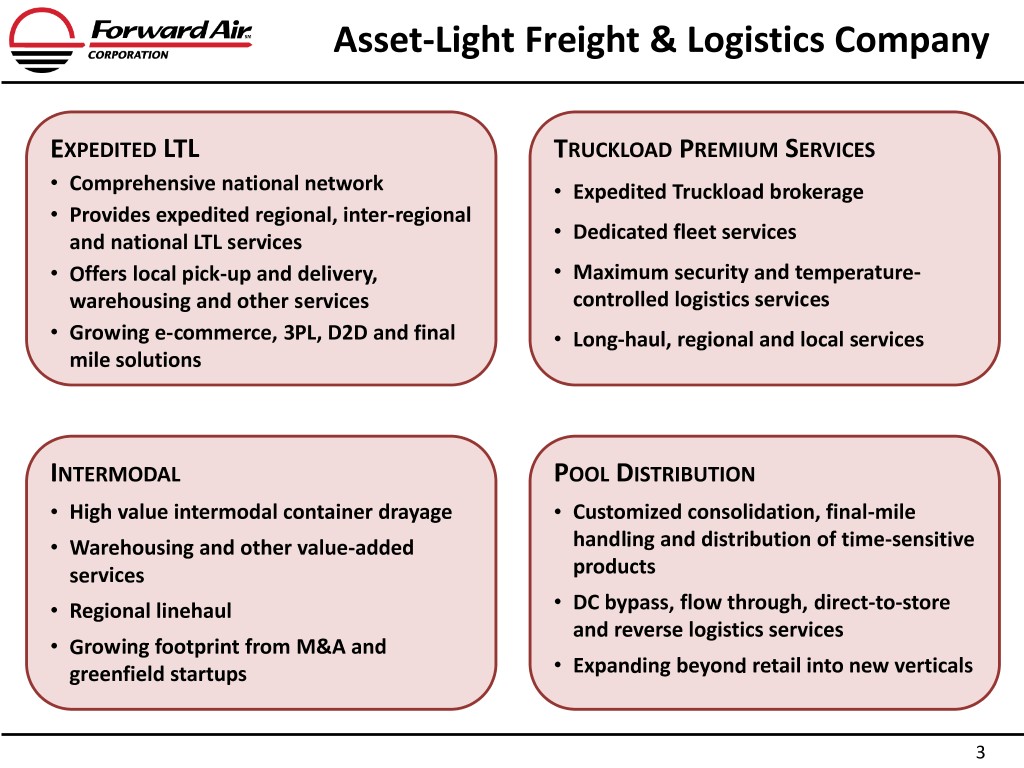

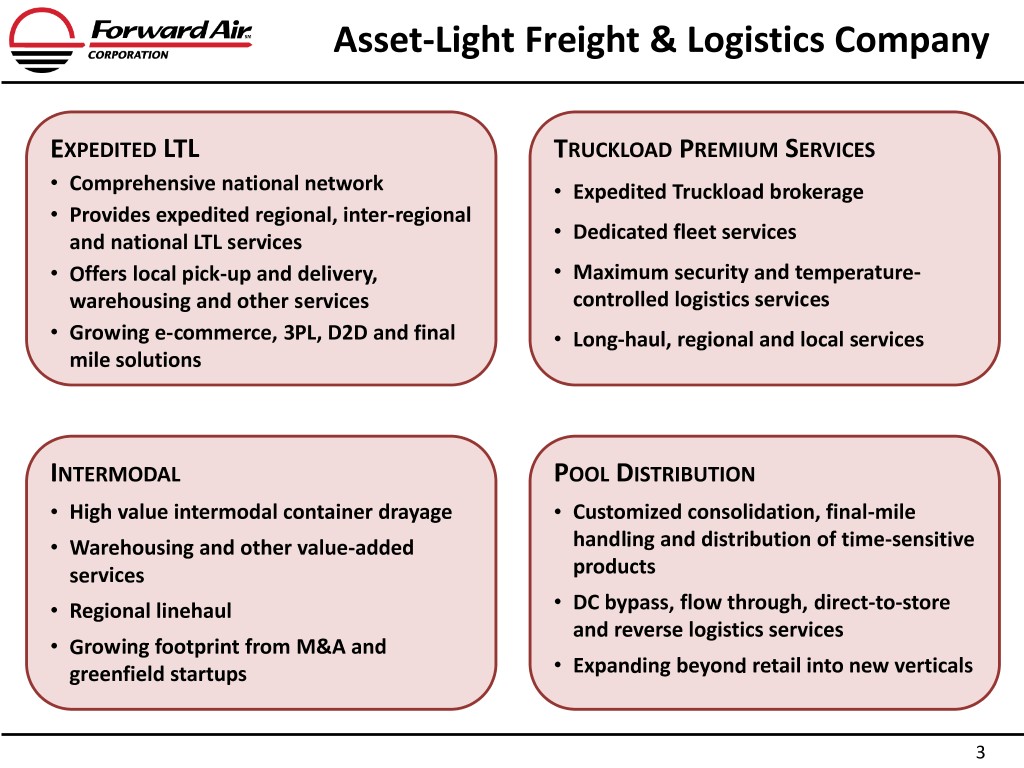

Asset-Light Freight & Logistics Company EXPEDITED LTL TRUCKLOAD PREMIUM SERVICES • Comprehensive national network • Expedited Truckload brokerage • Provides expedited regional, inter-regional and national LTL services • Dedicated fleet services • Offers local pick-up and delivery, • Maximum security and temperature- warehousing and other services controlled logistics services • Growing e-commerce, 3PL, D2D and final • Long-haul, regional and local services mile solutions INTERMODAL POOL DISTRIBUTION • High value intermodal container drayage • Customized consolidation, final-mile • Warehousing and other value-added handling and distribution of time-sensitive services products • Regional linehaul • DC bypass, flow through, direct-to-store and reverse logistics services • Growing footprint from M&A and greenfield startups • Expanding beyond retail into new verticals 3

Key Attributes Deliver premium solutions: expedited, time-definite, service-sensitive Most comprehensive provider of wholesale transportation services in North America, serving Freight Forwarders, Airlines, 3PLs, etc. Operate an asset-light model utilizing independent owner-operators and third-party carriers Provide our customers with safe, superior service Expanding into new areas organically and through acquisitions Leading technology lowers operating cost & improves customer service Superior service & operating flexibility regardless of economic cycle 4

Revenue Growth Consolidated Revenue 1,200 1,000 800 GAAP) - 600 400 $ millions millions $ (non 200 0 2010 2011 2012 2013 2014 2015* 2016 2017 Note: Historic revenue shown as non-GAAP since it does not reflect the implementation of ASC 606, Revenue from Contracts with Customers 12% annual revenue growth since 2010 Organic as well as acquisitive growth Expanded existing services and introduced new offerings (e.g., Intermodal) *Non-GAAP adjustment, see appendix 5

Operating Income Growth Consolidated Operating Income 120 100 80 60 $ millions $ 40 20 0 2010 2011 2012 2013 2014 2015* 2016* 2017 11% annual EBIT growth since 2010 Organic as well as acquisitive growth Expedited LTL key contributor; Intermodal growing rapidly *Non-GAAP adjustment, see appendix 6

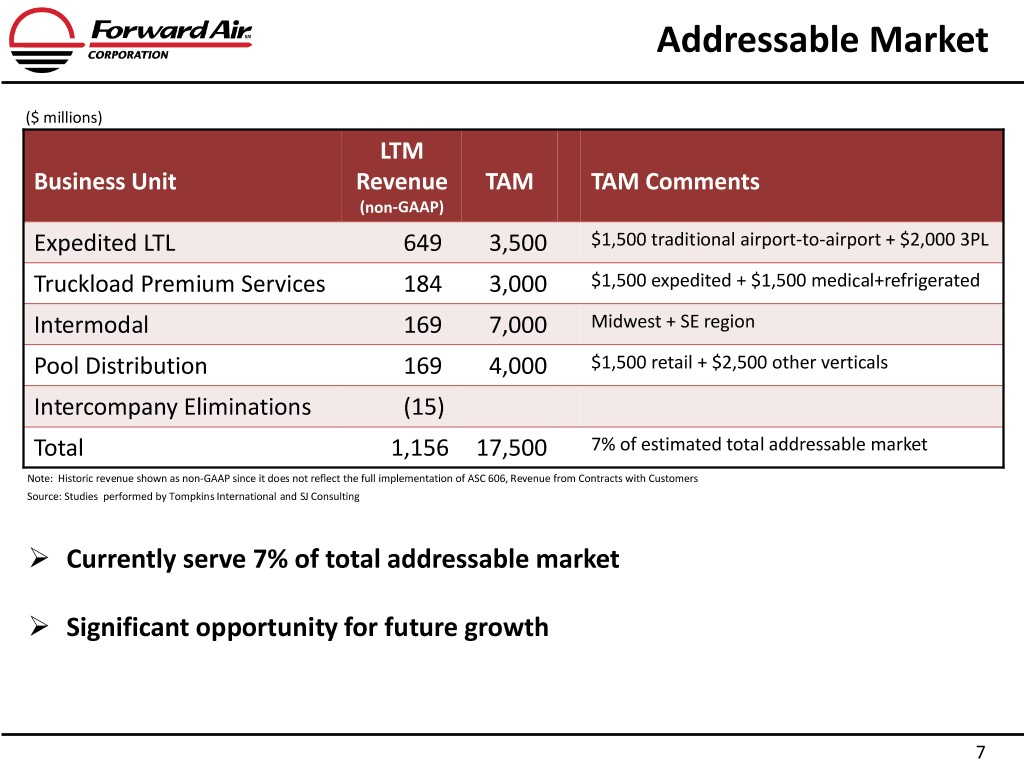

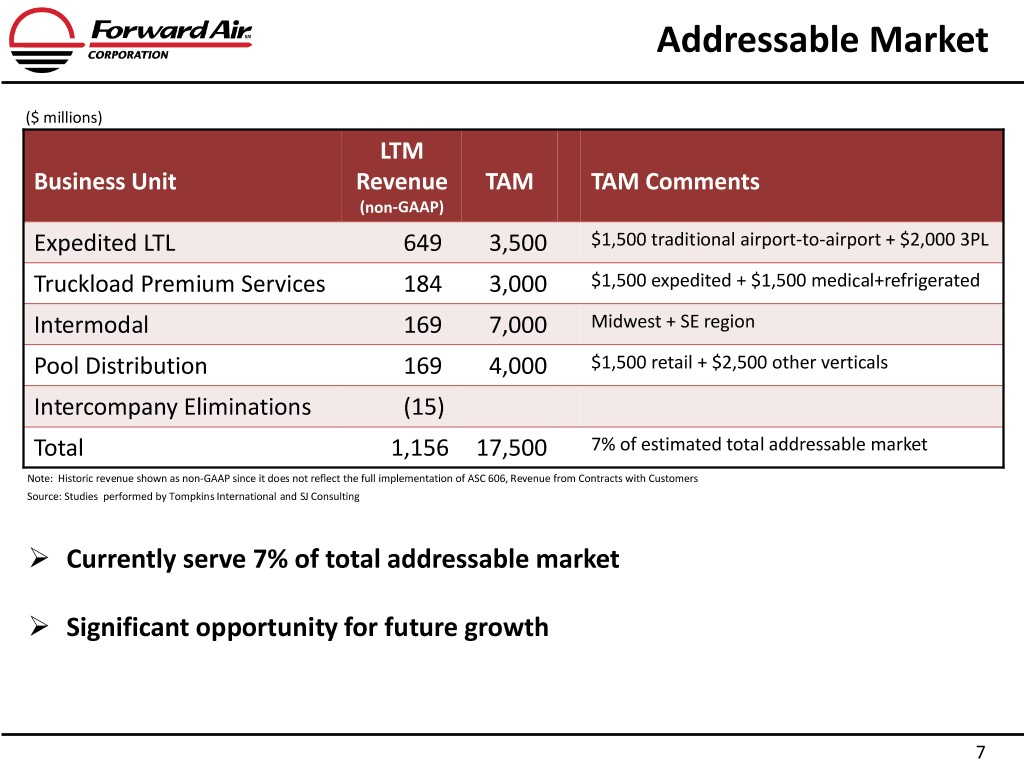

Addressable Market ($ millions) LTM Business Unit Revenue TAM TAM Comments (non-GAAP) Expedited LTL 649 3,500 $1,500 traditional airport-to-airport + $2,000 3PL Truckload Premium Services 184 3,000 $1,500 expedited + $1,500 medical+refrigerated Intermodal 169 7,000 Midwest + SE region Pool Distribution 169 4,000 $1,500 retail + $2,500 other verticals Intercompany Eliminations (15) Total 1,156 17,500 7% of estimated total addressable market Note: Historic revenue shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers Source: Studies performed by Tompkins International and SJ Consulting Currently serve 7% of total addressable market Significant opportunity for future growth 7

Management Team Bruce Campbell • 28 years with Forward Air Chairman and CEO • Previous: Ryder Glenn Adelaar • 18 years with Forward Air SVP, Information Systems • Previous: Sabre/American Airlines Matt Casey • 1 year with Forward Air SVP Safety • Previous: Forest City Technologies, Panther Premium Logistics Roger Gellis • 11 years with Forward Air SVP, Pool Distribution • Previous: Velocity Express, Federal Express Michael Hance • 12 years with Forward Air Chief Legal Officer • Previous: Baker, Donelson, Bearman, Caldwell & Berkowitz PLC Matthew Jewell • 18 years with Forward Air President, Logistics Services • Previous: Austin & Sparks, PC Kyle Mitchin • 4 years with Forward Air SVP, Human Resources • Previous: Panther Premium Logistics Mike Morris • 2 years with Forward Air CFO & Treasurer • Previous: XPO/Con-way Chris Ruble • 22 years with Forward Air President, Expedited Services • Previous: Federal Express 8

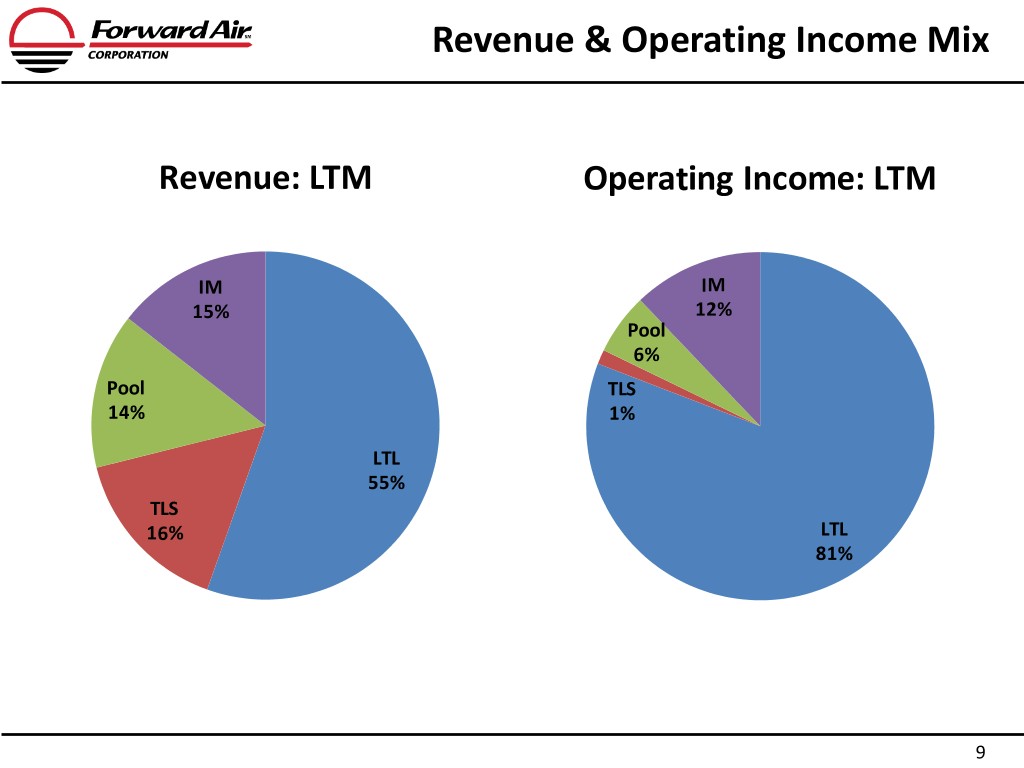

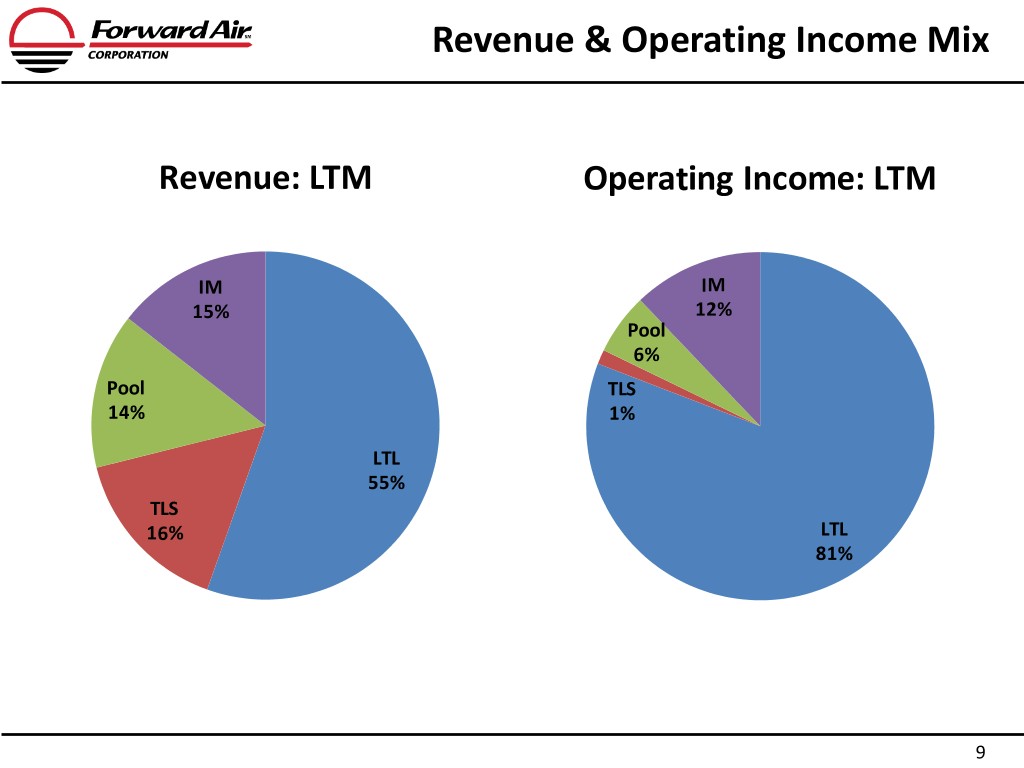

Revenue & Operating Income Mix Revenue: LTM Operating Income: LTM IM IM 15% 12% Pool 6% Pool TLS 14% 1% LTL 55% TLS 16% LTL 81% 9

Expedited LTL Highlights • Nationwide time-definite service • Pick-up and delivery covering 96% of continental US zip codes • Offer variety of freight management services (warehousing, dedicated final mile, consolidation/deconsolidation, etc.) Growth Areas Expedited LTL LTM • E-commerce solutions for freight Revenue (non-GAAP) $ 649 M intermediaries (forwarders, airlines, etc.) Operating Income $ 91 M • Expanding into 3PL market to supplement EBITDA $ 111 M network density Lbs per Day 10.1 M Shipments per Day 16.2 K • Door-to-door offerings for B2B and B2C solutions Lbs per Shipment 622 Lbs • Heavy goods white glove final mile service Note: Historic revenue shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers 10

Expedited LTL Network 11

Truckload Premium Services Highlights • Premium services (expedited, time definite, high value, etc.) for premium rates • Dedicated owner-operator capacity drives competitive advantage • Flexible capacity from qualified third party transportation providers • Beneficial synergies through cross- utilization with Expedited LTL fleet Truckload Premium Services LTM Growth Areas Revenue (non-GAAP) $ 184 M Operating Income $ 2 M • Expedited linehaul for LTL carriers, airlines, EBITDA $ 8 M forwarders, etc. Total Miles 94.2 M • Refrigerated and temperature-controlled Qualified 3rd Party Carriers 4,769 logistics solutions for pharmaceutical and Tractors (avg) 355 life-science companies Miles Per Tractor Per Week 5.2 K • Customized solutions for retail companies Note: Historic revenue shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers 12

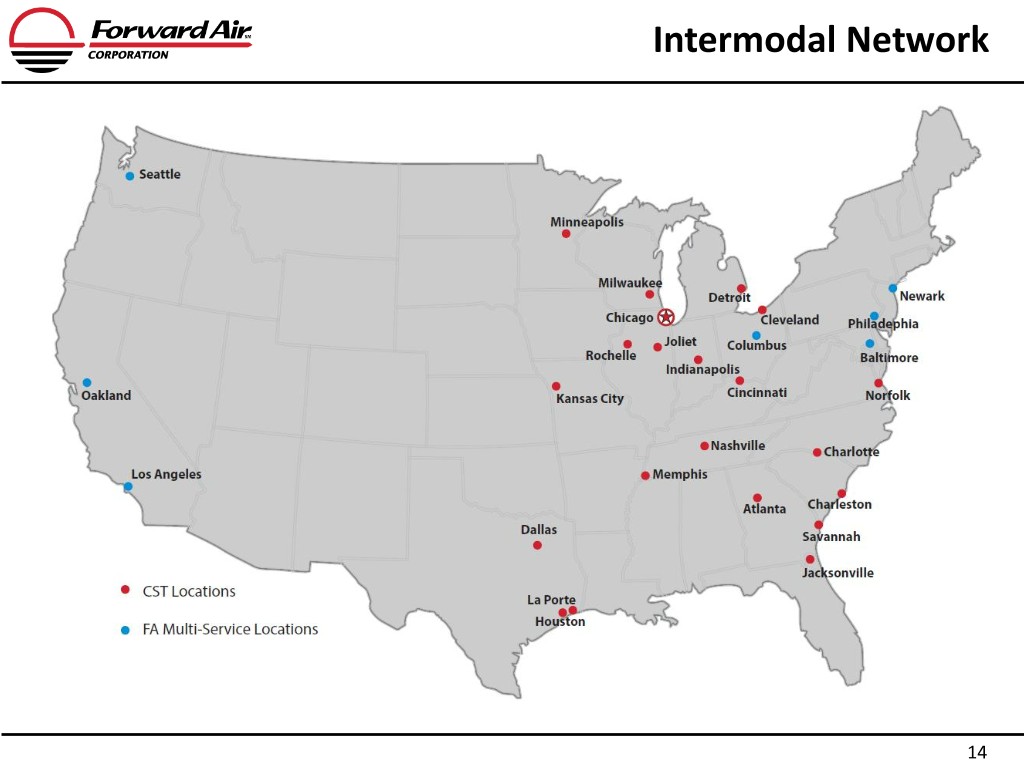

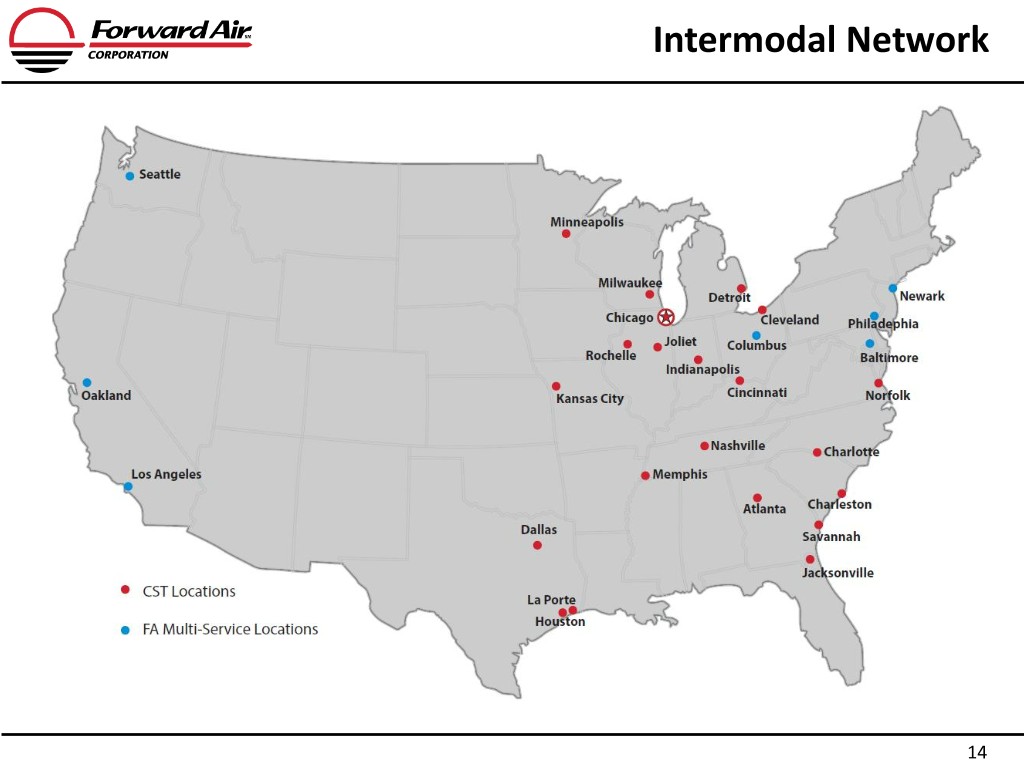

Intermodal Highlights • Premium intermodal drayage for forwarders, airlines and steamship lines • Branded as CST (Central States Trucking) • Growing Midwest, Southeast and Southwest footprint • Service partnerships with 20 of the top 100 importers • Offer dedicated contract and CFS Intermodal LTM warehouse services Revenue (non-GAAP) $ 169 M Operating Income $ 14 M Growth Areas EBITDA $ 20 M • M&A pipeline provides clear line of sight Drayage Shipments 262 K to revenue growth and footprint Drayage Revenue Per Shipment $ 573 expansion • Greenfield startups where right M&A candidate is not available Note: Historic revenue shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers 13

Intermodal Network 14

Pool Distribution Highlights • High-frequency handling and distribution of time-sensitive products to multiple destinations for multiple consignees (“pooled” final mile solution) • Branded as Forward Air Solutions • Mid-Atlantic, Midwest, Southeast and Southwest footprint • Leverages core competencies of Expedited LTL business Pool Distribution LTM (non-GAAP) Revenue $ 169 M Operating Income $ 6 M Growth Areas EBITDA $ 13 M • Expansion into vendor pickup and Cartons 83.7 M consolidation within current retail vertical Revenue Per Carton $ 2.02 • Applications in new verticals, such as healthcare, hospitality and parts distribution Note: Historic revenue shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers 15

Pool Distribution Network 16

Technology • Advanced technology is a cornerstone of every Forward Air business operation • Our technology priorities include: ‒ Extensive use of mobile and wireless technologies to drive operational efficiencies ‒ Real-time customer shipment visibility ‒ E-commerce links with our customers, drivers, trading and service partners via APIs and EDI ‒ Data analytics to enhance pricing and profitability analysis ‒ Web portals and messaging tools for owner-operators • Forward Air is committed to making long-term, on-going investments in technology to provide high level service and security 17

Financial Overview

Financial Overview • Goal to deliver superior returns to shareholders through profitable organic growth and disciplined acquisitions • Commitment to return capital to shareholders through dividends and share repurchases LTM 2017 2016 † Revenue (non-GAAP) $ 1,156 M $ 1101 M $ 983 M Operating Income $ 110 M $ 109 M $ 102 M * † Operating Margin (non-GAAP) 9.5% 9.9% 10.4%* EPS $ 3.02** $ 2.89 ** $ 2.08* EBITDA $ 151 M $ 150 M $ 141 M* EBITDA Margin† 13.1% 13.6% 14.3% * ROIC (w/o Goodwill & Intang.)‡ 28.2% 26.2% 24.5% ROIC (w/Goodwill & Intang.)‡ 14.0% 13.4% 12.2% Capital to Shareholders $ 77 M $ 67 M $ 56 M Debt / EBITDA 0.2 x 0.3 x 0.2 x † Shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers ‡ ROIC is calculated as Non Operating Profit After Tax (adjusted for the amortization of intangibles) divided by Operating Invested Capital * Non-GAAP adjustment, see appendix ** LTM and 2017 EPS of $3.02 and $2.89 includes $0.53 impact from Tax Cut and Jobs Act 19

Revenue & Earnings History Revenue (non-GAAP)† EBITDA EPS (CAGR = 12%) (CAGR = 11%) (CAGR = 15%) * * * + * * ++ ++ † Shown as non-GAAP since it does not reflect the full implementation of ASC 606, Revenue from Contracts with Customers * Non-GAAP adjustment, see appendix + Adjusted to exclude CST acquisition costs ($0.02) ++ LTM and 2017 EPS of $3.02 and $2.89 includes $0.53 impact from Tax Cut and Jobs Act 20

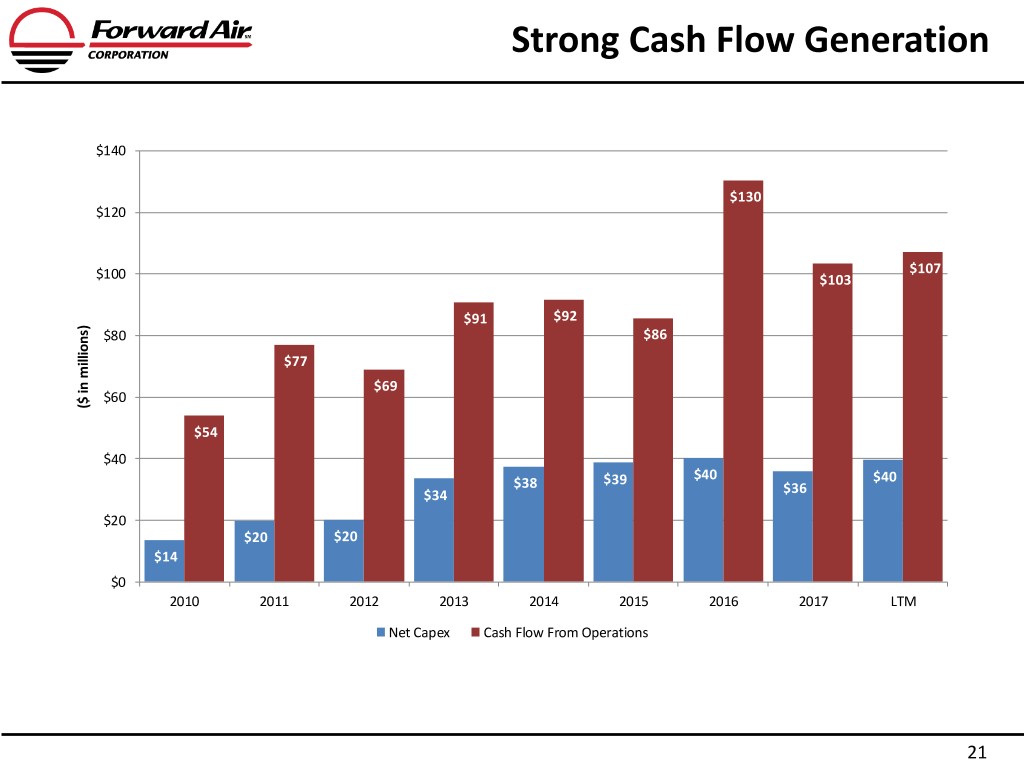

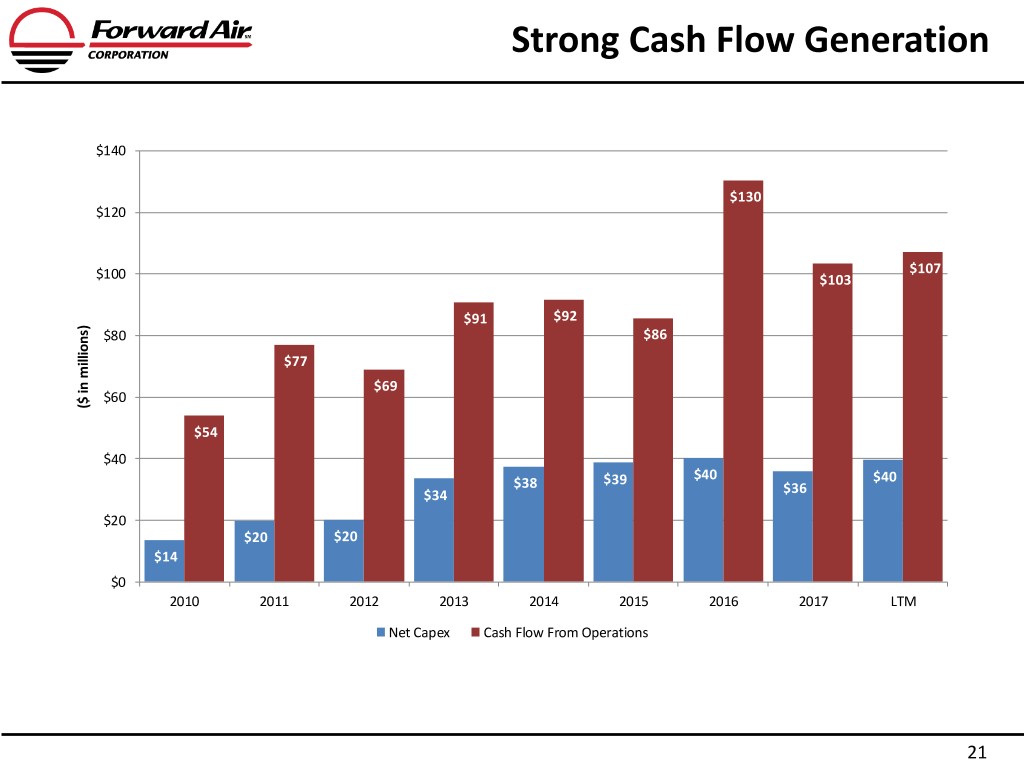

Strong Cash Flow Generation $140 $130 $120 $107 $100 $103 $91 $92 $80 $86 $77 $69 $60 ($ in millions) in ($ $54 $40 $40 $38 $39 $40 $34 $36 $20 $20 $20 $14 $0 2010 2011 2012 2013 2014 2015 2016 2017 LTM Net Capex Cash Flow From Operations 21

Value Proposition Sustainable Revenue Growth Flexible Asset-Light Model Solid Capital Returns Proven Operating Leverage Strong Balance Sheet 22

Appendix

Reconciliations GAAP vs Non-GAAP Reconciliation Segment EBITDA Reconciliation GAAP Revenue Reconciliation LTM 2017 2016 2015 2014 2013 2012 2011 2010 GAAP Revenue 1,156.4 1,100.8 982.5 959.1 781.0 652.5 584.5 536.4 483.9 Expedited LTL LTM Towne Integration - - - 0.6 - - - - - GAAP Operating Income 90.5 Adjusted Revenue 1,156.4 1,100.8 982.5 958.5 781.0 652.5 584.5 536.4 483.9 (+) Depreciation & Amortization 20.2 = EBITDA 110.7 GAAP Financials LTM 2017 2016 2015 2014 2013 2012 2011 2010 Operating Income 109.7 108.7 60.0 81.8 96.4 84.4 83.5 77.1 53.7 Operating Margin 9.5% 9.9% 6.1% 8.5% 12.3% 12.9% 14.3% 14.4% 11.1% Truckload Premium Services LTM Net Interest & Other Expense (1.3) (1.2) (1.6) (2.1) (0.3) (0.4) (0.3) (0.5) (0.6) GAAP Operating Income 1.5 Income Taxes 17.6 20.1 30.7 24.1 34.9 29.5 30.5 29.4 21.1 (+) Depreciation & Amortization 6.1 Net Income (Loss) 90.8 87.3 27.7 55.6 61.2 54.5 52.7 47.2 32.0 = EBITDA 7.6 Fully Diluted Share Count 29,792 29,949 30,444 31,040 31,072 30,762 29,536 29,435 29,111 Two Class (0.7) (0.7) (0.5) (0.4) (0.4) (0.6) (0.6) (0.4) (0.1) Intermodal LTM Fully Diluted EPS 3.02 2.89 0.90 1.78 1.96 1.77 1.78 1.60 1.10 GAAP Operating Income 13.6 Non GAAP Adjustments LTM 2017 2016 2015 2014 2013 2012 2011 2010 (+) Depreciation & Amortization 6.3 Towne Integration - - - (24.3) - - - - - = EBITDA 19.9 TQI Impairment - - (42.4) - - - - - - Operating Income - - (42.4) (24.3) - - - - - Pool Distribution LTM Net Interest & Other Expense - - - (0.4) - - - - - GAAP Operating Income 6.4 Income Taxes - - (6.4) (15.7) - - - - - (+) Depreciation & Amortization 6.5 Net Income (Loss) - - (36.0) (9.0) - - - - - = EBITDA 12.9 Fully Diluted Share Count 29,792 29,949 30,444 31,040 31,072 30,762 29,536 29,435 29,111 Fully Diluted EPS - - (1.18) (0.29) - - - - - Non GAAP Financials LTM 2017 2016 2015 2014 2013 2012 2011 2010 Adjusted Operating Income 109.7 108.7 102.4 106.1 96.4 84.4 83.5 77.1 53.7 Adjusted Operating Margin 9.5% 9.9% 10.4% 11.1% 12.3% 12.9% 14.3% 14.4% 11.1% Net Interest & Other Expense (1.3) (1.2) (1.6) (1.7) (0.3) (0.4) (0.3) (0.5) (0.6) Adjusted Income Taxes 17.6 20.1 37.1 39.8 34.9 29.5 30.5 29.4 21.1 Adjusted Net Income (Loss) 90.8 87.3 63.7 64.6 61.2 54.5 52.7 47.2 32.0 Fully Diluted Share Count 29,792 29,949 30,444 31,040 31,072 30,762 29,536 29,435 29,111 Two class (0.7) (0.7) (0.5) (0.4) (0.4) (0.6) (0.6) (0.4) (0.1) Adjusted EPS 3.02 2.89 2.08 2.07 1.96 1.77 1.78 1.60 1.10 Operating Income 109.7 108.7 102.4 106.1 96.4 84.4 83.5 77.1 53.7 (+) Depreciation & Amortization 41.7 41.1 38.2 37.1 31.1 23.6 21.0 21.0 20.5 Adjusted EBITDA 151.4 149.7 140.6 143.2 127.5 108.0 104.5 98.1 74.2 Adjusted EBITDA Margin 13.1% 13.6% 14.3% 14.9% 16.3% 16.6% 17.9% 18.3% 15.3% 24

Thank You For Your Time Investor Relations Contact: Mike Morris, CFO & Treasurer mmorris@forwardair.com (404) 362-8933