Forward Air 3Q24 Earnings Presentation November 4, 2024

Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements included in this presentation relate to expectations regarding customer demand for services of Forward Air Corporation (“Forward”, “we” or “us”) as well as expectations regarding the freight market, including any anticipated growth in the less-than-truckload sector; ability to achieve and timing of capturing the intended benefits of the acquisition of Omni Logistics, including any revenue and cost synergies; ability to improve liquidity; expectations regarding offering direct air and ocean services to certain regions and worldwide; ability to delever and focus on debt repayment; expectations regarding the timing and impact of forecasted or anticipated savings and ability to reach the run rate; Forward's ongoing commitment to provide excellent service to its customers; expectations regarding Forward's ability to execute on its plan to integrate Omni Logistics in order to generate long-term value for shareholders; expectations regarding Forward's ability to grow and retain its customer base, including the anticipated revenue generated from new customers; ability to run operations on a predictive and data-driven basis; capital allocation strategies, including the result of any portfolio review and expectations regarding our Consolidated EBITDA for the 2024 calendar year. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward- looking statements. Therefore, you should not rely on any of these forward-looking statements. The following is a list of factors, among others, that could cause actual results to differ materially from those contemplated by the forward-looking statements: economic factors such as recessions, inflation, higher interest rates and downturns in customer business cycles, Forward's ability to achieve the expected strategic, financial and other benefits of the acquisition of Omni Logistics, including the realization of expected synergies and the achievement of deleveraging targets within the expected timeframes or at all, the risk that the businesses will not be integrated successfully or that integration may be more difficult, time-consuming or costly than expected, the risk that operating costs, customer loss, management and employee retention and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) as a result of the acquisition of Omni Logistics may be greater than expected, continued weakening of the freight environment, future debt and financing levels, our ability to deleverage, including, without limitation, through capital allocation or divestitures of non-core businesses, our ability to secure terminal facilities in desirable locations at reasonable rates, more limited liquidity than expected which limits our ability to make key investments, the creditworthiness of our customers and their ability to pay for services rendered, our inability to maintain our historical growth rate because of a decreased volume of freight or decreased average revenue per pound of freight moving through our network, the availability and compensation of qualified Leased Capacity Providers and freight handlers as well as contracted, third-party carriers needed to serve our customers’ transportation needs, our inability to manage our information systems and inability of our information systems to handle an increased volume of freight moving through our network, the occurrence of cybersecurity risks and events, market acceptance of our service offerings, claims for property damage, personal injuries or workers’ compensation, enforcement of and changes in governmental regulations, environmental, tax, insurance and accounting matters, the handling of hazardous materials, changes in fuel prices, loss of a major customer, increasing competition, and pricing pressure, our dependence on our senior management team and the potential effects of changes in employee status, seasonal trends, the occurrence of certain weather events, restrictions in our charter and bylaws and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2023, and as may be identified in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We caution readers that any forward-looking statement made by us in this presentation is based only on information currently available to us and they should not place undue reliance on these forward-looking statements, which reflect management's opinion as of the date on which it is made. We undertake no obligation to publicly update any forward- looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise unless required by law. Non-GAAP Measures To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), we have included Consolidated EBITDA, Consolidated EBITDA Margin, Consolidated EBITDA excluding RIF, Net Leverage Ratio, each a non-GAAP financial measure (each, a “Non-GAAP Measure”), in this presentation. The reconciliation of each Non-GAAP Measure to the most directly comparable financial measure calculated and presented in accordance with GAAP can be found in the Appendix to this presentation. Because each Non-GAAP Measure excludes certain items as described herein, it may not be indicative of the results that Forward expects to recognize for future periods. As a result, each Non-GAAP Measure should be considered in addition to, and not a substitute for, financial information prepared in accordance with GAAP. The Company is also providing Consolidated EBITDA and Net Leverage Ratio calculated in accordance with Forward’s credit agreement as we believe it provides investors with important information regarding our liquidity, financial condition and compliance with our obligations under our credit agreement. 2

AGENDA 01 02 3Q24 Highlights Integration Update03 04 Leverage and Liquidity Cash Flow 3 All figures throughout presentation in $ millions where applicable LTL KPIs Capital Allocation / Deleveraging Conclusion 06 07 05

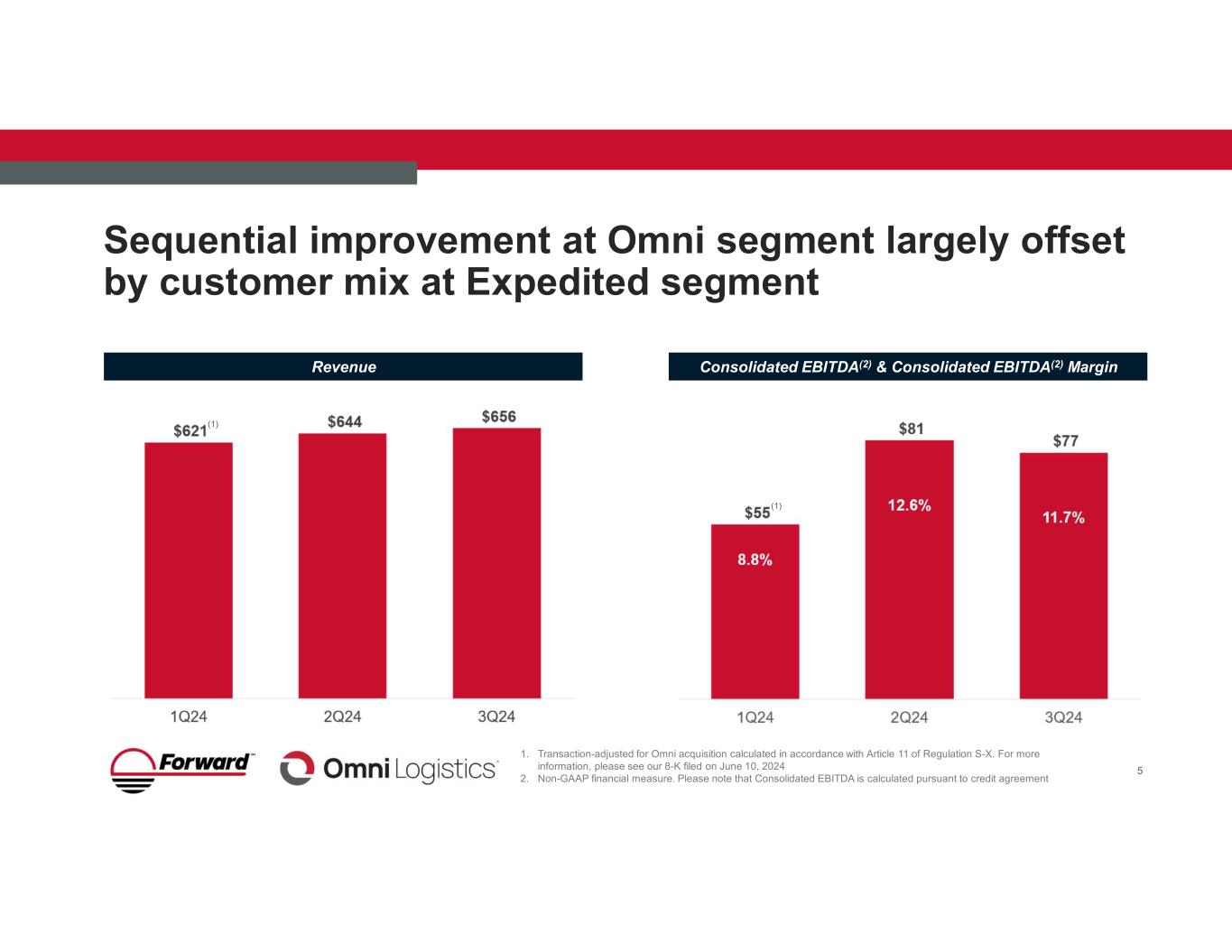

3Q24 Performance Steady Amidst Challenging Market Backdrop $23M O P E R AT I N G I N C O ME $77M 11.7% margin C O N S O LI D AT E D E B I T D A ( 1 ) $460M L I Q U I D I T Y ( 2 ) 5.4x LT M C O V E N A N T N E T L E V E RA G E ( 1 ) 1. Non-GAAP financial measure. Please note that this is calculated pursuant to our credit agreement 2. Includes $2M of restricted cash and $15M of cash in foreign subsidiaries $656M R E V E N U E 4

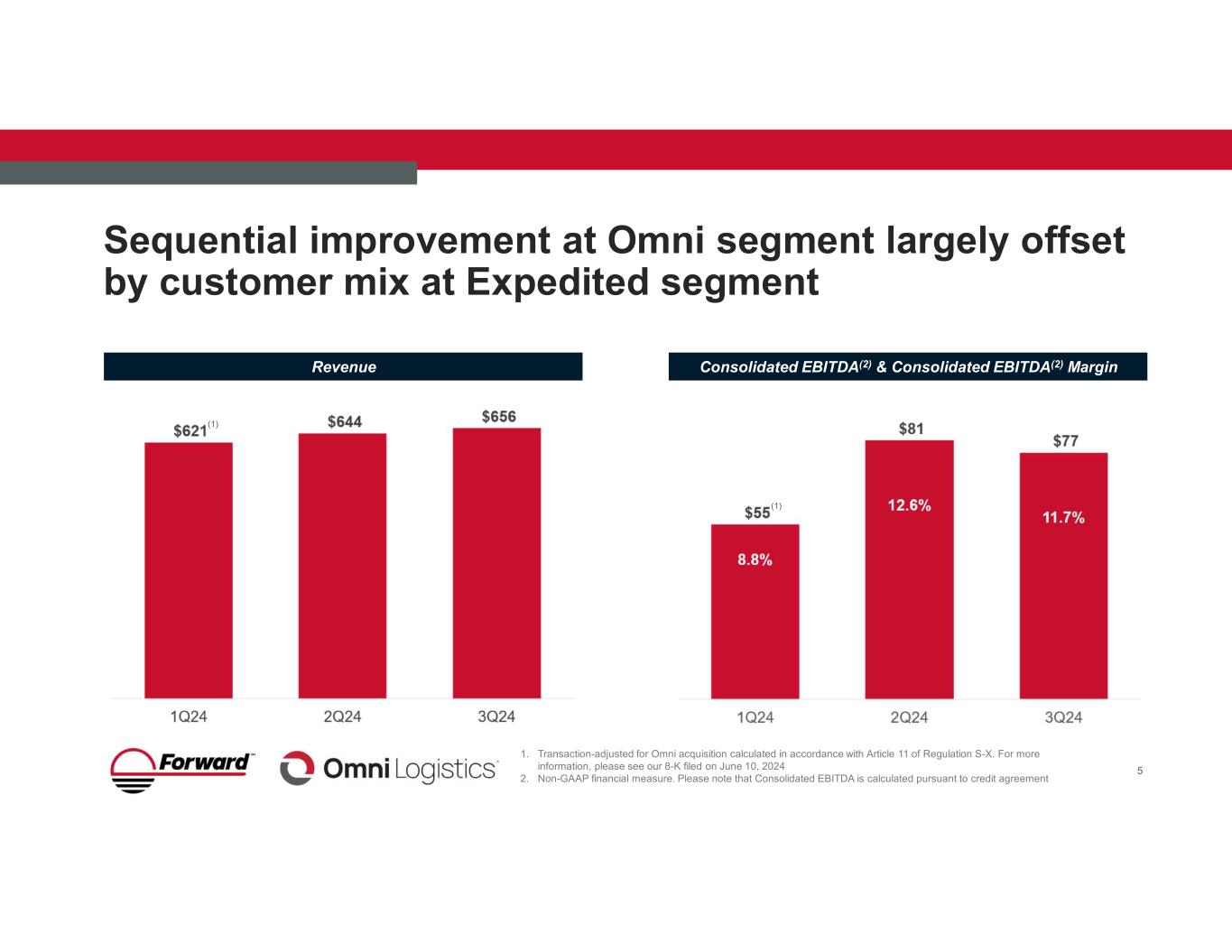

1. Transaction-adjusted for Omni acquisition calculated in accordance with Article 11 of Regulation S-X. For more information, please see our 8-K filed on June 10, 2024 2. Non-GAAP financial measure. Please note that Consolidated EBITDA is calculated pursuant to credit agreement Sequential improvement at Omni segment largely offset by customer mix at Expedited segment Revenue Consolidated EBITDA(2) & Consolidated EBITDA(2) Margin 5 (1) (1)

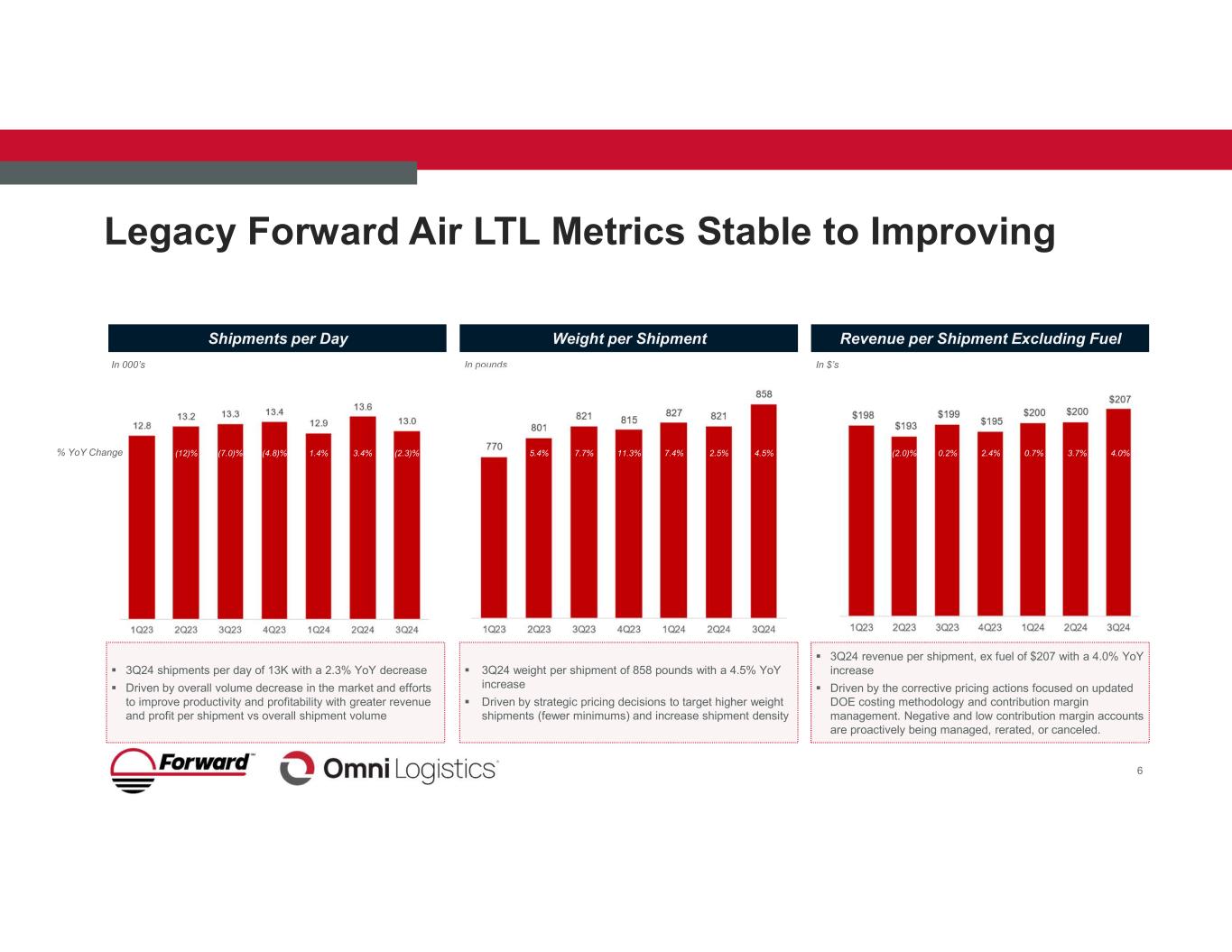

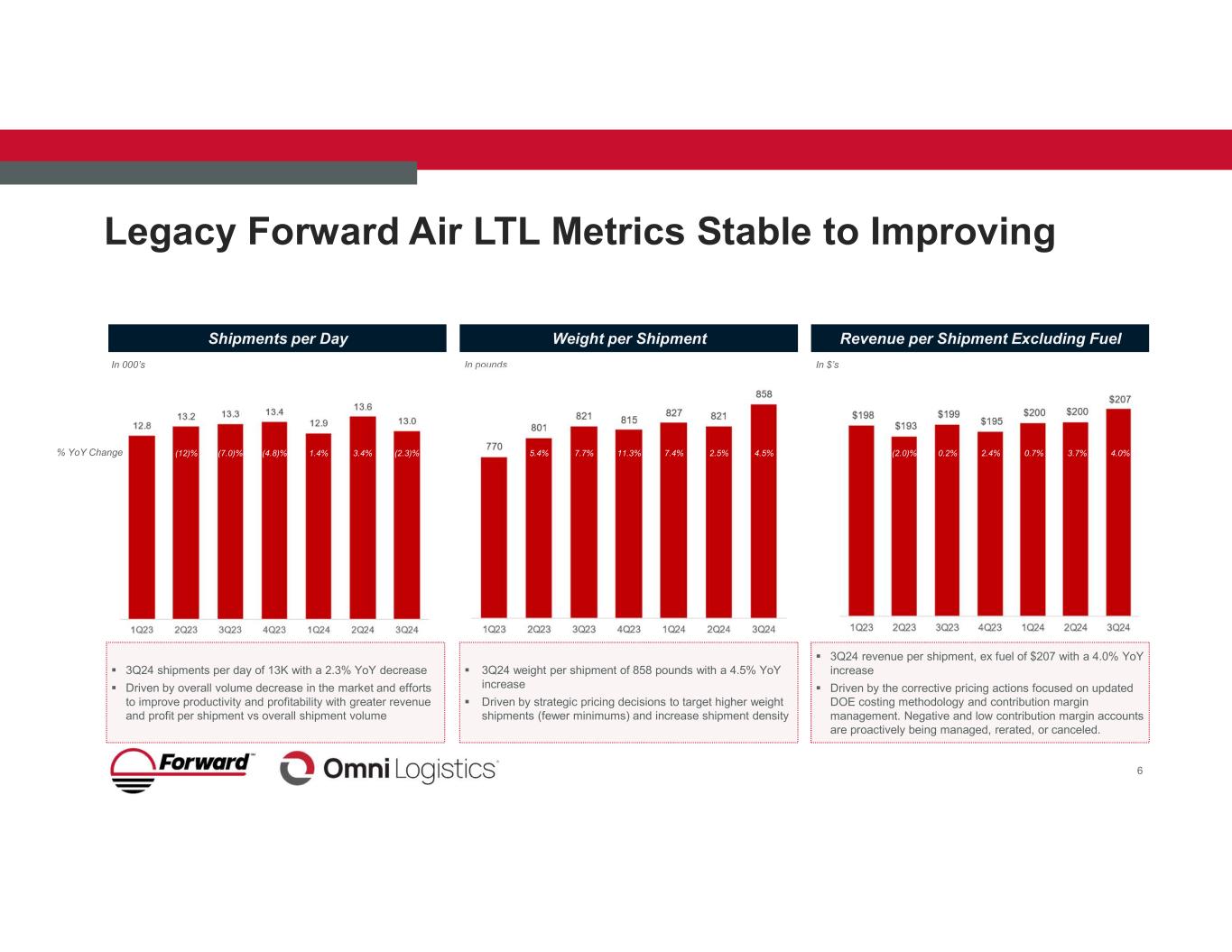

Legacy Forward Air LTL Metrics Stable to Improving 6 Shipments per Day Weight per Shipment Revenue per Shipment Excluding Fuel In 000’s In pounds In $’s 3Q24 weight per shipment of 858 pounds with a 4.5% YoY increase Driven by strategic pricing decisions to target higher weight shipments (fewer minimums) and increase shipment density 3Q24 revenue per shipment, ex fuel of $207 with a 4.0% YoY increase Driven by the corrective pricing actions focused on updated DOE costing methodology and contribution margin management. Negative and low contribution margin accounts are proactively being managed, rerated, or canceled. 3Q24 shipments per day of 13K with a 2.3% YoY decrease Driven by overall volume decrease in the market and efforts to improve productivity and profitability with greater revenue and profit per shipment vs overall shipment volume (2.3)%3.4%1.4%(4.8)%(7.0)%(12)% 4.5%2.5%7.4%11.3%7.7%5.4% 4.0%3.7%0.7%2.4%0.2%(2.0)%% YoY Change

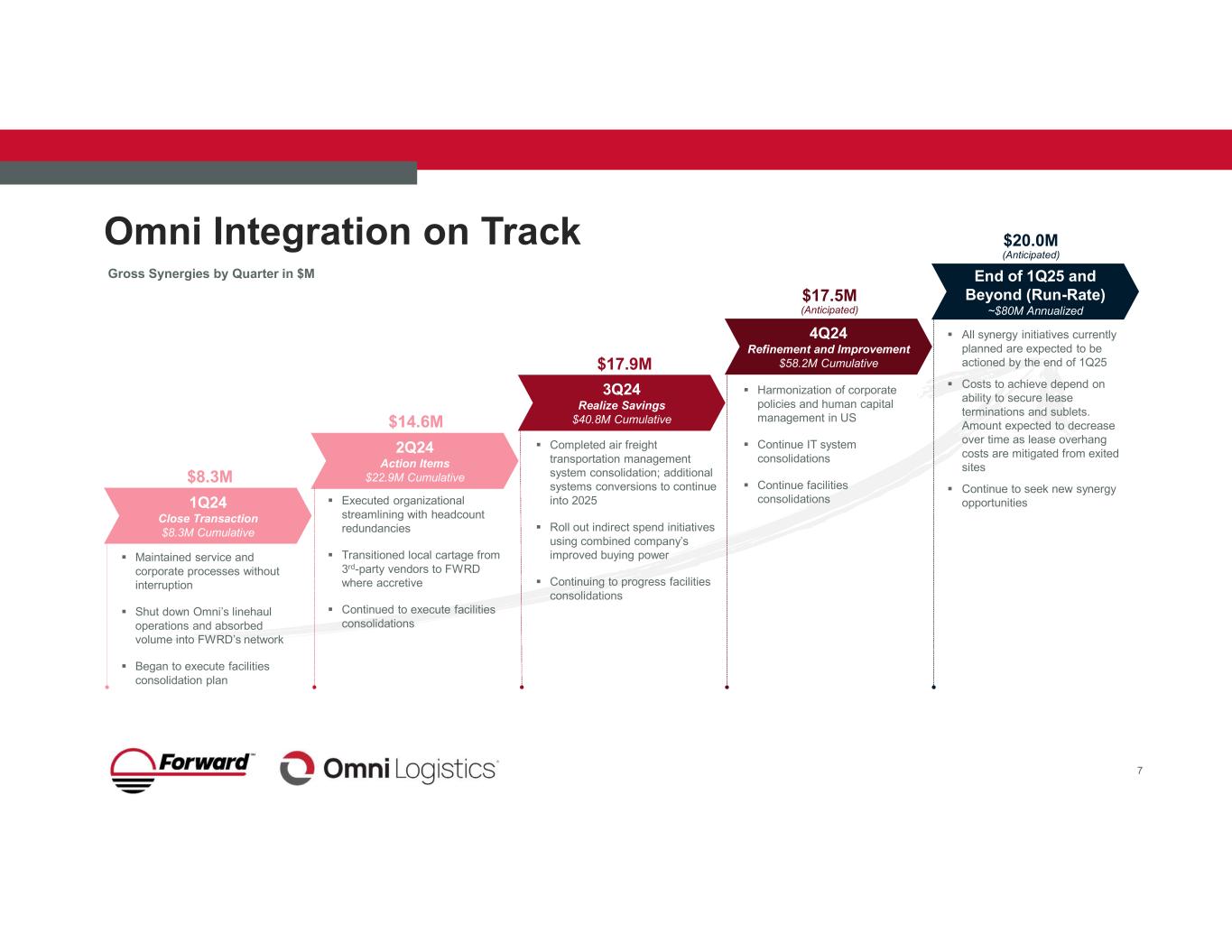

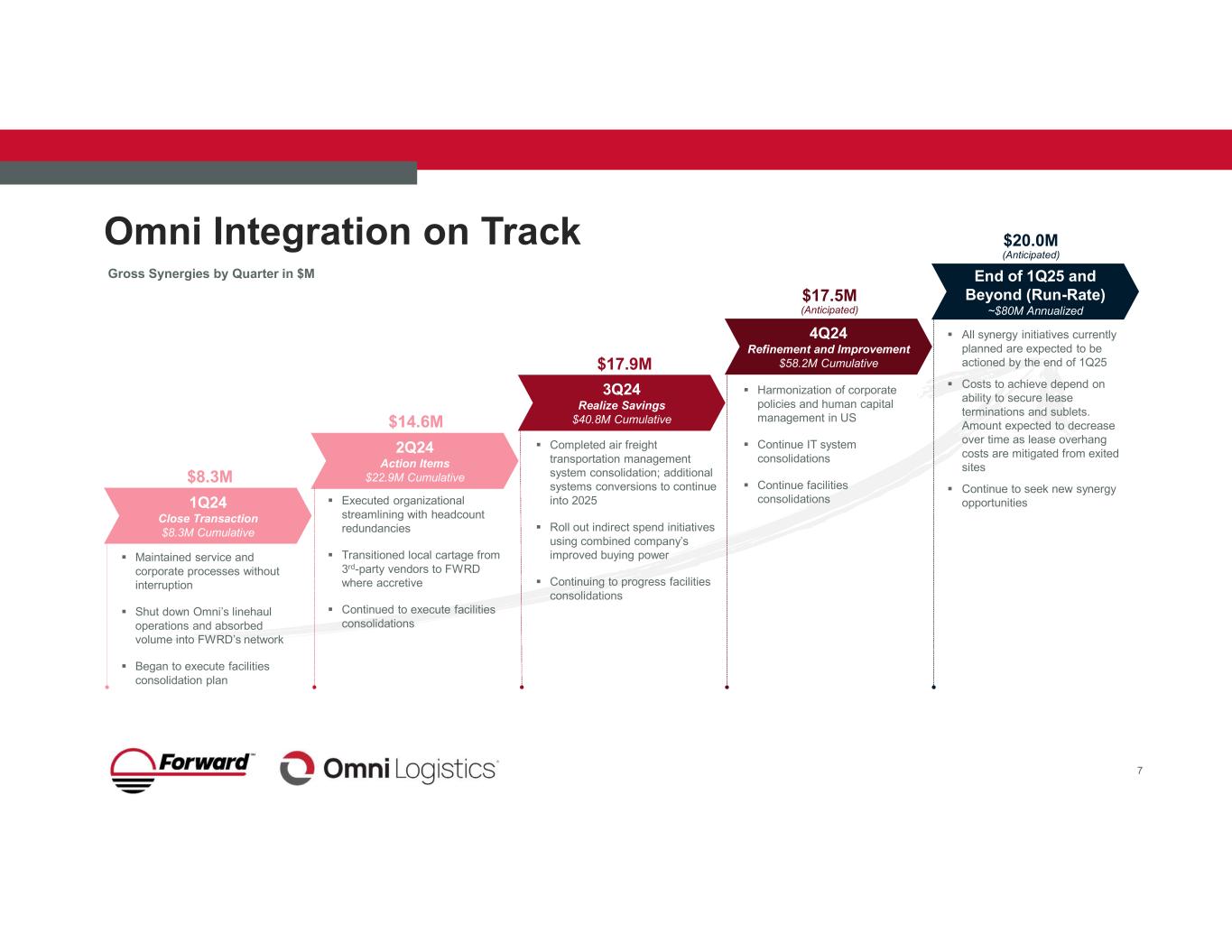

Omni Integration on Track 1Q24 Close Transaction $8.3M Cumulative Maintained service and corporate processes without interruption Shut down Omni’s linehaul operations and absorbed volume into FWRD’s network Began to execute facilities consolidation plan 2Q24 Action Items $22.9M Cumulative Executed organizational streamlining with headcount redundancies Transitioned local cartage from 3rd-party vendors to FWRD where accretive Continued to execute facilities consolidations 3Q24 Realize Savings $40.8M Cumulative Completed air freight transportation management system consolidation; additional systems conversions to continue into 2025 Roll out indirect spend initiatives using combined company’s improved buying power Continuing to progress facilities consolidations End of 1Q25 and Beyond (Run-Rate) ~$80M Annualized 4Q24 Refinement and Improvement $58.2M Cumulative Harmonization of corporate policies and human capital management in US Continue IT system consolidations Continue facilities consolidations Gross Synergies by Quarter in $M $8.3M $14.6M $17.9M $17.5M All synergy initiatives currently planned are expected to be actioned by the end of 1Q25 Costs to achieve depend on ability to secure lease terminations and sublets. Amount expected to decrease over time as lease overhang costs are mitigated from exited sites Continue to seek new synergy opportunities (Anticipated) $20.0M (Anticipated) 7

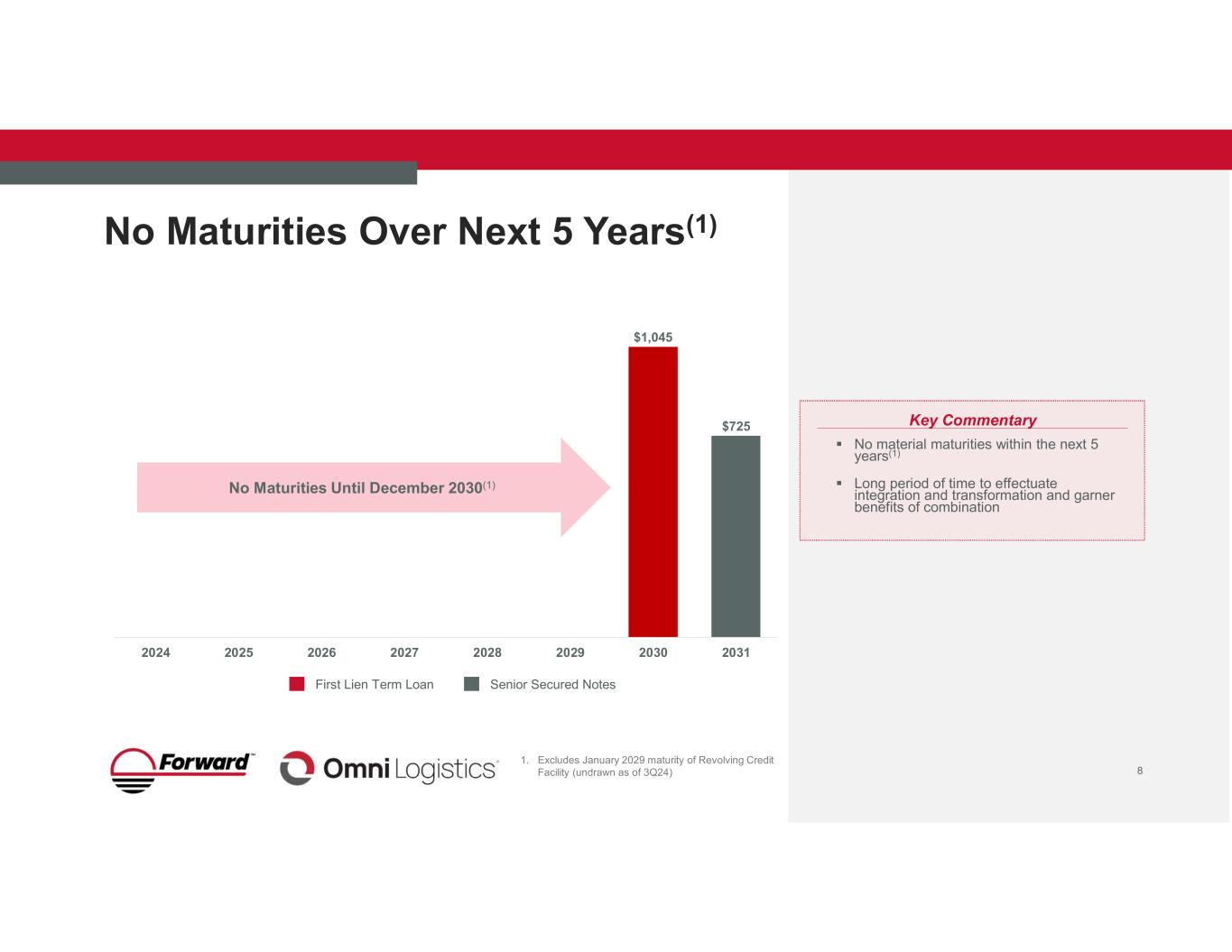

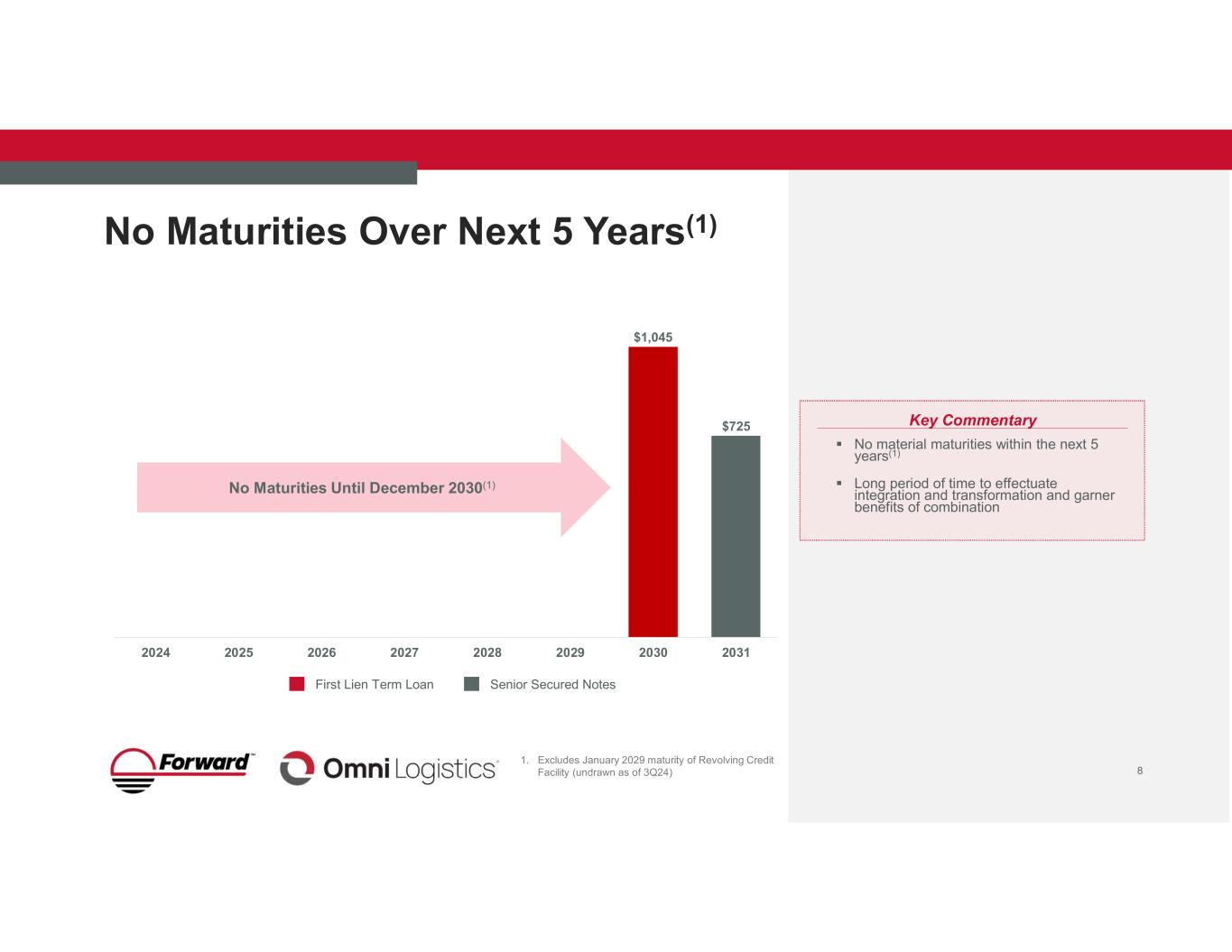

8 No Maturities Over Next 5 Years(1) Key Commentary $1,045 $725 2024 2025 2026 2027 2028 2029 2030 2031 First Lien Term Loan Senior Secured Notes No material maturities within the next 5 years(1) Long period of time to effectuate integration and transformation and garner benefits of combination No Maturities Until December 2030(1) 1. Excludes January 2029 maturity of Revolving Credit Facility (undrawn as of 3Q24)

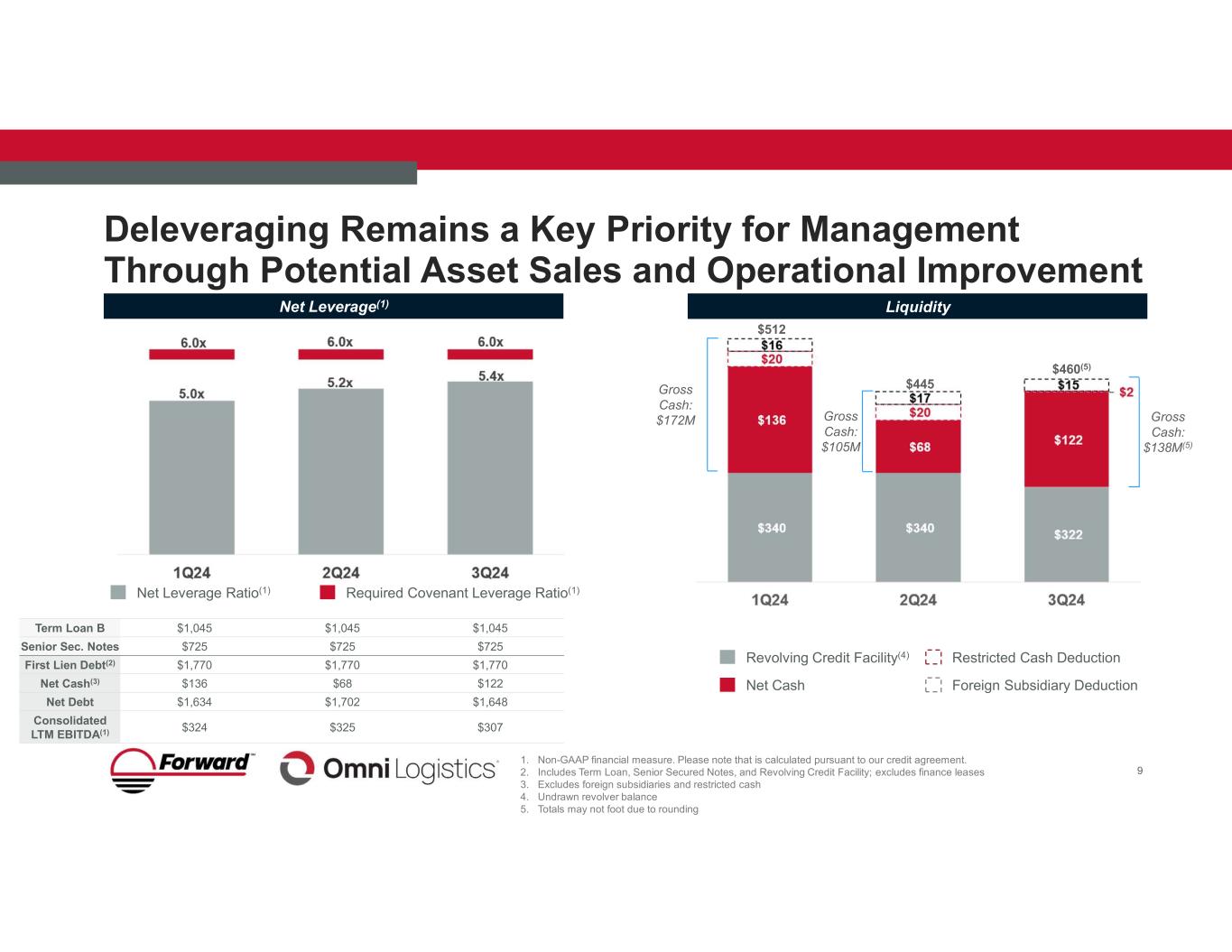

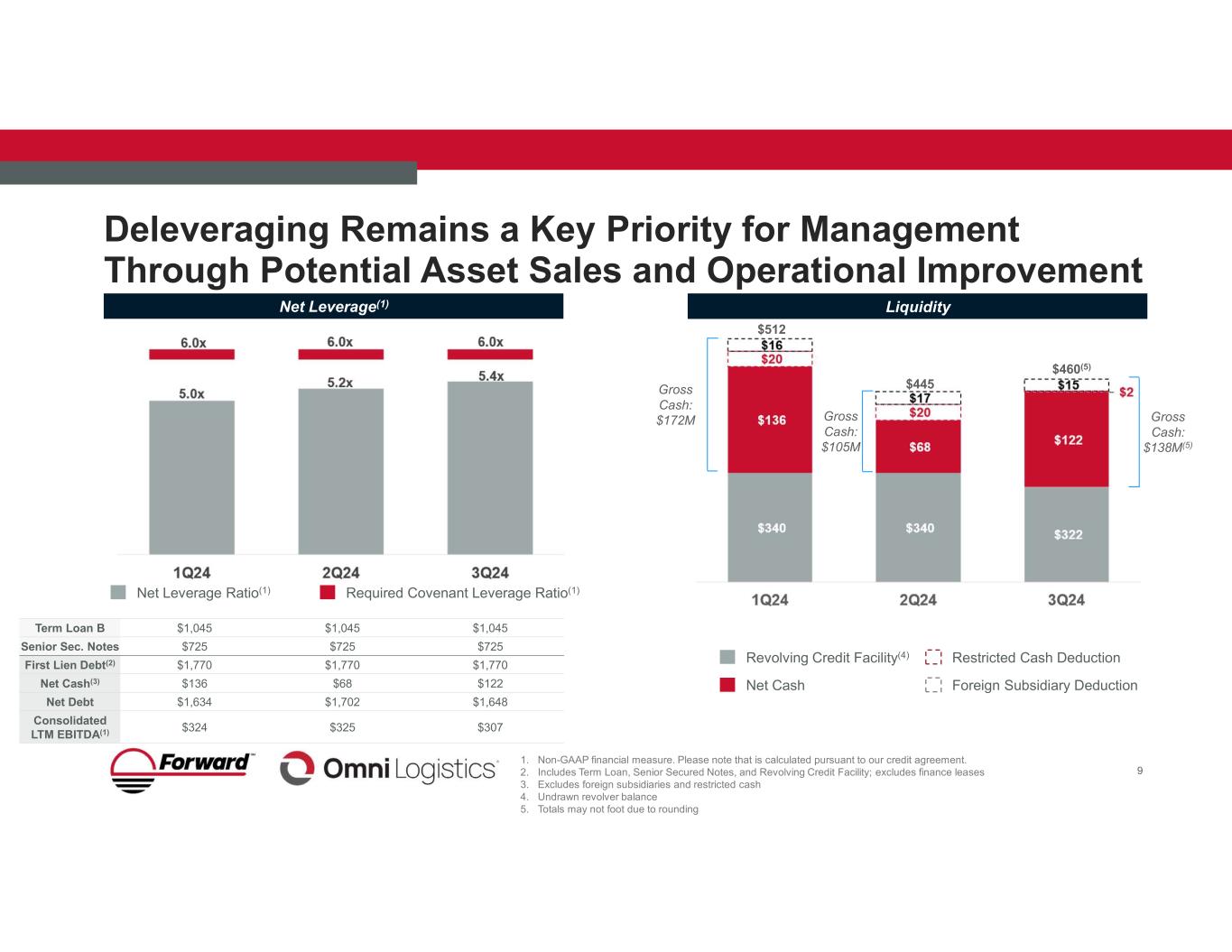

1. Non-GAAP financial measure. Please note that is calculated pursuant to our credit agreement. 2. Includes Term Loan, Senior Secured Notes, and Revolving Credit Facility; excludes finance leases 3. Excludes foreign subsidiaries and restricted cash 4. Undrawn revolver balance 5. Totals may not foot due to rounding Deleveraging Remains a Key Priority for Management Through Potential Asset Sales and Operational Improvement $1,045$1,045$1,045Term Loan B $725$725$725Senior Sec. Notes $1,770$1,770$1,770First Lien Debt(2) $122$68$136Net Cash(3) $1,648$1,702$1,634Net Debt $307$325$324 Consolidated LTM EBITDA(1) Net Leverage(1) Liquidity Gross Cash: $105M Net Cash Revolving Credit Facility(4) Restricted Cash Deduction Foreign Subsidiary Deduction 9 Gross Cash: $138M(5) $445 $460(5) Net Leverage Ratio(1) Required Covenant Leverage Ratio(1) $512 Gross Cash: $172M

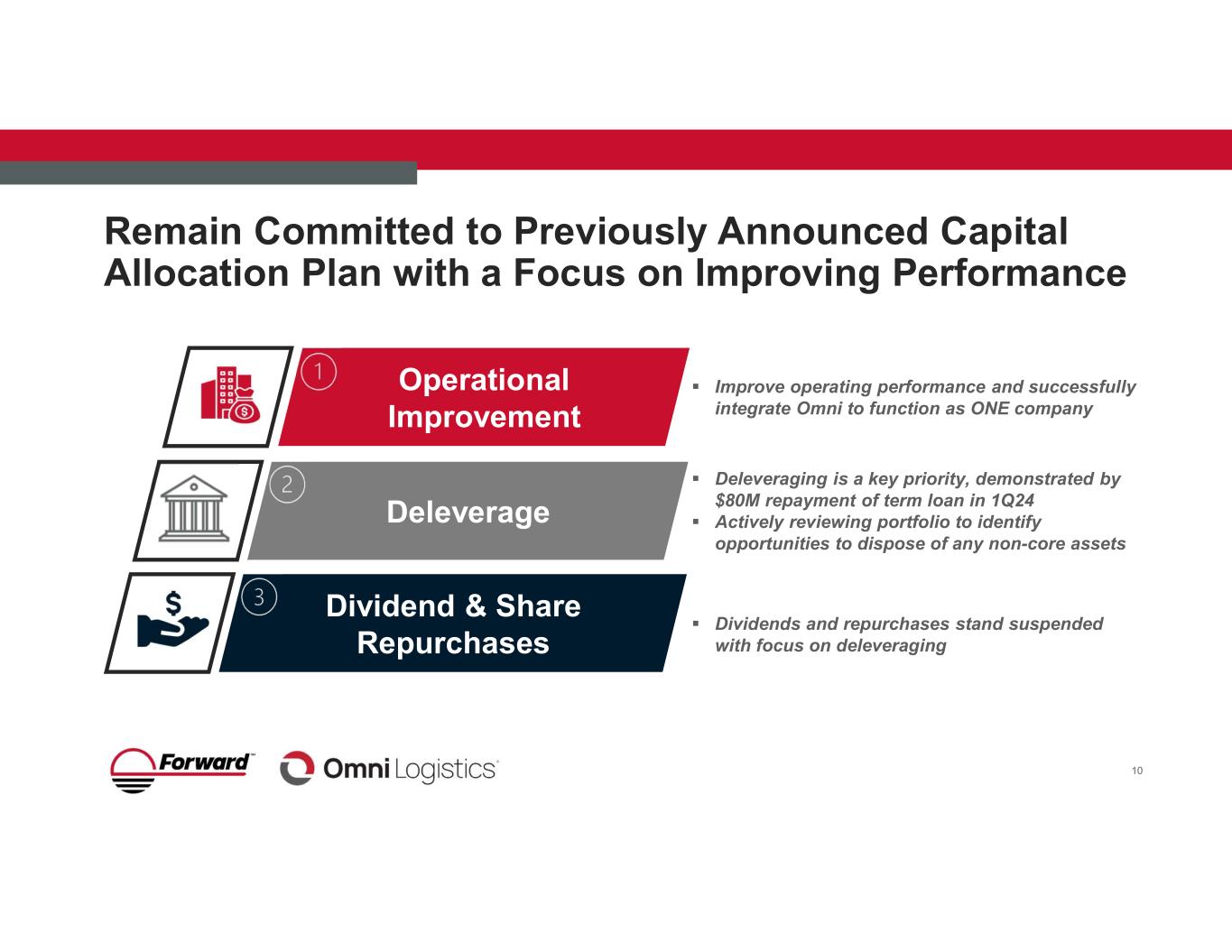

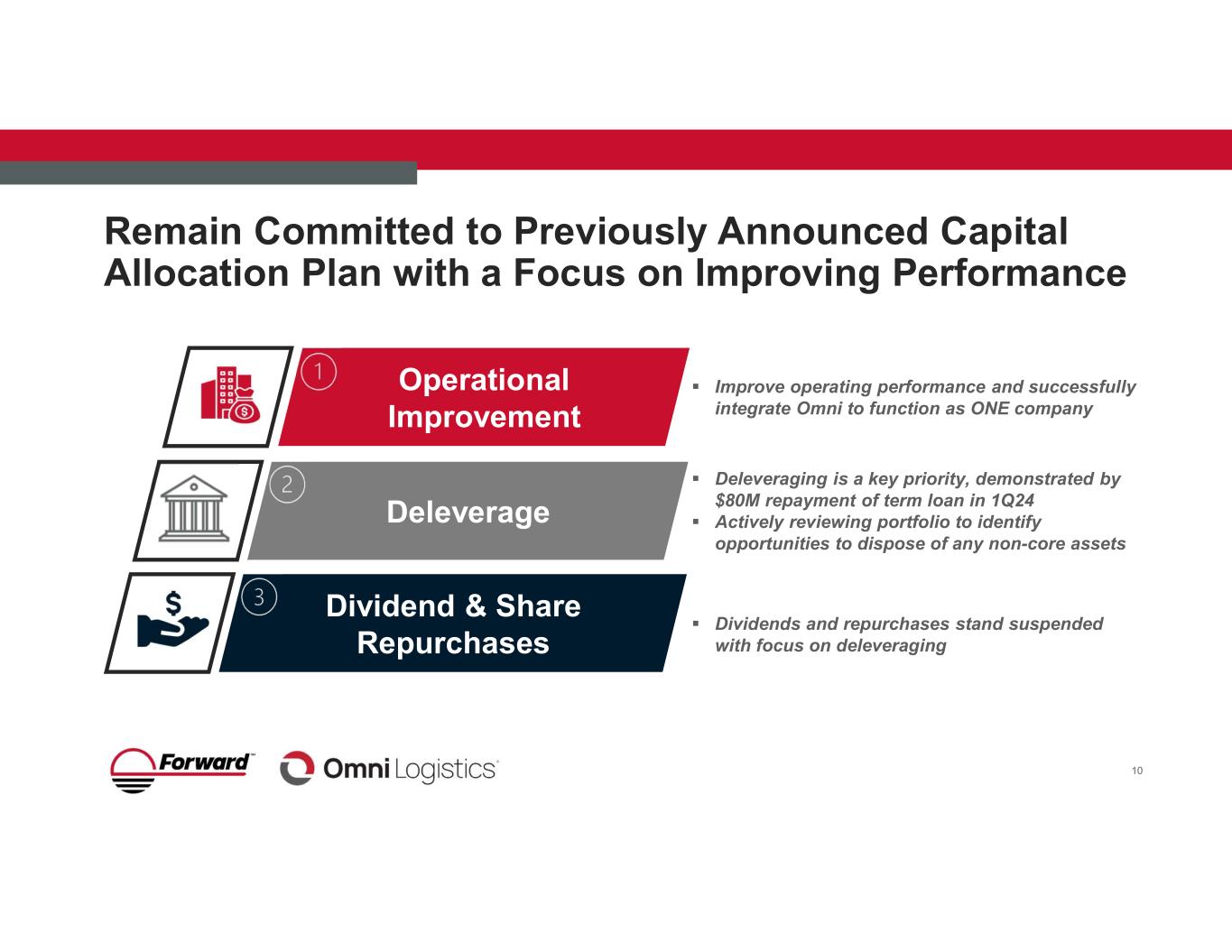

Remain Committed to Previously Announced Capital Allocation Plan with a Focus on Improving Performance 10 Deleverage Deleveraging is a key priority, demonstrated by $80M repayment of term loan in 1Q24 Actively reviewing portfolio to identify opportunities to dispose of any non-core assets Dividends and repurchases stand suspended with focus on deleveraging Dividend & Share Repurchases Improve operating performance and successfully integrate Omni to function as ONE company Operational Improvement

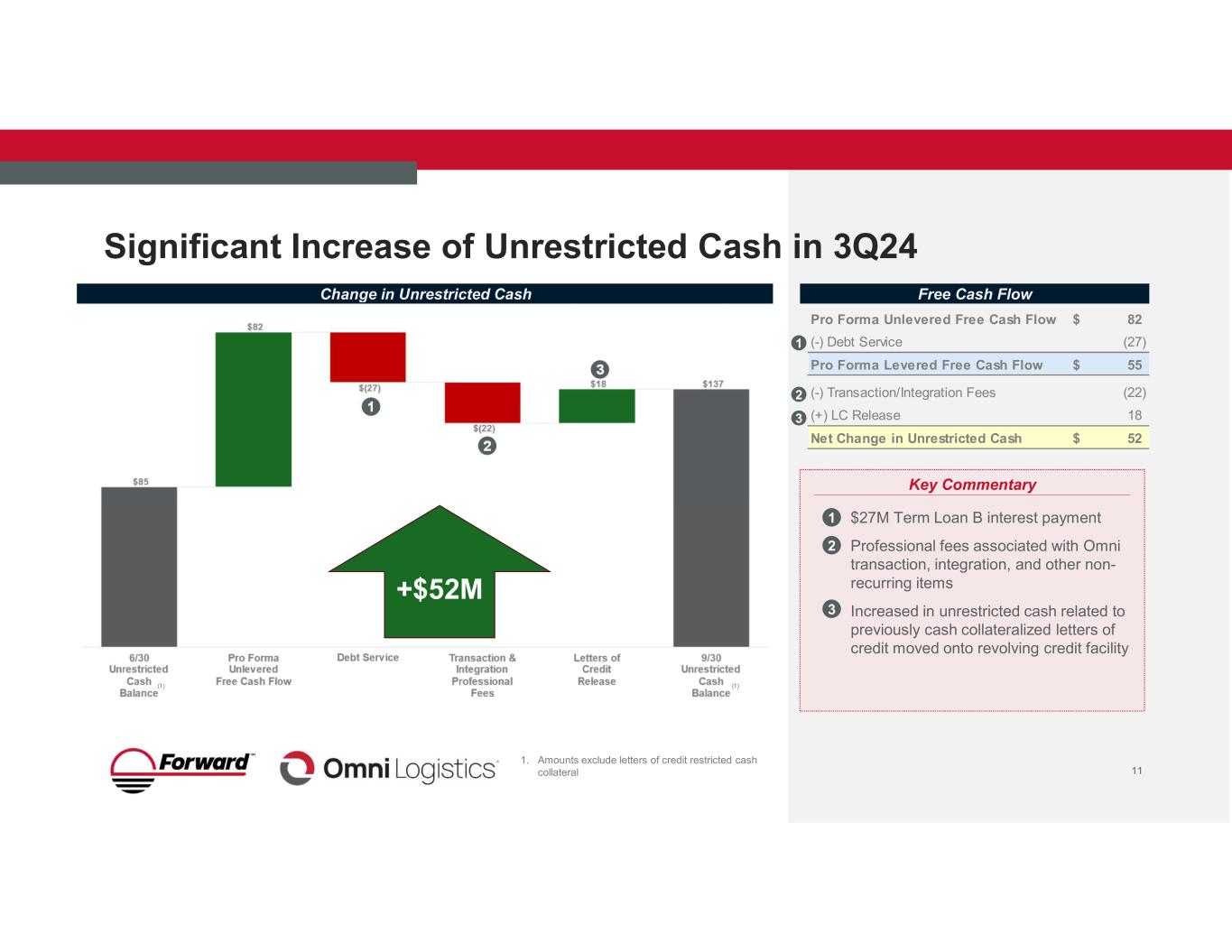

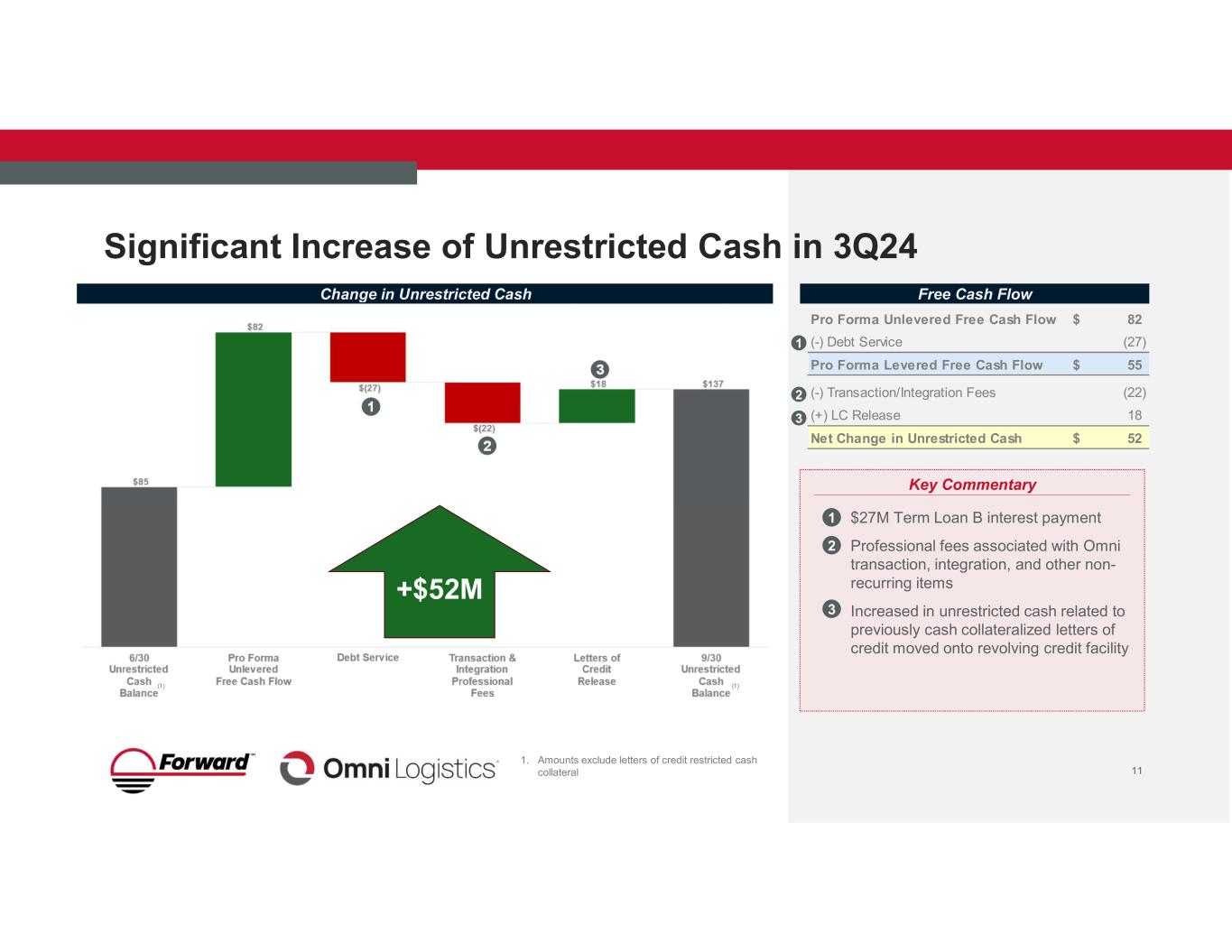

11 Significant Increase of Unrestricted Cash in 3Q24 1. Amounts exclude letters of credit restricted cash collateral Change in Unrestricted Cash (1) (1) Key Commentary 1• $27M Term Loan B interest payment • Professional fees associated with Omni transaction, integration, and other non- recurring items • Increased in unrestricted cash related to previously cash collateralized letters of credit moved onto revolving credit facility 2 3 1 2 3 Free Cash Flow 1 2 3 Pro Forma Unlevered Free Cash Flow 82$ (-) Debt Service (27) Pro Forma Levered Free Cash Flow 55$ (-) Transaction/Integration Fees (22) (+) LC Release 18 Net Change in Unrestricted Cash 52$ +$52M

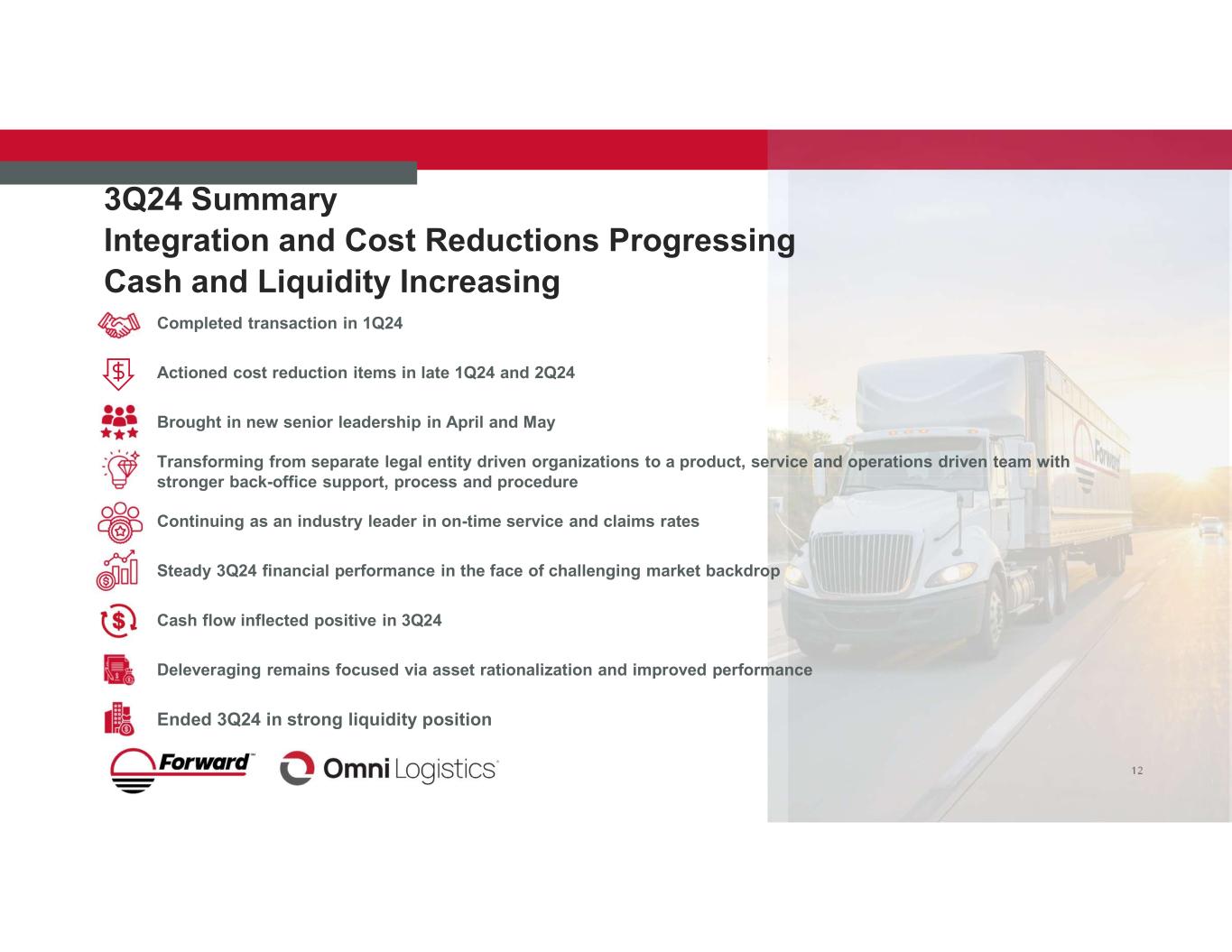

12 3Q24 Summary Integration and Cost Reductions Progressing Cash and Liquidity Increasing Completed transaction in 1Q24 Brought in new senior leadership in April and May Actioned cost reduction items in late 1Q24 and 2Q24 Continuing as an industry leader in on-time service and claims rates Transforming from separate legal entity driven organizations to a product, service and operations driven team with stronger back-office support, process and procedure Deleveraging remains focused via asset rationalization and improved performance Cash flow inflected positive in 3Q24 Steady 3Q24 financial performance in the face of challenging market backdrop Ended 3Q24 in strong liquidity position

Appendix 13

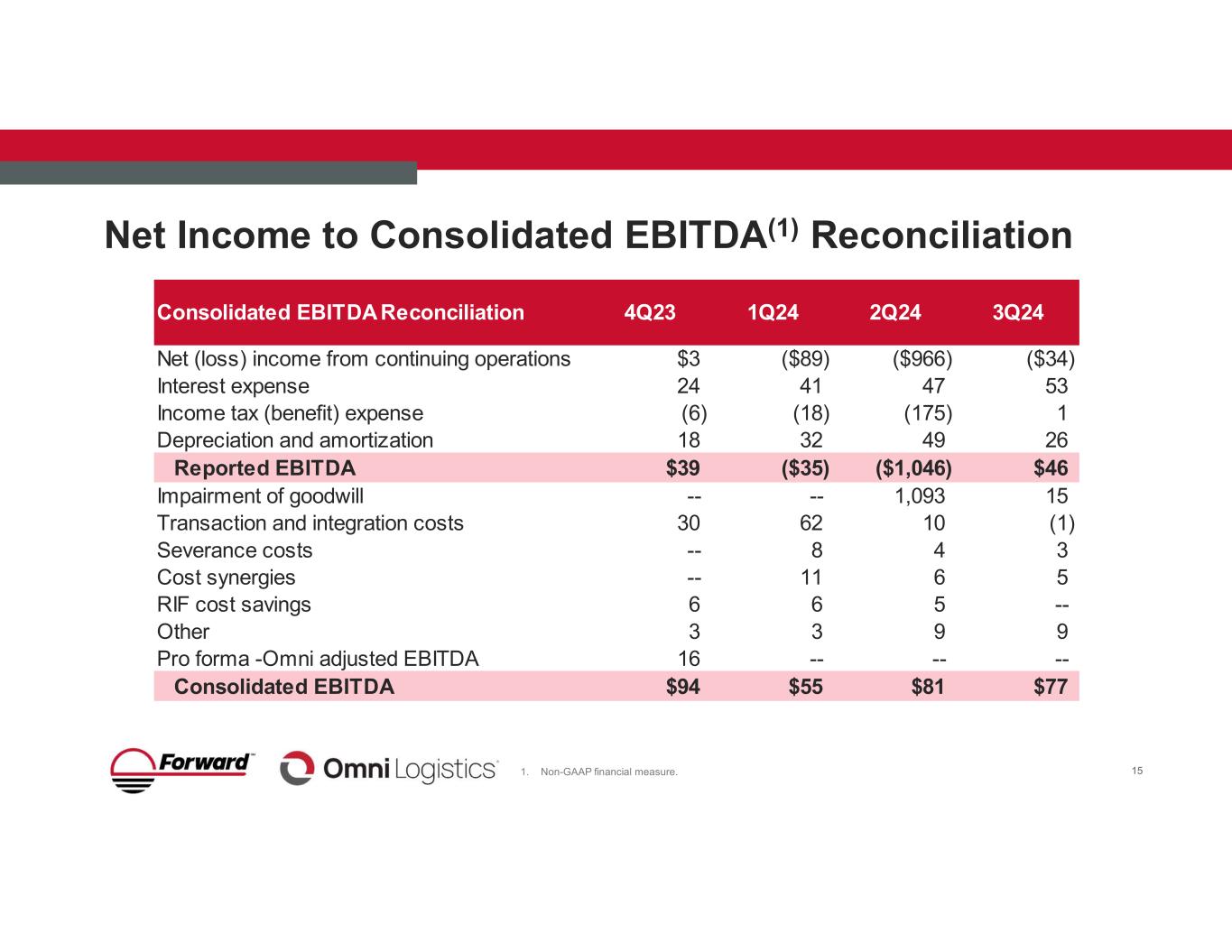

Covenant Leverage Reconciliation 14 1. Non-GAAP financial measure. Reconciliations and other information required by Regulation G can be found in the Appendix section of the presentation 2. Reversal of previously expensed debt issuance costs that were reversed and capitalized in 3Q24 3. Non-GAAP financial measure. Please note that Consolidated EBITDA is calculated pursuant to our credit agreement 4. As defined in the RCFTL (Revolving Credit Facility Term Loan) credit agreement, represents total amount of debt outstanding, including Term Loan, Senior Secured Notes, and Revolving Credit Facility; excludes finance leases 5. As defined in the RCFTL credit agreement, excludes foreign subsidiaries of $15M (3Q24) and restricted cash of $2M (3Q24) Consolidated EBITDA Reconciliation 4Q23 1Q24 2Q24 3Q24 TTM (9/30/2024) Net Income $30 ($159) ($971) ($35) ($1,136) Business Dispositions (Final Mile) (117) (0) 5 1 (111) Impairment Charge / Asset Write-Off 0 0 1,099 15 1,114 Omni Merger Transaction Costs 61 96 2 (11) 148 Other (Severance, Retention, change in Fair Value etc.) (20) 43 34 19 76 Consolidated Net Income ($46) ($21) $169 ($12) $90 Net Interest Expense 67 53 47 53 221 Taxes 0 (16) (180) 3 (193) Depreciation and Amortization 33 20 37 26 115 Trans. Expenses, Integration Costs, & Other Normalizing 15 2 (2) 3 18 Pro Forma Cost Synergies 19 11 6 5 40 Consolidated EBITDA Excluding RIF ¹ $88 $49 $76 $77 $290 PF September 2024 Headcount Reduction Savings 6 6 5 0 16 Consolidated EBITDA ³ $94 $55 $81 $77 $307 Consolidated First Lien Indebtedness ⁴ 1,770 Net Cash and Cash Equivalents ⁵ (122) Net Debt $1,648 Consolidated First Lien Net Leverage Ratio 5.4x 1 2

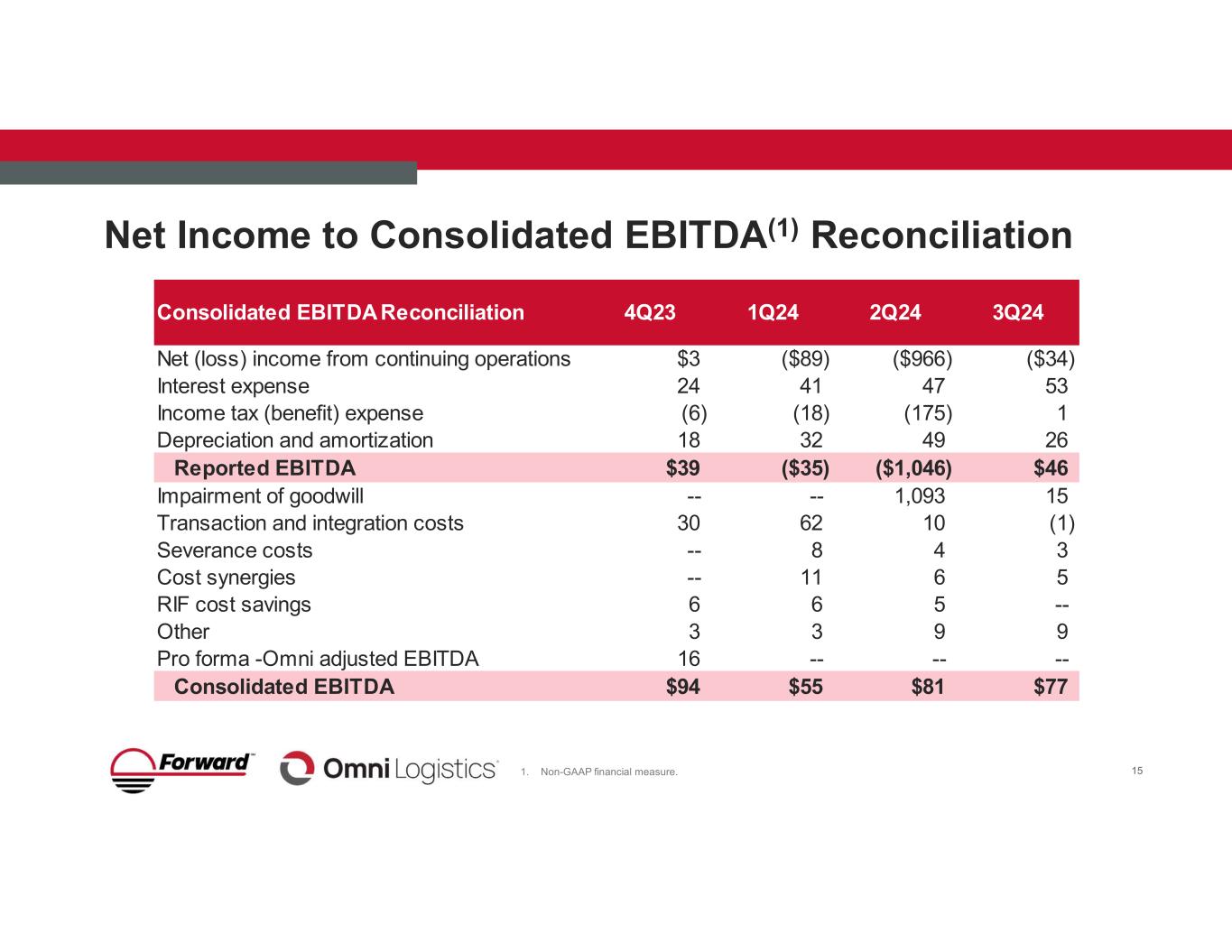

1. Non-GAAP financial measure. Net Income to Consolidated EBITDA(1) Reconciliation 15 Consolidated EBITDA Reconciliation 4Q23 1Q24 2Q24 3Q24 Net (loss) income from continuing operations $3 ($89) ($966) ($34) Interest expense 24 41 47 53 Income tax (benefit) expense (6) (18) (175) 1 Depreciation and amortization 18 32 49 26 Reported EBITDA $39 ($35) ($1,046) $46 Impairment of goodwill -- -- 1,093 15 Transaction and integration costs 30 62 10 (1) Severance costs -- 8 4 3 Cost synergies -- 11 6 5 RIF cost savings 6 6 5 -- Other 3 3 9 9 Pro forma -Omni adjusted EBITDA 16 -- -- -- Consolidated EBITDA $94 $55 $81 $77

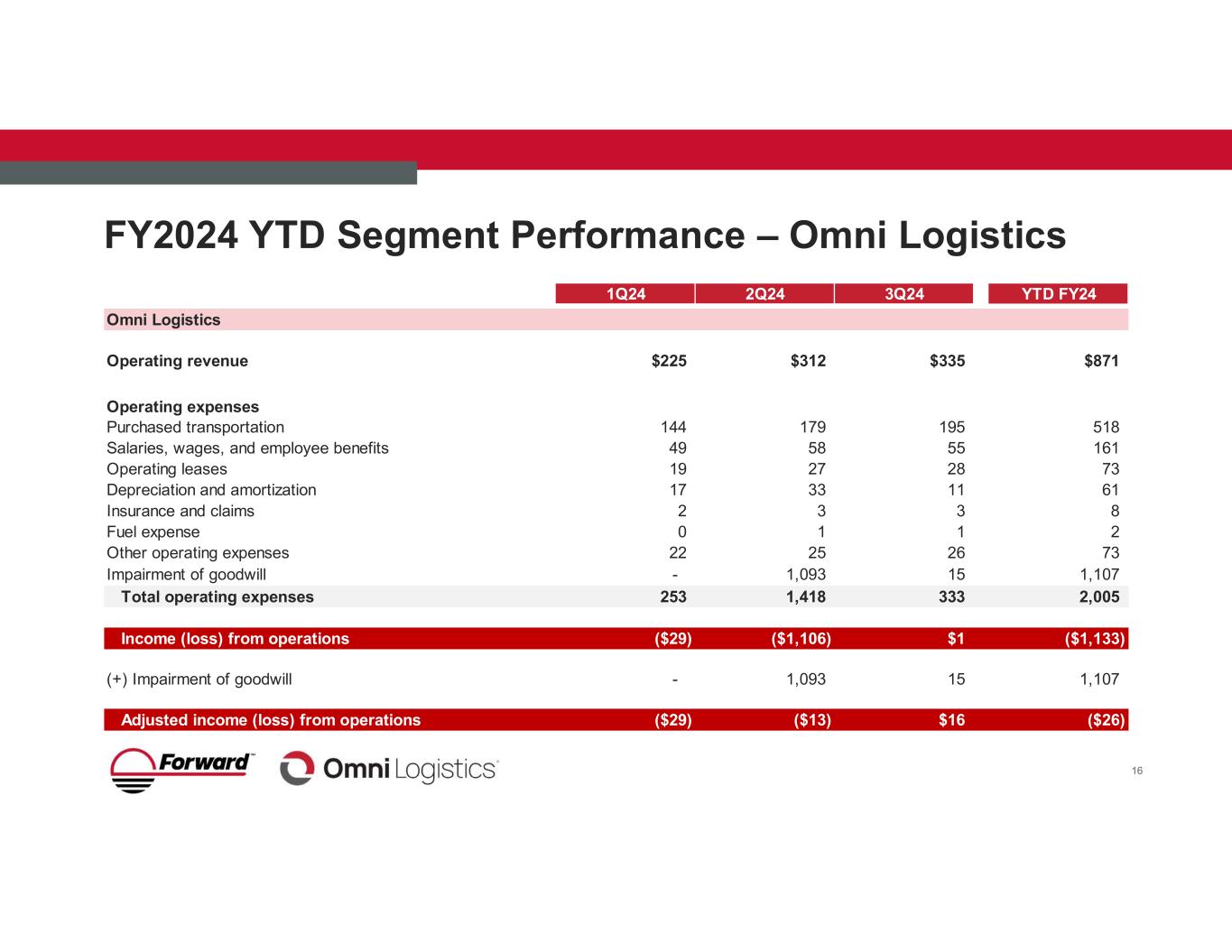

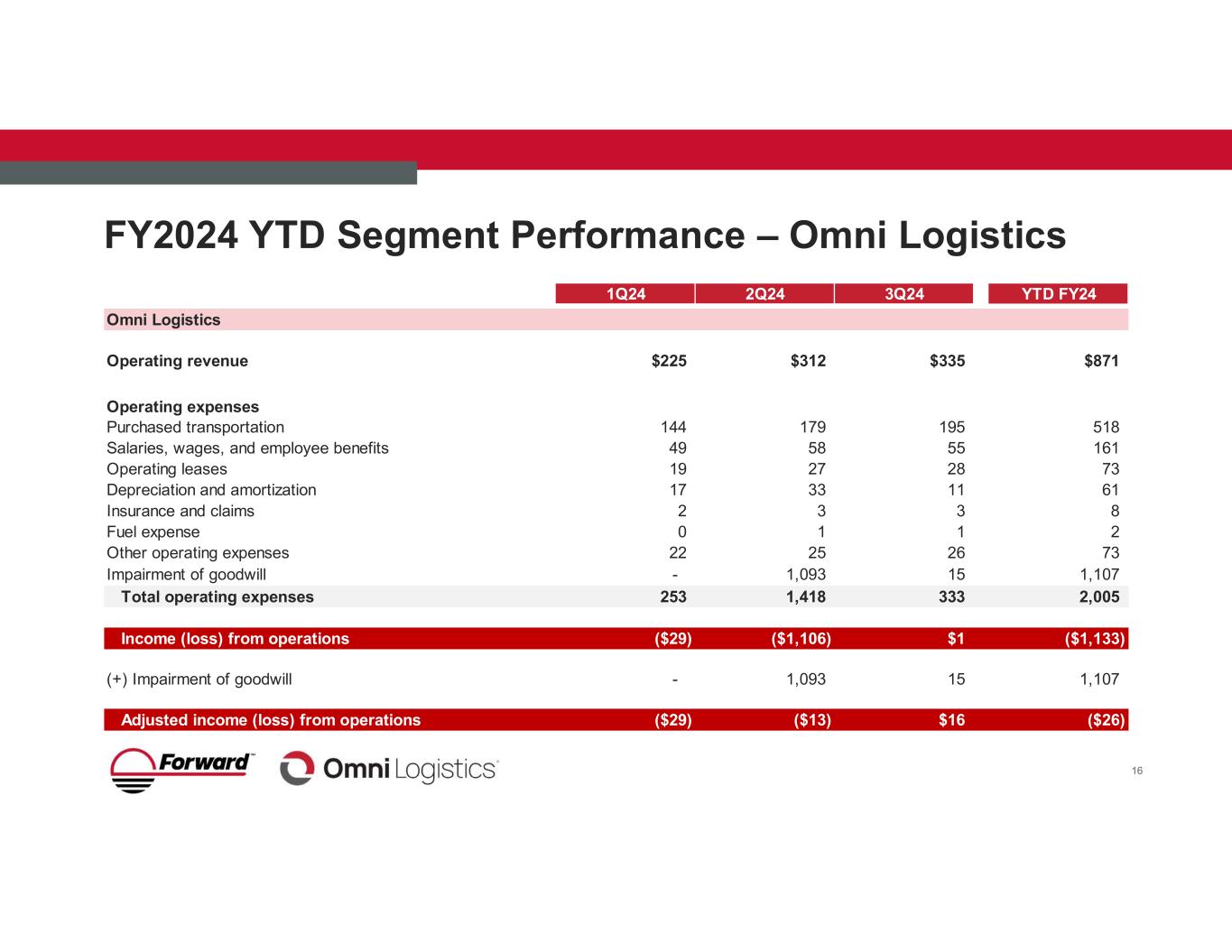

FY2024 YTD Segment Performance – Omni Logistics 16 1 1Q24 2Q24 3Q24 YTD FY24 Omni Logistics Operating revenue $225 $312 $335 $871 Operating expenses Purchased transportation 144 179 195 518 Salaries, wages, and employee benefits 49 58 55 161 Operating leases 19 27 28 73 Depreciation and amortization 17 33 11 61 Insurance and claims 2 3 3 8 Fuel expense 0 1 1 2 Other operating expenses 22 25 26 73 Impairment of goodwill - 1,093 15 1,107 Total operating expenses 253 1,418 333 2,005 Income (loss) from operations ($29) ($1,106) $1 ($1,133) (+) Impairment of goodwill - 1,093 15 1,107 Adjusted income (loss) from operations ($29) ($13) $16 ($26)

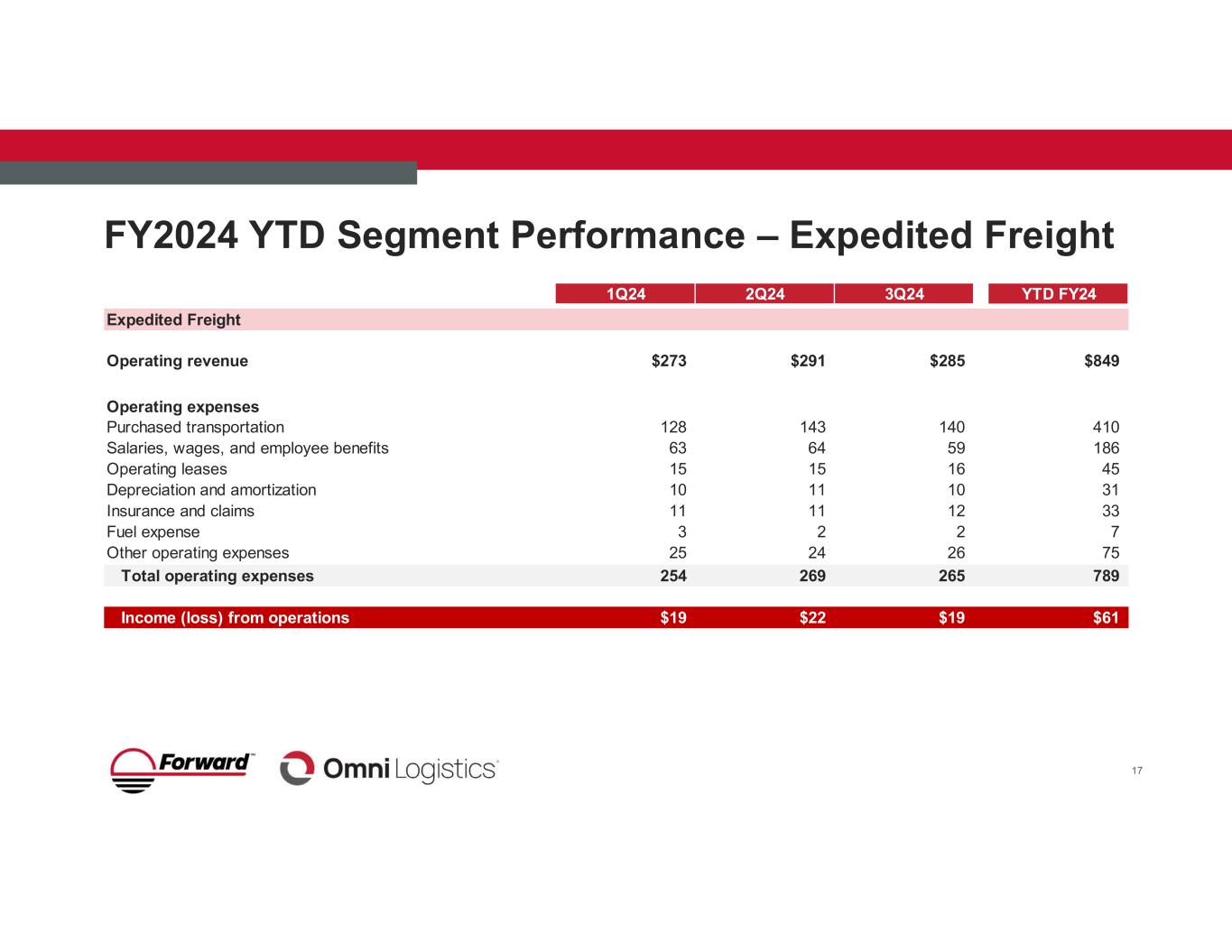

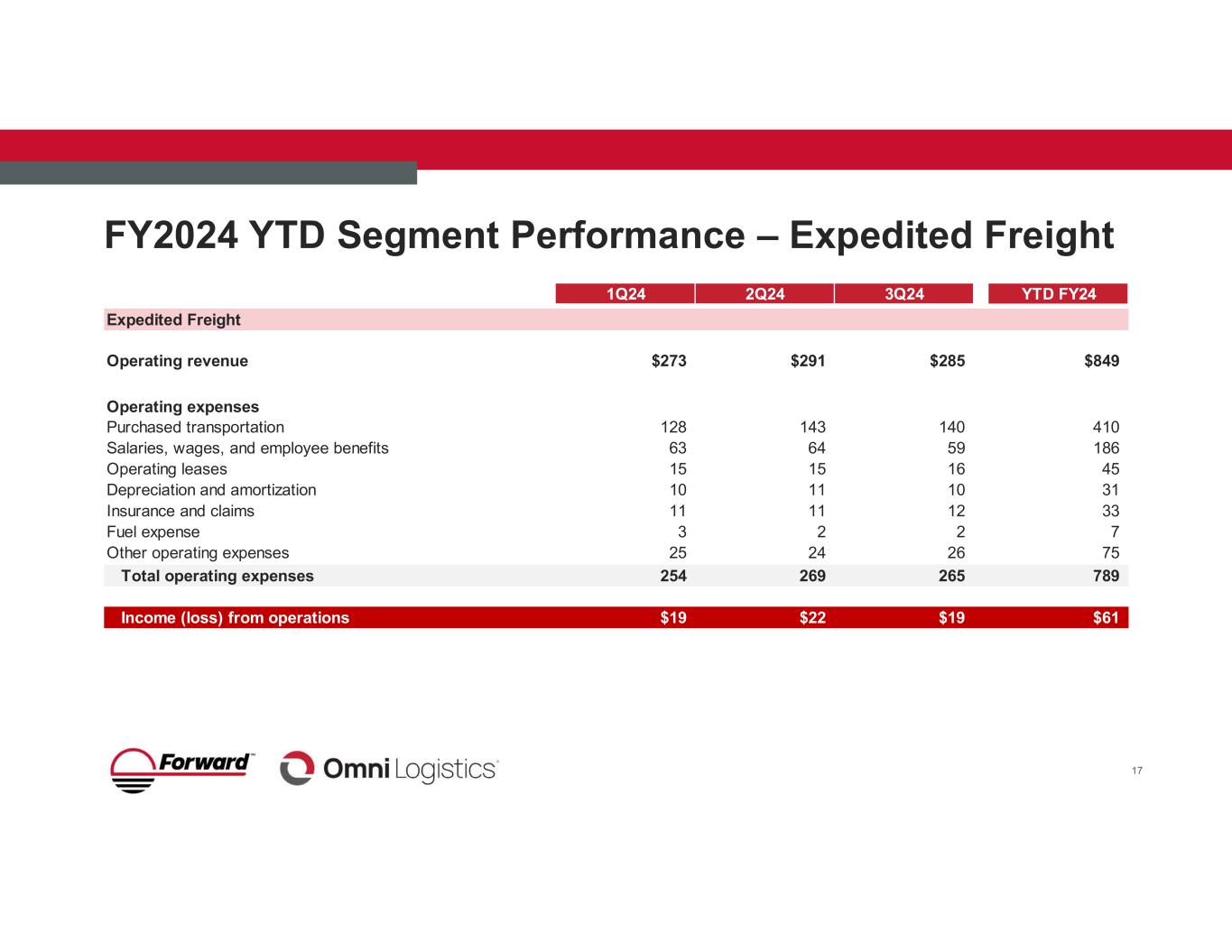

1Q24 2Q24 3Q24 YTD FY24 Expedited Freight Operating revenue $273 $291 $285 $849 Operating expenses Purchased transportation 128 143 140 410 Salaries, wages, and employee benefits 63 64 59 186 Operating leases 15 15 16 45 Depreciation and amortization 10 11 10 31 Insurance and claims 11 11 12 33 Fuel expense 3 2 2 7 Other operating expenses 25 24 26 75 Total operating expenses 254 269 265 789 Income (loss) from operations $19 $22 $19 $61 FY2024 YTD Segment Performance – Expedited Freight 17

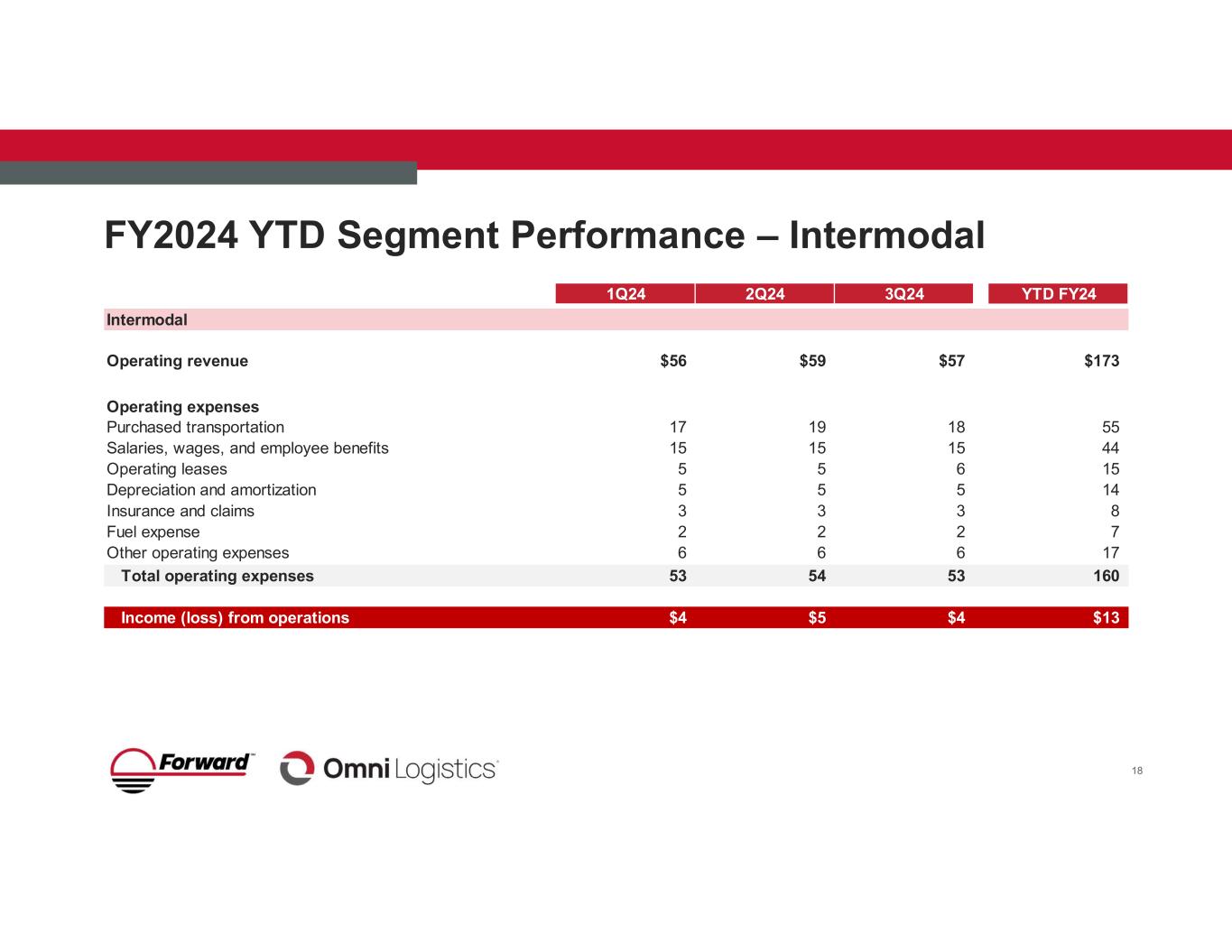

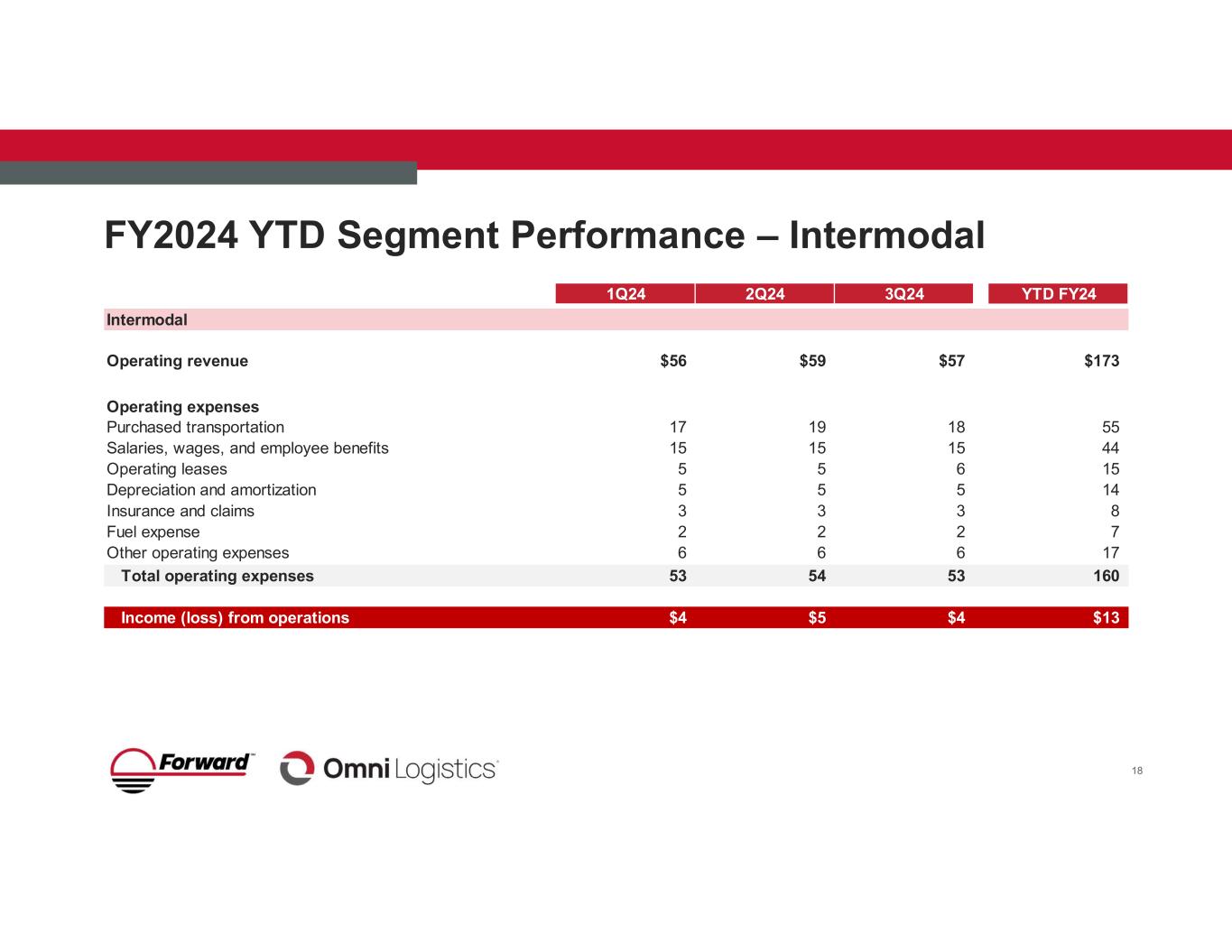

FY2024 YTD Segment Performance – Intermodal 18 1 1Q24 2Q24 3Q24 YTD FY24 Intermodal Operating revenue $56 $59 $57 $173 Operating expenses Purchased transportation 17 19 18 55 Salaries, wages, and employee benefits 15 15 15 44 Operating leases 5 5 6 15 Depreciation and amortization 5 5 5 14 Insurance and claims 3 3 3 8 Fuel expense 2 2 2 7 Other operating expenses 6 6 6 17 Total operating expenses 53 54 53 160 Income (loss) from operations $4 $5 $4 $13

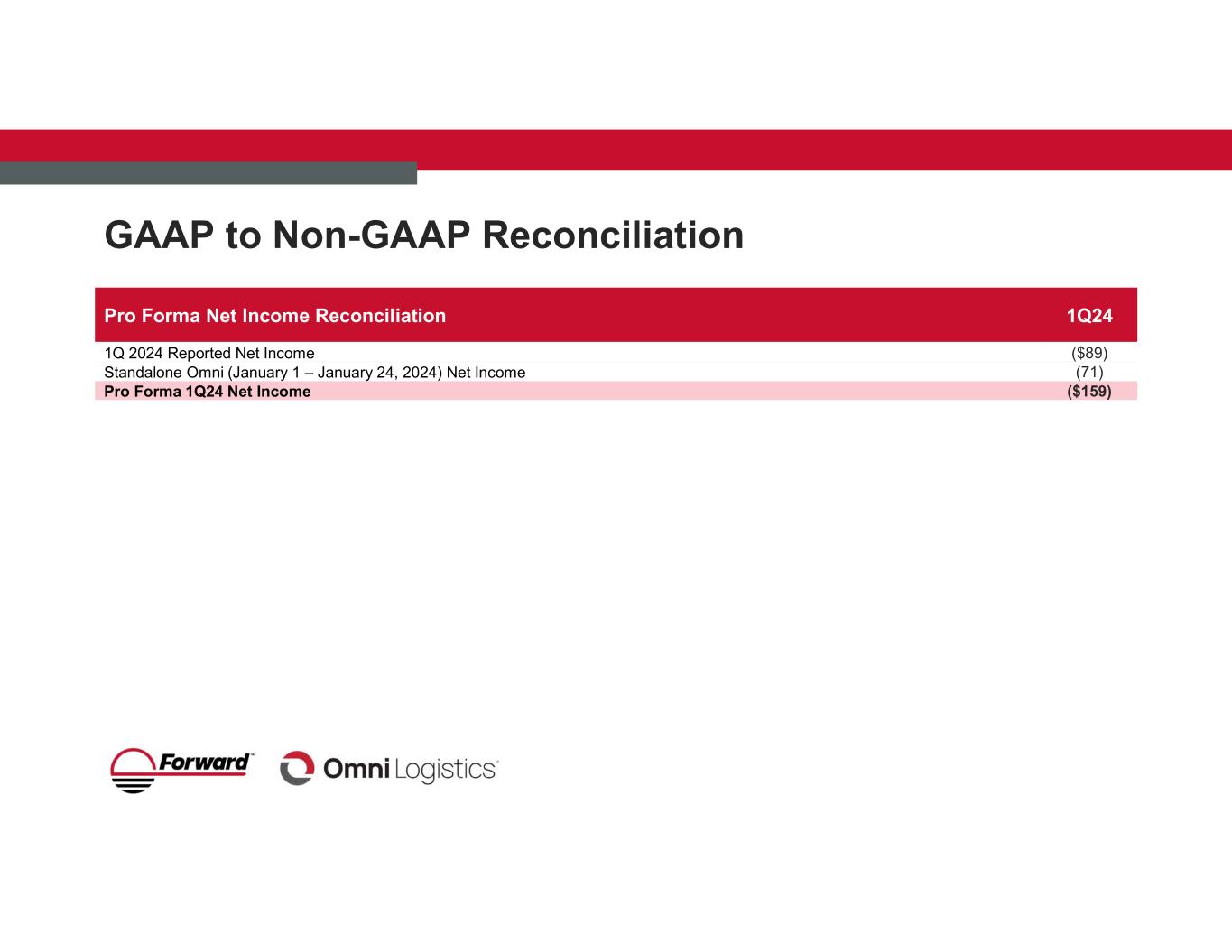

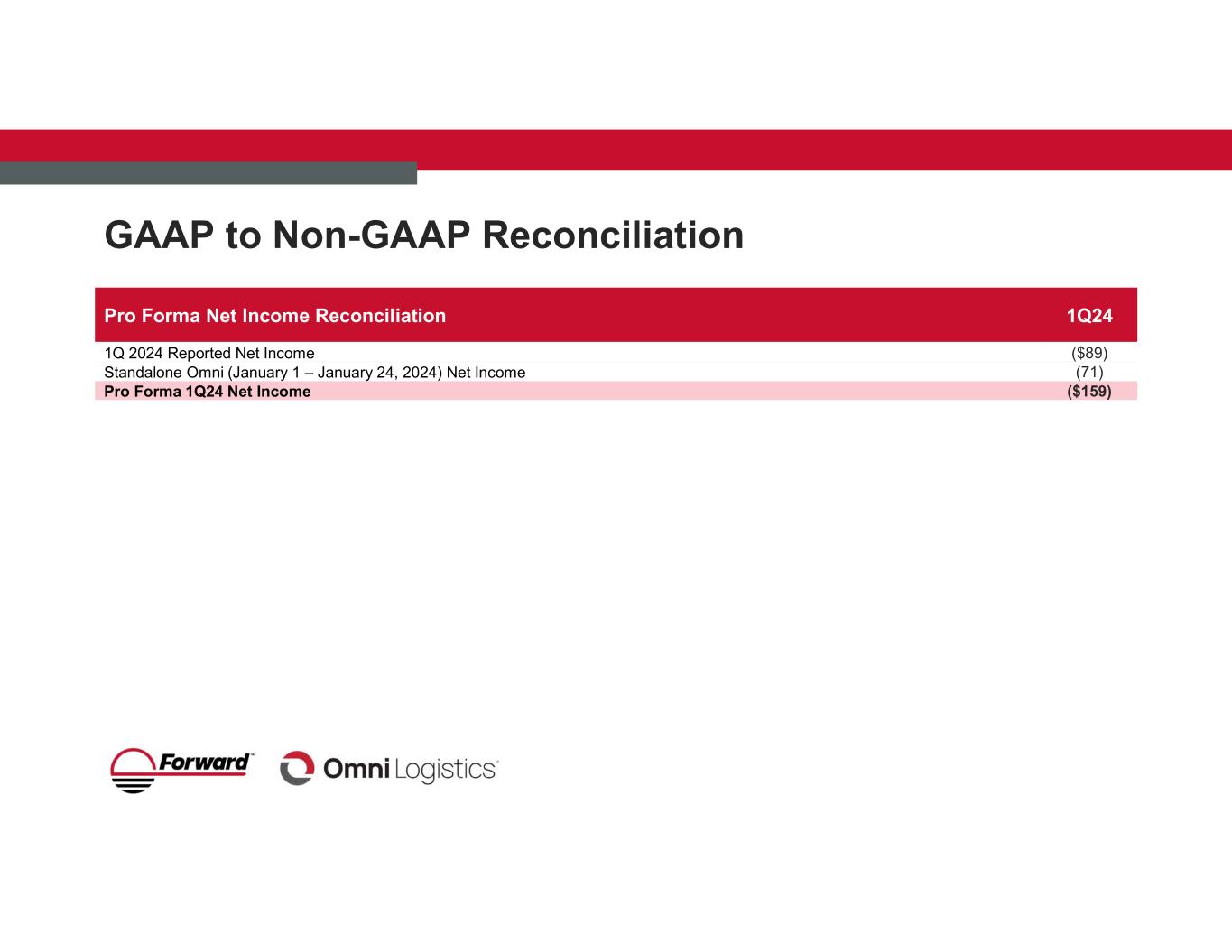

1Q24Pro Forma Net Income Reconciliation ($89)1Q 2024 Reported Net Income (71)Standalone Omni (January 1 – January 24, 2024) Net Income ($159)Pro Forma 1Q24 Net Income GAAP to Non-GAAP Reconciliation