Exhibit 10.1 Execution Version AMENDMENT NO. 3, dated as of December 30, 2024 (this “Amendment”), relating to the CREDIT AGREEMENT dated as of December 19, 2023 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement” and the Credit Agreement as amended by this Amendment, the “Amended Credit Agreement”), among CLUE OPCO LLC, a Delaware limited liability company (as successor by merger to GN Loanco, LLC) (“Borrower”), the Credit Parties signatory thereto from time to time, the Lenders signatory thereto from time to time and CITIBANK, N.A., as administrative agent and collateral agent for the Lenders and L/C Issuers (together, with any permitted successors in such capacity, “Agent”). WHEREAS Borrower has requested certain provisions of the Credit Agreement be amended as set forth herein; WHEREAS the Revolving Lenders party hereto (who constitute the Requisite Revolving Lenders) are willing to consent to such amendments to the Credit Agreement on the terms and subject to the conditions set forth herein; and WHEREAS, Citibank, N.A., has agreed to act as lead arranger and bookrunner for this Amendment (the “Amendment No. 3 Arranger”); NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, the parties hereto agree as follows: SECTION 1. Defined Terms. Capitalized terms used and not defined herein shall have the meanings assigned to such terms in the Credit Agreement. The rules of construction and interpretation set forth in Sections 1.2 and 1.3 of the Credit Agreement are hereby incorporated by reference herein, mutatis mutandis. SECTION 2. Amendments to Credit Agreement. Upon the Amendment No. 3 Effective Date (as defined below): (a) Section 1.1 of the Credit Agreement is hereby amended by inserting the following defined terms in the appropriate alphabetical order therein: “Amendment No. 3” means Amendment No. 3 to this Agreement, dated as of December 30, 2024, among Borrower, Agent and the Revolving Lenders signatory thereto. “Amendment No. 3 Effective Date” has the meaning ascribed to it in Amendment No. 3. “Covenant Relief Period” means the period from the Amendment No. 3 Effective Date through December 31, 2026. (b) The portion of Schedule B to the Credit Agreement that is set forth under the heading “Revolving Credit Commitments” is hereby amended and replaced in its entirety with the table attached hereto as Schedule I. (c) If the Consolidated First Lien Net Leverage Ratio as of the last day of any fiscal quarter (commencing with the fiscal quarter ending March 31, 2025), as set forth in the

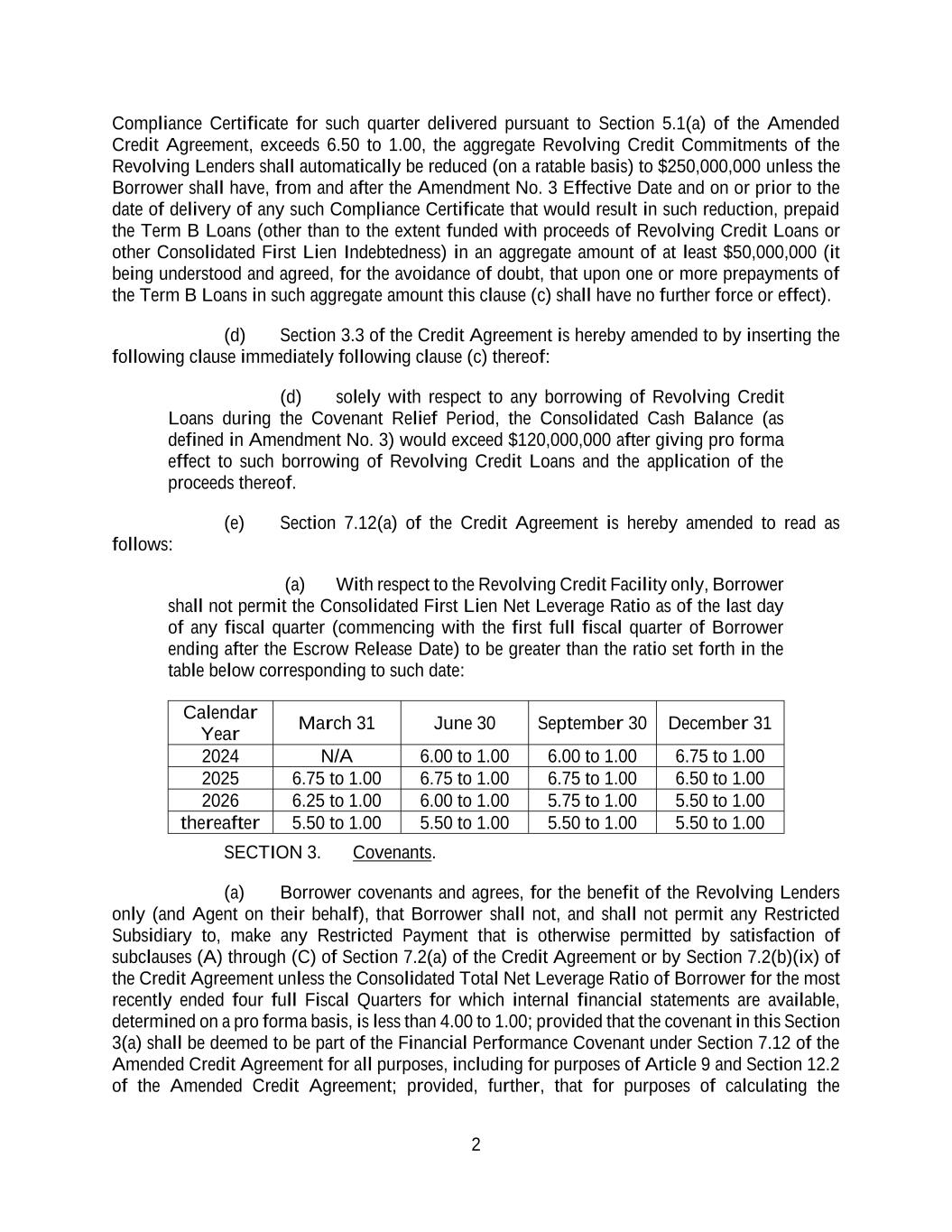

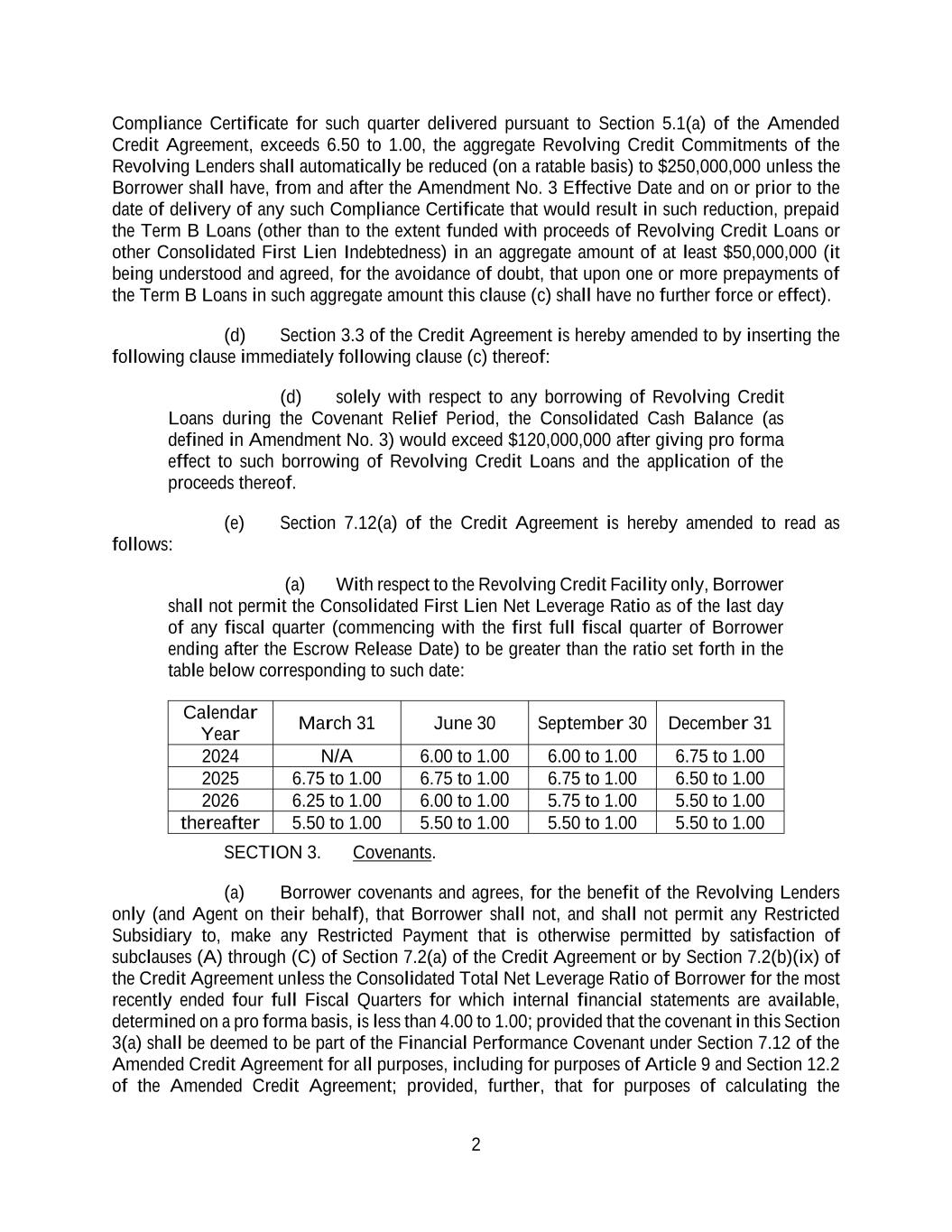

2 Compliance Certificate for such quarter delivered pursuant to Section 5.1(a) of the Amended Credit Agreement, exceeds 6.50 to 1.00, the aggregate Revolving Credit Commitments of the Revolving Lenders shall automatically be reduced (on a ratable basis) to $250,000,000 unless the Borrower shall have, from and after the Amendment No. 3 Effective Date and on or prior to the date of delivery of any such Compliance Certificate that would result in such reduction, prepaid the Term B Loans (other than to the extent funded with proceeds of Revolving Credit Loans or other Consolidated First Lien Indebtedness) in an aggregate amount of at least $50,000,000 (it being understood and agreed, for the avoidance of doubt, that upon one or more prepayments of the Term B Loans in such aggregate amount this clause (c) shall have no further force or effect). (d) Section 3.3 of the Credit Agreement is hereby amended to by inserting the following clause immediately following clause (c) thereof: (d) solely with respect to any borrowing of Revolving Credit Loans during the Covenant Relief Period, the Consolidated Cash Balance (as defined in Amendment No. 3) would exceed $120,000,000 after giving pro forma effect to such borrowing of Revolving Credit Loans and the application of the proceeds thereof. (e) Section 7.12(a) of the Credit Agreement is hereby amended to read as follows: (a) With respect to the Revolving Credit Facility only, Borrower shall not permit the Consolidated First Lien Net Leverage Ratio as of the last day of any fiscal quarter (commencing with the first full fiscal quarter of Borrower ending after the Escrow Release Date) to be greater than the ratio set forth in the table below corresponding to such date: SECTION 3. Covenants. (a) Borrower covenants and agrees, for the benefit of the Revolving Lenders only (and Agent on their behalf), that Borrower shall not, and shall not permit any Restricted Subsidiary to, make any Restricted Payment that is otherwise permitted by satisfaction of subclauses (A) through (C) of Section 7.2(a) of the Credit Agreement or by Section 7.2(b)(ix) of the Credit Agreement unless the Consolidated Total Net Leverage Ratio of Borrower for the most recently ended four full Fiscal Quarters for which internal financial statements are available, determined on a pro forma basis, is less than 4.00 to 1.00; provided that the covenant in this Section 3(a) shall be deemed to be part of the Financial Performance Covenant under Section 7.12 of the Amended Credit Agreement for all purposes, including for purposes of Article 9 and Section 12.2 of the Amended Credit Agreement; provided, further, that for purposes of calculating the Calendar Year March 31 June 30 September 30 December 31 2024 N/A 6.00 to 1.00 6.00 to 1.00 6.75 to 1.00 2025 6.75 to 1.00 6.75 to 1.00 6.75 to 1.00 6.50 to 1.00 2026 6.25 to 1.00 6.00 to 1.00 5.75 to 1.00 5.50 to 1.00 thereafter 5.50 to 1.00 5.50 to 1.00 5.50 to 1.00 5.50 to 1.00

3 Consolidated Total Net Leverage Ratio with respect to this Section 3(a), the definitions of “Consolidated Total Net Leverage Ratio” and “EBITDA” shall be modified as set forth below: (i) The first paragraph of the definition of “Consolidated Total Net Leverage Ratio” in Section 1.1 shall read as follows: “Consolidated Total Net Leverage Ratio” means, with respect to any Person, at any date, the ratio of (i) Consolidated Total Indebtedness of such Person and its Restricted Subsidiaries as of such date of calculation (determined on a consolidated basis in accordance with GAAP) less the amount of cash and Cash Equivalents held by such Person and its Domestic Subsidiaries that do not constitute Restricted Cash held by such Person and its Domestic Subsidiaries as of the end of the most recent Fiscal Quarter ending prior to the date of determination for which internal financial statements of such Person are available to (ii) EBITDA of such Person for the four full fiscal quarters for which internal financial statements of such Person are available immediately preceding such date of calculation. (ii) The fourth paragraph of the definition of “Consolidated Total Net Leverage Ratio” in Section 1.1 shall read as follows: For purposes of this definition, whenever pro forma effect is to be given to any pro forma event, the pro forma calculations shall be made in good faith by a responsible financial or accounting officer of Borrower. Any such pro forma calculation may include adjustments appropriate, in the reasonable good faith determination of Borrower, to reflect operating expense reductions, cost synergies and other operating improvements reasonably expected to result from the applicable event within 18 months of the date the applicable event is consummated. (iii) Clause (9) of the definition of “EBITDA” in Section 1.1 shall read as follows: the amount of net cost savings, cost synergies and operating improvements projected by Borrower in good faith to be realized within eighteen months following the date of any operational changes, business realignment projects or initiatives, restructurings or reorganizations which have been or are intended to be initiated (other than those operational changes, business realignment projects or initiatives, restructurings or reorganizations entered into in connection with any pro forma event (as defined in the definitions of “Fixed Charge Coverage Ratio”, “Consolidated First Lien Net Leverage Ratio”, “Consolidated Secured Net Leverage Ratio” and “Consolidated Total Net Leverage Ratio”) (calculated on a pro

4 forma basis as though such cost savings had been realized on the first day of such period)), net of the amount of actual benefits realized during such period from such actions; provided that such net cost savings, cost synergies and operating improvements are reasonably identifiable and quantifiable; provided, further, that the aggregate amount added to EBITDA pursuant to this clause (9), together with the aggregate amount added to EBITDA pursuant to clause (6) above, shall not exceed 20.0% of EBITDA for such period (determined after giving effect to such adjustments); plus (b) Borrower covenants and agrees, for the benefit of the Revolving Lenders only (and Agent on their behalf), that, if there are any Revolving Credit Loans outstanding as of the end of the day that is five Business Days after the date of any borrowing of Revolving Credit Loans during the Covenant Relief Period or the end of any calendar month during the Covenant Relief Period (commencing with the calendar month ending January 31, 2025) (each, a “Cash Test Date”) and, in each case, the Consolidated Cash Balance at such time exceeds $120,000,000, the Borrower shall, on or prior to the date that is five Business Days following such Cash Test Date, prepay Revolving Credit Loans (without, for the avoidance of doubt, any reduction or termination of Revolving Credit Commitments) in an amount equal to the lesser of (x) the amount by which the Consolidated Cash Balance exceeds $120,000,000 and (y) the amount of Revolving Credit Loans then outstanding; provided that, notwithstanding anything in the Amended Credit Agreement to the contrary, no prepayment notice shall be required to be delivered and no breakage or other amounts under Section 2.11 of the Amended Credit Agreement shall be required in connection with such prepayment; provided, further, that the covenant in this Section 3(b) shall be deemed to be part of the Financial Performance Covenant under Section 7.12 of the Amended Credit Agreement for all purposes, including for purposes of Article 9 and Section 12.2 of the Amended Credit Agreement. For purposes of this Section 3(b): “Consolidated Cash Balance” means, at any time, (a) the amount of cash and Cash Equivalents held by the Borrower and its Domestic Subsidiaries that do not constitute Restricted Cash less (b) the sum of (i) any cash or Cash Equivalents of the Borrower and its Domestic Subsidiaries (A) held for the purpose of any taxes, payroll, employee wage and benefit payments and trust and fiduciary obligations or other obligations of the Borrower and its Domestic Subsidiaries, including, without limitation, for the purpose of making principal and interest payments on Indebtedness or (B) in the amount of obligations of the Borrower and its Domestic Subsidiaries to third parties for which the Borrower and its Domestic Subsidiaries have issued checks or have initiated wires or ACH transfers (but which amounts have not, as of such time, been subtracted from the balance in the relevant account of the Borrower and its Domestic Subsidiaries), plus (ii) while and to the extent refundable, any cash or Cash Equivalents of the Borrower and its Domestic Subsidiaries constituting purchase price deposits held in escrow pursuant to a binding and enforceable purchase and sale agreement with a third party containing customary provisions regarding the payment and refunding of such deposits plus (iii) any cash or Cash Equivalents of the Borrower and its Domestic Subsidiaries

5 constituting deposits held in escrow in connection with utility or depositary arrangements. SECTION 4. Conditions to Effectiveness. The effectiveness of this Amendment is subject to the satisfaction or waiver of the following conditions (the date on which all such conditions are satisfied or waived, the “Amendment No. 3 Effective Date”): (a) Agent (or its counsel) shall have received from Borrower and Revolving Lenders who constitute the Requisite Revolving Lenders (i) a counterpart of this Amendment signed on behalf of such party or (ii) written evidence reasonably satisfactory to Agent (which may include facsimile or electronic transmission of a signed signature page of this Amendment) that such party has signed a counterpart of this Amendment; (b) as of the Amendment No. 3 Effective Date, immediately prior to and after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing; (c) Borrower shall have reimbursed Agent for all reasonable documented out- of-pocket expenses in connection with this Amendment, including reasonable fees and out-of- pocket expenses of counsel, presented at least three (3) Business Days prior to the Amendment No. 3 Effective Date, to the extent required under Section 12.3 of the Credit Agreement; (d) Agent shall have received a certificate of a Financial Officer of Borrower to the effect that the representations and warranties set forth in Section 5 of this Amendment are true and correct in all material respects as of the Amendment No. 3 Effective Date (provided that any such representations and warranties which are qualified by materiality, material adverse effect or similar language shall be true and correct in all respects); (e) Agent shall have received a certificate of Borrower’s corporate secretary or an assistant secretary, managing member, manager or equivalent senior officer, dated the Amendment No. 3 Effective Date: (i) either (x) attaching a true, correct and complete copy of Borrower’s certificate of formation and all amendments thereto, certified as of a recent date by the Secretary of State (or other similar official) of Borrower’s jurisdiction of organization or (y) certifying there have been no changes since the Escrow Release Date to Borrower’s certificate of formation that was delivered to Agent on the Escrow Release Date; (ii) either (x) attaching a true, correct and complete copy of Borrower’s limited liability company agreement and all amendments thereto, certified as of the Amendment No. 3 Effective Date as being in full force and effect without any modification or amendment or (y) certifying that there have been no changes since the Escrow Release Date to Borrower’s limited liability company agreement that was delivered to Agent on the Escrow Release Date;

6 (iii) attaching a true, correct and complete copy of resolutions duly adopted by Borrower’s sole member authorizing the execution, delivery and performance of this Amendment, the other documents, instruments, certificates or agreements delivered in connection herewith on behalf of Borrower and the transactions contemplated hereby, certified as of the Amendment No. 3 Effective Date as being in full force and effect without any modification or amendment; and (iv) either (x) certifying as to the incumbency and specimen signature of each officer of Borrower executing this Amendment and the other documents, instruments, certificates or agreements delivered in connection herewith or (y) certifying that there have been no changes since the Escrow Release Date to the incumbency and specimen signature of each officer of Borrower who executed such documents, which were delivered to Agent on the Escrow Release Date; (f) Agent shall have received a good standing certificate (or like certificate) for Borrower in its jurisdiction of formation as of a recent date; and (g) Borrower shall have paid to Citibank, N.A., as Agent and the Amendment No. 3 Arranger all fees due and payable to the Revolving Lenders in connection with this Amendment as previously agreed to with Borrower. SECTION 5. Representations and Warranties. Borrower represents and warrants as follows: (a) it has taken all necessary action to authorize the execution, delivery and performance of this Amendment; (b) this Amendment has been duly executed and delivered by Borrower and constitutes its legal, valid and binding obligation, enforceable against it in accordance with its terms, except to the extent that the enforceability thereof may be limited by applicable bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other similar laws generally affecting creditors’ rights and by equitable principles (regardless of whether enforcement is sought in equity or at law); (c) no consent or approval of any Governmental Authority or any other Person is required in connection with the execution, delivery or performance by Borrower of this Amendment, except where the failure to obtain such consent or approval would not reasonably be expected to result in a Material Adverse Effect; (d) the execution and delivery of this Amendment does not (i) violate, contravene or conflict with any provision of Borrower’s organization documents or (ii) violate any material provision of any law or regulation, or any material provision of any order or decree of any court or Governmental Authority, except where any such violation would not reasonably be expected to result in a Material Adverse Effect; (e) after giving effect to this Amendment, the representations and warranties set forth in Article 4 of the Credit Agreement and in each other Loan Document are true and correct

7 in all material respects on and as of the Amendment No. 3 Effective Date, except to the extent such representations and warranties expressly relate to an earlier date, in which case they were true and correct in all material respects on and as of such earlier date; provided that, in each case, such materiality qualifier shall not be applicable to any representation and warranty that already is qualified or modified by materiality in the text thereof; and (f) as of the Amendment No. 3 Effective Date, immediately prior to and after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing. SECTION 6. Governing Law; Waiver of Jury Trial. (a) THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK. (b) EACH PARTY HERETO KNOWINGLY WAIVES ALL RIGHTS TO TRIAL BY JURY IN ANY ACTION, SUIT OR PROCEEDING RELATING TO THIS AMENDMENT AND FOR ANY COUNTERCLAIM HEREIN. SECTION 7. Counterparts; Electronic Execution of Documents. This Amendment may be executed in any number of separate counterparts and by different parties in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Signature pages may be detached from multiple separate counterparts and attached to a single counterpart. The words “executed,” and words of like import in this Amendment shall be deemed to include electronic signatures or electronic records, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. SECTION 8. Section Titles. The Section titles contained in this Amendment are and shall be without substantive meaning or content of any kind whatsoever and are not a part of the agreement between the parties hereto. SECTION 9. Effectiveness; Successors and Assigns. This Amendment shall become effective when it shall have been executed by Borrower, Revolving Lenders constituting the Requisite Revolving Lenders and Agent. Thereafter, it shall be binding upon and inure to the benefit of, but only to the benefit of, Borrower, the Guarantors, Agent and each Revolving Lender, and their respective successors and permitted assigns. SECTION 10. Severability. Wherever possible, each provision of this Amendment shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision of this Amendment shall be prohibited by or invalid under applicable law, such provision shall be ineffective only to the extent of such prohibition or invalidity without invalidating the remainder of such provision or the remaining provisions of this Amendment.

8 SECTION 11. Amendments and Modification. This Amendment may be amended, modified or supplemented only as permitted by the Amended Credit Agreement and by written agreement of each of the parties hereto. SECTION 12. Reference to and Effect on the Loan Documents. On and after the Amendment No. 3 Effective Date, each reference in the Amended Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import referring to the Credit Agreement, and each reference in each of the other Loan Documents to “the Credit Agreement,” “thereunder,” “thereof” or words of like import referring to the Credit Agreement, shall mean and be a reference to the Amended Credit Agreement. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. This Amendment shall not constitute a novation of the Credit Agreement or any of the Loan Documents. This Amendment shall constitute a “Loan Document” for all purposes of the Amended Credit Agreement and the other Loan Documents. [Remainder of this page intentionally left blank]

[Signature Page to Amendment No. 3 to Credit Agreement] IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first above written. CLUE OPCO LLC, as Borrower by /s/ Jamie Pierson Name: Jamie Pierson Title: Chief Financial Officer

[Signature Page to Amendment No. 3 to Credit Agreement] CITIBANK, N.A., as Agent and a Revolving Lender by /s/ Kevin Clark Name: Kevin Clark Title: Vice President

[Signature Page to Amendment No. 3 to Credit Agreement] Morgan Stanley Bank, N.A., as a Revolving Lender by /s/ Jack Kuhns Name: Jack Kuhns Title: Authorized Signatory

[Signature Page to Amendment No. 3 to Credit Agreement] U.S. BANK NATIONAL ASSOCIATION, as a Revolving Lender by /s/ Eric M. Herm Name: Eric M. Herm Title: Vice President

[Signature Page to Amendment No. 3 to Credit Agreement] Goldman Sachs Bank USA, as a Revolving Lender by /s/ Priyankush Goswami Name: Priyankush Goswami Title: Authorized Signatory

[Signature Page to Amendment No. 3 to Credit Agreement] JPMorgan Chase Bank, N.A., as a Revolving Lender by /s/ James M. Shender Name: James M. Shender Title: Executive Director

[Signature Page to Amendment No. 3 to Credit Agreement] PNC Bank, National Association, as a Revolving Lender by /s/ Amy Tallia Name: Amy Tallia Title: SVP

[Signature Page to Amendment No. 3 to Credit Agreement] CAPITAL ONE, NATIONAL ASSOCIATION, as a Revolving Lender by /s/ William Panagis Name: William Panagis Title: Duly Authorized Signatory

[Signature Page to Amendment No. 3 to Credit Agreement] DEUTSCHE BANK AG NEW YORK BRANCH, as a Revolving Lender by /s/ Philip Tancorra Name: Philip Tancorra Title: Director If a second signature line is required: by /s/ Suzan Onal Name: Suzan Onal Title: Director

[Signature Page to Amendment No. 3 to Credit Agreement] The Toronto-Dominion Bank, New York Branch, as a Revolving Lender by /s/ Tefta Ghilaga Name: Tefta Ghilaga Title: Authorized Signatory

[Signature Page to Amendment No. 3 to Credit Agreement] CITIZENS BANK, N.A., as a Revolving Lender by /s/ Danielle Leverone Name: Danielle Leverone Title: Director

[Signature Page to Amendment No. 3 to Credit Agreement] Bank of America, N.A., as a Revolving Lender by /s/ Alexander Watts Name: Alexander Watts Title: Assistant Vice President

Schedule I Revolving Lender Revolving Credit Commitments Morgan Stanley Bank, N.A. $48,750,000 Citibank, N.A. $46,237,500 U.S. Bank National Association $45,000,000 Goldman Sachs Bank USA $34,875,000 JPMorgan Chase Bank, N.A. $34,875,000 PNC Bank, National Association $22,500,000 Capital One, National Association $15,000,000 Deutsche Bank AG New York Branch $15,000,000 The Toronto-Dominion Bank, New York Branch $15,000,000 Citizens Bank, N.A. $15,000,000 Bank of America, N.A. $7,762,500 Total $300,000,000