UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | |

| Investment Company Act file number: | | 811-08050 | | |

| | |

| Exact name of registrant as specified in charter: | | The Asia Tigers Fund, Inc. | | |

| | |

| Address of principal executive offices: | | 1735 Market Street, 32nd Floor Philadelphia, PA 19103 | | |

| | |

| Name and address of agent for service: | | Ms. Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street 32nd Floor Philadelphia, PA 19103 | | |

| | |

| Registrant’s telephone number, including area code: | | 1-866-839-5205 | | |

| | |

| Date of fiscal year end: | | October 31 | | |

| | |

| Date of reporting period: | | April 30, 2014 | | |

Item 1 - Reports to Stockholders.

The Report to Shareholders is attached herewith.

The Asia Tigers Fund, Inc.

Semi-Annual Report

April 30, 2014

Letter to Shareholders (unaudited)

Dear Shareholder,

We present this Semi-Annual Report covering the activities of The Asia Tigers Fund, Inc. (the “Fund”) for the six months ended April 30, 2014. The Fund’s investment objective is long-term capital appreciation, which the Fund seeks to achieve by investing primarily in equity securities of Asian companies.

Approval of Elimination of the Interval Fund Structure

Effective April 4, 2014 shareholders voted to eliminate the Fund’s Interval Structure.

Total Return Performance

For the six months ended April 30, 2014, the total return to shareholders of the Fund based on the net asset value (“NAV”) of the Fund, net of fees, was -0.2%, assuming reinvestments of dividends and distributions, versus a return of -0.9% for the Fund’s benchmark, the MSCI AC Asia Ex-Japan Index.1

Share Price and NAV

For the six months ended April 30, 2014, based on market price, the Fund’s total return was -2.5% assuming reinvestment of dividends and distributions. The Fund’s share price decreased 4.9% over the six month period from $12.08 on October 31, 2013 to $11.49 on April 30, 2014. The Fund’s share price on April 30, 2014 represented a discount of 11.7% to the NAV per share of $13.01 on that date, compared with a discount of 9.6% to the NAV per share of $13.37 on October 31, 2013.

Targeted Discount Policy

The Fund’s targeted discount policy seeks to manage the Fund’s discount by buying back shares of common stock in the open market at times when the Fund’s shares trade at a discount of 10% or more to NAV. The Board may potentially consider, although it is not obligated to, other actions that, in its judgment, may be effective to address the discount. The targeted discount policy, which became effective upon the elimination of the Fund’s interval structure, extended the Fund’s prior open market repurchase policy. During the six months ended April 30, 2014 and the year ended October 31, 2013, the Fund did not repurchase any shares under the open market repurchase policy.

Portfolio Holdings Disclosure

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund’s most recent Form N-Q is also available

to shareholders on the Fund’s website or upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve months ended June 30 is available by August 30 of the relevant year: (i) upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205 and (ii) on the SEC’s website at http://www.sec.gov.

Investor Relations Information

As part of our ongoing commitment to provide information to our shareholders, I invite you to visit the Fund on the web at www.aberdeengrr.com. From this page, you can view monthly fact sheets, portfolio manager commentary, distribution and performance information, updated daily fact sheets courtesy of Morningstar®, and view portfolio charting and other timely data.

Please visit Aberdeen’s award-winning Closed-End Fund Talk Channel, where you can watch fund manager web casts and view our latest short films. For replays of recent broadcasts or to register for upcoming events, please visit Aberdeen’s Closed-End Fund Talk Channel at www.aberdeen-asset.us/aam.nsf/usClosed/aberdeentv.

Please ensure that you are enrolled in our email services, which feature timely news from Aberdeen portfolio managers located around the world. Enroll today at www.aberdeen-asset.us/aam.nsf/usclosed/email, and be among the first to receive the latest closed-end fund news, announcements of upcoming fund manager web casts, films and other information.

Please contact Aberdeen Asset Management Inc. by:

| • | | calling toll free at 1-866-839-5205 in the United States, |

| • | | emailing InvestorRelations@aberdeen-asset.com or |

| • | | visiting Aberdeen Closed-End Fund Center at http://www.aberdeen-asset.us/aam.nsf/usclosed/home; |

| • | | visiting www.aberdeengrr.com |

Yours sincerely,

Alan R. Goodson

President

| 1 | | The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The MSCI AC Asia ex Japan Index consists of the following 10 developed and emerging market country indices: China, Hong Kong, India, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index. |

All amounts are U.S dollars unless otherwise stated.

The Asia Tigers Fund, Inc.

1

Report of the Investment Manager (unaudited)

Market review

Most Asian stock markets rose during the reporting period, helped by a rebound in the latter half of the reporting period. In India and Indonesia, pre-election euphoria trumped initial worries about wide current account deficits and elevated inflation. In Indonesia, investors cheered the nomination of popular Jakarta governor Joko Widodo in the upcoming presidential election. Shortly after the reporting period in mid-May 2014, India’s opposition Bharatiya Janata party won a widely anticipated victory with a clear majority as the electorate sought change. However, Thailand market was less fortunate. Late gains failed to offset losses earlier in the period, particularly given the worsening domestic backdrop. After months of political stalemate that led to the ousting of Premier Yingluck Shinawatra for alleged abuse of power, the military took control of the government in a coup. Another market laggard over the period was China, which saw economic growth decelerate further, alongside resurgent fears over a property market bubble and potential defaults of investment trust products. Meanwhile, the U.S. Federal Reserve ended months of uncertainty with its decision to start paring its asset purchases beginning in January 2014. However, fresh fears emerged as to when the central bank might start hiking interest rates, which had a negative impact on property and consumer-related stocks.

Fund performance review

Among the Fund’s holdings, the biggest detractor from relative performance for the reporting period was Oversea-Chinese Banking Corp. Ltd (“OCBC”). Shares of the Singapore lender fell on concerns that it might overpay for its acquisition of Hong Kong’s Wing Hang Bank Ltd., also a Fund holding. It subsequently reached a deal to buy Wing Hang Bank Ltd. at HK$125 (roughly US$16.00) a share, which in our view is a fair price, given the long-term advantages for OCBC, such as access to greater China and the offshore Yuan market. Another detractor was HSBC Holdings, whose revenues were affected by a weak rates market, even though better cost control helped reduce the cost-to-income ratio. The Fund holds “HSBC Holdings” because we believe it has a well-established Asian franchise, robust capital position and generous dividend policy. Meanwhile, not holding Tencent Holdings Limited (“Tencent”) hurt the Fund’s relative return. Shares of the Chinese Internet company rose to record highs after it bought a stake in a logistics firm in a bid to boost its e-commerce business. Nonetheless, we think that the technology sector appears frothy and has begun to correct, given the demanding valuations and string of initial public offerings (IPOs) seeking to cash in on the recent exuberance. With respect to Tencent, we remain deterred by its opaque ownership structure, in addition to its high valuation, in our view.

The most notable positive contributors to the Fund’s relative performance during the period included Samsung Electronics Co. Ltd. The Fund has a bigger weighting in the company’s preferred shares relative to the ordinary shares, and the preferred shares outperformed over the reporting period. While its first-quarter 2014 results slowed on a year-over-year basis, Samsung’s operating profit remains at record-high levels. The holding in Hong Kong conglomerate Jardine Strategic Holdings Ltd. (“Jardine”) also bolstered the Fund’s performance on the back of a turnaround in investor sentiment towards Indonesia in the run-up to the elections. Jardine has significant exposure to the Indonesian economy through its 50%-owned subsidiary, Astra International. In Hong Kong, shares of semiconductor equipment maker ASM Pacific Technology Ltd. rallied after profits improved in the second half of 2013 and management stated its opinion that earnings have troughed.

There have been significant changes to the Fund over the reporting period. In particular, we pared IT services provider Infosys Ltd. in November 2013 when its stock price rose sharply on signs of a stabilizing business backdrop after the return of Narayana Murthy, the company’s founder, as Executive Chairman. Murthy reiterated his commitment to improve margins and win market share through restructuring and investment in the sales force. We also took a partial profit in Samsung Electronics Co. Ltd. Additionally, we tendered the shares in GlaxoSmithKline Pharmaceuticals Ltd. to its parent company, UK-based GlaxoSmithKline Ltd., which made what we viewed as an attractive offer for the shares to bolster its holding in the Indian subsidiary to the maximum permitted level of 75%. Finally, we exited the position in Singapore Airlines. We believe that the company remains well-run and has a robust balance sheet, with an enviable brand in the aviation sector. The operating environment, however, remains challenging, in our opinion, and is not expected to improve in the near term. In a broader regional portfolio, we believe that there are better investment opportunities elsewhere.

With the proceeds from these sales, we added to the Fund’s holding in lender Standard Chartered PLC after its share price fell on news that profits would be lower than expected in the short term and the company was restructuring the business. We continue to like its solid franchise spread across geographies that we feel offers compelling prospects. In our view, efforts to cut costs and reorganize during the slowdown should benefit the company’s growth over the longer term. We also participated in Bank of the Philippine Islands’ rights issue, which we believed was attractively discounted. The bank is raising cash in an effort to fund its growth over the next few years.

The Asia Tigers Fund, Inc.

2

Report of the Investment Manager (unaudited) (concluded)

Outlook

Going forward, we think that key global market concerns include weakening growth amid slower Chinese expansion and sluggish recovery in the West. China’s moderation is taking a toll on commodities worldwide. In Indonesia, expectations that reformers will triumph in elections have been priced in to some extent, while India continues to rise on the back of the Bharatiya Janata Party’s triumph. Both markets have outperformed the overall region thus far

in 2014. On the corporate front, we see earnings under pressure as slower exports and tighter credit affect demand. Once the cycle turns and earnings recover, we believe that those companies focusing on margins and controlling costs now should reap the rewards. But in our view, the question remains as to whether growth rates will return to levels seen in the past decade.

Aberdeen Asset Management Asia Limited

The Asia Tigers Fund, Inc.

3

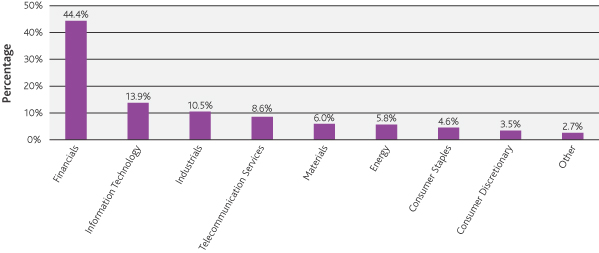

Portfolio Summary (unaudited)

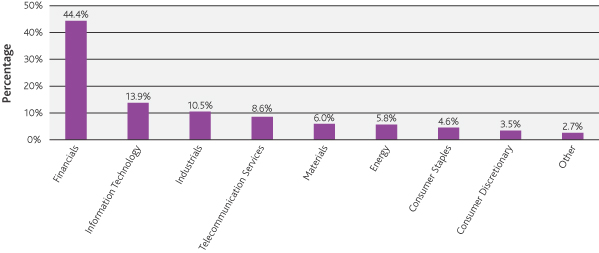

The following chart summarizes the composition of the Fund’s portfolio, in Standard & Poor’s Global Industry Classification Standard (“GICS”) sectors, expressed as a percentage of net assets. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries and 154 subindustries. An industry classification standard sector can include more than one industry group. As of April 30, 2014, the Fund did not have more than 25% of its assets invested in any industry group. The sectors, as classified by GICS Sectors, are comprised of several industries.

As of April 30, 2014, the Fund held 97.3% of its net assets in equities, 1.8% in a short-term investment and 0.9% in other assets in excess of liabilities.

Asset Allocation by Sector

Top Ten Equity Holdings (unaudited)

The following were the Fund’s top ten holdings as of April 30, 2014:

| | | | |

| Name of Security | | Percentage of Net Assets | |

Jardine Strategic Holdings Ltd. | | | 5.0% | |

Oversea-Chinese Banking Corp. Ltd. | | | 4.8% | |

Swire Pacific Ltd., Class B | | | 4.1% | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 4.0% | |

HSBC Holdings PLC | | | 4.0% | |

City Developments Ltd. | | | 3.8% | |

Housing Development Finance Corp. Ltd. | | | 3.7% | |

AIA Group Ltd. | | | 3.6% | �� |

Standard Chartered PLC | | | 3.5% | |

China Mobile Ltd. | | | 3.4% | |

The Asia Tigers Fund, Inc.

4

Total Investment Returns (unaudited)

The following table summarizes Fund performance compared to the Fund’s benchmark of the MSCI AC Ex-Japan Index for the 1-year, 3-year, 5-year and 10-year periods annualized as of April 30, 2014.

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Net Asset Value (NAV) | | | -2.8% | | | | -2.0% | | | | 11.7% | | | | 10.0% | |

Market Value | | | -5.8% | | | | -3.9% | | | | 10.1% | | | | 10.0% | |

MSCI AC Asia Ex-Japan Index | | | 2.0% | | | | 0.1% | | | | 13.1% | | | | 10.8% | |

Aberdeen Asset Management Asia Limited has entered into a written contract with the Fund to waive fees or limit expenses without which performance would be lower. This contract may not be terminated before December 18, 2014. Returns represent past performance. See Note 3 in the Notes to Financial Statements. Total investment return at net asset value is based on changes in the net asset value of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the Fund’s dividend reinvestment program. Total investment return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE during the period and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market price and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent month-end is available at www.aberdeengrr.com by calling 866-839-5205.

The annualized gross expense ratio is 2.48%. The annualized net expense ratio after fee waivers and/or expense reimbursements is 2.03%.

The Asia Tigers Fund, Inc.

5

Portfolio of Investments (unaudited)

As of April 30, 2014

| | | | | | | | |

| Shares | | | Description | | Value (US$) | |

| LONG-TERM INVESTMENTS—97.3% | | | | |

| COMMON STOCKS—94.2% | | | | |

| CHINA—6.8% | | | | |

| OIL, GAS & CONSUMABLE FUELS—3.4% | | | | |

| | 1,372,000 | | | PetroChina Co. Ltd., H Shares(a) | | $ | 1,579,453 | |

| WIRELESS TELECOMMUNICATION SERVICES—3.4% | | | | |

| | 166,700 | | | China Mobile Ltd.(a) | | | 1,586,730 | |

| | | | | Total China | | | 3,166,183 | |

| HONG KONG—26.3% | | | | |

| BANKS—5.7% | | | | |

| | 181,839 | | | HSBC Holdings PLC(a) | | | 1,860,647 | |

| | 8,766 | | | HSBC Holdings PLC, ADR | | | 449,871 | |

| | 21,926 | | | Wing Hang Bank Ltd. | | | 352,945 | |

| | | | | 2,663,463 | |

| FOOD & STAPLES RETAILING—1.6% | | | | |

| | 75,600 | | | Dairy Farm International Holdings Ltd. | | | 771,876 | |

| INDUSTRIAL CONGLOMERATES—5.0% | | | | |

| | 65,500 | | | Jardine Strategic Holdings Ltd.(a) | | | 2,343,389 | |

| INSURANCE—3.6% | | | | |

| | 346,000 | | | AIA Group Ltd.(a) | | | 1,682,803 | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT—6.8% | | | | |

| | 420,000 | | | Hang Lung Properties Ltd.(a) | | | 1,258,147 | |

| | 867,500 | | | Swire Pacific Ltd., Class B(a) | | | 1,926,120 | |

| | | | | 3,184,267 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—1.9% | | | | |

| | 78,900 | | | ASM Pacific Technology Ltd. | | | 876,220 | |

| TEXTILES, APPAREL & LUXURY GOODS—1.7% | | | | |

| | 532,000 | | | Li & Fung Ltd.(a) | | | 774,367 | |

| | | | | Total Hong Kong | | | 12,296,385 | |

| INDIA—13.5% | | | | |

| AUTOMOBILES—1.8% | | | | |

| | 22,500 | | | Hero MotoCorp Ltd.*(a) | | | 828,413 | |

| BANKS—2.1% | | | | |

| | 47,706 | | | ICICI Bank Ltd.(a) | | | 988,822 | |

| CONSTRUCTION MATERIALS—2.7% | | | | |

| | 38,000 | | | UltraTech Cement Ltd.(a) | | | 1,282,473 | |

| INFORMATION TECHNOLOGY SERVICES—3.2% | | | | |

| | 27,781 | | | Infosys Ltd.(a) | | | 1,476,754 | |

| PHARMACEUTICALS—0.0% | | | | |

| | 539 | | | GlaxoSmithKline Pharmaceuticals Ltd. | | | 22,073 | |

| THRIFTS & MORTGAGE FINANCE—3.7% | | | | |

| | 116,508 | | | Housing Development Finance Corp. Ltd.(a) | | | 1,741,050 | |

| | | | | Total India | | | 6,339,585 | |

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

6

Portfolio of Investments (unaudited) (continued)

As of April 30, 2014

| | | | | | | | |

| Shares | | | Description | | Value (US$) | |

| LONG-TERM INVESTMENTS (continued) | | | | |

| COMMON STOCKS (continued) | | | | |

| | INDONESIA—1.0% | | | | | | | |

| HOUSEHOLD PRODUCTS—1.0% | | | | |

| | 176,000 | | | Unilever Indonesia Tbk PT(a) | | $ | 447,141 | |

| | MALAYSIA—3.8% | | | | | | | |

| | BANKS—2.7% | | | | | | | |

| | 321,308 | | | CIMB Group Holdings Bhd(a) | | | 740,162 | |

| | 85,200 | | | Public Bank Bhd(a) | | | 525,949 | |

| | | | | 1,266,111 | |

| TOBACCO—1.1% | | | | |

| | 28,700 | | | British American Tobacco Bhd | | | 537,878 | |

| | | | | Total Malaysia | | | 1,803,989 | |

| | PHILIPPINES—4.0% | | | | | | | |

| BANKS—2.0% | | | | |

| | 460,428 | | | Bank of Philippine Islands(a) | | | 938,562 | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT—2.0% | | | | |

| | 1,380,000 | | | Ayala Land, Inc.(a) | | | 935,187 | |

| | | | | Total Philippines | | | 1,873,749 | |

| REPUBLIC OF SOUTH KOREA—2.6% | | | | |

| FOOD & STAPLES RETAILING—0.9% | | | | |

| | 1,760 | | | E-Mart Co. Ltd.(a) | | | 402,452 | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—1.7% | | | | |

| | 613 | | | Samsung Electronics Co. Ltd.(a) | | | 799,328 | |

| | | | | Total Republic of South Korea | | | 1,201,780 | |

| | SINGAPORE—20.9% | | | | | | | |

| AEROSPACE & DEFENSE—2.7% | | | | |

| | 425,000 | | | Singapore Technologies Engineering Ltd.(a) | | | 1,298,098 | |

| | BANKS—8.4% | | | | | | | |

| | 38,000 | | | DBS Group Holdings Ltd.(a) | | | 514,792 | |

| | 292,000 | | | Oversea-Chinese Banking Corp. Ltd.(a) | | | 2,251,956 | |

| | 67,000 | | | United Overseas Bank Ltd.(a) | | | 1,166,143 | |

| | | | | 3,932,891 | |

| DIVERSIFIED TELECOMMUNICATION SERVICES—3.1% | | | | |

| | 476,000 | | | Singapore Telecommunications Ltd.(a) | | | 1,454,200 | |

| INDUSTRIAL CONGLOMERATES—2.8% | | | | |

| | 155,300 | | | Keppel Corp. Ltd.(a) | | | 1,306,699 | |

| REAL ESTATE INVESTMENT TRUST (REIT)—0.1% | | | | |

| | 33,684 | | | Keppel REIT Management Ltd.(a) | | | 32,558 | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT—3.8% | | | | |

| | 206,000 | | | City Developments Ltd.(a) | | | 1,784,786 | |

| | | | | Total Singapore | | | 9,809,232 | |

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

7

Portfolio of Investments (unaudited) (continued)

As of April 30, 2014

| | | | | | | | |

| Shares | | | Description | | Value (US$) | |

| LONG-TERM INVESTMENTS (continued) | | | | |

| COMMON STOCKS (continued) | | | | |

| | TAIWAN—6.1% | | | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—4.0% | | | | |

| | 474,583 | | | Taiwan Semiconductor Manufacturing Co. Ltd.(a) | | $ | 1,864,805 | |

| WIRELESS TELECOMMUNICATION SERVICES—2.1% | | | | |

| | 305,000 | | | Taiwan Mobile Co. Ltd.(a) | | | 984,498 | |

| | | | | Total Taiwan | | | 2,849,303 | |

| | THAILAND—5.7% | | | | | | | |

| CONSTRUCTION MATERIALS—3.3% | | | | |

| | 115,200 | | | Siam Cement PCL, Foreign Shares(a) | | | 1,552,778 | |

| OIL, GAS & CONSUMABLE FUELS—2.4% | | | | |

| | 230,000 | | | PTT Exploration & Production PCL, Foreign Shares(a) | | | 1,135,234 | |

| | | | | Total Thailand | | | 2,688,012 | |

| UNITED KINGDOM—3.5% | | | | |

| BANKS—3.5% | | | | |

| | 74,800 | | | Standard Chartered PLC(a) | | | 1,619,961 | |

| | | | | TOTAL COMMON STOCKS | | | 44,095,320 | |

| PREFERRED STOCKS—3.1% | | | | |

| REPUBLIC OF SOUTH KOREA—3.1% | | | | |

| | 1,460 | | | Samsung Electronics Co. Ltd., Preferred Shares(a) | | | 1,468,145 | |

| | | | | TOTAL PREFERRED STOCKS | | | 1,468,145 | |

| | | | | Total Long-Term Investments—97.3% (cost $36,632,213) | | | 45,563,465 | |

Par Amount | | | | | | |

| SHORT-TERM INVESTMENT—1.8% | | | | |

| | $816,000 | | | Fixed Income Clearing Corp., 0.00% dated 04/30/2014, due 05/01/2014 repurchase price $816,000 collateralized by U.S.Treasury Note, maturing 04/30/2020; total market value of $835,587 | | | 816,000 | |

| | | | | Total Short-Term Investment—1.8% (cost $816,000) | | | 816,000 | |

| | | | | Total Investments—99.1% (cost $37,448,213) (b) | | | 46,379,465 | |

| | |

| | | | | Other Assets in Excess of Liabilities—0.9% | | | 438,820 | |

| | | | | Net Assets—100.0% | | $ | 46,818,285 | |

| * | | Non-income producing security. |

| (a) | | Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Board of Directors. See Note 2(a) of the accompanying notes to financial statements. |

| (b) | | See Notes to Financial Statements for tax unrealized appreciation/depreciation of securities. |

ADR—American Depositary Receipt

REIT—Real Estate Investment Trust

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

8

Statement of Assets and Liabilities (unaudited)

As of April 30, 2014

| | | | |

Assets | | | | |

Investments, at value (cost $36,632,213) | | $ | 45,563,465 | |

Repurchase agreement, at value (cost $816,000) | | | 816,000 | |

Foreign currency, at value (cost $109,048) | | | 109,634 | |

Cash | | | 37,118 | |

Dividends receivable | | | 340,874 | |

Receivable for investments sold | | | 37,248 | |

Tax refund receivable | | | 3,929 | |

Prepaid expenses | | | 47,283 | |

Total assets | | | 46,955,551 | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 46,486 | |

Investment adviser fees payable (Note 3) | | | 20,854 | |

Administration fees payable (Note 3) | | | 7,637 | |

Director fees payable | | | 6,263 | |

Investor relations fees payable (Note 3) | | | 4,313 | |

Accrued expenses | | | 51,713 | |

Total liabilities | | | 137,266 | |

| | | | | |

Net Assets | | $ | 46,818,285 | |

| |

Net Assets Consist of: | | | | |

Capital stock, $0.001 par value (Note 5) | | $ | 3,600 | |

Paid-in capital | | | 37,008,071 | |

Accumulated net investment income | | | 30,665 | |

Accumulated net realized gain from investments and foreign currency transactions | | | 843,462 | |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 8,932,487 | |

Net Assets | | $ | 46,818,285 | |

Net asset value per share based on 3,599,864 shares issued and outstanding | | $ | 13.01 | |

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

9

Statement of Operations (unaudited)

For the Six Months Ended April 30, 2014

| | | | |

Net Investment Income | | | | |

| |

Income | | | | |

Dividends (net of foreign withholding taxes of $15,191) | | $ | 499,612 | |

| | | | 499,612 | |

| |

Expenses | | | | |

Investment management fee (Note 3) | | | 230,315 | |

Administration fee (Note 3) | | | 46,063 | |

Legal fees and expenses | | | 72,925 | |

Independent auditors’ fees and expenses | | | 49,435 | |

Reports to stockholders and proxy solicitation | | | 31,738 | |

Insurance expense | | | 30,906 | |

Investor relations expenses (Note 3) | | | 25,467 | |

Directors’ fees and expenses | | | 23,770 | |

Custodian’s fees and expenses | | | 16,733 | |

Transfer agent’s fees and expenses | | | 12,633 | |

Pennsylvania tax expense | | | 1,939 | |

Miscellaneous | | | 29,313 | |

Total operating expenses before reimbursed/waived expenses | | | 571,237 | |

Less: Expenses waived (Note 3) | | | (102,818 | ) |

Net expenses | | | 468,419 | |

| | | | | |

Net investment income | | | 31,193 | |

| |

Realized and Unrealized Gains/(Losses) on Investments and Foreign Currency Related Transactions | | | | |

| |

Net realized gain/(loss) from: | | | | |

Investment transactions (including $0 capital gains tax) | | | 949,708 | |

Foreign currency transactions | | | 4,159 | |

| | | | 953,867 | |

| |

Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments (including $22,290 change in deferred capital gains tax) | | | (1,439,322 | ) |

Foreign currency translation | | | (121 | ) |

| | | | (1,439,443 | ) |

Net realized and unrealized loss from investments and foreign currency translation | | | (485,576 | ) |

Net Decrease in Net Assets Resulting from Operations | | $ | (454,383 | ) |

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

10

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Six Months Ended

April 30, 2014

(unaudited) | | | For the

Year Ended

October 31, 2013 | |

| | |

Increase/(Decrease) in Net Assets | | | | | | | | |

| | |

Operations: | | | | | | | | |

Net investment income | | $ | 31,193 | | | $ | 250,845 | |

Net realized gain from investments and foreign currency transactions | | | 953,867 | | | | 1,761,028 | |

Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (1,439,443 | ) | | | 907,958 | |

Net increase/(decrease) in net assets resulting from operations | | | (454,383 | ) | | | 2,919,831 | |

| | |

Distributions to Stockholders from: | | | | | | | | |

Net investment income | | | (227,966 | ) | | | (72,233 | ) |

Net realized gains | | | (860,557 | ) | | | (9,417,088 | ) |

Net decrease in net assets from distributions | | | (1,088,523 | ) | | | (9,489,321 | ) |

| | |

Capital Share Transactions: | | | | | | | | |

Issuance of 0 and 593,370 shares, respectively, due to stock distribution (Note 5) | | | — | | | | 7,589,202 | |

Cost of shares repurchased under repurchase offer (189,467 and 378,143 shares, net of repurchase fee of $45,710 and $100,343, including expenses of $0 and $84,913, respectively) | | | (2,286,915 | ) | | | (5,001,676 | ) |

Change in net assets from capital share transactions | | | (2,286,915 | ) | | | 2,587,526 | |

Change in net assets resulting from operations | | | (3,829,821 | ) | | | (3,981,964 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of period | | | 50,648,106 | | | | 54,630,070 | |

End of period (including accumulated net investment income of $30,665 and $227,438, respectively) | | $ | 46,818,285 | | | $ | 50,648,106 | |

Amounts listed as “—” are $0 or round to $0.

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

11

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | For the Six

Months Ended April 30, 2014

(unaudited) | | | For the Year Ended October 31, | |

| | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $13.37 | | | | $15.28 | | | | $17.74 | | | | $22.47 | | | | $19.10 | | | | $13.22 | |

| Net investment income/(loss) | | | 0.01 | | | | 0.07 | | | | 0.08 | | | | – | | | | (0.01 | ) | | | (0.04 | ) |

| Net realized and unrealized gain/(loss) on investments and foreign currency related transactions(b) | | | (0.09 | ) | | | 0.80 | | | | 0.87 | | | | (1.56 | ) | | | 3.92 | | | | 7.91 | |

| Total from investment operations | | | (0.08 | ) | | | 0.87 | | | | 0.95 | | | | (1.56 | ) | | | 3.91 | | | | 7.87 | |

| Dividends and distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.06 | ) | | | (0.02 | ) | | | – | | | | (0.05 | ) | | | – | | | | – | |

| Net realized gains | | | (0.23 | ) | | | (2.64 | ) | | | (3.16 | ) | | | (3.12 | ) | | | (0.34 | ) | | | (1.98 | ) |

| Tax return of capital | | | – | | | | – | | | | – | | | | – | | | | (0.18 | ) | | | – | |

| Total dividends and distributions to shareholders | | | (0.29 | ) | | | (2.66 | ) | | | (3.16 | ) | | | (3.17 | ) | | | (0.52 | ) | | | (1.98 | ) |

| Capital Share Transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Impact due to capital shares issued from stock distribution (Note 5) | | | – | | | | (0.13 | ) | | | (0.24 | ) | | | – | | | | – | | | | – | |

| Impact due to capital shares tendered or repurchased (Note 6) | | | 0.01 | | | | (0.01 | ) | | | (0.01 | ) | | | – | | | | (0.02 | ) | | | (0.01 | ) |

| Total capital share transactions | | | 0.01 | | | | (0.14 | ) | | | (0.25 | ) | | | – | | | | (0.02 | ) | | | (0.01 | ) |

| Net asset value, end of period | | | $13.01 | | | | $13.37 | | | | $15.28 | | | | $17.74 | | | | $22.47 | | | | $19.10 | |

| Market value, end of period | | | $11.49 | | | | $12.08 | | | | $13.93 | | | | $16.35 | | | | $21.80 | | | | $18.00 | |

| | | | | | |

| Total Investment Return Based on(c): | | | | | | | | | | | | | | | | | | | | | | | | |

| Market value | | | -2.45% | | | | 4.72% | | | | 5.88% | | | | -13.43% | | | | 24.27% | | | | 79.14% | |

| Net asset value | | | -0.20% | | | | 5.66% | | | | 7.04% | | | | -8.87% | | | | 20.72% | | | | 72.12% | |

| | | | | | |

| Ratio/Supplementary Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | | $46,818 | | | | $50,648 | | | | $54,630 | | | | $57,139 | | | | $79,916 | | | | $72,798 | |

| Average net assets (000 omitted) | | | $46,445 | | | | $51,801 | | | | $52,504 | | | | $67,947 | | | | $74,534 | | | | $58,310 | |

| Net operating expenses | | | 2.03% | (d) | | | 2.06% | | | | 2.11% | | | | 2.36% | | | | 2.24% | | | | 2.76% | |

| Net operating expenses, excluding fee waivers | | | 2.48% | (d) | | | 2.53% | | | | 2.82% | | | | 2.58% | | | | 2.24% | | | | 2.76% | |

| Net investment income/(loss) | | | 0.14% | (d) | | | 0.48% | | | | 0.54% | | | | 0.02% | | | | (0.04% | ) | | | (0.28% | ) |

| Portfolio turnover | | | 4.56% | | | | 1.24% | | | | 83.20% | | | | 41.69% | | | | 51.73% | | | | 69.25% | |

| (a) | | Based on average shares outstanding. |

| (b) | | Net of deferred foreign withholding taxes of $0.00, $0.01, $0.01, $0.01, $0.07 and $0.01 per share for the six months ended April 30, 2014 and for the years ended October 31, 2013, October 31, 2012, October 31, 2011, October 31, 2010, and October 31, 2009, respectively. |

| (c) | | Total investment return based on market value is calculated assuming that shares of the Fund’s common stock were purchased at the closing market price as of the beginning of the period, dividends, capital gains and other distributions were reinvested as provided for in the Fund’s dividend reinvestment plan and then sold at the closing market price per share on the last day of the period. The computation does not reflect any sales commission investors may incur in purchasing or selling shares of the Fund. The total investment return based on the net asset value is similarly computed except that the Fund’s net asset value is substituted for the closing market value. |

Amounts listed as “—” are $0 or round to $0.

See Notes to Financial Statements.

The Asia Tigers Fund, Inc.

12

Notes to Financial Statements (unaudited)

April 30, 2014

1. Organization

The Asia Tigers Fund, Inc. (the “Fund”) was incorporated in Maryland on September 23, 1993 and commenced operations on November 29, 1993. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified closed-end management investment company.

The Fund’s investment objective is long-term capital appreciation, which it seeks to achieve by investing primarily in equity securities of Asian companies.

2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The books and records of the Fund are maintained in U.S. Dollars.

(a) Security Valuation:

The Fund values its securities at current market value or fair value consistent with regulatory requirements. “Fair value” is defined in the Fund’s valuation and liquidity procedures as the price that could be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to contract at the measurement date.

Equity securities that are traded on an exchange are valued at the last quoted sale price on the principal exchange on which the security is traded at the “Valuation Time”, subject to application, when appropriate, valuation factors described in the paragraph below. The Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask quoted at the close on the principal exchange on which the security is traded. Securities traded on the NASDAQ are valued at the NASDAQ official closing price. Closed-end funds and exchange-traded funds (“ETF”s) are valued at the market price of the security at the Valuation Time. A security using any of these pricing methodologies is determined to be a Level 1 investment.

Foreign equity securities that are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an independent pricing service

provider. These valuation factors are used when pricing the Fund’s portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When prices with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

In the event that a security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which they trade closed before the Valuation Time), the security is valued at fair value as determined by the Fund’s Pricing Committee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been fair valued by the Pricing Committee may be classified as Level 2 or 3 depending on the nature of the inputs.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level hierarchy that classifies the inputs to valuation techniques used to measure the fair value. The hierarchy assigns Level 1 measurements to valuations based upon other significant observable inputs, including unadjusted quoted prices in active markets for identical assets, Level 2 measurements to valuations based upon other significant observable inputs, including adjusted quoted prices in active markets for identical assets, and Level 3 measurements to valuations based upon unobservable inputs that are significant to the valuation. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. A financial instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value measurement. The three-tier hierarchy of inputs is summarized below:

Level 1 – quoted prices in active markets for identical investments;

The Asia Tigers Fund, Inc.

13

Notes to Financial Statements (unaudited) (continued)

April 30, 2014

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

| | | | | | | | | | | | | | | | |

| Investments, at value | | Level 1 | | | Level 2 | | | Level 3 | | | Balance as of 04/30/2014 | |

Long-Term Investments | | | | | | | | | | | | | | | | |

Banks | | $ | 802,816 | | | $ | 10,606,994 | | | $ | – | | | $ | 11,409,810 | |

Food & Staples Retailing | | | 771,876 | | | | 402,452 | | | | – | | | | 1,174,328 | |

Pharmaceuticals | | | 22,073 | | | | – | | | | – | | | | 22,073 | |

Semiconductors & Semiconductor Equipment | | | 876,220 | | | | 4,132,278 | | | | – | | | | 5,008,498 | |

Tobacco | | | 537,878 | | | | – | | | | – | | | | 537,878 | |

Other | | | – | | | | 27,410,878 | | | | – | | | | 27,410,878 | |

Short-Term Investments | | | – | | | | 816,000 | | | | – | | | | 816,000 | |

Total | | $ | 3,010,863 | | | $ | 43,368,602 | | | $ | – | | | $ | 46,379,465 | |

The Fund held no Level 3 securities at April 30, 2014.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing transfers at the end of each period. During the period ended April 30, 2014, securities issued by ASM Pacific Technology Ltd., GlaxoSmithKline Pharmaceuticals Ltd. and Wing Hang Bank Ltd., in the amounts of $876,220, $22,073 and $352,945, respectively, transferred from Level 2 to Level 1 because there was not a fair value factor applied at April 30, 2014. For the period ended April 30, 2014, there have been no significant changes to the fair valuation methodologies.

(b) Repurchase Agreements:

The Fund may enter into repurchase agreements under the terms of a Master Repurchase Agreement. It is the Fund’s policy that its custodian/counterparty segregate the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates. To the extent that any repurchase transaction exceeds one business day, the collateral is valued on a daily basis to determine its adequacy. Under the Master Repurchase Agreement, if the counterparty defaults and the value of the collateral declines, or if bankruptcy proceedings are commenced with respect to the counterparty of the security, realization of the collateral by the Fund may be delayed or limited. Repurchase agreements are subject to contractual netting arrangements with the

counterparty, Fixed Income Clearing Corp. The Fund held a repurchase agreement of $816,000 as of April 30, 2014. The value of the related collateral exceeded the value of the repurchase agreement at April 30, 2014.

(c) Foreign Currency Translation:

The books and records of the Fund are maintained in U.S. Dollars. Foreign currency amounts are translated into U.S. Dollars at the current rate of exchange as of the Valuation Time to determine the value of investments, assets and liabilities. Purchases and sales of securities, and income and expenses are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. These fluctuations are included with the net realized and unrealized gain or loss from investments and foreign currencies within the Statements of Operations. Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. Dollars at the exchange rate of said currencies against the U.S. Dollar, as of the Valuation Time, as provided by an independent pricing service.

(d) Security Transactions, Investment Income and Expenses:

Security transactions are recorded on the trade date. Realized and unrealized gains/(losses) from security and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Interest income and expenses are recorded on an accrual basis. Expenses are recorded on an accrual basis.

(e) Distributions:

On an annual basis, the Fund intends to distribute its net realized capital gains, if any, by way of a final distribution to be declared during the calendar quarter ending December 31. Dividends and distributions to stockholders are recorded on the ex-dividend date.

Dividends and distributions to stockholders are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to net operating losses, foreign currency losses, capital gains taxes and investments in passive foreign investment companies.

(f) Federal Income Taxes:

The Fund intends to continue to qualify as a “regulated investment company” by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal

The Asia Tigers Fund, Inc.

14

Notes to Financial Statements (unaudited) (continued)

April 30, 2014

Revenue Code of 1986, as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax provision is required.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund’s U.S. federal and state tax returns for each of the four fiscal years up to the most recent fiscal year ended October 31, 2013 are subject to such review.

Dividend and interest income from non-U.S. sources received by the Fund are generally subject to non-U.S. withholding taxes. In addition, the Fund may be subject to capital gains tax in certain countries in which it invests. The above taxes may be reduced or eliminated under the terms of applicable U.S. income tax treaties with some of these countries. The Fund accrues such taxes when the related income is earned.

3. Agreements and Transactions with Affiliates

(a) Investment Manager

Aberdeen Asset Management Asia Limited (“AAMAL”) serves as the Fund’s investment manager with respect to all investments. For its services, AAMAL receives fees at an annual rate of: (i) 1.00% for the first $500 million of the Fund’s average weekly Managed Assets; (ii) 0.95% for the next $500 million of the Fund’s average weekly Managed Assets; and (iii) 0.90% of the Fund’s average weekly Managed Assets in excess of $1 billion. Managed Assets is defined in the management agreement as net assets plus the amount of any borrowings for investment purposes. For the six month period ended April 30, 2014, AAMAL earned a gross management fee of $230,315.

AAMAL entered into a written contract (“Expense Limitation Agreement”) with the Fund that is effective through December 18, 2014. The Expense Limitation Agreement limits the total ordinary operating expenses of the Fund (excluding any interest, taxes, brokerage fees, short sale dividend and interest expenses and non-routine expenses) from exceeding 2.00% of the average weekly Managed Assets of the Fund on an annualized basis. Through April 30, 2014, AAMAL waived and assumed a total of $102,818 attributable to its management fee and Fund expenses, including, among others, AAMI’s investor relations services, as described below.

(b) Fund Administration:

Aberdeen Asset Management Inc. (“AAMI”), an affiliate of AAMAL, serves as the Fund’s administrator, pursuant to an agreement under which AAMI receives a fee payable monthly by the Fund at an annual rate of 0.20% of the value of the Fund’s average monthly net assets for the first $1.5 billion of the Fund’s average monthly net assets and 0.15% of the value of the Fund’s average monthly net assets in excess of $1.5 billion of the Fund’s average monthly net assets. For the six month period ended April 30, 2014, the Fund paid a total of $46,063 in administrative fees to AAMI.

(c) Investor Relations:

Under the terms of an Investor Relations Services Agreement, AAMI serves as the Fund’s investor relations services provider.

Pursuant to the terms of the Investor Relations Services Agreement, AAMI provides, among other things, objective and timely information to shareholders based on publicly-available information; provides information efficiently through the use of technology while offering shareholders immediate access to knowledgeable investor relations representatives; develops and maintains effective communications with investment professionals from a wide variety of firms; creates and maintains investor relations communication materials such as fund manager interviews, films and webcasts, publishes white papers, magazine articles and other relevant materials discussing the Fund’s investment results, portfolio positioning and outlook; develops and maintains effective communications with large institutional shareholders; responds to specific shareholder questions; and reports activities and results to the Board and management detailing insight into general shareholder sentiment.

For the six months ended April 30, 2014, the Fund incurred fees of approximately $25,579 for investor relations services. Investor relations fees and expenses in the Statement of Operations include certain out-of-pocket expenses.

4. Investment Transactions

Purchases and sales of investment securities (excluding short-term securities) for the six months ended April 30, 2014, were $2,102,324 and $5,859,506, respectively.

5. Capital

The authorized capital of the Fund is 100 million shares of $0.001 par value common stock. As of April 30, 2014, there were 3,599,864 shares of common stock issued and outstanding.

On December 14, 2011, the Board of Directors declared the payment of an elective cash distribution to be paid in the amount of $3.16 per

The Asia Tigers Fund, Inc.

15

Notes to Financial Statements (unaudited) (continued)

April 30, 2014

share of common stock, on January 31, 2012, to stockholders of record at the close of business on December 22, 2011. As announced, the distribution was payable in the Fund’s common stock. However, stockholders had the option to request that their distributions be paid in cash in lieu of common stock. The aggregate amount of cash distributions to all stockholders was limited to 10% of the aggregate dollar amount of the total distribution. Because cash distribution requests exceeded this limit, the Fund pro-rated the cash distribution among all stockholders who made such requests. Stockholders who requested cash distributions received $0.58317 per share or 18.45% of the distribution in cash and received the balance in the Fund’s common stock. For purposes of computing the stock portion of the dividend, the common stock distributed was valued at $13.02 per share, which equaled the average closing price of the Fund’s common shares on the NYSE on January 25, 2012 and the two preceding trading days. Following the closing of the elective cash distribution, the Fund issued 703,218 shares.

On December 7, 2012, the Board of Directors declared the payment of an elective cash distribution to be paid in the amount of $2.65502 per share of common stock on January 31, 2013 to shareholders of record at the close of business on December 21, 2012. As announced, the distribution was payable in the Fund’s common stock. However, stockholders had the option to request that their distributions be paid in cash in lieu of common stock. The aggregate amount of cash distributions to all stockholders was limited to 20% of the aggregate dollar amount of the total distribution. Because

cash distribution requests exceeded this limit, the Fund pro-rated the cash distribution among all stockholders who made such requests. Stockholders who requested cash distributions received $1.00 per share or 37.70% of the distribution in cash and received the balance in the Fund’s common stock. For purposes of computing the stock portion of the dividend, the common stock distributed was valued at $12.79 per share, which equaled the average closing price of the Fund’s common shares on the NYSE on January 25, 2013 and the two preceding trading days. Following the closing of the elective cash distribution, the Fund issued 593,370 shares.

6. Semi-Annual Repurchase Offers:

At a Special Meeting of Stockholders on April 4, 2014, stockholders of the Fund voted to eliminate the Fund’s interval fund structure, effective that day. However, the Fund maintains a targeted discount policy whereby the Fund intends to buy back shares of common stock in the open market at times when the Fund’s shares trade at a discount of 10% or more to NAV (See Note 7).

Prior to the elimination of the interval fund structure, the Fund made semi-annual repurchase offers pursuant to fundamental policies adopted under Rule 23c-3 of the Investment Company Act of 1940. The repurchases were made at net asset value (less a 2% repurchase fee) to all stockholders in amounts permitted to be between 5% and 25% of the Fund’s then outstanding shares, as established by the Fund’s Board of Directors.

During the six month period ended April 30, 2014, the results of the periodic repurchase offers were as follows:

| | |

| | | Repurchase Offer #31 |

Commencement Date | | December 27, 2013 |

Expiration Date | | January 17, 2014 |

Repurchase Offer Date | | January 24, 2014 |

% of Issued and Outstanding Shares of Common Stock | | 5% |

Shares Validly Tendered | | 1,274,284 |

Final Odd Lot Shares | | N/A |

Final Pro-ration Shares | | 189,467 |

% of Shares Accepted | | 14.87% |

Shares Accepted for Tender | | 189,467 |

Net Asset Value as of Repurchase Offer Date ($) | | 12.07 |

Repurchase Fee per Share ($) | | 0.241 |

Repurchase Offer Price ($) | | 11.829 |

Repurchase Fee ($) | | 45,661 |

Expenses ($) | | 45,710 |

Total Cost ($) | | 2,286,915 |

The Asia Tigers Fund, Inc.

16

Notes to Financial Statements (unaudited) (continued)

April 30, 2014

During the year ended October 31, 2013, the results of the periodic repurchase offers were as follows:

| | | | |

| | | Repurchase Offer #29 | | Repurchase Offer #30 |

Commencement Date | | December 21, 2012 | | June 21, 2013 |

Expiration Date | | January 11, 2013 | | July 12, 2013 |

Repurchase Offer Date | | January 18, 2013 | | July 19, 2013 |

% of Issued and Outstanding Shares of Common Stock | | 5% | | 5% |

Shares Validly Tendered | | 822,211 | | 905,304 |

Final Odd Lot Shares* | | 91,461 | | N/A |

Final Pro-ration Non-Odd Lot Shares | | 87,243.5 | | 199,439 |

% of Non-Odd Lot Shares Accepted | | 11.9389% | | 22.03% |

Shares Accepted for Tender | | 178,704.5 | | 199,439 |

Net Asset Value as of Repurchase Offer Date ($) | | 13.60 | | 12.97 |

Repurchase Fee per Share ($) | | 0.2720 | | 0.2594 |

Repurchase Offer Price ($) | | 13.3280 | | 12.7106 |

Repurchase Fee ($) | | 48,608 | | 51,735 |

Expenses ($) | | 40,900 | | 44,013 |

Total Cost ($) | | 2,422,674 | | 2,579,002 |

| * | | Effective May 13, 2013, the Fund discontinued the practice of accepting all shares tendered by stockholders who own, beneficially or of record, an aggregate of not more than 99 shares before prorating shares tendered by others. |

7. Targeted Discount Policy

The Fund’s targeted discount policy seeks to manage the Fund’s discount by buying back shares of common stock in the open market at times when the Fund’s shares trade at a discount of 10% or more to NAV. The Board may potentially consider, although it is not obligated to, other actions that, in its judgment, may be effective to address the discount. The targeted discount policy, which became effective upon the elimination of the Fund’s interval structure, extended the Fund’s prior open market repurchase policy. During the six months ended April 30, 2014 and the year ended October 31, 2013, the Fund did not repurchase any shares under the open market repurchase policy.

8. Portfolio Investment Risks

(a) Risks Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers carry certain risks not ordinarily associated with investments in securities of U.S. issuers. These risks include, among others, future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, and political or social instability or

diplomatic developments, which could adversely affect investments in those countries.

Certain countries also may impose substantial restrictions on investments in their capital markets by foreign entities, including restrictions on investments in issuers of industries deemed sensitive to relevant national interests. These factors may limit the investment opportunities available and result in a lack of liquidity and high price volatility with respect to securities of issuers from developing countries. Foreign securities may also be harder to price than U.S. securities.

Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is deterioration in a country’s balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

(b) Risks Associated with Asian Markets:

The Asian securities markets are, among other things, substantially smaller, less developed, less liquid and more volatile than the major securities markets in the United States. Consequently, acquisitions and dispositions of Asian securities involve special risks and considerations not present with respect to U.S. securities.

The Asia Tigers Fund, Inc.

17

Notes to Financial Statements (unaudited) (concluded)

April 30, 2014

9. Contingencies

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund, and therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

10. Tax Information:

The U.S. federal income tax basis of the Fund’s investments and the net unrealized appreciation as of April 30, 2014 were as follows:

| | | | | | | | | | | | | | |

| Cost | | | Appreciation | | | Depreciation | | | Net Unrealized Appreciation | |

| | $37,448,213 | | | $ | 9,657,318 | | | $ | (726,066 | ) | | $ | 8,931,252 | |

11. Subsequent Events

Management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the Financial Statements were issued. Based on this evaluation, no disclosures and/or adjustments were required to the Financial Statements as of April 30, 2014.

The Asia Tigers Fund, Inc.

18

Proxy Voting Information (unaudited)

Results of Annual Meeting of Shareholders

The Annual Meeting of Shareholders was held on Thursday, March 27, 2014 at 712 Fifth Avenue, 49th Floor, New York, New York. The description of the proposal and number of shares voted at the meeting are as follows:

1. To elect two directors to serve as Class I directors for three year terms or until their successors are duly elected and qualify:

| | | | | | | | |

| | | Votes For | | | Votes Withheld | |

Leslie H. Gelb | | | 2,336,854 | | | | 517,647 | |

Luis F. Rubio | | | 2,347,022 | | | | 507,479 | |

Directors whose term of office continued beyond the meeting are as follows: Jeswald W. Salacuse, Martin Gilbert and Lawrence K. Becker.

Results of Special Meeting of Shareholders

A Special Meeting of Stockholders was held on Friday, April 4, 2014, at 712 Fifth Avenue, 49th Floor, New York, New York. The description of the proposal and number of shares voted at the meeting are as follows:

1. To approve elimination of the Fund’s interval Fund structure:

| | | | | | | | | | | | |

| | | Votes For | | | Votes Against | | | Votes Abstain | |

| | | 1,773,263 | | | | 682,399 | | | | 28,345 | |

Supplemental Information (unaudited)

Board Approval of Investment Advisory Agreement

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that the Board of Directors (the “Board”) of The Asia Tigers Fund, Inc. (the “Fund”), including a majority of its members who are not considered to be “interested persons” under the 1940 Act (the “Independent Directors”) voting separately, approve on an annual basis the continuation of the Fund’s investment advisory agreement (the “Agreement”) with the Fund’s investment adviser, Aberdeen Asset Management Asia Limited (the “Adviser”), a wholly-owned subsidiary of Aberdeen Asset Management PLC (“Aberdeen”). The Agreement was first approved by the Board and the Fund’s stockholders in 2011 for an initial two-year term, and the Adviser has provided the investment advisory and other services contemplated by the Agreement since December 19, 2011 (the “Aberdeen Assumption Date”). At a meeting (the “Contract Renewal Meeting”) held in person on October 29, 2013, the Board, including the Independent Directors, considered and approved the continuation of the Agreement for an additional one-year term. To assist in its consideration of the renewal of the Agreement, the Board requested, received and considered a variety of information (together with the information provided at the Contract Renewal Meeting, the “Contract Renewal Information”) about the Adviser, as well as the investment advisory arrangements for the Fund and one other closed-end fund in the same complex under the Board’s supervision (the “Other Aberdeen Fund”), certain portions of which are discussed below. The presentation made by the Adviser to the Board at the Contract Renewal Meeting in connection with its evaluation of the Agreement encompassed the Fund and the Other Aberdeen Fund. In addition to the Contract Renewal Information, the Board received performance and other information during the previous two years related to the services rendered by the Adviser to the Fund. The Board’s evaluation took into account the information received since the Fund’s inception, including the period since the Aberdeen Assumption Date, and also reflected the knowledge and familiarity gained as members of the Board with respect to the investment advisory and other services provided to the Fund by the Adviser under the Agreement.

Board Approval of the Agreement

In its deliberations regarding renewal of the Agreement, the Board, including the Independent Directors, considered various factors, including those set forth below.

The Asia Tigers Fund, Inc.

19

Supplemental Information (unaudited) (continued)

Nature, Extent and Quality of the Services Provided to the Fund under the Agreement

The Board received and considered Contract Renewal Information regarding the nature, extent and quality of services provided to the Fund by the Adviser under the Agreement since the Aberdeen Assumption Date. The Board also reviewed Contract Renewal Information regarding the Fund’s compliance policies and procedures established pursuant to the 1940 Act and the Fund’s compliance record since the Aberdeen Assumption Date.

The Board reviewed the qualifications, backgrounds and responsibilities of the Fund’s senior personnel and the portfolio management team primarily responsible for the day-to-day portfolio management of the Fund. The Board also considered, based on its knowledge of the Adviser and its affiliates, the Contract Renewal Information and the Board’s discussions with the Adviser at the Contract Renewal Meeting, the general reputation and investment performance records of the Adviser and its affiliates and the financial resources of Aberdeen available to support its activities in respect of the Fund and the Other Aberdeen Fund.

The Board considered the responsibilities of the Adviser under the Agreement, including the Adviser’s coordination and oversight of the services provided to the Fund by other affiliated and unaffiliated parties.

In reaching its determinations regarding continuation of the Agreement, the Board took into account that the Fund’s stockholders, in pursuing their investment goals and objectives, likely considered the reputation and the investment style, philosophy and strategy of the Adviser, as well as the resources available to the Adviser, in purchasing their shares.

The Board concluded that, overall, the nature, extent and quality of the advisory and other services provided to the Fund under the Agreement have been of high quality.

Fund Performance

The Board received and considered performance information and analyses for the Fund, as well as for a group of funds identified by the Adviser as comparable to the Fund regardless of asset size (the “Performance Peer Group”), prepared by Strategic Insight, an independent provider of investment company data (such information being hereinafter referred to as the “Strategic Insight Performance Information”) as part of the Contract Renewal Information. The Performance Peer Group consisted of three funds, including the Fund for the 1-, 3- and 5-year periods ended June 30, 2013 and two funds for the 10-year period ended such date. The Board noted that it had received and discussed information with the Adviser at periodic intervals since the Aberdeen Assumption Date comparing the Fund’s performance against its benchmarks and its peer funds. The Strategic Insight Performance Information comparing the Fund’s performance to that of the Performance Peer Group based on net asset value per share showed, among other things, that the Fund’s performance for the 1-year period ended June 30, 2013 was ranked first (i.e., best) among the funds in the Performance Peer Group. The Strategic Insight Performance showed further that the Fund’s performance for the 3- and 5-year periods ended June 30, 2013 in each case ranked second among the Performance Peer Group funds for that period and for the 10-year period ended such date ranked first among the Performance Peer Group funds for that period. The Fund’s performance since the Aberdeen Assumption Date reflects, in part, the impact of cash held by the Fund during orderly repositioning of the Fund’s portfolio following the Aberdeen Assumption Date to reflect the Adviser’s investment strategies and philosophy. The Board also noted that the small size of the Performance Peer Group made meaningful performance comparisons difficult. The Board noted further that the small size of the Fund and the continuing impact of the Fund’s interval structure have constrained the ability of the Adviser to carry out the Fund’s investment program. In addition to the Fund’s performance relative to the Performance Peer Group, the Board considered the Fund’s performance relative to its benchmarks and in absolute terms. The Contract Renewal Information showed that the Fund outperformed its benchmark for the 1-year period ended June 30, 2013 and during the period extending from the Aberdeen Assumption Date through June 30, 2013. The Contract Renewal Information also showed that the Fund underperformed its benchmark for the 3-, 5- and 10-year periods ended June 30, 2013. The Board considered that the Fund’s performance record for the 3-, 5- and 10-year periods was achieved, in part, by a predecessor investment adviser to the Fund and did not give significant weight to performance information relating to periods prior to the Aberdeen Assumption Date.

Based on its review of performance and on other relevant factors, including those described above, the Board concluded that, under the circumstances, the Fund’s performance supported continuation of the Agreement for an additional period of one year.

The Asia Tigers Fund, Inc.

20

Supplemental Information (unaudited) (continued)

Management Fees and Expenses

The Board reviewed and considered the investment advisory fee (the “Advisory Fee”) payable under the Agreement by the Fund to the Adviser in light of the nature, extent and overall high quality of the investment advisory and other services provided by the Adviser to the Fund.

Additionally, the Board received and considered information and analyses (the “Strategic Insight Expense Information”) prepared by Strategic Insight, comparing the Advisory Fee and the Fund’s overall expenses with those of funds in an expense group (the “Expense Group”) selected and provided by Strategic Insight as part of the Contract Renewal Information. The comparison was based upon the constituent funds’ latest fiscal years. The Expense Group consisted of the Fund, one other closed-end Pacific/Asia ex-Japan Stock fund, four closed-end China region funds, two closed-end India equity funds, one closed-end Diversified Pacific/Asia fund, and five miscellaneous regional funds, as classified by Strategic Insight. The Expense Group funds had portfolio assets ranging from $43 million to $1.13 billion. Only one of the other funds in the Expense Group was smaller than the Fund and twelve of the other funds were larger. The Strategic Insight Expense Information, comparing the Fund’s actual total expenses to the Expense Group, showed, among other things, that the Fund’s contractual management fee, which consists of the gross advisory fee and gross administrative fee, ranked eleventh of fourteen funds in the Expense Group (in these rankings first is best) and was worse (i.e., higher) than the Expense Group median for that expense component and that the Fund’s net management fee (i.e., giving effect to any voluntary fee waivers to the advisory fee and administration fee implemented by the Adviser and by the managers of the other Expense Group funds), ranked first of fourteen funds in the Expense Group and was better (i.e., lower) than the Expense Group median. The Strategic Insight Expense Information showed that, after all fee waivers the Fund’s total expense ratio ranked twelfth of fourteen funds in the Expense Group and was worse than the Expense Group median. The Board further noted both that the Fund was the second smallest in the Expense Group and that the small number and varying types and sizes of funds in the Expense Group made meaningful expense comparisons difficult.

The Board also reviewed Contract Renewal Information regarding fees charged by the Adviser to other U.S. clients, including registered investment companies with differing mandates, and to institutional and separate accounts (collectively, “institutional accounts”). Among other things, the Board considered: (i) that the Fund is subject to heightened regulatory requirements relative to institutional accounts; (ii) that the Fund is provided with administrative services, office facilities and Fund officers (including the Fund’s chief executive, chief financial and chief compliance officers); and (iii) that the Adviser coordinates and oversees the provision of services to the Fund by other fund service providers. The Board considered the fee comparisons in light of the different services provided in managing these other types of clients and funds.

Taking all of the above into consideration, the Board determined that the Advisory Fee was reasonable in light of the nature, extent and overall quality of the investment advisory and other services provided to the Fund under the Agreement. The Board considered that the Fund and the Adviser entered into an expense limitation agreement (the “Expense Limitation Agreement”), dated December 19, 2011, which, if not renewed, will expire on December 18, 2014.

Profitability

The Board, as part of the Contract Renewal Information, received an analysis of the profitability to the Adviser and its affiliates in providing services to the Fund for the past year and since the Aberdeen Assumption Date. In addition, the Board received the Adviser’s revenue and cost allocation methodologies used in preparing such profitability data. The profitability analysis, among other things, indicated that profitability to the Adviser in providing investment advisory and other services to the Fund was at a level which was not considered excessive by the Board in light of judicial guidance and the nature, extent and overall high quality of such services. The Board also considered that the Expense Limitation Agreement has reduced the Adviser’s profitability but, if not renewed, will expire on December 18, 2014.

Economies of Scale

The Board received and discussed Contract Renewal Information concerning whether the Adviser would realize economies of scale if the Fund’s assets grow. The Board noted that because the Fund is a closed-end fund with no current plans to seek additional assets beyond maintaining its dividend reinvestment plan, any significant growth in its assets generally will occur through appreciation in the value of the Fund’s investment portfolio, rather than sales of additional shares in the Fund. The Board considered that the Fund’s interval structure operates to reduce, and has reduced, Fund assets since the Aberdeen Assumption Date. The Board determined that the Advisory Fee structure was appropriate under present circumstances.

The Asia Tigers Fund, Inc.

21

Supplemental Information (unaudited) (concluded)

Other Benefits to the Adviser

The Board considered other benefits received by the Adviser and its affiliates as a result of the Adviser’s relationship with the Fund, including fees for administration and investor relation services, and did not regard such benefits as excessive.

* * * * *

In light of all of the foregoing and other relevant factors, the Board determined that, under the circumstances, continuation of Agreement would be in the best interests of the Fund and its stockholders and unanimously voted to continue the Agreement for a period of one additional year.

No single factor reviewed by the Board was identified by the Board as the principal factor in determining whether to approve continuation of the Agreement for the next year, and each Board member attributed different weights to the various factors. The Independent Directors were advised by separate independent legal counsel throughout the process. Prior to the Contract Renewal Meeting, the Board received a memorandum prepared by counsel to the Fund discussing its responsibilities in connection with the proposed continuation of the Agreement as part of the Contract Renewal Information and the Independent Directors separately received a memorandum discussing such responsibilities from their independent counsel. Prior to voting, the Independent Directors discussed the proposed continuation of the Agreement in a private session with their independent legal counsel at which no representatives of the Adviser were present.

The Asia Tigers Fund, Inc.

22

Dividend Reinvestment and Cash Purchase Plan (unaudited)

The Fund intends to distribute annually to stockholders substantially all of its net investment income and to distribute any net realized capital gains at least annually. Net investment income for this purpose is income other than net realized long-term and short-term capital gains net of expenses.

Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”), stockholders whose shares of Common Stock are registered in their own names will be deemed to have elected to have all distributions automatically reinvested by the Plan Agent in the Fund shares pursuant to the Plan, unless such stockholders elect to receive distributions in cash. Stockholders who elect to receive distributions in cash will receive such distributions paid by check in U.S. Dollars mailed directly to the stockholder by Computershare Trust Company N.A., as dividend paying agent. In the case of stockholders such as banks, brokers or nominees that hold shares for others who are beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the stockholders as representing the total amount registered in such stockholders’ names and held for the account of beneficial owners that have not elected to receive distributions in cash. Investors that own shares registered in the name of a bank, broker or other nominee should consult with such nominee as to participation in the Plan through such nominee, and may be required to have their shares registered in their own names in order to participate in the Plan.