Exhibit 13

FFLC BANCORP, INC.

2004 ANNUAL REPORT

OUR MISSION

Our mission is to operate First Federal Savings Bank as a community bank, in a manner consistent with the high expectations of our stockholders, customers and employees. We will achieve attractive financial results for our stockholders, provide quality financial services and products to our customers, and offer rewarding careers to our employees, while maintaining a high level of personal service and integrity. The Company’s primary goals are to: provide an attractive return to its stockholders, as measured by long-term capital appreciation and the continued payment of reasonable dividends; provide a competitive, progressive and profitable array of financial services and products in a manner focused on excellent customer service; attract and retain highly-motivated, top-quality employees; and make a positive impact on the communities that we serve.

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 evidences Congress’ determination that the disclosure of forward-looking information is desirable for investors and encourages such disclosure by providing a safe harbor for forward-looking statements by corporate management. This Annual Report, including the Letter to Stockholders and the Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that involve risk and uncertainty. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties that may affect the operations, performance, development, growth projections and results of the Company’s business include, but are not limited to, the growth of the economy, interest rate movements, timely development by the Company of technology enhancements for its products and operating systems, the impact of competitive products, services and pricing, customer business requirements, Congressional legislation and similar matters. Readers of this report are cautioned not to place undue reliance on forward-looking statements which are subject to influence by the named risk factors and unanticipated future events. Actual results, accordingly, may differ materially from management expectations.

CONTENTS

Inside Cover

CORPORATE PROFILE

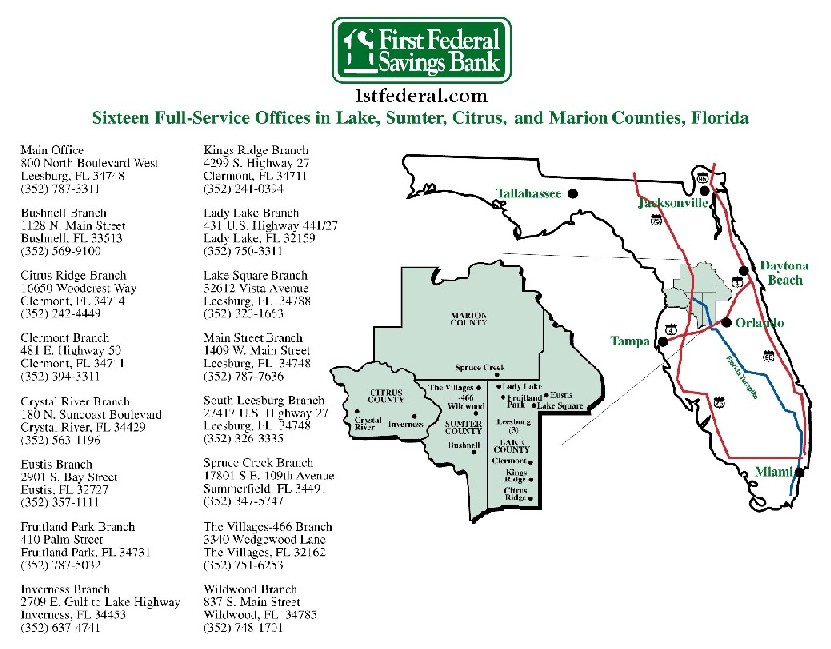

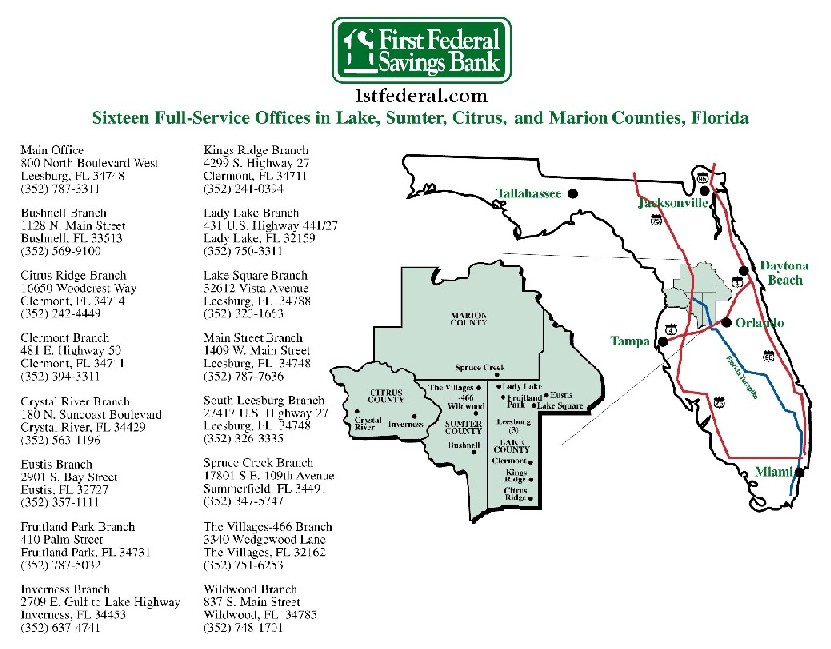

FFLC Bancorp, Inc. (“FFLC” or the “Holding Company”) was incorporated in Delaware on September 16, 1993, and acquired First Federal Savings Bank of Lake County (the “Bank”) (together, the “Company”) in connection with the Bank’s conversion to stock form on January 4, 1994. The Holding Company which transacts its business through its subsidiary, the Bank is a savings and loan holding company subject to regulation by the Office of Thrift Supervision (“OTS”). The Bank is a community-oriented savings institution, chartered in 1934, which offers a variety of financial services to individuals and businesses primarily located in Lake, Sumter, Citrus and Marion Counties in Florida. The deposits of the Bank are insured by the Federal Deposit Insurance Corporation (“FDIC”) through the Savings Association Insurance Fund (“SAIF”).

CORPORATE ORGANIZATION

Holding Company |

| FFLC Bancorp, Inc. |

| |

Subsidiaries |

| First Federal Savings Bank of Lake County |

| |

Bank’sSubsidiary |

| Lake County Service Corporation |

GENERAL INFORMATION

Corporate Headquarters |

| 800 North Boulevard West, Post Office Box 490420, Leesburg, Florida 34749-0420 |

| Telephone: | Local

Toll Free | (352) 787-3311

(877) 955-2265 |

| | | |

| |

Form 10-K |

| A copy of the Form 10-K, as filed with the Securities and Exchange Commission and the Holding Company’s Code of Ethics and Business Conduct, may be obtained by stockholders without charge upon written request to Sandra L. Rutschow, Vice President - Secretary, FFLC Bancorp, Inc., Post Office Box 490420, Leesburg, Florida 34749-0420. The Company’s SEC filings, annual and quarterly reports and press releases are also available at our Website, http://www.1stfederal.com/fflc.htm., in the “FFLC Bancorp” section. |

| |

Stockholder Assistance |

| Stockholders requiring a change of address, records or information about lost certificates, dividend checks or dividend reinvestment should contact: |

| |

| Registrar and Transfer Company

10 Commerce Drive

Cranford, New Jersey 07016

800-368-5948

Website: http://www.rtco.com |

| |

Corporate Counsel |

| George W. Murphy, Jr.

Muldoon Murphy & Aguggia LLP

5101 Wisconsin Avenue, N.W.

Washington, D.C. 20016 |

| |

Independent Auditors |

| Hacker, Johnson & Smith PA

Certified Public Accountants

930 Woodcock Road, Suite 211

Orlando, Florida 32803 |

1

COMMON STOCK PRICES AND DIVIDENDS

FFLC’s common stock is listed on the NASDAQ stock market under the symbol FFLC. The following table sets forth market price information, based on closing prices, as reported by the NASDAQ stock market for the common stock high and low closing sales prices and the amount of dividends paid on the common stock for the periods indicated (adjusted for the three-for-two stock split in February 2003). See Note 22 of the Consolidated Financial Statements for a summary of quarterly financial data.

| | High | | Low | | Cash

Dividends

Paid

Per Share | |

| |

| |

| |

| |

Quarter Ended: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| March 31, 2003 | | | 25.82 | | | 19.38 | | | | .10 | | |

| June 30, 2003 | | | 28.90 | | | 18.67 | | | | .10 | | |

| September 30, 2003 | | | 30.95 | | | 25.08 | | | | .13 | | |

| December 31, 2003 | | | 30.47 | | | 26.50 | | | | .13 | | |

| March 31, 2004 | | | 29.94 | | | 26.60 | | | | .13 | | |

| June 30, 2004 | | | 28.89 | | | 24.75 | | | | .13 | | |

| September 30, 2004 | | | 27.50 | | | 24.26 | | | | .13 | | |

| December 31, 2004 | | | 35.36 | | | 27.00 | | | | .13 | | |

As of January 31, 2005, the Company had 1,745 holders of record of common stock (includes shares held by brokers in street name).

2

CONSOLIDATED FINANCIAL HIGHLIGHTS

($ in thousands, except per share amounts)

| | 2004 | | 2003 | | 2002 | |

| |

| |

| |

| |

AT YEAR END: | | | | | | | | | | |

| | | | | | | | | | |

| Total assets | | $ | 1,065,287 | | | 947,914 | | | 915,976 | |

| Loans, net | | $ | 883,980 | | | 767,987 | | | 735,338 | |

| Securities | | $ | 74,513 | | | 82,137 | | | 77,324 | |

| Deposits | | $ | 795,160 | | | 705,589 | | | 668,058 | |

| Equity | | $ | 84,492 | | | 77,356 | | | 71,062 | |

| Book value per share (1) | | $ | 15.62 | | | 14.33 | | | 13.22 | |

| Shares outstanding (1) | | | 5,408,287 | | | 5,397,154 | | | 5,374,913 | |

| Equity-to-assets ratio | | | 7.93 | % | | 8.16 | % | | 7.76 | % |

| Nonperforming assets to total assets | | | .29 | % | | .65 | % | | .35 | % |

| | | | | | | | | | |

FOR THE YEAR: | | | | | | | | | | |

| | | | | | | | | | |

| Interest income | | $ | 55,405 | | | 52,840 | | | 56,533 | |

| Net interest income after provision for loan losses | | $ | 30,363 | | | 26,719 | | | 25,205 | |

| Net income | | $ | 10,019 | | | 9,148 | | | 8,836 | |

| Basic income per share (1) | | $ | 1.86 | | | 1.70 | | | 1.65 | |

| Diluted income per share (1) | | $ | 1.83 | | | 1.67 | | | 1.61 | |

| Loan originations | | $ | 455,828 | | | 406,510 | | | 323,728 | |

| Return on average assets | | | .99 | % | | .98 | % | | 1.00 | % |

| Return on average equity | | | 12.34 | % | | 12.23 | % | | 13.05 | % |

| Average equity to average assets ratio | | | 8.03 | % | | 8.02 | % | | 7.67 | % |

| Noninterest expense to average assets | | | 1.86 | % | | 1.86 | % | | 1.68 | % |

YIELDS AND RATES:

| | Weighted Average

Rate or Yield

at December 31, | | Average Rate or Yield During

Year Ended December 31, | |

| |

| |

| |

| | 2004 | | 2003 | | 2004 | | 2003 | | 2002 | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| Loans | | | 6.32 | % | | 6.45 | % | | 6.30 | % | | 6.71 | % | | 7.28 | % |

| Securities | | | 3.16 | % | | 3.24 | % | | 2.79 | % | | 2.48 | % | | 3.76 | % |

| All interest-earning assets | | | 5.88 | % | | 5.96 | % | | 5.86 | % | | 6.02 | % | | 6.73 | % |

| Interest-bearing deposits | | | 2.29 | % | | 2.22 | % | | 2.14 | % | | 2.48 | % | | 3.27 | % |

| All interest-bearing liabilities | | | 2.61 | % | | 2.70 | % | | 2.66 | % | | 2.99 | % | | 3.72 | % |

| Interest-rate spread (2) | | | 3.27 | % | | 3.26 | % | | 3.20 | % | | 3.03 | % | | 3.01 | % |

| Net yield on average interest-earning assets (3) | | | N/A | | | N/A | | | 3.39 | % | | 3.22 | % | | 3.22 | % |

(1) | Adjusted for the three-for-two stock split declared on February 14, 2003. |

| |

(2) | Average yield on all interest-earning assets less average rate paid on all interest-bearing liabilities. |

| |

(3) | Net interest income divided by average interest-earning assets. |

3

Dear Stockholders:

I am very pleased to be able to report to you that 2004 was not only another successful and profitable year, but also a year of significant milestones. During 2004, the Company celebrated its tenth anniversary of being a public company, its 70th anniversary as a financial institution, and surpassed $1 billion in total assets. The Board of Directors and the rest of the management team join me in expressing our sincere appreciation for your support, the hard work of our employees and the wonderful reception we have received from our customers and the communities we serve.

During 2004, the Company earned $10.0 million compared with $9.1 million for 2003, an increase of 10%. On a per share basis, the Company reported basic net income per share of $1.86 for 2004, compared to $1.70 for 2003, and diluted net income per share of $1.83 for 2004 and $1.67 for 2003. The increase in net income for 2004 compared to 2003 was primarily the result of an increase in net interest income of $3.8 million. That increase occurred in large part because of the continued reduction in the Bank’s cost of funds as a result of favorable market interest rates.

I am pleased to report that others also recognized our profitable performance and growth, and our stock price rose approximately 22% during the year, from $28.75 to $35.10. In addition, cash dividends paid per share increased from $.46 to $.52, an increase of 13%, from 2003 to 2004. Since our public offering in 1994, your stock has yielded an average annual return, including dividends, of 25.1%.

We have been very fortunate to serve a growing market, and that growth is reflected in the asset growth of FFLC. During 2004, total assets grew 12%, from $947.9 million at December 31, 2003 to $1.07 billion at December 31, 2004. During 2004, loans receivable increased by $116 million (or, 15%) that was primarily funded by an increase in deposits of $90 million (or, 13%) and in FHLB advances of $20 million (or, 15%). I am also pleased to report that FFLC’s stockholder’s equity increased from $77 million to $84 million during 2004, and book value per share increased from $14.33 at December 31, 2003 to $15.62 at December 31, 2004. In order to continue serving the growing needs of our customer base, we opened our 16th branch office in May 2004, on SR 466 in the Villages area.

In what will be the next exciting chapter in our corporate history, we recently announced that FFLC had signed a definitive agreement to merge with Colonial BankGroup, Inc. (“Colonial”). We believe this merger provides substantial benefit to our stockholders. In addition, linking with Colonial will provide our customers with additional products and an expanded network of branch offices for more convenient banking.

From a financial perspective, FFLC stockholders will have several options. Our stockholders can elect to receive two shares of Colonial stock for each share of FFLC, to receive $42 cash per share for each share of FFLC, or to receive a combination of Colonial stock and cash. In the aggregate, no more than 35% of the exchange can be in cash. An over-election of cash will result in a pro rata distribution of stock.

We are excited to be affiliating with Colonial, which is headquartered in Montgomery, Alabama, and also has a presence in Georgia, Texas and Nevada. However, Florida has been Colonial’s focus for the past decade, and business in Florida now represents over 50% of Colonial’s assets. Over the past ten years, Colonial will have gone from no presence in Florida to being the fifth largest commercial bank in the state following our merger.

4

While significantly larger than FFLC, Colonial shares in the same approach to community banking, and the same focus on providing great customer service. The members of the FFLC Board of Directors will remain involved after the merger, and will continue to have local lending authority. In addition, our customer service team of lenders and branch personnel will remain substantially unchanged. As a result, we will continue to offer the quality customer service for which First Federal Savings Bank has been known.

We sincerely appreciate the support we have received from our stockholders over the past eleven years as a public company. We look forward to the future with our new partner, Colonial BankGroup, Inc., and to the opportunity to continue providing quality banking services throughout Central Florida.

Cordially yours,

Stephen T. Kurtz

President & CEO

5

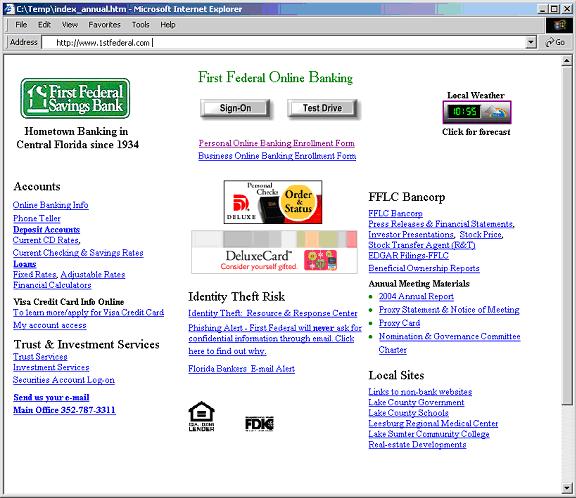

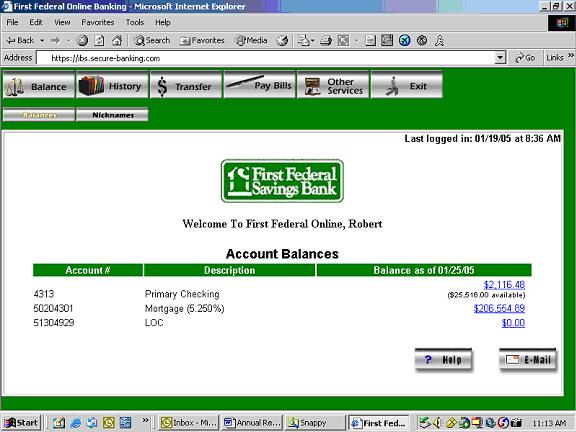

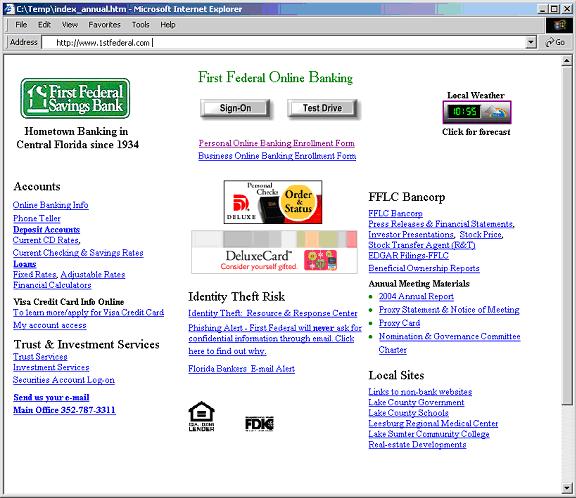

Visit First Federal’s website at http://www.1stfederal.com. This site serves as a portal for First Federal banking services, local news, and information regarding our communities. From this site, customers can gain access to First Federal Online Banking, our fully interactive banking system, that allows bill payments, account inquiries, transfer of funds and more. In addition, commercial customers can access cash management tools, make tax payments and make payroll direct deposit payments through First Federal Online Banking. You’ll also find current information about the Bank’s locations, products and services at our website.

Investors can also get the latest information regarding FFLC, including stock quotes, press releases, SEC filings, beneficial ownership reports, and other supplemental data, in the “FFLC Bancorp” section of our website.

www.1stfederal.com

First Federal online logo

6

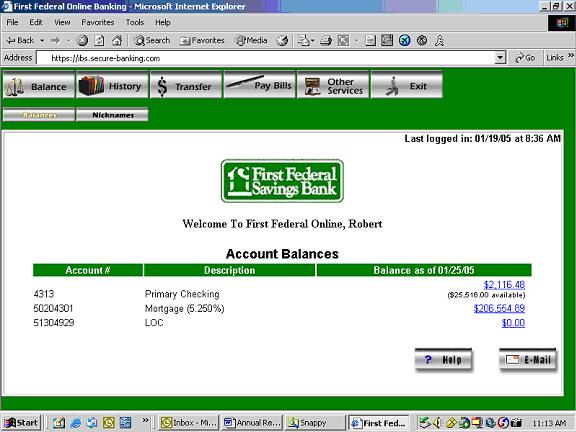

First Federal introduced First Federal Online Banking in July 2000 through the Bank’s website at http://www.1stfederal.com. First Federal customers can now access practically their entire First Federal relationship through the website, 24 hours a day, 7 days a week. From the First Federal website, customers can view our online banking product and may enroll online. After receiving their user ID and password, customers may log-on to check balances, pay their bills online, reconcile their account statements, transfer funds from one account to another, review account histories, reorder checks and more. First Federal Online Banking is just one more added convenience to banking with First Federal.

7

SELECTED CONSOLIDATED FINANCIAL DATA

($ in thousands, except per share amounts)

| | At December 31, | |

| |

| |

| | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| Total assets | | $ | 1,065,287 | | | 947,914 | | | 915,976 | | | 823,151 | | | 711,493 | |

| Loans, net | | | 883,980 | | | 767,987 | | | 735,338 | | | 685,935 | | | 615,484 | |

| Cash and cash equivalents | | | 64,606 | | | 62,160 | | | 69,394 | | | 49,792 | | | 30,481 | |

| Securities | | | 74,513 | | | 82,137 | | | 77,324 | | | 59,503 | | | 42,717 | |

| Deposits | | | 795,160 | | | 705,589 | | | 668,058 | | | 585,128 | | | 518,885 | |

| Borrowed funds | | | 175,186 | | | 155,941 | | | 168,458 | | | 167,327 | | | 129,376 | |

| Stockholders’ equity | | | 84,492 | | | 77,356 | | | 71,062 | | | 64,068 | | | 59,283 | |

| | For the Year Ended December 31, | |

| |

| |

| | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| Interest income | | $ | 55,405 | | | 52,840 | | | 56,533 | | | 56,485 | | | 49,128 | |

| Interest expense | | | 23,367 | | | 24,607 | | | 29,483 | | | 35,316 | | | 30,065 | |

| Net interest income | | | 32,038 | | | 28,233 | | | 27,050 | | | 21,169 | | | 19,063 | |

| Provision for loan losses | | | 1,675 | | | 1,514 | | | 1,845 | | | 1,115 | | | 880 | |

| Net interest income after provision for loan losses | | | 30,363 | | | 26,719 | | | 25,205 | | | 20,054 | | | 18,183 | |

| Noninterest income | | | 4,677 | | | 5,364 | | | 3,776 | | | 2,773 | | | 1,904 | |

| Noninterest expense | | | 18,809 | | | 17,355 | | | 14,868 | | | 12,841 | | | 11,414 | |

| Income before income taxes | | | 16,231 | | | 14,728 | | | 14,113 | | | 9,986 | | | 8,673 | |

| Income taxes | | | 6,212 | | | 5,580 | | | 5,277 | | | 3,697 | | | 3,364 | |

| Net income | | | 10,019 | | | 9,148 | | | 8,836 | | | 6,289 | | | 5,309 | |

| Basic income per share (1) | | $ | 1.86 | | | 1.70 | | | 1.65 | | | 1.18 | | | 1.00 | |

| Weighted average number of common shares outstanding for basic | | | 5,400,214 | | | 5,385,199 | | | 5,360,498 | | | 5,321,646 | | | 5,312,100 | |

| Diluted income per share (1) | | $ | 1.83 | | | 1.67 | | | 1.61 | | | 1.15 | | | .97 | |

| Weighted average number of common shares outstanding for diluted (1) | | | 5,470,430 | | | 5,456,896 | | | 5,466,880 | | | 5,444,148 | | | 5,423,610 | |

| (1) | Adjusted for the three-for-two stock split declared on February 14, 2003. |

8

SELECTED CONSOLIDATED FINANCIAL RATIOS

AND OTHER DATA:

| | At or For the Year Ended December 31, | |

| |

| |

| | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| Return on average assets | | | .99 | % | | .98 | % | | 1.00 | % | | 0.82 | % | | 0.82 | % |

| Return on average equity | | | 12.34 | % | | 12.23 | % | | 13.05 | % | | 10.20 | % | | 9.24 | % |

| Dividend payout ratio | | | 28.04 | % | | 27.18 | % | | 22.66 | % | | 29.35 | % | | 32.32 | % |

| Average equity to average assets | | | 8.03 | % | | 8.02 | % | | 7.67 | % | | 8.05 | % | | 8.88 | % |

| Total equity to total assets | | | 7.93 | % | | 8.16 | % | | 7.76 | % | | 7.78 | % | | 8.33 | % |

| Interest rate spread during year (1) | | | 3.20 | % | | 3.03 | % | | 3.01 | % | | 2.56 | % | | 2.66 | % |

| Net interest margin (2) | | | 3.39 | % | | 3.22 | % | | 3.22 | % | | 2.89 | % | | 3.08 | % |

| Nonperforming assets to total assets (3) | | | .29 | % | | 0.65 | % | | 0.35 | % | | 0.28 | % | | 0.39 | % |

| Nonperforming loans to total loans (4) | | | .30 | % | | 0.66 | % | | 0.34 | % | | 0.27 | % | | 0.40 | % |

| Allowance for loan losses to nonperforming loans | | | 228.99 | % | | 103.84 | % | | 199.88 | % | | 224.20 | % | | 141.51 | % |

| Allowance for loan losses to nonperforming assets | | | 212.30 | % | | 89.01 | % | | 161.00 | % | | 187.62 | % | | 127.49 | % |

| Allowance for loan losses to gross loans | | | .69 | % | | 0.69 | % | | 0.68 | % | | 0.61 | % | | 0.56 | % |

| Noninterest expenses to average assets | | | 1.86 | % | | 1.86 | % | | 1.68 | % | | 1.68 | % | | 1.76 | % |

| Operating efficiency ratio | | | 51.23 | % | | 51.66 | % | | 48.23 | % | | 53.63 | % | | 54.44 | % |

| Average interest-earning assets to average interest-bearing liabilities | | | 1.08 | | | 1.07 | | | 1.06 | | | 1.07 | | | 1.09 | |

| Net interest income to noninterest expenses | | | 1.70 | | | 1.63 | | | 1.82 | | | 1.69 | | | 1.69 | |

| Total shares outstanding (5) | | | 5,408,287 | | | 5,397,154 | | | 5,374,913 | | | 5,345,898 | | | 5,298,842 | |

| Book value per common share outstanding (5) | | $ | 15.62 | | | 14.33 | | | 13.22 | | | 11.99 | | | 11.19 | |

| Number of banking offices (all full-service) | | | 16 | | | 15 | | | 14 | | | 12 | | | 12 | |

(1) | Difference between weighted average yield on all interest-earning assets and weighted average rate on all interest-bearing liabilities. |

| |

(2) | Based upon net interest income before provision for loan losses divided by average interest-earning assets. |

| |

(3) | Nonperforming assets consist of nonperforming loans and foreclosed assets. |

| |

(4) | Nonperforming loans consist of loans 90 days or more delinquent. |

| |

(5) | Adjusted for the three-for-two stock split declared on February 14, 2003. |

9

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

GENERAL

First Federal Savings Bank of Lake County, the subsidiary of FFLC, was organized in 1934 as a federally chartered savings and loan association and converted to a federally chartered stock savings bank on January 4, 1994. The Bank’s principal business continues to be attracting retail deposits from the general public and investing those deposits, together with principal repayments on loans and investments and funds generated from operations, primarily in mortgage loans secured by one-to-four-family, owner-occupied homes, commercial loans, consumer loans and, to a lesser extent, construction loans and other loans, and multi-family residential mortgage loans. In addition, the Bank holds investments permitted by federal laws and regulations including securities issued by the U.S. Government and agencies thereof. The Bank’s revenues are derived principally from interest on its loan and mortgage-backed securities portfolios and interest and dividends on its investment securities.

The Bank is a community-oriented savings institution offering a variety of financial services to meet the needs of the communities it serves. The Bank’s deposit gathering and lending markets are primarily concentrated in the communities surrounding its full service offices located in Lake, Sumter, Citrus and Marion counties in central Florida. Management believes that its offices are located in communities that generally can be characterized as rural service and retirement communities with residential neighborhoods comprised predominately of one-to-four-family residences. The Bank is the largest (by asset size) locally-based financial institution in Lake County, and serves its market area with a wide selection of residential mortgage loans and other retail financial services. Management considers the Bank’s reputation for financial strength and customer service as a major advantage in attracting and retaining customers in its market area and believes it benefits from its community orientation as well as its established deposit base and level of core deposits.

On January 14, 2005, FFLC Bancorp, Inc. (the “Holding Company”) entered into a definitive agreement for the Holding Company and First Federal Savings Bank of Lake County (the “Bank”) to be acquired by Colonial BancGroup, Inc., a bank holding company incorporated in Delaware with a subsidiary bank, Colonial Bank, N.A., operating in Alabama, Florida, Georgia, Nevada, Tennessee, and Texas. Under the terms of the agreement, stockholders of the Holding Company will elect to receive either 2.0 shares of Colonial stock or $42.00 in cash for each share of the Holding Company stock they own. The cash consideration will be capped at 35% of the transaction and an over-election of cash will result in a pro rata distribution of stock. Completion of the transaction is subject to approval by the stockholders of the Holding Company and various regulatory agencies.

The Company’s net income from operations increased 9.5% to $10.0 million for the year ended December 31, 2004 from $9.1 million for the year 2003. The Company’s total assets increased 12.4% to $1,065.3 million at December 31, 2004 from $947.9 million at December 31, 2003. That increase resulted primarily from a 15.1% increase in net loans to $884.0 million at December 31, 2004 from $768.0 million at December 31, 2003, reflecting increased local loan demand. Securities decreased 9.3% or $7.6 million during 2004. Deposits increased 12.7% to $795.2 million at December 31, 2004 from $705.6 million at December 31, 2003. Advances from the Federal Home Loan Bank increased $20.0 million, to $153.0 million at December 31, 2004 from $133.0 million at December 31, 2003.

CRITICAL ACCOUNTING POLICIES

Our financial condition and results of operations are sensitive to accounting measurements and estimates of matters that are inherently uncertain. When applying accounting policies in areas that are subjective in nature, we use our best judgment to arrive at the carrying value of certain assets. The most critical accounting policy we apply is related to the valuation of the loan portfolio.

A variety of factors impact the carrying value of the loan portfolio, including the calculation of the allowance for loan losses, the valuation of underlying collateral, the timing of loan charge-offs and the amount and amortization of loan fees and deferred origination costs.

10

We believe that the determination of the allowance for loan losses represents a critical accounting policy. The allowance for loan losses is maintained at a level management considers to be adequate to absorb probable loan losses inherent in the portfolio, based on evaluations of the collectibility and historical loss experience of loans. Credit losses are charged and recoveries are credited to the allowance. In estimating probable credit losses, provisions for loan losses are based on our review of our historical loan loss experience and such other factors which, in management’s judgment, deserve consideration under existing economic conditions. The allowance is based on ongoing assessments of the probable estimated losses inherent in the loan portfolio. Our methodology for assessing the appropriate allowance level consists of several key elements described below.

Larger commercial loans that exhibit probable or observed credit weaknesses are subject to individual review. Where appropriate, reserves are allocated to individual loans based on our estimate of the borrower’s ability to repay the loan given the availability of collateral, other sources of cash flows, and available legal options. Included in the review of individual loans are those that are impaired as provided in Statement of Financial Accounting Standards No. 114, “Accounting by Creditors for Impairment of a Loan” as amended. Any specific reserves for impaired loans are measured based on the fair market value of the underlying collateral. We evaluate the collectibility of both principal and interest when assessing the need for a special reserve. Historical loss rates are applied to other commercial loans not subject to specific reserve allocations.

Homogenous loans, such as installment and residential mortgage loans, are not individually reviewed by management. Reserves are established for each pool of such loans based on the expected net charge-offs. Loss rates are based on the average net charge-off history by loan category.

Historical loss rates for commercial and consumer loans may be adjusted for significant factors that, in management’s judgment, reflect the impact of current conditions on loss recognition. Factors which management considers in the analysis include the effects of the local economy, trends in the nature and volume of loans (delinquencies, charge-offs, nonaccrual and problem loans), changes in the internal lending policies and credit standards, collection practices, and examination results from bank regulatory agencies and our internal credit review function. An unallocated reserve is maintained to recognize the imprecision in estimating and measuring loss when evaluating reserves for individual loans or pools of loans. Specific reserves on individual loans and historical loss rates are reviewed throughout the year and adjusted as necessary based on changing borrower and collateral conditions and actual collection and charge-off experience.

Based on the procedures discussed above, management believes that allowance for loan losses was adequate to absorb estimated loan losses associated with the loan portfolio at December 31, 2004. Actual results could differ from these estimates. However, since the allowance is affected by management’s judgment and uncertainties, there is the likelihood that materially different amounts would be reported under different conditions or assumptions. To the extent that the economy, collateral values, reserve factors, or the nature and volume of problem loans change, we may need to adjust the provision for loan losses. Material additions to our provision for loan losses would result in a decrease in net income and capital.

The allowance for loan losses is also discussed as part of “Results of Operations��� and in Note 3 to the consolidated financial statements. The significant accounting policies are discussed in Note 1 to the consolidated financial statements.

11

REGULATION AND LEGISLATION

General

The operating results of the Bank are affected by Federal laws and regulations and the Bank is subject to extensive regulation, examination and supervision by the OTS as its chartering agency, and the FDIC as the deposit insurer. The Bank is a member of the Federal Home Loan Bank (“FHLB”) System and its deposit accounts are insured up to applicable limits by the FDIC under the SAIF. The Bank must file reports with the OTS and the FDIC concerning its activities and financial condition in addition to obtaining regulatory approvals prior to entering into certain transactions such as mergers with, or acquisitions of, other financial institutions. The OTS and the FDIC conduct periodic examinations to test the Bank’s compliance with various regulatory requirements. The activities of the Company and the Bank are governed by the Home Owner’s Loan Act, as amended (the “HOLA”), and, in certain respects, the Federal Deposit Insurance Act (the “FDIA”). A more complete description of the HOLA and FDIA is included in the Form 10-K.

Capital Requirements

The capital regulations of the OTS require savings institutions to meet three capital standards: a 1.5% tangible capital standard; a 3% leverage (core capital) ratio; and an 8% risk-based capital standard. Under the OTS final rule implementing the Federal Deposit Insurance Corporation Improvement Act (“FDICIA”), a well-capitalized institution is defined generally as one that meets the following capital standards: a 5% tangible capital standard; a 6% leverage (core capital) ratio; and a 10% risk-based capital standard, and has not been notified by the OTS that it is in a “troubled condition.” At December 31, 2004, the Bank met each of its capital requirements and met the criteria of a “well-capitalized” institution as defined above.

Insurance of Deposit Accounts

The FDIC has adopted a risk-based deposit insurance system that assesses deposit insurance premiums according to the level of risk involved in an institution’s activities. An institution’s risk category is based upon whether the institution is classified as “well capitalized,” “adequately capitalized” or “less than adequately capitalized” and one of three supervisory subcategories within each capital group. The supervisory subgroup to which an institution is assigned is based on a supervisory evaluation and information which the FDIC determines to be relevant to the institution’s financial condition and the risk posed to the deposit insurance fund. The FDIC has authority to raise premiums if deemed necessary. If such action is taken, it could have an adverse effect on the earnings of the institution.

Under the FDIA, insurance of deposits may be terminated by the FDIC upon a finding that the institution has engaged in unsafe or unsound practices, is in an unsafe or unsound condition to continue operations or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC or the OTS. The management of the Bank does not know of any practice, condition or violation that might lead to termination of deposit insurance.

CREDIT RISK

The Bank’s primary business is lending on residential real estate, commercial real estate and consumer financing, activities with the inherent risk of generating potential loan losses the magnitude of which depend on a variety of factors affecting borrowers which are beyond the control of the Bank. The Bank has underwriting guidelines and credit review procedures designed to minimize such credit losses.

12

RESULTS OF OPERATIONS

The Company’s results of operations are dependent primarily on net interest income, which is the difference between the income earned on its interest-earning assets, primarily its loans, mortgage-backed securities and investment securities, and its interest-bearing liabilities, consisting of deposits and borrowings. The operating expenses of the Company principally consist of employee compensation, occupancy expenses and other general and administrative expenses. The Company’s results of operations are also significantly affected by general economic and competitive conditions, particularly changes in market interest rates, government policies and actions of regulatory authorities.

Net interest income represents the difference between income on interest-earning assets and expense on interest-bearing liabilities. Net interest income depends upon the volume of interest-earning assets and interest-bearing liabilities and the interest rates earned or paid on them.

13

The following table sets forth, for the periods indicated, information regarding (i) the total dollar amount of interest and dividend income of the Company from interest-earning assets and the resultant average yields; (ii) the total dollar amount of interest expense on interest-bearing liabilities and the resultant average costs; (iii) net interest/dividend income; (iv) interest-rate spread; (v) net interest margin; and (vi) weighted average yields and rates at December 31, 2004. Yields and costs were derived by dividing income or expense by the average balance of assets or liabilities, respectively, for the periods shown. The average balance of loans includes loans on which the Company has discontinued accruing interest. The yields and costs include fees which are considered to constitute adjustments to yields.

| | | | Year Ended December 31, | |

| | | |

| |

| | | | 2004 | | 2003 | | 2002 | |

| | | |

| |

| |

| |

| | Yield At

December 31,

2004 | | Average

Balance | | Interest

and

Dividends | | Average

Yeild/

Cost | | Average

Balance | | Interest

and

Dividends | | Average

Yeild/

Cost | | Average

Balance | | Interest

and

Dividends | | Average

Yeild/

Cost | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | ($ in thousands | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans | | 6.32 | % | | $ | 830,971 | | | 52,381 | | | 6.30 | % | $ | 742,461 | | | | 49,844 | | | 6.71 | % | | $ | 721,521 | | | 52,496 | | 7.28 | % | |

| Securities | | 3.16 | | | | 82,535 | | | 2,302 | | | 2.79 | | | 89,536 | | | | 2,218 | | | 2.48 | | | | 79,757 | | | 3,002 | | 3.76 | | |

| Other interest-earning assets (1) | | 2.38 | | | | 32,110 | | | 722 | | | 2.25 | | | 45,209 | | | | 778 | | | 1.72 | | | | 38,186 | | | 1,035 | | 2.71 | | |

| | | | |

|

| |

|

| | | | |

|

| | |

|

| | | | | |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | 5.88 | | | | 945,616 | | | 55,405 | | | 5.86 | | | 877,206 | | | | 52,840 | | | 6.02 | | | | 839,464 | | | 56,533 | | 6.73 | | |

| | | | | | | | | | | | | | | | | |

|

| | | | | | | | |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-earning assets | | | | | | 65,485 | | | | | | | | | 55,385 | | | | | | | | | | | 43,409 | | | | | | | |

| | | | |

|

| | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | | | $ | 1,011,101 | | | | | | | | $ | 932,591 | | | | | | | | | | $ | 882,873 | | | | | | | |

| | | | |

|

| | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW and money-market accounts | | .39 | | | | 176,712 | | | 669 | | | .38 | | | 149,486 | | | | 778 | | | .52 | | | | 131,538 | | | 1,449 | | 1.10 | | |

| Passbook and statement savings accounts | | .35 | | | | 28,221 | | | 133 | | | .47 | | | 25,886 | | | | 154 | | | .59 | | | | 23,501 | | | 216 | | .92 | | |

| Certificates | | 2.96 | | | | 506,513 | | | 14,424 | | | 2.85 | | | 484,379 | | | | 15,443 | | | 3.19 | | | | 460,206 | | | 18,461 | | 4.01 | | |

| FHLB advances | | 4.96 | | | | 144,817 | | | 7,640 | | | 5.28 | | | 139,372 | | | | 7,740 | | | 5.55 | | | | 160,235 | | | 8,999 | | 5.62 | | |

| Other borrowings | | 4.65 | | | | 22,105 | | | 501 | | | 2.27 | | | 22,654 | | | | 492 | | | 2.17 | | | | 16,915 | | | 358 | | 2.12 | | |

| | | | |

|

| |

|

| | | | |

|

| | |

|

| | | | | |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | 2.61 | | | | 878,368 | | | 23,367 | | | 2.66 | | | 821,777 | | | | 24,607 | | | 2.99 | | | | 792,395 | | | 29,483 | | 3.72 | | |

| | | | | | | |

|

| | | | | | | | |

|

| | | | | | | | |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing deposits | | | | | | 40,067 | | | | | | | | | 25,296 | | | | | | | | | | | 13,655 | | | | | | | |

| Noninterest-bearing liabilities | | | | | | 11,449 | | | | | | | | | 10,731 | | | | | | | | | | | 9,122 | | | | | | | |

| Stockholders’ equity | | | | | | 81,217 | | | | | | | | | 74,787 | | | | | | | | | | | 67,701 | | | | | | | |

| | | | |

|

| | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liabilities and equity | | | | | $ | 1,011,101 | | | | | | | | $ | 932,591 | | | | | | | | | | $ | 882,873 | | | | | | | |

| | | | |

|

| | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest-earning assets and interest-rate spread (2) | | 3.27 | % | | $ | 67,248 | | | | | | 3.20 | % | $ | 55,429 | | | | | | | 3.03 | % | | $ | 47,069 | | | | | 3.01 | % | |

| |

| | |

|

| | | | |

|

| |

|

| | | | | | |

| | |

|

| | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income and net

margin (3) | | | | | | | | $ | 32,038 | | | 3.39 | % | | | | | $ | 28,233 | | | 3.22 | % | | | | | $ | 27,050 | | 3.22 | % | |

| | | | | | | |

|

| |

|

| | | | | |

|

| | |

| | | | | |

|

| |

| | |

| Ratio of interest-earning assets to interest-bearing liabilities | | | | | | 1.08 | | | | | | | | | 1.07 | | | | | | | | | | | 1.06 | | | | | | | |

| | | | |

|

| | | | | | | |

|

| | | | | | | | | |

|

| | | | | | | |

(1) | Includes interest-earning deposits and FHLB Stock. |

| |

(2) | Interest-rate spread represents the difference between the average yield on interest-earning assets and the average cost of interest bearing liabilities. |

| |

(3) | Net interest margin is net interest income divided by average interest-earning assets. |

14

The following table discloses the extent to which changes in interest rates and changes in the volume of interest-earning assets and interest-bearing liabilities have affected the Company’s interest income and interest expense during the periods indicated. Information is provided in each category with respect to (i) changes attributable to changes in volume (changes in volume multiplied by prior rate), (ii) changes attributable to changes in rate (changes in rate multiplied by prior volume) and (iii) changes attributable to changes in rate/volume (changes in rate multiplied by changes in volume).

| | Year Ended December 31,

2004 vs. 2003

Increase (Decrease) | | Year Ended December 31,

2003 vs. 2002

Increase (Decrease) | |

| |

| |

| |

| | Due to | | Due to | |

| |

| |

| |

| | Rate | | Volume | | Rate/

Volume | | Net | | Rate | | Volume | | Rate/

Volume | | Net | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | ($ in thousands) | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans, net | | $ | (3,042 | ) | | 5,942 | | | | (363 | ) | | | 2,537 | | | (4,058 | ) | | 1,524 | | | (118 | ) | | (2,652 | ) |

| Securities | | | 279 | | | (173 | ) | | | (22 | ) | | | 84 | | | (1,026 | ) | | 368 | | | (126 | ) | | (784 | ) |

| Other interest-earning (1) | | | 239 | | | (225 | ) | | | (70 | ) | | | (56 | ) | | (378 | ) | | 190 | | | (69 | ) | | (257 | ) |

| |

|

| |

|

| | |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | (2,524 | ) | | 5,544 | | | | (455 | ) | | | 2,565 | | | (5,462 | ) | | 2,082 | | | (313 | ) | | (3,693 | ) |

| |

|

| |

|

| | |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW and money-market accounts | | | (212 | ) | | 142 | | | | (39 | ) | | | (109 | ) | | (765 | ) | | 198 | | | (104 | ) | | (671 | ) |

| Passbook and statement savings accounts | | | (32 | ) | | 14 | | | | (3 | ) | | | (21 | ) | | (76 | ) | | 22 | | | (8 | ) | | (62 | ) |

| Certificates | | | (1,649 | ) | | 706 | | | | (76 | ) | | | (1,019 | ) | | (3,789 | ) | | 970 | | | (199 | ) | | (3,018 | ) |

| FHLB advances | | | (387 | ) | | 302 | | | | (15 | ) | | | (100 | ) | | (100 | ) | | (1,172 | ) | | 13 | | | (1,259 | ) |

| Other borrowings | | | 21 | | | (12 | ) | | | — | | | | 9 | | | 9 | | | 121 | | | 4 | | | 134 | |

| |

|

| |

|

| | |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | (2,259 | ) | | 1,152 | | | | (133 | ) | | | (1,240 | ) | | (4,721 | ) | | 139 | | | (294 | ) | | (4,876 | ) |

| |

|

| |

|

| | |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net change in net interest income | | $ | (265 | ) | | 4,392 | | | | (322 | ) | | | 3,805 | | | (741 | ) | | 1,943 | | | (19 | ) | | 1,183 | |

| |

|

| |

|

| | |

|

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| (1) | Includes interest-earning deposits and FHLB Stock. |

15

CAPITAL RESOURCES

The Bank’s sources of funds include proceeds from payments and prepayments on mortgage loans and mortgage-backed securities, proceeds from the maturities of investment securities and deposits. While maturities and scheduled amortization of loans and investment securities are predictable sources of funds, deposit inflows and mortgage prepayments are greatly influenced by local conditions, general interest rates, and regulatory changes.

At December 31, 2004, the Bank had outstanding commitments to originate $18.3 million of loans, to fund unused lines of credit of $70.0 million, to fund the undisbursed portion of loans in process of $47.5 million and to fund $3.1 million in outstanding standby letters of credit. The Bank believes that it will have sufficient funds available to meet its commitments. At December 31, 2004, certificates of deposit which were scheduled to mature in one year or less totaled $253.9 million. Management believes, based on past experience, that a significant portion of those funds will remain with the Bank.

REGULATORY CAPITAL REQUIREMENTS

As a federally-chartered financial institution, the Bank is required to maintain certain minimum amounts of regulatory capital. Regulatory capital is not a valuation allowance and has not been created by charges against earnings. The following table provides a summary of the capital requirements, the Bank’s regulatory capital and the amounts in excess of the requirements at December 31, 2004:

| | Tangible | | Core | | Risk-Based | |

| |

| |

| |

| |

| | Amount | | % of

Adjusted

Assets | | Amount | | % of

Adjusted

Assets | | Amount | | % of Risk-

Weighted

Assets | |

| |

| |

| |

| |

| |

| |

| |

| | ($ in thousands) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Regulatory capital | | $ | 81,660 | | | | 7.70 | % | | $ | 81,660 | | | | 7.70 | % | | $ | 87,787 | | | | 11.71 | % | |

| Requirement | | | 15,913 | | | | 1.50 | | | | 31,826 | | | | 3.00 | | | | 59,975 | | | | 8.00 | | |

| |

|

| | |

|

| | |

|

| | |

|

| | |

|

| | |

|

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Excess | | $ | 65,747 | | | | 6.20 | % | | $ | 49,834 | | | | 4.70 | % | | $ | 27,812 | | | | 3.71 | % | |

| |

|

| | |

|

| | |

|

| | |

|

| | |

|

| | |

|

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk is the risk of loss from adverse changes in market prices and rates. The Company’s market risk arises primarily from interest-rate risk inherent in its lending and deposit taking activities. The Company has little or no risk related to trading accounts, commodities or foreign exchange.

Management actively monitors and manages its interest rate risk exposure. The primary objective in managing interest-rate risk is to limit, within established guidelines, the adverse impact of changes in interest rates on the Company’s net interest income and capital, while adjusting the Company’s asset-liability structure to obtain the maximum yield-cost spread on that structure. Management relies primarily on its asset-liability structure to control interest rate risk. However, a sudden and substantial increase in interest rates could adversely impact the Company’s earnings, to the extent that the interest rates borne by assets and liabilities do not change at the same speed, to the same extent, or on the same basis.

Disclosure about the fair value of financial instruments, which reflect changes in market prices and rates, can be found in Note 9 of the notes to the consolidated financial statements.

16

OFF-BALANCE SHEET ARRANGEMENTS AND AGGREGATE CONTRACTUAL OBLIGATIONS

The Company is a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of its customers and to reduce its own exposure to fluctuations in interest rates. These financial instruments include commitments to extend credit, unused lines of credit, undisbursed loans in process and standby letters of credit. These instruments involve, to varying degrees, elements of credit and interest-rate risk in excess of the amounts recognized in the consolidated balance sheet. The contract amounts of these instruments reflect the extent of the Company’s involvement in these financial instruments.

The Company’s exposure to credit loss in the event of nonperformance by the other party to the financial instrument for commitments to extend credit, unused lines of credit, undisbursed loans in process and standby letters of credit is represented by the contractual amount of those instruments. The Company uses the same credit policies in making commitments as it does for on-balance sheet instruments.

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed-expiration dates or other termination clauses and may require payment of a fee. Since certain commitments expire without being drawn upon, the total committed amounts do not necessarily represent future cash requirements. The Company evaluates each customer’s credit worthiness on a case-by-case basis. The amount of collateral obtained, if it is deemed necessary by the Company upon extension of credit, is based on management’s credit evaluation of the counter party.

Standby letters of credit are conditional commitments issued by the Company to guarantee the performance of a customer to a third party. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loans to customers.

The following is a summary of the Company’s contractual obligations, including certain on-balance sheet obligations, at December 31, 2004 (in thousands):

| | | | Payments Due by Period | |

| | | |

| |

Contractual Obligations | | Total | | Less

Than 1

Year | | 1-3

Years | | 3-5

Years | | More

Than 5

Years | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

| FHLB advances – assumed final maturity | | $ | 153,000 | | | 69,000 | | | 40,000 | | | 29,000 | | | 15,000 | |

| Time deposit maturities | | | 535,986 | | | 253,892 | | | 238,804 | | | 43,290 | | | — | |

| Junior subordinated debentures – assumed final maturity | | | 5,155 | | | — | | | — | | | — | | | 5,155 | |

| Accrued interest payable | | | 1,075 | | | 1,075 | | | — | | | — | | | — | |

| Other borrowings | | | 17,031 | | | 17,031 | | | — | | | — | | | — | |

| Operating leases | | | 313 | | | 46 | | | 99 | | | 109 | | | 59 | |

| Loan commitments | | | 18,326 | | | 18,326 | | | — | | | — | | | — | |

| Standby letters of credit | | | 3,129 | | | 3,129 | | | — | | | — | | | — | |

| Undisbursed construction and line of credit loans | | | 117,477 | | | 117,477 | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

| Total | | $ | 804,061 | | | 432,486 | | | 278,957 | | | 72,404 | | | 20,214 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

17

ASSET /LIABILITY MANAGEMENT

The Bank’s primary mission is to provide financing by offering permanent and construction residential mortgage loans, commercial real estate loans and consumer and commercial loans and by providing conveniently located depository facilities with transaction, savings and certificate accounts. The Bank’s goal is to continue to be a well-capitalized and profitable operation that provides service that is professional, efficient and courteous. The Bank seeks to fulfill its mission and accomplish its goals by pursuing the following strategies: (i) emphasizing lending in the one-to-four-family residential mortgage, commercial real estate and consumer lending markets; (ii) controlling interest-rate risk; (iii) managing deposit pricing and asset growth; (iv) emphasizing cost control; and (v) maintaining asset quality by investing in U.S. government and agency securities which, in management’s judgment, provide a balance between yield and safety. It is management’s intention to continue to employ these strategies over the foreseeable future.

The Bank’s profitability, like that of most financial institutions, is dependent to a large extent upon its net interest income, which is the difference between its interest income on interest-earning assets, such as loans, mortgage-backed securities and investment securities, and its interest expense on interest-bearing liabilities, such as deposits and other borrowings. Financial institutions continue to be affected by general changes in levels of interest rates and other economic factors beyond their control. At December 31, 2004, the Bank’s one-year interest sensitivity gap (the difference between the amount of interest-earning assets anticipated by the Bank to mature or reprice within one year and the amount of interest-bearing liabilities anticipated by the Bank to mature or reprice within one year) as a percentage of total assets was a positive 3.34% Generally, an institution with a positive gap would experience an increase in net interest income in a period of rising interest rates or a decrease in net interest income in a period of declining interest rates. However, certain shortcomings are inherent in the sensitivity analysis presented above. For example, although certain assets and liabilities may have similar maturities or periods to repricing, they may react in different manners to changes in market interest rates. Therefore, no assurance can be given that the Bank will be able to maintain its net interest-rate spread as market interest rates fluctuate.

The Bank monitors its interest-rate risk through the Asset/Liability Committee which meets monthly and reports the results of such monitoring quarterly to the Board of Directors. The Bank’s policy is to seek to maintain a balance between interest-earning assets and interest-bearing liabilities so that the Bank’s cumulative one-year gap is within a range established by the Board of Directors and which management believes is conducive to maintaining profitability without incurring undue risk. The Bank has increased its investment in adjustable-rate, and shorter average life, mortgage-related securities in order to position itself against the consequences of rising interest rates. The Bank also maintains liquid assets in an amount which allows for the possibility of disintermediation when interest rates fluctuate. The Bank’s liquidity ratio was 17.6% at December 31, 2004. In addition, the Bank’s large, stable, core deposit base resulting from its continuing commitment to quality customer service has historically provided it with a steady source of funds.

18

The following table sets forth the amounts of interest-earning assets and interest-bearing liabilities outstanding at December 31, 2004 that are expected to reprice, based upon certain assumptions and contractual maturities, in each of the future periods shown.

| | Three

Months

or Less | | More

than

Three

Months

to Six

Months | | More

than

Six

Months

to 12

Months | | More

than

One

Year

to 3

Years | | More

than

Three

Years

to 5

Years | | More

than

Five

Years

to 10

Years | | More

than

Ten

Years | | Total | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | ($ in thousands) | |

| Rate-sensitive assets: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mortgage loans, net of LIP | | $ | 196,244 | | | 70,651 | | | 116,714 | | | 180,280 | | | 55,783 | | | 25,872 | | | 22,445 | | | 667,989 | |

| Commercial and consumer loans, net of LIP | | | 94,062 | | | 14,327 | | | 23,724 | | | 53,610 | | | 19,227 | | | 11,388 | | | 5,005 | | | 221,343 | |

| Mortgage-backed securities | | | 3,925 | | | 3,585 | | | 5,950 | | | 6,257 | | | 2,965 | | | — | | | — | | | 22,682 | |

| Interest-earning deposits | | | 38,258 | | | | | | | | | | | | | | | | | | — | | | 38,258 | |

| Investment securities | | | | | | — | | | 3,996 | | | 22,966 | | | — | | | — | | | 7,043 | | | 42,663 | |

| Mutual funds | | | 9,168 | | | — | | | — | | | — | | | — | | | — | | | — | | | 9,168 | |

| FHLB stock | | | 8,782 | | | — | | | — | | | — | | | — | | | — | | | — | | | 8,782 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-earning assets | | | 359,097 | | | 88,563 | | | 150,384 | | | 263,113 | | | 77,975 | | | 37,260 | | | 34,493 | | | 1,010,885 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Rate-sensitive liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | | 29,891 | | | — | | | — | | | — | | | — | | | — | | | — | | | 29,891 | |

| NOW and money-market accounts | | | 187,487 | | | — | | | — | | | — | | | — | | | — | | | — | | | 187,487 | |

| Certificates | | | 98,564 | | | 56,995 | | | 98,333 | | | 238,804 | | | 43,290 | | | — | | | — | | | 535,986 | |

| Borrowed funds | | | 55,686 | | | 12,500 | | | 23,000 | | | 40,000 | | | 29,000 | | | 15,000 | | | — | | | 175,186 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing liabilities | | | 371,628 | | | 69,495 | | | 121,333 | | | 278,804 | | | 72,290 | | | 15,000 | | | — | | | 928,550 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-sensitivity gap | | $ | (12,531 | ) | | 19,068 | | | 29,051 | | | (15,691 | ) | | 5,685 | | | 22,260 | | | 34,493 | | | 82,335 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative interest-sensitivity gap | | $ | (12,531 | ) | | 6,537 | | | 35,588 | | | 19,897 | | | 25,582 | | | 47,842 | | | 82,335 | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative interest-earning assets | | $ | 359,097 | | | 447,660 | | | 598,044 | | | 861,157 | | | 939,132 | | | 976,392 | | | 1,010,885 | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative interest-bearing liabilities | | $ | 371,628 | | | 441,123 | | | 562,456 | | | 841,260 | | | 913,550 | | | 928,550 | | | 928,550 | | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative interest-sensitivity gap as a percentage of total assets | | | (1.18% | ) | | 0.61 | % | | 3.34 | % | | 1.87 | % | | 2.40 | % | | 4.49 | % | | 7.73 | % | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative interest-earning assets as a percentage of cumulative interest-bearing liabilities | | | 96.63 | % | | 101.48 | % | | 106.33 | % | | 102.37 | % | | 102.80 | % | | 105.15 | % | | 108.87 | % | | | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| | | | |

19

| COMPARISON OF THE YEAR ENDED DECEMBER 31, 2004 TO THE YEAR ENDED DECEMBER 31, 2003 |

| |

| General Operating Results. Net income for the year ended December 31, 2004 was $10.0 million, or $1.86 per basic share and $1.83 per diluted share, compared to $9.1 million, or $1.70 per basic share and $1.67 per diluted share, for the year ended December 31, 2003. All per share information has been adjusted to reflect the three-for-two stock split effected in 2003. The increase in net income was primarily due to an increase in net interest income of $3.8 million, partially offset by a $1.5 million increase in noninterest expense and a decrease in noninterest income of $.7 million. |

| |

| Interest Income. Interest income increased $2.6 million to $55.4 million for the year ended December 31, 2004. The increase resulted from a $68.4 million or 7.8% increase in average interest-earning assets outstanding for the year ended December 31, 2004 compared to 2003, partially offset by a decrease in the average yield earned on interest-earning assets from 6.02% for the year ended December 31, 2004 to 5.86% for the year ended December 31, 2003. |

| |

| Interest Expense. Interest expense decreased $1.2 million or 5.0%, from $24.6 million for the year ended December 31, 2003 to $23.4 million for the year ended December 31, 2004. The decrease was due primarily to a decrease in the average cost of interest-bearing liabilities from 2.99% for the year ended December 31, 2003 to 2.66% for 2004, partially offset by an increase of $56.6 million in average interest-bearing liabilities outstanding. Average interest-bearing deposits increased from $659.8 million outstanding during the year ended December 31, 2003 to $711.4 million outstanding during 2004. Average borrowings increased from $162.0 million outstanding during the year ended December 31, 2003 to $166.9 million in 2004. |

| |

| Provision for Loan Losses. The provision for loan losses is charged to income to increase the allowance for loan losses to the level deemed appropriate by management. The provision is based upon the volume and type of lending conducted by the Company, charge-off experience, industry standards, the amount of nonperforming loans, general economic conditions, particularly as they relate to the Company’s market area, and other factors related to the collectibility of the Company’s loan portfolio. The Company recorded provisions for loan losses for the years ended December 31, 2004 and 2003 of $1.7 million and $1.5 million, respectively. Net loans charged off for the years ended December 31, 2004 and 2003 were $673,000 and $1,205,000, respectively. Management believes that the allowance for loan losses, which was $6.5 million or .69% of gross loans at December 31, 2004, is adequate. |

| |

| Noninterest Income. Noninterest income decreased $.7 million, or 12.8% from $5.4 million for the year ended December 31, 2003 to $4.7 million for 2004. That decrease was primarily due to decreases of $384,000 in other service charges and fees and $683,000 in net gain on sales of loans held for sale. The decrease in gain on sales of loans held for sale was due to a decrease in the amount of residential mortgage loans originated and sold in the secondary market. The decrease in loans originated and sold was a result of a decrease in refinancings which had peaked in the prior year. |

| |

| Noninterest Expense. Noninterest expense increased by $1.5 million or 8.4%, from $17.4 million for the year ended December 31, 2003 to $18.8 million for the year ended December 31, 2004. The increase was primarily due to increases in salaries and employee benefits of $782,000, occupancy expense of $111,000 and $284,000 in data processing expenses related to the overall growth of the Company. |

| |

| Income Taxes. Income taxes were $6.2 million for the year ended December 31, 2004 (an effective tax rate of 38.3%) compared to $5.6 million (an effective tax rate of 37.9%) for the year ended December 31, 2003. |

20

| COMPARISON OF THE YEAR ENDED DECEMBER 31, 2003 TO THE YEAR ENDED DECEMBER 31, 2002 |

| |

| General Operating Results. Net income for the year ended December 31, 2003 was $9.1 million, or $1.70 per basic share and $1.67 per diluted share, compared to $8.8 million, or $1.65 per basic share and $1.61 per diluted share, for the year ended December 31, 2002. All per share information has been adjusted to reflect the three-for-two stock split in 2003. The increase in net income was primarily due to increases in net interest income of $1.2 million and noninterest income of $1.6 million, partially offset by a $2.5 million increase in noninterest expense. |

| |

| Interest Income. Interest income decreased $3.7 to $52.8 million for the year ended December 31, 2003. The decrease resulted from a decrease in the average yield earned on interest-earning assets from 6.73% for the year ended December 31, 2002 to 6.02% for the year ended December 31, 2003, partially offset by a $37.7 million or 4.5% increase in average interest-earning assets outstanding for the year ended December 31, 2003 compared to 2002. |

| |

| Interest Expense. Interest expense decreased $4.9 million or 16.5%, from $29.5 million for the year ended December 31, 2002 to $24.6 million for the year ended December 31, 2003. The decrease was due primarily to a decrease in the average cost of interest-bearing liabilities from 3.72% for the year ended December 31, 2002 to 2.99% for 2003, partially offset by an increase of $29.4 million in average interest-bearing liabilities outstanding. Average interest-bearing deposits increased from $615.2 million outstanding during the year ended December 31, 2002 to $659.8 million outstanding during 2003. Average borrowings decreased from $177.2 million outstanding during the year ended December 31, 2002 to $162.0 million in 2003. |

| |

| Provision for Loan Losses. The provision for loan losses is charged to income to increase the allowance for loan losses to the level deemed appropriate by management. The provision is based upon the volume and type of lending conducted by the Company, charge-off experience, industry standards, the amount of nonperforming loans, general economic conditions, particularly as they relate to the Company’s market area, and other factors related to the collectibility of the Company’s loan portfolio. The Company recorded provisions for loan losses for the years ended December 31, 2003 and 2002 of $1.5 million and $1.8 million, respectively. Net loans charged off for the years ended December 31, 2003 and 2002 were $1,205,000 and $953,000, respectively. Management believes that the allowance for loan losses, which was $5.5 million or .69% of gross loans at December 31, 2003 is adequate. |

| |

| Noninterest Income. Noninterest income increased $1.6 million, or 42.1% from $3.8 million for the year ended December 31, 2002 to $5.4 million for 2003. That increase was primarily due to increases of $475,000 in other service charges and fees and $775,000 in net gain on sales of loans held for sale. The increase in gain on sales of loans held for sale was due to an increase in the amount of residential mortgage loans originated and sold in the secondary market due to the low interest-rate environment. |

| |

| Noninterest Expense. Noninterest expense increased by $2.5 million or 16.7%, from $14.9 million for the year ended December 31, 2002 to $17.4 million for the year ended December 31, 2003. The increase was primarily due to increases in salaries and employee benefits of $1.4 million, occupancy expense of $367,000 and $279,000 in data processing expenses related to the overall growth of the Company. |

| |

| Income Taxes. Income taxes were $5.6 million for the year ended December 31, 2003 (an effective tax rate of 37.9%) compared to $5.3 million (an effective tax rate of 37.4%) for the year ended December 31, 2002. |

21

IMPACT OF INFLATION AND CHANGING PRICES

The Consolidated Financial Statements and Notes thereto presented herein have been prepared in accordance with GAAP, which requires the measurement of financial position and operating results in terms of historical dollars without considering the changes in the relative purchasing power of money over time due to inflation. The impact of inflation is reflected in the increased cost of the Company’s operations. Unlike most industrial companies, nearly all the assets and liabilities of the Bank are monetary in nature. As a result, interest rates have a greater impact on the Company’s performance than do the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or to the same extent as the price of goods and services.

22

FFLC BANCORP, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

($ in thousands, except per share amounts)

| | At December 31, | |

| |

| |

| | 2004 | | 2003 | |

| |

| |

| |

| Assets | | | | | | |

| | | | | | |

| Cash and due from banks | | $ | 26,348 | | 35,072 | |

| Interest-earning deposits | | | 38,258 | | 27,088 | |

| |

|

| |

| |

| | | | | | |

| Cash and cash equivalents | | | 64,606 | | 62,160 | |

| | | | | | |

| Securities available for sale | | | 74,513 | | 82,137 | |

| Loans, net of allowance for loan losses of $6,492 in 2004and $5,490 in 2003 | | | 883,980 | | 767,987 | |

| Accrued interest receivable: | | | | | | |

| Securities | | | 481 | | 660 | |

| Loans | | | 3,412 | | 3,189 | |

| Premises and equipment, net | | | 22,522 | | 21,448 | |

| Foreclosed assets | | | 223 | | 881 | |

| Federal Home Loan Bank stock, at cost | | | 8,782 | | 6,900 | |

| Deferred income taxes | | | 1,496 | | 1,134 | |

| Other assets | | | 5,272 | | 1,418 | |

| |

|

| |

| |

| | | | | | |

| Total | | $ | 1,065,287 | | 947,914 | |

| |

|

| |

| |

| | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | |

| | | | | | |

| Liabilities: | | | | | | |

| Noninterest-bearing demand deposits | | | 41,796 | | 31,481 | |

| NOW and money-market accounts | | | 187,487 | | 161,527 | |

| Savings accounts | | | 29,891 | | 26,636 | |

| Certificates | | | 535,986 | | 485,945 | |

| |

|

| |

| |

| | | | | | |

| Total deposits | | | 795,160 | | 705,589 | |

| | | | | | |

| Advances from Federal Home Loan Bank | | | 153,000 | | 133,000 | |

| Other borrowed funds | | | 17,031 | | 17,786 | |

| Junior subordinated debentures | | | 5,155 | | 5,155 | |

| Accrued expenses and other liabilities | | | 10,449 | | 9,028 | |

| |

|

| |

| |

| | | | | | |

| Total liabilities | | | 980,795 | | 870,558 | |

| |

|

| |

| |

| | | | | | |

| Commitments and contingencies (Notes 4, 9 and 12) | | | | | | |

| | | | | | |

| Stockholders’ equity: | | | | | | |

| Preferred stock, $.01 par value, 1,000,000 shares authorized, none outstanding | | | — | | — | |

| Common stock, $.01 par value, 15,000,000 shares authorized,6,411,660 in 2004 and 6,397,202 in 2003 shares issued | | | 64 | | 64 | |

| Additional paid-in-capital | | | 32,353 | | 31,837 | |

| Retained income | | | 72,281 | | 65,071 | |

| Accumulated other comprehensive income (loss) | | | (207 | ) | 297 | |

| Treasury stock, at cost (1,003,373 shares in 2004 and 1,000,048 shares in 2003) | | | (19,999 | ) | (19,913 | ) |

| |

|

| |

| |

| | | | | | |

| Total stockholders’ equity | | | 84,492 | | 77,356 | |

| |

|

| |

| |

| | | | | | |

| Total | | $ | 1,065,287 | | 947,914 | |

| |

|

| |

| |

| | | | | | | | | | | | |

See accompanying Notes to Consolidated Financial Statements.

23

FFLC BANCORP, INC. AND SUBSIDIARIES

Consolidated Statements of Income

($ in thousands, except per share amounts)

| | Year Ended December 31, | |

| |

| |

| | 2004 | | 2003 | | 2002 | |

| |

| |

| |

| |

| Interest income: | | | | | | | | |

| Loans | | $ | 52,381 | | 49,844 | | 52,496 | |

| Securities | | | 2,302 | | 2,218 | | 3,002 | |

| Other | | | 722 | | 778 | | 1,035 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Total interest income | | | 55,405 | | 52,840 | | 56,533 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Interest expense: | | | | | | | | |

| Deposits | | | 15,226 | | 16,375 | | 20,126 | |

| Borrowed funds | | | 8,141 | | 8,232 | | 9,357 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Total interest expense | | | 23,367 | | 24,607 | | 29,483 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Net interest income | | | 32,038 | | 28,233 | | 27,050 | |

| | | | | | | | |

| Provision for loan losses | | | 1,675 | | 1,514 | | 1,845 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Net interest income after provision for loan losses | | | 30,363 | | 26,719 | | 25,205 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Noninterest income: | | | | | | | | |

| Deposit account fees | | | 1,391 | | 1,036 | | 953 | |

| Other service charges and fees | | | 1,991 | | 2,375 | | 1,900 | |

| Net gain on sales of loans held for sale | | | 495 | | 1,178 | | 403 | |

| Other | | | 800 | | 775 | | 520 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Total noninterest income | | | 4,677 | | 5,364 | | 3,776 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Noninterest expense: | | | | | | | | |

| Salaries and employee benefits | | | 10,978 | | 10,196 | | 8,814 | |

| Occupancy expense | | | 2,898 | | 2,787 | | 2,420 | |

| Data processing expense | | | 1,554 | | 1,270 | | 991 | |

| Advertising and promotion | | | 592 | | 507 | | 492 | |

| Professional services | | | 576 | | 480 | | 432 | |

| Other | | | 2,211 | | 2,115 | | 1,719 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Total noninterest expense | | | 18,809 | | 17,355 | | 14,868 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Income before income taxes | | | 16,231 | | 14,728 | | 14,113 | |

| | | | | | | | |

| Income taxes | | | 6,212 | | 5,580 | | 5,277 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Net income | | $ | 10,019 | | 9,148 | | 8,836 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Basic income per share | | $ | 1.86 | | 1.70 | | 1.65 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Weighted-average number of shares outstanding for basic | | | 5,400,214 | | 5,385,199 | | 5,360,498 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Diluted income per share | | $ | 1.83 | | 1.67 | | 1.61 | |

| |

|

| |

| |

| |

| | | | | | | | |

| Weighted-average number of shares outstanding for diluted | | | 5,470,430 | | 5,456,896 | | 5,466,880 | |

| |

|

| |

| |

| |

| | | | | | | | | | |

See accompanying Notes to Consolidated Financial Statements.

24

FFLC BANCORP, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Stockholders’ Equity

Years Ended December 31, 2004, 2003 and 2002

($ in thousands, except per share amounts)

| | Common Stock | | | | | | | | Accumulated | | | |

| |

| | Additional | | | | | | Other | | Total | |

| | Number of

Shares | | Amount | | Paid-In

Capital | | Treasury

Stock | | Retained

Income | | Comprehensive

Income | | Stockholders’

Equity | |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | |

| Balance at December 31, 2001 | | 4,542,953 | | | $ | 45 | | | | 31,355 | | | | (19,347 | ) | | | 51,575 | | | | 440 | | | | 64,068 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | — | | | | — | | | | — | | | | — | | | | 8,836 | | | | — | | | | 8,836 | | |