@NFX is periodically published to keep shareholders aware of current operating activities at Newfield. It may include estimates of expected production volumes, costs and expenses, recent changes to hedging positions and commodity pricing.

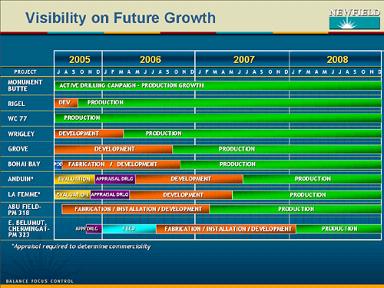

On July 26, we issued an expected range for our production for 2005-07. The increase in volumes is driven by large development projects underway today. The following table details the significant projects that are under development and the expected timing of first production. The second table shows historical production, as well as expected ranges for 2005-07.

Abu Cluster - Located on the shallow water PM 318 block offshore Malaysia, we expect to have the Abu Field on line in early 2007 at about 12,000 BOPD gross. We will have a 50% interest in the field. When combined with current production at Penara and North Lukut fields, we are expected to have more than 20,000 BOPD of gross production from Malaysia in early 2007.

Focus Area Updates

ONSHORE GULF COAST

During the second quarter, we drilled 11 successful wells out of 16 attempts and have two wells remaining to be tested in our onshore Gulf Coast division. We have eight operated rigs running along the Gulf Coast and are participating in two outside operated wells. We expect to drill 40-60 development wells in the area during 2005.

Monte Christo

In South Texas, we continue to have good success with our drilling program in the Monte Christo Field area, located in Hidalgo County, Texas. Since the beginning of 2005, we’ve drilled two successful wells out of three attempts in the Monte Christo Field. Located in a separate field in the same area, we have drilled four successful development wells out of as many attempts in the McCook Field. Our recent Johnson #75 well came on-line at 15.3 MMcf/d and total field production is about 30 MMcfe/d and limited by facilities. We expect the field to increase to nearly 40 MMcfe/d later this year. The Johnson #76 well was a recent success and is now being completed. We are drilling the Johnson #77. We have a 100% working interest in these wells.

Val Verde Basin

We remain active in the Val Verde Basin of southwest Texas where we hold more than 100,000 lease acres. Our production from the area is about 45 MMcfe/d gross and growing.

We recently completed a bite-size acquisition of the Snakebite Field. This acquisition adds 12,000 acres north of our Venom Field, a February ‘05 discovery. We see the potential to drill as many as 35 locations in the Snakebite Field. A pipeline is under construction to connect Venom with gathering assets acquired in the Snakebite transaction. The pipeline will provide for 30 MMcf/d of gross capacity from Venom. We have an 80-100% working interest in Venom and Snakebite and control more than 26,000 net acres in the area.

Poulter Field

We continue to develop the Poulter Field, also located in the Val Verde Basin. Current production is 12 MMcf/d from four wells and is expected to increase with further development drilling. The Packenham 2601 was a recent success that is being completed. We expect to bring two wells on-line during the next month and field production is expected to grow to over 20 MMcf/d. We operate Poulter and our working interest ranges from 60-100%. We control nearly 5,000 gross acres around this development.

Bravo Prospect

We are now completing a recent discovery at our Bravo Prospect, located in Zapata County, Texas. We expect to have this well on-line in the third quarter and are planning offset locations at this time. We have an 88% interest in Bravo. We have two additional exploration prospects drilling in Zapata County.

GULF OF MEXICO

During the first half of 2005, we participated in 14 wells in the Gulf of Mexico, eight of which were successful.

We have seven development projects underway that will add net production of about 30 MMcfe/d in the second half of 2005.

West Cameron 77 - This was a 2004 deep shelf discovery that came on-line in July at 15 MMcfe/d (gross). We are the operator with a 33% working interest. Another well is planned in the field in late 2005.

High Island 520 - We recently installed a used facility and first production of 10 MMcfe/d (gross) is expected in August 2005. We have a 75% interest in the field.

South Marsh Island 139 - A new platform was recently installed and first production of 500 BOPD (gross) is expected in September 2005. We have a 23% interest in the field.

West Delta 133 - We fabricated a new facility and first production of 3 MMcf/d and 2,000 BOPD is expected in October 2005. We have a 75% working interest.

North Padre Island 9- We recently installed a used facility and first production of 7.5 MMcfe/d (gross) is expected from this 1-2 well development in October 2005. We have a 51% working interest.

South Timbalier 299 - We are fabricating a platform and expect first production of 15 MMcf/d and 200 BOPD in November 2005. We have a 75% working interest.

South Marsh Island 155 - We recently acquired a used facility and first production of 3.5 MMcfe/d is expected in December 2005. We have a 100% working interest in the field.

In the second half of 2005, we expect to drill about 10 additional shelf wells and 5-7 deep shelf exploration wells. We expect to run 6-7 operated rigs in the Gulf of Mexico during the second half of 2005.

Mid-Continent

In 2005, we have drilled 43 company-operated wells and are currently operating 8 drilling rigs. In 2005, 42 operated wells have been completed or are in various stages of completion (excluding Cherokee Basin CBM wells).

WACCAWH - Our WACCAWH play is located in Coal, Pittsburgh and Hughes Counties, Oklahoma. We have been active in the play since 2002 and have drilled 77 wells to date. Gross operated production from the area is 25 MMcfe/d. We expect to drill 35-40 WACCAWH wells in 2005. We have two rigs operating in the play today. Our recent Blevins 3H-9 well, located in Pittsburg County, was our first operated horizontal Woodford test. The well has a 1,500’ lateral section and has averaged 800 Mcfe/d during its first 30 days of production. Another Woodford test - the Cometti well - was drilled in our southern WACCAWH area and found the thickest pay section we have seen to date in the three primary target horizons - Wapanucka, Cromwell and Woodford shale. The Woodford had initial production of 1.8 MMcfe/d and averaged 850 Mcfe/d during its first 3 weeks of production. We are planning an offset and control more than 20,000 net acres around this well. We maintain an interest in more than 100,000 net acres in the WACCAWH play.

Wash Plays - During the second quarter, we averaged six operated rigs in the Wash Plays - located in the Texas Panhandle and Western Oklahoma. We are continuing to lease acreage and captured another 20,000 acres net during the quarter. We now own interests in more than 50,000 net acres in the Wash Play. Our gross operated daily production is about 35 MMcfe/d.

Texas Wash Play - We are currently operating three drilling rigs in the Stiles Ranch field, located in Wheeler County. Completion operations are underway on four wells. The Britt Ranch B 45-6 is now producing to sales at 3.5 MMcf/d (gross). Our gross daily production in the Texas Wash Play is 28 MMcfe/d from 77 wells. For 2005, we plan to drill 20-25 wells in the Texas Wash Play. We have over 100 remaining locations at Stiles Ranch, where we have a 100% working interest in most of the area.

Oklahoma Wash Play - We are operating two rigs in the Cheyenne Area of Roger Mills County in western Oklahoma. Targets are the Marmaton, Cherokee, Red Fork and Atoka Washes. A third rig is anticipated to move into the area in October. Recent completions are producing 2-4 MMcfe/d gross and our working interest ranges from 60-100%. In August, we plan to begin the assessment drilling of our Sweetwater Area (west of Cheyenne), which has been the focus of our leasing activity during the first half of the year. For 2005, we plan to drill a total of 15-20 wells.

Cherokee Basin CBM Area - In 2005, we have drilled 88 wells in the northeast corner of Oklahoma - our Cherokee Basin coal bed methane play. We have one rig running in the area. Gross production has grown to about 16 MMcfe/d, up from about 11 MMcfe/d at this time last year.

ROCKY MOUNTAINS

Our gross production from the Monument Butte field has increased from 8,775 BOPD in January to a current rate of nearly 9,500 BOPD. We have been operating three rigs in the field, however a fourth rig has been secured and will be drilling by the end of July.

We recently entered into a joint exploration venture with Bill Barrett Group and will have a 40% interest in the Red River “B” play on 17,000 acres in the Williston Basin.

Third Quarter 2005 Estimates

Natural Gas Production and Pricing The Company’s natural gas production in the third quarter of 2005 is expected to be 49 - 54 Bcf (533 - 587 MMcf/d). The price the Company realizes for natural gas production from the Gulf of Mexico and onshore Gulf Coast, after basis differentials, transportation and handling charges, typically averages $0.15 - $0.20 less per MMBtu than the Henry Hub Index. Realized gas prices for the Company’s Mid-Continent properties, after basis differentials, transportation and handing charges, typically average $0.70 - $0.80 less per MMBtu than the Henry Hub Index. Hedging gains or losses will affect price realizations.

Crude Oil Production and Pricing The Company’s oil production, including international liftings, in the third quarter of 2005 is expected to be 2.2 - 2.4 million barrels (24,000 - 26,000 BOPD). Newfield expects to produce approximately 4,200 BOPD from its Malaysian operations. The timing of liftings in Malaysia may affect total reported production. The price the Company receives for Gulf Coast production typically averages about $2 per barrel below the NYMEX West Texas Intermediate (WTI) price. The price the Company receives for its production in the Rocky Mountains averages about $3 per barrel below WTI. Oil production from the Mid-Continent typically sells at a $1.00 - $1.50 per barrel discount to WTI. Oil production from Malaysia typically sells at Tapis, or about even with WTI. Hedging gains or losses will affect price realizations.

Lease Operating Expense and Production Taxes LOE is expected to be $46 - $51 million ($0.71 - $0.80 per Mcfe) in the third quarter of 2005. LOE guidance for the third quarter of 2005 includes $0.16 per Mcfe of well workover expense. Production taxes in the third quarter of 2005 are expected to be $17 - $19 million ($0.27 - $0.29 per Mcfe). These expenses vary and are subject to impact from, among other things, production volumes and commodity pricing, tax rates, service costs, the costs of goods and materials and workover activities.

General and Administrative Expense G&A expense for the third quarter of 2005 is expected to be $24 - $26 million ($0.36 - $0.40 per Mcfe), net of capitalized direct internal costs. Capitalized direct internal costs are expected to be $11 - $13 million. G&A expense includes stock and incentive compensation expense. Incentive compensation expense depends largely on adjusted net income (as defined in the Company’s incentive compensation plan), which excludes unrealized gains and losses on commodity derivatives.

Interest Expense The non-capitalized portion of the Company’s interest expense for the third quarter of 2005 is expected to be $6 - $7 million ($0.08 - $0.10 per Mcfe). As of July 25, 2005, Newfield had no outstanding borrowings under its credit arrangements. The remainder of long-term debt consists of four separate issuances of notes that in the aggregate total $875 million in principal amount. Capitalized interest for the third quarter of 2005 is expected to be about $11 - $12 million.

Income Taxes Including both current and deferred taxes, the Company expects its consolidated income tax rate in the third quarter of 2005 to be about 35 - 39%. About 75% of the tax provision is expected to be deferred.

Please see the tables below for our complete hedging positions.

Natural Gas Hedge Positions

The following hedge positions for the third quarter of 2005 and beyond are as of July 25, 2005:

Third Quarter 2005

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 11,806 MMMBtus | $6.40 | | — | | — | | — | | — |

| 18,495 MMMBtus | — | | — | | $5.74 — $7.87 | | $3.50 — $6.24 | | $4.16 — $9.00 |

| 10,800 MMMBtus | — | | $5.84 | | — | | $5.50 — $6.50 | | — |

| 6,150 MMMBtus* | — | | — | | $5.86 — $7.50 | | $5.50 — $6.15 | | $7.45 — $7.60 |

Fourth Quarter 2005

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 9,625 MMMBtus | $6.77 | | — | | — | | — | | — |

| 7,995 MMMBtus | — | | — | | $5.69 — $8.19 | | $3.50 — $6.24 | | $4.16 — $10.00 |

| 6,800 MMMBtus | — | | $6.62 | | — | | $5.50 — $7.50 | | — |

| 6,350 MMMBtus* | — | | — | | $6.48 — $10.64 | | $5.50 — $7.50 | | $7.45 — $14.50 |

First Quarter 2006

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 5,100 MMMBtus | $8.95 | | — | | — | | — | | — |

| 2,400 MMMBtus | — | | — | | $5.80 — $10.00 | | $5.80 | | $10.00 |

| 5,100 MMMBtus | — | | $7.55 | | — | | $7.50 — $7.65 | | — |

| 8,850 MMMBtus* | — | | — | | $7.06 — $12.12 | | $6.00 — $8.00 | | $10.00 — $14.50 |

*These 3-way collar contracts are standard natural gas collar contracts with respect to the periods, volumes and prices stated above. The contracts have floor and ceiling prices per MMMBtu as per the table above until the price drops below a weighted average price of $5.47 per MMMBtu. Below $5.47 per MMMBtu, these contracts effectively result in realized prices that are on average $1.07 per MMMBtu higher than the cash price that otherwise would have been realized.

Crude Oil Hedge Positions

The following hedge positions for the third quarter of 2005 and beyond are as of July 25, 2005:

Third Quarter 2005

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 635,000 Bbls | $33.25 | | — | | — | | — | | — |

| 681,000 Bbls | — | | — | | $40.20 — $57.45 | | $35.60 — $45.00 | | $48.00 — $64.00 |

| 304,000 Bbls** | — | | — | | $39.60 — $50.08 | | $35.00 — $46.00 | | $49.00 — $51.25 |

Fourth Quarter 2005

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 635,000 Bbls | $33.25 | | — | | — | | — | | — |

| 681,000 Bbls | — | | — | | $40.20 — $57.45 | | $35.60 — $45.00 | | $48.00 — $64.00 |

| 304,000 Bbls** | — | | — | | $39.60 — $50.08 | | $35.00 — $46.00 | | $49.00 — $51.25 |

First Quarter 2006

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 561,000 Bbls | $41.52 | | — | | — | | — | | — |

| 75,000 Bbls | — | | — | | $50.00 — $73.96 | | $50.00 | | $73.90 — $74.00 |

| 414,000 Bbls** | — | | — | | $45.96 — $63.91 | | $35.00 — $60.00 | | $50.50 — $80.00 |

Second Quarter 2006

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 565,000 Bbls | $41.58 | | — | | — | | — | | — |

| 75,000 Bbls | — | | — | | $50.00 — $73.96 | | $50.00 | | $73.90 — $74.00 |

| 417,000 Bbls** | — | | — | | $45.95 — $63.27 | | $35.00 — $60.00 | | $50.50 — $80.00 |

Third Quarter 2006

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 569,000 Bbls | $41.64 | | — | | — | | — | | — |

| 75,000 Bbls | — | | — | | $50.00 — $73.96 | | $50.00 | | $73.90 — $74.00 |

| 480,000 Bbls** | — | | — | | $44.69 — $62.21 | | $35.00 — $60.00 | | $50.50 — $80.00 |

Fourth Quarter 2006

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 569,000 Bbls | $41.64 | | — | | — | | — | | — |

| 75,000 Bbls | — | | — | | $50.00 — $73.96 | | $50.00 | | $73.90 — $74.00 |

| 480,000 Bbls** | — | | — | | $44.69 — $62.21 | | $35.00 — $60.00 | | $50.50 — $80.00 |

First Quarter 2007

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 120,000 Bbls | $27.00 | | — | | — | | — | | — |

| 810,000 Bbls** | — | | — | | $35.44 — $53.67 | | $32.00 — $55.00 | | $44.70 — $82.00 |

Second Quarter 2007

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 120,000 Bbls | $27.00 | | — | | — | | — | | — |

| 819,000 Bbls** | — | | — | | $35.44 — $53.67 | | $32.00 — $55.00 | | $44.70 — $82.00 |

Third Quarter 2007

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $35.44 — $53.67 | | $32.00 — $55.00 | | $44.70 — $82.00 |

Fourth Quarter 2007

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $35.44 — $53.67 | | $32.00 — $55.00 | | $44.70 — $82.00 |

First Quarter 2008

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 819,000 Bbls** | — | | — | | $33.00 — $50.29 | | $32.00 — $35.00 | | $49.50 — $52.90 |

Second Quarter 2008

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 819,000 Bbls** | — | | — | | $33.00 — $50.29 | | $32.00 — $35.00 | | $49.50 — $52.90 |

Third Quarter 2008

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $33.00 — $50.29 | | $32.00 — $35.00 | | $49.50 — $52.90 |

Fourth Quarter 2008

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $33.00 — $50.29 | | $32.00 — $35.00 | | $49.50 — $52.90 |

First Quarter 2009

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 810,000 Bbls** | — | | — | | $33.33 — $50.62 | | $32.00 — $36.00 | | $50.00 — $54.55 |

Second Quarter 2009

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 819,000 Bbls** | — | | — | | $33.33 — $50.62 | | $32.00 — $36.00 | | $50.00 — $54.55 |

Third Quarter 2009

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $33.33 — $50.62 | | $32.00 — $36.00 | | $50.00 — $54.55 |

Fourth Quarter 2009

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 828,000 Bbls** | — | | — | | $33.33 — $50.62 | | $32.00 — $36.00 | | $50.00 — $54.55 |

First Quarter 2010

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 900,000 Bbls** | — | | — | | $34.90 — $51.52 | | $32.00 — $38.00 | | $50.00 — $53.50 |

Second Quarter 2010

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 909,000 Bbls** | — | | — | | $34.90 — $51.52 | | $32.00 — $38.00 | | $50.00 — $53.50 |

Third Quarter 2010

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 918,000 Bbls** | — | | — | | $34.91 — $51.52 | | $32.00 — $38.00 | | $50.00 — $53.50 |

Fourth Quarter 2010

| | Weighted Average | | Range |

Volume | Fixed | | Floors | | Collars | | Floor | | Ceiling |

| 918,000 Bbls** | — | | — | | $34.91 — $51.52 | | $32.00 — $38.00 | | $50.00 — $53.50 |

**These 3-way collar contracts are standard crude oil collar contracts with respect to the periods, volumes and prices stated above. The contracts have floor and ceiling prices per barrel as per the table above until the price drops below a weighted average price of $45.88 per barrel. Below $45.88 per barrel, these contracts effectively result in realized prices that are on average $9.29 per barrel higher than the cash price that otherwise would have been realized.

The Company provides information regarding its outstanding hedging positions in its annual and quarterly reports filed with the SEC and in its electronic publication -- @NFX. This publication can be found on Newfield’s web page at http://www.newfld.com. Through the web page, you may elect to receive @NFX through e-mail distribution.

Newfield Exploration Company is an independent crude oil and natural gas exploration and production company. The Company relies on a proven growth strategy that includes balancing acquisitions with drill bit opportunities. Newfield’s areas of operation include the Gulf of Mexico, the U.S. onshore Gulf Coast, the Anadarko and Arkoma Basins of the Mid-Continent and the Uinta Basin of the Rocky Mountains. The Company has development projects underway offshore Malaysia, in the U.K. North Sea and Bohai Bay, China.

**The statements set forth in this publication regarding estimated or anticipated third quarter results and production volumes are forward looking and are based upon assumptions and anticipated results that are subject to numerous uncertainties. Actual results may vary significantly from those anticipated due to many factors, including drilling results, oil and gas prices, industry conditions, the prices of goods and services, the availability of drilling rigs and other support services, the availability of capital resources, labor conditions and other factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004. In addition, the drilling of oil and gas wells and the production of hydrocarbons are subject to governmental regulations and operating risks.