Exhibit 99.2

@NFX is periodically published to keep shareholders aware of current operating activities at Newfield. It may include estimates of expected production volumes, costs and expenses, recent changes to hedging positions and commodity pricing.

April 22, 2009

This edition of @NFX includes:

| · | 2009 FIRST QUARTER DRILLING ACTIVITY BY AREA |

| · | OPERATIONAL SUMMARIES BY GEOGRAPHIC REGION |

| UPDATED TABLES DETAILING COMPLETE HEDGE POSITIONS |

First Quarter 2009 Drilling Activity*

| | | | NFX Operated | | | | Non-Operated | | | | Gross Wells | | | | Dry Holes | |

| Mid-Continent | | | 22 | | | | 21 | | | | 43 | | | | 0 | |

| Rocky Mount. | | | 41 | | | | 3 | | | | 44 | | | | 0 | |

| Onshore GC | | | 11 | | | | 2 | | | | 13 | | | | 3 | |

| Gulf of Mexico | | | 2 | | | | 0 | | | | 2 | | | | 0 | |

| International | | | 1 | | | | 3 | | | | 4 | | | | 0 | |

| Total: | | | 77 | | | | 29 | | | | 106 | | | | 3 | |

* Represents a 97% success rate

KEY MESSAGES

| - | We are on track to deliver on our 2009 production growth target. Our guidance continues to call for 6-10% production growth over 2008 levels. |

| - | Our capital budget of $1.45 billion DOES NOT incorporate the significant service cost reductions we are seeing today. |

| - | Our cash flow in 2009 is well insulated by our hedges. Our 2009-2010 hedges have a mark-to-market value of $1.2 billion, including the $200 million realized in the first quarter of 2009. |

| - | Our diversified portfolio is an asset today and we possess exceptional “optionality.” We are shifting capital to ensure that we are funding the best opportunities based on oil and gas prices, changes in service costs and market demand. Our largest areas of operation are substantially held by production, which allows us to determine the timing and pace of development. |

MID-CONTINENT

Our fastest growing division over the last three years has been the Mid-Continent. Our gross operated production in the Mid-Continent recently set a new record of more than 400 MMcfe/d (nearly 300 MMcfe/d net). This includes a recent high in our Granite Wash play of 145 MMcfe/d gross.

Woodford Shale

We continue to optimize our drilling program in the Woodford. Its development has represented the largest portion of our annual capital expenditures for the last three years. We have 165,000 net acres, of which over 90% is “held-by-production,” providing us with control over timing of expenditures and the pace of drilling. Our average lateral length in 2009 is expected to be 5,000’ or greater, improving the efficiency of our operations. Approximately 80% of our wells in 2009 will be drilled from common pad locations.

We recently released an operated rig in the Woodford and are now running 11 rigs. Six of these remaining rigs come off of term contract during 2009. Our gross operated Woodford production is approximately 240 MMcfe/d. Due to the recent weakness in natural gas prices and a continuing decline in service costs, we are intentionally deferring new well completions. However, production from the Woodford is still expected to grow approximately 20% in 2009. Our working interest across the Woodford now averages 61% as compared to 58% at year-end 2008.

Gas sales will begin in June on the new Mid-Continent Express Pipeline (MEP), linking our Woodford production to Perryville, La. We have 300 MMcf/d of firm transportation on MEP that will reduce differentials to about half of the level we realized in the first quarter.

Granite Wash Play

Production from the Stiles Ranch field, located in the Texas Panhandle, recently set a record gross production rate of 145 MMcfe/d. We recently added a rig and are now running three operated rigs in the field, all of which are drilling horizontal wells. We have an approximate 80% interest in the field.

ROCKY MOUNTAINS

Monument Butte Field

Monument Butte oil sales are averaging 19,000 BOPD, up from 17,000 BOPD at year-end 2008. We continue to run three operated rigs (down from five in 2008). This three-rig program is expected to provide for modest production growth in 2009.

Differentials for our Black Wax crude oil have narrowed recently to approximately $12 per barrel compared to $16-$18 per barrel at year-end 2008.

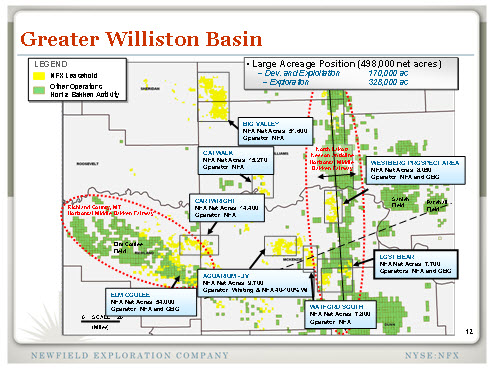

Williston Basin

We have a significant acreage position in the Williston Basin. We have nearly 500,000 net acres and are focused primarily on the Bakken Shale and Three Forks/Sanish formations. Based on our success to date, we have a growing inventory of locations in the region. We are operating a one-rig program in the Williston today.

We have drilled 10 wells (8 in the Bakken and 2 in the Sanish/Three Forks). The most recent wells are listed below:

| o | The Gladys 1-9H is a Bakken completion with a 24-hour average gross initial production (IP) rate of 1,328 BOPD. This was a 4,000’ lateral, located in McKenzie County, N.D. We operate the well with a 48% working interest. |

| o | The Wisness 1-4H is a Bakken completion with a 24-hour average gross IP rate of 1,256 BOPD. This was a 4,400’ lateral, located in McKenzie County, N.D. We operate the well with a 40% working interest. |

| o | The Moberg 1-29H is currently drilling the Sanish/Three Forks. The well is expected to have an 8,500’ lateral completion. We operate the well, located in McKenzie County, N. D., with a 72% working interest. |

Our recent drilling has focused in North Dakota on the Nesson Anticline and west of the Nesson. Complete drilling results are below:

| Well Name | Initial Rate | Target Zone |

| Olson 1-30H | 329 BOEPD | Bakken |

| Larsen 1-16H | 710 BOEPD | Bakken |

| Rolfsrud 1-32H | 590 BOEPD | Bakken |

| Wisness 1-21H | 538 BOEPD | Bakken |

| Jorgensen 1-10H | 911 BOEPD | Bakken |

| Jorgensen 1-4H | 622 BOEPD | Bakken |

| Jorgensen 1-15H | 1,010 BOEPD | Sanish/Three Forks |

| Lost Bridge 16-9H | 1,023 BOEPD | Sanish/Three Forks |

| Gladys 1-9H | 1,328 BOEPD | Bakken |

| Wisness 1-4H | 1,256 BOEPD | Bakken |

| Moberg 1-29H | Drilling | Sanish/Three Forks |

We are producing approximately 2,700 BOEPD net. Differentials in the Williston Basin today are less than $6 per barrel, significantly improved from year-end ’08.

INTERNATIONAL

Malaysia

We are producing more than 40,000 BOPD from seven shallow water oil fields on blocks, PM 318 and PM 323. Although planned activity levels were reduced in 2009 due to capital budget constraints, oil production is forecast to increase 10% over 2008 levels.

The PM 323 fields (East Belumut and Chermingat) are currently producing 13,000 BOPD gross. We have a 60% operated interest in PM 323.

We are proceeding with development of an additional fault block in the Penara Field in PM 318 with an NFX 50% working interest (2009 first production), the West Belumut satellite platform in PM 323 (2010 first production) and the field development plan for East Piatu Field in PM 329 (2011 first production – NFX 70% working interest).

We drilled the Paus-1 exploration well in February 2009 in deepwater Block 2C. The well made an encouraging natural gas find with several high quality reservoir sands in the objective interval. We are the operator with a 40% working interest. Other partners include Petronas Carigali (40%) and Mitsubishi (20%).

China

Current gross production from our fields in Bohai Bay is 19,000 BOPD, or approximately 2,000 BOPD net to our interest. We are making plans to drill an appraisal well to our 2008 discovery in Block 16/05 in the Pearl River Mouth Basin if an appropriate rig is secured. The LF 7-1-1 well will test an independent four-way closure downthrown to the LF 7-2 oil discovery. We have a 100% working interest in this well; CNOOC has a 51% back-in election to any commercial development.

2Q09 ESTIMATES

| | | 2Q09 Estimates | |

| | | Domestic | | | Int’l | | | Total | |

| Production/Liftings | | | | | | | | | |

| Natural gas – Bcf | | | 45.0 – 48.6 | | | | – | | | | 45.0 – 48.6 | |

| Oil and condensate – MMBbls | | | 1.5 – 1.7 | | | | 1.5 – 1.7 | | | | 3.0 – 3.4 | |

| Total Bcfe | | | 54.0 – 58.8 | | | | 9.0 – 10.2 | | | | 63.0 – 69.0 | |

| | | | | | | | | | | | | |

| Average Realized Prices | | | | | | | | | | | | |

| Natural gas – $/Mcf | | Note 1 | | | | | | | | | |

| Oil and condensate – $/Bbl | | Note 2 | | | Note 3 | | | | | |

| Mcf equivalent – $/Mcfe | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating Expenses: | | | | | | | | | | | | |

| Lease operating | | | | | | | | | | | | |

| Recurring ($MM) | | $ | 46.2 - $51.0 | | | $ | 15.4 - $17.0 | | | $ | 61.6 - $68.0 | |

| per/Mcfe | | $ | 0.86 - $0.87 | | | $ | 1.66 - $1.71 | | | $ | 0.97 - $0.99 | |

| Major (workover, repairs, etc.) ($MM) | | $ | 10.0 - $11.8 | | | $ | 1.1 - $1.3 | | | $ | 11.1 - $13.1 | |

| per/Mcfe | | $ | 0.18 - $0.20 | | | $ | 0.12 - $0.14 | | | $ | 0.17 - $0.19 | |

| | | | | | | | | | | | | |

Production and other taxes ($MM)Note 4 | | $ | 14.5 - $16.1 | | | $ | 5.0 - $5.5 | | | $ | 19.5 - $21.6 | |

| per/Mcfe | | $ | 0.27 - $0.28 | | | $ | 0.54 - $0.56 | | | $ | 0.30 - $0.32 | |

| | | | | | | | | | | | | |

| General and administrative (G&A), net ($MM) | | $ | 30.6 - $33.7 | | | $ | 1.4 - $1.6 | | | $ | 32.0 - $35.3 | |

| per/Mcfe | | $ | 0.57 - $0.58 | | | $ | 0.15 - $0.16 | | | $ | 0.50 - $0.52 | |

| | | | | | | | | | | | | |

| Capitalized internal costs ($MM) | | | | | | | | | | $ | (18.6 - $20.5 | ) |

| per/Mcfe | | | | | | | | | | $ | (0.28 – $0.30 | ) |

| | | | | | | | | | | | | |

| Interest expense ($MM) | | | | | | | | | | $ | 29.3 - $32.7 | |

| per/Mcfe | | | | | | | | | | $ | 0.46 - $0.48 | |

| | | | | | | | | | | | | |

| Capitalized interest ($MM) | | | | | | | | | | $ | (11.8 - $13.0 | ) |

| per/Mcfe | | | | | | | | | | $ | (0.18 - $0.20 | ) |

| | | | | | | | | | | | | |

Tax rate (%)Note 5 | | | | | | | | | | | 36-38 | |

| | | | | | | | | | | | | |

| Income taxes (%) | | | | | | | | | | | | |

| Current | | | | | | | | | | | 14% - 16 | % |

| Deferred | | | | | | | | | | | 84% - 86 | % |

| | | | | | | | | | | | | |

Note 1: Gas prices in the Mid-Continent, after basis differentials, transportation and handling charges, typically average 70 – 80% of the Henry Hub Index. Beginning late in the second quarter of 2009, our realized prices for Mid-Continent properties should improve to 80-85% of the Henry Hub Index as we begin to utilize our agreements that provide guaranteed pipeline capacity at a fixed price to move this natural gas production to the Perryville markets. Gas prices in the Gulf Coast, after basis differentials, transportation and handling charges, are expected to average $0.50 – $0.75 per MMBtu less than the Henry Hub Index. Note 2: Oil prices in the Gulf Coast typically average 90 – 95% of NYMEX WTI price. Rockies oil prices average about $12 - $14 per barrel below WTI. Oil production from the Mid-Continent typically averages 85 – 90% of WTI. Note 3: Oil in Malaysia typically sells at a slight discount to Tapis, or about 90% of WTI. Oil production from China typically sells at $8 – $10 per barrel below WTI. Note 4: Guidance for production taxes determined using $45/Bbl oil and $5/MMBtu gas. Note 5: Tax rate applied to earnings excluding unrealized gains or losses on commodity derivatives. |

NATURAL GAS HEDGE POSITIONS

Please see the tables below for our complete hedging positions.

The following hedge positions for the second quarter of 2009 and beyond are as of April 21, 2009:

Second Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 21,950 MMMBtus | | $ | 7.81 | | | | — | | | | — | | | | — | | | | — | |

| 13,485 MMMBtus | | | — | | | | — | | | $ | 8.00 — $11.83 | | | $ | 8.00 | | | $ | 8.97 — $14.37 | |

Third Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 22,150 MMMBtus | | $ | 7.81 | | | | — | | | | — | | | | — | | | | — | |

| 13,620 MMMBtus | | | — | | | | — | | | $ | 8.00 — $11.83 | | | $ | 8.00 | | | $ | 8.97 — $14.37 | |

Fourth Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 26,120 MMMBtus | | $ | 7.34 | | | | — | | | | — | | | | — | | | | — | |

| 8,435 MMMBtus | | | — | | | | — | | | $ | 8.23 — $11.20 | | | $ | 8.00 — $8.50 | | | $ | 8.97 — $14.37 | |

First Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 31,800 MMMBtus | | $ | 6.79 | | | | — | | | | — | | | | — | | | | — | |

| 5,700 MMMBtus | | | — | | | | — | | | $ | 8.50 — $10.44 | | | $ | 8.50 | | | $ | 10.00 — $11.00 | |

Second Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 27,570 MMMBtus | | $ | 6.44 | | | | — | | | | — | | | | — | | | | — | |

Third Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 27,840 MMMBtus | | $ | 6.44 | | | | — | | | | — | | | | — | | | | — | |

Fourth Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 22,180 MMMBtus | | $ | 6.47 | | | | — | | | | — | | | | — | | | | — | |

The following table details the expected impact to pre-tax income from the settlement of our derivative contracts, outlined above, at various NYMEX gas prices, net of premiums paid for these contracts (in millions).

| | | Gas Prices | |

| | | $ | 4.00 | | | $ | 5.00 | | | $ | 6.00 | | | $ | 7.00 | | | $ | 8.00 | | | $ | 9.00 | |

| 2009 | | | | | | | | | | | | | | | | | | | | | | | | |

| 2nd Quarter | | $ | 137 | | | $ | 102 | | | $ | 66 | | | $ | 31 | | | $ | (5 | ) | | $ | (27 | ) |

| 3rd Quarter | | $ | 138 | | | $ | 102 | | | $ | 67 | | | $ | 31 | | | $ | (5 | ) | | $ | (27 | ) |

| 4th Quarter | | $ | 123 | | | $ | 88 | | | $ | 54 | | | $ | 19 | | | $ | (15 | ) | | $ | (43 | ) |

| Total 2009 | | $ | 398 | | | $ | 292 | | | $ | 187 | | | $ | 81 | | | $ | (25 | ) | | $ | (97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | | | | | | | | | | | | | |

| 1st Quarter | | $ | 114 | | | $ | 77 | | | $ | 39 | | | $ | 2 | | | $ | (36 | ) | | $ | (70 | ) |

| 2nd Quarter | | $ | 67 | | | $ | 39 | | | $ | 12 | | | $ | (15 | ) | | $ | (43 | ) | | $ | (71 | ) |

| 3rd Quarter | | $ | 68 | | | $ | 40 | | | $ | 12 | | | $ | (16 | ) | | $ | (43 | ) | | $ | (71 | ) |

| 4th Quarter | | $ | 55 | | | $ | 33 | | | $ | 11 | | | $ | (12 | ) | | $ | (34 | ) | | $ | (56 | ) |

| Total 2010 | | $ | 304 | | | $ | 189 | | | $ | 74 | | | $ | (41 | ) | | $ | (156 | ) | | $ | (268 | ) |

In the Rocky Mountains, we hedged basis associated with 40% of the proved producing fields from January 2009 through full-year 2012. The weighted average hedged differential during this period was $(0.976) per Mmbtu.

Approximately 13% of our natural gas production correlates to Houston Ship Channel, 8% to Transco Zone 0, 36% to CenterPoint/East, 16% to Panhandle Eastern Pipeline, 7% to Waha, 9% to Colorado Interstate, 11% to others.

CRUDE OIL HEDGE POSITIONS

The following hedge positions for the second quarter of 2009 and beyond are as of April 21, 2009:

Second Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 819,000 Bbls | | $ | 128.93 | | | | — | | | | — | | | | — | | | | — | |

| 819,000 Bbls | | | — | | | $ | 107.11 | | | | — | | | $ | 104.50 — $109.75 | | | | — | |

Third Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 828,000 Bbls | | $ | 128.93 | | | | — | | | | — | | | | — | | | | — | |

| 828,000 Bbls | | | — | | | $ | 107.11 | | | | — | | | $ | 104.50 — $109.75 | | | | — | |

Fourth Quarter 2009

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 828,000 Bbls | | $ | 128.93 | | | | — | | | | — | | | | — | | | | — | |

| 828,000 Bbls | | | — | | | $ | 107.11 | | | | — | | | $ | 104.50 — $109.75 | | | | — | |

First Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 90,000 Bbls | | $ | 93.40 | | | | — | | | | — | | | | — | | | | — | |

| 810,000 Bbls | | | — | | | | — | | | $ | 127.97— $170.00 | | | $ | 125.50 — $130.50 | | | $ | 170.00 | |

Second Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 90,000 Bbls | | $ | 93.40 | | | | — | | | | — | | | | — | | | | — | |

| 819,000 Bbls | | | — | | | | — | | | $ | 127.97— $170.00 | | | $ | 125.50 — $130.50 | | | $ | 170.00 | |

Third Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 90,000 Bbls | | $ | 93.40 | | | | — | | | | — | | | | — | | | | — | |

| 828,000 Bbls | | | — | | | | — | | | $ | 127.97— $170.00 | | | $ | 125.50 — $130.50 | | | $ | 170.00 | |

Fourth Quarter 2010

| | | Weighted Average | | | Range | |

| Volume | | Fixed | | | Floors | | | Collars | | | Floor | | | Ceiling | |

| 90,000 Bbls | | $ | 93.40 | | | | — | | | | — | | | | — | | | | — | |

| 828,000 Bbls | | | — | | | | — | | | $ | 127.97— $170.00 | | | $ | 125.50 — $130.50 | | | $ | 170.00 | |

The following table details the expected impact to pre-tax income from the settlement of our derivative contracts, outlined above, at various NYMEX oil prices, net of premiums paid for these contracts (in millions).

Oil Prices | | |

| | | $ | 40.00 | | | $ | 50.00 | | | $ | 60.00 | | | $ | 70.00 | | $ | 80.00 | |

| 2009 | | | | | | | | | | | | | | | | | | | | |

| 2nd Quarter | | $ | 122 | | | $ | 105 | | | $ | 89 | | | $ | 72 | | $ | 56 | |

| 3rd Quarter | | $ | 123 | | | $ | 107 | | | $ | 90 | | | $ | 73 | | $ | 57 | |

| 4th Quarter | | $ | 145 | | | $ | 134 | | | $ | 122 | | | $ | 112 | | $ | 101 | |

| Total 2009 | | $ | 510 | | | $ | 450 | | | $ | 389 | | | $ | 329 | | $ | 269 | |

| | | | | | | | | | | | | | | | | | | | | |

| 2010 | | | | | | | | | | | | | | | | | | | | |

| 1st Quarter | | $ | 69 | | | $ | 59 | | | $ | 50 | | | $ | 42 | | $ | 33 | |

| 2nd Quarter | | $ | 69 | | | $ | 60 | | | $ | 51 | | | $ | 42 | | $ | 33 | |

| 3rd Quarter | | $ | 70 | | | $ | 61 | | | $ | 52 | | | $ | 42 | | $ | 33 | |

| 4th Quarter | | $ | 70 | | | $ | 61 | | | $ | 52 | | | $ | 42 | | $ | 33 | |

| Total 2010 | | $ | 278 | | | $ | 241 | | | $ | 205 | | | $ | 168 | | $ | 132 | |

We provide information regarding our outstanding hedging positions in our annual and quarterly reports filed with the SEC and in our electronic publication -- @NFX. This publication can be found on Newfield’s web page at http://www.newfield.com. Through the web page, you may elect to receive @NFX through e-mail distribution.

Newfield Exploration Company is an independent crude oil and natural gas exploration and production company. The Company relies on a proven growth strategy of growing reserves through an active drilling program and select acquisitions. Newfield's domestic areas of operation include the Anadarko and Arkoma Basins of the Mid-Continent, the Rocky Mountains, onshore Texas and the Gulf of Mexico. The Company has international operations in Malaysia and China.

FORWARD LOOKING STATEMENTS

**This publication contains forward-looking information. All information other than historical facts included in this publication, such as information regarding estimated or anticipated second quarter 2009 results, estimated 2009 capital expenditures, cash flow, production and cost reductions, drilling and development plans and the timing of activities, is forward-looking information. Although Newfield believes that these expectations are reasonable, this information is based upon assumptions and anticipated results that are subject to numerous uncertainties and risks. Actual results may vary significantly from those anticipated due to many factors, including drilling results, oil and gas prices, industry conditions, the prices of goods and services, the availability of drilling rigs and other support services, the availability of refining capacity for the crude oil Newfield produces from its Monument Butte field in Utah, the availability and cost of capital resources, labor conditions and severe weather conditions (such as hurricanes). In addition, the drilling of oil and gas wells and the production of hydrocarbons are subject to governmental regulations and operating risks.