Searchable text section of graphics shown above

[LOGO]

[LOGO] | | Universidade Anhembi Morumbi Joins

Laureate International Universities |

| |

| December 1, 2005 |

Safe Harbor Statement

This presentation includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements may involve risk and uncertainties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those described in the forward-looking statements:

The following factors might cause such a difference:

• The Company’s operations can be materially affected by competition in its target markets and by overall market conditions, among other factors.

• The Company’s foreign operations, in particular, are subject to political, economic, legal, regulatory and currency-related risks.

Additional information regarding these risk factors and uncertainties is detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Forms 10-K and 10-Q, available for viewing on our website. (To access this information on our website, please click on “Investor Relations,” “SEC Filings”).

[LOGO]

2

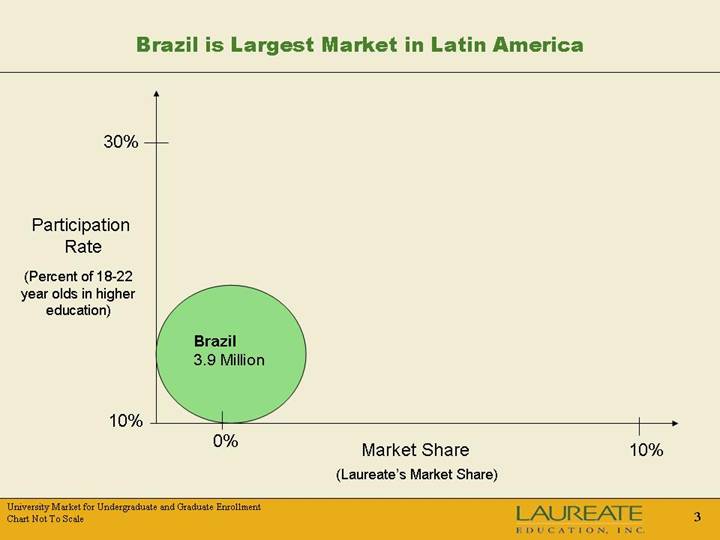

Brazil is Largest Market in Latin America

[CHART]

University Market for Undergraduate and Graduate Enrollment

Chart Not To Scale

3

[CHART]

University Market for Undergraduate and Graduate Enrollment

Chart Not To Scale

4

Attractive Macroeconomic Environment

• Strong GDP growth

• Improving currency stability

• Declining inflation

• Fiscal discipline

• Government debt reduction

5

Strong Growth Potential and High Participation of Private Universities

• Enrollments in private universities have grown 2x faster than public universities

• Increasing participation rates will continue to drive total growth in the future

• Ministry of Education expects participation rate increase to 30% by 2010

Millions | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | CAGR | |

| | | | | | | | | | | | | | | |

Total Enrollment | | 2.1 | | 2.4 | | 2.7 | | 3.0 | | 3.5 | | 3.9 | | 13 | % |

Growth | | | | 11 | % | 14 | % | 12 | % | 15 | % | 12 | % | | |

| | | | | | | | | | | | | | | |

Public | | 0.8 | | 0.8 | | 0.9 | | 0.9 | | 1.1 | | 1.1 | | 7 | % |

Private | | 1.3 | | 1.5 | | 1.8 | | 2.1 | | 2.4 | | 2.8 | | 16 | % |

| | | | | | | | | | | | | | | |

Private Share | | 62 | % | 65 | % | 67 | % | 69 | % | 70 | % | 71 | % | | |

| | | | | | | | | | | | | | | |

Population (18-24) | | 24 | | 24 | | 24 | | 24 | | 25 | | 25 | | | |

Participation Rate | | 9 | % | 10 | % | 11 | % | 12 | % | 14 | % | 16 | % | | |

Sources: MEC; INEP

6

Laureate Executes Disciplined Search and Entry Strategy

• Laureate has studied the Brazil market opportunity since 1999

• Six years understanding the market, regulations, and prospects

• As of 2005, we determined company was well prepared to enter Brazil

• Macroeconomic improvements

• Selected right moment for entry as macroeconomic characteristics strengthened

• Regulatory improvements

• New tax structure

7

Utilized rigorous selection model with the following characteristics:

• Multiple campus platform

• Strong academic reputation

• Capable management team in place

• Sao Paulo preferred entry city

• University Status most desirable

8

University Status Most Desirable

• There are 3 types of post-secondary institutions in Brazil

• University (163)

• University Center (81)

• Faculdade (1,522)

• University Status provides advantage

• Autonomy to open new campuses in home city

• Autonomy to launch new careers

• Streamlined process for new campus in same state

• New University application necessary for campuses in other states

9

Introducing Universidade Anhembi Morumbi (“AM”)

[LOGO]

• Sizable and scalable platform

• Fifth largest private university in Sao Paulo market

• 21,500 Students, 4 Campuses

• Average annual tuition between $3,000 -$3,500

• University Status – offers prestige and flexibility to grow

• Profitable, well-managed operation

• Strong brand and program offering

• 5 largest programs (advertising, tourism, business, hotel mgt, fashion) highly ranked by Melhores Universidades

• Positioned to grow in all segments of Brazil market (full-time, technical, online, working adult)

• Respected and well-connected partner in Professor Gabriel Rodrigues, founder of Anhembi

• President of the Association of Private Post-Secondary Institutions in Brazil (ABMES)

• Strong fit and synergistic opportunities with Laureate Network

10

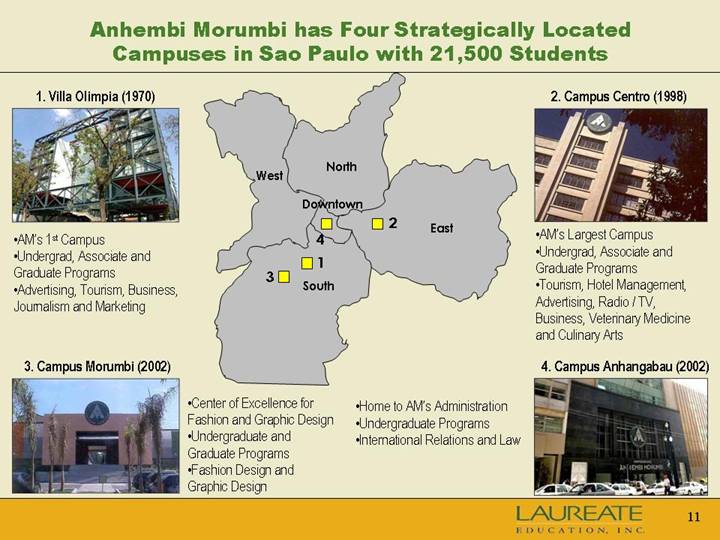

Anhembi Morumbi has Four Strategically Located Campuses in Sao Paulo with 21,500 Students

[GRAPHIC]

1. Villa Olimpia (1970)

[GRAPHIC]

• AM’s 1st Campus

• Undergrad, Associate and Graduate Programs

• Advertising, Tourism, Business, Journalism and Marketing

2. Campus Centro (1998)

[GRAPHIC]

• AM’s Largest Campus

• Undergrad, Associate and Graduate Programs

• Tourism, Hotel Management, Advertising, Radio / TV, Business, Veterinary Medicine and Culinary Arts

3. Campus Morumbi (2002)

[GRAPHIC]

• Center of Excellence for Fashion and Graphic Design

• Undergraduate and Graduate Programs

• Fashion Design and Graphic Design

4. Campus Anhangabau (2002)

[GRAPHIC]

• Home to AM’s Administration

• Undergraduate Programs

• International Relations and Law

11

Universidade Anhembi Morumbi Agreement

• 51% initial purchase for $69 million

• $54 million in cash

• $15 million in 3-year local currency seller note

• Our partner, a key figure in Brazil’s higher education community, to continue involvement with AM

• AM leases real estate from the founder

12

Laureate Model Produces Growth and Market Leadership

Andean Region

Enrollment:

[CHART]

Revenue in Constant Currency:

[CHART]

Mexico/Central America Region

Enrollment:

[CHART]

Revenue in Constant Currency:

[CHART]

* September 30, 2005 TTM

Includes Acquisitions

13

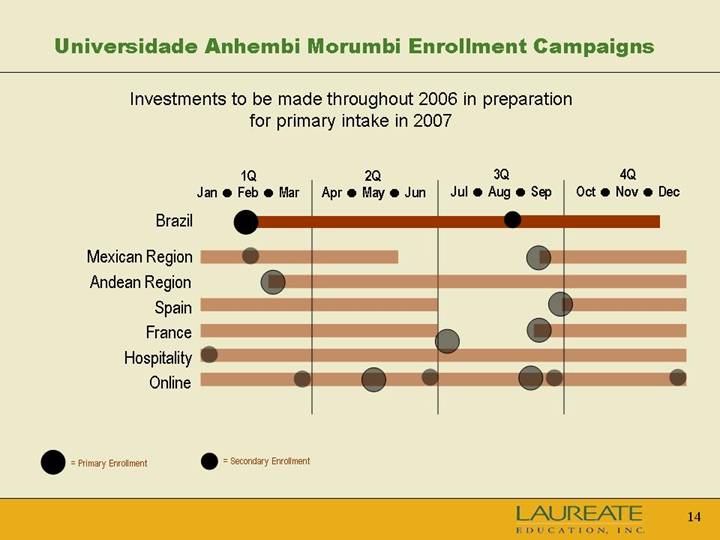

Universidade Anhembi Morumbi Enrollment Campaigns

Investments to be made throughout 2006 in preparation for primary intake in 2007

| | 1Q | | 2Q | | 3Q | | 4Q | |

| | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | |

Brazil | | | | * | | | | | | | | | | | | ** | | | | | | | | | |

Mexican Region | | | | ** | | | | | | | | | | | | | | * | | | | | | | |

Andean Region | | | | | | * | | | | | | | | | | | | | | | | | | | |

Spain | | | | | | | | | | | | | | | | | | * | | | | | | | |

France | | | | | | | | | | | | | | * | | | | * | | | | | | | |

Hospitality | | ** | | | | | | | | | | | | | | | | | | | | | | | |

Online | | | | | | ** | | | | * | | ** | | | | | | * | ** | | | | | | ** | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

* = Primary Enrollment

** = Secondary Enrollment

14

Universidade Anhembi Morumbi Growth Initiatives

• Add new programs at existing locations

• Launch network initiatives

• Expand campus locations

• Enter new market segments

• Develop online initiatives

15

Key Takeaways

• Brazil is largest market in Latin America – next engine of growth for Laureate

• Anhembi Morumbi is best platform for Laureate’s entry into Brazil – scale, status, management, brand, positioning

• Timing to enter Brazil is right – solid market growth, greater macro stability, multiple opportunities for organic and acquisitive growth

• Partner and Rector is greatly respected in education sector

• Strong fit and synergistic opportunities with Laureate Network

• 2006 is key transition year to prepare for growth in 2007 and beyond

16