Laureate Education, Inc.Earnings Conference Call and Webcast Fourth Quarter and Full-Year 2005 February 27, 2006

Safe Harbor Statement This presentation includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements may involve risk and uncertainties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those described in the forward-looking statements: The following factors might cause such a difference: • The Company’s operations can be materially affected by competition in its target markets and by overall market conditions, among other factors.

• The Company’s foreign operations, in particular, are subject to political, economic, legal, regulatory and currency-related risks. Additional information regarding these risk factors and uncertainties is detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Forms 10-K and 10-Q, available for viewing on our website. (To access this information on our website, please click on “Investor Relations,” “SEC Filings”).

2005 Highlights – Delivering Growth and Results

| • | Laureate’s Worldwide Student Enrollment - 217,429 |

| – | 41% Increase in Total Campus-Based Enrollment |

| – | 27% Increase in Total Online Enrollment |

| – | New Enrollment Growth: 25% (30% including acquisitions) |

| – | Total Enrollment Growth: 17% (43% including acquisitions) |

| – | Brazil Entry with Anhembi Morumbi Acquisition |

| – | Honduras Entry with UNITEC Acquisition |

| – | Addition of Torreon and Hermosillo (UNO) Campuses, Mexico |

| – | New Enrollment Growth: 36% (36% including acquisitions) |

| – | Total Enrollment Growth: 6% (29% including acquisitions) |

| – | Cyprus College Acquisition |

| • | Online Higher Education |

| – | New Enrollment Growth: 37% |

| – | Total Enrollment Growth: 27% (41% at Walden University) |

2005 Highlights – Network and Management Initiatives

| – | U.S. and Spanish dual-degree programs launched throughout Latin America |

| – | Glion Hospitality Management programs now offered at 6 campuses in Mexico |

| – | Over 750 students studied abroad within the network in 2005 |

| – | Shared Best Practices in marketing, operations, and technology |

| • | Building Bench Strength Worldwide: |

| • | Appointment of Isabel Aguilera to Board of Directors |

| • | Rosemarie Mecca joined Laureate as new EVP/CFO |

| • | Daniel Nickel joined Laureate as EVP, Corporate Operations |

| • | Jorge Selume selected to lead Andean Region |

| • | High Product and Student Quality: |

| – | Walden’s industry-leading cohort default rate 1.2% |

| – | Of private universities in Mexico, UVM has the second highest number of program-level accreditations |

| • | 23 programs (out of 34) accredited by independent agencies |

Key Campus-Based Successes in 2005 Working-Adults Grow to 16% of Total Campus-Based Enrollment First Mover in current markets Product leverages facilities, administration, and program content Working-adult is precursor to online

UVM Ranked within Top 10 Best Universities in Mexico for Second Year by AC Nielsen ECE Ranked within Top 10 Graduate Engineering Schools in France by Le Point Magazine New Country Entry into Brazil, Honduras, and Cyprus

Plus, Successful Organic Growth Excluding acquisitions, campus-based revenue increased 19%

Key Online Successes in 2005 Walden University’s Cohort Default Rate 1.2% Investments in Online Higher Education Opened enrollment advisor center in Phoenix, AZ Brand advertising doubled aided awareness as well as improved faculty recruitment efforts and faculty quality Pursuing Additional Professional Accreditations Commission on Collegiate Nursing Education (CCNE), Council on Education for Public Health (CEPH), and Counseling and Related Educational Programs (CACREP)

Launched New Programs & Specializations EdD. Specialization in Administration MSN - RN to MSN track MS Mental Health Counseling BS Early Childhood Education

Year 2000: Building The Network 5 Countries 5 Institutions 15 Campuses and Distance Learning 54,800 Students CANTER UNITED STATES LES ROCHES HOTEL MANAGEMENT SCHOOL SWITZERLAND UNIVERSIDAD EUROPEA DE MADRID (“UEM”) SPAIN WORLDWIDE HEADQUARTERS BALTIMORE, MD UNIVERSIDAD DEL VALLE DE MEXICO (“UVM”) MEXICO UNIVERSIDAD DE LAS AMERICAS (“UDLA”) CHILE

Year 2005: International University Network 15 Countries 24 Institutions 51 Campuses and Online 217,000 Students INSTITUT FRANCAIS DE GESTION (“IFG”) And ECOLE SUPERIEURE DU COMMERCE EXTERIEUR (“ESCE”)

And ECOLE CENTRALE D’ELECTRONIQUE FRANCE Laureate Online Education NETHERLANDS GLION HOTEL SCHOOL (“GLION”) SWITZERLAND Laureate Online Education WALDEN UNIVERSITY UNITED STATES UNIVERSIDAD EUROPEA DE MADRID (“UEM”) And INSTITUTE FOR EXECUTIVE DEVELOPMENT (“IEDE”) SPAIN LES ROCHES HOTEL MANAGEMENT SCHOOL SWITZERLAND CYPRUS COLLEGE CYPRUS WORLDWIDE HEADQUARTERS BALTIMORE, MD LES ROCHES - MARBELLA SPAIN UNIVERSIDAD INTERAMERICANA COSTA RICA & PANAMA UNIVERSIDAD DEL VALLE DE MEXICO (“UVM”) MEXICO UNIVERSIDAD TECNOLOGICA CENTROAMERICANA (“UNITEC”) HONDURAS UNIVERSIDAD DE LAS AMERICAS (“UDLA”) ECUADOR ULACIT PANAMA LES ROCHES JIN JIANG INTERNATIONAL HOTEL MANAGEMENT COLLEGE CHINAUNIVERSIDADE ANHEMBI MORUMBI BRAZIL UNIVERSIDAD PERUANA DE CIENCIAS APLICADAS (“UPC”) PERU UNIVERSIDAD DE LAS AMERICAS (“UDLA”) CHILE UNIVERSIDAD NACIONAL ANDRES BELLO (“UNAB”) CHILE ACADEMIA DE IDIOMAS Y ESTUDIOS PROFESIONALES (“AIEP”) CHILE

Laureate 2000-2005 Enrollment 32% CAGR Revenue 37% CAGR Operating Income (1) 46% CAGR (1) Excludes Corporate G&A to allow for comparability prior to sale of K-12 business and excludes Non-Cash Compensation

Distinguishing Characteristics Global Network and Brand Laureate International Universities Strong local brands Accreditation at Highest Level Diversification By Country, market segment, and degree offerings First Mover Advantage Selecting the best acquisitions in each market Lessons learned and applied Management Team Proven, disciplined, and experienced at all levels Industry-Leading Retention and Length of Stay Program length of up to 6 years

Forward Strategy and Objectives in 2006 Expand Capacity at Existing Locations France, Peru, Ecuador, and Mexico/Central America Add 3-4 New Campuses (includes Build or Buy) Continue Preparations for China Entry Launch New Network Programs Expand study abroad and double-degree programs Increase programs with shared curriculum Introduce Additional Online Initiatives Throughout Network

2006 Financial Outlook (Excludes Acquisitions) Revenue:$1.08 - 1.15 Billion An increase of 23% to 31% over 2005 14%-16% Campus-Based total enrollment growth 25+% Online total enrollment growth 4%-5% Price improvement Margin Improvement(1) : 60 - 120 bps Campus-based operational leverage Online margin improvement of 200 bps Earnings Per Share(2) : $2.05 - $2.15 An increase of 23% to 30% over 2005 Effect of SFAS123(R) (Per Share): ($0.10) - ($0.12) 2007 Outlook to be Announced in July 2006 (1) Margin improvement (operating income) includes Corporate G&A. (2) Earnings Per Share Outlook excludes stock options expense. Fully diluted weighted averages shares outstanding are expected to be 53.6 million for the year ended December 31, 2006.

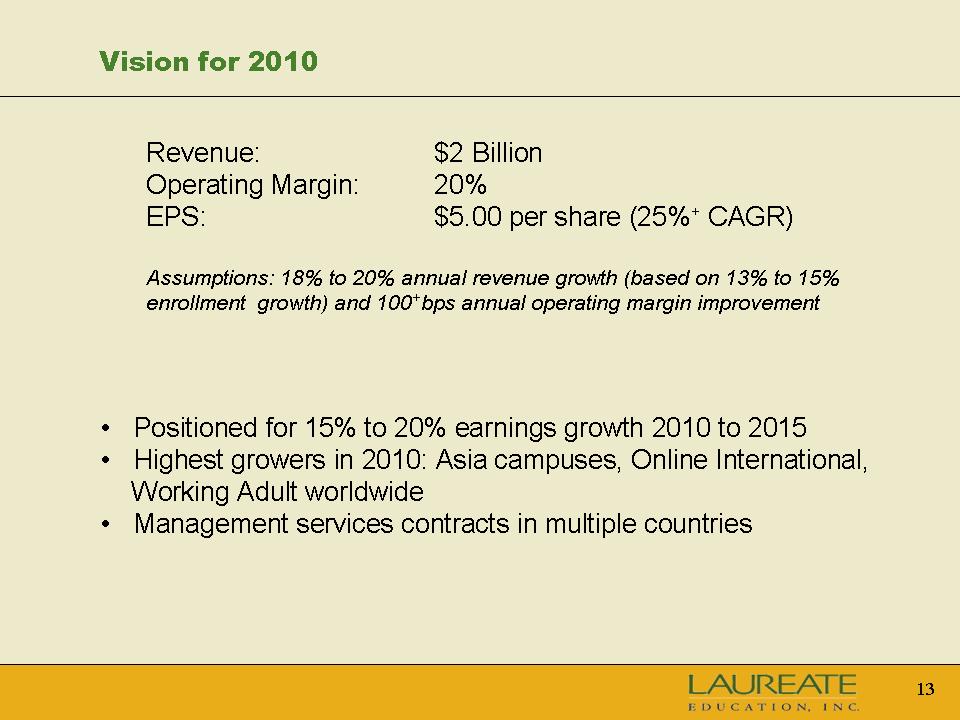

Vision for 2010 Revenue: $2 Billion Operating Margin: 20% EPS: $5.00 per share (25%+ CAGR) Assumptions: 18% to 20% annual revenue growth (based on 13% to 15% enrollment growth) and 100+bps annual operating margin improvement Positioned for 15% to 20% earnings growth 2010 to 2015 Highest growers in 2010: Asia campuses, Online International, Working Adult worldwide Management services contracts in multiple countries

Fourth Quarter 2005 Financial Summary Laureate reported earnings of $0.91 per diluted share in its seasonally strongest and most significant quarter Results in line with Company’s previously issued financial outlook Industry-leading predictability and visibility Strong 3Q 2005 enrollment High retention Program lengths of up to 6 years Earnings leverage on campus growth and G&A Company met or exceeded expectations for the quarter and full-year while investing for future growth Major investment in management Development of new academic programs and student services Investing in online initiatives and infrastructure worldwide Continuing investment in new market entry

Full-Year 2005 Financial Summary Reported 2005 earnings of $1.65 per diluted share 29% EPS growth ($1.65 in 2005 compared to $1.28 in 2004 - excluding the early repayment of K-12 seller note and UEM land divestment) Mid-point of previously issued financial outlook (which was increased by $0.02 in March 2005) Company operating margins increased from 14.1% to 14.9% in 2005 Latin America operating profit increased from 23.7% to 24.5% Europe declined 310 bps primarily due to the acquisition of IFG Online margins remained strong at 15%, while Company made substantial investment in Walden brand and enrollment advisors G&A was 2.9% percent of revenue in 2005 Balance Sheet at Year End 2005 (unaudited): Cash: $110 Million Debt: $228 Million Depreciation and Amortization: $51 Million

Non-Cash Compensation In 2005, $4.6 million (approximately $0.07 per share) of expenses related to equity based compensation were reported as operating expenses in a separate line item - “Non-Cash Stock Compensation Expense”. The Company’s historical financial statements and outlook already include charges associate with restricted stock. 2005 2006 (est.)Restricted Stock: $0.07 $0.14 In 2006, in accordance with SFAS123(R), the charges for stock options will be reported as a operating expense. 2005 2006 (est.) Other Equity Compensation (“stock options”): $0.07 $0.10 - $0.12 In the Company’s financial tables, “Segment Operating Profit (Loss)” will be reported with and without stock options expense. Laureate’s 2006 EPS and Margin Outlook contains estimates for restricted stock and does not contain the estimates for stock options expense. Stock options expense outlook is provided separately. Additionally, 2006 segment operating profit will be reported with and without this adjustment.

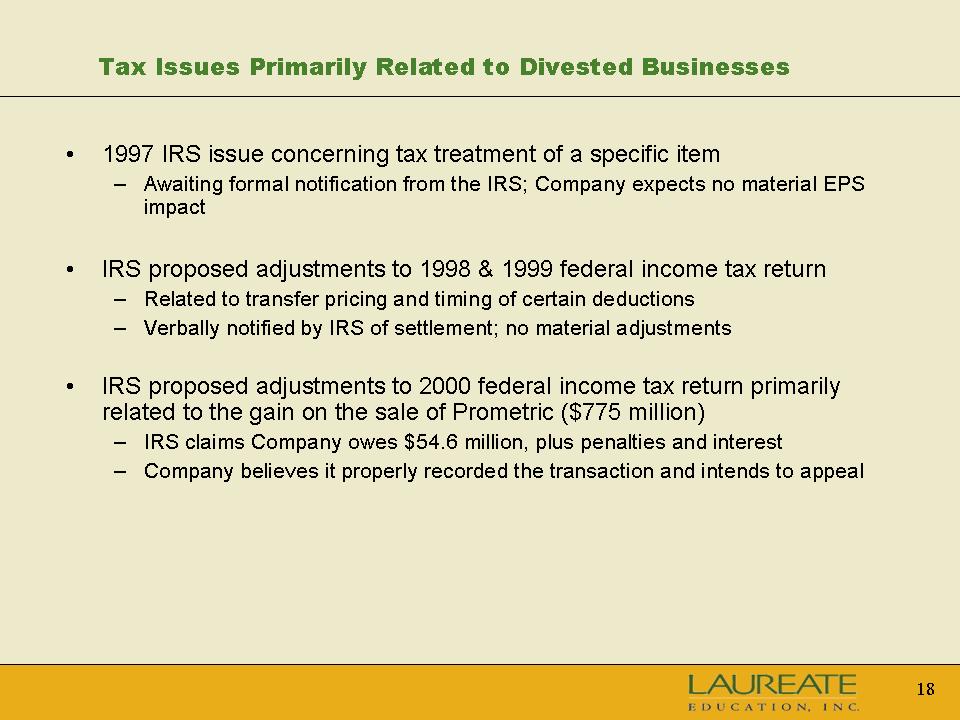

Tax Issues Primarily Related to Divested Businesses 1997 IRS issue concerning tax treatment of a specific item Awaiting formal notification from the IRS; Company expects no material EPS impact IRS proposed adjustments to 1998 & 1999 federal income tax return Related to transfer pricing and timing of certain deductions Verbally notified by IRS of settlement; no material adjustments IRS proposed adjustments to 2000 federal income tax return primarily related to the gain on the sale of Prometric ($775 million) IRS claims Company owes $54.6 million, plus penalties and interest Company believes it properly recorded the transaction and intends to appeal

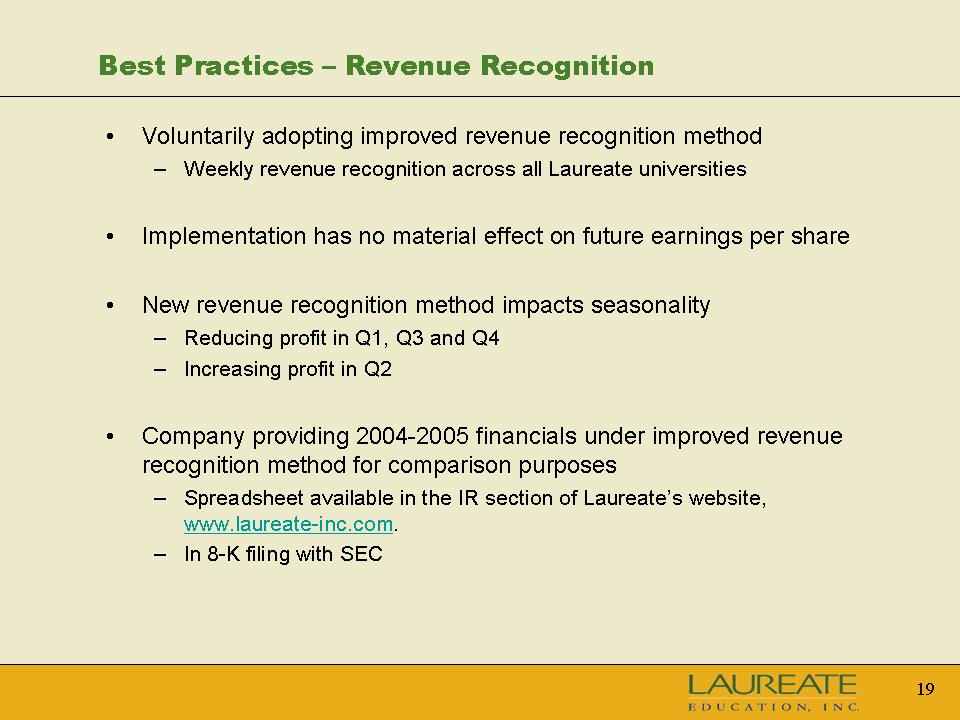

Best Practices - Revenue Recognition Voluntarily adopting improved revenue recognition method Weekly revenue recognition across all Laureate universities Implementation has no material effect on future earnings per share New revenue recognition method impacts seasonality Reducing profit in Q1, Q3 and Q4 Increasing profit in Q2 Company providing 2004-2005 financials under improved revenue recognition method for comparison purposes Spreadsheet available in the IR section of Laureate’s website, www.laureate-inc.com. In 8-K filing with SEC

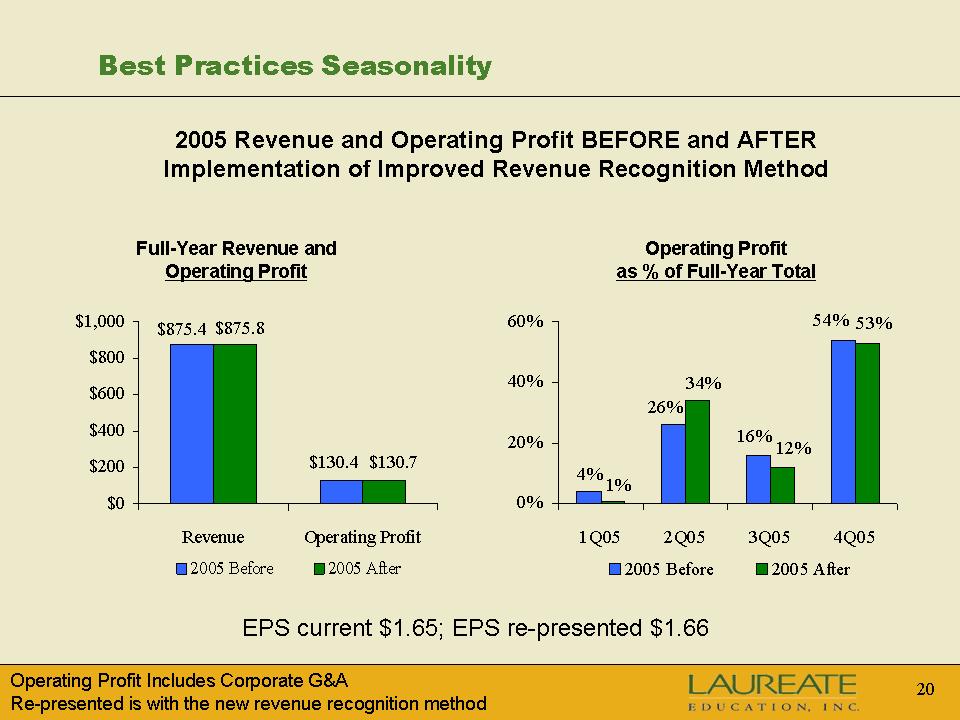

Best Practices Seasonality 2005 Revenue and Operating Profit BEFORE and AFTER Implementation of Improved Revenue Recognition Method Full-Year Revenue and Operating Profit

Operating Profit as % of Full-Year Total EPS current $1.65; EPS re-presented $1.66 Operating Profit Includes Corporate G&A Re-presented is with the new revenue recognition method

| | Revenue | Operating Profit |

| 2005 Before | 875.4 | 130.4 |

| 2005 After | 875.8 | 130.7 |

| | 1Q05 | 2Q05 | 3Q05 | 4Q05 |

| 2005 Before | 4% | 26% | 16% | 54% |

| 2005 After | 1% | 34% | 12% | 53% |

First Quarter 2006 Financial Outlook Revenue ($ in millions) Campus-Based Revenue: $165 - $180 Online Revenue: $50 - $55 Total Revenue: $215 - $235 Operating Margin Campus-Based: 3% - 4% Online: 7% - 8% Corporate G&A Expense: ~$9 Diluted Earnings Per Share(1): ($0.01) - ($0.03) Effect of SFAS123(R) (Per Share): ($0.02) to ($0.03)

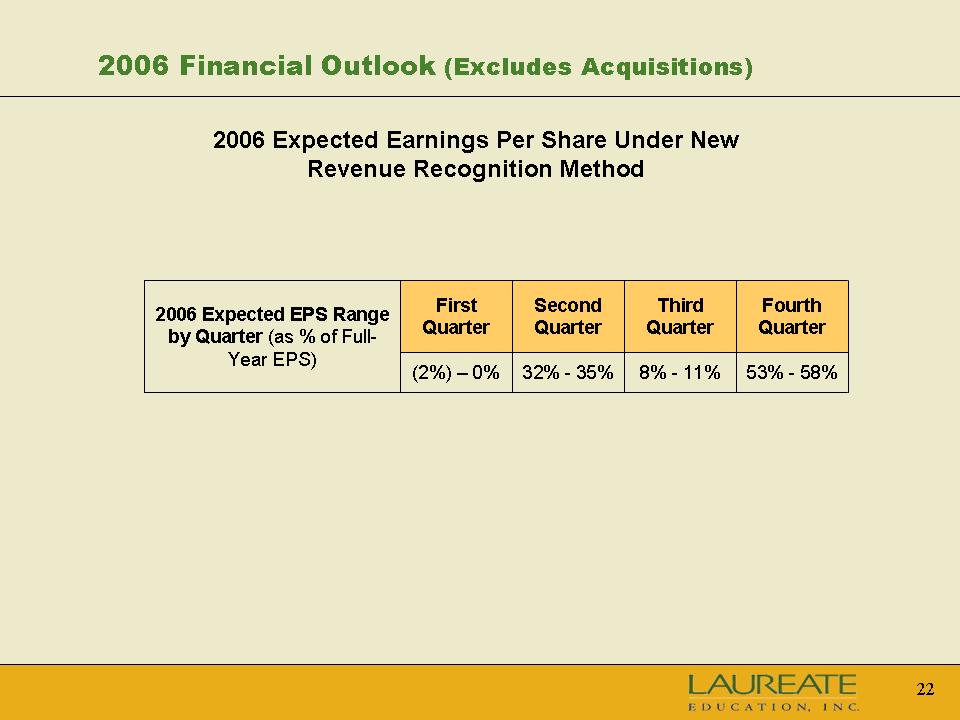

2006 Financial Outlook (Excludes Acquisitions) 2006 Expected Earnings Per Share Under New Revenue Recognition Method

2006 Expected EPS Range by Quarter (as % of Full-Year EPS) | First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

| (2%) - 0% | 32% - 35% | 8% - 11% | 53% - 58% |

2006 Financial Outlook (Excludes Acquisitions) Re-presented 2006 2005 % Change Revenue ($ in millions): $1,080 - 1,150 $875.8 23%-31% 14%-16% Campus-Based total enroll. growth

25+% Online total enrollment growth 4%-5% Price improvement Margin Improvement(1) : 60 - 120 bps 105bps Campus-based operational leverage Online margin improvement of 200 bps Earnings Per Share(2) : $2.05 - $2.15 $1.66 23%-30% Effect of SFAS123(R) (Per Share): ($0.10) - ($0.12) ($0.07)