Exhibit 99.02

Laureate Education, Inc. Earnings Conference Call and Webcast Second Quarter 2006 July 20, 2006

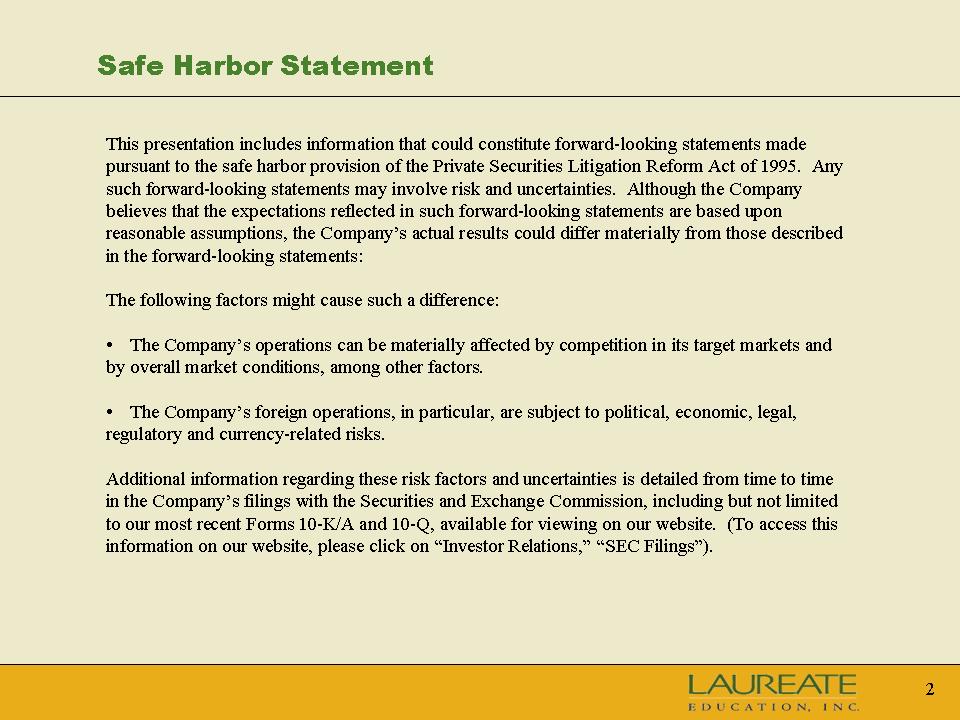

Safe Harbor Statement This presentation includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements may involve risk and uncertainties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those described in the forward-looking statements: The following factors might cause such a difference: The Company’s operations can be materially affected by competition in its target markets and by overall market conditions, among other factors. The Company’s foreign operations, in particular, are subject to political, economic, legal, regulatory and currency-related risks. Additional information regarding these risk factors and uncertainties is detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Forms 10-K/A and 10-Q, available for viewing on our website. (To access this information on our website, please click on “Investor Relations,” “SEC Filings”).

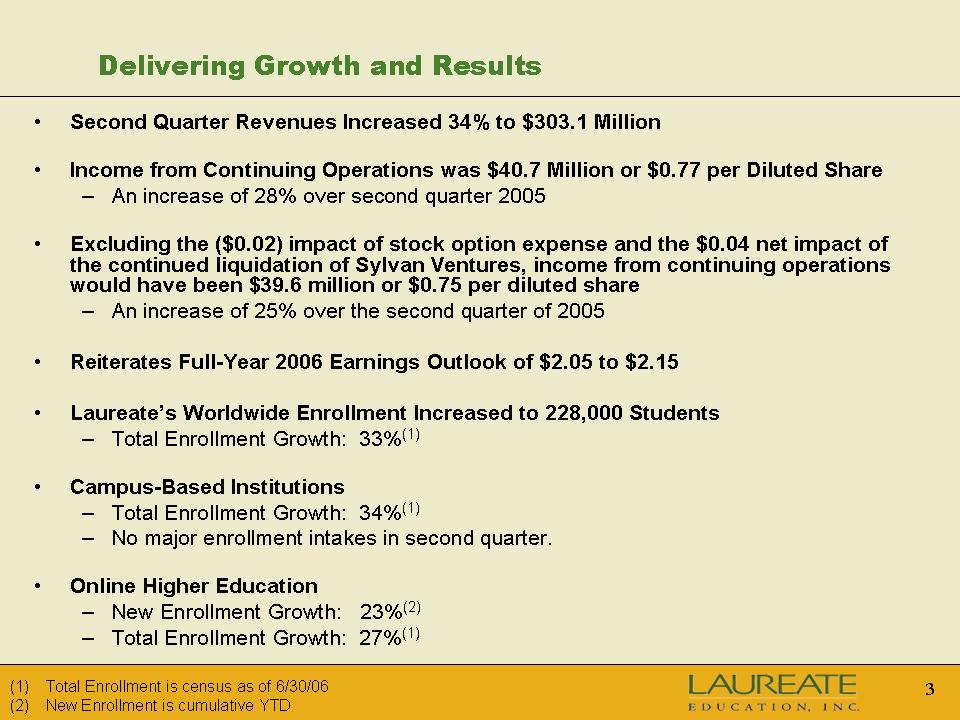

Delivering Growth and Results Second Quarter Revenues Increased 34% to $303.1 Million Income from Continuing Operations was $40.7 Million or $0.77 per Diluted Share An increase of 28% over second quarter 2005 Excluding the ($0.02) impact of stock option expense and the $0.04 net impact of the continued liquidation of Sylvan Ventures, income from continuing operations would have been $39.6 million or $0.75 per diluted share an increase of 25% over the second quarter of 2005 Reiterates Full-Year 2006 Earnings Outlook of $2.05 to $2.15 Laureate’s Worldwide Enrollment Increased to 228,000 Students Total Enrollment Growth: 33%(1) Campus-Based Institutions Total Enrollment Growth: 34%(1) No major enrollment intakes in second quarter. Online Higher Education New Enrollment Growth: 23%(2) Total Enrollment Growth: 27%(1) New Enrollment is cumulative YTD Total Enrollment is census as of 6/30/06

Delivering Growth and Results Second Quarter Revenues Increased 34% to $303.1 Million Income from Continuing Operations was $40.7 Million or $0.77 per Diluted Share An increase of 28% over second quarter 2005 Excluding the ($0.02) impact of stock option expense and the $0.04 net impact of the continued liquidation of Sylvan Ventures, income from continuing operations would have been $39.6 million or $0.75 per diluted share An increase of 25% over the second quarter of 2005 Reiterates Full-Year 2006 Earnings Outlook of $2.05 to $2.15 Laureate’s Worldwide Enrollment Increased to 228,000 Students Total Enrollment Growth: 33%(1) Campus-Based Institutions Total Enrollment Growth: 34%(1) No major enrollment intakes in second quarter. Online Higher Education New Enrollment Growth: 23%(2) Total Enrollment Growth: 27%(1) Total Enrollment is census as of 6/30/06 New Enrollment is cumulative YTD

Key Online Successes – Q2 2006 Online Higher Education New Enrollment Growth: 23%(2) Total Enrollment Growth: 27%(1) Online Growth Strategy Proceeding as Planned Conversion and retention rates show continued strength Diversification of marketing channels continues Expansion Through New Programs and Partners Focus on MSED in Leadership and on Masters in Early Childhood Development Kendall College is new partner for Canter Early Childhood Development Expect partnership enrollment increases in select geographies and programs New Programs: Masters in Public Health (University of Liverpool) and Doctorate in Nursing (Walden) Continued Strong Growth in Online International Walden University and University of Liverpool

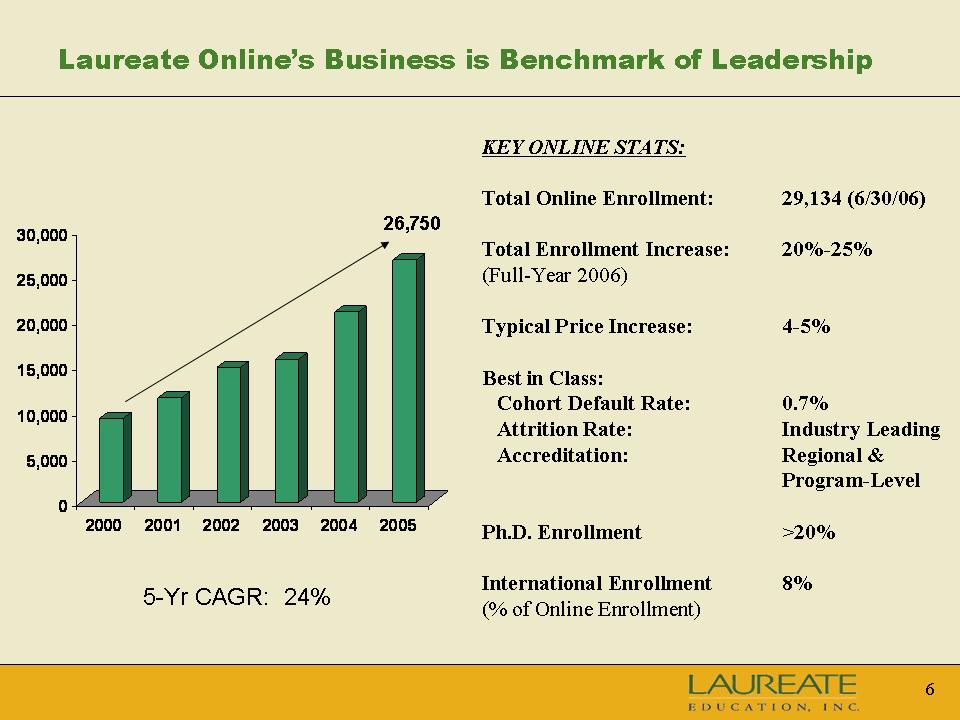

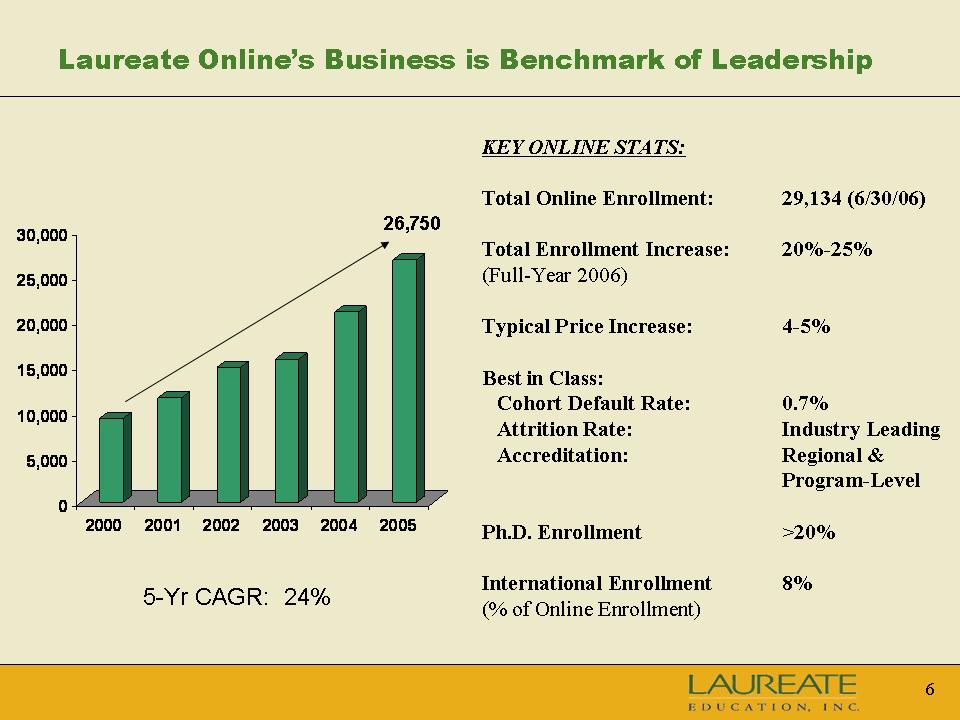

Laureate Online’s Business is Benchmark of Leadership 5-Yr CAGR: 24% 26,750 KEY ONLINE STATS: Total Online Enrollment:29,134 (6/30/06) Total Enrollment Increase:20%-25% (Full-Year 2006) Typical Price Increase:4-5% Best in Class: Cohort Default Rate:0.7% Attrition Rate:Industry Leading Accreditation:Regional & Program-Level Ph.D. Enrollment>20% International Enrollment8% (% of Online Enrollment)

Online Positioned for Growth and Margin Improvement Online 2006 new enrollment forecast per Q1 conference New student enrollment 2Q:high-teens (vs. a reported 23%) call(1) New student enrollment 3Q: low double-digits New student enrollment 4Q: high-teens to low-twenties Operating profit improvement of 200 bps in 2006 Continued improvement in conversion rates Realizing the return on major investments in infrastructure and brand

Leveraging fixed costs over larger student base Long-term target margins: mid-twenties Increased investment in International Online

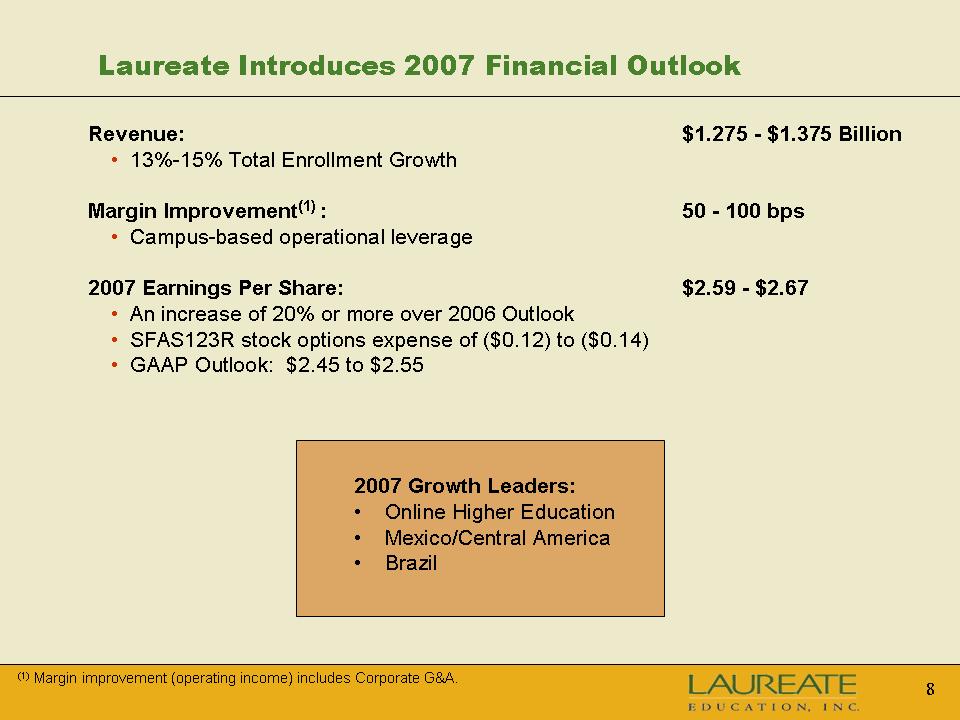

Laureate Introduces 2007 Financial Outlook Revenue:$1.275 - $1.375 Billion 13%-15% Total Enrollment Growth Margin Improvement(1) 50 - 100 bps 2007 Earnings Per Share: An increase of 20% or more over 2006 Outlook SFAS123R stock options expense of ($0.12) to ($0.14) GAAP Outlook: $2.45 to $2.55 2007 Growth Leaders: Online Higher Education Mexico/Central America Brazil Margin improvement (operating income) includes Corporate G&A.

Laureate Education, Inc. Financial Overview

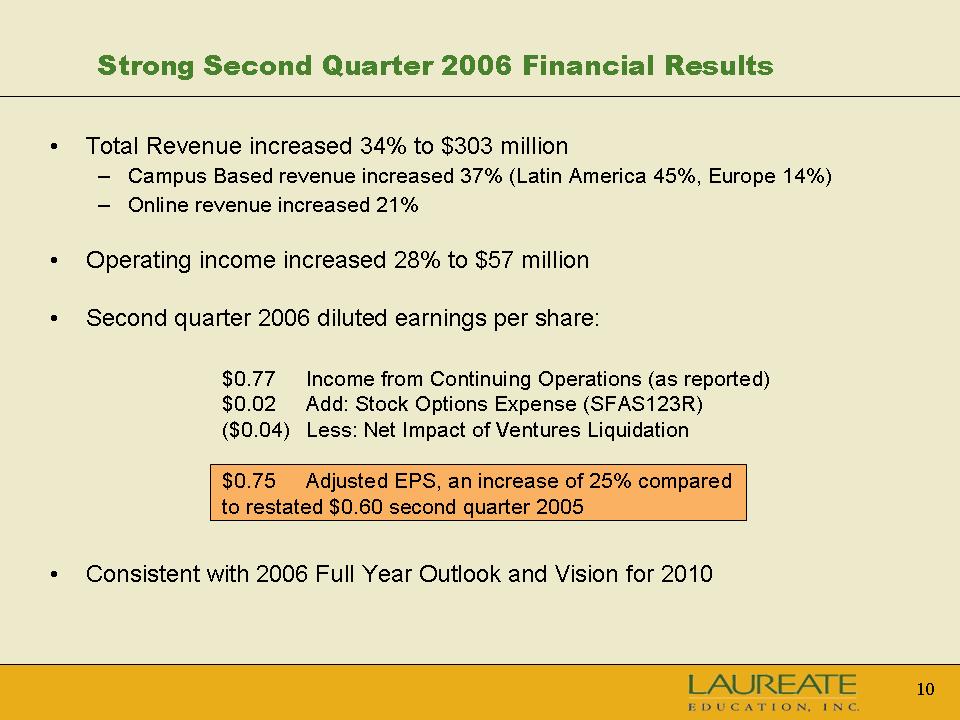

Strong Second Quarter 2006 Financial Results Total Revenue increased 34% to $303 million Campus Based revenue increased 37% (Latin America 45%, Europe 14%) Online revenue increased 21% Operating income increased 28% to $57 million Second quarter 2006 diluted earnings per share: $0.77Income from Continuing Operations (as reported) $0.02Add: Stock Options Expense (SFAS123R) ($0.04)Less: Net Impact of Ventures Liquidation $0.75Adjusted EPS, an increase of 25% compared to restated $0.60 second quarter 2005 Consistent with 2006 Full Year Outlook and Vision for 2010

Third Quarter 2006 Financial Outlook Revenue ($ in millions) Campus-Based Revenue: $185-$205 Online Revenue:$55 - $60 Total Revenue: $240 - $265 Operating Margin Campus-Based: 8% - 9% Online:20% - 22% Corporate G&A Expense: ~$10 Diluted Earnings Per Share(1):$0.19-$0.21Excludes Effect of SFAS123(R) (Per Share): ($0.02) to ($0.03) Third Quarter Guidance Consistent with Seasonality: Issued on 2/27/2006: 2006 Expected EPS(1) Seasonality by Quarter (as % of Full-Year EPS) First QuarterSecond QuarterThird QuarterFourth Quarter (2%) – 0%32% - 35%8% - 11%53% - 58% Earnings Per Share Outlook excludes stock options expense. Fully-diluted weighted average shares outstanding are expected to be 53.3 million for the third quarter 2006.

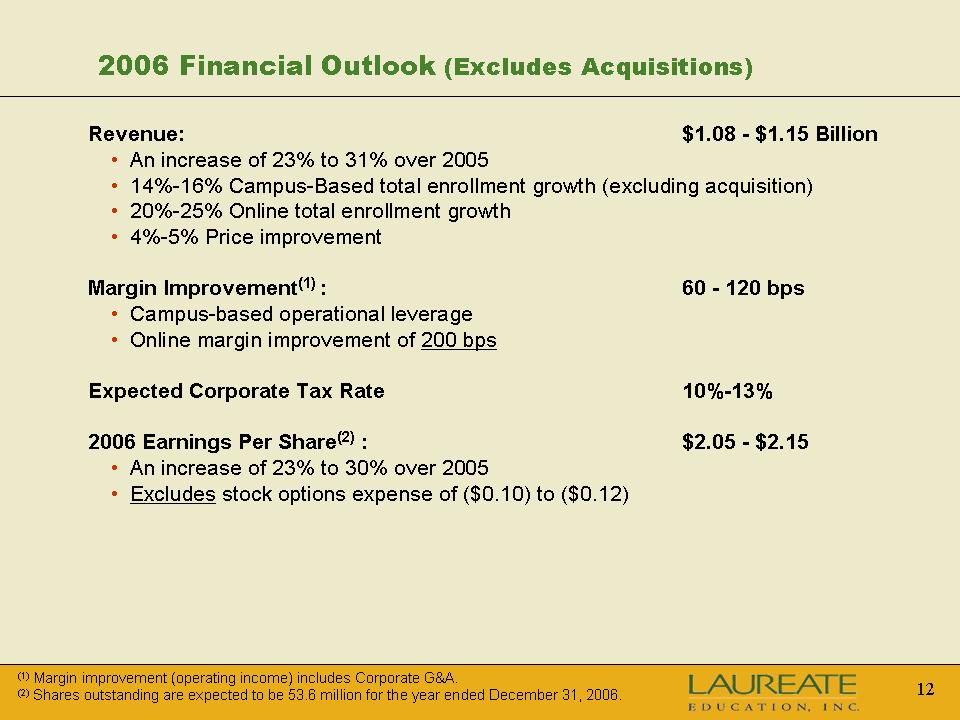

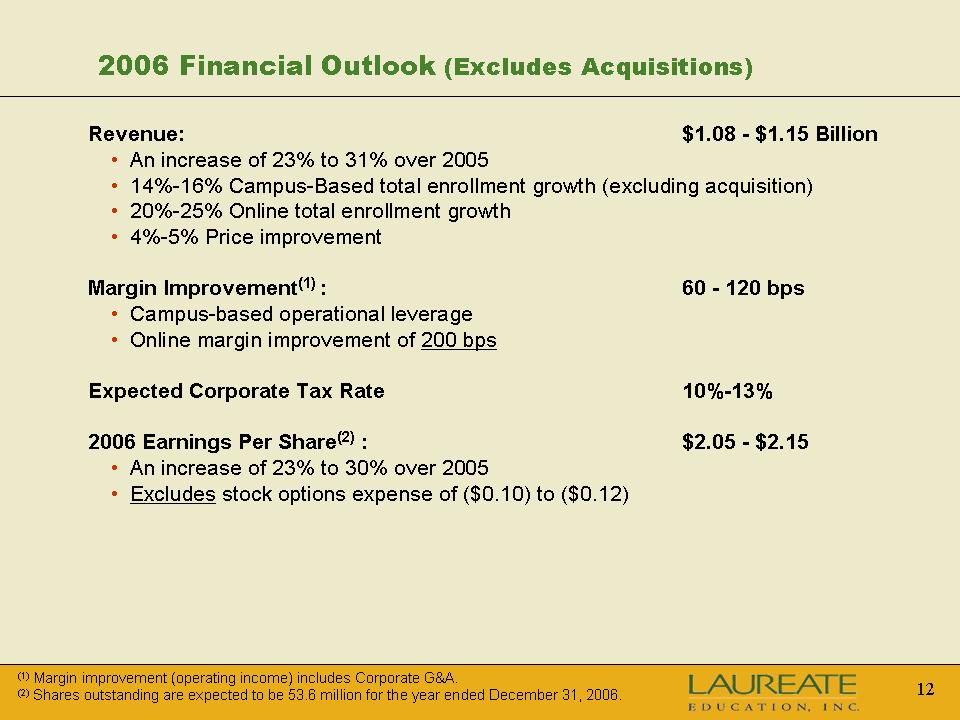

2006 Financial Outlook (Excludes Acquisitions) Revenue:$1.08 - $1.15 Billion An increase of 23% to 31% over 2005 14%-16% Campus-Based total enrollment growth (excluding acquisition) 20%-25% Online total enrollment growth 4%-5% Price improvement Margin Improvement(1) : 60 - 120 bps Campus-based operational leverage Online margin improvement of 200 bps Expected Corporate Tax Rate10%-13% 2006 Earnings Per Share(2) : $2.05 - $2.15 An increase of 23% to 30% over 2005 Excludes stock options expense of ($0.10) to ($0.12) (1) Margin improvement (operating income) includes Corporate G&A. (2) Shares outstanding are expected to be 53.6 million for the year ended December 31, 2006.

Laureate Education, Inc. Summary

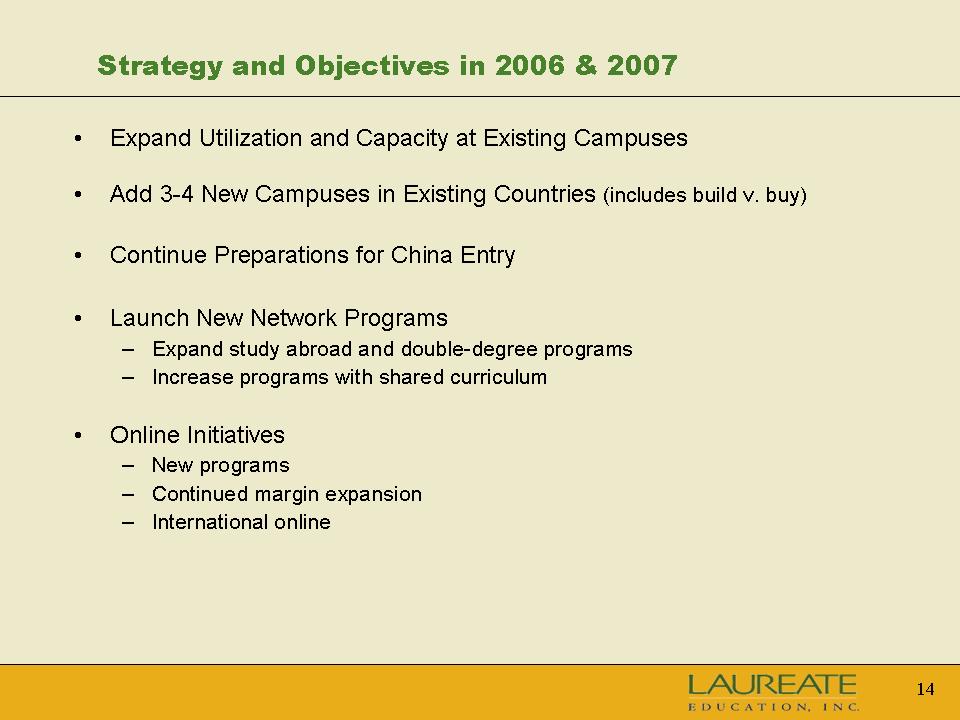

Strategy and Objectives in 2006 & 2007 Expand Utilization and Capacity at Existing Campuses Add 3-4 New Campuses in Existing Countries (includes build v. buy) Continue Preparations for China Entry Launch New Network Programs Expand study abroad and double-degree programs Increase programs with shared curriculum Online Initiatives New programs Continued margin expansion International online

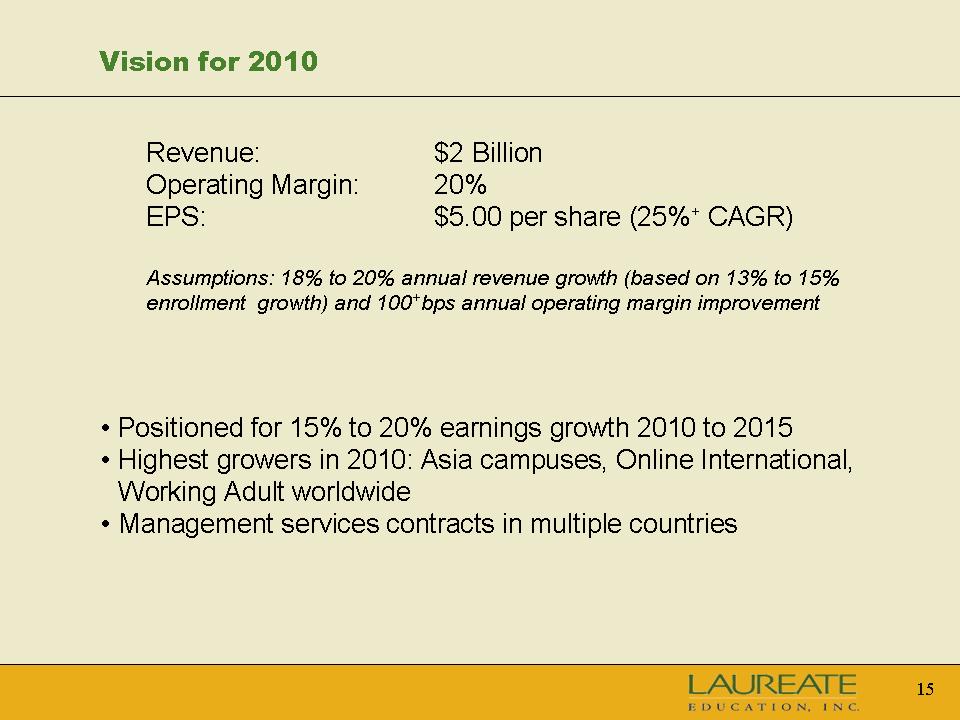

Vision for 2010 Revenue:$2 Billion Operating Margin:20% EPS:$5.00 per share (25%+ CAGR) Assumptions: 18% to 20% annual revenue growth (based on 13% to 15% enrollment growth) and 100+bps annual operating margin improvement Positioned for 15% to 20% earnings growth 2010 to 2015 Highest growers in 2010: Asia campuses, Online International, Working Adult worldwide Management services contracts in multiple countries