Exhibit 99.02

Laureate Education, Imc. Earnings Conference Call and Webcast Third Quarter 2006 October 19, 2006

Safe Harbor Statement This presentation includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements may involve risk and uncertainties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those described in the forward-looking statements: The following factors might cause such a difference: • The Company’s operations can be materially affected by competition in its target markets and by overall market conditions, among other factors. • The Company’s foreign operations, in particular, are subject to political, economic, legal, regulatory and currency-related risks. Additional information regarding these risk factors and uncertainties is detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Forms 10-K/A and 10-Q, available for viewing on our website. (To access this information on our website, please click on “Investor Relations,” “SEC Filings”).

Robust Growth Driven by Strong Student Enrollment New Student Enrollment is YTD, reported as of 10/18/2006 and 10/19/2005, respectively. Total Student Enrollment is census, reported as of 10/18/2006 and 10/19/2005, respectively. Acquisitions (less than 1 year) include the following: Cyprus College and Anhembi Morumbi (Brazil). • Total revenue increased 35% to $260.9 million • Laureate reported EPS of $0.19 in the third quarter 2006 - Excluding stock option expense, EPS would have been $0.22, an increase of 29% over the same period of 2005. • Over 240,000 Students Enrolled Worldwide - New Enrollment Growth: 24% (14% excluding acquisitions) - Total Enrollment Growth: 27% (14% excluding acquisitions) • Campus-Based Growth: - New Enrollment: 28% (15% excluding acquisitions) - Total Enrollment: 28% (13% excluding acquisitions) • Latin America Expansion Continues - Mexico/Central America as growth leader with 25% new student enrollment growth • Increased New Enrollment Growth in Europe - Improvement led by Les Roches & Glion in Switzerland, as well as UEM in Spain

Third Quarter Highlights Support Long-Term Plan • Online Growth: - New Enrollment: 10% - Total Enrollment: 20% • Online Growth, Conversion Rate and Student Retention Show Continued Strength - Diversification of online marketing channels continues as expected - Strong third quarter online margin improvement supports expected full year margin improvement of approximately 300 bps - International Online expansion continues • Concluded Purchase of Remaining 20% Interest in Chilean Businesses - Pursuing additional opportunities for growth and improved returns - Transition plan in place

Recent Management Additions • Jorge Brake has been hired as President and CEO of Laureate Education’s Mexico and Central America Region. Mr. Brake brings extensive management, marketing and product development experience to Laureate, having served as President and CEO of Procter & Gamble in Mexico and Central America. • Gary Wojtaszek has been hired Senior Vice President - Treasurer for Laureate Education. Mr. Wojtaszek was previously Vice President of Finance and Principal Accounting Officer of Agere Systems, a global semi-conductor manufacturer with operations throughout North America, Europe and Asia with responsibilities for the treasury, controllership and tax functions. • Cristina O’Naghten, CPA, has been hired as Vice President of Internal Audit for Laureate Education. Mrs. O’Naghten brings over 20 years of financial and audit experience to Laureate, having recently served as Audit Services Director for Latin America, Africa, and Middle East Region of General Motors Corporation. • Anthony Viola, CPA, has been hired as Senior Vice President of Tax for Laureate Education. Mr. Viola most recently served as the Vice President of Taxes for Sodexho, a $6.5 billion management services subsidiary of Sodexho Alliance.

Fundamentals of 2006 EPS Guidance 14%-16% Campus-Based total enrollment growth (excluding acquisitions) 20%+ Online total enrollment growth 4%-5% Price improvement Campus maturation (58 Campuses Worldwide) Campus Life-Cycle: • Performing: 25 • Developing: 25 • New: 8 Online margin improvement Fundamentals of 2006 EPS Guidance Company Updates Full-Year 2006 Outlook; Reiterates 2007 Earnings Outlook

Strategy and Objectives in 2006 & 2007 • Expand Utilization and Capacity at Existing Campuses • Add 3-4 New Campuses in Existing Countries (includes build v. buy) • Further Acquisitions in Brazil • China Entry Strategy • 1-2 New Countries • Online Initiatives - New programs - Continued margin expansion - International online

Laureate Education, Inc. Latin America Update

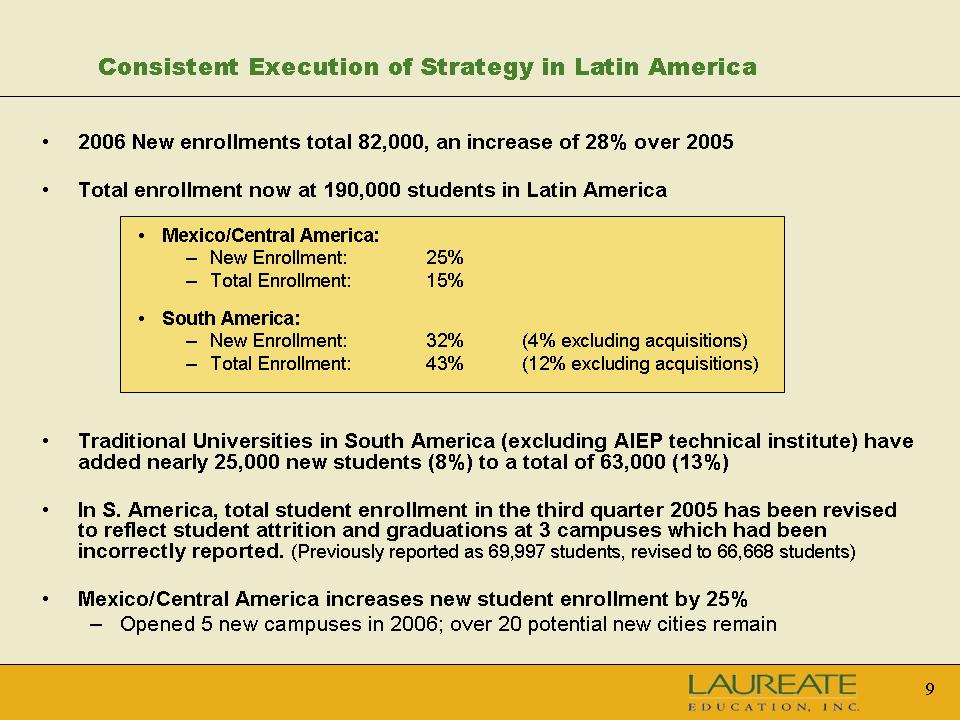

Consistent Execution of Strategy in Latin America • 2006 New enrollments total 82,000, an increase of 28% over 2005 • Total enrollment now at 190,000 students in Latin America • Mexico/Central America: - New Enrollment: 25% - Total Enrollment: 15% • South America: - New Enrollment: 32% (4% excluding acquisitions) - Total Enrollment: 43% (12% excluding acquisitions) • Traditional Universities in South America (excluding AIEP technical institute) have added nearly 25,000 new students (8%) to a total of 63,000 (13%) • In S. America, total student enrollment in the third quarter 2005 has been revised to reflect student attrition and graduations at 3 campuses which had been incorrectly reported. (Previously reported as 69,997 students, revised to 66,668 students) • Mexico/Central America increases new student enrollment by 25% - Opened 5 new campuses in 2006; over 20 potential new cities remain

Consistent Execution of Strategy in Latin America • Continued Progress with Working Adult Segment - Working adult students (students age 25+) experience high growth rates • Preparations at Anhembi Morumbi, in Brazil - Enrollment campaign underway for February intake

Laureate Education, Inc. Financial Overview

Strong Third Quarter 2006 Financial Results • Third quarter 2006 diluted earnings per share: • Total Revenue increased 35% to $260.9 million - Campus Based revenue increased 36% (Latin America 35%, Europe 41%) - Online revenue increased 31% • Operating income decreased $1.9 million - Chilean severance - Cyprus impact on seasonality - Stock option expense (“123R”) Adjusted for the above, operating income would have increased 37% y-o-y • Consistent with 2006 Full Year EPS Outlook $0.19 Income from Continuing Operations (as reported) $0.03 Stock Options Expense (SFAS123R) $0.02 Net Chilean Buyout Impact Strong Third Quarter 2006 Financial Results $0.24 Adjusted EPS, an increase of 41% compared to restated $0.17 third quarter 2005

Margin Analysis 3Q '06 Chile Brazil Cyprus 3Q '06 Reported FAS 123R Severance Impact Impact Underlying LATIN AMERICA 17.9% 0.1% 2.2% 2.1% 22.3% EUROPE -37.7% 0.4% 5.5% -31.8%

Strong Third Quarter 2006 Financial Position • Total cash and marketable securities $173.6 million • Total company debt $463.9 million - Company intends to expand current revolving credit facility to $350 million • Cash flow from operations was $134 million (YTD) • Depreciation and amortization expense was $46 million (YTD) • Capital expenditures were $143 million (YTD)

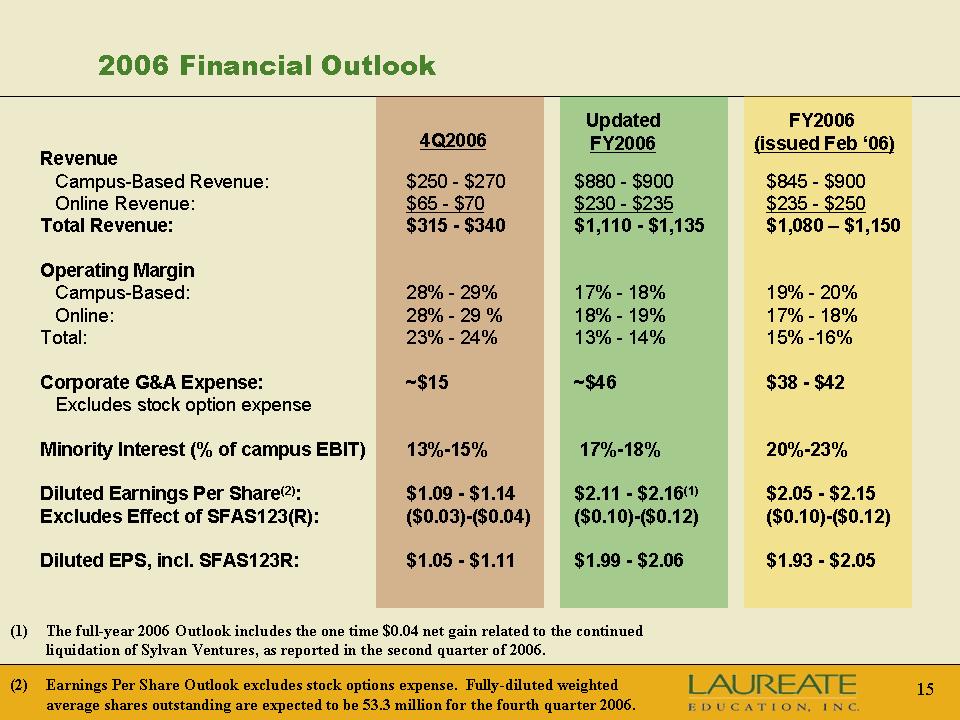

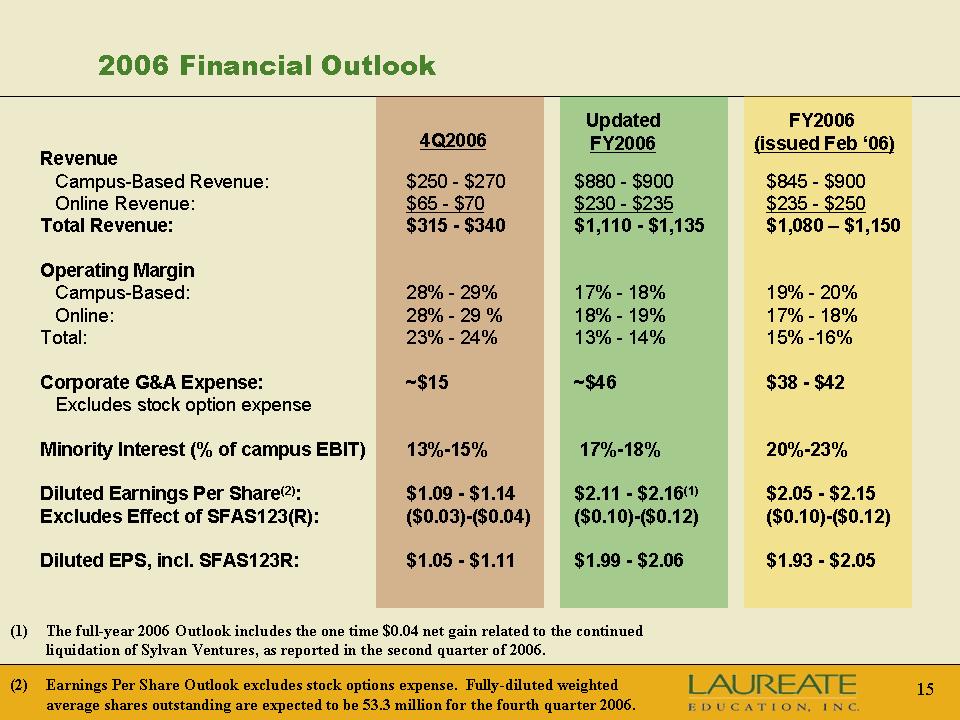

2006 Financial Outlook 4Q2006 Updated FY2006 FY2006 (issued Feb ‘06) Revenue Campus-Based Revenue: $250 - $270 $880 - $900 $845 - $900 Online Revenue: $65 - $70 $230 - $235 $235 - $250 Total Revenue: $315 - $340 $1,110 - $1,135 $1,080 - $1,150 Operating Margin Campus-Based: 28% - 29% 17% - 18% 19% - 20% Online: 28% - 29 % 18% - 19% 17% - 18% Total: 23% - 24% 13% - 14% 15% -16% Corporate G&A Expense: ~$15 ~$46 $38 - $42 Excludes stock option expense Minority Interest (% of campus EBIT) 13%-15% 17%-18% 20%-23% Diluted Earnings Per Share(2): $1.09 - $1.14 $2.11 - $2.16(1) $2.05 - $2.15 Excludes Effect of SFAS123(R): ($0.03)-($0.04) ($0.10)-($0.12) ($0.10)-($0.12) Diluted EPS, incl. SFAS123R: $1.05 - $1.11 $1.99 - $2.06 $1.93 - $2.05 2006 Financial Outlook (1) The full-year 2006 Outlook includes the one time $0.04 net gain related to the continued liquidation of Sylvan Ventures, as reported in the second quarter of 2006. (2) Earnings Per Share Outlook excludes stock options expense. Fully-diluted weighted average shares outstanding are expected to be 53.3 million for the fourth quarter 2006.

Laureate Reiterates 2007 Financial Outlook 2007 Growth Leaders: • Online Higher Education • Mexico/Central America • Brazil (1) Margin improvement (operating income) includes Corporate G&A. Revenue: $1.275 - $1.375 Billion • 13%-15% Total Enrollment Growth Margin Improvement(1) : 50 - 100 bps • Campus-based operational leverage • Excludes stock option expense 2007 Earnings Per Share: $2.59 - $2.67 • An increase of 20% or more over 2006 Outlook • SFAS123R stock options expense of ($0.12) to ($0.14) • GAAP Outlook: $2.45 to $2.55

Laureate Education, Inc. Questions & Answers