©2025 Laureate Education, Inc. Fourth Quarter & Year-End 2024 Earnings Presentation February 20, 2025 Exhibit 99.2

2©2025 Laureate Education, Inc. Forward Looking Statements This presentation includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 20, 2025, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law. In addition, this presentation contains various operating data, including market share and market position, that are based on internal company data and management estimates. While management believes that our internal company research is reliable and the definitions of our markets which are used herein are appropriate, neither such research nor these definitions have been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources, including those discussed under “Industry and Market Data” in Laureate’s filings with the SEC.

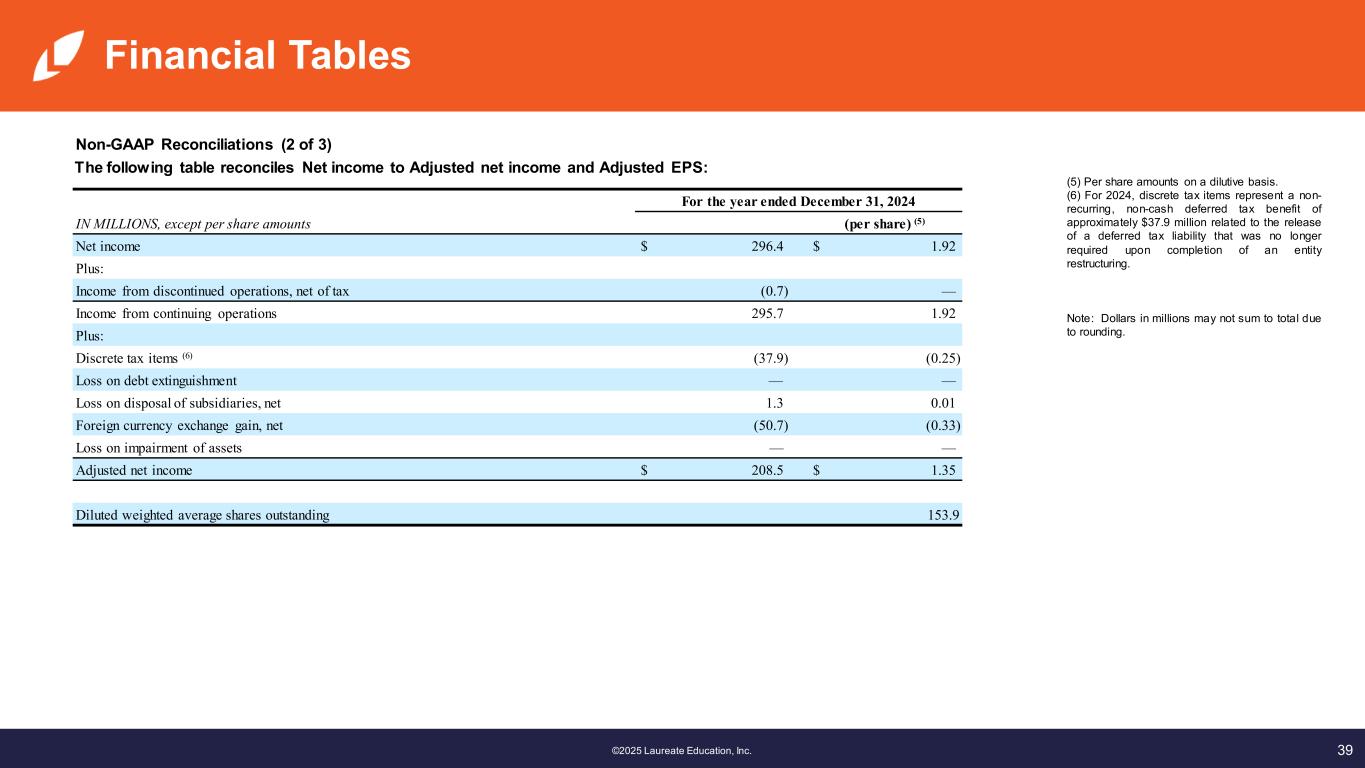

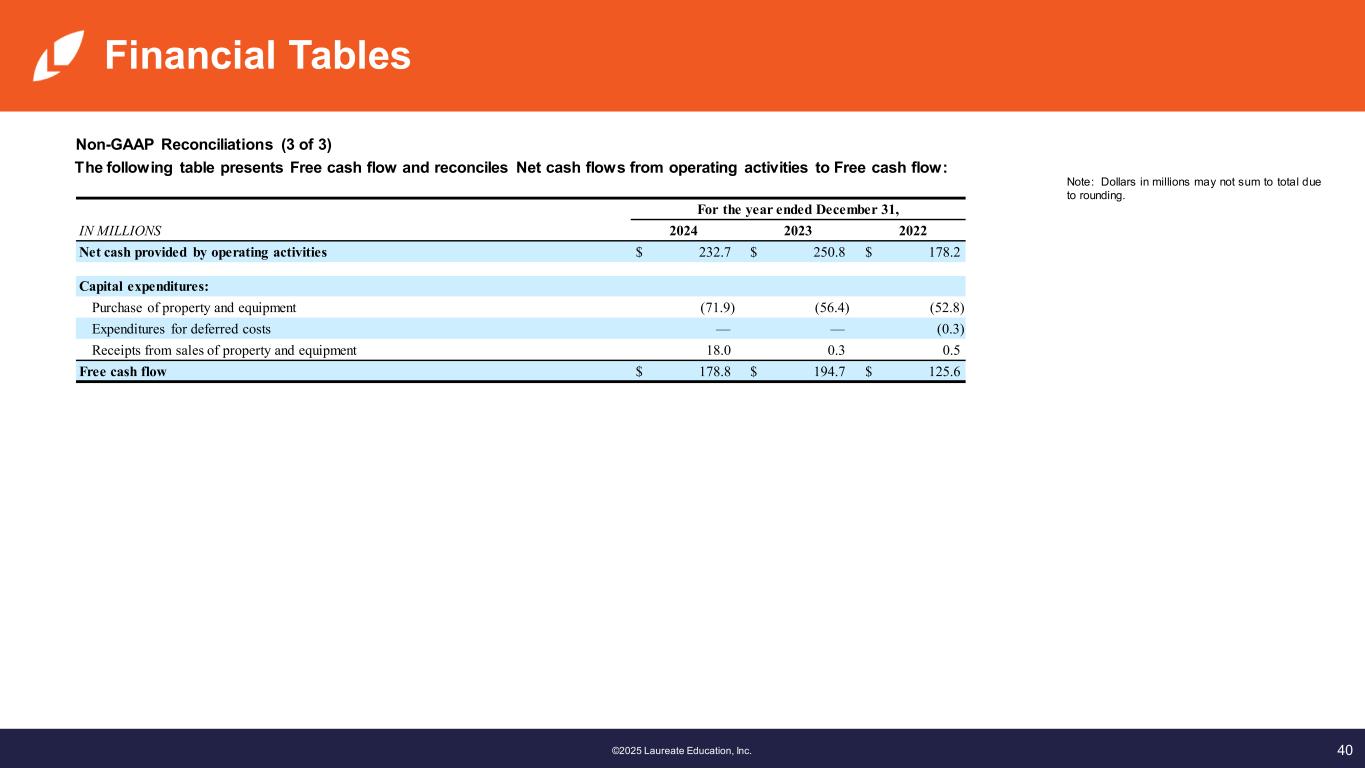

3©2025 Laureate Education, Inc. Presentation of Non-GAAP Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this presentation, Laureate provides the non-GAAP measures of Adjusted EBITDA and its related margin, Adjusted net income, Adjusted Earnings Per Share (Adjusted EPS), Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow. We have included the non-GAAP measures of Adjusted EBITDA and net debt because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. We have included the non-GAAP measures of Adjusted net income and Adjusted EPS because management believes that these measures provide investors with better visibility into the Company’s underlying earnings as they exclude items that may not be indicative of our core operating results. Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to- period comparisons of our core business. Additionally, Adjusted EBITDA and Adjusted EBITDA margin, which is calculated by dividing Adjusted EBITDA by revenue, are key inputs into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. We define Adjusted net income as net income (loss), before (income) loss from discontinued operations, plus discrete tax items, loss on debt extinguishment, loss (gain) on disposal of subsidiaries, net, foreign currency exchange (gain) loss, net, and loss on impairment of assets. We define Adjusted EPS as Adjusted net income divided by GAAP diluted weighted average shares outstanding. Adjusted net income and Adjusted EPS provide a useful indicator about Laureate’s earnings from core operations. Adjusted EBITDA to Unlevered Free Cash Flow Conversion consists of Unlevered Free Cash Flow (which is defined as cash flows from operating activities, less capital expenditures (net of sales of PP&E), plus net cash interest expense) divided by Adjusted EBITDA. Adjusted EBITDA to Unlevered Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flows. Total debt, net of cash and cash equivalents (or net debt) consists of total gross debt, less total cash and cash equivalents. Net debt provides a useful indicator about Laureate’s leverage and liquidity. Free Cash Flow consists of operating cash flow minus capital expenditures (net of sales of PP&E). Free Cash Flow provides a useful indicator about Laureate’s ability to fund its operations and repay its debt. Laureate’s calculations of Adjusted EBITDA and its related margin, Adjusted net income, Adjusted EPS, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total debt, net of cash and cash equivalents (or net debt), and Free Cash Flow are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA, Adjusted net income, Adjusted EPS and Free Cash Flow are reconciled from their most directly comparable GAAP measures in the attached tables under “Non-GAAP Reconciliations”. We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period, and then exclude the impact of acquisitions and divestitures.

4©2025 Laureate Education, Inc. Summary Overview Note: Throughout this presentation amounts may not sum to totals due to rounding

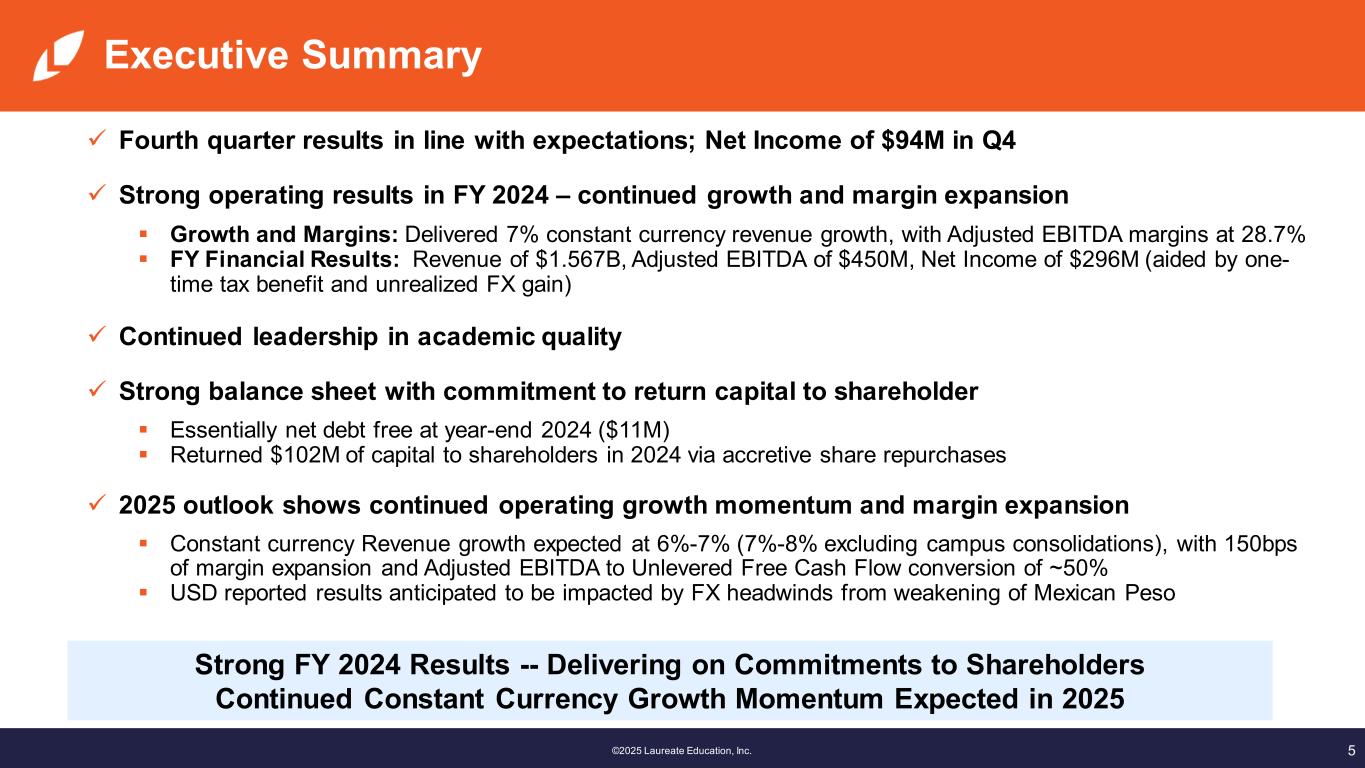

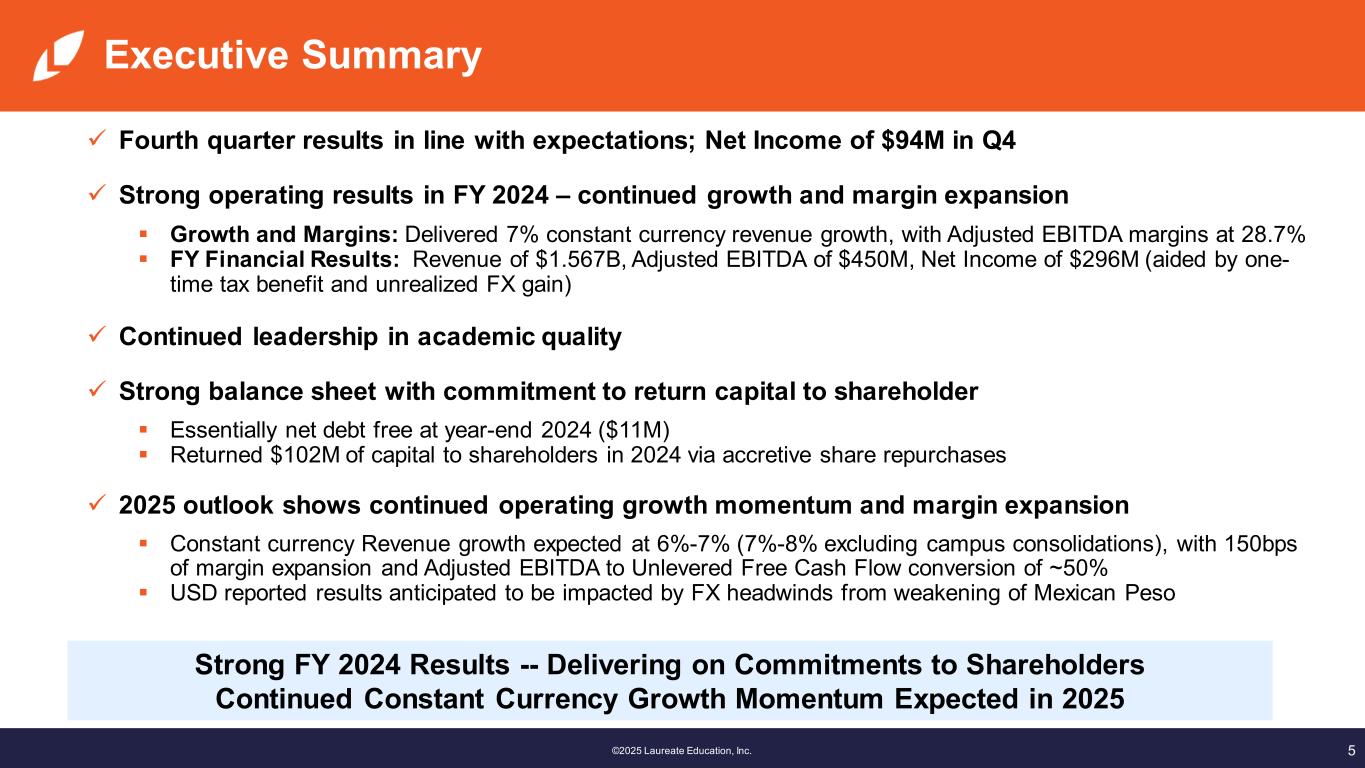

5©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Executive Summary Fourth quarter results in line with expectations; Net Income of $94M in Q4 Strong operating results in FY 2024 – continued growth and margin expansion Growth and Margins: Delivered 7% constant currency revenue growth, with Adjusted EBITDA margins at 28.7% FY Financial Results: Revenue of $1.567B, Adjusted EBITDA of $450M, Net Income of $296M (aided by one- time tax benefit and unrealized FX gain) Continued leadership in academic quality Strong balance sheet with commitment to return capital to shareholder Essentially net debt free at year-end 2024 ($11M) Returned $102M of capital to shareholders in 2024 via accretive share repurchases 2025 outlook shows continued operating growth momentum and margin expansion Constant currency Revenue growth expected at 6%-7% (7%-8% excluding campus consolidations), with 150bps of margin expansion and Adjusted EBITDA to Unlevered Free Cash Flow conversion of ~50% USD reported results anticipated to be impacted by FX headwinds from weakening of Mexican Peso Strong FY 2024 Results -- Delivering on Commitments to Shareholders Continued Constant Currency Growth Momentum Expected in 2025

6©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Key Academic Highlights in 2024 Unwavering Commitment to Academic Quality Leading Brands in our Markets Universidad Peruana de Ciencias Aplicadas (UPC) Universidad del Valle de México (UVM) Universidad Privada del Norte (UPN) Universidad Tecnológica de México (UNITEC) UPC in Peru: For the fourth consecutive year, UPC was ranked Peru’s #1 Education Brand in Peru by Merco. UPC also placed an impressive 11th overall among all Peruvian organizations across industries. UVM in Mexico: For the second consecutive year, UVM ranked as the #2 Private University in Mexico in the 2024 Reader’s Digest ranking. Additionally, UVM has consistently maintained its distinction as a Socially Responsible Enterprise for the past 14 years. UPN in Peru: UPN was ranked Peru’s #10 Education Brand by Merco. UNITEC in Mexico: UNITEC ranked as the #10 Private University in Mexico in the 2024 Reader’s Digest ranking. Additionally, UNITEC has consistently maintained its distinction as a Socially Responsible Enterprise for the past 15 years.

7©2025 Laureate Education, Inc. Compelling Investment Characteristics

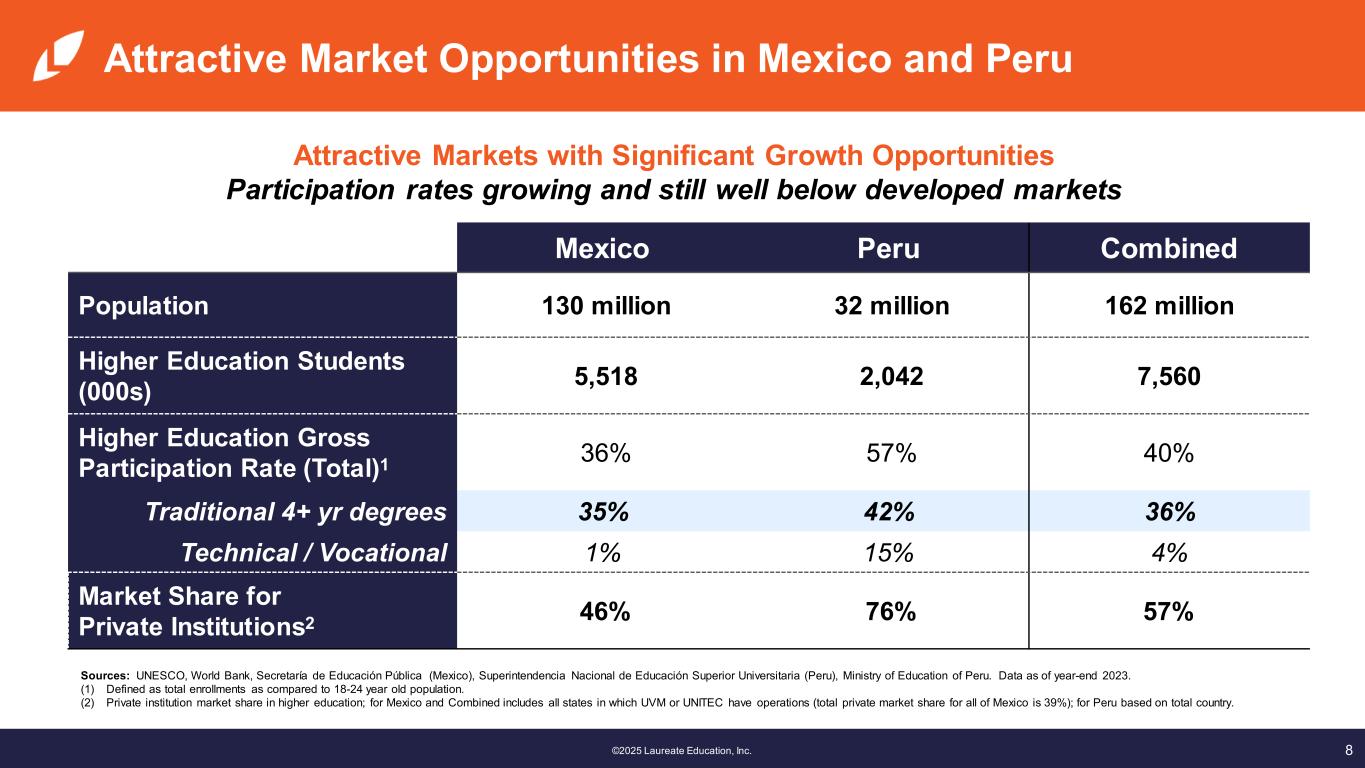

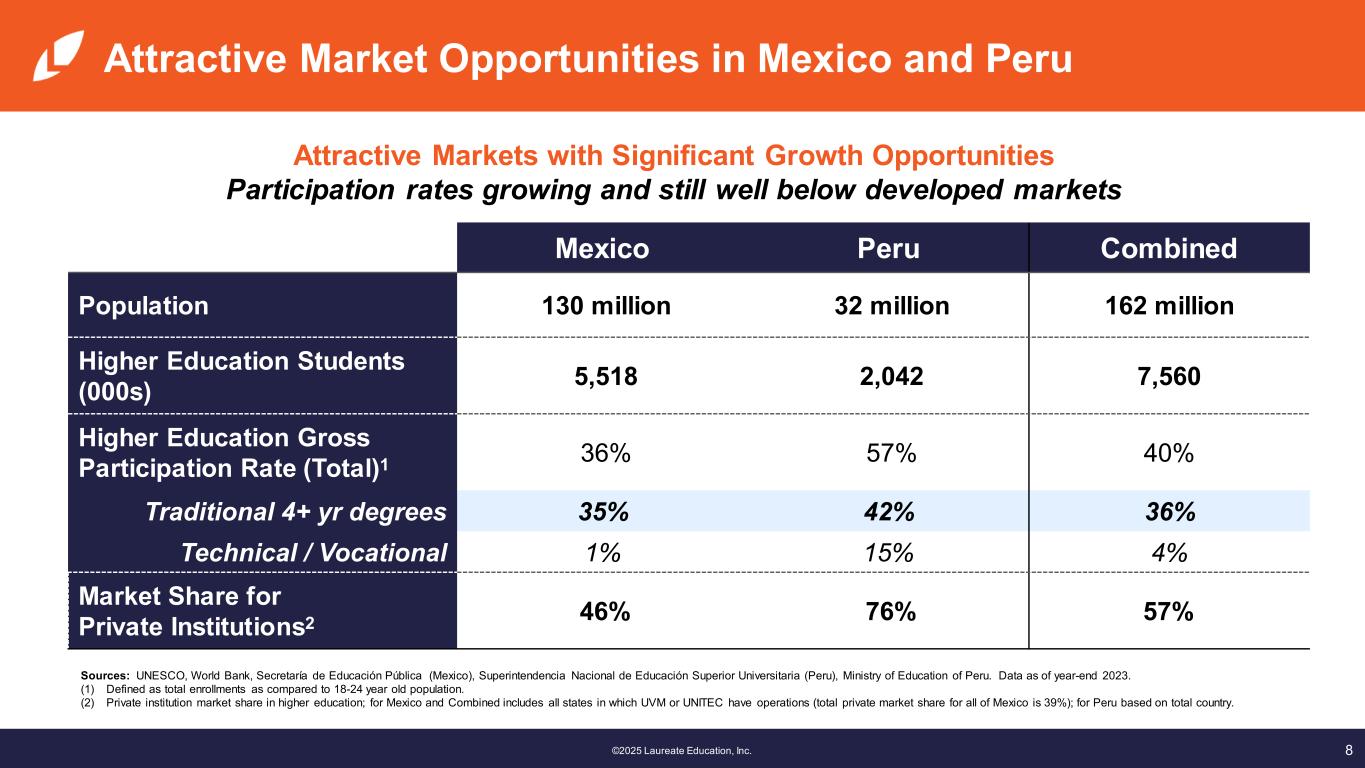

8©2025 Laureate Education, Inc. Mexico Peru Combined Population 130 million 32 million 162 million Higher Education Students (000s) 5,518 2,042 7,560 Higher Education Gross Participation Rate (Total)1 36% 57% 40% Traditional 4+ yr degrees 35% 42% 36% Technical / Vocational 1% 15% 4% Market Share for Private Institutions2 46% 76% 57% Sources: UNESCO, World Bank, Secretaría de Educación Pública (Mexico), Superintendencia Nacional de Educación Superior Universitaria (Peru), Ministry of Education of Peru. Data as of year-end 2023. (1) Defined as total enrollments as compared to 18-24 year old population. (2) Private institution market share in higher education; for Mexico and Combined includes all states in which UVM or UNITEC have operations (total private market share for all of Mexico is 39%); for Peru based on total country. Attractive Markets with Significant Growth Opportunities Participation rates growing and still well below developed markets Attractive Market Opportunities in Mexico and Peru

©2025 Laureate Education, Inc. 9 Leading University Portfolio in Mexico & Peru Sources: QS Stars™, Guía Universitaria (UVM), MERCO Institutional Reputation Ranking (UPC) 1960 Brand Founded Market Segment Ratings/RankingsQS StarsTM Overall Universidad del Valle de México (UVM) Premium/ Traditional Enrollment @ 12/31/24 124,400 1966Universidad Tecnológica de México (UNITEC) Value/ Teaching134,100 1994 Premium/ Traditional72,100 1994 Value/ Teaching122,100 1983 Technical/ Vocational19,300 Universidad Peruana de Ciencias Aplicadas (UPC) Universidad Privada del Norte (UPN) CIBERTEC M ex ic o Pe ru • Ranked Top 5 university in Mexico • 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Impact • Largest private university in Mexico • 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Impact • Ranked #1 in educational sector in Peru • 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Impact • 3rd largest private university in Peru • 5-Stars rated by QS Stars™ in categories of Employability, Inclusiveness, Online Learning & Social Impact • One of the largest private technical / vocational institutes in Peru

10©2025 Laureate Education, Inc. Q4 & FY 2024 Performance Results

11©2025 Laureate Education, Inc. 2024 Fourth Quarter – Financial Summary Q4 ’24 Variance Vs. Q4 ’23 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 11K n.m. n.m. • Not a material intake period Total Enrollment 472K 5% 5% • Mexico +7%, Peru +3% • Driven by new enrollment growth Revenue $423 3% 10% • Enrollment growth and price/mix • +8% organic/cc adjusted for timing of academic calendar; +$9M impact Adj. EBITDA $141 7% 14% • +8% organic/cc adjusted for timing of academic calendar; +$7M impact Adj. EBITDA margin 33.3% 126 bps 101 bps • +13 bps organic/cc adjusted for timing of academic calendar (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Strong Operating Performance During Fourth Quarter Q4 Timing Adjusted Organic/CC1: Revenue +8%, Adjusted EBITDA +8%

12©2025 Laureate Education, Inc. 2024 FY – Financial Summary FY ’24 Variance Vs. FY ’23 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 252K 5% 5% • Mexico +4% • Peru +6% Total Enrollment 472K 5% 5% • Mexico +7%, Peru +3% • Driven by new enrollment growth Revenue $1,567 6% 7% • Enrollment growth and price/mix Adj. EBITDA $450 8% 9% • Revenue growth and productivity gains Adj. EBITDA margin 28.7% 53 bps 43 bps • Continued focus on margin expansion (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Favorable Operating Performance in FY 2024 Adjusted EBITDA Margins at Historic High

13©2025 Laureate Education, Inc. Segment Results

14©2025 Laureate Education, Inc. Mexico Segment Results Q4 Results FY Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q4 ’24 Organic/CC Vs. Q4 ’23 1 FY ’24 Organic/CC Vs. FY ’23 1 New Enrollment 8K 10% 160K 4% Total Enrollment 259K 7% 259K 7% • Driven by new enrollment trends Revenue $226 15% $841 10% • Q4: +12% organic/cc adjusted for timing of academic calendar; +$6M impact Adj. EBITDA $78 29% $206 19% • Strong growth and productivity gains • Q4: +20% organic/cc adjusted for timing of academic calendar; +$5M impact Adj. EBITDA margin 34.7% 385 bps 24.5% 176 bps Continued Revenue Growth and Improvements in Profitability Q4 Timing Adjusted Organic/CC1: Revenue +12%, Adjusted EBITDA +20% (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures.

15©2025 Laureate Education, Inc. Peru Segment Results (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Q4 Results FY Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q4 ’24 Organic/CC Vs. Q4 ’23 1 FY ’24 Organic/CC Vs. FY ’23 1 New Enrollment 3K n.m. 92K 6% • Strong secondary intake in Sept. across all brands following macroeconomic recovery Total Enrollment 214K 3% 214K 3% Revenue $197 5% $725 4% • Q4: +3% organic/cc adjusted for timing of academic calendar; +$3M impact Adj. EBITDA $74 (9%) $283 (1%) • Q4: (11%) organic/cc adjusted for timing of academic calendar; +$2M impact Adj. EBITDA margin 37.5% (551 bps) 39.1% (172 bps) • Margin primarily impacted by discounts & scholarships and higher bad debt associated with final tail of recession in 1H Strong Secondary Intake in September Following Macroeconomic Recovery Q4 Timing Adjusted Organic/CC1: Revenue +3%, Adjusted EBITDA (11%)

16©2025 Laureate Education, Inc. Capitalization and Share Count

17©2025 Laureate Education, Inc. Q4 2024 Capitalization and Return of Capital Strong Balance Sheet and Cash Accretive Business Model Allow For Continued Return of Capital ($ in millions) Total Company as of 12/31/24 Gross Debt $102 Less: Cash & Cash Equivalents ($91) Net Debt $11 151M shares outstanding as of December 31st Share Repurchase Update $102M of shares repurchased in FY 2024 $98M authorization remains outstanding

18©2025 Laureate Education, Inc. Outlook

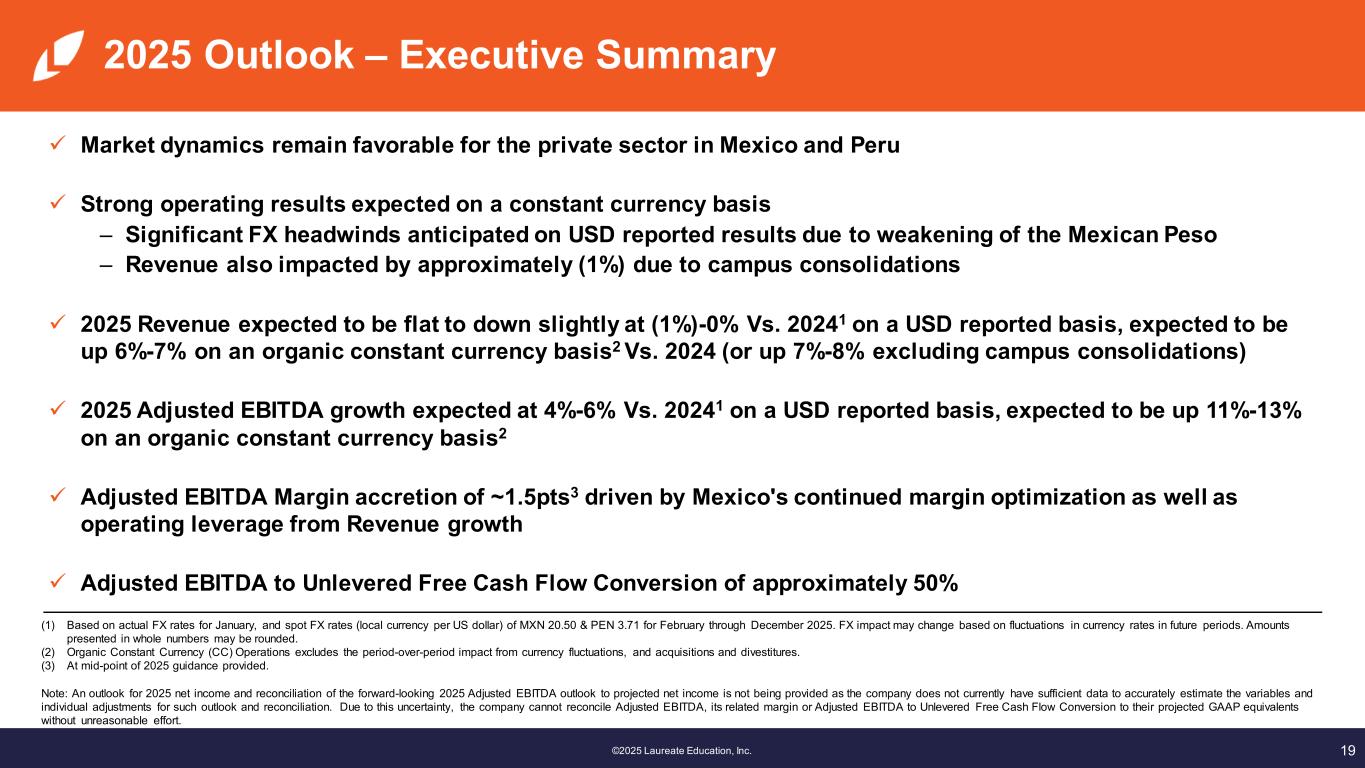

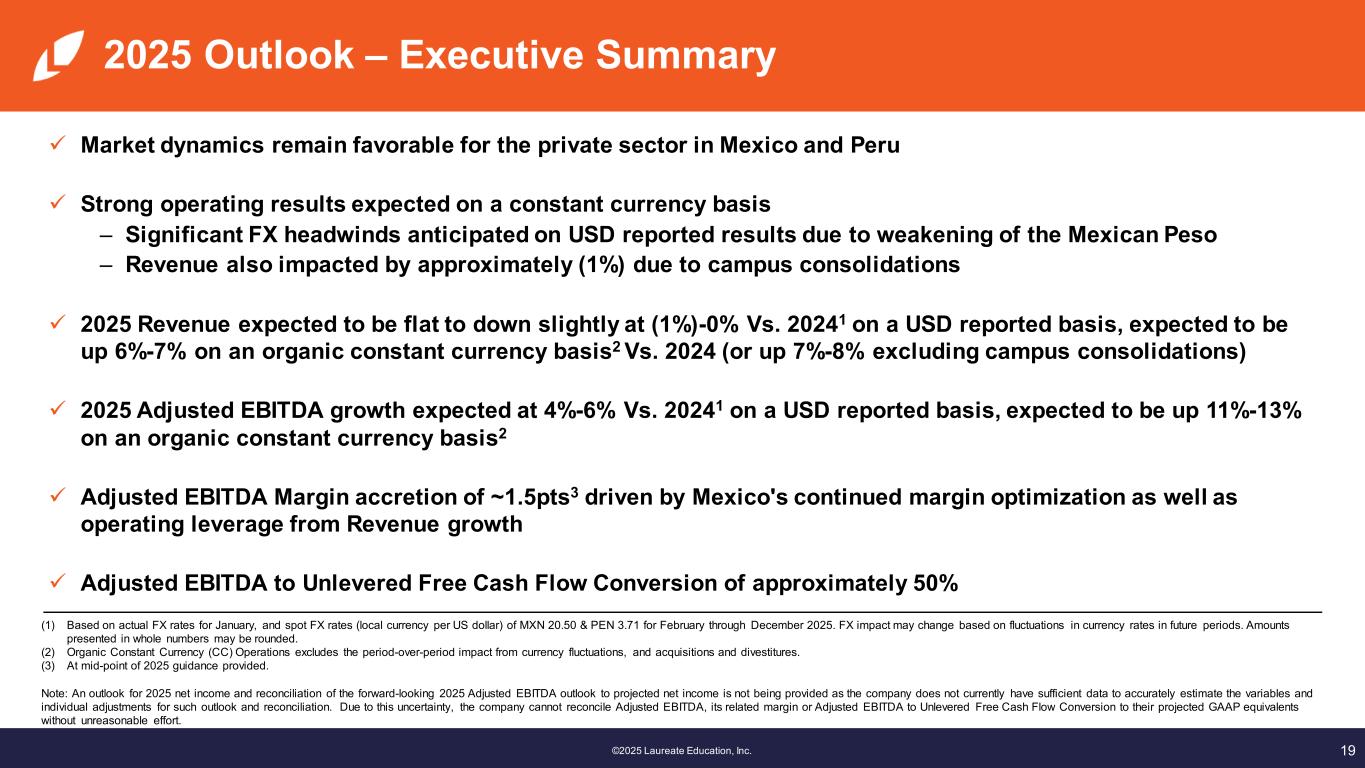

19©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. 2025 Outlook – Executive Summary Market dynamics remain favorable for the private sector in Mexico and Peru Strong operating results expected on a constant currency basis – Significant FX headwinds anticipated on USD reported results due to weakening of the Mexican Peso – Revenue also impacted by approximately (1%) due to campus consolidations 2025 Revenue expected to be flat to down slightly at (1%)-0% Vs. 20241 on a USD reported basis, expected to be up 6%-7% on an organic constant currency basis2 Vs. 2024 (or up 7%-8% excluding campus consolidations) 2025 Adjusted EBITDA growth expected at 4%-6% Vs. 20241 on a USD reported basis, expected to be up 11%-13% on an organic constant currency basis2 Adjusted EBITDA Margin accretion of ~1.5pts3 driven by Mexico's continued margin optimization as well as operating leverage from Revenue growth Adjusted EBITDA to Unlevered Free Cash Flow Conversion of approximately 50% (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. (2) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations, and acquisitions and divestitures. (3) At mid-point of 2025 guidance provided. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA, its related margin or Adjusted EBITDA to Unlevered Free Cash Flow Conversion to their projected GAAP equivalents without unreasonable effort.

20©2025 Laureate Education, Inc. 2025 Outlook Continued Constant Currency Revenue Growth And Margin Expansion ($ in millions) (Enrollments rounded to the nearest thousand) 2025 Guidance Outlook1 Total Enrollment 489K – 495K Revenue $1,545 – $1,570 Adjusted EBITDA $467 – $477 (1) Outlook is based on actual FX rates for January, and Spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort.

21©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. As Reported 2025 USD Outlook Impacted by Weaker FX Total Revenue Adjusted EBITDA Strong operational growth expected to be largely offset by MXN currency headwinds (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. 1,567M 1,558M 2024 Actuals (110M) (7%) FX Impact 1 101M +6% Operational Growth in Constant Currency 2025 Guidance Midpoint at Spot FX -1% 450M 472M 2024 Actuals (30M) (7%) FX Impact 1 52M +12% Operational Growth in Constant Currency 2025 Guidance Midpoint at Spot FX 5%

22©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Change in Academic Calendar in 2025 Expected Intra-Year Changes in Revenue Seasonality Vs 2024 ($ in millions) Q1 Q2 Q3 Q4 FY Mexico ($9) $9 - - - Peru ($18) ($2) ($8) $28 - Total Revenue Impact ($27) $7 ($8) $28 - Changes in academic calendar expected to impact seasonality during 2025 Start of certain classes shifted in both Mexico and Peru to align with updated academic scheduling requirements Start Dates for Classes Will Impact Timing of Revenue and Earnings in 2025 Q1 Negative Impact Offset Mainly by Benefit in Q4

23©2025 Laureate Education, Inc. Q1 2025 Guidance ($ in millions) Q1 2025 Outlook1 Revenue $221 – $226 Adjusted EBITDA ($7) – ($4) (1) Outlook is based on actual FX rates for January and Spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February and March 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for Q1 2025 net income and reconciliation of the forward-looking Q1 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Q1 Impacted by Intra-Year Academic Calendar Timing

24©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Target Profile Achieved – Transitioning to Annual Guidance Laureate went through a significant transformation from 2019 through 2021 – The company believed it was important to give investors insight into our new profile and growth trajectory post the transformation In conjunction with our year-end 2021 earnings call, we outlined a 3-5 year targeted profile, and subsequently updated those targets on our year-end 2022 earnings call to include margin and free cash flow targets – As we close out 2024 and look forward into our 2025 guidance, we will have achieved that targeted profile Having achieved our new financial profile, and with Laureate now better understood by the market, instead of providing a new 3-5 year targeted profile, we will focus on annual and quarterly guidance 3-5 Year Target Financial Profile1 2025 Expected Result (at mid-point guidance) Total Enrollment 5-7% CAGR 5% CAGR ’22-’25E Revenue 8-10% CAGR (FXN) 8% CAGR (FXN) ’22-’25E Adjusted EBITDA Margin 30%+ 30.3% Adjusted EBITDA to Unlevered FCF Conversion 50%+ ~50% Note: Foreign Currency Neutral or constant currency (FXN). (1) Target Profile over 3-5 year period, beginning with FY 2023 (as provided on February 23, 2023, during year-end 2022 Earnings Call).

25©2025 Laureate Education, Inc. Appendix

26©2025 Laureate Education, Inc. 2024 Fourth Quarter – Net Income Reconciliation Q4 ’24 B / (W) Notes ($ in millions) Reported Vs. Q4 ’23 Adjusted EBITDA 141 10 Depreciation & Amortization (16) 2 Interest Expense, net (2) - Other 16 44 • Mainly non-cash FX translation on intercompany loans Income Tax (47) (10) Income/(Loss) From Continuing Operations 93 46 Discontinued Operations (Net of Tax) - 6 Net Income / (Loss) 94 52 Net Income from Continuing Operations Improved Versus Prior Year

27©2025 Laureate Education, Inc. 2024 FY – Net Income Reconciliation FY ’24 B / (W) Notes ($ in millions) Reported FY ’23 Adjusted EBITDA 450 31 Depreciation & Amortization (68) 1 Interest Expense, net (10) 2 Other 43 125 • Mainly non-cash FX translation on intercompany loans Income Tax (119) 19 • Includes certain one-time benefits Income/(Loss) From Continuing Operations 296 179 Discontinued Operations (Net of Tax) 1 11 Net Income / (Loss) 296 189 Net Income from Continuing Operations Improved Versus Prior Year

28©2025 Laureate Education, Inc. 2025 Full Year Guidance Details ($ in millions) (Enrollments rounded to the nearest thousand) Total Enrollment Revenues Adj. EBITDA 2024 FY Results As Reported 472K $1,567 $450 Organic Growth (excl. Campus Consolidations) 21K - 27K $102 - $127 $53 - $63 Organic Growth % (excl. Campus Consolidations) 5% - 6% 7% - 8% 12% - 14% Campus Consolidation Impact (5K) ($13) ($6) 2025 FY Guidance (Constant Currency) 489K - 495K $1,655 - $1,680 $497 - $507 Organic Growth % (Constant Currency) 4% - 5% 6% - 7% 11% - 13% FX Impact (spot FX) (1) ($110) ($30) 2025 FY Guidance (@ spot FX) (1) 489K - 495K $1,545 - $1,570 $467 - $477 As Reported Growth % 4% - 5% (1%) - 0% 4% - 6% (1) Based on actual FX rates for January, and spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Continued Constant Currency Top Line Growth and Margin Expansion FX Headwinds From Weaker MXN Expected to Impact Reported USD Results

29©2025 Laureate Education, Inc. Q1 2025 Guidance Details (1) Based on actual FX rates for January and spot FX rates (local currency per US dollar) of MXN 20.50 & PEN 3.71 for February through March 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for Q1 2025 net income and reconciliation of the forward-looking Q1 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. First Quarter YoY Results Impacted by Intra-Year Timing of Academic Calendar Majority of Revenue and Adj. EBITDA Offset to Occur in 2H 2025 Q1 Guidance ($ in millions) Revenues Adj. EBITDA 2024 Q1 Results As Reported $275 $31 Timing Impact Intra-Year (academic calendar) ($27) ($24) 2024 Q1 Results Adjusted $248 $6 Organic Growth (excl. Campus Consolidations) $20 - $25 $3 - $6 Organic Growth % (excl. Campus Consolidations) 8% - 10% n.m. Campus Consolidation Impact ($3) ($1) 2025 Q1 Guidance (Constant Currency) $265 - $270 $8 - $11 Organic Growth % (Constant Currency) 7% - 9% n.m. FX Impact (spot FX) (1) ($44) ($15) 2025 Q1 Guidance (@ spot FX) (1) $221 - $226 ($7) - ($4) As Reported Growth % (20%) - (18%) n.m.

30©2025 Laureate Education, Inc. Return of Capital Summary Since 2019 ($ in millions) Stock Buybacks Cash Distributions / Dividends Total 2019 $264 - $264 2020 $100 - $100 2021 $380 $1,375 $1,755 2022 $282 $249 $531 2023 - $110 $110 2024 $102 - $102 Cumulative Since 2019 $1,128 $1,734 $2,862 Strong Track Record of Returning Capital to Shareholders Nearly $3 Billion of Capital Returned to Shareholders Since Start of 2019

31©2025 Laureate Education, Inc. New Enrollments Seasonality Intra-Year Seasonality Trends Revenue Seasonality Adjusted EBITDA Seasonality Factors Affecting Seasonality Large intake cycles at end of Q1 (Peru) and end of Q3 (Mexico) drive seasonality of earnings Q2 and Q4 are typically Laureate’s strongest earnings quarters Academic calendar FX trends 18% 30% 25% 27% 17% 31% 24% 28% 17% 31% 24% 28% 18% 32% 24% 27% Q1 Q2 Q3 Q4 2021 2022 2023 2024 4% 42% 30% 24% 8% 43% 21% 28% 8% 42% 19% 31% 7% 42% 20% 31% Q1 Q2 Q3 Q4 2021 2022 2023 2024 38% 10% 49% 2% 37% 11% 50% 3% 39% 10% 48% 3% 38% 10% 48% 4% Q1 Q2 Q3 Q4 2021 2022 2023 2024

32©2025 Laureate Education, Inc. Financial Results & Tables

33©2025 Laureate Education, Inc. Financial Tables Consolidated Statements of Operations Note: May not sum to total due to rounding. For the three months ended December 31, For the year ended December 31, IN MILLIONS, except per share amounts 2024 2023 Change 2024 2023 Change Revenues $ 423.4 $ 409.4 $ 14.0 $ 1,566.6 $ 1,484.3 $ 82.3 Costs and expenses: Direct costs 288.0 279.4 8.6 1,146.9 1,089.8 57.1 General and administrative expenses 11.2 18.6 (7.4) 45.8 52.6 (6.8) Loss on impairment of assets — 1.5 (1.5) — 3.1 (3.1) Operating income 124.2 110.0 14.2 374.0 338.8 35.2 Interest income 1.8 2.1 (0.3) 8.1 9.1 (1.0) Interest expense (3.3) (3.7) 0.4 (18.1) (21.0) 2.9 Other expense, net 0.7 (0.5) 1.2 1.2 (0.3) 1.5 Foreign currency exchange gain (loss), net 14.3 (24.1) 38.4 50.7 (75.7) 126.4 Gain (loss) on disposals of subsidiaries, net 1.8 — 1.8 (1.3) 3.6 (4.9) Income from continuing operations before income taxes and equity in net income of affiliates 139.5 83.7 55.8 414.5 254.5 160.0 Income tax expense (46.5) (36.2) (10.3) (119.0) (137.6) 18.6 Equity in net income of affiliates, net of tax 0.2 0.2 — 0.2 0.2 — Income from continuing operations 93.2 47.7 45.5 295.7 117.0 178.7 Income (loss) from discontinued operations, net of tax 0.3 (6.0) 6.3 0.7 (9.8) 10.5 Net income 93.6 41.7 51.9 296.4 107.3 189.1 Net loss attributable to noncontrolling interests 0.1 0.1 — 0.1 0.3 (0.2) Net income attributable to Laureate Education, Inc. $ 93.6 $ 41.9 $ 51.7 $ 296.5 $ 107.6 $ 188.9 Basic and diluted earnings per share: Basic weighted average shares outstanding 150.7 157.4 (6.7) 153.3 157.3 (4.0) Diluted weighted average shares outstanding 151.5 158.1 (6.6) 153.9 157.9 (4.0) Basic earnings per share $ 0.62 $ 0.26 $ 0.36 $ 1.93 $ 0.69 $ 1.24 Diluted earnings per share $ 0.62 $ 0.26 $ 0.36 $ 1.92 $ 0.68 $ 1.24

34©2025 Laureate Education, Inc. Financial Tables Revenue and Adjusted EBITDA by segment: Quarter nm - percentage changes not meaningful (1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2023 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures. Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS % Change $ Variance Components For the three months ended December 31, 2024 2023 Reported Organic Constant Currency(1) Total Organic Constant Currency Acq/Div. FX Revenues Mexico $ 226.1 $ 223.1 1% 15% $ 3.0 $ 33.0 $ — $ (30.0) Peru 197.2 186.3 6% 5% 10.9 8.5 — 2.4 Corporate & Eliminations 0.1 — nm nm 0.1 0.1 — — Total Revenues $ 423.4 $ 409.4 3% 10% $ 14.0 $ 41.6 $ — $ (27.6) Adjusted EBITDA Mexico $ 78.4 $ 67.9 15% 29% $ 10.5 $ 19.9 $ — $ (9.4) Peru 74.0 79.8 (7)% (9)% (5.8) (7.1) — 1.3 Corporate & Eliminations (11.2) (16.3) 31% 31% 5.1 5.1 — — Total Adjusted EBITDA $ 141.1 $ 131.3 7% 14% $ 9.8 $ 17.9 $ — $ (8.1)

35©2025 Laureate Education, Inc. Financial Tables Revenue and Adjusted EBITDA by segment: Fiscal Year nm - percentage changes not meaningful (2) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2023 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures. Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS % Change $ Variance Components For the year ended December 31, 2024 2023 Reported Organic Constant Currency(2) Total Organic Constant Currency Acq/Div. FX Revenues Mexico $ 841.2 $ 782.6 7% 10% $ 58.6 $ 82.1 $ — $ (23.5) Peru 725.2 701.7 3% 4% 23.5 26.3 — (2.8) Corporate & Eliminations 0.2 — nm nm 0.2 0.2 — — Total Revenues $ 1,566.6 $ 1,484.3 6% 7% $ 82.3 $ 108.6 $ — $ (26.3) Adjusted EBITDA Mexico $ 206.5 $ 177.0 17% 19% $ 29.5 $ 33.7 $ — $ (4.3) Peru 283.4 286.9 (1)% (1)% (3.5) (1.8) — (1.7) Corporate & Eliminations (39.8) (45.2) 12% 12% 5.4 5.4 — — Total Adjusted EBITDA $ 450.1 $ 418.6 8% 9% $ 31.5 $ 37.4 $ — $ (6.0)

36©2025 Laureate Education, Inc. Financial Tables Consolidated Balance Sheets Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS December 31, 2024 December 31, 2023 Change Assets Cash and cash equivalents $ 91.4 $ 89.4 $ 2.0 Receivables (current), net 91.8 92.1 (0.3) Other current assets 43.6 42.9 0.7 Property and equipment, net 514.3 562.2 (47.9) Operating lease right-of-use assets, net 292.4 371.6 (79.2) Goodwill and other intangible assets 711.3 830.7 (119.4) Deferred income taxes 60.8 71.4 (10.6) Other long-term assets 45.6 49.9 (4.3) Current and long-term assets held for sale 11.0 15.4 (4.4) Total assets $ 1,862.1 $ 2,125.6 $ (263.5) Liabilities and stockholders' equity Accounts payable and accrued expenses $ 187.6 $ 209.4 $ (21.8) Deferred revenue and student deposits 64.3 69.4 (5.1) Total operating leases, including current portion 327.1 417.6 (90.5) Total long-term debt, including current portion 100.3 165.1 (64.8) Other liabilities 214.5 303.6 (89.1) Current and long-term liabilities held for sale 9.7 11.5 (1.8) Total liabilities 903.5 1,176.5 (273.0) Redeemable noncontrolling interests and equity 1.4 1.4 — Total stockholders' equity 957.1 947.7 9.4 Total liabilities and stockholders' equity $ 1,862.1 $ 2,125.6 $ (263.5)

37©2025 Laureate Education, Inc. Financial Tables Consolidated Statements of Cash Flows Note: Dollars in millions may not sum to total due to rounding. For the year ended December 31, IN MILLIONS 2024 2023 Change Cash flows from operating activities Net income $ 296.4 $ 107.3 $ 189.1 Depreciation and amortization 68.2 69.6 (1.4) (Gain) loss on sales and disposal of subsidiaries, property and equipment and leases, net (5.1) 9.6 (14.7) Deferred income taxes (38.5) (55.9) 17.4 Unrealized foreign currency exchange (gain) loss (53.1) 75.5 (128.6) Income tax receivable/payable, net (30.6) 23.3 (53.9) Working capital, excluding tax accounts (103.9) (67.1) (36.8) Other non-cash adjustments 99.2 88.5 10.7 Net cash provided by operating activities 232.7 250.8 (18.1) Cash flows from investing activities Purchase of property and equipment (71.9) (56.4) (15.5) Receipts from sales of property and equipment 18.0 0.3 17.7 Net (payments) receipts from sales of discontinued operations (3.6) 4.3 (7.9) Net cash used in investing activities (57.5) (51.9) (5.6) Cash flows from financing activities Increase (decrease) in long-term debt, net (60.4) (89.7) 29.3 Payments of special dividends, special cash distributions, and dividend equivalent rights (1.7) (112.5) 110.8 Payments to repurchase common stock (102.1) — (102.1) Financing other, net (2.8) 0.3 (3.1) Net cash used in financing activities (166.9) (201.9) 35.0 Effects of exchange rate changes on Cash and cash equivalents and Restricted cash (7.5) 6.6 (14.1) Change in cash included in current assets held for sale 0.3 (0.5) 0.8 Net change in Cash and cash equivalents and Restricted cash 1.0 3.1 (2.1) Cash and cash equivalents and Restricted cash at beginning of period 96.9 93.8 3.1 Cash and cash equivalents and Restricted cash at end of period $ 97.9 $ 96.9 $ 1.0

38©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (1 of 3) The following table reconciles Net Income to Adjusted EBITDA and Adjusted EBITDA margin: (3) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718, "Stock Compensation." (4) Represents non-cash charges related to impairments of long-lived assets. Note: Dollars in millions may not sum to total due to rounding. For the three months ended December 31, For the year ended December 31, IN MILLIONS 2024 2023 Change 2024 2023 Change Net income $ 93.6 $ 41.7 $ 51.9 $ 296.4 $ 107.3 $ 189.1 Plus: (Income) loss from discontinued operations, net of tax (0.3) 6.0 (6.3) (0.7) 9.8 (10.5) Income from continuing operations 93.2 47.7 45.5 295.7 117.0 178.7 Plus: Equity in net income of affiliates, net of tax (0.2) (0.2) — (0.2) (0.2) — Income tax expense 46.5 36.2 10.3 119.0 137.6 (18.6) Income from continuing operations before income taxes and equity in net income of affiliates 139.5 83.7 55.8 414.5 254.5 160.0 Plus: (Gain) loss on disposal of subsidiaries, net (1.8) — (1.8) 1.3 (3.6) 4.9 Foreign currency exchange (gain) loss, net (14.3) 24.1 (38.4) (50.7) 75.7 (126.4) Other expense, net (0.7) 0.5 (1.2) (1.2) 0.3 (1.5) Interest expense 3.3 3.7 (0.4) 18.1 21.0 (2.9) Interest income (1.8) (2.1) 0.3 (8.1) (9.1) 1.0 Operating income 124.2 110.0 14.2 374.0 338.8 35.2 Plus: Depreciation and amortization 16.1 17.7 (1.6) 68.2 69.6 (1.4) EBITDA 140.3 127.7 12.6 442.2 408.4 33.8 Plus: Share-based compensation expense (3) 0.8 2.2 (1.4) 7.8 7.1 0.7 Loss on impairment of assets (4) — 1.5 (1.5) — 3.1 (3.1) Adjusted EBITDA $ 141.1 $ 131.3 $ 9.8 $ 450.1 $ 418.6 $ 31.5 Revenues $ 423.4 $ 409.4 $ 14.0 $ 1,566.6 $ 1,484.3 $ 82.3 Income from continuing operations margin 22.0 % 11.7 % 1,036 bps 18.9 % 7.9 % 1,100 bps Adjusted EBITDA margin 33.3 % 32.1 % 126 bps 28.7 % 28.2 % 53 bps

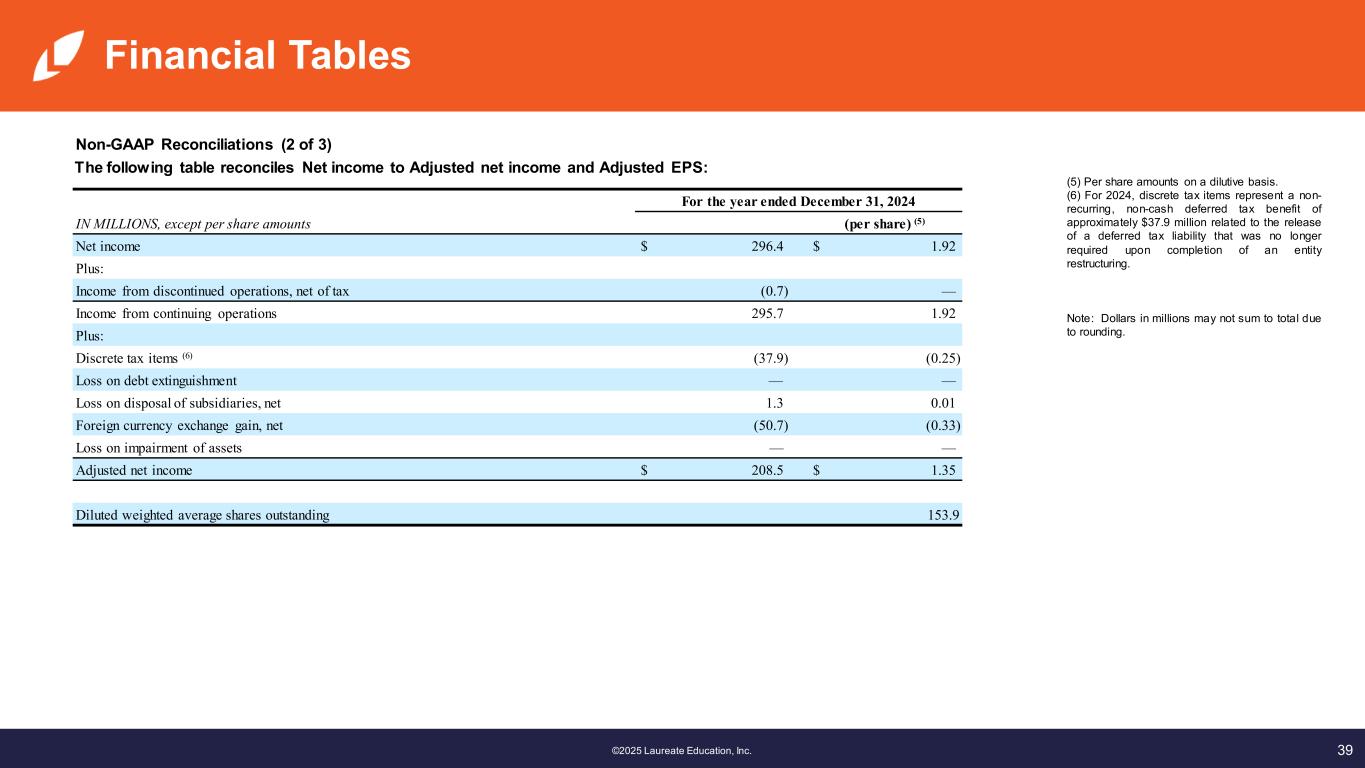

39©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (2 of 3) The following table reconciles Net income to Adjusted net income and Adjusted EPS: For the year ended December 31, 2024 IN MILLIONS, except per share amounts (per share) (5) Net income $ 296.4 $ 1.92 Plus: Income from discontinued operations, net of tax (0.7) — Income from continuing operations 295.7 1.92 Plus: Discrete tax items (6) (37.9) (0.25) Loss on debt extinguishment — — Loss on disposal of subsidiaries, net 1.3 0.01 Foreign currency exchange gain, net (50.7) (0.33) Loss on impairment of assets — — Adjusted net income $ 208.5 $ 1.35 Diluted weighted average shares outstanding 153.9 (5) Per share amounts on a dilutive basis. (6) For 2024, discrete tax items represent a non- recurring, non-cash deferred tax benefit of approximately $37.9 million related to the release of a deferred tax liability that was no longer required upon completion of an entity restructuring. Note: Dollars in millions may not sum to total due to rounding.

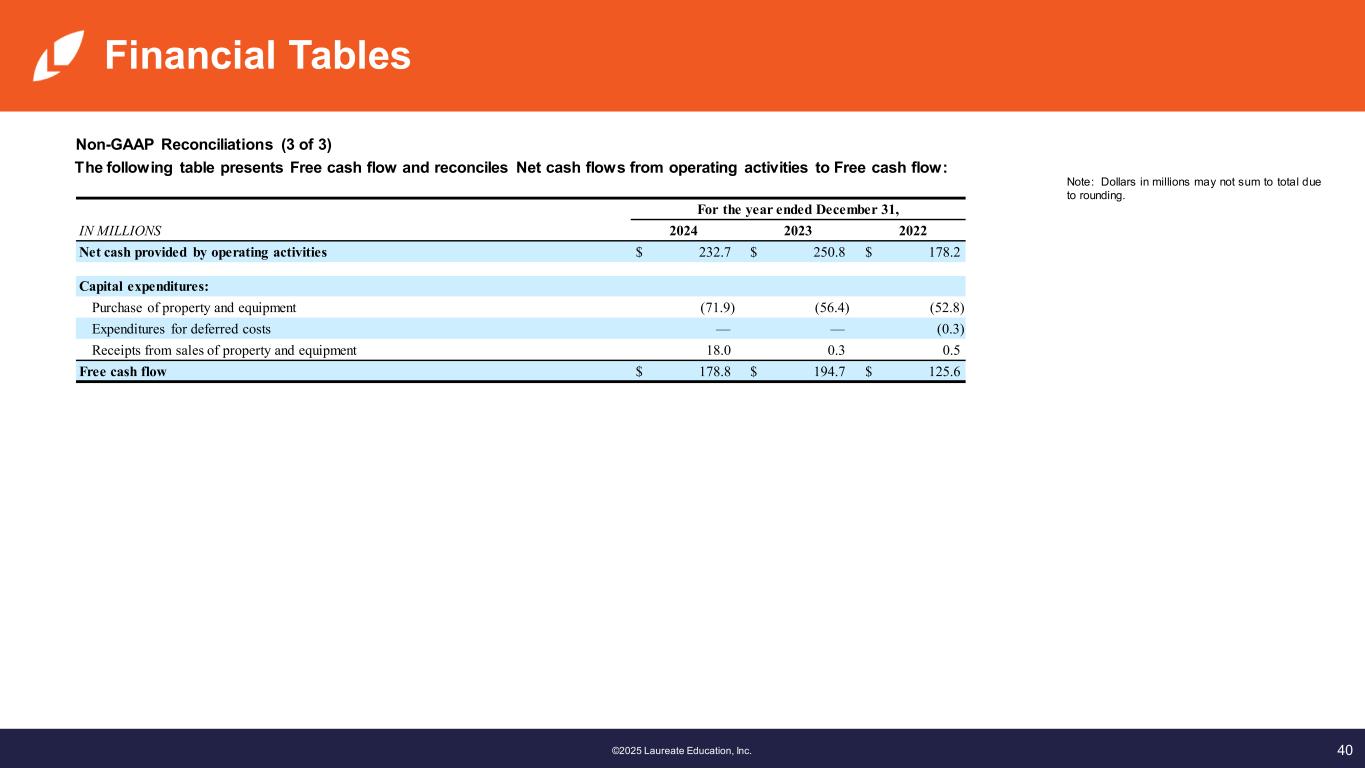

40©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (3 of 3) The following table presents Free cash flow and reconciles Net cash flows from operating activities to Free cash flow: Note: Dollars in millions may not sum to total due to rounding. For the year ended December 31, IN MILLIONS 2024 2023 2022 Net cash provided by operating activities $ 232.7 $ 250.8 $ 178.2 Capital expenditures: Purchase of property and equipment (71.9) (56.4) (52.8) Expenditures for deferred costs — — (0.3) Receipts from sales of property and equipment 18.0 0.3 0.5 Free cash flow $ 178.8 $ 194.7 $ 125.6

©2025 Laureate Education, Inc.