SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

West Marine, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

To the Stockholders of West Marine, Inc.

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of West Marine, Inc. to be held at our corporate headquarters, 500 Westridge Drive, Watsonville, California, on Wednesday, May 7, 2003, at 10:30 a.m., local time.

The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement explain the matters to be voted on at the meeting. Please read the enclosed Notice and Proxy Statement so you will be informed about the business to come before the meeting. Your vote is important, regardless of the number of shares you own. On behalf of the Board of Directors, I urge you to mark, date, sign and return the enclosed proxy card as soon as possible, even if you plan to attend the Annual Meeting. You may, of course, revoke your proxy by notice in writing to the Corporate Secretary at any time before the proxy is voted.

Sincerely, |

|

/s/ JOHN EDMONDSON

|

John Edmondson President and Chief Executive Officer |

Watsonville, California

April 7, 2003

500 Westridge Drive

Watsonville, California 95076-4100

(831) 728-2700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held on Wednesday, May 7, 2003, 10:30 a.m.

To the Stockholders of West Marine, Inc:

Notice is hereby given that the 2003 Annual Meeting of Stockholders of West Marine, Inc. will be held at West Marine’s corporate headquarters, 500 Westridge Drive, Watsonville, California, on Wednesday, May 7, 2003, at 10:30 a.m., local time, for the following purposes:

| | (1) | | To elect eight directors; and |

| | (2) | | To transact such other business as may properly come before the Annual Meeting. |

The Board of Directors has fixed March 14, 2003 as the record date for the Annual Meeting with respect to this proxy solicitation. Only stockholders of record at the close of business on that date are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

By Order of the Board of Directors |

|

/s/ RUSSELL SOLT

|

Russell Solt Corporate Secretary |

Watsonville, California

April 7, 2003

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE AS PROMPTLY AS POSSIBLE. A PROXY MAY BE REVOKED BY A STOCKHOLDER ANY TIME PRIOR TO ITS USE AS SPECIFIED IN THE ENCLOSED PROXY STATEMENT.

500 Westridge Drive

Watsonville, California 95076-4100

(831) 728-2700

PROXY STATEMENT

2003 Annual Meeting of Stockholders

Solicitation and Revocability of Proxies

The Board of Directors of West Marine, Inc. is furnishing this Proxy Statement to solicit proxies to be used at West Marine’s Annual Meeting of Stockholders to be held on May 7, 2003, at the time and place and for the purposes set forth in the foregoing Notice of Annual Meeting of Stockholders, and at any adjournment of the meeting. This Proxy Statement and the enclosed form of proxy were first sent for delivery to West Marine’s stockholders on or about April 7, 2003.

Each valid proxy received in time will be voted at the Annual Meeting in accordance with the choice specified, if any. Valid proxies include all properly executed written proxy cards and not later revoked. All proxies received that are executed but not voted will be voted as recommended by the Board of Directors.

Any proxy duly given pursuant to this solicitation may be revoked by the stockholder at any time prior to the voting of the proxy at the Annual Meeting or any adjournment thereof. A proxy may be revoked (i) by written notice delivered to the Corporate Secretary of West Marine stating that the proxy is revoked, (ii) by a later dated proxy signed by the same person who signed the earlier proxy and delivered to the Corporate Secretary of West Marine or (iii) by attendance at the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy.

Voting by Proxy

If a stockholder is a corporation or partnership, the accompanying proxy card must be signed in the full corporate or partnership name by a duly authorized person. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, the signer’s full title must be given and a certificate or other evidence of appointment must be furnished. If shares are owned jointly, each joint owner must sign the proxy card.

Voting Securities

Only stockholders of record on the books of West Marine as of the close of business on March 14, 2003, which has been fixed as the record date in accordance with our bylaws, will be entitled to vote at the Annual Meeting.

As of the close of business on March 14, 2003, there were outstanding 19,460,438 shares of common stock of West Marine, each share of which is entitled to one vote. The presence at the Annual Meeting in person or by proxy of holders of a majority of the issued and outstanding shares of common stock will constitute a quorum for the transaction of business at the meeting or any adjournment thereof, unless notice of the adjournment provides otherwise in accordance with our bylaws. Of the shares present at the Annual Meeting, in person or by proxy, and entitled to vote, the affirmative vote of the majority is required for the election of directors.

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the election inspector(s) appointed for the meeting and will determine whether or not a quorum is present. For purposes of determining the presence of a quorum, the election inspector(s) will treat abstentions and broker non-votes as shares that are present and entitled to

- 1 -

vote. A broker non-vote occurs when the nominee of a beneficial owner with the power to vote on at least one matter does not vote on another matter because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner with respect to such matter.

With respect to the election of directors, a stockholder may vote “For” or “Withhold Authority”. Votes indicating “Withhold Authority” will be counted as a vote against the nominee or slate of nominees. If any other proposal is properly brought to the Annual Meeting, shares that the stockholder does not vote “for” will be counted as a vote “against” the proposal. Thus, an abstention would have the effect of a vote against the applicable proposal. Broker non-votes are not considered shares entitled to vote on the applicable proposal and are not included in determining whether such proposal is approved. Accordingly, if a broker indicates on the proxy that it does not have discretionary authority to vote on a particular matter, it will have no effect on the outcome of a vote on the applicable proposal.

- 2 -

ELECTION OF DIRECTORS

Eight directors are to be elected at the Annual Meeting to hold office until the 2004 Annual Meeting of Stockholders or until their respective successors shall have been elected and qualified. The persons named below are nominees for election, and each of the nominees is currently a director.The persons named as proxies intend (unless authority is withheld) to vote for the election of all the nominees as directors.

The Board of Directors knows of no reason to believe that any nominee for director would be unable or unwilling to serve as a director. If at the time of the Annual Meeting, or any adjournment thereof, any of the nominees is unable or unwilling to serve as a director of West Marine, the persons named in the proxy intend to vote for such substitute nominees as may be nominated by the Corporate Governance and Compensation Committee or directed by the Board of Directors, unless directed by the proxy to do otherwise.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES.

The following information regarding the nominees, their occupations, employment history and directorships in certain companies is as reported by the respective nominees.

Nominees for Director | | Business Experience During Past Five Years and Other Information |

|

Randolph K. Repass | | Mr. Repass, 59, has served as Chairman of the Board of West Marine since its founding in 1968. He has also served as Chief Executive Officer, from 1968 to April 1995 and from July 1998 to November 1998, and as President, from 1968 to 1990 and from August 1993 to March 1994. Mr. Repass is also a director of National Marine Manufacturers Association and Sail America, a sailing industry association. Additionally, Mr. Repass is a member of the board of New England Rope, Inc. |

|

John Edmondson | | Mr. Edmondson, 58, has served as President and Chief Executive Officer of West Marine since November 1998. From 1992 to November 1998, Mr. Edmondson served initially as Corporate Chief Operating Officer, and then as President and Chief Executive Officer, of World Duty Free Americas, Inc., a duty free retailer. Prior to joining World Duty Free Americas, Inc., Mr. Edmondson was General Manager of Marriott’s Host Airport Merchandise and its Sports and Entertainment division. Mr. Edmondson began his career with Allied Stores’ Maas Bros./Jordan Marsh in 1965 and has held senior management positions with a number of retailers. |

|

Richard E Everett | | Mr. Everett, 50, has served as a director of West Marine since 1994. He has also served as Chief Operating Officer since 1995 and oversees the Merchandising, Marketing, Replenishment, Real Estate and Visual Merchandising operations of West Marine. From 2001 to 2002, Mr. Everett also served as President of Retail. From 1998 to 2001, Mr. Everett served as President of Stores. From 1996 to 1998, he served as Executive Vice President and has held various other positions since joining West Marine in 1981. |

|

Geoffrey A. Eisenberg | | Mr. Eisenberg, 50, has served as a director of West Marine since 1977. Mr. Eisenberg has served as Chief Executive Officer of Salz Leathers, Inc., a leather manufacturer, since December 2000. Mr. Eisenberg has been designated as a part-time, on-call employee of West Marine since January 2001, so that he is available to handle special projects if and as required by the Chief Executive Officer, although Mr. Eisenberg has not been assigned any such projects. From January 1995 to December 2000, Mr. Eisenberg served as a senior consultant to West Marine. Mr. Eisenberg was Senior Vice President of West Marine from 1988 to 1994 and was responsible for merchandising and marketing from 1991 to 1994. |

- 3 -

David McComas | | Mr. McComas, 60, has served as a director of West Marine since 1996. Mr. McComas has served as President and Chief Executive Officer of Eye Care Centers of America, Inc. since July 2001, and as President and Chief Operating Officer from July 1998 to July 2001. From June 1991 to July 1998, Mr. McComas served as Western Region President and Corporate Vice President and held several other senior management positions with Circuit City Stores, Inc. |

|

Peter Roy | | Mr. Roy, 46, has served as a director of West Marine since 2001. Mr. Roy is an entrepreneur and business advisor to companies in the healthy lifestyle industry. From 1993 to 1998, Mr. Roy served as President of Whole Foods Market, Inc., a natural food products retailer, and for 10 years prior to that served as its President of the West Coast Region. Mr. Roy is also a director of Avalon Natural Products and Traditional Medicinal, Inc. Mr. Roy is also a strategic advisor to North Castle Partners, a private equity fund, and an “Entrepreneur in Residence” at Tulane University’s Freeman School of Business. |

|

Daniel J. Sweeney, Ph.D. | | Dr. Sweeney, 60, has served as a director of West Marine since 2001. He is currently an adjunct professor at the Daniels College of Business at the University of Denver. From June 1995 to June 2000, Dr. Sweeney served as Vice President, Global Consulting, for IBM Global Services, a technology services company. Prior to joining IBM, Dr. Sweeney was Chairman of the Management Horizons Division of Price Waterhouse LLP (now PricewaterhouseCoopers), which provided research and consulting services to the retailing industry. Dr. Sweeney is also an author and commentator on the retailing and consumer marketing industries and has served as an advisor to leading firms in the industry. Dr. Sweeney is on the Dean’s Advisory Council at The Ohio State University, the Advisory Board of the Retail Management Institute at Santa Clara University, the National Advisory Board of the Marketing Institute at Brigham Young University and the Advisory Board of the Institute for Retail Management at the University of Florida. |

|

William U. Westerfield | | Mr. Westerfield, 71, has served as a director of West Marine since 2000. Mr. Westerfield serves both as a director and audit committee chairman of Gymboree Corporation and Twinlab Corporation. In 1992, Mr. Westerfield retired as an audit partner of Price Waterhouse LLP (now PricewaterhouseCoopers) after having been with the firm for 36 years and serving as an audit partner for 27 years. Mr. Westerfield also serves as a consultant in auditing disputes. |

Board of Directors and Committees

During 2002, the Board of Directors held four regular meetings and one special meeting. The Board of Directors has an Audit Committee and a Corporate Governance and Compensation Committee. Each director attended at least 75% of the total number of meetings of the Board of Directors and meetings of the committees on which each director served during 2002. The nominating functions are performed by the Corporate Governance and Compensation Committee.

Audit Committee

The members of the Audit Committee are William U. Westerfield, David McComas and Daniel J. Sweeney. The Audit Committee held seven meetings during 2002.Among the functions performed by the Audit Committee are (i) to engage or discharge independent auditors, (ii) to review with the independent auditors the plan for and results of the auditing engagement, (iii) to review West Marine’s internal auditing procedures and the system of internal accounting controls and (iv) to make inquiries into matters within the scope of the Audit Committee’s functions.

- 4 -

AUDIT COMMITTEE REPORT

The Audit Committee is responsible for selecting independent auditors for West Marine and for the review of auditing, accounting, financial reporting and internal control functions at West Marine. In addition, the Audit Committee is responsible for monitoring the quality of West Marine’s accounting principles and financial reporting, the independence of the independent auditors and the non-audit services provided to West Marine by its independent auditors. In discharging its duties, the Audit Committee is expected to:

| | • | | Review and approve the scope of the annual audit and the independent auditors’ fees; |

| | • | | Meet independently with West Marine’s internal auditing staff, independent auditors and senior management; |

| | • | | Review the general scope of West Marine’s accounting, financial reporting, annual audit and internal audit programs, matters relating to internal control systems and results of the annual audit; and |

| | • | | Review disclosures from West Marine’s independent auditors regarding Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. |

Pursuant to the Auditor Independence Policy adopted by the Audit Committee, West Marine may engage its independent auditors to provide audit and permissible non-audit services that have been approved by the Audit Committee. West Marine shall not engage the independent auditors to perform any services for West Marine or any of its subsidiaries without the prior approval of the Audit Committee. In addition, the independent auditors shall not be engaged to provide any service if the provision of such service to West Marine or any of its subsidiaries would cause the Securities and Exchange Commission or the Nasdaq National Market System to no longer consider the independent auditors to be “independent” or if such engagement would otherwise cause West Marine or any of its subsidiaries to violate any other applicable laws, regulations or policies.

The Board of Directors has determined that each of the Audit Committee members is an “independent” director as that term is defined in the National Association of Securities Dealers’ listing standards. In addition, the Board of Directors has determined that William U. Westerfield, Chairman of the Audit Committee, qualifies as an audit committee financial expert as that term is defined in Item 401 of Regulation S-K.

The Board of Directors adopted a written charter for the Audit Committee, which was filed as an appendix to West Marine’s definitive proxy statement filed with the Securities and Exchange Commission on April 9, 2001. During 2002, the Audit Committee reviewed and reassessed the adequacy of its charter, particularly in light of the Sarbanes-Oxley Act of 2002 and the related corporate reform initiatives undertaken by the Securities and Exchange Commission and the National Association of Securities Dealers. Although most of the corporate reform initiatives pertinent to the Audit Committee currently are in the form of rule proposals, the Audit Committee recommended, and the Board of Directors adopted, a revised audit committee charter that reflects the spirit and substance of these initiatives. A copy of the revised charter is filed with West Marine’s definitive proxy statement, of which this report forms a part. Once final rules are adopted, the Audit Committee will further review and, if necessary or appropriate, recommend further modification of its charter.

In connection with the financial statements for the year ended December 28, 2002, the Audit Committee: (i) reviewed and discussed with management the audited consolidated financial statements; (ii) discussed with Deloitte & Touche LLP, independent auditors during 2002, the matters required by Statement on Auditing Standards No. 61, as amended,Communication with Audit Committees; and (iii) received from the independent auditors the matters required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and discussed such matters with the independent auditors, as well as the independent auditor’s independence, including a consideration of the compatibility of non-audit services with such independence. Based on these reviews and discussions, the Audit Committee has recommended that the Board of Directors include the audited consolidated financial statements in West Marine’s Annual Report on Form 10-K for the year ended December 28, 2002 to be filed with the Securities and Exchange Commission.

- 5 -

The Audit Committee has selected and approved the engagement of Deloitte & Touche LLP as West Marine’s independent auditors for 2003.

March 11, 2003

2002 Audit Committee

William U. Westerfield, Chairman

David McComas

Daniel J. Sweeney

The Audit Committee Report set forth above will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that West Marine specifically incorporates such reports by reference, and such report will not otherwise be deemed to be soliciting materials or to be filed under such Acts.

- 6 -

Corporate Governance and Compensation Committee

The members of the Corporate Governance and Compensation Committee are Peter Roy and Daniel J. Sweeney, each of whom is independent from West Marine and its management as independence is defined in National Association of Securities Dealers’ current and proposed listing standards. The Organization and Compensation Committee, which was recently renamed the Corporate Governance and Compensation Committee by the Board in recognition of the Committee’s expanded responsibilities, held three meetings during 2002. Among the functions performed by the Corporate Governance and Compensation Committee are (i) to review the reasonableness of, and make recommendations to, the Board regarding the compensation of executive officers and senior management of West Marine, (ii) to administer our Equity Incentive Plan, (iii) to identify and recommend to the Board director nominees and (iv) to advise the Board on corporate governance issues.The Corporate Governance and Compensation Committee is not required under its charter or West Marine’s bylaws to consider stockholder recommendations for director nominations.

Compensation of Directors

Non-employee directors are paid director fees of $1,000 for each Board meeting attended, payable on the meeting date, plus an annual retainer of $16,000, payable quarterly, plus $8,000 in the form of West Marine stock, payable as of each annual meeting. In addition, during fiscal year 2002, each member of the Corporate Governance and Compensation Committee received an annual fee of $4,000, each member of the Audit Committee received an annual fee of $6,000 and each director who is a committee chairperson received an annual fee of $2,500. All of these additional annual fees were also payable in quarterly installments. Non-employee directors are also reimbursed for expenses incurred to attend meetings of the Board or committees on which they serve.

In light of the new responsibilities given to committees of the Board as a result of the Sarbanes-Oxley Act of 2002, the Board, in February 2003, approved an increase in non-employee director compensation for committee service. As a result, for fiscal year 2003, each member of the Corporate Governance and Compensation Committee will receive an annual fee of $6,000, the chairperson of the Corporate Governance and Compensation Committee will receive an annual fee of $3,500, each member of the Audit Committee will receive an annual fee of $12,000, and the chairperson of the Audit Committee will receive an annual fee of $5,000. All of these committee fees also will be payable in quarterly installments.

Under the Equity Incentive Plan, each non-employee director is eligible to annually receive an option exercisable for up to 2,000 shares of our common stock. In 2002, each of Messrs. Westerfield, Sweeney, Roy and McComas was granted a nonqualified stock option to purchase 2,000 shares of our common stock at the fair market value of the shares on the date of grant. The option was awarded on May 3, 2002, became exercisable on November 3, 2002, and will remain exercisable until 2012.

Directors who are affiliated with West Marine do not receive any compensation for serving on the Board. Mr. Eisenberg also received an option to purchase 2,000 shares of our common stock in May 2002, but he did not receive additional compensation or benefits (other than a de minimis 401(k) matching contribution) in his role as a part-time, on-call employee of West Marine.

- 7 -

Executive Compensation

The following table sets forth certain information for fiscal years 2002, 2001 and 2000, concerning the cash and non-cash compensation for services in all capacities to West Marine and its subsidiaries earned by, or awarded or paid to, the Chief Executive Officer and the other two most highly compensated executive officers whose combined salary and bonus exceeded $100,000 in the fiscal year ended December 28, 2002:

SUMMARY COMPENSATION TABLE

| | | Year

| | Annual Compensation

| | Long Term Compensation Awards

| | All Other Compensation ($)(1)

|

| | | | | Securities Underlying | |

Name and Principal Position

| | | Salary ($)

| | Bonus ($)

| | Options (#)

| |

John Edmondson President and Chief Executive Officer | | 2002 2001 2000 | | $ | 483,120 464,540 450,008 | | $ | 450,184 537,030 84,375 | | 75,000 50,000 50,000 | | $ | 5,842 516 516 |

|

Richard E Everett Chief Operating Officer | | 2002 2001 2000 | | $ | 304,547 291,152 270,194 | | $ | 189,193 225,675 34,375 | | 40,000 50,000 22,800 | | $ | 4,882 4,049 1,135 |

|

Russell Solt Executive Vice President and Chief Financial Officer | | 2002 2001 2000 | | $ | 302,170 290,387 245,769 | | $ | 189,180 225,675 39,540 | | 40,000 40,000 100,000 | | $ | 1,264 676 276 |

| (1) | | Reflects matching contributions to the West Marine, Inc. 401(k) Plan made on behalf of the named executive officer and insurance premiums paid by West Marine for term life insurance secured for the benefit of West Marine’s executive officers in 2002 as follows: Mr. Edmondson $3,685 and $2,157, respectively; Mr. Everett $4,441 and $441, respectively; Mr. Solt $0 and $1,264, respectively. |

Long-Term Incentives

In general, West Marine provides long-term incentives to the named executive officers through awards under its Equity Incentive Plan. The Equity Incentive Plan provides for various forms of equity-based incentive compensation with respect to our common stock, including stock options, stock appreciation rights, stock bonuses, restricted stock awards and performance units and awards consisting of combinations of such incentives.

The following table sets forth for the named executive officers information regarding stock options granted under the West Marine Equity Incentive Plan during the fiscal year ended December 28, 2002:

- 8 -

OPTION GRANTS IN FISCAL YEAR 2002

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

| | | Number of Securities Underlying Options | | Percent of Total Options Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Sh)

| | Expiration Date(2)

| |

Name

| | Granted(#)(1)

| | | | | 5%

| | 10%

|

John Edmondson | | 75,000 | | 9.46 | % | | $ | 17.30 | | 02/12/2012 | | $ | 816,132 | | $ | 2,068,239 |

Richard E Everett | | 40,000 | | 5.04 | % | | $ | 17.30 | | 02/12/2012 | | $ | 435,271 | | $ | 1,103,061 |

Russell Solt | | 40,000 | | 5.04 | % | | $ | 17.30 | | 02/12/2012 | | $ | 435,271 | | $ | 1,103,061 |

| (1) | | These options are exercisable in annual increments of 20% commencing one year from the date of grant. Under the terms of the Equity Incentive Plan, the Corporate Governance and Compensation Committee retains discretion, subject to plan limits, to modify the terms of outstanding options. |

| (2) | | All options granted in fiscal 2002 were granted for a term of ten years, conditioned on continued employment. |

| (3) | | Potential realizable values are reported net of the option exercise price. The dollar amounts under these columns are the result of calculations at the 5% and 10% rates (determined from the price at the date of grant, not the current market value, of our common stock) set by the Securities and Exchange Commission, and therefore, are not intended to forecast possible future appreciation, if any, of the West Marine stock price. Actual gains, if any, on stock option exercises are dependent on the future performance of our common stock as well as the optionholder’s continued employment through the vesting period. The potential realizable value calculation assumes that the optionholder waits until the end of the option term to exercise the option. |

The following table sets forth information related to the exercise of stock options during fiscal 2002 and the number and value of stock options held by the named executive officers as of December 28, 2002.

OPTION EXERCISES IN FISCAL YEAR 2002

AND OPTION VALUES AT FISCAL YEAR END

| | | Shares Acquired on Exercise(#)

| | Value Realized($)

| | Number of Unexercised Options at December 28, 2002(#)

| | Value of Unexercised In-the-Money Options at December 28, 2002($)(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

John Edmondson | | 65,000 | | $ | 824,792 | | 62,000 | | 219,000 | | $ | 343,865 | | $ | 924,691 |

Richard E Everett | | 153,300 | | $ | 1,406,849 | | 243,729 | | 79,280 | | $ | 1,011,115 | | $ | 200,956 |

Russell Solt | | 48,000 | | $ | 591,560 | | -0- | | 132,000 | | $ | -0- | | $ | 590,590 |

| (1) | | Based on a price per share of $13.77 which was the price of a share of our common stock on the Nasdaq National Market at the close of business on December 27, 2002. |

- 9 -

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes information about West Marine’s equity compensation plans as of December 28, 2002. All outstanding awards relate to West Marine’s common stock.

| | | (a)

| | | (b)

| | | (c)

| |

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights(#)

| | | Weighted-average exercise price of outstanding options, warrants and rights($)

| | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (#)

| |

Equity compensation plans/arrangements approved by securityholders | | 3,358,467 | (1) | | $ | 12.67 | (1) | | 1,780,702 | (2) |

Equity compensation plans/arrangements not approved by securityholders | | -0- | | | | -0- | | | -0- | |

| (1) | | Consists of stock options outstanding under the Equity Incentive Plan. Does not include purchase rights accruing under the Associate Stock Buying Plan as the number of shares issuable and the exercise price under that plan will not be determinable until the end of the current offering period, April 30, 2003. Does not include the 14,634 shares of restricted stock that have been awarded under the Equity Incentive Plan. |

| (2) | | Includes 1,381,028 shares of common stock reserved for future issuance under the Equity Incentive Plan and 399,674 shares of common stock reserved for issuance under the Associates Stock Buying Plan. |

- 10 -

Employment Arrangements

In August 1999, West Marine entered into an Executive Termination Compensation Agreement with Mr. Everett. The agreement provides that, if Mr. Everett is terminated without cause or is constructively terminated, he will receive (i) severance pay equal to his base salary until the earlier to occur of the expiration of 18 months after the date of termination or the date he accepts other employment, and (ii) for a period of five years, continued health and life insurance benefits and the right to exercise any vested options. In addition, West Marine has agreed to retain Mr. Everett as a consultant for a period of time after his termination, with or without cause.

As of March 29, 2002, West Marine entered into an employment agreement with Mr. Edmondson to serve as President and Chief Executive Officer through February 28, 2004. Under the agreement, Mr. Edmondson is entitled to receive his current annual base salary, subject to merit increases, and a target annual bonus of 75% of salary, subject to adjustment up or down based on West Marine’s financial results. If the annual bonus exceeds 50% of his salary, Mr. Edmondson will use such excess to purchase West Marine common stock on the open market. Mr. Edmondson may receive, as recommended by the Corporate Governance and Compensation Committee, an annual stock option grant with a minimum market value of $1 million, provided that in the event West Marine common stock is selling for less than $20.00 per share, the option grant will be 50,000 shares. The options become exercisable in installments of 20% per year and have a life of 10 years. Mr. Edmondson is required to achieve certain minimum ownership levels of West Marine common stock over a two-year period. If Mr. Edmondson’s employment is terminated other than for cause prior to expiration of the agreement, then he will be entitled to severance pay in an amount equal to his salary and estimated bonuses for a period of 12 months and all outstanding stock options will immediately vest and remain exercisable through February 28, 2005. Mr. Edmondson is entitled to continue to participate in West Marine’s group health plan, at no cost, so long as he holds unexercised stock options. As part of the employment agreement, Mr. Edmondson also entered into West Marine’s employee confidentiality and two-year non-compete agreement.

As of May 1, 2002, West Marine entered into an employment agreement with Mr. Solt to serve as Chief Financial Officer, Executive Vice President and Secretary through April 30, 2003, and pursuant to an amendment to the agreement, for successive one year periods thereafter unless and until either party gives notice of termination. Upon termination of such position, Mr. Solt will serve as Director of Investor Relations for a one-year period, and for successive one-year periods thereafter unless and until either party gives notice of termination. As Chief Financial Officer, Mr. Solt is entitled to receive his current annual base salary, subject to merit increases, and an annual bonus under West Marine’s executive bonus program. In addition, he may participate in all benefit plans available to West Marine executives, including the Equity Incentive Plan. As Director of Investor Relations, Mr. Solt will be entitled to receive an annual salary of $50,000, subject to increases based on quarterly reviews, and group health plan benefits. If Mr. Solt’s employment is terminated other than for cause prior to expiration of the agreement, then he will be entitled to severance pay in an amount equal to (i) the balance of his unpaid annual salary for the remaining term of employment in that position or for six months, whichever is greater, and (ii) if then serving as Chief Financial Officer, any estimated annual bonus which would have been paid to him but for his termination. In addition, all outstanding stock options will continue to vest during the remainder of his one-year term of employment. As part of the employment agreement, Mr. Solt also entered into West Marine’s employee confidentiality and two-year non-compete agreement.

- 11 -

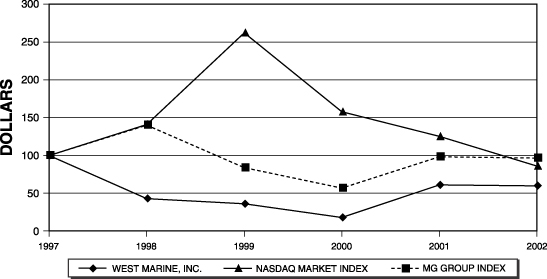

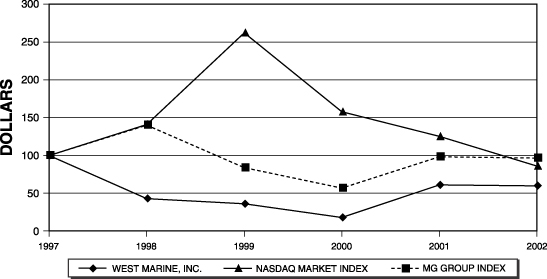

Performance Graph

The following graph compares the five-year cumulative total stockholder return on West Marine common stock with the five-year cumulative total return of (i) the Nasdaq Market Index and (ii) the MG Industry Group 745 index consisting of 41 specialty retailers.

ASSUMES $100 INVESTED ON JAN. 3, 1998

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 28, 2002

The performance graph set forth above will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference, and will not otherwise be deemed to be soliciting material or to be filed under such Acts.

- 12 -

Corporate Governance and Compensation Committee Interlocks and Insider Participation

The Corporate Governance and Compensation Committee during fiscal year 2002 consisted of Messrs. Roy and Sweeney, each of whom are independent from West Marine and its management as independence is defined in National Association of Securities Dealers’ current and proposed listing standards. No director, executive officer or member of the Corporate Governance and Compensation Committee had any interlocking relationship with any other company that would require disclosure in this Proxy Statement.

CORPORATE GOVERNANCE AND COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The Corporate Governance and Compensation Committee is responsible for developing compensation plans, reviewing compensation levels and approving compensation policies.

Compensation Policy

West Marine’s compensation policies are intended to attract, motivate and reward highly qualified executives for the execution of long-term strategic management and the enhancement of stockholder value. Additionally, the policies support a performance-oriented environment directed towards specific company goals and serve to retain executives whose abilities are critical to West Marine’s long-term success and competitiveness.

In developing compensation plans and reviewing compensation levels, the Corporate Governance and Compensation Committee reviewed last year’s compensation report and a peer group study on salary and bonus levels as reported by proxy statements, which allows West Marine to examine compensation levels at companies with which it competes for talent in the marketplace. The peer group study included a comparison of the base salary and annual incentives programs of the peer group with that of West Marine. West Marine was compared to the National Retail Federation Foundation’sAnnual Specialty Store Compensation and Benefit Survey and the HewittTotal Compensation Measurement, Retail Cash Compensation by Industry: Executive. West Marine’s compensation practices compare favorably with those in these peer group studies. The Corporate Governance and Compensation Committee was then presented with the Chief Executive Officer’s statement of proposed executive pay ranges, which included base salary and incentive compensation levels for the executive officers. The Corporate Governance and Compensation Committee reviewed and approved the proposed ranges.

Executive Officers’ Compensation

The compensation of executive officers consists of three components:

| | • | | annual incentive compensation; and |

| | • | | long-term (equity) incentive awards. |

Base Salary. Base salary is designed to provide meaningful levels of compensation to executives, while helping to manage fixed costs. Salaries for top executives are determined annually, and are based on:

| | • | | job scope and responsibilities; |

| | • | | corporate, unit and individual performance; and |

| | • | | competitive rates for similar positions as indicated by the peer group study. |

We have targeted executive officers’ salaries at a competitive level for comparable companies. When considered together with annual and long-term compensation, we believe these levels are adequate to attract and retain key executives.

Annual Incentive Compensation. Short-term incentives for executive officers are intended to reflect our policy that a significant portion of the annual compensation of executive officers who have a material impact on West Marine’s performance should be contingent upon a comparison of individual executive’s performance against pre-established

- 13 -

objectives for West Marine and the individual officer. The bonus program closely ties the executive officer awards to the overall growth of West Marine’s net income and comparable store sales. The short-term incentives received by executive officers were determined by a formula based on:

| | • | | net income performance; and |

| | • | | comparable store sales. |

Short-term incentives are based on the achievement of goals relating to performance in the fiscal year. Objective performance goals are set to represent a range of performance, with the level of the associated incentive award varying with different levels of performance achievement. The “minimum” goal is set to reflect the minimum acceptable levels of performance which will warrant payment of incentive awards. The “maximum” goal reflects an ambitious level of performance which would only be attainable in an outstanding year.

For fiscal year 2002, net income rose to $18.9 million which reflects a 36% increase over net income of $13.9 million for fiscal 2001. Comparable store sales for fiscal year 2002 increased 0.9% compared to the same period a year ago. Based on results for 2002, bonuses were paid for 2002 to the executive officers.

Long-Term Incentive Compensation. Long-term incentives generally are provided through the issuance of stock options for common stock under the Equity Incentive Plan. A stock option permits the holder to buy West Marine stock at a specific price during a specific period of time. If the price of our common stock rises, the option increases in value. The intent of such stock option awards is to motivate executive officers to perform at levels that will result in better company performance and enhanced stock value, thereby linking the interests of management and stockholders. In general, stock option awards are issued annually with an exercise price equal to the market price of our common stock.

All options issued in 2002, 2001 and 2000 have a ten-year term. To encourage continued employment with West Marine, these options, with the exception of a one-time grant to Mr. Everett in 2001 of 50,000 options which became fully vested at six months, were designed to vest over a five-year period, with 20% becoming exercisable one year after the date of grant and an additional 20% becoming exercisable each year thereafter.

Chief Executive Officer Compensation

The executive compensation policy previously described is applied in establishing Mr. Edmondson’s compensation each year. Mr. Edmondson’s compensation package includes a salary with a target annual bonus of 75% of salary. The maximum bonus payable is three times that amount. Mr. Edmondson’s bonus for 2002 was based primarily on net income and comparable store sales results. In addition, Mr. Edmondson is granted stock options to purchase shares of common stock annually as recommended by the Corporate Governance and Compensation Committee, subject to a minimum grant equal to the greater of 50,000 shares or the number of shares which have a market value as of the date of grant of $1 million.

In 2002, Mr. Edmondson had a base salary of $483,120. On the basis of West Marine’s performance versus established goals, the Corporate Governance and Compensation Committee has determined that Mr. Edmondson has earned a bonus for fiscal year 2002 of $450,184.

Compensation for the Chairman of the Board

The Chairman of the Board of Directors of West Marine, Randolph K. Repass, had a base salary in 2002 of $100,000. Mr. Repass currently holds 6,605,258 shares or 34.1% of the outstanding common stock. Mr. Repass has not been granted any stock options since the initial public offering in 1993 and receives no bonus.

Tax Deductibility Considerations

Section 162(m) of the Internal Revenue Code limits the deductibility of compensation in excess of $1 million paid to the executive officers named in this proxy statement unless certain requirements are met. It is the present intention of the Corporate Governance and Compensation Committee to preserve the deductibility of compensation under Section 162(m) to the extent it believes that doing so would be consistent with the best interests of stockholders. Accordingly, it will be the policy of the Corporate Governance and Compensation Committee to consider the impact, if any, of Section

- 14 -

162(m) on West Marine and to document as necessary specific performance goals and take all other reasonable steps in order to preserve West Marine’s tax deductions. Consistent with such policy, long-term incentive compensation awards, particularly stock option awards, generally are designed to meet the requirements for deductibility under Section 162(m) as bonus awards.

March 11, 2003

2002 Corporate Governance and Compensation Committee

Peter Roy, Chairman

Daniel J. Sweeney

The Corporate Governance and Compensation Committee Report set forth above will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate such reports by reference, and such report will not otherwise be deemed to be soliciting materials or to be filed under such Acts.

- 15 -

Security Ownership of Management and Certain Beneficial Owners

The following table indicates, as to (i) each person who is known to own beneficially more than 5% of the outstanding shares of our common stock, (ii) each director and director nominee, (iii) each named executive officer and (iv) all directors and executive officers as a group, the number of shares and percentage of common stock beneficially owned as of February 28, 2003.

| | | Amount and Nature of common stock Beneficially Owned as of February 28,2003(1)

| |

Beneficial Owner

| | Number of Shares

| | | Percent

| |

Randolph K. Repass (2) | | 6,605,258 | (3) | | 34.1 | % |

John Edmondson | | 61,634 | (4) | | * | |

Richard E Everett | | 294,569 | (4) | | 1.5 | % |

Russell Solt | | 8,000 | (4) | | * | |

Geoffrey A. Eisenberg | | 498,764 | (5) | | 2.6 | % |

David McComas | | 35,556 | (6) | | * | |

Peter Roy | | 11,364 | (6) | | * | |

Daniel J. Sweeney | | 5,364 | (6) | | * | |

William U. Westerfield | | 7,064 | (6) | | * | |

All directors and executive officers as a group (9 persons) | | 7,527,573 | (7) | | 38.9 | % |

| (1) | | Except as otherwise noted, each person has sole voting and investment power over the common stock shown as beneficially owned, subject to community property laws where applicable. |

| (2) | | The address of Mr. Repass is 500 Westridge Drive, Watsonville, California 95076-4100. |

| (3) | | Includes 272,600 shares held by Mr. Repass’ wife. Also includes stock options, held by Mr. Repass’ wife, exercisable within 60 days to purchase 6,000 shares. Also includes 18,900 shares held by Mr. Repass’ minor son and 300,000 shares held by the Repass-Rodgers Family Foundation Inc. Mr. Repass has sole voting and dispositive power with respect to 6,326,658 shares and is deemed to have shared voting and dispositive power with respect to 278,600 shares. Mr. Repass disclaims beneficial ownership of all shares attributed to his spouse and all shares held by the Repass-Rodgers Family Foundation. |

| (4) | | Includes stock options exercisable within 60 days to purchase shares as follows: John Edmondson, 47,000 shares; Richard E Everett, 259,669 shares; and Russell Solt, 8,000 shares. |

| (5) | | Includes stock options exercisable within 60 days to purchase 40,900 shares. Also includes 10,640 shares held by Mr. Eisenberg’s minor children. |

| (6) | | Includes stock options exercisable within 60 days as follows: David McComas, 25,812 shares; Peter Roy, 4,000 shares; Daniel J. Sweeney, 4,000 shares; and William U. Westerfield, 6,000 shares. |

| (7) | | Includes stock options exercisable within 60 days to purchase 401,381 shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors, and persons who own more than 10% of our common stock, to file reports of ownership and changes in ownership of West Marine common stock with the Securities and Exchange Commission. Executive officers, directors and greater than 10% stockholders are required by Securities and Exchange Commission regulation to furnish West Marine with copies of all Section 16(a) forms they file.

Based solely on a review of copies of such reports received by West Marine, or written representations from certain reporting persons that no Forms 5 were required for those persons, we believe that, during the period from December 31, 2001 to December 28, 2002, our executive officers, directors and greater than 10% stockholders filed on a timely basis all reports due under Section 16(a).

Certain Transactions

Since February 2002, West Marine has leased its store in Palo Alto, California from the FBO Trust, for which Randolph K. Repass is the trustee. Prior to that, West Marine leased its Palo Alto store directly from Randolph K. Repass. In addition, West Marine leases its corporate headquarters and its stores in Santa Cruz, California and

- 16 -

Braintree, Massachusetts from three partnerships. Mr. Repass is a general partner of each such partnership and, together with certain members of his family, owns substantially all of the partnership interests in such partnerships. Richard E Everett is a 2.5% limited partner in one of the partnerships, and Geoffrey A. Eisenberg is a 7.5% limited partner in two of the partnerships. Pursuant to these leases, West Marine paid rent to Mr. Repass and such partnerships, as appropriate, during fiscal years 2002, 2001 and 2000 in the aggregate amount of approximately $1.4 million, $1.4 million and $1.3 million, respectively.

Mr. Repass is a member of the board of directors and a stockholder of New England Ropes, Inc., a major supplier of West Marine. Mr. Repass’ brother is the President and his father is a member of the board of directors and a major stockholder of New England Ropes, Inc. West Marine’s cost of sales during fiscal years 2002, 2001 and 2000 included $7.1 million, $6.5 million and $6.8 million, respectively, related to purchases from New England Ropes. Accounts payable to New England Ropes at year-end 2002 and 2001 were $234,000 and $269,000, respectively.

- 17 -

Auditors

Deloitte & Touche LLP, independent certified public accountants, served as our independent auditors for 2002 and has been selected as our independent auditors for 2003. Representatives of Deloitte & Touche LLP will be present at the Annual Meeting, will be offered the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Principal Accounting Firm Fees

Aggregate fees billed to West Marine for the year ended December 29, 2001 and December 28, 2002, by West Marine’s independent auditor and principal accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates, are as follows:

| | | 2002

| | 2001

|

Audit Fees | | $ | 282,286 | | $ | 278,062 |

Audit-Related Fees(1) | | $ | 79,300 | | $ | 28,376 |

Tax Fees(2) | | $ | 228,222 | | $ | 144,276 |

All Other Fees(3) | | $ | -0- | | $ | 27,097 |

| (1) | | Includes fees for audit of West Marine’s employee benefit plans in 2002 and 2001 and due diligence assistance and consultations in 2002 related to West Marine’s acquisition of the retail store, catalog sales and wholesale operations of Boat America Corporation. |

| (2) | | Includes fees for tax advise and tax return assistance in 2001 and 2002. |

| (3) | | Includes fees for internal audit services in 2001. |

The Audit Committee considered whether the provision of the services covered under the captions “Audit Related Fees,” “Tax Fees” and “All Other Fees” above, if any, is compatible with maintaining Deloitte & Touche LLP’s independence.

Other Matters

As of the date of this proxy statement, management does not know of any other matters to be considered at the Annual Meeting. If any other matters do properly come before the meeting, the persons named in the accompanying proxy intend to vote thereon in accordance with their best judgment, and the discretionary authority to do so is included in the proxy.

Annual Report on Form 10-K

We will provide upon request and without charge to each stockholder receiving this proxy statement a copy of our Annual Report on Form 10-K for the fiscal year ended December 28, 2002, including the financial statements included therein.

Stockholder Proposals

We anticipate that the 2004 Annual Meeting of Stockholders will be held in May 2004. Any stockholders who intend to present proposals at the 2004 annual meeting, and who wish to have such proposal included in the proxy statement for the 2004 annual meeting, must ensure that our Corporate Secretary receives such proposals not later than December 6, 2003. Such proposals must meet the requirements set forth in the rules and regulations of the Securities and Exchange Commission in order to be eligible for inclusion in our 2004 proxy materials. Proposals should be addressed to West Marine at 500 Westridge Drive, Watsonville, California 95076-4100, Attention: Corporate Secretary. Any stockholder proposals that a stockholder intends to present at the 2004 annual meeting, other than through the inclusion in the proxy materials, should be received at least 30 (but not more than 60) days prior to the scheduled date of the 2004 annual meeting.

- 18 -

Cost of Solicitation

All expenses in connection with the solicitation of this proxy, including the charges of brokerage houses and other custodians, nominees or fiduciaries for forwarding documents to stockholders, will be paid by West Marine.

By Order of the Board of Directors |

|

/s/ RUSSELL SOLT

|

Russell Solt Corporate Secretary |

Watsonville, California

April 7, 2003

- 19 -

APPENDIX I

AUDIT COMMITTEE CHARTER — WEST MARINE, INC.

PURPOSE

The Audit Committee of the Board of Directors of West Marine, Inc. serves as the representative of the Board for the general oversight of the company’s accounting and financial reporting processes and the internal control environment established by management. Through its activities, the committee seeks to facilitate open communication amongst committee members, the Board, outside auditors, management, and the internal auditor (or any third party engaged to carry out the internal audit function) by holding periodic meetings with these parties.

The committee’s primary purpose is to provide oversight as to the integrity of the company’s financial statements, the outside auditor’s qualifications and independence, and the performance of the company’s internal and outside auditors. In carrying out its oversight responsibilities, the committee does not itself prepare financial statements or plan or perform audits, and it is not the duty or responsibility of the committee or its members to serve as auditors or to certify or provide other special or professional assurances with respect to the company’s financial statements.

The committee may delegate authority to one or more designated members of the committee, provided that any resulting decisions are presented at the following committee meeting.

DUTIES AND RESPONSIBILITIES

Among other functions the committee will:

1. Annually determine the retention or replacement of the company’s auditors (including the replacement of the lead and reviewing partners every five years and certain other audit partners after seven years), who will report directly to the committee and who are ultimately accountable to the Board, as representatives of the stockholders of the company.

2. Review and approve the proposed scope and timing of each year’s audit plan and the proposed audit fee of the outside auditors.

3. Review and pre-approve any permitted non-audit services and the fees for such services proposed to be provided by the outside auditors. Pre-approval of audit and non-audit services may be delegated to one or more committee members who will report any resulting decisions at the following committee meeting. In considering whether to pre-approve any non-audit services, the committee will consider whether the provision of such services is compatible with maintaining the independence of the outside auditor.

4. Resolve any disagreements between management and the outside auditors.

5. Review annually the appointment, responsibilities, functions, performance and compensation of the internal auditor, including audit plans and results.

6. Review with the outside auditors, the internal auditor and management, the audited financial statements and related opinion and costs of the audit of that year. In conferring with these parties, the committee will:

a. Review the letter and written disclosures from the auditors consistent with Independence Standards Board Standard No. 1, including a formal written statement delineating all services provided or any relationships between the auditors and the company; actively engage in dialogue with the auditors with respect to its independence and any disclosed services or relationships that may impact the independence and objectivity of the auditors; and take, or recommend that the Board take, appropriate action to oversee the outside auditors’ independence; and

b. Consider the control environment, including the outside auditors’ judgment as to the company’s accounting policies and the consistency of their application to the financial statements.

7. Review with management and the outside auditors any material financial or non-financial arrangements that do not appear in the financial statements.

A-1

8. Review with management and the outside auditors the accounting policies, alternative treatments of financial information that have been discussed, and any material written communications between the outside auditors and management.

9. Review with management and the outside auditors, the company’s annual financial statements prior to the distribution to the company’s stockholders, and the filing with the SEC of the company’s related Form 10-K report, and recommend to the Board whether such financial statements should be included in the company’s Form 10-K report.

10. Review with management and the outside auditors earnings press releases and interim financial results and reports prior to publication and distribution to the company’s stockholders, and the filing with the SEC of the earnings press releases and the company’s related Form 10-Q report.

11. Review periodic reports from the chief financial officer of significant accounting developments including emerging issues and the impact of accounting changes where material, on the effectiveness of, or any deficiencies in, the design or operation of the company’s system of internal controls for financial reporting, any fraud, whether or not material, that involves management or other employees who have a significant role in the company’s internal controls, and any report issued by the outside auditors regarding their and management’s assessment of the company’s internal controls.

12. Provide the committee report required to be included in the company’s annual proxy statement.

13. Review and discuss with the general counsel, and, as appropriate, outside counsel such matters as may warrant the attention of the committee.

14. Review the company’s hiring policy of employees or former employees of the outside auditor.

15. Review and approve related-party transactions.

16. Oversee compliance with the company’s code of conduct for its chief executive officer, senior financial officers, other personnel and the Board.

17. Review and discuss reports from the company’s disclosure committee.

18. Meet, at least annually, in separate executive session with the internal auditor and the outside auditors.

19. Establish procedures, in conjunction with the general counsel and internal auditor, for the receipt, retention and treatment of complaints received by the company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of any concerns regarding questionable accounting or auditing matters.

20. Review with the outside auditors any audit problems or difficulties and management’s response, including disagreements with management, any adjustments noted by the outside auditor but not taken by management, communication between the audit team and their national office, and any management or internal control letters issued or proposed to be issued.

21. Report to the Board any significant matters arising from the committee’s work and provide minutes of committee meetings.

22. Review and reassess at least annually the adequacy of this charter.

MEMBERSHIP

The committee will consist of at least three members appointed by the Board, including one member of the committee as chairperson. Each member of the committee will be an “independent” member of the Board and “financially literate,” and at least one committee member will be qualified as a “financial expert.”

MEETINGS, INVESTIGATIONS AND OUTSIDE ADVISORS

The committee will convene at least four times each year. It will endeavor to determine that auditing procedures and controls are adequate to safeguard company assets and to assess compliance with policies. The committee will be given full access to the company’s internal auditor, Board Chairman, executives, general counsel, outside auditors and outside

A-2

counsel. The committee will have the authority to conduct or authorize investigations into any matters within its scope of responsibilities and to retain such outside counsel, accounting and other professionals, experts and advisors as it determines appropriate to assist in the performance of any of its functions, including determining the fees to be paid and the other terms of engagement for such advisors.

A-3

APPENDIX II

PROXY

WEST MARINE, INC.

PROXY FOR 2003 ANNUAL MEETING OF STOCKHOLDERS MAY 7, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Randolph K. Repass, John Edmondson and Richard E Everett, or any of them, each with power of substitution, as proxies of the undersigned, to attend the 2003 Annual Meeting of Stockholders of WEST MARINE, INC. to be held at the office of the company at 500 Westridge Drive, Watsonville, California, on May 7, 2003, at 10:30 A.M., and any adjournment or postponement thereof, and to vote the number of shares the undersigned would be entitled to vote if personally present on the following matters set forth on the reverse side, and upon such other business as may properly come before such meeting and any adjournment or postponement thereof.

| | |

|

SEE REVERSE SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE SIDE |

| | |

|

PC-1

WEST MARINE, INC.

C/O EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

x | | Please mark |

| | votes as in |

| | this example |

This proxy will be voted as directed. In the absence of contrary directions, this proxy will be voted FOR the election of all of the director nominees listed below and in the discretion of the proxy holder(s) on any matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

|

1. To elect eight directors. Nominees: (01) Randolph K. Repass, (02) John Edmondson, (03) Richard E Everett, (04) Geoffrey A. Eisenberg, (05) David McComas, (06) Peter Roy, (07) Daniel J. Sweeney and (08) William U. Westerfield FOR ALL NOMINEES WITHHELD FROM ALL NOMINEES ¨ ¨ ¨______________________________________ For all nominee(s) except as written above | | 2. To transact such other business as may properly come before the Annual Meeting. |

|

| | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT ¨ |

|

| | | STOCKHOLDERS ARE URGED TO MARK, DATE, SIGN AND RETURN THIS PROXY PROMPTLY IN THE ENVELOPE PROVIDED, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. The signature should correspond exactly with the name appearing on the certificate evidencing your Common Stock. If more than one name appears, all should sign. Joint owners should each sign personally. |

|

Signature ____________________________ Date: ________________ | | Signature ____________________________ Date: ________________ |

PC-2