| ALWAYS CLOSE ALWAYS CONNECTED 2023 ANNUAL REPORT |

| Grupo Televisa S.A.B. (“Televisa”) is a major telecommunications corporation which owns and operates one of the most significant cable companies as well as a leading direct-to-home satellite pay television system in Mexico. Televisa’s cable business offers integrated services, including video, high-speed data and voice to residential and commercial customers as well as managed services to domestic and international carriers. Televisa owns a majority interest in Sky, a leading direct-to-home satellite pay television system and broadband provider in Mexico, operating also in the Dominican Republic and Central America. Televisa holds a number of concessions by the Mexican government that authorizes it to broadcast programming over television stations for the signals of TelevisaUnivision, Inc. (“TelevisaUnivision”), and Televisa’s cable and DTH systems. In addition, Televisa is the largest shareholder of TelevisaUnivision, a leading media company producing, creating, and distributing Spanish-speaking content through several broadcast channels in Mexico, the US and over 50 countries through television networks, cable operators and over-the-top or “OTT” services. Unless expressly stated otherwise, the information included in this report is as of December 31, 2023 and reflects the Company’s operations and businesses as of such date. Some information, especially related to the former Other Businesses segment, has materially changed as a result of the spin-off described in this report. |

| CONTENTS 02 This is Televisa 04 Letter to Shareholders 10 Financial highlights 12 Cable 14 Sky 16 Other Businesses 18 TelevisaUnivision* 20 Commitment to sustainability 22 Fundación Televisa 24 Board of Directors * This annual report includes certain fi-nancial information of TelevisaUnivision as well other important information concerning TelevisaUnivision’s busi-ness. The Company is not responsible for such information. |

| 2 Revenues Contribution OSI* Contribution THIS IS TELEVISA 65.7% Cable 23.7% Sky 10.6% Other Businesses 70.9% Cable 21.7% Sky 7.4% Other Businesses * Operating segment income (OSI) is defined as operating income before corporate expenses depreciation and amortization, and other expense, net. For a reconciliation of operating segment income with consolidated operating income, see Note 26 to our year-end consolidated financial statements. Investments in Associate and Joint Ventures TelevisaUnivision is the world’s leading Spanish-language media company. Powered by the largest library of owned Spanish-language content and a prolific production capability, TelevisaUnivision is the top producer of original content in Spanish across news, sports and entertainment verticals. TelevisaUnivision is also the owner of ViX, the largest Spanish-language streaming platform in the world. |

| 3 CABLE 2023 Televisa Annual Report CABLE DIVISIONS Multiple System Operators (“MSOs”) division which offers high-speed data, video, voice and mobile services to residential and commercial customers, including small and medium sized businesses. Enterprise Provides telecommunications services, including data, voice, managed services, as well as integration and cloud services to domestic and international carriers and to enterprise, corporate, and government customers in Mexico and the United States. Televisa is one of the most important participants in Mexico’s telecom industry Revenue Generating Units ("RGUs") Broadband 5,678,431 Video 4,059,494 Voice 5,351,145 Mobile 307,807 Total RGUs 15,396,877 SKY Operates in Mexico, Central America and the Dominican Republic. SKY offers a complete and high-quality entertainment experience, including comprehensive pay-TV packages, encompassing exclusive content ranging from sports to concerts and special events, along with broadband services delivering speeds of up to 1,000Mbps. On April 3, 2024, Grupo Televisa announced that it reached an agreement with AT&T for the acquisition of its participation in Sky Mexico, by which the Company would become owner of 100% of Sky’s capital stock. On January 31, 2024, we carried out the spin-off of these businesses by incorporating a new controlling entity, Ollamani, S.A.B., which was listed and began trading on February 20, 2024, in the form of Ordinary Participation Certificates (Certificados de Participación Ordinarios or CPOs), on the Mexican Stock Exchange under the ticker symbol “AGUILAS CPO”. A leading direct-to-home satellite television system and broadband provider interest owned by Televisa Revenue Generating Units ("RGUs") Broadband 515,089 Video 5,567,426 Voice 344 Mobile 32,502 Total RGUs 6,115,361 OTHER BUSSINESS Gaming PlayCity Casino includes 18 locations across the country. Publishing Distribution Distributes publications in Mexico. Publishing A leading Spanish-language magazine publisher. Soccer First division soccer team of the Mexican league and owner of Azteca Stadium, located in Mexico City. 58.7% |

| 4 Last year we achieved several milestones despite a tougher global macro backdrop than initially expected. We also faced some operating challenges both at Grupo Televisa and TelevisaUnivision, but we are confident that the strategic decisions implemented in 2023 will allow us to improve our operating and financial performance in 2024. We made significant progress in spinning-off our other businesses, including the soccer team America, the Azteca Stadium, the gaming operations, and the publishing & distribution of magazines. DEAR SHAREHOLDERS At Grupo Televisa: • We reorganized izzi’s management struc-ture, appointing new hires to our Senior Leadership team with extensive expe-rience in our industry, led by Francisco Valim as CEO. We also implemented a corporate restructuring process at izzi, including headcount reduction with sav-ings of around 14% of our payroll. • We also redefined izzi’s business strategy, prioritizing free-cash-flow over an ongo-ing aggressive cable footprint expansion, particularly considering that we have the largest network in Mexico, excluding the incumbent, ending last year with around 19.6 million homes passed or a coverage of over 55% of total homes in the country. Under this new strategy, we intend to improve the quality and life cycle of our subscriber base, enhance profitability, optimize capex deployment, expand free-cash-flow generation, and as such increase returns on invested capital. • We launched an array of new products at Sky that are gradually gaining traction Bernardo Gómez Alfonso de Angoitia Co-Chief Executive Officers |

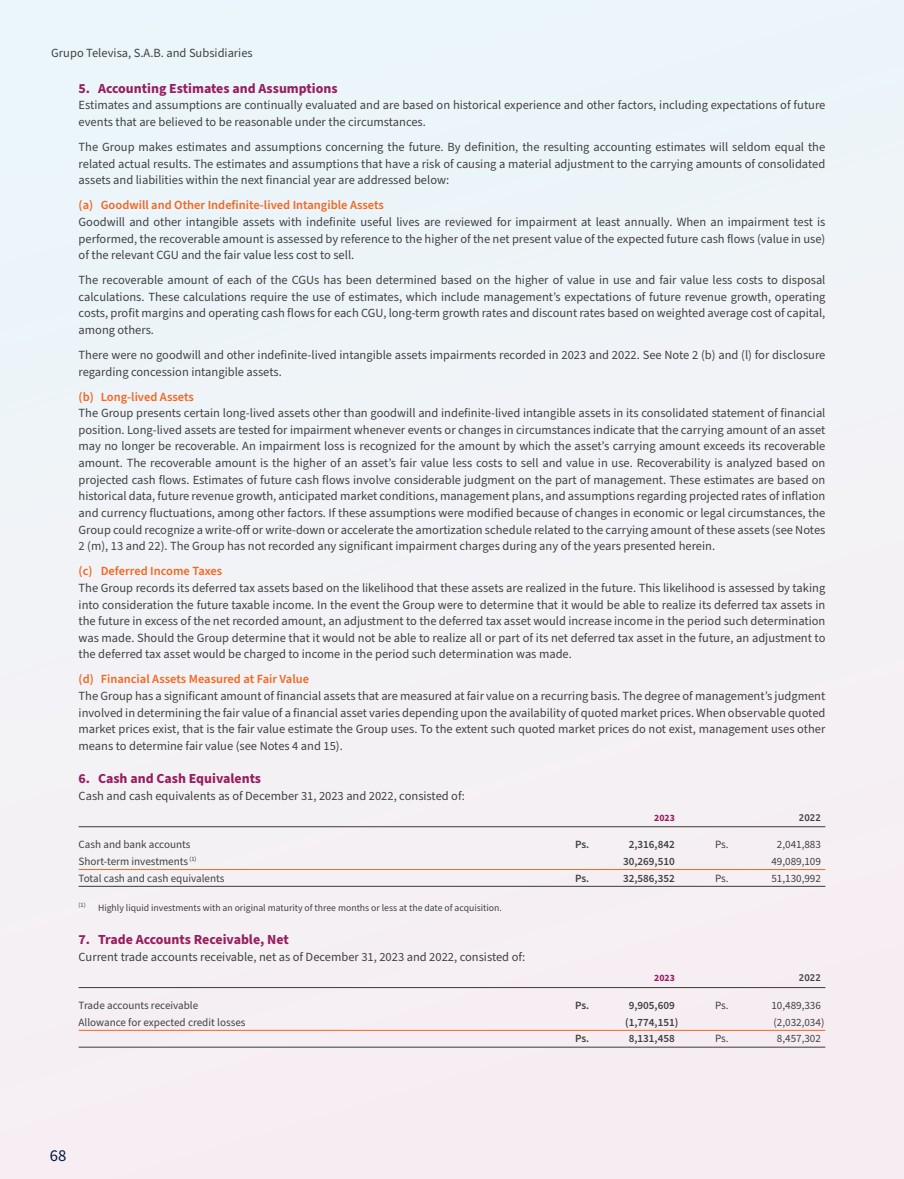

| 5 2023 Televisa Annual Report in the market. This innovative portfolio underscores our commitment to enhance our competitiveness and reflects our dedication to delivering better solutions to our customers. Our digital transformation strategy is underway and is intended to help us gradually stabilize our revenue base at Sky. • As part of our strategy to streamline our operations and simplify our asset structure, we made significant progress in spinning-off our other businesses, includ-ing the soccer team America, the Azteca Stadium, the gaming operations, and the publishing & distribution of magazines. This allowed us to conclude the listing of a new controlling company called Ollamani under the ticker symbol AGUILAS.CPO on the Mexican Stock Exchange on February 20th, 2024. • We delivered progress on our corporate optimization process, including savings in corporate expenses of almost $280 million pesos for the full year, contribut-ing to a year-on-year decline in corporate expenses of around 18%. Moreover, we continue to explore alternatives to keep reducing corporate expenses at Grupo Televisa on an ongoing basis. • We decreased our total leverage by around $340 million dollars, allowing us to have savings related to net interest expenses. At TelevisaUnivision: • The company has been showing that its strategy, assets, and execution against a differentiated market opportunity can yield superior operational and financial results on a consistent basis. In the U.S., TelevisaUnivision continued to outperform growth of the broader advertising market, in 2023 by around 850 basis points – even against a backdrop of ad market and macroeconomic softness. In Mexico, TelevisaUnivision’s ad business had another extraor-dinary year driven by the combination of a strong and growing economy and an excellent execution by its sales team. This is the first time following a World Cup year that TelevisaUnivision has been able to deliver absolute year-on-year growth above and beyond the huge World Cup comp. • TelevisaUnivision’s direct-to-consumer business, ViX, is building and resonating with its audience. In Decem-ber, ViX exceeded 7 million subscribers on its Premium subscription video on demand (SVOD) tier. But perhaps most importantly, as ViX continues to rapidly scale monthly active users (MAUs) on the free advertising video on demand (AVOD) tier, it has increased the engagement of its audience. In 2023, TelevisaUnivision doubled the amount of total streamed hours and con-sistently grew consumption per user. • As a result, in direct-to-consumer, a business launched around two years ago, TelevisaUnivision closed 2023 with more than US$700 million dollars in revenue, headed towards near-term profitability. And this was the first full year of operations for ViX. • 2023 was a critical year for ViX as TelevisaUnivision saw huge improvements across all major areas of the business: Content performance, product stability and features, marketing efficiency and distribution. TelevisaUnivision exits 2023 with a distribution foot-print that is nearly complete in its core markets with a handful of significant partnerships pending and in the later stages of execution. • On the content side, TelevisaUnivision now has suffi-cient audience scale and consumption data to scien-tifically refine its content offering. TelevisaUnivision’s new original series, “El Gallo de Oro,” was the strongest premiere to date in terms of U.S. user engagement; and one of its ViX original films, “Radical,” became the highest-earning Spanish language movie in the U.S. in nearly four years, winning 11 awards, including the “Festival Favorite” at Sundance. It is expected that TelevisaUnivision’s 2024 content slate will be the strongest yet. |

| 6 • TelevisaUnivision has successfully concluded upfront nego - tiations with its customers in Mexico, with the upfront plan reaching the highest level in absolute terms in history. We believe this will be a great base for the year. Moreover, with 2024 being an election year in Mexico, it is expected that advertisers will hold some of their ad spend for the scatter market, which therefore should be higher than normal. • Finally, looking more closely at TelevisaUnivision’s debt, the company now has no maturities until March 2026. TelevisaUnivision’s management refinanced US$1.5 billion dollars of debt during 2023 and an additional US$341 mil - lion dollars in January 2024. BUSINESS PERFORMANCE In 2023, Grupo Televisa’s consolidated revenue reached $73.8 billion pesos, representing year-on-year decline of 2%; while operating segment income reached $26.4 billion pesos, equivalent to a year-on-year decrease of 6% mainly driven by lower revenue at Sky, and inflationary pressures in labor and content related costs. At our unconsolidated affiliate, TelevisaUnivision, results for 2023 were great as we outperformed the industry, accom - plished many important milestones, set new records, and consolidated many aspects of our business for future growth. Such company’s full year revenue increased by 5% year-on-year to US$4.9 billion dollars. Excluding non-recurring revenue of around US$200 million dollars in 2022 related to the sublicensing of the World Cup rights in Mexico and Latin America, and political advertising around mid-term elections in the U.S., TelevisaUnivision’s full year revenue grew by 9%. Adjusted EBITDA of US$1.6 billion dollars declined by 4% year-on-year. Excluding the contribution from the US$200 million dollars of non-recurring revenue in 2022, TelevisaUnivision’s adjusted EBITDA grew by 3%, reflecting a reduction in losses related to its direct-to-consumer business. CABLE – OPTIMIZATION STRATEGY TO GENERATE VALUE In 2023, we reorganized izzi’s management structure, ap - pointing new hires to our Senior Leadership team with exten - sive experience in our industry, including Francisco Valim as CEO, Juan Vico as CFO, Nina Muyshondt as CMO, and Ricardo Hinojosa as Head of our Enterprise operations. Changes in our Senior Leadership team were followed by an ongoing evolution of the company’s operating philosophy supported by five strategic pillars: First, product offering. We shifted our focus to local rather than regional strategies, growing in places where we have a competitive advantage. We enhanced our sales quality, aim - ing to provide higher-speed bundles. And we created a unique video value proposition focusing on the seamless aggregation of streaming platforms. Second, subscriber base management and tools. We have boosted big data and artificial intelligence to: (1) have better management of our subscriber base with a more for more strategy; and (2) handle churn with a more proficient execu - tion, prioritizing long-term-value. |

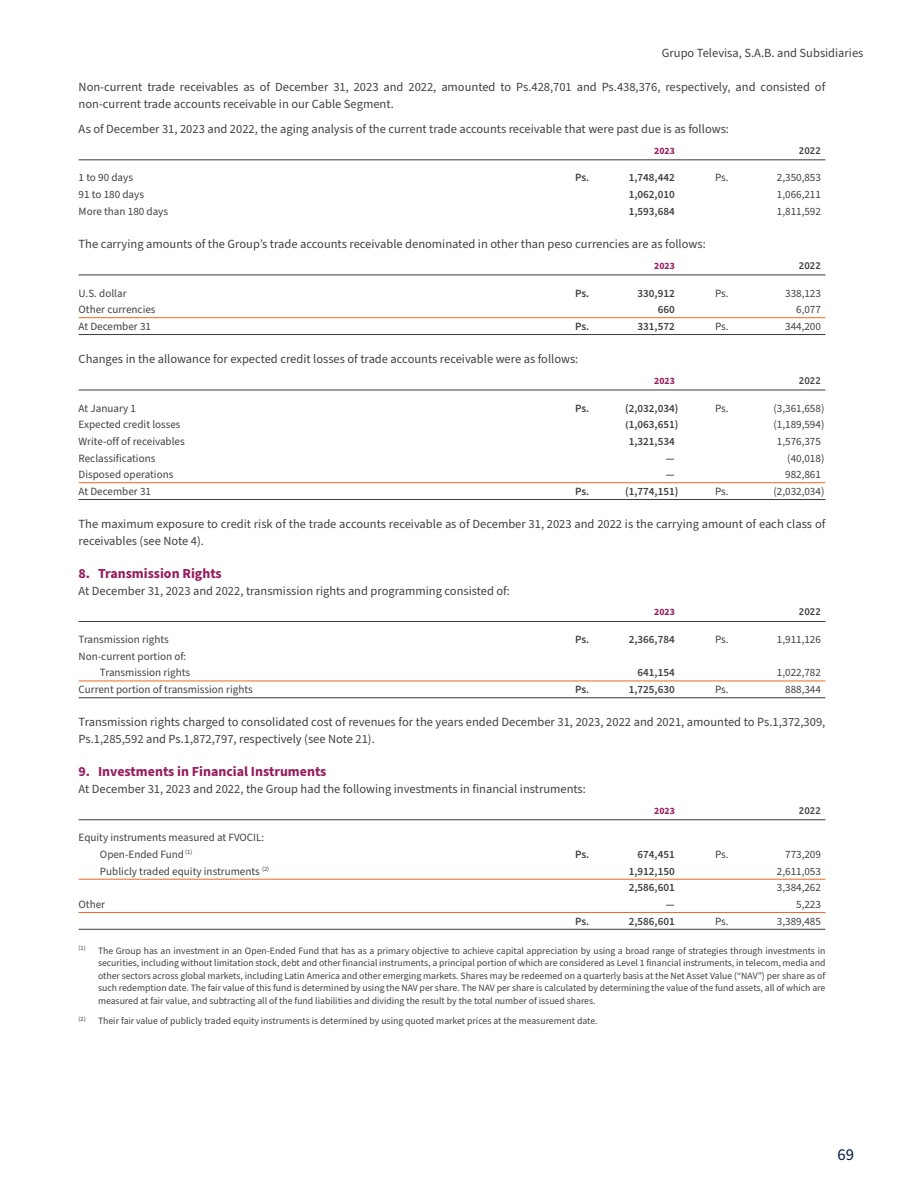

| 7 2023 Televisa Annual Report Third, sales channels. We implemented a structural shift in our distribu-tion channels, emphasizing digitalization, bringing us closer to high-val-ue customers, and optimizing our subscriber acquisition costs. Fourth, cost structure. We implemented an in-depth review of our cost structure, both at the opex and capex levels. On the opex front, we have carried out: (1) a material headcount reduction with savings of around 14% of our payroll effective from the fourth quarter of 2023; and (2) ratio-nalized third-party providers. On the capex side, we are working on im-proving: (1) inventory management; (2) logistics; (3) field operations; (4) optimization of real estate; and (5) rationalization of network expansion. Fifth and final pillar, the Enterprise operations and SME segment, where we see great opportunity to leverage our strong capabilities. So far, we have: (1) reorganized the Enterprise operations structure, with the new leadership team already in place; (2) carried out a re-segmentation of our customer base; (3) optimized our cost structure by eliminating duplication of networks; (4) revamped the value proposition of our SME segment; and (5) renewed our focus on revenue and EBITDA growth. We believe that our turnaround strategy will contribute to gradually recover the growth path by already having sequential stability since the beginning of 2024. We have been able to grow our customer base and improve our ARPU through both customer base management and higher sales quality. Moreover, the churn experienced in recent quarters has been proactively addressed and has already come back to our historical levels, allowing us to better capitalize our growth. In 2023, we passed 843 thousand homes with FTTH, closing the year with around 19.6 million homes passed with our network, of which approx-imately 73% are connected either with fiber-to-the-node or fiber-to-the-home. The investments that we have made over the last few years have been paying off and have allowed us to keep up with the increase in demand for high-speed broadband. We ended 2023 with 15.4 million total revenue generating units (RGUs), with around 519 thousand RGU disconnections mainly due to a proactive subscriber base clean-up car-ried out during the third quarter. In 2023, we delivered modest revenue growth of 0.8%, while operating segment income fell by 5.9%. Revenue in our MSO operations (89% of Cable revenue) increased by 2.4%, while operating segment income de-clined by 4.0%, for a margin of 40.2%. Revenue in our Enterprise opera-tions (11% of Cable revenue) declined by 13.7%, while operating segment income fell by 26.4%, translating into a 22.9% margin. SKY – TRANSFORMATIVE JOURNEY CONTINUES In 2022, Sky initiated a transformative journey guided by a new vision structured across three key stages. The initial phase focused on strengthening the core business, involved initiatives such as streamlining the product portfolio now under a unified strong brand, modernizing the IT infrastructure to mitigate risks and transition to the cloud, enhancing the customer journey through digital technology utilization, diversifying sales channels by revamping the sales com-mission model, and implementing a value-based customer manage-ment approach to boost life-time-value. All this while embarking on an ambitious efficiency and simplification program aimed at improving return on investment. In the second phase of our transformation journey, we focused on evolving the core business while persistently enhancing our operation-al foundation. In October 2023, we launched SKY+, an android-based streaming platform that seamlessly integrates ViX Premium; Uni-versal+; Disney+; Star+; Max; Prime Video and Fox, along with our exclusive Sky Sports, featuring highly demanded content such as La Liga, Bundesliga, and UEFA Euro 2024, among many others. It also includes all linear channels and our partners’ libraries into a unified viewing experience on a single screen. All this vast content, curated by our experts and a cutting-edge recommendation engine based on Artificial Intelligence. SKY+ stands out as the market’s sole platform offering live sports events in authentic 4K quality, with the added flexibility to extend this premium customer experience to any mobile device, including mobile phones, tablets, and laptops. And third, the last phase of our strategic plan starts in 2024. In this stage, we expect to capitalize on our new portfolio, customer experi-ence enhancement and process digitalization to strategically leverage our entry into the streaming market. This shift is expected to not only gradually offset the decline of a product facing competitive challeng-es like direct-to-home (DTH) satellite pay-TV, but also positions us to meet households’ evolving needs by delivering more entertainment at competitive prices. During 2023, Sky had almost 800 thousand RGU disconnections. This was mainly driven by the loss of approximately 690 thousand video subscribers. We closed the year with about 6.1 million RGUs, of which 8.4%, or 515 thousand, are broadband subscribers. In 2023, we passed 843 thousand homes with FTTH, closing the year with around 19.6 million homes passed with our network, of which approximately 73% are connected either with fiber-to-the-node or fiber-to-the-home. |

| 8 The above-mentioned factors led Sky’s revenue to decline by 13.5% year-on-year in 2023, while operating segment income fell by 10.7% for a margin of 32.6%. We expect revenue to gradually stabilize over the coming quarters as our new products gain momentum. TELEVISAUNIVISION – VIX’S FIRST FULL YEAR OF OPERATIONS 2023 was another great year for TelevisaUnivision. The company outperformed the industry, accomplished many important milestones, set new records, and consolidated many aspects of its business aiming for future growth. TelevisaUnivision continues to benefit from its leading position in a massive and attractive market where the demographic and economic tailwinds are intensifying, and the alignment between its two core markets: the U.S. and Mexico is increasing. Moreover, this was the first full year of operations of ViX, the largest Spanish-language streaming platform in the world, delivering outstanding results. ViX ended 2023 with over 40 million MAUs on the free AVOD tier, and more than 7 million subscribers on its Premium SVOD tier. As a result, TelevisaUnivision delivered full year revenue of more than US$700 million dollars in its direct-to-consum-er business. TelevisaUnivision’s full year consolidated revenue increased by 5% to US$4.9 billion dollars. Excluding non-recurring revenue of around US$200 million dollars in 2022 related to the sublicensing of the World Cup rights in Mexico and Latin America, and political advertising around mid-term elections in the U.S., TelevisaUnivision’s full year consolidated revenue grew by 9%. Total advertising revenue increased by 6%. In the U.S., advertising revenue declined by 1%; excluding political and advocacy and the impact of divested radio stations, advertising revenue increased by 5%, mainly driven by TelevisaUnivision’s direct-to-consumer business as it continues to see strong demand for ViX. In Mexico, adver-tising revenue increased by 18%, driven by growth in both linear and direct-to-consumer across all sectors. Despite accounting for around 60% of the entire linear advertising market in Mexico, TelevisaUnivision’s sales team continued to onboard new clients throughout the year. Total subscription and licensing revenue increased by 2%. Excluding revenue from sublicensing transmission rights for the World Cup in 2022, subscription and licensing reve-nue increased 12%. In the U.S., subscription and licensing revenue fell by 4%; excluding revenue from sublicensing transmission rights for the World Cup in 2022, subscription and licensing revenue in the U.S. increased by 8% sup-ported by ViX’s subscription tier, while linear subscription revenue declined low single digits because of subscriber declines that were partially offset by contractual rate increases. In Mexico, growth of 23% benefited from ViX’s subscription tier and linear subscription price increases, partially offset by modest subscriber declines. Adjusted EBITDA of US$1.6 billion dollars declined by 4% year-on-year. Excluding the contribution from the US$200 million dollars of non-recurring revenue in 2022, TelevisaU-nivision’s adjusted EBITDA grew by 3%, reflecting a reduc-tion in losses related to its direct-to-consumer business. ESG – AN INTEGRAL PART OF OUR BUSINESS PURPOSE In 2023, our purpose brings to life the mission and vision of our business – WE BRING PEOPLE CLOSER TO WHAT MAT-TERS MOST TO THEM. Our focus on environmental, social and governance issues is an integral part of our business purpose and strategy. We continue to strengthen our com-mitment to connect lives, the reason why we redefined our ESG strategy focused on four pillars: Climate Resilient Connections, Digital Inclusion, Empowering People and 2023 was another great year for TelevisaUnivision. The company outperformed the industry, accomplished many important milestones, set new records, and consolidated many aspects of its business aiming for future growth. |

| 9 2023 Televisa Annual Report Leading by Example. Through these pillars we make significant contri-butions to our key stakeholders: shareholders, customers, employees, and the overall society. 2023 was a year of great impulse in our ESG strategy implementation, through initiatives focused on decarbonizing our operations and building climate resilient networks, investing in our talent, empower-ing people through our programs with Fundación Televisa, strength-ening our policies and process related to ESG and building capacity of our management and operational teams through dedicated ESG training programs. Our ESG strategy continues to act as a catalyst for accelerating our sustainability efforts. Our success is grounded on leadership, collabo-ration, and disciplined execution of our action plans. Through our Sus-tainability Committee, we create alignment and maintain a continued improvement mindset to identify opportunities and create value. We believe in the relevance of our ESG initiatives to foster opportu-nities for our commitment to deliver timely, useful, and meaningful digital experiences that enrich people’s lives by fusing the best of groundbreaking technology and human creativity. EXECUTING ON OUR STRATEGY IS KEY IN 2024 We are confident that full implementation of our new value focused strategy will allow us to improve our operating and financial perfor-mance in 2024. At Grupo Televisa we have been putting a lot of effort into rethink-ing our corporate structure to unlock value, and into restructuring our consolidated businesses to come out stronger from the current environment. These structural reforms are focused on protecting profitability, optimizing capex, and enhancing free-cash-flow genera-tion. Initial results have been encouraging and we expect the positive sequential trend to continue throughout 2024. And at TelevisaUnivision, we are very excited about the prospects for 2024. TelevisaUnivision is seeking to deliver a record political year from an ad sales perspective in the U.S., and a profitable streaming business in the second half of the year – faster than any other major streaming service in history – which should then return the company back to overall EBITDA growth and allow it to continue to focus on strengthening its balance sheet through organic deleveraging and by extending and smoothing its maturities. We feel privileged to be leading Grupo Televisa through this digital transformation and simplification process. Most importantly, we are very thankful to all employees at our consolidated subsidiaries and uncon-solidated affiliates for their unwavering dedication to continue providing the high-quality broadband, video and voice services that our customers need and expect; and informing and entertaining our audiences. We also have an incredibly strong and dedicated board of directors working for the benefit of Grupo Televisa and its stakeholders, and we are grateful for their many contributions and thoughtful advice during 2023. To our shareholders, we want to extend our appreciation for your con-tinued confidence in our vision and in our long-term prospects. Bernardo Gómez Alfonso de Angoitia Co-Chief Executive Officers |

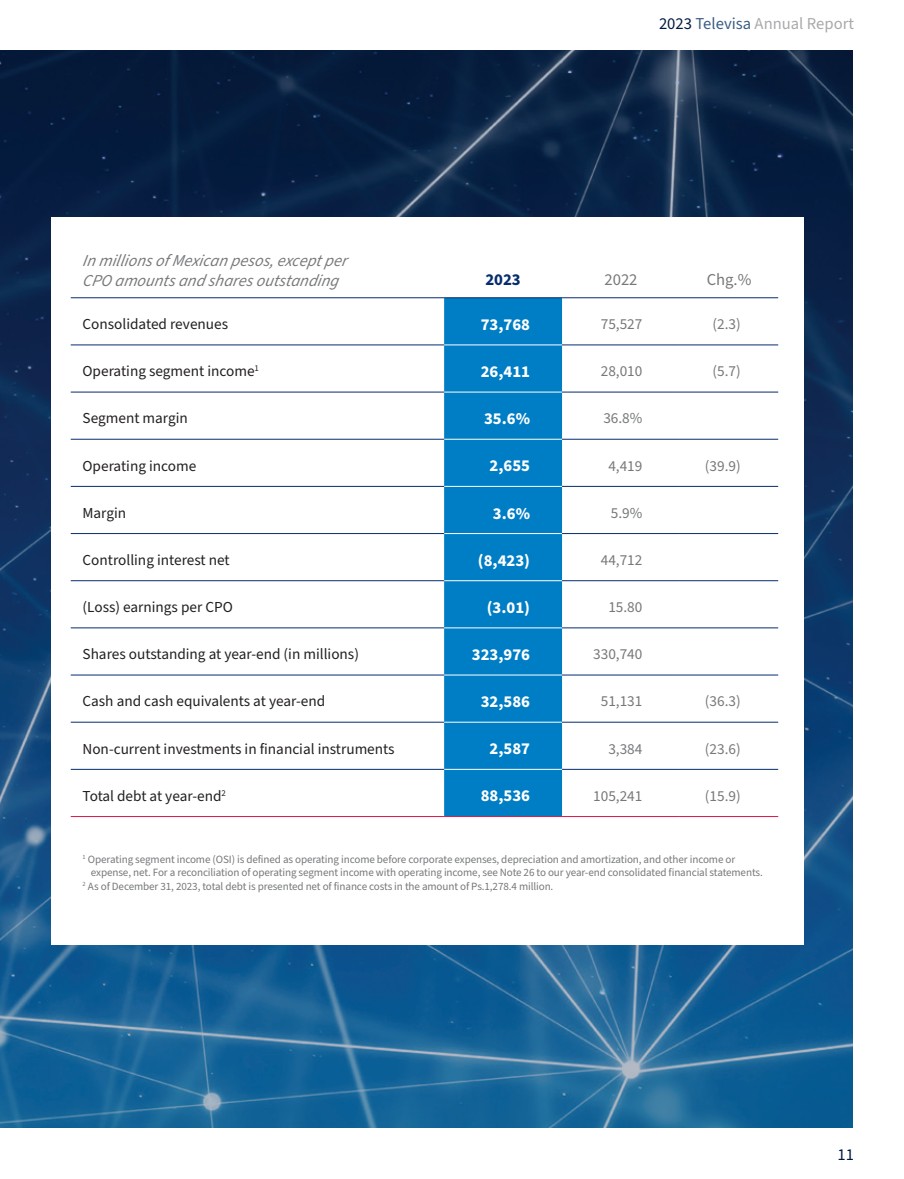

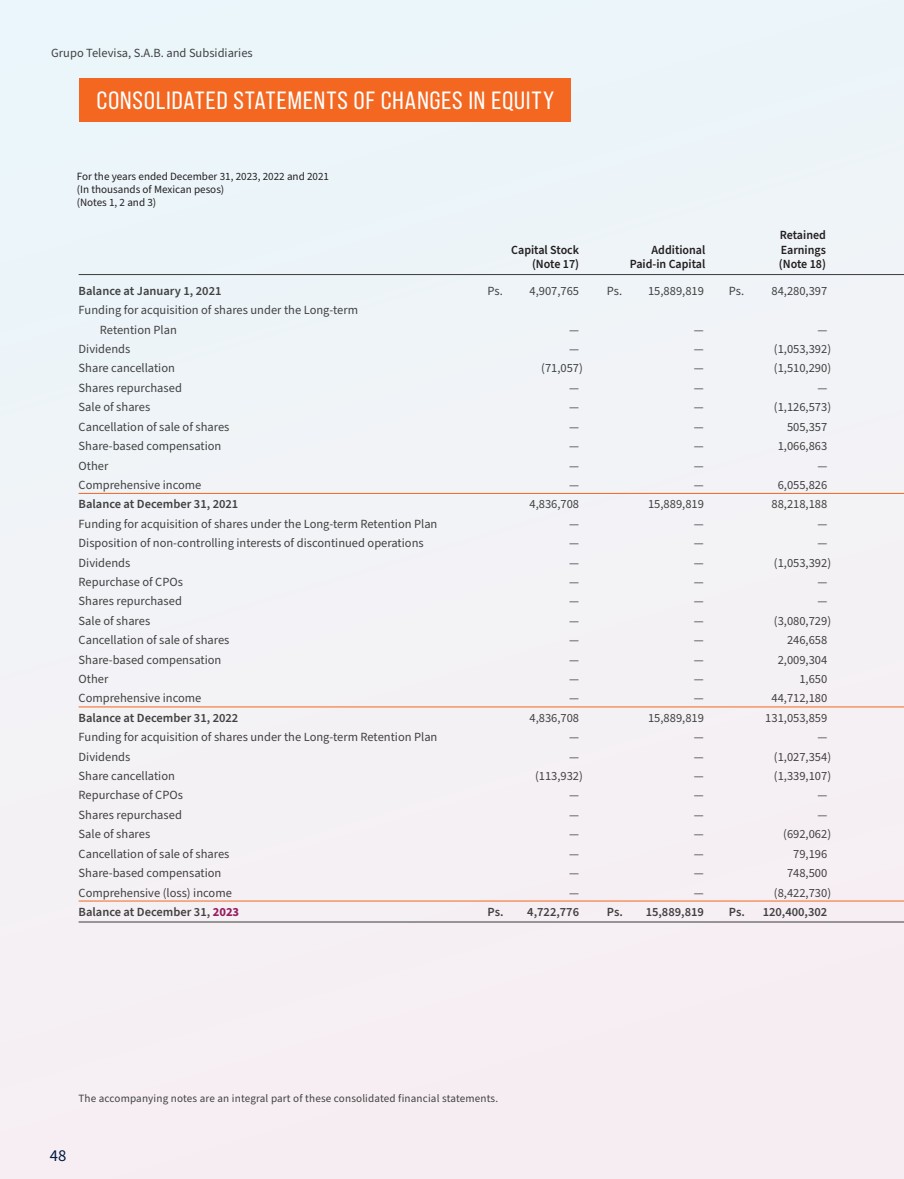

| 10 73.8 26.4 FINANCIAL HIGHLIGHTS Consolidated Revenues billion pesos billion pesos Operating Segment Income |

| 11 2023 Televisa Annual Report In millions of Mexican pesos, except per CPO amounts and shares outstanding 2023 2022 Chg.% Consolidated revenues 73,768 75,527 (2.3) Operating segment income1 26,411 28,010 (5.7) Segment margin 35.6% 36.8% Operating income 2,655 4,419 (39.9) Margin 3.6% 5.9% Controlling interest net (8,423) 44,712 (Loss) earnings per CPO (3.01) 15.80 Shares outstanding at year-end (in millions) 323,976 330,740 Cash and cash equivalents at year-end 32,586 51,131 (36.3) Non-current investments in financial instruments 2,587 3,384 (23.6) Total debt at year-end2 88,536 105,241 (15.9) 1 Operating segment income (OSI) is defined as operating income before corporate expenses, depreciation and amortization, and other income or expense, net. For a reconciliation of operating segment income with operating income, see Note 26 to our year-end consolidated financial statements. 2 As of December 31, 2023, total debt is presented net of finance costs in the amount of Ps.1,278.4 million. |

| 12 During 2023, our Cable segment expanded its footprint by more than 840 thousand homes, reaching more than 19.6 million homes passed in the country. Televisa’s Cable business offers cable and conver-gent services across 31 states in Mexico, covering the main metropolitan areas of the country and continuing to expand to new regions. During the year, we continued with our growth program in which we expanded our footprint by more than 840 thousand homes, reaching more than 19.6 million homes passed in the country. Our network is up to cable industry standards, combining traditional hybrid fiber-coaxial, fiber deep, and deployments of Gigabit Passive Optical Networks (GPON). CABLE |

| 13 19.6 0.8% 2023 Televisa Annual Report million homes passed Revenue growth Our infrastructure fully integrates Internet Protocol Access and Large-Scale Core net-works, strategically positioned across mul-tiple regions to optimize our capacity in serving both residential and enterprise cus-tomers. Presently, our capabilities can de-liver high-speed connectivity, reaching up to 1,000 megabits in the vast majority of homes passed within the residential segment, while also offering tailored solutions to meet the unique demands of our enterprise customers. Revenue for our Cable segment grew by 0.8% in 2023, despite a decrease of 519 thousand total RGUs mainly due to a proactive subscriber base clean-up in the third quarter of 2023. We continue to lead aggregating services of Over the Top (OTT) platforms in Mexico. During the year, we continued to add new OTT services into our packages, such as Vix+, strengthening our product suite. In addition, we continue to deploy our state of the art Android TV set-top boxes, up-grading portions of our network to DOCSIS 3.1 technology and Fiber to the Home (FTTH). Our mobile service (izzi Móvil), with its disruptive pricing and services, has continued to grow, reach-ing 308 thousand subscribers at the end of 2023. |

| 14 6.1 SKY In 2023, we launched Sky+, an Android-based streaming platform that seamlessly integrates both Sky TV, VOD and OTTs content in a unified viewing experience on a single screen. million RGUs |

| 15 2023 Televisa Annual Report In 2023, we introduced Sky+, a groundbreak-ing product from Sky Mexico. Sky+ is an An-droid-based streaming platform, developed in our own laboratories, that seamlessly integrates both Sky TV, VOD and OTTs content in a unified viewing experience on a single screen that adapts to current consumer needs and preferences. Sky+ eliminates the need for a dish or specific installation requirements and can run over any broadband network. By leveraging the power of Artificial Intelligence, our cutting-edge search and recommendation engine curates content for each member of the household, eliminating the need to switch between multiple OTTs. Furthermore, Sky+ is the only platform in the market that offers live sports events in true 4K quality and provides the option to extend this experience to any mobile device including cell phones, tablets, and laptops. Sky+ currently integrates Universal+, Disney+, Star+, HBO Max, and ViX Premium, along with all linear channels and our partners’ libraries, solidifying our position as a comprehensive and dynamic content provider in the ever-evolving digital landscape. Sky+ stands as the premier ‘broadband-agnostic’ platform for the Mexican sports enthusiasts, offering a comprehensive col-lection of all major worldwide soccer leagues and tournaments in one place. |

| 16 In connection with the spin-off approved by our Board of Directors and Stock-holders to separate most of the net assets comprising the operations of our former Other Businesses segment (“Spun-off Businesses”): • a new controlling entity of the Spun-off Businesses, Ollamani, S.A.B. (“Ollamani”), was incorporated under the laws of Mexico as a limited liability public stock corporation on January 31, 2024; • a spin-off of the Spun-off Businesses was carried out on January 31, 2024; • we obtained all required corporate and regulatory authorizations for this spin-off proposal on February 12, 2024; • the shares of Ollamani were listed and began to trade on February 20, 2024, in the form of CPOs, on the Mexican Stock Exchange under the tick-er symbol “AGUILAS CPO.”; and • As of the date of the spin-off, Grupo Televisa no longer controls its former Other Business segment, and, beginning in the first quarter of 2024, the Grupo Televisa’s operating results from the Spun-off Businesses through January 31, 2024, will be classified as discontinued operations, including the corresponding information for prior periods. OTHER BUSinesses |

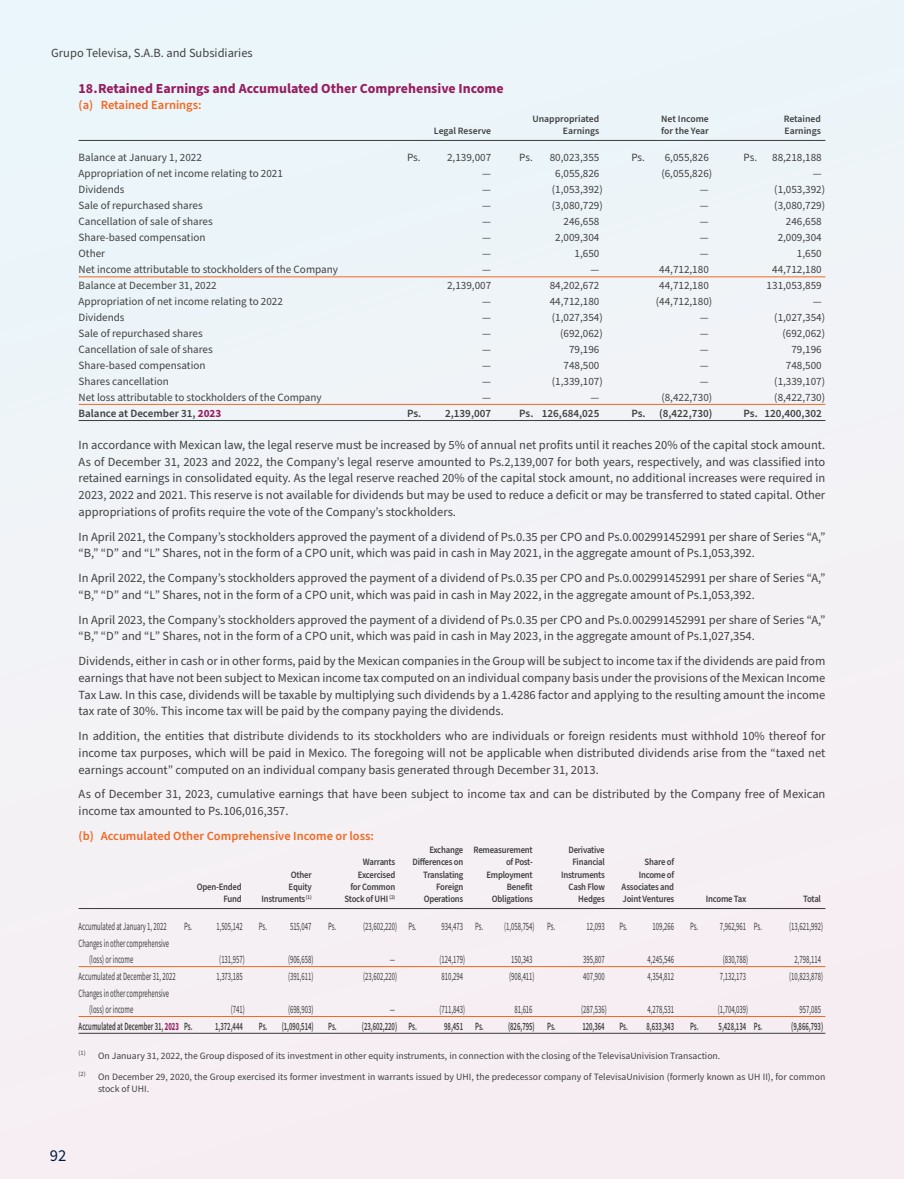

| 17 2023 Televisa Annual Report Gaming PlayCity Casino includes 18 locations in 13 states in Mexico, with over 6,000 Electronic Gaming Machines. Its rooms, with an aver-age of four million visitors a year, also offer restaurant services with premium food and beverages. Customers can also place online sports and casino bets in our website playcity.com. Publishing Editorial Televisa (“Editorial”) publishes 11 titles: six wholly-owned trademarks and five trademarks licensed by renowned advertising houses, including Spanish-language editions of some international magazines. It also has 9 digital platforms and two digital local brands. During 2023, Editorial continued to focus on a multiplatform content generation model— print and digital—for its most profitable brands. Slots or gaming terminals are Type III, based on traditional ran-dom number generator games and Latin Bingo. We operate with 45 gaming licenses from internationally recognized brands in the industry such as Bryke, Aristocrat, Zitro, Ainsworth, Cadillac and IGT, among others. We focus on offering high-end products, the latest in games, and cabinets for an ABC+ socioeconomic level. PlayCity is a recognized brand in the gaming segment in Mexico, with modern and exceptional locations for the development of its business and with state-of-the-art technological machines, which represent a positive aspect in our competitive position. |

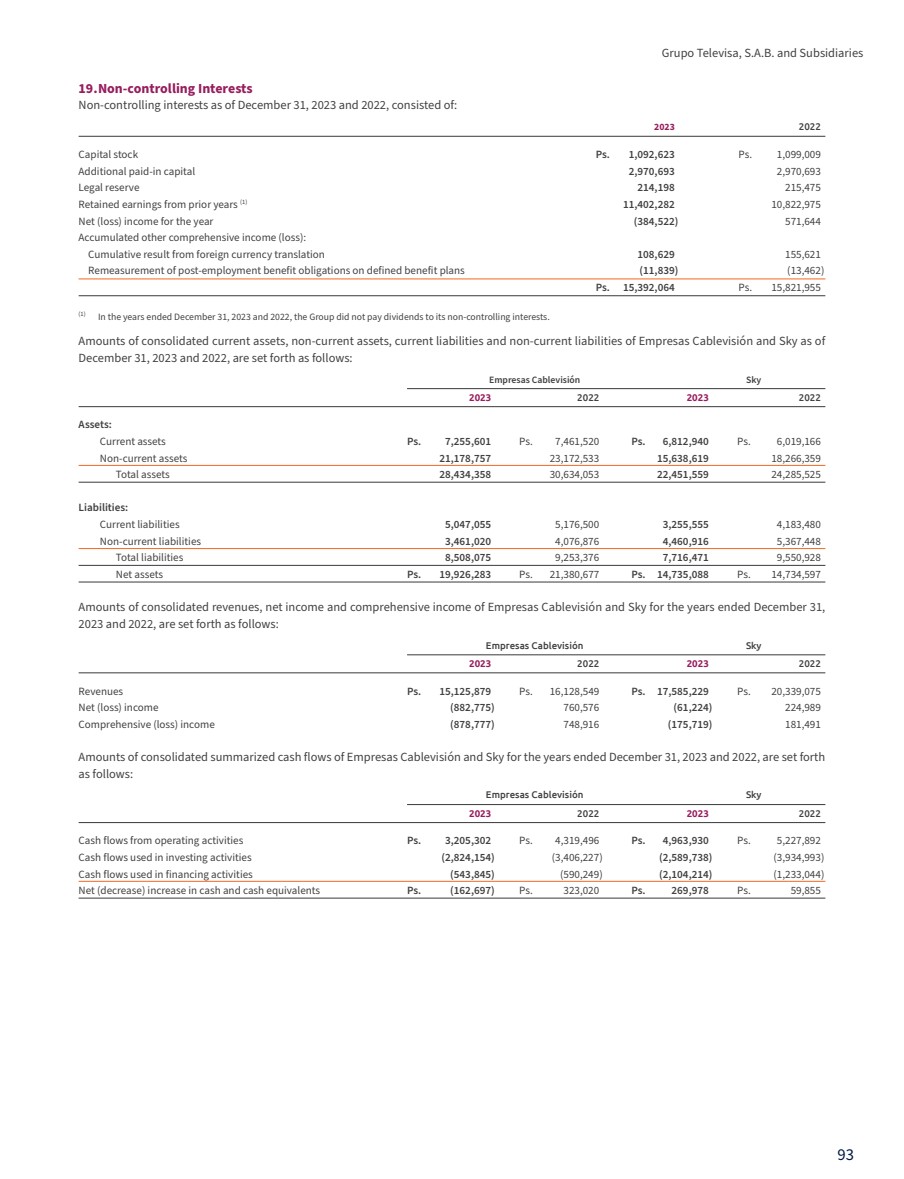

| 18 TelevisaUnivision is the world’s leading Spanish-language media company. Powered by the largest library of owned Spanish-language content and a prolific production ca-pability, TelevisaUnivision is the top producer of original content in Spanish across news, sports and entertain-ment verticals. This original content powers all of Telev-isaUnivision’s platforms, which include market-leading broadcast networks Univision, Las Estrellas, Canal 5 and UniMas, and a portfolio of 38 cable networks, which in-clude TUDN, Galavision, Distrito Comedia and TL Nove-las. TelevisaUnivision also operates the leading Mexican movie studio, Videocine, and owns and operates the larg-est Spanish-language audio platform in the U.S. across 35 terrestrial stations and the Uforia digital platform. ViX is the world’s first large-scale streaming service ex-clusively targeting Spanish-speaking audiences. Owned by TelevisaUnivision, ViX celebrates Latino cultures and Spanish-language storytellers with an unprecedented 75,000 hours of free and paid premium content across all genres, includ-ing movies, comedy series, novelas, drama series and children’s content, as well as live news and sports. Leveraging more than 300,000 hours of TelevisaUnivision´s content library and a robust intellectual property catalog to create an unparalleled offering, the global streaming service enlightens Spanish-language entertain-ment by pushing boundaries and igniting joy with its unparalleled content. ViX includes a free tier and a premium subscription plan. Giving subscribers access to a breadth of content and a premium Spanish-language offering never seen before in a streaming ser-vice, the premium plan offers ad-free entertainment, including more than 7,000 hours of live sports, with more than 70 ViX original series and movies. In 2023, ViX contributed to total direct-to-consumer revenues ex-ceeding $700 million, while ending the year with more than 40 mil-lion MAUs on the free tier and more than 7 million subscribers on the premium tier. For more information, please visit televisaunivision.com. |

| 19 2023 Televisa Annual Report |

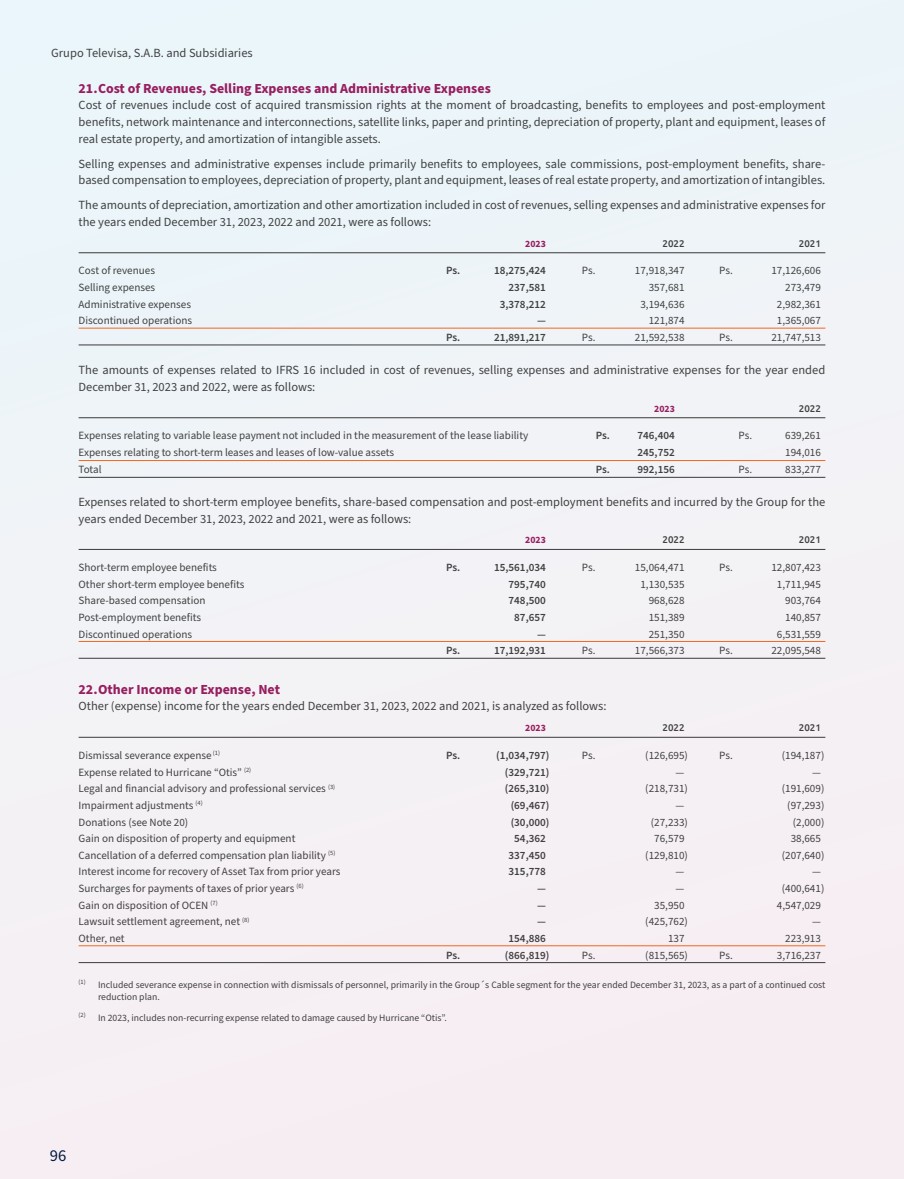

| 20 COMMITMENT TO SUSTAINABILITY At Grupo Televisa, we continue building short- and long-term value for our stakeholders, including employees, customers, investors, and the commu-nities we serve through our services. In 2023, we embarked upon a new purpose that gives life to the mission and vision of our business: BRINGING PEOPLE CLOSER TO WHAT MATTERS MOST TO THEM. Our focus on ESG issues is an integral part of our purpose and business strategy. Year after year, we become more firmly committed to connecting lives through innovation and investment in resilient telecommu-nications networks that empower society. Our value chain provides products and services that are basic to our so-ciety. We are present in everyone’s daily life, from education to business connectivity and entertainment through our wide range of communication infrastructure and products. Our ESG strategy is integrated into the core of our business and contributes to our goals through four strategic pillars: • Resilient climate connections • Digital inclusion • Empowering people • Leading by example Our climate action strategy focuses on reducing emissions in our val-ue chain, strengthening the resilience of our network, and promoting a low-emission economy. To achieve this, we are committed to investing in climate-resilient networks, introducing efficiency initiatives to reduce our energy consumption, and incorporating renewable electricity to decarbon-ize our operations. We work hand-in-hand with our suppliers to promote reuse, recycling, and emission reduction practices, encourage our staff to take pro-environmental actions in their daily lives, and create partnerships to accelerate the transition to a sustainable economy. At Grupo Televisa, we follow the carbon mitigation hierarchy to avoid, re-duce, and minimize our greenhouse gas emissions. Since 2019, we have adopted the recommendations of the Task Force on Climate-related Finan-cial Disclosures (TCFD) and strengthened our climate governance and risk management strategy. In 2023, we deepened our understanding of these risks and opportunities, and we will continue integrating TCFD recommen-dations into our business practices. Additionally, we promote a circular business model in our value chain, encouraging the reuse and recycling of electronic devices to extend their lifespan and reduce the environmental impact of our operations. Our mission at Grupo Televisa is to merge cutting-edge technology with the best of human creativity. We are committed to delivering timely, use-ful, and meaningful digital experiences that enrich people and the world around them. We build the necessary infrastructure for society to connect and stay in sync with rest of the world. We understand that connections are fundamental to giving meaning to life, so we strive to meet society’s connection needs by investing in the infrastructure required to facilitate that global connection. Digital inclusion has been a deeply rooted priority in our company for de-cades and is a fundamental pillar of our business strategy. Throughout the years, we have focused our efforts on providing access to digital technolo-gy, developing digital skills, ensuring school connectivity, promoting dig-ital inclusion for women and girls, as well as facilitating digital access for vulnerable users and groups. In 2023, we successfully connected millions of people through the Cable and Sky segments. We are firmly committed to reducing the digital divide by providing affordable internet access and a wide range of entertainment products and services. |

| 21 2023 Televisa Annual Report We are committed to empowering people in two key ways. Internally, we aim to offer job securi-ty, attractive benefit schemes, ongoing training, and programs to encourage promotion within the Company. Externally, through Fundacion Televisa, we drive innovative programs in education, cul-ture, entrepreneurship, and environmental protection, using advanced digital tools and providing financial support. Grupo Televisa values and celebrates diversity as a strategic asset. We promote an environment where each individual is recognized, appreciated, and respected for their uniqueness, thereby contributing to our goals as a company. Grupo Televisa is committed to conducting its operations in full compliance with ethics and cur-rent legislation. Our Code of Ethics establishes the values, principles, and standards of conduct that guide our business activities, addressing issues such as bribery and corruption prevention. All new hires accept this code when they join the Company and pledge to abide by its terms, and we provide them with regular training, while some executive positions are required to renew their commitment to the Code each year. Grupo Televisa offers confidential communication channels for employees and third parties to report violations of the Code of Ethics or other internal policies, as well as any situation that may affect our interests, business objectives, or human capital. The Sustainability Committee, which is comprised of senior executives from various areas, reviews ESG performance and recommends best practices, while monitoring is carried out throughout the year, considering the potential impacts of ESG-related risks and designing short and long-term strat-egies. Furthermore, we have a continuous process of strategic risk management at the corporate level, which allows us to identify, assess, treat, monitor, and communicate sociopolitical, environ-mental, social, economic, and health risks and opportunities. Under the supervision of the Audit Committee, the Corporate Risk Management Office reports on the results of these processes. The progress we have made toward sustainability has been fueled by an ongoing process of policy and program review, focused on improving our corporate management and aligned with interna-tional best practices, including the United Nations Sustainable Development Goals (SDG). We iden-tify the most relevant risks and opportunities in ESG areas, and then decide on specific initiatives to address them. Our five priority SDG, which range from climate action, education, gender equality, decent work, and peace and justice, reflect the opportunities we have to create shared value and contribute to collective well-being. Our transparency and reporting strategy aligns with international frameworks and standards to address the information requirements of external institutions. We publish a Sustainability Report aligned with the recommendations of the Global Reporting Initiative (GRI), an internationally rec-ognized framework for sustainability reporting that helps organizations disclose their economic, environmental, and social impacts, as well as with the industry standards of the Sustainability Ac-counting Standards Board (SASB) and the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Grupo Televisa also supports the Ten Principles of the United Nations Global Compact (UNGC). |

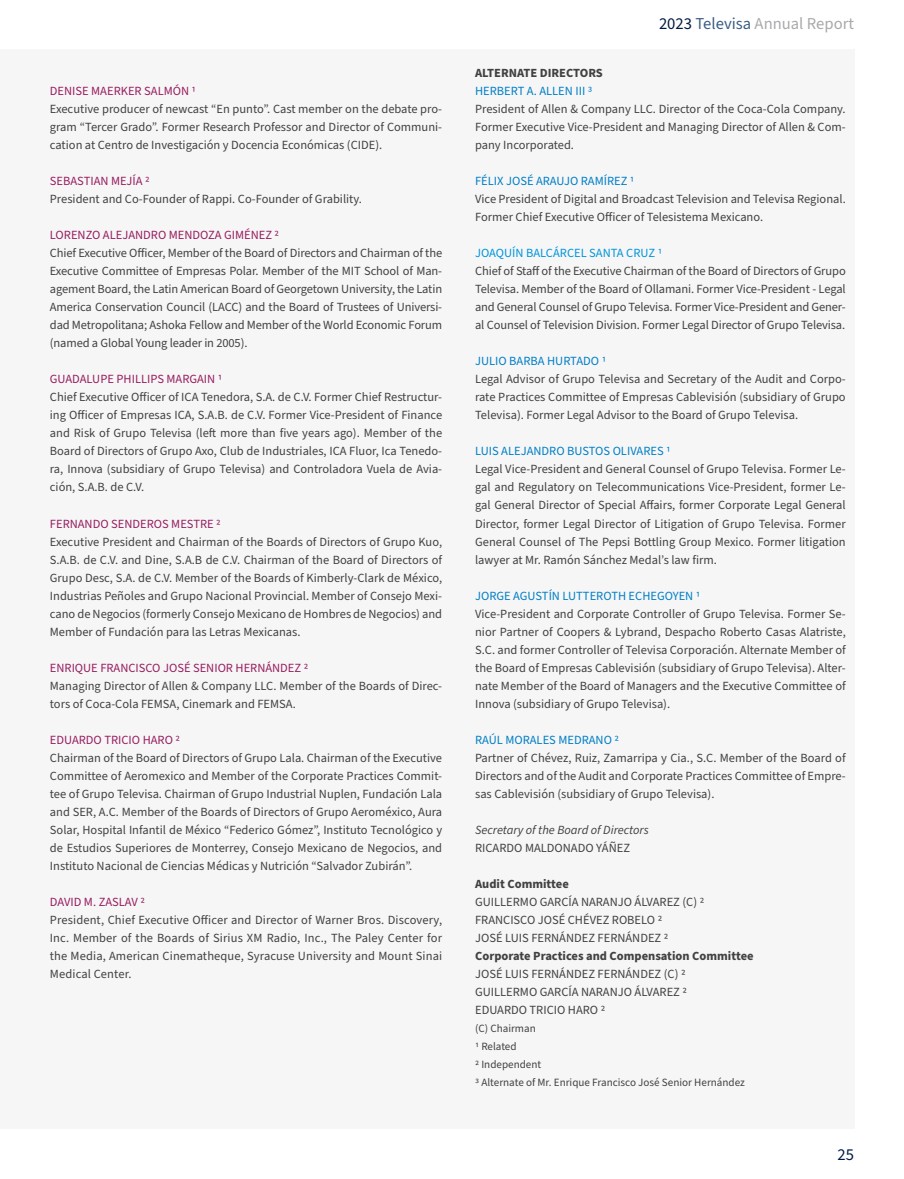

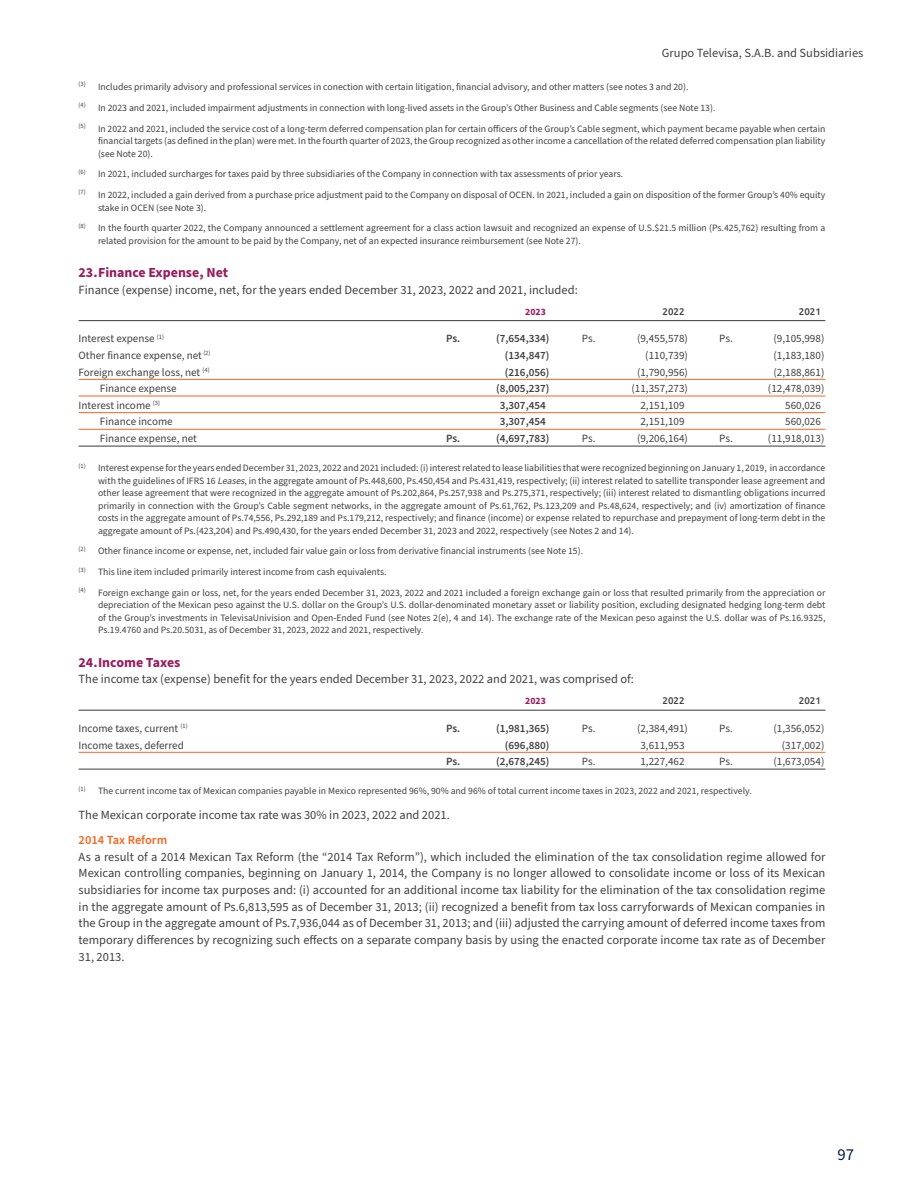

| 22 Our innovative programs and platforms in education, health, culture, entrepreneurship, and environmental protection enhance opportunities through empowering hundreds of thousands of people. In 2023, Fundación Televisa (or “Fundación”) continued to show growth on the impact of its programs and consolidated communica-tions of Grupo Televisa to demonstrate how we can use them to help create real, enduring change with a strong commitment to helping those most in need. As a result, Fundacion was able to help transform the lives of 785,583 children, youth and adults in Mexico and the Unit-ed States, investing (together with our 261 allies) more than Ps.380 million, a growth of 13% vs 2022. We continue to innovate in programs in education, culture, entrepre-neurship, and environmental protection to provide an empowering platform for hundreds of thousands of people to improve their lives, transform their communities, and build better and more sustainable communities. Our approach combines effective leveraging of the Company’s communication channels with state-of-the-art digital tools, financial support, and on-the-ground multidisciplinary teams. Our sustainability programs and initiatives are intended to help fur-ther 12 of 17 of the United Nations Sustainable Development Goals. In 2023, our communication efforts to promote early childhood initiatives, education programs,, entrepreneurship, health and cultural opportunities consisted of more than 61.5 million dig-ital impacts and more than 75,896 TV media impacts, reaching more than 45.8 million people on TV. At the same time, we pro-moted through our media efforts third parties´ social and sus-tainability initiatives. In addition, Fundación’s cultural and environmental programs cut across ages serving the general public through actions in specific locations and through digital and media spaces. FotograficaMx is the digital platform that spreads the vast photographic and film collection of Fundación Televisa through fotografica.mx website. This year we are proud to have presented the exhibit Mexichrome: Photography and Color in Mexico at one of the finest Museums in Mexico, the Palacio de Bellas Artes (Fine Arts Palace). Through our social media platforms we have actively engaged and enrolled more than 2.1 million persons in our educational and cultural programs (growth of 31% vs 2022). More than 5.5 million people have accesed and participated in our community outreach programs. Fundación programs work along different life stages. Empieza Temprano focuses on early childhood development by provid-ing parents and families with information and practical tips. To enhance the skills of K-12 students, Fundación has a civic values program called Valores that is recognized by 80% of the Mexican adult population. Cuantrix teaches computer science and coding. Technolochicas empowers young women through STEAM (Science, Technology, Engineering, Art and Mathematics). Bécalos works to increase high school and college completion while improving the student’s employability. POSiBLE helps ex-pand high-impact innovation-driven entrepreneurship through |

| 23 2023 Televisa Annual Report training, networking, resources, visibility and acceleration for high-potential startups and Gol por México combines the pas-sion for helping others with the passion for sports. Through this program, every soccer goal scored –of the soccer games transmitted by TelevisaUnivision– is transformed into aid for the neediest communities in México. Our media partner has be-come a client of TelevisaUnivision, allowing the Fundacion to continue this initiative after the spin-off of the soccer business. This year, in a powerful partnership with “Club America” soccer team, “Nuestras Alas” program was born. One of these efforts entails a new binational sustainability program called Tenis con Alas together with the Green Education Foundation in the US. These efforts have allowed Fundación Televisa to enhance its binational efforts. Despite significant progress, structural inequality based on edu-cation, inclusion, environment, and health persists around Mex-ico and is compounded and complicated by today’s challenges. In response to the devastation of Hurricane Otis in Guerrero Mexico, we were able to raise $3.1million USD. We made a time-ly donation of 8,200 pantries to affected families in Acapulco, benefiting 41,000 people. In addition, we have equipped 15 me-dia school classrooms with computers and high-speed satellite internet. We continue our efforts in the reconstruction of the af-fected areas with several partners and allies. Our numbers and recognitions include the following: • We had more than 101,670 students from public schools, 5,877 teachers and instructors, and 835 elementary schools, across Mexico, registered in our Cuantrix platform to learn basic coding skills. • We doubled the number of middle-school girls that participated in Technolochicas (16,150) STEAM activities in Mexico and the United States. • We had 38,577 recipients of Bécalos scholarships, reaching 550,696 scholarships in the program’s history. 7,855 scholarships were desig-nated for students and teachers developing employment competen-cies, 300 scholarships for students attending a program for talented youth, and 3,217 scholarships for women registered in STEAM training. • We continued our partnership with Schmidt Futures and Rhodes Trust to promote their RISE scholarship program in Mexico. This international program provides support to exceptional teenagers that want to change the world. • We supported 37,000-plus entrepreneurs in developing their business models through our POSiBLE program. • We participated in far-reaching communication campaigns, “Play this Summer” and “Early Childhood Week”, focused on delivering messag-es to promote early childhood stimulation. • We provided guidance to 67,153 parents with practical tips, TV spots, social media content, SMS messages and workshops through our Em-pieza Temprano program. • We provided 69,000 recipients with new aid in health, nutrition, devel-opment, dwelling, reforestation and support of women through our “Gol por México” program. • We held the successful exhibition Mexichrome, which attracted more than 150,000 visitors and more than 60,000 users through the mexichrome.mx website. We received the following recognitions: • The “Alebrijes” award to the program Posible for “Impact Gen-erator in the Innovation and Entrepreneurship Ecosystem in the South-Southeast” awarded by the Mexican Private Capital Associa-tion and the Inter American Development Bank. • Winners of the Social Entrepreurship 2023 award from Fomento So-cial Citibanamex. • Bécalos renewed CEMEFI’s Institutional and Transparency Accredi-tation for the third consecutive year. • Recognized by CEMEFI and awarded with the ESR (Empresa Social-mente Responsable) Socially Responsible Company 2023. By responsibly leveraging media, talent, partnerships and financial assets, the efforts led by Fundación reflect the commitment of the Company to enviromental and social initiatives. We intend to make a strategic contri-bution to building a more empowered, prosperous and democratic society where all people have a platform to succeed. For more information, please visit our 2023 Fundación Televisa Annual Report: https://fundaciontelevisa.org/informe2023 |

| 24 BOARD OF DIRECTORS EMILIO FERNANDO AZCÁRRAGA JEAN (C) 1 Executive Chairman of the Board and Chairman of the Executive Committee of Grupo Televisa. Member and Chairman of the Board of Empresas Cablevisión (subsidiary of Grupo Televisa). Former President and Chief Executive Officer of Grupo Televisa. Chief Executive Officer and Chairman of the Board of Directors of Ollamani, S.A.B. (“Ollamani”). Member of the Board of TelevisaUnivision and former member of the Board of Grupo Financiero Banamex. Member and Chairman of the Board of Managers of Innova (subsidiary of Grupo Televisa). Member of Consejo Mexicano de Negocios (formerly Consejo Mexicano de Hombres de Negocios) and Fundacion Teletón. In alphabetical order: ALFONSO DE ANGOITIA NORIEGA 1 Co-Chief Executive Officer, Member of the Executive Committee of Grupo Televisa. Member of the Board of Empresas Cablevisión (subsidiary of Grupo Televisa). Co-Chief Executive Officer of TelevisaUnivision Mexico. Executive Chairman of the Board of TelevisaUnivision. Member of the Boards of Liberty Latin America, Grupo Axo y Grupo Financiero Banorte and Innova (subsidiary of Grupo Televisa). Chairman of the Board of Trustees of Fundación Kardias. Member of the Boards of Trustees of Fundación Mexicana para la Salud, Fun-dación UNAM and The Paley Center for Media. Former Executive Vice President and Chief Financial Officer of Grupo Televisa. JOSÉ ANTONIO CHEDRAUI EGUÍA 2 Member of the Board of Directors and Chief Executive Officer of Grupo Comer-cial Chedraui, S.A.B. de C.V. FRANCISCO JOSÉ CHEVEZ ROBELO 2 In-house advisor, co-founder and retired partner of Chevez, Ruiz, Zamarripa y Cía, S.C., Member of the Audit Committee of Grupo Televisa. Member of the Board of Directors and Member and Chairman of the Audit and Corporate Practices Committee of Empresas Cablevisión (subsidiary of Grupo Televisa). Former Managing Partner of Ruiz Urquiza y Cia, S.C., representative of Arthur Andersen & Co. Member of the Board of Directors and Chairman of the Audit Committees of Regiomontana de Perfiles y Tubos, S.A. de C.V., Quality Tube, S.A. de C.V. and Pytco, S.A. de C.V. JON FELTHEIMER 2 Chief Executive Officer of Lionsgate. Former President of Columbia TriStar Television Group, former Executive Vice President of Sony Pictures Entertain-ment. Member of the Boards of Lionsgate and Pilgrim Media Group. JOSÉ LUIS FERNÁNDEZ FERNÁNDEZ 2 Managing Partner of Chévez, Ruíz, Zamarripa y Cía., S.C., Member of the Au-dit Committee and Chairman of the Corporate Practices Committee of Grupo Televisa. Member of the Board of Directors of Controladora Vuela Compañía de Aviación. Alternate member of the Board of Directors of Arca Continental Corporativo. Alternate Member of the Board of Directors and Alternate Mem-ber of the Audit and Corporate Practices Committee of Empresas Cablevisión (subsidiary of Grupo Televisa). SALVI RAFAEL FOLCH VIADERO 2 Chief Executive Officer of Grupo Jumex. Former Chief Executive Officer of Grupo Televisa’s Cable Division. Member of the Board of Consorcio Ara, S.A.B., Member of the Board and Chairman of the Audit and Corporate Prac-tices Committee of Ollamani, S.A.B. Former Chief Financial Officer of Grupo Televisa. Former Vice President of Financial Planning of Grupo Televisa. For-mer Member of the Board of Directors and Former Alternate Member of the Executive Committee of Empresas Cablevisión (subsidiary of Grupo Televisa). MICHAEL THOMAS FRIES 2 President and Chief Executive Officer of Liberty Global, plc. Vice Chairman of the Board of Liberty Global, Executive Chairman of the Board of Liberty Latin America, Member of the Boards of Directors of Lionsgate and Ca-ble Television Labs, Trustee of the Board of The Paley Center for Media, Chairman of the Boards of Directors of Museum of Contemporary Art Den-ver and Biennial of the Americas, Digital Communications Governor and Steering Committee Member of the World Economic Forum. Member of Young Presidents’ Organization. GUILLERMO GARCÍA NARANJO ÁLVAREZ 2 Chairman of the Audit Committee and member of the Corporate Practices Committee of Grupo Televisa. Former Chairman of the Board of Trustees of Consejo Mexicano de Normas de Información Financiera. Former Chief Executive Officer and Former Audit Partner of KPMG Cárdenas Dosal, S.C. Member of the Board and Chairman of the Audit Committee of Grupo Fi-nanciero Citibanamex, S.A. de C.V., Banco Nacional de México, S.A. and Citibanamex, Casa de Bolsa, S.A. de C.V. and CBM Banco, S.A., Member of the Board of Directors, Member of the Corporate Practices Committee and Chairman of the Audit Committee of Grupo Posadas, S.A.B. de C.V. Statutory Auditor of Total Systems de México. Member of the Board and the Audit and Corporate Practices Committee of Internacional de Céramica, S.A.B. de C.V. BERNARDO GÓMEZ MARTÍNEZ 1 Co-Chief Executive Officer and Member of the Executive Committee of Grupo Televisa. Member of the Board of Empresas Cablevisión (subsidiary of Grupo Televisa). Co-Chief Executive Officer of TelevisaUnivision Mexico. Member of the Boards of TelevisaUnivision and Innova (subsidiary of Gru-po Televisa). Former Executive Vice President and Deputy Director of the President of Grupo Televisa and Former President of Cámara Nacional de la Industria de Radio y Televisión. CARLOS HANK GONZÁLEZ 2 Chairman of the Board of Directors of Grupo Financiero Banorte and Banco Mercantil del Norte. Vice-President of the Board of Directors of Gruma. Chief Executive Officer of Grupo Hermes. Former Chief Executive Officer of Grupo Financiero Interacciones, Banco Interacciones and Interacciones Casa de Bol-sa. Former Deputy General Manager of Grupo Financiero Banorte. Member of the Boards of Directors of Bolsa Mexicana de Valores and Grupo Hermes. ENRIQUE KRAUZE KLEINBORT 1 Chief Executive Officer, Chairman of the Board of Directors and Founder of Editorial Clío, Libros y Videos, S.A. de C.V. and Letras Libres, S.A. de C.V. Member of Academia Mexicana de la Historia and Colegio Nacional. Information as of March 12, 2024 |

| 25 2023 Televisa Annual Report DENISE MAERKER SALMÓN 1 Executive producer of newcast “En punto”. Cast member on the debate pro-gram “Tercer Grado”. Former Research Professor and Director of Communi-cation at Centro de Investigación y Docencia Económicas (CIDE). SEBASTIAN MEJÍA 2 President and Co-Founder of Rappi. Co-Founder of Grability. LORENZO ALEJANDRO MENDOZA GIMÉNEZ 2 Chief Executive Officer, Member of the Board of Directors and Chairman of the Executive Committee of Empresas Polar. Member of the MIT School of Man-agement Board, the Latin American Board of Georgetown University, the Latin America Conservation Council (LACC) and the Board of Trustees of Universi-dad Metropolitana; Ashoka Fellow and Member of the World Economic Forum (named a Global Young leader in 2005). GUADALUPE PHILLIPS MARGAIN 1 Chief Executive Officer of ICA Tenedora, S.A. de C.V. Former Chief Restructur-ing Officer of Empresas ICA, S.A.B. de C.V. Former Vice-President of Finance and Risk of Grupo Televisa (left more than five years ago). Member of the Board of Directors of Grupo Axo, Club de Industriales, ICA Fluor, Ica Tenedo-ra, Innova (subsidiary of Grupo Televisa) and Controladora Vuela de Avia-ción, S.A.B. de C.V. FERNANDO SENDEROS MESTRE 2 Executive President and Chairman of the Boards of Directors of Grupo Kuo, S.A.B. de C.V. and Dine, S.A.B de C.V. Chairman of the Board of Directors of Grupo Desc, S.A. de C.V. Member of the Boards of Kimberly-Clark de México, Industrias Peñoles and Grupo Nacional Provincial. Member of Consejo Mexi-cano de Negocios (formerly Consejo Mexicano de Hombres de Negocios) and Member of Fundación para las Letras Mexicanas. ENRIQUE FRANCISCO JOSÉ SENIOR HERNÁNDEZ 2 Managing Director of Allen & Company LLC. Member of the Boards of Direc-tors of Coca-Cola FEMSA, Cinemark and FEMSA. EDUARDO TRICIO HARO 2 Chairman of the Board of Directors of Grupo Lala. Chairman of the Executive Committee of Aeromexico and Member of the Corporate Practices Commit-tee of Grupo Televisa. Chairman of Grupo Industrial Nuplen, Fundación Lala and SER, A.C. Member of the Boards of Directors of Grupo Aeroméxico, Aura Solar, Hospital Infantil de México “Federico Gómez”, Instituto Tecnológico y de Estudios Superiores de Monterrey, Consejo Mexicano de Negocios, and Instituto Nacional de Ciencias Médicas y Nutrición “Salvador Zubirán”. DAVID M. ZASLAV 2 President, Chief Executive Officer and Director of Warner Bros. Discovery, Inc. Member of the Boards of Sirius XM Radio, Inc., The Paley Center for the Media, American Cinematheque, Syracuse University and Mount Sinai Medical Center. ALTERNATE DIRECTORS HERBERT A. ALLEN III 3 President of Allen & Company LLC. Director of the Coca-Cola Company. Former Executive Vice-President and Managing Director of Allen & Com-pany Incorporated. FÉLIX JOSÉ ARAUJO RAMÍREZ 1 Vice President of Digital and Broadcast Television and Televisa Regional. Former Chief Executive Officer of Telesistema Mexicano. JOAQUÍN BALCÁRCEL SANTA CRUZ 1 Chief of Staff of the Executive Chairman of the Board of Directors of Grupo Televisa. Member of the Board of Ollamani. Former Vice-President - Legal and General Counsel of Grupo Televisa. Former Vice-President and Gener-al Counsel of Television Division. Former Legal Director of Grupo Televisa. JULIO BARBA HURTADO 1 Legal Advisor of Grupo Televisa and Secretary of the Audit and Corpo-rate Practices Committee of Empresas Cablevisión (subsidiary of Grupo Televisa). Former Legal Advisor to the Board of Grupo Televisa. LUIS ALEJANDRO BUSTOS OLIVARES 1 Legal Vice-President and General Counsel of Grupo Televisa. Former Le-gal and Regulatory on Telecommunications Vice-President, former Le-gal General Director of Special Affairs, former Corporate Legal General Director, former Legal Director of Litigation of Grupo Televisa. Former General Counsel of The Pepsi Bottling Group Mexico. Former litigation lawyer at Mr. Ramón Sánchez Medal’s law firm. JORGE AGUSTÍN LUTTEROTH ECHEGOYEN 1 Vice-President and Corporate Controller of Grupo Televisa. Former Se-nior Partner of Coopers & Lybrand, Despacho Roberto Casas Alatriste, S.C. and former Controller of Televisa Corporación. Alternate Member of the Board of Empresas Cablevisión (subsidiary of Grupo Televisa). Alter-nate Member of the Board of Managers and the Executive Committee of Innova (subsidiary of Grupo Televisa). RAÚL MORALES MEDRANO 2 Partner of Chévez, Ruiz, Zamarripa y Cia., S.C. Member of the Board of Directors and of the Audit and Corporate Practices Committee of Empre-sas Cablevisión (subsidiary of Grupo Televisa). Secretary of the Board of Directors RICARDO MALDONADO YÁÑEZ Audit Committee GUILLERMO GARCÍA NARANJO ÁLVAREZ (C) 2 FRANCISCO JOSÉ CHÉVEZ ROBELO 2 JOSÉ LUIS FERNÁNDEZ FERNÁNDEZ 2 Corporate Practices and Compensation Committee JOSÉ LUIS FERNÁNDEZ FERNÁNDEZ (C) 2 GUILLERMO GARCÍA NARANJO ÁLVAREZ 2 EDUARDO TRICIO HARO 2 (C) Chairman 1 Related 2 Independent 3 Alternate of Mr. Enrique Francisco José Senior Hernández |

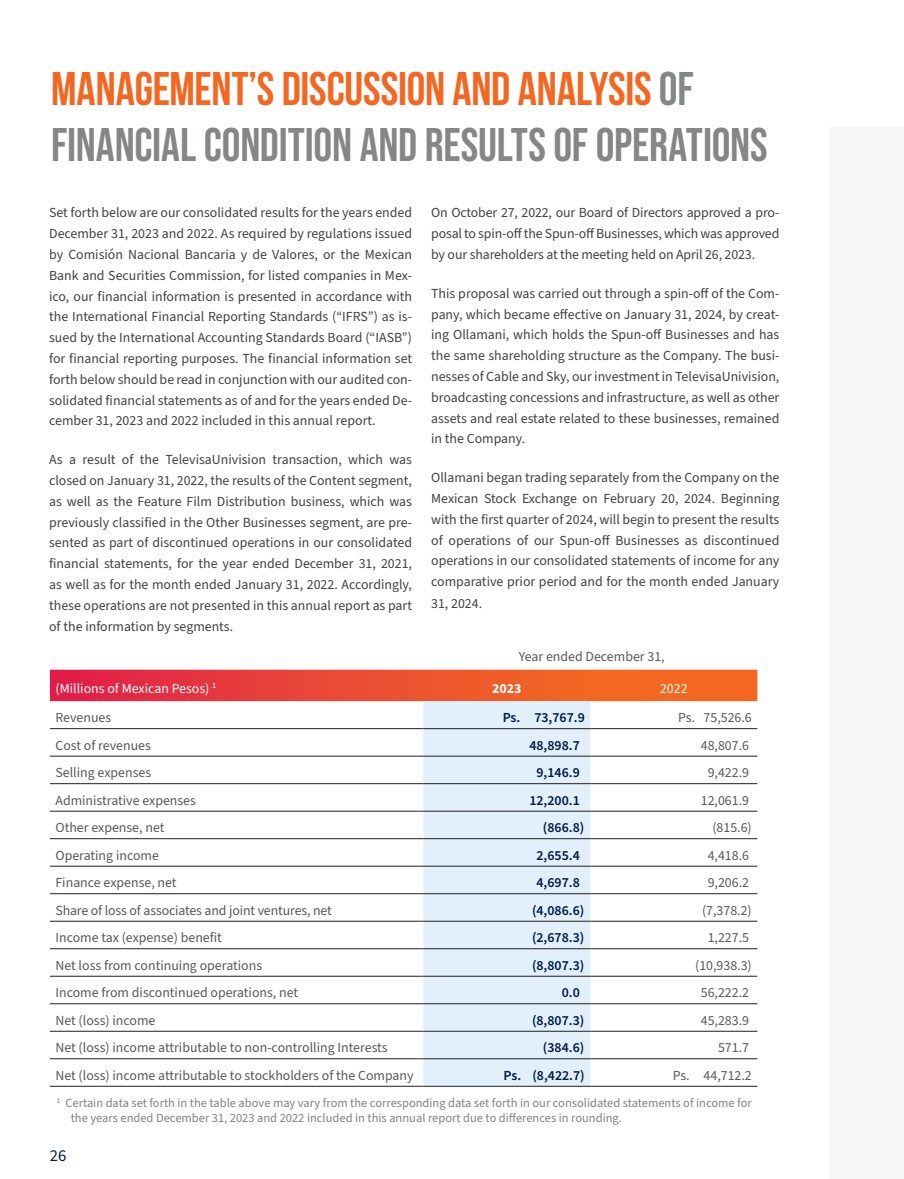

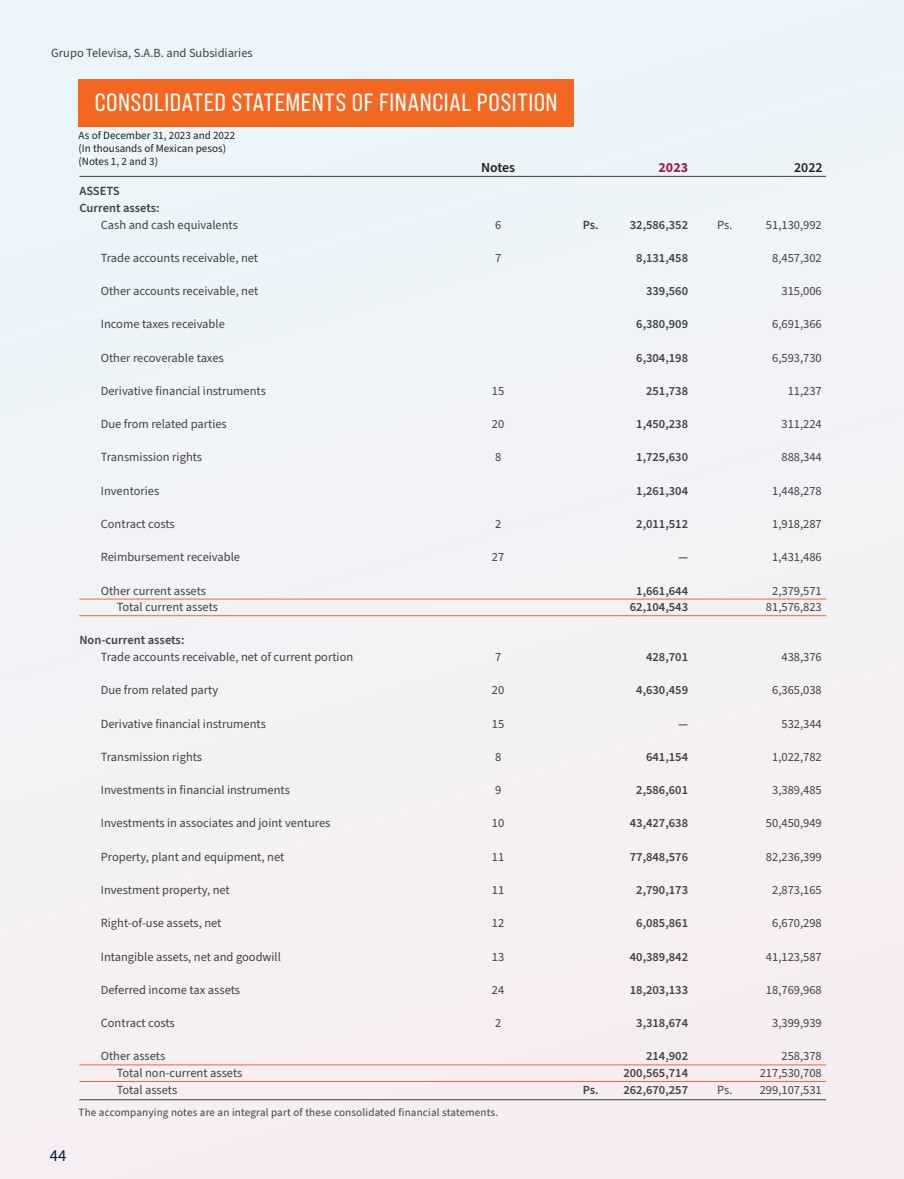

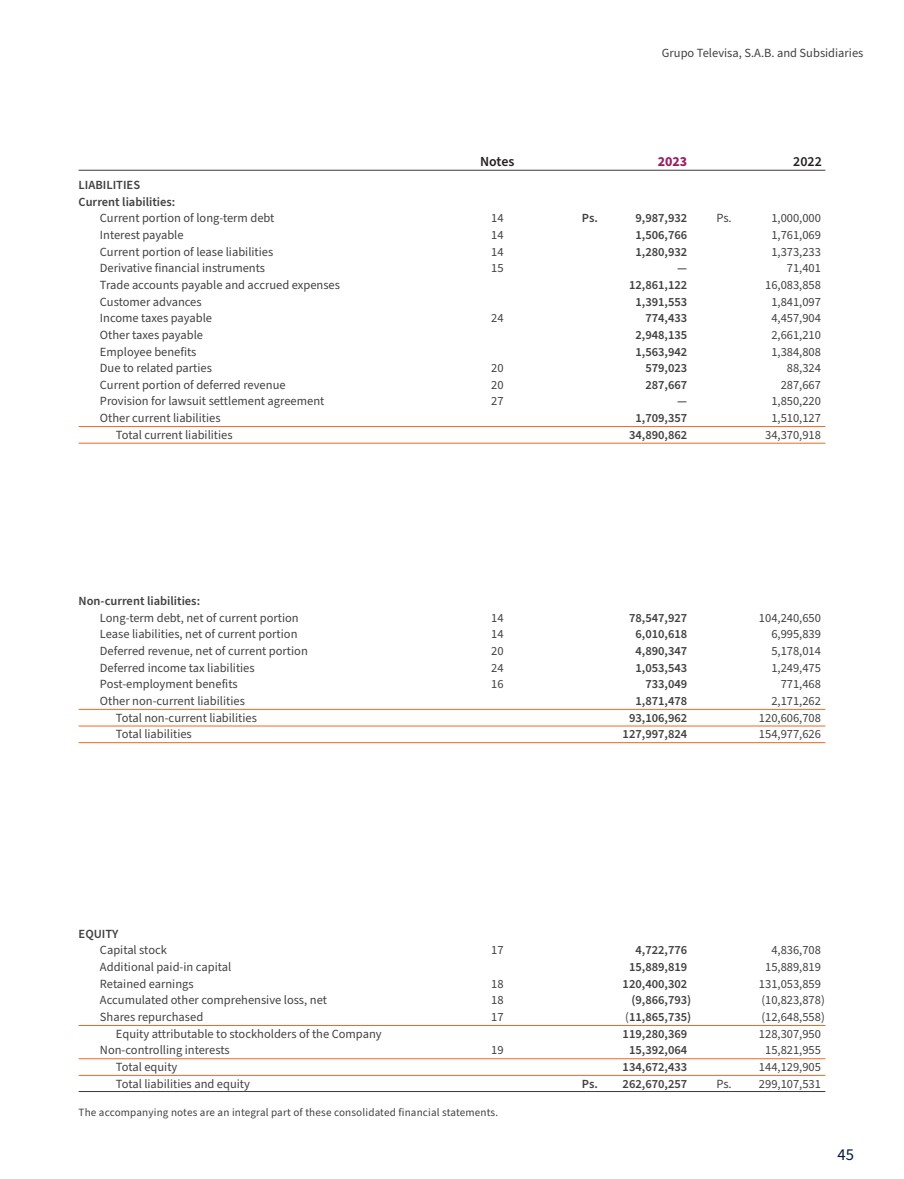

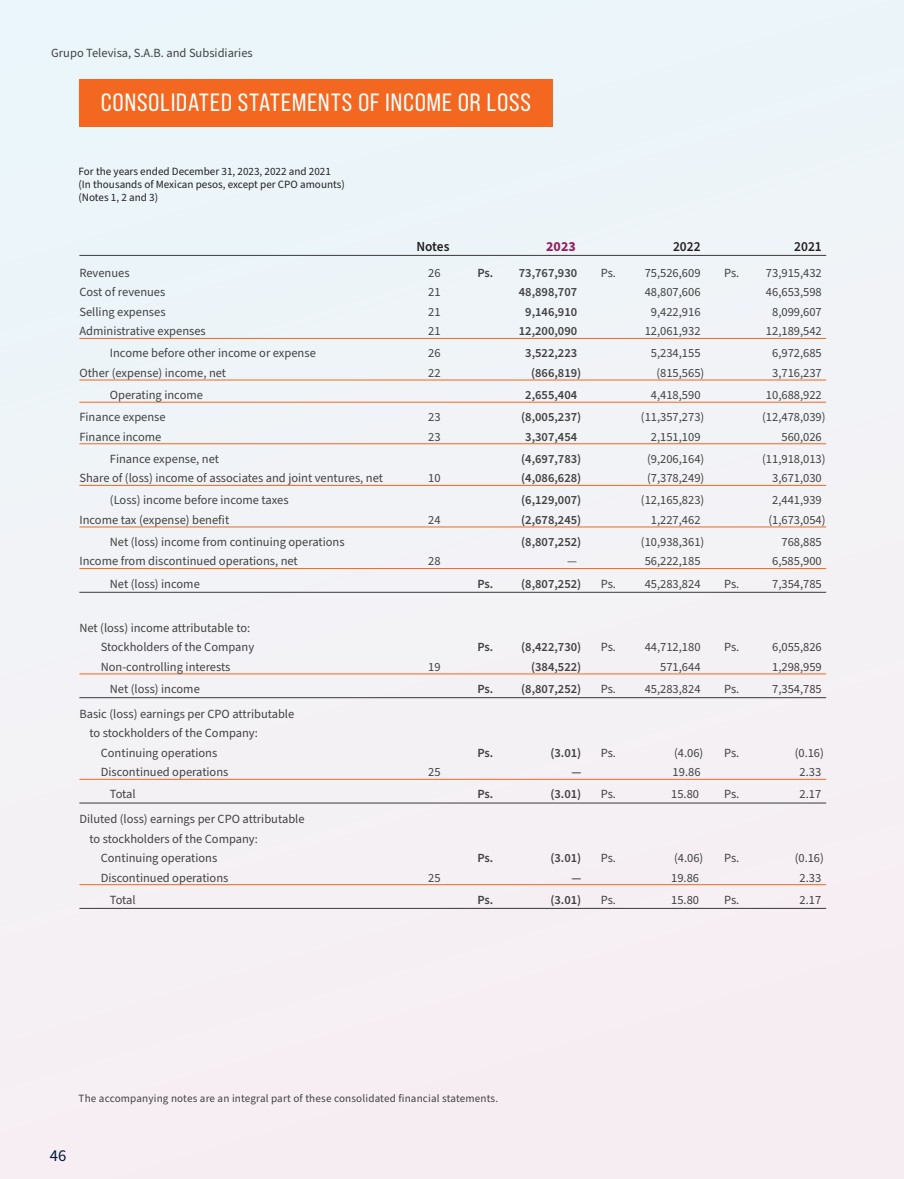

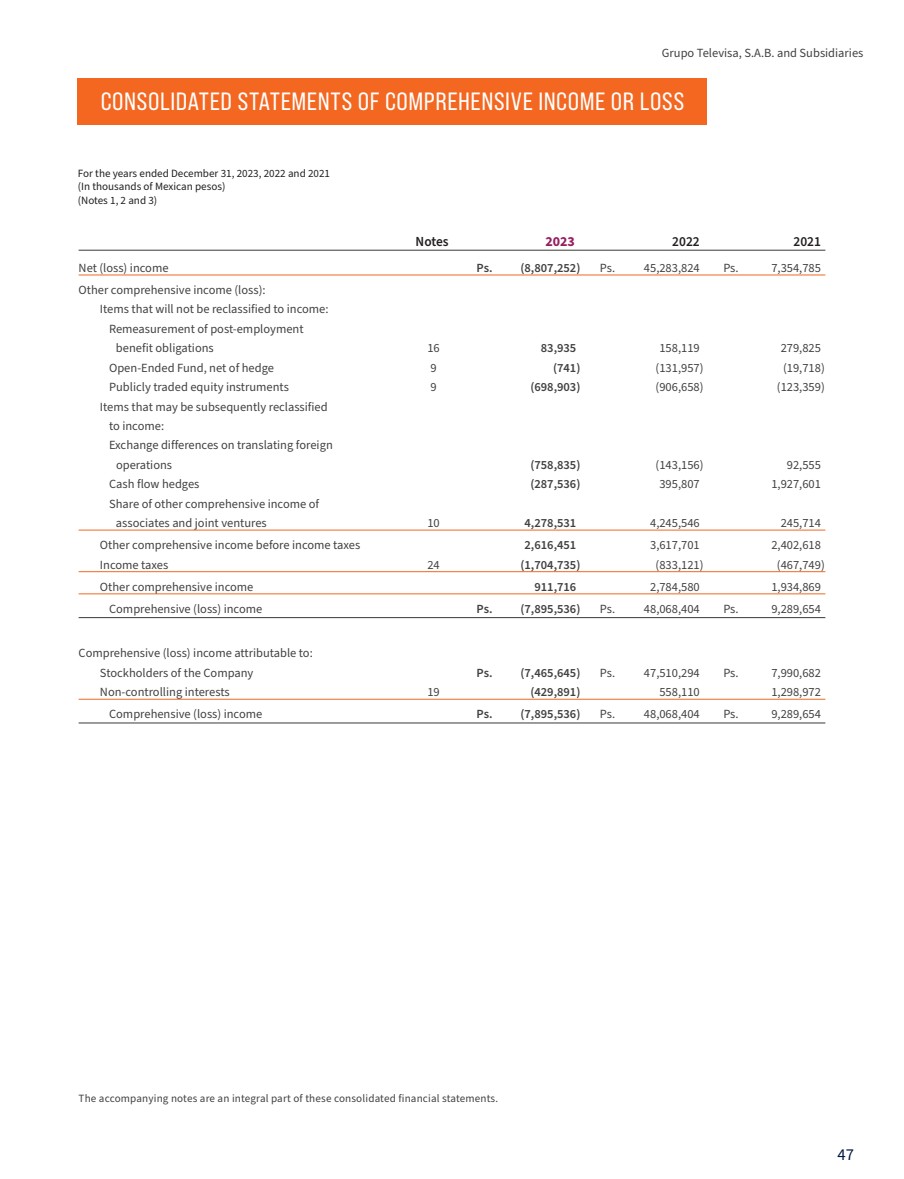

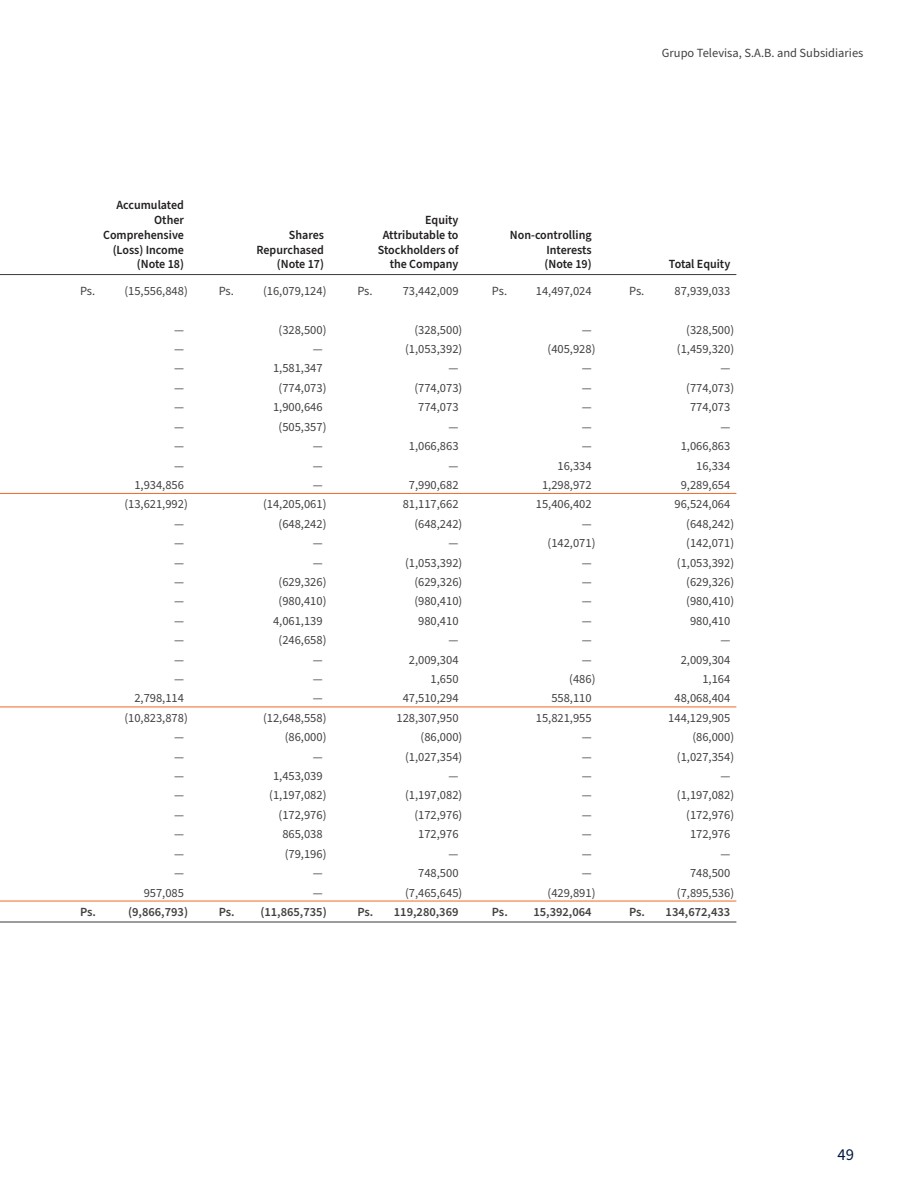

| 26 Set forth below are our consolidated results for the years ended December 31, 2023 and 2022. As required by regulations issued by Comisión Nacional Bancaria y de Valores, or the Mexican Bank and Securities Commission, for listed companies in Mex-ico, our financial information is presented in accordance with the International Financial Reporting Standards (“IFRS”) as is-sued by the International Accounting Standards Board (“IASB”) for financial reporting purposes. The financial information set forth below should be read in conjunction with our audited con-solidated financial statements as of and for the years ended De-cember 31, 2023 and 2022 included in this annual report. As a result of the TelevisaUnivision transaction, which was closed on January 31, 2022, the results of the Content segment, as well as the Feature Film Distribution business, which was previously classified in the Other Businesses segment, are pre-sented as part of discontinued operations in our consolidated financial statements, for the year ended December 31, 2021, as well as for the month ended January 31, 2022. Accordingly, these operations are not presented in this annual report as part of the information by segments. On October 27, 2022, our Board of Directors approved a pro-posal to spin-off the Spun-off Businesses, which was approved by our shareholders at the meeting held on April 26, 2023. This proposal was carried out through a spin-off of the Com-pany, which became effective on January 31, 2024, by creat-ing Ollamani, which holds the Spun-off Businesses and has the same shareholding structure as the Company. The busi-nesses of Cable and Sky, our investment in TelevisaUnivision, broadcasting concessions and infrastructure, as well as other assets and real estate related to these businesses, remained in the Company. Ollamani began trading separately from the Company on the Mexican Stock Exchange on February 20, 2024. Beginning with the first quarter of 2024, will begin to present the results of operations of our Spun-off Businesses as discontinued operations in our consolidated statements of income for any comparative prior period and for the month ended January 31, 2024. Year ended December 31, (Millions of Mexican Pesos) 1 2023 2022 Revenues Ps. 73,767.9 Ps. 75,526.6 Cost of revenues 48,898.7 48,807.6 Selling expenses 9,146.9 9,422.9 Administrative expenses 12,200.1 12,061.9 Other expense, net (866.8) (815.6) Operating income 2,655.4 4,418.6 Finance expense, net 4,697.8 9,206.2 Share of loss of associates and joint ventures, net (4,086.6) (7,378.2) Income tax (expense) benefit (2,678.3) 1,227.5 Net loss from continuing operations (8,807.3) (10,938.3) Income from discontinued operations, net 0.0 56,222.2 Net (loss) income (8,807.3) 45,283.9 Net (loss) income attributable to non-controlling Interests (384.6) 571.7 Net (loss) income attributable to stockholders of the Company Ps. (8,422.7) Ps. 44,712.2 1 Certain data set forth in the table above may vary from the corresponding data set forth in our consolidated statements of income for the years ended December 31, 2023 and 2022 included in this annual report due to differences in rounding. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

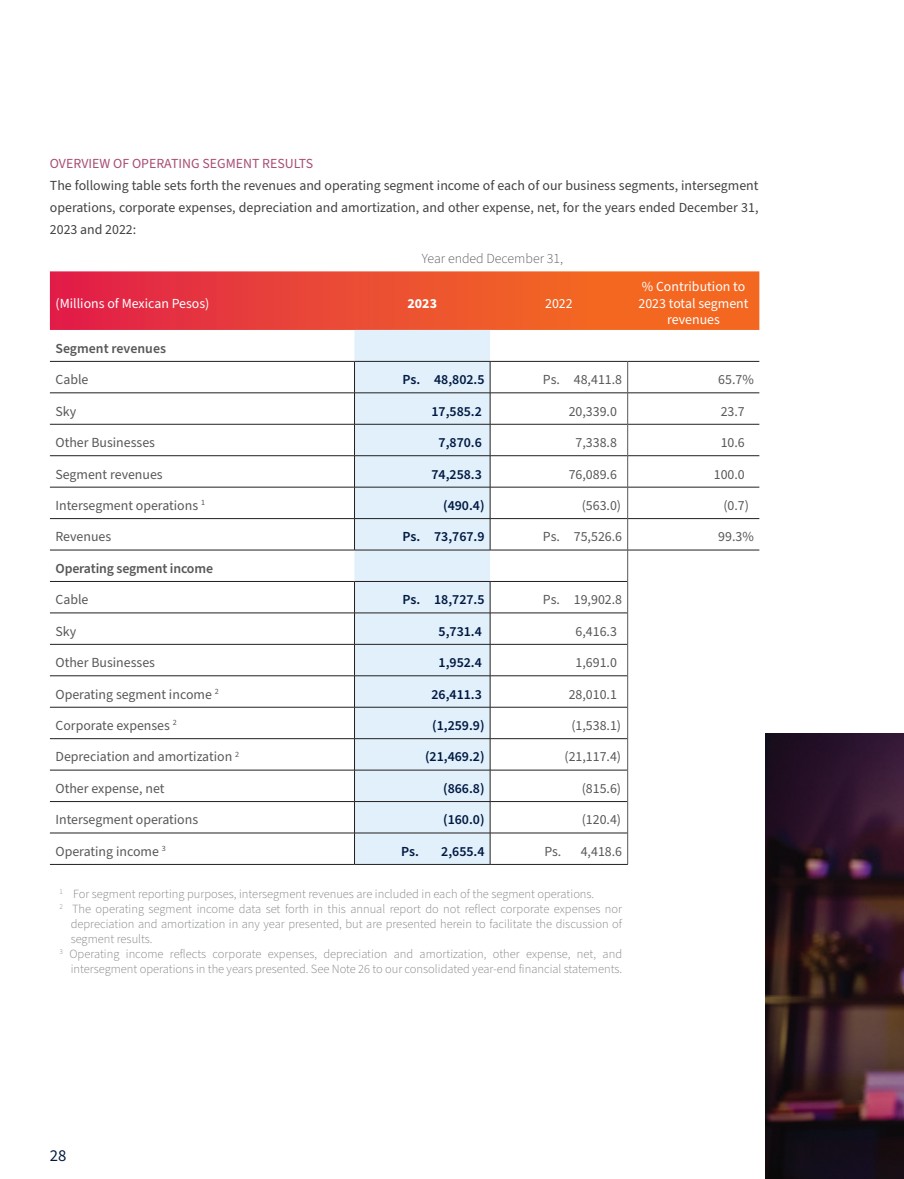

| 27 2023 Televisa Annual Report RESULTS OF OPERATIONS The following table sets forth the reconciliation between our operating segment income and the consolidated operating income according to IFRS, for the years ended December 31, 2023 and 2022: Year ended December 31, (Millions of Mexican Pesos) 1 2023 2022 Revenues Ps. 73,767.9 Ps. 75,526.6 Cost of revenues 2 31,045.3 31,242.5 Selling expenses 2 8,909.3 9,065.2 Administrative expenses 2 7,562.0 7,329.2 Intersegment operations 160.0 120.4 Operating segment income 26,411.3 28,010.1 Corporate expenses 1,259.9 1,538.1 Depreciation and amortization 21,469.2 21,117.4 Other expense, net (866.8) (815.6) Intersegment operations (160.0) (120.4) Operating income Ps. 2,655.4 Ps. 4,418.6 1 Certain data set forth in the table above may vary from the corresponding data set forth in our consolidated statements of income for the years ended December 31, 2023 and 2022 included in this annual report due to differences in rounding. 2 Excluding corporate expenses and depreciation and amortization. |

| 28 OVERVIEW OF OPERATING SEGMENT RESULTS The following table sets forth the revenues and operating segment income of each of our business segments, intersegment operations, corporate expenses, depreciation and amortization, and other expense, net, for the years ended December 31, 2023 and 2022: Year ended December 31, (Millions of Mexican Pesos) 2023 2022 % Contribution to 2023 total segment revenues Segment revenues Cable Ps. 48,802.5 Ps. 48,411.8 65.7% Sky 17,585.2 20,339.0 23.7 Other Businesses 7,870.6 7,338.8 10.6 Segment revenues 74,258.3 76,089.6 100.0 Intersegment operations 1 (490.4) (563.0) (0.7) Revenues Ps. 73,767.9 Ps. 75,526.6 99.3% Operating segment income Cable Ps. 18,727.5 Ps. 19,902.8 Sky 5,731.4 6,416.3 Other Businesses 1,952.4 1,691.0 Operating segment income 2 26,411.3 28,010.1 Corporate expenses 2 (1,259.9) (1,538.1) Depreciation and amortization 2 (21,469.2) (21,117.4) Other expense, net (866.8) (815.6) Intersegment operations (160.0) (120.4) Operating income 3 Ps. 2,655.4 Ps. 4,418.6 1 For segment reporting purposes, intersegment revenues are included in each of the segment operations. 2 The operating segment income data set forth in this annual report do not reflect corporate expenses nor depreciation and amortization in any year presented, but are presented herein to facilitate the discussion of segment results. 3 Operating income reflects corporate expenses, depreciation and amortization, other expense, net, and intersegment operations in the years presented. See Note 26 to our consolidated year-end financial statements. |

| 29 2023 Televisa Annual Report OVERVIEW OF RESULTS OF OPERATIONS Revenues Revenues decreased by Ps.1,758.7 million, or 2.3%, to Ps.73,767.9 million for the year ended December 31, 2023, from Ps.75,526.6 million for the year ended December 31, 2022. This decrease was due to a revenue decline in the Sky segments, which was partially offset by a increase in revenues in our Cable and Other Businesses segments. Cost of Revenues Cost of revenues decreased by Ps.197.2 million, or 0.6%, to Ps.31,045.3 million for the year ended December 31, 2023, from Ps. 31,242.5 million for the year ended December 31, 2022. The decrease mainly reflects lower to cost in our Sky segment, which was partially offset by a increase in costs in our Cable and Other Businesses segments. Selling Expenses Selling expenses decreased by Ps.155.9 million, or 1.7%, to Ps.8,909.3 million for the year ended December 31, 2023 from Ps.9,065.2 million for the year ended December 31, 2022. This decrease was primarily attributable to lower selling expenses in our Sky segment, which was partially offset by a increase in selling expenses in our Cable and Other Businesses segments. Administrative and Corporate Expenses Administrative and corporate expenses decreased by Ps.45.4 million, or 0.5%, to Ps.8,821.9 million for the year ended December 31, 2023, from Ps.8,867.3 million for the year ended December 31, 2022. The decrease mainly re-flects lower corporate expenses and was partially offset by an increase in administrative expenses in our Cable and Other Businesses segments. Corporate expenses decreased by Ps.278.2 million, or 18.1%, to Ps.1,259.9 million in 2023, from Ps.1,538.1 million in 2022. The decrease reflected primarily a lower share-based compensation expense, as well as a decrease in oth-er non-allocated corporate expenses. Share-based compensation expense in 2023 and 2022 amounted to Ps.748.5 million and Ps.968.6 million, respec-tively, and was accounted for as corporate expense. Share-based compensation expense is measured at fair value at the time the equity benefits are conditionally sold to officers and employees and is recognized over the vesting period. |

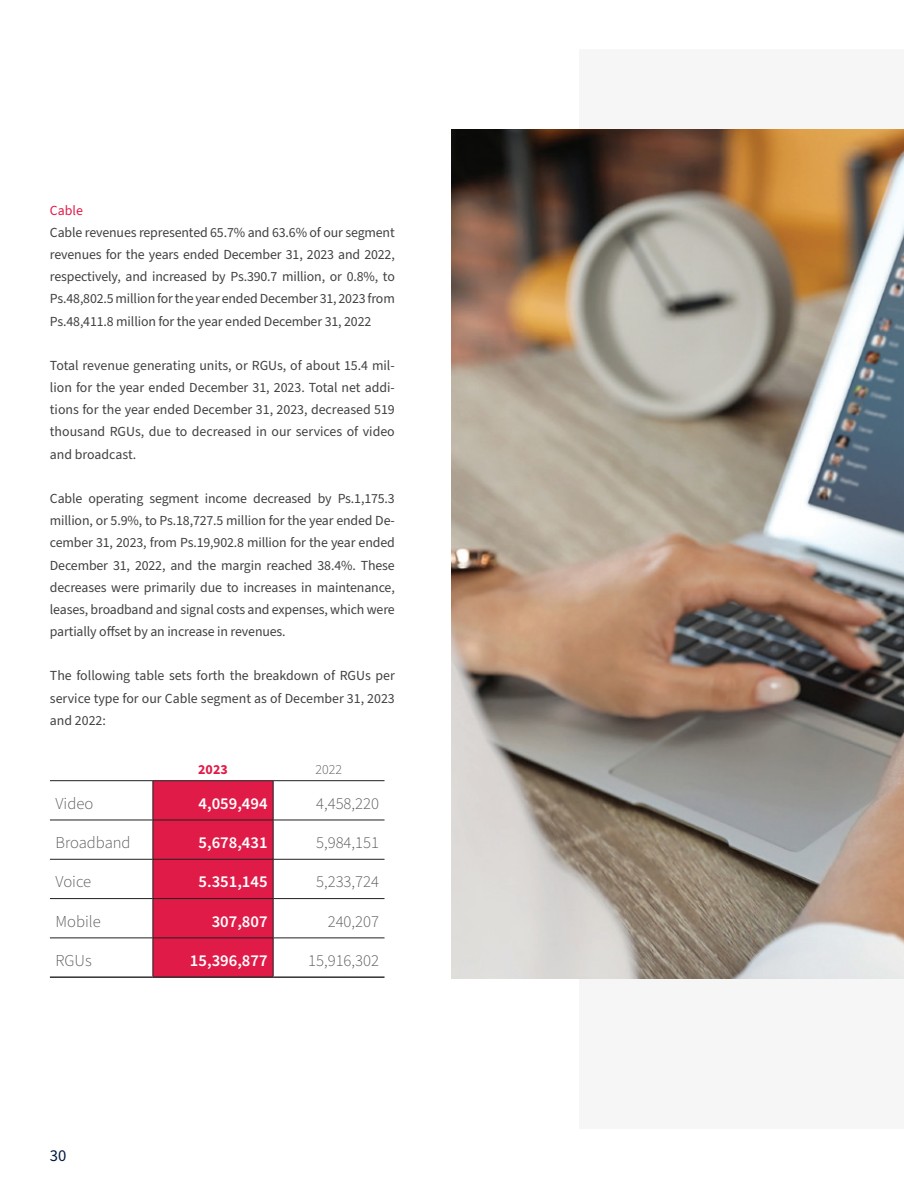

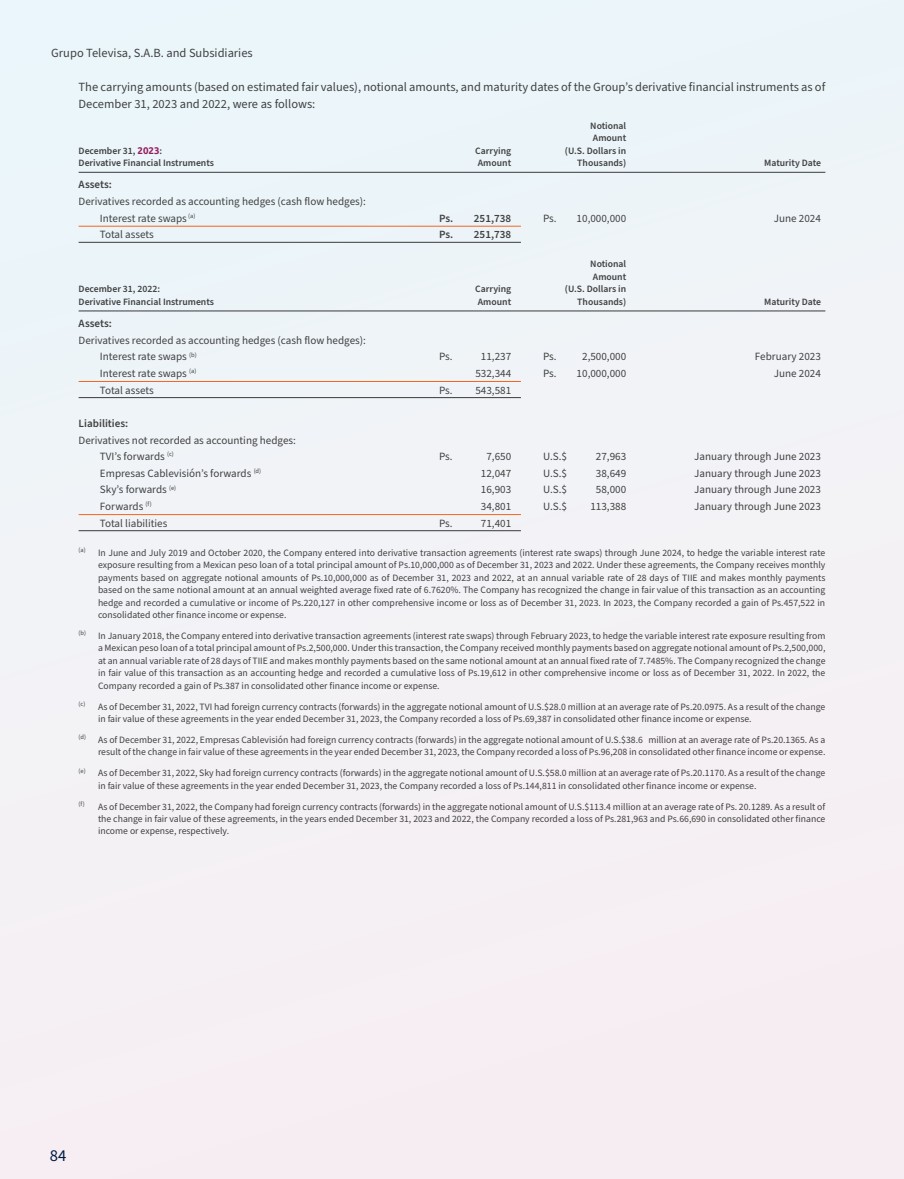

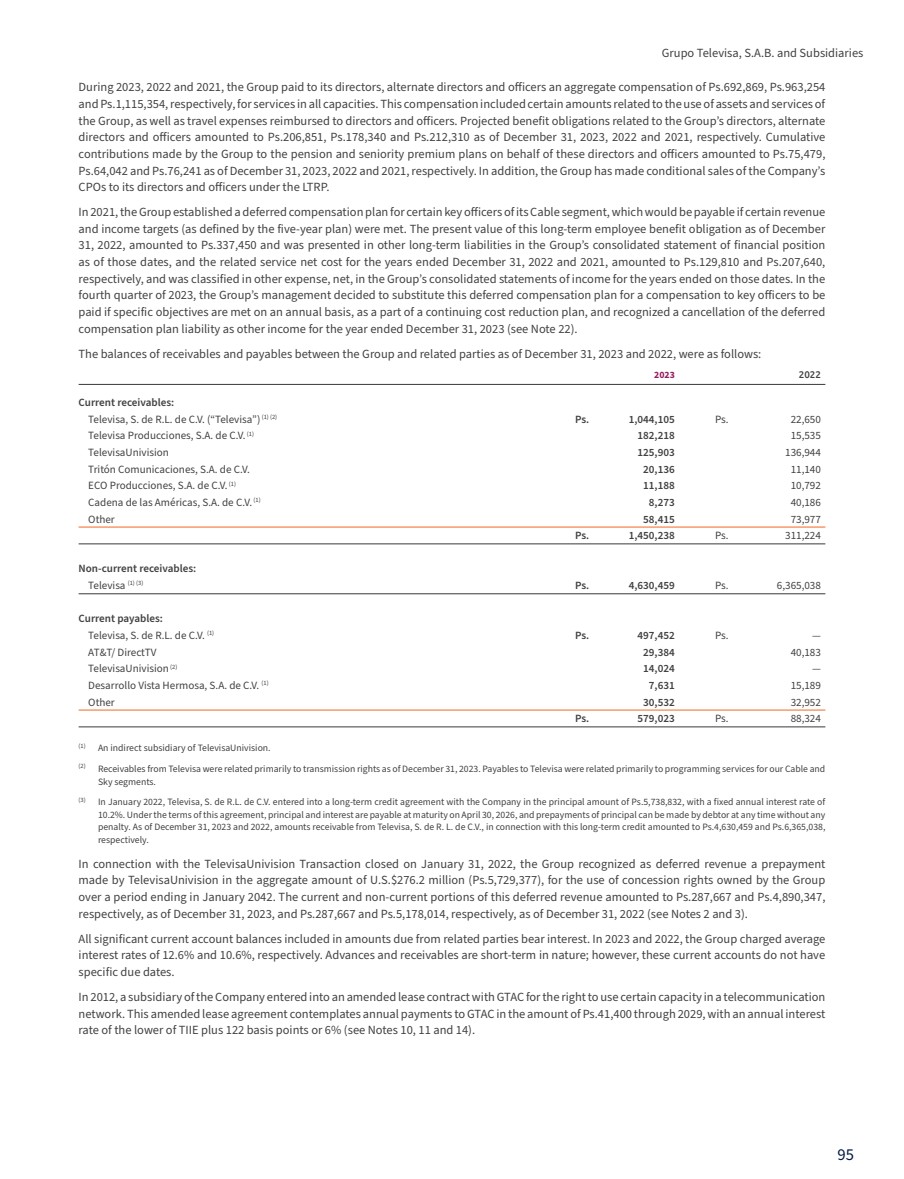

| 30 Cable Cable revenues represented 65.7% and 63.6% of our segment revenues for the years ended December 31, 2023 and 2022, respectively, and increased by Ps.390.7 million, or 0.8%, to Ps.48,802.5 million for the year ended December 31, 2023 from Ps.48,411.8 million for the year ended December 31, 2022 Total revenue generating units, or RGUs, of about 15.4 mil-lion for the year ended December 31, 2023. Total net addi-tions for the year ended December 31, 2023, decreased 519 thousand RGUs, due to decreased in our services of video and broadcast. Cable operating segment income decreased by Ps.1,175.3 million, or 5.9%, to Ps.18,727.5 million for the year ended De-cember 31, 2023, from Ps.19,902.8 million for the year ended December 31, 2022, and the margin reached 38.4%. These decreases were primarily due to increases in maintenance, leases, broadband and signal costs and expenses, which were partially offset by an increase in revenues. The following table sets forth the breakdown of RGUs per service type for our Cable segment as of December 31, 2023 and 2022: 2023 2022 Video 4,059,494 4,458,220 Broadband 5,678,431 5,984,151 Voice 5.351,145 5,233,724 Mobile 307,807 240,207 RGUs 15,396,877 15,916,302 |

| 31 2023 Televisa Annual Report Sky Sky revenues represented 23.7% and 26.7% of our seg-ment revenues for the years ended December 31, 2023 and 2022, respectively, and decreased by Ps.2,753.8 million, or 13.5%, to Ps.17,585.2 million for the year ended December 31, 2023 from Ps.20,339.0 million for the year ended De-cember 31, 2022. This decrease was due to the decrease in the number of video and broadband RGUs for the year ended December 31, 2023. Total disconnections for the year ended December 31, 2023, were approximately 798 thousand RGUs. This was mainly driven by the loss of 689.6 thousand video RGUs and 125.2 thousand broadband net disconnections. Mobile RGUs increased by 16.9 thousand. In addition, Sky closed the year with 118,670 video RGUs in Central America and the Dominican Republic. The following table sets forth the breakdown of RGUs per service type for Sky as of December 31, 2023, and 2022. 2023 2022 Video 5,567,426 6,257,059 Broadband 515,089 640,294 Voice 344 453 Mobile 32,502 15,602 RGUs 6,115,361 6,913,408 Sky operating segment income decreased by Ps.684.9 million, or 10.7%, to Ps.5,731.4 million for the year ended December 31, 2023, from Ps.6,416.3 million for the year ended December 31, 2022, and the margin totaled 32.6%. This decrease in operating segment income was due to the lower revenue, which was partially offset by a decrease in programming costs, sales promotion and broadcast rights. |

| 32 Other Businesses Other Businesses revenues represented 10.6% and 9.7% of our segment revenues for the years ended December 31, 2023, and 2022, respectively, and increased by Ps.531.8 million, or 7.2%, to Ps.7,870.6 million for the year ended De-cember 31, 2023, from Ps.7,338.8 million for the year ended December 31, 2022. This increase was primarily attributable to higher revenues in the gamming and futbol businesses. Other Businesses operating segment income increased by Ps.261.4 million, or 15.5%, to Ps.1,952.4 million for the year ended December 31, 2023, from Ps.1,691.0 million for the year ended December 31, 2022. This increase was primarily due to an increase in revenues, which was partially offset by an increase in cost of revenues and operating expenses. Depreciation and Amortization Depreciation and amortization expense increased by Ps.351.8 million, or 1.7%, to Ps.21,469.2 million for the year ended December 31, 2023, from Ps.21,117.4 million for the year ended December 31, 2022. This increase was primari-ly due to an increase in depreciation and amortization ex-pense in our Cable segment, which was partially offset by a decrease in depreciation and amortization expense in our Sky and Other Businesses segments. Other Expense, Net Other expense, net, increased by Ps.51.2 million, to Ps.866.8 million for the year ended December 31, 2023, from Ps.815.6 million for the year ended December 31, 2022. This increase reflected primarily (i) an increase in non-recurring severance expense in connection with headcount reductions in our Cable segment; (ii) non-re-curring expense related to damage caused by Hurricane “Otis” in our Cable segment; and (iii) impairment adjust-ments of long-lived assets. These unfavorable variances were partially offset by (i) the absence in 2023 of other expense in connection with a settlement agreement of a class action in the fourth quarter of 2022; and (ii) an inter-est income for recovery of asset tax from prior years. Operating Income Operating Income decreased by Ps.1,763.2 million, or 39.9%, to Ps.2,655.4 million for the year ended December 31, 2023, from Ps.4,418.6 million for the year ended De-cember 31, 2022. This decrease reflected primarily a de-creased in revenues as well as an increase in depreciation and amortization and other expense, net and was partial-ly offset by a decrease in cost and operating expenses. |

| 33 2023 Televisa Annual Report NON-OPERATING RESULTS Finance Expense, Net Finance expense, net, significantly impacts our consolidated financial statements in periods of currency fluctuations. Un-der IFRS, finance income or expense, net, reflects: • interest expense; • interest income; • foreign exchange gain or loss attributable to monetary assets and liabilities denominated in foreign currencies; and • other finance income or expense, net, including gains or losses from derivative instruments. Our foreign exchange position is affected by our assets or lia-bilities denominated in foreign currencies, primarily U.S. dol-lars. We record a foreign exchange gain or loss if the exchange rate of the Mexican Peso to the other currencies in which our monetary assets or liabilities are denominated varies. Finance expense, net, decreased by Ps.4,508.4 million, or 49.0%, to Ps.4,697.8 million for the year ended December 31, 2023, from Ps.9,206.2 million for the year ended De-cember 31, 2022. This decrease reflected: (i) a Ps.1,801.3 million decrease in interest expense in connection with a lower average principal amount of debt in the year ended December 31, 2023, resulting primarily from prepayments made in 2023 of our long-term debt; (ii) a Ps.1,156.3 million increase in interest income explained primarily by higher interest rates in 2023, which effect was partially offset by a lower average amount of cash and cash equivalents for the year ended December 31, 2023; and (iii) a Ps.1,574.9 million decrease in foreign exchange loss, net, resulting primarily from the appreciation of the Mexican peso against the U.S. dollar on a lower average U.S. dollar net asset position for the year ended December 31, 2023, compared to a higher average U.S. dollar net asset position for the year ended December 31, 2022, which was partially offset by a 13.1% appreciation of the Mexican peso against the U.S. dollar in 2023, compared to a 5.0% appreciation in 2022. These favorable variances were partially offset by a Ps.24.1 million increase in other finance expense, net, resulting from a higher loss in fair value of our derivative contracts for the year ended December 31, 2023. |

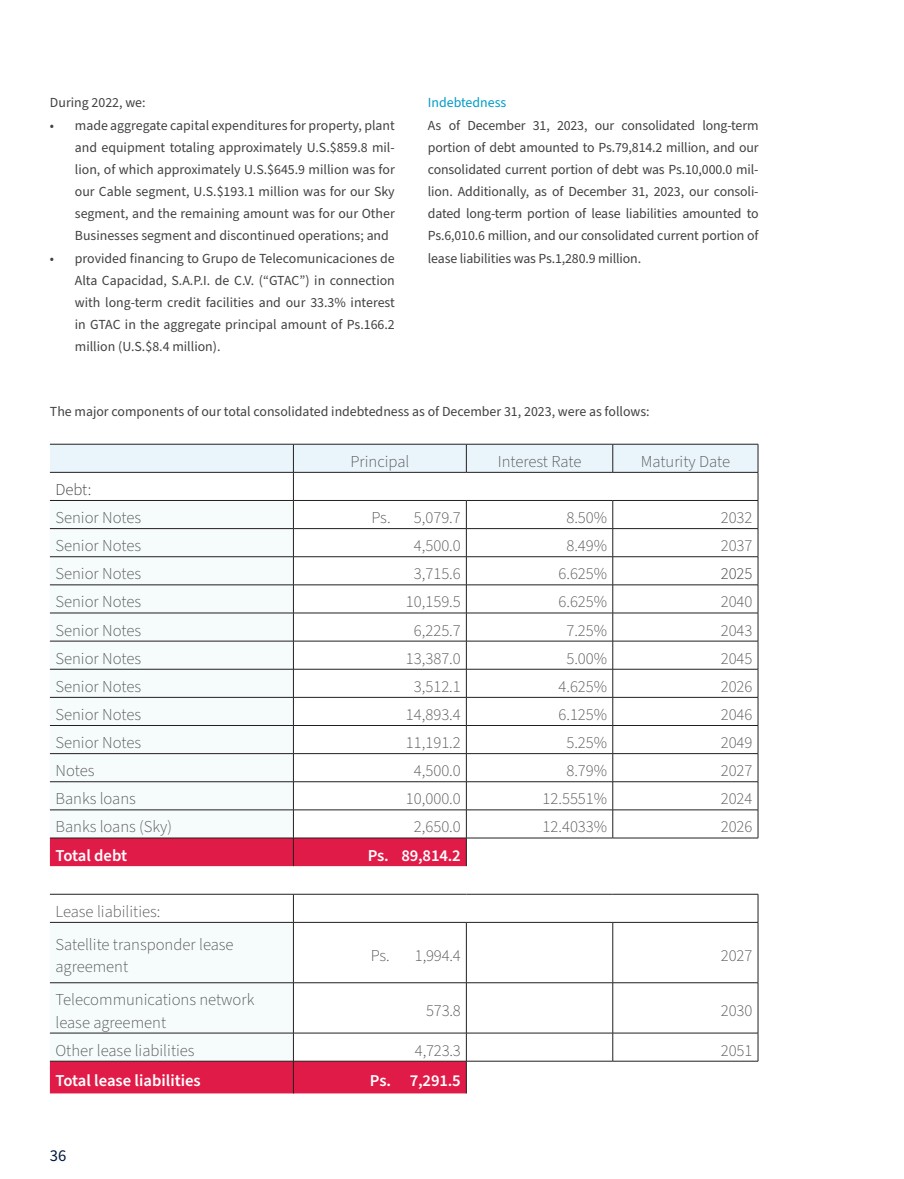

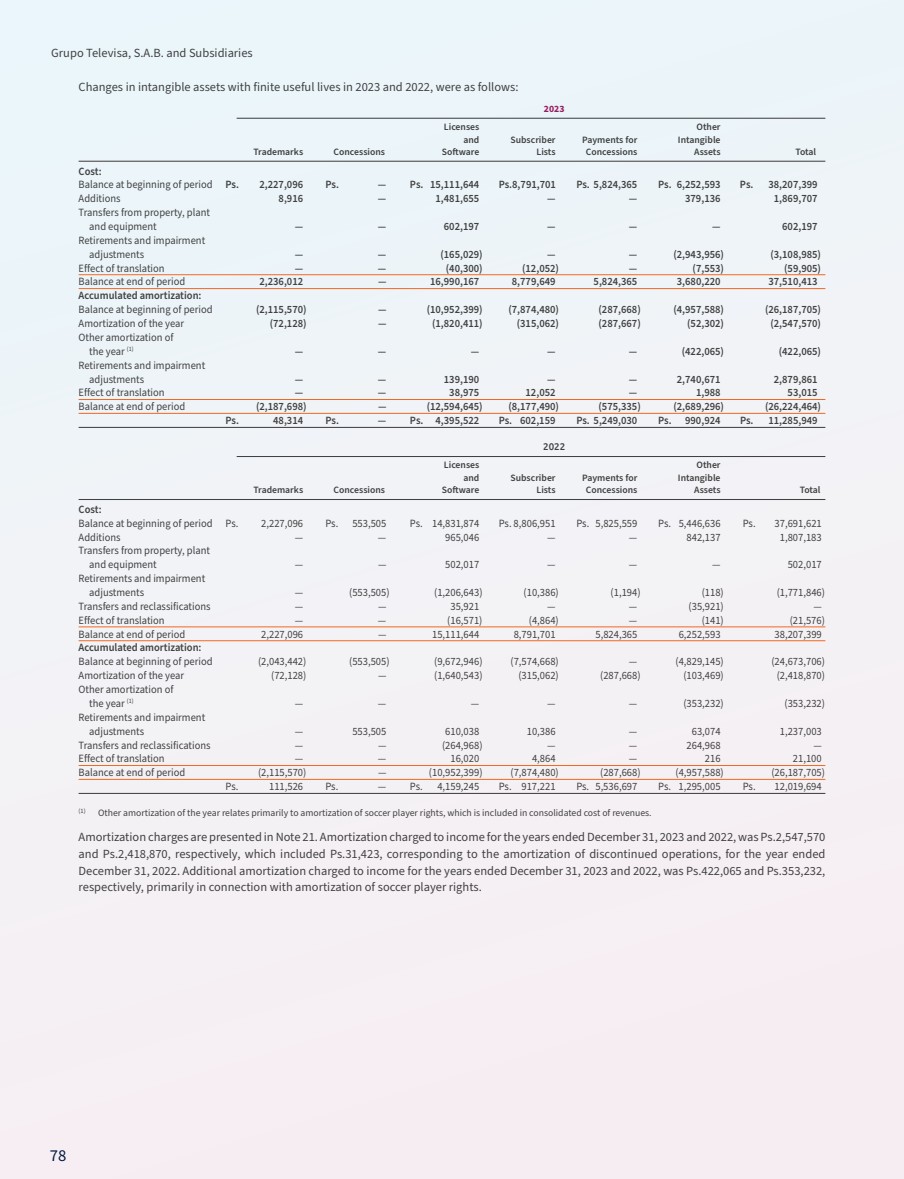

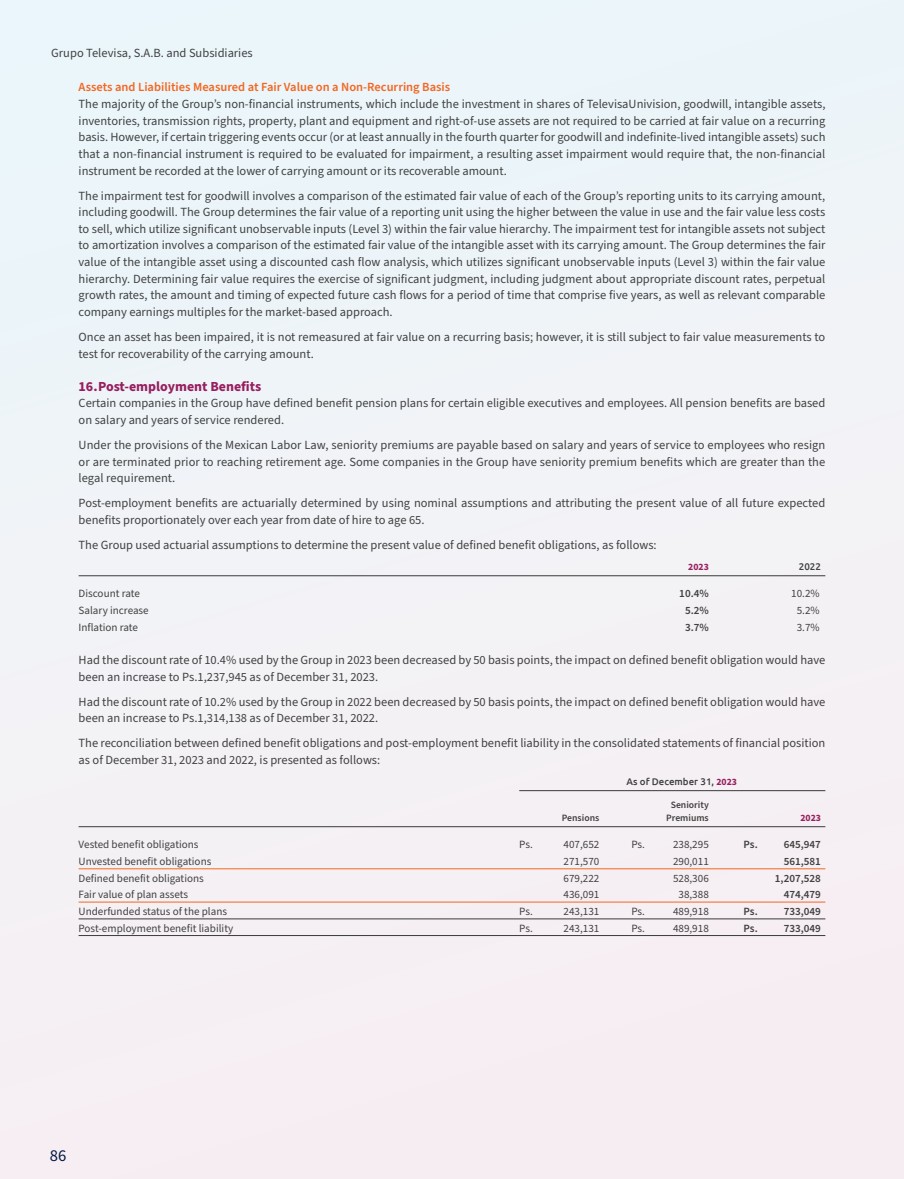

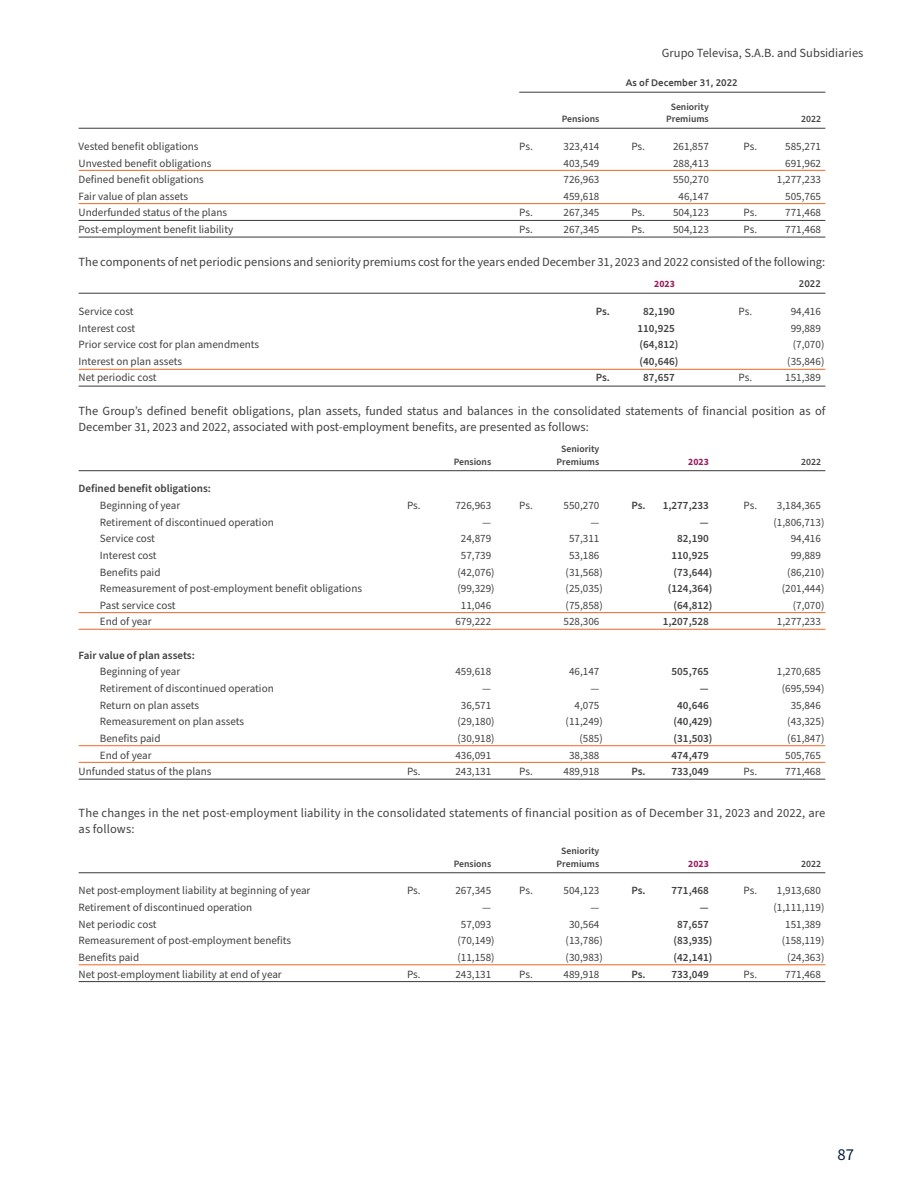

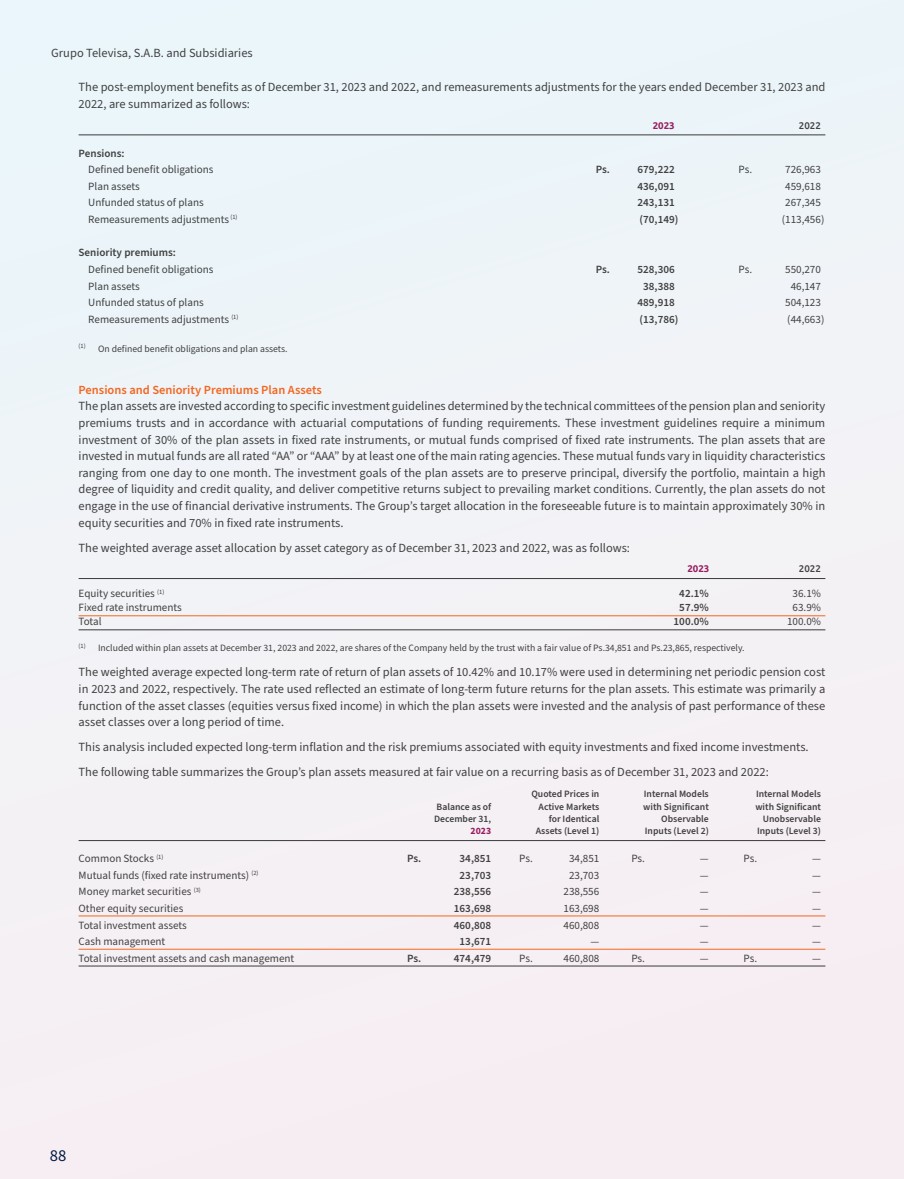

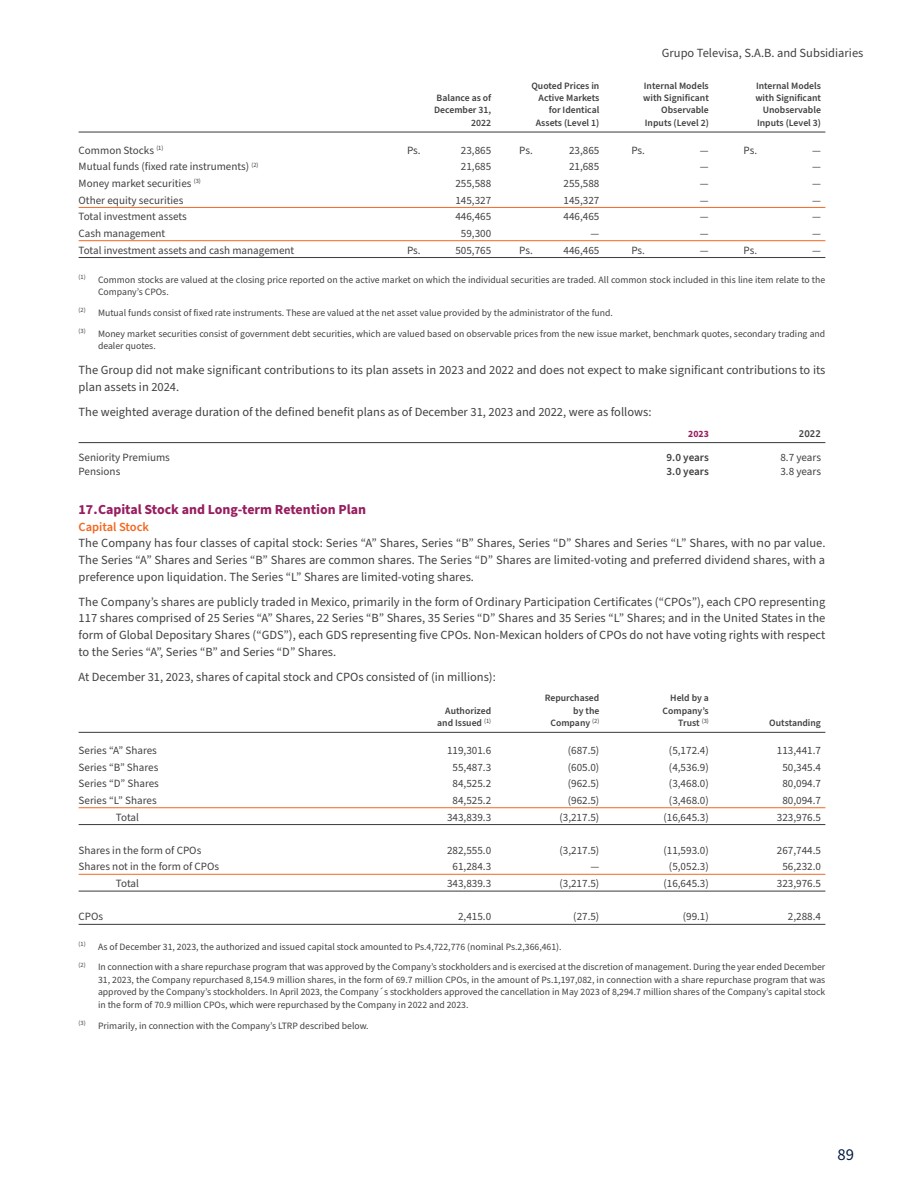

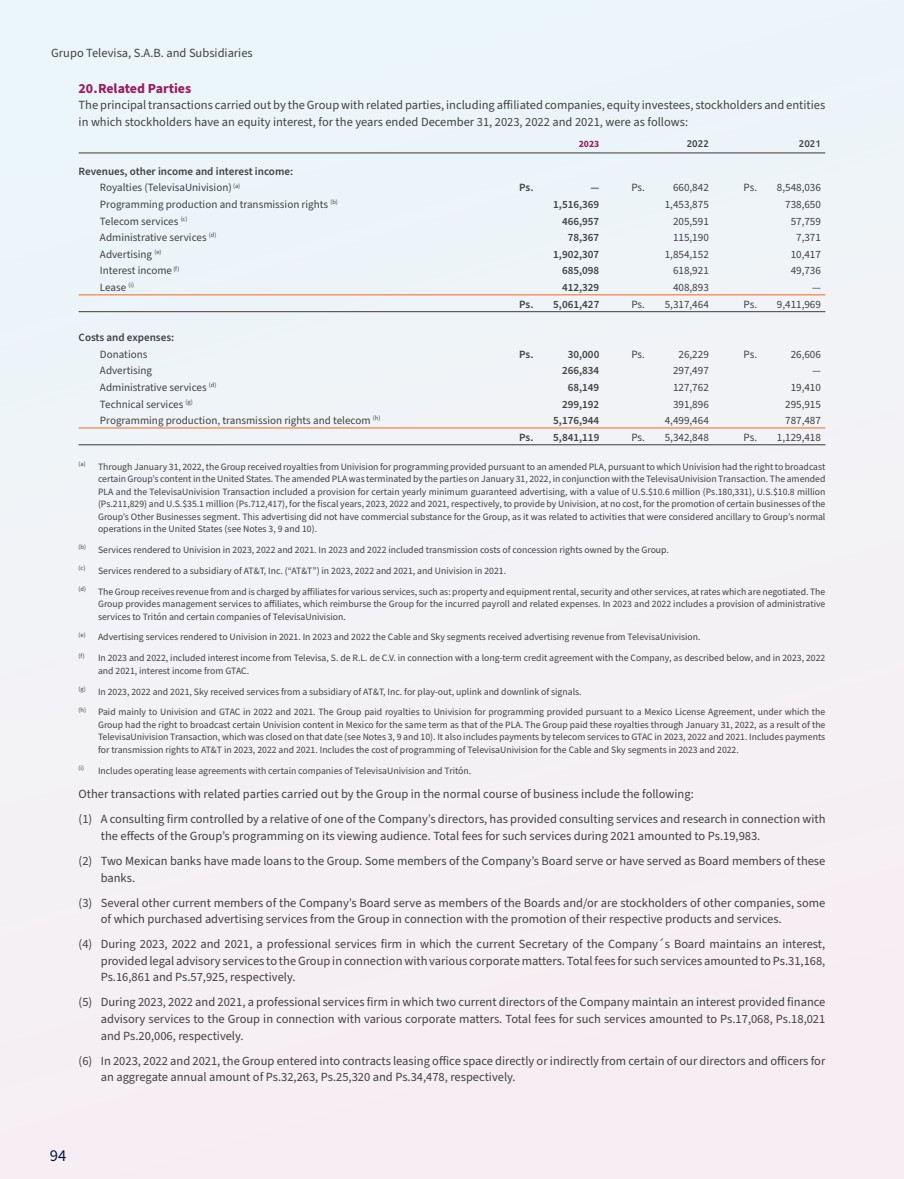

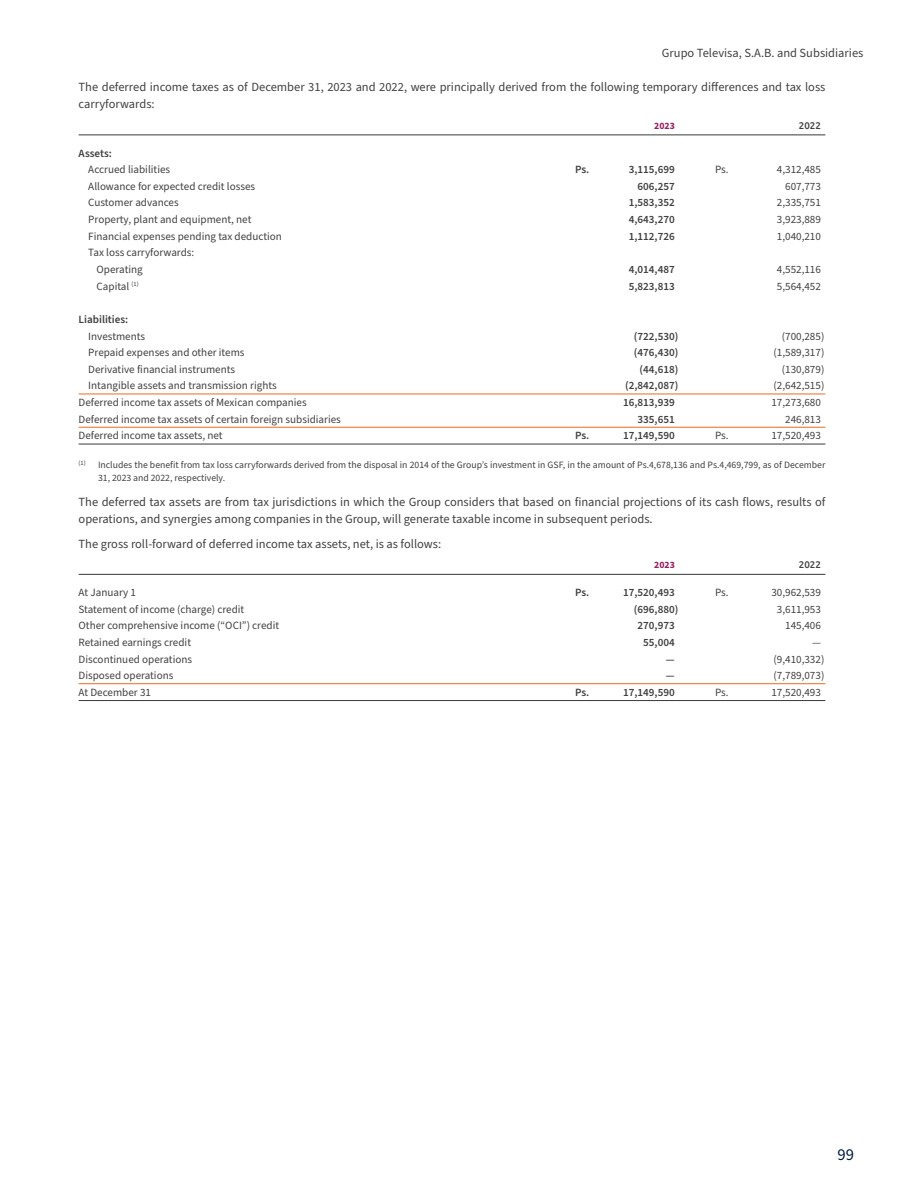

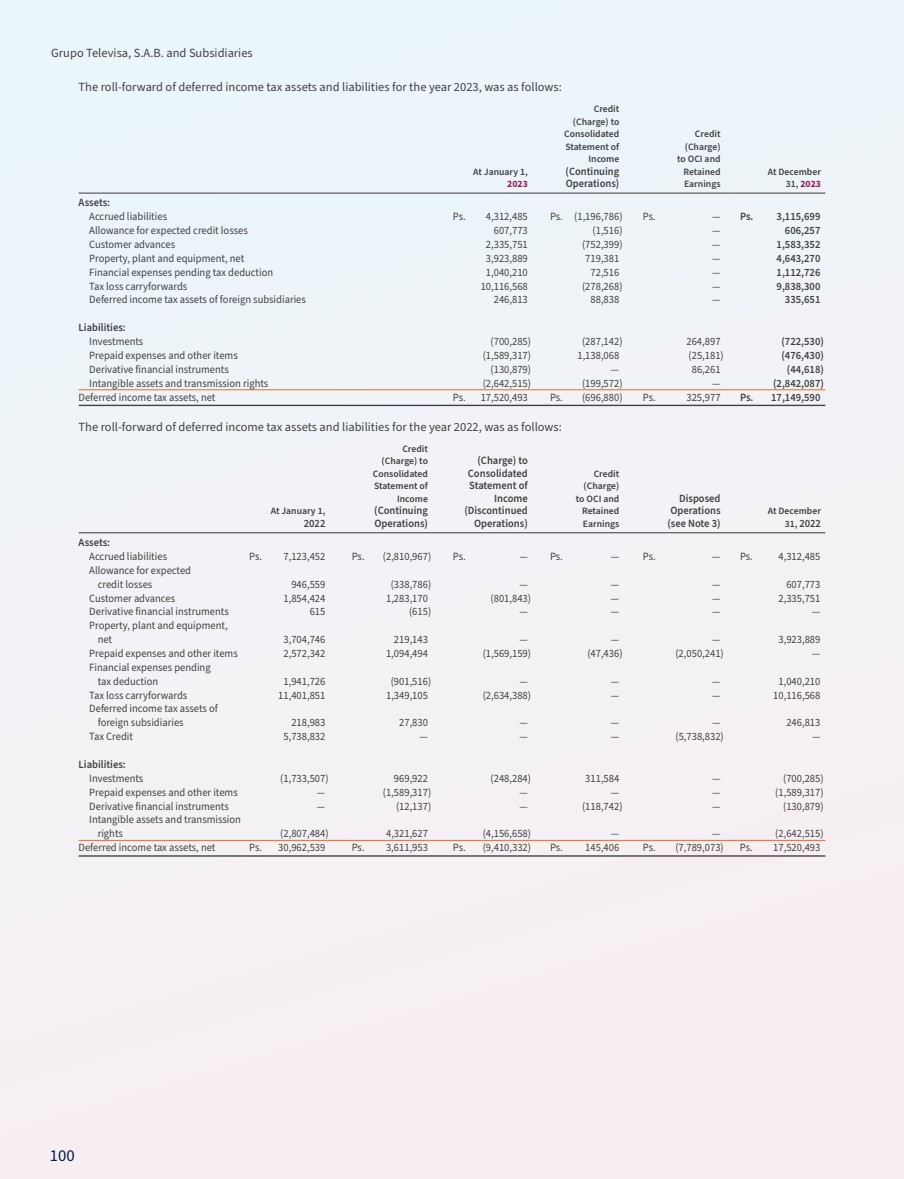

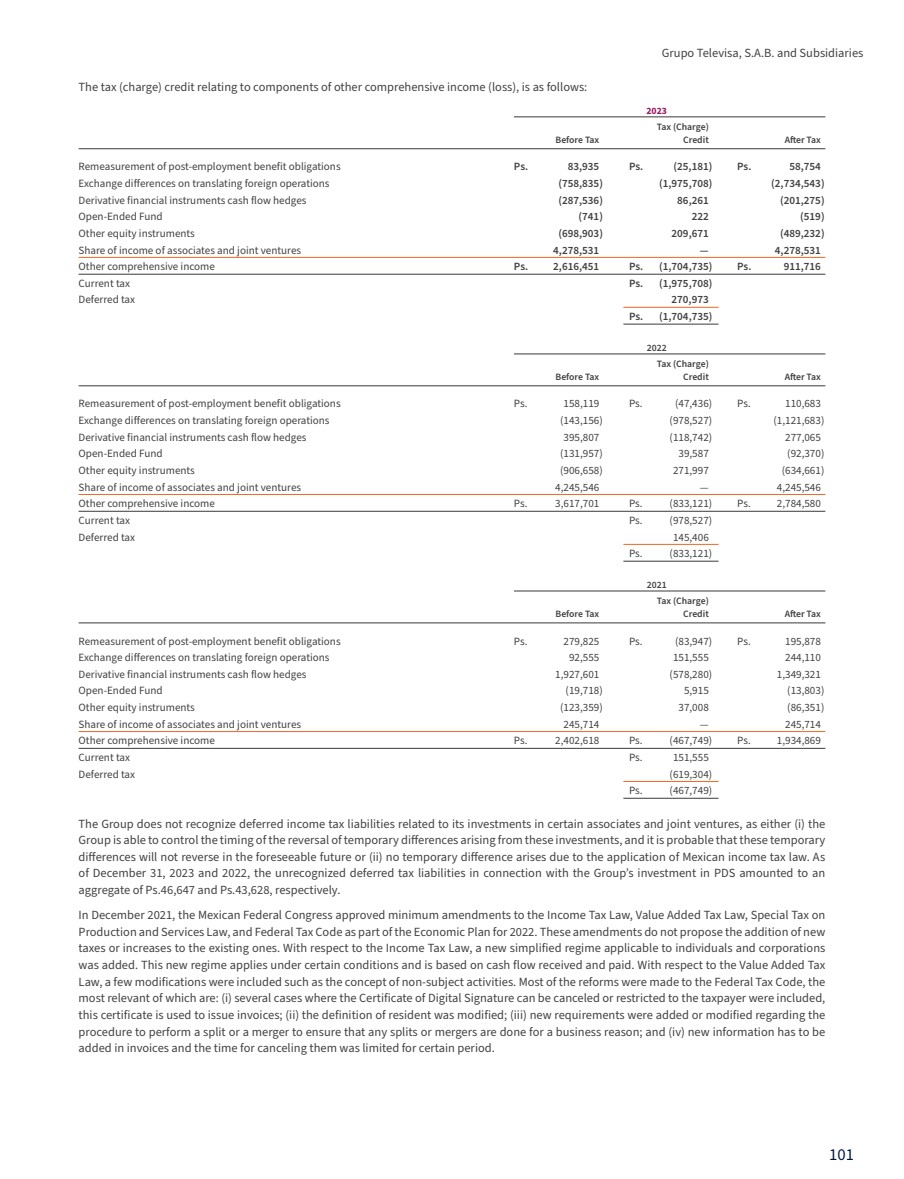

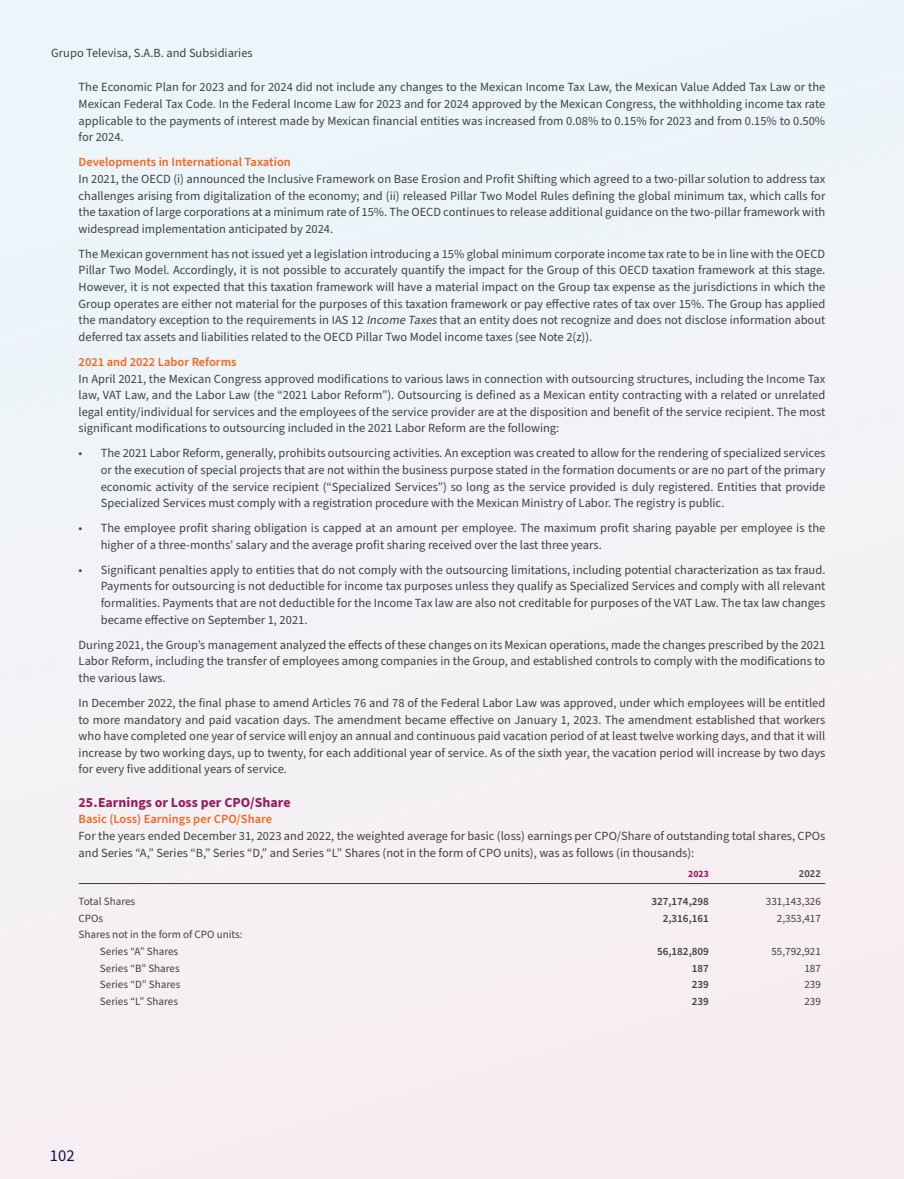

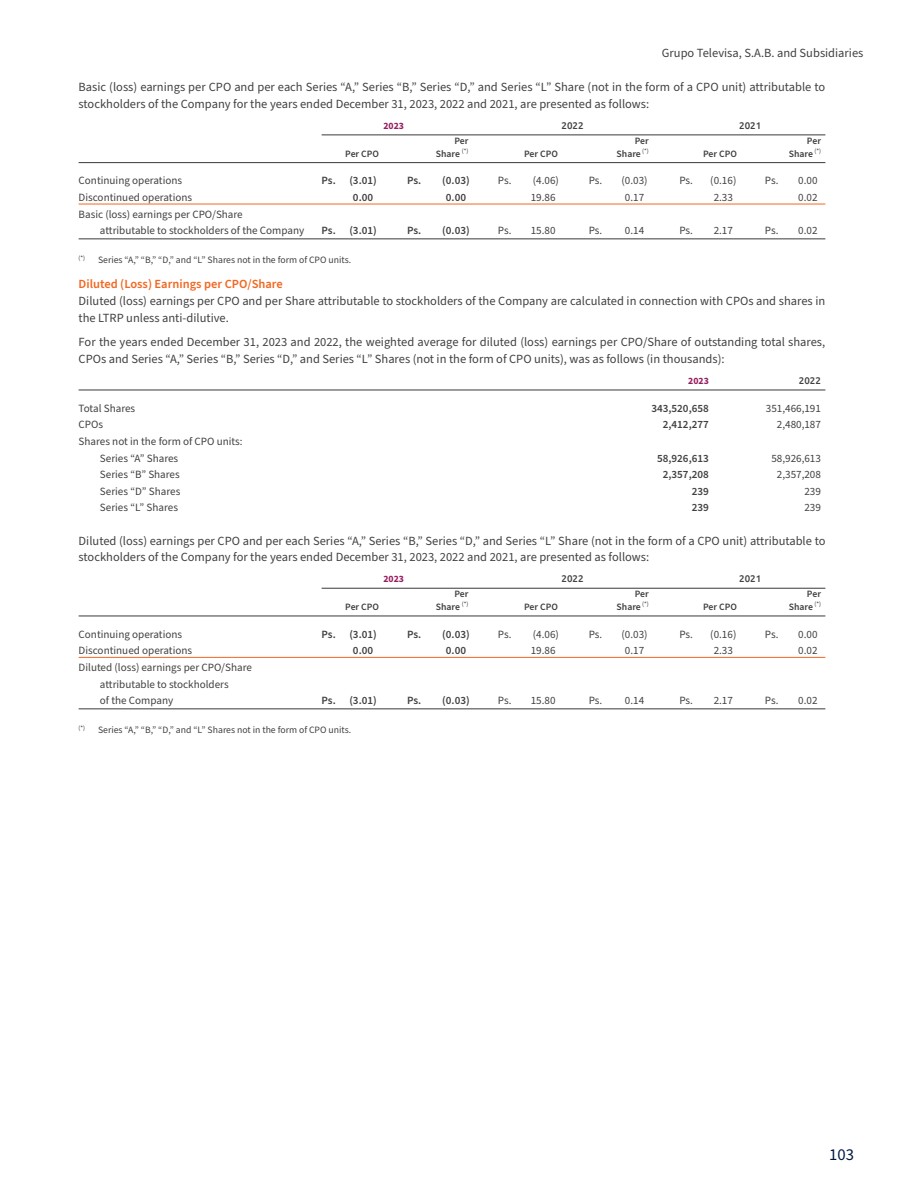

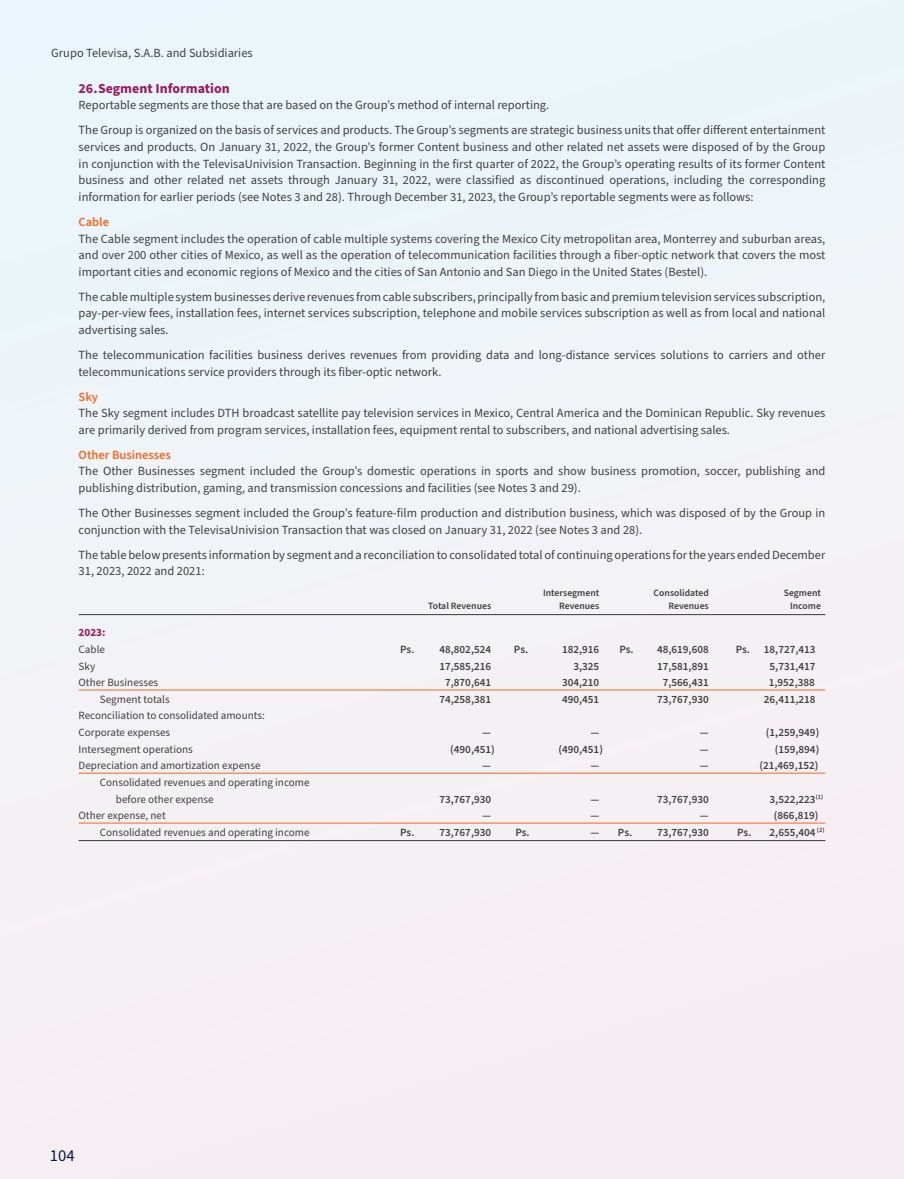

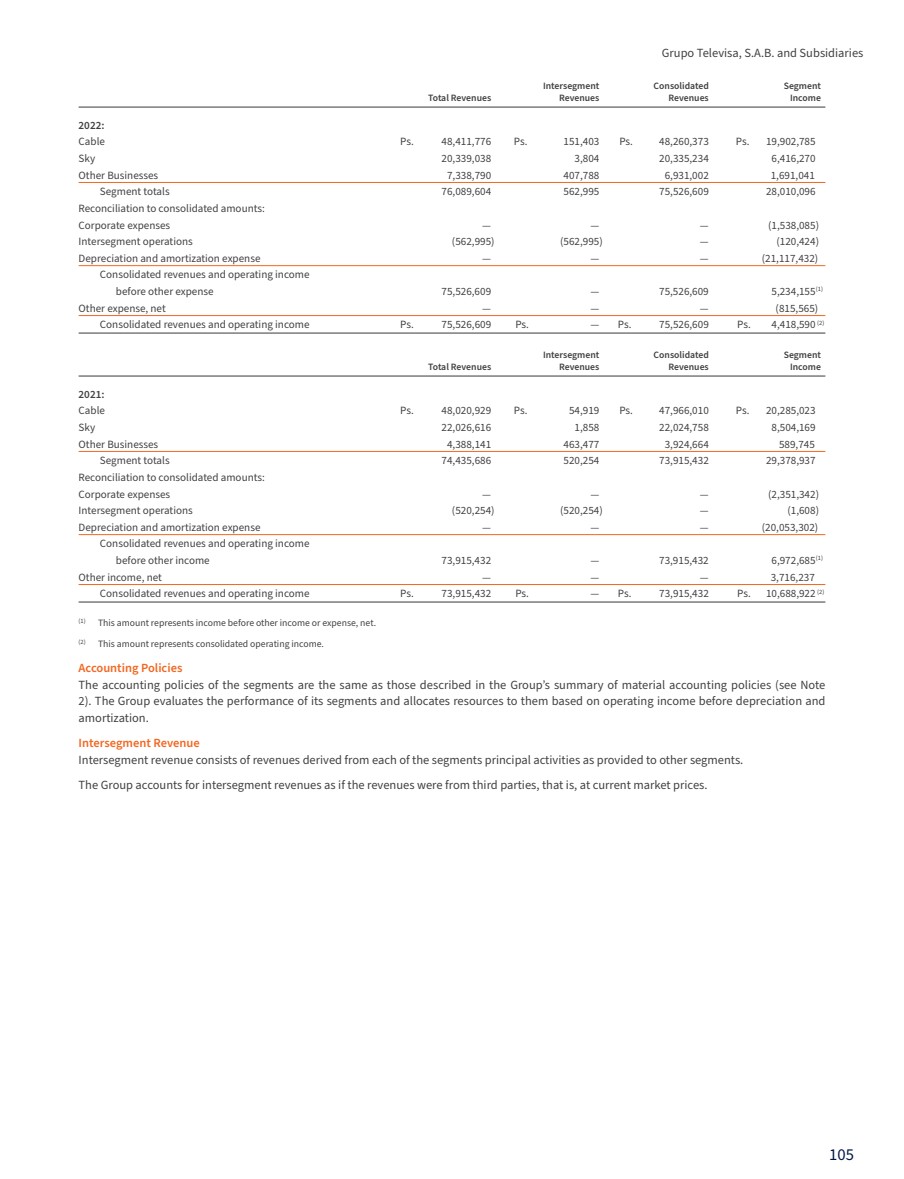

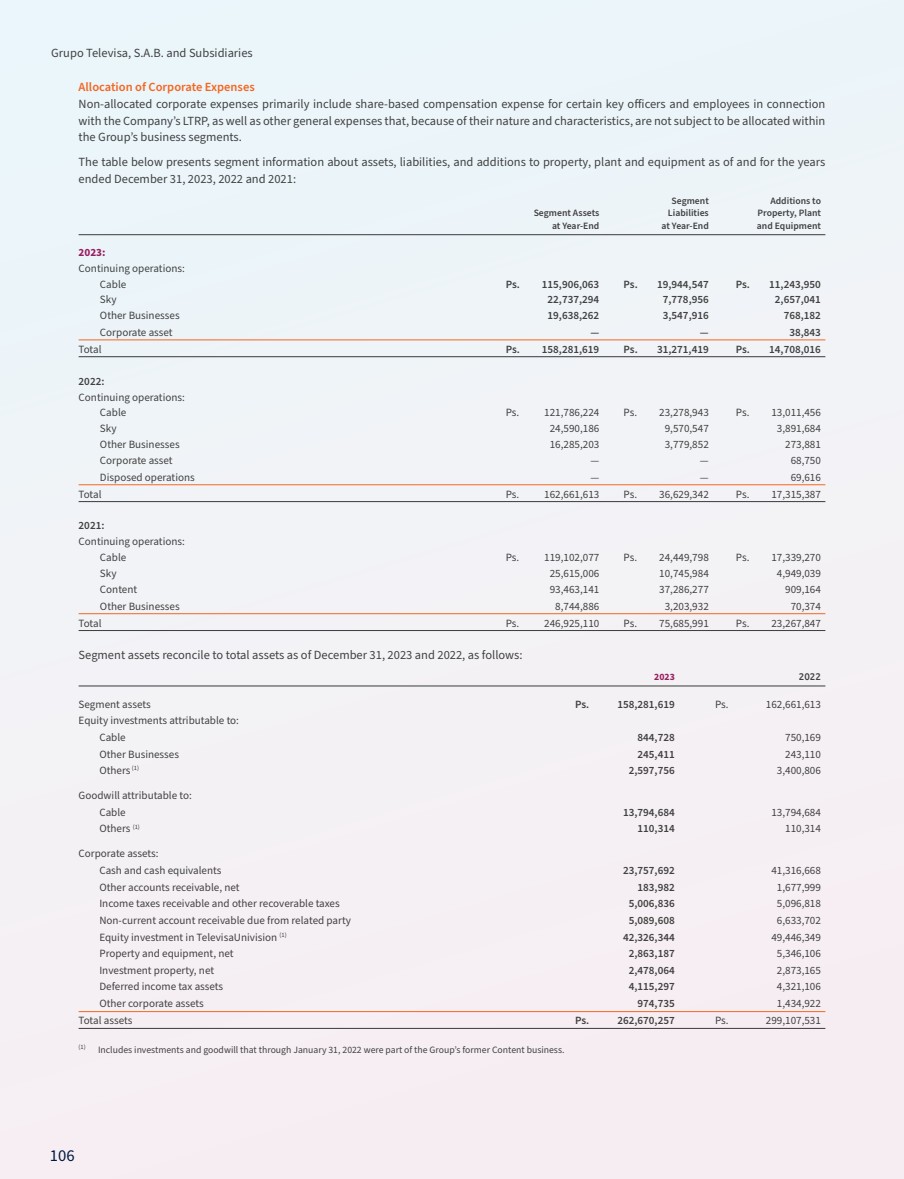

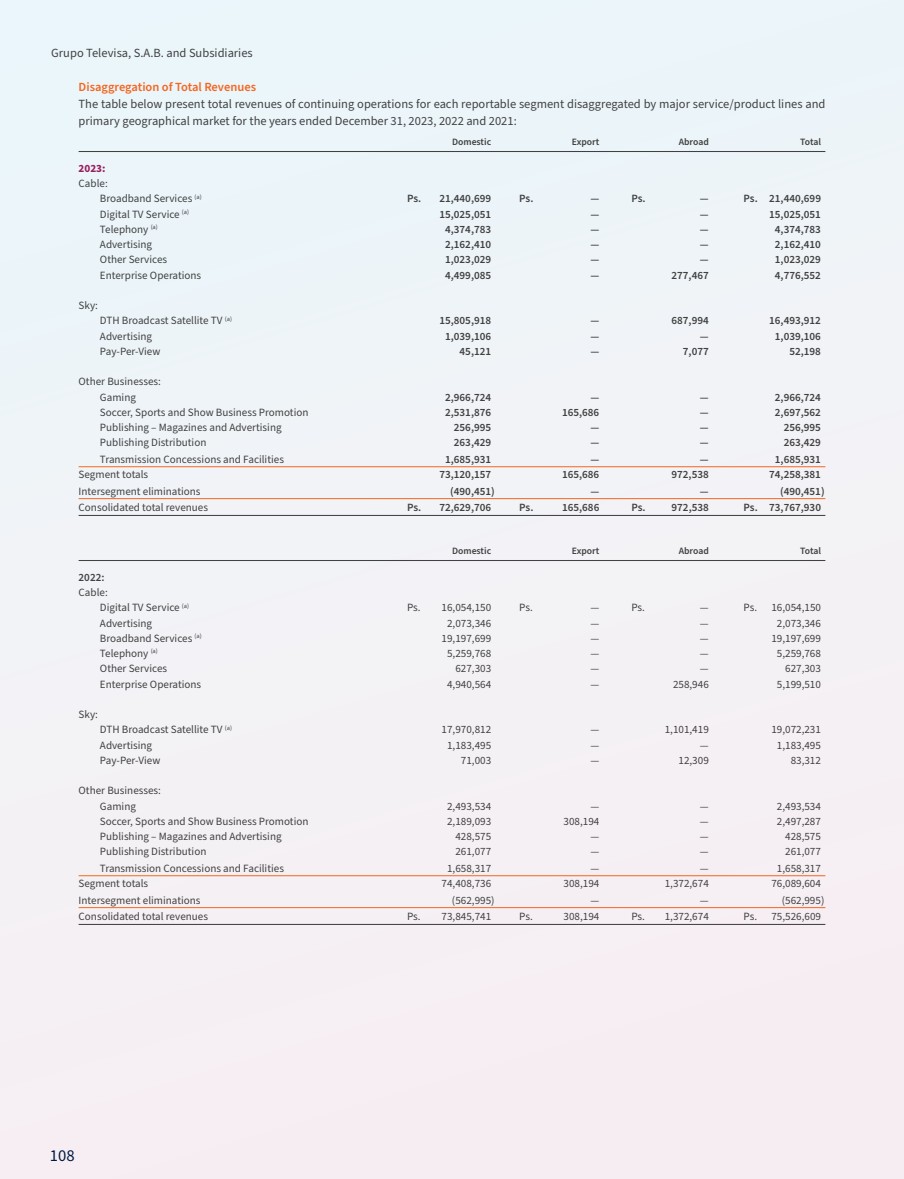

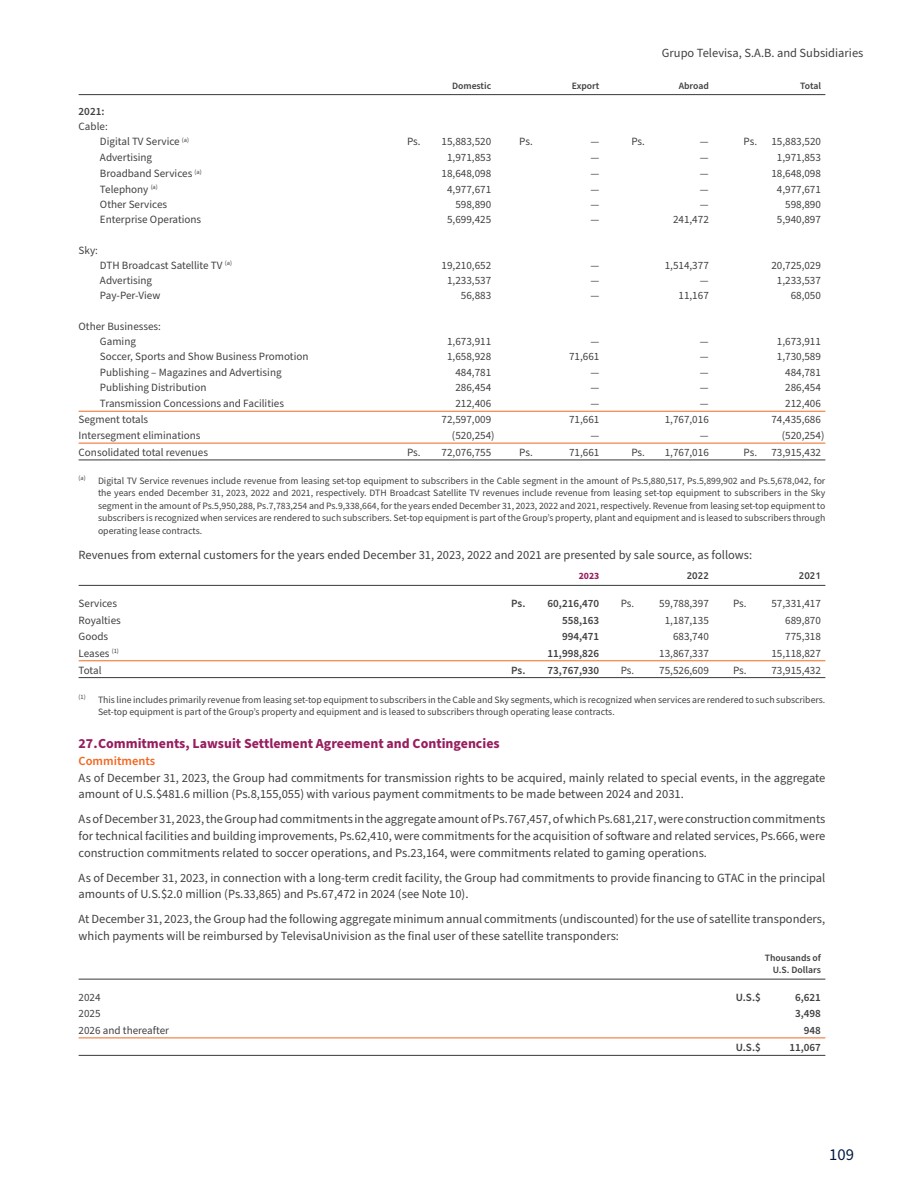

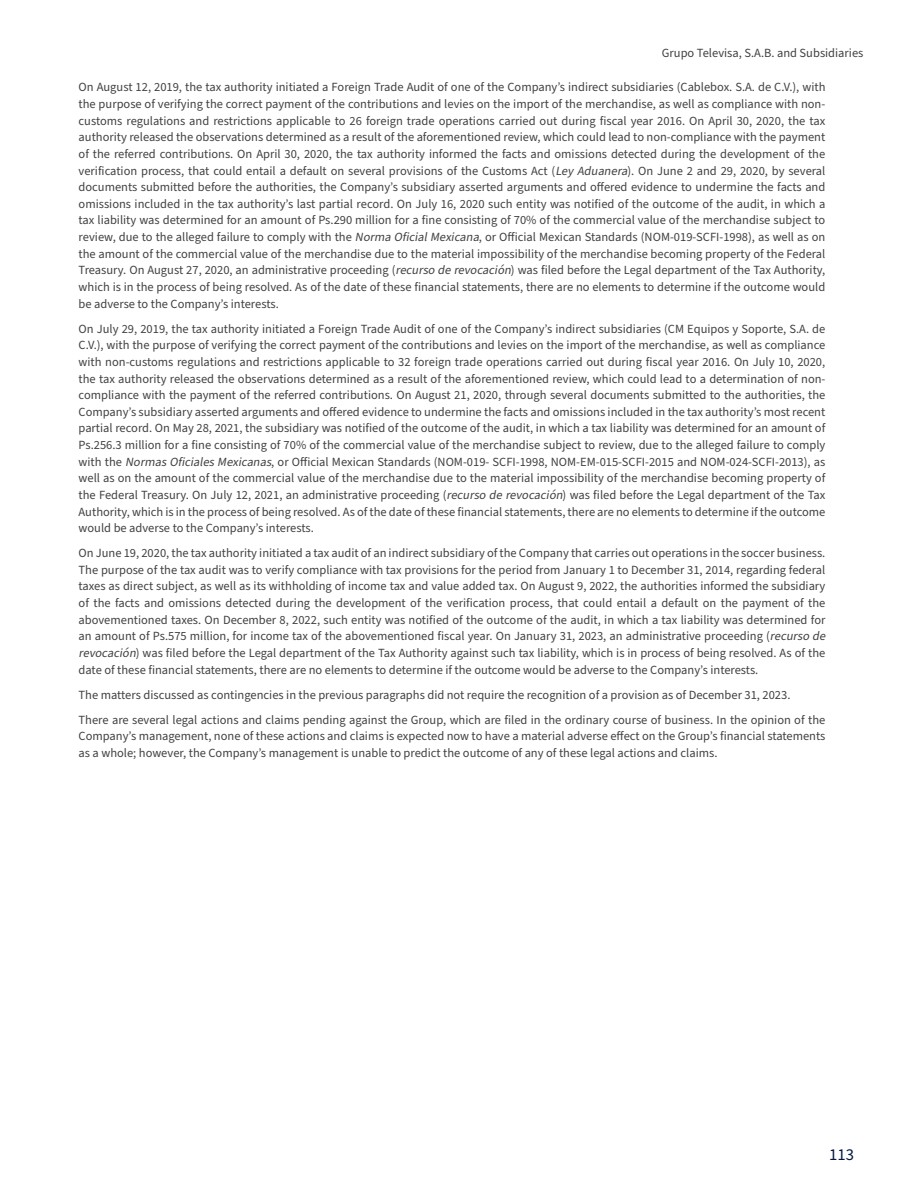

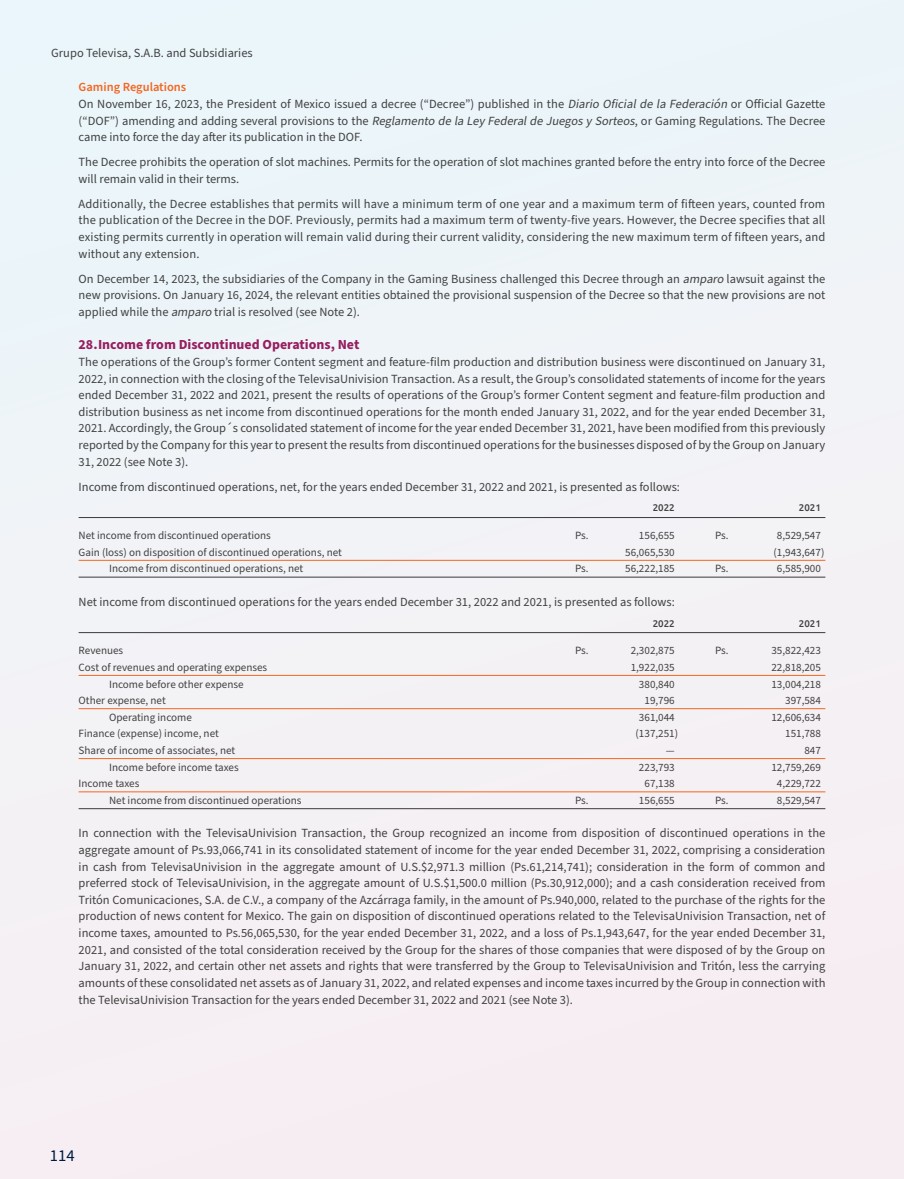

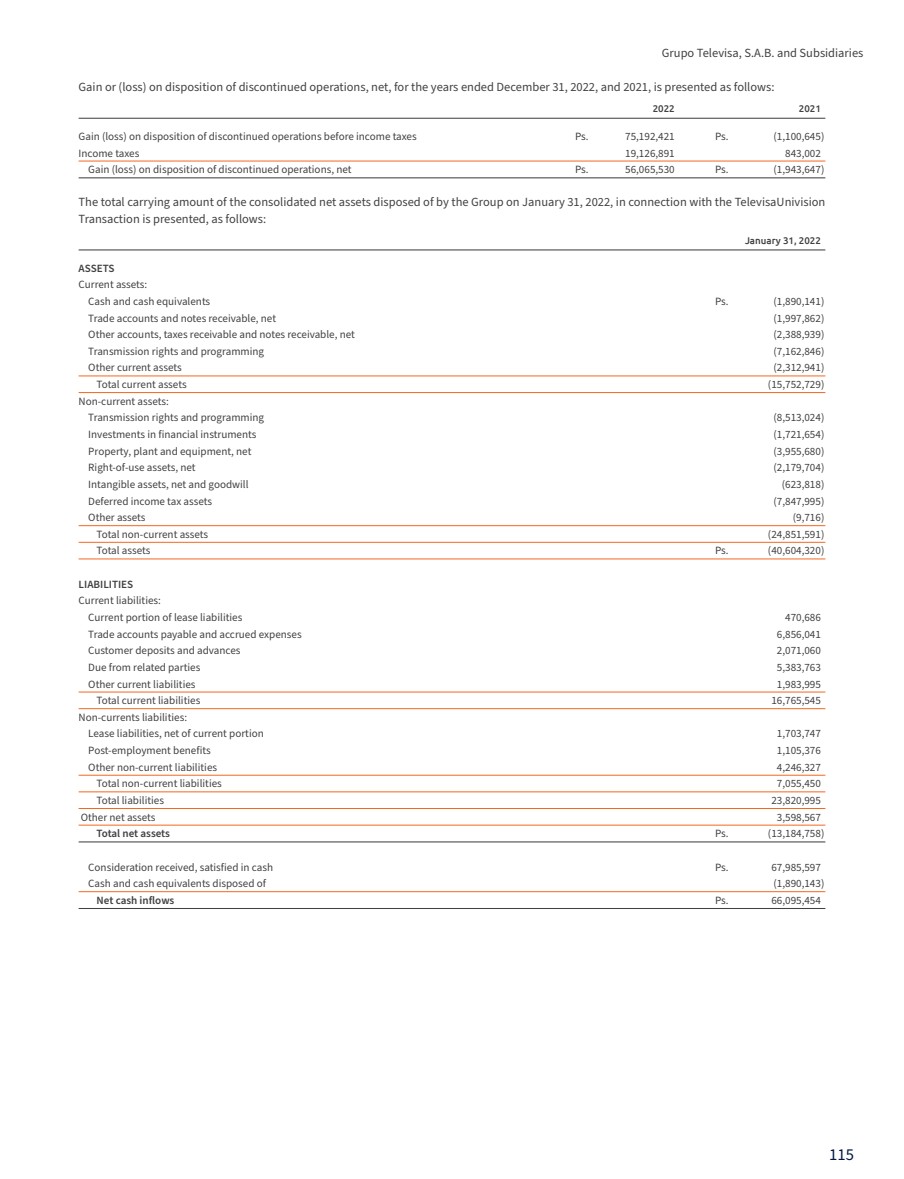

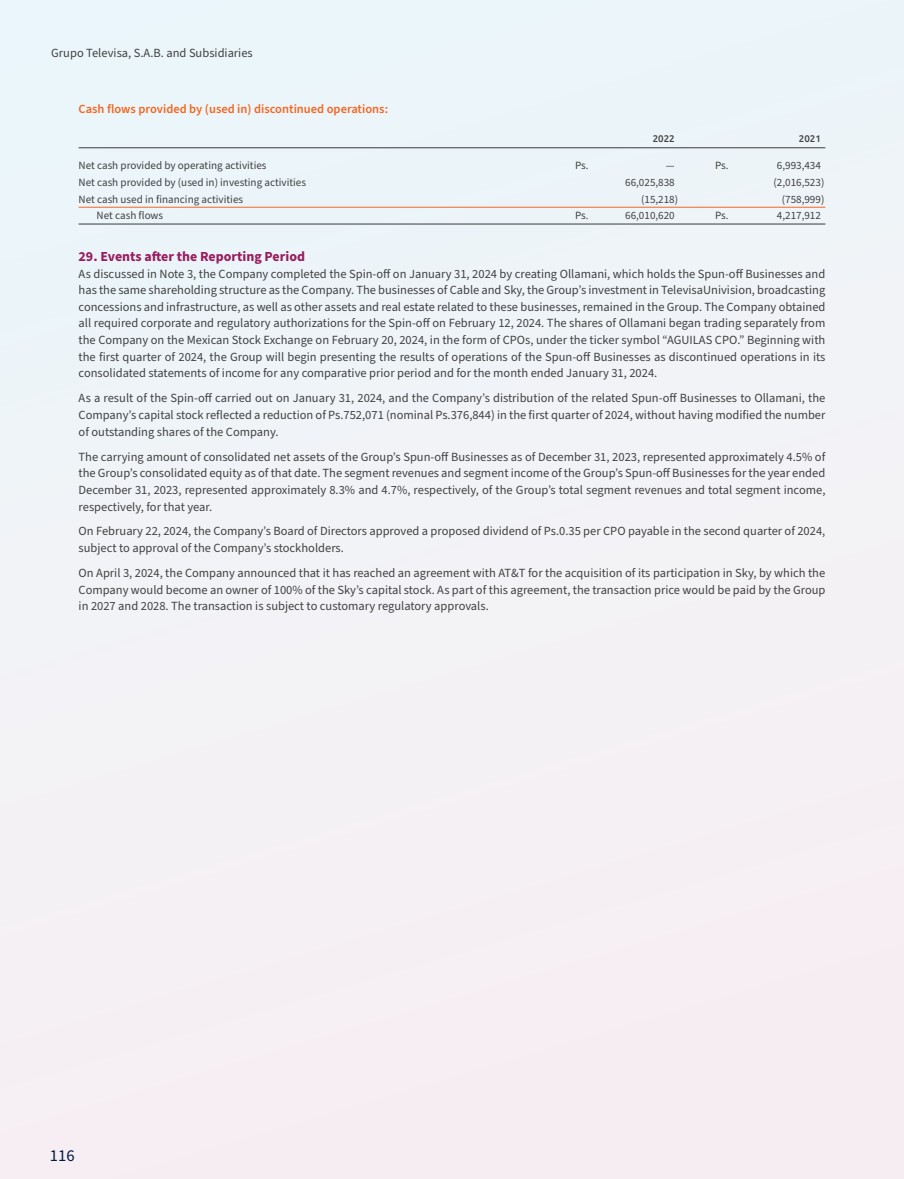

| 34 Share of Loss of Associates and Joint Ventures, Net This line item reflects our equity participation in the operating results and net assets of unconsolidated businesses in which we maintain an interest, but which we do not control. We rec-ognize equity in losses of associates and joint ventures up to the amount of our initial investment, subsequent capital con-tributions and long-term loans, or beyond that amount when we have made guaranteed commitments in respect of obliga-tions incurred by associates and joint ventures. Share of loss of associates and joint ventures, net, decreased by Ps.3,291.6 million, to a share of loss of Ps.4,086.6 million in 2023, from Ps.7,378.2 million in 2022. This decrease re-flected primarily a lower net loss of TelevisaUnivision for the year ended December 31, 2023. We recognized a share of loss of TelevisaUnivision in 2023 and 2022, primarily in connection with a goodwill impair-ment adjustment recognized by TelevisaUnivision in the fourth quarter of 2023 and 2022. Share of loss of associates and joint ventures, net, for the year ended December 31, 2023, included primarily our share of loss of TelevisaUnivision. Income Taxes Income taxes changed by Ps.3,905.8 million, to an income tax expense of Ps.2,678.3 million for the year ended Decem-ber 31, 2023, from an income tax benefit of Ps.1,227.5 million for the year ended December 31, 2022. |