QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

Centerpoint Properties Trust | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

CENTERPOINT PROPERTIES TRUST

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 16, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CenterPoint Properties Trust (the "Company") will be held at 1808 Swift Drive, Oak Brook, Illinois on Friday, May 16, 2003 at 11:00 a.m., Central Daylight Time, for the following purposes:

- 1.

- to elect ten trustees to serve until the next annual meeting of shareholders or special meeting of shareholders held in place thereof and until their respective successors are elected and qualified;

- 2.

- to approve the 2003 Omnibus Employee Retention and Incentive Plan; and

- 3.

- to transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

The Board of Trustees has fixed the close of business on March 20, 2003 as the record date for the determination of common shareholders entitled to vote at the meeting. Only those shareholders of record at the close of business on such date are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or adjournments thereof.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please sign and date the enclosed proxy and return it as promptly as possible in the enclosed self-addressed, postage-prepaid envelope. If you attend the Annual Meeting of Shareholders and wish to vote in person, your proxy will not be used.

| By Order of the Board of Trustees, | ||

Paul S. Fisher Secretary | ||

| March 31, 2003 Oak Brook, Illinois |

CENTERPOINT PROPERTIES TRUST

1808 Swift Road

Oak Brook, Illinois 60523

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 16, 2003

This proxy statement is furnished to holders of the Common Shares ("Common Shares" or "Shares") of Beneficial Interest, par value $.001 per share, of CENTERPOINT PROPERTIES TRUST (hereinafter called the "Company") in connection with the solicitation of proxies by the Board of Trustees of the Company to be used at the Annual Meeting of Shareholders of the Company to be held at 1808 Swift Drive, Oak Brook, Illinois on Friday, May 16, 2003 at 11:00 a.m., Central Daylight Time, and at any adjournment or adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

If the accompanying form of proxy is executed and returned, it may nevertheless be revoked at any time insofar as it has not yet been exercised. Unless otherwise directed in proxies received, the persons named in the accompanying form of proxy will vote such proxy for election to the board of the nominees named below. It is anticipated that this proxy statement and the enclosed proxy will be first mailed to record holders of the Company's Common Shares on or about March 31, 2003.

The Board of Trustees has fixed the close of business on March 20, 2003 as the record date for the determination of shareholders entitled to receive notice of and vote at the Annual Meeting of Shareholders. As of March 20, 2002, the Company had outstanding 23,209,746 Common Shares.

Each Common Share is entitled to one vote on each matter presented. At the Annual Meeting, inspectors of election will determine whether there is a quorum present. A quorum is required to conduct any business at the meeting. For a quorum to be present, the holders of a majority of the outstanding Common Shares must be present in person or by proxy. If you mark your proxy card "abstain," or if your proxy is held in street name by your broker and it is not voted on all proposals, your proxy will nonetheless be counted as present for purposes of determining a quorum. Similarly, in the event a nominee holding shares for beneficial owners votes on certain matters pursuant to discretionary authority or instruction from the beneficial owners, but with respect to one or more other matters does not receive instructions from the beneficial owners and does not exercise discretionary authority (a so-called "non-vote"), the shares held by the nominee will be deemed present at the meeting for quorum purposes, but will not be deemed to have voted on such other matters.

Under the rules of the New York Stock Exchange, brokers who hold shares in street name have the authority to vote on certain routine matters on which they have not received voting instructions from beneficial owners. Consequently, brokers holding Common Shares in street name who do not receive voting instructions are entitled to vote on the election of directors of the Company.

The Company will pay all of the costs of soliciting these proxies, including the cost of mailing the proxy solicitation material and the cost of services rendered by Corporate Investor Communications, Inc., a proxy solicitation firm, which are estimated at $6,000. In addition, our directors and employees may also solicit proxies in person, by telephone or by other electronic means of communication. The Company will not compensate these directors and employees additionally for this solicitation, but the Company may reimburse them for any out-of-pocket expenses that they incur in the process of soliciting the proxies. We will arrange for brokers and other custodians, nominees and fiduciaries to forward the solicitation materials to their principals, and the Company will reimburse them for any out-of-pocket expenses, which they reasonably incur in the process of forwarding the materials.

1

SHAREHOLDER PROPOSALS AND DISCRETIONARY

AUTHORITY FOR THE 2004 ANNUAL MEETING

Any proposal of a shareholder intended to be presented at the Company's 2004 Annual Meeting of Shareholders must be received by the Company for inclusion in the proxy statement and form of proxy for that meeting no later than December 2, 2003.

If the Company does not receive notice of any proposal to be presented at the Company's 2004 Annual Meeting of Shareholders on or before February 15, 2004, the Company's proxy holders shall have discretionary authority to vote on such proposal.

ELECTION OF TRUSTEES

(Proposal 1)

At the meeting a Board of Trustees is to be elected. The nominees for election as trustee are Nicholas C. Babson, Martin Barber, Norman R. Bobins, Alan D. Feld, Paul S. Fisher, John S. Gates, Jr., Michael M. Mullen, Thomas E. Robinson, John C. Staley and Robert L. Stovall. Each trustee elected is to hold office until the next annual meeting of shareholders or special meeting of shareholders held in place thereof, and until his successor is elected and qualified. Trustees are elected by a plurality of the votes cast. If you are present and do not vote, or if you send in your proxy marked "withheld," your vote will have no impact on the election of those directors as to whom you have withheld votes. The Board of Trustees does not contemplate that any nominee will be unable to serve as a trustee for any reason; however, if such inability should occur prior to the meeting, the proxy holders will select another nominee to stand for election in his place and stead. The Board of Trustees recommends that the shareholders vote "FOR" the election of Messrs. Babson, Barber, Bobins, Feld, Fisher, Gates, Mullen, Robinson, Staley and Stovall.

Following is a summary of the name, age and principal occupation or employment for the past five years of each nominee for election as a trustee and each executive officer of the Company.

| Name | Age | Position | ||

|---|---|---|---|---|

| Martin Barber | 58 | Co-Chairman of the Board and Trustee | ||

John S. Gates, Jr. | 49 | Co-Chairman of the Board, Chief Executive Officer and Trustee | ||

Robert L. Stovall. | 70 | Vice Chairman of the Board and Trustee | ||

Michael M. Mullen | 48 | President, Chief Operating Officer and Trustee | ||

Paul S. Fisher | 47 | Executive Vice President, Secretary, Chief Financial Officer, General Counsel and Trustee | ||

Rockford O. Kottka | 52 | Executive Vice President, Treasurer and Chief Accounting Officer | ||

Paul T. Ahern | 42 | Executive Vice President, Chief Investment Officer and Director of Portfolio Operations | ||

Nicholas C. Babson | 56 | Independent Trustee | ||

Norman R. Bobins | 60 | Independent Trustee | ||

Alan D. Feld | 66 | Independent Trustee | ||

Thomas E. Robinson | 55 | Independent Trustee | ||

John C. Staley | 61 | Independent Trustee |

2

Martin Barber. Mr. Barber has been the Chairman of the Board of Trustees of the Company since its formation in 1984. He has been involved in commercial real estate since 1964. In 1978, he formed Capital and Regional plc (which became publicly-traded in the London stock market in 1986) to engage in real estate and related activities in the United Kingdom, and served as its Chairman until 2002 when he became CEO and an outside Director took the chair. In 1984, together with Mr. Gates, he formed the Company to engage in real estate activities in the United States, and has also served as its Chairman since that time. Since 1984, Mr. Barber has served as Director and from 1995 as Chairman of Primesight, plc, a UK-based billboard company which became listed on the London Stock Exchange in 1997. During 1999, Scottish Media Group acquired Primesight on an agreed basis and Mr. Barber retired from the Board. He was appointed Chairman of PRICOA Property plc ("PRICOA"), an indirect subsidiary of Prudential Financial. PRICOA is a real estate fund management group investing in continental Europe. He is a member of the Board of the British Property Federation which is the trade association of the UK property industry.

John S. Gates, Jr. Mr. Gates was appointed Co-Chairman of the Board and Chief Executive Officer in December 2001. Previously, he had been the President, Chief Executive Officer and a Trustee of the Company since its formation in 1984. From 1977 to 1981, he was a leasing agent and an investment property acquisition specialist with CB Richard Ellis Commercial, a real estate brokerage and acquisition firm. In 1981 he co-founded the Chicago office of Jones Lang Wooton which advised foreign and domestic institutions on property investment throughout the Midwest. He received his Bachelors degree in Economics from Trinity College (Hartford). Mr. Gates is Chairman of the Board of Trustees of the Metropolitan Planning Council of Chicago and sits on the Executive Committee of the Board of Governors of the National Association of Real Estate Investment Trusts. He is also a member of the Board of Directors of Children's Hospital of Chicago and the Center for Urban Land Economics Research of the University of Wisconsin. Mr. Gates is an active member of the Young Presidents Organization, the Real Estate Roundtable, Urban Land Institute and the National Association of Industrial and Office Parks.

Robert L. Stovall. Mr. Stovall has been a Trustee of the Company since August 1993 and was appointed Vice Chairman of the Board of Trustees in July 1997. From August 1993 to July 1997, Mr. Stovall was an Executive Vice President and the Chief Operating Officer of the Company. From 1975 until he joined the Company, he served as President and Chief Executive Officer of FCLS Investors Group, Inc. ("FCLS"), a Chicago-based owner and manager of warehouse/industrial real estate which he co-founded in 1987 and the operations of which were consolidated in 1993 with those of the Company. Mr. Stovall began his career as a real estate salesman in 1957 for the Great Southwest Industrial District in Arlington-Grand Prairie, Texas. He joined J.L. Williams and Co. Inc. ("Williams"), a Texas-based industrial developer, in 1961. In 1967, he opened the Chicago branch office of Williams and became Executive Vice President of the firm. In 1978, he formed Four Columns, Ltd. and purchased Williams' Chicago operation and properties. In 1987, Four Columns, Ltd. was merged with Stava Construction Company, another warehouse/industrial development company, and FCLS/Stava Group was formed, where Mr. Stovall served as Chairman until he joined the Company. He is a member of the Board of Trustees of Greater North Pulaski Development Corporation, a not-for-profit community development corporation. Mr. Stovall is a 1955 honors graduate of Yale University with a Bachelors of Arts degree in American Studies. Mr. Stovall is a member of the National Association of Industrial and Office Parks. Mr. Stovall is the father-in-law of Mr. Mullen.

Michael M. Mullen. Mr. Mullen was appointed President of the Company in December 2001 and Trustee in May 1999. He held the position of Executive Vice President and Chief Operating Officer of the Company since July 1997; and, from August 1993 to July 1997, was the Executive Vice President-Marketing and Acquisitions and Chief Investment and Development Officer of the Company. He was a co-founder of FCLS and served as its Vice President-Sales with responsibility for leasing, built-to-suit sales and acquisitions since 1987. Mr. Mullen graduated from Loyola University in 1975 with a

3

Bachelor's degree in Finance. He serves on the Board of Directors of Brauvin Trust, a privately held retail REIT. Mr. Mullen is the son-in-law of Mr. Stovall.

Paul S. Fisher. Mr. Fisher was appointed a Trustee of the Company in May 1999. He has been an Executive Vice President of the Company since August 1993, the Secretary, Chief Financial Officer and General Counsel of the Company since 1991 and was appointed the President and Chief Executive Officer of all of the Company's subsidiaries in December 2001. Between 1988 and 1991, Mr. Fisher was Vice President-Finance and Acquisitions of Miglin-Beitler, Inc., a Chicago-based office developer. From 1986 to 1988, Mr. Fisher was Vice President-Corporate Finance, at The First National Bank of Chicago. From 1982 through 1985, he was Vice President-Partnership Finance, at VMS Realty, a Chicago-based real estate syndication company. Mr. Fisher graduated from The University of Notre Dame, summa cum laude, with a Bachelor of Arts degree in Economics in 1977 and was elected to Phi Beta Kappa. Mr. Fisher received his Doctor of Law degree from The University of Chicago School of Law in 1980. He serves on the advisory board of the Guthrie Center for Real Estate Research at the Kellogg Graduate School of Management.

Rockford O. Kottka. Mr. Kottka has been an Executive Vice President of the Company since July 2000 and a Senior Vice President and the Treasurer of the Company since 1989. From 1978 to 1989, Mr. Kottka served as the Vice President and Controller of Globe Industries, Inc., a Chicago based manufacturer of roofing and automotive acoustical materials. Mr. Kottka graduated from St. Joseph's Calumet College in 1975 with a Bachelor of Science degree in Accountancy. Mr. Kottka is a certified public accountant. He serves on the advisory board of Welton Enterprises, a privately held company located in Madison, Wisconsin, and is a member of the American Institute of Certified Public Accountants and the Illinois CPA Society.

Paul T. Ahern. Mr. Ahern has been Executive Vice President, Chief Investment Officer and Director of Portfolio Operations since February 1999. From June 1994 to February 1999, Mr. Ahern served as Senior Vice President of Investments of the Company. Mr. Ahern started his career as an accountant for Centex Homes Corporation. From June 1985 to June 1990, he was an investment analyst, leasing agent and an investment property specialist with CB Commercial, a real estate brokerage firm. From June 1990 to January 1993, he was an investment property specialist for American Heritage Corporation, a real estate investment firm. Mr. Ahern graduated from Indiana University in 1982 with a bachelor's degree in Accounting. Mr. Ahern is a member of The Society of Industrial and Office Realtors and the National Association of Real Estate Investment Trusts.

Nicholas C. Babson. Mr. Babson has been an independent trustee of the Company since December 1993, when he was appointed to fill a vacancy on the Board of Trustees. Mr. Babson currently serves as Chief Executive Officer of Babson Holdings, Inc. an investment company serving the interests of the Babson family. He has held this position for the past three years. Prior to this position, Mr. Babson served as Chairman and CEO of Babson Bros. Co., a worldwide distributor and manufacturer of dairy equipment, located in Naperville, Illinois. Mr. Babson also serves as a member of the Board of Trustees of the Farm Foundation, and has served as a member and Past Chairman of the National FFA Foundation and Equipment Manufacturers Institute (EMI). Mr. Babson's directorships for publicly traded companies, other than CenterPoint Properties Trust, include the Gehl Company (NASDAQ) and for private companies include SunTx Capital Partners, located in Dallas Texas, and RREEF America REIT II, Inc., located in Chicago, Illinois. Mr. Babson is also a member of the Board and Board Chairman of the Chicago Shakespeare Theater. Mr. Babson graduated from the University of the South with a Bachelor of Arts degree in Political Science (1968) and minor study concentration in Forestry (1972). He currently serves as Chairman on the Board of Regents of the University.

Norman R. Bobins. In March 1998, Mr. Bobins was nominated by the Board to fill a vacancy created by an increase in the number of trustees. Mr. Bobins is Chairman, President and Chief Executive Officer of LaSalle Bank, N.A., President and Chief Executive Officer of LaSalle Bank

4

Corporation, the parent company of LaSalle Bank, N.A., and Standard Federal Bank N.A., and a Vice Chairman of Standard Federal Bank N.A. From April 1981, until its acquisition by LaSalle National Corporation in 1990, Mr. Bobins served as Senior Executive Vice President and Chief Lending Officer of the Exchange National Bank of Chicago. Mr. Bobins is Chairman of the Chicago Clearing House Association, and he holds directorships with the following organizations: Standard Federal Bank N.A., the Chicago Clearing House Association, the Anti-Defamation League of B'nai B'rith, Braun Consulting, Inc., RREEF America REIT II, Inc., and Transco, Inc. Mr. Bobins is also a trustee of the University of Chicago Hospitals and serves on the Council of the Graduate School of Business at the University of Chicago. He is a member of the Kellogg Graduate School of Management Advisory Board, the board of Spertus College, the Executive Council of Chicago Metropolis 2020, WTTW Communications, Inc., and the Field Museum, the Illinois Business Roundtable, and is a member of the Board of Education of the City of Chicago. Mr. Bobins earned his B.S. from the University of Wisconsin in 1964 and his M.B.A. from the University of Chicago in 1967.

Alan D. Feld. Mr. Feld has been an independent trustee of the Company since December 1993, when he was appointed to fill a vacancy on the Board of Trustees. Since 1960, Mr. Feld has been associated with the law firm of Akin, Gump, Straus, Hauer & Feld, L.L.P. in Dallas, Texas. He currently serves as a Senior Executive Partner of the firm and sole shareholder of a professional corporation that is a partner of the firm. Mr. Feld graduated from Southern Methodist University with a Bachelor of Arts degree in 1957. Mr. Feld received his LL.B. degree from the Southern Methodist University in 1960. He has served as a member of the Texas State Bar since 1960 and a member of the District of Columbia Bar since 1971. He has served as a member of the Board of Trustees of Brandeis University (1986 - 1996) and presently serves on the Board of Trustees of Southern Methodist University. He also serves on the Board of Directors of Clear Channel Communications, Inc., a New York Stock Exchange listed company, and is a Trustee of the AMR AAdvantage Funds (Mutual Funds).

Thomas E. Robinson. Mr. Robinson has been an independent trustee of the Company since December 1993, when he was appointed to fill a vacancy on the Board of Trustees. Mr. Robinson is currently a Managing Director in the Corporate Finance Real Estate Group of Legg Mason Wood Walker, Inc., an investment-banking firm headquartered in Baltimore, Maryland, which he joined in June 1997. Prior to joining that firm, Mr. Robinson was President and Chief Financial Officer of Storage USA, Inc., a REIT headquartered in Columbia, Maryland, engaged in the business of owning and operating self-storage warehouses, which he joined in August 1994. He also serves as a director of Tanger Factory Outlet Centers, Inc. Between August 1993 and August 1994, Mr. Robinson was a Senior Executive of Jerry J. Moore Investments, an owner and operator of community and neighborhood shopping centers located in Texas. Prior to joining Jerry J. Moore Investments, Mr. Robinson served as National Trustee of REIT Advisory Services for the national accounting firm of Coopers & Lybrand from 1989 to 1993. From 1981 to 1989, Mr. Robinson served as Vice President and General Counsel for the National Association of Real Estate Investment Trusts. Mr. Robinson received his Bachelor's degree from Washington and Lee University, his Master's degree in taxation from Georgetown University Law School, and his Juris Doctorate degree from Suffolk University Law School.

John C. Staley. Mr. Staley has been an independent trustee of the Company since November 1, 2002, when he was appointed to fill a vacancy on the Board of Trustees. Mr. Staley joined Ernst & Young's New York office in 1965, transferring to Chicago in 1966. He served as European Tax Practice Coordinator in Brussels, Belgium, their Continental European Headquarters, from 1975 to1977, returning to Chicago in 1977. Mr. Staley served as area managing partner of Ernst & Young LLP's Lake Michigan Area until his retirement in June 2001. Currently, he serves on the advisory board of two privately held companies, Carl Buddig & Co. and Brook Furniture, Ltd., and on the board of directors of one publicly held company, eLoyalty Corp. Active in professional and civic societies, he is Chairman of the Board of Trustees of DePaul University, a member of the Board of Directors of the Lyric Opera of Chicago and a member of the Commercial Club. Previously, he has served as chairman

5

of Ballet Chicago and the Woodlands Academy of Lake Forest, Chicago Lighthouse for the Blind, the Lake Forest School Board, Mercy Hospital, Ravinia Festival, and St. Ignatius Preparatory School. Both an attorney and certified public accountant, he received his B.S. degree from the College of the Holy Cross and his J.D. from DePaul University School of Law. He has also completed the Advanced Management Program of Harvard University's Graduate School of Business Administration. Prior to retiring, he was a member of the American Institute of Certified Public Accountants and the Illinois CPA Society; he has also been a lecturer on taxation in the Masters of Taxation program at DePaul University School of Law.

Board of Trustees and Committees

During 2002, the Board of Trustees held ten meetings. Each trustee attended more than 75% of the aggregate of the meetings of the Board of Trustees and the meetings held by Board committees on which he served.

The Board of Trustees of the Company has standing Asset Allocation, Audit, Compensation and Governance and Nominating Committees.

Asset Allocation Committee. The Asset Allocation Committee is comprised of two trustees, Messrs. Babson and Stovall, one of whom is an independent trustee. The Asset Allocation Committee is authorized to review investment and disposition recommendations of management, make investment decisions for investments under $25 million and to make recommendations to the Board of Trustees for other investments. The Asset Allocation Committee held eleven meetings during 2002.

Audit Committee. The Audit Committee is comprised of four trustees, Messrs. Barber, Bobins, Robinson and Staley, all of whom are independent trustees. The Audit Committee is authorized to review management's accounting and control practices and compliance with prevailing financial reporting standards, to make recommendations to the Board of Trustees regarding financial reporting policy, and to oversee the Company's annual audit. The Audit Committee held six meetings during 2002.

Compensation Committee. The Compensation Committee is comprised of three trustees, Messrs. Babson, Bobins and Feld, all of whom are independent trustees. The Compensation Committee exercises all powers of the Board of Trustees in connection with the compensation of executive officers, including incentive compensation and benefit plans. The independent trustees on the Compensation Committee also serve as the Company's Long Term Incentive Committee and, as such, are empowered to grant restricted shares and share options in accordance with the Amended and Restated 1993 Stock Option Plan (the "1993 Plan"), the 1995 Restricted Stock Incentive Plan (the "1995 Plan"), and the 2000 Omnibus Employee Retention and Incentive Plan (the "2000 Plan") to the trustees, including nominees recommended by shareholders, management and other employees of the Company. The Compensation Committee held three meetings during 2002.

Governance and Nominating Committee. The Governance and Nominating Committee is comprised of three trustees, Messrs. Barber, Feld and Robinson, all of whom are independent trustees. The Governance and Nominating Committee is authorized to review the Company's governance practices, including the size and composition of the Board of Trustees, and to make recommendations to the Board of Trustees concerning nominees for election as trustees, including nominees recommended by shareholders. Any shareholder wishing to propose a nominee should submit a recommendation in writing to the Company's Secretary, indicating the nominee's qualifications and other relevant biographical information and provide confirmation of the nominee's consent to serve as a trustee. The Governance and Nominating Committee held two meetings during 2002.

6

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's trustees and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the Securities and Exchange Commission (the "SEC") and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of Common Shares and other equity securities of the Company. Officers, trustees and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that all Section 16(a) filing requirements applicable to its officers, trustees and greater than ten percent beneficial owners were complied with during the fiscal year ended December 31, 2002.

7

APPROVAL OF THE 2003 OMNIBUS EMPLOYEE RETENTION AND INCENTIVE PLAN

(Proposal 2)

INFORMATION ABOUT THE 2003 EMPLOYEE RETENTION AND INCENTIVE PLAN

On March 7, 2003, the Board of Trustees adopted, subject to shareholder approval, the CenterPoint Properties Trust 2003 Omnibus Employee Retention and Incentive Plan (the "2003 Plan") to allow the Company to continue making share-based awards of Common Shares as part of the Company's compensation. The 2003 Plan is intended to succeed the Company's 2000 Omnibus Employee Retention and Incentive Plan (the "2000 Plan") which has no issuable shares remaining to support the Company's compensation needs. If the 2003 Plan is approved, no other grants will be made under the 2000 Plan. The number of shares issuable under the 2003 Plan is initially 1,200,000 which is approximately 6.1% of the Company's outstanding shares less the number of shares covered by outstanding grants under the Company's previous share based plans. No grants may be made under the 2003 Plan after July 31, 2006.

The Board of Trustees believes that the 2003 Plan will successfully advance the Company's long-term financial success by permitting it to attract and retain outstanding executive talent and motivate superior performance by encouraging and providing a means for employees to obtain an ownership interest in the Company.

The affirmative vote of holders of a majority of Common Shares present at the annual meeting of shareholders, in person or by proxy, is necessary for approval of the 2003 Plan. Unless such vote is received, the 2003 Plan will not become effective.

The complete text of the 2003 Plan is set forth as Exhibit A hereto. The following description of the 2003 Plan is qualified in its entirety by reference to Exhibit A.

Administration and Eligibility

The 2003 Plan will be administered by a committee (the "Committee") which shall consist of two or more trustees designated by the Board of Trustees of the Company. Each of these trustees shall be a "non-employee director" as that term is defined by Rule 16b-3 promulgated under the Securities Exchange Act of 1934 (the "Exchange Act") or any similar rule which may subsequently be in effect ("Rule 16b-3"). In addition, the Company presently intends for each of these trustees to be an "outside director" within the meaning of Internal Revenue Code Section 162(m)(4)(C)(i) and the regulations promulgated thereunder. Since the Compensation Committee currently satisfies such requirements, the Board intends to appoint the Compensation Committee to administer the 2003 Plan. The 2003 Plan provides that the Company will fully indemnify members of the Committee against losses, costs, expenses and liabilities arising from actions taken or failure to act under the 2003 Plan. The committee is authorized, from time to time, to grant awards under the 2003 Plan to such employees (including executive officers) of the company and its subsidiaries as the Committee, in its discretion, selects. There are approximately 97 employees eligible to participate in the 2003 Plan. The Committee is authorized to delegate any of its authority under the 2003 Plan to such persons, such as officers of the Company, as it deems appropriate. Shares awarded under the 2003 Plan will be made available from authorized but unissued Common Shares or from Common Shares held in the treasury.

During 2000, 2001, and 2002, the Company made awards to an average of 98 employees per year, covering an average of approximately 393,413 shares per year under its stock option and grant plans. However, these awards are not necessarily indicative of the number of participants or the number of awards that might be made under the proposed 2003 Plan. Therefore, the Company cannot at this time identify the persons to whom awards will be granted, or would have been granted, if the 2003 Plan had been in effect during 2002; nor can the Company state the form or value of any such awards.

8

The maximum number of shares that a participant may be granted in any calendar year pursuant to the 2003 Plan is 250,000.

Options and Appreciation Rights

The 2003 Plan authorizes the Committee to grant to employees options to purchase the Company's Common Shares which may be in the form of statutory stock options, including "incentive stock options" ("ISOs") or other types of tax-qualified options which may subsequently be authorized under the federal tax laws or in the form of non-statutory options. The exercise price of options granted under the 2003 Plan (subject to amendment as discussed herein under the caption "Terms of the 2003 Plan; Amendment and Adjustment") may not be less than 100% of the fair market value of such share at the time the option is granted. Fair market value on any given date for this and other purposes of the 2003 Plan will be the mean between the highest and lowest sale prices reported on the New York Stock Exchange Composite Transactions Table on such date or the last previous date reported (or, if not so reported, on any domestic stock exchange on which the Company's Common Shares are then listed); or, if the Company's Common Shares are not listed on a domestic stock exchange, the mean between the closing high bid and low asked prices thereof as reported by the NASDAQ Stock Market on such date or the last previous date reported (or, if not so reported, by the system then regarded as the most reliable source of such quotation); or, if the foregoing do not apply, the fair values as determined in good faith by the Committee or the Board of Trustees.

The 2003 Plan permits optionees, with certain exceptions, to pay the exercise price of options in cash, Common Shares of the Company which have been held for a period of at least six months (valued at its fair market value on the date of exercise and including shares received upon exercise of options or share appreciation rights under any Company share-based plan) or a combination thereof. Accordingly, any optionee who owns any Common Shares for a period of at least six months may generally, by using shares in payment of the exercise price of an option, receive, in one transaction or a series of essentially simultaneous transactions, without any cash payment of the purchase price, (i) Common Shares equivalent in value to the excess of the fair market value of the shares subject to exercised option rights over the purchase price specified for such shares in the option, plus (ii) a number of shares equal to that used to pay the purchase price. Cash received by the Company upon exercise of options will constitute general funds of the Company. Once an award has been granted under the Plan, neither the Board of Trustees nor the Committee shall thereafter modify or change the exercise price of such Award without the approval of the Company's shareholders.

If a participant ceases to be an employee of the Company or its subsidiaries due to death, disability, retirement, or with the consent of the Committee, each outstanding option held by that participant which is then exercisable will remain exercisable for the period set forth in the option grant; provided that non-statutory options may be exercised up to one year after the death of a participant, despite any earlier expiration date set forth in the option grant. In all other cases, all options (whether or not then exercisable) will expire upon termination of a participant's employment.

The 2003 Plan also authorizes the Committee to grant appreciation rights to key employees (including executive officers). An appreciation right entitles the grantee to receive upon exercise the excess of (a) the fair market value of a specified number of shares of the Company's Common Shares at the time of exercise over (b) a price specified by the Committee which may not be less than 100% of the fair market value of the Common Shares at the time the appreciation right was granted (subject to amendment as discussed herein under the caption "Terms of the 2003 Plan; Amendment and Adjustment"). The Company will pay such amount to the holder in the form of the Company's Common Shares (valued at its fair market value on the date of exercise), cash or a combination thereof, as determined by the Committee.

9

Appreciation rights may be either unrelated to any option or an alternative to a previously or contemporaneously granted option. Appreciation rights granted as an alternative to a previously or contemporaneously granted option will entitle the optionee, in lieu of exercising the option, to receive the excess of the fair market value of a share of the Company's Common Shares on the date of exercise over the option price multiplied by the number of shares as to which such optionee is exercising the appreciation right. If an appreciation right is an alternative to an option, such option shall be deemed canceled to the extent that the appreciation right is exercised and the alternative appreciation right shall be deemed canceled to the extent that such option is exercised.

Performance Awards

The 2003 Plan authorizes the Committee to grant performance awards to employees in the form of either grants of performance shares (each performance share representing one share of the Company's Common Shares) or performance units representing an amount established by the Committee at the time of the award (which amount can be but does not have to be equal to the fair market value of one share of the Company's Common Shares). Performance awards are credited to a participant's performance account when awarded and are earned over a performance period (which shall not be less than six months) determined by the Committee at the time of the award. There may be more than one performance award in existence at any one time, and the performance periods may differ. At the time a performance award is granted, the Committee will establish superior and satisfactory performance targets measuring the Company's performance over the performance period. The portion of the performance award earned by the participant will be determined by the Committee, based on the degree to which the superior performance is achieved. The participant will earn no awards unless the satisfactory performance targets are met.

When earned, performance awards will be paid in a lump sum or installments in cash, Common Shares, or a combination thereof as the Committee may determine. Participants may elect during the performance period to defer payment of performance awards. The committee is authorized to determine yields for any deferred amounts and to establish a trust to hold any deferred amounts or portions thereof for the benefit of the participants.

If a participant ceases to be an employee of the Company or its subsidiaries during the performance period due to death, disability, retirement or with the consent of the Committee, the Committee may authorize payment of all or a portion of the amount the participant would have been paid if such participant had continued as an employee to the end of the performance period. In all other cases, all unearned performance awards will be forfeited.

Restricted Shares or Restricted Share Equivalents

The 2003 Plan authorizes the Committee to grant restricted Common Shares of the Company or restricted share equivalents to employees with such restriction periods as the Committee may designate at the time of the award; provided, however, that such restriction periods shall be at least one year for either time-based restrictions or performance-based restrictions. The Company will hold share certificates evidencing restricted shares, and restricted shares may not be sold, assigned, transferred, pledged or otherwise encumbered during the restriction period (except to family members with permission of the Committee). During the restriction period, the Committee generally will retain custody of any distributions (other than regular cash dividends) made or declared with respect to restricted shares. Other than these restrictions on transfer, the participant will have all the rights of a holder of such restricted shares. In lieu of restricted shares, the Committee may grant restricted share equivalents. Each restricted share equivalent would represent the right to receive an amount determined by the Committee at the time of the award, which value may be equal to the full monetary value of one share.

10

If a holder of restricted shares or restricted share equivalents ceases to be employed by the Company or any subsidiary due to death, disability or with the consent of the Committee, the restrictions will lapse on a number of shares or share equivalents determined by the Committee, but not less than a pro rata number of shares or share equivalents based on the portion of the restriction period for which the participant remained an employee. In all other cases, all restricted shares or restricted share equivalents will be forfeited to the Company.

Terms of Grants

The term of each share option and appreciation right will be determined by the Committee on the award date. ISOs may be granted for terms of not more than ten years from the date of grant, and the term of non-statutory options will be determined by the Committee at the time of the award (subject to amendment as discussed herein under caption "Terms of the 2003 Plan; Amendment and Adjustment").

Awards granted under the 2003 Plan generally will not be transferable (except to family members with permission of the Committee or by will and the laws of descent and distributions). However, the Committee may grant awards to participants that may be transferable (other than incentive share awards) subject to terms and conditions established by the Committee.

Participants who leave the Company holding unexercised share options or appreciation rights, unearned performance awards or restricted shares may forfeit such awards if they fail to honor consulting or non-competition obligations to the Company.

The 2003 Plan authorizes the Committee to grant awards to participants who are employees of foreign subsidiaries or foreign branches of the Company in alternative forms that approximate the benefits such participant would have received if the award were made in the forms described above.

Terms of the 2003 Plan; Amendment and Adjustment

No awards may be granted under the 2003 Plan after July 31, 2006. The 2003 Plan may be terminated by the Board of Trustees of the Company or by the Committee at any time with respect to options and appreciation rights that have not been granted. In addition, the Board of Trustees or the Committee may amend the 2003 Plan from time to time, without authorization or approval of the Company's shareholders but no amendment shall impair the rights of the holder of any award without such holder's consent. Any such amendment could increase the cost of the 2003 Plan to the Company. However, neither the Board nor the Committee may amend the 2003 Plan without the approval of the Company's shareholders (to the extent such approval is required by law, agreement or the rules of any exchange upon which the Company's common shares are listed) to (i) materially increase the maximum amount of shares subject to the 2003 Plan (other than pursuant to adjustment provisions discussed below), (ii) materially modify the requirements as to eligibility for participation in the 2003 Plan, (iii) materially increase the benefits accruing to participants under the 2003 Plan or (iv) extend the term of the 2003 Plan.

The 2003 Plan provides that in the event of a share dividend or share split, or a combination or other increase or reduction in the number of issued shares, the Board of Trustees or the Committee may, in order to prevent dilution or enlargement of rights under awards, make adjustments in the number of shares authorized by the 2003 Plan and covered by outstanding awards and the exercise prices and other terms of awards. The Committee may provide in any award agreement that in the event of a merger, consolidation, reorganization, sale or exchange of substantially all assets, or dissolution of the Company, any of which could involve a change in control of the Company, the rights under outstanding awards may be accelerated or adjustments may be made in order to prevent the dilution or enlargement of rights under those agreements.

11

Federal Income Tax Consequences

The following discussion is intended only as a brief summary of the federal income tax rules relevant to stock options, appreciation rights, performance awards, restricted stock and supplemental cash payments. These rules are highly technical and subject to change. The following discussion is limited to the federal income tax rules relevant to the Company and to the individuals who are citizens or residents of the United States. The discussion does not address the state, local or foreign income tax rules relevant to stock options, appreciation rights, performance awards, restricted stock and supplemental cash payments. Employees are urged to consult their personal tax advisors with respect to the federal, state, local, and foreign tax consequences relating to stock options, appreciation rights, performance awards, restricted stock, and supplemental cash payments.

ISOs. A participant who is granted an ISO recognizes no income upon grant or exercise of the option. However, the excess of the fair market value of the shares of stock on the date of exercise over the option exercise price is an item includible in the optionee's alternative minimum taxable income. An optionee may be required to pay an alternative minimum tax even though the optionee receives no cash upon exercise of the ISO with which to pay such tax.

If an optionee holds the Common Shares acquired upon exercise of the ISO for at least two years from the date of grant and at least one year following exercise (the "Statutory Holding Periods"), the optionee's gain, if any, upon a subsequent disposition of such Common Shares, is taxed as capital gain. If an optionee disposes of Common Shares acquired pursuant to the exercise of an ISO before satisfying the Statutory Holding Periods (a "Disqualifying Disposition"), the optionee may recognize both compensation income and capital gain in the year of disposition. The amount of the compensation income generally equals the excess of (1) the lesser of the amount realized on disposition or the fair market value of the Common Shares on the exercise date over (2) the exercise price. The balance of the gain realized on such a disposition, if any, is long-term or short-term capital gain depending on whether the Common Shares have been held for more than one year following exercise of the ISO.

Special rules apply for determining an optionee's tax basis in and holding period for Common Shares acquired upon the exercise of the ISO if the optionee pays the exercise price of the ISO in whole or in part with previously owned Common Shares. Under these rules, the optionee does not recognize any income or loss from delivery of Common Shares (other than shares previously acquired through the exercise of the ISO and not held for the Statutory Holding Periods) in payment of the exercise price. The optionee's tax basis in and holding period for the newly-acquired Common Shares will be determined as follows: as to a number of newly-acquired shares equal to the previously-owned shares delivered, the optionee's tax basis in and holding period for the previously-owned shares will carry over to the newly-acquired shares on a share-for-share-basis; as to each remaining newly-acquired share, the optionee's basis will be zero (or, if part of the exercise price is paid in cash, the amount of such cash divided by the number of such remaining newly-acquired shares) and the optionee's holding period will begin on the date such share is transferred. Under proposed regulations, any Disqualifying Disposition is deemed made from shares with the lowest basis first.

If any optionee pays the exercise price of an ISO in whole or in part with previously-owned shares that were acquired upon the exercise of the ISO and that have not been held for the Statutory Holding Periods, the optionee will recognize compensation income (but not capital gain) under the rules applicable to Disqualifying Dispositions.

The Company is not entitled to any deduction with respect to the grant or exercise of the ISO or the subsequent disposition by the optionee of the shares acquired if the optionee satisfies the Statutory Holding Periods. If these holding periods are not satisfied, the Company is generally entitled to a deduction in the year the optionee disposes of the Common Shares in an amount equal to the optionee's compensation income.

12

Non-statutory Stock Options. A participant who is granted a non-statutory stock option recognizes no income upon grant of the option. At the time of exercise, however, the optionee recognizes compensation income equal to the difference between the exercise price and the fair market value of the Common Shares received on the date of exercise. This income is subject to income and employment tax withholding. The Company is generally entitled to an income tax deduction corresponding to the compensation income recognized by the optionee.

When an optionee disposes of Common Shares received upon the exercise of a non-statutory stock option, the optionee will recognize capital gain or loss equal to the difference between the sales proceeds received and the optionee's basis in the shares sold. The Company will not receive a deduction for any capital gain recognized by the optionee.

If an optionee pays the exercise price for a non-statutory option entirely in cash, the optionee's tax basis is the Common shares received equals the share's fair market value on the exercise date and the optionee's holding period begins on the day after the exercise date. If, however, an optionee pays the exercise price of a non-statutory option in whole or in part with previously-owned Common Shares, then the optionee's tax basis in and holding period for the newly-acquired shares will be determined as follows: as to a number of newly acquired shares equal to the previously-owned shares delivered, the optionee's basis in and holding period for the previously-owned shares will carry over to the newly acquired shares on a share-for-share basis; as to each remaining newly-acquired share, the optionee's basis will equal the share's value on the exercise date, and the optionee's holding period will begin on the day after the exercise date.

Tax Treatment of Capital Gains. The maximum federal income tax rate applied to capital gains realized on a taxable disposition of Common Shares held by a participant as a capital asset will be (i) 20% if such Common Shares are held by the participant for more than 12 months or 18% if held by the participant for more than 5 years and (ii) the rate that applies to ordinary income (i.e., a graduated rate up to a maximum of 38.6%) if such Common Shares are held by the participant for no more than 12 months.

Appreciation Rights. A participant who is granted an appreciation right recognizes no income upon grant of the appreciation right. At the time of exercise, however, the participant shall recognize compensation income equal to any cash received and the fair market value of any Common Shares received. This income is subject to withholding. The Company is generally entitled to an income tax deduction corresponding to the ordinary income recognized by the participant.

Performance Awards. The grant of a performance award does not generate taxable income to the participant or an income tax deduction to the Company. Any cash and the fair market value of any Common Shares received as payment in respect of a performance award will constitute ordinary income to the participant. The participant's income is subject to income and employment tax withholding. The Company is generally entitled to an income tax deduction corresponding to the ordinary income recognized by the participant.

Restricted Shares. Restricted shares are subject to a "substantial risk of forfeiture" within the meaning of Section 83 of the Code. A participant who is granted restricted shares may make an election under Section 83(b) of the Code (a "Section 83(b) Election") to have the grant taxed as compensation income at the date of receipt, with the result that any future appreciation (or depreciation) in the value of the Common Shares granted shall be taxed as capital gain (or loss) upon a subsequent sale of the shares. Such an election must be made within 30 days of the date such restricted shares are granted.

However, if the participant does not make a Section 83(b) Election, then the grant shall be taxed as compensation income at the full fair market value on the date that the restrictions imposed on the shares expire. Unless a participant makes a Section 83(b) Election, any dividends paid on Common

13

Shares subject to the restriction is compensation income to the participant and compensation expense to the Company. Any compensation income a participant recognizes from a grant of restricted shares is subject to income and employment tax withholding. The Company is generally entitled to an income tax deduction for any compensation income taxed to the participant.

Payment of Withholding Taxes. The Company shall have the power to withhold, or require a participant to remit to the Company, an amount sufficient to satisfy any Federal, state, local, or foreign withholding tax requirements on any grant or exercise made pursuant to the 2003 Plan. However, to the extent permissible under applicable tax, securities, and other laws, the Committee may, in its sole discretion, permit the participant to satisfy a tax withholding requirement by delivering Common Shares previously owned by the participant or directing the Company to apply Common Shares to which the participant is entitled as a result of the exercise of an option or the lapse of a period of restriction, to satisfy such requirement.

New Plan Benefits

As the benefits or amounts to be received under the 2003 Plan are not currently determinable, the following chart presents the benefits or amounts which would have been received by or allocated to each of the following for the fiscal year ended December 31, 2002 if the 2003 Plan had been in effect, to the extent such benefits or amounts may be determined.

2003 Omnibus Employee Retention and Incentive Plan(1)

| Name and Position | Dollar Value ($)(2) Restricted Shares/ Options(3) | Number of Units (#) Restricted Shares/ Options(3) | ||

|---|---|---|---|---|

| John S. Gates, Jr. Co-Chairman, Chief Executive Officer and Trustee | $552,641/-0- | 9,816/93,250 | ||

Michael M. Mullen President, Chief Operating Officer and Trustee | $552,641/-0- | 9,816/93,250 | ||

Paul S. Fisher Executive Vice President, Secretary, Chief Financial Officer, General Counsel and Trustee | $497,354/-0- | 8,834/83,925 | ||

Rockford O. Kottka Executive Vice President and Treasurer | $276,320/-0- | 4,908/46,625 | ||

Paul T. Ahern Executive Vice President, Chief Investment Officer and Director of Portfolio Operations | $828,961/-0- | 14,724/-0- | ||

All Executives as a Group | $2,707,917/-0- | 48,098/317,050 | ||

Non-Executive Trustee Group | - -0-/-0- | - -0-/38,000 | ||

Non-Executive Officer and Employee Group | $3,761,741/-0- | 66,816/-0- |

- (1)

- The total number of shares underlying the 2003 Plan is 1,200,000.

- (2)

- The market value of the restricted shares is calculated at the close of business of the most recent grant, March 7, 2003. The market value of one Common Share at the close of business on March 7, 2003 was $56.30 per share.

- (3)

- Options expire ten years after the date of grant and vest equally over a five year period.

14

Equity Compensation Plans

The following table summarizes information, as of December 31, 2002, relating to equity compensation plans of the Company pursuant to which options, restricted shares or other rights to acquire shares may be granted from time to time.

Equity Compensation Plan Information

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders(1) | 1,899,774 | $ | 39.43 | 56,194 | |||

| Equity compensation plans not approved by security holders | N/A | N/A | N/A | ||||

| Total | 1,899,774 | $ | 39.43 | 56,194 | |||

- (1)

- These plans include the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan.

15

SHARE OWNERSHIP OF PRINCIPAL SHAREHOLDERS AND MANAGEMENT

The following table sets forth information as of March 1, 2003 with respect to the beneficial ownership of the Common Shares of the Company by (1) each person who is known by the Company to own beneficially more than 5% of its Shares, (2) each trustee of the Company, (3) the Company's Chief Executive Officer and four other executive officers and (4) the Company's trustees and executive officers as a group.

| | Shares Beneficially Owned | |||

|---|---|---|---|---|

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial ownership(1) | Percent of Class | ||

| Davis Selected Advisers, L.P. 2949 East Elvira Road, Suite 101 Tucson, Arizona 85706 | 3,698,403 | (2) | 16.01% | |

FMR Corp. 82 Devonshire Street Boston, Massachusetts 02109 | 3,143,431 | (3) | 13.61% | |

European Investors Inc. 717 5th Avenue New York, NY 10022 | 1,218,500 | (4) | 5.28% | |

Martin Barber (Co-Chairman and Trustee) 10 Lower Grosvenor Place London, England SW1W 0EN | 59,270 | (5) | * | |

John S. Gates, Jr. (Co-Chairman, Chief Executive Officer and Trustee) 1808 Swift Road Oak Brook, Illinois 60523 | 726,396 | (6) | 3.14% | |

Robert L. Stovall (Vice Chairman and Trustee) 1808 Swift Road Oak Brook, Illinois 60523 | 133,556 | (7) | * | |

Nicholas C. Babson (Trustee) 980 N. Michigan Ave., Suite 1400 Chicago, Illinois 60611 | 33,392 | (8) | * | |

Norman R. Bobins (Trustee) LaSalle National Bank 135 South LaSalle Street Chicago, Illinois 60603 | 15,971 | (9) | * | |

Alan D. Feld (Trustee) 1700 Pacific Avenue Suite 4100 Dallas, Texas 75201 | 36,676 | (10) | * | |

16

Thomas E. Robinson (Trustee) Legg Mason Wood Walker 100 Light Street 34th Floor Baltimore, Maryland 21202 | 36,429 | (10) | * | |

John C. Staley (Trustee) Sears Tower Suite 1600 233 South Wacker Drive Chicago, IL 60606 | 124 | (11) | * | |

Michael M. Mullen (President, Chief Operating Officer and Trustee) 1808 Swift Road Oak Brook, Illinois 60523 | 303,953 | (12) | 1.32% | |

Paul S. Fisher (Executive Vice President Secretary, Chief Financial Officer, General Counsel and Trustee) 1808 Swift Road Oak Brook, Illinois 60523 | 346,358 | (13) | 1.50% | |

Rockford O. Kottka (Executive Vice President and Treasurer) 1808 Swift Road Oak Brook, Illinois 60523 | 104,379 | (14) | * | |

Paul T. Ahern (Executive Vice President Chief Investment Officer and Director of Portfolio Operations) 1808 Swift Road Oak Brook, Illinois 60523 | 53,870 | (15) | * | |

All trustees and executive officers as a group (12 persons) | 1,850,374 | (16) | 8.01% |

- *

- Less than one percent.

- (1)

- Beneficial ownership is the direct ownership of Common Shares of the Company including the right to control the vote or investment of or acquire such Common Shares (for example, through the exercise of share options or pursuant to trust agreements) within the meaning of Rule 13d-3 under the Securities and Exchange Act of 1934. The shares owned by each person or by the group and shares included in the total number of shares outstanding have been adjusted in accordance with said Rule 13d-3.

17

- (2)

- As reported on a Schedule 13G filed by Davis Selected Advisors, L.P. on February 18, 2003, Davis Selected Advisers, L.P. has sole voting power and sole dispositive power with respect to all 3,698,403 Common Shares.

- (3)

- As reported on a Schedule 13G/A filed by FMR Corp. on February 13, 2003, FMR Corp. has sole voting power with respect to 1,016,937 Common Shares and has sole dispositive power with respect to all of the 3,143,431 Common Shares.

- (4)

- As reported on a Schedule 13G filed by European Investors Inc. on February 4, 2003, European Investors Inc. has sole voting power with respect to 1,076,200 Common Shares and has sole dispositive power with respect to 1,212,100 Common Shares.

- (5)

- Includes options to purchase 27,700 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (6)

- Includes options to purchase 243,885 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days and 725 shares owned by an IRA for the benefit of John S. Gates, Jr. Also includes 29,000 Common Shares owned by the Gates Charitable Trust, under which Mr. Gates acts as trustee and exercises voting power with respect to such Common Shares. Mr. Gates disclaims beneficial ownership of 185 shares owned by an IRA for the benefit of his wife.

- (7)

- Includes options to purchase 23,700 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (8)

- Includes options to purchase 31,800 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (9)

- Includes options to purchase 14,700 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (10)

- Includes options to purchase 32,400 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (11)

- Does not include any options to purchase Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (12)

- Includes options to purchase 217,668 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days and 2,000 shares owned by his wife.

- (13)

- Includes options to purchase 290,492 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (14)

- Includes options to purchase 76,886 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

- (15)

- Includes options to purchase 27,331 Common Shares under the Company's 1993 Stock Option Plan exercisable within 60 days.

- (16)

- Includes options to purchase 1,018,962 Common Shares under the Company's 1993 Stock Option Plan and 2000 Omnibus Employee Retention and Incentive Plan exercisable within 60 days.

18

Summary Compensation Table

The following table sets forth information concerning compensation awarded to the Company's Chief Executive Officer and four other executive officers for the years ended December 31, 2002, December 31, 2001 and December 31, 2000.

| | | Annual Compensation | Long Term Compensation | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary($)(1) | Bonus($) | Other Annual Compensation($)(2) | Restricted Share Award($)(3)(4) | Securities Underlying Options(#) | All Other Compensation($)(5) | |||||||

| John S. Gates Jr., Chief Executive Officer | 2002 2001 2000 | 380,435 352,935 318,100 | 308,328 445,000 319,994 | 76,999 56,926 14,672 | 396,383 475,478 252,423 | 56,907 75,000 46,245 | 5,500 5,250 5,250 | |||||||

Michael M. Mullen President and Chief Operating Officer | 2002 2001 2000 | 328,500 306,000 280,000 | 277,817 462,000 338,420 | 82,928 65,680 16,752 | 463,258 950,956 252,423 | 56,907 50,000 146,245 | 5,500 5,250 5,250 | |||||||

Paul S. Fisher Executive Vice-President, Secretary, Chief Financial Officer and General Counsel | 2002 2001 2000 | 318,240 306,000 280,000 | 226,202 328,500 206,100 | 45,974 24,254 2,400 | 297,312 475,478 - -0- | 42,680 75,000 192,485 | 5,500 5,250 5,250 | |||||||

Rockford O. Kottka Executive Vice-President, Treasurer and Chief Accounting Officer | 2002 2001 2000 | 212,160 204,000 175,000 | 108,989 147,000 124,500 | 32,879 24,618 9,682 | 231,629 316,985 168,294 | 28,453 50,000 30,828 | 6,000 5,250 5,250 | |||||||

Paul Ahern Executive Vice-President, Chief Investment Officer and Director of Portfolio Operations | 2002 2001 2000 | 286,416 275,400 255,000 | 188,434 203,850 154,880 | 72,123 49,237 19,514 | 594,624 633,971 336,588 | - -0- - -0- - -0- | 5,500 5,250 5,250 | |||||||

- (1)

- Includes amounts deferred at the election of the named executive officer under the Company's 401(k) Plan.

- (2)

- Represents dividend equivalent payments on restricted shares.

- (3)

- Restricted shares awarded under the 1995 Plan and the 2000 Plan will vest eight years from the date of the grant; however, restricted shares awarded under such plans may vest earlier as follows: (i) if total shareholder return averaged over a consecutive sixty day trading period commencing no earlier than two years from the date of the grant is greater than a target established by the Compensation Committee at the time of the respective award, all of the restricted shares awarded for such year will vest; (ii) upon the death, disability or retirement of a participant, the number of vested shares will be determined by dividing the number of months which have elapsed from the date of such award by 96; or (iii) in the event of a change of control of the Company, all of the restricted shares previously awarded will vest. Dividends are paid on the restricted shares to the same extent as on any other Common Shares.

- (4)

- At December 31, 2002, 242,352 restricted shares were outstanding having a market value of $13,850,417.

- (5)

- Represents the Company's matching contribution to the 401(k) Plan.

19

The following table sets forth, for the Company's Chief Executive Officer and each of the other executive officers named in the Summary Compensation Table, information with respect to option grants during the last fiscal year and potential realizable values for such option grants for the term of the options.

Option Grants in Fiscal Year Ended December 31, 2002

| Individual Grants | | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Potential Realizable Value at Assumed Annual Rates of Share Price Appreciation for Option Term | |||||||||||||

| | | Percent of Total Options Granted to Employees in the Year Ended December 31, 2002 | | | |||||||||

| | Number of Securities Underlying Options Granted (#) | | | ||||||||||

| Name | Exercise of Base Price ($/Share) | Expiration Date | |||||||||||

| 5%($) | 10%($) | ||||||||||||

| John S. Gates, Jr. | 56,907 | 30.77 | % | $ | 48.90 | 1/29/2012 | 1,750,058 | 4,434,990 | |||||

| Michael M. Mullen | 56,907 | 30.77 | % | $ | 48.90 | 1/29/2012 | 1,750,058 | 4,434,990 | |||||

| Paul S. Fisher | 42,680 | 23.08 | % | $ | 48.90 | 1/29/2012 | 1,312,536 | 3,326,223 | |||||

| Rockford O. Kottka | 28,453 | 15.38 | % | $ | 48.90 | 1/29/2012 | 875,014 | 2,217,456 | |||||

| Paul Ahern | -0- | 0 | % | — | — | — | — | ||||||

The following table sets forth, for the Company's Chief Executive Officer and each of the other executive officers named in the Summary Compensation Table, information with respect to option exercises during the last fiscal year and option values at the end of the last fiscal year.

Aggregated Option Exercises in Fiscal Year Ended December 31, 2002

Option Values at December 31, 2002

| | | | Number of securities underlying unexercised options at fiscal year end(5)(#) | Value of unexercised in-the-money options at fiscal year end(7)($) | ||||

|---|---|---|---|---|---|---|---|---|

| | Shares Acquired on Exercise(#) | Value Realized($) | Exercisable/ unexercisable(6) | Exercisable/ unexercisable(6) | ||||

| John S. Gates, Jr. | 110,035 | 3,810,465(1 | ) | 182,509/179,850 | 4,282,967/2,783,006 | |||

| Michael M. Mullen | 23,355 | 799,881(2 | ) | 176,810/219,850 | 3,776,831/4,116,756 | |||

| Paul S. Fisher | 43,345 | 1,547,514(3 | ) | 222,713/253,367 | 5,068,843/4,896,897 | |||

| Rockford O. Kottka | 9,112 | 175,437(4 | ) | 47,340/99,029 | 999,099/1,505,227 | |||

| Paul Ahern | -0- | -0- | 15,316/16,425 | 376,433/398,273 |

- (1)

- Based on the difference between exercise prices of $18.25, $19.50, $22.50 and $31.50 per share and the closing price of the Common Shares as reported on the New York Stock Exchange on the dates of exercise, April 26, 2002 which was $54.16, April 29, 2002 which was $54.40 and May 6, 2002 which was $55.75.

- (2)

- Based on the difference between exercise prices of $18.25, $19.50 and $22.50 per share, and the closing price of the Common Shares as reported on the New York Stock Exchange on the dates of exercise, February 22, 2002 which was $51.09 and August 22, 2002 which was $55.90.

- (3)

- Based on the difference between an exercise price of $18.25 per share, and the closing price of the Common Shares as reported on the New York Stock Exchange on the dates of exercise, February 12, 2002 which was $50.76, February 13, 2002 which was $51.00, February 27, 2002 which was $51.30, July 29, 2002 which was $57.02, July 31, 2002 which was $58.42 and December 27, 2002 which was $56.81.

- (4)

- Based on the difference between exercise prices of $22.50, $31.50 and $33.875 per share and the closing price of the Common Shares as reported on the New York Stock Exchange on the date of exercise, February 28, 2001, which was $46.05.

- (5)

- All options are for Common Shares.

- (6)

- The first number appearing in the column refers to exercisable options, and the second number refers to unexercisable options. Options granted under the 1993 Plan, as amended, and the 2000 Plan become exercisable at the rate of 20% per year and are fully exercisable five years after the date of the grant. Upon a change of control, all unvested options become exercisable.

- (7)

- Based on the difference between exercise prices of $18.25, $19.50, $22.50, $31.50, $33.875, $32.0625, $34.9375, $41.00, or $45.90 per share, as the case may be, and the closing price of the Common Shares on December 31, 2002 of $57.15 per share as reported on the New York Stock Exchange.

20

Long-Term Incentive Plan Awards Table

The following table sets forth, for the Company's Chief Executive Officer and each of the other executive officers named in the Summary Compensation Table, information with respect to long-term incentive awards during the last fiscal year. For additional information on these awards, see "Board Compensation Committee Report on Executive Compensation—Long-Term Incentive Plan" below.

Long-Term Incentive Plans—Awards in Fiscal Year Ended December 31, 2002

| | | | Estimated Future Payouts Under Non-Stock Price-Based Plans | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Shares, Units or Other Rights(#) Restricted Shares(1)/Options(1) | Performance or Other Period Until Maturation or Payout Restricted Shares(2)/Options(3) | ||||||||

| Name | Threshold Restricted Shares($)/Options(#) | Target Restricted Shares($)/Options(#) | Maximum Restricted Shares($)/Options(#) | |||||||

| John S. Gates, Jr. | 8,106/56,907 | 01/29/2010/ 01/29/2012 | $257,500/ 43,750 | $515,000/ 87,500 | $1,030,000/ 175,000 | |||||

Michael M. Mullen | 8,106/56,907 | 01/29/2010/ 01/29/2012 | $184,500/ 25,000 | $369,000/ 50,000 | $738,000/ 100,000 | |||||

Paul S. Fisher | 6,080/42,680 | 01/29/2010/ 01/29/2012 | $132,500/ 22,500 | $265,000/ 45,000 | $530,000/ 85,000 | |||||

Rockford O. Kottka | 4,053/28,453 | 01/29/2010/ 01/29/2012 | $75,000/ 12,500 | $150,000/ 25,000 | $300,000/ 50,000 | |||||

Paul Ahern | 12,160/-0- | 01/29/2010/ N/A | $125,000/ 21,250 | $250,000/ 42,500 | $500,000/ 85,000 | |||||

- (1)

- Awards are measured on rate of return goals established by the Company's independent trustees, with a 25% weighting factor assigned to total shareholder return and a 75% weighting factor assigned to return on total invested capital.

- (2)

- Restricted shares awarded under the 2000 Plan will vest eight years from the date of the grant; however, restricted shares awarded under such plans may vest earlier if total shareholder return averaged over a consecutive sixty day trading period commencing no earlier than two years from the date of the grant is greater than 60%, in which case all of the restricted shares awarded for such year will vest.

- (3)

- Options expire ten years after the date of grant and vest equally over a five year period.

Compensation of Trustees

Each trustee who is not an employee of the Company is entitled to receive an annual fee of $25,000 except for the Chairman who receives $35,000, at least 50% of which is payable in Common Shares. Trustees may elect to receive up to 100% of the annual fee in Common Shares, under the Company's 1995 Plan, as amended. The Company also pays its non-employee trustees a fee of $1,500 for attendance at each meeting of the Board, but only $1,000 if telephonic, and the Company reimburses independent trustees for travel expenses incurred in connection with their activities on behalf of the Company. Under the 1995 Plan, as amended, each independent trustee was awarded 430 Common Shares on May 16, 2001, except Martin Barber and Norman Bobins, who were awarded 215 Common Shares in lieu of the cash portion of their annual retainer fee at election. Trustees who are employees of the Company are not paid any trustees' fees.

21

Other fees paid to non-employee trustees include an annual fee of $2,500 for the Chairman of the Governance and Nominating Committee, $5,000 for the Chairman of the Compensation Committee, $6,000 for the Chairman of the Audit Committee and $10,000 for each member of the Asset Allocation Committee except Robert Stovall. For attendance at committee meetings, a payment of $1,500 is made to each member of the Audit Committee and $1,000 for each member of the Governance and Nominating Committee and Compensation Committee.

Robert Stovall, Vice Chairman and the retired Executive Vice President and Chief Operating Officer of the Company, receives $100,000 annually pursuant to a non-competition agreement. The agreement, effective upon his retirement on October 31, 1997, continued until December 31, 2000 and was extended by the Board of Trustees until the annual meeting on May 16, 2003.

Independent trustees were eligible for the grant of options under the Company's 2000 Plan. Under the 2000 Plan, each independent trustee was granted options on May 16, 2002 to acquire 5,000 Common Shares, except Martin Barber and Robert Stovall who were each awarded options to acquire 6,500 Common Shares, at $55.25 per share, expiring on May 16, 2012. Under the 2000 Plan, options become exercisable at the rate of 20% per year and are fully exercisable five years after the date of the grant. Upon a change of control, all unvested options become exercisable.

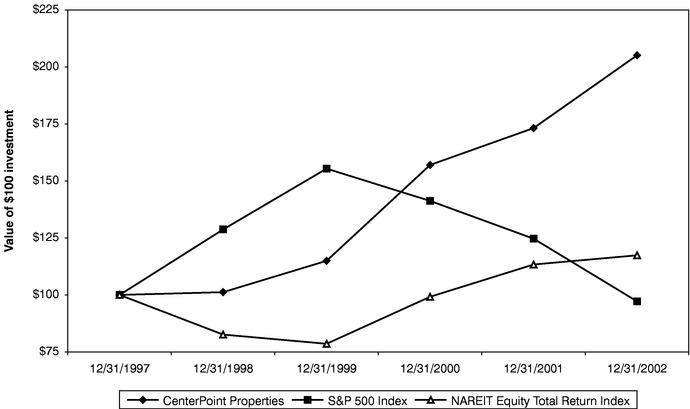

Employment Contracts