UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8056

MMA Praxis Mutual Funds

(Exact name of registrant as specified in charter)

| P.O. Box 483, Goshen, IN | 46527 |

| (Address of principal executive offices) | (Zip code) |

Anthony Zacharski, Dechert LLP, 200 Clarendon Street, 27th Floor, Boston, MA 02116

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 878-4000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/09

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semi-annual Report for MMA Praxis Mutual Funds.

Table of contents

| Message from the President | 1 |

| MMA Praxis Stewardship Investing Report | 2 |

| MMA Praxis Intermediate Income Fund | |

| | Portfolio managers’ letter | 5 |

| | Performance review | 6 |

| | Schedule of portfolio investments | 8 |

| MMA Praxis Core Stock Fund | |

| | Portfolio managers’ letter | 17 |

| | Performance review | 18 |

| | Schedule of portfolio investments | 20 |

| MMA Praxis Value Index Fund | |

| | Portfolio manager’s letter | 25 |

| | Performance review | 26 |

| | Schedule of portfolio investments | 28 |

| MMA Praxis Growth Index Fund | |

| | Portfolio manager’s letter | 38 |

| | Performance review | 39 |

| | Schedule of portfolio investments | 41 |

| MMA Praxis International Fund | |

| | Portfolio manager’s letter | 50 |

| | Performance review | 53 |

| | Schedule of portfolio investments | 55 |

| MMA Praxis Small Cap Fund | |

| | Portfolio manager’s letter | 63 |

| | Performance review | 64 |

| | Schedule of portfolio investments | 66 |

| | | |

| Statements of assets and liabilities | 70 |

| Statements of operations | 74 |

| Statements of changes in net assets | 76 |

| Financial highlights | 78 |

| Notes to financial statements | 95 |

| Additional fund information (unaudited) | 112 |

Glossary of Terms

Barclay’s Capital Aggregate Bond Index is an unmanaged index composed of the Barclay’s Capital Government/Credit Index and the Barclay’s Capital Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities, and is intended to be generally representative of the bond market as a whole .

The Morgan Stanley Capital International-Europe, Australia and the Far East Index (MSCI EAFE Index) is a widely recognized unmanaged index composed of a sample of companies representative of the developed markets throughout the world, excluding the United States and Canada.

The Morgan Stanley Capital All Country World Free (ex. U.S.) Index is a widely recognized, unmanaged index composed of a sample of companies representative of the markets of both developed and emerging markets throughout the world, excluding the United States.

Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) is a widely recognized, unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange.

Standard & Poor’s 500/Citigroup Value Index (the “S&P 500/Cititgroup Value Index”), is unmanaged and is constructed by dividing the stocks in the S&P 500 Index into two categories, growth and value, according to price-to-book ratios. Prior to December 16, 2005, this index represented the S&P/Barra Value Index.

The Domini 400 Social Index is an unmanaged index of 400 common stocks that pass multiple broad-based social screens and is intended to be generally representative of the socially responsible investment market.

MSCI US Prime Market Growth Index represents the growth companies of the MSCI US Prime Market 750 Index. The MSCI US Prime market 750 Index represents the universe of large and medium capitalization companies in the US equity market.

MSCI US Prime Market Value Index represents the value companies of the MSCI US Prime Market 750 Index. The MSCI Prime Market 750 Index represents the universe of large and medium capitalization companies in the U.S. equity market.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. Equity Universe. It measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Gross Domestic Product (the “GDP”), is the measure of the market value of the goods and services produced by labor and property in the United States.

Consumer Price Index (the “CPI”), is an index of prices used to measure the change in the cost of basic goods and services in comparison with a fixed base period.

Price-to-Earnings Ratio (the “P/E Ratio”), is a valuation ratio of a company's current share price compared to its per-share earnings.

SuperComposite 1500 Index. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price to-book ratio, and three-year sales-per share growth value, compared to the S&P 500 Index.

The above indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. An investor cannot invest directly in an index, although they can invest in the underlying securities.

| Message from the President |

Message from the President

Dear MMA Praxis Shareholder:

The year 2008 was an unprecedented one for investors in the market, and the first six months of 2009 have been a challenging time as well. Although the equities markets have turned positive for the six-month period, this remains a time of uncertainty and volatility. With continued uncertainty as to when an economic recovery will occur, volatility may well continue for some time to come.

During the first six months, domestic equities, as measured by the Standard & Poor’s 500 Index rose by 3.19 percent. The MMA Core Stock Fund Class A share (NAV) outperformed its benchmark and was up 3.75 percent. Over the same period, the Class A Share (NAV) of the Value Index Fund fell by 0.52 percent, but outperformed its benchmark, the MSCI US Prime Market Value Index, which fell 2.49 percent. The Class A Share (NAV) of the Growth Index Fund rose by 10.46 percent, and its benchmark, the MSCI US Prime Market Growth Index, rose 10.74 percent. The Class A Share (NAV) of the Small Cap Fund rose by 8.25 percent and outperformed its benchmark, the Russell 2000 Index, which rose 2.64 percent. While we are pleased to see returns in positive territory, we recognize that there is still a long way to go for the market to reach its historic highs.

The international equity benchmark MSCI EAFE Index was up 7.95 percent for the six-month period ending June 30, 2009. The MMA Praxis International Class A Share (NAV) underperformed its benchmark over the same period, declining 4.41 percent.

Coming off of strong performance in 2008, the MMA Praxis Intermediate Income Fund continues to provide positive returns for the six month period. The Class A Share (NAV) posted a gain of 5.08 percent for the period ending June 30, 2009, with 3-year annualized returns of 6.28 percent and 5-year annualized returns of 4.65 percent. This fund’s benchmark, Barclay’s Capital US Aggregate Bond Index returned 5.02 percent over the same five-year period.

As shareholders of Class B shares of MMA Praxis have been informed, the Class B shares are being closed as of Aug. 14, 2009. Funds in the B shares will be automatically converted to Class A shares of the corresponding fund.

MMA Praxis remains committed to fulfill its mission as a faith-based mutual fund by being actively engaged in shareholder advocacy and community development investing (CDI). While nearly all equities fell last year, MMA Praxis continued working for the greater good. CDI and other stewardship investing initiatives continued in spite of the market decline. One CDI partner, HOPE Community Credit Union, based in Jackson, Miss., serves low-income people in a four-state region. HOPE has generated over $1 billion in financing for economic growth and opportunity for over 40,000 people that would have struggled to receive help from traditional banking. This is just one of many stories of how investments in underserved communities are building a better world in spite of the market’s volatility. Without your investments in MMA Praxis, we would not be able to participate in this way.

Additionally, you likely have heard about the ground-breaking shareholder advocacy work that MMA has led related to predatory practices in the credit card industry. Many national news sources have documented our involvement. You can find some of this coverage by going to www.mmapraxis.com and to the “In the media” section. MMA Praxis is making a difference on many fronts.

In the following pages, you will find portfolio managers’ letters and performance review for each of the funds. Please read these reports for in-depth explanations and observations.

Thank you for being an investor with MMA Praxis Mutual Funds. We know money invested with MMA Praxis is being set aside for retirement, educational pursuits, and other goals important to you. Our commitment is to be good stewards of these resources and fulfill our mission as a faith-based mutual fund. We are deeply appreciative of your confidence in placing these important resources in our care.

Sincerely,

David C. Gautsche

President

MMA Praxis Mutual Funds

| MMA Praxis Stewardship Investing Report |

MMA Praxis Stewardship Investing Report

The Economics of Hope—part 2

“Blessed are the meek, for they will inherit the earth.” (Matthew 5:5)

No one has ever claimed the Beatitudes as a functional economic model. These passages do, however, raise hallmarks of “right societies” that bear further reflection. In the MMA Praxis Mutual Funds Annual Report for the year ended Dec. 31, 2008, I wrote about the challenge and need for our nation to relearn the “economics of hope”; to understand that for this wonderful, demented, intricate global economy to work - -- truly work -- then hope for a better life must exist on every level of society.

Now, more than six months later, there are small signs the economy – at least as defined on Wall Street – is thinking of recovery. The situation on Main Street, however, remains troubling with national unemployment continuing to increase. Pundit discussions of another “jobless recovery,” with unemployment at current levels, suggest the lessons of the past two years may not have been fully learned. With credit card defaults continuing to climb, credit for small – even successful -- small businesses difficult to secure, and unemployment benefits expiring, the noose continues to tighten on the consumer economy. Life remains hard – and continues to get harder – for tens of millions of Americans and others around the world.

While the rise of the markets may buoy the hopeful spirits of those invested in pensions, mutual funds, and 401(k) plans, we believe it will be the ability to (quickly) translate that spirit into a hope-filled reality for those at the middle and bottom of the economic pyramid that demonstrates the depth and sustainability of the recovery. This situation continues to underscore the important role people of faith play in connecting long-term investment perspectives with financial practices and policies that offer opportunity and hope for all.

A proxy season to remember

Fear, anger, confusion, mistrust were all themes evident in the 2008-2009 shareholder proxy season. It was largely defined by investor reaction to the chaos in the financial system and greater economy. For the first time ever, a CEO, Bank of America’s Ken Lewis, was forcibly separated from the chairman’s role through a binding shareholder resolution.1 (MMA Praxis generally supports the separation of CEO and chair roles and voted in favor of this resolution.)

Corporate practices ranging from executive compensation to the selection of corporate directors came under fire from shareholders. Through its votes, MMA Praxis supported shareholder measures to promote corporate governance reform. Overall, MMA Praxis voted on more than 6,000 corporate resolutions during 543 company meetings. MMA Praxis voted against corporate management’s recommendation 1,176 times, or 19 percent of the time, a relatively high percentage. And while social resolutions did not garner the same amount of support as those focused on corporate governance issues, they still played an important role in shaping the proxy season.

During this proxy season, MMA Praxis voted in support of three resolutions seeking to limit predatory credit card practices, six resolutions increasing disclosure of greenhouse gas emissions, eight resolutions promoting comprehensive sustainability reporting and 13 resolutions promoting human rights under International Labor Organization standards. In addition, MMA Praxis voted for 64 resolutions seeking a shareholder “say-on-pay,” 29 resolutions seeking the separation of chair and CEO positions, and voted against/withheld votes from 597 board candidates.

_____________

| 1 | According to the RiskMetrics Group, the recent vote by Bank of America shareholders to separate the two positions is the first time that shareholders have forced an S&P 500 company to split the two posts.” Found at: http://www.pomtalk.com/pomtalk/2009/06/movement-grows-to-split-chair-ceo-posts.html. |

You can find a more detailed 2008-2009 Proxy Voting Report, our proxy voting guidelines, and full disclosure of all MMA Praxis votes, online at www.mmapraxis.com.

Investing in the future

The charge to care for God’s creation and leave a better world for future generations is a responsibility we all carry. The MMA Praxis Intermediate Income Fund is putting this stewardship investing value into practice with investments in bond issues that help finance major wind and solar energy projects.

The Biglow Canyon Wind Farm in Sherman County, Ore., is a project of Portland General Electric Company (PGE) that will include 217 wind turbines when it is complete; 76 turbines are already running and generating electricity. Bonds supporting a solar wind farm in the Mojave Desert in California, operated by FPL Energy/Caithness Funding Corporation, were used to fund construction of two 80-megawatt solar electricity generating stations. Combined, these investments are valued at about $1.2 million.

Driving change

While the Toyota Car Company is a long-time leader in the development and promotion of environmental technology, this doesn’t ensure all of the company’s practices align with MMA’s stewardship investing core values. In February, MMA Praxis joined with shareholder members of the Interfaith Center on Corporate Responsibility (ICCR) to discuss human rights with Toyota. A report last summer detailed human rights abuses by Toyota and its parts suppliers that included allegations of forced 80-hour work weeks, human trafficking, brutal working conditions and more. During a dialogue with Toyota management, MMA Praxis and other concerned shareholders recommended that the company use third-party auditors to monitor and enforce fair working conditions for employees and others in their supply chain. In September, the shareholders will meet to discuss progress and the need for any further action. The effort with Toyota is especially important because of its size and influence on other companies in its industry.

Letting kids be kids

Every day, tens of millions of children are forced – by outright coercion or economic desperation – to work to help their families survive. MMA believes that putting a limit on the health and potential of future generations is not what God wants for us.

MMA Praxis joined a letter-writing campaign to 113 companies who use cotton from Uzbekistan asked the firms to pressure the Uzbek government to rid the industry of forced child labor. The evidence appears clear: the Uzbek government is complicit in human rights abuses involving children – going as far as closing schools to force children to pick cotton. This most valuable export ends up on the shelves of clothing stores all over the world. The letter campaign produced 28 responses, which is a start to investor dialogue. A second round of letters is currently under way.

Predatory credit card resolutions draw big votes

Following more than two years worth of work, MMA Praxis led an interfaith shareholder coalition focused on predatory credit card practices at seven companies representing nearly 85 percent of the nation’s credit card business. MMA Praxis filed resolutions at American Express and JP Morgan Chase and co-filed resolutions at Citigroup, Bank of America, Discover, and Wells Fargo. The purpose of these resolutions was to encourage the companies to adopt better credit card policies that help – rather than hurt – consumers, as well as increase the companies’ financial sustainability. Three resolutions went to ballot garnering an 8.5 percent vote at JP Morgan Chase, 33.4 percent at Bank of America, and 28.4 percent at Citigroup. These are all strong, first year votes - -- particularly for a socially-based resolution -- and set the stage for dialogues in the coming year focused on the implementation of new federal regulatory and legislative mandates related to these concerns.

Community development investing: generating social and financial returns

MMA Praxis Mutual Funds’ commitment to including up to 3% of each Fund’s net assets in community development investments, served to be a bright spot, both socially and financially, in many of the Praxis Funds. While successfully returning more than $2.1 million to MMA Praxis due to market declines and rebalancing, MMA community development investments (MMA CDI) continues to channel nearly $8 million to disadvantaged communities for the MMA Praxis Mutual Funds. These investments, now more than ever, are needed to help ensure that capable businesses and individuals from disadvantaged communities are not shut out of the rapidly constricting, highly risk-averse credit markets. While clearly feeling the impact of the economic downturn, most community development financial institutions continue to weather this storm through internal cost-savings, working closely with their borrowers and carefully leveraging investments like those from MMA CDI.

The organizations benefiting from MMA Praxis’s commitment to community development investing, through MMA CDI, include:

Mercy Housing serves more than 117,000 people every day -- including families, seniors, and people with special needs, and children -- who need a dependable place to call home. They are directly addressing the fallout from the recession by increasing access to safe, stable, affordable housing.

Southern Bancorp, the largest community development financial institutions fund (CDFI) serving the Mississippi Delta, is no stranger to economic hardship, helps thousands of people face life’s daily challenges. Through investments in charter schools, education, health and training programs, Southern Bancorp is helping those on margins with the vital and lengthy process of building lasting wealth and confidence in the future.

Mark Regier

Stewardship Investing Services Manager

| MMA Praxis Intermediate Income Fund |

MMA Praxis Intermediate Income Fund

Annual report to shareholders

Portfolio managers’ letter

After a shaky start to the year, the fixed markets began a steady recovery that accelerated in the second quarter. The MMA Praxis Intermediate Income Fund did exceptionally well with a 5.08 percent net return (Class A Shares). This was 3.18 percent better than the Barclays Aggregate Index, the Fund’s benchmark, which was up 1.9 percent.

The big driver of the outperformance was the very strong recovery of credit-related bonds. Corporate bonds, which now make up approximately 40 percent of the portfolio, had an 8.32 percent return while Commercial Mortgage Backed Securities (CMBS) were up 10.36 percent. CMBS makes up roughly 10 percent of the Fund’s assets.

Another positive for the Fund was the absence of U.S. Treasury bonds, which were down 4.3 percent. Treasuries were hurt by rising rates, which drive down the price of fixed income securities. For example, the 10-year Treasury note began the year at 2.25 percent and finished midyear at 3.52 percent. The magnitude of the poor performance was very important. Agencies, which were the next weakest sector, were only down .04 percent. All other sectors had positive returns.

Credit-related bonds did well as panic subsided and the attraction of double-digit interest rates for high-quality corporate and CMBS bonds began to attract buyers early in the year. Once the stock market bottomed in early March, investor’s interest in credit-related bonds rebounded, which added to the rally. By the end of June, the market was getting back to more normal levels for a recessionary time period.

Outlook

We expect the second half of 2009 to confirm expectations that the worst of the recession is over and a gradual recovery has begun. Unlike most post-World War II economic recoveries, we expect this one to be long and drawn out. The main reasons for this are the continued problems in housing with depressed demand for new homes, a huge glut of inventories that are often foreclosure-related, and a lack of available financing for many consumers and businesses. We expect the dearth of credit availability to keep consumer savings rates high, which will limit the potential for recovery.

Federal Reserve policy will remain easy with very low interest rates for short maturity securities. Despite the large federal deficit we expect interest rates on Treasury bonds to remain low. This is largely a function of very low inflation rates with extremely large amounts of excess capacity. Further, the savings rate is rising, which may be adequate to fund the government’s borrowing until the economy rebounds.

With recessionary conditions continuing we expect defaults to remain high, which should limit the room for a further rally in lower quality bonds. As a result, we plan to continue to focus on credit-related issues, and we will stay with higher-quality securities unless – or until – there is a correction that creates better opportunities.

Benjamin J. Bailey, CFA®

MMA Praxis Intermediate Income Fund Co-manager

Delmar King

MMA Praxis Intermediate Income Fund Co-manager

MMA Praxis Intermediate Income Fund

Performance review

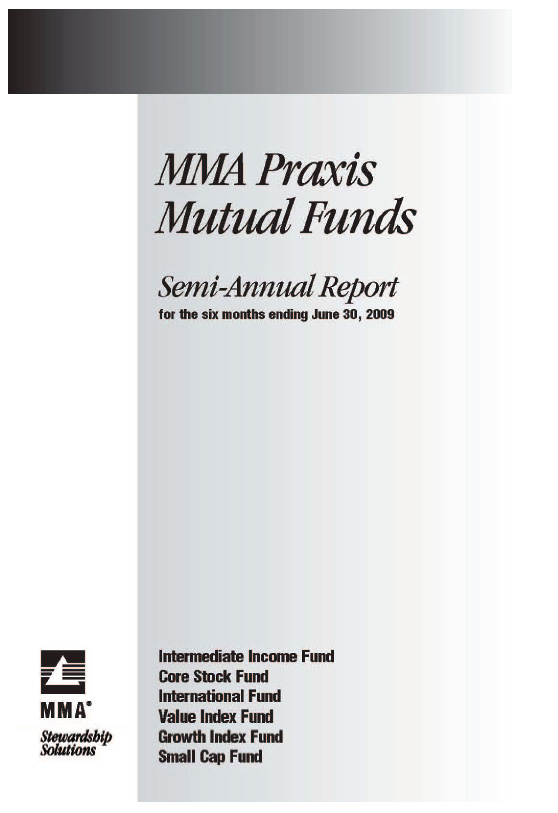

Average annual total returns as of 6/30/09

| | Inception Date | 1 Year | 3 Year | 5 Year | 10 Year |

| Class A | 5/12/99 | 7.34% | 6.29% | 4.66% | 5.04% |

| Class A* | 5/12/99 | 3.27% | 4.93% | 3.87% | 4.64% |

| | | | | | |

| Class B | 1/4/94 | 6.87% | 5.83% | 4.19% | 4.65% |

| Class B** | 1/4/94 | 2.87% | 4.93% | 4.02% | 4.65% |

| | | | | | |

| Class I | 5/1/06 | 7.61% | 6.55% | 4.65% | 4.83% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.

| * | Reflects maximum front-end sales charge of 3.75%. |

| ** | Assumes redemption at the end of the stated period. The Fund imposes a back-end sales charge (load) on Class B Shares if you sell your shares before a certain period of time has elasped. This is called a Contingent Deferred Sales Charge (“CDSC”). The CDSC declines over five years starting with year one and ending in year six as follows: 4%, 4%, 3%, 2%, 1%. |

Class A Share and Class I Share of this Fund were not in existence prior to 5/12/99 and 5/1/06, respectively. Class A Share performance and Class I Share performance calculated for any period prior to 5/12/99 and 5/1/06 are based on the performance of Class B Share since inception of 1/4/94. The B Share Contingent Deferred Sales Charge (CDSC) does not apply to performance over 5 years; therefore, the 10-year return does not reflect the CDSC.

The total return set forth reflects certain expenses that were voluntarily reduced, reimbursed or paid by third party. In such instances, and without this activity, total return would have been lower.

MMA Praxis Intermediate Income Fund

Performance review

Growth of $10,000 investment 6/30/99 to 6/30/09

For performance purposes, the above graph has not been adjusted for CDSC charges.

This chart represents historical performance of a hypothetical investment of $10,000 in the Intermediate Income Fund from 6/30/99 to 6/30/09, and represents the reinvestment of dividends and capital gains in the Fund.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.

The total return set forth reflects certain expenses that were voluntarily reduced, reimbursed or paid by third party. In such instances, and without this activity, total return would have been lower.

| * | Reflects maximum front-end sales charge of 3.75%. |

Class A Share and Class I Share of this Fund were not in existence prior to 5/12/99 and 5/1/06, respectively. Class A Share performance and Class I Share performance calculated for any period prior to 5/12/99 and 5/1/06 are based on the performance of Class B Share since inception of 1/4/94. The B Share Contingent Deferred Sales Charge (CDSC) does not apply to performance over 5 years; therefore, the 10-year return does not reflect the CDSC.

| 1 | Barclay's Capital Aggregate Bond Index is an unmanaged index composed of the Barclay's Capital Government/Credit Index and the Barclay's Capital Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities, and is intended to be generally representative of the bond market as a whole. |

The above indices are for illustrative purposes only and the Barclay's Capital Aggregate Bond Index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund's performance reflects the deduction of these value-added services. An investor cannot invest directly in an index, although they can invest in its underlying securities.

| Schedule of portfolio investments |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| ASSET BACKED SECURITIES — 0.5% | | | | | | |

| Discover Card Master Trust, 5.10%, 10/15/13 | | $ | 500,000 | | | $ | 518,760 | |

| Residential Funding Mortgage Securities, 5.53%, 1/25/36 | | | 424,002 | | | | 407,146 | |

| Wachovia Auto Loan Owner Trust, 5.10%, 7/20/11 (a) | | | 91,531 | | | | 91,833 | |

| TOTAL ASSET BACKED SECURITIES | | | | | | | 1,017,739 | |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 0.2% | | | | | | | | |

| JPMorgan Securities, Inc., 4.50%, 9/25/19 | | | 451,400 | | | | 431,070 | |

| COMMERCIAL MORTGAGE BACKED SECURITIES — 10.3% | | | | | | | | |

| Banc of America Commercial Mortgage, Inc., 5.12%, 7/11/43 | | | 500,000 | | | | 496,106 | |

| Bear Stearns Commercial Mortgage Securities, 5.20%, 12/1/38 | | | 1,000,000 | | | | 830,774 | |

| Bear Stearns Commercial Mortgage Securities, 4.95%, 2/11/41 | | | 283,975 | | | | 281,316 | |

| Bear Stearns Commercial Mortgage Securities, 5.12%, 2/11/41 | | | 1,000,000 | | | | 858,621 | |

| Bear Stearns Commercial Mortgage Securities, 4.67%, 6/11/41 | | | 1,000,000 | | | | 861,288 | |

| Bear Stearns Commercial Mortgage Securities, 5.54%, 9/11/41 | | | 2,000,000 | | | | 1,658,596 | |

| Bear Stearns Commercial Mortgage Securities, 4.56%, 2/13/42 | | | 1,000,000 | | | | 989,499 | |

| Bear Stearns Commercial Mortgage Securities, 5.74%, 9/11/42 | | | 1,000,000 | | | | 825,204 | |

| Bear Stearns Commercial Mortgage Securities, 5.13%, 10/12/42 | | | 1,125,000 | | | | 1,097,553 | |

| Bear Stearns Commercial Mortgage Securities, 5.61%, 6/11/50 | | | 1,000,000 | | | | 903,332 | |

| Bear Stearns Commercial Mortgage Securities, 4.52%, 11/11/41 | | | 500,000 | | | | 457,833 | |

| Chase Commercial Mortgage Securities Corp., 7.32%, 10/15/32 | | | 877,651 | | | | 895,969 | |

| First Union National Bank Commercial Mortgage, 6.22%, 12/12/33 | | | 500,000 | | | | 514,151 | |

| GE Capital Commercial Mortgage Corp., 6.53%, 5/15/33 | | | 850,000 | | | | 874,768 | |

| GMAC Commercial Mortgage Securities, 6.47%, 4/15/34 | | | 944,428 | | | | 960,179 | |

| Heller Financial Commercial Mortgage Asset Corp., 7.75%, 1/17/34 | | | 363,602 | | | | 364,892 | |

| JPMorgan Chase Commercial Mortgage Securities, 4.92%, 10/15/42 | | | 1,000,000 | | | | 850,264 | |

| JPMorgan Chase Commercial Mortgage Securities, 5.40%, 5/15/45 | | | 2,000,000 | | | | 1,584,492 | |

| JPMorgan Chase Commercial Mortgage Securities, 4.63%, 3/15/46 | | | 995,611 | | | | 974,601 | |

| JPMorgan Trust, 4.90%, 10/15/42 | | | 1,000,000 | | | | 830,008 | |

| Morgan Stanley Capital, 5.01%, 1/14/42 | | | 1,000,000 | | | | 929,050 | |

| Morgan Stanley Capital, 4.83%, 6/12/47 | | | 1,000,000 | | | | 918,593 | |

| Morgan Stanley Capital I, 5.93%, 12/15/35 | | | 1,225,000 | | | | 1,076,609 | |

| Morgan Stanley Capital I, 5.98%, 8/12/41 | | | 1,000,000 | | | | 845,959 | |

| PNC Mortgage Acceptance Corp., 7.51%, 12/10/32 | | | 2,000,000 | | | | 1,998,553 | |

| TOTAL COMMERCIAL MORTGAGE BACKED SECURITIES | | | | | | | 22,878,210 | |

| CORPORATE BONDS — 42.6% | | | | | | | | |

| ADVERTISING AGENCIES — 0.4% | | | | | | | | |

| Omnicom Group, Inc., 6.25%, 7/15/19 | | | 1,000,000 | | | | 981,020 | |

| AGRICULTURAL SERVICES — 0.6% | | | | | | | | |

| Cargill, Inc., 7.50%, 9/1/26 (a) | | | 1,250,000 | | | | 1,267,934 | |

| BANKING — 1.6% | | | | | | | | |

| Bank of New York Mellon Bank, 5.13%, 8/27/13 | | | 830,000 | | | | 873,653 | |

| Citigroup, Inc., 5.13%, 5/5/14 | | | 1,000,000 | | | | 910,346 | |

| Wells Fargo & Co., 5.25%, 10/23/12 | | | 1,250,000 | | | | 1,293,918 | |

| Wells Fargo & Co., 7.98%, 2/28/49+ | | | 500,000 | | | | 415,000 | |

| | | | | | | | 3,492,917 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| CORPORATE BONDS — 42.6%, continued | | | | | | |

| BEVERAGES — 0.5% | | | | | | |

| Bottling Group LLC, 5.13%, 1/15/19 | | $ | 1,000,000 | | | $ | 1,019,237 | |

| BROKERAGE SERVICES — 0.7% | | | | | | | | |

| Goldman Sachs Group, Inc., 6.88%, 1/15/11 | | | 500,000 | | | | 528,604 | |

| Morgan Stanley, 5.75%, 8/31/12 | | | 1,000,000 | | | | 1,033,219 | |

| | | | | | | | 1,561,823 | |

| BUILDING MATERIALS & CONSTRUCTION — 0.4% | | | | | | | | |

| Martin Marietta Material, 6.60%, 4/15/18 | | | 1,000,000 | | | | 950,736 | |

| COMMERCIAL BANKS — 0.7% | | | | | | | | |

| American Express Bank FSB, 5.55%, 10/17/12 | | | 630,000 | | | | 631,292 | |

| State Street Corp., 7.35%, 6/15/26 | | | 1,000,000 | | | | 1,013,209 | |

| | | | | | | | 1,644,501 | |

| COMPUTER & OFFICE EQUIPMENT — 0.4% | | | | | | | | |

| Xerox Corp., 6.35%, 5/15/18 | | | 1,000,000 | | | | 892,500 | |

| COMPUTER SERVICES — 0.5% | | | | | | | | |

| Dell, Inc., 5.63%, 4/15/14 | | | 500,000 | | | | 528,058 | |

| Dell, Inc., 4.70%, 4/15/13 | | | 500,000 | | | | 514,574 | |

| | | | | | | | 1,042,632 | |

| COSMETICS & TOILETRIES — 0.5% | | | | | | | | |

| Avon Products, Inc., 5.63%, 3/1/14 | | | 1,000,000 | | | | 1,057,003 | |

| DIVERSIFIED MANUFACTURING — 0.9% | | | | | | | | |

| Cooper US, Inc., 5.45%, 4/1/15 | | | 1,000,000 | | | | 992,599 | |

| Harsco Corp., 5.75%, 5/15/18 | | | 1,000,000 | | | | 981,584 | |

| | | | | | | | 1,974,183 | |

| ELECTRIC - INTEGRATED — 4.1% | | | | | | | | |

| Atlantic City Electric Co., 7.75%, 11/15/18 | | | 500,000 | | | | 590,593 | |

| Centerpoint Energy Houston, 7.00%, 3/1/14 | | | 750,000 | | | | 809,648 | |

| Consolidated Edison Co. of New York, 5.55%, 4/1/14 | | | 1,000,000 | | | | 1,065,851 | |

| Consumers Energy Co., 6.70%, 9/15/19 | | | 625,000 | | | | 680,259 | |

| Midamerican Energy Co., 6.75%, 12/30/31 | | | 1,500,000 | | | | 1,695,517 | |

| Pacific Gas & Electric Co., 8.25%, 10/15/18 | | | 500,000 | | | | 610,164 | |

| Portland General Electric, 6.10%, 4/15/19 | | | 1,100,000 | | | | 1,155,988 | |

| Potomac Electric Power, 6.50%, 11/15/37 | | | 1,000,000 | | | | 1,044,803 | |

| Puget Sound Energy, Inc., 6.74%, 6/15/18 | | | 1,000,000 | | | | 1,074,205 | |

| Transalta Corp., 6.65%, 5/15/18 | | | 500,000 | | | | 483,393 | |

| | | | | | | | 9,210,421 | |

| ELECTRIC SERVICES — 0.8% | | | | | | | | |

| AEP Texas North Co., Series B, 5.50%, 3/1/13 | | | 1,000,000 | | | | 1,019,508 | |

| FPL Energy Caithness Funding, 7.65%, 12/31/18 (a) | | | 656,213 | | | | 662,460 | |

| | | | | | | | 1,681,968 | |

| ELECTRONIC COMPONENTS - SEMICONDUCTORS — 0.2% | | | | | | | | |

| Applied Materials, Inc., 7.13%, 10/15/17 | | | 500,000 | | | | 519,388 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| CORPORATE BONDS — 42.6%, continued | | | | | | |

| FINANCE - AUTO LOANS — 1.2% | | | | | | |

| American Honda Finance, 4.63%, 4/2/13 | | $ | 1,500,000 | | | $ | 1,420,640 | |

| Ford Motor Credit Co., 7.25%, 10/25/11 | | | 1,000,000 | | | | 864,938 | |

| GMAC LLC, 6.75%, 12/1/14 (a) | | | 600,000 | | | | 471,000 | |

| | | | | | | | 2,756,578 | |

| FINANCIAL SERVICES — 3.0% | | | | | | | | |

| Charles Schwab Corp., 4.95%, 6/1/14 | | | 150,000 | | | | 152,576 | |

| Countrywide Financial Corp., 5.80%, 6/7/12 | | | 1,000,000 | | | | 1,006,231 | |

| Dun & Bradstreet Corp., 6.00%, 4/1/13 | | | 1,000,000 | | | | 1,002,515 | |

| ERAC USA Finance Co., 5.90%, 11/15/15 (a) | | | 1,000,000 | | | | 916,310 | |

| General Electric Capital Corp., 6.15%, 8/7/37 | | | 1,000,000 | | | | 823,710 | |

| JPMorgan Chase & Co., 4.75%, 5/1/13 | | | 1,000,000 | | | | 1,012,688 | |

| National Rural Utilities Corp., 10.38%, 11/1/18 | | | 780,000 | | | | 977,982 | |

| NYSE Euronext, 4.80%, 6/28/13 | | | 1,000,000 | | | | 1,035,166 | |

| | | | | | | | 6,927,178 | |

| FIRE, MARINE & CASUALTY INSURANCE — 0.4% | | | | | | | | |

| Berkley Corp., 5.13%, 9/30/10 | | | 1,000,000 | | | | 966,828 | |

| FOODS — 1.7% | | | | | | | | |

| General Mills, 5.65%, 9/10/12 | | | 936,000 | | | | 998,905 | |

| H.J. Heinz Co., 15.59%, 12/1/11 (a) | | | 850,000 | | | | 1,058,556 | |

| Kellogg Co., 4.25%, 3/3/13 | | | 1,000,000 | | | | 1,029,441 | |

| Pepsico, Inc., 7.90%, 11/1/18 | | | 500,000 | | | | 608,302 | |

| | | | | | | | 3,695,204 | |

| INSURANCE — 2.2% | | | | | | | | |

| AllState Life Global Funding Trust, 5.38%, 4/30/13 | | | 500,000 | | | | 516,993 | |

| American International Group, 6.25%, 5/1/36 | | | 1,000,000 | | | | 429,372 | |

| Chubb Corp., 6.50%, 5/15/38 | | | 500,000 | | | | 542,038 | |

| Fidelity National Title, 7.30%, 8/15/11 | | | 1,000,000 | | | | 992,570 | |

| Markel Corp., 6.80%, 2/15/13 | | | 1,000,000 | | | | 989,311 | |

| Met Life Global Funding I, 5.13%, 6/10/14 (a) | | | 500,000 | | | | 496,109 | |

| Principal Life Global, 6.25%, 2/15/12 (a) | | | 1,000,000 | | | | 1,005,640 | |

| | | | | | | | 4,972,033 | |

| INTERNAL COMBUSTION ENGINES, N.E.C. — 0.5% | | | | | | | | |

| Briggs & Stratton Corp., 8.88%, 3/15/11 | | | 1,000,000 | | | | 1,016,250 | |

| MEDIA — 0.7% | | | | | | | | |

| Comcast Corp., 5.70%, 5/15/18 | | | 500,000 | | | | 502,687 | |

| McGrawHill Companies, Inc., 5.38%, 11/15/12 | | | 1,000,000 | | | | 1,023,142 | |

| | | | | | | | 1,525,829 | |

| MEDICAL - BIOMEDICAL/GENETIC — 1.2% | | | | | | | | |

| Amgen, Inc., 5.70%, 2/1/19 | | | 500,000 | | | | 527,506 | |

| Biogen Idec, Inc., 6.00%, 3/1/13 | | | 500,000 | | | | 511,668 | |

| Johnson & Johnson, 5.95%, 8/15/37 | | | 500,000 | | | | 538,743 | |

| Roche Holdings, Inc., 6.00%, 3/1/19 (a) | | | 1,000,000 | | | | 1,066,280 | |

| | | | | | | | 2,644,197 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| CORPORATE BONDS — 42.6%, continued | | | | | | |

| MEDICAL - DRUGS — 2.0% | | | | | | |

| Abbott Laboratories, 5.13%, 4/1/19 | | $ | 1,000,000 | | | $ | 1,029,630 | |

| Express Scripts, Inc., 6.25%, 6/15/14 | | | 550,000 | | | | 581,959 | |

| McKesson Corp., 6.50%, 2/15/14 | | | 1,000,000 | | | | 1,066,919 | |

| Merck & Company, Inc., 4.00%, 6/30/15 | | | 500,000 | | | | 508,798 | |

| Novartis Capital Corp., 4.13%, 2/10/14 | | | 1,250,000 | | | | 1,286,712 | |

| | | | | | | | 4,474,018 | |

| MEDICAL EQUIPMENT & SUPPLIES — 0.4% | | | | | | | | |

| Beckman Coulter, Inc., 6.00%, 6/1/15 | | | 900,000 | | | | 942,899 | |

| NATURAL GAS PRODUCTION AND/OR DISTRIBUTION — 1.8% | | | | | | | | |

| Indiana Gas Co., 6.55%, 6/30/28 | | | 250,000 | | | | 224,280 | |

| Kinder Morgan Energy Partners, 5.63%, 2/15/15 | | | 500,000 | | | | 505,359 | |

| National Fuel Gas Co., 6.50%, 4/15/18 | | | 500,000 | | | | 488,211 | |

| Northern Natural Gas, 5.38%, 10/31/12 (a) | | | 1,000,000 | | | | 1,043,578 | |

| Sempra Energy, 6.50%, 6/1/16 | | | 600,000 | | | | 626,306 | |

| Southern Union Co., 8.25%, 11/15/29 | | | 1,050,000 | | | | 984,938 | |

| | | | | | | | 3,872,672 | |

| OIL & GAS EXPLORATION, PRODUCTION & SERVICES — 2.2% | | | | | | | | |

| Conoco, Inc., 6.95%, 4/15/29 | | | 1,075,000 | | | | 1,158,328 | |

| Devon Energy Corp., 5.63%, 1/15/14 | | | 500,000 | | | | 526,763 | |

| Motiva Enterprises LLC, 5.20%, 9/15/12 (a) | | | 1,000,000 | | | | 1,026,372 | |

| Ras Laffan, 5.83%, 9/30/16 (a) | | | 1,000,000 | | | | 980,590 | |

| XTO Energy, Inc., 7.50%, 4/15/12 | | | 1,000,000 | | | | 1,107,748 | |

| | | | | | | | 4,799,801 | |

| OIL COMPOSITION - INTEGRATED — 0.5% | | | | | | | | |

| Shell International Finance, 4.00%, 3/21/14 | | | 1,000,000 | | | | 1,026,826 | |

| PUBLISHING - JOURNALS — 0.8% | | | | | | | | |

| Thomson Corp., 6.20%, 1/5/12 | | | 1,200,000 | | | | 1,249,922 | |

| Washington Post Co., 7.25%, 2/1/19 | | | 575,000 | | | | 598,272 | |

| | | | | | | | 1,848,194 | |

| REAL ESTATE INVESTMENT TRUST — 0.6% | | | | | | | | |

| Simon Property Group, 6.35%, 8/28/12 | | | 1,200,000 | | | | 1,220,591 | |

| RESTAURANTS — 0.5% | | | | | | | | |

| YUM! Brands, Inc., 8.88%, 4/15/11 | | | 1,000,000 | | | | 1,091,588 | |

| RETAIL - BUILDING PRODUCTS — 0.9% | | | | | | | | |

| Home Depot, Inc., 5.25%, 12/16/13 | | | 500,000 | | | | 513,724 | |

| Home Depot, Inc., 5.40%, 3/1/16 | | | 500,000 | | | | 499,111 | |

| Lowe's Companies, Inc., 6.50%, 3/15/29 | | | 1,000,000 | | | | 1,021,464 | |

| | | | | | | | 2,034,299 | |

| RETAIL - DISCOUNT — 0.8% | | | | | | | | |

| Wal-Mart Stores, Inc., 7.55%, 2/15/30 | | | 1,000,000 | | | | 1,269,886 | |

| Wal-Mart Stores, Inc., 3.20%, 5/15/14 | | | 500,000 | | | | 495,899 | |

| | | | 1,500,000 | | | | 1,765,785 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| CORPORATE BONDS — 42.6%, continued | | | | | | |

| RETAIL - FOOD — 0.3% | | | | | | |

| Kroger Co., 7.50%, 1/15/14 | | $ | 500,000 | | | $ | 559,485 | |

| RETAIL - OFFICE SUPPLIES — 0.3% | | | | | | | | |

| Staples, Inc., 9.75%, 1/15/14 | | | 500,000 | | | | 558,465 | |

| SEMICONDUCTOR EQUIPMENT — 0.6% | | | | | | | | |

| Analog Devices, 5.00%, 7/1/14 | | | 500,000 | | | | 500,854 | |

| KLA Instruments Corp., 6.90%, 5/1/18 | | | 1,000,000 | | | | 899,074 | |

| | | | | | | | 1,399,928 | |

| SUPRANATIONAL BANK — 1.4% | | | | | | | | |

| Corporation Andina de Fomento, 5.20%, 5/21/13 | | | 1,000,000 | | | | 1,004,531 | |

| IFFIM, 5.00%, 11/14/11 (a) | | | 1,000,000 | | | | 1,041,433 | |

| Inter-American Development Bank, 3.50%, 3/15/13 | | | 1,000,000 | | | | 1,028,330 | |

| | | | | | | | 3,074,294 | |

| TELECOMMUNICATIONS — 0.5% | | | | | | | | |

| Embarq Corp., 6.74%, 6/1/13 | | | 1,000,000 | | | | 1,009,441 | |

| TELEPHONE - INTEGRATED — 1.9% | | | | | | | | |

| AT&T, Inc., 4.95%, 1/15/13 | | | 1,000,000 | | | | 1,040,006 | |

| Sprint Capital Corp., 7.63%, 1/30/11 | | | 1,000,000 | | | | 988,750 | |

| Verizon Communications, 7.35%, 4/1/39 | | | 1,000,000 | | | | 1,089,652 | |

| Verizon Communications, Inc., 5.50%, 4/1/17 | | | 1,000,000 | | | | 1,001,717 | |

| | | | | | | | 4,120,125 | |

| TOOLS & HARDWARE — 0.4% | | | | | | | | |

| Stanley Works, 6.15%, 10/1/13 | | | 725,000 | | | | 778,413 | |

| TRANSPORTATION SERVICES — 2.1% | | | | | | | | |

| Canadian National Railways, 4.40%, 3/15/13 | | | 1,000,000 | | | | 1,021,890 | |

| CSX Transportation, Inc., 8.38%, 10/15/14 | | | 480,519 | | | | 529,512 | |

| GATX Corp., 9.00%, 11/15/13 | | | 460,883 | | | | 482,102 | |

| Golden State Petroleum Transportation, 8.04%, 2/1/19 | | | 920,024 | | | | 891,172 | |

| Paccar, Inc., 6.88%, 2/15/14 | | | 760,000 | | | | 832,336 | |

| TTX Co., 4.90%, 3/1/15 (a) | | | 1,000,000 | | | | 847,849 | |

| | | | | | | | 4,604,861 | |

| UTILITIES — 0.4% | | | | | | | | |

| American Water Cap Corp., 6.09%, 10/15/17 | | | 1,000,000 | | | | 960,067 | |

| UTILITIES - NATURAL GAS — 1.0% | | | | | | | | |

| Michigan Consolidated Gas Co., 8.25%, 5/1/14 | | | 1,000,000 | | | | 1,134,901 | |

| Vectren Utility Holdings, 6.63%, 12/1/11 | | | 1,000,000 | | | | 1,048,503 | |

| | | | | | | | 2,183,404 | |

| TOTAL CORPORATE BONDS | | | | | | | 94,125,516 | |

| FOREIGN BOND — 0.5% | | | | | | | | |

| Ontario (Providence of), 4.10%, 6/16/14 | | | 1,000,000 | | | | 1,019,809 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| CORPORATE NOTES — 1.1% | | | | | | |

| COMMUNITY DEVELOPMENT — 1.1% | | | | | | |

| MMA Community Development Investment, Inc., 0.84%, 12/31/09 (b)+ | | $ | 910,000 | | | $ | 910,000 | |

| MMA Community Development Investment, Inc., 1.26%, 12/31/09 (b)+ | | | 1,605,000 | | | | 1,605,000 | |

| TOTAL CORPORATE NOTES | | | | | | | 2,515,000 | |

| INTEREST ONLY BONDS — 0.1% | | | | | | | | |

| FREDDIE MAC — 0.0% | | | | | | | | |

| 5.00%, 4/15/29 | | | 2,000,000 | | | | 173,697 | |

| GOVERNMENT NATIONAL MORTGAGE ASSOC. — 0.1% | | | | | | | | |

| 1.03%, 4/16/27 | | | 6,840,186 | | | | 146,959 | |

| TOTAL INTEREST ONLY BONDS | | | 8,840,186 | | | | 320,656 | |

| MUNICIPAL BONDS — 0.5% | | | | | | | | |

| LL&P Wind Energy, Inc. Washington Rev., 5.73%, 12/1/17 | | | 1,000,000 | | | | 1,007,590 | |

| U.S. GOVERNMENT AGENCIES — 41.3% | | | | | | | | |

| FANNIE MAE — 15.9% | | | | | | | | |

| 7.25%, 1/15/10 | | | 3,450,000 | | | | 3,578,885 | |

| 4.13%, 4/15/14 | | | 900,000 | | | | 953,143 | |

| 7.00%, 7/1/15 | | | 6,704 | | | | 7,385 | |

| 5.00%, 2/13/17 | | | 1,000,000 | | | | 1,091,111 | |

| 5.00%, 7/1/18 | | | 631,649 | | | | 661,415 | |

| 5.00%, 9/1/18 | | | 847,528 | | | | 887,468 | |

| 7.00%, 11/1/19 | | | 84,368 | | | | 92,745 | |

| 7.00%, 11/1/19 | | | 52,259 | | | | 57,448 | |

| 5.50%, 6/1/22 | | | 1,481,749 | | | | 1,553,892 | |

| 5.00%, 4/1/25 | | | 1,455,386 | | | | 1,491,490 | |

| 5.00%, 7/1/25 | | | 1,290,731 | | | | 1,322,751 | |

| 5.00%, 10/1/25 | | | 1,576,359 | | | | 1,615,465 | |

| 5.50%, 11/1/25 | | | 416 | | | | 433 | |

| 8.50%, 9/1/26 | | | 236,931 | | | | 259,257 | |

| 6.63%, 11/15/30 | | | 3,750,000 | | | | 4,592,907 | |

| 4.90%, 6/1/33 | | | 190,002 | | | | 195,119 | |

| 6.00%, 10/1/33 | | | 427,465 | | | | 447,244 | |

| 5.08%, 2/1/34 | | | 486,153 | | | | 490,792 | |

| 5.50%, 2/4/34 | | | 826,451 | | | | 854,207 | |

| 4.18%, 5/1/34 | | | 441,046 | | | | 441,761 | |

| 6.00%, 11/1/34 | | | 1,703,280 | | | | 1,782,091 | |

| 5.50%, 1/1/35 | | | 1,646,095 | | | | 1,707,035 | |

| 5.00%, 10/1/35 | | | 2,041,902 | | | | 2,082,021 | |

| 5.50%, 10/1/35 | | | 2,433,162 | | | | 2,520,960 | |

| 6.00%, 10/1/35 | | | 1,084,453 | | | | 1,134,631 | |

| 6.00%, 6/1/36 | | | 1,136,391 | | | | 1,188,972 | |

| 5.50%, 11/1/36 | | | 2,042,708 | | | | 2,111,311 | |

| 5.43%, 5/1/37 | | | 1,997,596 | | | | 2,087,081 | |

| | | | | | | | 35,209,020 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| U.S. GOVERNMENT AGENCIES — 41.3%, continued | | | | | | |

| FDIC GUARANTEED — 2.2% | | | | | | |

| General Electric Capital Corp., 1.63%, 1/7/11 | | $ | 1,400,000 | | | $ | 1,413,483 | |

| General Electric Capital Corp., 2.20%, 6/8/12 | | | 175,000 | | | | 175,897 | |

| JPMorgan Chase & Co., 2.63%, 12/1/10 | | | 1,000,000 | | | | 1,024,260 | |

| PNC Funding Corp., 1.88%, 6/22/11 | | | 650,000 | | | | 654,674 | |

| Regions Bank, 3.25%, 12/9/11 | | | 1,500,000 | | | | 1,556,349 | |

| | | | | | | | 4,824,663 | |

| FEDERAL FARM CREDIT BANK — 1.0% | | | | | | | | |

| 4.88%, 12/16/15 | | | 2,000,000 | | | | 2,151,722 | |

| FEDERAL HOME LOAN BANK — 3.0% | | | | | | | | |

| 4.13%, 8/13/10 | | | 1,000,000 | | | | 1,039,128 | |

| 6.63%, 11/15/10 | | | 900,000 | | | | 970,821 | |

| 3.88%, 6/14/13 | | | 300,000 | | | | 314,620 | |

| 5.00%, 11/17/17 | | | 4,000,000 | | | | 4,256,456 | |

| | | | | | | | 6,581,025 | |

| FREDDIE MAC — 16.9% | | | | | | | | |

| 4.13%, 7/12/10 | | | 1,987,000 | | | | 2,064,406 | |

| 6.88%, 9/15/10 | | | 1,081,000 | | | | 1,156,840 | |

| 6.00%, 9/1/17 | | | 793,830 | | | | 840,418 | |

| 4.50%, 6/1/18 | | | 1,204,727 | | | | 1,249,477 | |

| 3.75%, 3/27/19 | | | 2,500,000 | | | | 2,456,610 | |

| 5.00%, 4/1/19 | | | 1,240,875 | | | | 1,294,698 | |

| 5.00%, 12/1/21 | | | 2,140,802 | | | | 2,223,624 | |

| 5.00%, 12/10/21 | | | 2,625,000 | | | | 2,776,027 | |

| 5.50%, 4/1/22 | | | 2,025,075 | | | | 2,119,557 | |

| 6.00%, 4/1/27 | | | 1,963,109 | | | | 2,064,281 | |

| 7.00%, 2/1/30 | | | 330,079 | | | | 355,295 | |

| 7.50%, 7/1/30 | | | 547,597 | | | | 589,075 | |

| 7.00%, 3/1/31 | | | 305,628 | | | | 328,977 | |

| 5.00%, 2/15/32 | | | 2,000,000 | | | | 2,065,800 | |

| 5.50%, 11/1/33 | | | 935,746 | | | | 970,681 | |

| 3.75%, 5/1/34 | | | 270,534 | | | | 274,080 | |

| 3.76%, 5/1/34 | | | 514,484 | | | | 521,210 | |

| 5.00%, 7/1/35 | | | 1,978,598 | | | | 2,020,257 | |

| 5.50%, 3/1/36 | | | 1,295,425 | | | | 1,341,764 | |

| 5.50%, 6/1/36 | | | 1,831,794 | | | | 1,894,744 | |

| 5.50%, 6/1/36 | | | 1,987,747 | | | | 2,055,746 | |

| 6.00%, 6/1/36 | | | 1,316,398 | | | | 1,376,484 | |

| 5.50%, 12/1/36 | | | 1,948,236 | | | | 2,014,883 | |

| 5.50%, 12/1/36 | | | 1,985,045 | | | | 2,052,951 | |

| 6.00%, 8/1/37 | | | 1,293,022 | | | | 1,351,031 | |

| | | | | | | | 37,458,916 | |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | PRINCIPAL AMOUNT | | | VALUE | |

| U.S. GOVERNMENT AGENCIES — 41.3%, continued | | | | | | |

| GOVERNMENT NATIONAL MORTGAGE ASSOC. — 2.0% | | | | | | |

| 6.75%, 4/15/16 | | $ | 59,859 | | | $ | 64,270 | |

| 7.00%, 12/20/30 | | | 95,959 | | | | 102,711 | |

| 7.00%, 10/20/31 | | | 63,564 | | | | 68,036 | |

| 7.00%, 3/20/32 | | | 222,415 | | | | 238,064 | |

| 5.50%, 1/20/34 | | | 205,644 | | | | 209,586 | |

| 5.50%, 10/20/38 | | | 2,783,836 | | | | 2,873,006 | |

| 6.50%, 11/20/38 | | | 785,142 | | | | 817,284 | |

| | | | | | | | 4,372,957 | |

| SMALL BUSINESS ADMINISTRATION — 0.3% | | | | | | | | |

| 1.00%, 9/25/18 | | | 75,494 | | | | 74,752 | |

| 5.60%, 2/25/32 | | | 687,807 | | | | 672,957 | |

| | | | | | | | 747,709 | |

| TOTAL U.S. GOVERNMENT AGENCIES | | | | | | | 91,346,012 | |

| | | | | | | | | |

| MUTUAL FUND — 0.5% | | | | | | | | |

| Pax World High Yield Fund | | | 167,685 | | | | 1,185,535 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT — 1.7% | | | | | | | | |

| JPMorgan U.S. Government Money Market Fund | | | 3,817,617 | | | | 3,817,617 | |

| TOTAL INVESTMENTS (Cost* $218,505,197) — 99.3% | | | | | | $ | 219,664,754 | |

| Other assets in excess of liabilities — 0.7% | | | | | | | 1,585,286 | |

| NET ASSETS — 100.0% | | | | | | $ | 221,250,040 | |

_____________

| (a) | 144A security is restricted as to resale to institutional investors. These securities have been deemed liquid under guidelines established by the Board of Trustees. At June 30, 2009, these securities were valued at $11,975,946 or 5.4% of net assets. |

| (b) | Represents affiliated restricted security as to resale to shareholders and is not registered under the Securities Act of 1933. These securities have been deemed illiquid under guidelines established by the Board of Trustees. Acquisition date and current cost: MMA Community Development Investment, Inc., 0.84% - 12/2001, $910,000 and MMA Community Development Investment, Inc., 1.26% - 12/2001, $1,605,000. At June 30, 2009 these securities had an aggregate market value of $2,515,000, representing 1.1% of net assets. |

| + | Variable rate security. Rates presented are the rates in effect at June 30, 2009. |

| * | Represents cost for financial reporting purposes. |

MMA Praxis Intermediate Income Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bond | | $ | — | | | $ | 100,925,152 | | | $ | 2,515,000 | | | $ | 103,440,152 | |

| FHLMC | | | — | | | | 32,226,279 | | | | — | | | | 32,226,279 | |

| FNMA | | | — | | | | 34,928,833 | | | | — | | | | 34,928,833 | |

| Foreign Bond | | | — | | | | 1,019,809 | | | | — | | | | 1,019,809 | |

| GNMA | | | — | | | | 4,372,957 | | | | — | | | | 4,372,957 | |

| Government Bond | | | — | | | | 14,918,527 | | | | — | | | | 14,918,527 | |

| Interest Only Bond | | | — | | | | 320,657 | | | | — | | | | 320,657 | |

| Mutual Fund | | | 5,003,152 | | | | — | | | | — | | | | 5,003,152 | |

| Mortgage Related | | | — | | | | 22,426,798 | | | | — | | | | 22,426,798 | |

| Municipal Bond | | | — | | | | 1,007,590 | | | | — | | | | 1,007,590 | |

| | | | | | | | | | | | | | | $ | 219,664,754 | |

Following is a reconciliation of Level 3 assets for which significant unobservable inputs for Investments in Securities were used to determine fair value for the Fund:

| Balance as of December 31, 2008 | | $ | 2,515,000 | |

| Proceeds from Sales | | | — | |

| Balance as of June 30, 2009 | | $ | 2,515,000 | |

See accompanying notes to financial statements.

| MMA Praxis Core Stock Fund |

MMA Praxis Core Stock Fund

Annual report to shareholders

Portfolio managers’ letter

For the six-month period ended June 30, 2009, the Class A Shares of MMA Praxis Core Stock Fund returned 3.75 percent, outperforming its benchmark, the Standard & Poor’s 500 Index (Index), which returned 3.16 percent.

Factors affecting the Fund’s performance

The sectors within the S&P 500 Index that turned in the strongest performance over the six-month period were information technology, materials, and consumer discretionary. The sectors that turned in the weakest performance over the six-month period were Industrials, telecommunication Services, and Financials.

Consumer Staple companies were the most important detractors from performance. The Fund’s Consumer Staple companies underperformed the corresponding sector within the Index (down 10 percent versus down 2 percent for the Index). Fund holdings Costco and Procter & Gamble were among the most important detractors from performance.

Information Technology companies were the most important contributors to the Index, and they were also the most important contributors to the Fund. A lower relative average weighting in this strongly performing sector (10 percent versus 17 percent for the Index) was the most important detractor from relative performance. Texas Instruments, Microsoft, and Google were among the most important contributors to performance.

Health Care companies made important contributions to performance. The Fund’s Health Care companies outperformed the corresponding sector within the Index (up 16 percent versus roughly flat for the Index). Fund holding Schering Plough was among the most important contributors to performance.

The Fund’s investment in Industrial companies was the most important contributor to relative performance. While the Index’s industrial companies lost 6 percent, the Fund’s industrial companies gained 20 percent.

Individual companies (and fund holdings) making important contributions to performance included two Financial companies, Julius Baer and American Express, and an energy company, Canadian Natural Resources. Individual companies (and fund holdings) that were among the most important detractors from performance were two financial companies (and fund holdings), Wells Fargo and Berkshire Hathaway, and two energy companies, ConocoPhillips and Devon Energy.

The Fund held approximately 11 percent of assets in foreign companies (including American Depositary Receipts) at June 30, 2009. As a whole these companies outperformed the domestic companies held by the Fund.

Christopher C. Davis

Portfolio Manager and CEO of Davis Advisors

Kenneth C. Feinberg

Portfolio Manager

MMA Praxis Core Stock Fund

Performance review

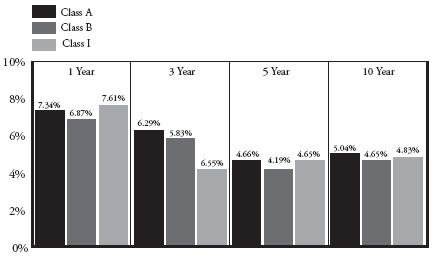

Average annual total returns as of 6/30/09

| | Inception

Date | 1 Year | 3 Year | 5 Year | 10 Year |

| Class A | 5/12/99 | -29.51% | -12.14% | -5.93% | -4.06% |

| Class A* | 5/12/99 | -33.22% | -13.71% | -6.94% | -4.57% |

| | | | | | |

| Class B | 1/4/94 | -30.05% | -12.75% | -6.57% | -4.61% |

| Class B** | 1/4/94 | -32.85% | -13.57% | -6.74% | -4.61% |

| | | | | | |

| Class I | 5/1/06 | -29.28% | -11.84% | -5.93% | -4.36% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.

| * | Reflects maximum front-end sales charge of 5.25%. |

| ** | Assumes redemption at the end of the stated period. The Fund imposes a back-end sales charge (load) on Class B Shares if you sell your shares before a certain period of time has elasped. This is called a Contingent Deferred Sales Charge (“CDSC”). The CDSC declines over five years starting with year one and ending in year six as follows: 4%, 4%, 3%, 2%, 1%. |

Class A Share and Class I Share of this Fund were not in existence prior to 5/12/99 and 5/1/06, respectively. Class A Share performance and Class I Share performance calculated for any period prior to 5/12/99 and 5/1/06 are based on the performance of Class B Share since inception of 1/4/94. The B Share Contingent Deferred Sales Charge (CDSC) does not apply to performance over 5 years; therefore, the 10-year return does not reflect the CDSC.

The total return set forth reflects certain expenses that were voluntarily reduced, reimbursed or paid by third party. In such instances, and without this activity, total return would have been lower.

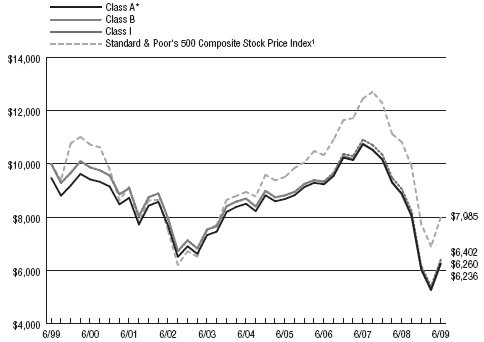

MMA Praxis Core Stock Fund

Performance review

Growth of $10,000 investment 6/30/99 to 6/30/09

For performance purposes, the above graph has not been adjusted for CDSC charges.

This chart represents historical performance of a hypothetical investment of $10,000 in the Core Stock Fund from 6/30/99 to 6/30/09, and represents the reinvestment of dividends and capital gains in the Fund.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.

The total return set forth reflects certain expenses that were voluntarily reduced, reimbursed or paid by third party. In such instances, and without this activity, total return would have been lower.

| * | Reflects maximum front-end sales charge of 5.25%. |

Class A Share and Class I Share of this Fund were not in existence prior to 5/12/99 and 5/1/06, respectively. Class A Share performance and Class I Share performance calculated for any period prior to 5/12/99 and 5/1/06 are based on the performance of Class B Share since inception of 1/4/94. The B Share Contingent Deferred Sales Charge (CDSC) does not apply to performance over 5 years; therefore, the 10-year return does not reflect the CDSC.

| 1 | The Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) is a widely recognized, unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. |

The above index is for illustrative purposes only and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The fund's performance reflects the deduction of these value-added services. An investor cannot invest directly in an index, although they can invest in its underlying securities.

| Schedule of portfolio investments |

MMA Praxis Core Stock Fund

Schedule of portfolio investments

June 30, 2009 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS — 96.9% | | | | | | |

| AUTOMOBILES — 1.7% | | | | | | |

| CarMax, Inc. (a) | | | 67,100 | | | $ | 986,370 | |

| Harley-Davidson, Inc. | | | 88,200 | | | | 1,429,722 | |

| PACCAR, Inc. | | | 16,310 | | | | 530,238 | |

| | | | | | | | 2,946,330 | |

| BANKS — 6.5% | | | | | | | | |

| Bank of New York Mellon Corp. | | | 122,800 | | | | 3,599,268 | |

| Wells Fargo & Co. | | | 303,558 | | | | 7,364,316 | |

| | | | | | | | 10,963,584 | |

| BROADCASTING/CABLE — 2.8% | | | | | | | | |

| Comcast Corp., Class A | | | 216,750 | | | | 3,056,175 | |

| Grupo Televisa S.A. - ADR (Mexico) | | | 96,600 | | | | 1,642,200 | |

| | | | | | | | 4,698,375 | |

| BROKERAGE SERVICES — 0.6% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 7,280 | | | | 1,073,363 | |

| BUILDING MATERIALS & CONSTRUCTION — 0.6% | | | | | | | | |

| Vulcan Materials Co. | | | 24,200 | | | | 1,043,020 | |

| BUSINESS SERVICES — 2.2% | | | | | | | | |

| Iron Mountain, Inc. (a) | | | 133,300 | | | | 3,832,375 | |

| CAPITAL MARKETS — 1.9% | | | | | | | | |

| Julius Baer Holding AG (Switzerland) | | | 81,800 | | | | 3,175,924 | |

| COMPUTER EQUIPMENT & SERVICES — 3.3% | | | | | | | | |

| Google, Inc., Class A (a) | | | 13,460 | | | | 5,674,601 | |

| COMPUTERS & PERIPHERALS — 2.1% | | | | | | | | |

| Cisco Systems, Inc. (a) | | | 65,200 | | | | 1,215,328 | |

| Hewlett-Packard Co. | | | 60,250 | | | | 2,328,663 | |

| | | | | | | | 3,543,991 | |

| CONSTRUCTION — 1.1% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 23,700 | | | | 1,869,456 | |

| CONSUMER FINANCIAL SERVICES — 4.0% | | | | | | | | |

| American Express Co. | | | 247,800 | | | | 5,758,872 | |

| H&R Block, Inc. | | | 65,150 | | | | 1,122,535 | |

| | | | | | | | 6,881,407 | |

| CONSUMER GOODS & SERVICES — 4.1% | | | | | | | | |

| Procter & Gamble Co. | | | 133,200 | | | | 6,806,520 | |

| CONTAINERS - PAPER & PLASTIC — 2.0% | | | | | | | | |

| Sealed Air Corp. | | | 187,800 | | | | 3,464,910 | |

| E-COMMERCE — 0.6% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 10,400 | | | | 870,064 | |

| Liberty Media Corp - Interactive, Class A (a) | | | 44,175 | | | | 221,317 | |

| | | | | | | | 1,091,381 | |

MMA Praxis Core Stock Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS — 96.9%, continued | | | | | | |

| ELECTRIC SERVICES — 0.2% | | | | | | |

| AES Corp. (a) | | | 31,600 | | | $ | 366,876 | |

| ELECTRONIC & ELECTRICAL - GENERAL — 1.9% | | | | | | | | |

| Texas Instruments, Inc. | | | 152,600 | | | | 3,250,380 | |

| ENERGY — 0.9% | | | | | | | | |

| Transocean Ltd. (Switzerland) (a) | | | 21,755 | | | | 1,616,179 | |

| FINANCIAL SERVICES — 4.5% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 45,500 | | | | 1,104,285 | |

| JPMorgan Chase & Co. | | | 141,200 | | | | 4,816,332 | |

| Moody's Corp. | | | 59,200 | | | | 1,559,920 | |

| | | | | | | | 7,480,537 | |

| FOOD, BEVERAGE & TOBACCO — 0.6% | | | | | | | | |

| The Coca-Cola Co. | | | 12,400 | | | | 595,076 | |

| The Hershey Co. | | | 12,900 | | | | 464,400 | |

| | | | | | | | 1,059,476 | |

| HEALTH CARE EQUIPMENT & SERVICES — 1.9% | | | | | | | | |

| Becton, Dickinson & Co. | | | 18,500 | | | | 1,319,235 | |

| Laboratory Corp. of America Holdings (a) | | | 6,900 | | | | 467,751 | |

| UnitedHealth Group, Inc. | | | 58,800 | | | | 1,468,824 | |

| | | | | | | | 3,255,810 | |

| HOME FURNISHINGS — 0.2% | | | | | | | | |

| Hunter Douglas N.V. (Netherlands) | | | 8,300 | | | | 338,871 | |

| INSURANCE — 11.4% | | | | | | | | |

| American International Group, Inc. (a) | | | 104,200 | | | | 120,872 | |

| Berkshire Hathaway, Inc., Class A (a) | | | 90 | | | | 8,100,001 | |

| Loews Corp. | | | 138,300 | | | | 3,789,420 | |

| Markel Corp. (a) | | | 590 | | | | 166,203 | |

| NIPPONKOA Insurance Co. (Japan) | | | 39,500 | | | | 230,459 | |

| Principal Financial Group, Inc. | | | 16,600 | | | | 312,744 | |

| Sun Life Financial, Inc. (Canada) | | | 11,600 | | | | 312,272 | |

| The Hartford Financial Services Group, Inc. | | | 40,300 | | | | 478,361 | |

| The Progressive Corp. (a) | | | 240,500 | | | | 3,633,955 | |

| Transatlantic Holdings, Inc. | | | 48,410 | | | | 2,097,605 | |

| | | | | | | | 19,241,892 | |

| MANUFACTURING — 1.2% | | | | | | | | |

| ABB LTD. (Switzerland) | | | 41,040 | | | | 647,611 | |

| Tyco International Ltd. (Bermuda) | | | 52,990 | | | | 1,376,680 | |

| | | | | | | | 2,024,291 | |

| MATERIALS — 1.0% | | | | | | | | |

| Potash Corp. of Saskatchewan, Inc. | | | 4,627 | | | | 430,542 | |

| Sino-Forest Corp., Class A (Canada) (a) | | | 113,860 | | | | 1,213,672 | |

| | | | | | | | 1,644,214 | |

MMA Praxis Core Stock Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS — 96.9%, continued | | | | | | |

| MEDIA — 0.6% | | | | | | |

| Liberty Media Corp - Entertainment, Series A (a) | | | 36,240 | | | $ | 969,420 | |

| METAL MINING — 0.2% | | | | | | | | |

| Rio Tinto plc (United Kingdom) | | | 12,000 | | | | 415,563 | |

| MINERALS — 0.4% | | | | | | | | |

| BHP Billiton plc (United Kingdom) | | | 33,700 | | | | 756,219 | |

| MULTIMEDIA — 1.8% | | | | | | | | |

| News Corp., Class A | | | 208,600 | | | | 1,900,346 | |

| The Walt Disney Co. | | | 52,600 | | | | 1,227,158 | |

| | | | | | | | 3,127,504 | |

| OIL & GAS EXPLORATION, PRODUCTION & SERVICES — 9.9% | | | | | | | | |

| Canadian Natural Resources Ltd. (Canada) | | | 70,400 | | | | 3,695,296 | |

| ConocoPhillips | | | 79,450 | | | | 3,341,667 | |

| Devon Energy Corp. | | | 88,600 | | | | 4,828,700 | |

| EOG Resources, Inc. | | | 74,800 | | | | 5,080,416 | |

| | | | | | | | 16,946,079 | |

| PHARMACEUTICALS — 9.5% | | | | | | | | |

| Cardinal Health, Inc. | | | 42,130 | | | | 1,287,072 | |

| Express Scripts, Inc. (a) | | | 32,100 | | | | 2,206,875 | |

| Johnson & Johnson | | | 66,100 | | | | 3,754,480 | |

| Merck & Co., Inc. | | | 56,500 | | | | 1,579,740 | |

| Schering-Plough Corp. | | | 290,300 | | | | 7,292,336 | |

| | | | | | | | 16,120,503 | |

| REAL ESTATE — 1.3% | | | | | | | | |

| Brookfield Asset Management, Inc., Class A (Canada) | | | 43,600 | | | | 744,252 | |

| Hang Lung Group Ltd. (Hong Kong) | | | 313,000 | | | | 1,474,091 | |

| | | | | | | | 2,218,343 | |

| RETAIL — 10.3% | | | | | | | | |

| Bed Bath & Beyond, Inc. (a) | | | 68,900 | | | | 2,118,675 | |

| Costco Wholesale Corp. | | | 244,400 | | | | 11,169,080 | |

| CVS Caremark Corp. | | | 128,622 | | | | 4,099,183 | |

| | | | | | | | 17,386,938 | |

| SOFTWARE & COMPUTER SERVICES — 2.2% | | | | | | | | |

| Microsoft Corp. | | | 139,500 | | | | 3,315,915 | |

| Visa Inc., Class A | | | 7,170 | | | | 446,404 | |

| | | | | | | | 3,762,319 | |

| SOFTWARE & SERVICES — 0.6% | | | | | | | | |

| Activision Blizzard, Inc. (a) | | | 81,500 | | | | 1,029,345 | |

MMA Praxis Core Stock Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

| | | SHARES | | | VALUE | |

| COMMON STOCKS — 96.9%, continued | | | | | | |

| TRANSPORTATION SERVICES — 2.8% | | | | | | |

| China Merchants Holdings International Company Ltd. (Hong Kong) | | | 618,525 | | | $ | 1,783,700 | |

| China Shipping Development Company Ltd. (China) | | | 472,000 | | | | 609,017 | |

| Cosco Pacific Ltd. (Bermuda) | | | 408,000 | | | | 459,580 | |

| Kuehne & Nagel International AG (Switzerland) | | | 12,600 | | | | 986,985 | |

| United Parcel Service, Inc., Class B | | | 19,400 | | | | 969,806 | |

| | | | | | | | 4,809,088 | |

| TOTAL COMMON STOCKS | | | | | | | 164,885,084 | |

| | | | | | | | | |

| RIGHT — 0.0% | | | | | | | | |

| Rio Tinto plc NPR (a) (United Kingdom) | | | 6,300 | | | | 72,344 | |

| | | | | | | | | |

| SHORT TERM INVESTMENT — 0.0% | | | | | | | | |

| JPMorgan U.S. Government Money Market Fund | | | 25,897 | | | | 25,897 | |

| | | | | | | | | |

| COMMERCIAL PAPER — 3.0% | | | | | | | | |

| Societe Generale North America CP, .16%, 7/1/09 | | | 5,070,000 | | | | 5,070,000 | |

| | | | | | | | | |

| CORPORATE NOTES — 1.7% | | | | | | | | |

| COMMUNITY DEVELOPMENT — 1.7% | | | | | | | | |

| MMA Community Development Investment, Inc., .84%, 12/31/09 (b)+ | | | 903,000 | | | | 903,000 | |

| MMA Community Development Investment, Inc., 1.26%, 12/31/09 (b)+ | | | 2,032,000 | | | | 2,032,000 | |

| TOTAL CORPORATE NOTES | | | | | | | 2,935,000 | |

| | | | | | | | | |

| CORPORATE BONDS — 0.6% | | | | | | | | |

| AUTOMOBILES — 0.6% | | | | | | | | |

| Harley-Davidson, Inc., 15.00%, 2/1/14 | | | 1,000,000 | | | | 1,053,397 | |

| TOTAL INVESTMENTS (Cost*216,244,885) — 102.2% | | | | | | $ | 174,041,722 | |

| Other liabilities in excess of assets — (2.2%) | | | | | | | (3,704,525 | ) |

| NET ASSETS — 100.0% | | | | | | $ | 170,337,197 | |

_____________

| (a) | Non-income producing securities. |

| (b) | Represents affiliated restricted security as to resale to shareholders and is not registered under the Securities Act of 1933. These securities have been deemed illiquid under guidelines established by the Board of Trustees. Acquisition date and current cost: MMA Community Development Investment, Inc., 0.84% - 12/2001, $903,000 and MMA Community Development Investment, Inc., 1.26% - 12/2001, $2,032,000. At June 30, 2009, these securities had an aggregate market value of $2,935,000, representing 1.7% of net assets. |

| + | Variable rate security. Rates presented are the rates in effect at June 30, 2009. |

| * | Represents cost for financial reporting purposes. |

ADR – American Depository Receipt

plc – Public Liability Company

MMA Praxis Core Stock Fund

Schedule of portfolio investments, continued

June 30, 2009 (Unaudited)

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

Valuation Inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Commerical Paper | | $ | — | | | $ | 5,070,000 | | | $ | — | | | $ | 5,070,000 | |

| Common Stock | | | 153,441,003 | | | | — | | | | — | | | | 153,441,003 | |

| Corporate Bond | | | — | | | | 1,053,397 | | | | 2,935,000 | | | | 3,988,397 | |

| Foreign Stock | | | 11,444,081 | | | | — | | | | — | | | | 11,444,081 | |

| Mutual Fund | | | 25,897 | | | | — | | | | — | | | | 25,897 | |

| Right | | | 72,344 | | | | — | | | | — | | | | 72,344 | |

| | | | | | | | | | | | | | | $ | 174,041,722 | |

Following is a reconciliation of Level 3 assets for which significant unobservable inputs for Investments in Securities were used to determine fair value for the Fund:

| Balance as of December 31, 2008 | | $ | 2,935,000 | |

| Proceeds from Sales | | | — | |

| Balance as of June 30, 2009 | | $ | 2,935,000 | |

See accompanying notes to financial statements.

| MMA Praxis Value Index Fund |

MMA Praxis Value Index Fund

Annual report to shareholders

Portfolio manager’s letter

What a difference a few months makes. In January, we wrote about how nearly all stocks, regardless of the financial strength of the company, declined in the midst of a massive market sell-off during the second half of 2008. A credit-induced financial crisis quickly morphed into a full-blown recession complete with declining economic activity and quickly rising unemployment. The market malaise continued until early March of this year when, at a point when prospects seemed most dim, equity markets began to surge higher.

The second quarter saw an equal opportunity equity rally with the growth style and value style indexes rising in tandem. For the full first half of the year, however, the growth style handily beat out the value style among large and medium capitalization stocks.

Despite the strong rally during the March to May period, the Fund’s A shares declined 0.52 percent during the first half of the year, outperforming the MSCI US Prime Market Value Index, which declined 2.49 percent.

The Fund’s overweight position in several financial industries and underweight to the energy sector contributed to its outperformance during the period. Despite the continuing challenges in the global financial system, many financial stocks recovered during the period, even though many remain at prices significantly below where they were a year ago. Energy stocks, which generally held up somewhat better last year, did not recover nearly as dramatically as other parts of the market during the first half of 2009. Both of these phenomena contributed to the positive relative performance of the Fund.

Chad Horning, CFA®

MMA Praxis Value Index Fund Manager

MMA Praxis Value Index Fund

Performance review

Average annual total returns as of 6/30/09

| | Inception

Date | 1 Year | 3 Year | 5 Year | Since

Inception |

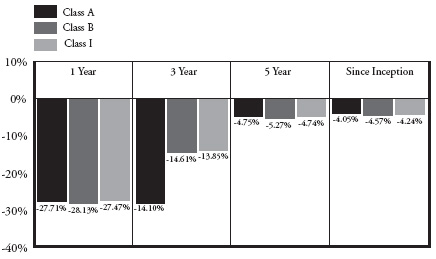

| Class A | 5/1/01 | -27.71% | -14.10% | -4.75% | -4.05% |

| Class A* | 5/1/01 | -31.54% | -15.64% | -5.77% | -4.68% |

| | | | | | |

| Class B | 5/1/01 | -28.13% | -14.61% | -5.27% | -4.57% |

| Class B** | 5/1/01 | -30.92% | -15.37% | -5.43% | -4.57% |

| | | | | | |

| Class I | 5/1/06 | -27.47% | -13.85% | -4.74% | -4.24% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.

| * | Reflects maximum front-end sales charge of 5.25%. |

| ** | Assumes redemption at the end of the stated period. The Fund imposes a back-end sales charge (load) on Class B Shares if you sell your shares before a certain period of time has elasped. This is called a Contingent Deferred Sales Charge (“CDSC”). The CDSC declines over five years starting with year one and ending in year six as follows: 4%, 4%, 3%, 2%, 1%. |

Class I Share of this Fund was not in existence prior to 5/1/06. Class I Share performance calculated for any period prior to 5/1/06 is based on the performance of Class B Share since inception of 5/1/01.

The total return set forth reflects certain expenses that were voluntarily reduced, reimbursed or paid by third party. In such instances, and without this activity, total return would have been lower.

MMA Praxis Value Index Fund

Performance review

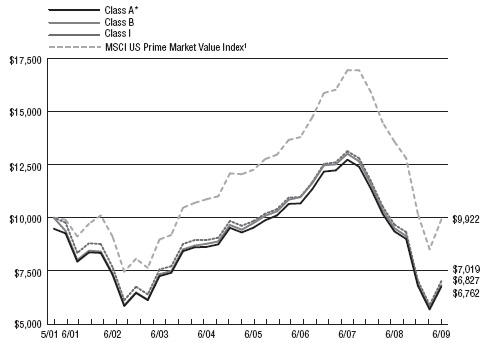

Growth of $10,000 investment 5/1/01 to 6/30/09

This chart represents historical performance of a hypothetical investment of $10,000 in the Value Index Fund from 5/1/01 to 6/30/09, and represents the reinvestment of dividends and capital gains in the Fund.

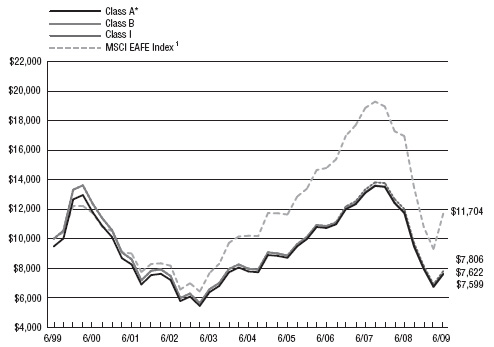

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit mmapraxis.com.