UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8056

Praxis Mutual Funds

(Exact name of registrant as specified in charter)

1110 N. Main Street

Goshen, IN 46527

(Address of principal executive offices) (Zip code)

Anthony Zacharski

Dechert LLP

200 Clarendon Street, 27th Floor

Boston, MA 02116

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 977-2947

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

| Item 1. | Reports to Stockholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

Table of Contents

| | |

Message from the President | 1 |

Stewardship Investing Report | 2 |

Praxis Impact Bond Fund | |

Portfolio Managers’ Commentary | 4 |

Performance Review | 6 |

Schedule of Investments | 7 |

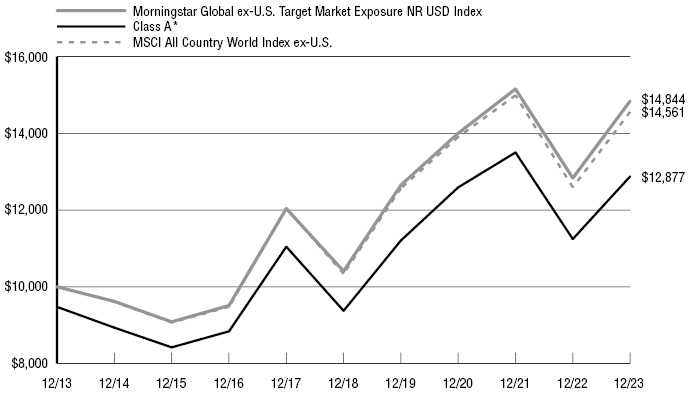

Praxis International Index Fund | |

Portfolio Managers’ Commentary | 15 |

Performance Review | 17 |

Schedule of Investments | 18 |

Praxis Growth and Value Index Fund | |

Portfolio Manager’s Commentary | 24 |

Praxis Value Index Fund Performance Review | 26 |

Praxis Value Index Fund Schedule of Investments | 27 |

Praxis Growth Index Fund Performance Review | 32 |

Praxis Growth Index Fund Schedule of Investments | 33 |

Praxis Small Cap Index Fund | |

Portfolio Manager’s Commentary | 36 |

Performance Review | 38 |

Schedule of Investments | 39 |

Praxis Genesis Portfolios | |

Portfolio Managers’ Commentary | 45 |

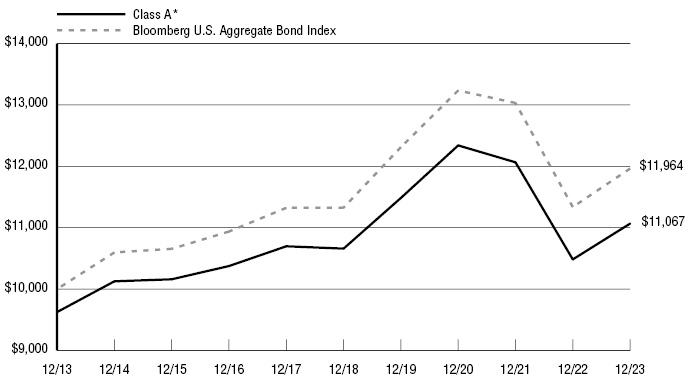

Praxis Genesis Conservative Portfolio | |

Performance Review | 46 |

Schedule of Investments | 47 |

Praxis Genesis Balanced Portfolio | |

Performance Review | 48 |

Schedule of Investments | 49 |

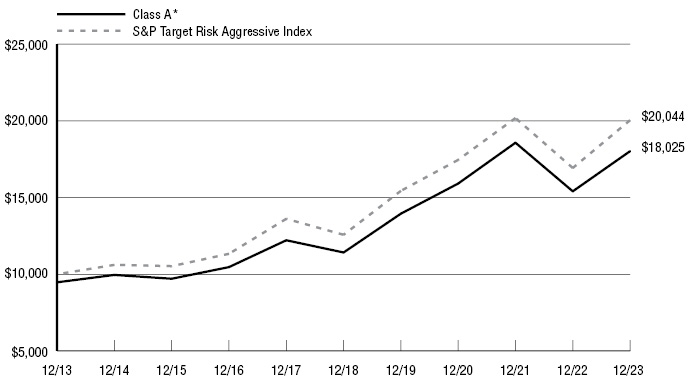

Praxis Genesis Growth Portfolio | |

Performance Review | 50 |

Schedule of Investments | 51 |

Financial Statements | |

Statements of Assets & Liabilities | 52 |

Statements of Operations | 54 |

Statements of Changes in Net Assets | 56 |

Financial Highlights | 59 |

Notes to Financial Statements | 67 |

Report of Independent Registered Public Accounting Firm | 79 |

Additional Fund Information | 80 |

Management of the Trust | 86 |

This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

Message from the President | Annual report to shareholders |

Dear Praxis shareholders:

In business and in our personal lives, the turning of the calendar fills us with introspection about the year that just passed and draws our focus toward the future with hope and expectation. Summarizing an entire year, with its ups and downs across many dimensions, is an impossible task. Is it even fair to declare that a full year was “good” or “bad”?

In the financial world, of course, we often sum up the year by reviewing the investment performance of prominent benchmarks. Stocks, as measured by the S&P 500 Index, rose 26% during the year while bonds, measured by the Bloomberg U.S. Aggregate Bond Index, rose 5.5%. Such strong performance was anything but assured at various points during the year. Recall that in early March, the U.S. banking industry came under heavy scrutiny as Silicon Valley Bank and a few others failed when depositors ran for the exits at the same time. This panic resulted from a quick rise in interest rates that drove down the value of banks’ bond and mortgage portfolios. An assessment of the year from the March vantage point would have been decidedly “bad”.

However, as the year progressed, the fortunes of investors turned positive as large technology companies captured investor enthusiasm. Later in the year leadership spread to other industries, lifted more stocks into positive returns. Bond investors were also rewarded for their patience in the face of interest rate volatility. As late as mid-October, major corporate bond indexes were down more than 3% for the year before surging more than 9% during the rest of the year, breaking a two-year streak of negative returns.

Also on the “good” side of the ledger, investors continued to express their desire to integrate their values into their investments even in the midst of a cultural and political debate on the merits of applying environmental, social and governance factors into investment decision-making. For Praxis Mutual Funds, as we approach the 30th anniversary of the fund family and our flagship Impact Bond Fund, this support played out in the form of near-record net inflows into the funds. It was the tenth straight year that contributions to the funds outpaced redemptions. Inflows into the Impact Bond Fund outpaced the other funds, presumably due to investor expectations that the reset in interest rates in 2022 set bonds up for better prospective returns.

In addition to the investment excellence we strive for, the Praxis team carried your values into our work through the full range of ImpactX strategies we employ. These strategies are intended to ensure that the funds placed with us make a real-world difference to the planet and its people. ImpactX includes screening, corporate engagement, impact bonds, values-driven proxy voting and more with the companies in which we invest. Our goal is to ensure companies understand and address the very real risks of climate change, inequality, and poor governance. This is good for business, for investors, and it’s good for the global community we share with each other.

It would be inaccurate to suggest that nothing challenging happened during the year, but from this vantage point, it was a good year – maybe a very good year – for Praxis Mutual Funds. We are grateful for the steadfast support we’ve received from advisors and shareholders that makes this success possible.

We look forward to continuing to serve you by providing practical investment solutions that make a real-world impact.

Sincerely,

Chad M. Horning, CFA®

President

Praxis Mutual Funds

Praxis Mutual Funds are advised by Everence Capital Management and distributed through FINRA member Foreside Financial Services, LLC.

The views expressed are those of the Praxis Mutual Funds’ President as of Dec. 31, 2023, are subject to change, and may differ from the views of portfolio managers or Everence Capital Management as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Fund’s investment strategy could cause the fund to sell or avoid securities that may subsequently perform well, and the application of ESG (environmental, social, governance) and/or faith-based screens may cause a Fund to lag the performance of its Index.

The Fund’s stewardship investing strategy could the fund to sell or avoid securities that may subsequently perform well, and the application of social screens may cause the Fund to lag the performance of its index.

Mutual fund investing involves risk. Principal loss is possible. There can be no guarantee that any strategy will be successful.

1

Message from the Vice President of Stewardship Investing | Annual report to shareholders |

30 Years of Stewardship Investing

Since 1994, Praxis Mutual Funds® has sought to provide investors with:

| | ● | Broadly diversified, core portfolio holdings. |

| | ● | Consistent performance through benchmark-level returns. |

| | ● | Investments reflecting faith-driven core values. |

| | ● | Opportunities to promote real-world change. |

Each of these relates to our philosophy of Stewardship Investing, which brings a principled approach to balancing investors’ financial needs and their desire to impact our world positively.

In Chad Horning’s introduction to our recently issued annual Praxis Real Impact Report 2023, he writes, “We know that our shareholders invest with Praxis Mutual Funds for something different – something deeper that connects them with others who want to make an impact beyond contributing to their own well-being.”

One way to view the “something different, something deeper” that unites Praxis shareholders is through the lens of the Praxis ImpactX framework. Following are brief highlights from 2023, drawn from each of the seven distinct impact strategies that make up ImpactX:

Values + ESG Screening

| | ● | Praxis screens exclude between 8-20% of companies in our stock indices. |

Proxy Voting

| | ● | 17,976 total proposals voted on by Praxis on behalf of our shareholders. |

| | ● | Votes with management recommendations: 82%. |

ESG Integration

| | ● | Praxis doesn’t just screen out; we also invest in – or invest a higher weight into – companies that better represent our core values. |

Positive Impact Bonds

| | ● | 36% of Praxis Impact Bond Fund holdings invested in impact bonds (balance in other ESG/SRI holdings). |

| | ● | $81 million in impact bonds purchased in this year. |

| | ● | 174 total impact bonds held in the Fund. |

Company Engagement

| | ● | ICCR members, including Praxis, filed over 450 proposals last year, ranging in subjects from human rights and child labor to environmental stewardship and political lobbying. |

Advocacy and Education

| | ● | Praxis joined or wrote three investor initiatives addressing the SEC, U.S. Government and U.S. House of Representatives. |

Community Investing

| | ● | About 1% of Praxis Mutual Fund assets dedicated to community development investments. |

| | ● | $17 million in community development investments through our partner Calvert Impact and $5.6 million community development investments through our partner Capital Impact Partners. |

What unites all seven impact strategies is the underpinning desire to move from what should we do, to what could we do. This movement has been a part of Praxis since our founding 30 years ago, even before we had the words to describe it. We’ve always known that our investments need to be about more than what we avoid. Our investments should represent what God is calling us to do in this world, in as many forms as possible.

2

Message from the Vice President of Stewardship Investing | Annual report to shareholders |

Our many achievements – including a record 10 years of positive inflows – have not happened in a vacuum. From our Board of Trustees and Everence® management; from industry colleagues, advisor partners and service providers to our passionate and dedicated staff, we have been blessed in more ways than we can count.

Of course, none of this work – this mission – would be possible without the tens of thousands of faith-based and values-driven investors who have trusted us to be their partners in stewarding the resources entrusted to them. We are grateful and look forward to serving you in even more ways during the anniversary year to come.

Mark A. Regier

Vice President of Stewardship Investing

Praxis Mutual Funds

To learn more about ImpactX, view editions of our Real Impact Quarterly, and explore our latest Real Impact Annual Report, along with details of the difference Praxis is making in the world, please visit praxismutualfunds.com/real-impact.

The views expressed are those of the Vice President of Stewardship Investing as of Dec. 31, 2023, are subject to change, and may differ from the views of portfolio managers or Everence Capital Management as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

3

Praxis Impact Bond Fund

Annual Report to Shareholders

Portfolio Managers’ Commentary (unaudited)

For the year ended December 31, 2023, the Praxis Impact Bond Fund’s Class I Shares had a return of 5.87%, and the Class A Shares (without load) returned 5.56%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s benchmark, returned 5.53%.

Over the last five years, the Class I Shares returned 1.15% (average annual return) versus 1.10% for the Fund’s benchmark. And over the last 10 years, the Class I Shares returned 1.81% (average annual return) versus 1.81% for the Fund’s benchmark. As of December 31, 2023, within the Morningstar Intermediate Core Bond category, the Class I Shares’ total return ranked in the 37th percentile for the one-year period (out of 471 funds), 40th percentile for the five-year period (out of 385 funds) and 31st percentile for the last 10 years (out of 277 funds).

At the beginning of 2023, the market was expecting Federal Reserve Fed Funds rate increases of between 0.50% and 0.75% in the first half of the year. The market expected economic growth to slow in the second half – enough for a mild recession – and that would bring a couple of rate decreases. While this was happening, the market expected Consumer Price Index (CPI) to decrease dramatically to the low 3% area. It turned out that their expectation on CPI was about the only thing that was correct. Instead of cutting in the second half of 2023, the Fed kept the Fed Funds rate range at 5.25% - 5.5%, as growth surprised to the upside. Gross Domestic Produce (GDP) growth at over 2.5% in the second half of the year was much better than expectations.

The 2-year U.S. Treasury yield started 2023 at 4.43% and finished the year at 4.25%. The 10-year U.S. Treasury yield started 2023 at 3.88% and finished the year at 3.88%. Higher rates in short maturities versus long maturities is a yield curve inversion, and that is also how 2023 began and ended. These inversions have preceded every recession since the 1970s, but recessions don’t always follow a yield curve inversion.

The Praxis Impact Bond Fund had a duration of 99% versus the index to start the year. As interest rates decreased, we decreased our duration to about 97% of the index by May. Interest rates reached their peak at 5.0% in late October, and by that time we had moved to a duration of 105% of the index. Interest rates fell after that, and we kept our duration above the index. Those duration moves during the year benefited the Fund in 2023.

Our lack of Treasuries in the Fund was by far the biggest reason for our outperformance in 2023, as all major sectors posted positive excess returns relative to Treasuries. We tend to offset our lack of Treasury holdings by investing in agency-related securities (which was very beneficial in 2023) and longer-duration corporate bonds with higher ratings. This helps to mitigate for the lack of safety and quality that we miss by not holding Treasury securities. Our overweight to corporate bonds aided performance in 2023. When looking at our security selection within the corporate sector, our higher-quality holdings did not have spreads tighten as much as some of the lower-quality issues that can be found in the index. Our underweight to mortgage-backed securities was a slight negative for the year, but we have a large overweight to Agency Commercial mortgage-backed securities (CMBS) and Asset-Backed Securities and those both had a nice positive effect.

The Fund’s holdings of positive impact bonds – fixed-income investments that have a positive impact on the climate and/or community – is over 35% of the portfolio by December 31, 2023. We purchased 52 different impact bonds in 2023. Many new and exciting issues came to the market with impact bonds in green, sustainability and social bonds.

Of the 175 bonds in the Fund that we define as positive impact holdings, 104 provide clear benefits to the climate. The remaining positive impact bonds produce benefits to communities by funding affordable housing, community development, education, sustainability, social bonds, and more.

Our Morningstar Historical Corporate Sustainability Percent Rank (as of Nov. 30, 2023) is the 8th percentile and is a 5 out of 5 Globes Sustainability Rating.

As we start 2024, we are positioned for the expectation that interest rates and corporate bond performance may be volatile, and we will stay nimble just as we did in 2023. We continue to look for more opportunities to enhance the financial return of the Praxis Impact Bond Fund and to make a positive impact on the world we share.

Benjamin J. Bailey, CFA®

Praxis Impact Bond Fund Co-Manager

Praxis Mutual Funds®

Chris Woods, CFA®

Praxis Impact Bond Fund Co-Manager

Praxis Mutual Funds®

The views expressed are those of the portfolio managers as of Dec. 31, 2023, are subject to change, and may differ from the views of other portfolio managers or Everence Capital Management as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index composed of the Bloomberg U.S. Government/Credit Index and the Bloomberg U.S. Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities, and is intended to be generally representative of the bond market as a whole.

The Morningstar percentile ranking is based on the fund’s total-return percentile rank relative to all managed products that have the same category for the same time period. The highest (or most favorable) percentile rank is 1%, and the lowest (or least favorable) percentile rank is the highest number in the category. Morningstar total return includes both income and capital gains or losses and is not adjusted for sales charges. © 2023 Morningstar, Inc. All Rights

4

Praxis Impact Bond Fund

Annual Report to Shareholders

Portfolio Managers’ Commentary, (unaudited) continued

Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Morningstar Sustainability Rating™ is intended to measure how well the issuing companies of the securities within a fund’s portfolio holdings are managing their financially material environmental, social and governance, or ESG, risks relative to the fund’s Morningstar Global Category peers. The Morningstar Sustainability Rating calculation is a five -step process. First, each fund with at least 67% of assets covered by a company-level ESG Risk Score from Sustainalytics receives a Morningstar Portfolio Sustainability Score. The Morningstar Portfolio Sustainability Score is an asset-weighted average of company level ESG Risk Scores. The Portfolio Sustainability Score ranges between 0 to 100, with a higher score indicating that a fund has, on average, more of its assets invested in companies with high ESG Risk. Second, the Historical Sustainability Score is an exponential weighted moving average of the Portfolio Sustainability Scores over the past 12 months. The process rescales the current Portfolio Sustainability Score to reflect the consistency of the scores. The Historical Sustainability Score ranges between 0 to 100, with a higher score indicating that a fund has, on average, more of its assets invested in companies with high ESG Risk, on a consistent historical basis. Third, the Morningstar Sustainability Rating is then assigned to all scored funds within Morningstar Global Categories in which at least thirty (30) funds receive a Historical Sustainability Score and is determined by each fund’s Morningstar Sustainability Rating Score rank within the following distribution: High (highest 10%), Above Average (next 22.5%), Average (next 35%), Below Average (next 22.5%), and Low (lowest 10%). Fourth, then Morningstar applies a 1% rating buffer from the previous month to increase rating stability. This means a fund must move 1% beyond the rating breakpoint to change ratings. Fifth, they adjust downward positive Sustainability Ratings to funds with high ESG Risk scores. The logic is as follows: If Portfolio Sustainability score is above 40, then the fund receives a Low Sustainability Rating. If Portfolio Sustainability score is above 35 and preliminary rating is Average or better, then the fund is downgraded to Below Average. If the Portfolio Sustainability score is above 30 and preliminary rating is Above Average, then the fund is downgraded to Average. If the Portfolio Sustainability score is below 30, then no adjustment is made. The Morningstar Sustainability Rating is depicted by globe icons where High equals 5 globes and Low equals 1 globe. Since a Sustainability Rating is assigned to all funds that meet the above criteria, the rating it is not limited to funds with explicit sustainable or responsible investment mandates. Morningstar updates its Sustainability Ratings monthly. The Portfolio Sustainability Score is calculated when Morningstar receives a new portfolio. Then, the Historical Sustainability Score and the Sustainability Rating is calculated one month and six business days after the reported as-of date of the most recent portfolio. As part of the evaluation process, Morningstar uses Sustainalytics’ ESG scores from the same month as the portfolio as-of date. Please click on http://corporate1.morningstar.com/SustainableInvesting/ for more detailed information about the Morningstar Sustainability Rating methodology and calculation frequency. Sustainalytics is an independent ESG and corporate governance research, ratings, and analysis firm. Morningstar, Inc. holds a non-controlling ownership interest in Sustainalytics. © 2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5

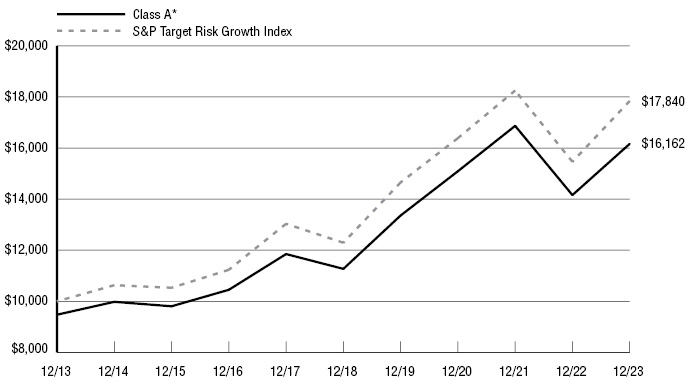

Praxis Impact Bond Fund

Performance Review (unaudited)

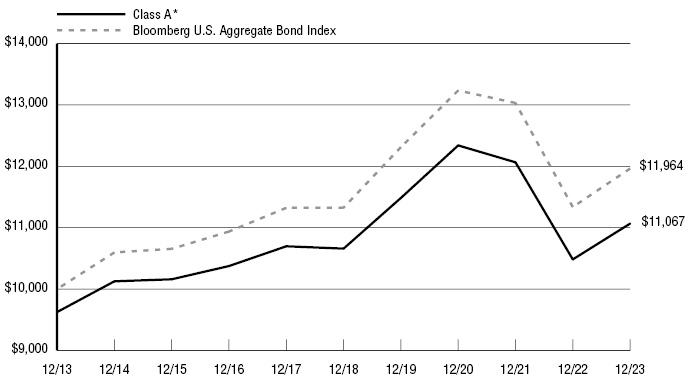

Growth of $10,000 investment from 12/31/13 to 12/31/23

This chart represents historical performance of a hypothetical investment of $10,000 in Class A Shares (adjusted for the maximum sales charge of 3.75%) of the Fund and Index from 12/31/13 to 12/31/23 and includes the reinvestment of dividends and capital gains.

| | | | Average Annual | | |

| Inception

Date | One

Year

Ended | Three

Year

Ended | Five

Year

Ended | Ten

Year

Ended | Expense

Ratio**

Gross/Net |

Praxis Impact Bond Fund | | | | | | | |

Class A * | 5/12/99 | 1.58% | -4.80% | -0.01% | 1.02% | 0.94% | 0.94% |

Class A (Without Load) | 5/12/99 | 5.56% | -3.57% | 0.75% | 1.41% | | |

Class I | 5/1/06 | 5.87% | -3.20% | 1.15% | 1.81% | 0.49% | 0.49% |

Bloomberg U.S. Aggregate Bond Index 1 | | 5.53% | -3.31% | 1.10% | 1.81% | | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance information current to the most recent month end, please visit www.praxismutualfunds.com. Indexes are unmanaged, do not incur fees, and it is not possible to invest directly in an index.

The total returns shown reflect any expenses that were contractually or voluntarily reduced, reimbursed or paid by any party during the periods presented. In such instances, and without activity, the total returns would have been lower.

* The total return figures shown reflect the maximum sales charge applicable to Class A Shares for the Fund. Class A Shares have a maximum sales charge on purchases of 3.75%.

** Reflects the expense ratios as reported in the Prospectus dated May 1, 2023.

1 Bloomberg U.S. Aggregate Bond Index is an unmanaged index composed of the Bloomberg U.S. Government/Credit Index and the Bloomberg U.S. Mortgage-Backed Securities Index and includes Treasury issues, agency issues, corporate bond issues and mortgage-backed securities, and is intended to be generally representative of the bond market as a whole.

The above index is for illustrative purposes only and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of these expenses. An investor cannot invest directly in an index, although an investor can invest in its underlying securities.

6

Schedule of Investments

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

MUNICIPAL BONDS — 1.0% |

American Municipal Power Ohio, Inc., Rev. Taxable-Hydroelectric Projects, Series 2010-A | | | 7.334 | % | | | 02/15/28 | | | $ | 1,000,000 | | | $ | 1,061,928 | |

Findlay City School District, Series 2010-B | | | 6.250 | % | | | 12/01/37 | | | | 270,000 | | | | 270,443 | |

Houston, Texas, Independent School District, Series 2009A-2 | | | 6.168 | % | | | 02/15/34 | | | | 1,000,000 | | | | 1,002,840 | |

Massachusetts St., Series 2016-F | | | 3.277 | % | | | 06/01/46 | | | | 3,100,000 | | | | 2,472,095 | |

University of Texas, Rev., Series 2020 B | | | 2.439 | % | | | 08/15/49 | | | | 1,875,000 | | | | 1,252,396 | |

University of Virginia, Rev., Series 2009 | | | 6.200 | % | | | 09/01/39 | | | | 2,000,000 | | | | 2,268,440 | |

TOTAL MUNICIPAL BONDS (COST $8,900,910) | | $ | 8,328,142 | |

| |

CORPORATE BONDS — 34.1% |

APPAREL & TEXTILE PRODUCTS — 0.1% |

VF Corp. | | | 2.400 | % | | | 04/23/25 | | | | 536,000 | | | | 512,006 | |

| |

ASSET MANAGEMENT — 0.1% |

Ameriprise Financial, Inc. | | | 3.000 | % | | | 04/02/25 | | | | 730,000 | | | | 712,037 | |

| |

AUTOMOTIVE — 0.3% |

BorgWarner, Inc. (a) | | | 2.650 | % | | | 07/01/27 | | | | 601,000 | | | | 557,219 | |

Honda Motor Co. Ltd. | | | 2.967 | % | | | 03/10/32 | | | | 760,000 | | | | 694,989 | |

Hyundai Capital Services, Inc. (b) | | | 1.250 | % | | | 02/08/26 | | | | 200,000 | | | | 183,760 | |

Magna International, Inc. | | | 2.450 | % | | | 06/15/30 | | | | 1,250,000 | | | | 1,094,674 | |

| | | | | | | | | | | | | | | | 2,530,642 | |

BANKING — 3.8% |

Bank of America Corp., Series N | | | 0.981 | % | | | 09/25/25 | | | | 1,500,000 | | | | 1,447,700 | |

Bank of America Corp., Series N | | | 2.456 | % | | | 10/22/25 | | | | 1,000,000 | | | | 973,753 | |

Bank of America Corp., Series N | | | 1.530 | % | | | 12/06/25 | | | | 2,000,000 | | | | 1,922,697 | |

Bank of America Corp., Series N | | | 4.271 | % | | | 07/23/29 | | | | 1,000,000 | | | | 965,489 | |

Bank of America Corp., Series N | | | 2.572 | % | | | 10/20/32 | | | | 1,500,000 | | | | 1,243,608 | |

Bank of Montreal (a) | | | 5.203 | % | | | 02/01/28 | | | | 1,750,000 | | | | 1,782,640 | |

Bank of New York Mellon Corp. (The), Series J | | | 4.967 | % | | | 04/26/34 | | | | 2,000,000 | | | | 1,990,125 | |

Citigroup, Inc. | | | 3.700 | % | | | 01/12/26 | | | | 1,750,000 | | | | 1,707,729 | |

Citigroup, Inc. (a) | | | 2.014 | % | | | 01/25/26 | | | | 1,000,000 | | | | 960,913 | |

Citigroup, Inc. | | | 2.572 | % | | | 06/03/31 | | | | 2,000,000 | | | | 1,708,434 | |

ING Groep N.V. (b) | | | 4.625 | % | | | 01/06/26 | | | | 1,250,000 | | | | 1,241,355 | |

JPMorgan Chase & Co. | | | 0.563 | % | | | 02/16/25 | | | | 500,000 | | | | 496,648 | |

JPMorgan Chase & Co. | | | 3.200 | % | | | 06/15/26 | | | | 2,557,000 | | | | 2,467,212 | |

JPMorgan Chase & Co. | | | 2.739 | % | | | 10/15/30 | | | | 2,000,000 | | | | 1,778,248 | |

KeyBank National Association | | | 4.150 | % | | | 08/08/25 | | | | 1,000,000 | | | | 969,376 | |

M&T Bank Corp. | | | 4.553 | % | | | 08/16/28 | | | | 1,500,000 | | | | 1,445,035 | |

PNC Financial Services Group, Inc. (The) | | | 4.758 | % | | | 01/26/27 | | | | 1,500,000 | | | | 1,488,188 | |

PNC Financial Services Group, Inc. (The) (a) | | | 5.582 | % | | | 06/12/29 | | | | 1,000,000 | | | | 1,021,332 | |

Regions Financial Corp. (a) | | | 2.250 | % | | | 05/18/25 | | | | 1,000,000 | | | | 953,031 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

BANKING — 3.8%, continued |

State Street Corp. | | | 7.350 | % | | | 06/15/26 | | | $ | 1,000,000 | | | $ | 1,053,374 | |

State Street Corp. | | | 4.164 | % | | | 08/04/33 | | | | 1,000,000 | | | | 942,690 | |

Toronto-Dominion Bank, Series C (a) | | | 5.264 | % | | | 12/11/26 | | | | 2,000,000 | | | | 2,039,306 | |

Truist Financial Corp. (SOFR+ 60.90) (c) | | | 1.267 | % | | | 03/02/27 | | | | 1,000,000 | | | | 915,446 | |

UBS AG London | | | 5.650 | % | | | 09/11/28 | | | | 550,000 | | | | 570,878 | |

| | | | | | | | | | | | | | | | 32,085,207 | |

BEVERAGES — 0.2% |

Coca-Cola Co. (The) | | | 3.450 | % | | | 03/25/30 | | | | 500,000 | | | | 480,144 | |

Coca-Cola Femsa S.A.B. de C.V. | | | 1.850 | % | | | 09/01/32 | | | | 1,000,000 | | | | 795,387 | |

| | | | | | | | | | | | | | | | 1,275,531 | |

BIOTECH & PHARMA — 0.4% |

AbbVie, Inc. (a) | | | 2.950 | % | | | 11/21/26 | | | | 500,000 | | | | 479,449 | |

Amgen, Inc. (a) | | | 3.000 | % | | | 02/22/29 | | | | 2,500,000 | | | | 2,351,430 | |

Gilead Sciences, Inc. | | | 3.650 | % | | | 03/01/26 | | | | 750,000 | | | | 734,784 | |

| | | | | | | | | | | | | | | | 3,565,663 | |

CABLE & SATELLITE — 0.4% |

Comcast Corp. | | | 3.300 | % | | | 04/01/27 | | | | 500,000 | | | | 482,081 | |

Comcast Corp. (a) | | | 4.650 | % | | | 02/15/33 | | | | 1,000,000 | | | | 1,006,024 | |

Comcast Corp. | | | 2.937 | % | | | 11/01/56 | | | | 672,000 | | | | 441,988 | |

Time Warner Cable, Inc. | | | 4.500 | % | | | 09/15/42 | | | | 500,000 | | | | 392,368 | |

WarnerMedia Holdings, Inc. | | | 4.054 | % | | | 03/15/29 | | | | 1,500,000 | | | | 1,423,186 | |

| | | | | | | | | | | | | | | | 3,745,647 | |

CHEMICALS — 0.6% |

Avery Dennison Corp. | | | 2.650 | % | | | 04/30/30 | | | | 1,250,000 | | | | 1,104,359 | |

DowDuPont, Inc. | | | 4.493 | % | | | 11/15/25 | | | | 1,500,000 | | | | 1,488,950 | |

Ecolab, Inc. | | | 4.800 | % | | | 03/24/30 | | | | 140,000 | | | | 143,556 | |

Ecolab, Inc. | | | 2.750 | % | | | 08/18/55 | | | | 1,470,000 | | | | 988,826 | |

LG Chemical Ltd. (b) | | | 3.250 | % | | | 10/15/24 | | | | 290,000 | | | | 285,236 | |

Nutrien Ltd. | | | 5.875 | % | | | 12/01/36 | | | | 840,000 | | | | 874,627 | |

| | | | | | | | | | | | | | | | 4,885,554 | |

CONSTRUCTION MATERIALS — 0.3% |

Carlisle Cos., Inc. | | | 3.500 | % | | | 12/01/24 | | | | 1,250,000 | | | | 1,226,146 | |

Owens Corning | | | 4.200 | % | | | 12/01/24 | | | | 1,000,000 | | | | 988,329 | |

Owens Corning | | | 3.950 | % | | | 08/15/29 | | | | 300,000 | | | | 285,716 | |

| | | | | | | | | | | | | | | | 2,500,191 | |

CONSUMER SERVICES — 4.8% |

Andrew W. Mellon Funding | | | 0.947 | % | | | 08/01/27 | | | | 1,050,000 | | | | 925,420 | |

California Endowment (The) | | | 2.498 | % | | | 04/01/51 | | | | 4,500,000 | | | | 2,922,147 | |

Conservation Fund, Series 2019 | | | 3.474 | % | | | 12/15/29 | | | | 535,000 | | | | 479,235 | |

Ford Foundation (The), Series 2017 | | | 3.859 | % | | | 06/01/47 | | | | 4,620,000 | | | | 3,956,772 | |

Ford Foundation (The), Series 2020 (a) | | | 2.415 | % | | | 06/01/50 | | | | 235,000 | | | | 153,378 | |

John D. & Catherine T. MacArthur Foundation, Series 2020 | | | 1.299 | % | | | 12/01/30 | | | | 1,500,000 | | | | 1,175,772 | |

Leland Stanford Junior University (The) | | | 3.460 | % | | | 05/01/47 | | | | 2,415,000 | | | | 2,002,227 | |

7

See accompanying notes to financial statements.

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

CONSUMER SERVICES — 4.8%, continued |

Local Initiatives Support Corp. | | | 4.649 | % | | | 03/01/37 | | | $ | 1,500,000 | | | $ | 1,330,892 | |

Massachusetts Institute of Technology, Series D-2 | | | 3.959 | % | | | 07/01/38 | | | | 1,700,000 | | | | 1,574,682 | |

Massachusetts Institute of Technology, Series F | | | 2.989 | % | | | 07/01/50 | | | | 1,000,000 | | | | 749,066 | |

Massachusetts Institute of Technology, Series H | | | 3.067 | % | | | 04/01/52 | | | | 4,200,000 | | | | 3,155,258 | |

President & Fellows of Harvard College, Series 2016-B | | | 3.150 | % | | | 07/15/46 | | | | 3,961,000 | | | | 3,118,590 | |

President & Fellows of Harvard College, Series 2020-B | | | 2.517 | % | | | 10/15/50 | | | | 1,600,000 | | | | 1,080,066 | |

President & Fellows of Harvard College, Series 2022-A | | | 3.745 | % | | | 11/15/52 | | | | 700,000 | | | | 606,311 | |

Rockefeller Foundation (The) | | | 2.492 | % | | | 10/01/50 | | | | 4,290,000 | | | | 2,817,936 | |

Stanford University California, Series 2020-A | | | 2.413 | % | | | 06/01/50 | | | | 4,400,000 | | | | 2,912,184 | |

Trustees of Princeton University (The) (a) | | | 2.516 | % | | | 07/01/50 | | | | 6,650,000 | | | | 4,520,456 | |

University of Notre Dame, Series 2017 | | | 3.394 | % | | | 02/15/48 | | | | 3,424,000 | | | | 2,764,835 | |

Yale University (a) | | | 2.402 | % | | | 04/15/50 | | | | 6,765,000 | | | | 4,436,863 | |

| | | | | | | | | | | | | | | | 40,682,090 | |

CONTAINERS & PACKAGING — 0.3% |

CCL Industries, Inc. (b) | | | 3.050 | % | | | 06/01/30 | | | | 1,750,000 | | | | 1,532,977 | |

Sonoco Products Co. | | | 5.750 | % | | | 11/01/40 | | | | 1,000,000 | | | | 1,017,444 | |

| | | | | | | | | | | | | | | | 2,550,421 | |

DIVERSIFIED INDUSTRIALS — 0.1% |

Illinois Tool Works, Inc. | | | 3.900 | % | | | 09/01/42 | | | | 1,000,000 | | | | 893,032 | |

| |

ELECTRIC UTILITIES — 5.7% |

Ameren Illinois Co. | | | 5.900 | % | | | 12/01/52 | | | | 2,250,000 | | | | 2,517,802 | |

Avangrid, Inc. | | | 3.150 | % | | | 12/01/24 | | | | 1,800,000 | | | | 1,758,978 | |

Avista Corp. | | | 4.000 | % | | | 04/01/52 | | | | 1,000,000 | | | | 801,640 | |

Caledonia Generating, LLC (b) | | | 1.950 | % | | | 02/28/34 | | | | 1,626,298 | | | | 1,377,941 | |

CenterPoint Energy, Inc., Series AL | | | 5.300 | % | | | 04/01/53 | | | | 1,000,000 | | | | 1,045,567 | |

Consolidated Edison Co. | | | 3.350 | % | | | 04/01/30 | | | | 1,000,000 | | | | 932,403 | |

DTE Electric Co. | | | 4.050 | % | | | 05/15/48 | | | | 1,750,000 | | | | 1,481,907 | |

DTE Electric Co. | | | 3.650 | % | | | 03/01/52 | | | | 750,000 | | | | 593,027 | |

DTE Energy Co., Series C | | | 4.875 | % | | | 06/01/28 | | | | 1,500,000 | | | | 1,513,002 | |

Duke Energy Carolinas, LLC | | | 3.550 | % | | | 03/15/52 | | | | 2,200,000 | | | | 1,680,665 | |

Duke Energy Progress, LLC | | | 3.450 | % | | | 03/15/29 | | | | 1,750,000 | | | | 1,669,012 | |

Duke Energy Progress, LLC | | | 4.000 | % | | | 04/01/52 | | | | 1,500,000 | | | | 1,232,581 | |

Electricite de France S.A. (b) | | | 3.625 | % | | | 10/13/25 | | | | 1,250,000 | | | | 1,220,498 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

ELECTRIC UTILITIES — 5.7%, continued |

Enel Finance International N.V. (b) | | | 2.650 | % | | | 09/10/24 | | | $ | 1,250,000 | | | $ | 1,220,478 | |

Florida Power & Light Co. | | | 3.700 | % | | | 12/01/47 | | | | 1,550,000 | | | | 1,252,984 | |

Florida Power & Light Co. | | | 2.875 | % | | | 12/04/51 | | | | 2,000,000 | | | | 1,385,379 | |

Georgia Power Co. | | | 3.250 | % | | | 04/01/26 | | | | 1,000,000 | | | | 961,218 | |

Interstate Power & Light Co. | | | 3.600 | % | | | 04/01/29 | | | | 1,250,000 | | | | 1,185,508 | |

Liberty Utilities Financial Services (b) | | | 2.050 | % | | | 09/15/30 | | | | 1,355,000 | | | | 1,099,088 | |

MidAmerican Energy Co. | | | 3.950 | % | | | 08/01/47 | | | | 1,750,000 | | | | 1,462,492 | |

Midland Cogeneration Venture, L.P. (b) | | | 6.000 | % | | | 03/15/25 | | | | 118,675 | | | | 119,825 | |

Narragansett Electric Co. (b) | | | 3.395 | % | | | 04/09/30 | | | | 1,500,000 | | | | 1,366,147 | |

National Rural Utilities | | | 1.350 | % | | | 03/15/31 | | | | 2,000,000 | | | | 1,568,916 | |

NextEra Energy Capital Holdings, Inc. | | | 6.051 | % | | | 03/01/25 | | | | 500,000 | | | | 504,453 | |

Niagara Mohawk Power Corp. (b) | | | 1.960 | % | | | 06/27/30 | | | | 1,500,000 | | | | 1,244,639 | |

Northern States Power Co. | | | 2.900 | % | | | 03/01/50 | | | | 1,500,000 | | | | 1,050,779 | |

NSTAR Electric Co. | | | 3.950 | % | | | 04/01/30 | | | | 600,000 | | | | 572,254 | |

NSTAR Electric Co. | | | 5.500 | % | | | 03/15/40 | | | | 1,250,000 | | | | 1,266,327 | |

NY State Electric & Gas (a)(b) | | | 5.650 | % | | | 08/15/28 | | | | 1,650,000 | | | | 1,691,777 | |

Potomac Electric Power Co. | | | 6.500 | % | | | 11/15/37 | | | | 1,000,000 | | | | 1,147,605 | |

Public Service Co. | | | 3.700 | % | | | 06/15/28 | | | | 2,250,000 | | | | 2,162,036 | |

Public Service Electric and Gas Co. | | | 4.650 | % | | | 03/15/33 | | | | 2,500,000 | | | | 2,500,257 | |

Puget Energy, Inc. | | | 4.223 | % | | | 06/15/48 | | | | 1,000,000 | | | | 840,479 | |

Rochester Gas & Electric Corp. (b) | | | 1.850 | % | | | 12/01/30 | | | | 500,000 | | | | 399,181 | |

San Diego Gas and Electric Co. | | | 4.500 | % | | | 08/15/40 | | | | 841,000 | | | | 769,690 | |

Solar Star Funding, LLC (b) | | | 3.950 | % | | | 06/30/35 | | | | 247,645 | | | | 221,664 | |

Solar Star Funding, LLC (b) | | | 5.375 | % | | | 06/30/35 | | | | 388,786 | | | | 385,464 | |

Southern California Edison | | | 4.050 | % | | | 03/15/42 | | | | 1,165,000 | | | | 980,956 | |

Tenaska Virginia Partners, L.P. (b) | | | 6.119 | % | | | 03/30/24 | | | | 90,323 | | | | 89,881 | |

Topaz Solar Farms, LLC (b) | | | 4.875 | % | | | 09/30/39 | | | | 216,137 | | | | 199,058 | |

Topaz Solar Farms, LLC (b) | | | 5.750 | % | | | 09/30/39 | | | | 515,866 | | | | 512,564 | |

Union Electric Co. | | | 2.625 | % | | | 03/15/51 | | | | 2,000,000 | | | | 1,271,391 | |

Westar Energy, Inc. | | | 2.550 | % | | | 07/01/26 | | | | 1,292,000 | | | | 1,223,833 | |

| | | | | | | | | | | | | | | | 48,481,346 | |

ELECTRICAL EQUIPMENT — 0.2% |

Johnson Controls International plc | | | 1.750 | % | | | 09/15/30 | | | | 1,800,000 | | | | 1,495,142 | |

Roper Technologies, Inc. | | | 2.000 | % | | | 06/30/30 | | | | 440,000 | | | | 373,511 | |

| | | | | | | | | | | | | | | | 1,868,653 | |

FOOD — 1.1% |

Campbell Soup Co. | | | 3.950 | % | | | 03/15/25 | | | | 1,500,000 | | | | 1,476,649 | |

Cargill, Inc. (b) | | | 4.760 | % | | | 11/23/45 | | | | 1,500,000 | | | | 1,431,784 | |

General Mills, Inc. | | | 4.000 | % | | | 04/17/25 | | | | 1,500,000 | | | | 1,478,937 | |

Hormel Foods Corp. | | | 1.800 | % | | | 06/11/30 | | | | 2,250,000 | | | | 1,912,980 | |

Ingredion, Inc. | | | 2.900 | % | | | 06/01/30 | | | | 1,000,000 | | | | 892,920 | |

Mars, Inc. (b) | | | 4.650 | % | | | 04/20/31 | | | | 1,000,000 | | | | 1,002,705 | |

See accompanying notes to financial statements.

8

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

FOOD — 1.1%, continued |

Mars, Inc. (b) | | | 3.600 | % | | | 04/01/34 | | | $ | 1,500,000 | | | $ | 1,362,247 | |

| | | | | | | | | | | | | | | | 9,558,222 | |

FORESTRY, PAPER & WOOD PRODUCTS — 0.1% |

Suzano S.A. (a) | | | 5.500 | % | | | 01/17/27 | | | | 800,000 | | | | 810,028 | |

| |

GAS & WATER UTILITIES — 0.3% |

American Water Capital Corp. | | | 2.800 | % | | | 05/01/30 | | | | 1,500,000 | | | | 1,342,189 | |

Brooklyn Union Gas Co. (b) | | | 4.504 | % | | | 03/10/46 | | | | 1,250,000 | | | | 1,007,895 | |

Indiana Gas Co., Inc. | | | 6.550 | % | | | 06/30/28 | | | | 250,000 | | | | 256,328 | |

| | | | | | | | | | | | | | | | 2,606,412 | |

HEALTH CARE FACILITIES & SERVICES — 0.2% |

Kaiser Foundation Hospital | | | 3.150 | % | | | 05/01/27 | | | | 1,500,000 | | | | 1,434,514 | |

| |

HOME & OFFICE PRODUCTS — 0.1% |

Steelcase, Inc. (a) | | | 5.125 | % | | | 01/18/29 | | | | 1,000,000 | | | | 947,785 | |

| |

HOME CONSTRUCTION — 0.1% |

NVR, Inc. | | | 3.000 | % | | | 05/15/30 | | | | 1,000,000 | | | | 890,932 | |

| |

INSTITUTIONAL FINANCIAL SERVICES — 1.2% |

Brookfield Finance, Inc. | | | 4.250 | % | | | 06/02/26 | | | | 1,570,000 | | | | 1,533,765 | |

Goldman Sachs Group, Inc. | | | 3.272 | % | | | 09/29/25 | | | | 1,500,000 | | | | 1,474,630 | |

Goldman Sachs Group, Inc. | | | 4.223 | % | | | 05/01/29 | | | | 1,000,000 | | | | 967,327 | |

Goldman Sachs Group, Inc. | | | 3.800 | % | | | 03/15/30 | | | | 1,500,000 | | | | 1,409,359 | |

Morgan Stanley, Series F | | | 3.125 | % | | | 07/27/26 | | | | 2,000,000 | | | | 1,915,104 | |

Morgan Stanley, Series I | | | 5.449 | % | | | 07/20/29 | | | | 1,000,000 | | | | 1,018,952 | |

Morgan Stanley, Series I | | | 2.699 | % | | | 01/22/31 | | | | 1,250,000 | | | | 1,092,721 | |

National Securities Clearing Corp. (b) | | | 1.500 | % | | | 04/23/25 | | | | 1,000,000 | | | | 958,431 | |

| | | | | | | | | | | | | | | | 10,370,289 | |

INSURANCE — 4.2% |

Aflac, Inc. | | | 4.000 | % | | | 10/15/46 | | | | 1,408,000 | | | | 1,157,042 | |

Allstate Corp. (The) | | | 5.250 | % | | | 03/30/33 | | | | 1,000,000 | | | | 1,021,008 | |

F&G Global Funding (b) | | | 2.300 | % | | | 04/11/27 | | | | 535,000 | | | | 480,900 | |

Fidelity National Financial, Inc. | | | 3.400 | % | | | 06/15/30 | | | | 1,000,000 | | | | 891,178 | |

First American Financial Corp. | | | 2.400 | % | | | 08/15/31 | | | | 1,500,000 | | | | 1,185,918 | |

GA Global Funding Trust (b) | | | 2.250 | % | | | 01/06/27 | | | | 2,000,000 | | | | 1,815,470 | |

Horace Mann Educators Corp. | | | 4.500 | % | | | 12/01/25 | | | | 1,235,000 | | | | 1,210,384 | |

Horace Mann Educators Corp. (a) | | | 7.250 | % | | | 09/15/28 | | | | 965,000 | | | | 1,026,085 | |

Jackson National Life Global Funding (b) | | | 1.750 | % | | | 01/12/25 | | | | 385,000 | | | | 369,081 | |

Jackson National Life Global Funding (b) | | | 5.500 | % | | | 01/09/26 | | | | 1,250,000 | | | | 1,248,177 | |

Kemper Corp. | | | 4.350 | % | | | 02/15/25 | | | | 1,250,000 | | | | 1,223,556 | |

Marsh & McLennan Cos., Inc. | | | 3.750 | % | | | 03/14/26 | | | | 1,000,000 | | | | 981,169 | |

Massachusetts Mutual Life Insurance Co. (b) | | | 3.375 | % | | | 04/15/50 | | | | 2,500,000 | | | | 1,822,038 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

INSURANCE — 4.2%, continued |

Met Life Global Funding I (b) | | | 5.150 | % | | | 03/28/33 | | | $ | 1,250,000 | | | $ | 1,271,699 | |

Mutual of Omaha Global, Series 2023-1 (b) | | | 5.800 | % | | | 07/27/26 | | | | 385,000 | | | | 392,304 | |

Mutual of Omaha Global (b) | | | 5.450 | % | | | 12/12/28 | | | | 365,000 | | | | 372,480 | |

New York Life Global Funding (b) | | | 4.900 | % | | | 06/13/28 | | | | 3,000,000 | | | | 3,026,764 | |

Northwestern Mutual, Series 2023-3 (b) | | | 4.900 | % | | | 06/12/28 | | | | 1,740,000 | | | | 1,746,368 | |

Pacific Life Global Funding II, Series 2020-1 (b) | | | 1.200 | % | | | 06/24/25 | | | | 415,000 | | | | 393,598 | |

Pacific Life Global Funding II, Series 2021-1 (a)(b) | | | 1.450 | % | | | 01/20/28 | | | | 1,000,000 | | | | 872,240 | |

Pricoa Global Funding I (b) | | | 5.100 | % | | | 05/30/28 | | | | 2,000,000 | | | | 2,022,555 | |

Primerica, Inc. | | | 2.800 | % | | | 11/19/31 | | | | 1,000,000 | | | | 845,861 | |

Principal Financial Group, Inc. | | | 3.700 | % | | | 05/15/29 | | | | 1,250,000 | | | | 1,177,751 | |

Protective Life Global Funding (b) | | | 5.366 | % | | | 01/06/26 | | | | 500,000 | | | | 503,502 | |

Protective Life Global Funding (b) | | | 5.209 | % | | | 04/14/26 | | | | 1,000,000 | | | | 998,845 | |

Prudential Financial, Inc. | | | 1.500 | % | | | 03/10/26 | | | | 644,000 | | | | 600,269 | |

Prudential Funding Asia plc | | | 3.125 | % | | | 04/14/30 | | | | 750,000 | | | | 680,599 | |

Reliance STD Life Insurance Co. (b) | | | 2.750 | % | | | 05/07/25 | | | | 1,280,000 | | | | 1,229,950 | |

Sammons Financial Group, Inc. (a)(b) | | | 4.450 | % | | | 05/12/27 | | | | 1,200,000 | | | | 1,139,719 | |

Security Benefit Global (b) | | | 1.250 | % | | | 05/17/24 | | | | 1,500,000 | | | | 1,471,165 | |

Teachers Insurance & Annuity Association (b)(c) | | | 4.375 | % | | | 09/15/54 | | | | 2,678,000 | | | | 2,615,184 | |

Trustage Financial Group, Inc. (b) | | | 4.625 | % | | | 04/15/32 | | | | 400,000 | | | | 348,370 | |

| | | | | | | | | | | | | | | | 36,141,229 | |

LEISURE FACILITIES & SERVICES — 0.2% |

McDonald’s Corp. | | | 3.500 | % | | | 07/01/27 | | | | 1,000,000 | | | | 971,328 | |

Starbucks Corp. | | | 2.450 | % | | | 06/15/26 | | | | 1,000,000 | | | | 951,611 | |

| | | | | | | | | | | | | | | | 1,922,939 | |

MACHINERY — 0.4% |

Ingersoll-Rand Global Holding Co. Ltd. | | | 6.391 | % | | | 11/15/27 | | | | 655,000 | | | | 679,348 | |

John Deere Capital Corp. | | | 1.750 | % | | | 03/09/27 | | | | 250,000 | | | | 230,232 | |

John Deere Capital Corp. | | | 3.050 | % | | | 01/06/28 | | | | 1,250,000 | | | | 1,187,732 | |

Xylem, Inc. | | | 1.950 | % | | | 01/30/28 | | | | 1,775,000 | | | | 1,604,269 | |

| | | | | | | | | | | | | | | | 3,701,581 | |

MEDICAL EQUIPMENT & DEVICES — 0.1% |

Alcon Finance Corp. (b) | | | 2.600 | % | | | 05/27/30 | | | | 1,250,000 | | | | 1,083,534 | |

| |

PERSONAL PRODUCTS — 0.1% |

Estée Lauder Cos., Inc. (The) | | | 2.600 | % | | | 04/15/30 | | | | 1,000,000 | | | | 885,565 | |

| |

PIPELINES — 0.1% |

Northern Natural Gas Co. (b) | | | 4.100 | % | | | 09/15/42 | | | | 1,200,000 | | | | 954,359 | |

| |

9

See accompanying notes to financial statements.

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

REITS — 3.5% |

Agree Ltd. Partnership | | | 2.900 | % | | | 10/01/30 | | | $ | 650,000 | | | $ | 556,833 | |

Agree Ltd. Partnership | | | 4.800 | % | | | 10/01/32 | | | | 715,000 | | | | 677,455 | |

Alexandria Real Estate Equities, Inc. | | | 2.950 | % | | | 03/15/34 | | | | 1,000,000 | | | | 833,844 | |

Alexandria Real Estate Equities, Inc. (a) | | | 4.750 | % | | | 04/15/35 | | | | 1,250,000 | | | | 1,212,502 | |

Boston Properties, L.P. | | | 4.500 | % | | | 12/01/28 | | | | 1,250,000 | | | | 1,190,518 | |

Camden Property Trust | | | 2.800 | % | | | 05/15/30 | | | | 1,500,000 | | | | 1,341,341 | |

Digital Realty Trust, L.P. (a) | | | 5.550 | % | | | 01/15/28 | | | | 2,250,000 | | | | 2,292,042 | |

ERP Operating, L.P. | | | 4.150 | % | | | 12/01/28 | | | | 1,250,000 | | | | 1,226,964 | |

ESSEX Portfolio, L.P. | | | 2.650 | % | | | 03/15/32 | | | | 1,500,000 | | | | 1,252,700 | |

Federal Realty Investment Trust | | | 1.250 | % | | | 02/15/26 | | | | 515,000 | | | | 475,301 | |

Federal Realty Investment Trust | | | 5.375 | % | | | 05/01/28 | | | | 1,500,000 | | | | 1,516,161 | |

Kilroy Realty Corp. | | | 2.500 | % | | | 11/15/32 | | | | 1,750,000 | | | | 1,325,250 | |

Kimco Realty Corp. (a) | | | 2.700 | % | | | 10/01/30 | | | | 1,750,000 | | | | 1,512,524 | |

Lexington Realty Trust | | | 2.700 | % | | | 09/15/30 | | | | 1,500,000 | | | | 1,242,375 | |

Mid-America Apartment Communities, Inc. | | | 3.950 | % | | | 03/15/29 | | | | 1,750,000 | | | | 1,699,500 | |

Ontario Teachers Cadillac Fairview Properties Trust (b) | | | 2.500 | % | | | 10/15/31 | | | | 1,255,000 | | | | 1,014,021 | |

Prologis, L.P. | | | 2.875 | % | | | 10/06/29 | | | | 1,500,000 | | | | 1,361,676 | |

Prologis, L.P. (a) | | | 4.625 | % | | | 01/15/33 | | | | 1,500,000 | | | | 1,509,478 | |

Realty Income Corp. | | | 4.700 | % | | | 12/15/28 | | | | 1,000,000 | | | | 1,007,367 | |

Regency Centers, L.P. | | | 3.750 | % | | | 06/15/24 | | | | 1,000,000 | | | | 988,297 | |

Rexford Industrial Realty, L.P. (a) | | | 5.000 | % | | | 06/15/28 | | | | 500,000 | | | | 499,505 | |

Rexford Industrial Realty, L.P. | | | 2.150 | % | | | 09/01/31 | | | | 1,750,000 | | | | 1,400,708 | |

Sun Communities Operating, L.P. | | | 2.700 | % | | | 07/15/31 | | | | 500,000 | | | | 416,627 | |

Sun Communities Operating, L.P. | | | 5.700 | % | | | 01/15/33 | | | | 750,000 | | | | 759,235 | |

UDR, Inc. | | | 1.900 | % | | | 03/15/33 | | | | 1,500,000 | | | | 1,140,449 | |

Vornado Realty, L.P. | | | 3.500 | % | | | 01/15/25 | | | | 567,000 | | | | 549,083 | |

WP Carey, Inc. | | | 2.450 | % | | | 02/01/32 | | | | 1,500,000 | | | | 1,218,393 | |

| | | | | | | | | | | | | | | | 30,220,149 | |

RETAIL - CONSUMER STAPLES — 0.2% |

Kroger Co. (The) | | | 5.000 | % | | | 04/15/42 | | | | 1,000,000 | | | | 938,094 | |

Walmart, Inc. | | | 1.800 | % | | | 09/22/31 | | | | 500,000 | | | | 423,674 | |

| | | | | | | | | | | | | | | | 1,361,768 | |

RETAIL - DISCRETIONARY — 0.4% |

Home Depot, Inc. (The) | | | 3.625 | % | | | 04/15/52 | | | | 1,000,000 | | | | 810,325 | |

Lowe’s Cos., Inc. | | | 4.650 | % | | | 04/15/42 | | | | 1,000,000 | | | | 930,447 | |

Lowe’s Cos., Inc. | | | 3.000 | % | | | 10/15/50 | | | | 500,000 | | | | 340,111 | |

Lowe’s Cos., Inc. (a) | | | 5.625 | % | | | 04/15/53 | | | | 1,000,000 | | | | 1,048,426 | |

| | | | | | | | | | | | | | | | 3,129,309 | |

SEMICONDUCTORS — 0.3% |

Intel Corp. (a) | | | 4.150 | % | | | 08/05/32 | | | | 1,000,000 | | | | 977,180 | |

Intel Corp. | | | 3.734 | % | | | 12/08/47 | | | | 1,361,000 | | | | 1,105,412 | |

NVIDIA Corp. | | | 2.850 | % | | | 04/01/30 | | | | 500,000 | | | | 462,417 | |

| | | | | | | | | | | | | | | | 2,545,009 | |

SOFTWARE — 0.4% |

Microsoft Corp. | | | 2.525 | % | | | 06/01/50 | | | | 4,500,000 | | | | 3,072,028 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

SOFTWARE — 0.4%, continued |

Microsoft Corp. | | | 2.921 | % | | | 03/17/52 | | | $ | 1,000,000 | | | $ | 738,036 | |

| | | | | | | | | | | | | | | | 3,810,064 | |

SPECIALTY FINANCE — 0.7% |

American Express Credit Corp. | | | 3.000 | % | | | 10/30/24 | | | | 1,000,000 | | | | 982,773 | |

BlueHub Loan Fund, Inc. | | | 3.099 | % | | | 01/01/30 | | | | 1,030,000 | | | | 886,750 | |

Community Preservation Corp. (The) | | | 2.867 | % | | | 02/01/30 | | | | 1,750,000 | | | | 1,533,108 | |

GATX Corp. | | | 4.350 | % | | | 02/15/24 | | | | 300,000 | | | | 299,032 | |

Low Income Investment Fund | | | 3.386 | % | | | 07/01/26 | | | | 115,000 | | | | 108,459 | |

USAA Capital Corp. (b) | | | 2.125 | % | | | 05/01/30 | | | | 3,000,000 | | | | 2,519,012 | |

| | | | | | | | | | | | | | | | 6,329,134 | |

STEEL — 0.1% |

Nucor Corp. | | | 2.000 | % | | | 06/01/25 | | | | 460,000 | | | | 441,593 | |

| |

TECHNOLOGY HARDWARE — 0.6% |

Apple, Inc. | | | 3.000 | % | | | 06/20/27 | | | | 1,000,000 | | | | 961,264 | |

Apple, Inc. | | | 2.650 | % | | | 05/11/50 | | | | 1,000,000 | | | | 688,337 | |

Apple, Inc. | | | 2.650 | % | | | 02/08/51 | | | | 2,000,000 | | | | 1,369,171 | |

HP, Inc. | | | 4.750 | % | | | 01/15/28 | | | | 1,100,000 | | | | 1,100,948 | |

HP, Inc. | | | 4.000 | % | | | 04/15/29 | | | | 915,000 | | | | 887,164 | |

| | | | | | | | | | | | | | | | 5,006,884 | |

TECHNOLOGY SERVICES — 0.2% |

Experian Finance plc (b) | | | 2.750 | % | | | 03/08/30 | | | | 635,000 | | | | 555,430 | |

Moody’s Corp. | | | 3.250 | % | | | 05/20/50 | | | | 500,000 | | | | 367,429 | |

Moody’s Corp. | | | 3.750 | % | | | 02/25/52 | | | | 1,000,000 | | | | 818,109 | |

| | | | | | | | | | | | | | | | 1,740,968 | |

TELECOMMUNICATIONS — 0.6% |

AT&T, Inc. | | | 5.250 | % | | | 03/01/37 | | | | 500,000 | | | | 502,003 | |

AT&T, Inc. | | | 4.750 | % | | | 05/15/46 | | | | 2,000,000 | | | | 1,807,711 | |

Verizon Communications, Inc. (a) | | | 3.875 | % | | | 02/08/29 | | | | 1,000,000 | | | | 969,482 | |

Verizon Communications, Inc. (a) | | | 1.500 | % | | | 09/18/30 | | | | 1,000,000 | | | | 823,856 | |

Verizon Communications, Inc. | | | 2.987 | % | | | 10/30/56 | | | | 1,799,000 | | | | 1,194,261 | |

| | | | | | | | | | | | | | | | 5,297,313 | |

TRANSPORTATION & LOGISTICS — 1.2% |

British Airways, Series 2013-1 (b) | | | 4.625 | % | | | 12/20/25 | | | | 129,459 | | | | 128,959 | |

Burlington Northern Santa Fe, LLC | | | 5.750 | % | | | 05/01/40 | | | | 2,078,000 | | | | 2,261,788 | |

Canadian Pacific Railway Co. | | | 2.050 | % | | | 03/05/30 | | | | 1,750,000 | | | | 1,497,683 | |

Norfolk Southern Corp. | | | 4.837 | % | | | 10/01/41 | | | | 1,000,000 | | | | 963,415 | |

Norfolk Southern Corp. | | | 3.050 | % | | | 05/15/50 | | | | 1,500,000 | | | | 1,066,893 | |

Penske Truck Leasing Co. (b) | | | 3.450 | % | | | 07/01/24 | | | | 1,250,000 | | | | 1,234,792 | |

Penske Truck Leasing Co. (b) | | | 5.750 | % | | | 05/24/26 | | | | 500,000 | | | | 503,959 | |

TTX Co. (b) | | | 4.600 | % | | | 02/01/49 | | | | 280,000 | | | | 257,436 | |

TTX Co. (b) | | | 5.650 | % | | | 12/01/52 | | | | 500,000 | | | | 533,066 | |

Union Pacific Corp. | | | 4.950 | % | | | 09/09/52 | | | | 2,000,000 | | | | 2,040,602 | |

| | | | | | | | | | | | | | | | 10,488,593 | |

See accompanying notes to financial statements.

10

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

CORPORATE BONDS — 34.1%, continued |

TRANSPORTATION EQUIPMENT — 0.2% |

Ryder System, Inc. (a) | | | 5.650 | % | | | 03/01/28 | | | $ | 1,250,000 | | | $ | 1,287,423 | |

| |

WHOLESALE - CONSUMER STAPLES — 0.2% |

Bunge Ltd. Finance Corp. | | | 1.630 | % | | | 08/17/25 | | | | 395,000 | | | | 373,413 | |

Sysco Corp. | | | 2.400 | % | | | 02/15/30 | | | | 1,750,000 | | | | 1,543,641 | |

| | | | | | | | | | | | | | | | 1,917,054 | |

| |

TOTAL CORPORATE BONDS (COST $320,938,861) | | $ | 291,170,670 | |

| |

CORPORATE NOTES — 1.0% |

COMMUNITY DEVELOPMENT — 1.0% |

Calvert Impact Capital, Inc. (d) | | | 1.000 | % | | | 06/14/24 | | | | 550,000 | | | | 536,355 | |

Calvert Impact Capital, Inc. (d) | | | 3.000 | % | | | 06/17/24 | | | | 980,000 | | | | 963,880 | |

Calvert Impact Capital, Inc. (d) | | | 3.000 | % | | | 12/15/24 | | | | 400,000 | | | | 389,319 | |

Calvert Impact Capital, Inc. (d) | | | 2.500 | % | | | 06/13/25 | | | | 1,400,000 | | | | 1,336,404 | |

Calvert Impact Capital, Inc. (d) | | | 2.500 | % | | | 12/15/25 | | | | 650,000 | | | | 611,309 | |

Calvert Impact Capital, Inc. (d) | | | 4.000 | % | | | 06/15/28 | | | | 1,200,000 | | | | 1,119,050 | |

Calvert Impact Capital, Inc. (d) | | | 5.000 | % | | | 12/15/28 | | | | 450,000 | | | | 450,000 | |

Calvert Impact Climate, Inc. (d) | | | 5.500 | % | | | 12/15/53 | | | | 1,000,000 | | | | 1,028,495 | |

Capital Impact Partners Investment (d) | | | 5.750 | % | | | 06/15/24 | | | | 1,200,000 | | | | 1,202,133 | |

Capital Impact Partners Investment (d) | | | 5.000 | % | | | 12/15/26 | | | | 500,000 | | | | 501,690 | |

TOTAL CORPORATE NOTES (COST $8,330,000) | | $ | 8,138,635 | |

| |

FOREIGN GOVERNMENTS — 3.8% |

FOREIGN AGENCY — 0.5% |

BNG Bank N.V. (b) | | | 1.500 | % | | | 10/16/24 | | | | 1,500,000 | | | | 1,457,925 | |

BNG Bank N.V. (b) | | | 0.500 | % | | | 11/24/25 | | | | 2,000,000 | | | | 1,855,482 | |

Kommunalbanken A.S. (b) | | | 2.125 | % | | | 02/11/25 | | | | 1,000,000 | | | | 970,438 | |

Kommunivest I Sverige AB, Series 4901 (b) | | | 0.375 | % | | | 06/19/24 | | | | 500,000 | | | | 488,685 | |

| | | | | | | | | | | | | | | | 4,772,530 | |

SUPRANATIONAL — 3.3% |

Asian Development Bank | | | 3.125 | % | | | 09/26/28 | | | | 1,000,000 | | | | 963,001 | |

Central American Bank for Economic Integration (b) | | | 1.140 | % | | | 02/09/26 | | | | 1,200,000 | | | | 1,103,910 | |

European Bank for Reconstruction & Development | | | 1.500 | % | | | 02/13/25 | | | | 200,000 | | | | 192,917 | |

European Investment Bank (a) | | | 2.125 | % | | | 04/13/26 | | | | 1,000,000 | | | | 954,370 | |

European Investment Bank | | | 2.375 | % | | | 05/24/27 | | | | 4,000,000 | | | | 3,786,211 | |

Inter-American Development Bank | | | 0.875 | % | | | 04/03/25 | | | | 3,000,000 | | | | 2,861,566 | |

Inter-American Development Bank | | | 4.375 | % | | | 01/24/44 | | | | 3,000,000 | | | | 2,950,692 | |

International Bank for Reconstruction & Development | | | 3.126 | % | | | 11/20/25 | | | | 1,000,000 | | | | 976,700 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

FOREIGN GOVERNMENTS — 3.8%, continued |

SUPRANATIONAL — 3.3%, continued |

International Bank for Reconstruction & Development | | | 0.875 | % | | | 07/15/26 | | | $ | 3,000,000 | | | $ | 2,762,933 | |

International Bank for Reconstruction & Development | | | 3.125 | % | | | 06/15/27 | | | | 4,000,000 | | | | 3,876,538 | |

International Development Association (b) | | | 0.375 | % | | | 09/23/25 | | | | 2,000,000 | | | | 1,865,059 | |

International Development Association (a)(b) | | | 0.876 | % | | | 04/28/26 | | | | 2,000,000 | | | | 1,850,353 | |

International Finance Corp., Series GMTN | | | 2.126 | % | | | 04/07/26 | | | | 3,000,000 | | | | 2,862,698 | |

International Finance Corp., Series 2622 | | | 4.375 | % | | | 01/15/27 | | | | 1,000,000 | | | | 1,007,753 | |

| | | | | | | | | | | | | | | | 28,014,701 | |

| |

TOTAL FOREIGN GOVERNMENTS (COST $34,672,391) | | $ | 32,787,231 | |

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 0.0% (e) |

Commercial Mortgage Pass-Through Certificates, Class A-3 (COST $33,588) | | | 2.853 | % | | | 10/17/45 | | | | 32,965 | | | | 30,056 | |

| | | | | | | | | | | | | | | | | |

U.S. GOVERNMENT AGENCIES — 51.8% |

DEVELOPMENT FINANCE CORPORATION — 0.9% |

DFC (c) | | | 5.520 | % | | | 09/15/26 | | | | 458,333 | | | | 458,333 | |

DFC | | | 1.590 | % | | | 04/15/28 | | | | 2,000,000 | | | | 1,809,117 | |

DFC | | | 1.650 | % | | | 04/15/28 | | | | 3,500,000 | | | | 3,210,540 | |

DFC | | | 3.130 | % | | | 04/15/28 | | | | 1,000,000 | | | | 954,192 | |

DFC | | | 3.540 | % | | | 06/15/30 | | | | 382,367 | | | | 375,142 | |

DFC | | | 3.520 | % | | | 09/20/32 | | | | 625,000 | | | | 599,893 | |

DFC | | | 3.820 | % | | | 06/01/33 | | | | 733,816 | | | | 705,963 | |

| | | | | | | | | | | | | | | | 8,113,180 | |

FEDERAL HOME LOAN BANK — 6.5% |

FHLB | | | 1.250 | % | | | 12/21/26 | | | | 4,000,000 | | | | 3,677,459 | |

FHLB | | | 4.250 | % | | | 12/10/27 | | | | 11,000,000 | | | | 11,113,213 | |

FHLB | | | 4.500 | % | | | 03/10/28 | | | | 3,000,000 | | | | 3,070,942 | |

FHLB | | | 4.000 | % | | | 06/30/28 | | | | 3,200,000 | | | | 3,213,426 | |

FHLB | | | 3.250 | % | | | 11/16/28 | | | | 13,000,000 | | | | 12,616,382 | |

FHLB | | | 5.500 | % | | | 07/15/36 | | | | 18,620,000 | | | | 21,039,738 | |

FHLB | | | 2.340 | % | | | 03/26/40 | | | | 1,000,000 | | | | 708,182 | |

| | | | | | | | | | | | | | | | 55,439,342 | |

FEDERAL HOME LOAN MORTGAGE CORPORATION — 18.4% |

FHLMC | | | 4.000 | % | | | 11/01/24 | | | | 10,620 | | | | 10,539 | |

FHLMC | | | 0.375 | % | | | 09/23/25 | | | | 3,500,000 | | | | 3,266,648 | |

FHLMC | | | 4.000 | % | | | 10/01/25 | | | | 10,211 | | | | 10,112 | |

FHLMC | | | 2.875 | % | | | 04/25/26 | | | | 3,000,000 | | | | 2,891,618 | |

FHLMC | | | 6.000 | % | | | 04/01/27 | | | | 26,262 | | | | 26,694 | |

FHLMC | | | 2.500 | % | | | 10/01/27 | | | | 157,960 | | | | 152,239 | |

FHLMC | | | 2.738 | % | | | 04/25/29 | | | | 2,180,859 | | | | 2,084,512 | |

FHLMC | | | 2.939 | % | | | 04/25/29 | | | | 4,000,000 | | | | 3,722,067 | |

FHLMC | | | 2.412 | % | | | 08/25/29 | | | | 5,780,000 | | | | 5,236,977 | |

FHLMC | | | 7.000 | % | | | 02/01/30 | | | | 10,948 | | | | 11,308 | |

FHLMC | | | 1.297 | % | | | 06/25/30 | | | | 4,200,000 | | | | 3,484,802 | |

FHLMC | | | 7.500 | % | | | 07/01/30 | | | | 41,265 | | | | 42,700 | |

FHLMC | | | 1.406 | % | | | 08/25/30 | | | | 2,000,000 | | | | 1,659,271 | |

FHLMC | | | 1.503 | % | | | 09/25/30 | | | | 4,000,000 | | | | 3,347,251 | |

FHLMC | | | 1.487 | % | | | 11/25/30 | | | | 11,900,000 | | | | 9,877,787 | |

11

See accompanying notes to financial statements.

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

U.S. GOVERNMENT AGENCIES — 51.8%, continued |

FEDERAL HOME LOAN MORTGAGE CORPORATION — 18.4%, continued |

FHLMC | | | 1.878 | % | | | 01/25/31 | | | $ | 1,500,000 | | | $ | 1,272,345 | |

FHLMC | | | 2.000 | % | | | 01/25/31 | | | | 3,000,000 | | | | 2,559,658 | |

FHLMC | | | 7.000 | % | | | 03/01/31 | | | | 18,710 | | | | 19,325 | |

FHLMC | | | 1.777 | % | | | 10/25/31 | | | | 5,000,000 | | | | 4,157,826 | |

FHLMC | | | 2.154 | % | | | 10/25/31 | | | | 4,000,000 | | | | 3,412,304 | |

FHLMC | | | 2.091 | % | | | 11/25/31 | | | | 2,500,000 | | | | 2,112,778 | |

FHLMC | | | 2.450 | % | | | 04/25/32 | | | | 7,100,000 | | | | 6,129,359 | |

FHLMC | | | 2.650 | % | | | 05/25/32 | | | | 9,000,000 | | | | 7,877,840 | |

FHLMC | | | 6.250 | % | | | 07/15/32 | | | | 7,050,000 | | | | 8,173,546 | |

FHLMC | | | 3.123 | % | | | 08/25/32 | | | | 5,710,000 | | | | 5,173,523 | |

FHLMC | | | 3.000 | % | | | 11/01/32 | | | | 289,999 | | | | 274,504 | |

FHLMC | | | 3.000 | % | | | 11/01/32 | | | | 379,204 | | | | 358,942 | |

FHLMC | | | 5.500 | % | | | 11/01/33 | | | | 21,254 | | | | 21,918 | |

FHLMC (H15T1Y + 223.10) (c) | | | 5.356 | % | | | 05/01/34 | | | | 1,907 | | | | 1,906 | |

FHLMC (H15T1Y + 223.10) (c) | | | 5.356 | % | | | 05/01/34 | | | | 22,875 | | | | 23,344 | |

FHLMC | | | 1.783 | % | | | 06/25/34 | | | | 2,084,061 | | | | 1,635,012 | |

FHLMC | | | 5.000 | % | | | 07/01/35 | | | | 43,294 | | | | 43,820 | |

FHLMC | | | 4.500 | % | | | 10/01/35 | | | | 60,244 | | | | 60,450 | |

FHLMC | | | 2.438 | % | | | 02/25/36 | | | | 4,000,000 | | | | 3,163,060 | |

FHLMC | | | 5.500 | % | | | 03/01/36 | | | | 16,884 | | | | 17,412 | |

FHLMC | | | 1.500 | % | | | 04/01/36 | | | | 5,031,553 | | | | 4,396,578 | |

FHLMC | | | 5.500 | % | | | 06/01/36 | | | | 24,618 | | | | 25,387 | |

FHLMC | | | 6.000 | % | | | 06/01/36 | | | | 20,197 | | | | 21,007 | |

FHLMC | | | 5.500 | % | | | 12/01/36 | | | | 20,226 | | | | 20,858 | |

FHLMC | | | 2.000 | % | | | 02/01/37 | | | | 4,084,498 | | | | 3,660,610 | |

FHLMC | | | 6.000 | % | | | 08/01/37 | | | | 10,269 | | | | 10,741 | |

FHLMC | | | 5.000 | % | | | 03/01/38 | | | | 103,860 | | | | 105,690 | |

FHLMC | | | 4.500 | % | | | 06/01/39 | | | | 114,376 | | | | 114,356 | |

FHLMC | | | 5.000 | % | | | 06/01/39 | | | | 163,922 | | | | 166,819 | |

FHLMC | | | 4.500 | % | | | 07/01/39 | | | | 105,314 | | | | 105,284 | |

FHLMC | | | 4.500 | % | | | 11/01/39 | | | | 96,451 | | | | 96,443 | |

FHLMC | | | 4.500 | % | | | 09/01/40 | | | | 145,263 | | | | 145,110 | |

FHLMC | | | 4.500 | % | | | 05/01/41 | | | | 282,327 | | | | 282,365 | |

FHLMC | | | 4.500 | % | | | 07/01/41 | | | | 329,822 | | | | 329,865 | |

FHLMC | | | 5.000 | % | | | 09/01/41 | | | | 135,243 | | | | 137,509 | |

FHLMC | | | 3.500 | % | | | 10/01/41 | | | | 160,693 | | | | 152,769 | |

FHLMC | | | 4.000 | % | | | 10/01/41 | | | | 170,461 | | | | 166,044 | |

FHLMC | | | 3.500 | % | | | 02/01/42 | | | | 286,414 | | | | 271,520 | |

FHLMC | | | 4.000 | % | | | 02/01/42 | | | | 76,404 | | | | 74,456 | |

FHLMC | | | 3.500 | % | | | 06/01/42 | | | | 321,355 | | | | 304,379 | |

FHLMC | | | 3.500 | % | | | 06/01/42 | | | | 322,738 | | | | 305,622 | |

FHLMC | | | 3.500 | % | | | 08/01/42 | | | | 378,256 | | | | 357,961 | |

FHLMC | | | 3.000 | % | | | 11/01/42 | | | | 721,877 | | | | 664,397 | |

FHLMC | | | 3.000 | % | | | 01/01/43 | | | | 408,781 | | | | 376,231 | |

FHLMC | | | 3.000 | % | | | 05/01/43 | | | | 556,664 | | | | 512,328 | |

FHLMC | | | 3.500 | % | | | 10/01/44 | | | | 319,226 | | | | 298,337 | |

FHLMC | | | 3.500 | % | | | 11/01/44 | | | | 289,149 | | | | 270,227 | |

FHLMC | | | 3.500 | % | | | 04/01/45 | | | | 358,822 | | | | 335,336 | |

FHLMC | | | 3.000 | % | | | 05/01/46 | | | | 626,487 | | | | 570,680 | |

FHLMC | | | 3.000 | % | | | 12/01/46 | | | | 1,533,489 | | | | 1,397,932 | |

FHLMC | | | 3.500 | % | | | 03/01/48 | | | | 1,709,558 | | | | 1,605,878 | |

FHLMC | | | 3.500 | % | | | 03/01/49 | | | | 469,227 | | | | 437,612 | |

FHLMC | | | 3.500 | % | | | 07/01/49 | | | | 765,664 | | | | 711,316 | |

FHLMC | | | 3.000 | % | | | 09/01/49 | | | | 882,371 | | | | 789,176 | |

FHLMC | | | 3.000 | % | | | 07/01/50 | | | | 2,168,253 | | | | 1,937,597 | |

FHLMC | | | 2.000 | % | | | 08/01/50 | | | | 3,073,932 | | | | 2,531,111 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

U.S. GOVERNMENT AGENCIES — 51.8%, continued |

FEDERAL HOME LOAN MORTGAGE CORPORATION — 18.4%, continued |

FHLMC | | | 2.050 | % | | | 08/19/50 | | | $ | 2,500,000 | | | $ | 1,388,378 | |

FHLMC | | | 2.000 | % | | | 01/01/51 | | | | 7,581,286 | | | | 6,233,866 | |

FHLMC | | | 2.500 | % | | | 04/01/51 | | | | 7,399,077 | | | | 6,316,726 | |

FHLMC | | | 2.500 | % | | | 09/01/51 | | | | 2,956,878 | | | | 2,517,777 | |

FHLMC | | | 2.500 | % | | | 02/01/52 | | | | 6,228,276 | | | | 5,300,488 | |

FHLMC | | | 2.000 | % | | | 04/01/52 | | | | 4,607,742 | | | | 3,766,434 | |

FHLMC | | | 3.000 | % | | | 04/01/52 | | | | 5,434,723 | | | | 4,808,296 | |

FHLMC | | | 2.500 | % | | | 05/01/52 | | | | 6,464,747 | | | | 5,501,177 | |

FHLMC | | | 3.500 | % | | | 09/01/52 | | | | 4,711,265 | | | | 4,320,521 | |

FHLMC | | | 4.000 | % | | | 10/01/52 | | | | 11,290,664 | | | | 10,678,444 | |

| | | | | | | | | | | | | | | | 156,835,035 | |

FEDERAL NATIONAL MORTGAGE ASSOCIATION — 25.8% |

FNMA (c) | | | 2.584 | % | | | 07/25/24 | | | | 1,535,115 | | | | 1,510,802 | |

FNMA | | | 2.890 | % | | | 12/01/24 | | | | 4,000,000 | | | | 3,908,160 | |

FNMA | | | 3.080 | % | | | 12/01/24 | | | | 2,062,133 | | | | 2,019,933 | |

FNMA | | | 2.710 | % | | | 01/01/25 | | | | 4,500,000 | | | | 4,383,270 | |

FNMA | | | 5.000 | % | | | 04/01/25 | | | | 6,424 | | | | 6,366 | |

FNMA | | | 5.000 | % | | | 07/01/25 | | | | 6,390 | | | | 6,328 | |

FNMA | | | 3.500 | % | | | 10/01/25 | | | | 11,872 | | | | 11,672 | |

FNMA | | | 5.000 | % | | | 10/01/25 | | | | 10,275 | | | | 10,165 | |

FNMA | | | 5.500 | % | | | 11/01/25 | | | | 5 | | | | 5 | |

FNMA | | | 0.500 | % | | | 11/07/25 | | | | 6,934,000 | | | | 6,458,682 | |

FNMA | | | 4.000 | % | | | 03/01/26 | | | | 61,549 | | | | 60,711 | |

FNMA | | | 2.910 | % | | | 04/01/26 | | | | 3,000,000 | | | | 2,876,082 | |

FNMA | | | 2.125 | % | | | 04/24/26 | | | | 2,000,000 | | | | 1,911,011 | |

FNMA | | | 8.500 | % | | | 09/01/26 | | | | 748 | | | | 745 | |

FNMA | | | 2.500 | % | | | 09/01/27 | | | | 176,059 | | | | 169,620 | |

FNMA | | | 0.750 | % | | | 10/08/27 | | | | 8,000,000 | | | | 7,102,420 | |

FNMA | | | 2.500 | % | | | 11/01/27 | | | | 291,607 | | | | 280,661 | |

FNMA | | | 2.500 | % | | | 01/01/28 | | | | 189,964 | | | | 182,748 | |

FNMA (c) | | | 3.302 | % | | | 06/25/28 | | | | 1,810,871 | | | | 1,740,827 | |

FNMA | | | 3.547 | % | | | 09/25/28 | | | | 3,481,368 | | | | 3,371,170 | |

FNMA | | | 2.530 | % | | | 05/01/29 | | | | 3,949,068 | | | | 3,585,946 | |

FNMA | | | 2.522 | % | | | 08/27/29 | | | | 5,354,298 | | | | 4,866,014 | |

FNMA | | | 1.470 | % | | | 11/01/29 | | | | 2,599,000 | | | | 2,201,133 | |

FNMA | | | 0.875 | % | | | 08/05/30 | | | | 19,750,000 | | | | 16,094,769 | |

FNMA | | | 6.625 | % | | | 11/15/30 | | | | 12,750,000 | | | | 14,675,102 | |

FNMA (c) | | | 1.469 | % | | | 11/25/30 | | | | 3,000,000 | | | | 2,470,678 | |

FNMA (c) | | | 1.383 | % | | | 12/25/30 | | | | 5,000,000 | | | | 4,111,469 | |

FNMA | | | 1.245 | % | | | 01/25/31 | | | | 3,000,000 | | | | 2,431,804 | |

FNMA | | | 1.410 | % | | | 02/01/31 | | | | 3,000,000 | | | | 2,448,361 | |

FNMA | | | 1.375 | % | | | 03/25/31 | | | | 1,000,000 | | | | 813,260 | |

FNMA | | | 2.000 | % | | | 01/01/32 | | | | 990,805 | | | | 919,122 | |

FNMA | | | 3.000 | % | | | 12/01/32 | | | | 426,058 | | | | 402,678 | |

FNMA | | | 4.506 | % | | | 04/25/33 | | | | 2,000,000 | | | | 2,003,748 | |

FNMA | | | 6.000 | % | | | 10/01/33 | | | | 16,876 | | | | 17,463 | |

FNMA | | | 5.500 | % | | | 02/01/34 | | | | 18,549 | | | | 19,101 | |

FNMA (H15T1Y + 211.70) (c) | | | 4.832 | % | | | 05/01/34 | | | | 20,218 | | | | 20,458 | |

FNMA | | | 6.000 | % | | | 11/01/34 | | | | 45,272 | | | | 47,232 | |

FNMA | | | 5.500 | % | | | 01/01/35 | | | | 26,647 | | | | 27,909 | |

FNMA | | | 2.500 | % | | | 02/01/35 | | | | 1,024,962 | | | | 950,608 | |

FNMA | | | 5.000 | % | | | 10/01/35 | | | | 41,023 | | | | 41,686 | |

FNMA | | | 5.500 | % | | | 10/01/35 | | | | 49,534 | | | | 51,011 | |

FNMA | | | 6.000 | % | | | 10/01/35 | | | | 24,664 | | | | 25,711 | |

FNMA | | | 5.500 | % | | | 06/01/36 | | | | 10,305 | | | | 10,586 | |

FNMA | | | 6.000 | % | | | 06/01/36 | | | | 12,185 | | | | 12,727 | |

FNMA | | | 5.500 | % | | | 11/01/36 | | | | 15,702 | | | | 16,170 | |

See accompanying notes to financial statements.

12

Schedule of Investments, continued

Praxis Impact Bond Fund

December 31, 2023

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

U.S. GOVERNMENT AGENCIES — 51.8%, continued |

FEDERAL NATIONAL MORTGAGE ASSOCIATION — 25.8%, continued |

FNMA (RFUCCT1Y + 156.50) (c) | | | 4.065 | % | | | 05/01/37 | | | $ | 1,963 | | | $ | 1,960 | |

FNMA | | | 5.625 | % | | | 07/15/37 | | | | 14,250,000 | | | | 16,122,642 | |

FNMA | | | 4.500 | % | | | 09/01/40 | | | | 86,243 | | | | 86,132 | |

FNMA | | | 4.500 | % | | | 10/01/40 | | | | 86,982 | | | | 86,870 | |

FNMA | | | 4.000 | % | | | 12/01/40 | | | | 224,757 | | | | 219,185 | |

FNMA | | | 4.000 | % | | | 01/01/41 | | | | 159,538 | | | | 155,485 | |

FNMA | | | 3.500 | % | | | 02/01/41 | | | | 236,632 | | | | 224,661 | |

FNMA | | | 4.000 | % | | | 10/01/41 | | | | 123,539 | | | | 120,223 | |

FNMA | | | 4.000 | % | | | 11/01/41 | | | | 139,549 | | | | 135,803 | |

FNMA | | | 4.000 | % | | | 12/01/41 | | | | 167,197 | | | | 162,638 | |

FNMA | | | 4.000 | % | | | 12/01/41 | | | | 234,417 | | | | 228,025 | |

FNMA | | | 4.000 | % | | | 01/01/42 | | | | 529,207 | | | | 517,758 | |

FNMA | | | 3.500 | % | | | 05/01/42 | | | | 272,001 | | | | 256,023 | |

FNMA | | | 3.000 | % | | | 06/01/42 | | | | 511,112 | | | | 470,598 | |

FNMA | | | 3.000 | % | | | 08/01/42 | | | | 389,331 | | | | 358,494 | |

FNMA | | | 3.000 | % | | | 08/01/42 | | | | 408,563 | | | | 376,383 | |

FNMA | | | 3.500 | % | | | 12/01/42 | | | | 558,962 | | | | 528,464 | |

FNMA | | | 3.000 | % | | | 06/01/43 | | | | 472,399 | | | | 434,167 | |

FNMA | | | 4.000 | % | | | 12/01/44 | | | | 651,793 | | | | 630,029 | |

FNMA | | | 3.500 | % | | | 05/01/45 | | | | 732,528 | | | | 686,946 | |

FNMA | | | 3.000 | % | | | 04/01/46 | | | | 603,543 | | | | 550,619 | |

FNMA | | | 3.500 | % | | | 11/01/46 | | | | 1,024,564 | | | | 956,215 | |

FNMA | | | 4.000 | % | | | 10/01/48 | | | | 467,934 | | | | 450,051 | |

FNMA | | | 4.000 | % | | | 11/01/48 | | | | 1,242,132 | | | | 1,195,446 | |

FNMA | | | 3.500 | % | | | 05/01/49 | | | | 382,306 | | | | 354,777 | |

FNMA | | | 4.000 | % | | | 06/01/49 | | | | 585,556 | | | | 562,089 | |

FNMA | | | 3.500 | % | | | 08/01/49 | | | | 1,571,843 | | | | 1,462,908 | |

FNMA | | | 3.000 | % | | | 09/01/49 | | | | 842,799 | | | | 755,560 | |

FNMA | | | 3.000 | % | | | 06/01/50 | | | | 1,732,940 | | | | 1,547,502 | |

FNMA | | | 2.500 | % | | | 07/01/50 | | | | 2,841,066 | | | | 2,436,874 | |

FNMA | | | 2.500 | % | | | 08/01/50 | | | | 2,008,333 | | | | 1,720,139 | |

FNMA | | | 3.000 | % | | | 08/01/50 | | | | 3,072,108 | | | | 2,740,469 | |

FNMA | | | 2.000 | % | | | 11/01/50 | | | | 5,092,935 | | | | 4,189,320 | |

FNMA | | | 2.000 | % | | | 01/01/51 | | | | 9,109,101 | | | | 7,488,197 | |

FNMA | | | 2.000 | % | | | 02/01/51 | | | | 5,390,224 | | | | 4,426,882 | |

FNMA | | | 2.500 | % | | | 04/01/51 | | | | 15,222,012 | | | | 13,028,144 | |

FNMA | | | 2.000 | % | | | 08/01/51 | | | | 12,815,480 | | | | 10,500,429 | |

FNMA | | | 2.000 | % | | | 11/01/51 | | | | 5,294,499 | | | | 4,333,697 | |

FNMA | | | 2.500 | % | | | 05/01/52 | | | | 5,550,141 | | | | 4,723,628 | |

FNMA | | | 3.500 | % | | | 05/01/52 | | | | 5,447,441 | | | | 4,998,414 | |

FNMA | | | 3.500 | % | | | 05/01/52 | | | | 7,538,771 | | | | 6,916,762 | |

FNMA | | | 3.000 | % | | | 07/01/52 | | | | 4,675,568 | | | | 4,135,077 | |

FNMA | | | 4.500 | % | | | 07/01/52 | | | | 4,548,975 | | | | 4,410,947 | |

FNMA | | | 4.500 | % | | | 08/01/52 | | | | 6,383,432 | | | | 6,189,742 | |

FNMA | | | 5.000 | % | | | 04/01/53 | | | | 10,467,106 | | | | 10,355,198 | |

FNMA | | | 5.000 | % | | | 06/01/53 | | | | 3,930,277 | | | | 3,889,763 | |

| | | | | | | | | | | | | | | | 220,397,459 | |

GOVERNMENT NATIONAL MORTGAGE ASSOCIATION — 0.0% (e) |

GNMA | | | 7.000 | % | | | 12/20/30 | | | | 6,950 | | | | 7,146 | |

GNMA | | | 7.000 | % | | | 10/20/31 | | | | 4,813 | | | | 5,071 | |

GNMA | | | 7.000 | % | | | 03/20/32 | | | | 21,602 | | | | 22,538 | |

GNMA (H15T1Y + 150.00) (c) | | | 3.625 | % | | | 01/20/34 | | | | 13,547 | | | | 13,625 | |

GNMA | | | 5.500 | % | | | 10/20/38 | | | | 4,893 | | | | 4,864 | |

GNMA | | | 6.500 | % | | | 11/20/38 | | | | 3,093 | | | | 3,152 | |

| | | | | | | | | | | | | | | | 56,396 | |

| | Coupon | | | Maturity | | | Principal

Amount | | | Fair

Value | |

U.S. GOVERNMENT AGENCIES — 51.8%, continued |

SMALL BUSINESS ADMINISTRATION — 0.0% (e) |

SBA (Prime — 2.65) (c) | | | 5.850 | % | | | 02/25/32 | | | $ | 4,660 | | | $ | 4,638 | |

| |

UNITED STATES AGENCY OF INTERNATIONAL DEVELOPMENT — 0.2% |

Hashemite Kingdom of Jordan AID Bond | | | 3.000 | % | | | 06/30/25 | | | | 1,450,000 | | | | 1,401,933 | |

| | | | | | | | | | | | | | | | | |

TOTAL U.S. GOVERNMENT AGENCIES (COST $469,971,606) | | $ | 442,247,983 | |

| |

ASSET BACKED SECURITIES — 4.5% |

Ahold Finance U.S.A., LLC | | | 8.620 | % | | | 01/02/25 | | | | 60,083 | | | | 61,443 | |

Aligned Data Centers Issuer, LLC (b) | | | 6.000 | % | | | 08/17/48 | | | | 1,510,000 | | | | 1,496,331 | |

American Tower Trust I (b) | | | 3.652 | % | | | 03/23/28 | | | | 2,000,000 | | | | 1,889,282 | |

Beacon Container Finance II, LLC (b) | | | 2.250 | % | | | 10/22/46 | | | | 814,667 | | | | 722,283 | |

Cards II Trust (b) | | | 0.602 | % | | | 04/15/27 | | | | 2,250,000 | | | | 2,216,835 | |

CLI Funding, LLC (b) | | | 2.720 | % | | | 01/18/47 | | | | 1,127,289 | | | | 988,232 | |

DB Master Finance, LLC (b) | | | 2.493 | % | | | 11/20/51 | | | | 1,984,500 | | | | 1,738,583 | |