Exhibit 99 (c)(2)

PRESENTATION TO

SPECIAL COMMITTEE of BOARD OF DIRECTORS

[Confidential Treatment has been requested for the names and other identifying information of certain

bidders and prospective bidders. The Confidential Portions have been filed with the

United States Securities and Exchange Commission]

2

SUMMARY OF PROCESS

4

» | Covington Associates LLC (“CA”) was retained by The Vermont Teddy Bear Company, Inc. (“the Company”) on October 20, 2004 in connection with various strategic alternatives to enhance shareholder value including a possible going private transaction |

| |

» | CA due diligence began on October 25th with a kickoff meeting at the Company |

| |

» | CA due diligence proceeded until the end of November when the Offering Memorandum was completed and signed off by the Company |

| |

» | Marketing process began in earnest in mid to late November with “pre-marketing calls” (on a no-names basis) to gauge interest in a transaction |

| |

» | Confidentiality agreements (“NDA’s”) were executed beginning the week of November 15th |

| |

» | Offering Memoranda were printed on November 19th and the first round of materials were sent to investors that had executed an NDA on Monday November 22nd |

| |

» | Indications of Interest due to CA on Wednesday December 15th by 5:00 pm |

5

» | A total of 94 parties were contacted (see Exhibits) |

| |

| • | 79 Private Equity Groups |

| • | 5 Mezzanine lenders |

| • | 10 Individual/High Net Worth Individuals (as part of Fresh Tracks syndicate) |

| | |

» | A total of 63 potential parties executed confidentiality agreements and reviewed the Offering Memorandum |

| |

| • | 50 Private Equity Groups |

| • | 5 Mezzanine lenders |

| • | 8 Individual/High Net Worth Individuals (as part of Fresh Tracks syndicate) |

| | |

» | 29 Private Equity Groups were not interested in executing an NDA based upon CA’s no-names description or overview of the Company |

| |

» | 2 parties still currently reviewing NDA’s (Fresh Tracks syndicate) |

6

» | 8 “indications of interest” to acquire the Company were received by CA |

| |

» | Most offers were made on an enterprise value basis and not a per share basis due to the changing liquidity in the Company’s balance sheet |

| |

» | Summary as follows: [Confidential Treatment has been requested for the bidder names in the following table] : |

| | | | | As a Multiple of: | | Existing Capital Structure(1) | |

| | | | |

| |

| |

Firm Name | | Enterprise Value | | LTM

EBITDA | | FYE 2005E

EBITDA | | Debt(1) | | Series A Preferred Stock(3) | | Cash(1) | | Cash From Options / Warrants Exercise (2) | | Total Equity Value (4) | | Fully Diluted S/O | | Price Per Fully Diluted Share | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Bidder A | | | $35.0 | | | 6.4x | | | 5.7x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $37.1 | | | 6.96 | | | $5.33 | |

Bidder B | | | $37.0-$40.0 | | | 6.7x - 7.3x | | | 6.0x - 6.5x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $39.2-$42.2 | | | 6.96 | | | $5.63-$6.06 | |

Bidder C | | | $34.0-$36.0 | | | 6.2x - 6.5x | | | 5.5x - 5.8x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $36.2-$38.2 | | | 6.96 | | | $5.20-$5.49 | |

Bidder D | | | $28.0-$31.0 | | | 5.0x - 5.6x | | | 4.5x - 5.0x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $30.2-$33.2 | | | 6.96 | | | $4.33-$4.77 | |

Bidder E | | | $36.2 | | | 6.6x | | | 5.9x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $38.3 | | | 6.96 | | | $5.50 | |

FreshTracks | | | $39.6-$43.8 | | | 7.2x - 8.0x | | | 6.4x - 7.1x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $41.8-$46.0 | | | 6.96 | | | $6.00-$6.60 | |

Bidder G | | | $36.2 | | | 6.6x | | | 5.9x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $38.3 | | | 6.96 | | | $5.50 | |

Bidder H | | | $38.5-$40.1 | | | 7.0x - 7.3x | | | 6.25x - 6.5x | | $ | 6.6 | | $ | 1.5 | | $ | 8.1 | | $ | 2.2 | | | $40.7-$42.3 | | | 6.96 | | | $5.85-$6.08 | |

|

(1) Projected Debt and Cash balances as of June 30, 2005 per Company model. |

(2) Assumes that all option holders exercise options. |

(3) Owned by Joan Martin. |

(4) Formula is Enterprise Value, less debt, plus cash on BS, plus cash from options exercise. |

|

Note: Most offers expressed in terms of enterprise value and not per share range (due to balance sheet changes). Bidder E and Bidder G provided per share amounts. |

7

» | Invited the following firms in for further due diligence and to meet with the management team during January 2005 : [Confidential Treatment has been requested for the bidder names] |

| |

| | » | Bidder A |

| | » | Bidder B |

| | » | Bidder E |

| | » | Bidder G |

| | » | Bidder H |

| | | |

» | All bidders received a secure user ID and passcode to login to a secure website hosted by the Company that contained detailed due diligence items and other pertinent data |

| | | |

» | [Confidential Treatment has been requested for the bidder names] Extended invitation to Bidder C, but they declined due to run up in stock price during December 2004 |

| |

» | FreshTracks did not want to meet with management because they were already familiar with the Company and needed time to build an equity syndicate to consummate the transaction |

| | | |

» | [Confidential Treatment has been requested for the bidder names] Extended an invitation to Bidder D to meet with management if they could improve their offer significantly, and they declined |

8

» | Meetings were conducted at the Company throughout January 2005 |

| |

» | Meeting agenda as follows: Plant Tour, Detailed Management Presentation, Question and Answer Session |

| |

» | Management meetings led by: |

| | | |

| | » | Elisabeth Robert, CEO and President |

| | » | Irene Steiner, VP of Marketing |

| | » | Katie Camardo, VP of Operations |

| | » | Greg Laduc, Finance Manager |

| | » | Mark Sleeper, Chief Accounting Officer |

| | | |

» | CA representative in attendance at each and every meeting |

| |

» | No communication between outside investors and management without CA representative physically present or available via teleconference or prior approval from CA |

| |

» | Continued to work with FreshTracks and their syndicate to execute CA’s and answer questions |

9

[Confidential Treatment has been requested for the bidder names]

Management Meeting Dates:

» | Bidder H(1): January 6th / January 26th |

| |

» | Bidder B(3)(4): January 7th |

| |

» | Bidder E(2)(3)(4): January 18th / January 31st |

| |

» | Bidder A(3): January 19th |

| |

» | Bidder G(5): January 27th |

|

(1) | Bidder H asked for permission to visit the Company a second time for further meetings and due diligence |

(2) | Bidder E asked for permission to visit the Company a second time for further meetings and due diligence |

(3) | Representatives from CA and Liz Robert, CEO met with these firms in New York in their respective offices on December 9, 2004 |

(4) | Liz Robert, CEO met with representatives of these firms in New York on January 27, 2004 |

(5) | Firm visited management and Company’s facility prior to the start of the process with CA during the summer of 2004 |

SUMMARY OF OFFERS

11

» | 6 “letters of intent” to invest in or purchase the Company were received by CA |

| |

» | Summary as follows: |

[Confidential Treatment has been requested for the bidder names]

Firm Name | | | Enterprise

Value | | | Less Net Debt | | | Equity Value | | | Shares O/S | | | Fully Diluted

Price Per Share | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Bidder A | | | $39.0 | | | $1.5 | | | $37.2 | | | 6.501 | | | $5.72 | |

Bidder B | | | $45.3 | | | $1.5 | | | $43.8 | | | 6.962 | | | $6.35 | |

Bidder E(1) | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | |

FreshTracks(2) | | | $42.2 to $46.4 | | | $0.5 | | | $41.7 to $45.9 | | | 6.962 | | | $6.00-$6.60 | |

Bidder G | | | $42.6 | | | ($0.9) | | | $43.5 | | | 6.962 | | | $6.25 | |

Bidder H | | | $51.3 | | | $6.0 | | | $45.3 | | | 6.962 | | | $6.50 | |

|

(1) | Bidder E has proposed to invest $10.0MM into the Company to commence a tender offer of public shares. Refer to powerpoint presentation for further detail. |

(2) | Multiples based upon the high end of the range offered by FreshTracks. Lead investor is Mustang Management. |

12

[Confidential Treatment has been requested for the bidder name]

BIDDER A

» | $5.72 on a fully diluted basis |

| |

» | Enterprise Value of $39.0MM represents 7.3x LTM 12/31/04 EBITDA of $5.3MM; 6.0x 2005E EBITDA of $6.5MM |

| |

» | Would assume the Company’s capital lease debt obligations of $4.8MM |

| |

» | Seller note from Joan Martin of $4.7MM |

| |

» | Proforma capitalization: $15.0MM of funded senior and subordinated debt, $4.8MM of capital leases; $4.7MM seller note and $16.9MM of equity |

| |

» | Minimum working capital at closing of $1.1MM |

| |

» | Closing fee of $800,000 or 2% of Enterprise Value; annual management fee of $250,000 or 3.5% of annual EBITDA (greater of) |

| |

» | Required 100% rollover equity from Liz Robert, 50% from Irene Steiner, and Katie Camardo; 10% option pool going forward for management |

| |

» | Timing: 30 days to completion of Merger Agreement |

13

[Confidential Treatment has been requested for the bidder name]

BIDDER B

» | $6.35 on a fully diluted basis |

| |

» | Enterprise Value of $45.8MM represents 8.6x LTM 12/31/04 EBITDA of $5.3MM; 7.0x 2005E EBITDA of $6.5MM |

| |

» | Maximum total debt at closing of $7.8MM; Cash balance of $8.2MM at closing |

| |

» | Maximum exposure on 538 Madison Realty litigation of $2.0MM |

| |

» | Proforma capitalization: 2.5x Senior Debt / 3.5x Total Debt |

| |

» | Receive cash upon the exercise of options and warrants of $2.2MM |

| |

» | Mutually agreed upon rollover equity amounts for management; 10% option pool for management; employment contracts for Liz Robert and Irene Steiner |

| |

» | Timing: No mention of specifically in letter, verbally okay with 30 days to Merger Agreement |

14

[Confidential Treatment has been requested for the bidder name]

BIDDER E

» | Invest $10.0MM into the Company to conduct a tender offer for public shares in the open market |

| |

» | Structured as either: Convertible Subordinated Debt or Convertible Preferred Stock |

| |

» | Conversion Price: The Lower of $7.00 per share or the lowest 10 day average closing price of the Company’s stock over the next 12 months, with a floor of $4.50 |

| |

» | 5% cash pay; 7% Paid in Kind Interest, accruing semi-annually |

| |

» | 5 Year Term; required 2 board seats |

| |

» | Funding fee of 3% |

| |

» | Annual monitoring Fees of $100,000 |

| |

» | Key man life insurance policy required on Liz Robert in an amount equal to amount invested |

| |

» | Timing: 30 to 60 days |

15

FreshTracks (Middlebury, VT)

» | Working with Mustang Management Partners (www.mustangmp.com) of Wellesley, MA as lead investor |

| |

» | Range of $6.00 to $6.60 per share on a fully diluted basis |

| |

» | Enterprise Value range of between $42.2MM to $46.4MM, represents a range of 7.9x to 8.8x LTM 12/31/04 EBITDA of $5.3MM; and 6.5x to 7.1x 2005E EBITDA of $6.5MM |

| |

» | 75% rollover equity amounts for management |

| |

» | Expect an additional 20 to 25% of existing shareholders would likely (not necessary) rollover |

| |

» | Timing: 60 to 90 days to execution of a Merger Agreement |

16

[Confidential Treatment has been requested for the bidder name]

BIDDER G

» | $6.25 on a fully diluted basis |

| |

» | Enterprise Value of $42.6MM represents 8.0x LTM 12/31/04 EBITDA of $5.3MM; 6.5x 2005E EBITDA of $6.5MM |

| |

» | Would assume the Company’s capital lease debt obligations of $4.8MM |

| |

» | Seller note from Joan Martin of $1.5MM; |

| |

» | Proforma capitalization: $12.8MM of funded senior debt; $10.5MM of funded subordinated debt, $4.8MM of capital leases; and $15.0MM of equity |

| |

» | Required 50% rollover equity from Liz Robert, 50% from Directors and Employees and 41% from Joan Martin |

| |

» | Timing: 60 days |

17

[Confidential Treatment has been requested for the bidder name]

BIDDER H

» | $6.50 on a fully diluted basis |

| |

» | Enterprise Value of $51.3MM represents 9.8x LTM 12/31/04 EBITDA of $5.3MM; 7.9x 2005E EBITDA of $6.5MM |

| |

» | Would assume the Company’s capital lease debt obligations of $4.8MM |

| |

» | Seller note from Joan Martin of $4.0MM |

| |

» | Proforma capitalization: $15.2MM of funded senior and subordinated debt, $4.8MM of capital leases; $4.0MM seller note and $22.0MM of equity |

| |

» | Minimum working capital at closing of $850,000; maximum seller fees of $700,000 |

| |

» | Closing fee of $450,000; annual management fee of $250,000 or 3.0% of annual EBITDA (greater of) |

| |

» | Required 100% rollover equity from senior management team valued at $8.5MM; 10% option pool going forward for management |

| |

» | Timing: 30 days to completion and execution of Merger Agreement |

18

» | Valuation Analytics [Confidential Treatment has been requested for the bidder names in the following table] |

| | | | | Valuation Analysis | |

| | | | |

| |

Firm Name | | Fully Diluted Price Per Share | | Enterprise Value/ | |

| |

| |

| |

| | | | LTM EBITDA | | FYE 2005E EBITDA | |

Bidder A | | | $5.72 | | | 7.4x | | | 6.0x | |

Bidder B | | | $6.35 | | | 8.5x | | | 6.9x | |

Bidder E(1) | | | N/A | | | N/A | | | N/A | |

FreshTracks(2) | | | $6.00-$6.60 | | | 8.8x | | | 7.1x | |

Bidder G | | | $6.25 | | | 8.0x | | | 6.5x | |

Bidder H | | | $6.50 | | | 9.7x | | | 7.8x | |

| | Premium Analysis | |

| |

| |

Firm Name | | Close | | 30 Day | | 60 Day | | 90 Day | | 120 Day | | 180 Day | | 1 Year Average | | 52 Week High | | 52 Week Low | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Bidder A | | | -7.8 | % | | -13.0 | % | | -1.7 | % | | 5.7 | % | | 7.9 | % | | 8.3 | % | | 5.5 | % | | -21.5 | % | | 41.9 | % |

Bidder B | | | 2.3 | % | | -3.5 | % | | 9.1 | % | | 17.3 | % | | 19.7 | % | | 20.2 | % | | 11.7 | % | | -12.9 | % | | 64.9 | % |

Bidder E(1) | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | | | N/A | |

FreshTracks(2) | | | 6.3 | % | | 0.3 | % | | 13.4 | % | | 21.9 | % | | 24.5 | % | | 24.9 | % | | 21.6 | % | | -9.5 | % | | 57.1 | % |

Bidder G | | | 0.6 | % | | -5.0 | % | | 7.3 | % | | 15.4 | % | | 17.8 | % | | 18.3 | % | | 1.4 | % | | -14.3 | % | | 55.0 | % |

Bidder H | | | 4.7 | % | | -1.2 | % | | 11.7 | % | | 20.1 | % | | 22.6 | % | | 23.0 | % | | 12.1 | % | | -10.8 | % | | 86.7 | % |

|

(1) | Bidder E has proposed to invest $10.0MM into the Company to commence a tender offer of public shares. Refer to powerpoint presentation for further detail. |

(2) | Multiples based upon the high end of the range offered by FreshTracks. Lead investor is Mustang Management. |

LTM 12/31/04 EBITDA | | | 5.3 | |

FYE 2005 EBITDA | | | 6.5 | |

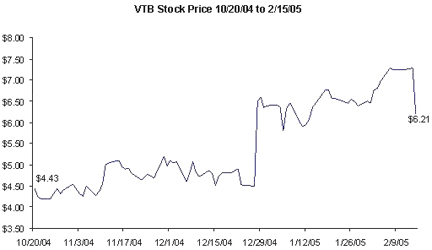

“BEAR” Stock Price Information (as of 2/15/05)

30-day | | $ | 6.58 | | High: | | $ | 7.29 | |

60-day | | $ | 5.82 | | Low: | | $ | 4.20 | |

90-day | | $ | 5.41 | | Average: | | $ | 5.43 | |

120-day | | $ | 5.30 | | Close (1): | | $ | 6.21 | |

180-day | | $ | 5.28 | | | | | | |

| |

| |

(1) As of 2/15/05 | |

19

» | Other Considerations: [Confidential Treatment has been requested for the bidder names in the following table] |

| | Other Considerations |

| |

|

Firm Name | | Working Capital | | Management | | Other Items |

| |

| |

| |

|

Bidder A | | Pegged at $1.1MM | | Conditional Upon 100% rollover by Liz Robert, Irene Steiner, and Katie Camardo

10% option pool reserved for Senior Mgmt

Salary for Liz Robert at $260K | | Termination Fee of $2MM

$4.7MM Seller Note from Joan Martin at 9%

Closing Fee of $800K |

| | | | | | |

Bidder B | | N/A | | Will negotiate rollover amounts separately with management

10% option pool reserved for Senior Mgmt | | Maximum Debt at Closing of $7.8MM

Litigation (Madison Ave) less than $2.0MM

Conditional on $6.5MM of EBITDA

Termination Fee of $2.0MM |

| | | | | | |

Bidder E(1) | | N/A | | N/A | | Invest $10.0MM of capital to finance a tender offer to buyback stock. Want 2 board seats. |

| | | | | | | |

FreshTracks(2) | | N/A | | Management to rollover 75%

Other shareholders to rollover 20 to 25% | | Have not met with management

Need 60 to 90 days |

| | | | | | | |

Bidder G | | N/A | | Assumes Liz Robert rollover of 50%

Employees and Directors rollover 50% | | Joan Martin rollover equity of 41%

Need 60 days |

| | | | | | | |

Bidder H | | Pegged at $0.85MM | | Conditional Upon 100% rollover by Liz Robert, Irene Steiner, and Katie Camardo

10% option pool reserved for Senior Mgmt | | No mention of Termination Fee

$4.0MM Seller Note from Joan Martin

Closing Fee of $450K

Maximum Seller Fees of $700K |

|

(1) | Bidder E has proposed to invest $10.0MM into the Company to commence a tender offer of public shares. Refer to powerpoint presentation for further detail. |

(2) | Multiples based upon the high end of the range offered by FreshTracks. Lead investor is Mustang Management. |

EXHIBITS

21

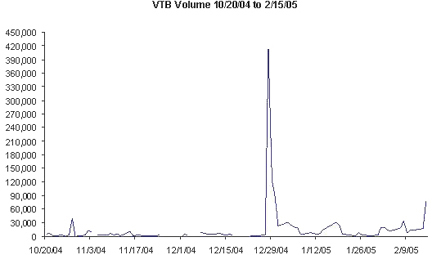

Stock Price and Volume

22

Fully Diluted Shares Outstanding

Shareholder Profile | | Shares | | %

Ownership | | Dilutive

Shares | | Total

Ownership | | %

Ownership | |

| |

| |

| |

| |

| |

| |

Joan Martin | | | 1,197,297 | | | 23.9 | % | | 0 | | | 1,197,297 | | | 17.2 | % |

Fred Marks | | | 460,339 | | | 9.2 | % | | 0 | | | 460,339 | | | 6.6 | % |

Spencer Putnam | | | 119,592 | | | 2.4 | % | | 0 | | | 119,592 | | | 1.7 | % |

Jason Bacon | | | 63,169 | | | 1.3 | % | | 0 | | | 63,169 | | | 0.9 | % |

Elisabeth Robert | | | 354,710 | | | 7.1 | % | | 355,000 | | | 709,710 | | | 10.2 | % |

Robert Hamilton | | | 0 | | | 0.0 | % | | 0 | | | 0 | | | 0.0 | % |

Barabara Johnson | | | 0 | | | 0.0 | % | | 0 | | | 0 | | | 0.0 | % |

Maxine Brandenburg | | | 100 | | | 0.0 | % | | 0 | | | 100 | | | 0.0 | % |

TSG Preferred | | | 0 | | | 0.0 | % | | 88,564 | | | 88,564 | | | 1.3 | % |

Series D | | | 0 | | | 0.0 | % | | 708,115 | | | 708,115 | | | 10.2 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total Insider Ownership | | | 2,195,207 | | | 43.8 | % | | 1,151,679 | | | 3,346,886 | | | 48.1 | % |

Employee Stock Option Plan | | | 0 | | | 0.0 | % | | 403,530 | | | 403,530 | | | 5.8 | % |

Non-employee Director Option Plan | | | 0 | | | 0.0 | % | | 204,590 | | | 204,590 | | | 2.9 | % |

W.P. Carey Warrants | | | 0 | | | 0.0 | % | | 193,111 | | | 193,111 | | | 2.8 | % |

Total Outsider Ownership | | | 2,813,752 | | | 56.2 | % | | 0 | | | 2,813,752 | | | 40.4 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total Shares Outstanding | | | 5,008,959 | | | 100.0 | % | | 1,952,910 | | | 6,961,869 | | | 100.0 | % |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Options Schedule

| | | | | Strike Price | | Cash Received | |

| | | | |

| |

| |

Liz Robert | | | 355,000 | | | 1.36 | | | 482,800 | |

ESOP | | | 403,530 | | | 2.48 | | | 1,000,754 | |

NESOP | | | 204,590 | | | 2.48 | | | 507,383 | |

Warrants | | | 42,500 | | | 1.05 | | | 44,625 | |

Warrants | | | 150,611 | | | 1.31 | | | 197,300 | |

Total | | | 1,156,231 | | | | | | 2,232,863 | |

23

Status Update Report [Confidential Treatment has been requested for the bidder and prospective bidder names and contact persons]

1 - Proposal Received | Bidder E |

1 - Proposal Received | FreshTracks Capital |

1 - Proposal Received | Bidder G |

1 - Proposal Received | Bidder A |

1 - Proposal Received | Bidder H |

1 - Proposal Received | Bidder B |

3 - Reviewing IM | Individual (Freshtracks Syndicate) |

3 - Reviewing IM | Individual (Freshtracks Syndicate) |

3 - Reviewing IM | Individual (Freshtracks Syndicate) |

3 - Reviewing IM | Individual (Freshtracks Syndicate) |

3 - Reviewing IM | Prospect (Freshtracks Syndicate) |

3 - Reviewing IM | Prospect (Freshtracks Syndicate) |

3 - Reviewing IM | Prospect (Freshtracks Syndicate) |

3 - Reviewing IM | Prospect (Freshtracks Syndicate) |

3 - Reviewing IM | Prospect (Freshtracks Syndicate) |

4 - Reviewing CA | Individual (Freshtracks Syndicate) |

4 - Reviewing CA | Individual (Freshtracks Syndicate) |

5 - On Hold | Prospective Mezz Firm (Mezzanine Firm) |

5 - On Hold | Prospective Mezz Firm (Mezzanine Firm) |

5 - On Hold | Prospective Mezz Firm (Mezzanine Firm) |

5 - On Hold | Prospective Mezz Firm (Mezzanine Firm) |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

7 - Declined | Prospect |

Note: Parties noted as reviewing IM or Reviewing CA are part of Fresh Tracks syndicate

24

Status Update Report [Confidential Treatment has been requested for the bidder and prospective bidder names and contact persons]

7 - Declined | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |

8 - Not Interested | Prospect |