UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

MERRILL MERCHANT BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| | 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Dear Stockholder:

On behalf of the Board of Directors and management of Merrill Merchants Bancshares, Inc. (the “Company”), you are cordially invited to attend the 2006 Annual Meeting of Stockholders which will be held at the Bangor Conference Center, 701 Hogan Road, Bangor, Maine 04401, on Thursday, May 4, 2006 at 5:00 p.m.

The notice of meeting and proxy statement accompanying this letter describe the specific business to be acted upon. In addition to the specific matters to be acted upon, there will be a report on the progress of the Company and an opportunity for questions of general interest to the stockholders.

It is important that your shares be represented at the meeting. Whether or not you plan to attend in person, you are requested to vote, sign, date, and promptly return the enclosed proxy card in the envelope provided.

| | | |

| | | Sincerely yours, |

|

|

|

| | | /s/ Edwin N. Clift |

| |

Edwin N. Clift |

| | Chairman and Chief Executive Officer |

Merrill Merchants Bancshares, Inc.

201 Main Street

Bangor, Maine 04401-0925

(207) 942-4800

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2006 Annual Meeting of Stockholders of Merrill Merchants Bancshares, Inc. (the “Company”) will be held at the Bangor Motor Inn, 701 Hogan Road, Bangor, Maine 04401, on Thursday, May 4, 2006 at 5:00 p.m. for the following purposes, all of which are more completely set forth in the accompanying proxy statement:

| | 1. | To elect three directors for a three-year term and to elect one director for a one-year term and; |

| | 2. | To ratify the appointment of Berry, Dunn, McNeil & Parker as our independent registered public accountants for 2006; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. We are not aware of any other such business. |

You may vote at the Annual Meeting and at any adjournment or postponement thereof, if you were a stockholder of the Company on March 6, 2006, the record date.

| | | |

| | |

| | | By Order of the Board of Directors, |

|

|

|

| | | /s/ Deborah A. Jordan |

| |

Deborah A. Jordan |

| | Secretary |

March 16, 2006

Whether you expect to attend the meeting or not, please vote, sign, date, and return the enclosed proxy card in the envelope provided as promptly as possible. If you attend the meeting, you may vote your shares in person, even though you have previously signed and returned your proxy card.

MERRILL MERCHANTS BANCSHARES, INC.

201 Main Street

Bangor, ME 04401

Proxy Statement

2006 Annual Meeting of Stockholders to be held May 4, 2006

Solicitation and Revocation of Proxies

This proxy statement is furnished to the stockholders of Merrill Merchants Bancshares, Inc., a Maine corporation (the “Company”), in connection with the 2006 Annual Meeting of Stockholders of the Company.

A proxy card is furnished by the Company. This proxy is being solicited by the Board of Directors of the Company for use at the May 4, 2006 Annual Meeting of Stockholders and at any adjournment thereof. A proxy duly executed and returned by a stockholder will be voted as directed by the proxy. If no choice is specified, the proxy will be voted “FOR” proposals 1 and 2. As to other matters, if any, to be voted upon, the persons named in the proxy will take such action as a majority of the Board of Directors may deem advisable.

A stockholder who signs and returns a proxy may revoke it at any time before it is exercised by signing and submitting a new proxy with a later date, notifying the Secretary of the Company in writing before the Annual Meeting or by attending the meeting and voting in person.

All expenses of the solicitation of proxies are being borne by the Company. It is expected that solicitations will be made primarily by mail, but regular employees or representatives of the Company and Merrill Merchants Bank (the “Bank”) may also solicit proxies by telephone, telex, facsimile and in person, but no employee will receive any compensation for solicitation activities in addition to his or her regular compensation. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

We began mailing this Proxy Statement, the Notice of Annual Meeting and the enclosed proxy card on or about March 16, 2006, to all stockholders entitled to vote. If you owned the Company’s common stock at the close of business on March 6, 2006, the record date, you are entitled to vote at the Annual Meeting.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. If the holders of at least a majority of the total number of the outstanding shares of common stock of the Company entitled to vote are represented in person or by proxy at the Annual Meeting, a quorum will exist. We will include proxies marked as abstentions and broker non-votes to determine the number of shares present at the Annual Meeting.

Confidential Voting Policy

The Company maintains a policy of keeping stockholder votes confidential. We only let our Inspector of Election and our transfer agent examine the voting materials. We will not disclose your vote to management unless it is necessary to meet legal requirements. We will, however, forward any written comments that you may have to management.

Voting Securities

Only stockholders of record at the close of business on March 6, 2006, are entitled to vote at the Annual Meeting. As of March 6, 2006, there were 3,441,463 shares of common stock outstanding. Each share has one vote.

The nominees for directors who receive the most votes will be elected. If you vote against the nominees for director or “withhold authority” for any nominee on your proxy card, your vote will not count “for” or “against” the nominee. The approval of the independent registered public accountants requires the majority of the votes cast by stockholders present in person or by proxy and entitled to vote at the Annual Meeting. If you “abstain” from voting on the independent registered public accountant proposal, your vote will not count “for” or “against” the proposal. Broker non-votes will not be counted as having voted in person or by proxy for each proposal and will have no effect on the outcome of the proposals.

BENEFICIAL OWNERSHIP OF COMMON STOCK

BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of Merrill Merchants Bancshares, Inc. common stock beneficially owned by each person or entity (or group of affiliated persons or entities) known by management to beneficially own more than five percent of the outstanding common stock of the Company, the Company's directors, the executive officers named in the Summary Compensation Table and the directors and executive officers as a group. For purposes of the table below, in accordance with Rule 13(d)(3) of the Securities Exchange Act of 1934, as amended, a person is deemed to be the beneficial owner, for purposes of any shares of common stock: (1) over which he or she has or shares, directly or indirectly, voting or investment power; or (2) of which he or she has the right to acquire beneficial ownership at any time within 60 days after December 31, 2005. As used in this proxy statement, "voting power" is the power to vote or direct the voting of shares, and "investment power" includes the power to dispose or direct the disposition of shares.

| | | Shares Beneficially Owned | |

| | | As of December 31, 2005 (1) | |

Name of Beneficial Owner | | Amount | | | Percent | |

| Directors and Executive Officers: | | | | | | |

| The Bullock Family Trust | | | 207,821 | | (2 | ) | | 6.0 | % |

| William C. Bullock, Jr. | | | - | | (2 | ) | | 6.0 | % |

| Edwin N. Clift | | | 70,938 | | | | | 2.1 | % |

| Joseph H. Cyr | | | 166,216 | | (3 | ) | | 4.8 | % |

| John R. Graham | | | 61,009 | | (4 | ) | | 1.8 | % |

| Perry B. Hansen | | | 356,364 | | (5 | ) | | 10.4 | % |

| Deborah A. Jordan | | | 20,311 | | (6 | ) | | 0.6 | % |

| William P. Lucy | | | 19,449 | | (7 | ) | | 0.6 | % |

| Frederick A. Oldenburg, Jr., M.D. | | | 52,734 | | (8 | ) | | 1.5 | % |

| Lloyd D. Robinson | | | 48,871 | | (9 | ) | | 1.4 | % |

| Dennis L. Shubert, M.D., Ph.D. | | | 67,009 | | (10 | ) | | 2.0 | % |

| All current directors and executive officers as a group (10 persons) | | | 1,070,722 | | | | | 31.2 | % |

| | (1) | Except as otherwise noted, each individual in the table above has sole voting and investment power over the shares listed. |

| | (2) | Mr. Bullock is the trustee of The Bullock Family Trust and as such, has voting and investment power over the shares held in the Trust. Mr. Bullock holds no other shares of common stock. Mr. Bullock’s mailing address is 44 Bald Hill Reach Road, Orrington, Maine 04474. |

| | (3) | Includes 138,493 shares of common stock held jointly with spouse. |

| | (4) | Includes 2,785 shares of common stock held by spouse and 5,544 shares of common stock held by Automatic Distributors, Inc. |

| | (5) | Mr. Hansen’s mailing address is P.O. Box 280, Rapids City, Illinois 61278-0280. |

| | (6) | Includes 436 shares of common stock held by spouse. |

| | (7) | Includes 1,251 shares of common stock held by spouse. |

| | (8) | Includes 23,616 shares of common stock held under the name Penobscot Respiratory PA FBO Frederick A. Oldenburg, Jr. and 19,647 shares of common stock held by spouse. |

| | (9) | Includes 24,823 shares of common stock held by spouse. |

| | (10) | Includes 33,265 shares of common stock held by spouse. Also includes 5,645 shares of common stock held in the name of Dr. Shubert’s children, of which his spouse serves as Trustee. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors, executive officers, and any person holding more than ten percent of the Company’s common stock file with the SEC reports of their ownership and changes in ownership of the Company’s securities. The Company believes that during 2005, its directors, executive officers and 10% shareholders complied with all Section 16(a) filing requirements. In making this statement, the Company has relied upon examination of the copies of Forms 3, 4 and 5 provided to the Company and the representations of its directors, executive officers and 10% shareholders.

Election of Directors of Merrill Merchants Bancshares, Inc.

(Item 1 on Proxy Card)

The Board has nominated four persons for election as directors at the Annual Meeting. Mr. Cyr and Mr. Lucy currently serve on the Company’s Board of Directors. Mr. Shea and Mr. Graham both serve on the Merrill Merchants Bank’s Board of Directors. Mr. Graham was nominated by the Board of Directors to replace a vacant position and Mr. Shea was nominated by the Board of Directors to replace Mr. Robinson, who is retiring from the Board of Directors and whose term was to expire in 2007. If you elect the nominees, Mr. Cyr, Mr. Lucy and Mr. Graham will hold office until the Annual Meeting in 2009 and Mr. Shea will hold office until the Annual Meeting of 2007, or until their successors have been elected.

We know of no reason why any nominee may be unable to serve as a director. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the Board. If for any reason these nominees prove unable or unwilling to stand for election, the Board will nominate alternates or reduce the size of the Board of Directors to eliminate the vacancy. The Board has no reason to believe that its nominees would prove unable to serve if elected. We recommend that you vote “FOR” each of the nominees for election as directors.

Nominees

Joseph H. Cyr, 65, has served as a Director of the Company and the Bank since 1992. He has been the owner of John T. Cyr & Sons, Inc., Old Town, Maine, a privately held charter bus service, since 1967. Mr. Cyr has been involved in that business since 1962. He was formerly a director of Norstar Bank in Bangor. He has been active in a number of civic and charitable organizations including: trustee of Husson College and St. Joseph Hospital and president of the Bangor Area Chamber of Commerce. He is a former director of Bangor Hydro-Electric Company and the Maine Community Foundation. Mr. Cyr’s term expires in 2009.

John R. Graham, III

John R. Graham, III, 68, has served as a director of the Bank since its inception in 1992. Mr. Graham is the president of Automatic Distributors, Inc. in Bangor, a wholesale and retail distribution company he has owned and operated for over thirty years. He has also been involved in real estate development in the Bangor area for many years. Mr. Graham’s term expires in 2009.

William P. Lucy, age 47, has served as President of the Company and Bank since April 2004, as Executive Vice President of the Bank since December 1999, and as Senior Loan Officer of the Bank since 1992. Mr. Lucy began his banking career at The Merrill Trust Company in 1981, and he has both commercial lending and branch administration experience. He is a graduate of the University of Maine and Williams College School of Banking. Mr. Lucy serves on the board of directors of the Penobscot Community Healthcare, New Hope Hospice, Action Committee of 50 and M & J Company, a subsidiary of St. Joseph Healthcare Foundation. In addition, he is a trustee of the YMCA Foundation and he formerly served as chairman of the United Way Campaign. Mr. Lucy’s term expires in 2009.

Michael T. Shea

Michael T. Shea, 56, has served as a director of the Bank since 2004. Mr. Shea is the president and chief executive officer of Webber Energy Fuels of Bangor, a position he has held since 2000. He also serves as a director of the Webber board. Prior to assuming his current responsibilities, he had been with the company for four years and his career in the petroleum business spans thirty years. He is a member of the Board of Governors of the New England Fuel Institute, has served as a trustee of St. Joseph College, his alma mater, for more than twenty years, and he recently completed a term as chairman of the board of United Way of Eastern Maine.

Continuing Directors

William C. Bullock, Jr., 69, served as Chairman of the Company and the Bank from 1992 to April 2004. He is the former Chairman of The Merrill Trust Company and its successor bank, Merrill/Norstar Bank. He also served as an executive vice president and director of the holding company, Fleet/Norstar Financial Group of Providence, Rhode Island. Prior to moving to Maine in 1969, he held a number of officer positions with Morgan Guaranty Trust Company of New York. Mr. Bullock has served on and chaired several committees of the American Bankers Association (“ABA”) and is a former chairman of the Maine Bankers Association (“MBA”). From 1987 to 1989, Mr. Bullock was a Class A director of the Federal Reserve Bank of Boston. Mr. Bullock is a graduate of Yale University. He is a former trustee of the State of Maine Retirement System, Maine Maritime Academy, the Maine Community Foundation and Bangor Theological Seminary. Mr. Bullock is a former director of a number of companies including Fieldcrest Cannon, Bangor & Aroostook Railroad and Bangor Hydro-Electric Company and he served as a director of Eastern Maine Healthcare. Mr. Bullock’s term expires in 2007.

Edwin N. Clift, 66, has served as Chairman and Chief Executive Officer of the Company and Bank since April 2004 and served as President and Chief Executive Officer of the Company and the Bank from its inception in 1992 to April 2004. Prior to that, Mr. Clift was associated with three other Maine banks including more than 20 years as an executive of The Merrill Trust Company. Mr. Clift is a graduate of Strayer College in Washington, D.C. Mr. Clift is chairman of the St. Joseph Healthcare Foundation board of trustees, past president and current director of the Bangor Target Area Development Corporation and director and treasurer of the Bangor Historical Society. He is former chairman of the Maine Committee for Employer Support for the Guard and Reserve and a member of the Advisory Board for Maine’s Bureau of Financial Institutions. Mr. Clift also serves as a member of the ABA’s Community Bankers Council. Mr. Clift completed a three-year term in 2000 as a Class A director of the Federal Reserve Bank of Boston. He is a past chairman of the MBA and a past president of the Independent Community Bankers Association of Maine. He serves as chairman of the board of directors of Seven Islands Land Company, a privately held company that manages one million acres of certified forest in Maine. Mr. Clift’s term expires in 2007.

Perry B. Hansen, 58, has been a Director of the Company and the Bank since 1992. He is chairman of THE National Bank, Bettendorf, Iowa and a director of its bank holding company, National Bancshares, Inc. Mr. Hansen’s thirty-six years of banking experience includes management of two other banks in the Quad City area. Presently he is also an investor, holding senior management positions in several privately held companies. Mr. Hansen’s term expires in 2008.

Frederick A. Oldenburg, Jr., M.D., 58, has served as a Director of the Company since 1999 and a Director of the Bank since 1996. He has been a practicing physician since 1973 and a director of Penobscot Respiratory, P.A. He was head of Respiratory Care at St. Joseph Hospital in Bangor from 1993 to 2003. He is a graduate of Dartmouth College and Case Western Reserve University Medical School. Dr. Oldenburg is past president of the National Association for the Medical Direction of Respiratory Care. He also has been involved in real estate development in Bangor and Brooksville, Maine. Dr. Oldenburg’s term expires in 2008.

Dennis L. Shubert, M.D., Ph.D., 58, has served as a Director of the Company since May 1998 and a Director of the Bank since 1992. He is a neurosurgeon and past president of Maine Neurosurgery of Bangor and Portland, Maine. Dr. Shubert is a Bangor native who graduated from Tufts University, received an M.D. from George Washington University, a Ph.D. from the University of Minnesota, and a M.S. in Health Care Management from Harvard. He serves as executive director of Maine Quality Forum and served as a director of Eastern Maine Healthcare. Dr. Shubert has been active in a number of professional organizations including: president of the Penobscot County Medical Association and president of the Maine Neurosurgical Society. Dr. Shubert’s term expires in 2008.

Retiring Director

Lloyd D. Robinson, 70, has served as a Director of the Company since May 2001 and a Director of the Bank since 1992. He has been retired since 1985. From 1977 to 1985, he was the owner/operator of McKay’s R.V. Center, a privately held recreational equipment business. He also has real estate investments in the Bangor area. Mr. Robinson is a U.S. Air Force veteran.

Ratification of Appointment of Independent Registered Public Accountants

(Item 2 on Proxy Card)

The Audit Committee of the Board of Directors has appointed Berry, Dunn, McNeil & Parker (“BDMP”) as the Company’s independent registered public accountants for the fiscal year ending December 31, 2006. BDMP has served as the Company’s independent registered public accountants since the incorporation of the Company in 1992. We recommend that you vote “FOR” the ratification of the appointment of BDMP.

Representatives of BDMP will be present at the Annual Meeting to respond to appropriate questions and will have the opportunity to make a statement if they desire to do so.

During the fiscal year ended December 31, 2005, the Company retained and paid BDMP to provide audit and other services. The following table displays the aggregate fees for professional audit services for the audit of the financial statements for the years ended December 31, 2005 and 2004 and fees billed for other services during those periods by our independent registered public accountants.

| | | | | 2004 | |

| Audit fees (1) | | $ | 55,525 | | $ | 50,550 | |

| Audit-related fees | | | - | | | - | |

| Tax fees (2) | | | 8,290 | | | 5,500 | |

| All other fees (3) | | | 8,150 | | | 5,550 | |

| Total | | $ | 71,965 | | $ | 61,600 | |

| | (1) | Audit fees consisted of audit work performed in the preparation of financial statements as well as work generally only the independent registered public accountants can reasonably be expected to provide, such as statutory audits. |

| | (2) | Tax fees consisted of assistance with matters related to tax compliance, tax advice and tax planning. The nature of the services comprising the fees disclosed under this category are preparation of federal and state tax returns, review of estimated tax payments and review of tax planning, and assistance with an Internal Revenue Service audit. |

| | (3) | The nature of the services comprising the fees disclosed under this category are an employee benefit plan audit and training for the Board of Directors relative to Section 404 of the Sarbanes-Oxley Act. |

The Audit Committee's pre-approval policies and procedures require the Audit Committee Chair to pre-approve all audit and non-audit services, and report such pre-approvals to the Audit Committee at its next regularly scheduled meeting.

With respect to each of the services described in the table above, pre-approval by the Audit Committee pursuant to 17 CFR 210.2-01(c)(7)(i)(C) was not waived.

Board of Directors and Its Committees

The Company’s Board of Directors currently consists of eight members. The Company’s Articles of Incorporation provides that the Board of Directors shall be divided into three classes, as nearly equal in number as possible. The terms of two directors expire at the Annual Meeting, and a third director is retiring effective at the Annual Meeting.

The Board of Directors oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the Board of Directors does not involve itself in the day-to-day operations of the Company. The Company’s executive officers and management oversee the day-to-day operations of the Company. Our directors fulfill their duties and responsibilities by attending regular meetings of the Board.

The Board of Directors of the Company held five meetings during the calendar year 2005 and each director attended at least 75% of all Board meetings.

It is our policy that all directors and nominees should attend the Annual Meeting. At the 2005 Annual Meeting, all the members of the Board of Directors were in attendance.

The Board of Directors has established the following standing committees:

Executive Committee

The Executive Committee is comprised of Directors Clift (Chair), Bullock, Cyr, Robinson, and Shubert. The Executive Committee considers strategic planning and industry issues and is authorized to act as appropriate between meetings of the Board of Directors. The Executive Committee held one meeting during 2005.

Compensation Committee

The Compensation Committee is comprised of Directors Hansen (Chair), Cyr, Oldenburg, and Shubert, each of whom is independent, as defined under The Nasdaq Stock Market listing standards. The Compensation Committee determines the salaries and incentive compensation of the officers of the Company and Bank and provides recommendations for the salaries and incentive compensation of the other employees of the Bank. The Compensation Committee also administers the Company’s various incentive compensation, stock and benefit plans. The Compensation Committee met four times during 2005 and each director attended at least 75% of all committee meetings.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is comprised of Directors Hansen (Chair), Cyr, Oldenburg, Robinson, and Shubert, each of whom is independent, as defined under The Nasdaq Stock Market listing standards. The Nominating and Corporate Governance Committee met three times during 2005 and each director attended at least 75% of all committee meetings.

The Nominating and Corporate Governance Committee’s written charter, which sets forth the duties and responsibilities of the Committee, was attached as an appendix to the proxy statement for the 2004 Annual Meeting and filed with the SEC on March 18, 2004.

The Nominating and Corporate Governance Committee discusses director nominations prior to each Annual Meeting of the Company and recommends nominees for election as directors and reviews, if any, shareholder nominations to ensure compliance with the notice procedures set forth in the Company's Bylaws.

In accordance with our Bylaws, nominations of individuals for election to the Board at an annual meeting of stockholders may be made by any stockholder of record entitled to vote for the election of directors at such meeting who provides timely notice in writing to the clerk. With respect to an election of directors to be held at an annual meeting of stockholders, to be timely, a stockholder's notice must be delivered to or received by the clerk not later than ninety (90) days prior to the anniversary of the previous year's annual meeting. With respect to an election to be held at a special meeting of stockholders for the election of directors, a stockholder's notice must be received by the clerk by the close of business on the tenth (10th) day following the date on which notice of such meeting is first given to stockholders. The stockholder's notice to the clerk must set forth certain information regarding the proposed nominee and the stockholder making such nomination. If a nomination is not properly brought before the meeting in accordance with the Company's Bylaws, the chairperson of the meeting may determine that the nomination was not properly brought before the meeting and shall not be considered. For additional information about the Company's director nomination requirements, please see the Company's Bylaws.

It is the policy of the Nominating and Corporate Governance Committee to select individuals as director nominees who shall have the highest personal and professional integrity, who shall have demonstrated exceptional ability and judgment and who shall be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the stockholders. Stockholder nominees are analyzed by the Nominating and Corporate Governance Committee in the same manner as nominees that are identified by the Nominating and Corporate Governance Committee. The Corporation does not pay a fee to any third party to identify or evaluate nominees.

Joseph H. Cyr, John R. Graham, William P. Lucy and Michael T. Shea were each nominated by the non-management, independent directors that comprise the Nominating and Corporate Governance Committee. As of January 27, 2006, the Nominating and Corporate Governance Committee had not received any stockholder recommendations for nominees in connection with the 2006 Annual Meeting.

Audit Committee

The Company’s Audit Committee is comprised of Directors Shubert (Chair) and Hansen, each of whom is independent, as defined under The Nasdaq Stock Market listing standards. The Bank’s Audit Committee is comprised of Directors Shubert and Hansen as well as Michael Shea, Royce Cross and Herbert Sargent, who are members of the Board of Directors of the Bank. The Board of Directors has determined that Perry B. Hansen qualifies as an Audit Committee Financial Expert, as the term is defined by SEC regulations and in satisfaction of The Nasdaq Stock Market listing standards. The function of the Audit Committee is described below under the heading Report of the Audit Committee. The Audit Committee met eight times during 2005. The Audit Committee meets the requirements of Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and operates under a written charter adopted by the Board of Directors of the Company and attached as an appendix to the proxy statement for the 2004 Annual Meeting and filed with the SEC on March 18, 2004.

The Audit Committee of the Board of Directors of the Company serves as the representative of the Board by overseeing the audit coverage and monitoring the accounting, financial reporting, data processing, regulatory and internal control environments. The primary duties and responsibilities of the Audit Committee are to: (1) serve as an independent and objective party to monitor the Company's financial reporting process and internal control systems; (2) select and monitor the independent registered public accountants; (3) pre-approve all audit and permissible non-audit services performed by the independent registered public accountants; (4) review and appraise the audit efforts of the Company's independent registered public accountants and internal audit department; (5) review the Company's quarterly financial performance, as well as its compliance with laws and regulations; (6) oversee management's establishment and enforcement of financial policies; (7) provide an open avenue of communication among the independent registered public accountants, financial and senior management, the internal audit department, and the Board; and (8) establish procedures for the receipt, retention and treatment of complaints or concerns, including confidential employee submissions, about accounting, internal accounting controls or auditing matters. The Company's independent registered public accountants, Berry, Dunn, McNeil & Parker, are responsible for expressing an opinion on the fairness of presentation of the Company's audited financial statements in accordance with generally accepted accounting principles.

Report of the Audit Committee

The following Audit Committee Report is provided in accordance with the rules and regulations of the Securities and Exchange Commission (the "SEC"). Pursuant to such rules and regulations, this report shall not be deemed "soliciting materials," filed with the SEC, subject to Regulation 14A or 14C of the SEC or subject to the liabilities of section 18 of the Securities Exchange Act of 1934, as amended.

In this context, the Audit Committee hereby reports as follows:

| | 1. | The Audit Committee has reviewed and discussed the audited financial statements with management. |

| | 2. | The Audit Committee has discussed with the independent registered public accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). |

| | 3. | The Audit Committee has received written disclosures and the letter from the independent registered public accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with the independent registered public accountants the independent registered public accountants’ independence. |

On the basis of these reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the Securities and Exchange Commission.

| Members of the Audit Committee | | |

| Dennis L. Shubert, M.D., Ph.D., Chair | Perry B. Hansen | |

Remuneration of Directors and Officers

Directors’ Fees

Each non-employee director of the Company receives the following fees:

| | · | Directors of the Bank receive an annual retainer fee of $3,000. |

| | · | Directors of the Bank receive $500 per meeting for their attendance at monthly and any special meetings of the Board of Directors. |

| | · | Directors of the Company receive $200 per meeting for their attendance at monthly and any special meetings of the Board of Directors and any committee meeting held on the same day as the Board of Directors’ meetings. |

| | · | Committee members also receive $300 for each committee meeting that is not held on the same day as the Board of Directors meetings. |

Non-employee directors may elect to have the payment of their directors’ fees deferred pursuant to the Directors’ Deferred Compensation Plan. Total directors’ meeting and committee fees for fiscal 2005 were $120,000. We do not compensate our employees for service as directors. Directors are also entitled to the protection of certain indemnification provisions in our Articles of Incorporation and Bylaws.

Executive Officers

The following individuals are executive officers of the Company and the Bank and hold the offices set forth below opposite their names.

| | Position Held | |

| Edwin N. Clift | Chairman and Chief Executive Officer of the Company and Bank |

| William P. Lucy | President of the Company and Bank | |

| Deborah A. Jordan | Secretary/Treasurer of the Company and | |

| | Executive Vice President/Treasurer of the Bank | |

The Board of Directors elects the executive officers of the Company and the Bank annually. The elected officers hold office until their respective successors have been elected and qualified, or until death, resignation or removal by the Board of Directors.

Biographical information of executive officers, who are not directors or proposed directors of the Company, is set forth below.

Deborah A. Jordan, age 40, has served as Executive Vice President since December 1999, and as Chief Financial Officer of the Bank and Treasurer of the Company since 1993. From 1987 to 1992, she was employed as an audit manager at Arthur Andersen, LLP in Boston. She is a graduate of Husson College, Eastern Maine Technical College and is a Certified Public Accountant. Ms. Jordan serves as a director of Eastern Maine Technical College Foundation.

Compensation of Executive Officers and Transactions with Management

The following table sets forth cash and non-cash compensation received during each of the Company’s last three fiscal years by Mr. Clift, Mr. Lucy and Ms. Jordan, who are the only executive officers for whom compensation exceeded $100,000 in any year.

Summary Compensation Table

| | | | | Annual Compensation | | Long-Term Compensation | | |

Executive Officer | | Year | | Salary | | Bonus | | Number of Stock Options Granted | | All Other Compensation | | |

| | | | | | | | | | | | | |

| Edwin N. Clift | | | 2005 | | $ | 200,000 | | $ | 110,000 | | | -- | | $ | 32,496 | | (1 | ) |

| Chairman and Chief | | | 2004 | | | 190,000 | | | 100,000 | | | -- | | | 41,699 | | | |

| Executive Officer | | | 2003 | | | 170,000 | | | 90,000 | | | -- | | | 39,712 | | | |

| | | | | | | | | | | | | | | | | | | |

| William P. Lucy | | | 2005 | | | 150,000 | | | 50,000 | | | -- | | | 12,316 | | (1 | ) |

| President | | | 2004 | | | 130,000 | | | 45,000 | | | -- | | | 12,805 | | | |

| | | | 2003 | | | 115,000 | | | 45,000 | | | -- | | | 14,667 | | | |

| | | | | | | | | | | | | | | | | | | |

| Deborah A. Jordan | | | 2005 | | | 122,500 | | | 45,000 | | | -- | | | 13,932 | | (1 | ) |

| Executive Vice President | | | 2004 | | | | | | | | | | | | | | | |

| | | | 2003 | | | 100,000 | | | 40,000 | | | -- | | | 11,343 | | | |

| | (1) | Totals for 2005 in this column are comprised of: (a) employer contributions to the 401(k) plan of $6,300 for Mr. Clift, $5,862 for Mr. Lucy and $4,887 for Ms. Jordan; (b) dollar value of premiums paid by the Bank with respect to term life insurance and life insurance under the Life Insurance Endorsement Method Split-Dollar Plan Agreement of $6,834 for Mr. Clift, $577 for Mr. Lucy and $640 for Ms. Jordan; (c) the value to the officers of a Company-owned vehicle of $5,824 for Mr. Clift, $4,082 for Mr. Lucy and $7,091 for Ms. Jordan; and (d) the vested benefit accrued under the Supplemental Executive Retirement Plan of $13,538 for Mr. Clift, $1,795 for Mr. Lucy and $1,314 for Ms. Jordan. |

Supplemental Executive Retirement Plan

The Company provides a non-qualified supplemental executive retirement plan (the “SERP”) for the benefit of key employees. Life insurance policies were acquired for the purpose of serving as the primary funding source. The amount of each annual benefit is indexed to the financial performance of each insurance policy owned by the Bank over the Bank’s cost of funds expense. The first year’s projected retirement benefit for Mr. Clift is $37,000. Assuming twenty years of service, the projected retirement benefits for Mr. Lucy and Ms. Jordan are $30,000 per year. The SERP provides that in the event of a change of control and the executive suffers a termination of service, then the executive shall receive full retirement benefits upon early retirement age.

Employment Agreements

The Company currently has an employment agreement with Mr. Bullock. This agreement provides for the payment of an annual salary of $24,000 through April 2007 and a $24,000 annual payment thereafter for the remainder of Mr. Bullock’s life or his spouse, whichever survives.

The agreement also provides that, to the extent not inconsistent with applicable federal, state or local law (including common law), or with the Articles of Incorporation or Bylaws of the Company and the Bank, and to the extent that Mr. Bullock is not in material breach of the agreement, the Company will provide for representation on or will recommend nomination for election to the Board of Directors of the Company and the Bank for Mr. Bullock, another designee of the Bullock Family Trust (the “Trust”) or a member of Mr. Bullock’s immediate family, so long as the Trust and/or Mr. Bullock’s immediate family owns more than 3% of the common stock of the Company.

The Bank has also entered into employment agreements with each of Edwin N. Clift, William P. Lucy and Deborah A. Jordan to secure their services to the Bank in their current positions. The employment agreements may be renewed annually after a review of each executive's performance. These agreements provide for a minimum annual salary of $200,000, $150,000 and $122,500 to be paid to Mr. Clift, Mr. Lucy and Ms. Jordan, respectively. The employment agreements also provide for discretionary cash bonuses and participation on generally applicable terms and conditions in other compensation and fringe benefit plans. The Bank may terminate each executive's employment, and each executive may resign, at any time with or without cause. However, in the event of termination during the term without cause, the Bank will owe the executive severance benefits generally equal to the value of the salary that the executive would have received if he or she had continued working for the remaining unexpired term of the agreement plus continued insurance benefits for the remaining unexpired term of the agreement. The same severance benefits would be payable if an executive resigns during the term following a material breach of contract by the Bank which is not cured within 30 days. For 90 days after a change in control, each executive may also resign for any reason and collect severance benefits as if he or she had been discharged without cause calculated as if the remaining unexpired term of the agreement is two years.

If the Company or the Bank experiences a change in ownership, a change in effective ownership or control or a change in the ownership of a substantial portion of their assets as contemplated by section 280G of the Internal Revenue Code ("Section 280G"), the severance payments under the employment agreements will be capped at 2.99 multiplied by each executive's respective "base amount" as such term is defined in Section 280G such that no amount might constitute an "excess parachute payment" under current federal tax laws. The effect of this provision is that deductions for payments made under the employment agreements to Mr. Clift, Mr. Lucy and Ms. Jordan will not be disallowed due to Section 280G.

Interests in Certain Transactions

The Company’s executive officers, its directors and their associates have had, and can be expected to have in the future, financial transactions with the Bank in the ordinary course of business. All such transactions have been and will be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with others. These transactions do not involve more than normal risk of collectibility or present other unfavorable features.

Compensation Committee Report

The Compensation Committee Report (the “Report”) and the Performance Graph (the “Graph”) included in this section are provided in accordance with the rules and regulations of the SEC. Pursuant to such rules and regulations, the Report and the Graph shall not be deemed “soliciting material,” filed with the SEC, subject to Regulation 14A or 14C of the SEC or subject to the liabilities of Section 18 of the Exchange Act.

The 2005 compensation program described in this Proxy Statement was established by the Compensation Committee of the Company’s Board of Directors. This Committee is comprised entirely of non-employee directors. Each member of the Compensation Committee is independent, as set forth in The Nasdaq Stock Market’s listing standards.

Each December, the members of the Compensation Committee review and approve changes to base compensation, bonuses and benefits for senior management and other officers. The Company’s compensation program is designed to attract, develop and retain strong individuals who are capable of maximizing the Company’s performance for the benefit of the stockholders.

The 2005 compensation program consisted of three components: (1) base salary; (2) bonuses; and (3) long-term incentives, e.g., fringe benefits. These elements were intended to provide an overall compensation package that is commensurate with the Company’s financial resources, that is appropriate to assure the retention of experienced management personnel, and align their financial interests with those of the Company’s stockholders.

During 2005, base salaries were set at levels determined, in the subjective judgment of the Compensation Committee, to be commensurate with the officers’ customary respective duties and responsibilities. Bonuses were based primarily on the achievement of established goals. Fringe benefit plans, consisting of a 401(k) plan and group insurance coverage, were designed to provide for health and welfare of the officers and their families, as well as for their long-term financial needs.

The Committee established the Chief Executive Officer’s base salary for 2005 at $200,000, a 5% increase over his base salary for 2004, using the criteria above, together with an independent salary survey of Chief Executive Officers of similar financial institutions located in New England.

Members of the Compensation Committee

| Perry B. Hansen, Chair | Dennis L. Shubert, M.D., Ph.D. | |

| Joseph H. Cyr | Frederick A. Oldenburg, Jr., M.D. | |

Compensation Committee Interlocks and Insider Participation. The Compensation Committee consists of Directors Hansen (Chair), Cyr, Oldenburg, and Shubert. No member of the Compensation Committee was an officer or employee of the Company or the Bank during 2005 or was formerly an officer of the Company or the Bank. In addition, no executive officer of the Company served as a member of another entity’s Board of Directors or as a member of the Compensation Committee of another entity (or other board committee performing equivalent functions) during 2005, which entity had an executive officer serving on the Board of Directors of the Company or the Bank.

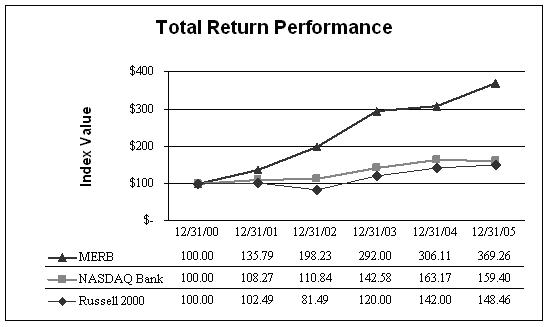

Performance Graph

Set forth below is a line graph comparing the five-year cumulative total return of $100.00 invested in the Company’s common stock (“MERB”), assuming reinvestment of all cash dividends and retention of all stock dividends, with a comparable amount invested in the Russell 2000 Stock Index (“Russell”) and the NASDAQ Bank Stock Index (“NASDAQ Bank”). The NASDAQ Bank Index is a capitalization-weighted index designed to measure the performance of all NASDAQ stocks in the banking sector.

Additional Information

Stockholder Communications with our Board of Directors

Stockholders may contact our Board of Directors by contacting Deborah A. Jordan, Secretary, Merrill Merchants Bancshares, Inc., 201 Main Street, Bangor, ME 04402-0925. All comments will be forwarded directly to the Board of Directors.

Stockholder Proposals for the 2007 Annual Meeting

Stockholders interested in submitting a proposal for inclusion in the proxy materials for the Annual Meeting of Stockholders in 2007 may do so by following the procedures prescribed in SEC Rule 14a-8. To be eligible for inclusion, stockholder proposals must be received by the Company’s Corporate Secretary no later than November 11, 2006. In addition, under our Bylaws, if you wish to nominate a director or bring other business before the Annual Meeting, you must be a stockholder and give timely notice in writing to the Company as specified in our Bylaws.

Other Matters

The Board of Directors of the Company knows of no business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to the Company will be voted in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

A copy of our annual report on Form 10-K for the year ending December 31, 2005 accompanies this proxy statement, as does a summary annual report to stockholders for this year. These reports are not part of the proxy solicitation materials.

MERRILL MERCHANTS BANCSHARES, INC.

201 Main Street

Post Office Box 925

Bangor, Maine 04402-0925

(207) 942-4800

www.merrillmerchants.com