Table of Contents

SCHEDULE 14A

(RULE 14a-101)

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the registrantþ

Filed by a party other than the registranto

Check the appropriate box:

| o | Preliminary proxy statement | |||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| þ | Definitive proxy statement | |||||

| o | Definitive additional materials | |||||

| o | Soliciting material pursuant to Rule 14a-12 |

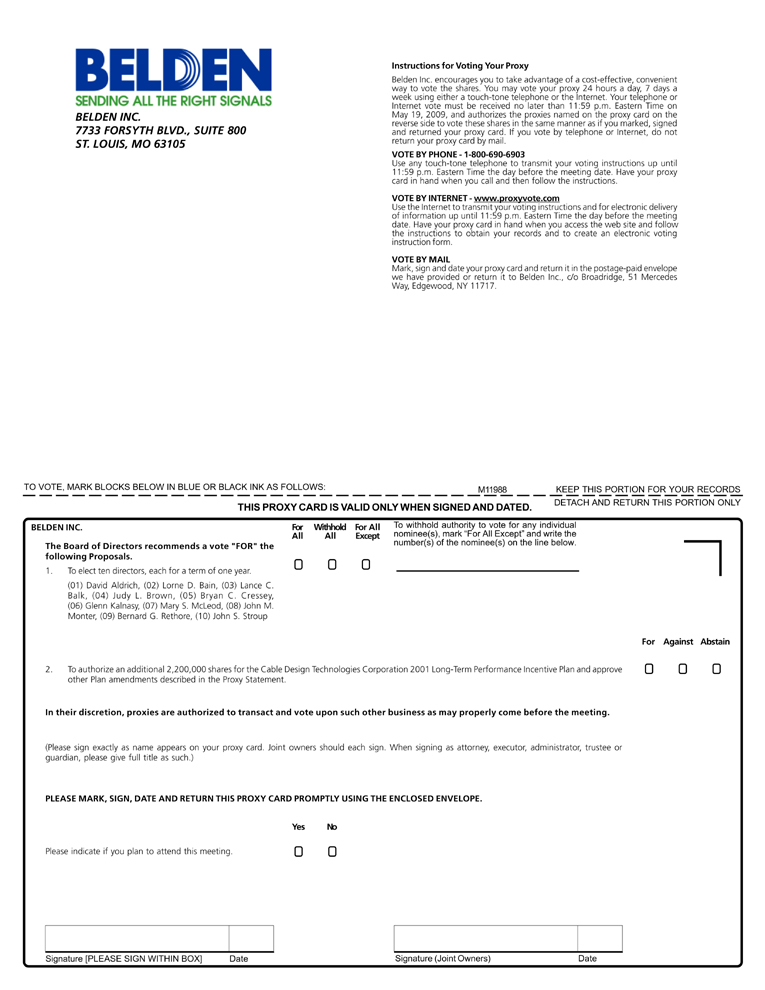

BELDEN INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| þ | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Table of Contents

April 6, 2009

Dear Stockholder:

I am pleased to invite you to our 2009 Annual Stockholders’ Meeting. We will hold the meeting at 11 a.m. Central time on May 20, 2009 at the Saint Louis Club (16th Floor), Pierre Laclede Center, 7701 Forsyth Boulevard, St. Louis, Missouri.

We are pleased to be taking advantage of the U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders primarily over the Internet. We believe that thise-proxy process should expedite stockholders’ receipt of proxy materials, lower the associated costs and conserve natural resources.

On April 6, 2009, we mailed our stockholders a notice containing instructions on how to access our 2009 Proxy Statement and 2008 Annual Report and vote online. The notice also included instructions on how to receive a paper copy of your annual meeting materials, including the notice of annual meeting, proxy statement, and proxy card. If you received your annual meeting materials by mail, the notice of annual meeting, proxy statement and proxy card from our Board of Directors were enclosed. If you received your annual meeting materials viae-mail, thee-mail contained voting instructions and links to the annual report and the proxy statement on the Internet, which are both available athttp://investor.belden.com/annuals.cfm.

The agenda for this year’s annual meeting includes the following items:

Agenda Item | Board Recommendation | |||

| 1. | Election of Ten Directors Nominated By the Company’s Board of Directors | FOR | ||

| 2. | Increase the Share Reserve Under our Long-Term Incentive Plan by 2,200,000 Shares and approve other Plan amendments described in the Proxy Statement | FOR | ||

Please refer to the proxy statement for detailed information on each proposal and the annual meeting. Your vote is important and we kindly request that you cast your vote.

Sincerely,

John Stroup

President and Chief Executive Officer

Table of Contents

BELDEN INC.

7733 Forsyth Boulevard

Suite 800

St. Louis, Missouri 63105

(314) 854-8000

7733 Forsyth Boulevard

Suite 800

St. Louis, Missouri 63105

(314) 854-8000

NOTICE OF 2009 ANNUAL STOCKHOLDERS’ MEETING

| TIME AND DATE | 11:00 a.m. on Wednesday, May 20, 2009 | |

| PLACE | Lewis & Clark Room, Saint Louis Club, 16th Floor, Pierre Laclede Center, 7701 Forsyth Boulevard, St. Louis, Missouri 63105 | |

| AGENDA | • To elect the ten directors nominated by the Company’s Board of Directors, each for a term of one year | |

| • To authorize an additional 2,200,000 shares for issuance under the Cable Design Technologies 2001 Long Term Incentive Plan and approve other Plan amendments described in the Proxy Statement | ||

| • To transact any other business as may properly come before the meeting (including adjournments and postponements) | ||

| WHO CAN VOTE | You are entitled to vote if you were a stockholder at the close of business on Wednesday, March 25, 2009 (our record date) | |

| FINANCIAL STATEMENTS | The Company’s 2008 Annual Report to Stockholders which includes the Company’s Annual Report onForm 10-K is available on the same website as this Proxy Statement. If you were mailed this Proxy Statement, the Annual Report was included in the package. TheForm 10-K includes the Company’s audited financial statements and notes for the year ended December 31, 2008, and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

| VOTING | Please vote as soon as possible to record your vote promptly, even if you plan to attend the annual meeting. You have three options for submitting your vote before the annual meeting: | |

| • Internet | ||

| • Phone (if you request a full delivery of the proxy materials) | ||

| • Mail (if you request a full delivery of the proxy materials) |

By Authorization of the Board of Directors,

Kevin Bloomfield

Senior Vice President, Secretary and General Counsel

St. Louis, Missouri

April 6, 2009

Table of Contents

PROXY STATEMENT FOR THE

2009 ANNUAL MEETING OF STOCKHOLDERS

BELDEN INC.

To be held on Wednesday, May 20, 2009

2009 ANNUAL MEETING OF STOCKHOLDERS

BELDEN INC.

To be held on Wednesday, May 20, 2009

TABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 |

i

Table of Contents

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 28 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 |

ii

Table of Contents

INTERNET AVAILABILITY OF PROXY MATERIALS

Under rules of the United States Securities and Exchange Commission (SEC), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On April 6, 2009, we mailed to our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability also instructs you on how to access your proxy card to vote through the Internet or by telephone.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials viae-mail unless you elect otherwise.

QUESTIONS

| For questions Regarding: | Contact | |

| Annual meeting | Belden Investor Relations,(314) 854-8054 | |

| Stock ownership | Computershare Investor Services, LLC www.computershare.com/contactus (877) 282-1168 (within the U.S. and Canada) or (781) 575-2000 (outside the U.S. and Canada) | |

| Voting | Belden Corporate Secretary,(314) 854-8035 |

1

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | Why am I receiving these materials? | |

| A: | The Board of Directors (the “Board”) of Belden Inc. (sometimes referred to as the “Company” or “Belden”) is providing these proxy materials to you in connection with the solicitation of proxies by Belden on behalf of the Board for the 2009 annual meeting of stockholders which will take place on May 20, 2009. This proxy statement includes information about the issues to be voted on at the meeting. You are invited to attend the meeting and we request that you vote on the proposals described in this proxy statement. | |

| Q: | Why am I being asked to review materials on-line? | |

| A: | Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are now furnishing proxy materials to our stockholders on the Internet, rather than mailing printed copies of those materials to each stockholder. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials on the Internet. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. We began mailing the Notice of Internet Availability to stockholders on or about April 6, 2009. | |

| Q: | Who is qualified to vote? | |

| A: | You are qualified to receive notice of and to vote at the annual meeting if you owned shares of common stock of the Company at the close of business on our record date of March 25, 2009. On the record date, there were 46,572,305 shares of Belden common stock outstanding. Each share is entitled to one vote on each matter properly brought before the annual meeting. | |

| Q: | What information is available for review? | |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and our most highly-paid officers, and certain other required information. Our 2008 Annual Report to Stockholders, which includes our Annual Report onForm 10-K, is also available on-line. TheForm 10-K includes our 2008 audited financial statements with notes and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

| Q: | What matters will be voted on at the meeting? | |

| A: | Two matters will be voted on at the meeting: | |

| • To elect the ten directors nominated by the Company’s Board of Directors, each for a term of one year; and | ||

| • To authorize an additional 2,200,000 shares for issuance under the Cable Design Technologies 2001 Long-Term Incentive Plan and approve other plan amendments described herein. | ||

| Q: | What is Belden’s voting recommendation? | |

| A: | Our Board of Directors recommends that you vote your shares“FOR”both proposals. | |

| Q: | What shares owned by me can be voted? | |

| A: | All shares owned by you as of March 25, 2009, the record date, may be voted by you. These shares include those (1) held directly in your name as theshareholder of record, and (2) held for you as thebeneficial ownerthrough a stockbroker, bank or other nominee. | |

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? | |

| A: | Some Belden stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. | |

| Shareholder of Record | ||

| If your shares are registered directly in your name with Belden’s transfer agent, Computershare, you are considered (with respect to those shares)the shareholder of recordand the Notice of Internet Availability of Proxy Materials is being sent directly to you by Belden. As theshareholder of record, you have the right to grant your voting proxy directly to Belden or to vote in person at the meeting. |

2

Table of Contents

| Beneficial Owner | ||

| If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial ownerof shares held in “street name” (that is, the name of your stock broker, bank or other nominee) and the Notice of Internet Availability of Proxy Materials is being forwarded to you by your broker or nominee who is considered, with respect to those shares, theshareholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the meeting. However, since you are not theshareholder of record, you may not vote these shares in person at the meeting. | ||

| Q: | How can I vote my shares in person at the meeting? | |

| A: | Shares held directly in your name as the shareholder of record may be voted in person at the annual meeting. If you choose to do so, please bring proof of identification. | |

| Even if you plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you decide later not to attend the meeting. | ||

| Q: | How can I vote my shares without attending the meeting? | |

| A: | Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. You will be able to do this over the Internet by following the instructions on your Notice of Internet Availability of Proxy Materials. If you request a full delivery of the proxy materials, a proxy card will be included that will contain instructions on how to vote by telephone or mail in addition to the Internet. | |

| Q: | Can I change my vote? | |

| A: | You may change your proxy or voting instructions at any time prior to the vote at the annual meeting. For shares held directly in your name, you may accomplish this by granting a new proxy or by attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee. | |

| Q: | What are the voting requirements to approve the proposals? | |

| A: | The first proposal –Election of ten directors, each for a term of one year –requires a plurality of the votes cast to elect a director. | |

| The second proposal –Authorization of 2,200,000 additional shares under our equity plan and other plan amendments – requires the affirmative vote of a majority of those shares present and represented at the annual meeting and eligible to vote. | ||

| Q: | What is the quorum requirement for the meeting? | |

| A: | The quorum requirement for holding the meeting and transacting business is a majority of the outstanding shares entitled to vote. The shares may be present in person or represented by proxy at the meeting. Both abstentions and withheld votes are counted as present for the purpose of determining the presence of a quorum for the proposal. | |

| Q: | How are votes withheld, abstentions and broker non-votes treated? | |

| A: | Votes withheld and abstentions are deemed as “present” at the meeting, are counted for quorum purposes, and other than for Proposal I (Election of ten directors for a term of one year),will have the same effect as a vote against the matter. Broker non-votes, if any, while counted for general quorum purposes, are not deemed to be “present” with respect to any matter for which a broker does not have authority to vote, absent instructions from his or her beneficial owner. A broker non-vote may have an impact with respect to Proposal II (Authorization of 2,200,000 additional shares under our equity plan and other plan amendments). A broker non-vote will not have an impact with respect to the first proposal because a broker will have the discretionary authority to vote on this proposal absent instructions from his or her beneficial owner. | |

| Q: | Where can I find the voting results of the meeting? | |

| A: | We will announce preliminary voting results at the meeting and publish final results in our quarterly report onForm 10-Q for the second quarter of 2009. |

3

Table of Contents

| Q: | What happens if additional proposals are presented at the meeting? | |

| A: | Other than the proposals described in this proxy statement, we do not expect any matters to be presented for a vote at the annual meeting. If you grant a proxy, the persons named as proxy holders, Kevin L. Bloomfield, the Company’s Secretary, and Christopher E. Allen, the Company’s Assistant Secretary, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any unforeseen reason any of our nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors. | |

| Q: | What class of shares is entitled to be voted? | |

| A: | Each share of our common stock outstanding as of the close of business on March 25, 2009, the record date, is entitled to one vote at the annual meeting. | |

| Q: | Who will count the votes? | |

| A: | A representative of Broadridge Financial Solutions, Inc. will tabulate the votes and will act as the inspector of election. | |

| Q: | Is my vote confidential? | |

| A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Belden or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by our Board. Occasionally, shareholders provide written comments on their proxy cards, which are then forwarded to Belden management. | |

| Q: | Who will bear the cost of soliciting votes for the meeting? | |

| A: | Belden will pay the cost of soliciting proxies. Upon request, the Company will reimburse brokers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of the Company’s common stock. | |

| Q: | May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors? | |

| A: | You may submit proposals for consideration at future stockholder meetings, including director nominations. | |

| Stockholder Proposals:To be included in the Company’s proxy statement and form of proxy for the 2010 annual meeting, a stockholder proposal must, in addition to satisfying the other requirements of the Company’s bylaws and the Securities and Exchange Commission’s rules and regulations, be received at the Company’s principal executive offices by December 8, 2009. If you want the Company to consider a proposal at the 2010 annual meeting that will not be included in the Company’s proxy statement, among other things, the Company’s bylaws require that you notify our Board of Directors of your proposal no earlier than January 20, 2010 and no later than February 19, 2010. | ||

| Nomination of Director Candidates: The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such nominations are submitted to the Company prior to the deadline for proposals to be included in future proxy statements as noted in the above paragraph. To have a candidate considered by the Committee, a stockholder must submit the recommendation in writing and must include the following information: | ||

| • The name of the stockholder and evidence of the person’s ownership of Company stock, including the number of shares owned (whether direct ownership or derivative ownership) and the length of time of ownership; and | ||

| • The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of Belden, the candidate’s ownership interest in the Company, a description of any arrangements between the candidate and the nominating stockholder and the person’s consent to be named as a director if selected by the Committee and nominated by the Board. | ||

| In considering candidates submitted by stockholders, the Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Committee may also take into |

4

Table of Contents

| consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. The Committee believes that the minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. In addition, the Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and Belden. The Committee also seeks to have the Board represent a diversity of backgrounds and experience. | ||

| The Committee will identify potential nominees by asking current directors and executive officers to notify the Committee if they become aware of persons, meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the Board. The Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by stockholders. | ||

| Once a person has been identified by the Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Chairman or another member of the Committee may contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Committee will request information from the candidate, review the person’s accomplishments and qualifications, and conduct one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Committee’s evaluation process will not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. |

5

Table of Contents

BOARD STRUCTURE AND COMPENSATION

The Belden Board has eleven members and three standing committees: Audit, Compensation, and Nominating and Corporate Governance. The Board had eleven meetings during 2008; six were telephonic. All directors attended 75% or more of the Board meetings and the Board committee meetings on which they served. The maximum number of directors authorized under the Company’s bylaws is eleven.

Mr. Harris, who had been a Company director since 1985, expressed his intent not to seek reelection and will retire from the Board when his term expires at this year’s annual meeting. The Board and management wish to thank Mr. Harris for his strong leadership and significant contributions to the Board and the Company.

| Nominating and | |||||||||

| Corporate | |||||||||

| Name of Director | Audit | Compensation | Governance | ||||||

| David Aldrich | 5 | ||||||||

| Lorne D. Bain | 5 | ||||||||

| Lance C. Balk | 5 | ||||||||

| Judy L. Brown | 5 | ||||||||

| Bryan C. Cressey | 5 | ||||||||

| Michael F.O. Harris | 5 | ||||||||

| Glenn Kalnasy | 5* | ||||||||

| Mary S. McLeod | 5 | ||||||||

| John M. Monter | 5 | 5* | |||||||

| Bernard G. Rethore | 5* | ||||||||

| John Stroup | |||||||||

| Number of meetings held in 2008 | 14 | 4 | 5 | ||||||

| 5 | Committee member | |

| * | Chair |

At its regular meeting in February 2009, the Board determined that Ms. Brown, Ms. McLeod and Messrs. Aldrich, Bain, Balk, Cressey, Harris, Kalnasy, Monter and Rethore, each met the independence requirements of the NYSE listing standards. As part of this process, the Board determined that each such member had no material relationship with the Company.

Audit Committee

The Audit Committee operates under a Board-approved written charter and each member meets the independence requirements of the NYSE’s listing standards. The Committee assists the Board in overseeing the Company’s accounting and reporting practices by:

| • | meeting with its financial management and independent registered public accounting firm (Ernst & Young LLP) to review the financial statements, quarterly earnings releases and financial data of the Company; | |

| • | reviewing and selecting the independent registered public accounting firm who will audit the Company’s financial statements; | |

| • | reviewing the selection of the internal auditors (Brown Smith Wallace LLC) who provide internal audit services; |

6

Table of Contents

| • | reviewing the scope, procedures and results of the Company’s financial audits, internal audit procedures and internal controls assessments and procedures under Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”); and | |

| • | evaluating the Company’s key financial and accounting personnel. |

A representative of Ernst & Young LLP is expected to be present at the annual meeting and will have the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

At its February 25, 2009 meeting, the Board determined that each of Ms. Brown and Messrs. Rethore, Bain and Harris was an Audit Committee Financial Expert as defined in the rules pursuant to the Sarbanes-Oxley Act of 2002 and each is independent.

Audit Committee Report

The Audit Committee assists the Company’s Board of Directors in its general oversight of the Company’s financial reporting process. Management is responsible for the preparation and presentation of the Company’s financial statements. Ernst & Young LLP (“EY”), the Company’s independent registered public accounting firm for 2008, is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of the Company’s financial statements with accounting principles generally accepted in the United States.

The Committee has reviewed and discussed the Company’s audited financial statements for 2008 with management and has discussed with EY the matters that are required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended.

EY has provided to the Committee the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence. The Committee has discussed with EY and confirmed that firm’s independence. The Committee has concluded that EY’s provision of non-audit services to the Company and its subsidiaries is compatible with EY’s independence.

Based on these reviews and discussions, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report onForm 10-K for 2008.

Bernard G. Rethore (Chair)

Lorne D. Bain

Judy L. Brown

Michael F.O. Harris

Fees to Independent Registered Public Accountants for 2008 and 2007

The following table presents fees for professional services rendered by EY for the audit of the Company’s annual financial statements and internal control over financial reporting for 2008 and 2007 as well as other permissible audit-related and tax services.

| 2008 | 2007 | |||||||

| Audit Fees | $ | 2,959,818 | $ | 3,095,609 | ||||

| Audit-Related Fees | 238,700 | 1,170,893 | ||||||

| Tax Fees | 946,030 | 79,966 | ||||||

| All Other Fees | 0 | 0 | ||||||

| Total EY fees | $ | 4,144,548 | $ | 4,346,468 | ||||

“Audit fees” primarily represent amounts paid or expected to be paid for audits of the Company’s financial statements and internal control over financial reporting under SOX 404, review of SEC comment letters, reviews of SECForms 10-Q,Form S-4 andForm 10-K, and statutory audit requirements at certainnon-U.S. locations.

7

Table of Contents

“Audit-related fees” are primarily related to due diligence services on completed and potential acquisitions.

“Tax fees” for 2008 and 2007 are for domestic and international compliance totaling $541,232 and $20,252, respectively, and tax planning totaling $404,798 and $59,714, respectively.

In approving such services, the Audit Committee did not rely on the pre-approval waiver provisions of the applicable rules of the SEC.

Audit Committee’s Pre-Approval Policies and Procedures

Audit Fees: For 2008, the Committee reviewed and pre-approved the audit services and estimated fees for the year. Throughout the year, the Committee received project updates and, if appropriate, approved or ratified any amounts exceeding the original estimates.

Audit-Related and Non-Audit Services and Fees: Annually, and otherwise as necessary, the Committee reviews and pre-approves all audit-related and non-audit services and the estimated fees for such services. For recurring services, such as tax compliance, expatriate tax returns, and statutory filings, the Committee reviews and pre-approves the services and estimated total fees for such matters by category and location of service. The projected fees are updated quarterly and the Committee considers and, if appropriate, approves any amounts exceeding the original estimates.

For non-recurring services, such as special tax projects, due diligence or other tax services, the Committee reviews and pre-approves the services and estimated fees by individual project. The projections are updated quarterly and the Committee reviews, and, if appropriate, approves any amounts exceeding the original estimates.

Should an engagement need pre-approval before the next Committee meeting, the Committee has delegated to the Committee Chair (or if he were unavailable, another Committee member) authority to grant such approval. Thereafter, the entire Committee will review such approval at its next quarterly meeting.

Compensation Committee

The Compensation Committee of Belden determines, approves and reports to the Board on compensation for the Company’s elected officers. The Committee reviews the design, funding and competitiveness of the Company’s retirement programs. The Committee also assists the Company in developing compensation and benefit strategies to attract, develop and retain qualified employees. The Committee operates under a written charter approved by the Board.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies, evaluates and recommends nominees for the Board for each annual meeting (and to fill vacancies during interim periods); evaluates the composition, organization, and governance of the Board and its committees; oversees senior management succession planning; and develops and recommends corporate governance principles and policies applicable to the Company. The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such nominations are submitted to the Company prior to the deadline for proposals as noted above under the caption “Nomination of Director Candidates.”

The Committee’s responsibilities with respect to its governance function include considering matters of corporate governance and reviewing (and recommending to the Board revisions to) the Company’s corporate governance guidelines and its code of ethics, which applies to all Company employees, officers and directors. The Committee is governed by a written charter approved by the Board.

Corporate Governance

Current copies of the Audit, Compensation and Nominating and Corporate Governance charters, as well as the Company’s governance principles and code of ethics, are available on the Company’s website atwww.belden.com under the heading “Corporate Governance.” Printed copies of these materials are also available to stockholders upon request, addressed to the Corporate Secretary, Belden Inc., 7733 Forsyth Boulevard, Suite 800, St. Louis, Missouri 63105.

8

Table of Contents

Communications with Directors

The Company’s Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board (including Bryan Cressey, Chairman of the Board and presiding director for non-management director meetings), any Board committee or any chair of any such committee by U.S. mail, through calling the Company’s hotline or viae-mail.

To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Company’s Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent“c/o Corporate Secretary, Belden Inc.” at 7733 Forsyth Boulevard, Suite 800, St. Louis, MO 63105. To communicate with any of our directors electronically or through the Company’s hotline, stockholders should go to our corporate website atwww.belden.com. Under the heading “Corporate Governance,” you will find the Company’s hotline number (with access codes for dialing from outside the U.S.) and ane-mail address that may be used for writing an electronic message to the Board, any individual directors, or any group or committee of directors. Please follow the instructions on our website to send your message.

All communications received as set forth in the preceding paragraph will be opened by (or in the case of the hotline, initially reviewed by) our corporate ombudsman for the sole purpose of determining whether the contents represent a message to our directors. The Belden Ombudsman will not forward certain items which are unrelated to the duties and responsibilities of the Board, including: junk mail, mass mailings, product inquiries, product complaints, resumes and other forms of job inquiries, opinion surveys and polls, business solicitations, promotions of products or services, patently offensive materials, advertisements, and complaints that contain only unspecified or broad allegations of wrongdoing without appropriate information support.

In the case of communications to the Board or any group or committee of directors, the corporate ombudsman’s office will send copies of the contents to each director who is a member of the group or committee to which the envelope ore-mail is addressed.

In addition, it is the Company’s policy that each director attends the annual meeting absent exceptional circumstances. Each director attended the Company’s 2008 annual meeting.

9

Table of Contents

DIRECTOR COMPENSATION

Each non-employee director receives a $60,000 annual cash retainer; a time vested (twelve month) annual restricted share (RSU) award of $115,000 divided by the then-current share price; an additional $10,000 per year for the chair of the Audit Committee; an additional $5,000 per year to the chairs of the Compensation and Nominating and Corporate Governance Committees; an additional $5,000 per year to members of the Audit Committee and members of other committees who serve on more than one committee; and upon appointment, a non-employee director receives a time-vested RSU award of 2,500 shares. The following table provides information on non-employee director compensation for 2008.

| Fees Earned or | Option | All Other | |||||||||||||

| Paid in Cash(1) | Stock Awards(2) | Awards(3) | Compensation(4) | Total | |||||||||||

| ($) | ($) | ($) | ($) | ($) | |||||||||||

| David Aldrich | 60,000 | 134,904 | -- | - | 194,904 | ||||||||||

| Lorne D. Bain | 65,000 | 114,975 | -- | - | 179,975 | ||||||||||

| Lance C. Balk | 60,833 | 114,975 | -- | 11,217 | 187,025 | ||||||||||

| Judy L. Brown | 59,583 | 151,510 | -- | - | 211,093 | ||||||||||

| Bryan C. Cressey | 60,000 | 114,975 | -- | - | 174,975 | ||||||||||

| Michael F.O. Harris | 65,000 | 114,975 | -- | - | 179,975 | ||||||||||

| Glenn Kalnasy | 65,000 | 114,975 | -- | - | 179,975 | ||||||||||

| Mary S. McLeod | 50,000 | 95,572 | -- | - | 145,572 | ||||||||||

| John M. Monter | 70,000 | 114,975 | -- | 11,098 | 196,073 | ||||||||||

| Bernard G. Rethore | 75,000 | 114,975 | -- | - | 189,975 | ||||||||||

| (1) | Amount of cash retainer and committee fees. | |

| (2) | As required by the instructions for completing this column “Stock Awards,” amounts shown are the amounts recognized by the Company in 2008 for financial statement reporting purposes in accordance with FAS 123R. Each director received 2,978 RSUs in May 2008. Ms. Brown received an additional RSU award of 2,500 in February 2008 upon her appointment to the Board; these vested on the anniversary date of her appointment. Ms. McLeod received an additional RSU award of 2,500 in February 2008 upon her appointment to the Board; due to a change in policy, her award vests equally over three years; the first one-third vested on the anniversary date of her appointment. | |

| (3) | The aggregate number of option awards outstanding at the end of 2008. |

| Options Outstanding | |||

| (#) | |||

| Aldrich | - | ||

| Bain | - | ||

| Balk | 11,000 | ||

| Brown | - | ||

| Cressey | 14,000 | ||

| Harris | 12,000 | ||

| Kalnasy | 11,000 | ||

| McLeod | - | ||

| Monter | - | ||

| Rethore | - | ||

| (4) | Amount of interest earned on deferred dividends and director fees. |

10

Table of Contents

Director Stock Ownership Policy

The Board’s policy is that each non-employee director holds Company stock equal in value to five times his or her annual cash retainer (currently 5 times $60,000). Upon appointment, a member has five years to meet this requirement, but must meet interim goals during the five-year period of: 20% after one year; 40% after two years; 60% after three years; and 80% after four years. The in-the-money value of vested stock options and the value of unvested RSUs are included in making this determination at the higher of their grant date value or current market value. Each non-employee director meets either the full-period or interim-period holding requirement: Messrs. Bain, Balk, Cressey, Harris, Kalnasy, Monter and Rethore each meet 100% of the stock holding requirement. Mr. Aldrich, who was appointed to the Board in February 2007, meets the second-year interim requirement and Ms. Brown and Ms. McLeod, who were appointed to the Board in February 2008, meet the first-year interim requirement.

PROPOSALS TO BE VOTED ON:

ITEM I – ELECTION OF DIRECTORS

The Company has eleven directors-Ms. Brown, Ms. McLeod, and Messrs. Aldrich, Bain, Balk, Cressey, Harris, Kalnasy, Monter, Rethore and Stroup. The term of each director will expire at this annual meeting and the Board proposes that each of them (other than Mr. Harris who plans to retire at this meeting) be reelected for a new term of one year and until their successors are duly elected and qualified. Each nominee has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

| David Aldrich,52, was appointed to the Company’s Board in February 2007. Since April 2000, he has served as President, Chief Executive Officer, and Director of Skyworks Solutions, Inc. (“Skyworks”). Skyworks is an innovator of high performance analog and mixed signal semiconductors enabling mobile connectivity. Mr. Aldrich received a B.A. degree in political science from Providence College and an M.B.A. degree from the University of Rhode Island. | |

| Lorne D. Bain,67, had been a director of Belden 1993 Inc. since 1993 and was appointed to the Company’s Board at the time of the merger of Belden 1993 Inc. and Cable Design Technologies Corporation in 2004 (the “Merger”). Until September 2000, he served as Chairman, President and Chief Executive Officer of WorldOil.com, a trade publication and Internet-based business serving the oilfield services industry. From 1997 to February 2000, he was Managing Director of Bellmeade Capital Partners, L.L.C., a venture capital firm. From 1991 to 1996, he was Chairman and Chief Executive Officer of Sanifill, Inc., an environmental services company. Mr. Bain received a B.B.A. degree from St. Edwards University and a J.D. degree from the University of Texas School of Law and has completed Harvard Business School’s Advanced Management Program. |

11

Table of Contents

| Lance C. Balk,51, has been a director of the Company since March 2000. Since November 2007, Mr. Balk has served as Senior Vice President and General Counsel of Siemens Healthcare Diagnostics. From May 2006 to November 2007, he served in those positions with Dade Behring, a leading supplier of products, systems and services for clinical diagnostics, which was acquired by Siemens Healthcare Diagnostics in November 2007. Siemens Healthcare Diagnostics is the world’s largest provider of diagnostic products, formed by the strategic combination of Bayer HealthCare Diagnostics Division, Diagnostic Products Corporation and Dade Behring. Previously, he had been a partner of Kirkland & Ellis LLP since 1989, specializing in securities law and mergers and acquisitions. Mr. Balk received a B.A. degree from Northwestern University and a J.D. degree and an M.B.A. degree from the University of Chicago. | |

| Judy L. Brown, 40, was appointed to the Company’s Board in February 2008. Since July 2006, she has served as Executive Vice President, Chief Financial Officer and Chief Accounting Officer of Perrigo Company (“Perrigo”). Ms. Brown joined Perrigo in September 2004 as Vice President and Corporate Controller. Perrigo is a leading global healthcare supplier and the world’s largest manufacturer of over-the-counter pharmaceutical and nutritional products for store brand products sold by food, drug, mass merchandise, dollar store and club store retailers under their own labels. Previously, Ms. Brown held various senior positions in finance and operations at Whirlpool Corporation from 1998 to August 2004. She received a B.S. degree from the University of Illinois and an M.B.A. from the University of Chicago. | |

| Bryan C. Cressey, 59, has been Chairman of the Board of the Company since 1988 and a director of the Company since 1985. For the past twenty-eight years, he has also been a General Partner and Principal of Golder, Thoma and Cressey, Thoma Cressey Bravo, and Cressey & Company, all private equity firms. The firms have specialized in healthcare software and business services. He is also a director of Jazz Pharmaceutical, a public company, and several private companies. Jazz Pharmaceutical is a specialty pharmaceutical company that identifies, develops and commercializes products to satisfy unmet medical needs in neurology and psychiatry. Mr. Cressey received a B.A. degree from the University of Washington and a J.D. degree and an M.B.A. degree from Harvard University. | |

| Glenn Kalnasy,65, has been a director of the Company since 1985. From February 2002 through October 2003, Mr. Kalnasy served as the Chief Executive Officer and President of Elan Nutrition Inc., a privately held company. From 1982 to 2003, he was a Managing Director of The Northern Group, Inc. Mr. Kalnasy received a B.S. degree from Southern Methodist University. | |

| Mary S. McLeod, 52, was appointed to the Company’s Board in February 2008. Since April 2007, Ms. McLeod has served as Senior Vice President of Global Human Resources at Pfizer Inc. (“Pfizer”), the world’s largest research-based pharmaceutical company. Prior to joining Pfizer, from January to April 2007, Ms. McLeod was an executive vice president of Korn Consulting Group (“Korn”), a firm specializing in helping companies through large-scale change, where she spent much of her time consulting on behalf of Pfizer. Before joining Korn, from March 2005 to January 2007, Ms. McLeod led human resources for Symbol Technologies (“Symbol”), a worldwide supplier of mobile data capture and delivery equipment. Prior to joining Symbol, from October 2001 to February 2005, she was head of human resources for Charles Schwab. Ms. McLeod received a B.A. degree from Loyola University and a master’s degree from the University of Missouri. |

12

Table of Contents

| John M. Monter,61, had been a director of Belden 1993 Inc. since 2000 and was appointed to the Company’s Board at the time of the Merger. From 1993 to 1996, he was President of the Bussmann Division of Cooper Industries, Inc. Bussmann manufactures electrical and electronic fuses. From 1996 through 2004, he was President and Chief Executive Officer of Brand Services, Inc. (“Brand”) and also a member of the board of directors of the parent companies, Brand DLJ Holdings(1996-2002) and Brand Holdings, LLC (2002-2006). He was named Chairman of DLJ Holdings in 2001 and Chairman of Brand Holdings, LLC in 2002. From January 1, 2005 through April 30, 2006, he served as Vice Chairman, Brand Holdings, LLC. Brand is a supplier of scaffolding and specialty industrial services. In 2008, Mr. Monter was elected a director on the board of Environmental Logistics Services, a privately held company that is owned by Centre Partners. Environmental Logistics Services is a hauler and disposer of solid wastes. He received a B.S. degree in journalism from Kent State University and an M.B.A. degree from the University of Chicago. | |

| Bernard G. Rethore,67, had been a director of Belden 1993 Inc. since 1997 and was appointed to the Company’s Board at the time of the Merger. In 1995 he became Director, President and Chief Executive Officer of BW/IP, Inc., a supplier of fluid transfer equipment, systems and services, and was elected its Chairman in 1997. In July 1997, Mr. Rethore became Chairman and Chief Executive Officer of Flowserve Corporation, which was formed by the merger of BW/IP, Inc., and Durco International, Inc. In 2000, he retired as an executive officer and director and was named Chairman of the Board, Emeritus. From 1989 to 1995, Mr. Rethore was Senior Vice President of Phelps Dodge Corporation and President of Phelps Dodge Industries. He received a B.A. degree in economics (Honors) from Yale University and an M.B.A. degree from the Wharton School of the University of Pennsylvania. He also is a director of Dover Corporation (a diversified manufacturer of industrial products), Walter Industries, Inc. (a producer of coal, coal bed methane gas, furnace and foundry coke and other related products) and Mueller Water Products Inc. (a manufacturer and marketer of water infrastructure and control products). | |

| John S. Stroup, 42, was appointed President, Chief Executive Officer and member of the Board effective October 31, 2005. From 2000 to the date of his appointment with the Company, he was employed by Danaher Corporation, a manufacturer of professional instrumentation, industrial technologies, and tools and components. At Danaher, he initially served as Vice President, Business Development. He was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Earlier, he was Vice President of Marketing and General Manager with Scientific Technologies Inc. He received a B.S. degree in mechanical engineering from Northwestern University and an M.B.A. degree from the University of California at Berkeley. Mr. Stroup is a director of RBS Global, Inc. RBS Global manufactures power transmission components, drives, conveying equipment and other related products under the Rexnord name. |

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

NOMINATED SLATE OF DIRECTORS.

NOMINATED SLATE OF DIRECTORS.

ITEM II – APPROVE AN ADDITIONAL 2,200,000 SHARES FOR THE

COMPANY’S 2001 LONG-TERM INCENTIVE PLAN AND OTHER PLAN AMENDMENTS

COMPANY’S 2001 LONG-TERM INCENTIVE PLAN AND OTHER PLAN AMENDMENTS

General

In 2000, the shareholders of the Company (then named Cable Design Technologies Corporation) approved the Cable Design Technologies Corporation 2001 Long-Term Incentive Plan (the “Plan”). The Plan originally authorized the issuance of 900,000 shares (adjusted for a2-for-1 reverse stock split in 2004). In 2005, the Company’s shareholders authorized an additional 2,500,000 shares under the Plan. Now, the Board has amended the Plan to increase the number of shares available under the Plan, subject to approval by the Company’s shareholders. At this meeting, you are requested

13

Table of Contents

to approve an amendment to the Plan that increases by 2,200,000 the number of shares that may be granted under the Plan. Of this amount, beginning in 2009, no more than 1,100,000 shares shall be available for grants of awards other than stock options or stock appreciation rights (SARs). As part of the amendment you are also being asked to approve language that was added to the Plan to clarify that the following shares of stock may not again be made available for issuance as awards under the Plan: (i) shares of stock not issued or delivered as a result of the net settlement of an outstanding SAR or as a result of the net settlement of an option; (ii) shares of stock used to pay the exercise price or withholding taxes in connection with an exercise or vesting of an award, or (iii) shares of stock repurchased on the open market with proceeds from an option exercise. These clarifications are consistent with the Company’s historical practices.

As reflected below in theEquity Compensation Plan Information on December 31, 2008Table, there were 802,356 shares available for issuance under the Plan at the end of 2008. On February 24, 2009, 1,361,275 awards of SARs, PSUs and RSUs were awarded to eligible participants, including the named officers. At the time of these awards, there were 903,401 shares available for issuance under the Plan. Certain executive officers (including Messrs. Stroup, Benoist and Bloomfield) received 458,600 of the equity awards granted on February 24, 2009, which were in the form of SARs and PSUs granted on the condition that shareholders approve this proposal to increase the share reserve under the Plan by 2,200,000 and approve the other Plan amendments described above.

The table below shows equity awards made or anticipated to be made that are contingent on approval of this proposal.

Plan Benefits Subject to Stockholder Approval of Proposal

| Cable Design Technologies Corporation 2001 Long Term Incentive Plan | |||||||||||||||

| Dollar Value | Number of | Number of | |||||||||||||

| Name and Position | ($) | SARs | PSUs(1) | ||||||||||||

| John Stroup, President and Chief Executive Officer | 2,501,000 | 167,800 | 88,200 | ||||||||||||

| Gray Benoist, Senior Vice President, Finance and Chief Financial Officer | 770,300 | 52,000 | 27,000 | ||||||||||||

| Kevin Bloomfield, Senior Vice President, Secretary and General Counsel | 356,100 | 24,000 | 12,500 | ||||||||||||

| Naresh Kumra, Executive Vice President, Asia Pacific Operations | - | - | - | ||||||||||||

| Executive Group | 4,448,698 | 305,300 | 153,300 | ||||||||||||

| Non-Executive Director Group(2) | 1,150,000 | - | - | ||||||||||||

| Non-Executive Employee Group(3) | - | - | - | ||||||||||||

| (1) | As described elsewhere in this proxy statement, amounts shown are based on target Company performance measured against performance goals determined by the Compensation Committee. There are two performance periods in 2009, the first from January through June and the second from July until December. Half of the PSUs are applicable to each performance period. The PSUs shown above may be converted into restricted stock units (RSUs). The maximum number of RSUs to be issued per PSU is 1.5 and the minimum number is 0. | |

| (2) | It is anticipated, following the annual meeting, that each non-executive director will receive an annual RSU award of $115,000 divided by the then-current Belden share price. The number of RSUs is not determinable at this time and can only be made if this proposal is approved by shareholders. Due to his impending retirement from the Board, Mr. Harris may receive a partial award or a cash-equivalent award. This determination will be made at the May Board meeting. | |

| (3) | Awards to plan participants (other than the certain executive officers) were made under the Plan’s existing share reserve and therefore were not issued on the condition of obtaining shareholder approval of this proposal. |

14

Table of Contents

If this proposal is not approved, the awards shown above will be void and will be replaced with cash equivalent awards and there will be no shares available for future grants. If the proposal is approved the number of shares available for future grants (including the May 2009 director grants) would be approximately 1,742,000.

The Plan is intended to promote the long-term interests of the Company by aligning employee financial interests with long-term stockholder value. Additional shares are necessary in order to achieve the purpose of the Plan over its remaining term.

Summary of Plan

General. The Plan provides for the granting to employees, directors and other individuals who perform services for the Company (“Participants”) the following types of incentive awards: stock options, stock appreciation rights (“SARs”), restricted stock, performance grants and other types of awards that the Board of Directors or a duly appointed committee of the Board of Directors deems to be consistent with the purposes of the Plan.

The Plan provides that no Participant is entitled to receive grants of common stock, stock options or SARs in a calendar year in excess of 400,000 shares or units. The Plan affords the Company latitude in tailoring incentive compensation to support corporate and business objectives, and to anticipate and respond to a changing business environment and competitive compensation practices.

Plan Administration. The Plan is administered by the Compensation Committee and the Committee has the exclusive authority to select Plan participants and to determine the type, size and terms of each award, to modify the terms of awards, to determine when awards will be granted and paid, and to make all other determinations which it deems necessary or desirable in the interpretation and administration of the Plan.

With limited exceptions, including termination of employment as a result of death, disability or retirement, or except as otherwise determined by the Committee, rights to these forms of contingent compensation are forfeited if a recipient’s employment or performance of services terminates within a specified period following the award. Generally, a Participant’s rights and interests under the Plan will not be transferable except by will or by the laws of descent and distribution.

Awards under the Plan

Options: The Committee may grant non-qualified stock options (“NSO”) and incentive stock options (“ISO”) at a price fixed by the Committee. The option price may not be less than the fair market value of the Company’s stock on the grant date and, for ISOs issued to an employee owning more than ten percent of the voting power of the Company’s stock, may not be less than 110% of the fair market value of the Company’s stock on the grant date.

Options generally will expire not later than ten years after the date on which they are granted. Options will become exercisable at such times and in such installments as the Committee shall determine. Payment of the option price must be made in full at the time of exercise in such form (including cash, common stock of the Company or the surrender of another outstanding award or any combination thereof) as the Committee may determine.

SARs: A SAR (or stock appreciation right) entitles the holder to receive cash or common stock (or combination thereof) equal to (or, in the discretion of the Committee, less than) the difference between the exercise price or option price per share and the fair market value per share at the time of such exercise, times the number of shares subject to the SAR or option or other award, or portion thereof, which is exercised. The Plan prohibits SARs issued below the fair market value of the Company Stock on the grant date.

Restricted Stock Units. A restricted stock unit is an award of a given number of shares of common stock which are subject to a restriction against transfer and to a risk of forfeiture during a period set by the Committee. During the restriction period, dividends on the underlying shares accrue and are distributed if and when the restricted stock vests.

Performance Grants: Performance grants are awards whose final value, if any, is determined by the degree to which specified performance objectives have been achieved during an award period set by the Committee, subject to such adjustments as the Committee may approve based on relevant factors. The Committee may

15

Table of Contents

determine performance measures based on measures of industry, Company, unit or Participant performance (or any combination of the foregoing) and the Committee may adjust these as it deems appropriate.

A target value of an award is established (and may be amended thereafter) by the Committee and may be a fixed dollar amount, an amount that varies from time to time based on the value of a share of common stock, or an amount that is determinable from other criteria specified by the Committee. Payment of the final value of an award is made as promptly as practicable after the end of the award period or at such other times as the Committee may determine.

Adjustments

Upon the liquidation or dissolution of the Company, all outstanding awards under the Plan shall terminate immediately prior to the consummation of such liquidation or dissolution, unless otherwise provided by the Committee. In the event of a proposed sale of all or substantially all of the assets of the Company, or the merger of the Company with or into another corporation, all restrictions on any outstanding awards shall lapse and Participants will be entitled to the full benefit of such awards immediately prior to the closing date of such sale or merger, unless otherwise provided by the Committee.

Amendments

The Board of Directors or the Committee may amend or terminate the Plan, except that no amendment shall become effective without the prior approval of the Company’s stockholders if such approval is necessary for continued compliance with the performance-based compensation exception of Section 162(m) of the Internal Revenue Code, under the Incentive Stock Options provisions of Section 422 of the Internal Revenue Code or by any NYSE listing requirements. Furthermore, any termination may not materially and adversely affect any outstanding right or obligation under the Plan without the affected participant’s consent.

Termination

By its terms, the Plan will expire on December 6, 2010, ten years from the date that the Plan was initially approved by the Company’s shareholders. However, prior to such expiration, the Plan permits the Company’s Board to extend the Plan for up to an additional five years with certain limitations.

U.S. Federal Tax Consequences Under the Plan

Federal Income Tax Consequences — Incentive Stock Options. The grant of incentive stock options to an employee does not result in any income tax consequences. The exercise of an incentive stock option does not result in any income tax consequences to the employee if the incentive stock option is exercised by the employee during his employment with the Company or a subsidiary, or within a specified period after termination of employment due to death or retirement for age or disability under then established rules of the Company. However, the excess of the fair market value of the shares of stock as of the date of exercise over the option price is a tax preference item for purposes of determining an employee’s alternative minimum tax. An employee who sells shares acquired pursuant to the exercise of an incentive stock option after the expiration of (i) two years from the date of grant of the incentive stock option, and (ii) one year after the transfer of the shares to him (the “Waiting Period”) will generally recognize long-term capital gain or loss on the sale.

An employee who disposes of his incentive stock option shares prior to the expiration of the Waiting Period (an “Early Disposition”) generally will recognize ordinary income in the year of sale in an amount equal to the excess, if any, of the lesser of (i) the fair market value of the shares as of the date of exercise or (ii) the amount realized on the sale, over the option price. Any additional amount realized on an Early Disposition should be treated as capital gain to the employee, short- or long-term, depending on the employee’s holding period for the shares. If the shares are sold for less than the option price, the employee will not recognize any ordinary income but will recognize a capital loss, short- or long-term, depending on the holding period.

The Company will not be entitled to a deduction as a result of the grant of an incentive stock option, the exercise of an incentive stock option, or the sale of incentive stock option shares after the Waiting Period. If an

16

Table of Contents

employee disposes of his incentive stock option shares in an Early Disposition, the Company will be entitled to deduct the amount of ordinary income recognized by the employee.

Federal Income Tax Consequences — Non-Qualified Stock Options. The grant of NSO’s under the Incentive Plan will not result in the recognition of any taxable income by the participants. A participant will recognize income on the date of exercise of the non-qualified stock option equal to the difference between (i) the fair market value on the date the shares were acquired, and (ii) the exercise price. The tax basis of these shares for purposes of a subsequent sale includes the option price paid and the ordinary income reported on exercise of the option. The income reportable on exercise of the option by an employee is subject to federal and state income and employment tax withholding.

Generally, the Company will be entitled to a deduction in the amount reportable as income by the participant on the exercise of a non-qualified stock option.

Federal Income Tax Consequences — Stock Appreciation Rights. Stock Appreciation Rights awards involve the issuance of shares, without other payment by the recipient, as additional compensation for services to the Company. The recipient will recognize taxable income upon exercise equal to the fair market value of the shares on the date of the exercise, which becomes the tax basis in a subsequent sale, less the exercise price, which is paid in shares. Generally, the Company will be entitled to a corresponding deduction in an amount equal to the income recognized by the recipient.

Federal Income Tax Consequences — Restricted Stock and Performance Share Grants. Restricted stock granted under the Plan generally will not be taxed to the recipient, nor deductible by the Company, at the time of grant. On the date the restrictions lapse and the shares become transferable or not subject to a substantial risk of forfeiture, the recipient recognizes ordinary income equal to the excess of the fair market value of the shares on that date over the purchase price paid for the stock, if any. The participant’s tax basis for the shares includes the amount paid for the shares and the ordinary income recognized. Generally, the Company will be entitled to a deduction in an amount of income recognized by the recipient. Performance share units that are converted into restricted stock units will result in the same treatment. Performance share units not converted into restricted stock units have no tax consequences.

The discussion set forth above is intended only as a summary and does not purport to be a complete enumeration or analysis of all potential tax effects relevant to recipients of awards under the Plan. Accordingly, all award recipients are advised to consult their own tax advisors concerning the federal, state, local and foreign income and other tax considerations relating to such awards and rights thereunder.

Incorporation by Reference. The foregoing is only a summary of the Plan and is qualified in its entirety by reference to the full text of the amended Plan, a copy of which is attached hereto as Appendix I.

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

APPROVAL OF THE RESERVE INCREASE.

APPROVAL OF THE RESERVE INCREASE.

17

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION ON DECEMBER 31, 2008

| A | B | C | ||||||||||||||||||||||||

| Number of | Weighted | Number of Securities | ||||||||||||||||||||||||

| Securities to be | Average | Remaining Available for | ||||||||||||||||||||||||

| Issued Upon | Exercise Price | Future Issuance Under | ||||||||||||||||||||||||

| Exercise of | of | Equity Compensation Plans | ||||||||||||||||||||||||

| Outstanding | Outstanding | (Excluding Securities | ||||||||||||||||||||||||

| Plan Category | Options | Options | Reflected in Column A) | |||||||||||||||||||||||

| Equity Compensation Plans Approved by Stockholders(1) | 1,842,226 | (2) | 33.5392 | 802,356 | (3) | |||||||||||||||||||||

| Equity Compensation Plans Not Approved by Stockholders(4) | 388,615 | (5) | 21.7006 | 0 | ||||||||||||||||||||||

| Total | 2,230,841 | 802,356 | ||||||||||||||||||||||||

| (1) | Consists of the Belden Inc. Long-Term Incentive Plan (the “1993 Belden Plan”); the Belden Inc. 2003 Long-Term Incentive Plan (the “2003 Belden Plan”); the Cable Design Technologies Corporation Supplemental Long-Term Performance Incentive Plan (the “CDT Supplemental Plan”); and the Cable Design Technologies Corporation 2001 Long-Term Performance Incentive Plan (the “2001 CDT Plan”). The 1993 Belden Plan and the CDT Supplemental Plan have expired or have been terminated, but stock option awards remain outstanding under these plans. No further awards can be issued under the 2003 Belden Plan. | |

| (2) | Consists of 228,564 shares under the 1993 Belden Plan; 163,328 shares under the 2003 Belden Plan; 1,875 shares under the CDT Supplemental Plan; and 1,448,459 shares under the 2001 CDT Plan. All of these shares pertain to outstanding stock options or stock appreciation rights (“SARs”). | |

| (3) | Consists of 802,356 shares under the 2001 CDT Plan. | |

| (4) | Consists of Cable Design Technologies Corporation 1999 Long-Term Performance Incentive Plan (the “1999 CDT Plan”) and the Executive Employment Agreement between the Company and John Stroup dated September 26, 2005 (the “Employment Agreement”). The Company has terminated the 1999 CDT Plan but stock option awards remain outstanding under it. Mr. Stroup’s Employment Agreement, effective October 31, 2005, provided for, among other things, the award to Mr. Stroup of 451,580 stock options and 150,526 restricted stock units (“RSUs”) to compensate him for the “in the money” value of his unvested options and unvested restricted stock that he forfeited upon leaving his prior employer and as a further inducement to leave his prior employment. The amount of Mr. Stroup’s RSUs excludes the amount of accrued stock dividends, which he is entitled to receive per his Employment Agreement. At December 31, 2008, Mr. Stroup had accrued 2,528.12 RSUs for accrued dividends. 100,000 of Mr. Stroup’s stock options were granted under the 2001 CDT Plan; the remaining stock options and all of the restricted stock units were granted outside of any long-term incentive plan. Starting in 2006, Mr. Stroup began participating in the Company’s long-term incentive plans. | |

| (5) | Consists of 37,035 shares under the 1999 CDT Plan and 351,580 shares under Mr. Stroup’s Employment Agreement. |

18

Table of Contents

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of Belden common stock beneficially owned (unless otherwise indicated) by our directors, the executive officers named in theSummary Compensation Tablebelow and the directors and named executive officers as a group. Except as otherwise noted, all information is as of March 25, 2009.

BENEFICIAL OWNERSHIP TABLE OF DIRECTORS, NOMINEES AND

EXECUTIVE OFFICERS

EXECUTIVE OFFICERS

| Number of Shares | Acquirable Within | Percent of Class | |||||||||||||

| Name | Beneficially Owned(1)(2) | 60 Days(3) | Outstanding(4) | ||||||||||||

David Aldrich | 7,511 | - | * | ||||||||||||

| Lorne D. Bain | 22,046 | - | * | ||||||||||||

| Lance Balk | 31,365 | 11,000 | * | ||||||||||||

| �� | |||||||||||||||

| Gray Benoist(5) | 42,659 | 38,333 | * | ||||||||||||

| Kevin Bloomfield | 18,696 | 107,234 | * | ||||||||||||

| Judy L. Brown | 5,478 | - | * | ||||||||||||

| Bryan C. Cressey | 106,700 | 14,000 | * | ||||||||||||

| Michael F. O. Harris | 29,564 | 12,000 | * | ||||||||||||

| Glenn Kalnasy | 18,115 | 11,000 | * | ||||||||||||

| Naresh Kumra(6) | 7,100 | 18,167 | * | ||||||||||||

| Mary S. McLeod | 5,478 | - | * | ||||||||||||

| John M. Monter(7) | 73,106 | - | * | ||||||||||||

| Louis Pace** | - | 5,967 | * | ||||||||||||

| Bernard G. Rethore(8) | 27,611 | - | * | ||||||||||||

| Peter Sheehan** | - | - | * | ||||||||||||

| John Stroup | 196,580 | 664,647 | * | ||||||||||||

| All directors and named officers as a group (16 persons) | 592,009 | 882,348 | * | ||||||||||||

| * | Less than one percent | |

| ** | Mr. Sheehan left the Company in February 2008. Mr. Pace left the Company in January 2009. | |

| (1) | The number of shares includes shares that are individually or jointly owned, as well as shares over which the individual has either sole or shared investment or voting authority. Mr. Cressey’s number does not include shares held by the Bryan and Christina Cressey Foundation. Mr. Cressey is the President of the foundation and disclaims any beneficial ownership of shares owned by the foundation. | |

| (2) | The number of shares shown for Ms. McLeod includes 1,666 unvested RSUs from the 2,500 that were awarded to her on the date she was appointed to the Board in February 2008. For each of Ms. Brown, Ms. McLeod and Messrs. Aldrich, Bain and Cressey, the number of shares includes unvested RSUs of 2,978 awarded to them in May 2008. For each of Messrs. Balk, Harris, Kalnasy, Monter and Rethore, the number of shares includes awards, the receipt of which has been deferred pursuant to the 2004 Belden Inc. Non-Employee Director Deferred Compensation Plan as follows: Mr. Balk – 10,011; Mr. Harris – 7,511; Mr. Kalnasy – 10,011; Mr. Monter – 7,978; and Mr. Rethore – 7,478. For executive officers, the number of shares includes unvested RSUs granted under the Company’s longterm incentive plans and, for Mr. Stroup, the number of shares includes unvested employment inducement RSUs granted outside such plans on the date of his employment, as follows: Mr. Stroup – 153,418; Mr. Benoist – 14,715; Mr. Bloomfield – 3,150; Mr. Kumra – 1,800; and all named executive officers as a group – 173,083. |

19

Table of Contents

| (3) | Reflects the number of shares that could be purchased by exercise of stock options and the number of SARs that are exercisable at March 25, 2009, or within 60 days thereafter, under the Company’s long-term incentive plans. Upon exercise of a SAR, the holder would receive the difference between the market price of Belden shares on the date of exercise and the exercise price paid in the form of Belden shares. | |

| (4) | Represents the total of the “Number of Shares Beneficially Owned” column (excluding RSUs, which do not have voting rights before vesting) divided by the number of shares outstanding at March 25, 2009 — 46,572,305. | |

| (5) | Includes 3,000 shares held by spouse, 3,000 shares held by child and 3,000 shares held by another child. | |

| (6) | Includes 1,000 shares held by spouse. | |

| (7) | Includes 14,292 shares held in spouse’s trust, 4,944 shares held in child’s trust, 4,939 shares held in another child’s trust and 22,320 shares held in charitable remainder unitrust. | |

| (8) | Includes 20,133 shares held in trust. |

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of filings with the Securities and Exchange Commission and other reports submitted by our directors and officers, we believe that all of our directors and executive officers complied during 2008 with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934 with two exceptions. On November 13, 2008, Gray Benoist inadvertently filed a Form 4 seventeen days late upon learning of the purchase of 3,000 shares of common stock by each of his sons. On January 26, 2009, Steven Biegacki inadvertently filed a Form 4 102 days late upon learning of the purchase and sale during 2008 of a total of 2,030 shares of common stock by his son.

BENEFICIAL OWNERSHIP TABLE OF SHAREHOLDERS OWNING MORE THAN FIVE PERCENT

The following table shows information regarding those shareholders known to the Company to beneficially own more than 5% of the outstanding Belden shares for the period ending on December 31, 2008.

| Amount and Nature of | Percent of Outstanding | |||||||||

| Name and Address of Beneficial Owner | Beneficial Ownership | Common Stock(1) | ||||||||

| Barclays Global Investors, N.A. Barclays Global Fund Advisors Barclays Global Investors, Ltd (collectively the “Barclays Group”) 45 Fremont Street San Francisco, California 94105 | 3,012,930 | (2) | 6.48 | % | ||||||

| FMR LLC 82 Devonshire Street Boston, Massachusetts 02109 | 4,093,700 | (3) | 8.81 | % | ||||||

| Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 | 4,840,524 | (4) | 10.41 | % | ||||||

| (1) | Based on 46,491,245 shares outstanding on December 31, 2008. | |

| (2) | Information based on Schedule 13G filed with the SEC by the Barclays Group on February 5, 2009, reporting sole voting power over 2,300,160 shares and sole dispositive power over 3,012,930 shares, the aggregate number owned by the Barclays Group. | |

| (3) | Information based on Schedule 13G/A filed with the SEC by FMR LLC on February 17, 2009, reporting sole voting power over 414,300 shares and sole dispositive power over 4,093,700 shares. | |

| (4) | Information based on Schedule 13G/A filed with the SEC by Wellington Management Company, LLP on February 17, 2009, reporting shared voting power over 3,655,863 shares and shared dispositive power over 4,840,524 shares. |

20

Table of Contents

EXECUTIVE COMPENSATION

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the following Compensation Discussion and Analysis section of this proxy statement. Based on such review and discussion, the Committee recommended to the Board of Belden that the Compensation Discussion and Analysis be included in the proxy statement.

Glenn Kalnasy (Chair)

David Aldrich

Mary McLeod

John Monter

David Aldrich

Mary McLeod

John Monter

Compensation Discussion and Analysis (“CD&A”)

This part of the proxy statement is divided into six sections:

| • | Executive Summary |

| • | Determining Executive Compensation |