operating companies are domiciled in, and operate exclusively from, Bermuda. For example, Bermuda, a small jurisdiction, may be disadvantaged in participating in global or cross border regulatory matters as compared with larger jurisdictions such as the U.S. or the leading European Union countries. In addition, Bermuda, which is currently an overseas territory of the United Kingdom ("U.K."), may consider changes to its relationship with the U.K. in the future. These changes could adversely affect Bermuda's position in respect of future regulatory initiatives, which could impact us commercially.

A decline in our investment performance could reduce our profitability.

We derive a significant portion of our income from our invested assets. As a result, our financial results depend in part on the performance of our investment portfolio, which contains fixed maturity securities, such as bonds and mortgage-backed securities. Our operating results are subject to a variety of investment risks, including risks relating to general economic conditions, market volatility, interest rate fluctuations, foreign currency risk, liquidity risk and credit and default risk. Additionally, with respect to certain of our investments, we are subject to pre-payment or reinvestment risk.

The market value of our fixed maturity investments will be subject to fluctuation depending on changes in various factors, including prevailing interest rates. As a result of large reinsurance or insurance losses, we may be forced to liquidate our investments at times and prices that are not optimal, which could have a material adverse effect on the performance of our investment portfolio.

Increases in interest rates could cause the market value of our investment portfolio to decrease, perhaps substantially. Conversely, a decline in interest rates could reduce our investment yield, which would reduce our overall profitability. Interest rates are highly sensitive to many factors, including governmental monetary policies, domestic and international economic and political conditions and other factors beyond our control. Any measures we take that are intended to manage the risks of operating in a changing interest rate environment may not effectively mitigate such interest rate sensitivity.

In recent years we have increased our allocation to other investments which have different risk characteristics than our traditional fixed maturity securities and short-term investment portfolios. These other investments include hedge fund investments, a fund that invests in senior secured bank loans, a European high yield credit fund and private equity partnerships. Also included in other investments are investments in a medium term note, representing an interest in a pool of European fixed income securities, a non-U.S. dollar convertible fund and miscellaneous other investments. Our percentage allocation to these other investments will likely increase. The performance of these other investments had a positive impact on the performance of our investment portfolio in 2004.

These other investments are recorded on our consolidated balance sheet at fair value. The fair value of certain of these investments is generally established on the basis of the net valuation criteria established by the managers of such investments. These net valuations are determined based upon the valuation criteria established by the governing documents of the investments. Due to a lag in the valuations reported by the fund managers, the majority of our other investments are reported on a one month or one quarter lag. Such valuations may differ significantly from the values that would have been used had ready markets existed for the shares, partnership interests or notes of the investments. Many of the investments are subject to restrictions on redemptions and sales which are determined by the governing documents and limit our ability to liquidate these investments in the short term. These investments expose us to market risks including interest rate risk, foreign currency risk, equity price risk and credit risk. We are unable to quantify these risks as we do not have timely access to the securities underlying each investment. To the extent these risks move against us it could result in a material adverse change to our investment performance. The performance of these investments is also dependent on the individual investment managers and the investment strategies. It is possible that the investment managers will leave and/or the investment strategies will become ineffective. The result of either of the foregoing would be a material adverse change to our investment performance.

U.S. taxing authorities could contend that our Bermuda subsidiaries are subject to U.S. corporate income tax.

If the U.S. Internal Revenue Service (the "IRS") were to contend successfully that Renaissance Reinsurance, Glencoe, DaVinci or Top Layer Re is engaged in a trade or business in the U.S., Renaissance Reinsurance, Glencoe, DaVinci or Top Layer Re would, to the extent not exempted from tax by the U.S.-Bermuda income tax treaty, be subject to U.S. corporate income tax on that portion of its net income treated as effectively connected with a U.S. trade or business, as well as the U.S. corporate branch profits tax. Although we would vigorously resist the imposition of any such tax, if we were ultimately held to be subject to this taxation, our earnings would correspondingly decline.

In addition, benefits of the U.S.-Bermuda income tax treaty which may limit any such tax to income attributable to a permanent establishment maintained by Renaissance Reinsurance, Glencoe, DaVinci or Top Layer Re in the U.S. are only available to any of Renaissance Reinsurance, Glencoe, DaVinci or Top Layer Re if more than 50% of its shares are beneficially owned, directly or indirectly, by individuals who are Bermuda residents or U.S. citizens or residents. Renaissance Reinsurance, Glencoe, DaVinci or Top Layer Re may not be able to continually satisfy such beneficial ownership test or be able to establish its satisfaction to the IRS. Finally, it should be noted that it is unclear whether the income tax treaty (assuming satisfaction of the beneficial ownership test) applies to income other than premium income, such as investment income.

Because we depend on a few reinsurance brokers for a large portion of revenue, loss of business provided by them could adversely affect us.

We market our reinsurance products worldwide exclusively through reinsurance brokers. Four brokerage firms accounted for 82.2%, 80.4% and 71.1%, respectively, of our net premiums written for the years ended December 31, 2004, 2003 and 2002. Subsidiaries and affiliates of Marsh Inc., the Benfield Group Limited, the Willis Group and AON Corporation accounted for approximately 27.2%, 25.1%, 17.2% and 12.7%, respectively, of our Reinsurance segment gross written premiums in 2004. The loss of all or a substantial portion of the business provided by these brokers could have a material adverse effect on us. Our ability to market our products could decline as a result of any loss of the business provided by these brokers and it is possible that our premiums written would decrease.

Our reliance on reinsurance brokers exposes us to their credit risk.

In accordance with industry practice, we pay virtually all amounts owed on claims under our policies to reinsurance brokers, and these brokers, in turn, pay these amounts over to the insurers that have reinsured a portion of their liabilities with us (we refer to these insurers as ceding insurers). Likewise, premiums paid by ceding insurers are paid to brokers, who then pass such amounts on to us. In many jurisdictions, if a broker were to fail to make such a payment to a ceding insurer, we would remain liable to the ceding insurer for the deficiency. Conversely, in many jurisdictions, when the ceding insurer pays premiums for these policies to reinsurance brokers for payment over to us, these premiums are considered to have been paid and the ceding insurer will no longer be liable to us for those amounts, whether or not we have actually received the premiums. Consequently, in connection with the settlement of reinsurance balances, we assume a degree of credit risk associated with brokers around the world. Due to recent developments in the industry, we believe that the degree of this credit risk has increased.

A decline in the ratings assigned to our financial strength would adversely impact our business.

Third party rating agencies assess and rate the financial strength of reinsurers and insurers, such as Renaissance Reinsurance, our Glencoe Group carriers, Top Layer Re and DaVinci. These ratings are based upon criteria established by the rating agencies. Periodically the rating agencies evaluate us to confirm that we continue to meet the criteria of the ratings previously assigned to us. The financial strength ratings assigned by rating agencies to reinsurance or insurance companies are based upon factors relevant to policyholders and are not directed toward the protection of investors. Recently, certain rating agencies have placed us on credit watch with negative implications in connection with our restatement of our financial results for the years ended December 31, 2001, 2002 and 2003. See "Business—Recent Developments."

39

The rating agencies may downgrade or withdraw their financial strength ratings in the future if we do not continue to meet the criteria of the ratings previously assigned to us. Our ability to compete with other reinsurers and insurers, and our results of operations, could be materially adversely affected by any such ratings downgrade. For example, following a ratings downgrade we might lose clients to more highly rated competitors or retain a lower share of the business of our clients. The rating of Top Layer Re is dependent in large part upon the rating of State Farm, who provides Top Layer Re with $3.9 billion of stop loss reinsurance.

As is customary in our industry, a portion of our reinsurance policies provide our clients with the right to cancel or not renew our policies in the event our financial strength ratings are downgraded. We cannot precisely estimate the amount of premium that would be at risk to this development, as this amount depends on the particular facts and circumstances at the time, including the degree of the downgrade, the time elapsed on the impacted in-force policies, and the effects of any related catastrophic event on the industry generally. In the event any of these provisions are triggered, we will vigorously seek to retain our clients. However, we cannot assure you that our premiums would not decline, perhaps materially, following a ratings downgrade.

We could be adversely affected if TRIA is not renewed.

In response to the tightening of supply in certain insurance and reinsurance markets resulting from, among other things, the September 11th tragedy, TRIA was enacted to ensure the availability of commercial insurance coverage for terrorist acts in the U.S. This law established a federal assistance program through the end of 2005 to help the commercial property and casualty insurance industry cover claims related to future terrorism related losses and required that coverage for terrorist acts be offered by insurers. It is possible that TRIA will not be renewed following 2005, or could be adversely amended, which could adversely affect the insurance industry if a material subsequent event occurred. Given these uncertainties, we are currently unable to determine with certainty the impact that TRIA's non-renewal could have on us.

The covenants in our debt agreements limit our financial and operational flexibility, which could have an adverse effect on our financial condition.

We have incurred indebtedness, and may incur additional indebtedness in the future. At December 31, 2004, we had an aggregate of approximately $350 million of indebtedness outstanding, consisting of $100 million of 5.875% Senior Notes due 2013, $150 million of 7.0% Senior Notes due 2008 and a $100 million bank loan incurred and fully drawn by our consolidated subsidiary, DaVinciRe Holdings Ltd. ("DaVinciRe"). RenaissanceRe is also party to a $500 million syndicated revolving credit agreement, none of which was drawn at December 31, 2004.

In addition, we have issued $100 million aggregate liquidation amount of mandatorily redeemable capital securities ("Capital Securities") through the Capital Trust holding solely $103.1 million of the Company's 8.54% junior subordinated debentures due March 1, 2027. Because we hold $15.4 million of these securities and also hold $3.1 million of equity interest in the Capital Trust, our net obligation is $84.6 million.

Our insurance and reinsurance subsidiaries maintain letter of credit facilities in connection with their insurance and reinsurance business. The largest of these is a secured letter of credit facility established under a reimbursement agreement entered into by certain of RenaissanceRe's subsidiaries and affiliates. The obligations of each of RenaissanceRe's subsidiaries and affiliates party to the reimbursement agreement are secured by certain collateral, including cash, eligible high-quality marketable securities and redeemable preference shares of RIHL. The facility currently is in the amount of $850 million. The term of the reimbursement agreement was extended to April 30, 2005 in November 2004 and in March 2005, the reimbursement agreement was amended to conform certain default provisions of the agreement to comparable provisions in existing credit agreements of the Company and DaVinciRe. At December 31, 2004, the aggregate face amount of letters of credit outstanding under the reimbursement agreement was $548.4 million and total letters of credit outstanding was $670.6 million.

The agreements covering our indebtedness, particularly our bank loans, contain numerous covenants that limit our ability, among other things, to borrow money, make particular types of investments or

40

other restricted payments, sell assets, merge or consolidate. These agreements also require us to maintain specific financial ratios. If we fail to comply with these covenants or meet these financial ratios, the lenders under our credit facilities could declare a default and demand immediate repayment of all amounts owed to them, cancel their commitments to lend or issue letters of credit, or both, and require us to pledge additional or a different type of collateral.

In addition, if we are in default under the junior subordinated debentures, discussed above, or if we have given notice of our intention to defer our related payment obligations, the terms of our indebtedness would, among other things, restrict our ability to:

|  |

| • | declare or pay any dividends on our capital shares; |

|  |

| • | redeem, purchase or acquire any capital shares; or |

|  |

| • | make a liquidation payment with respect to our capital shares. |

Because we are a holding company, we are dependent on dividends and payments from our subsidiaries.

As a holding company with no direct operations, we rely on investment income, cash dividends and other permitted payments from our subsidiaries to make principal and interest payments on our debt and to pay dividends to our shareholders. The holding company does not have any operations and from time to time may not have significant liquid assets. If our subsidiaries are restricted from paying dividends to us, we may be unable to pay dividends or to repay our indebtedness.

Bermuda law and regulations require our subsidiaries which are registered in Bermuda as insurers to maintain a minimum solvency margin and minimum liquidity ratio, and prohibit dividends that would result in a breach of these requirements. Further, Renaissance Reinsurance and DaVinci, as Class 4 insurers in Bermuda, may not pay dividends which would exceed 25% of their respective capital and surplus, unless they first make filings confirming that they meet the required margins. As Class 3 insurers, Glencoe, Lantana and Top Layer Re may not declare or pay dividends during any financial year that would cause Glencoe, Lantana or Top Layer Re (as the case may be) to fail to meet its minimum solvency margin and minimum liquidity ratio.

Generally, our U.S. insurance subsidiaries may only pay dividends out of earned surplus. Further, the amount payable without the prior approval of the applicable state insurance department is generally limited to the greater of 10% of policyholders' surplus or statutory capital, or 100% of the subsidiary's prior year statutory net income. Since our U.S. insurance subsidiaries' earned surplus is negative, these subsidiaries cannot currently pay dividends without the applicable state insurance department approval.

The loss of one or more key executive officers could adversely affect us.

Our success has depended, and will continue to depend, in substantial part upon our ability to attract and retain our executive officers. If we were to lose the services of members of our senior management team, our business could be adversely affected. For example, we might lose clients whose relationship depends in part on the service of a departing executive. In addition, the loss of services of members of our management team would strain our ability to execute our growth initiatives, as described above.

Our ability to execute our business strategy is dependent on our ability to attract and retain a staff of qualified underwriters and service personnel. The location of our global headquarters in Bermuda may impede our ability to recruit and retain highly skilled employees. We do not currently maintain key man life insurance policies with respect to any of our employees.

Under Bermuda law, non-Bermudians may not engage in any gainful occupation in Bermuda without the specific permission of the appropriate government authority. The Bermuda government will issue a work permit for a specific period of time, which may be extended upon showing that, after proper public advertisement, no Bermudian (or spouse of a Bermudian) is available who meets the minimum standards for the advertised position. Substantially all of our officers are working in Bermuda under work permits that will expire over the next three years. The Bermuda government could refuse to extend these work permits. In addition, a Bermuda government policy limits the duration of work

41

permits to a total of six years, which is subject to certain exemptions only for key employees. If any of our senior executive officers were not permitted to remain in Bermuda, our operations could be disrupted and our financial performance could be adversely affected as a result.

Regulatory challenges in the U.S. or elsewhere to our Bermuda operations' claims of exemption from insurance regulation could restrict our ability to operate, increase our costs, or otherwise adversely impact us.

Renaissance Reinsurance, DaVinci and Top Layer Re are not licensed or admitted in any jurisdiction except Bermuda. Renaissance Reinsurance, Glencoe, DaVinci and Top Layer Re each conduct business only from their principal offices in Bermuda and do not maintain an office in the U.S. Recently, the insurance and reinsurance regulatory framework has been subject to increased scrutiny in many jurisdictions, including the U.S. and various states within the U.S. If our Bermuda insurance or reinsurance operations become subject to the insurance laws of any state in the U.S., we could face inquiries or challenges to the future operations of these companies.

Moreover, we could be put at a competitive disadvantage in the future with respect to competitors that are licensed and admitted in U.S. jurisdictions. Among other things, jurisdictions in the U.S. do not permit insurance companies to take credit for reinsurance obtained from unlicensed or non-admitted insurers on their statutory financial statements unless security is posted. Our contracts generally require us to post a letter of credit or provide other security after a reinsured reports a claim. In order to post these letters of credit, issuing banks generally require collateral. It is possible that European Union or other countries might adopt a similar regime in the future, or that the U.S. rules could be altered in a way that treats Bermuda disproportionately. Any such development could adversely affect us.

Glencoe and Lantana are currently eligible, non-admitted excess and surplus lines insurers in, respectively, 51 and 50 states and territories of the U.S. and are each subject to certain regulatory and reporting requirements of these states. However, neither Glencoe nor Lantana is admitted or licensed in any U.S. jurisdiction; moreover, Glencoe only conducts business from Bermuda. Accordingly, the scope of Glencoe's and Lantana's activities in the U.S. is limited, which could adversely affect their ability to compete.

In addition, Stonington, which writes insurance in all 50 states on an admitted basis, is subject to extensive regulation under state statutes which confer regulatory, supervisory and administrative powers on state insurance commissioners. Such regulation generally is designed to protect policyholders rather than investors, and relates to such matters as: rate setting; policy forms; limitations on dividends and transactions with affiliates; solvency standards which must be met and maintained; the licensing of insurers and their agents; the examination of the affairs of insurance companies, which includes periodic market conduct examinations by the regulatory authorities; annual and other reports, prepared on a statutory accounting basis; establishment and maintenance of reserves for unearned premiums and losses; and requirements regarding numerous other matters. We could be required to allocate considerable time and resources to comply with these requirements, and could be adversely affected if a regulatory authority believed we had failed to comply with applicable law or regulation. We plan to grow Stonington's business and, accordingly, expect our regulatory burden to increase.

Our growth plans could cause one or more of our subsidiaries to become subject to additional regulation in other jurisdictions. Any failure to comply with applicable laws could result in the imposition of significant restrictions on our ability to do business, and could also result in fines and other sanctions, any or all of which could adversely affect our financial results and operations.

Retrocessional reinsurance may become unavailable on acceptable terms.

In order to limit the effect of large and multiple losses upon our financial condition, we buy reinsurance for our own account. This type of insurance is known as "retrocessional reinsurance." Our primary insurance companies also buy reinsurance from third parties. A reinsurer's insolvency or inability to make payments under the terms of its reinsurance treaty with us could have a material adverse effect on us.

42

From time to time, market conditions have limited, and in some cases have prevented, insurers and reinsurers from obtaining the types and amounts of reinsurance, which they consider adequate for their business needs. Accordingly, we may not be able to obtain our desired amounts of retrocessional reinsurance. In addition, even if we are able to obtain such retrocessional reinsurance, we may not be able to negotiate terms as favorable to us as in the past. This could limit the amount of business we are willing to write, or decrease the protection available to us as a result of large loss events.

We may be adversely affected by foreign currency fluctuations.

Our functional currency is the U.S. dollar. A portion of our premium is written in currencies other than the U.S. dollar and a portion of our claims and claim expense reserves are also in non-dollar currencies. Moreover, we maintain a portion of our cash equivalent investments in currencies other than the U.S. dollar. Although we generally seek to hedge significant non-U.S. dollar positions, we may, from time to time, experience losses resulting solely from fluctuations in the values of these foreign currencies, which could cause our consolidated earnings to decrease. In addition, failure to manage our foreign currency exposures could cause our results to be more volatile.

Consolidation in the insurance industry could adversely impact us.

We believe that many insurance industry participants are seeking to consolidate. These consolidated entities may try to use their enhanced market power to negotiate price reductions for our products and services. If competitive pressures reduce our prices, we would expect to write less business. As the insurance industry consolidates, competition for customers will become more intense and the importance of acquiring and properly servicing each customer will become greater. We could incur greater expenses relating to customer acquisition and retention, further reducing our operating margins. In addition, insurance companies that merge may be able to spread their risks across a consolidated, larger capital base so that they require less reinsurance. We could also experience more robust competition from larger, better capitalized competitors.

We may encounter difficulties in maintaining the information technology systems necessary to run our business.

We believe our modeling, underwriting and information technology systems are critical to our business. Moreover, our proprietary technology has been an important part of our underwriting process and our ability to compete successfully. We have also licensed certain systems and data from third parties. We cannot be certain that we will also continue to have access to these, or comparable, service providers, or that our proprietary technology will continue to operate as intended. Our business growth strategy will require further development of our technology infrastructure, and any defect or error in our information technology systems could result in reduced or delayed revenue growth, higher than expected losses, management distraction, or harm to our reputation.

Some aspects of our corporate structure may discourage third party takeovers and other transactions or prevent the removal of our current board of directors and management.

Some provisions of our Memorandum of Association and of our Amended and Restated Bye-Laws have the effect of making more difficult or discouraging unsolicited takeover bids from third parties or preventing the removal of our current board of directors and management. In particular, our Bye-Laws prohibit transfers of our capital shares if the transfer would result in a person owning or controlling shares that constitute 9.9% or more of any class or series of our shares. The primary purpose of this restriction is to reduce the likelihood that we will be deemed a "controlled foreign corporation" within the meaning of the Internal Revenue Code for U.S. federal tax purposes. However, this limit may also have the effect of deterring purchases of large blocks of common shares or proposals to acquire us, even if some or a majority of our shareholders might deem these purchases or acquisition proposals to be in their best interests.

In addition, our Bye-Laws provide for:

|  |

| • | a classified Board, whose size is fixed and whose members may be removed by the shareholders only for cause upon a 66 2/3% vote; |

|  |

| • | restrictions on the ability of shareholders to nominate persons to serve as directors, submit resolutions to a shareholder vote and requisition special general meetings; |

43

|  |

| • | a large number of authorized but unissued shares which may be issued by the Board without further shareholder action; and |

|  |

| • | a 66 2/3% shareholder vote to amend, repeal or adopt any provision inconsistent with several provisions of the Bye-Laws. |

These Bye-Law provisions make it more difficult to acquire control of us by means of a tender offer, open market purchase, proxy contest or otherwise. These provisions are designed to encourage persons seeking to acquire control of us to negotiate with our directors, which we believe would generally best serve the interests of our shareholders. However, these provisions could have the effect of discouraging a prospective acquirer from making a tender offer or otherwise attempting to obtain control of us. In addition, these Bye-Law provisions could prevent the removal of our current board of directors and management. To the extent these provisions discourage takeover attempts, they could deprive shareholders of opportunities to realize takeover premiums for their shares or could depress the market price of the shares.

RenaissanceRe indirectly owns Stonington, Stonington Lloyd's and Newstead. Our ownership of a U.S. insurance company such as these can, under applicable state insurance company laws and regulations, delay or impede a change of control of RenaissanceRe. Under applicable state insurance regulations, any proposed purchase of 10% or more of our voting securities would require the prior approval of the relevant insurance regulatory authorities.

Investors may have difficulties in serving process or enforcing judgments against us in the U.S.

We are a Bermuda company. In addition, certain of our officers and directors reside in countries outside the U.S. All or a substantial portion of our assets and the assets of these officers and directors are or may be located outside the U.S. Investors may have difficulty effecting service of process within the U.S. on our directors and officers who reside outside the U.S. or to recover against us or these directors and officers on judgments of U.S. courts based on civil liabilities provisions of the U.S. federal securities laws whether or not we appoint an agent in the U.S. to receive service of process.

44

GLOSSARY OF SELECTED INSURANCE AND REINSURANCE TERMS

|  |  |  |  |  |  |

| Accident year |  | Year of occurrence of a loss. Claim payments and reserves for claims and claim expenses are allocated to the year in which the loss occurred. |

| Acquisition expenses |  | The aggregate expenses incurred by a company acquiring new business, including commissions, underwriting expenses and administrative expenses. |

| Attachment point |  | The dollar amount of loss (per occurrence or in the aggregate, as the case may be) above which excess of loss reinsurance becomes operative. |

| Backup premiums written |  | The premiums written for additional reinsurance coverage purchased after a series of catastrophic events has exhausted or significantly reduced the initial and reinstatement limits available under the original coverages purchased. |

| Bordereau |  | A report providing premium or loss data with respect to identified specific risks. This report is periodically furnished to a reinsurer by the ceding insurers or reinsurers. |

| Broker |  | An intermediary who negotiates contracts of insurance or reinsurance, receiving a commission for placement and other services rendered, between (1) a policy holder and a primary insurer, on behalf of the insured party, (2) a primary insurer and reinsurer, on behalf of the primary insurer, or (3) a reinsurer and a retrocessionaire, on behalf of the reinsurer. |

| Capacity |  | The percentage of surplus, or the dollar amount of exposure, that an insurer or reinsurer is willing or able to place at risk. Capacity may apply to a single risk, a program, a line of business or an entire book of business. Capacity may be constrained by legal restrictions, corporate restrictions or indirect restrictions. |

| Case reserves |  | Loss reserves, established with respect to specific, individual reported claims. |

Casualty insurance or

reinsurance |  |

Insurance or reinsurance that is primarily concerned with the losses caused by injuries to third persons and their property (in other words, persons other than the policyholder) and the legal liability imposed on the insured resulting therefrom. Also referred to as liability insurance. |

| Catastrophe |  | A severe loss, typically involving multiple claimants. Common perils include earthquakes, hurricanes, hailstorms, severe winter weather, floods, fires, tornadoes, explosions and other natural or man-made disasters. Catastrophe losses may also arise from acts of war, acts of terrorism and political instability. |

Catastrophe excess of loss

reinsurance |  |

A form of excess of loss reinsurance that, subject to a specified limit, indemnifies the ceding company for the amount of loss in excess of a specified retention with respect to an accumulation of losses resulting from a "catastrophe." |

|

45

|  |  |  |  |  |  |

| Cede; cedant; ceding company |  | When a party reinsures its liability with another, it "cedes" business and is referred to as the "cedant" or "ceding company." |

| Claim |  | Request by an insured or reinsured for indemnification by an insurance company or a reinsurance company for loss incurred from an insured peril or event. |

Claims and claim expense

Ratio, net |  |

The ratio of net claims and claim expenses to net premiums earned determined in accordance with either SAP or GAAP. |

| Claim reserves |  | Liabilities established by insurers and reinsurers to reflect the estimated costs of claim payments and the related expenses that the insurer or reinsurer will ultimately be required to pay in respect of insurance or reinsurance policies it has issued. Claims reserves consist of case reserves, established with respect to individual reported claims, and "IBNR" reserves. For reinsurers, loss expense reserves are generally not significant because substantially all of the loss expenses associated with particular claims are incurred by the primary insurer and reported to reinsurers as losses. |

| Combined ratio |  | The combined ratio is the sum of the net claims and claim expense ratio and the underwriting expense ratio. A combined ratio below 100% generally indicates profitable underwriting prior to the consideration of investment income. A combined ratio over 100% generally indicates unprofitable underwriting prior to the consideration of investment income. |

| Earned Premium |  | (1) That part of the premium applicable to the expired part of the policy period, including the short-rate premium on cancellation, the entire premium on the amount of loss paid under some contracts, and the entire premium on the contract on the expiration of the policy, which is recognized as income during the period. |

| |  | (2) That portion of the reinsurance premium calculated on a monthly, quarterly or annual basis which is to be retained by the reinsurer and recognized as income in the period should their cession be canceled. |

| |  | (3) When a premium is paid in advance for a certain time, the company is said to "earn" the premium as the time advances. For example, a policy written for three years and paid for in advance would be one-third earned at the end of the first year. |

Excess and surplus lines

reinsurance |  |

Any type of coverage that cannot be placed with an insurer admitted to do business in a certain jurisdiction. Risks placed in excess and surplus lines markets are often substandard as respects adverse loss experience, unusual, or unable to be placed in conventional markets due to a shortage of capacity. |

|

46

|  |  |  |  |  |  |

| Excess of loss |  | Reinsurance or insurance that indemnifies the reinsured or insured against all or a specified portion of losses on underlying insurance policies in excess of a specified amount, which is called a "level" or "retention." Also known as non-proportional reinsurance. Excess of loss reinsurance is written in layers. A reinsurer or group of reinsurers accepts a layer of coverage up to a specified amount. The total coverage purchased by the cedant is referred to as a "program" and will typically be placed with predetermined reinsurers in pre-negotiated layers. Any liability exceeding the outer limit of the program reverts to the ceding company, which also bears the credit risk of a reinsurer's insolvency. |

| Exclusions |  | Those risk, perils, or classes of insurance with respect to which the reinsurer will not pay loss or provide reinsurance, notwithstanding the other terms and conditions of reinsurance. |

| Frequency |  | The number of claims occurring during a given coverage period. |

| Generally accepted accounting principles ("GAAP") |  |

Accounting principles as set forth in opinions of the Accounting Principles Board of the American Institute of Certified Public Accountants and/or statements of the Financial Accounting Standards Board and/or their respective successors and which are applicable in the circumstances as of the date in question. Also referred to as GAAP. |

| Gross premiums written |  | Total premiums for insurance written and assumed reinsurance during a given period. |

Incurred but not reported

("IBNR") |  |

Reserves for estimated losses that have been incurred by insureds and reinsureds but not yet reported to the insurer or reinsurer including unknown future developments on losses which are known to the insurer or reinsurer. |

| Layer |  | The interval between the retention or attachment point and the maximum limit of indemnity for which a reinsurer is responsible. |

| Line of Business |  | The general classification of insurance written by insurers, i.e., fire, allied lines, homeowners, among others. |

| Loss; losses |  | An occurrence that is the basis for submission and/or payment of a claim. Whether losses are covered, limited or excluded from coverage is dependant on the terms of the policy. |

| Losses occurring contracts |  | Contracts that cover claims arising from loss events that occur during the term of the reinsurance contract. |

| Loss ratio |  | Net claims incurred expressed as a percentage of net earned premiums. |

| Loss reserve |  | For an individual loss, an estimate of the amount the insurer expects to pay for the reported claim. For total losses, estimates of expected payments for reported and unreported claims. May include amounts for claims expenses. |

|

47

|  |  |  |  |  |  |

| Net claims and claim expenses |  | The expenses of settling claims net of recoveries, including legal and other fees and the portion of expenses general expenses allocated to claim settlement costs (also known as claim adjustment expenses) plus losses incurred with respect to net claims. |

| Net premiums earned |  | The portion of net premiums written during or prior to a given period that was actually recognized as income during such period. |

| Net premiums written |  | Gross premiums written for a given period less premiums ceded to reinsurers and retrocessionaires during such period. |

| No claims bonus |  | A reduction of premiums assumed or ceded if no claims have been made within a specified period. |

| Non-proportional reinsurance |  | See Excess of loss. |

| Perils |  | This term refers to the causes of possible loss in the property field, such as fire, windstorm, collision, hail, etc. In the casualty field, the term "hazard" is more frequently used. |

Premiums; written, earned and

unearned |  |

The amount charged during the term on policies and contracts issued, renewed or reinsured by an insurance company or reinsurance company. Written premium is premium registered on the books of an issuer or reinsurer at the time a policy is issued and paid for. Unearned premium is premium for a future exposure period. Earned premium is written premium minus unearned premium for an individual policy. |

Property insurance or

reinsurance |  |

Insurance or reinsurance that provides coverage to a person with an insurable interest in tangible property for that person's property loss, damage or loss of use. |

Property per risk treaty

reinsurance |  |

Reinsurance on a treaty basis of individual property risks insured by a ceding company. |

| Proportional reinsurance |  | A generic term describing all forms of reinsurance in which the reinsurer shares a proportional part of the original premiums and losses of the reinsured. (Also known as pro rata reinsurance, quota share reinsurance or participating reinsurance.) In proportional reinsurance the reinsurer generally pays the ceding company a ceding commission. The ceding commission generally is based on the ceding company's cost of acquiring the business being reinsured (including commissions, premium taxes, assessments and miscellaneous administrative expense) and also may include a profit factor. See also "Quota Share Reinsurance" and "Surplus Share Reinsurance." |

| Quota Share Reinsurance |  | A form of proportional reinsurance in which the reinsurer assumes an agreed percentage of each insurance being reinsured and shares all premiums and losses according with the reinsured. See also "Proportional Reinsurance" and "Surplus Share Reinsurance." |

|

48

|  |  |  |  |  |  |

| Reinstatement premium |  | The premium charged for the restoration of the reinsurance limit of a catastrophe contract to its full amount after payment by the reinsurer of losses as a result of an occurrence. |

| Reinsurance |  | An arrangement in which an insurance company, the reinsurer, agrees to indemnify another insurance or reinsurance company, the ceding company, against all or a portion of the insurance or reinsurance risks underwritten by the ceding company under one or more policies. Reinsurance can provide a ceding company with several benefits, including a reduction in net liability on individual risks and catastrophe protection from large or multiple losses. Reinsurance also provides a ceding company with additional underwriting capacity by permitting it to accept larger risks and write more business than would be possible without a concomitant increase in capital and surplus, and facilitates the maintenance of acceptable financial ratios by the ceding company. Reinsurance does not legally discharge the primary insurer from its liability with respect to its obligations to the insured. |

| Retention |  | The amount or portion of risk that an insurer retains for its own account. Losses in excess of the retention level are paid by the reinsurer. In proportional treaties, the retention may be a percentage of the original policy's limit. In excess of loss business, the retention is a dollar amount of loss, a loss ratio or a percentage. |

Retrocessional reinsurance;

retrocessionaire |  |

A transaction whereby a reinsurer cedes to another reinsurer, the retrocessionaire, all or part of the reinsurance that the first reinsurer has assumed. Retrocessional reinsurance does not legally discharge the ceding reinsurer from its liability with respect to its obligations to the reinsured. Reinsurance companies cede risks to retrocessionaires for reasons similar to those that cause primary insurers to purchase reinsurance: to reduce net liability on individual risks, to protect against catastrophic losses, to stabilize financial ratios and to obtain additional underwriting capacity. |

| Risk excess of loss reinsurance |  | A form of excess of loss reinsurance that covers a loss of the reinsured on a single "risk" in excess of its retention level of the type reinsured, rather than to aggregate losses for all covered risks, as does catastrophe excess of loss reinsurance. A "risk" in this context might mean the insurance coverage on one building or a group of buildings or the insurance coverage under a single policy, which the reinsured treats as a single risk. |

| Risks |  | A term used to denote the physical units of property at risk or the object of insurance protection that are not perils or hazards. Also defined as chance of loss or uncertainty of loss. |

| Risks attaching contracts |  | Contracts that cover claims that arise on underlying insurance policies that incept during the term of the reinsurance contract. |

| Specialty lines |  | Lines of insurance and reinsurance that provide coverage for risks that are often unusual or difficult to place and do not fit the underwriting criteria of standard commercial products carriers. |

|

49

|  |  |  |  |  |  |

| Statutory accounting principles ("SAP") |  |

Recording transactions and preparing financial statements in accordance with the rules and procedures prescribed or permitted by Bermuda and/or the U.S. state insurance regulatory authorities including the NAIC, which in general reflect a liquidating, rather than going concern, concept of accounting. |

| Stop Loss |  | A form of reinsurance under which the reinsurer pays some or all of a cedant's aggregate retained losses in excess of a predetermined dollar amount or in excess of a percentage of premium. |

| Submission |  | An unprocessed application for (i) insurance coverage forwarded to a primary insurer by a prospective policyholder or by a broker on behalf of such prospective policyholder, (ii) reinsurance coverage forwarded to a reinsurer by a prospective ceding insurer or by a broker or intermediary on behalf of such prospective ceding insurer or (iii) retrocessional coverage forwarded to a retrocessionaire by a prospective ceding reinsurer or by a broker or intermediary on behalf of such prospective ceding reinsurer. |

| Surplus share reinsurance |  | A form of pro rata reinsurance (proportional) indemnifying the ceding company against loss to the extent of the surplus insurance liability ceded, on a share basis similar to quota share. See also "Proportional Reinsurance" and "Quota Share Reinsurance." |

| Total Managed Cat Premium |  | The total catastrophe reinsurance premiums written on a gross basis by our managed catastrophe joint ventures as well as by our wholly owned subsidiaries. |

| Treaty |  | A reinsurance agreement covering a book or class of business that is automatically accepted on a bulk basis by a reinsurer. A treaty contains common contract terms along with a specific risk definition, data on limit and retention, and provisions for premium and duration. |

| Underwriting |  | The insurer's or reinsurer's process of reviewing applications submitted for insurance coverage, deciding whether to accept all or part of the coverage requested and determining the applicable premiums. |

| Underwriting capacity |  | The maximum amount that an insurance company can underwrite. The limit is generally determined by the company's retained earnings and investment capital. Reinsurance serves to increase a company's underwriting capacity by reducing its exposure from particular risks. |

| Underwriting expense ratio |  | The ratio of the sum of the acquisition expenses and operational expenses to net premiums earned, determined in accordance with U.S. GAAP. |

| Underwriting expenses |  | The aggregate of policy acquisition costs, including commissions, and the portion of administrative, general and other expenses attributable to underwriting operations. |

| Unearned premium |  | The portion of premiums written representing the unexpired portions of the policies or contracts which the insurer or reinsurer has on its books as of a certain date. |

|

50

AVAILABLE INFORMATION

We maintain a website at http://www.renre.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K and the Internet address is included as an inactive textual reference only.

We make available, free of charge through our website, our financial information, including the information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. We also make available, free of charge from our website, our Audit Committee Charter, Compensation/Governance Committee Charter, Corporate Governance Guidelines and Statement of Policies and Code of Ethics and Conduct ("Code of Ethics"). Such information is also available in print for any shareholder who sends a request to the Investor Relations Department of: RenaissanceRe Holdings Ltd., P.O. Box HM 2527, Hamilton, HMGX, Bermuda. Reports filed with the SEC may also be viewed or obtained at the SEC Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. Information on the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

ITEM 2. PROPERTIES

We lease office space in Bermuda, where our executive offices are located. In addition, Stonington leases office space in Addison, Texas, and our other U.S. based subsidiaries lease office space in Richmond, Virginia and Raleigh, North Carolina. We also lease office space in Dublin, Ireland. As we anticipate additional growth in our businesses, it is likely that we will need to expand into additional facilities to accommodate this growth.

ITEM 3. LEGAL PROCEEDINGS

Our insurance and reinsurance subsidiaries are subject in the course of their business to claims litigation involving, among other things, disputed interpretations of policy coverages. These lawsuits involving claims on policies issued by our subsidiaries which are typical to the insurance industry in general and in the normal course of business are considered in our claims and claim expense reserves which are addressed in the reserve for claims and claim expenses discussion.

In addition to claims litigation, we and our subsidiaries may be subject from time to time to lawsuits or regulatory actions that do not arise from or directly relate to claims on insurance policies. This type of potential litigation could include, for example, allegations of underwriting errors or misconduct, employment claims, regulatory activity or disputes arising from our business ventures. We are not currently subject to any litigation of this type whose impact is likely to be material to us. We believe that over the next few years the ultimate outcomes of matters in this category of business litigation should not have a material adverse effect on our financial condition, future operating results or liquidity, although we believe that litigation of this nature will increase in the future, and it is possible that an adverse resolution of a number of these matters could have a material adverse effect on our results of operations in a particular quarter or fiscal year.

See "Recent Developments" for a discussion of recent subpoenas received.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of RenaissanceRe's shareholders during the fourth quarter of 2004.

51

PART II.

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER REPURCHASES OF EQUITY SECURITIES

PRICE RANGE OF COMMON SHARES

Our common shares began publicly trading on June 27, 1995. Our New York Stock Exchange symbol is "RNR". The following table sets forth, for the periods indicated, the high and low prices per share of our common shares as reported in composite New York Stock Exchange trading.

|  |  |  |  |  |  |  |  |  |  |

| |  | Price Range

of Common Shares |

| Period |  | High |  | Low |

| 2001 |  | | | |  | | | |

| First Quarter |  | $ | 27.95 | |  | $ | 21.18 | |

| Second Quarter |  | | 25.23 | |  | | 20.83 | |

| Third Quarter |  | | 29.64 | |  | | 22.87 | |

| Fourth Quarter |  | | 34.57 | |  | | 30.47 | |

| |  |

| 2002 |  | | | |  | | | |

| First Quarter |  | | 36.35 | |  | | 28.90 | |

| Second Quarter |  | | 39.65 | |  | | 33.85 | |

| Third Quarter |  | | 39.40 | |  | | 31.30 | |

| Fourth Quarter |  | | 43.24 | |  | | 37.49 | |

| |  |

| 2003 |  | | | |  | | | |

| First Quarter |  | | 40.78 | |  | | 34.40 | |

| Second Quarter |  | | 46.93 | |  | | 40.07 | |

| Third Quarter |  | | 48.69 | |  | | 41.15 | |

| Fourth Quarter |  | | 49.35 | |  | | 44.45 | |

| |  |

| 2004 |  | | | |  | | | |

| First Quarter |  | | 54.87 | |  | | 48.51 | |

| Second Quarter |  | | 56.34 | |  | | 48.80 | |

| Third Quarter |  | | 54.84 | |  | | 48.12 | |

| Fourth Quarter |  | | 52.08 | |  | | 46.82 | |

| |  |

| 2005 |  | | | |  | | | |

| First Quarter (through March 1, 2005) |  | | 51.83 | |  | | 47.62 | |

|

At March 1, 2005 the last reported sale price for our common shares was $47.99 per share. At March 1, 2005 there were 132 holders of record of our common shares and approximately 25,000 beneficial holders.

DIVIDEND POLICY

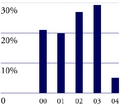

Historically, we have paid dividends on our common shares every quarter, and have increased our dividend during each of the nine years since our initial public offering. The Board of Directors of RenaissanceRe declared regular quarterly dividends of $0.19 per share on March 9, June 1, September 1 and December 3, 2004. The Board of Directors declared regular quarterly dividends of $0.15 per share on March 3, June 2, September 10 and December 5, 2003. Most recently, on March 8, 2005, our Board declared a dividend of $0.20 per share payable on March 31, 2005 to shareholders of

52

record on March 15, 2005. The declaration and payment of dividends are subject to the discretion of the Board and depend on, among other things, our financial condition, general business conditions, legal, contractual and regulatory restrictions regarding the payment of dividends by us and our subsidiaries and other factors which the Board may in the future consider to be relevant. See Item 12 for Equity Compensation Plan information.

Below is a summary of stock repurchases for the quarter ended December 31, 2004 which exclusively represent common stock withholdings from employees surrendered in respect of withholding tax obligations on the vesting of restricted stock, or in lieu of cash payments for the exercise price of employee stock options. RenaissanceRe's Board has authorized a share repurchase program of $150 million. No shares were repurchased under this program in the quarter ended December 31, 2004. See Note 10 of our Notes to Consolidated Financial Statements for information regarding RenaissanceRe's stock repurchase plan.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Total

number of

shares

purchased |  | Average

price paid

per share |  | Total number of

shares purchased as

part of publicly

announced plans or

programs |  | Maximum number of

shares that may be

purchased for approximate

dollar values under the

publicly announced plans

or programs available for

repurchase (1) |

| |  | |  | |  | (in thousands) |  | (in millions) |

| Beginning shares available to be repurchased |  | | — | |  | | — | |  | | — | |  | $ | 150.0 | |

| October 1 — 31, 2004 |  | | 451 | (2) |  | $ | 48.81 | |  | | — | |  | | 150.0 | |

| November 1 — 30, 2004 |  | | 1,833 | (2) |  | | 48.09 | |  | | — | |  | | 150.0 | |

| December 1 — 31, 2004 |  | | — | |  | | — | |  | | — | |  | | 150.0 | |

| Total |  | | 2,284 | |  | | — | |  | | — | |  | $ | 150.0 | |

|

|  |

| (1) | The Company publicly announced its share repurchase program of $150 million on August 7, 2003. No expiration date has been established for this program. |

|  |

| (2) | These repurchases exclusively represent withholdings from employees surrendered in respect of withholding tax obligations on the vesting of restricted stock, or in lieu of cash payments for the exercise price of employee stock options. |

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following table sets forth our selected financial data and other financial information at the end of and for each of the years in the five-year period ended December 31, 2004. The historical financial information was prepared in accordance with U.S. GAAP. The statement of income data for the years ended December 31, 2004, 2003, 2002, 2001 and 2000 and the balance sheet data at December 31, 2004, 2003, 2002, 2001 and 2000 were derived from our consolidated financial statements. You should read the selected financial data in conjunction with our consolidated financial statements and related notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this filing and all other information appearing elsewhere or incorporated into this filing by reference.

See Note 2 to the Consolidated Financial Statements for a discussion of the restated amounts.

53

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Year ended December 31, |  | 2004 |  | 2003 |  | 2002 |  | 2001 |  | 2000 |

| (in thousands, except per share data) |  | |  | (Restated) |  | (Restated) |  | (Restated) |  | |

| Statement of Income Data: |  |

| Gross premiums written |  | $ | 1,544,157 | |  | $ | 1,382,209 | |  | $ | 1,173,049 | |  | $ | 501,321 | |  | $ | 433,002 | |

| Net premiums written |  | | 1,349,287 | |  | | 1,154,776 | |  | | 925,964 | |  | | 342,341 | |  | | 293,303 | |

| Net premiums earned |  | | 1,338,227 | |  | | 1,118,525 | |  | | 763,970 | |  | | 334,518 | |  | | 267,681 | |

| Net investment income |  | | 162,722 | |  | | 129,542 | |  | | 102,686 | |  | | 75,156 | |  | | 77,868 | |

| Net realized gains (losses) on sales of investments |  | | 23,442 | |  | | 80,504 | |  | | 10,177 | |  | | 18,096 | |  | | (7,151 | ) |

| Net claims and claim expenses incurred |  | | 1,096,299 | |  | | 369,181 | |  | | 314,525 | |  | | 129,917 | |  | | 108,604 | |

| Acquisition costs |  | | 244,930 | |  | | 194,140 | |  | | 95,644 | |  | | 45,359 | |  | | 38,530 | |

| Operational expenses |  | | 56,361 | |  | | 67,397 | |  | | 49,159 | |  | | 39,466 | |  | | 37,954 | |

| Income before taxes and change in accounting principle |  | | 168,245 | |  | | 624,775 | |  | | 364,135 | |  | | 200,636 | |  | | 131,876 | |

| Net income available to common shareholders |  | | 133,108 | |  | | 605,992 | |  | | 342,879 | |  | | 184,956 | |  | | 127,228 | |

| Earnings per common share — diluted (1) |  | | 1.85 | |  | | 8.53 | |  | | 4.88 | |  | | 2.96 | |  | | 2.17 | |

| Dividends per common share |  | | 0.76 | |  | | 0.60 | |  | | 0.57 | |  | | 0.53 | |  | | 0.50 | |

| Weighted average common shares outstanding |  | | 71,774 | |  | | 71,002 | |  | | 70,211 | |  | | 62,391 | |  | | 58,728 | |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| At December 31, |  | 2004 |  | 2003 |  | 2002 |  | 2001 |  | 2000 |

| (in thousands) |  | |  | |  | (Restated) |  | (Restated) |  |

| Balance Sheet Data: |  | | | |  | | | |  | | | |  | | | |  | | | |

| Total investments |  | $ | 4,826,249 | |  | $ | 4,159,081 | |  | $ | 3,077,901 | |  | $ | 2,054,715 | |  | $ | 964,305 | |

| Total assets |  | | 5,526,318 | |  | | 4,729,702 | |  | | 3,747,173 | |  | | 2,670,089 | |  | | 1,468,989 | |

| Reserve for claims and claim expenses |  | | 1,459,398 | |  | | 977,892 | |  | | 804,795 | |  | | 572,877 | |  | | 403,611 | |

| Reserve for unearned premiums |  | | 365,335 | |  | | 349,824 | |  | | 331,985 | |  | | 125,053 | |  | | 112,541 | |

| Debt |  | | 350,000 | |  | | 350,000 | |  | | 275,000 | |  | | 183,500 | |  | | 50,000 | |

| Subordinated obligation to capital trust |  | | 103,093 | |  | | 103,093 | |  | | — | |  | | — | |  | | — | |

| Company obligated mandatorily redeemable capital securities of a subsidiary trust holding solely junior subordinated debentures of RenaissanceRe |  | | — | |  | | — | |  | | 84,630 | |  | | 87,630 | |  | | 87,630 | |

| Preferred shares |  | | 500,000 | |  | | 250,000 | |  | | 150,000 | |  | | 150,000 | |  | | — | |

| Total shareholders' equity attributable to common shareholders |  | | 2,144,042 | |  | | 2,084,643 | |  | | 1,490,690 | |  | | 1,095,614 | |  | | 700,818 | |

| Common shares outstanding |  | | 71,029 | |  | | 70,399 | |  | | 69,750 | |  | | 67,893 | |  | | 58,863 | |

|

|  |

| (1) | Earnings per common share — diluted was calculated by dividing net income available to common shareholders by the number of weighted average common shares and common share equivalents outstanding. Common share equivalents are calculated on the basis of the treasury stock method. |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Year ended December 31, |  | 2004 |  | 2003 |  | 2002 |  | 2001 |  | 2000 |

| (in thousands, except ratios) |  | |  | (Restated) |  | (Restated) |  | (Restated) |  | |

| Segment Information: |  | | | |  | | | |  | | | |  | | | |  | | | |

| Reinsurance |  | | | |  | | | |  | | | |  | | | |  | | | |

| Gross premiums written (1) |  | $ | 1,066,065 | |  | $ | 935,485 | |  | $ | 890,470 | |  | $ | 451,364 | |  | $ | 382,816 | |

| Net premiums written |  | | 930,946 | |  | | 792,022 | |  | | 698,863 | |  | | 329,474 | |  | | 287,941 | |

| Income (2) |  | | 46,389 | |  | | 455,777 | |  | | 286,713 | |  | | 82,971 | |  | | 150,003 | |

| Net claims and claim expense ratio |  | | 79.0 | % |  | | 25.9 | % |  | | 40.9 | % |  | | 40.5 | % |  | | 40.4 | % |

| Underwriting expense ratio |  | | 16.1 | % |  | | 18.0 | % |  | | 16.4 | % |  | | 22.4 | % |  | | 26.8 | % |

| Combined ratio |  | | 95.1 | % |  | | 43.9 | % |  | | 57.3 | % |  | | 62.9 | % |  | | 67.2 | % |

| Individual Risk |  | | | |  | | | |  | | | |  | | | |  | | | |

| Gross premiums written |  | $ | 478,092 | |  | $ | 446,724 | |  | $ | 282,579 | |  | $ | 49,957 | |  | $ | 50,186 | |

| Net premiums written |  | | 418,341 | |  | | 362,754 | |  | | 227,101 | |  | | 12,867 | |  | | 5,362 | |

| Income (loss) (2) |  | | (105,752 | ) |  | | 32,030 | |  | | 17,929 | |  | | (1,469 | ) |  | | (4,406 | ) |

| Net claims and claim expense ratio |  | | 89.0 | % |  | | 51.7 | % |  | | 43.2 | % |  | | (30.9 | %) |  | | 47.0 | % |

| Underwriting expense ratio |  | | 37.9 | % |  | | 37.8 | % |  | | 37.5 | % |  | | 149.6 | % |  | | 98.1 | % |

| Combined ratio |  | | 126.9 | % |  | | 89.5 | % |  | | 80.7 | % |  | | 118.7 | % |  | | 145.1 | % |

|

|  |

| (1) | Excludes $18.8 million, $20.8 million and $22.2 million of premium assumed from the Individual Risk segment in the years ended December 31, 2004, 2003 and 2002, respectively. |

|  |

| (2) | Income (loss) for the Reinsurance and Individual Risk segments represents net underwriting income. Net underwriting income consists of net premiums earned less claims and claim expenses, acquisition costs and operational expenses. |

54

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is a discussion and analysis of our results of operations for the year ended December 31, 2004 compared with the years ended December 31, 2003 and December 31, 2002. The following also includes a discussion of our financial condition at December 31, 2004. This discussion and analysis should be read in conjunction with the audited consolidated financial statements and related notes included in this filing. This filing contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from the results described or implied by these forward-looking statements (see "Note on Forward-Looking Statements").

OVERVIEW

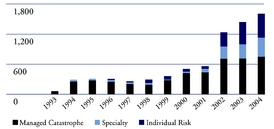

RenaissanceRe was established in 1993 to write property catastrophe reinsurance. By pioneering the use of sophisticated computer models to construct our portfolio, we have become one of the world's largest and most successful catastrophe reinsurers. Recently, we have leveraged our expertise and established growing franchises in additional selected areas of insurance and reinsurance.

Since a substantial portion of the reinsurance and insurance we write provides protection from damages relating to natural and man-made catastrophes, our results depend to a large extent on the frequency and severity of such catastrophic events, and the coverages we offer to clients impacted by these events. Currently, we conduct our business through two reportable segments, Reinsurance and Individual Risk.

Our revenues are principally derived from three sources: 1) net premiums earned from the reinsurance and insurance policies we sell; 2) net investment income and realized gains and losses from the investment of our capital funds and the investment of the cash we receive on the policies which we sell; and 3) other income received from our joint ventures and various other items.

Our expenses primarily consist of: 1) net claims and claim expenses incurred on the policies of reinsurance and insurance we sell; 2) acquisition costs which typically represent a percentage of the premiums we write; 3) operational expenses which primarily consist of personnel expenses, rent and other operating expenses; and 4) interest and dividend costs related to our debt, preference shares and subordinated obligation to our capital trust. We are also subject to taxes in certain jurisdictions in which we operate; however, since the majority of our income is currently earned in Bermuda, a non-taxable jurisdiction, the tax impact to our operations has historically been minimal.

The operational results, also known as the underwriting results, of an insurance or reinsurance company are discussed frequently by reference to its net claims and claim expense ratio, underwriting expense ratio, and combined ratio. The net claims and claim expense ratio is calculated by dividing net claims and claim expenses incurred by net premiums earned. The underwriting expense ratio is calculated by dividing underwriting expenses (acquisition expenses and operational expenses) by net premiums earned. The combined ratio is the sum of the net claims and claim expense ratio and the underwriting expense ratio. A combined ratio below 100% generally indicates profitable underwriting prior to the consideration of investment income. A combined ratio over 100% generally indicates unprofitable underwriting prior to the consideration of investment income. We also discuss our net claims and claim expense ratio on an accident year basis. This ratio is calculated by taking net claims and claim expenses, excluding development on net claims and claim expenses from events that took place in prior years, divided by net premiums earned.

Modeling

We have developed a proprietary, computer-based pricing and exposure management system, Renaissance Exposure Management System (REMS©). REMS© has analytic and modeling capabilities that help us to assess the risk and return of each incremental reinsurance contract in relation to our overall portfolio of reinsurance contracts. Before we bind any risk, exposure data is gathered from clients and this exposure data is input into REMS© modeling system. The REMS© modeling system enables us to measure each policy on a consistent basis and provides us with a measurement of an appropriate price to charge for each policy based upon the risk that is assumed. We combine the

55

analyses generated by REMS© with other information available to us, including our own knowledge of the client submitting the proposed program. While REMS© is most developed in analyzing catastrophe risks, it is also used for analyzing other classes of risk.

REMS© combines computer-generated simulations that estimate event probabilities with exposure and coverage information on each client's reinsurance contract to produce an estimate of expected claims for reinsurance programs submitted to us. We have also customized REMS© by including additional perils, risks and geographic areas that are not captured in the commercially available models.

RESTATEMENT OF FINANCIAL STATEMENTS

As previously disclosed, in the fourth quarter of 2004 we engaged Boies Schiller to complete a review of the Company's business practices in light of the industry-wide investigations by the New York Attorney General and other government authorities into a wide range of practices in the insurance and reinsurance industry. Supervision of this review was subsequently taken over by the Board of Directors, with Boies Schiller reporting directly to the independent members of the Board of Directors. See "Business - Recent Developments." This review has led to the restatement of the Company's audited financial statements for the fiscal years ended December 31, 2003, 2002 and 2001 to correct accounting errors associated with reinsurance ceded by the Company. These restatements arose out of the transactions described below.

Certain of the restatement corrections are attributable to an Aggregate Excess of Loss Reinsurance contract and an Assignment Agreement, each entered into by Renaissance Reinsurance with Inter-Ocean in 2001. The Aggregate Excess of Loss Reinsurance contract initially provided for $45.0 million of maximum limit over a three-year period in exchange for annual premium of $7.3 million. This agreement was subsequently amended to provide for $30.0 million of maximum limit for the same annual premium. The Assignment Agreement provided for the sale by Renaissance Reinsurance to Inter-Ocean of $50.0 million face amount of reinsurance recoverables for $30.0 million. In prior financial statements, the Company accounted for the Aggregate Excess of Loss Reinsurance contract as traditional reinsurance and for the Assignment Agreement as a sale of reinsurance recoverables. In connection with the aforementioned review, the Company concluded that these contracts, based on the totality of the surrounding facts and circumstances, should have been treated as a single transaction and, when so treated, lacked the necessary risk transfer to be accounted for as transactions involving ceded reinsurance and a sale of reinsurance recoverables.

The remaining restatement corrections are attributable to four multi-year ceded reinsurance contracts. The adjustments correct for an error in the amortization period resulting in the amortization of future contractual premium beginning at the end of the third quarter of 2001 rather than beginning at the end of the fourth quarter of 2001.

The aggregate net effect of the corrections is to increase 2003 net income by $1.3 million; to decrease 2002 net income by $21.9 million; and to increase 2001 net income by $20.6 million. The amounts reflect: (1) the timing of the recognition of Inter-Ocean reinsurance recoverables (with the impact of decreasing net income by $1.4 million in 2003; decreasing net income by $25.0 million in 2002; and increasing net income by $26.4 million in 2001), and (2) the timing of premium ceded on multi-year contracts (with the impact of increasing net income by $2.7 million in 2003; increasing net income by $3.1 million in 2002; and decreasing net income by $5.8 million in 2001). These restatements only affect the Reinsurance segment. See Note 2 to our Consolidated Financial Statements.

The independent members of the Board of Directors, in connection with the aforementioned review, have concluded that certain members of senior management (James N. Stanard, Chief Executive Officer; William I. Riker, President; John M. Lummis, Chief Operating Officer/Chief Financial Officer; Michael W. Cash, Senior Vice President; and Martin J. Merritt, Controller) made mistakes and in some instances lacked due care in connection with the original accounting for the Inter-Ocean transactions that led to the restatement. The independent members of the Board of Directors plan to discuss their findings directly with each of the aforementioned executives. The independent members of the Board of Directors also concluded that, since 2001, the Company has made significant improvements in its internal controls, including controls over financial reporting. These improvements include:

56

|  |

| • | significantly increasing the number of accounting professionals dedicated to financial reporting; |

|  |

| • | hiring a general counsel and developing a legal department, including legal resources dedicated to the Company's reinsurance underwriting function; |

|  |

| • | hiring an internal auditor and developing an internal audit function; |

|  |

| • | designing and implementing controls related to accounting for complex reinsurance contracts; and |

|  |

| • | developing training programs regarding the contractual features contained within reinsurance contracts that may require an accounting review in accordance with the Company's policies and procedures. |

During the last two fiscal years, the Company has also formalized its internal control environment over financial reporting in connection with its compliance with the requirements of Section 404 of the Sarbanes-Oxley Act.

SUMMARY OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Claims and Claim Expense Reserves

We believe that the most significant accounting judgment made by management is our estimate of claims and claim expense reserves. Claims reserves represent estimates, including actuarial and statistical projections at a given point in time, of the ultimate settlement and administration costs of claims incurred. Our estimates are not precise in that, among other things, they are based on predictions of future developments and estimates of future trends and other variable factors such as inflation. It is likely that the ultimate liability will be greater or less than such estimates and that, at times, this variance will be material. Also, reserving for our Reinsurance and Individual Risk businesses can involve uncertainty because of the dependence on information from ceding companies, the time lag inherent in reporting information from the primary insurer to us, and differing reserving practices among ceding companies. The information received from ceding companies is typically in the form of bordereaux, broker notifications of loss and/or discussions with ceding companies or their brokers. This information can be received on a monthly, quarterly or transactional basis and normally includes estimates of paid and incurred losses and may sometimes also include an estimate of incurred but not reported reserves ("IBNR").

For our property catastrophe reinsurance business, which is characterized by loss events of low frequency and high severity, reporting of claims in general tends to be prompt (as compared to reporting of claims for "long-tail" products, which tends to be slower). However, the timing of claims reporting also varies depending on various factors, including: whether the claims arise under reinsurance of primary companies or reinsurance of other reinsurance companies; the nature of the events (e.g., hurricanes or earthquakes); the geographic area involved; and the quality of each customer's claims management and reserving practices. Management's judgments as regards to these factors are reflected in management's reserve estimates. Because the events from which claims arise under policies written by our property catastrophe reinsurance business are typically prominent, public occurrences such as hurricanes and earthquakes, we are often able to use independent reports of such events to augment our loss reserve estimation process. However, based upon the amount and timing of the reported claims from any one or more catastrophic event, such reserve estimates may change significantly from one quarter to another. Once we receive a notice of loss under a catastrophe reinsurance contract, we are generally able to process such claims promptly.

For our property catastrophe reinsurance operations, we initially set our claims reserves based on case reserves reported by insureds and ceding companies. We then add to these case reserves our estimates for additional case reserves, and an estimate for IBNR. In addition to the loss information and estimates communicated by cedants, we also utilize industry information which we gather and retain in our REMS© modeling system. When property catastrophe losses do occur, the information stored in

57

our REMS© modeling system enables us to analyze each of our policies against such loss and compare our estimate of the loss with those reported by our policyholders. The REMS© modeling system also allows us to compare and analyze individual losses reported by policyholders affected by the same loss event. Although the REMS modeling system assists with the analysis of the underlying loss, and provides us with the information and ability to perform increased analysis, the estimation of claims resulting from catastrophic events is inherently difficult because of the variability and uncertainty associated with property catastrophe claims and the unique characteristics of each loss. During 2003, with the accumulation of 10 years of historical information on our claims and claim expenses, we adopted a new system to reassess our property catastrophe reserves on our older accident years.

During 2003 our Individual Risk segment began issuing insurance policies for certain commercial liability coverages, including general, automobile and professional liability risks. The claim reporting and claim development periods of these risks are generally expected to be longer than the reporting and development periods for our property risks, and accordingly there is normally greater uncertainty in the estimation of the reserves associated with these policies.