UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

EXACTECH, INC.

(Name of Registrant as Specified in Its Charter)

EXACTECH, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| (6) | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or Registration Statement no.: |

| (3) | Filing party: |

| (4) | Date Filed: |

EXACTECH, INC.

2320 N.W. 66th Court

Gainesville, Florida 32653

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on May 4, 2005

To the Shareholders of

EXACTECH, INC.:

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Shareholders (the “Annual Meeting”) of Exactech, Inc., a Florida corporation (the “Company”), will be held at the Company’s headquarters, 2320 N.W. 66th Court, Gainesville, Florida, on Wednesday, May 4, 2005, at 9:00 a.m., local time, for the following purposes:

| (1) | To elect one member to the Company’s Board of Directors to hold office for a term of three years or until his successor is duly elected and qualified; |

| (2) | To ratify the selection of Deloitte & Touche LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2005; and |

| (3) | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

All shareholders are cordially invited to attend; however, only shareholders of record at the close of business on March 31, 2005 are entitled to vote at the Annual Meeting or any adjournments thereof.

| By Order of the Board of Directors |

BETTY PETTY |

Secretary |

Gainesville, Florida

April 4, 2005

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. SHAREHOLDERS WHO EXECUTE A PROXY CARD MAY NEVERTHELESS ATTEND THE ANNUAL MEETING, REVOKE THEIR PROXY AND VOTE THEIR SHARES IN PERSON.

2005 ANNUAL MEETING OF SHAREHOLDERS

OF

EXACTECH, INC.

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Exactech, Inc., a Florida corporation (the “Company”), of proxies from the holders of the Company’s Common Stock, par value $.01 per share (the “Common Stock”), for use at the 2005 Annual Meeting of Shareholders of the Company to be held at the Company’s headquarters, 2320 N.W. 66th Court, Gainesville, Florida, on Wednesday, May 4, 2005, at 9:00 a.m., local time, or at any adjournment(s) or postponement(s) thereof (the “Annual Meeting”), pursuant to the foregoing Notice of Annual Meeting of Shareholders.

The approximate date that this Proxy Statement and the enclosed form of proxy are first being sent to shareholders is April 4, 2005. Shareholders should review the information provided herein in conjunction with the Company’s 2004 Annual Report, which accompanies this Proxy Statement. The Company’s principal executive offices are located at 2320 N.W. 66th Court, Gainesville, Florida 32653, and its telephone number is (352) 377-1140.

INFORMATION CONCERNING PROXY

The enclosed proxy is solicited on behalf of the Company’s Board of Directors. The giving of a proxy does not preclude the right to vote in person should any shareholder giving the proxy so desire. Shareholders have an unconditional right to revoke their proxy at any time prior to the exercise thereof, either in person at the Annual Meeting or by filing with the Company’s Secretary at the Company’s headquarters a written revocation or duly executed proxy bearing a later date; however, no such revocation will be effective until written notice of the revocation is received by the Company at or prior to the Annual Meeting.

The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Annual Meeting of Shareholders and the enclosed proxy is to be borne by the Company. In addition to the use of mail, employees of the Company may solicit proxies personally and by telephone. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in so doing.

PURPOSES OF THE ANNUAL MEETING

At the Annual Meeting, the Company’s shareholders will consider and vote upon the following matters:

| (1) | The election of one member to the Company’s Board of Directors to serve for a term of three years or until his successor is duly elected and qualified; |

| (2) | Ratification of the selection of Deloitte & Touche LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2005; and |

| (3) | Such other business as may properly come before the Annual Meeting, including any adjournments or postponements thereof. |

QUORUM AND VOTING REQUIREMENTS

The Board of Directors has set the close of business on March 31, 2005 as the record date (the “Record Date”) for determining shareholders of the Company entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 11,153,872 shares of Common Stock issued and outstanding, all of which are entitled to be voted at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter submitted to

2

shareholders for approval at the Annual Meeting. Shareholders do not have the right to cumulate their votes for directors. The attendance, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum.

If less than a majority of outstanding shares entitled to vote are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place, and notice need not be given of the new date, time or place if the new date, time or place is announced at the meeting before an adjournment is taken.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth above) will be voted (a) FOR the election of the nominee for director named below and (b) FOR the ratification of the selection of Deloitte & Touche LLP to serve as the Company’s independent auditors for the fiscal year ending December 31, 2005. In the event a shareholder specifies a different choice by means of the enclosed proxy, his shares will be voted in accordance with the specification so made. The Board of Directors does not know of any other matters that may be brought before the Annual Meeting nor does it foresee or have reason to believe that proxy holders will have to vote for substitute or alternate nominees. In the event that any other matter should come before the Annual Meeting or any nominee is not available for election, the persons named in the enclosed Proxy will have discretionary authority to vote all proxies not marked to the contrary with respect to such matters in accordance with their best judgment.

A plurality of the votes cast at the Annual Meeting is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated although it will be counted for purposes of determining whether there is a quorum. Shareholders do not have the right to cumulate their votes for directors.

Any other proposal that is properly brought before the Annual Meeting requires approval by the affirmative vote of a majority of votes cast at the Annual Meeting unless otherwise required by law. Neither abstentions nor broker non-votes will be counted as votes cast for purposes of determining whether these proposals have received sufficient votes for approval.

Prior to the Annual Meeting, the Company will select one or more inspectors of election for the meeting. Such inspector(s) shall determine the number of shares of Common Stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall receive, count and tabulate ballots and votes and determine the results thereof.

Pursuant to Florida law, abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. However, abstentions are treated as present and entitled to vote, but are not counted as votes cast “for” or “against” any matter. A broker non-vote on a matter is considered not entitled to vote on that matter and thus is not counted in determining whether a matter requiring approval of a majority of the shares present and entitled to vote has been approved or a plurality of the shares present and entitled to vote has been voted. Thus, abstentions and broker non-votes have the same effect as votes cast against proposals requiring a majority or greater percentage of the outstanding shares entitled to vote but do not have any effect on proposals requiring a majority or plurality of the shares present and entitled to vote.

A list of shareholders entitled to vote at the Annual Meeting will be available at the Company’s executive offices, 2320 N.W. 66th Court, Gainesville, Florida 32653, for a period of ten days prior to the Annual Meeting and at the Annual Meeting itself for examination by any shareholder.

3

SECURITY OWNERSHIP

The following table sets forth, as of the Record Date, the number of shares of Common Stock of the Company which were owned beneficially by (i) each person who is known by the Company to own beneficially more than 5% of its Common Stock, (ii) each director and nominee for director, (iii) each of the Named Executive Officers (as defined in “Executive Compensation”) and (iv) all directors and executive officers of the Company as a group:

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2)(3) | Percentage of Outstanding Shares Owned(2) | ||||

William Petty, M.D. | 3,941,298 | (4) | 33.7 | % | ||

Betty Petty | 3,941,298 | (4) | 33.7 | % | ||

Gary J. Miller, Ph.D. | 583,396 | (5) | 5.0 | % | ||

David W. Petty | 88,176 | (6) | * | |||

Joel C. Phillips, CPA | 105,077 | (7) | * | |||

Albert H. Burstein, Ph.D. | 6,400 | (8) | * | |||

R. Wynn Kearney, Jr., M.D. | 448,260 | (9) | 3.8 | % | ||

Paul Metts, CPA William B. Locander, Ph.D | 15,800 5,400 | (10) (11) | * * | | ||

Prima Investments, Limited Partnership | 3,688,498 | (4) | 33.1 | % | ||

Millerworks, Limited Partnership | 440,712 | (5) | 4.0 | % | ||

FMR Corp. | 900,000 | (12) | 8.1 | % | ||

All directors and executive officers as a group (9 persons) | 5,193,807 | (13) | 44.4 | % |

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the address of each beneficial owner is Exactech, Inc., 2320 N.W. 66th Court, Gainesville, Florida 32653. |

| (2) | A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from the date hereof upon exercise of options, warrants and convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not those held by any other person) and that are exercisable within 60 days from the date hereof have been exercised. |

| (3) | Unless otherwise noted, the Company believes that all persons named in the table have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them. |

| (4) | Includes 3,688,498 shares of Common Stock held by Prima Investments, Limited Partnership, a Nevada limited partnership (“Prima Partnership”). Prima Investments, Inc., a Nevada corporation wholly-owned by Dr. and Mrs. Petty, is the general partner of Prima Partnership. Dr. and Mrs. Petty along with their children hold all limited partnership interests in Prima Partnership. Also includes (i) 32,400 shares of Common Stock held by William Petty, (ii) 33,400 shares of Common Stock held by Betty Petty, (iii) 126,000 shares of Common Stock issuable upon the exercise of options granted to William Petty which are currently exercisable, and (iv) 61,000 shares of Common Stock issuable upon the exercise of options granted to Betty Petty which are currently exercisable. |

| (5) | Includes 440,712 shares of Common Stock held by Millerworks, Limited Partnership, a Nevada limited partnership (“Millerworks Partnership”). Millerworks, Inc., a Nevada corporation wholly-owned by Dr. Miller, is the general partner of Millerworks Partnership. Dr. Miller, his wife and children hold all partnership interests in Millerworks Partnership. Also includes (i) 13,024 shares of Common Stock held by Dr. Miller and (ii) 129,660 shares of Common Stock issuable upon the exercise of options granted to Dr. Miller which are currently exercisable. |

| (6) | Includes (i) 79,160 shares of Common Stock issuable upon the exercise of options granted to Mr. Petty which are currently exercisable and (ii) 448 shares of Common Stock held by Mr. Petty’s spouse. |

| (7) | Includes 99,328 shares of Common Stock issuable upon the exercise of options granted to Mr. Phillips which are currently exercisable. |

| (8) | Includes 400 shares of Common Stock issuable upon the exercise of options granted to Dr. Burstein which are currently exercisable. |

| (9) | Includes (i) 40,400 shares of Common Stock issuable upon the exercise of options granted to Dr. Kearney which are currently exercisable and (ii) 122,692 shares of Common Stock held by Dr. Kearney’s spouse. |

4

| (10) | Includes 400 shares of Common Stock issuable upon the exercise of options granted to Mr. Metts which are currently exercisable. |

| (11) | Consists of 5,400 shares of Common Stock issuable upon the exercise of options granted to Dr. Locander which are currently exercisable. |

| (12) | Based on Amendment No. 1, dated February 14, 2005, to Schedule 13G. Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp. and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is the beneficial owner of 900,000 shares or 8.1% of the Company’s outstanding Common Stock as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. Fidelity has its principal business office at 82 Devonshire Street, Boston, Massachusetts 02109. In addition, each of Edward C. Johnson, 3rd and Abigail P. Johnson may be deemed beneficial owner of the shares due to their status as affiliates of Fidelity. |

| (13) | See notes (4)-(11). Includes 541,748 shares of Common Stock issuable upon the exercise of options which are currently exercisable. |

ELECTION OF DIRECTORS

Under the terms of the Company’s Articles of Incorporation, as amended to date, the Company’s Board of Directors is currently comprised of five members divided into three classes of directors. Class I and Class III have two directors each and Class II has one director. Each year, one class of directors is elected to serve a three-year term. The current term of the Class II director terminates on the date of the Annual Meeting.

The Company has nominated William B. Locander, Ph.D. (the “Nominee”) to be elected as a Class II director at the Annual Meeting to serve for a term of three years. The Nominee now serves as a Class II director of the Company. The Board of Directors has no reason to believe that the Nominee will refuse or be unable to accept election; however, in the event that the Nominee is unable to accept election or if any other unforeseen contingencies should arise, each proxy that does not direct otherwise will be voted for such other persons as may be designated by the Board of Directors. Unless instructed otherwise, the persons named on the accompanying proxy card will vote for the election of the Nominee for election to the Board of Directors, to serve for a term of three years or until his successor is duly elected and qualified.

The term of each class of directors and the names of the directors in each class appear in the below table:

Class | Term | Names of Nominees/Directors | ||

| Class I | Term Expires at the 2007 Annual Meeting | R. Wynn Kearney, Jr., M.D. Paul Metts, CPA | ||

| Class II | Term Expires at the 2005 Annual Meeting | William B. Locander, Ph.D. | ||

| Class III | Term Expires at the 2006 Annual Meeting | William Petty, M.D. Albert Burstein, Ph.D. | ||

5

MANAGEMENT

Executive Officers and Directors

The executive officers and directors of the Company are as follows:

Name | Age | Position | ||

William Petty, M.D. | 62 | Chairman of the Board, President and Chief Executive Officer | ||

Gary J. Miller, Ph.D. | 57 | Executive Vice President, Research and Development | ||

David W. Petty | 38 | Executive Vice President, Sales and Marketing | ||

Joel C. Phillips, CPA | 37 | Chief Financial Officer and Treasurer | ||

Betty Petty | 62 | Vice President, Administration and Human Resources and Corporate Secretary | ||

Albert Burstein, Ph.D. | 67 | Director | ||

R. Wynn Kearney, Jr., M.D. | 61 | Director | ||

Paul E. Metts, CPA | 62 | Director | ||

William B. Locander, Ph.D. | 61 | Director |

William Petty, M.D.was a founder of the Company. He has been Chairman of the Board and Chief Executive Officer of the Company since its inception and President since January 2002. Dr. Petty was a Professor at the University of Florida College of Medicine from July 1975 to September 1998. Dr. Petty also served as Chairman of the Department of Orthopaedic Surgery at the University of Florida College of Medicine from July 1981 to January 1996. Dr. Petty has served as a member of the Hospital Board of Shands Hospital, Gainesville, Florida, as an examiner for the American Board of Orthopaedic Surgery, as a member of the Orthopaedic Residency Review Committee of the American Medical Association, on the Editorial Board of theJournal of Bone and Joint Surgery,and on the Executive Board of the American Academy of Orthopaedic Surgeons. He holds the Kappa Delta Award for Outstanding Research from the American Academy of Orthopaedic Surgeons. His book,Total Joint Replacement,was published in 1991. Dr. Petty received his B.S., M.S., and M.D. degrees from the University of Arkansas. He completed his residency in Orthopaedic Surgery at the Mayo Clinic in Rochester, Minnesota. Dr. Petty is the husband of Betty Petty and the father of David W. Petty.

Gary J. Miller, Ph.D.was a founder and has been Executive Vice President, Research and Development of the Company since February 2000. He was Vice President, Research and Development from 1986 until 2000 and was a Director from March 1989 through May 2003.Dr. Miller was Associate Professor of Orthopaedic Surgery and Director of Research and Biomechanics at the University of Florida College of Medicine from July 1986 until August 1996. Dr. Miller received his B.S. from the University of Florida, his M.S. (Biomechanics) from the Massachusetts Institute of Technology, and his Ph.D. in Mechanical Engineering (Biomechanics) from the University of Florida. He has held an Adjunct Associate Professorship in the College of Veterinary Medicine’s Small Animal Surgical Sciences Division since 1982 and was appointed as an Adjunct Associate Professor in the Department of Aerospace, Mechanics and Engineering Sciences in 1995. He was a consultant to the Food and Drug Administration from 1989 to 1992 and has served as a consultant to such companies as Johnson & Johnson Orthopaedics, Dow-Corning Wright and Orthogenesis.

David W. Pettyhas been Executive Vice President, Sales and Marketing since February 2000. He has been employed by the Company in successive capacities in the areas of Operations and Sales and Marketing for the past seventeen years, serving as Vice President, Operations from April 1991 until April 1993 and Vice President, Marketing from April 1993 until February 2000. He also served as a Director from March 1989 until March 1996 and again from January 2002 until May 2003. Mr. Petty received his B.A. from the University of Virginia in 1988 and completed The Executive Program of the Darden School of Business in 1999. He is the son of Dr. and Ms. Petty.

6

Joel C. Phillips, CPAhas been Chief Financial Officer of the Company since July 1998 and Treasurer since March 1996. Mr. Phillips was Manager, Accounting and Management Information Systems at the Company from April 1993 to June 1998. From January 1991 to April 1993, Mr. Phillips was employed by Arthur Andersen. Mr. Phillips received a B.S. and a Masters in Accounting from the University of Florida and is a Certified Public Accountant.

Betty Pettywas a founder of the Company and has been Vice President, Human Resources and Administration since February 2000. She has also been Secretary of the Company since its inception and served as Treasurer and a Director until March 1996. Ms. Petty served in the dual capacities of Human Resources Coordinator and Director of Marketing Communications from the founding of the Company until 2001.She received her B.A. from the University of Arkansas at Little Rock and her M.A. in English from Vanderbilt University. Ms. Petty is the wife of Dr. Petty and the mother of David W. Petty.

Albert Burstein, Ph.D.has been a director of the Company since March 1996. From 1976 to 1996, Dr. Burstein was Senior Scientist, Department of Research and Associate Attending Orthopaedic Surgeon (Biomechanical Engineering) at the Hospital for Special Surgery, New York, New York and Adjunct Associate Professor of Mechanical Engineering at the Sibley School of Mechanical and Aerospace Engineering, Cornell University, Ithaca, New York. In addition, he was Professor of Applied Biomechanics (in surgery) at Cornell University Medical College, New York, New York from 1978 through 1996. From 1976 until 1992, he served as Director, Department of Biomechanics, Research Division, at the Hospital for Special Surgery. He served as Deputy Editor for Research forThe Journal of Bone and Joint Surgery from 1980 to 2003.Dr. Burstein is an author of six textbooks on Orthopaedic Biomechanics. He holds the Shands Award of the Orthopaedic Research Society for outstanding career contributions to orthopaedic research, the Kappa Delta Award of the American Academy of Orthopaedic Surgeons for research and is a Past President of the American Society of Biomechanics. Dr. Burstein holds twenty-three patents for orthopaedic devices.

R. Wynn Kearney, Jr., M.D. has been a director of the Company since September 1989. Since 1972, he has practiced with the Orthopaedic and Fracture Clinic, P.A., a medical group with locations in southern Minnesota, and is its Senior Partner. He received his B.S. and M.D. degrees through the Honors Program of Northwestern University Medical School in Chicago. He completed an orthopaedic surgery post-graduate residency at the Mayo Clinic in Rochester, Minnesota and was a member of the team that implanted the first total knee replacement in the United States in 1970. He is an Associate Professor of the University of Minnesota Medical School. Dr. Kearney has served as President of the Minnesota Orthopaedic Society, the Southern Minnesota Medical Association and the Orthopaedic Practice Society. He is a member of the Foundation Board of Minnesota State University, Mankato. Dr. Kearney is a member of the board of directors of Hickory Tech Corporation and is a minority owner of the Minnesota Timberwolves NBA basketball team.

Paul Metts, CPAhas been a director of the Company since April 1998. Mr. Metts is a health care industry consultant serving hospitals of various sizes throughout Florida. He was the Chief Executive Officer of Shands HealthCare at the University of Florida from 1987 to 1997, where he retired after twenty years. Shands HealthCare System is a 2000-bed, nine-hospital system with approximately 12,000 employees. Mr. Metts currently serves as a member of the Robert Wood Johnson Foundation’s National Advisory Committee for Urgent Matters and has served as a board member of many local civic and business organizations including Barnett Bank, the University of Florida Foundation and University Medical Center in Jacksonville. Mr. Metts has also chaired or served as a member on state and national industry organizations such as the Florida Institute of Certified Public Accountants Healthcare Industry Committee, the Florida Hospital Association Board, the Association of Voluntary Hospitals of Florida Board, the University Health System Consortium Board, and several committees for the Association of American Medical Colleges. Mr. Metts, a Certified Public Accountant, received his undergraduate degree in Accounting from the University of South Florida and his Masters Degree in Health Care Administration from the University of Minnesota.

7

William B. Locander, Ph.D.has been a Director of the Company since May 2003. Dr. Locander is presently the Director of the Davis Leadership Center and holds the Davis Chair of Leadership at Jacksonville University in Jacksonville, Florida. Dr. Locander was the Chairman of Marketing, Professor of Marketing and Quality at the University of South Florida in Tampa, Florida from 1992 to 2004. He was also the Director of the USF Leadership Center. He was previously Professor of Marketing at the University of Tennessee, Knoxville from 1983 until 1992. From 1973 through 1983 he was a faculty member at the University of Houston, serving as Associate Professor, Chairman of the Department of Marketing, and Associate Dean for Research and Administration at that institution. Dr. Locander has authored numerous articles in reference publications and has served on the editorial board of the Journal of Marketing and the Journal of Marketing Research. He was president of the National American Marketing Association in 1988 and 1989. He was an examiner for the Malcolm Baldridge National Quality Award in 1991 and 1992. Dr. Locander has spoken and consulted in the areas of marketing, total quality, organizational change, strategic planning, and customer satisfaction, with companies such as IBM, General Electric, 3M, Proctor and Gamble, and Chevron. In 2004, Dr. Locander received an award from the American Marketing Association for strategic facilitation to the Academic Division. He received his B.S., M.S. and Ph.D. degrees from the University of Illinois in Champaign-Urbana.

Election of Executive Officers and Directors

The Company’s officers are elected annually by the Board of Directors and serve at the discretion of the Board of Directors. The Company’s directors hold office until the expiration of their term or until their successors have been duly elected and qualified.

Committees and Meetings of the Board of Directors

During the fiscal year ended December 31, 2004, the Company’s Board of Directors held four meetings and did not take any action by written consent. Each director of the Company attended 100% of the aggregate of (i) the number of the meetings of the Board which were held during the period that such person served on the Board and (ii) the number of meetings of committees of the Board of Directors held during the period that such person served on such committee.

The Company has two committees: the Audit Committee and the Compensation Committee. The Company does not have a nominating or corporate governance committee, or any other committee of the Board of Directors performing equivalent functions. Each of these committees is governed by a charter. A copy of any of these charters and the Company’s Corporate Governance Principles may be obtained for no cost upon request from the Company’s Corporate Secretary.

The Audit Committee is currently composed of R. Wynn Kearney, Jr. M.D., William B. Locander, Ph.D. and Paul Metts, CPA. Paul Metts, CPA serves as Chairman of the Committee. The Audit Committee’s functions include overseeing the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the selection and qualifications of the independent auditors, the performance of the Company’s internal audit function and controls regarding financial reporting and disclosure, accounting, legal compliance and ethics that management and the Board of Directors have established. In this oversight capacity, the Audit Committee reviews the scope, timing and fees for the annual financial statement audit and attestation of internal control over financial reporting and disclosure and the results of audit examinations performed by the internal auditors and independent registered public accounting firm, including their recommendations to improve the system of accounting and internal controls. The Audit Committee met eight times during the year ended December 31, 2004.

The Audit Committee is comprised of three non-employee members of the Board of Directors. After reviewing the qualifications of the current members of the Audit Committee, and any relationships they may have with us that might affect their independence from the Company, the Board of Directors has determined that (1) all current committee members are “independent” as that concept is defined in Section 10A of the Securities Exchange Act of 1934, (2) all current committee members are “independent” as that concept is defined in the applicable rules of the Nasdaq National Market (“Nasdaq”), (3) all current committee members are financially literate, and (4) Paul

8

Metts qualifies as an “audit committee financial expert” under the applicable rules promulgated under to the Securities Exchange Act of 1934. In making the determination as to Mr. Metts’ status as an audit committee financial expert, the Board determined he has accounting and related financial management expertise within the meaning of the aforementioned rules as well as the listing standards of the Nasdaq.

Please refer to the Audit Committee Report, which is set forth on page 19, for a further description of the Audit Committee’s responsibilities and its recommendation with respect to the Company’s audited consolidated financial statements for the year ended December 31, 2004.

The Compensation Committee is currently comprised of Paul Metts, CPA, R. Wynn Kearney, Jr., M.D., and William B. Locander, Ph.D. Dr. Kearney serves as Chairman of the Committee. The Compensation Committee’s functions consist of administering the Company’s Incentive Compensation Plan (the “Incentive Compensation Plan”), recommending and approving grants of stock-based compensation awards under the Incentive Compensation Plan, and recommending, reviewing and approving the salary and fringe benefits policies of the Company, including compensation of executive officers of the Company. The Compensation Committee met three times during the year ended December 31, 2004.

Please refer to the Compensation Committee Report, which is set forth on page 17, for a further description of the Compensation Committee’s responsibilities and its compensation philosophy and a description of considerations underlying each component of compensation paid to the Company’s executive officers for 2004.

Additional Information Concerning Directors

The Company reimburses all directors for their expenses in connection with their activities as directors of the Company.

Non-employee directors are eligible to receive stock-based incentive awards under the Executive Incentive Compensation Plan. In 2004, the Company compensated non-employee Directors (i) $20,000 each as an annual retainer, (ii) $1,000 plus travel expenses for each of four board meetings held at the Company, (iii) $500 for each committee meeting, eight total in the case of the Audit Committee, and three total in the case of the Compensation Committee, (iv) $3,500 as an annual retainer to the Chairman of the Audit Committee, and (v) $1,500 as an annual retainer to the Chairman of the Compensation Committee.

Corporate Governance

The Company operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. The Company regularly monitors developments in the area of corporate governance to insure the Company’s continued compliance with changing standards and regulations. In 2004, the Company completed the formal documentation and evaluation of its system of internal controls over financial reporting based on criteria established inInternal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO Framework). A summary of the Company’s corporate governance measures follows:

Independent Directors

| • | A majority of the members of the Company’s Board of Directors are independent from management. When making determinations regarding independence, the Board references the listing standards adopted by Nasdaq as well as the independence standards set forth in the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated by the SEC under that Act. In particular, the Company’s Audit Committee periodically evaluates and reports to the Board on the independence of each member of the Board. The committee analyzes whether a director is independent by evaluating, among other factors, the following: |

| 1. | Whether the member of the Board has any material relationship with the Company, either directly, or as a partner, shareholder or officer of an organization that has a relationship with the Company; |

9

| 2. | Whether the member of the Board is a current employee of the Company or was an employee of the Company within three years preceding the date of determination; |

| 3. | Whether the member of the Board is, or in the three years preceding the date of determination has been, affiliated with or employed by (i) a present internal or external auditor of the Company or any affiliate of such auditor, or (ii) any former internal or external auditor of the Company or any affiliate of such auditor, which performed services for the Company within three years preceding the date of determination; |

| 4. | Whether the member of the Board is, or in the three years preceding the date of determination has been, part of an interlocking directorate, in which an executive officer of the Company serves on the compensation committee of another company that concurrently employs the member as an executive officer; |

| 5. | Whether the member of the Board receives any compensation from the Company, other than fees or compensation for service as a member of the Board and any committee of the Board and reimbursement for reasonable expenses incurred in connection with such service and for reasonable educational expenses associated with Board or committee membership matters; |

| 6. | Whether an immediate family member of the member of the Board is a current executive officer of the Company or was an executive officer of the Company within three years preceding the date of determination; |

| 7. | Whether an immediate family member of the member of the Board is, or in the three years preceding the date of determination has been, affiliated with or employed in a professional capacity by (i) a present internal or external auditor of ours or any affiliate of the Company, or (ii) any former internal or external auditor of the Company or any affiliate of ours which performed services for the Company within three years preceding the date of determination; and |

| 8. | Whether an immediate family member of the member of the Board is, or in the three years preceding the date of determination has been, part of an interlocking directorate, in which an executive officer of the Company serves on the compensation committee of another company that concurrently employs the immediate family member of the member of the Board as an executive officer. |

The above list is not exhaustive and the Audit Committee considers all other factors which could assist it in its determination that a director has no material relationship with us that could compromise that director’s independence.

As a result of this review, the Board affirmatively determined that R. Wynn Kearney, Jr., M.D., Paul E. Metts, CPA and William B. Locander, Ph.D. are independent of the Company and its management under the standards set forth above. William Petty, M.D. is considered an inside director because of his employment as one of our senior executives. Albert Burstein, Ph.D. is considered a non-independent outside director because of certain consulting arrangements Dr. Burstein maintains with the Company as well as certain transactions between the Company and an affiliate of Dr. Burstein. Additional information regarding these consulting arrangements and transactions between Dr. Burstein and the Company can be found under “Certain Transactions” below.

| • | The Company’s non-management directors hold formal meetings, separate from management, at least two times per year. |

| • | The Company has no formal policy regarding attendance by its directors at annual shareholders meetings, |

10

although the Company encourages such attendance and most of the Company’s directors have historically attended those meetings. Each of the Company’s five directors attended the 2004 Annual Meeting of Shareholders. |

Audit Committee

| • | All Audit Committee members possess the required level of financial literacy and at least one member of the Committee meets the current standard of requisite financial management expertise as required by Nasdaq and applicable SEC rules and regulations. |

| • | The Audit Committee operates under a formal charter that governs its duties and conduct. |

| • | All members of the Audit Committee are independent from the Company’s executive officers and management. |

| • | Deloitte & Touche LLP, the Company’s independent registered public accounting firm, reports directly to the Audit Committee. |

| • | The Audit Committee meets with management and representatives of the registered public accounting firm prior to the filing of officers’ certifications with the SEC to receive information concerning, among other things, effectiveness of the design or operation of the Company’s internal controls over financial reporting, as required by section 404 of the Sarbanes-Oxley Act of 2002. |

| • | The Audit Committee has adopted a Policy for Reporting Improper Activity to enable confidential and anonymous reporting of improper activities to the Audit Committee. |

Compensation Committee

| • | The Compensation Committee operates under a formal charter that governs its duties and conduct. |

| • | Members of the Compensation Committee are independent from the Company’s executive officers and management. |

Code of Business Conduct and Ethics

| • | Management has adopted a Code of Business Conduct and Ethics that includes provisions ranging from restrictions on gifts to conflicts of interest. All employees are bound by this Code of Business Conduct and Ethics, violations of which may be reported to the Audit Committee. |

| • | The Code of Business Conduct and Ethics includes provisions applicable to all of the Company’s employees, including senior financial officers. This Code of Business Conduct and Ethics is available in the “Investors” section of the Company’s website (http://www.exac.com/Investors/default.asp). The Company intends to post amendments to or waivers from the Company’s Code of Business Conduct and Ethics. |

Personal Loans to Executive Officers and Directors

| • | The Company prohibits extensions of credit in the form of a personal loan to or for its Directors and executive officers. |

Director Nomination Policy

| • | The Company believes that, as a result of the role of the independent directors in the nominations process, it is not necessary at this time for the Company to have a separate nominating committee. In connection with this, the Company’s Board of Directors has adopted certain nomination procedures. Pursuant to these procedures: |

| • | All nominations and recommendations for nominations to the Board of Directors shall be addressed to the Chairman of the Audit Committee of the Board of Directors who shall submit such nominations to all members of the Board of Directors who satisfy the criteria for independence promulgated by Nasdaq for review and discussion; |

11

| • | Such reviewing members of the Board of Directors shall refer such nominee or recommended individual to the full Board of Directors for nomination for election by the Company’s shareholders if such members determine election of such nominee or recommended individual is in the best interests of the Company based upon such Board member’s knowledge of the Company’s operations, financial position, prospects and strategic goals as well as historical criteria for membership on the Board of Directors; and |

| • | All issues concerning the timing of receipt of nominations or recommendations for election of members to the Company’s Board of Directors shall be governed by applicable provisions of the Company’s Articles of Incorporation and Bylaws as well as applicable rules and regulations promulgated by the United States Securities and Exchange Commission such as those described on page 24 of this Proxy Statement. |

| • | Anyone who has a concern about the Company’s conduct, including accounting, internal accounting controls or audit matters, may communicate directly with the Company’s Chairman of the Board of Directors, the Company’s non-management directors or the Audit Committee. These communications may be confidential or anonymous, and may be e-mailed, submitted in writing or reported by phone. All of these concerns will be forwarded to the appropriate directors for their review, and will be simultaneously reviewed and addressed by our Chief Financial Officer in the same way that we address other concerns. Our Code of Business Conduct and Ethics prohibits any employee from retaliating or taking any adverse action against anyone for raising or helping to resolve an integrity concern. |

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than ten percent of the Company’s outstanding Common Stock, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock. Such persons are required by SEC regulation to furnish the Company with copies of all such reports they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports are required, during the fiscal year ended December 31, 2004, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners have been timely filed.

12

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following compensation table sets forth, for the fiscal years ended December 31, 2004, 2003 and 2002, the cash and certain other compensation paid or accrued by the Company to the Company’s Chief Executive Officer, and each of the Company’s other four most highly compensated executive officers whose total 2004 salary and bonus exceeded $100,000 (collectively, the “Named Executive Officers”).

| Annual Compensation | Long-Term Compensation Awards | |||||||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus | Other Annual Compensation ($) | Options/SARS (#) | All Other Compensation ($) | ||||||||||||||

William Petty, M.D. President and Chief Executive Officer | 2004 2003 2002 | $ $ $ | 346,083 294,731 230,607 | $ $ $ | 3,508 55,910 2,315 | (1) (6) (8) | $ $ $ | 170,470 166,510 136,707 | (2)(3) (2)(3) (2)(3) | 30,000 15,000 — | (4) (7) | $ $ $ | 7,239 8,842 6,629 | (5) (5) (5) | ||||||

Gary J. Miller, Ph.D. Research and Development | 2004 2003 2002 | $ $ $ | 188,300 181,729 171,229 | $ $ $ | 1,889 26,665 1,720 | (1) (6) (8) | $ $ $ | 169,471 167,660 137,632 | (2)(3) (2)(3) (2)(3) | 7,500 7,500 — | (4) (7) | $ $ $ | 5,649 5,452 5,137 | (5) (5) (5) | ||||||

Betty A. Petty | 2004 2003 2002 | $ $ $ | 182,336 148,276 121,458 | $ $ $ | 1,855 15,141 1,220 | (1) (6) (8) | $ $ $ | — — — | (3) (3) (3) | 15,000 10,000 — | (4) (7) | $ $ $ | 5,473 4,448 3,644 | (5) (5) (5) | ||||||

David W. Petty Sales and Marketing | 2004 2003 2002 | $ $ $ | 240,044 205,657 171,358 | $ $ $ | 2,432 30,064 1,720 | (1) (6) (8) | $ $ $ | — — — | (3) (3) (3) | 20,000 10,000 — | (4) (7) | $ $ $ | 7,024 6,170 5,141 | (5) (5) (5) | ||||||

Joel C. Phillips, CPA and Treasurer | 2004 2003 2002 | $ $ $ | 221,626 183,215 152,180 | $ $ $ | 2,251 26,781 1,530 | (1) (6) (8) | $ $ $ | — — — | (3) (3) (3) | 10,000 — 60,000 | (4) (9) | $ $ $ | 6,648 5,496 4,565 | (5) (5) (5) | ||||||

| (1) | Includes profit-sharing plan payments in 2004. |

| (2) | Consists of royalties paid pursuant to employment agreements between the Company and each of Drs. Petty and Miller. See “Certain Transactions.” |

| (3) | The aggregate amount of perquisites and other personal benefits provided to each Named Executive Officer is less than 10% of the total annual salary and bonus of such officer. |

| (4) | Represents options granted under the 2003 Executive Incentive Compensation Plan on May 17, 2004 at an exercise price of $18.60 per share, the market value of the Common Stock on that date. |

| (5) | Represents matching contributions made by the Company under its 401(k) plan. |

| (6) | Includes profit-sharing plan payments in 2003 and performance incentive payment for 2003 under the Executive Incentive Compensation Plan, paid in February 2004. |

| (7) | Represents options granted under the 2003 Executive Incentive Compensation Plan on May 2, 2003 at an exercise price of $14.46 per share, the market value of the Common Stock on that date. |

13

| (8) | Includes profit-sharing plan payments in 2002. |

| (9) | Represents options granted under the Company’s Employee Stock Option and Incentive Plan (which was superseded by the 2003 Executive Incentive Compensation Plan) on July 18, 2002 at an exercise price of $7.58 per share, the market value of the Common Stock on that date. |

Option Grants in Last Fiscal Year

The following table sets forth certain information concerning grants of stock options made during the fiscal year ended December 31, 2004 to the Named Executive Officers. No Named Executive Officer received grants of stock appreciation rights during the fiscal year ended December 31, 2004.

| Individual Grants | ||||||||||||||||

Name | Number of Securities Underlying Options/ SARs Granted | Percent of Total Options/ SARs Granted to Employees In Fiscal | Exercise Price ($/Sh) | Expiration Date | Potential Realizable Value Stock Price Appreciation for Option Term | |||||||||||

| 5%($) | 10%($) | |||||||||||||||

William Petty, M.D | 30,000 | 20.4 | % | $ | 18.60 | 5/17/2014 | $ | 350,923 | $ | 889,308 | ||||||

Gary J. Miller, Ph.D | 7,500 | 5.1 | % | 18.60 | 5/17/2014 | 87,731 | 222,327 | |||||||||

Betty Petty | 15,000 | 10.2 | % | 18.60 | 5/17/2014 | 175,462 | 444,654 | |||||||||

David W. Petty | 20,000 | 13.6 | % | 18.60 | 5/17/2014 | 233,949 | 592,872 | |||||||||

Joel C. Phillips, CPA | 10,000 | 6.8 | % | 18.60 | 5/17/2014 | 116,974 | 296,436 | |||||||||

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table

The following table sets forth certain information concerning (i) the exercise of stock options by the Named Executive Officers during the fiscal year ended December 31, 2004 and (ii) unexercised stock options held by the Named Executive Officers as of December 31, 2004. No stock appreciation rights were granted or are outstanding.

Name | Shares Acquired on Exercise | Value Realized | Number of Unexercised Options Held at December 31, 2004 | Value of Unexercised In-the- Money Options at December 31, 2004(1) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

William Petty, M.D. | 32,400 | $ | 427,356 | 117,000 | 42,000 | $ | 1,050,270 | $ | 45,960 | ||||||

Gary J. Miller, Ph.D. | — | — | 132,660 | 13,500 | 1,808,262 | 22,980 | |||||||||

Betty Petty | 22,160 | 292,290 | 56,000 | 23,000 | 513,640 | 30,640 | |||||||||

David W. Petty | — | — | 73,160 | 28,000 | 952,777 | 30,640 | |||||||||

Joel C. Phillips, CPA | — | — | 97,328 | 46,000 | 1,249,227 | 385,560 | |||||||||

| (1) | The closing sale price of the Common Stock on December 31, 2004 as reported by Nasdaq was $18.29 per share. Value is calculated by multiplying (a) the difference between $18.29 and the option exercise price by (b) the number of shares of Common Stock underlying the option. |

14

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2004 with respect to compensation plans (including individual compensation arrangements) under which the Company’s equity securities are authorized for issuance.

| Equity Compensation Plan Information | |||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (in thousands) | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) (in thousands) | ||||

| (a) | (b) | (c) | |||||

Equity compensation plans approved by security holders | 1,061 | $ | 9.18 | 932 | |||

Equity compensation plans not approved by security holders(1) | — | — | — | ||||

Total | 1,061 | $ | 9.18 | 932 | |||

| (1) | The 2003 Executive Incentive Compensation Plan approved by the Company’s shareholders at the annual meeting on May 2, 2003, superseded and consolidated all of the Company’s existing incentive stock plans. |

| (2) | For further details regarding the Company’s equity compensation plans see “Stock Option Plans” on page 16 of this Proxy Statement. |

Employment Agreements

On January 1, 2003, the Company extended its existing employment agreement with Dr. Petty through December 31, 2007. Dr. Petty’s employment agreement provides for an annual base salary in an amount equal to $294,000. The agreement with Dr. Petty provides that the Company may elect to extend his employment agreement for an additional term and that, if it elects to do so, the Company and Dr. Petty will mutually agree upon compensation terms. In the event the Company elects not to extend the term of Dr. Petty’s employment agreement, the Company must continue to pay to Dr. Petty the base salary and bonus provided for in the employment agreement at the then current rate for a minimum of six (6) months from the date notice of the Company’s decision not to extend is sent to Dr. Petty, even if the payments extend beyond the expiration of the term. In all events, whenever Dr. Petty’s term as Chairman and Chief Executive Officer has expired, whether due to the decision of the Company not to extend such term or for other reasons, the Company agrees to continue employing Dr. Petty until December 31, 2013 in another capacity as designated by Dr. Petty’s successor to the office of Chief Executive Officer. While performing in this other capacity, Dr. Petty’s total annual base and incentive compensation may not be less than 70% of the average compensation paid to him for the last two years he served as Chief Executive Officer of the Company. Dr. Petty’s employment agreement provides for the continuation of the royalty payments required under his consulting agreement with the Company, which consulting agreement expired. The provision for royalty payments was included in Dr. Petty’s employment agreement and consists of 0.5% of all domestic sales and 0.25% of all international sales of the Optetrak® knee product on a quarterly basis, not to exceed $150,000 annually.

15

On January 1, 2003, the Company extended the existing employment agreement with Dr. Miller and entered into employment agreements with Ms. Betty Petty and Mr. David Petty effective through the end of December 2005. The agreements with each of Ms. Petty, Mr. Petty and Dr. Miller extend automatically by one year on each anniversary date (each December 31st) of the agreement unless the Board specifically provides notice to the executive that the agreement is not being extended on the anniversary date. Dr. Miller’s employment agreement provides for the continuation of the royalty payments required under his consulting agreement with the Company, which consulting agreement expired. The provision for royalty payments was included in Dr. Miller’s employment agreement and consists of 0.5% of all domestic sales and 0.25% of all international sales of the Optetrak® knee product on a quarterly basis, not to exceed $150,000 annually.

If any of these executives is terminated for cause, as defined in his or her employment agreement, the executive is not entitled to receive severance pay. If the executive is terminated without cause, he is entitled to receive his or her then current salary for the remaining term of the employment agreement. All of the employment agreements contain a provision that the executive will not compete or engage in a business competitive with the current business of the Company for the term of the agreement and for one year thereafter if the executive is terminated for cause or the executive terminates his or her employment. In addition, pursuant to the employment agreements, each executive agreed not to disclose confidential information of the Company during the term of his or her employment or thereafter and agreed that all work, research and results thereof, including inventions, processes or formulas conceived or developed by the executive during the term of employment which are related to the business, research and development work, or field of operation of the Company is the property of the Company.

Stock Option Plans

In February 2003, the Company’s Board of Directors adopted the Company’s 2003 Executive Incentive Compensation Plan (“Incentive Compensation Plan”), which was approved by the Company’s shareholders in May 2003. This comprehensive plan superseded and replaced all of the Company’s pre-existing stock option plans (the “Preexisting Plans”). Under the Incentive Compensation Plan, the Compensation Committee of the Company has the authority to grant stock-based incentive awards to key employees, directors, consultants and independent sales agents, including stock options, stock appreciation rights, or SARs, restricted stock, deferred stock, other stock-related awards and performance or annual incentive awards that may be settled in cash, stock or other property (collectively, the “Awards”). The effective date of the Incentive Compensation Plan was February 19, 2003. As of February 28, 2005, options to purchase an aggregate of 1,095,846 shares of the Company’s Common Stock were outstanding under the plan.

Shares Available for Awards; Annual Per-Person Limitations. Under the Incentive Compensation Plan, the total number of shares of Common Stock that may be subject to the granting of Awards under the Incentive Compensation Plan at any time during the term of the Incentive Compensation Plan is equal to 1,000,000 shares, plus (i) the number of shares with respect to which Awards previously granted under the Preexisting Plans terminate without being exercised, (ii) the number of shares that remain available for future issuance under the Preexisting Plans, and (iii) the number of shares that are surrendered in payment of any Awards or any tax withholding requirements. The Incentive Compensation Plan limits the number of shares which may be issued pursuant to incentive stock options to 1,000,000 shares.

In addition, the Incentive Compensation Plan imposes individual limitations on the amount of some Awards in part to comply with Code Section 162(m). Under these limitations, during any fiscal year the number of options, SARs, restricted shares of Common Stock, deferred shares of Common Stock, shares as a bonus or in lieu of other Company obligations, and other stock-based Awards granted to any one participant may not exceed 250,000 for all types of these Awards, subject to adjustment in specified circumstances. The maximum amount that may be paid out as an annual incentive Award or other cash Award in any fiscal year to any one participant is $1,000,000, and the maximum amount that may be earned as a performance Award or other cash Award in respect of a performance period by any one participant is $5,000,000.

The Company’s Compensation Committee is authorized to adjust the above-described limitations and is authorized to adjust outstanding Awards (including adjustments to exercise prices of options and other affected terms

16

of Awards) in the event that a dividend or other distribution (whether in cash, shares of Common Stock or other property), recapitalization, forward or reverse split, reorganization, merger, consolidation, spin-off, combination, repurchase, share exchange or other similar corporate transaction or event affects the Common Stock so that an adjustment is appropriate in order to prevent dilution or enlargement of the rights of participants. The Committee is also authorized to adjust performance conditions and other terms of Awards in response to these kinds of events or in response to changes in applicable laws, regulations or accounting principles.

Eligibility. The persons eligible to receive Awards under the Incentive Compensation Plan are the officers, directors, employees and independent contractors of the Company and its subsidiaries. An employee on leave of absence may be considered as still in the employ of the Company or a subsidiary for purposes of eligibility for participation in the Incentive Compensation Plan. As of February 28, 2005, approximately two hundred sixty persons were eligible to participate in the Incentive Compensation Plan.

401(k) Plan

Effective January 1, 1996, the Company implemented a 401(k) pension plan. The Company currently intends to match employee contributions at the rate of $1.00 for each dollar of employee contributions up to 3% of the employee’s salary subject to the availability of funds. The Company is not required to match employee contributions in the future. The plan is administered by and offers the funds of a national mutual fund company.

Compensation Committee Interlocks and Insider Participation

No member or nominee for election as a member of the Board or any committees of the Board has an interlocking relationship with the board (or member of such board) or any committee (or member of such committee) of a board of any other company.

The following Report of the Compensation Committee and the Report of the Audit Committee and the Performance Graph included elsewhere in this Proxy Statement do not constitute soliciting material and should not be deemed filed or incorporated by reference into any of the Company’s other filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporate the reports or the performance graph by reference in that filing.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is generally responsible for determining the compensation of the Company’s executive officers. The Compensation Committee is comprised of three outside directors, Paul Metts, CPA, R. Wynn Kearney, Jr., M.D. and William B. Locander, Ph.D.

The Compensation Committee’s general philosophy with respect to the compensation of the Company’s executive officers is to offer competitive compensation programs designed to (i) attract and retain key executives critical to the Company’s long-term success, (ii) reward an individual’s contribution and personal performance and (iii) align the interests of the Company’s executives with the Company’s shareholders. The components of the Company’s executive compensation program are base salary, performance incentives and stock-based awards for specific achievement of predefined objectives.

In determining the 2004 base salary of the Company’s executive officers, the Compensation Committee took into account a number of factors, including the recommendations of Dr. Petty, the executive’s position and responsibilities, compensation levels at other companies generally and the Company’s performance. Increases in base salary are based primarily on individual performances as well as competitive market conditions and Company performance.

During 1998, the Company implemented a profit sharing plan for all employees under which it distributes a portion of earnings after the Company’s financial targets are achieved.

17

The Company believes that stock-based performance awards are an important long-term incentive to its executive officers to remain with the Company and to improve performance. In keeping with that philosophy, the Company’s Incentive Compensation Plan has as its primary goal to provide the Company the ability to attract and retain executive officers and other key employees by rewarding them for delivering long-term value to the Company through the achievement of specific strategic goals and initiatives.

The Compensation Committee determines the base compensation for the Company’s Chairman of the Board, President and Chief Executive Officer. The Company’s employment agreement with Dr. Petty provided for an annual base salary of $346,083 for the year ended December 31, 2004, which could be increased at the discretion of the Committee. Under his employment agreement, Dr. Petty also received royalty payments equal to one-half of one percent of the Company’s net sales of implanted knee prostheses in the United States and one-quarter of one percent of the Company’s sales of such products outside the United States. In addition, Dr. Petty participated in the Company’s profit sharing plan to the same extent as the Company’s other employees. The committee believes that the terms of Dr. Petty’s compensation, as well as the compensation for the other executive officers, are consistent with the Company’s overall compensation philosophy and clearly related to the goals and strategies of the Company for such period.

Salaries for each of the other executive officers were based upon recommendations by Dr. Petty, subject to the review and approval of the Company’s Board of Directors. Effective as of February 1, 2005, all executive officers of the Company received increases in their base salaries which increases ranged from 3-16% of the executive officer’s previous year’s base salary. These increases resulted from calculations based upon the Company’s performance and the individual’s performance utilizing a salary merit matrix.

In February 2003, the Board of Directors adopted the 2003 Executive Incentive Compensation Plan. The Incentive Compensation Plan was approved and adopted by the Company’s shareholders at its annual meeting on May 2, 2003. The terms of the Incentive Compensation Plan provide for grants of stock options, stock appreciation rights, restricted stock, deferred stock, other stock-related awards and performance or annual incentive awards that may be settled in cash, stock or other property. The Incentive Compensation Plan supersedes and replaces the Company’s Employee Stock Option and Incentive Plan and the Company’s Director’s Stock Option Plan. The 2003 Executive Incentive Compensation Plan became effective February 19, 2003.

Submitted by the Compensation Committee of the Board of Directors.

Members of The Compensation Committee

R. Wynn Kearney, Jr.

Paul E. Metts

William B. Locander

18

AUDIT COMMITTEE REPORT

The role of the Audit Committee is to assist the Board of Directors in its oversight of the integrity of the Company’s financial reporting process and compliance with legal and regulatory requirements. The Board of Directors, in its business judgment, has determined that each current member of the Committee is “independent”, as required by applicable listing standards of the Nasdaq National Market and the Sarbanes-Oxley Act of 2002 and applicable SEC rules. Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements. Management is also responsible for the Company’s accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America, as well as assessing the effectiveness of the Company’s controls over financial reporting and management’s assessment of those same controls, and expressing an opinion on management’s assessment and an opinion on the effectiveness of the Company’s internal control over financial reporting based on their audit. The Audit Committee acts in accordance with a written charter adopted by the Board of Directors. The Committee reviews this charter annually.

In the performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements and unaudited quarterly financial statements with management and the independent registered public accounting firm, including a discussion of the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effectiveness of internal control over financial reporting, as required by section 404 of the Sarbanes-Oxely Act of 2002. The Audit Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, and Statement on Auditing Standards No. 90, Audit Committee Communications. Finally, the Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standard No. 1,Independence Discussions with Audit Committees, and has discussed with the auditors the auditors’ independence from the Company and its management, and reviewed and approved the compatibility of non-audit services provided by Deloitte & Touche LLP and approved the fees paid to them for the 2004 fiscal year.

The Audit Committee meets with the representatives of the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s systems of internal control, and the overall quality of the Company’s financial reporting.The Audit Committee reviewed the Company’s internal control over financial reporting with the Company’s independent auditors and, consistent with Section 302 of the Sarbanes-Oxley Act of 2002 and the rules adopted thereunder, met with management and the auditors prior to the filing of officers’ certifications required by that statute to receive any information concerning (a) significant deficiencies in the design or operation of internal controls which could adversely affect the Company’s ability to record, process, summarize and report financial data and (b) any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting.

On an informal basis the chairman communicates with the members outside of meetings with regard to significant issues that need to be brought to their immediate attention. Otherwise, communication between the members is mostly during meetings.

It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. Audit Committee members are not employees of the Company and may not be, and may not represent themselves to be, or to serve as, accountants or auditors by profession. Members of the Audit Committee rely, without independent verification, on the information provided to them and on the representations made by management and the independent accountants.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 filed with the Securities and Exchange Commission. The Committee has also recommended to

19

the Company’s shareholders the re-appointment of Deloitte & Touche LLP as the Company’s independent auditors for the 2005 fiscal year.

Submitted by the Audit Committee of the Board of Directors.

Members of The Audit Committee

Paul E. Metts

R. Wynn Kearney, Jr.

William B. Locander

20

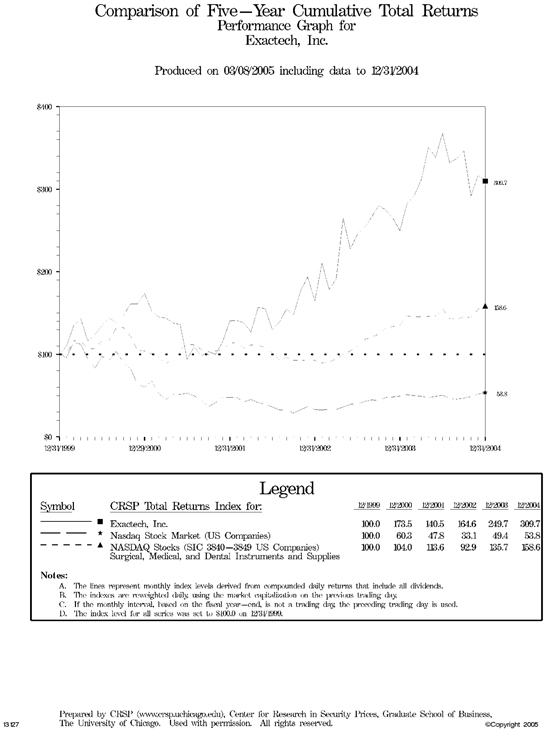

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Company’s Common Stock since December 31, 1999 with (i) the Nasdaq Stock Market index prepared by the Center for Research in Security Prices (“CRSP”), and (ii) CRSP’s index for companies with similar Standard Industry Codes (“SIC”) as the Company.

21

CERTAIN TRANSACTIONS

Purchase Arrangement with Brighton Partners

The Company has entered into a purchase agreement with Brighton Partners, Inc. (“Brighton Partners”) to purchase raw materials and equipment used in the ongoing production of its products. Purchases of raw materials and equipment associated with these agreements totaled $895,223, $966,314, and $712,617 in 2004, 2003 and 2002, respectively. Brighton Partners is deemed to be 30% beneficially owned by Albert H. Burstein, Ph.D., a director of the Company. Additionally, William Petty, Chairman of the Board, President and Chief Executive Officer of the Company, and Betty Petty, Secretary of the Company, jointly own 5.5% of Brighton Partners. Gary J. Miller, Executive Vice President of the Company, beneficially owns 3.3% of Brighton Partners. Other executive officers of the Company own less than 3% of Brighton Partners, Inc.

Consulting Agreement with Albert Burstein, Ph.D.

The Company has also entered into a verbal consulting agreement with Albert Burstein, Ph.D, a director of the Company. The agreement provides for the rendering of Dr. Burstein’s services with respect to many facets of the orthopaedic industry, including product design rationale, manufacturing and development techniques and product sales and marketing. During the year ended December 31, 2004, the Company paid Dr. Burstein $180,000 as compensation under the consulting agreement.

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors of the Company has recommended the firm of Deloitte & Touche LLP as the independent auditors of the Company for the current fiscal year. Deloitte & Touche LLP has served as our independent auditors since prior to our initial public offering in 1996. Although the appointment of Deloitte & Touche LLP as the independent auditors of the Company does not require ratification by the Company’s shareholders, the Board of Directors considers it appropriate to obtain such ratification. Accordingly, the vote of the Company’s shareholders on this matter is advisory in nature and has no effect upon the Audit Committee’s appointment of an independent auditor, and the Audit Committee may change the Company’s auditors at any time without the approval or consent of the shareholders. The Board proposes and unanimously recommends that the shareholders ratify the selection of Deloitte & Touche LLP.

If the shareholders do not ratify the selection of Deloitte & Touche LLP by the affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting, the selection of another independent auditor will be considered by the Audit Committee.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting and will be afforded the opportunity to make a statement if they so desire and to respond to appropriate questions.

Aggregate fees and costs billed to us by Deloitte & Touche LLP, our principal accountant, for the fiscal years ended December 31, 2004 and 2003, were as follows for the referenced services:

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2004 and for the reviews of the financial statements in the Company’s quarterly reports on Form 10-Q for that fiscal year were $121,585, as compared to $93,518 for the fiscal year ended December 31, 2003.

The aggregate fees billed by Deloitte & Touche LLP for professional services rendered for the attestation of the Company’s internal controls over financial reporting as of December 31, 2004 were $118,790.

22

Audit Related Fees

The aggregate fees billed by Deloitte & Touche LLP for professional services rendered in connection with the Company’s response to comment letters received from the Securities and Exchange Commission for the fiscal year ended December 31, 2004 were $7,280 as compared to $5,390 for the review and discussion of the appropriate accounting treatment related to the Company’s acquisition of a minority interest in Altiva Corporation for the fiscal year ended December 31, 2003.

Tax Fees

Deloitte & Touche LLP did not provide professional tax services for either of the fiscal years ended December 31, 2004 and 2003.

All Other Fees

For the fiscal year ended December 31, 2004, the Company paid Deloitte & Touche LLP $300 tuition for continuing educations workshops. For the fiscal year ended December 31, 2003, the Company paid Deloitte & Touche LLP $7,800 tuition for workshops related to compliance with requirements of the Sarbanes-Oxley Act of 2002 concerning internal controls over financial reporting.

All audit related services, tax services and other services were pre-approved by the Audit Committee, which concluded that the provision of such services by Deloitte & Touche LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee’s charter provides the Audit Committee has authority to pre-approve all audit and allowable non-audit services to be provided to the Company by its outside auditors.

In its performance of these responsibilities, prior approval of some non-audit services is not required if:

| (i) | these services involve no more than 5% of the revenues paid by the Company to the auditors during the fiscal year; |

| (ii) | these services were not recognized by the Company to be non-audit services at the time of the audit engagement, and |

| (iii) | these services are promptly brought to the attention of the Audit Committee and are approved by the Audit Committee prior to completion of the audit for that fiscal year. |

The Audit Committee is permitted to delegate the responsibility to pre-approve audit and non-audit services to one or more members of the Audit Committee so long as any decision made by that member or members is presented to the full Audit Committee at its next regularly scheduled meeting.

The Audit Committee has considered the compatibility of the provision of services covered by the preceding paragraphs with the maintenance of the principal accountant’s independence from us and has determined that the provision of these services is not incompatible with the maintenance of the requisite independence.

The Audit Committee annually reviews the performance of the independent auditors and the fees charged for their services.

23

SHAREHOLDER PROPOSALS